- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 16-02-2023

- EUR/USD takes offers to refresh intraday low, prints three-day downtrend near 1.5-month low.

- ECB policymakers, monthly bulletin hesitate over further rate hikes.

- Strong US data, yields allow Fed talks to propel policy pivot rate.

- Geopolitical fears, light calendar ahead of next week’s FOMC Minutes keep bears in the driver’s seat.

EUR/USD renews intraday low around 1.0660 as bears cheer a three-day losing streak at the lowest levels since early January. In doing so, the major currency pair justifies the broad US Dollar gains.

That said, the major currency pair’s latest weakness could be linked to the firmer US data that allows the Federal Reserve (Fed) policymakers to remain hawkish versus the European Central Bank (ECB) updates that suggest a receding urge towards the highest rate.

On Thursday, St. Louis Federal Reserve's James Bullard and Cleveland Fed President Loretta Mester were the latest to bolster the greenback while conveying their hawkish bias, backed by upbeat US data. Among them, the Fed hawk Bullard said, “Continued policy rate increases can help lock in a disinflationary trend during 2023, even with ongoing growth and strong labor markets, by keeping inflation expectations low.” Fed’s Mester, on the same line, stated that the Fed will need to go above 5% and stay there for a while. The policymaker also added that she is not ready to say if the Fed needs a bigger rate increase at the next policy meeting but said that she would not want to surprise the markets.

Talking about the data, the US Producer Price Index (PPI) for January gained major attention as it jumped the most since June with 0.7% MoM figure. Also positive was the improvement in the US Initial Jobless Claims for the week ended on February 10, 194K versus 200K expected and 195K prior. Alternatively, a slump in the Housing Starts for January and the Philadelphia Fed Manufacturing Survey for February seemed to have gained a little attention.

Considering the aforementioned catalysts, the latest FEDWATCH read from Reuters signals that the interest rate futures market shows US rates could peak close to 5.25% by July before dropping to 5.0% by the end of the year. The same signals a higher policy pivot than the 5.10% peak conveyed by the Fed in the December meeting, which in turn hints at a few more rate hikes from the Fed.

On the other hand, ECB’s monthly bulletin said, “The Governing Council's future policy rate decisions will continue to be data-dependent and follow a meeting-by-meeting approach.” The central bank’s document also stated that the survey data point to weakening global economic activity at the turn of the year, following robust growth in the third quarter of 2022.

Furthermore, ECB executive board member Fabio Panetta mentioned, “ECB should not unconditionally pre-commit to future policy moves.” On the same line, ECB Chief Economist Philip Lane said, “Calibration of the monetary policy stance needs to be regularly reviewed in line with the incoming information about underlying inflation."

On a different page, the fresh US-China tension and Russia’s refrain from stepping back when it comes to attacking Ukraine also weigh on the risk appetite and the EUR/USD prices, due to the US Dollar’s safe-haven demand.

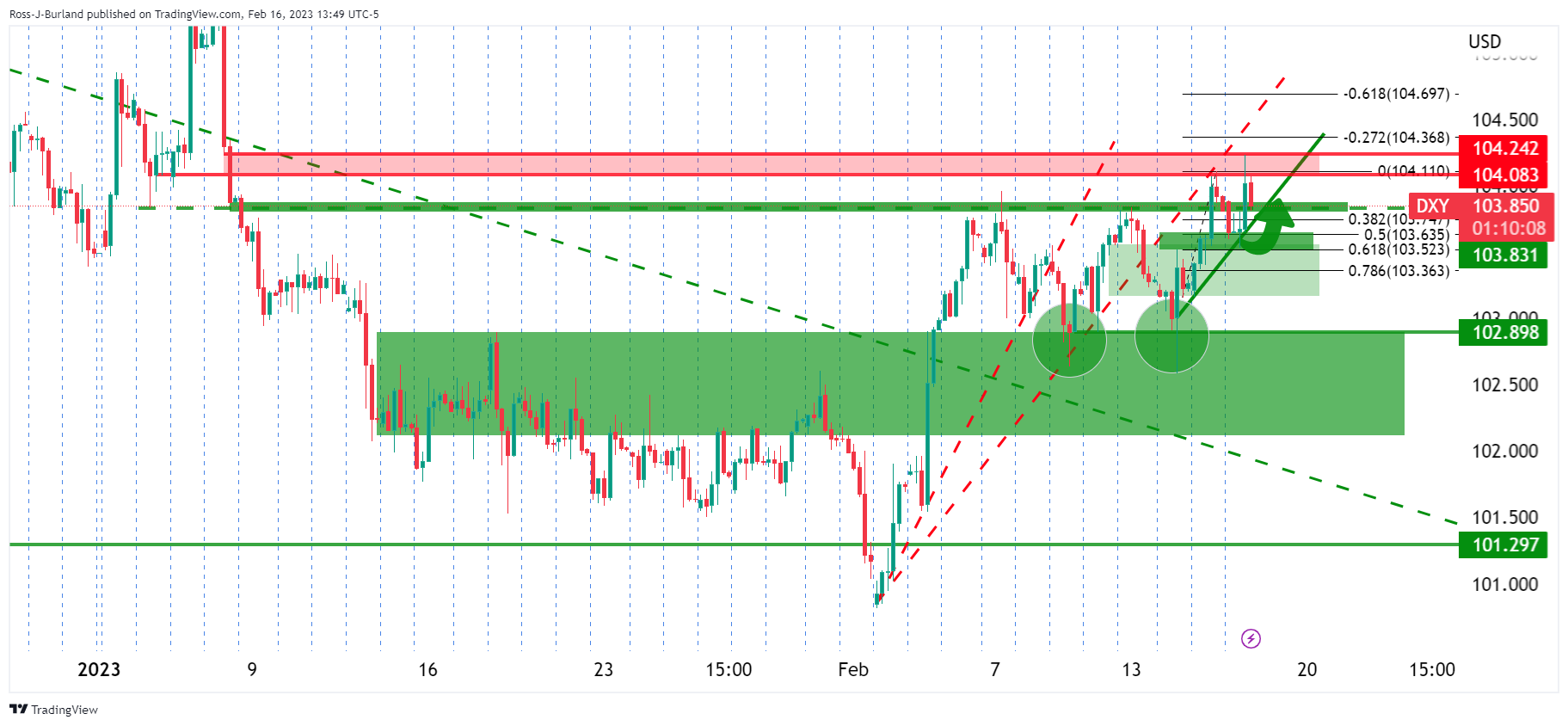

Against this backdrop, Wall Street closed negative and the S&P 500 Futures dropped 0.25% intraday by the press time. Moving on, the US 10-year Treasury bond yields rose to the highest levels in 2023 with the latest print of 3.86% while its two-year counterpart also printed mild gains to end the day around 4.64%, making rounds to the highest levels since November 2022. The same propelled the US Dollar Index (DXY) to refresh a six-week high around 104.23 before retreating to 104.03 by Thursday’s end.

Looking forward, a lack of major data/events keeps EUR/USD grinding towards the south amid the latest hawkish bias for the Fed and strong US data.

Technical analysis

The first daily closing below the 50-day Exponential Moving Average (EMA), around 1.06860 by the press time, since early November 2022 directs EUR/USD toward a 10-week-old ascending support line, close to 1.0620 at the latest.

- AUD/USD holds lower ground near the six-week bottom, prints three-day downtrend.

- RBA’s Lowe, Elis fail to renew hawkish bias despite signaling higher rates, inflation fear.

- Strong US data propels US Treasury bond yields and the US Dollar to weigh on Aussie price.

- Risk catalysts are important for fresh impulse amid light calendar.

