- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 16-03-2011

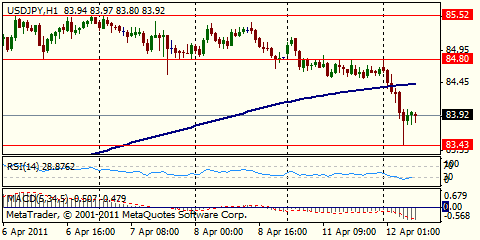

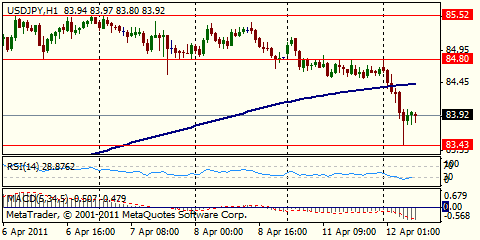

USD/JPY challenged historic lows on Y79.80 before recovered to Y80.00. Traders will watch the overnight session in dollar-yen for any sign that officials are inclined to intervene to weaken the yen and one imagines that the risk of "verbal intervention" is likely quite high.

Stocks have fallen another leg lower so that the S&P 500 now sits at a new two-month low.

Underlying share volume has been robust this session. There are still two full hours before the toll of the closing bell and more than 700 million shares have already traded hands on the New York Stock Exchange. The increase in activity comes as investors juggle their portfolios amid ongoing headline risk related to Japan's nuclear facilities and the political and social tumult in the Middle East and North Africa.

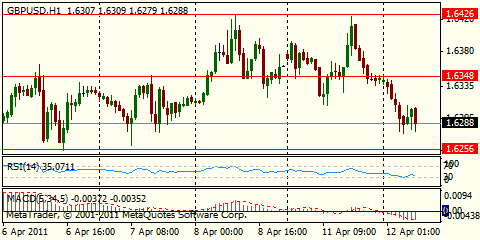

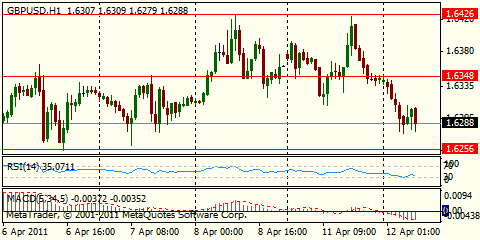

GBP/USD finally fills the bids in the $1.6000/10 level and falls below $1.60 to test lows near $1.5990. There are bids near last Friday's lows around $1.5975/80.

USD/CHF posts a record low around Chf0.9070. BNP Paribas chief technical analyst Andy Chaveriat says the Chf0.9010/Chf0.9000 remains the key target and psychological barrier, with Chf0.9202 (the March 2 low) acting as "first resistance". On the downside, breaking under Chf0.9000 would target "down channel" support at Chf0.8922 and then Chf0.8887/Chf0.8828.

The overall mood among morning participants was weakened by reports of increased violence and instability surrounding the social and political turmoil in the Middle East and North Africa. That news helped prop up oil prices, which are currently up 1.3% to $98.45 per barrel. The advance has come in the face of a greater-than-expected build in weekly inventories.

The dollar has attracted additional buying interest in recent trade. It is now up approximately 0.5% against a basket of major foreign currencies. Although the greenback is currently up against a collection of competing currencies, it was recently down against Japan's yen to 80.15 yen per dollar, which marked the dollar's lowest level against the yen since 1995.

The yen reached its strongest level since 1995 versus the dollar as increased risk in Japan of radiation leaks from crippled nuclear power plants boosted speculation investors there will bring home overseas assets.

Japan’s currency gained for the fourth straight day amid speculation the strength of the yen may prompt intervention to weaken it by the Bank of Japan for the first time since September.

“The more macabre headlines you see pertaining to the nuclear reactors, the more speculation you are going to see over repatriation,” said Jessica Hoversen, an analyst at MF Global Holdings Ltd. “I think 80 is a line in the sand for the central bank.”

“There are real concerns that if it’s a disorderly move down in dollar-yen, the BOJ may start to intervene,” said Paresh Upadhyaya at Bank of America Corp.

