- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 16-07-2024

- NZD/USD trades on a positive note near 0.6065 in Wednesday’s early Asian session, up 0.23% on the day.

- New Zealand CPI inflation eased more than expected in the second quarter, triggering RBNZ rate cut expectations.

- US Retail Sales unchanged in June.

The NZD/USD pair trades on a stronger note around 0.6065 on the weaker US Dollar (USD) during the early Asian session on Wednesday. The New Zealand Dollar (NZD) edges higher after the release of the New Zealand Consumer Price Index (CPI) reading. Later in the day, the US Building Permits, Housing Starts, Industrial Production and the Fed Beige Book are due. The Federal Reserve’s (Fed) Barkin and Waller are also scheduled to speak.

Data released by Statistics New Zealand on Wednesday showed that the country’s Consumer Price Index (CPI) rose 0.4% QoQ in the second quarter (Q2), compared to 0.6% in the previous quarter. This figure was below analysts' forecasts of 0.6%. The annual rate of CPI inflation fell to its lowest rate in three years, coming in at 3.3% YoY in Q2 from a 4% rise in the 12 months to the March 2024 quarter.

Finance Minister Nicola Willis said that the recent inflation rate showed "we are turning our economy around and winning the fight against rampant inflation.” Westpac analysts noted that more signs of easing inflation could give the RBNZ enough confidence to begin cutting rates as soon as November.

On the USD’s front, the US Retail Sales for June did not change much for the central bank's expectations. Retail Sales in the United States held steady at $704.3 billion in June, after a 0.3% gain (revised from 0.1%) in May and in line with market expectations. Retail sales grew 2.3% year over year in June. Traders are currently betting that the Fed will start cutting the interest rate at the September 17-18 meeting, which might drag the Greenback lower and create a tailwind for NZD/USD.

New Zealand Dollar FAQs

The New Zealand Dollar (NZD), also known as the Kiwi, is a well-known traded currency among investors. Its value is broadly determined by the health of the New Zealand economy and the country’s central bank policy. Still, there are some unique particularities that also can make NZD move. The performance of the Chinese economy tends to move the Kiwi because China is New Zealand’s biggest trading partner. Bad news for the Chinese economy likely means less New Zealand exports to the country, hitting the economy and thus its currency. Another factor moving NZD is dairy prices as the dairy industry is New Zealand’s main export. High dairy prices boost export income, contributing positively to the economy and thus to the NZD.

The Reserve Bank of New Zealand (RBNZ) aims to achieve and maintain an inflation rate between 1% and 3% over the medium term, with a focus to keep it near the 2% mid-point. To this end, the bank sets an appropriate level of interest rates. When inflation is too high, the RBNZ will increase interest rates to cool the economy, but the move will also make bond yields higher, increasing investors’ appeal to invest in the country and thus boosting NZD. On the contrary, lower interest rates tend to weaken NZD. The so-called rate differential, or how rates in New Zealand are or are expected to be compared to the ones set by the US Federal Reserve, can also play a key role in moving the NZD/USD pair.

Macroeconomic data releases in New Zealand are key to assess the state of the economy and can impact the New Zealand Dollar’s (NZD) valuation. A strong economy, based on high economic growth, low unemployment and high confidence is good for NZD. High economic growth attracts foreign investment and may encourage the Reserve Bank of New Zealand to increase interest rates, if this economic strength comes together with elevated inflation. Conversely, if economic data is weak, NZD is likely to depreciate.

The New Zealand Dollar (NZD) tends to strengthen during risk-on periods, or when investors perceive that broader market risks are low and are optimistic about growth. This tends to lead to a more favorable outlook for commodities and so-called ‘commodity currencies’ such as the Kiwi. Conversely, NZD tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- USD/CAD trades with mild losses around 1.3670 in Wednesday’s early Asian session.

- US Retail Sales held steady in June, followed a 0.3% increase in May, in line with expectations.

- The cooler-than-expected Canadian CPI triggered expectations of another rate cut by the BoC next week.

The USD/CAD pair trades in a negative territory near 1.3670 during the early Asian session on Wednesday. The rising speculation of a rate cut by the Federal Reserve (Fed) in September continues to undermine the USD Index (DXY). Investors will monitor US Building Permits, Housing Starts, Industrial Production, and the Fed Beige Book. Also, Fed’s Barkin and Waller are set to speak.

US Retail Sales were unchanged in June and did not change expectations that the Fed would start cutting interest rates in September amid the signs of cooling inflation. Retail Sales in the US held steady at $704.3 billion in June, followed the 0.3% increase (revised from 0.1%) in May, and came in line with the market expectations. Retail sales rose 2.3% on a year-on-year basis in June.

Fed Governor Adriana Kugler said on Tuesday that inflation is on course to reach the Fed's 2% target, with goods, services and now housing contributing to easing price pressures. However, the US central bank still needs more evidence of the rate cut puzzle before considering rate cuts. Fed Chair Jerome Powell stated that recent data has boosted confidence that inflation will ease to the 2% target from its current level about half a percentage point above that mark. Financial markets expect a rate cut in September followed by additional cuts in November and December. This, in turn, weighs on the Greenback against the Loonie.