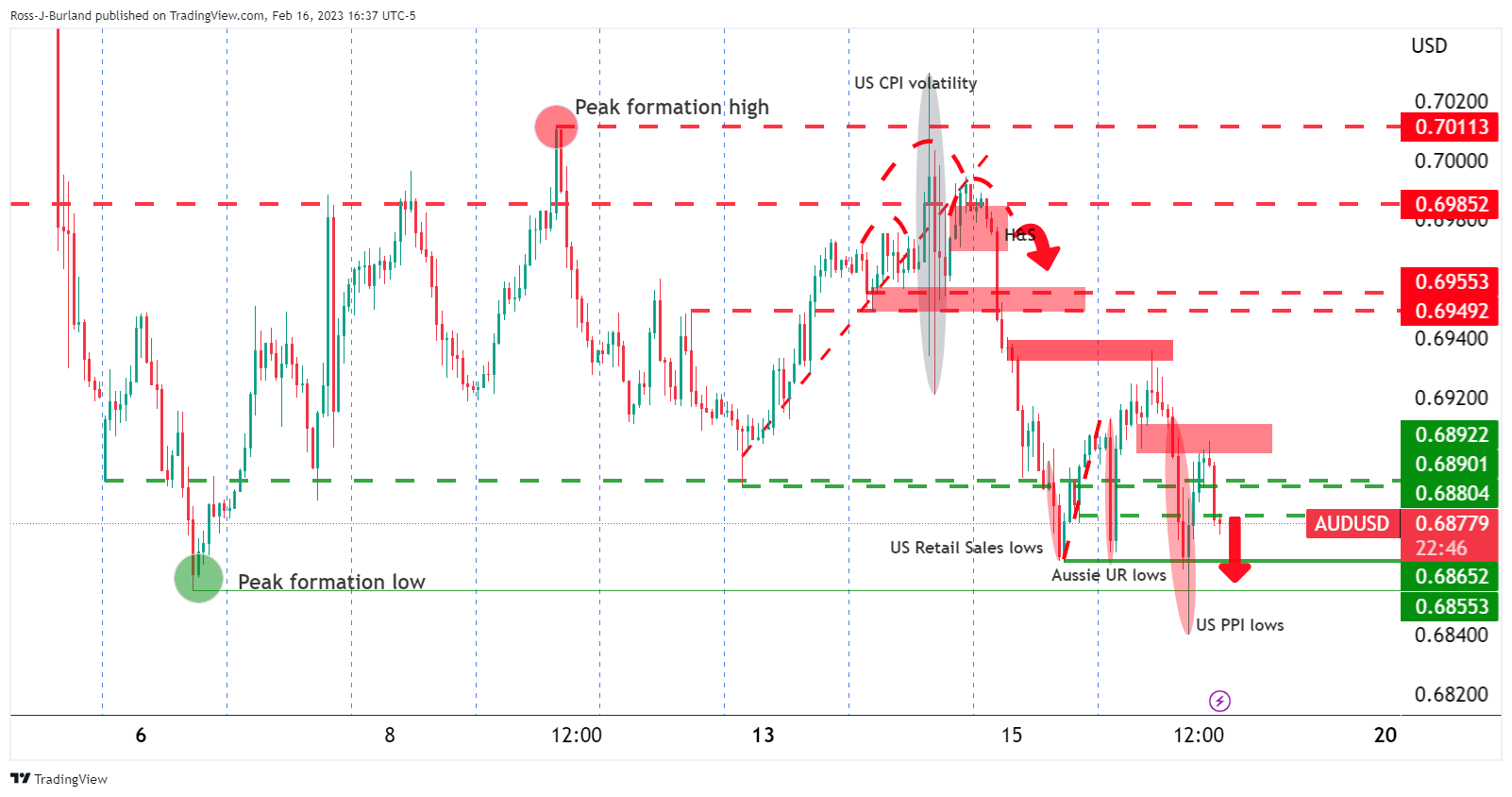

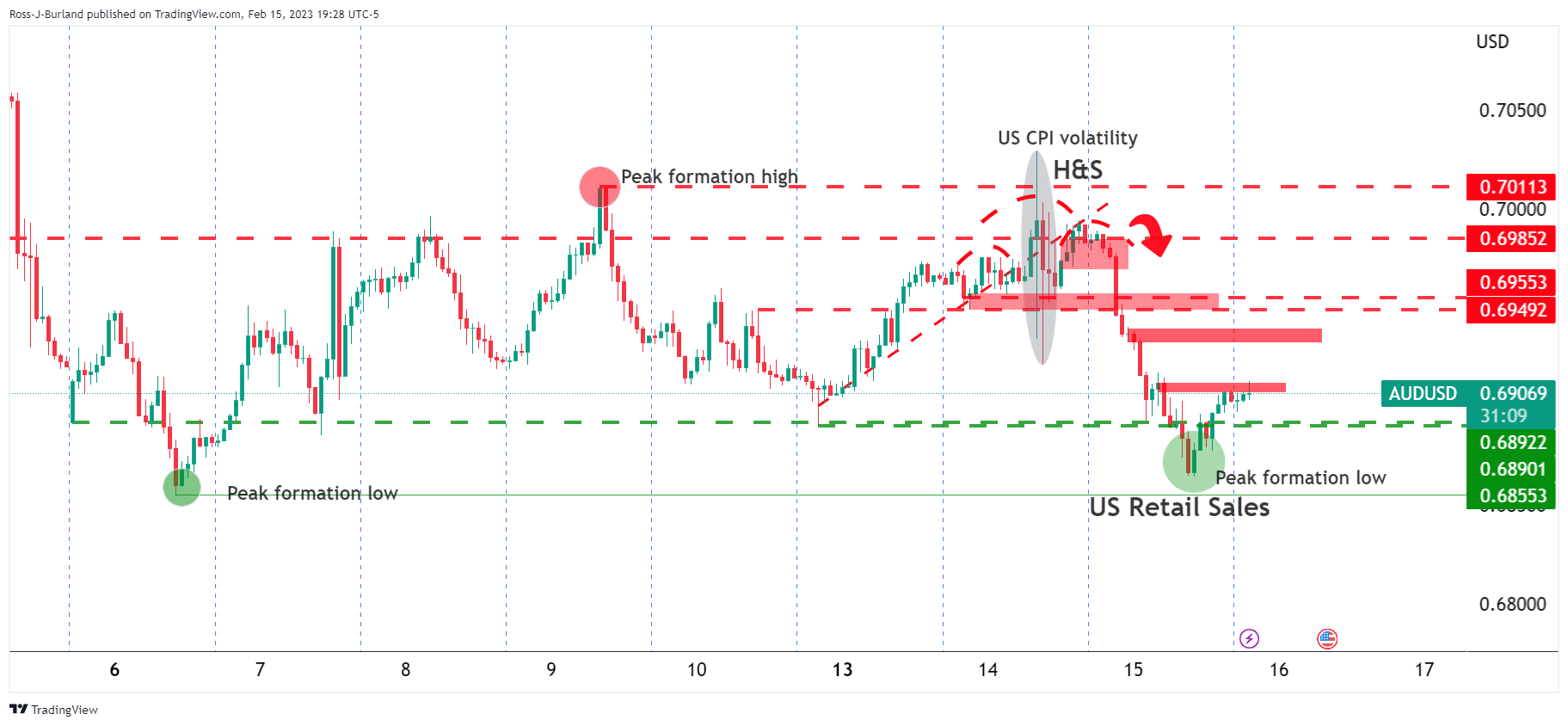

AUD/USD takes offers to refresh intraday bottom around 0.6870 as it prints a three-day losing streak following a failed recovery from the six-week low. In doing so, the Aussie pair takes clues from the hawkish Fed bets while hesitating in praising Reserve Bank of Australia (RBA) Governor Philip Lowe’s readiness for higher rates. It’s worth noting that the job market fears signaled by RBA Assistant Governor (Economic) Luci Ellis exert additional downside pressure on the Aussie pair.

“High inflation is damaging and corrosive,” said Reserve Bank of Australia (RBA) Governor Philip Lowe in his Testimony to the House Economics Committee early Friday in Asia. The policymaker also stated, “We are not done yet on rates”.

Following that, RBA’s Ellis said that the labor market is a little less tight than a few months ago. “Exceptionally huge number of people are awaiting new jobs,” added RBA’s Ellis.

On a different page, Federal Reserve (Fed) officials were quite hawkish and backed by the strong US data to propel the US Dollar, as well as weigh on the AUD/USD price. Among them, St. Louis Federal Reserve's James Bullard and Cleveland Fed President Loretta Mester were the latest to bolster the greenback.

The Fed hawk Bullard said, “Continued policy rate increases can help lock in a disinflationary trend during 2023, even with ongoing growth and strong labor markets, by keeping inflation expectations low.” Fed’s Mester, on the same line, stated that the Fed will need to go above 5% and stay there for a while. The policymaker also added that she is not ready to say if the Fed needs a bigger rate increase at the next policy meeting but said that she would not want to surprise the markets.

US data have recently pushed back the calls for the Federal Reserve’s (Fed) policy pivot. That said, the latest FEDWATCH read from Reuters signals that the interest rate futures market shows US rates could peak close to 5.25% by July before dropping to 5.0% by the end of the year.

Out of the latest US statistics, Producer Price Index (PPI) for January gained major attention as it jumped the most since June with 0.7% MoM figure. Also positive was the improvement in the US Initial Jobless Claims for the week ended on February 10, 194K versus 200K expected and 195K prior. Alternatively, a slump in the Housing Starts for January and the Philadelphia Fed Manufacturing Survey for February seemed to have gained a little attention.

Elsewhere, US President Joe Biden fired shots at his Chinese counterpart while conveying the expectations for a talk with the Chinese leader, during an interview with NBC News. “I think the last thing that Xi wants is to fundamentally rip the relationship with the United States and with me," said US President Biden per Reuters. The same weighs on the market sentiment and the AUD/USD price.

Amid these plays, Wall Street closed negative and the S&P 500 Futures dropped 0.30% intraday by the press time. It should be noted that the US 10-year Treasury bond yields rose to the highest levels in 2023 with the latest print of 3.86% while its two-year counterpart also printed mild gains to end the day around 4.64%, making rounds to the highest levels since November 2022. With this, the US Dollar Index (DXY) refreshed a six-week high around 104.23 before retreating to 104.03 by Thursday’s end.

Moving on, a lack of major data/events joins the risk-off mood and hawkish Fed bets to keep the AUD/USD bears hopeful.

Technical analysis

A daily closing below the 50-DMA, around 0.6885 by the press time, directs AUD/USD price towards the 200-DMA key support surrounding the 0.6800 round figure, backed by bearish MACD signals and an absence of oversold RSI (14).

- After facing solid resistance at a confluence of EMAs, the GBP/JPY it slid 0.51% on Thursday.

- GBP/JPY: For a bearish resumption, a break below 160.00 is needed; otherwise, buyers would remain hopeful of testing 161.00.

The GBP/JPY slides, after hitting the year-to-date (YTD) high at 162.17, retraces and breaks crucial support levels during the last couple of days as bears drive the GBP/JPY pair toward the 160 handle. At the time of writing, the GBP/JPY exchanges hand at 160.59 as Friday’s Asian Pacific session begins.

Long-term, the GBP/JPY daily chart indicates the pair is neutrally biased after facing a solid resistance area, with the 50, 200, and 100-day Exponential Moving Averages (EMAs), each at 160.83, 161.79, and 161.95, respectively. However, buyers could not hold the GBP/JPY prices at around the previously mentioned EMAs, which opened the door for further losses.

The Relative Strength Index (RSI) shifted course, and after peaking at 58, its slope turned south, while the Rate of Change (RoC) shows that sellers moved in as the GBP/JPY dived towards the 160.60 area.

For a bearish resumption, the GBP/JPY first support will be the psychological 160.00 figure. A breach of the latter will expose the 20-day EMA at 159.97, followed by the 159.00 figure and the February 13 swing low at 158.18.

As an alternate scenario, if the GBP/JPY pair edges north and reclaims the 50-day EMA at 160.83, that would pave the way for testing the 161.00 mark. Once cleared, that will expose the 200 and 100-day EMAs on the GBP/JPY way towards 162.00.

GBP/JPY Daily chart

GBP/JPY Key technical levels

Following this week's disappointments in the labour market data, traders are timing into Australia's top central bankers on Friday who are crossing the wires currently.

Reserve Bank of Australia (RBA) Governor Philip Lowe said further increases in interest rates would be needed in the months ahead to ensure sky-high inflation returns to the target range.

Speaking before lawmakers, he said how much further interest rates need to increase would depend on developments in the global economy, how household spending evolves and the outlook for inflation and the labour market.

