- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 16-03-2022

February month employment statistics from the Australian Bureau of Statistics, up for publishing at 00:30 GMT on Thursday, will be the immediate catalyst for the AUD/USD pair traders. Along with the data, the RBA Bulletin for Q4 will also be released and should be watched too.

The jobs figures have been important considering the recent run-up in inflation and the Reserve Bank of Australia’s (RBA) slightly easy hesitance to rate-hike. It should be noted, however, that the recently mixed signals from the Aussie central bank and more importance to the risk catalysts dim the charm of today’s Aussie jobs report.

Market consensus suggests that the headline Unemployment Rate may ease to 4.1% from 4.2% on a seasonally adjusted basis whereas Employment Change could rise from 12.9K to 37K. Further, the Participation Rate may also rise to 66.3% from 66.2% during the stated month.

Ahead of the event, analysts at Westpac said,

Given that the recent floods in NSW and QLD have come after the February reference period, Westpac anticipates employment to lift by 60k for the month (median forecast is 37k, range 5k to 60k). A lift in participation to 66.4% should temper the fall in the unemployment rate to around 0.1ppt (Westpac f/c: 4.1%), with risks favoring a smaller rise in participation and a larger fall in unemployment.

ANZ also mentioned,

We expect to see the unemployment rate drop to 3.9% (4.2% previously), led by a 50k lift in employment. We’ve already seen a surge in Australian job ads in the wake of the disruption caused by the Omicron outbreak – and it’s looking like the labor market should be able to shake off its impacts pretty quickly. For New Zealand, we expect to see something similar.

How could the data affect AUD/USD?

AUD/USD bulls take a breather around a one-week high near 0.7285, after rising for the last two consecutive days, during Thursday morning in Asia. In doing so, the risk barometer portrays the market’s indecision over the Russia-Ukraine peace talks ahead of the key data release.

Although expectations of firmer data may offer immediate strength to the AUD/USD prices, the quote needs support from the market sentiment to recall the buyers, due to the recent emphasis on risk catalysts. Another reason that weighs on the importance of the Aussie jobs report is the RBA’s latest Minutes repeating its no rate-hike pledge, as well as higher importance to inflation concerns.

Technically, the weekly resistance line challenges the AUD/USD pair’s immediate upside around 0.7300, a break of which will quickly propel the quote towards the 0.7370 level. Adding to the upside filter is the 200-DMA level surrounding 0.7305.

Key Notes

AUD/USD bulls on standby for Aussie Employment data

Australian Employment Preview: Upbeat figures to fuel the optimism-related rally

About the Employment Change

The Employment Change released by the Australian Bureau of Statistics is a measure of the change in the number of employed people in Australia. Generally speaking, a rise in this indicator has positive implications for consumer spending which stimulates economic growth. Therefore, a high reading is seen as positive (or bullish) for the AUD, while a low reading is seen as negative (or bearish).

About the Unemployment Rate

The Unemployment Rate released by the Australian Bureau of Statistics is the number of unemployed workers divided by the total civilian labor force. If the rate hikes, indicates a lack of expansion within the Australian labor market. As a result, a rise leads to weaken the Australian economy. A decrease of the figure is seen as positive (or bullish) for the AUD, while an increase is seen as negative (or bearish).

- The DXY pauses around 98.40 posts in-line interest rate decision by the Fed.

- Seven interest rate hikes are announced for 2022 to contain the inflation mess.

- The monetary policies of BOJ and BOE will be keenly watched this week.

The US dollar index (DXY) has witnessed some long liquidation after the Federal Reserve (Fed) announced an interest rate hike by 25 basis points (bps) to curtail the soaring inflation. The decision was in-line with the estimates, which brought a temporary pause in a firmer rally by the DXY.

Fed's interest rate bulletin

A rate hike of 25 bps received a green flag from seven out of eight monetary policy committee (MPC) members as St. Louis Fed President Jim Bullard was in favor of a 50 bps rate hike this time. It is worth noting that the Fed has increased its interest rates after a span of three years. Although a 25 bps hike interest rate decision was in-line with the estimates, the announcement of seven hikes in 2022 has surprised the market. The aggressive tightening bulletin claims that the inflation mess is much worse than the estimated, which is why the Fed is looking to elevate the interest rates quickly.

US Retail Sales

The underperformance of US Retail Sales for February month has mounted concerns over the US economy going forward. The US Census Bureau reported February Retail Sales at 0.3% lower than the market consensus of 0.4% and much lower than the previous figure of 4.9%.

Major events this week: Building Permits, Housing Starts, Initial Jobless Claims, Industrial Production, and Existing Home Sales.

Eminent issues on the back boiler: Russia-Ukraine peace talks, monetary policy from Bank of England (BOE) and Bank of Japan (BOJ), Federal Reserve Bank Gov. Michelle Bowman speech.

- USD/CAD consolidates recent losses around two-week low, grinds lower of late.

- Bearish MACD signals, key DMAs challenge buyers, 1.2880-90 is the key hurdle.

- Two-month-old support line, 200-DMA adds to the downside filters.

USD/CAD bears take a breather around a fortnight low while making rounds to 1.2680-85 during Thursday’s Asian session.

In doing so, the Loonie pair snaps a two-day downtrend to recover from a multi-day bottom. However, a convergence of the 100-DMA and the 50-DMA challenge the quote’s immediate upside, around 1.2685-90, amid bearish MACD signals.

Even if the USD/CAD prices manage to rally past 1.2690, multiple resistance levels near the 1.2800 threshold and a three-month-old horizontal area surrounding 1.2880-90 will challenge the pair’s further advances.

Following that, a free run-up towards the 1.3000 psychological magnet can’t be ruled out.

On the flip side, an upward sloping support line from January 20, near 1.2630 by the press time, lures the USD/CAD bears.

Should the quote drops below 1.2630, the 200-DMA and a five-month-long rising trend line, respectively around 1.2600 and 1.2555, will be in focus.

USD/CAD: Daily chart

Trend: Further weakness expected

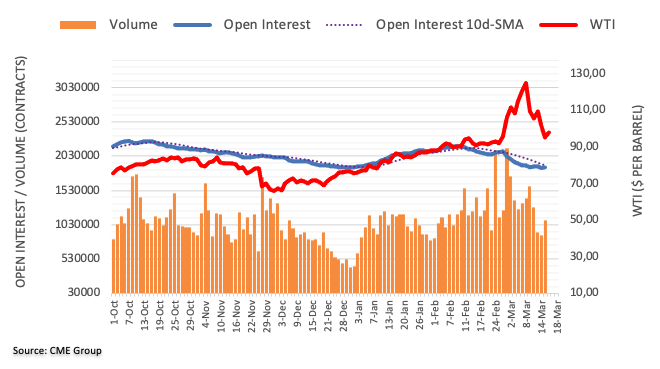

- WTI crude oil prices pick up bids to pare recent losses around three-week low.

- Risk-on mood battles bearish EIA inventories, IEA demand forecasts to portray lackluster moves.

- Ukraine, China headlines become more important for immediate directions.

WTI crude oil prices stay in the recovery mode, despite being sluggish at around $94.55 during Thursday’s initial Asian session.

The black gold offered a choppy end to Wednesday, following a volatile day, amid mixed catalysts concerning the risk sentiment and energy market.

On the positive side, Ukraine praises the softness of Russian diplomats’ voice and the International Court of Justice in The Hague also ordered Moscow to abandon the Ukraine invasion, which in turn favors risk-on mood.

Also favoring the risk-on mood is a softer COVID-19 daily count from China, as well as headlines suggesting the government’s readiness to propel economic growth, by China Vice Premier Liu He.

Elsewhere, weekly inventory data from the US Energy Information Administration (EIA), 4.345M versus -1.375M expected and -1.863M prior, challenged oil buyers. Additionally weighing the energy prices is the International Energy Agency’s (IEA) lowering of the Q2-Q4 2022 forecast for world oil demand, by 1.3 million BPD amidst the Ukraine crisis.

That said, WTI crude oil prices also get hammered by the Fed’s hawkish rate-hike, even if Chairman Jerome Powell couldn’t lift the greenback.

Moving on, risk catalysts are likely to entertain WTI crude oil buyers with China and Ukraine news being the major ones.

Technical analysis

50-DMA and a one-week-old previous resistance line, respectively around $92.20 and $90.45, restrict the short-term downside of the black gold whereas the recovery moves need to cross the last Friday’s swing high near $107.00 to regain the buyer’s confidence.

- Aussie bulls are firmer post the breakout of an ascending triangle.

- The asset holds above 20 and 200-period EMAs, which adds to the upside filters.

- Bears can dictate levels if the asset slip below 84.60.