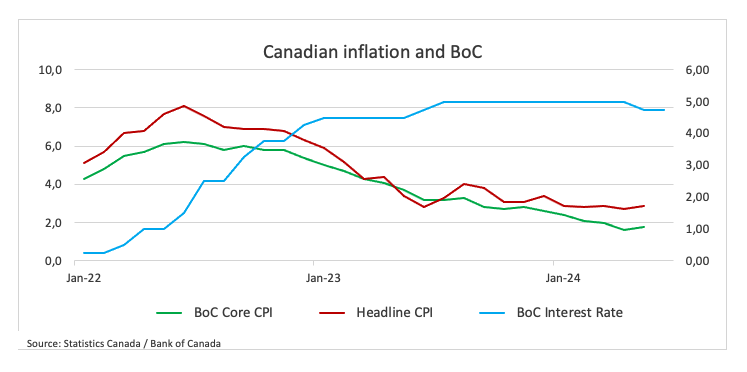

On the other hand, the softer Canadian Consumer Price Index has spurred expectations that the Bank of Canada (BoC) would cut interest rates further next week. "The inflation data for June gave the Bank of Canada what it needed in order to cut interest rates at next week's meeting," said Katherine Judge, senior economist at CIBC Capital Markets. Meanwhile, the decline in crude oil prices might exert some selling pressure on the Canadian Dollar (CAD) and cap the downside of the pair. It’s worth noting that Canada is the biggest Oil exporter to the United States (US).

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

Inflation in New Zealand, as measured by the change in the Consumer Price Index (CPI), drops to 0.4% QoQ in the second quarter (Q2) of 2024 from 0.6% in the previous reading, Statistics New Zealand reported on Wednesday. The figure was below the market consensus of 0.6%.

Annualized CPI inflation in New Zealand came in at 3.3% YoY compared to the previous period's 4.0%, weaker than the estimation of 3.5%.

Market reaction to New Zealand CPI data

The New Zealand Dollar (NZD) edged higher with the immediate reaction. The NZD/USD pair was last seen rising 0.12% on the day at 0.6058.

New Zealand Dollar FAQs

The New Zealand Dollar (NZD), also known as the Kiwi, is a well-known traded currency among investors. Its value is broadly determined by the health of the New Zealand economy and the country’s central bank policy. Still, there are some unique particularities that also can make NZD move. The performance of the Chinese economy tends to move the Kiwi because China is New Zealand’s biggest trading partner. Bad news for the Chinese economy likely means less New Zealand exports to the country, hitting the economy and thus its currency. Another factor moving NZD is dairy prices as the dairy industry is New Zealand’s main export. High dairy prices boost export income, contributing positively to the economy and thus to the NZD.

The Reserve Bank of New Zealand (RBNZ) aims to achieve and maintain an inflation rate between 1% and 3% over the medium term, with a focus to keep it near the 2% mid-point. To this end, the bank sets an appropriate level of interest rates. When inflation is too high, the RBNZ will increase interest rates to cool the economy, but the move will also make bond yields higher, increasing investors’ appeal to invest in the country and thus boosting NZD. On the contrary, lower interest rates tend to weaken NZD. The so-called rate differential, or how rates in New Zealand are or are expected to be compared to the ones set by the US Federal Reserve, can also play a key role in moving the NZD/USD pair.

Macroeconomic data releases in New Zealand are key to assess the state of the economy and can impact the New Zealand Dollar’s (NZD) valuation. A strong economy, based on high economic growth, low unemployment and high confidence is good for NZD. High economic growth attracts foreign investment and may encourage the Reserve Bank of New Zealand to increase interest rates, if this economic strength comes together with elevated inflation. Conversely, if economic data is weak, NZD is likely to depreciate.

The New Zealand Dollar (NZD) tends to strengthen during risk-on periods, or when investors perceive that broader market risks are low and are optimistic about growth. This tends to lead to a more favorable outlook for commodities and so-called ‘commodity currencies’ such as the Kiwi. Conversely, NZD tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- EUR/USD hung up on tense bidding near 1.0900.

- Bullish momentum pulls up short as Fiber fails to crack into new technical highs.

- ECB rate call in the barrel for Thursday after US data sparks renewed rate cut hopes.

EUR/USD rotated around 1.0900 on Tuesday as markets grappled with September rate cut hopes getting pinned even further into the high end after US Retail Sales figures eased in June. Markets have fully priced in the start of a Federal Reserve (Fed) rate-cutting cycle in September, with up to three quarter-point cuts expected for the year. On the European side, the European Central Bank’s (ECB) latest rate call looms ahead on Thursday.

Forex Today: UK, EMU inflation come to the fore along with US data

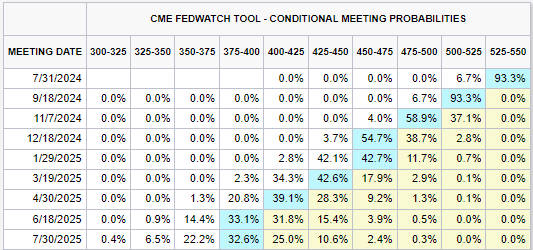

In June, US Retail Sales remained flat at 0.0%, matching forecasts and dropping from the revised 0.3% in the previous month. This decline in Retail Sales added to the market's expectation of a rate cut at the upcoming Federal Open Market Committee (FOMC) meeting on September 18. The softening of US Retail Sales combined with a recent cooling in Consumer Price Index (CPI) data last week has increased the likelihood of a rate cut in September. According to the CME’s FedWatch Tool, the markets are now anticipating almost a 100% chance of at least a quarter-point rate reduction in September, with the possibility of up to three cuts by 2024.

The ECB is broadly expected to keep rates on hold on Thursday as policymakers wait to see if data will improve following an initial quarter-point cut in June.

Euro PRICE This week

The table below shows the percentage change of Euro (EUR) against listed major currencies this week. Euro was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.07% | 0.10% | 0.13% | 0.21% | 0.76% | 0.92% | -0.08% | |

| EUR | -0.07% | 0.07% | 0.24% | 0.33% | 0.73% | 1.04% | 0.04% | |

| GBP | -0.10% | -0.07% | 0.27% | 0.26% | 0.66% | 0.92% | -0.03% | |

| JPY | -0.13% | -0.24% | -0.27% | 0.08% | 0.42% | 0.75% | -0.40% | |

| CAD | -0.21% | -0.33% | -0.26% | -0.08% | 0.49% | 0.71% | -0.29% | |

| AUD | -0.76% | -0.73% | -0.66% | -0.42% | -0.49% | 0.31% | -0.69% | |

| NZD | -0.92% | -1.04% | -0.92% | -0.75% | -0.71% | -0.31% | -1.00% | |

| CHF | 0.08% | -0.04% | 0.03% | 0.40% | 0.29% | 0.69% | 1.00% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

EUR/USD technical outlook

EUR/USD was unable to break decisively through the 1.0900 handle last week, and intraday bidding churns just south of the key technical barrier as markets await a meaningful push in either direction. The Fiber is holding close to a four-month high set at 1.0922 last Friday, and the key for buyers will be to keep EUR/USD buoyed above the 200-day Exponential Moving Average (EMA) at 1.0789.