Key comments

We are not done yet on rates.

The labour market is still very tight.

Could see additional 50,000-70,000 jobs come through data in next month or so.

If we saw another weak jobs report might reconsider if labour market still tight.

RBA's Ellis said more people than usual took leave in January and unusually large numbers waiting to start new job.

More to come..

“Floating Canadian Dollar gives the bank the flexibility to chart a different path than trading partners and focus on setting interest rates,” said Bank of Canada Deputy Governor Paul Beaudry on Thursday per Reuters.

More to come

- Gold Price holds lower ground at 1.5-month low, eyed third weekly loss.

- United States Producer Price Index (PPI) bolsters hawkish Federal Reserve bets and fuels US Treasury bond yields, US Dollar.

- Mixed updates on major XAU/USD consumers, US-China tension adds to the downside pressure.

- No major data/events ahead of next week’s Fed Minutes.

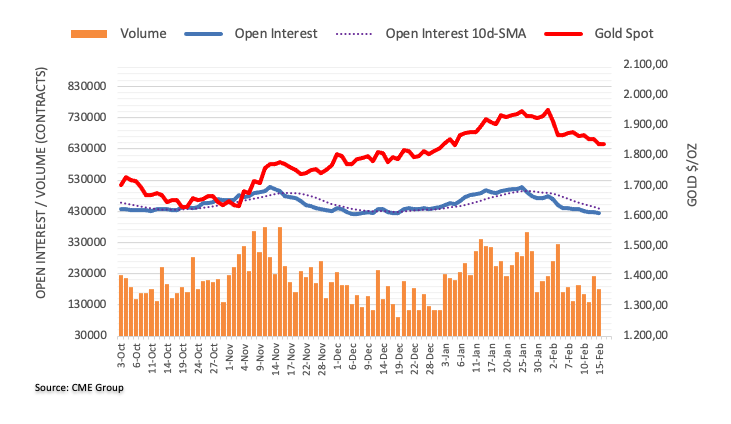

Gold price (XAU/USD) braces for the third consecutive weekly loss as it holds lower grounds near $1,835 during early Friday morning. The major catalyst for the yellow metal’s latest losses could be linked to the United States economics which renew hawkish bias for the Federal Reserve (Fed). Also weighing on the XAU/USD could be the headlines surrounding India and China, as well as a lack of major data/events ahead of the next week’s Minutes of the latest Federal Open Market Committee (FOMC) monetary policy meeting.

United States data weigh on Gold price

Upbeat statistics from the United States have recently pushed back the calls for the Federal Reserve’s (Fed) policy pivot. That said, the latest FEDWATCH read from Reuters signals that the interest rate futures market shows US rates could peak close to 5.25% by July before dropping to 5.0% by the end of the year. The same allows the US Treasury bond yields and the US Dollar to remain firmer and weigh on the Gold price.

Among the latest US data, Producer Price Index (PPI) for January gained major attention as it jumped the most since June with 0.7% MoM figure. Also positive was the improvement in the US Initial Jobless Claims for the week ended on February 10, 194K versus 200K expected and 195K prior. Alternatively, a slump in the Housing Starts for January and the Philadelphia Fed Manufacturing Survey for February seemed to have put a floor under the Gold price.

That said, the US 10-year Treasury bond yields rose to the highest levels in 2023 with the latest print of 3.86% while its two-year counterpart also printed mild gains to end the day around 4.64%, making rounds to the highest levels since November 2022. With this, the US Dollar Index (DXY) refreshed a six-week high around 104.23 before retreating to 104.03 by the day’s end.

XAU/USD bears cheer India, China news

Other than the Federal Reserve concerns, the mixed headlines surrounding the Gold imports from India and China, as well as the latest geopolitical tension between the US and China, also seems to weigh on the XAU/USD price. It should be noted that India and China are the world’s leading Gold consumers.

As per the latest World Gold Council (WGC) data, China's Gold imports increased by 64% year-on-year last year, totaling up to 1,343 mt of gold, the highest level since 2018.

On the other hand, Reuters quoted an anonymous source on Thursday to mention that India's Gold imports plunged 76% in January from a year earlier to a 32-month low, as record high domestic prices dented physical demand.

Elsewhere, US President Joe Biden fired shots at his Chinese counterpart while conveying the expectations for a talk with the Chinese leader, during an interview with NBC News. “I think the last thing that Xi wants is to fundamentally rip the relationship with the United States and with me," said US President Biden per Reuters.

Smooth run for Gold sellers ahead of Federal Reserve Minutes

Apart from what’s already mentioned above, a lack of major data and events ahead of the next week’s Monetary Policy Meeting Minutes for the Federal Open Market Committee’s (FOMC) latest action also seems to keep the Gold bears on the driver’s seat. The reason could be linked to the majority of the US data that has put a floor under the hawkish Fed expectations.

Gold price technical analysis

Gold price remains depressed below a two-week-old descending trend line, previous support, as well as a downward-sloping resistance line from February 02. Adding strength to the downside is the metal’s sustained trading below the 200-bar Simple Moving Average (SMA).

It’s worth noting that the sluggish signals from the Moving Average Convergence and Divergence (MACD) indicator join the downbeat Relative Strength Index (RSI) line, placed at 14, to suggest a slower grind toward the south.

With this, the Gold price decline towards two-month-old horizontal support, near $1,820 by the press time, appears imminent. However, the quote’s further downside will need a strong catalyst to break the stated key support and aim for the $1,800 threshold.

Alternatively, a convergence of the aforementioned support-turned-resistance and an 11-day-old descending trend line offers strong resistance to the Gold price around $1,845, a break of which could allow the XAU/USD to pare recent losses and challenge the 200-SMA level of near $1,892.

In a case where the Gold price remains firmer past $1,892, the $1,900 threshold will be important to watch for further guidance.

Gold price: Four-hour chart

Trend: Further downside expected

- USD/CHF is subdued but looms around the 50-day EMA, at around 0.9282.

- In the short term, the USD/CHF is range-though slightly tilted upwards, and it might rise to 0.9300.

USD/CHF edges higher above the 20-day Exponential Moving Average (EMA) at 0.9221 and is threatening to register a daily close above Wednesday’s high of 0.9262, cementing a bullish continuation in the USD/CHF. At the time of typing, the USD/CHF is trading at 0.9256 after hitting a daily low of 0.9213.

As the Asian session begins, the USD/CHF daily chart depicts the pair distanced from the 20-day EMA and threatened to break the 50-day Exponential Moving Average (EMA) at 0.9282, though it fell short and retraced. Traders should be aware that the Relative Strength Index (RSI) shifted to bullish territory, but it’s flat, meaning buyers are getting a respite before launching an assault on the 50-day EMA. As an alternate scenario, If the USD/CHF tumbles below the 20-day EMA at 0.9221, that would expose the 0.9200 figure, followed by the current week low of 0.9139.

On an intraday time frame, the USD/CHF 4-Hour chart suggests the pair is sideways, within the 0.9160/0.9260 range, but the jump from YTD lows at around 0.9059 opened the door for further upside.

A breach of 0.9260 will expose the 0.9300 figure, which would be up for grabs. A move upward and January 12 at 0.9360 would be the bears’ next line of defense, followed by the psychological 0.9400 mark.

On the downside, sellers need to break below the 200-EMA at 0.9242. Once done, the confluence of the 20/50 EMA around 0.9220/30 would be tested ahead of 0.9200.

USD/CHF 4-Hour chart

USD/CHF Key technical levels

“High inflation is damaging and corrosive,” said Reserve Bank of Australia (RBA) Governor Philip Lowe in his Testimony to the House Economics Committee.

Additional comments

Will do what is necessary to make sure that inflation returns to the target range.

It would be dangerous, indeed, not to contain and reverse this period of high inflation.

Based on the currently available information, the board expects that further increases will be needed over the months ahead.

How much further interest rates need to increase will depend on developments in the global economy, how household spending evolves and the outlook for inflation and the labour market.

Path here is a narrow one.

It is important that people expect that the high inflation is only temporary.

One is the risk of not doing enough, which would result in high inflation persisting and then later proving very costly to get down. The other is the risk that we move too fast, or too far.

Inflation expectations remain well anchored and aggregate wage outcomes are not inconsistent with inflation returning to target.

It is still possible for us here in Australia to navigate this path.

But it is also possible that we are knocked off that narrow path.

Very conscious that the impact of higher rates is being felt very unevenly across the community.

AUD/USD stays pressured below 0.6900

AUD/USD pays a little heed to the macro as RBA’s Lowe refrains from any fresh signals from what he already spoke in the first round of the testimony. That said, the Aussie pair remains depressed near 0.6875, after declining to a six-week low the previous day.

Also read: AUD/USD Price Analysis: Bears and bulls about to standoff at key 0.6850s

President Biden said that early indications show the three objects downed over North American airspace in the past week were privately-owned balloons and were not conducting surveillance, BBC reported.

''It follows White House spokesman John Kirby's comments on Tuesday that the objects were likely “tied to some commercial or benign purpose".

The trio of objects were much smaller than the alleged Chinese spy balloon, but officials said they were flying at an altitude that posed a threat to commercial airlines as a justification for shooting them down.''

Biden also said, ''I believe the last thing xi wants is to fundamentally rip the relationship with the US and with me,'' in an NBC news interview.''

- AUD/USD bears are coming in form the resistance in the hour time frame.

- Bulls are lurking below the lows and eye an opportunity to balance the books.

AUD/USD has stalled on the bid and has been making tracks to the downside in the last couple of hours in the hunt for territory below 0.685o lows. The pair needs to get below there or face immediate p[pressures to the upside for the bulls searching for money above 0.6920. The following illustrates the market structure and the developments over the course of this week's template and arrives at a semi-bullish bias for the end of the week.

AUD/USD H1 chart

AUD/USD has been in the hands of the bears throughout the course of this week with 0.6850 standing in the way of the final push lower. However, given the build-up of shorts, this could be an overstretched position in the spot market and it might warrant a sizeable correction to balance the books into the weekend:

- NZD/USD creeps below the 0.6260 area after US data showed that inflation is still looming.