The AUD/JPY pair is auctioning above its three-year-old resistance at 86.70. The cross has formed a positive open drive session on Thursday as the aussie bulls witnessed carry-forward buying right from the first tick of the trading session.

On a weekly scale, AUD/JPY has given a breakout of an ascending triangle that signals a slippage in the standard deviation and indicates a balanced auction but with a positive bias. The upper end of the ascending triangle was marked from 14 May 2021 high at 85.80 while the lower end was placed from 30 October 2020 low at 73.14.

The 20-period and 200-period Exponential Moving Averages (EMA) at 83.16 and 80.36 respectively are scaling higher, which adds to the upside filters.

The Relative Strength Index (RSI) (14) has breached 60.00 from below, showing no signs of divergence and overbought. Holding above 60.00 levels indicates a bullish setup going forward.

For more upside, bulls need to violate Thursday’s high at 86.74, which will send the pair towards 9 February 2018 high at 87.51, followed by the round level at 88.00.

On the contrary, bulls can lose their control if the cross slips below March 15 low at 84.60, which will drag the pair to March 8 low at 83.80. Breach of the latter will send the cross to the round level at 83.00.

AUD/JPY weekly chart

-637830682610914211.png)

- The EUR/JPY continues gaining in the week, up some 2.42%.

- Risk-sensitive peers appreciate while safe-haven weakened.

- EUR/JPY Price Forecast: Neutral upward, above 131.00, but downside risks remain.

The EUR/JPY extends its weekly gains on the back of the improved market sentiment, courtesy of progress in talks between Russia-Ukraine, despite the US central bank hiking rates for the first time since 2018. At the time of writing, the EUR/JPY is trading at 131.06.

US equity indices reflected the market mood, finishing Wednesday’s trading session with gains. In the FX space, safe-haven peers depreciated, led by the Japanese yen, while the greenback ended on the backfoot, as measured by the US Dollar Index (DXY), losing 0.70%, sitting at 98.40,

In the bond market, global bond yields were mixed, while US Treasury yields ended mixed, led by the short-term of the curve. The 10-year T-note rose three basis points and sat at 2.192%.

Aside from that, the EUR/JPY overnight traded within a 150-pip range, opening around 129.52, but reaching the daily high above 131.00, after the Fed’s monetary policy decision.

EUR/JPY Price Forecast: Technical outlook

The EUR/JPY is neutral upward biased, though short of the 78.6% Fibonacci retracement, which sits around 131.27, a level that could witness some selling pressure, based on the steeper move in the week, so far up 2.42%. Oscillator-based, the Relative Strenght Index (RSI) sits at 59, slightly aiming horizontal, meaning that the pair might consolidate before resuming to the upside.

That said, the EUR/JPY first resistance level would be 131.27. Breach of the latter, the following resistance would be 132.00, followed by 133.00. On the flip side, the first support would be the confluence of the 200-day moving average (DMA) at 129.98 and the 130.00 mark. A decisive break would expose the 50-DMA at 129.68, followed by the 129.00 mark.

“Russia has an advantage in the air; I hope for the allies' assistance,” Ukrainian President Volodymyr Zelenskyy said during early Thursday morning in Asia.

More comments

Negotiations between Russia and Ukraine are challenging.

Talks between Russia and Ukraine are still ongoing.

Elsewhere, the UK’s Ministry of Defense (MoD) came out with their latest Defence Intelligence update suggesting that Russia is resorting to the use of older, less precise weapons, which are less military effective and more likely to result in civilian casualties.

FX implications

The news is concerning a challenge to the previous risk-on mood. However, the S&P 500 Futures remain mildly bid by, up 0.10% around 4,362 by the press time.

Read: Forex Today: Fed, war and inflation not enough to take down Wall Street

- Silver prices struggle to extend the bounce off two-week low.

- 100-SMA, previous support line from early February and weekly resistance line highlight $25.20 as the key hurdle.

- 50% Fibonacci retracement level, 200-SMA adds to the downside filters.

Silver (XAG/USD) prices fail to carry the bounce off a fortnight low, taking rounds to $25.00 during the initial Asian session on Thursday.

The bright metal’s rebound from the 50% Fibonacci retracement (Fibo.) of February-March upside, near $24.45, fades near the $25.20 resistance confluence, including the 100-SMA, a three-week-old support-turned-resistance and descending trend line from the previous Tuesday.

It should be noted, however, that the rebound in MACD signals keeps XAG/USD buyers hopeful to overcome the key hurdle to the north.

Following that, a run-up towards the $26.00 threshold and the monthly high of $26.95 becomes imminent.

However, silver’s upside past $26.95 depends upon how well it can stay beyond the $27.00 threshold.

Alternatively, pullback moves may retest the 50% Fibo. level of $24.45 before the 200-SMA, around $24.20, restricts XAG/USD downside.

Also acting as a short-term downside filter is the mid-February’s high near the $24.00 round figure and the 61.8% Fibonacci retracement level of $23.88.

Silver: Four-hour chart

Trend: Further recovery expected

- Antipodean bulls are firmer above 20-period EMA.

- The RSI (14) has surpassed 60.00, showing no signs of divergence and overbought.

- The kiwi is underpinned against the greenback after a pullback near 0.6820.

The NZD/USD is inching higher after hitting a low of 0.6767 as the demand for the risk-sensitive assets have jumped sharply. The major has printed a fresh weekly high at 0.6844 and is expected to continue its strength going forward.

On a four-hour scale, NZD/USD is auctioning in a rising channel in which the market participants consider pullbacks towards the lower end as a buying opportunity. The upper end of the rising channel is placed from February 4 high at 0.6684 and the lower end is marked from January 28 low at 0.6529. The major has sensed support near the 200-period Exponential Moving Average (EMA) at around 0.6760. The asset has breached the trendline placed from March 7 high at 0.6926.

The pair is comfortable holding above the 20-period EMA at 0.6797, which adds to the upside filters.

The Relative Strength Index (RSI) (14) has breached 60.00 from below, showing no signs of divergence and overbought. Holding above 60.00 levels indicates a bullish setup going forward.

Now, the kiwi bulls will find significant bids near pullback at the above-mentioned trendline around 0.6820. A successful test of the trendline will drive the pair higher towards March 10 high at 0.6876, which will be followed by March 7 high at 0.6926.

On the flip side, bears can dictate levels if the pair slip below February 22’s average traded price at 0.6718 decisively, which will drag the major to February 27 low at 0.6664. Breach of the latter will drag the asset towards February 24 low at 0.6630.

NZD/USD hourly chart

-637830660602999903.png)

- AUD/USD is holding firm in bullish territory, awaiting today's Employment data.

- The Fed was a disappointment for the US dollar bulls.

AUD/USD is starting out the day in Asian markets on the front foot due to in part comments from a senior Chinese official that boosted hopes for more stimulus, as well as following a mixed Federal Reserve outcome on Wednesday. The Aussie is sat at 0.7288 as traders await today's Employment data for Australia.

On Wednesday, Xinhua news agency cited Vice Premier Liu He said China will roll out policy steps favourable for its capital markets. This was already offering to support the Aussie until the US dollar rallied in the New York trade after the US Federal Reserve moved to a hawkish monetary policy. However, the bid was shortlived when the Fed was not delivering a firmer rhetoric in the presser.

The fEd hiked by 25 basis points and the statement showed that most Fed officials see as many as seven rate increases in 2022. The Fed explained that the economic activity and employment indicators have continued to gain strength, jobs gains have been sold in recent months, and the unemployment rate has fallen notably.

"The committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run," the FOMC said. "With appropriate firming in the stance of monetary policy, the committee expects inflation to return to its 2 percent objective and the labor market to remain strong," it added.

Separately, the Fed's dot is also pointing to a consensus funds rate of 1.9% by the end of this year. It sees three more increases in 2023 and then none the following year, pencilling in rate hikes at every remaining meeting this year.

However, the hawkishness was erased in comments during the Fed chairman's presser. Jerome Powell said rate rises will depend on inflation and economic data. He has stated that the Fed is looking for the month on month inflation to come down.

For the day ahead, the Australian labour market data for February are released at 11:30am. ''We expect to see the unemployment rate drop to 3.9% (4.2% previously), led by a 50k lift in employment.

We’ve already seen a surge in Australian job ads in the wake of the disruption caused by the Omicron outbreak – and it’s looking like the labour market should be able to shake off its impacts pretty quickly,'' analysts at ANZ Bank said.

- AUD/NZD extends recovery from two-month low on softer-than-expected NZ Q4 GDP.

- New Zealand GDP reversed previous contractions but missed upbeat forecasts.

- Ukraine-Russia headlines, China news propel risk-on mood even as Fed hikes rate by 0.25%.

- Australian employment data for February, risk catalysts will be important for fresh impulse.

