- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 16-02-2022

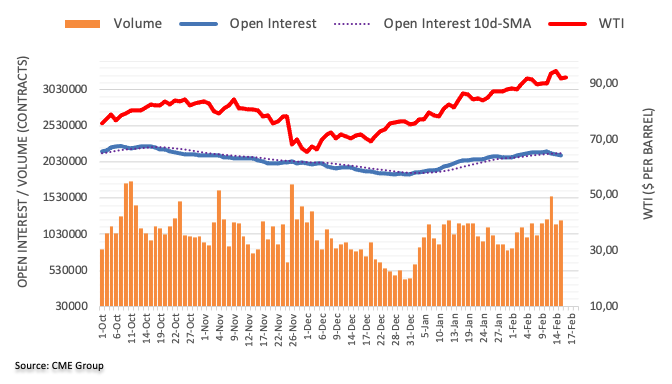

- WTI struggles to extend two-day downtrend, grinds lower around weekly bottom.

- Downside break of fortnight-long rising channel joins bearish MACD signals to keep sellers hopeful.

- 100-SMA, 200-SMA tests short-term downside, recovery moves have a bumpy road to the north.

WTI crude oil prices remain pressured around $89.00 during Thursday’s Asian session, following a clear downside break of a two-week-old bullish channel formation the previous day.

In addition to the stated channel break, bearish MACD signals and fundamentals also hint at the quote’s extended pullback from a multi-day high.

However, the 100-SMA level near $88.80 seems to challenge the black gold’s latest fall, a break of which will direct the commodity prices towards the $85.80-75 support zone before directing WTI bears to the 200-SMA level of $85.15.

It’s worth noting that the $85.00 threshold will act as an extra filter to the south before recalling the oil bears targeting the late January lows near $82.85.

Alternatively, an upward sloping trend line from January 03, close to $90.20, challenges the energy benchmark’s recovery moves, in addition to the stated channel’s lower line surrounding $89.40.

Even if the WTI bulls manage to cross the $90.20 hurdle, $91.80, $93.00 and the recent peak of $94.00 will challenge the further upside ahead of the upper line of the channel, around $94.65 by the press time.

WTI: Four-hour chart

Trend: Further weakness expected

- The dollar index (DXY) was pressured on Wednesday.

- FOMC minutes disappoint vs. the uber hawkish rhetoric of late from Fed officials.

The index slid to a low of 95.67 when the Federal Open market Committee minutes disappointed investors who had been in anticipation of more hawkish language in the discussions at the January meeting between board members.

While the Federal Reserve still thinks inflation will come down and that there was no discussion of a 50bp hike, it was unlikely that the minutes would have pointed to the 50bps solution. The minutes were from a meeting held before the release of strong payrolls and the hot Consumer Price Index. Nevertheless, the policymakers are still not set on a particular pace of interest rate hikes and decisions thereof would depend on a meeting-by-meeting analysis of data.

In contrast, voting member and known hawk, St. Louis Fed President James Bullard, reiterated calls for a faster pace of Fed rate hikes. At the Fed's Jan. 25-26 meeting, the board agreed that it would "soon be appropriate" to raise the Fed's benchmark overnight interest rate from its near-zero level, so March remains to be a live meeting.

As for the geopolitical risks, the United States and NATO are warning that Russia was still building up troops at the border of Ukraine, contradicting Moscow's insistence it was pulling back:

-

US State Department: Russian military moving concerningly into fighting positions

A US Senior Administration Official has in recent trade announced that Russia has increased troops near Ukraine by up to 7,000. The stream of disappointing headlines is continuing to sink USD/JPY which now trades at 115.33.

US inflation expectations, as measured by the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, add to the market’s anxiety by recently easing from the highest levels since January 12.

In doing so, the inflation precursor fade the previous rebound from the three-month low, marked in late January, with the latest pullback from 2.48% to 2.46%.

It’s worth noting that the recent easing in inflation expectations joins the mixed comments from the latest Federal Open Market Committee (FOMC) Minutes as the policymakers backed rate hikes but showed no confirmations over the pace of it. “Federal Reserve officials agreed last month that it was time to tighten monetary policy, but also that decisions would depend on a meeting-by-meeting analysis of data, according to minutes of the most recent policy meeting,” reported Reuters.

Given the unclear FOMC Minutes and recently downbeat US inflation expectations, markets are likely to witness further grinding. The same could restrict the moves of the US Treasury yields, equities and the US dollar while benefiting the traditional safe-havens like gold.

Read: Gold Price Forecast: XAU/USD rebound aims $1,880 amid geopolitics, Fed-linked anxiety

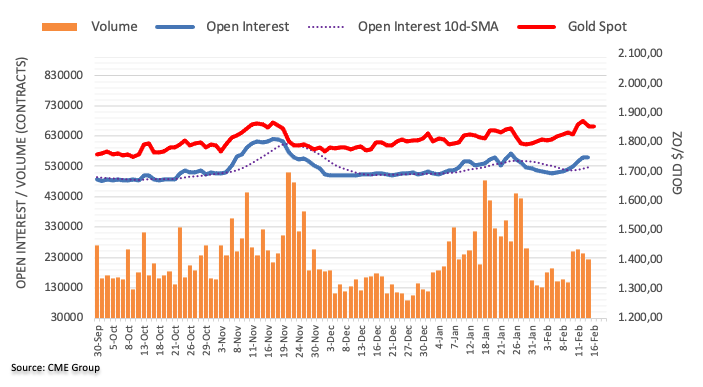

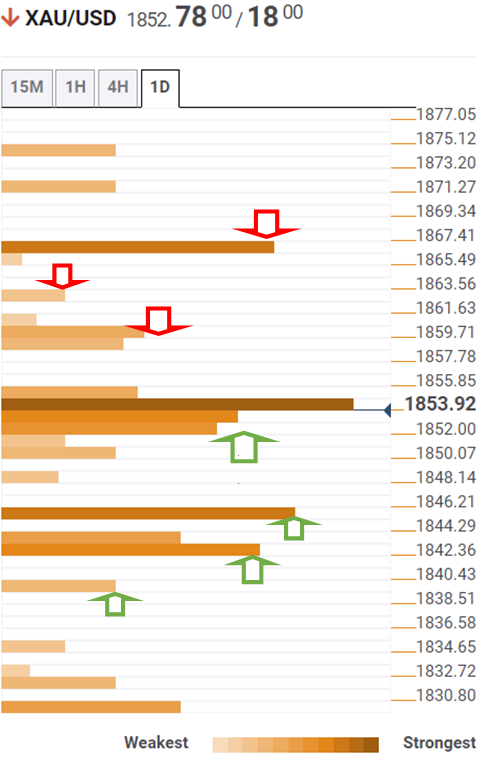

- Gold prices edge higher after refreshing eight-month top, recent recovery eyes important resistance.