- The US Producer Price Index rose above estimates as inflationary pressures reignited.

- NZD/USD Price Analysis: To resume its downtrend, with a daily close below the 100-DMA; otherwise, a test of 0.6300 is on the cards.

The NZD/USD extends its losses, though trimmed some after hitting a year-to-date (YTD) low of 0.6232, on the back of US data showing that inflationary pressures remain. Hence, speculators had begun to push back rate cuts foreseen by the end of 2023 as they began to price-in higher rates. At the time of writing, the NZD/USD exchanges hands at 0.6260.

High US bond yields underpin the US Dollar after strong US data

Economic data revealed in the United States (US) keep investors nervous, as shown by Wall Street, set to finish with losses. The Producer Price Index (PPI) for January on a monthly basis, came higher-than-expected, in headline PPI and core PPI, with readings at 0.7% and 0.4%, respectively. Echoing some of the inflationary pressures witnessed in the Bureau of Labor Statistics (BLS) data, the Philadelphia Fed Manufacturing Index plummeted severely to -24.3 from -7.4 estimates, underscoring higher input prices after ten straight months of lower printings.

Once data hit the screens, the NZD/USD tumbled and reached a new daily low of 0.6232, before reversing its course, influenced by US Dollar (USD) strength. US Treasury bond yields climbed as traders began to price in no cuts by the Federal Reserve (Fed) in 2023, after CPI and PPI data showed a slight uptick in inflation.

On the New Zealand front, the impact of cyclone Gabrielle would impact the country’s economy, as its damages are pending to be quantified. According to ANZ analysts, “there will be cost pressures as a result of the cyclone. Construction costs, rents, insurance, the cost of food (and many other costs) are likely to face further upwards pressure. There is not much monetary policy can do to help in an event like this – that is best managed through fiscal policy which is faster acting and more targeted. Although the impact of the cyclone is considered inflationary, we expect the RBNZ will lift the OCR 50bp this week, rather than the 75bp they signalled in November.”

NZD/USD Technical analysis

Once the NZD/USD edged below the 200 and 100-day Exponential Moving Averages (EMAs), each at 0.6289 and 0.6263, exposed the pair to sellers. Nevertheless, failure to crack below the 0.6230 area keeps investors hopeful that the bounce could open the door to reclaim the previously-mentioned long-term moving averages. If that scenario plays out, the NZD/USD could rally towards 0.6300 after regaining the 0.6260/90 area. Otherwise, the NZD/USD pair would resume its bearish continuation toward the 0.6200 area.

- EUR/USD bears are staying the course as bullish attempts are faded at resistance.

- Bears eye the 1.0650s for the ending sessions of the week.

EUR/USD bulls have come up for air near 1.0700 to a US session high of 1.0697 to meet resistance, both horizontal and dynamic. The US Dollar came under pressure again despite a slew of inflationary data over the last several days and the EUR/USD bears are out in force:

EUR/USD H1 chart

EUR/USD has broken through numerous supports casting a bearish shadow in its tracks that leaves scope for a downside continuation should the 1.0650s give out in the forthcoming days. We have seen a move up into the third day of shorts and a positive close on Thursday will give rise to the prospects of a deeper correction of the recent bearish run.

However, a late session surge from the bears is underway and that could leave prospects of a bearish close for another day and the downside bias underpinned:

As illustrated, there have been three days of shorts, old and new, with the latest coming in the last hours on Wall Street.1.0650 is on the bear's radar but given the build-up of shorts, a big squeeze could come into play to end the week and to balance the books:

What you need to take care of on Friday, February 17:

US Dollar reached fresh weekly peaks against most major rivals, giving back some ground ahead of the Wall Street close as US indexes bounced from their early lows. The catalyst came from the US Producer Price Index (PPI), up 6% YoY in January, down from 6.5% in December, but above the 5.4% forecast. The figures revived speculation the US Federal Reserve will maintain the pace of tightening for more than anticipated while a pivot in monetary policy moved further away.

Stocks came under intense selling pressure, although Wall Street trimmed most of its intraday losses ahead of the close. US government bond yields, on the other hand, advanced, with the 10-year note now offering 3.83% and the 2-year note paying 4.61%.

The EUR/USD pair trades a handful of pips below 1.0700, while GBP/USD hovers around 1.2010.

European Central Bank Executive Board member Fabio Panetta said raising borrowing costs in small increments would allow a better monetary policy adjustment as previous tightening has started to put a brake on economic activity.

According to the Federal Reserve Bank of Atlanta's GDPNow model, the US economy is expected to grow at an annualized rate of 2.5% in the first quarter, up from 2.4% in the previous estimate.

Bank of Canada Governor Tiff Macklem said he expects CPI inflation to fall to around 3% in the middle of this year and reach the 2% target in 2024. However, he added, "if evidence begins to accumulate to show that inflation is not declining in line with forecast, we are prepared to raise policy rate further." USD/CAD trades at around 1.3420.

AUD/USD battles to regain the 0.6900 threshold after falling to a fresh monthly low on the back of soft Australian employment data and the sour tone of equities.

USD/JPY topped 134.45 with US yields intraday peaks, now down to 133.80.

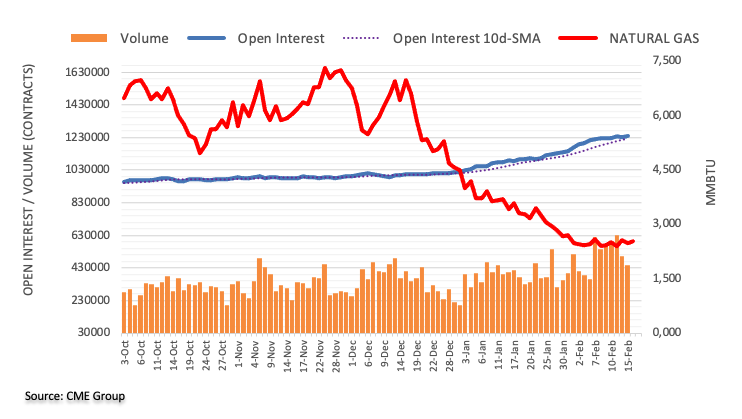

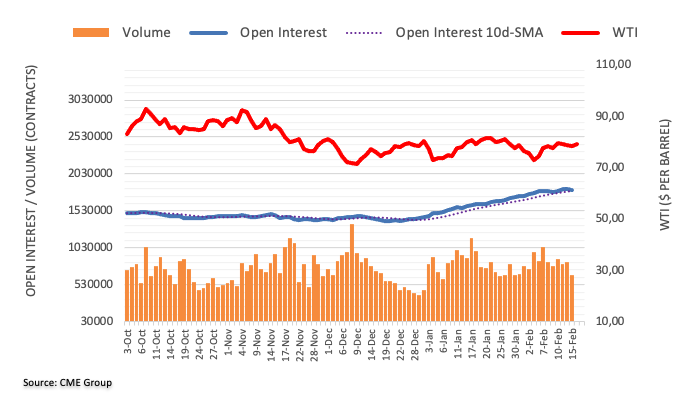

XAU/USD fell to $1,827.58 a troy ounce, its lowest since early January. It currently hovers at around $1,842, helped by receding risk aversion. Crude oil prices remained stable, with WTI changing hands at $78.45 a barrel.

Bitcoin price could run up to $41,000 over the next month if it follows this pattern

Like this article? Help us with some feedback by answering this survey:

There is growing speculation that a deal between the UK and EU on the Northern Ireland Protocol is imminent.

the BBC reported that Mr Sunak last visited Northern Ireland in December when he met the parties to discuss the controversial post-Brexit trade arrangements for the region.

''It is understood that the prime minister will speak to the main political parties again on Friday.''

His spokesperson said:

"Whilst talks with the EU are ongoing ministers continue to engage with relevant stakeholders to ensure any solution fixes the practical problems on the ground, meets our overarching objectives and safeguards Northern Ireland's place in the UK's internal market. The prime minister... [is] travelling to Northern Ireland this evening to speak to political parties as part of this engagement process."

The BBC said ''the suggestions are that if the UK and the EU can get all of their T's crossed and their I's dotted a deal on the Northern Ireland Protocol might be done early next week.;;

EUR/GBP update

The Euro has been a better performer of late and has travelled higher vs. the Pound towards the 0.90 area. so far, support is holding and the bulls have reemerged within the ascending channel.

- Silver price stopped its fall but remains shy of reclaiming the 200-EMA.

- A third daily close below the 200-day EMA will cement Sllver's price downward bias.

- Silver Price Analysis: Break below $21.40 would expose the $21.00 mark.

Silver price attempts to recover the 200-day Exponential Moving Average (EMA) but stays shy of reclaiming the $21.94 price level, which would underpin the XAG/USD towards the psychological $22.00 mark. Nevertheless, the Silver price registers gains, and the XAG/USD is trading at $21.71 after hitting a daily low of $21.44.

Once the XAG/USD extended its losses beyond the 200-day EMA, sellers faced difficulties dragging prices below the weekly low of $21.43. The Relative Strength Index (RSI) is in bearish territory but turned flat, meaning bears are getting a respite before re-attempting to drive prices toward the November 28 low at $20.87.

In the short term, the XAG/USD 1-hour chart suggests the pair is sideways. Even though the white metal dived towards the S1 daily pivot at $21.40, it encountered bids and climbed back above the daily pivot at $21.64. However, failure to crack the R1 daily pivot at $21.84 would keep the daily chart bias intact.

That said, the XAG/USD first support would be the daily pivot at $21.64, followed by the S1 pivot point at 21.40. A breach of the latter and the following line of defense for Silver bulls would be the S2 daily pivot at $21.19, followed by the S2 area at $20.96.

XAG/USD 1-Hour chat

XAG/USD Key technical levels

The St. Louis Federal Reserve's James Bullard has crossed the wires and stated that the market-based expectations of inflation are "now relatively low" and that the economy is growing faster than previously thought with unemployment below the long-run rate and output above its potential.

He said inflation "remains too high" but note that it has come down recently noting that a "disinflationary" process had begun and could continue with additional Fed rate increases.

