- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 16-07-2014

Stock indices closed higher, supported by gains of Portuguese banks and the better-than-expected Chinese gross domestic product. Banco Espirito Santo SA shares jumped 18% as Diario Economico reported the bank may raise 2 billion euros from new shareholders.

China's gross domestic product rose 7.5% in the second quarter, exceeding expectations for a 7.4% increase, after a 7.4% in the previous quarter.

Eurozone's trade balance surplus rose to €15.3 billion in May from €15.2 billion in April, missing expectations for an increase to €16.3 billion. April's figure was revised down from a surplus of €15.8 billion.

The unemployment rate in the UK decreased to 6.5% in the three months to May, from 6.6% in the previous three months. That was the lowest level since October to December 2008.

Husqvarna AB shares surged 7.9% after reporting the better-than-expected second-quarter operating income.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,784.67 +74.22 +1.11%

DAX 9,859.27 +139.86 +1.44%

CAC 40 4,369.06 +63.75 +1.48%

The U.S. dollar traded higher against the most major currencies. The U.S. currency remained supported by yesterday's comments by the Fed Chair Janet Yellen. The Fed Chair said the economy in the U.S. is continuing to improve but the recovery is not yet complete. She added that if the labour market continues to improve more quickly, the Fed will hike its interest rate sooner than expected, but weaker conditions will mean a longer period of low interest rate.

The U.S. producer price index rose 0.4% in June, exceeding expectations for a 0.2% increase, after a 0.2% decline in May.

On a yearly basis, producer prices climbed 1.9%, beating forecasts of a 1.8% rise, after a 2.0% gain in May.

Producer price index excluding food and energy climbed 0.2% in June, missing expectations for a 0.3% gain, after a 0.1 fall in May.

On a yearly basis, the PPI excluding food and energy gained 1.8%, exceeding expectations for a 1.7% rise, after 2.0% increase May.

Net foreign purchases of long-term securities rose to $19.4 billion in May, missing expectations for an increase to $27.4 billion, after net sales of $41.2 billion in April. April's figure was revised down from net sales of $24.2 billion.

Industrial production in the U.S. climbed 0.2% in June, missing forecasts of a 0.4% gain, after a 0.5% rise in May. May's figure was revised down from a 0.6% increase.

The NAHB housing market index increased to 53 in July from 49 in June, beating expectations for a rise to 51.

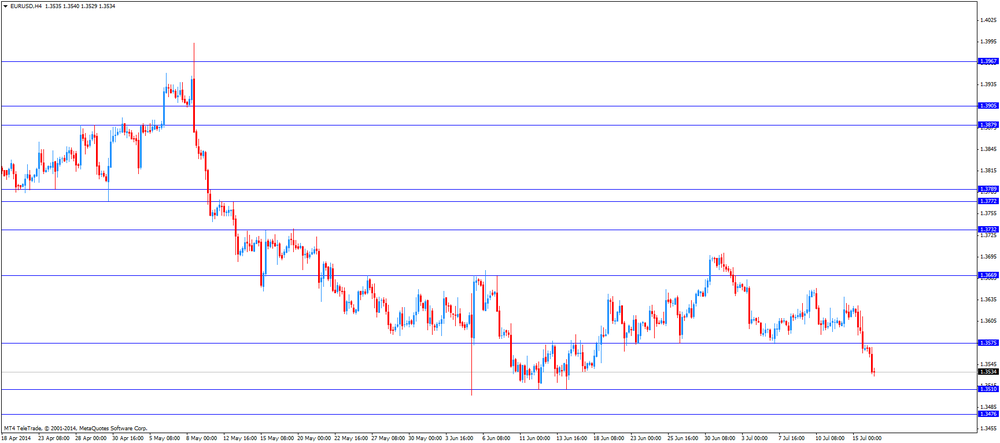

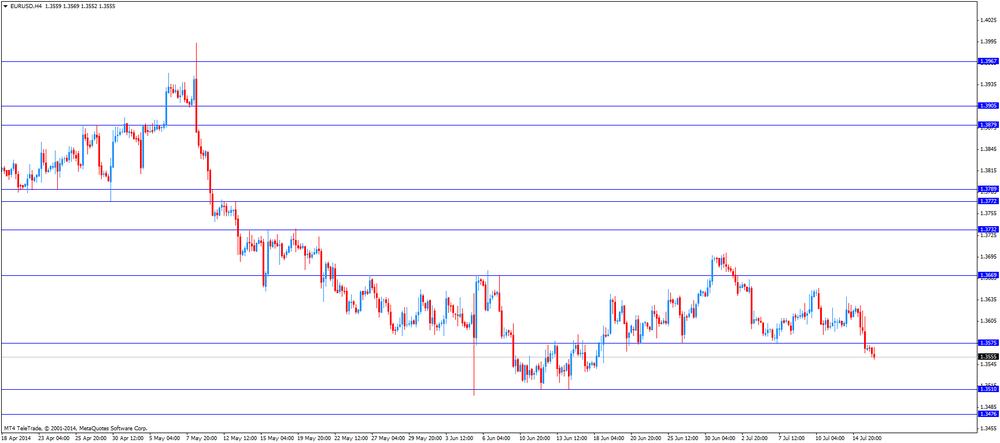

The euro traded lower against the U.S. dollar after the weaker-than-expected trade data from the Eurozone. Eurozone's trade balance surplus rose to €15.3 billion in May from €15.2 billion in April, missing expectations for an increase to €16.3 billion. April's figure was revised down from a surplus of €15.8 billion.