In an attempt to slow the yen’s 15% appreciation last year, the Bank of Japan sold 2 trillion yen ($25 billion) in September in the nation’s first currency market intervention since 2004.

The euro fell for the first time in four days after Moody’s Investors Service downgraded Portugal’s credit rating, reviving concern about the region’s ability to solve its debt crisis. The company cited the nation’s “less supportive” economic environment and said its outlook remained negative given Portugal’s “subdued growth prospects” and risks that the government won’t be able to implement deficit-reduction plans.

The Swiss franc gained as violence in the Middle East and concern in Japan prompted haven-asset buying. Bahrain closed its stock exchange as clashes between security forces and anti-government protesters intensified.

Concern that violence may spread to neighboring Saudi Arabia, the world’s biggest oil producer, damped demand for higher-yielding assets and increased commodity prices. The Thomson Reuters/Jefferies CRB Index of raw materials rose 1.1% after falling 3.6% yesterday.

“The focus will remain on Bahrain as well as Japan,” Kathy Lien at GFT Forex. “For the time being, risk aversion will still be something that’s more dominant in the market right now.”

- Greece needs 3.5%/GDP new cuts to hit 2011 deficit target

- Debt seen peaking in 2013, then declining

- Greek economy seen bottoming out in 2h 2011

- Bank system must free itself from eurosystem support

- Greece should start enacting medium-term policy reforms in 2h 2011

- Credit, liquidity both remain tight

- Banks continue to tightening lending, credit standards

- Inflation broadly in line with program estimates

- Inflation to hit 1% by end-2011; stay there for some time

GBP/USD breaks lower earlier lows at $1.6038 to $1.6020. Support area seen from around $1.6015 through to $1.6000. Below the figure and stronger area between $1.5980/75.

- Need new, more sustainable growth model;

- Labour data showed disappointing jobless rise;

- Labour data showed evidence of economic rebalancing

- BOE Bank Rate Should Rise Only Slowly From mid-2011;

- UK Monpol Should Be Expansionary Even If CPI Over Target

Sellers hit stocks at the open to send the major equity averages markedly lower. Stocks have made modest attempts to rebound from the gap down, though.

Leadership is lacking in the early going. Tech, the largest sector by market weight in the S&P 500, is down 0.8%, which makes it the worst performing sector.

General weakness among stocks has helped refresh the bid for Treasuries, but the yield on the 10-year Note is still above the three-month low of about 3.20% that was set yesterday.

U.S. stocks were set for a flat open Wednesday, as investors digested disappointing housing numbers.

Investors also continue to weigh the impact of Japan's deadly earthquake and subsequent nuclear crisis, with other geopolitical tensions around the world.

Early Wednesday, Moody's Investors Service downgraded Portugal's credit rating from A1 to A3 -- a lower investment grade status. And Fitch downgraded Bahrain's debt to below investment grade, following a government clash with protestors.

U.S. stocks are coming off sharp losses Tuesday, as investors looked past a somewhat positive statement from the Federal Reserve, to focus on the deteriorating situation at Japan's Fukushima Daiichi nuclear power plant.

Investors, stunned by the devastation in Japan, had been reducing their exposure to risky assets and flocking to investments that are considered safe, including U.S. Treasuries. But the Wednesday rebound in Japanese stocks sent U.S. bond markets lower.

Economy:

The Commerce Department reported that an annual rate of 479,000 new homes were built in February, down from a revised 618,000 in January.

Economists had expected the number of housing starts to rise to an annual rate of 575,000 units in the month, according to consensus estimates from economists.

Building permits -- considered a leading indicator of activity in the housing sector -- fell to an annual rate of 517,000 last month, down from a revised 563,000 in January.

Permits were expected to have increased slightly to 563,000.

Separately, the government's Producer Price Index showed that prices at the wholesale level jumped 1.6% in February, which was much more than expected. The PPI was forecast to show prices at the wholesale level increased 0.6% in February.

Core PPI, which excludes food and energy costs, increased by 0.2% in the month, matching expectations.