"Continued policy rate increases can help lock in a disinflationary trend during 2023, even with ongoing growth and strong labor markets, by keeping inflation expectations low."

US Dollar update

As the above analysis illustrates, the US dollar, as measured against a basket of currencies, has been breaking to the upside and out of a geometrical consolidation's top side resistance albeit on the backside of the prior bullish trends supporting lines.

It has been a slow grind higher for the US Dollar and not even firmly hawkish Federal Reserve rhetoric and data have been able to free up the bulls from the clutches o the bears. However, should the DXY close firmly above 103.65/80 this week, a case for higher could be drawn, as per the following daily chart analysis:

- Gold price bears came close but there was no cigar.

- The US data of late has been in contrary to the belief that the Fed is about to pivot.

- Investors could now be looking to diversify in uncertain times.

Gold price bears have been on a quest for the $1,825 target since the start of the month in anticipation of a long squeeze into higher time-frame breakout traders getting long at the break of $1,800 towards the end of 2022. In Thursday's Gold price action, fuelled by a resurgence in the US Dollar pertaining to a slew of inflationary US economic data, the bears moved in again and came in close to the $1,825 target, but there was no cigar.

At the time of writing, Gold price is trading higher by some 0.3% and close to the highs of the day ($1,844.80) near $1,842 and has rallied from the session low of $1,827.62 in a typical volatile fashion. The US Dollar is trying to claim higher grounds on the back of a fickle narrative surrounding the Federal Reserve and what the latest key data points are revealing to be sticky inflation for longer.

US data feeds the offer in Gold price

In mixed data on Thursday, the Labor Department's Producer Price Index (PPI) leapt by 0.7% in January, which was an abrupt reversal of December's 0.2% dip and well above the 0.4% consensus. Year-over-year, the measure fell in at 6%, hotter than the 5.4% projection but a cool-down from the prior (upwardly revised) 6.5% print. The core PPI measure posted a monthly increase of 0.6%, triple the December rate, and an annual increase of 4.5% - a 20 basis point drop from the previous month.

On top of that, as if any further proof was needed after the blowout January Nonfarm Payrolls report, the jobs market data again today confirmed that the labour market is still carrying plenty of momentum. The Labor Department reported that jobless claims, for the fifth straight week, came in below the 200,000 level associated with a healthy employment churn.

A day prior, the United States Retail sales jump 3% in January, smashing expectations despite an inflation increase that might have otherwise kept consumers' hands in their pockets, highlighting the strength of the economy. On Tuesday, the annual Consumer Price Index inflation rate in the US slowed slightly to 6.4% in January from 6.5% in December, the lowest since October 2021 but above market expectations of 6.2%. Last week's Services PMI data for the prior month was impressively high also.

All in all, the data comes in contrast to wheat the markets had been pricing in terms of the Federal Reserve. However, following all of this inflationary data, the whole yield curve rose, and markets have started to embrace a higher for longer sentiment as estimates are now rising that the Fed may continue to raise rates into the summer.

However, the question for market watchers is how well can the economy continue to hold up, especially as rates head much higher than many originally thought. so this might have put a meanwhile bid back into the Gold price as it steers back into shorts that have built up over the last couple of days as investors seek out diversification in their portfolios.

Gold technical analysis

In the prior analysis, Gold Price Forecast: XAU/USD bears remain keen on $1,825, the chart above highlighted the prospects of a continuation to the downside with D1 and D2 shorts in the market to trigger a third day of shorts on Thursday. This is what we got, but the $1,825 level was not quite reached.

Instead, we now have the possibility of a first green day in a series of red days and that means longs are moving in:

This could mean a correction of the downtrend is imminent which puts $1,854 on the map as a 61.8% Fibonacci retracement target. However, we have both dynamic trendline resistance and horizontal resistance to break first between the 38.2% Fibo and the 50% mean reversion levels around $1,850 accumulatively.

- GBP/USD is registering minuscule losses of 0.05% on Thursday.

- The jump in producer prices in the US and strong labor market data would keep the Fed tightening monetary policy.

- GBP/USD Price Analysis: Daily close below the 100-day EMA will cement the downward bias.

The GBP/USD is subdued in the mid-North American session spurred by a jump in producer inflation in the United States (US). In contrast, Wednesday’s UK inflation data weakened the Pound Sterling (GBP) as inflation slowed. Hence, the GBP/USD is trading around the 1.2000/15 range, below its opening price.

The US PPI uptick and the tight labor market are likely to pressure the Federal Reserve

The US Bureau of Labor Statistics (BLS) revealed that the Producer Price Index in January increased by 0.7% from December, which was higher than the expected jump of 0.4%. Excluding items prone to rapid price changes, the so-called core PPI rose by 0.5% vs. an estimated increase of 0.3%. Although the year-over-year data was lower than the previous month, the monthly figures indicate that inflation is persistently high and may require additional actions by the Federal Reserve to address it.

Following the data release, the GBP/USD slid from around the daily pivot point at 1.2060 and dropped towards the 1.1978 area before reclaiming the 1.2000 figure.

At the same time, Initial Jobless Claims for the week ending on February 11 came at 194K, beneath the prior reading of 196K, and showed the labor market’s resilience. Albeit high-tech companies announced layoffs, unemployment claims lower reads would pressure the Federal Reserve, and it might open the door for additional tightening than foreseen.

In the meantime, the Philadelphia Fed Manufacturing Index plunged sharply to -24.3 vs. -7.4 estimates by analysts. The poll delivered comments by producers which said that input prices are rising after ten months of cooling down.

Across the pond, a softer Consumer Price Index (CPI) in the UK, down to 10.1% from 10.5% in December, on an annual basis. UK bond yields eased after the data release as a reflection that the Bank of England (BoE) would not need to tighten monetary conditions aggressively.

Given the backdrop, the GBP/USD might extend its losses due to recent data in the United States (US), which would trigger a reaction by the Fed. Money market futures expect at least two 25 bps interest rate increases, which will lift the Federal Funds Rate (FFR) to the 5-5.25% range. That said, further GBP/USD downside is expected, with sellers already dragging prices below the 20, 50, and 100-day Exponential Moving Averages (EMAs).

GBP/USD Technical analysis

The GBP/USD daily chart portrays the pair as neutral to downward biased. Thursday’s price action shows sellers pushing the exchange rate to close below the 100-day EMA at 1.2035. That would cement the downward bias, exposing the 1.2000 figure, followed by February’s low at 1.1960 and the psychological 1.1900 figure. As an alternate scenario, if the GBP/USD reclaims the 100-day EMA, that could pave the way for 1.2100.

- USD/JPY hit a weekly high of 134.46 but retraced toward the 134.10 area.

- USD/JPY Price Analysis: Negative divergence between oscillators and price action could pave the way for downside action.

The USD/JPY consolidated around the 134.00 area after hitting a daily high of 134.46, though bears stepped in around the highs of the week, dragging prices lower. Hence, the USD/JPY changed its course gears and records minimal losses of 0.08%. The USD/JPY pair is trading around 134.10s on Thursday.

On February 15, the USD/JPY reached a daily high at 134.35, and since then, the USD/JPY has remained sideways within the 133.60/134.30 area. Even though the Relative Strength Index (RSI) is in bullish territory, as USD/JPY price action has headed north, the RSI did not. Hence, a negative divergence could emerge, suggesting that a price reversal looms.

If that scenario plays out, the USD/JPY first support would be this week’s low at 133.60. Break below, and the 20-day Exponential Moving Average (EMA) would be exposed at 133.28, followed by the February 13 daily high-turned support at 132.90.

On an alternate scenario, the USD/JPY’s first resistance would be the day’s high at 134.46, which, once cleared, could lift the USD/JPY to January 6 high at 134.77 before the major climbs to 135.00.

USD/JPY Daily chart

USD/JPY Key technical levels

"If evidence begins to accumulate to show that inflation is not declining in line with forecast, we are prepared to raise policy rate further, Bank of Canada Governor Tiff Macklem said while testifying before the Standing Committee on Finance.

Key takeaways

"We’ve seen some evidence that our interest rate increases are starting to slow demand and rebalance our overheated economy."

"With inflation above 6%, we are still a long way from the 2% target, but inflation is turning the corner."

"Canadian economy remains overheated and clearly in excess demand, and this continues to put upward pressure on many domestic prices."

"Expect CPI inflation to fall to around 3% in the middle of this year and reach the 2% target in 2024."

"Global energy prices could jump again, pushing inflation up around the world."

Market reaction

USD/CAD showed no immediate reaction to these comments and was last seen trading at 1.3460, where it was up 0.5% on a daily basis.

Gold is seeing a more severe setback below the crucial 55-Day Moving Average (DMA) at $1,853. Strategists at Credit Suisse expect the yellow metal to find a solid support at the 200-DMA of $1,775.

Move above $1,998 can reassert an upward bias

“Gold has been capped at resistance at $1,973/98 as expected and continues to fall further and is now clearly below the 55-DMA, currently seen at $1,853, which raises the odds of further losses towards the long-term 200-DMA, currently seen at $1,775, which we expect to floor the precious metal.”

“Above $1,998 can reassert an upward bias for a test of long-term resistance from the $2,070/72 record highs of 2020 and 2022.”

According to the Federal Reserve Bank of Atlanta's GDPNow model, the US economy is expected to grow at an annualized rate of 2.5% in the first quarter, up slightly from 2.4% in the previous estimate.

"After this morning’s housing starts report from the US Census Bureau, the nowcast of first-quarter real residential investment growth increased from -10.4 percent to -8.1 percent," the Atlanta Fed explained in its publication.

Market reaction

This report doesn't seem to be having a noticeable impact on risk mood. As of writing, the S&P 500 Index was down 0.75% on a daily basis.

Cleveland Fed President Loretta Mester said on Thursday that the recent data showed the demand side of the economy was not softening as expected and added that she was expecting growth to slow appreciably this year, as reported by Reuters.

Mester further noted that she is not ready to say if the Fed needs a bigger rate increase at the next policy meeting but said that she would not want to surprise the markets.

Elaborating on the rate outlook, Mester reiterated that the main focus now is on raising rates and added that she doubts there will be a need to cut rates this year.