AUD/NZD justifies New Zealand’s Q4 GDP miss while extending the previous day’s rebound towards 1.0700, around 1.0680 during the early Thursday morning in Asia. The reason for the pair’s latest strength could be linked to the market’s optimism of overcoming the Ukraine-Russia crisis, as well as easing covid fears from China.

New Zealand’s (NZ) fourth quarter (Q4) GDP came in 3.0% and 3.1% QoQ and YoY while reversing the previous contraction of -3.7% and -0.3% respectively. However, market forecasts were too upbeat, 3.2% for the quarter and 3.3% for yearly print, which in turn dented the New Zealand dollar.

Read: New Zealand GDP rebounds but fails to lift NZD

ANZ also raised bars for the AUD/NZD prices as it predicted before the data, “Unfortunately, the prospects for further strong GDP prints over the first half of 2022 in particular are looking weaker by the minute.”

On a different page, progress on the Ukraine-Russia peace talks isn’t clear even as Moscow cheers the nearness of an agreement including ceasefire and withdrawal of Russian troops. However, Ukraine praises the softness of Russian diplomats’ voice and the International Court of Justice in The Hague also ordered Moscow to abandon the Ukraine invasion, which in turn favors risk-on mood.

Elsewhere, a softer COVID-19 daily count from China tames virus woes from the dragon nation and adds to the upbeat sentiment. On the same line were headlines suggesting the government’s readiness to propel economic growth, by China Vice Premier Liu He.

That said, Wall Street portrayed a risk-on mood and the US 10-year Treasury yields gained 2.0% on Wednesday to refresh the highest level since 2019 as the Fed hiked benchmark rate by 0.25% and signaled more.

Looking forward, Australia’s employment data for February will be important for AUD/NZD prices. Forecasts suggest that the headline Unemployment Rate may ease to 4.1% from 4.2% on a seasonally adjusted basis whereas Employment Change could rise from 12.9K to 37K. Along with the data, the RBA Bulletin for Q4 will also be released and should be watched too. However, major attention will be given to risk catalysts as the Reserve Bank of Australia (RBA) is more concerned with the inflation of late.

Read: Australian Employment Preview: Upbeat figures to fuel the optimism-related rally

Technical analysis

A two-week-old descending trend line around 1.0685 holds the key to the further upside of the AUD/NZD prices.

The Gross Domestic Product (GDP), released by Statistics New Zealand arrived as +3.0% for the quarter (vs. expected 3.2%).

For the year, it came in at Q4 3.1% vs the estimated 3.3% vs the previous -0.3%.

NZD/USD is steady on the outcome as a rebound was widely expected.

More to come...

About NZD GDP

The Gross Domestic Product (GDP), released by Statistics New Zealand, highlights the overall economic performance on a quarterly basis. The gauge has a significant influence on the Reserve Bank of New Zealand’s (RBNZ) monetary policy decision, in turn affecting the New Zealand dollar. A rise in the GDP rate signifies improvement in the economic conditions, which calls for tighter monetary policy, while a drop suggests deterioration in the activity. An above-forecast GDP reading is seen as NZD bullish.

- GBP/USD rallies to 1.3147 highs post Fed and market's turnaround.

- Bulls back in control despite Fed's hawkish statement.

GBP/USD is up over 0.8% at the time of writing in the aftermath of the Federal Reserve that had something for both the bulls and the bears from start to finish. Initially, the US dollar rallied on the rate decision and statement. GBP/USD dropped to 1.3042 after the Fed announced it had hiked 25 basis points in the Federal Funds Rate.

In the statement, it read that "inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher energy prices, and broader price pressures.'' The Fed statement also noted that the Ukraine war could lead to higher inflation and slower Gross Domestic Product.

Most Fed officials see as many as seven rate increases in 2022. The Fed explained that the economic activity and employment indicators have continued to gain strength, jobs gains have been sold in recent months, and the unemployment rate has fallen notably.

"The committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run," the FOMC said. "With appropriate firming in the stance of monetary policy, the committee expects inflation to return to its 2 percent objective and the labor market to remain strong," it added.

Separately, the Fed's dot is also pointing to a consensus funds rate of 1.9% by the end of this year. It sees three more increases in 2023 and then none the following year, pencilling in rate hikes at every remaining meeting this year.

However, the hawkishness was erased in comments during the Fed chairman's presser. Jerome Powell said rate rises will depend on inflation and economic data. He has stated that the Fed is looking for the month on month inflation to come down. This helped US stocks to rebound and weighed on the greenback, lifting cable higher again.

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 (GMT) | Australia | RBA Bulletin | |||

| 00:30 (GMT) | Australia | Unemployment rate | February | 4.2% | 4.1% |

| 00:30 (GMT) | Australia | Changing the number of employed | February | 12.9 | 37 |

| 07:00 (GMT) | Switzerland | Trade Balance | February | 2.2 | |

| 09:30 (GMT) | Eurozone | ECB President Lagarde Speaks | |||

| 10:00 (GMT) | Eurozone | Harmonized CPI, Y/Y | February | 5.1% | 5.8% |

| 10:00 (GMT) | Eurozone | Harmonized CPI ex EFAT, Y/Y | February | 2.3% | 2.7% |

| 10:00 (GMT) | Eurozone | Harmonized CPI | February | 0.3% | 0.9% |

| 12:00 (GMT) | United Kingdom | BoE Interest Rate Decision | 0.5% | 0.75% | |

| 12:00 (GMT) | United Kingdom | Bank of England Minutes | |||

| 12:30 (GMT) | U.S. | Continuing Jobless Claims | March | 1494 | 1485 |

| 12:30 (GMT) | U.S. | Initial Jobless Claims | March | 227 | 220 |

| 12:30 (GMT) | U.S. | Building Permits | February | 1.899 | 1.85 |

| 12:30 (GMT) | U.S. | Housing Starts | February | 1.638 | 1.69 |

| 12:30 (GMT) | U.S. | Philadelphia Fed Manufacturing Survey | March | 16 | 15 |

| 13:15 (GMT) | U.S. | Capacity Utilization | February | 77.6% | 77.8% |

| 13:15 (GMT) | U.S. | Industrial Production YoY | February | 4.1% | |

| 13:15 (GMT) | U.S. | Industrial Production (MoM) | February | 1.4% | 0.5% |

| 23:30 (GMT) | Japan | National CPI Ex-Fresh Food, y/y | February | 0.2% | 0.6% |

| 23:30 (GMT) | Japan | National Consumer Price Index, y/y | February | 0.5% |

- Despite the more hawkish than expected Fed, EUR/USD rallied and is at session highs in the 1.1030s.

- The Fed signaled rate hikes at every remaining meeting this year and four more in 2023, pushing US yields higher.

- But it was risk-on after Powell’s presser and a rally in equities weighed on USD demand.

Though most analysts, economists and commentators were unanimous in their agreement that the latest Fed policy announcement and round of the remarks from Fed Chair Jerome Powell was far more hawkish than expected, markets do not seem to have gotten the memo. The central bank hiked interest rates as expected, with the surprise coming in the new dot-plots, which showed that the median expectation of Fed members is for 25bps rate hikes at all of this year's remaining meetings (i.e. another six), followed by a further four in 2023. That means the Federal Funds rate reaching 1.75-2.0% by the end of 2022 and 2.75-3.0% by the end of 2.23.

Powell’s remarks were suitably hawkish to match the new interest rate guidance and even though this sent US yields higher across the curve, that was not enough to trigger a lasting rally in the US dollar. After dipping as low as the 1.0950s in the immediate aftermath of the Fed’s initial policy announcement, EUR/USD has now been able to recover all the way back to the 1.1030s, where it trades higher by about 0.7% on the day and is eyeing a test of last week’s highs to the north of 1.1100.

Analysts were at a loss to explain why the dollar could hold onto its initial post-Fed announcement gains. It could have something to do with equities rallying in wake of Powell’s press conference, thus reducing the demand for safe-haven currencies like the buck. Again, analysts weren't sure why US equities would rally on a more hawkish Fed. It could be because equity market investors deem the Fed’s hawkish shift on Wednesday as appropriate and necessary. If so, gone are the days where equity investors crave a dovish Fed no matter what.

In the current environment of high inflation, perhaps equity investors are taking the view that its better for long-term earnings if the Fed lifts interest rates and brings back price stability than keeping interest rates lower. Either way, if this is the new mindset, that means equity market downside as a result of Fed hawkishness might be more limited going forward, meaning lesser demand for the safe-haven dollar. However, the dollar still stands to benefit from widening rate differentials versus its G10 peers, so it seems unlikely that Wednesday’s rally would be the start of a more sustained move higher. A retest of recent lows around 1.0800 seems more likely that a recovery back above 1.1200 at this point.