World markets:

Oil prices -- which fell nearly 4% on Tuesday -- were higher early Wednesday, as concerns the ongoing turmoil in North Africa and the Middle East were revived. Oil for April delivery gained $1.80 to $98.98 a barrel.

Gold futures for April delivery climbed $11.10 to $1,403.90 an ounce.

The price on the benchmark 10-year U.S. Treasury was slightly higher, sending the yield ticking up to 3.3%.

The euro halted three days of gains versus the dollar as Moody’s Investors Service downgraded Portugal’s credit rating, reviving concern about Europe’s ability to solve its debt crisis.

The 17-nation common currency depreciated versus all but two its major counterparts after Portugal was cut two steps by Moody’s yesterday to A3, four steps from so-called junk status. The rating company said its outlook remained negative given Portugal’s “subdued growth prospects” and risks that the government won’t be able to implement deficit-reduction plans.

Portugal “faces significant challenges, not least a less supportive economic environment,” Moody’s said in a statement late yesterday. The country’s gross domestic product is expected to “decline this year and experience a weak recovery at best in 2012,” Moody’s said.

“The euro’s under pressure after Portugal’s downgrade,” said Jane Foley, a senior strategist at Rabobank International in London. “Momentum for euro buying has waned.”

Technical analysis suggests the euro’s outlook has worsened after its failure to sustain gains past $1.4000.

US data starts at 1100GMT with the weekly MBA Mortgage Application Index. Meanwhile, US data at 1230GMT includes Housing Starts, Building Permits, the Q4 Current Account and PPI. The pace of housing starts is expected to slow to 560,000 annual rate in February after improving to a 596,000 annual rate in January. Builders continue to hold the line on

new home supply. NAHB reported no change in the builders index in February. Producer prices are expected to increase by 0.7% in February after a 0.8% increase in January. Core prices are expected to increase by 0.2% after the surprise 0.5% jump in January. Later US data sees the weekly EIA Crude Oil Stocks data at 1430GMT.

USD/JPY

Offers: Y81.20/25, Y81.50/55, Y82.05, Y82.50

Bids: Y80.60, Y80.25/20, Y80.15/10, Y80.00

EUR/USD $1.3650, $1.3830, $1.3920, $1.4000, $1.4025

USD/JPY Y82.50

EUR/JPY Y115.65

GBP/USD $1.5900, $1.6125, $1.6200

AUD/USD $0.9800, $0.9850, $0.9940, $0.9945, $0.9950, $1.0015

Banks leading the falls afer Moody's downgraded Portuguese debt and as uncertainty persisted over whether Japan can contain its nuclear disaster.

EUR/JPY Y115.65

GBP/USD $1.5900, $1.6125, $1.6200

AUD/USD $0.9800, $0.9850, $0.9940, $0.9945, $0.9950, $1.0015

Nikkei +5.68% 9093.72

new home supply. NAHB reported no change in the builders index in February. Producer prices are expected to increase by 0.7% in February after a 0.8% increase in January. Core prices are expected to increase by 0.2% after the surprise 0.5% jump in January. Later US data sees the weekly EIA Crude Oil Stocks data at 1430GMT.

Stocks sank, with the Nikkei 225 index posting its biggest two-day drop since 1987. The MSCI World Index fell 2.9 percent while the Standard & Poor’s 500 Index lost 2 percent.

Currencies of commodity-exporting countries plunged as speculation increased the explosions at the nuclear power station will damp demand for raw materials.

The Swiss franc advanced to a record against the dollar on demand for a refuge as Japan’s Prime Minister Naoto Kan said his government is doing everything it can to contain the radioactive leaks following last week’s earthquake and tsunami. The euro pared losses against the U.S. currency even as European Central Bank President Jean-Claude Trichet called “insufficient” a package of economic-oversight rules adopted by European Union finance ministers.

new home supply. NAHB reported no change in the builders index in February. Producer prices are expected to increase by 0.7% in February after a 0.8% increase in January. Core prices are expected to increase by 0.2% after the surprise 0.5% jump in January. Later US data sees the weekly EIA Crude Oil Stocks data at 1430GMT.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.