Market reaction

The US Dollar Index clings to modest daily gains slightly below 104.00 following these comments.

- USD/MXN clings to its gains, hovering nearby $18.58, after solid US data.

- US labor market data show a tight labor market, while the PPI came higher than expected.

- USD/MXN Price Analysis: Is still neutral-downward biased, but positive divergence could make a case for a rally to $19.00.

The Mexican Peso (MXN) lost some ground against the US Dollar (USD) on Thursday following US economic data, which sparked speculation that there could be more rate hikes than just two by the Federal Reserve (Fed) as money market futures data showed. At the time of writing, the USD/MXN exchanges hands at around 18.6481.

The US economic calendar is a busy one on Thursday. On the inflation side, the Producer Price index (PPI) for January rose by 0.7% MoM, above estimates of 0.4%, while Core PPI, which excludes volatile items, came at 0.5% vs. 0.3% foreseen. Even though year-over-year data was lower than the previous month, monthly figures underscore stubbornly stickier inflation that might need further tightening by the Fed.

Aside from this, Initial Jobless Claims for the week ending on February 11 hit 194K, below the prior reading of 196K, and below the 200K foreseen by analysts, emphasizing the tightness of the labor market, which remains pending of displaying the effects of 450 bps of rate hikes by the Fed.

In other data, the Philadelphia Fed Manufacturing Index plunged below estimates of -7.4, down to -24.3. Comments from the poll showed that cost increases accelerated for the first time in 10 months, contrarily to their own prices, which slowed down.

According to Reuters, “the survey’s two measures of prices, those paid by producers and those they charge their customers - both closely watched inflation indicators - showed margins were slimming. The prices paid index edged up to 26.5 from 24.5 to mark its first increase since April 2022, while the prices received index fell by 50% to 14.9, the lowest reading since February 2021.”

Meanwhile, the USD/MXN regained some composure after hitting a low of 18.5361. Albeit it hit a daily high of 18.6832, it has remained pressured, by market sentiment, with risk-on impulses increasing demand for the Mexican Peso.

Elsewhere, Cleveland Fed President Loretta Mester said she sees compelling evidence to hike rates by 50 bps in the upcoming meetings. She sees upside risks to inflation and justifies that the scenario supports the case for “overshooting” on policy. “Over-tightening also has costs, but if inflation begins to move down faster than anticipated, we can react appropriately,” Mester said.

USD/MXN Technical analysis

From a technical perspective, the USD/MXN remains neutral-downward biased. Still, the positive divergence between the Relative Strength Index (RSI) and price action is looming, meaning that prices could move higher. For a bearish continuation, the USD/MXN needs to break below the YTD low at 18.4836, so it can test the psychological $18.00. On the other hand, if the USD/MXN reclaims the 20-day EMA at 18.7714, the USD/MXN would be poised to challenge $19.00.

European Central Bank (ECB) Chief Economist Philip Lane said on Thursday that policy actions are clearly tightening financial conditions, as reported by Reuters.

"Much of the ultimate inflation impact of our policy measures to date is still in the pipeline," Lane added. "Over time, our monetary policy will make sure that inflation returns to our target in a timely manner."

Additional takeaways

"Models signal for the most part point to a strong and orderly transmission of the ECB’s policy tightening to the relevant financial and real variables."

"Open minded about the precise scale of the monetary policy tightening that will be needed to achieve this outcome."

"Calibration of the monetary policy stance needs to be regularly reviewed in line with the incoming information about underlying inflation."

"Models suggest that reducing our asset portfolio by a normalised cumulative €500 billion reduction over 12 quarters contributes to lowering inflation by 0.15 percentage points and output by 0.2 percentage points."

"Tightening is estimated to have already lowered inflation by around 0.2 percentage points in 2022."

"Inflation is estimated to be around 1.2 percentage points lower in 2023 and 1.8 percentage points lower in 2024 as a result of the tightening."

"Significant amount of excess savings could dampen the transmission of higher policy rates to the economy and inflation."

Market reaction

EUR/USD stays on the back foot following these comments and the pair was last seen losing 0.2% on the day at 1.0670.

Optimistic investors are sending US stocks higher, but they should be wary of moves that “fight the Fed,” Lisa Shalett, Chief Investment Officer, Wealth Management at Morgan Stanley reports.

The economic outlook is blurry

“Some investors expect the economic recovery in China to rescue the US. economy from steeper decline, but if US growth rebounds, that could put upward pressure back on prices and prompt the Fed to keep rates higher for longer, in turn weighing on asset prices.”

Corporate profits remain vulnerable

“For the past 10 quarters, US nominal GDP has run between 9% and 14%, versus the long-run trend of 4-5%, and S&P 500 operating margins have averaged 14.5-16.5%, versus the 25-year average of 12.5%. The tendency for performance to revert to a long-term average could bring about a negative year-over-year change in earnings growth, known as a ‘profits recession’.”

Strength in the labor market persists

“A resilient jobs market could help the economy achieve a ‘soft landing’ if robust real wages support consumption. The conundrum, however, is that strong wages and spending would likely add to inflationary pressures and thus provide little rationale or incentive for the Fed to cut rates.”

EUR/USD has extended its setback. However, this phase should prove to be temporary, in the view of analysts at Credit Suisse.

Key level to watch is 1.0655 in EUR/USD

“Near-term momentum stays lower, and below 1.0695/55 would be seen to warn of a deeper but still, we think corrective setback to next support at the 38.2% retracement of the 2022/2023 rally and early January YTD low at 1.0483/63. We look for this though to prove better support if tested.”

“Above 1.0802/06 is needed to clear the way for strength back to test the 50% retracement of the 2021/2022 fall at 1.0944. A weekly close above here should see a move back to the 1.1035 current YTD high and eventually what we look to be tougher resistance at 1.1185/1.1275.”

US rates are helping the Dollar, while we wait for a new market theme to emerge, Kit Juckes, Chief Global FX Strategist at Société Générale, reports.

The Dollar is rising with US rates again

“Absent a genuinely new driver, we have seen strong US data push up pricing of terminal Fed Funds and the dollar has reverted to rising in sync with real rates. Reviving an old relationship is fine for a while, but can only take the Dollar so far. We're still looking for a new story.”

“Current pricing looks for two or three 25 bps hikes by September, and it may take a bigger inflation scare than we saw in this week's CPI data, or another very strong labour market report at the start of March, to push them higher. Absent that, we will probably get stuck in a range again, before the next move (which we'd guess is more likely to be towards Dollar softness as growth resumes elsewhere).”

Economists at Commerbznka believe that the Euro has little scope to strengthen.

Little scope for the ECB to deviate from the course set by the Fed

“The market seems to see little scope for the ECB to deviate from the course set by the Fed. This would lead to a weaker Euro and thus to new inflationary impulses, which the euro area cannot afford in view of the still seriously high inflation.”

“We now see the market more in line with the hawkish comments from the ECB. However, this also means that further appreciation potential for the Euro is limited.”

- EUR/USD now adds to Wednesday’s decline below 1.0700.

- Fed’s L.Mester stressed inflation risks remain on the upside.

- US Producer Prices rose more than estimated in January.

Another data-led rebound in the greenback puts EUR/USD under fresh pressure and drag it to the sub-1.0700 region on Thursday.

EUR/USD weak on USD bounce

EUR/USD now extends the selling pressure seen in the previous session in response to another bullish attempt in the greenback, this time following results from the US docket and hawkish remarks from Fed’s L.Mester (2024 voter, hawk).

Indeed, the pair revisited the area below 1.0700 the figure after US Producer Price rose more than expected a monthly 0.7% in January and 6.0% from a year earlier. Still on the strong side, weekly Initial Claims increased by 194K in the week to February 11, showing once again the persistent good health of the labour market.

On the not-so-bright side, Building Permits expanded at a monthly 0.1% in January - or 1.339M units - Housing Starts shrank 4.5% MoM - or 1.309M units - and the Philly Fed Manufacturing Index disappointed everybody after declining to -24.3 for the current month.

Earlier in the session, ECB’s F.Panetta suggested inflation in the region could drop below the 3% at some point towards the end of the year, while he also warned against risks of over-tightening (seriously?).

From the Fed’s playground, Cleveland Fed and well-known hawk L.Mester (2024 voter) reiterated that inflation remains too high at the time when she noted that the current Fed’s tightening cycle should slow growth and increase unemployment. She also advocated for rates to climb above the 5% level and stay there for an extended period of time.

What to look for around EUR

Despite the recent rebound to the 1.0800 region, EUR/USD remains within the multi-day consolidative phase and decently supported near 1.0650 for the time being.

In the meantime, price action around the European currency should continue to closely follow dollar dynamics, as well as the potential next moves from the ECB after the bank has already anticipated another 50 bps rate raise at the March event.

Back to the euro area, recession concerns now appear to have dwindled, which at the same time remain an important driver sustaining the ongoing recovery in the single currency as well as the hawkish narrative from the ECB.

Eminent issues on the back boiler: Continuation of the ECB hiking cycle amidst dwindling bets for a recession in the region and still elevated inflation. Impact of the Russia-Ukraine war on the growth prospects and inflation outlook in the region. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is retreating 0.13% at 1.0672 and a drop below 1.0655 (weekly low February 13) would target 1.0481 (2023 low January 6) en route to 1.0325 (200-day SMA). On the upside, the next up barrier aligns at 1.0804 (weekly high February 14) seconded by 1.1032 (2023 high February 2) and finally 1.1100 (round level).

The S&P 500 rally has stalled near term, but analysts at Credit Suisse still see scope for an eventual test of 4312/4325.

Initial support seen at 4016

“The S&P 500 rally looks to have stalled near term, and we see scope for some near-term consolidation and a pullback. This stays viewed as a temporary setback ahead of further strength in due course to test key resistance at the 61.8% retracement of the 2022 fall and summer 2022 high at 4312/4325. We look for this to then prove a tough barrier to define the top of what we believe could be a broad and lengthy range.”

“Support is seen at 4016 initially, then the 63 and 200-day averages at 3975/43, which we look to ideally hold. Below 3886 though is needed to suggest we may have seen a ‘false’ break higher and more important peak.”