- Risk appetite remains fragile amid indecision over Russia-Ukraine, Fed.

- Yields curve steepens, equities closed mixed and DXY weakened.

- Gold Price Forecast: Resuming the advance ahead of FOMC Minutes

Gold (XAU/USD) prices keep the previous day’s rebound from a weekly low to around $1,870 during the initial Asian session on Thursday.

In doing so, the yellow metal benefits from the market’s uncertainty over the de-escalation of Russia-Ukraine tension and the pace of the Fed’s March rate hike.

Softer comments from Moscow seem to ease the tension surrounding the invasion of Ukraine. However, the West and some of the Ukrainian sources reject the Russian troops’ retreat. On the other hand, the latest update from an Estonian diplomat suggests that Russia moves more military battalions towards the area near Ukraine and has also built a road and working on a bridge to soften the transport.

On other hand, the Federal Open Market Committee (FOMC) Minutes showed the hawkish concerns among the board members even if marking no strong support for a 0.50% rate hike in March. “Federal Reserve officials agreed last month that it was time to tighten monetary policy, but also that decisions would depend on a meeting-by-meeting analysis of data, according to minutes of the most recent policy meeting,” reported Reuters.

Talking about the data, US Retail Sales and Industrial Production rose notably beyond the market forecasts and previous readouts with the latest MoM figures of 3.8% and 1.4% respectively in January.

Amid mixed concerns, Wall Street failed to keep the previous day’s gains, closing mixed by the day’s end, whereas the US 10-year Treasury yields grind higher around multi-day tops, down 0.5 basis points (bps) to 2.04% at the latest. Further, the US Dollar Index (DXY) dropped for the last two days to refresh the weekly low.

Moving on, the second-tier US economics, mainly the housing market numbers, jobless claims and Philadelphia Fed Manufacturing Survey, may entertain gold traders. However, major attention will be given to the key risk catalysts, namely the Russia-Ukraine update and Fed-linked chatters.

Read: Fat or flat: Gold price in 2022

Technical analysis

Gold prices eased earlier in the week on RSI divergence and failure to offer a decisive close beyond November 2021 high.

However, the metal’s inability to conquer the January month high of $1,853 during the declines joins firmer MACD signals to redirect gold buyers towards the $1,880 key hurdle.

Should the quote cross the $1,880 resistance, the $1,900 threshold and late 2021 peak of $1,917 will return to the chart.

Alternatively, an upward sloping trend line from February 03, near $1,840, will act as an extra filter to the south even if the gold sellers manage to break January’s peak surrounding $1,853.

It’s worth noting that the 200-DMA and a two-month-long support line, close to $1,807 and $1,797 in that order, act as additional downside filters to challenge the gold bears.

Overall, gold is likely to grind higher but the buyers have a bumpy road to the north.

Gold: Daily chart

Trend: Further recovery expected

- USD/CAD rebounds from weekly low after three-day downtrend.

- MACD signals don’t favor bulls, 1.2625 becomes the key support.

- Recovery remains elusive below six-week-old resistance line.

USD/CAD licks its wounds around the weekly bottom, recently recovering to 1.2690 during Thursday’s Asian session.

In doing so, the quote portrays a corrective pullback from an upward sloping support line from January 26.

However, the MACD conditions aren’t supporting rebound, which in turn challenge the buyers until the quote crosses a six-week-long resistance line, near 1.2780 by the press time.

During the rise, the 1.2750 level may act as an intermediate halt whereas January’s peak surrounding 1.2815 will act as an extra filter to the north.

On the contrary, a downside break of the stated immediate support line, near 1.2670, isn’t a green card for the USD/CAD sellers as a convergence of the 100-DMA and 50% Fibonacci retracement (Fibo.) of October-December 2021 upside will be a tough nut to crack for the pair bears around 1.2625.

Also acting as strong downside support is the 61.8% Fibo. and the 200-DMA, respectively around 1.2545 and 1.2538 by the press time.

USD/CAD: Daily chart

Trend: Sideways

- The common currency has gained 0.30% in the week, vs. the Japanese yen.

- Raising geopolitical tensions could exacerbate a downward move, despite the neutral-upward bias, on the safe-haven status of the JPY.

- EUR/JPY Technical Outlook: Downward bias, confirmed by a “gravestone doji” on the daily chart.

The EUR/JPY advances for the second consecutive day in the week amid a mixed market mood as Russia/Ukraine conflict tension increases. At the time of writing, the EUR/JPY is trading at 131.30

On Wednesday, during the overnight session, the EUR/JPY cross-currency pair rallied towards Pitchfork’s 25% parallel line around the 131.50-60 range, reaching a daily high at 131.89, retreating below the former, end even pushing below the February 15 daily high at 131.58. Therefore, it printed a “gravestone doji,” a candlestick meaning that a EUR/JPY reversal may be on the cards.

EUR/JPY Price Forecast: Technical outlook

Therefore, the EUR/JPY first support level would be the February 16 daily low at 131.10. Breach of the latter will expose a previously broken four-month-old downslope trendline around 130.50-60, followed by the confluence of Pitchfork’s bottom trendline and the 200-day moving average (DMA) at 130.44.

Trend: Downward biased unless the 132.00 level is reclaimed.