- In the North American session, the Swiss franc gains vs. the greenback, up some 0.06%.

- The Fed projects the Federal Funds Rate at 1.9% by the end of 2022.

- USD/CHF Price Forecast: Above 0.9373, the bias is upwards; otherwise, a move downwards is on the cards.

The USD/CHF snaps four consecutive days of gains, down 0.12%, in the North American session, as the Federal Reserve hiked rates 25 basis points, from 0.25% to 0.50%, amid a risk-on market mood. The USD/CHF slides from 0.9472 to 0.9401 at the time of writing.

Following the Federal Reserve’s first rate hike in three years, the financial market mood stays positive. US equity indices recovered from losses at the headline and following Fed’s Chief Jerome Powell presser, which appeared to be more dovish than the statement.

The greenback remains soft, losing almost 0.80% in the session, sitting at 98.36, while US Treasury yields are practically flat, with the 10-year T-benchmark note at 2.217%, after reaching 2.246%.

Summary of remarks of Fed monetary policy statement

The Federal Reserve stated that inflationary pressures remain high, caused by supply difficulties, the Covid-19 pandemic, and high oil and energy prices. Furthermore, the Russia-Ukraine conflict spurred a steeper move in oil, and Fed policymakers commented that the implications of the conflict are highly uncertain and would create additional upward pressure on inflation.

That said, policymakers worried about the actual scenario signaled the necessity of rate hikes to tame inflation, as reflected by the dot-plot, where Fed Governors expect at least seven increases to the Federal Funds Rate this year as the median forecasts rates to end around 1.90% in 2022.

Labor market-wise, Fed members foresaw the unemployment rate would hit 3.5% by 2022 and 2023. Regarding the balance sheet reduction, also known as Quantitative Tightening (QT), officials would expect to begin reducing it at a coming meeting.

USD/CHF Price Forecast: Technical outlook

Overnight, the USD/CHF seesawed around the 0.9400 area, ahead of the Federal Reserve meeting. However, once Fed’s monetary policy decision crossed the wires, the pair moved, with the USD/CHF appreciating and reaching a new YTD high at 0.9460, retracing afterward to pre-Fed levels.

The USD/CHF bias is upwards, though downside risks remain unless USD/CHF bulls hold their reins above the November 24, 2021, high at 0.9373, previous resistance-turned-support. In that event, March 15 high at 0.9431 would be the first resistance, followed by April 1, 2021, high at 0.9472, which would expose the 0.9500 mark once cleared.

On the flip side, the USD/CHF first support would be 0.9400. Breach of the latter would expose 0.9373, followed by January 31 resistance-turned-support at 0.9343 and the 0.9300 psychological level.

What you need to take care of on Thursday, March 17:

The American dollar ended the day lower after the US Federal Reserve monetary policy decision. The US central bank hiked rates by 25 bps, as expected, with Bullard being the only dissenter voting for a 50 bps hike. However, the dot-plot now indicates six rate hikes for the year, while Fed officials see the Fed Funds rate at a median of 1.9% at the end of this year and 2.8% at the end of 2024.

Stocks initially fell with the announcement but quickly recovered as chief Jerome Powell sounded optimistic about the economic progress and convinced market participants that the central bank is in control of the situation.

Meanwhile, there has been no real progress in Ukrainian and Russian peace talks. Moscow said they made “significant progress” towards a 15-point peace plan that would include a ceasefire and Russian withdrawal from Ukraine if Kyiv declares neutrality and accepts limits on its military forces. However, Kyiv rejected the proposed neutrality. Also, the International Court of Justice in The Hague ordered Russia to suspend the invasion of Ukraine.

Financial markets remained optimistic, with most global indexes closing in the green. All of the US indexes closed with gains, with the Nasdaq Composite being the best performer by adding over 3%.

US government bond yields continued to pressure the upside. The yield on the 10-year Treasury note peaked at 2.246% to later settle at 2.16%.

The EUR/USD pair reached fresh weekly highs in the 1.1040 price zone, while GBP/USD extended its recovery to 1.3155. Meanwhile, the AUD/USD pair flirts with 0.7300 while USD/CAD plunged to 1.2690.

The USD/JPY pair hit a fresh multi-year high of 119.11 before retreating towards the current 118.60 price zone.

Gold posted a nice comeback after dipping to $1,895 a troy ounce, now trading at around $1,929.40. Crude oil prices, on the other hand, remained under pressure, and WTI settled just below $95 a barrel.

Like this article? Help us with some feedback by answering this survey:

- US stocks rebound in the Fed aftermath, S&P500 is 1.5% in the green.

- Ukraine/Russia peace talk hopes gain traction in global financial markets.

The S&P 500 is in the green by some 1.6% at the time of writing and after the volatility surrounding the Federal Reserve that on Wednesday raised its benchmark lending rate for the first time since 2018, citing continued inflation pressures and saying the economic outlook remains "highly uncertain" amid the ongoing war between Russia and Ukraine.

By 19:40 GMT, the S&P 500 was ar 4,328 and had travelled between a low of 4,251.99 and a high of 4,347.06. The US central bank increased the federal funds rate to a range of 0.25% to 0.5% from its prior range of zero to 0.25%. This was in line with the market consensus. However, the statement and dots were more hawkish than expected which initially drive down prices on Wall Street.

"Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher energy prices, and broader price pressures," the bank's Federal Open Market Committee said in a statement after its two-day meeting. The Fed statement noted that the Ukraine war could lead to higher inflation and slower Gross Domestic Product.

It also stated that most Fed officials see as many as seven rate increases in 2022. The Fed explained that the economic activity and employment indicators have continued to gain strength, jobs gains have been sold in recent months, and the unemployment rate has fallen notably.

"The committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run," the FOMC said. "With appropriate firming in the stance of monetary policy, the committee expects inflation to return to its 2 percent objective and the labor market to remain strong," it added.

Separately, the Fed’s dot plot is pencilling in rate hikes at every remaining meeting this year, pointing to a consensus funds rate of 1.9% by the end of this year. It sees three more increases in 2023 and then none the following year.

The committee members also raised their inflation estimates, expecting the personal consumption expenditures price index excluding food and energy to reflect 4.1% growth in 2022, compared to December's 2.7% projection. Core PCE is expected to be 2.6% and 2.3%, respectively, in the next two years before settling to 2% over the longer term.

However, during the Fed chairman's presser, Jerome Powell said rate rises will depend on inflation and economic data. He has stated that the Fed is looking for the month on month inflation to come down, pouring dovish water on what was a more hawkish statement. This helped US stocks rebound ad fall back in line with the broader relief rallies pertaining to hopes of peace talks between Ukraine and Russia.

Ukraine / Russia peace talk momentum shines

Earlier in the day, Russia's foreign minister, Sergei Lavrov, said some formulations of agreements with Ukraine were close to being agreed upon. Moscow added that the two sides had been discussing status for Ukraine similar to that of Austria or Sweeden, meaning being members of the European Union but staying neutral and outside the NATO military alliance.

Ukraine's chief negotiator said it would give Kyiv binding international security guarantees to prevent future attacks. Ukrainian President Volodymyr Zelensky crosse the worse and explained that the peace talks between Russia and Ukraine were sounding more realistic. However, he added that more time was needed, as Russian airstrikes killed five people in the capital Kyiv and the refugee tally from Moscow's invasion reached 3 million.

Fed Chair Jerome Powell said in his post-FOMC meeting press conference on Wednesday that the Fed will move interest rates higher as quickly as it practically can and will move rates beyond the neutral rate if required. We will not let high inflation become entrenched, he said.

Additional remarks:

"Nothing in our framework has caused us to wait longer than we would have."

"You can't blame the framework, it was a sudden burst of inflation."

"The labor market has a lot of momentum and the underlying economy is strong."

"I expected bottlenecks to get better, but they haven't."

"The goal is to restore price stability and sustain a strong labor market."

"Price stability is an essential goal."

"Price stability is a pre-condition for a strong labor market."

"The economy can handle tighter monetary policy."

"We are fully committed to bringing inflation back down."

"High inflation takes a toll on everyone."

"We anticipate inflation will move back down."

"I expect demand to slow enough to better match supply."

"Our plan is to bring inflation down over time."

"We are strongly committed to not allow high inflation to become entrenched."

"The way we do that is by raising interest rates and shrinking the balance sheet."

"The good news is that the economy and labor market is quite strong, can handle interest rate increases."

"We believe our policy is the appropriate one."

"Sanctions are the business of elected officials."

"Wages moving up is a great thing."

"Wage increases are well above what's consistent with 2% inflation over time."

"We don't see an entrenched wage-price spiral."

"I don't see too-high wage increases becoming entrenched."

