- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 16-06-2014

Gold $1,274.90 -6.60 -0.52%

ICE Brent Crude Oil $112.83 -0.58 -0.51%

NYMEX Crude Oil $106.63 -0.70 -0.65%

Nikkei 14,933.29 -164.55 -1.09%

Hang Seng 23,300.67 -18.50 -0.08%

Shanghai Composite 2,085.98 +15.27 +0.74%

S&P 1,937.78 +1.62 +0.08%

NASDAQ 4,321.11 +10.45 +0.24%

Dow 16,781.01 +5.27 +0.03%

FTSE 1,383.95 -5.88 -0.42%

CAC 4,510.05 -33.23 -0.73%

DAX 9,883.98 -28.89 -0.29%

EUR/USD $1,3571 +0,22%

GBP/USD $1,6979 +0,08%

USD/CHF Chf0,8970 -0,31%

USD/JPY Y101,81 -0,21%

EUR/JPY Y138,17 +0,03%

GBP/JPY Y172,86 -0,13%

AUD/USD $0,9398 -0,02%

NZD/USD $0,8676 +0,12%

USD/CAD C$1,0841 -0,10%

01:30 Australia RBA Meeting's Minutes

01:30 Australia New Motor Vehicle Sales (MoM) May 0.0%

01:30 Australia New Motor Vehicle Sales (YoY) May -1.9%

05:45 Switzerland SECO Economic Forecasts Quarter III

07:15 Switzerland Producer & Import Prices, m/m May -0.3% 0.0%

07:15 Switzerland Producer & Import Prices, y/y May -1.2% -0.8%

08:30 United Kingdom Retail Price Index, m/m May +0.4% +0.2%

08:30 United Kingdom Retail prices, Y/Y May +2.5% +2.5%

08:30 United Kingdom RPI-X, Y/Y May +2.6%

08:30 United Kingdom Producer Price Index - Input (MoM) May -1.1% +0.1%

08:30 United Kingdom Producer Price Index - Input (YoY) May -5.5% -4.1%

08:30 United Kingdom Producer Price Index - Output (MoM) May 0.0% +0.1%

08:30 United Kingdom Producer Price Index - Output (YoY) May +0.6% +0.8%

08:30 United Kingdom HICP, m/m May +0.4% +0.2%

08:30 United Kingdom HICP, Y/Y May +1.8% +1.7%

08:30 United Kingdom HICP ex EFAT, Y/Y May +2.0%

09:00 Eurozone ZEW Economic Sentiment June 55.2 59.6

09:00 Germany ZEW Survey - Economic Sentiment June 33.1 35.2

12:30 U.S. Building Permits, mln May 1.08 1.07

12:30 U.S. Housing Starts, mln May 1.07 1.04

12:30 U.S. CPI, m/m May +0.3% +0.2%

12:30 U.S. CPI, Y/Y May +2.0% +2.0%

12:30 U.S. CPI excluding food and energy, m/m May +0.2% +0.2%

12:30 U.S. CPI excluding food and energy, Y/Y May +1.8% +1.8%

20:30 U.S. API Crude Oil Inventories June +1.5

22:45 New Zealand Current Account Quarter I -1.43 1.42

23:50 Japan Monetary Policy Meeting Minutes

23:50 Japan Adjusted Merchandise Trade Balance, bln May -808.9 -1100

Stock

indices fell due to escalating violence in Iraq weighed on stock markets and gas

dispute between Russia and Ukraine. The violence in Iraq could lead to

disruptions in the oil supplies in OPEC’s second-biggest oil producer. B

Russia

threats to cut off Ukraine gas supplies

Eurozone’s

harmonized consumer price index declined 0.1% in May, meeting expectations,

after a 0.2% gain in April. On a yearly basis, harmonized consumer price index

in the Eurozone climbed 0.5%, as expected.

The core

inflation (excluding energy and food) in the Eurozone rose 0.7%, in line with

forecasts.

Indexes on

the close:

Name Price Change Change %

FTSE

100 6,754.64 -23.21 -0.34%

DAX 9,883.98 -28.89 -0.29%

CAC 40 4,510.05 -33.23 -0.73%

The U.S.

dollar traded mixed against the most major currencies after the economic

reports in the U.S. The lowering forecast of the U.S. economic growth by the International

Monetary Fund (IMF) weighed on the U.S. The IMF expects the U.S. economy to grow

2% in 2014, down from its forecast of 2.8% in April.

On the

other side, the U.S. currency was supported by concerns over escalating

violence in Iraq and the better-than-expected economic data.