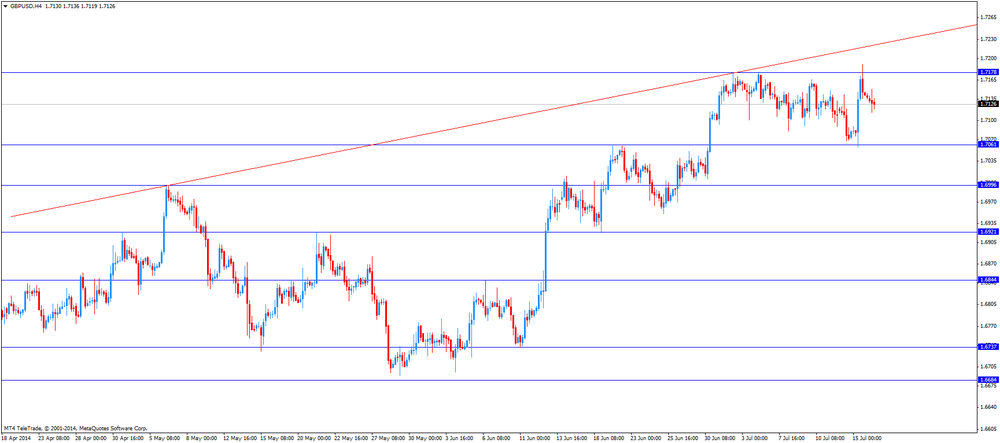

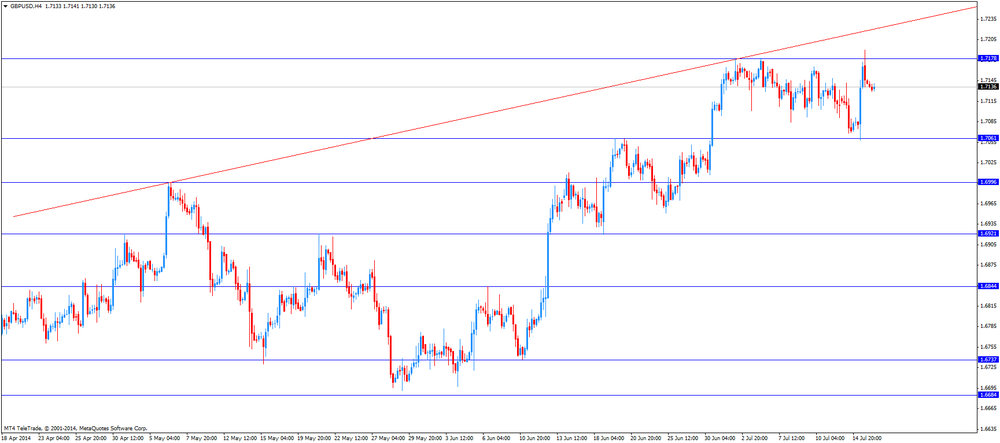

The British pound traded mixed against the U.S. dollar despite the better-than-expected labour market data from UK. The unemployment rate in the UK decreased to 6.5% in the three months to May, from 6.6% in the previous three months. That was the lowest level since October to December 2008.

Analysts had expected the unemployment rate to remain unchanged at 6.5%.

The number of people claiming unemployment benefit dropped by 36,300 in June, exceeding expectations for a decline by 27,100, after, after a fall by 27,400 in May.

These strong figures could mean that the Bank of England will hike its interest rate sooner than expected, perhaps before the end of the year.

But there is a problem. The growth in real wages remains weak. Average weekly earnings, excluding bonuses, increased by an annual 0.7% in the three months to May, after a 0.9% rise in the previous three months. That was the slowest growth since records began in 2001. Inflation over the same period was 1.6%.

Average weekly earnings, including bonuses, rose by an annual 0.3% in the three months to May, after a revised 0.8% rise in the previous three months.

The Swiss franc traded lower against the U.S. dollar after the weaker-than-expected ZEW/ Credit Suisse index for economic expectations. The ZEW/ Credit Suisse index for economic expectations in Switzerland declined to 0.1 in July from 4.8 in June.

The Canadian dollar traded slightly higher against the U.S. dollar after the Bank of Canada's interest rate decision. The BoC kept unchanged its interest rate at 1.00%. Canada's central bank said consumer inflation increased sooner than expected, caused by higher energy and import prices. The BoC added that it is is neutral with respect to the timing and direction of the next change to the interest rate.

Canadian manufacturing shipments gained 1.6% in May, beating forecasts of 0.4% rise, after a 0.2% decline in April. April' s figure was revised down from a 0.1% decrease.