"There is a misalignment of supply and demand in labor market."

"We need to use our tools to guide inflation back down to 2%."

"We think the labor market can handle tighter monetary policy."

"Wages are moving up faster than what is consistent with 2% inflation."

"Current wage growth isn't sustainable."

"We do expect people to come back into the labor market."

"We expect people will come back to the labor market as Covid-19 becomes less of a factor."

"In hindsight, it would have been appropriate to move earlier, if we knew then what we know now."

"The committee is very focused on using tools."

"No one wants to have to put restrictive policy to bring inflation down."

- The Federal Reserve hiked rates 25 bps as widely expected, the US dollar strengthened.

- The USD/CAD reacted violently, reaching 1.2777, today’s daily high.

- FOMC voted 8-1 with St. Louis Fed President Bullard favoring a 50 bps hike.

USD/CAD reached a new daily high after the US central bank raised the benchmark interest rate by 25 basis points, as widely estimated, the first hike since December of 2018. As Fed’s Chair Powell speaks, the USD/]CAD is trading at 1.2716.

USD/CAD Market’s reaction

The Loonie weakened severely, reacting upwards and printing a daily high at 1.2777

The British pound dropped from nearly 1.3100 towards 1.3070s once the headline crossed the wires, while the US 10-year Treasury note yield rose to 2.212%, the highest since May 2019.

Summary of remarks of Fed monetary policy statement

Overall, the Fed noted that inflationary pressures remain high courtesy of supply difficulties, the pandemic, increasing energy prices, and broadening inflationary pressures. Additionally, policymakers commented that the implications of the Russian war are “highly uncertain” for the US economy and would likely create additional upward pressure on inflation and weigh on economic activity. Also, Fed officials have signaled the necessity of hiking rates to tame inflation, which was confirmed by the dot-plot, in which the board members forecast at least seven hikes in 2022.

Meanwhile, Fed money market futures are pricing in a 50% chance of a 50 bps rate hike on the May 4 meeting, while the US 10-year T-note yield retreats from daily highs around 2.246% to 2.183%.

Labor market-wise, Fed members forecast the unemployment rate would hit 3.5% by the end of 2022 and 2023. Concerning the reduction of the balance sheet, also known as Quantitative Tightening (QT), officials would expect to begin reducing it at a coming meeting. The Fed added that they would adjust monetary policy stance as appropriate if risks emerge, which could impede the central bank goals.

USD/CAD Price Forecast: Technical outlook

Once the Federal Reserve monetary policy decision is on the rearview mirror, the USD/CAD extends its fall, approaching the 1.2700 mark. In fact, the daily high reached post-Fed, pierced the 38.2% Fibonacci level, though at press time is looking for a re-test of the 50% Fibonacci retracement at 1.2706.

The USD/CAD is upward biased. However, the 1-hour chart shows that the USD/CAD is downward biased in the near term, with hourly simple moving averages (SMAs) above the exchange rate. The USD/CAD first support would be 1.2706, the 50% Fibonacci level. Once cleared, the next support would be the 61.8% Fibonacci at 1.2654, followed by 1.2636, February 10 daily low.

- The dollar hits fresh 7-year highs beyond 119.00 after Fed's hike.

- The Federal Reserve raises rates to 0.5% and hints at six more hikes.

- USD/JPY seen rallying towards 122.90/123.00 – Credit Suisse.

The US dollar has jumped about 0.5% against the Japanese yen to hit fresh long-term highs above 119.00 after the Federal Reserve announced its decision to hike interest rates.

Fed’s rate hike pushes the US dollar higher

The greenback has extended its recent rally, pushing an already battered yen to hit fresh seven-year lows at 119.10.

The Federal Reserve has confirmed market expectations increasing the Federal Funds Rate by 25 basis points to 0.50% for the first time since 2018.

Furthermore, the bank has hinted at seven rate hikes in 2022, which would mean one at each remaining monetary policy meeting.

The Monetary Policy Committee notes that supply difficulties and the consequences of the COVID-19 pandemic have pushed inflation to its highest levels in the last four decades and that Ukraine’s invasion is highly likely to increase inflationary pressures and weigh on economic activity.

The rate hike has been approved by 8 votes to 1 with the dissenting voice of the St. Louis Fed President James Bullard, who wanted a 50-basis-point hike.

USD/JPY seen appreciating to 122.90/123.00 area – Credit Suisse

On a longer-term perspective, FX Analysts at Credit Suisse see further room for USD appreciation: “We maintain our long-held bullish outlook with resistance seen next at the 2018 highs at 118.61/66 and with 122.90/123.00 still our ultimate objective (…) Support at 116.35/10 now ideally holds, although only a close back below the 55-day average at 115.24 would warn of a ‘false’ break higher.”

Technical levels to watch

Fed Chair Jerome Powell, in his post-FOMC meeting press conference on Wednesday, said that the committee made excellent progress on their balance sheet reduction plan which could be finalised at the next meeting.

Additional remarks:

"By end of this year, policymakers are broadly at, or above, their estimates of the neutral rate."

"Balance sheet reduction also adds tightening."

"Wage increases are expected to move back down."

"We want to slow demand to get it into better alignment with supply to bring down inflation."

"We are prepared to use our tools as needed to restore price stability."

"It's a really attractive labor market for people, we hope that will lead to more labor supply."

"Raising rates will lead to some tightening of financial conditions and should move to a more normal level."

"The economy no longer needs or wants very highly accommodative stance."

"As we tighten policy, or remove accommodation, we expect broader financial conditions to tighten."

"We made excellent progress on the balance sheet plan."

"We could finalize the balance sheet plan at next meeting in May."

"We will be mindful of broader financial context and want to avoid adding uncertainty."

"Our framework on the balance sheet reduction will be faster than last time."

"Balance sheet reduction will look familiar to last time though faster."

"There will be more details on our discussion will be in next Fed minutes."

- AUD/USD bulls are pressing against 0.7250 resistance.

- Fed's Powell pours dovish water over the hawkish statement.

Following an initial sell-off in AUD/USD over the Federal Reserve interest rate decision and statement, the bulls are moving in as the greenback gives back a significant portion of its rally. At the time of writing, AUD/USD is trading at 0.7250 up some 0.78% on the day and has travelled between a low of 0.7180 and 0.7274.

AUD/USD is trading in lockstep with US stocks which have started to recover the initial sell-off as the Federal Reserve Jerome Powell states that each meeting is a live meeting, but it will depend on inflation and economic data. He has stated that the Fed is looking for the month on month inflation to come down, pouring dovish water on what was a more hawkish statement.

Hawkish Fed statement

Meanwhile, the Fed statement noted that the Ukraine war could lead to higher inflation and slower Gross Domestic Product. It also stated that most Fed officials see as many as seven rate increases in 2022. Additionally, the Fed’s dot plot is pencilling in rate hikes at every remaining meeting this year.

RBA and jobs in focus

Meanwhile, in his speech last week, the Reserve Bank of Australia's Governor Phillip Lowe remarked about inflation risks to all advanced economies. As for the RBA minutes for March, they did not represent any major shift in its rhetoric, though the Board did admit that the wage outlook risks were “skewed to the upside” and that firms were “increasingly prepared to pass on higher costs”.

As for key data in the immediate future, the focus is now on the Aussie labour market. ''We anticipate a strong labour market print for Jan as economic activity continues to pick up amid loose restrictions and robust labour demand,'' analysts at Td Securities said.

''We forecast 50k for the headline and for the participation rate to edge higher to 66.4% which brings the unemployment rate to 4.1%, levels last seen since Mar 2008. We also see a rebound in hours worked after the 8.8% m/m decline in Jan.''

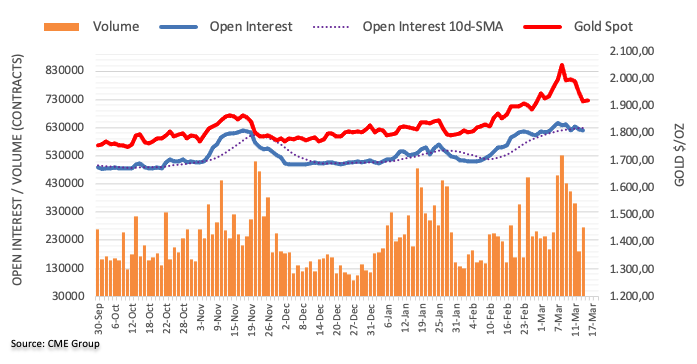

- XAU/USD is eroding support at $1,900 on a 9% reversal from $2,065 highs.

- Gold’s spikes down to $1,894 lows after Fed's rate hike.

- Muted reaction after the Federal Reserve confirms market expectations.