The NAHB housing

market index in the U.S. increased to 49 in June from 45 in May, exceeding

expectations for a gain to 47.

The

capacity utilisation in U.S. climbed to 79.1% in May from 78.6% in April,

beating expectations for a rise to 78.9%.

The U.S. industrial

production rose a seasonally adjusted 0.6% in April, in line with forecasts,

after a 0.6% decline in March.

NY Fed

Empire State manufacturing index increased to 19.3 in June from 19.0 in May, exceeding

expectations from a decline to 15.2.

The euro increased

against the U.S. dollar due to speculation the European Central Bank will not

add further stimulus measures.

Eurozone’s

harmonized consumer price index declined 0.1% in May, meeting expectations,

after a 0.2% gain in April. On a yearly basis, harmonized consumer price index

in the Eurozone climbed 0.5%, as expected.

The core

inflation (excluding energy and food) in the Eurozone rose 0.7%, in line with

forecasts.

The British

pound traded lower against the U.S. dollar, but remained supported by the last

week’s comments of the Bank of England (BoE) Governor Mark Carney. He said the

BoE may raise its key interest rate earlier than investors expected.

The

Canadian dollar dropped against the U.S. dollar ahead of the foreign securities

purchases in Canada. The foreign securities purchases in Canada rose to 10.13

billion CAD in April, exceeding expectations for a gain to 4.27, after -1.41

billion CAD in March.

The New

Zealand dollar traded mixed against the U.S dollar. The Westpac index of

consumer sentiment for Q2 declined to 121.2 from 121.7 the previous quarter.

The

Australian dollar traded mixed against the U.S. dollar in the absence of any

economic reports in Australia.

The Reserve

Bank of Australia Assistant Governor Christopher Kent said today that the

unemployment rate in Australia will remain elevated for the next two years. He

added moderate wage growth and better productivity should help the economy. Mr.

Kent also pointed out “a decline in the real exchange rate is one important way

in which the economy can adjust to the decline in the terms of trade”.

The

Japanese yen mixed against the U.S. dollar. The yen was supported by the

increasing demand for safe-haven currency. The increasing demand for safe-haven

currency was driven by escalating violence in Iraq. No economic reports were

released in Japan.

The Bank of

Japan (BoJ) released its monthly economic report. The BoJ said Japan's economy

has continued to recover moderately as a trend, but there is a decline in

demand following caused by the consumption tax hike.

Prices for WTI crude oil rose slightly, while the price of Brent crude oil fell moderately, due to the escalation in Iraq and concerns about possible violations of oil exports from the second largest producer in OPEC.

Iraq conflict, according to analysts, creates the risk of another spike in oil prices. The goal now is to create a rebel Islamic state on the border with Syria, where there is significant oil reserves. So far it can go only about the risk of missed deadlines shipment. However, the escalation of violence in the country in case of conflict from spreading further south could endanger oil supplies. A similar situation exists in the countries of the Organization for difficult - while oil exporters, which are struggling to keep the rate of production of 30 million barrels per day due to a significant reduction in production in Libya. Iraq ranks second in terms of production by OPEC, is actually on the verge of civil war, increasing the geopolitical premium in oil prices. Iraqi factor does not look short-term phenomenon, but rather is designed for long-term, analysts say.

According to the International Energy Agency, OPEC will have to raise daily production by one million barrels in the second half to balance the oil market, which is expected seasonal increase in demand.

Meanwhile, we add that the data showed that U.S. oil production have increased to record levels in 44 years. Note that production fell almost four decades. In fact, to change the situation, it only took five years. According to the averaged data in America last month produced 11.27 million barrels of oil and condensate per day. Figure is close to the average production in 1970 of 11.3 million barrels, which was the maximum for the United States. Statistics last seven days, says that the present results have surpassed the previous record.

Cost of the August futures on U.S. light crude oil WTI (Light Sweet Crude Oil) rose to $ 106.30 per barrel on the New York Mercantile Exchange (NYMEX).

August futures price for North Sea Brent crude oil mixture fell $ 0.45 to $ 113.00 a barrel on the London exchange ICE Futures Europe.

Gold prices fell sharply, while retreating from three-week highs reached earlier, that was due to the weakening of the U.S. currency.

It is worth noting that the markets continue to monitor developments in Iraq, where militants linked to al-Qaeda, threatened to seize Baghdad after the capture key cities in other parts of the country over the weekend.

Investors were also cautious in anticipation of the outcome of the upcoming policy meeting of the Federal Reserve System, scheduled for Wednesday, searching for fresh hints as possible increase in interest rates.