The New Zealand dollar dropped against the U.S dollar due to the weaker-than-expected inflation data from New Zealand and yesterday's comments by the Fed Chair Janet Yellen, but later recovered a part of its losses. New Zealand's consumer price index increased 0.3% in the second quarter, missing expectations for a 0.5% rise, after a 0.3% gain in the previous quarter.

On a yearly basis, the consumer price index in New Zealand rose 1.6% in the second quarter, after a 1.5% increase in the previous quarter.

The Australian dollar declined against the U.S. dollar due to yesterday's comments by the Fed Chair Janet Yellen, but later recovered a part of its losses. The leading index for Australia released by Westpac and the Melbourne Institute climbed 0.1% in June, after a 0.1% rise in the previous month.

Some better-than-expected economic data from China hadn't any positive impact on the Australian and New Zealand dollar. China's gross domestic product rose 7.5% in the second quarter, exceeding expectations for a 7.4% increase, after a 7.4% in the previous quarter.

Industrial production in China climbed 9.2% in June, beating forecasts for a 9.0% rise, after a 8.8% gain in May.

Fixed asset investment in China rose 17.3% in June period, exceeding expectations for a 17.2% gain, after a 17.2% increase in May.

Retail sales in China gained 12.4% in June, after 12.5% rise in May.

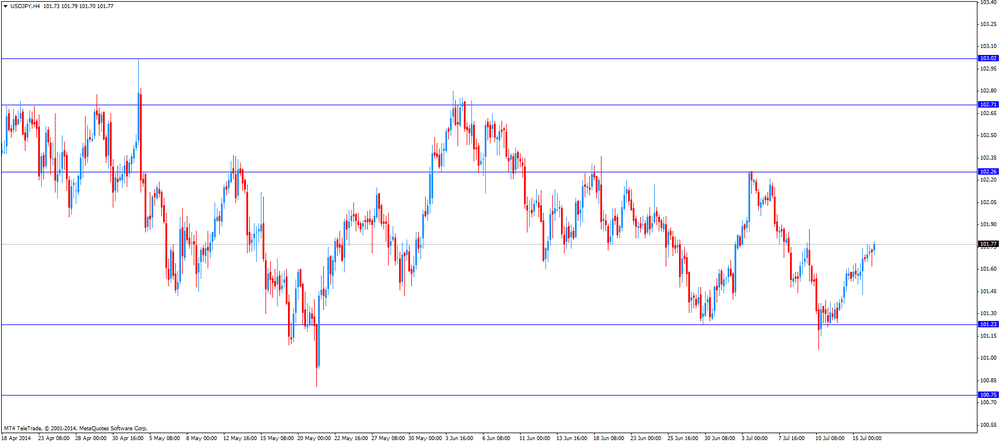

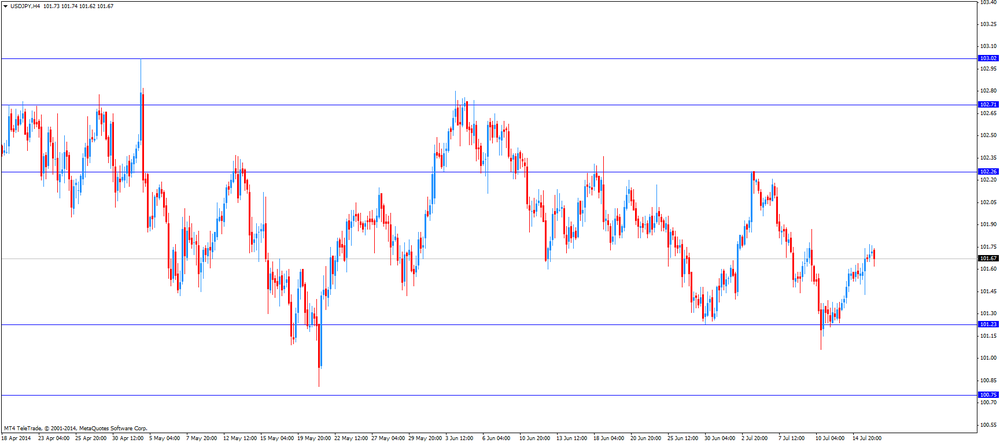

The Japanese yen traded mixed against the U.S. dollar dollar due to yesterday's comments by the Fed Chair Janet Yellen. The Bank of Japan (BoJ) said in its monthly report on Wednesday that Japan's economy has continued to recover moderately. The BoJ also said that Japan's output gap was 0.6% in January-March, turning positive for the first time since Q2 2008.

The price of oil rose today, while rising above $ 100.00 per barrel (mark WTI), as data from China pointed to more substantial growth than expected.

According to a report released today by the Bureau of Statistics in Beijing, the first time in the last three quarters of China's economic growth increased by 7.5% compared with a year earlier. In accordance with the average estimate of analysts, the index was 7.4%. Another indicator - industrial production - grew by 9.2% in June compared with a year earlier, exceeding the average analyst estimate of 95 and the May figure of 8.8%. In addition, in the first half of the investment in fixed assets, with the exception of rural households increased by 17.3% compared with a year earlier.