Gold futures have spiked down to fresh two-week lows at $1,894 per troy ounce on Wednesday following the Federal Reserve’s decision to hike interest rates by 25 basis points to 0.50%.

Gold little changed after Fed’s rate hike

The precious metal has been practically unaffected after the US Central Bank met market expectations, raising interest rates for the first time since 2018 and hinting towards more hikes over the coming months.

The Fed’s committee has agreed to increase borrowing costs, forced by the higher inflation in the last four decades and with rather gloomy perspectives, as Ukraine’s invasion is likely to increase inflationary pressures and may derail economic growth.

Beyond that, fed chair Jerome Powell has signaled a total of seven rate hikes in 2022 and has committed to set the plan to begin reducing its $9 trillion balance sheet over the coming meeting.

XAU/USD eroding support at $1,900 area

The yellow metal is now pushing against the support area at $1,900 following a nearly 9% sell-off from early-March highs beyond $2,000.

On the downside, a successful break below $1,900, would increase bearish pressure towards $1,875 (February 24 low) and 1,844 (February 15 low).

On the contrary, any bullish reaction should extend past $1,927 intra-day high before aiming to $1,0960 (March 11 lows) ahead of the $2,000 psychological level.

Technical levels to watch

Fed Chair Jerome Powell said in his post-FOMC meeting press conference on Wednesday that every meeting going forward is going to be a live meeting (i.e. there could be a 25bps rate hike) and, if it's appropriate to move rates up more quickly, we will do so.

Additional Remarks:

"It's certainly a possibility to move more quickly as we go through the year."

"I still expect inflation to come down in the second half of this year."

"I expect inflation to remain high until the middle of the year."

"The committee understands the time for rate increases and reducing balance sheet has come."

"It's clearly time to raise interest rate and shrink the balance sheet."

"The committee is acutely aware of the need to return to price stability."

"Part of the drop in inflation in the near-term will be due to supply chain fixes."

"We are looking for month-by-month inflation to come down."

"If monetary policy starts to bite on inflation, growth with a lag, we will see it more in 2023 and 2024."

"The Fed is getting regulatory business done at the full committee level."

"I haven't made any decisions on the front-loading policy tightening."

"If inflation readings show the need to raise rates more quickly, we will do so."

"We have the tools that we need and will use them."

"We have a plan to raise rates steadily over the course of the year."

"We will take the steps to ensure high inflation does not become entrenched."

"We will also reduce the balance sheet to make sure high inflation does not become entrenched."

"The committee acutely feels an obligation to make sure we restore price stability."

Fed Chair Jerome Powell said in his post-FOMC meeting press conference on Wednesday that the US economy is very strong and the Fed thus expects to reduce the size of its balance sheet. The slowdown from Omicron was mild and brief, Powell added, noting that labour markets are extremely tight and improvements in labour markets have been widespread. Labour demand remains very strong, he added, and labour supply subdued and the Fed expects the labour market to remain strong. Inflation remains well above the Fed's goal, Powell said.

Additional remarks:

"Supply disruptions are larger and longer-lasting than expected."

"The surge in energy prices putting additional upward pressure on US inflation."

"Russia's invasion of Ukraine has added to inflation pressures."

"A strong labor market is only possible with price stability."

"We expect inflation to return to 2.0%."

"Inflation will take longer to return to our goal than initially expected."

"Reducing the balance sheet will also play an important role in tightening policy."

"Implications of Russia's invasion of Ukraine are highly uncertain."

"We will strive to avoid adding to uncertainty."

"We are attentive to risks of further upward pressure on inflation."

- The US central bank hiked rates 25 bps, as widely expected by the markets.

- The Brtish pound’s initial reaction was downwards, piercing the 1.3060, though of late extended losses towards 1.3050.

- FOMC voted 8-1 with St. Louis Fed President Bullard favoring a 50 bps hike.

On Wednesday, the Federal Reserve hiked 25 basis points the Federal Funds Rate (FFR) for the first time in three years. At press time, the GBP/USD is trading around 1.3053, clinging to 0.10% gains.

GBP/USD’s Market reaction

The British pound dropped from nearly 1.3100 towards 1.3060 once the headline crossed the wires, while the US 10-year Treasury note yield rose to 2.212%, the highest since May 2019.

Summary of remarks of Fed monetary policy statement

Fed officials noted that inflationary pressures remain high courtesy of supply difficulties and the pandemic. Furthermore, they said that the implications of the Russian war are “highly uncertain” for the US economy and would likely create additional upward pressure on inflation and weigh on economic activity.

Meanwhile, the Summary of Economic Projections (SEP) revealed the dot-plot, where Fed board members expect at least seven hikes in 2022.

Regarding the labor market, the committee expects the Unemployment rate to hit 3.5% by the end of 2022 and remain at that level in the following year. Policymakers expected to begin reducing Fed’s holdings of Treasuries and mortgage-backed securities (MBS) at a coming meeting. They added that they would adjust monetary policy stance as appropriate if risks emerge that could impede Fed’s goals.

Noteworthy that the Federal Open Market Committee voted 8-1 with St. Louis President James Bullard dissenting, who favored a 50 basis point increase.

Hourly chart

- EUR/USD drops o a strong US dollar following hawkish Fed statement.

- Traders await Powell's comments in the presser.

EUR/USD has dropped to 1.0947 after the Federal Reserve has raised the benchmark interest rate by 25 basis points, in line with expectations. This was the first rate hike since 2018, aimed at stemming soaring inflation.

The single currency that had been rising on Ukraine crisis peace talks hopes had its legs taken out when the US dollar rallied some 0.30% on the Fed decision and statement.

The Fed statement noted that the Ukraine war could lead to higher inflation and slower Gross Domestic Product. It also stated that most Fed officials see as many as seven rate increases in 2022. In the statement, it said that the members expect to begin reducing holdings of treasury securities and agency mortgage-backed securities at a coming meeting.

Overall, the Fed sees inflation still high, owing to supply and demand mismatches caused by the pandemic, rising energy prices, and broader pricing pressures. Fed officials have signalled plans to lift rates steadily this year to lower inflation and this hawkish rhetoric is giving the US dollar a boost.

Essentially, the Fed’s dot plot is pencilling in rate hikes at every remaining meeting this year. Fed funds are now pricing in a 63% chance of a 50 bps hike on May 4, as a consequence, the US 2-year yields have moved in on the 2% mark.

The focus will now turn to the Fed's chairman, Jerome Powell, who will speak live at the presser.

Watch Live: Jerome Powell at the FOMC presser

Traders betting on a stronger US dollar will be looking for Powell to sound hawkish and play down geopolitical risks, hinting at the potential for faster or even 50bp hikes later this year.

However, the dollar would come under pressure if he plays up the risk of geopolitical uncertainty on the US economy. If he suggests that inflation may slow in the second half of the year as COVID shocks fade, then that would be very negative for the US dollar.

EUR/USD technical analysis

The 4-hour M-formation and trendline support is compelling as the price stalls at the closing price from yesterday's business. This is acting as support, so there could be some upside from here with the neckline of the formation as a bullish target near 1.0980. This comes in as a 50% mean reversion of the hourly bearish impulse:

The US Federal Reserve announced on Wednesday that the Federal Open Market Committee (FOMC) had voted to lift the Federal Funds Rate (FFR) target range to 0.25-0.50% from 0.00-0.25%, as expected. In the Fed's updated statement on monetary policy, it signaled that further rate hikes would be appropriate, as expected.

Eight out of nine policy voters supported the move, with the one dissenting vote coming from St Louis Fed President James Bullard who favoured a larger 50bps move to 0.50-0.75%. The Fed said it expects inflation to return to its 2.0% target and for the labour market to remain strong with an appropriate firming of the stance of monetary policy.

The Fed noted that inflation remains elevated, reflecting supply/demand imbalances related to the pandemic, higher energy costs and broader price pressures. The Fed noted, as Chairman Jerome Powell did in a speech last week, that the invasion of Ukraine by Russia is causing tremendous human and economic hardship and that the implications for the US economy are highly uncertain, but in the near-term, the invasion and related events are likely to create additional upwards pressure on inflation and to weigh on economic activity.

Dot-plot

- The Fed's median view of the Fed funds rate at the end of 2022 was raised to 1.9% from 0.9% back in December. That implies the Fed now sees itself raising interest rates at every meeting for the rest of the year, meaning a total of seven 25bps hikes in 2022 (including this Wednesday's hike).

- The Fed's median view of the Fed funds rate at the end of 2023 was raised to 2.8% from 1.6% back in December. That means the Fed views itself hiking interest rates by 25bps another four times in 2023 after seven 25bps moves in 2022. 11 of the Fed's 16 policymakers see the Fed Funds rate moving above the 2.4% neutral rate by the end of 2023, the new dot-plot showed.