Federal Reserve Bank of Cleveland President Loretta Mester said on Thursday that she saw a 'compelling case' for a 50 basis points (bps) rate hike at the last FOMC meeting, as reported by Reuters.

Key takeaways

"Fed has more work to do to control inflation."

"Fed will need to go above 5% and stay there for a while."

"Transition back to price stability will bring some pain."

"How far Fed goes above 5% depends on data."

"Upside risks to inflation remain in place."

"Fed actions will slow growth, push up unemployment."

"January CPI data showed still more to do on cooling inflation."

"Inflation levels remain too high."

"Bigger risk is to undershoot in effort to control inflation."

"How far Fed goes with future hikes depends on inflation."

"Expecting to make good progress on lowering inflation."

Market reaction

The US Dollar holds its ground against its major rivals following these comments and the US Dollar Index was last seen rising 0.12% on the day at 103.93.

Alvin Liew, Senior Economist at UOB Group, assesses the recent Q4 GDP results in the Japanese economy.

Key Takeaways

“Japan’s 4Q 2022 GDP rebounded as expected, but the pace of increase was below forecast at 0.2% q/q, 0.6% q/q SAAR while the contraction in 3Q was revised worse to -0.3% q/q, -1.0% q/q SAAR. For the full year, GDP expanded by 1.1% in 2022, easing from 2.1% in 2021.”

“We had expected Japan’s economy to rebound in 4Q but the momentum was weaker than forecast as we underestimated the impact of stronger inflation and the decline in business spending, offsetting the recovering private consumption while the stronger yen and falling commodity prices in 4Q helped trim the country’s previously ballooning import bill. But weaker external demand (as overseas markets slowed down) made the export recovery shallower.”

“Japan GDP Outlook – Our 2023 outlook is largely premised on broad moderation in external economies this year, and we project the US and European economies to enter a (shallow) recession this year amidst aggressive monetary policy tightening stance among these advanced economies. This will directly impact the manufacturing and external-oriented services sectors and will imply softer demand for Japan’s exports. In comparison, services is expected to fare better and help anchor the domestic economic recovery as upside growth factors could be attributed to the continued recovery in leisure and business air travel and inbound tourism, which will benefit many in-person services sectors, and the impact of China’s reopening is likely to be positive for these sectors. With the weaker 2023 manufacturing outlook cushioned by the improving tourism and barring external events (such as escalating war in Europe, worsening US-China relations and a deadlier variant of COVID-19), we keep our modest 2023 GDP growth forecast of 1.0% (from 1.1% in 2022).”

- GBP/USD comes under renewed selling pressure on Thursday and refreshes the weekly low.

- The emergence of fresh USD buying turns out to be a key factor dragging spot prices lower.

- The technical setup favours bearish traders and supports prospects for a further downfall.

The GBP/USD pair attracts fresh selling following an intraday move up to the 1.2075 area and drops to a fresh daily low during the early North American session. The pair slips back below the 1.2000 psychological mark in the last hour and is now seen flirting with the weekly low touched on Wednesday.

The prospects for further policy tightening by the Fed, along with the risk-off impulse, assist the safe-haven US Dollar to recover a major part of its intraday losses. Furthermore, expectations that the Bank of England's (BoE) current rate-hiking cycle is nearing the end continue to undermine the British Pound and act as a headwind for the GBP/USD pair.

From a technical perspective, spot prices this week struggled to find acceptance above the 50-day SMA and the overnight slump suggests that the near-term downtrend is still far from being over. The outlook is reinforced by the fact that oscillators on the daily chart are holding in the bearish territory and are still far from being in the oversold zone.

Hence, a subsequent slide towards challenging the very important 200-day SMA, currently around the 1.1940-1.1935 region, looks like a distinct possibility. Against the backdrop of a double-top formation near the 1.2445-1.2450 region, some follow-through selling will confirm a fresh bearish breakdown and set the stage for a further depreciating move.

The GBP/USD pair might then turn vulnerable to weaken further below the 1.1900 round-figure mark and accelerate the slide towards retesting the YTD low, around the 1.1840 region touched in January.

On the flip side, the 1.2060-1.2070 region now seems to act as an immediate hurdle ahead of the 1.2100 mark and the 1.2125-1.2130 horizontal zone. This is followed by the 50-day SMA, around the 1.2175 area, above which a fresh bout of a short-covering could lift the GBP/USD pair beyond the 1.2200 mark, towards the 1.2265-1.2270 region, or the weekly high.

GBP/USD daily chart

Key levels to watch

- Housing Starts in the US declined sharply in January.

- US Dollar Index holds in positive territory slightly below 104.00.

The monthly data published by the US Census Bureau revealed on Thursday showed that Housing Starts declined by 4.5% on a monthly basis in January following December's 2.4% drop.

In the same period, Building Permits rose by 0.1% but fell short of the market expectation for an increase of 0.8%.

Market reaction

The US Dollar Index edged higher in the early American session following the latest data releases and was last seen rising 0.08% on the day at 103.90.

Senior Economist at UOB Group Alvin Liew comments on the recent revision of GDP figures in Singapore.

Key Takeaways

“Singapore’s final 4Q22 GDP growth was revised lower to 2.1% y/y, 0.1% q/q (versus Bloomberg median forecast & UOB est. of 2.3% y/y) from the advance estimate of 2.2% y/y, 0.2% q/q. The downward revision for 4Q GDP came about despite the better-than-expected manufacturing sector performance and instead, it was let down by the downward revisions to the services and construction sectors. For the full year, GDP growth was revised lower to 3.6% in 2022 (from advance estimate of 3.8%) as growth in the manufacturing and services growth were revised a tad lower.”

“The message from the Ministry of Trade and Industry (MTI) provided a small silver lining as it noted that “Singapore’s external demand outlook has improved slightly.” The MTI sounded an optimistic tone for the growth outlook for aviation- and tourism-related sectors but remained downbeat towards outward-oriented sectors. With the cautious but “slightly” improved external outlook and barring the materialisation of the highlighted risk factors, the MTI kept its Singapore GDP growth forecast for 2023 unchanged at the range of “0.5-2.5%.” As for the trade outlook, the Enterprise Singapore (ESG) is maintaining the forecast of “-2.0% to 0.0%” for both total merchandise trade and NODX, due to a high base in 2022 and lower expected oil prices.”

“Our SG GDP Outlook - Our 2023 outlook is largely premised on broad moderation in external economies, and we project key end markets for Singapore to enter a (shallow) recession this year amidst aggressive monetary policy tightening stance among advanced economies. Services could fare better in 2023 as upside growth factors could be attributed to the continued recovery in leisure and business air travel and inbound tourism. We keep our modest 2023 GDP growth forecast of 0.7% (closer to the lower end of the official forecast).”

- Initial Jobless Claims in the US decreased by 1,000 in the week ending February 11.

- US Dollar Index stays in the upper half of its daily range.

There were 194,000 initial jobless claims in the week ending February 11, the weekly data published by the US Department of Labor (DOL) showed on Thursday. This print followed the previous week's print of 195,000 and came in slightly better than the market expectation of 200,000.

Further details of the publication revealed that the advance seasonally adjusted insured unemployment rate was 1.2% and the 4-week moving average was 189,500, an increase of 500 from the previous week's revised average.

"The advance number for seasonally adjusted insured unemployment during the week ending February 4 was 1,696,000, an increase of 16,000 from the previous week's revised level," the DOL noted.

Market reaction

The US Dollar Index clings to small daily gains but stays below 104.00 after this data.

- US annual PPI in January declined at a softer pace than expected.

- US Dollar Index stays below 104.00 after the data.

The Producer Price Index (PPI) for final demand in the US declined to 6% on a yearly basis in January from 6.5% in December, the data published by the US Bureau of Labor Statistics revealed on Thursday. This reading came in higher than the market expectation of 5.4%.

The annual Core PPI edged lower to 5.4% in the same period from 5.5%, compared to analysts' estimate of 4.9%. On a monthly basis, the Core PPI came in at 0.5%.

Market reaction

The US Dollar Index staged a modest rebound with the initial reaction to the PPI data and was last seen posting small daily gains at 103.87.

- EUR/USD regains the smile following Wednesday’s marked drop.

- Immediately to the downside appears the monthly low near 1.0650.

EUR/USD extends the multi-session consolidative phase around the 1.0700 neighbourhood so far on Thursday.

If the selling pressure gathers extra impulse, the pair could challenge he February low at 1.0655 (February 13) in the short-term horizon. The breach of the latter exposes further weakness to the YTD low at 1.0481 (January 6).

In the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0325.

EUR/USD daily chart

- Silver fails to capitalize on its modest intraday uptick to the 100-day SMA support breakpoint.

- The technical setup supports prospects for an extension of the well-established downtrend.

- Bears, however, might wait for a break below the 50% Fibo. level before placing fresh bets.

Silver struggles for a firm direction on Thursday and seesaws between tepid gains/minor losses heading into the North American session. The white metal is currently placed just above the mid-$21.00s and remains well within the striking distance of its lowest level since November 2022 touched on Wednesday.

From a technical perspective, the overnight convincing break and acceptance below the 100-day SMA could be seen as a fresh trigger for bears. That said, oscillators on the daily chart have moved on the verge of breaking into oversold territory. This, in turn, assists the XAG/USD to defend the 50% Fibonacci retracement level of the recent rally from October 2022.

This makes it prudent to wait for some follow-through selling below the aforementioned support, around the $21.40 area, before positioning for a further decline. The XAG/USD might then accelerate the slide

towards a technically significant 200-day SMA, currently near the $21.00 mark. Spot prices could eventually drop to 61.8% Fibo. level support around the $20.60 zone.

On the flip side, the 100-day SMA support breakpoint, around the $21.85 region, now seems to act as an immediate hurdle ahead of the $22.00 mark and the 38.2% Fibo., near the $22.15 area. Any further move up might continue to attract fresh sellers near the $22.60-$22.70 supply zone. This, in turn, should cap the XAG/USD near the $23.00 mark, representing the 23.6% Fibo.