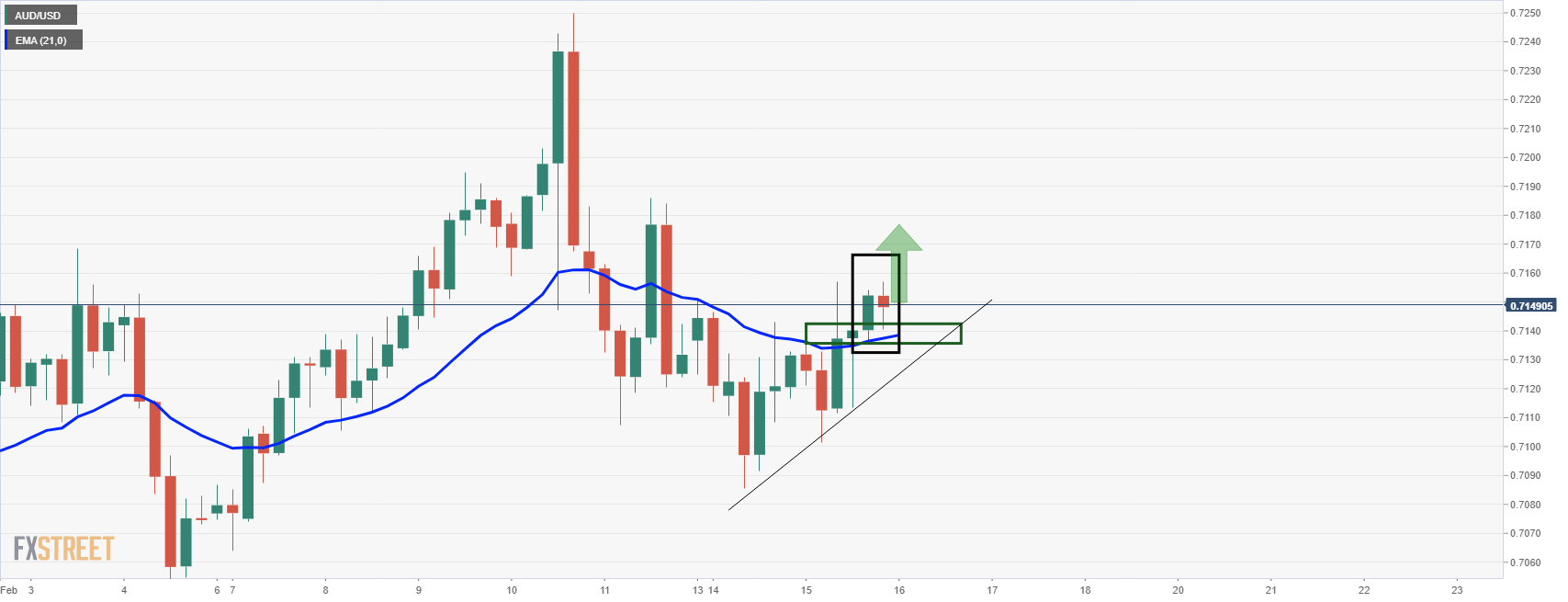

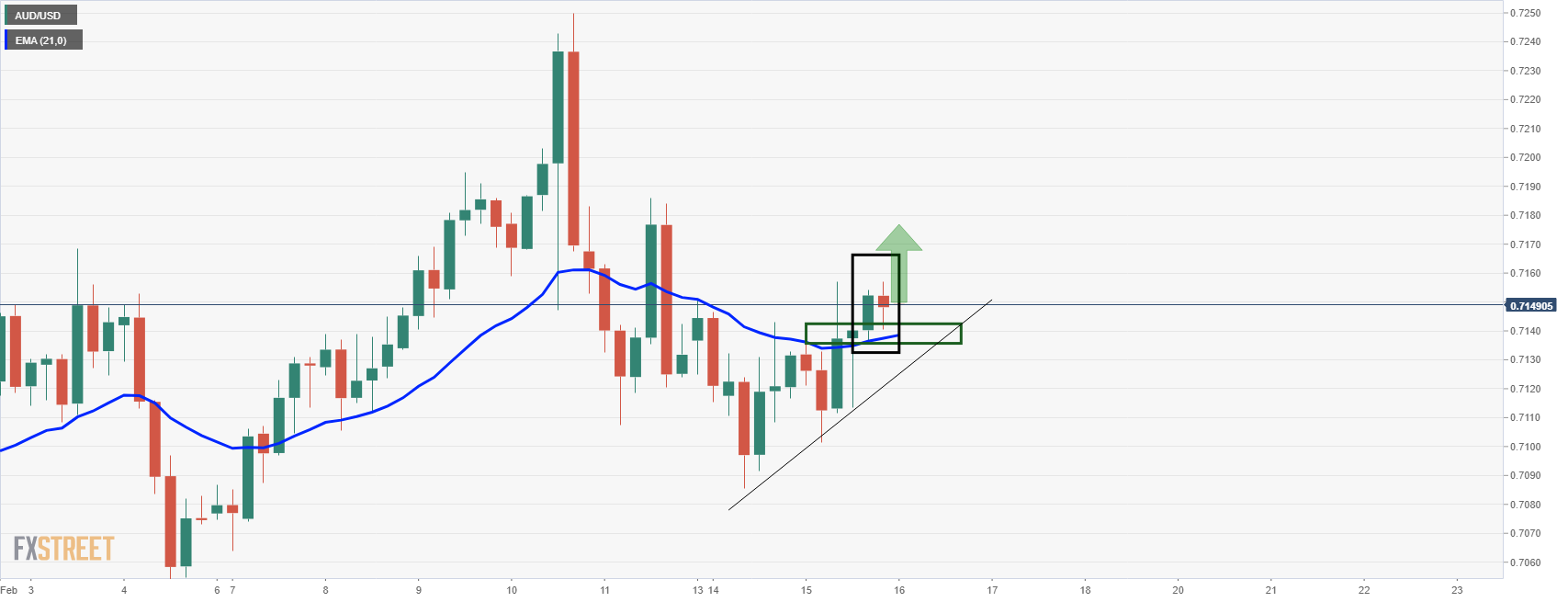

- AUD/USD grinds higher at weekly top after two-day uptrend.

- Market sentiment dwindles amid lack of clarity over geopolitics, Fed concerns but softer USD favors riskier assets.

- Equities edge lower, yields seesaw around recent tops but gold stays firmer.

- Softer Aussie employment data for January may trigger consolidation of recent gains on RBA’s hesitance to support rate-hike.

AUD/USD bulls take a breather around a one-week high near 0.7200, after rising for the last two consecutive days to Thursday morning in Asia.

The risk barometer pair’s previous gains could be linked to the US dollar weakness and a pause in the further Russia-Ukraine tension, even if the de-escalation is doubted. Also favoring the quote were upbeat Aussie data and firmer gold prices.

Although recently softer comments from Moscow seem to ease the tension surrounding the invasion of Ukraine, the West and some of the Ukrainian sources reject the Russian troops’ retreat. On the other hand, the latest update suggests that Russia moves more military battalions towards the area near Ukraine and has also built a road and working on a bridge to soften the transport.

On the other hand, US Retail Sales and Industrial Production rose notably beyond the market forecasts and previous readouts with the latest MoM figures of 3.8% and 1.4% respectively in January. Further, the Federal Open Market Committee (FOMC) Minutes also showed the hawkish concerns among the board members even if marking no strong support for a 0.50% rate hike in March. Hence, the US Dollar Index (DXY) dropped for the last two days to refresh the weekly low.

It should be noted that Australia’s January Westpac Leading Index rose 0.13% versus the previous reading of 0% whereas China’s inflation figures eased for the said month.

Amid these plays, Wall Street failed to keep the previous day’s gains, closing mixed by the day’s end, whereas the US 10-year Treasury yields grind higher around multi-day tops, down 0.5 basis points (bps) to 2.04% at the latest.

That said, the AUD/USD traders will pay attention to today’s Australia Employment Change and Unemployment Rate figures for January for clear direction. Forecasts suggest that the Employment Change to print 0K figures versus 64.8K prior whereas the Unemployment Rate may remain unchanged at 4.2K. Given the downbeat market consensus and the Reserve Bank of Australia’s (RBA) repeated resistance to back the rate-hike environment, the pair may witness a pullback in case of softer numbers.