- The median view of the Fed funds rate at the end of 2024 was lifted to 2.8% from 2.1% in December.

- The median view of the Fed funds rate in the longer-term was lowered to 2.4% from 2.5% in December.

Economic Forecasts

- The Fed forecasts the unemployment rate to end 2022 at 3.5%, unchanged from its prior estimate, to end 2023 at 3.5% and to then edge up to 3.6% in 2024 before returning to its normal level of 4.0% in the long term.

- The Fed sees PCE inflation of 4.3% in 2022 (revised up from the 2.6% estimate in December), 2.7% in 2023 and 2.3% in 2024, before returning to 2.0% in the long-run.

Market Reaction

The Fed's new dot-plot was much more hawkish than expected, with the Fed signaling a 25bps rate hike at every meeting to the rest of the year followed by a further four in 2023. US 2-year yields (the most sensitive to Fed rate hike expectations) have rocketed towards 2.0% from under 1.90% to reflect the more hawkish rate path and are now up about 14bps on the day.

Longer-term yields are also higher, with the 10-year jumping above 2.20% to hit new cycle highs but up a comparatively more modest 7bps on the day. The belly of the US curve has inverted for the first time since March 2020, with the 7-year yields now above the 10-year yield (at 2.26%ish and 2.23%ish respectively).

The US dollar has been driven higher by Fed hawkishness and higher US yields, with the DXY testing 99.00 again, up from its pre-ed levels under 98.80. Further aiding USD upside is a safe-haven bid with US equities tumbling in wake of the Fed's latest announcement. The S&P 500 has dropped over 30 points from the 4310s to 4280 area in recent trade and is now barely trading with gains on the day.

Focus now turns to Fed Chair Jerome Powell's post-meeting press conference which is scheduled to begin at 1830GMT.

- The NZD/USD advances some 0.52% ahead of the Fed in the day.

- An upbeat market mood keeps the pair in the bid, though downside risks remain.

- The Fed is expected to raise rates by 25 bps.

The New Zealand dollar jumps from daily lows and so far is gaining some 0.53%, amid a positive market mood, ahead of the FOMC monetary policy decision. At press time, the NZD/USD is trading at 0.6810.

Upbeat market mood courtesy of improved discussions between Russia-Ukraine

Market sentiment remains positive, reflected by US equities trading in the green, meanwhile, European bourses closed with gains. Safe-haven peers depreciate in the FX space, benefiting the risk-sensitive currencies, like the NZD and the AUD.

Russia-Ukraine jitters keep grabbing the headlines throughout the day. However, of late, as the Federal Reserve decision looms, market players’ focus is on the US central bank. Analysts expect the Fed to hike rates by 0.25% for the first time in three years. While money market futures have already priced in an 87% chance of that, the focus would be on balance sheet reduction and the Summary of Economic Projections (SEP), with its dot-plot that reflects interest rates expectations of the board. Noteworthy, what the board projects on inflation and the US economic outlook.

Around 18:30 GMT, Fed’s Chief Jerome Powell would hold its press conference. He would be asked about the war in Ukraine, which injected plenty of volatility into the financial markets and its impact in the domestic and global economies.

Late on the day, the New Zealand economic docket would release GDP figures for Q1, with a gain of 3.2% YoY expected.

Technical levels to watch

- The Australian dollar consolidates at 0.7250 after pulling back from 0.7275.

- The positive market sentiment has favored the aussie against the US dollar.

- AUD/USD might retreat towards 0.7100 on a hawkish Fed – Westpac.

The Australian dollar has seen some positive price action during the Asian and European sessions to extend its recovery from 0.7180 lows. Later on, the pair has been capped at 0.7275 before consolidating around 0.7250 as the market braces for the Federal Reserve’s Monetary policy decision.

The USD has lost ground on a risk-on session

The more positive market sentiment, triggered by hopes of progress in the Russia – Ukraine peace talks and the Chinese Government’s announcement of a new set of economic stimulus measures, has boosted the market mood, which has favored the Australian dollar.

Equity markets in Asia and Europe have posted solid gains on Wednesday, while the major US indexes remain positive with all eyes on the US Central Bank's Monetary Policy Committee.

The Federal Reserve is widely expected to hike interest rates for the first time since 2018 in order to ease the highest inflation in four decades. The focus, however, will be on the ensuing statement and on the bank's plan to bring prices under control without hurting the economic growth.

AUD/USD to dip towards 0.71 on hawkish Fed – Westpac

The FX Analysis team at Westpac expects the pair to pull back about 150 pips from current levels on the back of a hawkish Fed statement: “Near-term, risks lie towards the 0.7100 area, with the US dollar benefiting from both haven/liquidity demand and what should be a hawkish tone from the FOMC as it delivers the first of many rate rises.”

Technical levels to watch

- GBP/USD continues to consolidate just under 1.3100 pre-Fed policy announcement, boosted amid the market’s risk-on vibe.

- The Fed is expected to hike rates by 25bps, with focus on the new forecasts, dot-plot and Powell’s tone.

GBP/USD continues to consolidate just to the south of the 1.3100 level with the Fed policy announcement due at the top of the hour. At present, the pair is trading with gains of about 0.4%, with sterling performing well with markets in a risk-on mode amid hopes for further progress in Russo-Ukrainian peace talks. Headlines regarding this topic have been mixed in recent hours, but FX markets haven’t paid too much head and are instead in their typically pre-Fed policy announcement holding pattern.

The bank is expected to lift rates by 25bps for the first time in three years. Traders/market participants will be predominantly focused on 1) the Fed’s new economic forecasts, 2) the Fed’s new dot-plot and 3) the tone of the statement and Fed Chair Jerome Powell’s press conference remarks. Any dovish surprises may be enough to see GBP/USD break back above 1.3100, opening the door to a push on towards 1.3200.

But most do not expect a dovish outcome, with the Fed policymakers having seemingly expressed more worry in recent weeks about the worsening inflation outlook given recent geopolitical events. Recent moves in long-term US bond yields suggest markets increasingly believe that, in the long-run, the Fed will lift rates back to the so-called “neutral” level (in the 2.0-2.5% region). Any hawkish signals from Wednesday’s meeting that spur further upside in long-term US yields would risk sending GBP/USD back towards weekly lows in the 1.3000 area, especially given that the BoE, who set rates on Thursday, won’t be expected to match any Fed hawkishness.

- Gold is offered but is running into a demand area.

- XAU/USD bulls could be tempted should the bears start to bail out.

- Gold to extend downward correction on hawkish Fed.

The gold price is on the backfoot on Wednesday with the signs of a compromise by Russia and Ukraine in "more realistic" peace talks. This also weighed on the US dollar that slid further from almost two-year highs reached over the past week. Markets now await a likely rate hike by the Federal Reserve.

The Fed is expected to boost its benchmark overnight rate by 25 basis points when it releases a policy statement at 2 pm ET (1800 GMT). However, this is well and truly priced in, so the decision itself may not be the driver. Instead, traders will be in anticipation of how hawkish the Fed will be in the face of the Ukraine crisis.

Meanwhile, the signs of Ukraine and Russia compromise has sent relief through global financial markets. Russia's foreign minister, Sergei Lavrov, also said some formulations of agreements with Ukraine were close to being agreed upon. Moscow said the sides were discussing status for Ukraine similar to that of Austria or Sweeden, meaning being members of the European Union but staying neutral and outside the NATO military alliance.

Risk rallies in global stock markets

Ukraine's chief negotiator said it would give Kyiv binding international security guarantees to prevent future attacks. Ukrainian President Volodymyr Zelensky said peace talks between Russia and Ukraine were sounding more realistic but more time was needed, as Russian airstrikes killed five people in the capital Kyiv and the refugee tally from Moscow's invasion reached 3 million.

In light of the prospects of a ceasefire that could come in due course, abating the risks of further escalation in Europe, or indeed worldwide, world stocks recovered ground on Wednesday. The MSCI world equity index rose 0.87%, moving away from the one-year lows hit in the previous session. We have seen a relief rallying European stocks as well, with STOXX gaining 2.2%. On Wall Street, the S&P 500 is u over 1%, the Nasdaq Composite higher by 1.5% and the DJI is higher by 0.7%.

Gold on the Fed

Analysts at TD Securities have argued that ''we could now see a coordinated reversal of flows should the FOMC meeting tilt hawkishly.''

''In this lens, while we don't expect much forward guidance, a rise in the dot plot could be a potential catalyst. We look for an increase in the median to 5 dots for 2022 from 3, and an increase beyond this could be seen as very hawkish.''

''Importantly for global macro, any details on caps for the balance sheet runoff could also push rates higher, with quantitative tightening likely to be a particularly potent channel for asset prices.''