Fiber trading is hung up on the upper bound of a rough descending channel, and continued weakness could drag bulls back into the low end with the last swing low priced in just north of 1.0650.

EUR/USD hourly chart

EUR/USD daily chart

Euro FAQs

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- GBP/USD cycled familiar territory on Tuesday as markets weigh rate cuts.

- Sterling traders are buckling down for a key print in UK CPI inflation.

- UK labor figures and Retail Sales promise a hectic back half of the trading week.

GBP/USD churned close to recent highs on Tuesday as markets readjusted odds of a rate cut from the Federal Reserve (Fed). A decline in US Retail Sales capped off a recent batch of US data, implying price pressures have finally eased enough that the Fed may get pushed into a rate-cutting cycle in September.

Forex Today: UK, EMU inflation come to the fore along with US data

US Retail Sales slumped to a flat 0.0% in June, matching forecasts and falling from the previous month’s revised 0.3%. Softening US Retail Sales was the final feather in the cap for rate-cut-hungry markets, which piled into bets of a rate cut when the Federal Open Market Committee (FOMC) gathers for its rate call on September 18.

Slumping Retail Sales growth adds on to a batch of Consumer Price Index (CPI) inflation data last week that reignited broad-market hopes for a September rate cut. According to the CME’s FedWatch Tool, rate markets are now pricing in nearly 100% odds of at least a quarter-point rate trim in September, with up to three rate cuts in total for 2024.

GBP traders are rounding the corner into a series of key data releases on the UK side for the latter half of the trading week. Wednesday kicks things off with a fresh print of UK CPI inflation. Near-term UK CPI inflation is expected to tick down to 0.1% MoM in June from the previous 0.3%, while annualized CPI inflation is expected to hold steady at 2.0% YoY.

Thursday continues the UK data parade with updated labor figures. The UK’s Claiming Count Change in June is expected to fall back to 23.4K from the previous print of 50.4K. Friday will follow up with UK Retail Sales for June, which is forecast to decline -0.4% from the previous print of 2.9%.

British Pound PRICE This week

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.08% | 0.12% | 0.14% | 0.20% | 0.77% | 0.97% | -0.06% | |

| EUR | -0.08% | 0.07% | 0.26% | 0.31% | 0.72% | 1.08% | 0.05% | |

| GBP | -0.12% | -0.07% | 0.29% | 0.24% | 0.65% | 0.96% | -0.02% | |

| JPY | -0.14% | -0.26% | -0.29% | 0.05% | 0.40% | 0.78% | -0.39% | |

| CAD | -0.20% | -0.31% | -0.24% | -0.05% | 0.50% | 0.76% | -0.27% | |

| AUD | -0.77% | -0.72% | -0.65% | -0.40% | -0.50% | 0.35% | -0.67% | |

| NZD | -0.97% | -1.08% | -0.96% | -0.78% | -0.76% | -0.35% | -1.03% | |

| CHF | 0.06% | -0.05% | 0.02% | 0.39% | 0.27% | 0.67% | 1.03% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

GBP/USD technical outlook

GBP/USD rallied into a 12-month high last week, coming within reach of the 1.3000 major handle before falling into chart churn just beneath the critical technical level. The Cable put in a stellar two-week run, climbing nearly 3% bottom-to-top before getting stopped just shy of 1.3000.

Bullish momentum has frozen in place, with bidding pressure holding steady and keeping GBP/USD bolstered into the high end well above the 200-day Exponential Moving Average (EMA) at 1.2612.

GBP/USD hourly chart

GBP/USD daily chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, aka ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- USD/JPY edges higher by 0.24%, trading just below 158.50 during North American session.

- Technical signals turn neutral-bearish with price below Tenkan and Kijun-Sen lines.

- Key levels to watch: support at 158.00 and resistance at 158.50, with further gains toward 160.00 possible.

The USD/JPY edged higher during Tuesday’s North American session, registering minuscule gains of 0.24% and trading below the 158.50 figure. As Wednesday’s Asian session begins, the pair trades at 158.34, virtually unchanged.

USD/JPY Price Analysis: Technical outlook

More technical signals suggest the USD/JPY is turning neutral-bearishly biased, with price diving below the Tenkan and Kijun-Sen, showing the lack of buyers in the market. This is confirmed by the Relative Strength Index (RSI) standing bearish but flat, hinting that neither buyers nor sellers are in charge.

If USD/JPY drops below the 158.00 figure, this would pave the way for a test of the July 15 low of 157.14. Once surpassed, the next stop would be the top of the Ichimoku Cloud (Kumo) at 156.30/50.

On the other hand, if buyers lift USD/JPY’s exchange rate past 158.50, this will expose the Kijun-Sen at 158.84, ahead of the 159.00 mark. Additional gains are seen above the Tenkan-Sen lying at 159.47, on buyers’ way towards the 160.00 mark.

USD/JPY Price Action – Daily Chart

Japanese Yen FAQs

The Japanese Yen (JPY) is one of the world’s most traded currencies. Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors.