Technical analysis

A daily closing beyond the 50-DMA, near 0.7170 by the press time, joins firmer RSI and MACD signals to direct AUD/USD buyers towards the 0.7235-45 key resistance area comprising the 100-DMA and a descending trend line from early November.

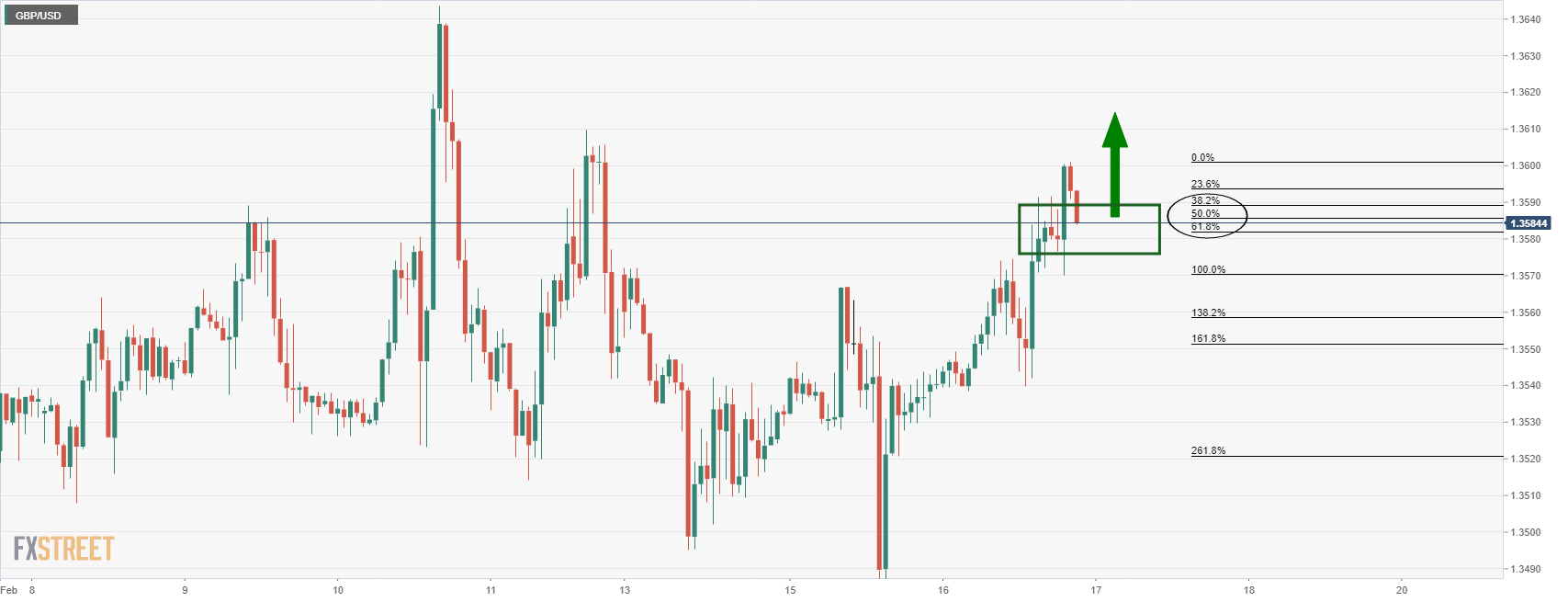

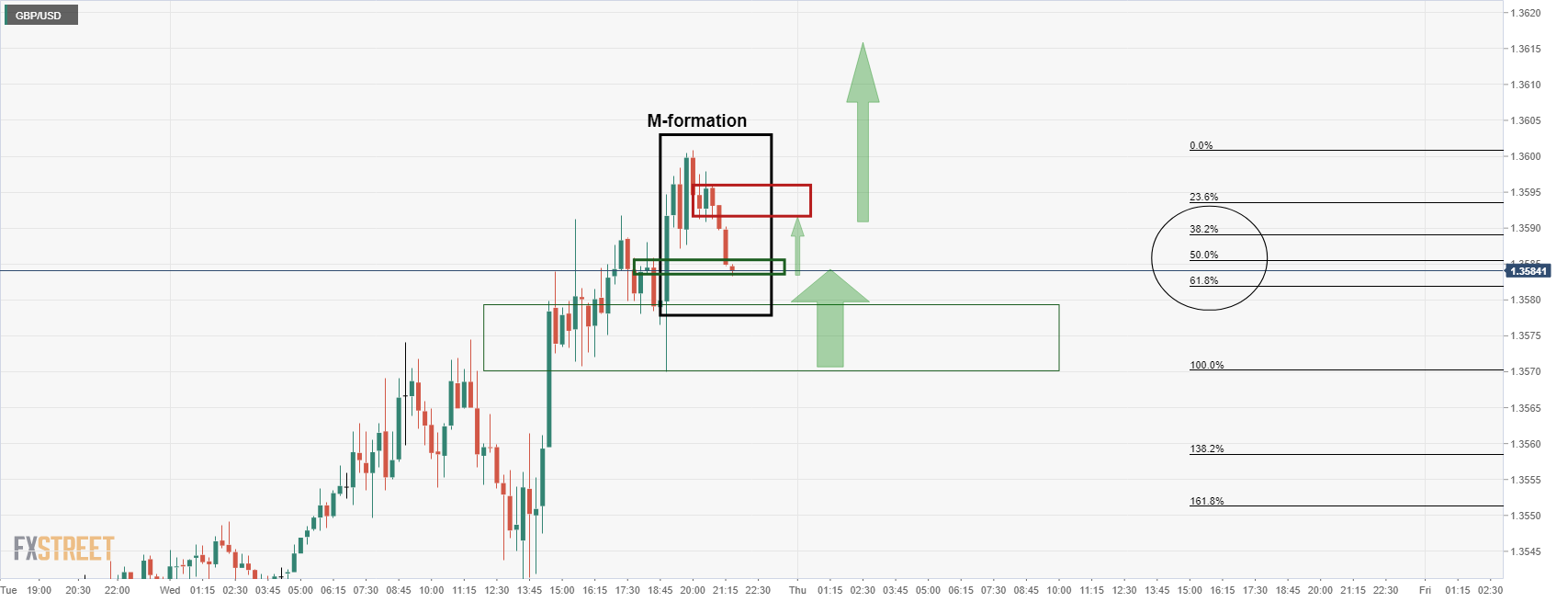

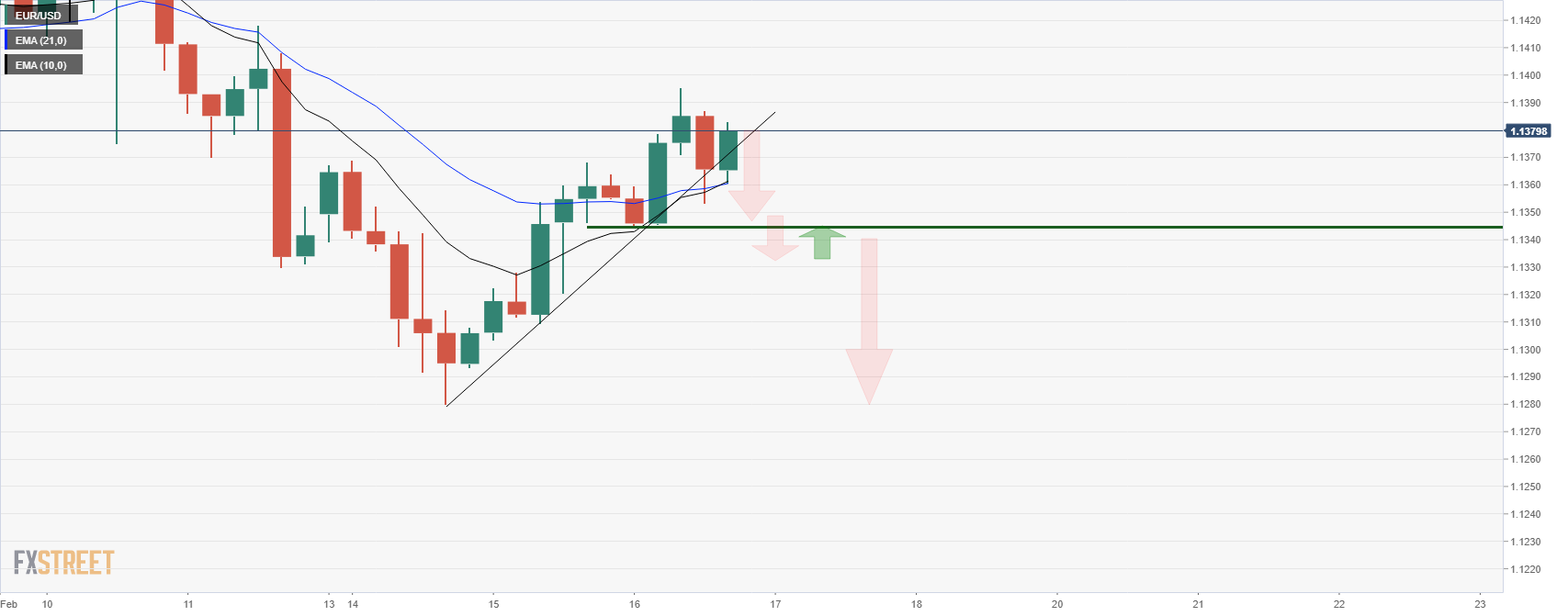

- GBP/USD bulls reaching up to the daily resistance.

- Bulls will be monitoring for a slow down in the hourly bearish correction.

GBP/USD rallied to a fresh hourly high son Wednesday following a sell-off in the greenback on the back of a less hawkish outcome at the Federal Reserve's meeting in January.

The minutes of the meeting did not underscore the possibility of a 50bps hike at the March meeting which knocked some wind out of the US dollar and yields. Meanwhile, the following illustrates the market structure from an hourly, 15-minute and daily perspective:

GBP/USD H1 chart

GBP/USD M15 chart

There are some 15-min structures that have taken shape, potentially offering support as illustrated above with the bias to the upside should the levels hold up.

GBP/USD daily chart

Meanwhile, the daily outlook is somewhat trapped around 1.3520 and 1.3650 from which scapers will be able to lean against as boundaries to trade within for the forth coming sessions.

- The shared currency advances 0.15% in the day.

- Geopolitical jitters appeared to be “ignored” by EUR/USD traders, which boosted the EUR.

- EUR/USD Technical Outlook: Neutral, but subject to up or down breaks, as it remains trapped between the 50 and the 100-DMA.

During the North American session, the shared currency extended its rally, so far up 0.40% in the week, amid uncertainty in the Russia/Ukraine conflict. At the time of writing, the EUR/USD is trading at 1.1379.

Russia/Ukraine conflict headlines dominate the session

The conflict between Russia and Ukraine has kept the market mood continuously swinging since last Friday, putting macroeconomic data aside. On Tuesday, Russian officials reported the withdrawal of troops near the border of Ukraine. However, developments in the last couple of hours suggested that ten new Russian battlegroups approached the border, as reported by Estonian and Ukraine intelligence, according to Reuters.

Fed minutes telegraph a rate hike “soon” but would be data dependant, perceived as dovish