On the dynamics of trade also affected U.S. data. The survey revealed that the Fed-New York manufacturing index in the region rose slightly in June compared with the previous month. According to the data, the manufacturing index in June rose to 19.3 against 19.0 in May. Note that the previous value has not been revised. Economists had forecast a drop in the index to the level of 15.2 points.

Meanwhile, another report showed: industrial production rose a seasonally adjusted 0.6% from April. Capacity utilization rate, closely watched gauge of efficiency in the economy, increased by 0.2 percentage points to 79.1% in May. Economists had expected industrial production to rise by 0.6% in May and capacity utilization will rise to 78.9%.

Increased production in the last month replaced drop by 0.3% in April compared with the previous month - a smaller drop than originally voiced reduction of 0.6%.

Growth in May, reflecting an increase of 0.6% in the production of the manufacturer and an increase of 1.3% in the mining sector, which was partially offset by a decrease in production in the municipal sector by 0.8%. Total industrial production in May rose 4.3% compared with a year earlier.

The cost of the August gold futures on the COMEX today dropped to $ 1275.8 per ounce.

EUR/USD $1.3500, $1.3560, $1.3630, $1.3635

USD/JPY Y101.95, Y102.20/25, Y102.30/40, Y102.50, Y103.00

USD/CAD Cad1.0855

AUD/USD $0.9260, $0.9345, $0.9350, $0.9365

USD/CHF Chf0.9100

NZD/USD NZ$0.8575

U.S. stock-index futures declined as intensifying unrest from Iraq to Ukraine overshadowed corporate deals.

Global markets:

TOPIX 1,234.68 -9.29 -0.75%

SHANGHAI COMP 2,085.98 +15.27 +0.74%

HANG SENG 23,300.67 -18.50 -0.08%

DAX 9,890.57 -22.30 -0.22%

CAC 4,521.15 -22.13 -0.49%

FTSE 6,752.94 -24.91 -0.37%

Crude oil $107.10 (+0.18%)

Gold $1281.50 (+0.57%)

(company / ticker / price / change, % / volume)

AT&T Inc | T | 35.04 | +0.03% | 0.5K |

Boeing Co | BA | 132.50 | +0.16% | 0.4K |

Chevron Corp | CVX | 127.50 | +0.19% | 0.2K |

Visa | V | 212.10 | +0.38% | 0.9K |

Nike | NKE | 74.90 | +0.38% | 2.1K |

Cisco Systems Inc | CSCO | 24.69 | -0.04% | 1.0K |

Procter & Gamble Co | PG | 79.60 | -0.05% | 0.8K |

Microsoft Corp | MSFT | 41.19 | -0.10% | 1.0K |

Verizon Communications Inc | VZ | 49.12 | -0.12% | 6.7K |

Pfizer Inc | PFE | 29.49 | -0.14% | 0.2K |

International Business Machines Co... | IBM | 182.26 | -0.16% | 6.9K |

Exxon Mobil Corp | XOM | 102.43 | -0.21% | 0.3K |

3M Co | MMM | 143.00 | -0.25% | 34.4K |

General Electric Co | GE | 26.97 | -0.26% | 7.7K |

Intel Corp | INTC | 29.77 | -0.33% | 2.0K |

JPMorgan Chase and Co | JPM | 56.83 | -0.37% | 2.1K |

Economic calendar (GMT0):

03:20 Australia

RBA Assist Gov Kent Speaks

05:00 Japan

BoJ monthly economic report June

09:00 Eurozone Harmonized CPI May +0.2% -0.1% -0.1%

09:00 Eurozone Harmonized CPI, Y/Y (Finally) May +0.5% +0.5% +0.5%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y May +0.7% +0.7% +0.7%

The U.S.

dollar traded higher against the most major currencies ahead of the release of

economic reports in the U.S. The U.S.

currency was supported by concerns over escalating violence in Iraq.

The euro traded

lower against the U.S. dollar. Eurozone’s harmonized consumer price index

declined 0.1% in May, meeting expectations, after a 0.2% gain in April. On a

yearly basis, harmonized consumer price index in the Eurozone climbed 0.5%, as

expected.

The core

inflation (excluding energy and food) in the Eurozone rose 0.7%, in line with

forecasts.

The British

pound traded lower against the U.S. dollar, but remained supported by the last

week’s comments of the Bank of England (BoE) Governor Mark Carney. He said the

BoE may raise its key interest rate earlier than investors expected.