One of the Bank of Japan’s mandates is currency control, so its moves are key for the Yen. The BoJ has directly intervened in currency markets sometimes, generally to lower the value of the Yen, although it refrains from doing it often due to political concerns of its main trading partners. The current BoJ ultra-loose monetary policy, based on massive stimulus to the economy, has caused the Yen to depreciate against its main currency peers. This process has exacerbated more recently due to an increasing policy divergence between the Bank of Japan and other main central banks, which have opted to increase interest rates sharply to fight decades-high levels of inflation.

The BoJ’s stance of sticking to ultra-loose monetary policy has led to a widening policy divergence with other central banks, particularly with the US Federal Reserve. This supports a widening of the differential between the 10-year US and Japanese bonds, which favors the US Dollar against the Japanese Yen.

The Japanese Yen is often seen as a safe-haven investment. This means that in times of market stress, investors are more likely to put their money in the Japanese currency due to its supposed reliability and stability. Turbulent times are likely to strengthen the Yen’s value against other currencies seen as more risky to invest in.

- NZD/USD fails to preserve the 0.6070 level, plunging to lows seen in mid-May.

- Pairs are now trading below the critical 20, 100, and 200-day SMA lines, suggesting a bearish outlook.

- Daily indicators emphasize a mounting selling pressure.

In Tuesday's session, the NZD/USD declined by 0.40% to reach 0.6052 levels. Buyers failed to hold the 0.6070 mark, causing the pair to hit mid-May lows. Notably, the NZD/USD is now below the important Simple Moving Averages (SMA) of 20, 100, and 200 days, indicating a bearish outlook.

Daily technical indicators present a stronger bearish picture. The Relative Strength Index (RSI) stands at 38 after being above 50 last week. Meanwhile, the Moving Average Convergence Divergence (MACD) shows rising red bars, implying an increasing bearish momentum.

NZD/USD daily chart

Resistance can now be found at the previous support of 0.6070, followed by the 20-day SMA around 0.6100 and then at 0.6150 and above at 0.6200. Bulls need a decisive close above these levels for a bullish turnaround and to shift the focus upwards.

The downside has a firm support at 0.6050 and then at 0.6030 and adjusting to the bearish shift, a key psychological mark at 0.6000 floats into view. A significant plunge below these levels would confirm the bearish outlook, potentially setting a path for a correction toward lower ranges.

- WTI tumbled below $80.00 per barrel as Crude Oil bids crumble.

- Crude Oil markets are extending a downside slide as Chinese demand slumps.

- WTI bull run sputters, bids within touch range of long-term averages.

West Texas Intermediate (WTI) Crude Oil fell on Tuesday as barrel traders grow fearful at the prospect of a slowdown in Chinese demand for fossil fuels. A decline in American Petroleum Institute (API) week-on-week barrel counts helped to bolster WTI prices into a weak recovery in late Tuesday trading, but an equivalent buildup of distillate products limited bullish potential.

China recently posted a slowdown in growth figures for the second quarter, hobbling broad-market expectations of a surge in Chinese demand for fossil fuels. After spending most of 2024 waiting for an uptick in Chinese Crude Oil demand, barrel traders have flipped to concerns that limited Chinese growth won’t provide enough barrel demand to eat up overhang in global markets.

The API reported yet another contraction in overall Crude Oil supply, showing a -4.44 million barrel contraction in privately counted supplies for the week ended June 12. Despite the extended decline in barrel counts, fully-refined gasoline stocks rose 365K barrels, with an additional buildup of partially-refined distillate inventories of 4.92 million barrels as end-chain refiners struggle to keep up with the availability of Crude Oil products.

WTI technical outlook

Tuesday’s bearish break has dragged WTI further below the 200-hour Exponential Moving Average (EMA) at $81.30 as downside momentum accelerates. WTI has extended a backslide from a recent upswing that fell just short of the $84.00 handle, and US Crude Oil prices have backslid over -5.5% peak-to-trough in July.

After a failed bull run through the top end of a consolidation pattern on daily candlesticks, A low break has dragged WTI bids into touch range of the 200-day EMA at $79.07 after shedding the $80.00 key handle on Tuesday.

WTI hourly chart

WTI daily chart

WTI Oil FAQs

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

OPEC (Organization of the Petroleum Exporting Countries) is a group of 13 Oil-producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact WTI Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.

- Tuesday's session saw additional losses in the NZD/JPY.

- The cross extended its four-day losing streak to five being 2.50% lower compared to last week.

- The pair might consolidate as indicators approach the oversold terrain.

On Tuesday, the NZD/JPY saw more losses and fell below 96.00. The cross extended its bearish streak to five and is now down by more than 2.50% since last week.

The daily technical indicators still remain under the bear's control. The Relative Strength Index (RSI), currently at 35, marginally moved downwards, keeping the bearish bias intact. In line with this, the Moving Average Convergence Divergence (MACD) continues to print flat red bars that suggest persistent selling activity. However, the RSI near 30, suggests that a correction looms.

NZD/JPY daily chart

Reflecting the prevailing bearish tone, immediate support levels are identified at 95.50 and the key level at 95.50 and 95.30. A fall below these levels, particularly the strong support at 95.50, could serve as a confirmation of the bear's domination in the short term. On the flip side, the resistance levels can now be spotted at the previous support breakpoints of 97.00, the 20-day Simple Moving Average (SMA) residing at 97.70, and the vital level of 98.00.

- Gold price hits an all-time high of $2,465 on growing expectations of a Fed rate cut in September.

- Trump’s potential election win fuels market volatility, driving investors to non-yielding assets.

- Lower-than-expected inflation data and Powell’s dovish comments underpins Gold.

Gold price skyrockets to a new all-time high of $2,465 on Tuesday amid growing bets that the US Federal Reserve (Fed) will begin its easing cycle in September. This, along with increasing chances that former President Donald Trump would win November’s election, underpinned the yellow metal. The XAU/USD trades at $2465, gains more than 1.70%.