In the meantime, the Federal Reserve released its January meeting minutes. The minutes revealed that the US central bank would end the QE by March, as scheduled on the December meeting. Also, Fed policymakers would like to remove policy accommodation faster than they anticipate and “soon” would like to raise the Federal Funds Rate (FFR).

However, the Committee emphasized that they would remain data-dependent and track the economic and financial developments. It is worth noting that Fed officials noted that “risks to inflation were weighed to the upside,” as reported by Reuters.

Back to the EUR/USD, the pair reacted upwards, to 1.1395, but geopolitical jitters put a lid on the move, retreating afterward to the 1.1380 area.

EUR/USD Price Forecast: Technical outlook

The EUR/USD remains neutral biased, trading within the 50 and the 100-day moving averages (DMAs) lying at 1.1328 and 1.1403, respectively. That said, any up/down break of the DMAs above can provide EUR/USD traders with a clear trend.

That said, if EUR buyers reclaim the 100-DMA, that will open the door for further gains. The EUR/USD first resistance would be February 11 daily high at 1.1430, followed by February 4 high at 1.1483 and the February 10 YTD high at 1.1494.

On the flip side, the break of the 50-DMA would send the EUR/USD towards 1.1300. Breach of the latter would expose December 15, 2021, 1.1221 daily low, followed by 1.1200.

The Chief of UK Defence Intelligence Jim Hockenhull said on Wednesday that, contrary to Russia's claims, it has continued to build up its military capabilities on the Ukrainian border and we have not seen any evidence that Russia has withdrawn troops, according to Reuters. Reuters said that public comment from Hockenhull is "rare".

Market Reaction

The commentary from UK intelligence is in fitting with commentary from the US and various Eastern NATO members, as well as Ukrainian officials, and is keeping investors nervous, though there hasn't been any reaction to the latest headlines.

- WTI has been selling off sharply in recent trade on headlines suggesting that a US/Iran nuclear deal is near.

- A deal that saw US sanctions on Iranian oil exports removed could add well over 1M BPD to global markets.

- WTI has fallen $2.0 in the last hour and is now down $3.50 from earlier session highs near $95.00.