The

Canadian dollar dropped against the U.S. dollar ahead of the foreign securities

purchases in Canada. The foreign securities purchases in Canada should rise to

4.27 billion CAD in April, after -1.23 billion CAD in March.

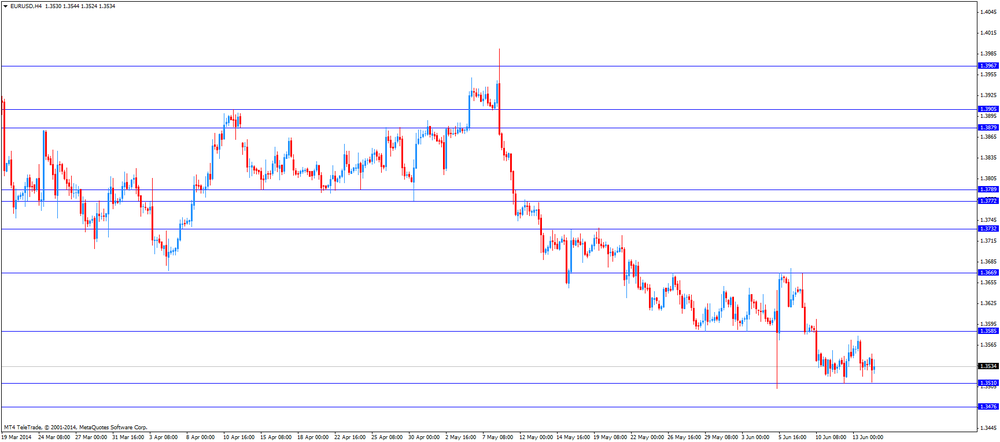

EUR/USD:

the currency pair declined to $1.3511

GBP/USD:

the currency pair decreased to $1.6958

USD/JPY:

the currency pair traded mixed

The most

important news that are expected (GMT0):

12:30 Canada Foreign Securities Purchases April -1.23

4.27

12:30 U.S. NY Fed Empire State manufacturing

index June 19.0

15.2

13:00 U.S. Net Long-term TIC Flows April 4.0 41.3

13:00 U.S. Total Net TIC Flows

April -126.1

13:15 U.S.

Industrial Production

(MoM) May -0.6%

+0.6%

13:15 U.S. Capacity Utilization

May 78.6% 78.9%

14:00 U.S. NAHB Housing Market Index June 45 47

EUR/USD

Bids $1.3500, $1.3485/80, $1.3460/50

GBP/USD

Offers $1.7080/85, $1.7040/50, $1.7015-20, $1.6995/00

Bids $1.6950, $1.6930/20, $1.6910/00, $1.6885/80

AUD/USD

Offers $0.9500, $0.9450

Bids $0.9350, $0.9320, $0.9300

EUR/JPY

Offers Y139.20, Y139.00, Y138.80, Y138.50

Bids Y137.50, Y137.20, Y137.00, Y136.50

USD/JPY

Offers Y102.75/80, Y102.50

Bids Y101.70, Y101.50, Y101.00

EUR/GBP

Offers stg0.8050, stg0.8035/40

Bids stg0.7950, stg0.7900, stg0.7850

Stock

indices sank due to concerns over escalating violence in Iraq. The violence in

Iraq could lead to disruptions in the oil supplies in OPEC’s second-biggest oil

producer. Brent oil increased 0.3%.

Eurozone’s harmonized

consumer price index declined 0.1% in May, meeting expectations, after a 0.2%

gain in April. On a yearly basis, harmonized consumer price index in the

Eurozone climbed 0.5%, as expected.

The core

inflation (excluding energy and food) in the Eurozone rose 0.7%, in line with forecasts.

Current

figures:

Name Price Change Change %

FTSE

100 6,760.07 -17.78 -0.26%

DAX 9,887.92 -24.95 -0.25%

CAC 40 4,522.02 -21.26 -0.47%

EUR/USD $1.3500, $1.3560, $1.3630, $1.3635

USD/JPY Y101.95, Y102.20/25, Y102.30/40, Y102.50, Y103.00

USD/CAD Cad1.0855

AUD/USD $0.9260, $0.9345, $0.9350, $0.9365

USD/CHF Chf0.9100

NZD/USD NZ$0.8575

Most Asian

stock fell due to concerns over escalating violence in Iraq. The violence in

Iraq could lead to disruptions in the oil supplies in OPEC’s second-biggest oil

producer.

The Bank of

Japan (BoJ) released its monthly economic report. The BoJ said Japan's economy

has continued to recover moderately as a trend, but there is a decline in

demand following caused by the consumption tax hike.