"Statistical data from China have become a positive factor for the oil market, as they indicate that the incentives bring results," - said a senior oil market analyst at Energy Aspects Amrita Sen

Market participants are also watching the situation in Libya. According to the latest information, Libya has increased oil production to 588,000 barrels per day, but various groups continue to fight for control of the international airport of the capital Tripoli.

The course of trade also influenced today's U.S. Department of Energy report that showed: commercial U.S. crude inventories last week fell by 7,525 thousand barrels - up to 375.04 million barrels., While gasoline inventories - increased by 171 thousand barrels. Gasoline inventories rose by 171 thousand barrels and reached 214,492 million barrels. Commercial distillate stocks rose by 2,528 thousand barrels, reaching 124,296 million barrels. Experts expected a decrease of oil reserves by 2750 thousand barrels, gasoline inventories increase by 950 thousand barrels and distillate stocks increase for 2000 thousand barrels. We also learned that the oil terminal in Cushing last week fell by 0.65 million barrels to 20.273 million barrels and refinery utilization in the United States rose to 93.8% against 91.6% a week earlier

Recall that yesterday, the American Petroleum Institute (API) reported a decline in oil inventory in the U.S. by 4.8 million barrels, and the reduction of stocks at the terminal in Cushing at 944 thousand barrels per day. It was also said that distillate stocks rose by 1.3 million barrels, while gasoline inventories fell by 1.6 million barrels.

Cost of the August futures on U.S. light crude oil WTI (Light Sweet Crude Oil) rose to $ 101.25 per barrel on the New York Mercantile Exchange (NYMEX).

August futures price for North Sea Brent crude oil mixture fell $ 0.40 to $ 106.21 a barrel on the London exchange ICE Futures Europe.

The Bank of Canada (BoC) released its interest rate decision today:

- The BoC kept its interest rate unchanged at 1.00%;

- Consumer inflation increased to around 2%, sooner than expected;

- Core inflation also increased but remains below 2%;

- The pace of inflation has been caused by higher energy and import prices;

- The central bank lowered its GDP growth forecasts to 2.2 and 2.4 per cent, this year and next;

- The BoC expects Canada's economy to return to full capacity full capacity around mid-2016;

- The central bank is neutral with respect to the timing and direction of the next change to the interest rate.

Gold futures rose moderately today, offsetting more than half of yesterday's fall, which was associated with the release of better than expected U.S. data on producer price index.

U.S. Labor Department reported that the producer price index for final demand rose by a seasonally adjusted 0.4% in June compared with the previous month. It was more than 0.2% increase on the forecast of economists, and a 0.2% decline in May.

In June, producer prices rose by 1.9% compared with a year ago, slightly less than 2% of the annual increase tion in May and increase in April by 2.1%. The rise in prices in June was led by a 2.1 percent increase in energy prices. Gasoline prices rose by 6.4% at the beginning of the summer driving season, while accommodation and airline passenger traffic has also increased. Food prices fell 0.2%, showing a decline for the second month in a row after a sharp rise earlier this year.

Investors will also pay attention to today's speech of Fed Janet Yellen before the Financial Services Committee of the House of Representatives. In general, she repeated her speech yesterday, saying that the U.S. economic recovery is not yet complete, despite a marked improvement in recent years, and a high degree of accommodation of monetary policy is still needed. As an example, Yellen noted the continuing weakness of the labor market. She made it clear that, if the situation on the labor market will stabilize sooner than expected, and that the rate increase may occur earlier than planned FOMC. However, as she believes that rates will remain low for a long time after the completion of QE. Fed chief expressed concerns about the recovery of the housing market, which has recently slowed.

"Despite the fact that the Fed's Yellen position has conservation soft policy, gold markets interpreted her words about the possibility of an early increase in interest rates as a negative for gold," - analysts said HSBC.

Apparently, in the coming days the price of gold price dynamics will be limited to the level of support $ 1290.0 per ounce and resistance level $ 1310.0 per ounce, experts say.

The cost of the August gold futures on the COMEX today rose to $ 1303.20 per ounce.

The U.S. Labor Department released producer prices on Wednesday. The U.S. producer price index rose 0.4% in June, exceeding expectations for a 0.2% increase, after a 0.2% decline in May.

On a yearly basis, producer prices climbed 1.9%, beating forecasts of a 1.8% rise, after a 2.0% gain in May.

Food prices dropped 0.2%. That was a second straight month decline. Gasoline prices rose 6.4%. That was the largest increase since September 2012.

Producer price index excluding food and energy climbed 0.2% in June, missing expectations for a 0.3% gain, after a 0.1 fall in May.

On a yearly basis, the PPI excluding food and energy gained 1.8%, exceeding expectations for a 1.7% rise, after 2.0% increase May.

EUR/USD $1.3550, $1.3570, $1.3600, $1.3620/30

USD/JPY Y101.00, Y101.30, Y101.80/90

AUD/USD $0.9350, $0.9395

GBP/USD $1.7025, $1.7050, $1.7075, $1.7100/05

EUR/GBP Stg0.7915

USD/CAD C$1.0700, C$1.0725/30

NZD/USD $0.8660

EUR/CHF Chf1.2125

U.S. stock futures advanced as companies from Apple Inc. to Time Warner Inc. and Intel Corp. rallied amid deals and earnings reports while data showed China's second-quarter economic growth topped estimates.