Gold technical analysis

Gold is meeting a support area on the daily chart at the time of writing and is due for a correction from within. There is room for a continuation to 24 Feb. lows $1,878, but as it stands, a 50% mean reversion from here could be on the cards, targeting the neckline of the M-formation at around $1,960/70.

Jerome Powell, Chairman of the Federal Reserve System, will be delivering his remarks on the monetary policy outlook at a press conference following the meeting of the Board of Governors. Powell's speech will start at 18:30 GMT.

Follow our live coverage of the Fed's policy announcements and the market reaction.

About Jerome Powell (via Federalreserve.gov)

"Jerome H. Powell took office as Chairman of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term*. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028."

"*Note: On February 4, 2022, the Federal Reserve Board named Jerome H. Powell as Chair Pro Tempore, pending Senate confirmation to a second term as Chair of the Board of Governors."

Payment on Russian government dollar bonds with coupons due on Wednesday had not been posted by close of business in London, according to two sources familiar with the situation.

This could lead to the sanctions-racked country defaulting for the first time since 1998.

Moscow was due to make $117m (£89.4m) interest payments, or coupons, to investors holding two bonds denominated in dollars. But with much of its foreign exchange reserves frozen by international sanctions, it may be unable to pay.

There is a 30-day grace period, but this could be paving the way to a historic default that would add to the intense pressure on the Russian economy.

However, on the flip side, as the sanctions dig in, there could be a compromise on the horizon between Ukraine and Russia and for that, markets are risk on. The MSCI world equity index rose 0.87%, moving away from the one-year lows hit in the previous session. On Wall Street, the S&P 500 is u over 1%, the Nasdaq Composite higher by 1.5% and the DJI is higher by 0.7%.

Russia's foreign minister Sergei Lavrov also said some formulations of agreements with Ukraine were close to being agreed upon. Moscow said the sides were discussing status for Ukraine similar to that of Austria or Sweeden, meaning being members of the European Union but staying neutral and outside the NATO military alliance.

- The euro attempts to return above 1.1000 after its reversal from 1.1040 area.

- The pair is trading sideways with the market awaiting the Fed's statement.

- EUR/USD could drop to 1.08 on the back of a hawkish Fed – Scotiabank.

The common currency’s pullback from session highs at 1.1040 has been contained at 1.0990, and the pair is now trying to return above 1.1000 with the investors awaiting the release of the Fed’s monetary policy decision.

The euro is hovering around 1.1000 with all eyes on the Fed

The pair remains trading sideways within a tight range around 1.1000 in a rather quiet session as the market braces for the first Federal Reserve’s rate hike since 2018.

The brighter risk sentiment has been supportive to the euro during the previous sessions, and has fuelled a moderate rebound from Tuesday’s lows at 1.0925.

Some positive comments on the Eastern European crisis by Russian and Ukrainian representatives have boosted optimism about a cease-fire, while earlier on Wednesday, the announcement that China is planning to roll out a new set of economic stimulus measures has boosted market mood, which has supported the euro against safer assets like the US dollar.

A hawkish Fed might send the euro to 1.08 – Scotiabank

Scotiabank’s FX analysis team, however, is skeptical about the euro’s near-term uptrend and warns about a bearish reaction to Fed’s statement: “A more hawkish than expected decision should pull EUR/USD under the 1.09 mark toward a re-test of 1.08 over the balance of the week, while a cautious hike could see the pair aim for a test of 1.11 – although we think the trend remains negative with the Fed set to generally meet market expectations through 2022.”

Technical levels to watch

- The Mexican peso consolidates near the 100-day moving average (DMA), pre FOMC.

- Global equity indices reflect the positive market sentiment.

- USD/MXN Price Forecast: Upward biased, but would depend on the Federal Reserve decision.

The Mexican peso is strengthening for the second straight day in the week, after a significant depreciation in the last week, where the USD/MXN reached a YTD high at 21.4679, on a flight to safe-haven assets, courtesy of the conflict between Russia-Ukraine. At the time of writing, the USD/MXN is trading at 20.70, down 0.59% ahead of the FOMC meeting.

A positive market mood surrounds the financial markets. The European and US equity indices are rallying, while the Mexican bourse rises 1.06% in the session.

USD/MXN Price Forecast: Technical outlook

Overnight, the USD/MXN slid from daily highs near 20.8525 to 20.6545 lows, on goodish US economic data, with the US Retail Sales moderating its pace in February, though fell short of forecasts. However, around 18:00 GMT, the Federal Reserve would unveil its monetary policy, an event that could cause violent swings in the USD/MXN exchange rate.

Daily chart

From a technical perspective, the USD/MXN aims upward, as depicted by the daily chart, with all daily moving averages (DMAs) sitting below the exchange rate. However, in the near term, the 1-hour chart shows the pair consolidated in the 20.80-21.05 area, and worth noting the simple moving averages (SMAs) reside above the spot price, which would be tested in the event of a hawkish than expected Federal Reserve.

Hourly chart

Upwards, the USD/MXN first resistance would be March 2 high at 20.7981. Breach of it would expose the 50 and 100-hour SMA at 20.84 and 20.8885, respectively. Once cleared, the next ceiling level would be the confluence of the 200-hour SMA and the 21.0000 figure.

Downwards, the USD/MXN first support would be 20.7000. A decisive break would expose 20.5783 March 2 low, followed by the 50-day moving average (DMA) at 20.5668 and the 200-DMA at 20.4060.

- Euro bulls lose momentum and the pair stalls at 0.8400.

- BoE rate hike expectations are supporting the GBP

- EUR/GBP, looking for direction between 0.8385 and 0.8450.

The euro has been moving sideways around the 0.8400 level on Wednesday, looking for direction after pulling back from one-month highs at 0.8450.

The euro remains flat with all eyes on the Federal Reserve

In absence of first-tier macroeconomic data in Europe or the UK, the EUR/GBP remains practically unchanged on the daily chart, with the investors awaiting the release of the Federal Reserve’s monetary policy decision.

The Fed is widely expected to hike interest rates for the first time since 2018 with the country facing the highest inflation in four decades. The main focus, however, will be on the bank’s statement and the ensuing press release to assess how is the Fed going to manage to bring consumer prices under control without hurting economic growth in a rather delicate moment.

Furthermore, the Bank of England is expected to follow suit and raise its benchmark interest rate on Thursday, which might be supporting the GBP from further depreciation.

EUR/GBP is trapped between 0.8450 and 0.8385

At the moment, the pair remains capped below March 15 high at 0.8450, which is defending February 7 high at 0.8475 and December 20 and 21 highs at 0.8550.

On the downside, immediate support lies at 0.8385 (March 15 low) and below here, 0.8355, where the 50-day SMA and March 11 lows meet. A breach of that level would cancel the near-term uptrend and, probably add pressure towards 0.8300 (February 21, 22 lows).

Technical levels to watch

- The Loonie advances some 0.30% vs. the greenback amid an increased risk appetite.

- Discussions between Russia-Ukraine would continue, though fighting remains.

- Canadian inflation approaches the 6% threshold, while US Retail Sales moderate.

USD/CAD slides for the second straight day in the week, ahead of the FOMC monetary policy decision amid a risk-on market mood, as geopolitical jitters around Russia-Ukraine appear to abate. However, of late, a contradiction between newswires keeps traders on their toes, weighing the outcome in Eastern Europe after a three-week war so far. At press time, the USD/CAD is trading at 1.2725, down 0.33%.

In tone with a positive market sentiment, European and US equity indexes keep trading in the green. In contrast, the CBOE Volatility Index (VIX), the so-called fear index, fell below the 28 mark for the first time since February 25, signaling increased investor appetite for riskier assets.

The US Dollar Index, a gauge of the greenback’s value vs. six rivals, is down 0.50%, sitting at 98.56, ahead of the Federal Reserve monetary policy meeting.

Discussions between Russia-Ukraine “appear” to improve

Earlier in the day, sources cited by the Financial Times said that Russia and Ukraine had made significant progress towards a potential 15-point peace plan that would include a ceasefire and Russian withdrawal from Ukraine. The deal includes that Ukraine would not join NATO and would not host foreign military bases. However, of late, Ukraine has reportedly rejected Russian claims that it was open to adopting a neutrality model comparable to Sweden in peace talks, reported the Independent on Wednesday.

The USD/CAD barely moved to those newswires; instead, traders were focused on the Canadian and US economic dockets. In Canada, inflation rose by 5.7%, higher than the 5.5% y/y estimated by analysts, while the so-called core, which excludes volatile items, rose by 4.8%, more than the 4.5% foreseen.

Canadian inflation approaches the 6% threshold, and US Retail Sales moderate in February