Last week’s lower-than-expected consumer inflation figures pushed non-yielding metal prices higher amid the Fed’s dovish pivot. The CME FedWatch Tool shows that the odds for a 25-basis point rate cut in September are 100%, with a minuscule part of economists foreseeing a 50 bps of easing.

Besides this, over-the-weekend political developments involving former President Trump sponsored a leg-up on the Golden metal. Trump’s Presidency will aim to increase tariffs and cut taxes, which will most likely increase the US budget deficit and generate inflationary pressures.

Meanwhile, Fed Chair Jerome Powell appeared at the Economic Club of Washington, where he commented that the economy performed well and added that the Fed will lower borrowing costs once it is confident that inflation is moving toward the 2% goal.

Data-wise, the US Census Bureau reported that Retail Sales in June were unchanged, as expected. However, excluding autos, sales rose sharply, exceeding forecasts.

Daily digest market movers: Gold climbs as traders ignore mixed US data

- Weaker-than-expected US Consumer Price Index (CPI) data sponsored Gold’s leg-up above $2,400, as the odds for Fed rate cuts increased, as reflected by falling US Treasury bond yields.

- US Retail Sales in June were flat at 0% MoM, as expected. Core sales expanded by 0.4% MoM, above the projected 0.1%.

- June Export and Import Prices both decreased, with Export prices dropping -0.5% MoM, below the forecast of -0.1%. Import prices rose compared to May’s -0.2% decline, coming in at 0%, beneath the estimated 0.2% increase.

- Meanwhile, the US Dollar Index (DXY), which tracks the Greenback against a basket of six currencies, is up by a minimal 0.02% at 104.27.

- December 2024 fed funds rate futures contract implies that the Fed will ease policy by 53 basis points (bps) toward the end of the year, up from 50 last Friday.

- Bullion prices retreated slightly due to the People's Bank of China (PBoC) decision to halt gold purchases in June, as it did in May. By the end of June, China held 72.80 million troy ounces of the precious metal.

Gold technical analysis: XAU/USD surged and extended rally as traders eye $2,500

Gold prices remain bullish and trading at all-time highs, clearing the May 20 high of $2450, which opened the door for further gains. Momentum is still in the bulls' favor, as depicted by the Relative Strength Index (RSI), which aims higher and is shy of reaching “regular” overbought conditions.

XAU/USD's next resistance would be $2,475, followed by the $2,500 figure. Conversely, if gold prices slide below $2,450, the first resistance would be the $2,400 figure, followed by the July 5 high at $2,392. If cleared, XAU/USD would continue to $2,350.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

- AUD/JPY eases to 106.80, still under the 20-day SMA support.

- Downward trajectory continues, yet with a slackening pace as the bearish sentiment seems to be decelerating.

- As bears lose steam the pair might side-ways trade in the next sessions.

In Tuesday's session, the AUD/JPY pair recorded a slight decline to 106.70, following up on the gradual declining trend from last week. However, the bearish momentum seems to be flattening as suggested by the shape of the daily candles, following a four-day losing streak. As such, while the pair is projected to maintain its descent, a slowdown in bearish activity may be approaching.

The daily Relative Strength Index (RSI) for the AUD/JPY pair now stands at 51 while the daily Moving Average Convergence Divergence (MACD) prints flat red bars, implying that the selling activity is easing.

AUD/JPY daily chart

Taking a wider view, the AUD/JPY pair seems to maintain a bearish tendency, further accentuated by its position below the 20-day Simple Moving Average (SMA) support. Should the downward movement proceed, the immediate support levels at 106.50 and 106.00 remain the critical markers to watch. On the flip side, to limit further potential losses, buyers should aim to retrieve the 107.00 level, the 107.30 zone (20-day SMA), and then target the 108.00 barrier as a signal for recovery.

Tuesday’s inconclusive price action in the FX universe came on the back of incessant speculation of a rate cut by the Fed in September, leaving the US Dollar and most of the risk-linked assets almost unchanged from Monday’s closing levels.

Here is what you need to know on Wednesday, July 17:

The USD Index (DXY) hovered around the low-104.00s after the effects from better-than-expected US Retail Sales fizzled out towards the end of Tuesday’s session.The usual weekly Mortgage Applications are due in the first turn on July 17, seconded by Building Permits, Housing Starts, Industrial Production and the Fed Beige Book. In addition, the Fed’s Barkin and Waller are also due to speak.

EUR/USD managed to leave behind the earlier knee-jerk and revisited the 1.0900 zone. On July 17, the final Inflation Rate in the broader Euroland will be the salient event on the old continent.

GBP/USD traded in a vacillating fashion, although it succeeded in keeping business near recent peaks just below 1.3000. The release of UK Inflation Rate takes centre stage on July 17.

USD/JPY added to Monday’s gains on the back of the resumption of the selling pressure around the Japanese currency. The Reuters Tankan Index is expected on July 17.

AUD/USD dropped markedly to multi-day lows near 0.6710, adding to Monday’s pullback amidst lower commodity prices and small gains in the Greenback. The Leading Index tracked by Westpac and the speech by the RBA’s Simon are due in Oz on July 17.

Persistent demand concerns weighed on traders and prompted WTI prices to retreat for the third session in a row and approach the $80.00 mark per barrel.

Prices of Gold advanced to a record high past the $2,460 mark per ounce troy as traders continued to assess rate cuts by the Fed. Its cousin Silver followed suit and rose past the $31.00 mark per ounce after two daily retracements in a row.

Federal Reserve (Fed) Board of Governors member Dr. Adriana Kugler noted on Tuesday that while inflationary pressures have certainly eased, the Fed still needs some pieces to the rate cut puzzle before movement on rates can occur.

Key highlights

If incoming data does not provide confidence that inflation is moving toward the 2% target, it may be appropriate to hold rates steady a little longer.