Global markets:

Nikkei 15,379.3 -15.86 -0.10%

Hang Seng 23,523.28 +63.32 +0.27%

Shanghai Composite 2,067.28 -3.08 -0.15%

FTSE 6,788.19 +77.74 +1.16%

CAC 4,371.73 +66.42 +1.54%

DAX 9,862.82 +143.41 +1.48%

Crude oil $100.73 (+0.77%)

Gold $1300.40 (+0.25%)

(company / ticker / price / change, % / volume)

| E. I. du Pont de Nemours and Co | DD | 64.61 | +0.05% | 0.1K |

| Nike | NKE | 78.13 | +0.13% | 2.0K |

| Merck & Co Inc | MRK | 58.00 | +0.16% | 0.7K |

| Home Depot Inc | HD | 80.03 | +0.21% | 0.9K |

| Visa | V | 222.31 | +0.24% | 0.6K |

| Chevron Corp | CVX | 129.59 | +0.26% | 1.3K |

| Exxon Mobil Corp | XOM | 102.66 | +0.26% | 1.3K |

| Goldman Sachs | GS | 169.66 | +0.29% | 3.9K |

| AT&T Inc | T | 36.35 | +0.30% | 6.8K |

| Pfizer Inc | PFE | 30.50 | +0.30% | 0.4K |

| Johnson & Johnson | JNJ | 103.60 | +0.31% | 6.0K |

| Travelers Companies Inc | TRV | 96.25 | +0.31% | 0.4K |

| Verizon Communications Inc | VZ | 50.87 | +0.32% | 7.4K |

| United Technologies Corp | UTX | 115.22 | +0.33% | 0.6K |

| Boeing Co | BA | 129.56 | +0.36% | 2.1K |

| Cisco Systems Inc | CSCO | 25.77 | +0.39% | 7.0K |

| General Electric Co | GE | 26.72 | +0.41% | 4.4K |

| American Express Co | AXP | 94.85 | +0.42% | 4.5K |

| Caterpillar Inc | CAT | 110.38 | +0.48% | 0.7K |

| JPMorgan Chase and Co | JPM | 58.55 | +0.48% | 14.0K |

| Microsoft Corp | MSFT | 42.67 | +0.52% | 9.5K |

| International Business Machines Co... | IBM | 191.90 | +1.81% | 19.9K |

| Intel Corp | INTC | 33.45 | +5.49% | 812.4K |

| UnitedHealth Group Inc | UNH | 83.90 | 0.00% | 3.0K |

| McDonald's Corp | MCD | 99.71 | -0.59% | 18.1K |

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Leading Index May +0.1% +0.1%

02:00 China Retail Sales y/y June +12.5% +12.4%

02:00 China Industrial Production y/y June +8.8% +9.0% +9.2%

02:00 China Fixed Asset Investment June +17.2% +17.2% +17.3%

02:00 China GDP y/y Quarter II +7.4% +7.4% +7.5%

05:00 Japan BoJ monthly economic report July

08:30 United Kingdom Average earnings ex bonuses, 3 m/y May +0.9% +0.7%

08:30 United Kingdom Average Earnings, 3m/y May +0.7% +0.7% +0.3%

08:30 United Kingdom Claimant count June -27.4 -27.1 -36.3

08:30 United Kingdom Claimant Count Rate June 3.2% 3.2% 3.1%

08:30 United Kingdom ILO Unemployment Rate May 6.6% 6.6% 6.5%

09:00 Eurozone Trade Balance s.a. May 15.8 16.3 15.3

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) July 4.8 0.1

The U.S. dollar traded higher against the most major currencies. The U.S. currency remained supported by yesterday's comments by the Fed Chair Janet Yellen. The Fed Chair said the economy in the U.S. is continuing to improve but the recovery is not yet complete. She added that if the labour market continues to improve more quickly, the Fed will hike its interest rate sooner than expected, but weaker conditions will mean a longer period of low interest rate.

The Fed Chair Yellen will testifiy before the House Financial Services Committee today.

The euro fell against the U.S. dollar after the weaker-than-expected trade data from the Eurozone. Eurozone's trade balance surplus rose to €15.3 billion in May from €15.2 billion in April, missing expectations for an increase to €16.3 billion. April's figure was revised down from a surplus of €15.8 billion.

The British pound traded lower against the U.S. dollar despite the better-than-expected labour market data from UK. The unemployment rate in the UK decreased to 6.5% in the three months to May, from 6.6% in the previous three months. That was the lowest level since October to December 2008.

Analysts had expected the unemployment rate to remain unchanged at 6.5%.

The number of people claiming unemployment benefit dropped by 36,300 in June, exceeding expectations for a decline by 27,100, after, after a fall by 27,400 in May.