Indexes on

the close:

Nikkei

225 14,933.29 -164.55 -1.09%

Hang

Seng 23,300.67 -18.50 -0.08%

Shanghai

Composite 2,085.98 +15.27 +0.74%

Korean Air

Lines Co. shares declined 2.2% due to increasing oil prices.

Panasonic

Corp. shares sank 1.5%.

Economic

calendar (GMT0):

03:20 Australia RBA Assist Gov Kent Speaks

05:00 Japan BoJ monthly economic report June

The U.S.

dollar traded mixed against the most major currencies. Friday’s

weaker-than-expected U.S. economic data and escalating violence in Iraq weighed

on markets. The U.S. producer price index decreased 0.2% in May, missing

expectations for a 0.1% increase, after a 0.6 rise in April. The U.S. producer price index excluding food

and energy declined 0.1% in May, missing expectation for a 0.2% rise, after a

0.5% gain in April.

Reuters/Michigan

consumer sentiment index for the U.S. fell to 81.2 in June from 81.9 in May,

missing expectations for a rise to 83.2.

The

violence in Iraq could lead to disruptions in the oil supplies in OPEC’s

second-biggest oil producer. U.S. president Barack Obama warned to use air

strikes to help the government in Baghdad.

The New

Zealand dollar traded higher against the U.S dollar due to the Friday’s weaker

economic data from U.S. The Westpac index of consumer sentiment for Q2 declined

to 121.2 from 121.7 the previous quarter.

The

Australian dollar traded higher against the U.S. dollar in the absence of any

economic reports in Australia.

The Reserve

Bank of Australia Assistant Governor Christopher Kent said today that the unemployment

rate in Australia will remain elevated for the next two years. He added moderate

wage growth and better productivity should help the economy. Mr. Kent also

pointed out “a decline in the real exchange rate is one important way in which

the economy can adjust to the decline in the terms of trade”.

The

Japanese yen increased against the U.S. dollar due to the increasing demand for

safe-haven currency. The increasing demand for safe-haven currency was driven

by escalating violence in Iraq. No economic reports were released in Japan.

The Bank of

Japan (BoJ) released its monthly economic report. The BoJ said Japan's economy

has continued to recover moderately as a trend, but there is a decline in

demand following caused by the consumption tax hike.

EUR/USD:

the currency pair traded mixed

GBP/USD:

the currency pair traded mixed

USD/JPY:

the currency pair declined to Y101.75

The most

important news that are expected (GMT0):

09:00 Eurozone Harmonized CPI May +0.2% -0.1%

09:00 Eurozone Harmonized CPI, Y/Y (Finally) May +0.5% +0.5%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y May +0.7% +0.7%

12:30 Canada Foreign Securities Purchases April -1.23 4.27

12:30 U.S. NY Fed Empire State manufacturing index June 19.0 15.2

13:00 U.S. Net Long-term TIC Flows April 4.0 41.3

13:00 U.S. Total Net TIC Flows April -126.1

13:15 U.S. Industrial Production (MoM) May -0.6% +0.6%

13:15 U.S. Capacity Utilization May 78.6% 78.9%

14:00 U.S. NAHB Housing Market Index June 45 47

EUR / USD

Resistance levels (open interest**, contracts)

$1.3643 (3003)

$1.3615 (1555)

$1.3575 (71)

Price at time of writing this review: $ 1.3543

Support levels (open interest**, contracts):

$1.3511 (1010)

$1.3495 (3712)

$1.3473 (4546)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 28378 contracts, with the maximum number of contracts with strike price $1,3700 (3448);

- Overall open interest on the PUT optionswith the expiration date July, 3 is 40990 contracts, with the maximum number of contractswith strike price $1,3500 (4904);

- The ratio of PUT/CALL was 1.44 versus 1.46 from the previous trading day according to data from June, 13

GBP/USD

Resistance levels (open interest**, contracts)

$1.7201 (1215)

$1.7103 (1819)

$1.7006 (2050)

Price at time of writing this review: $1.6981

Support levels (open interest**, contracts):

$1.6894 (840)

$1.6797 (1385)

$1.6699 (1947)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 17332 contracts, with the maximum number of contracts with strike price $1,7000 (2050);

- Overall open interest on the PUT optionswith the expiration date July, 3 is 20720 contracts, with the maximum number of contracts with strike price $1,6750 (2247);

- The ratio of PUT/CALL was 1.20 versus 1.12 from the previous trading day according to data from June, 13

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.