That said, a convincing break through the latter could offset the negative outlook and shift the near-term bias in favour of bullish traders. The subsequent move up has the potential to lift the XAG/USD towards the $24.00 round-figure mark. Bulls might then aim back to challenge the $24.50 supply zone, which if cleared decisively should pave the way for a fresh leg up.

Silver daily chart

Key levels to watch

GBP/USD consolidates. Pressure on the low 1.20s may trigger more softness, in the view of economists at Scotiabank.

Cable price action may be forming a bear flag

“Cable price action has been generally consolidative.”

“Modest gains from yesterday’s low are running into better selling pressure near 1.2070/75 and GBP's price action may be forming a bear flag – implying renewed weakness on a break under minor support at 1.2040.”

See – GBP/USD should continue to find support in the 1.1950/2000 area – ING

US Dollar eases but undertone remains firm. Renewed gains are likely, according to analysts at Scotiabank.

USD to steady or strengthen somewhat in the short run

“Losses have been limited and beyond these short-term swings, USD prospects do appear to be edging a little more positively.”

“There is a window opening for the USD to steady or strengthen somewhat in the short run – which would be in keeping with the DXY’s seasonal tendency to appreciate in Q1.”

“There is a fair bit more US data to get through. PPI is expected to reflect still significant MoM gains but some moderation in YoY price growth. Higher than expected results will lift the USD. Starts, permits and claims data may not have much impact.”

- USD/CAD reverses an intrada dip and draws some support from a combination of factors.

- Recession fears cap the attempted recovery in crude oil prices and undermine the Loonie.

- The USD trims a part of its intraday losses and further contributes to the intraday bounce.

The USD/CAD pair attracts some buyers near the 1.3360-1.3355 region on Thursday and for now, seems to have stalled the pullback from the weekly high touched the previous day. The pair is currently placed just below the 1.3400 round-figure mark, nearly unchanged for the day, heading into the North American session.

Crude oil prices trim a part of the modest intraday gains amid worried that economic headwinds stemming from rising borrowing costs will dent fuel demand and undermines the commodity-linked Loonie. Apart from this, a combination of supporting factors assists the US Dollar to bounce off the daily low, which, in turn, acts as a tailwind for the USD/CAD pair.

Looming recession risks cap the recent optimistic move in the equity markets. Furthermore, expectations that the Fed will stick to its hawkish stance for longer, in the wake of stubbornly high inflation, lends some support to the safe-haven buck. In fact, the markets are now pricing in at least a 25 bps lift-off at the next two FOMC meetings in March and May.

The aforementioned fundamental backdrop seems tilted firmly in favour of the USD bulls and supports prospects for a further intraday move up for the USD/CAD pair. Hence, a subsequent strength towards the weekly high, around the 1.3440 area touched on Wednesday, looks like a distinct possibility. Traders now look to the US macro data for some meaningful impetus.

Thursday's US economic docket features the release of the Producer Price Index (PPI), the Philly Fed Manufacturing Index, Weekly Initial Jobless Claims, Building Permits and Housing Starts. This, along with the US bond yields and the broader risk sentiment, will drive the USD demand. Apart from this, oil price dynamics should produce short-term opportunities around the USD/CAD pair.

Technical levels to watch

EUR’s mini rebound runs out of steam. The EUR/USD pair remains prone to more losses, economists at Scotiabank report.

Losses should accelerate below 1.0650

“Near-term risks still appear to be tilted more towards a push to the 1.05/1.06 range than a break back above 1.08.”

“Intraday signals suggest a minor peak/reversal formed around the daily high in the low 1.07s and broader technical patterns remain bearish.”

“Minor EUR gains remain a technical sell; losses should accelerate below 1.0650.”

See: EUR/USD to trade well within the confines of a 1.0650-1.0750 range – ING

- The index keeps the choppiness well and sound below 104.00.

- A move beyond the monthly high at 104.11 exposes extra gains.

DXY sees its recent marked uptick to new monthly highs past the 104.00 mark somewhat trimmed on Thursday.

The ongoing price action leaves the door open to the continuation of the consolidative note for the time being. Occasional bouts of strength, however, should face the February high at 104.11 (February 15) as the immediate hurdle, while the trespass of this level could open the door to a potential challenge of the 2023 top at 105.63 (January 6) in the relatively near term.

In the longer run, while below the 200-day SMA at 106.44, the outlook for the index remains negative.

DXY daily chart

USD/JPY closed the third straight in positive territory on Wednesday. Analysts at Credit Suisse expect the pair to stage a race higher on a weekly close above the 133.06 resistance.

Move below 129.80 needed to reassert a downward bias

“Key resistance from the 55-Day Moving Average looks to be breaking. Above 133.06 on a weekly closing basis should mark a conclusive break, with resistance then seen next at 134.78 ahead of now we think the 38.2% retracement of the 2022/2023 fall and 200-DMA at 136.67/86. We look for this to then prove a much tougher barrier for an eventual turn lower again.”

“Below 129.80 is needed to reassert a downward bias for a retest of 127.53/23. An eventual break below here can see support next at 126.36 ahead of the 61.8% retracement of the 2021/2022 uptrend at 121.44.”

Economist at UOB Group Ho Woei Chen reviews the latest credit figures in the Chinese economy.

Key Takeaways

“China’s local currency loans rose by a record CNY4.90 tn in Jan (Bloomberg est: CNY4.20 tn, Dec: CNY1.40 tn). Similar to the trend in the preceding months, the biggest contributor to higher credit growth was corporate loans.”

“Confidence in the household sector has remained weak, resulting in weaker home purchases as well as consumption loans. Notably for 2022, loans to households slowed sharply to account for just 18% of the new loans compared to 40% in 2020-21.”

“The low credit impulse implies the recovery momentum had been weak. We maintain our forecast for China’s GDP growth to improve moderately to 3.4% y/y in 1Q23 (4Q22: 2.9%), accounting for a relatively higher base of 4.8% y/y in year ago period.”

“As the economy continues to recover and normalise in 2023, we expect credit growth to pick up along with stronger corporate activities, infrastructure construction and private consumption. The PBOC may also need to further cut its interest rate and RRR to boost the economic outlook.”

“On a longer-term basis, the growth in TSF in China would likely remain below 10% as the GDP growth moderates which limits banks’ credit expansion.”

- EUR/JPY comes under some pressure following recent YTD highs.

- The continuation of the uptrend remains focused on 146.70.

EUR/JPY gives away part of Wednesday’s advance to new 2023 highs past the 143.00 hurdle on Thursday.

While the cross looks broadly side-lined for the time being, a convincing breakout of the upper end of the range near 143.50 could trigger a move higher to, initially, the December 2022 top at 146.72 (December 15).

In the meantime, while above the 200-day SMA, today at 141.17, the outlook for the cross is expected to remain positive.

EUR/JPY daily chart

Sustained strong labour and inflation numbers are boosting expectations that the US Federal Reserve will continue monetary tightening longer than anticipated. This is benefitting the US Dollar and weighing on the Gold price, strategists at ANZ Bank report.

Weakening inverse correlation of Gold with US yield

“Gold price is inversely tracking the USD. Strong labour and retail sales data are raising the spectre of sticky inflation, which means the Fed will likely keep rates higher than expected. This is a downside risk for the Gold price. Furthermore, the relationship between real rates and Gold is weakening.”

“Investors’ net-long positions have increased, but physical allocation (via ETF holdings) is still missing. Higher Gold prices are also impacting physical demand in India. Chinese wholesale demand for gold is weak too. Central banks’ purchases have been resilient.”

Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group said the outlook for USD/CNH still points to further gains in the near term.

Key Quotes

24-hour view: “Yesterday, we expected USD to strengthen but we were of the view that ‘a break of the major resistance at 6.8500 is unlikely today’. The anticipated USD strength exceeded our expectations as it surged to a high of 6.8710. While conditions are overbought, USD could continue to advance. However, a break above the major resistance at 6.8800 is unlikely today. Support is at 6.8580, a breach of 6.8420 would indicate that the current upward pressure has eased.”

Next 1-3 weeks: “We have held a positive view in USD since early this month. In our latest narrative from three days ago (13 Feb, spot at 6.8275), we highlighted that ‘the likelihood of USD breaking above 6.8500 has increased’. USD broke above 6.8500 yesterday and soared to a high of 6.8710. The 6.8800 level we indicated early this month appears to be within reach. A break of 6.8800 will shift the focus to 6.9000. Overall, we continue to hold a positive USD stance as long as it does not break below 6.8250 (‘strong support’ level previously at 6.7800).”

The US Dollar is expected to see a lengthier but still temporary consolidation/recovery phase, according to economists at Credit Suisse.

Key levels to watch include the 55-Day Moving Average at 103.65/96 in DXY

“The DXY extends its consolidation as expected beneath the 55-DMA at 103.65/96. A close above here would suggest a deeper recovery can be seen to 105.63, potentially the 38.2% retracement of the 2022/2023 fall and 200-DMA at 106.15/45. We would expect this to prove the extent of the recovery though, and we would look for this to cap to define the top of a broader range.”

“Post this consolidation phase, our bigger picture view remains that 101.30 will eventually break, triggering further weakness later on to test 99.82/37, then the 61.8% retracement at 98.98.”

Bank Indonesia (BI) kept its policy rate unchanged at 5.75% today. USD/IDR is trading in the red and a failure to hold last week low of 15000 would trigger more losses, economists at Société Générale report.

15400 is a crucial resistance

“Bank Indonesia kept rates unchanged at 5.75%.”

“Lower band of the November/December consolidation at 15400 is a crucial resistance. Failure to cross would mean persistence in down move.”

“Break of last week's low at 15000 is likely to result in a decline towards 14810 and perhaps even towards April 2021 high of 14600.”

- AUD/USD attracts some dip-buying on Thursday despite disappointing Australian jobs data.

- Retreating US bond yields triggers a modest USD pullback and lends support to the major.

- Hawkish Fed expectations should limit the USD losses and cap the pair ahead of the US data.

The AUD/USD pair once again show some resilience below the 50-day SMA and attracts fresh buying near the 0.6870-0.6865 region on Thursday. The pair sticks to its intraday gains through the first half of the European session and is currently placed around the 0.6920 region, just a few pips below the daily top.