These strong figures could mean that the Bank of England will hike its interest rate sooner than expected, perhaps before the end of the year.

But there is a problem. The growth in real wages remains weak. Average weekly earnings, excluding bonuses, increased by an annual 0.7% in the three months to May, after a 0.9% rise in the previous three months. That was the slowest growth since records began in 2001. Inflation over the same period was 1.6%.

Average weekly earnings, including bonuses, rose by an annual 0.3% in the three months to May, after a revised 0.8% rise in the previous three months.

The Swiss franc dropped against the U.S. dollar after the weaker-than-expected ZEW/ Credit Suisse index for economic expectations. The ZEW/ Credit Suisse index for economic expectations in Switzerland declined to 0.1 in July from 4.8 in June.

The Canadian dollar traded mixed against the U.S. dollar ahead of the Bank of Canada's interest rate decision. Analysts expect the BoC will keep unchanged its interest rate at 1.00%.

EUR/USD: the currency pair declined to $1.3529

GBP/USD: the currency pair decreased to $1.7113

USD/JPY: the currency pair climbed to Y101.79

The most important news that are expected (GMT0):

12:30 Canada Manufacturing Shipments (MoM) May -0.1% +0.4%

12:30 U.S. PPI, m/m June -0.2% +0.2%

12:30 U.S. PPI, y/y June +2.0% +1.8%

12:30 U.S. PPI excluding food and energy, m/m June -0.1% +0.3%

12:30 U.S. PPI excluding food and energy, Y/Y June +2.0% +1.7%

13:00 U.S. Net Long-term TIC Flows May -24.2 27.4

13:00 U.S. Total Net TIC Flows May 136.8

13:15 U.S. Industrial Production (MoM) June +0.6% +0.4%

13:15 U.S. Capacity Utilization June 79.1% 79.4%

14:00 Canada Bank of Canada Rate 1.00% 1.00%

14:00 Canada Bank of Canada Monetary Policy Report

14:00 Canada BOC Rate Statement

14:00 U.S. Federal Reserve Chair Janet Yellen Testifies

14:00 U.S. NAHB Housing Market Index July 49 51

15:15 Canada BOC Press Conference

16:00 U.S. FOMC Member Richard Fisher Speaks

18:00 U.S. Fed's Beige Book July

EUR/USD

Offers $1.3640, $1.3590/600

Bids $1.3520, $1.3500, $1.3485/80

GBP/USD

Offers $1.7200

Bids $1.7055, $1.7040/30

AUD/USD

Offers $0.9450, $0.9420, $0.9400

Bids $0.9320, $0.9300, $0.9250

EUR/JPY

Offers Y138.80, Y138.50, Y138.20, Y137.95/00

Bids Y137.50, Y137.20, Y137.00, Y136.50

USD/JPY

Offers Y102.20, Y102.00, Y101.80

Bids Y101.50, Y101.20, Y101.00, Y100.80

EUR/GBP

Offers stg0.8000, stg0.7980/85

Bids stg0.7890, stg0.7880, stg0.7850

Stock indices traded higher due to the better-than-expected Chinese gross domestic product. China's gross domestic product rose 7.5% in the second quarter, exceeding expectations for a 7.4% increase, after a 7.4% in the previous quarter.

Markets participants are awaiting the Fed Chair Yellen's testimony before the House Financial Services Committee later in the day.

Eurozone's trade balance surplus rose to €15.3 billion in May from €15.2 billion in April, missing expectations for an increase to €16.3 billion. April's figure was revised down from a surplus of €15.8 billion.

The unemployment rate in the UK decreased to 6.5% in the three months to May, from 6.6% in the previous three months. That was the lowest level since October to December 2008.

Banco Espirito Santo SA shares increased 5.3%.

Current figures:

Name Price Change Change %

FTSE 100 6,771.67 +61.22 +0.91%

DAX 9,838.01 +118.60 +1.22%

CAC 40 4,366.16 +60.85 +1.41%

The Office for National Statistics in the UK released the labour market data. The unemployment rate in the UK decreased to 6.5% in the three months to May, from 6.6% in the previous three months. That was the lowest level since October to December 2008.

Analysts had expected the unemployment rate to remain unchanged at 6.5%.

The number of people claiming unemployment benefit dropped by 36,300 in June, exceeding expectations for a decline by 27,100, after, after a fall by 27,400 in May.

These strong figures could mean that the Bank of England will hike its interest rate sooner than expected, perhaps before the end of the year.

But there is a problem. The growth in real wages remains weak. Average weekly earnings, excluding bonuses, increased by an annual 0.7% in the three months to May, after a 0.9% rise in the previous three months. That was the slowest growth since records began in 2001. Inflation over the same period was 1.6%.

Average weekly earnings, including bonuses, rose by an annual 0.3% in the three months to May, after a revised 0.8% rise in the previous three months.

Asian stock indices traded little changed after the better-than-expected economic data from China. China's gross domestic product rose 7.5% in the second quarter, exceeding expectations for a 7.4% increase, after a 7.4% in the previous quarter.

Industrial production in China climbed 9.2% in June, beating forecasts for a 9.0% rise, after a 8.8% gain in May.