Oil has been selling off sharply in recent trade as headlines pick up regarding a possible deal between the US, Iran and other world powers that would revive the 2015 nuclear pact and end US sanctions on Iranian oil exports. Front-month WTI futures have slipped more than $2.0 in the last hour and are now down more than $3.50 versus earlier session highs near $95.00. On the day, WTI is now just over 50 cents lower. WTI will now be eyeing a test of support in the form of a long-term uptrend that has been in play all year so far, with any break below likely to be followed by a swift drop back under $90.00 and towards support in the $88.00s.

Iran's top nuclear negotiator Ali Bagheri Kani tweeted on Wednesday that, following weeks of intensive talks, the JCPOA participants including the US and Iran are closer than ever to an agreement. Shortly after Kani's tweet, the US State Department said that the US is in the midst of the very final stages of talks with Iran reviving the 2015 nuclear deal. A deal would open the door for well over 1M barrels per day in addition Iranian exports to return to global markets.

While chatter about an imminent return to the 2015 nuclear deal and return of Iranian supply will likely weigh on markets in the short-term, analysts said, Russia/Ukraine tensions remain another wildcard. The latest headlines on this front have not been positive, with government and intelligence officials in the US and various NATO nations warning that there is no evidence yet that Russia is reducing its military presence on Ukraine’s border. Intelligence officials have been warning about the risk that a limited attack in Eastern Ukraine’s Donbas region remains a distinct possibility.

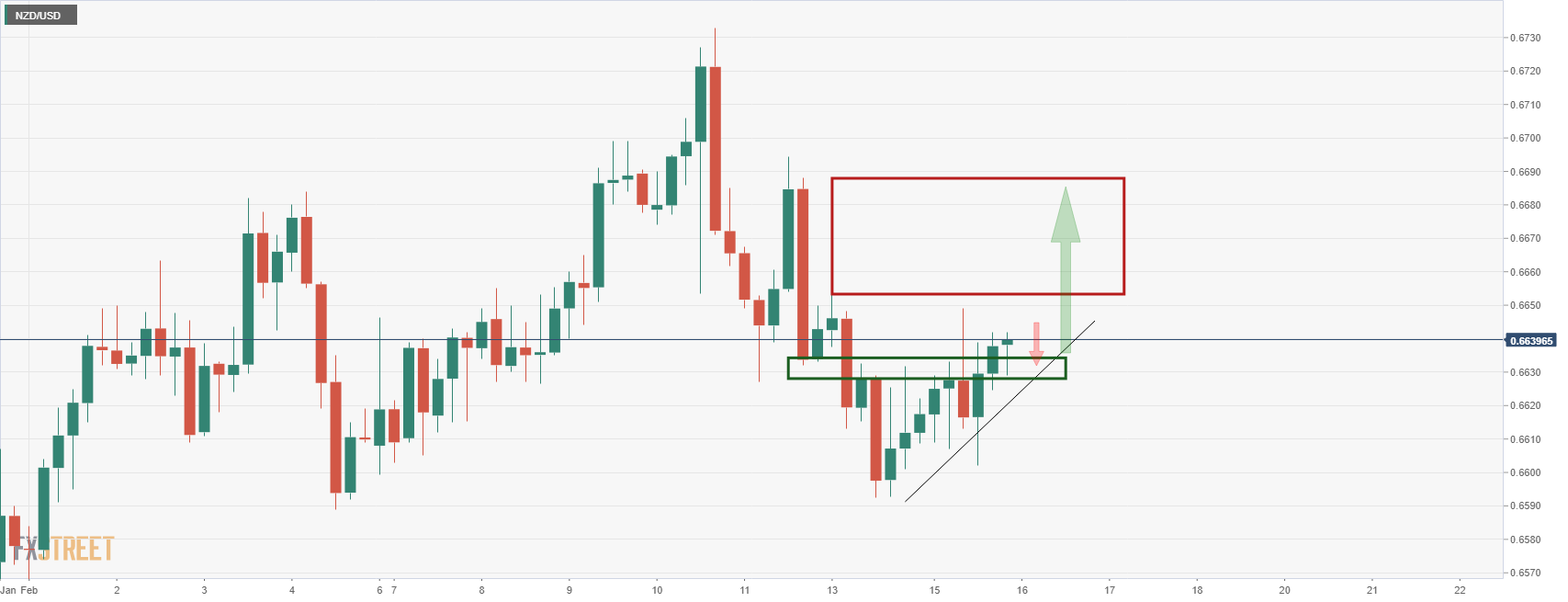

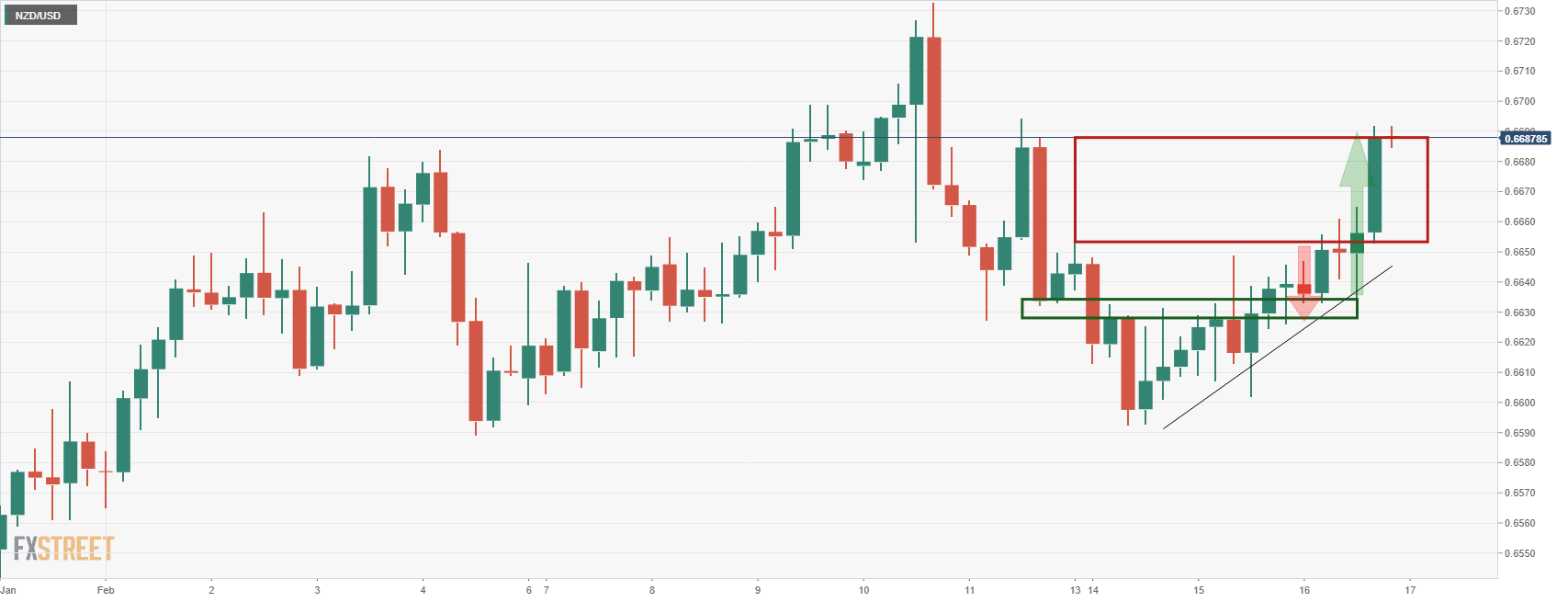

- NZD/USD soars above the hawks of the FOMC and the US dollar is under pressure.