If the labor market cools too much, it will be appropriate to cut interest rates sooner rather than later.

Upside risks to inflation, downside risks to employment have become more balanced.

It will be appropriate to begin easing monetary policy later this year if economic conditions continue to evolve favorably.

Continued labor market rebalancing suggests inflation will continue to move toward 2% target.

The labor market has seen substantial rebalancing.

Supply and demand are gradually coming into better balance.

Inflation remains above the US central bank's target.

Inflation has continued to trend down, despite a few bumps at start of this year.

- AUD/USD shows a further decrease in Tuesday falling below 0.6730.

- Australian labor data will dictate short-term dynamics which might prompt a more hawkish RBA.

- Strong US data might not be enough to close the divergence between the Fed and RBA policies.

The Australian Dollar (AUD) continued to lose ground against the USD on Tuesday, falling to 0.6730. After an initial decline in Monday's session, the AUD has extended its losses as profit booking by investors heightens. However, the fundamental outlook hints at the AUD's potential resilience against the USD amidst monetary policy divergences between the Federal Reserve and the Reserve Bank of Australia (RBA).

Despite signs of frailty in the Australian economy, stubbornly high inflation has put the brakes on the RBA's intention of lowering interest rates. It is anticipated that the RBA will be one of the last central banks among the G10 countries to begin cutting rates, a factor that might limit the AUD's downside and extend its gains.

Daily digest market movers: AUD may see an upside as the labor market could justify a hike

- Investors are keeping a close eye on the Australian Employment data due for release on Thursday. The report is forecasted to show that in June, 20,000 job-seekers found employment, compared to 39,700 in May.

- If the unemployment rate remains steady at 4.0%, it will signify a robust labor market that may further fuel expectations of the RBA's policy-tightening stance.

- Retail Sales went from 0.1% to 0.0%, with the previous 0.1% revised to 0.3%.

- Retail Sales ex Autos rose by 0.4% after the 0.1% decline in May. That same decline has been revised to 0.1%.

- Market pricing currently indicates nearly a 50% chance of the RBA increasing rates in either September or November. Conversely, the odds of a rate cut by the Federal Reserve in September stand at 90%, subject to incoming data.

Technical Analysis: AUD/USD enters consolidation phase, overall outlook remains positive

Despite the recent losses, the AUD/USD's outlook remains positive, with the pair retaining levels not seen since January. Following a rally of over 1.5% in July, indicators including the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) approached overbought territory which prompted a slight correction.

The target for the buyers is to sustain between the 0.6700-0.6730 range while additional support lines are marked at 0.6680 and 0.6650.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

- Dow Jones gains 1.5% in a single day as rate cut hopes surge.

- Easing US Retail Sales data reignited market bets of a September rate cut.

- Dow Jones sets a new record high for a second day in a row.

The Dow Jones Industrial Average (DJIA) surged to a second record-setting day in a row, climbing over 650 points to chalk in a fresh all-time peak above 40,850 as market sentiment buries the needle even further into hopes of a September rate cut from the Federal Reserve (Fed).

US Retail Sales slumped flat in June, printing at 0.0% in-line with forecasts and falling from the previous month’s revised 0.3% uptick, signaling that the US domestic economy is continuing to soften and prompting a broad-market rush into expectations of a September rate cut.

According to the CME’s FedWatch Tool, rate markets have a September rate trim fully priced in, with functionally 100% odds of at least a quarter-point rate cut when the Federal Open Market Committee (FOMC) meets on September. The FOMC’s upcoming rate call on July 31 is still broadly expected to be a hold as policymakers wait for a few more months of data to confirm inflation is easing to targets before pulling the trigger.

Dow Jones news

The Dow Jones soared over 600 points at its highest point on Tuesday as the major equity index makes its way toward 41,000.00 after crossing the 40,000.00 major handle for the first time back in May.

Unitedhealth Group Inc. (UNH) soared 5.55% to $544.16 per share on Tuesday after it reported better-than-expected earnings in Q2, helping to send the Dow Jones further into the stratosphere. Over two-thirds of the Dow Jones in in the green for the day, though tech stocks and AI-adjacents suffered small losses as the market pivots into rate cut exposure.

Merck & Co Inc. (MRK) fell -1.5% to $126.20 per share, followed closely by Microsoft Corp. (MSFT) and Intel Corp. (INTC), falling -1.43% and -1.2%, respectively.

Dow Jones technical outlook

Buyers ran a clinic on short interest on Tuesday, sending the Dow Jones into a record intraday high for the second day in a row. Technical resistance has evaporated on the top end as the major equity index is on pace for one of its best single-day performances of 2024.

The Dow Jones has climbed over 4% and counting over the past five trading days and the index is set to challenge the 41,000.00 technical level sooner rather than later.

Dow Jones five minute chart

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.

- Mexican Peso strengthens by 0.35% as traders fully price in the Fed rate cut for September.

- Banxico’s dovish comments and Fed Chair Powell’s balanced mandate remarks influence market sentiment.

- US Dollar Index (DXY) rises slightly to 104.18; US Retail Sales data meet expectations.

The Mexican Peso recovered and registered gains of more than 0.35% against the US Dollar on Tuesday as traders had fully priced in the Federal Reserve's decision to cut interest rates in September. This will widen the interest rate differential between Mexico and the US, boosting the emerging market currency; hence, the USD/MXN trades at 17.65, down 0.40%.

Mexico’s economic docket remains absent for the current week. Yet, dovish comments by Bank of Mexico’s (Banxico) Deputy Governor Omar Mejia Castelazo spurred a leg-up in the USD/MXN pair.

Across the borders, Federal Reserve Chair Jerome Powell said the US economy fared well in the last couple of years and that they need further confidence in the disinflation process to lower borrowing costs. Powell added that the dual mandate risks had become more balanced and stated, “There is no slack in the labor market…essentially, we’re at equilibrium now.”