Fixed asset investment in China rose 17.3% in June period, exceeding expectations for a 17.2% gain, after a 17.2% increase in May.

Retail sales in China gained 12.4% in June, after 12.5% rise in May.

The Bank of Japan (BoJ) said in its monthly report on Wednesday that Japan's economy has continued to recover moderately. The BoJ also said that Japan's output gap was 0.6% in January-March, turning positive for the first time since Q2 2008.

TPK Holding Co. shares declined 4.9%.

Indexes on the close:

Nikkei 225 15,379.3 -15.86 -0.10%

Hang Seng 23,523.28 +63.32 +0.27%

Shanghai Composite 2,067.28 -3.08 -0.15%

EUR/USD $1.3550, $1.3570, $1.3600, $1.3620/30

USD/JPY Y101.00, Y101.30, Y101.80/90

AUD/USD $0.9350, $0.9395

GBP/USD $1.7025, $1.7050, $1.7075, $1.7100/05

EUR/GBP Stg0.7915

USD/CAD C$1.0700, C$1.0725/30

NZD/USD NZ$0.8660

EUR/CHF Chf1.2125

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Leading Index May +0.1% +0.1%

02:00 China Retail Sales y/y June +12.5% +12.4%

02:00 China Industrial Production y/y June +8.8% +9.0% +9.2%

02:00 China Fixed Asset Investment June +17.2% +17.2% +17.3%

02:00 China GDP y/y Quarter II +7.4% +7.4% +7.5%

05:00 Japan BoJ monthly economic report July

08:30 United Kingdom Average earnings ex bonuses, 3 m/y May +0.9% +0.7%

08:30 United Kingdom Average Earnings, 3m/y May +0.7% +0.7% +0.3%

08:30 United Kingdom Claimant count June -27.4 -27.1 -36.3

08:30 United Kingdom Claimant Count Rate June 3.2% 3.2% 3.1%

08:30 United Kingdom ILO Unemployment Rate May 6.6% 6.6% 6.5%

09:00 Eurozone Trade Balance s.a. May 15.8 16.3 15.3

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) July 4.8 0.1

The U.S. dollar traded higher against the most major currencies due to yesterday's comments by the Fed Chair Janet Yellen. The Fed Chair said the economy in the U.S. is continuing to improve but the recovery is not yet complete. She added that if the labour market continues to improve more quickly, the Fed will hike its interest rate sooner than expected, but weaker conditions will mean a longer period of low interest rate.

The Fed Chair Yellen will testifiy before the House Financial Services Committee today.

The New Zealand dollar dropped against the U.S dollar due to the weaker-than-expected inflation data from New Zealand and yesterday's comments by the Fed Chair Janet Yellen. New Zealand's consumer price index increased 0.3% in the second quarter, missing expectations for a 0.5% rise, after a 0.3% gain in the previous quarter.

On a yearly basis, the consumer price index in New Zealand rose 1.6% in the second quarter, after a 1.5% increase in the previous quarter.

The Australian dollar declined against the U.S. dollar due to yesterday's comments by the Fed Chair Janet Yellen. The leading index for Australia released by Westpac and the Melbourne Institute climbed 0.1% in June, after a 0.1% rise in the previous month.

Some better-than-expected economic data from China hadn't any positive impact on the Australian and New Zealand dollar. China's gross domestic product rose 7.5% in the second quarter, exceeding expectations for a 7.4% increase, after a 7.4% in the previous quarter.

Industrial production in China climbed 9.2% in June, beating forecasts for a 9.0% rise, after a 8.8% gain in May.

Fixed asset investment in China rose 17.3% in June period, exceeding expectations for a 17.2% gain, after a 17.2% increase in May.

Retail sales in China gained 12.4% in June, after 12.5% rise in May.

The Japanese yen traded lower against the U.S. dollar dollar due to yesterday's comments by the Fed Chair Janet Yellen. The Bank of Japan (BoJ) said in its monthly report on Wednesday that Japan's economy has continued to recover moderately. The BoJ also said that Japan's output gap was 0.6% in January-March, turning positive for the first time since Q2 2008.

EUR/USD: the currency pair declined to $1.3560

GBP/USD: the currency pair decreased to $1.7135

USD/JPY: the currency pair rose to Y101.80

The most important news that are expected (GMT0):

12:30 Canada Manufacturing Shipments (MoM) May -0.1% +0.4%

12:30 U.S. PPI, m/m June -0.2% +0.2%

12:30 U.S. PPI, y/y June +2.0% +1.8%

12:30 U.S. PPI excluding food and energy, m/m June -0.1% +0.3%

12:30 U.S. PPI excluding food and energy, Y/Y June +2.0% +1.7%

13:00 U.S. Net Long-term TIC Flows May -24.2 27.4

13:00 U.S. Total Net TIC Flows May 136.8

13:15 U.S. Industrial Production (MoM) June +0.6% +0.4%

13:15 U.S. Capacity Utilization June 79.1% 79.4%

14:00 Canada Bank of Canada Rate 1.00% 1.00%

14:00 Canada Bank of Canada Monetary Policy Report

14:00 Canada BOC Rate Statement

14:00 U.S. Federal Reserve Chair Janet Yellen Testifies

14:00 U.S. NAHB Housing Market Index July 49 51

15:15 Canada BOC Press Conference

16:00 U.S. FOMC Member Richard Fisher Speaks

18:00 U.S. Fed's Beige Book July

EUR / USD

Resistance levels (open interest**, contracts)