- Ears are to the ground for headlines surrounding Russia and NATO diplomacy.

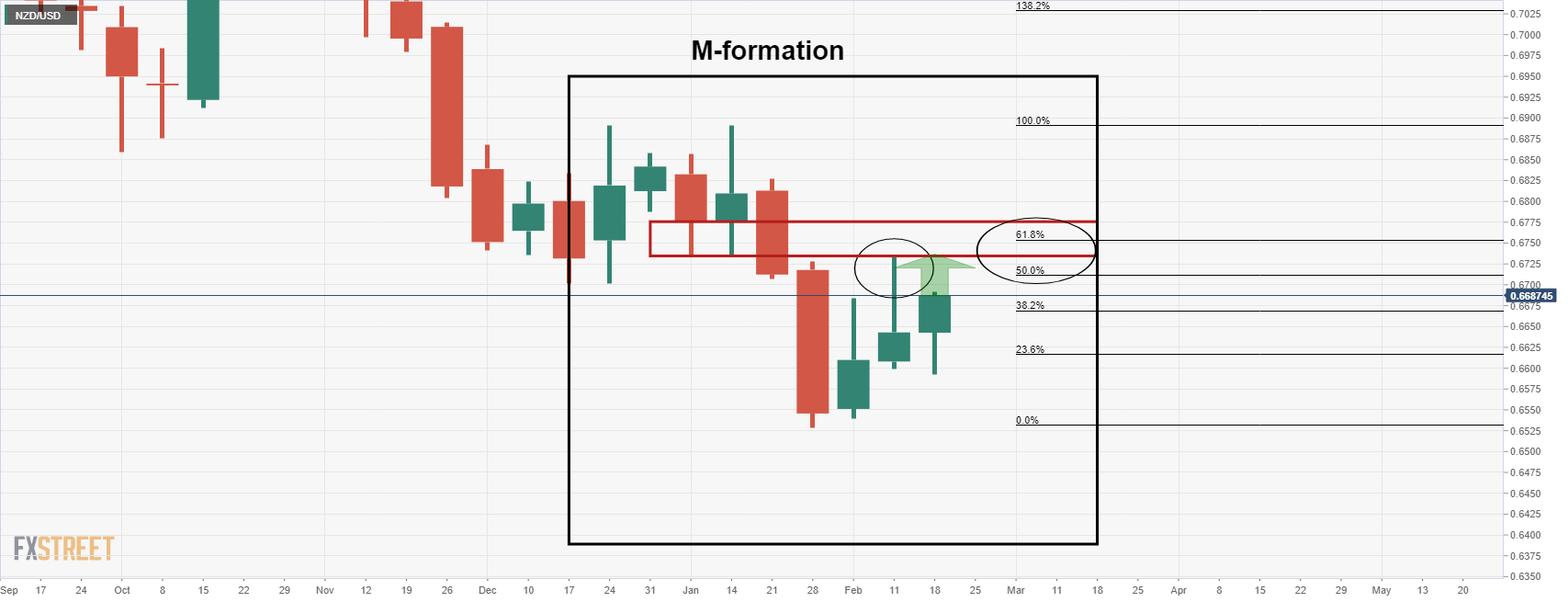

- Bulls target the 50% mean reversion level through 0.67 the figure and the 61.8% golden ratio is sat near 0.6750.

NZD/USD is reaching fresh corrective highs in the pursuit of the weekly wick as illustrated below. The kiwi is printing a high of 0.6691 following a rally from the lows of 0.6633.

The US dollar is bleeding out some of the 50bps rate hike premium that speculators had drilled into the markets in anticipation of the Federal Reserve's March meeting. This has followed a less than satisfying set of Federal Open Market Committee minutes released on Wednesday mid-afternoon, clipping the wings of the hawks that have been circling over the Fed March meeting.

The FOMC minutes from the January meeting noted that inflation was high and policy tightening was warranted soon, adding:” Most participants noted that, if inflation does not move down as they expect, it would be appropriate for the Committee to remove policy accommodation at a faster pace than they currently anticipate”.

On Fed's holdings of bonds: ”The Committee expects that reducing the size of the Federal Reserve's balance sheet will commence after the process of increasing the target range for the federal funds rate has begun”. However, there was no confirmation that a 50 basis point hike was being considered and that was disappointing enough to derail the US dollar further.

The greenback has already been suffering from a steadier risk tone in financial markets despite the contracting sentiment surrounding Russian troops at the border of Ukraine. Instead, markets are clinging t hopes of diplomacy and the newswires that are creating hopes that the Ukraine situation will be de-escalated. Meanwhile, there is no local data for New Zealand today, so it will be all ears to the ground for further news related to the Russian/NATO standoff.

NZD/USD technical analysis

As per the prior analysis, NZD/USD bulls eye the 0.6650's and 6690's on Russia's withdrawal of troops, the price has reached the 0.6690's target in Wall Street's trade on Wednesday:

It was noted that ''the price had been creeping in on the old support turned to resistance but the prospects of a downside continuation were thwarted in New York's trade when the price broke to fresh corrective highs:

This leaves the bulls in play and there are prospects of a surge into the imbalance left between 0.6690's and the 0.6650's for the days ahead.''

NZD/USD live market

As illustrated, the price has continued in the forecasted trajectory. However, noting the weekly wick, there are prospects for higher still, as follows:

NZD/USD weekly chart

The price could now be destined to fill in the prior week's wick, mitigating the price imbalances on lower time frames and in turn completing a correction to the M-formation's neckline. Moreover, the price would be expected to retrace to a 50% mean reversion level through 0.67 the figure if not embark on a full retracement to the 61.8% golden ratio near 0.6750.

What you need to know on Thursday, February 17:

The American dollar edged lower on Wednesday, despite the release of upbeat US data and uncertainty related to Russian and Ukrainian border tensions. Also, the US Federal Reserve released the Minutes of the latest FOMC meeting, which indicated that policymakers are willing to hike rates but did not mention a 50 bps move in March.