Later, San Francisco Fed President Mary Daly said that “confidence is growing that inflation is heading towards the US central bank’s 2% goal.”

In the meantime, the CME FedWatch Tools show the chances for a quarter of a percentage rate cut to the federal funds rate are at 100%, capping the Greenback’s advance. The US Dollar Index (DXY), which tracks the buck's performance against the other six currencies, rose 0.10% to 104.18.

US data-wise, the US Census Bureau revealed that Retail Sales in June were unchanged as expected, excluding autos, which rose sharply, exceeding forecasts.

Daily digest market movers: Mexican Peso appreciates on Fed rate cut bets

- Mexico’s economic docket will be absent during the week, resuming on July 22, when the National Statistics Agency (INEGI) reveals growth figures for the month of May. Nevertheless, Bank of Mexico (Banxico) policymakers and political developments could rock the boat.

- Banxico’s Deputy Governor Omar Mejia Castelazo's recent comments on interest rates have sparked significant interest in the financial markets. Mejia, the sole dissenter in Banxico’s June 27 monetary policy decision, advocated for a quarter of a percentage rate cut, emphasizing the need for any rate adjustments to be gradual and not continuous, adding that further easing would not imply the beginning of a cycle of interest rate cuts.

- Mexico’s June inflation figures were higher than expected due to a rise in food prices when most economists expect Banxico to resume lowering interest rates.

- US Retail Sales in June were flat at 0% MoM, as expected. Core sales expanded by 0.4% MoM, above the 0.1% projected by the consensus.

- Export and Import Prices for the same period decreased, with the former dropping -0.5% MoM, below forecasts of -0.1%. Import prices rose compared to May’s -0.2% plunge and came at 0%, beneath estimates of 0.2% increase.

- June consumer inflation figures were lower than expected in the United States, increasing the chances that the Federal Reserve would lower borrowing costs in 2024 by at least 54 basis points, according to the December 2024 fed funds rate futures contract.

Technical analysis: Mexican Peso climbs as USD/MXN tumbles below 17.70

The USD/MXN is downward biased despite Monday’s upward correction, which breached last Friday’s high of 17.80. Momentum is bearish, as depicted by the Relative Strength Index (RSI), but strong support is found at the 50-day Simple Moving Average (SMA) at 17.63.

In the outcome of a breach under the 50-day SMA, the first support would be the December 5 high at 17.56, followed by the 200-day SMA at 17.27. Further losses would test the 100-day SMA at 17.21.

Conversely, if USD/MXN aims up, the next resistance would be the June 24 low-turned resistance at 17.87, followed by the 18.00 figure. Further upside potential is seen above the July 5 high at 18.19, followed by the June 28 high of 18.59, allowing buyers to aim for the YTD high of 18.99.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- Canadian Dollar went sideways after misfire in Canadian CPI inflation.

- Canada reported a downturn in near-term CPI, but BoC YoY CPI ticked up.

- US Retail Sales print kicks off a fresh round of rate cut hopes.

The Canadian Dollar (CAD) went sideways on Tuesday after CAD traders found little reason to bid too firmly in either direction after a mixed Canadian Consumer Price Index (CPI) inflation print. US data dominated market focus, with a soft print driving broad-market bets of a September rate cut even higher.

With Canadian CPI inflation out of the way, the next data beat worth focusing on for CAD traders will be Friday’s upcoming Canadian Retail Sales. Median market forecasts expect a return to contraction territory in monthly figures after June data recovered from a three-month streak of negative Canadian Retail Sales growth.

Daily digest market movers: Canadian Dollar furrowed by lopsided CPI print, Fed rate cut bets max out

- Headline Canadian CPI inflation in June contracted -0.1% MoM versus the previous 0.6%, missing the forecast slowdown to 0.1%.

- Annualized Canadian CPI eased to 2.7% from the previous 2.9%.

- The Bank of Canada’s (BoC) own CPI inflation gauge likewise fell to -0.1% from 0.6% MoM, while the YoY figure accelerated to 1.9% from the previous 1.8%.

- US Retail Sales fell flat in June, printing at the expected 0.0% MoM compared to the previous month’s 0.3% (revised from 0.1%).

- With a steeper-than-expected decline post-revision, market bets of a Federal Reserve (Fed) rate cut in September have been pinned to the ceiling.

- Rate traders are pricing in 100% odds of at least a quarter-point rate trim in September, according to the CME’s FedWatch Tool.

Canadian Dollar PRICE Today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.09% | 0.11% | 0.30% | 0.03% | 0.54% | 0.60% | -0.09% | |

| EUR | -0.09% | 0.01% | 0.22% | -0.04% | 0.43% | 0.50% | -0.19% | |

| GBP | -0.11% | -0.01% | 0.21% | -0.05% | 0.42% | 0.48% | -0.17% | |

| JPY | -0.30% | -0.22% | -0.21% | -0.28% | 0.26% | 0.29% | -0.34% | |

| CAD | -0.03% | 0.04% | 0.05% | 0.28% | 0.51% | 0.56% | -0.09% | |

| AUD | -0.54% | -0.43% | -0.42% | -0.26% | -0.51% | 0.04% | -0.62% | |

| NZD | -0.60% | -0.50% | -0.48% | -0.29% | -0.56% | -0.04% | -0.65% | |

| CHF | 0.09% | 0.19% | 0.17% | 0.34% | 0.09% | 0.62% | 0.65% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Canadian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent CAD (base)/USD (quote).

Technical analysis: Canadian Dollar flattens amid a mild uptick in intraday volatility

The Canadian Dollar (CAD) found some chart churn on Tuesday, but struggled to develop any meaningful momentum as CAD traders failed to find a reason to push the needle too far in either direction. The CAD is trading within one-tenth of one percent against its major competitors the US Dollar (USD), Euro (EUR), and Pound Sterling (GBP), while gains of around one-half of one percent against the Australian Dollar (AUD) and the New Zealand Dollar (NZD) were owed to weakness in the Antipodeans.