$1.3648 (2866)

$1.3624 (632)

$1.3694 (77)

Price at time of writing this review: $ 1.3559

Support levels (open interest**, contracts):

$1.3542 (4005)

$1.3497 (2624)

$1.3464 (7848)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 24722 contracts, with the maximum number of contracts with strike price $1,3800 (3700);

- Overall open interest on the PUT options with the expiration date August, 8 is 33597 contracts, with the maximum number of contracts with strike price $1,3500 (7848);

- The ratio of PUT/CALL was 1.36 versus 1.35 from the previous trading day according to data from July, 15

GBP/USD

Resistance levels (open interest**, contracts)

$1.7401 (1015)

$1.7303 (1277)

$1.7206 (1454)

Price at time of writing this review: $1.7123

Support levels (open interest**, contracts):

$1.7093 (2021)

$1.6996 (2276)

$1.6898 (1995)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 15929 contracts, with the maximum number of contracts with strike price $1,7250 (2196);

- Overall open interest on the PUT options with the expiration date August, 8 is 21684 contracts, with the maximum number of contracts with strike price $1,7000 (2276);

- The ratio of PUT/CALL was 1.36 versus 1.33 from the previous trading day according to data from Jule, 15

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

(raw materials / closing price /% change)

Light Crude 100.18 +0.22%

Gold 1,295.00 -0.16%

(index / closing price / change items /% change)

Nikkei 225 15,395.16 +98.34 +0.64%

Hang Seng 23,459.96 +113.29 +0.49%

Shanghai Composite 2,070.36 +3.71 +0.18%

FTSE 100 6,710.45 -35.69 -0.53%

CAC 40 4,305.31 -44.73 -1.03%

Xetra DAX 9,719.41 -63.60 -0.65%

S&P 500 1,973.28 -3.82 -0.19%

NASDAQ 4,416.39 -24.03 -0.54%

Dow Jones 17,060.68 +5.26 +0.03%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3567 -0,39%

GBP/USD $1,7141 +0,32%

USD/CHF Chf0,8956 +0,42%

USD/JPY Y101,68 +0,14%

EUR/JPY Y137,95 -0,25%

GBP/JPY Y174,28 +0,48%

AUD/USD $0,9367 -0,26%

NZD/USD $0,8761 -0,48%

USD/CAD C$1,0755 +0,42%

(time / country / index / period / previous value / forecast)

01:45 New Zealand CPI, q/q Quarter II +0.3% +0.5%

01:45 New Zealand CPI, y/y Quarter II +1.5%

03:30 Australia Leading Index May +0.1%

05:00 China Retail Sales y/y June +12.5% +12.5%

05:00 China Industrial Production y/y June +8.8% +9.0%

05:00 China Fixed Asset Investment June +17.2% +17.2%

05:00 China GDP y/y Quarter II +7.4% +7.4%

08:00 Japan BoJ monthly economic report July

11:30 United Kingdom Average earnings ex bonuses, 3 m/y May +0.9%

11:30 United Kingdom Average Earnings, 3m/y May +0.7% +0.7%

11:30 United Kingdom Claimant count June -27.4 -27.1

11:30 United Kingdom Claimant Count Rate June 3.2% 3.2%

11:30 United Kingdom ILO Unemployment Rate May 6.6% 6.6%

12:00 Eurozone Trade Balance s.a. May 15.8 16.3

12:00 Switzerland Credit Suisse ZEW Survey (Expectations) July 4.8

15:30 Canada Manufacturing Shipments (MoM) May -0.1% +0.4%

15:30 U.S. PPI, m/m June -0.2% +0.2%

15:30 U.S. PPI, y/y June +2.0% +1.8%

15:30 U.S. PPI excluding food and energy, m/m June -0.1% +0.3%

15:30 U.S. PPI excluding food and energy, Y/Y June +2.0% +1.7%

16:00 U.S. Net Long-term TIC Flows May -24.2 27.4

16:00 U.S. Total Net TIC Flows May 136.8

16:15 U.S. Industrial Production (MoM) June +0.6% +0.4%

16:15 U.S. Capacity Utilization June 79.1% 79.4%

17:00 Canada Bank of Canada Rate 1.00% 1.00%

17:00 Canada Bank of Canada Monetary Policy Report

17:00 Canada BOC Rate Statement

17:00 U.S. Federal Reserve Chair Janet Yellen Testifies

17:00 U.S. NAHB Housing Market Index July 49 51

17:30 U.S. Crude Oil Inventories July -2.4

18:15 Canada BOC Press Conference

19:00 U.S. FOMC Member Richard Fisher Speaks

21:00 U.S. Fed's Beige Book July

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.