USD/CAD continued to battle the 1.3700 handle as broad-market bidding bolstered the Greenback. Intraday momentum has evaporated into a choppy standstill just beneath the key handle as bidders struggle to push the pair into further gains after last week’s recovery from a swing low below 1.3600.

USD/CAD hourly chart

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

Gold markets lurched into a fresh all-time high on Tuesday as rate markets fully price in a September rate cut from the Federal Reserve (Fed). US Retail Sales slumped flat in June, piling soft data on top of more soft data after last week's US Consumer Price Index (CPI) inflation print cooled more than expected.

With US data softening and growing concerns about an economic downturn weighing on the US domestic economy, rate cut bets have been pinned to the ceiling and investors are piling into Gold, pushing XAU/USD to a record high of $2,465.30 during Tuesday's US market session.

XAU/USD hourly chart

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

- US Retail Sales saw a slight uptick in June.

- USD's overall outlook still remains skewed to the downside due to dovish bets on the Fed.

- Markets remain confident about a September cut.

On Tuesday, the US Dollar, as measured by the DXY index, saw some gains following promising results in June’s Retail Sales figures reported during the European session.

That being said, the US economic outlook shows indications of disinflation, bolstering the markets' confidence in a rate cut in September. Federal Reserve officials, however, are maintaining a cautious stance, emphasizing their reliance on data before making any significant moves.

Daily digest market movers: DXY sees some light following encouraging Retail Sales, outlook still negative

- As the week began, the USD found itself under pressure due to the effect of the previous week's inflation statistics, which fueled confidence among traders for a likely rate cut in September.

- On the data front, retail sales remained flat at 0.0%, though the previously reported increase of 0.1% was revised upward to 0.3%.

- Retail Sales ex Autos rose by 0.4% after the 0.1% decline in May. That same -0.1% has been revised to 0.1%.

- The CME FedWatch Tool broadly supports the notion of a rate cut in September, with the odds currently standing over 85% for a 25-basis-point cut.

DXY Technical Outlook: Bearish attitude steady while bulls make a stride to recover the 200-day SMA

The outlook for the USD remains bearish despite the DXY index regaining the 200-day Simple Moving Average (SMA). Technical indicators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are both deep in negative terrain, suggesting it’s the seller's time now.

Despite losing more than 0.80% towards the end of last week, a slight upward correction may occur. Nonetheless, the bullish momentum gained on Tuesday is fragile, making the overall technical outlook decidedly bearish.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

The Dollar Index (DXY) initially rose 0.2% to 104.32 on the “Trump Trade”, but returned to last Friday’s 104.09. DXY needs to break below 104 to move towards 103, DBS Senior FX Strategist Philip Wee notes.

DXY turns up after Powell’s comments

“DXY appreciated slightly by 0.1% to 104.19 amid a 4.7 bps increase in the US Treasury 10Y bond yield to 4.23%. DXY initially rose 0.2% to 104.32 on the “Trump Trade” triggered by the assassination attempt on presidential candidate Donald Trump. However, DXY returned to last Friday’s 104.09 close in anticipation of a dovish interview by Federal Reserve Chair Jerome Powell.”

“Apart from expressing more confidence about US inflation returning to the 2% target, Powell said the Fed could lower rates before inflation hit the target, especially if the labour market weakened unexpectedly. However, DXY started turning up after Powell clearly stated that the Fed was not there yet to provide time-based guidance on rate cuts.”

“DXY needs to break below 104, the support levels in April and June, before it can think about revisiting the year’s low beneath 103. Meanwhile, the DXY’s upside is capped around 104.4-104.8 where its 200- and 100-day moving averages are located.”

Crude oil markets could be about to break down. A downtape could now force trend-followers to liquidate a massive -40% of their max size, TDS senior commodity strategist Daniel Ghali notes.

Trend-followers to liquidate -40% of their max size

“Crude oil markets could be about to break down. The downside in crude markets has remained relatively tame over the last weeks; a downtape could now force trend-followers to liquidate a massive -40% of their max size, suggesting the window for large-scale algorithmic liquidations is now open.”

“With our gauge of global commodity demand trending notably lower, we expect downside pressures to continue to build without an additional boost to supply risk.”

- GBP/USD down 0.14%, after failing to break 1.3000 level.

- Technical outlook shows upward bias, but RSI hints at profit booking.

- Key support at 1.2894, with resistance at 1.2995 and 1.3000, ahead of UK inflation data release.

The Pound Sterling begins the North American session on the backfoot and registers losses of 0.14% after failing to crack the 1.3000 figure. The lack of economic data from the United Kingdom boosted the Greenback, which was battered last week. The GBP/USD trades at 1.2946 after hitting a daily high of 1.2979.

GBP/USD Price Analysis: Technical outlook

From a daily chart perspective, the GBP/USD remains upward biased as price action has registered successive series of higher highs and higher lows, though the bullish momentum has slightly vanished. The Relative Strength Index (RSI) remains bullish, but exiting from overbought conditions triggered a sell signal, hinting that buyers are booking profits ahead of the release of UK inflation data on Wednesday.

If GBP/USD drops below the March 8 peak turned support at 1.2894, that would sponsor a leg down to challenge the June 12 high at 1.2860. Further losses are seen beneath those two levels, extending toward the 1.2800 figure, ahead of the 50-day moving average (DMA) at 1.2723.

On the other hand, if GBP/USD holds the forth above 1.2900 and climbs past 1.2950, the first resistance would be the July 27, 2023 high at 1.2995 ahead of 1.3000. Further gains lie overhead at 1.3125, July 18, 2023, peak, followed by last year’s top at 1.3142.

GBP/USD Price Action – Daily Chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, aka ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).