US Retail Sales were up 3.8% in January, much better than anticipated, while Industrial Production in the same month surged by 1.4% vs the 0.4% expected.

Regarding geopolitical tensions, the latest on the matter was the Estonian Foreign Intelligence Service chief reporting that Russia was moving some 10 battle groups towards the area near Ukraine, where more groups are already awaiting.

European indexes closed in the red with modest losses. Wall Street spent most of the day in the red but managed to recover post-FOMC Minutes now mixed around their opening levels.

Government bond yields remained up the upper end of their weekly range, with the yield on the US 10-year Treasury note hovering around 2.05%.

EUR/USD trades around 1.1390, while GBP/USD flirts with 1.3600 amid the broad dollar's weakness. The AUD/USD pair is also up, trading around 0.7200, while USD/CAD lags, hovering around 1.2670. Weaker oil prices limit the CAD as the black gold retreated sharply from its daily high and trades around $92.50 a barrel.

Iran's top nuclear negotiator Ali Bagheri Kani tweeted that, following weeks of intensive talks, the JCPOA participants, including the US and Iran are closer than ever to an agreement. However, he added that "nothing is agreed until everything is agreed."

Safe-haven currencies managed to advance against the greenback, with USD/CHF down to 0.9210.

Gold edged higher and trades at around $1870 a troy ounce.

Cardano Price Prediction: ADA readies for another run to $1.30

Like this article? Help us with some feedback by answering this survey:

Iran's top nuclear negotiator Ali Bagheri Kani tweeted on Wednesday that, following weeks of intensive talks, the JCPOA participants including the US and Iran are closer than ever to an agreement. However, he added that "nothing is agreed until everything is agreed". His tweet comes after French officials had said earlier in the day that a decision on salvaging the 2015 nuclear pact between Iran and major world powers was just days away and it was up to Iran.

Shortly after Kani's tweet, the US State Department said that the US is in the midst of the very final stages of talks with Iran reviving the 2015 nuclear deal. The State Department added, however, that they were not expecting a direct meeting between US Secretary of State Anthony Blinken and Iran's foreign minister.

Market Reaction

Oil prices have been falling sharply in recent trade on the prospect that a deal would eliminate US restrictions on Iranian crude oil exports, thus allowing well over 1M barrels per day in addition supply onto global markets. Front-month WTI futures have tumbled all the way below $92.50 from previously trading in the upper-$93.00 area just a few minutes ago.

- The British pound vs. the Japanese yen is up in the week 0.29%.

- US officials and Estonian intelligence confirm the movement of Russian troops to Ukraine’s border, per Reuters.

- GBP/JPY Technical Outlook: If GBP bulls achieve a daily close above 156.81, a move towards 157.00 is on the cards.

The British pound edges higher for the second straight day, amid a risk-off market mood courtesy of Russian/Ukraine headlines crossing the wires. At the time of writing, the GBP/JPY is trading at 156.90.

The financial market mood remains sour on increased geopolitical tensions. US equity indices trade in the red, while in the FX space, risk-sensitive currencies appear to be unaware of the recent developments in the last hour.

Following the Federal Reserve monetary policy minutes release, around 19:15 GMT, Estonian intelligence reported that Russia is moving ten new battle groups to Ukraine’s border, per Reuters. A couple of minutes afterward, the US State Department confirmed that more Russian forces, not fewer, are on the Ukraine border and moving into fighting positions.

Putting the geopolitical jitters aside, the GBP/JPY seesaws in the 156.40-157.00 range for the last couple of days. Even though the GBP posted gains, the average daily range (ADR) of the last two days shrank from 112 to 50 pips.

GBP/JPY Price Forecast: Technical outlook

The GBP/JPY is upward biased, as shown by the daily chart. On Wednesday, the GBP/JPY reclaimed so far, the February 15 daily high at 156.81, and if it prints a daily close above of it, it could pave the way for further gains.

Upside, the GBP/JPY first resistance would be 157.00. Breach of the latter would expose a five-month-old downslope trendline around the 157.30-45 area that, once cleared, would exacerbate a move towards 158.00.

On the flip side, the GBP/JPY first support would be February 4 daily high previous resistance-turned-support at 156.47, followed by 156.00 and the February 14 daily low at 155.29.

- The S&P 500 is flat, having rebounded to around 4470 in wake of “dovish” Fed minutes despite negative geopolitical headlines.

- The index had been trading lower prior to the minutes release after hot US Retail Sales bolstered Fed tightening bets.

The release of the Fed minutes of the January 25-26 meeting followed shortly thereafter by a flurry of headlines relating to US/NATO concerns about continued Russian military build-up on Ukraine’s border has made for choppy US equity market trading conditions. Markets seem to have interpreted the minutes as dovish, helping spur a rebound from earlier session lows. The S&P 500 now trading in the 4470 area and close to session highs at 4480 where it trades flat on the day, having previously been as low as the 4430 mark, where it at the time was trading down by about 0.8%. A stronger than expected US January Retail Sales report on Wednesday released prior to the US open was said to have been weighing on stocks earlier in the session as it boosts the likelihood of a more aggressive Fed.

The minutes of the last Fed meeting did not seemingly indicate any desire to lift rates at a faster than usual pace of 25bps per minute, which may explain the dovish market reaction. Indeed, US money markets have revised lower the implied odds of a 50bps move at next month’s meeting to about 44% versus nearly 60% on Tuesday. However, analysts have noted that the latest upside Consumer and Producer Price Inflation surprises have likely rendered the opinions seen in the latest minutes release as out of date. Recall that in wake of the release of the January CPI report, Fed policymakers (and 2022 voter) James Bullard said he had become much more hawkish.

That is to say, perhaps stock markets shouldn’t read too much into the latest minutes release, and should pay more attention to what Fed members are saying right now, with their comments reflective of the most recent economic developments. On which note, there is plenty of Fed speak on Thursday and Friday. While the Fed minutes release has distracted attention momentarily from further negative geopolitical headlines, investors may soon start fretting about Russia/Ukraine war risk.

Shortly after the Fed minutes were released, US officials were again on the wires warning that despite Russia pledged to partially withdraw troops from the Ukraine border, it is actually seeing a build-up. Ukrainian and Estonian intelligence reports on Wednesday have concurred with this analysis, with the intelligence chief of the latter recently saying that 10 new Russian battlegroups were moving to the Ukraine border to join the 100 already there. The intelligence chief echoed US warnings that an escalation to the fighting in the Eastern Ukraine breakaway provinces located in the Donbas is considered highly likely.

Looking back at US equities, the Nasdaq 100 index has swung within a 14.4-14.6K range and currently trades in the mid-14.5K area, down about 0.5% on the day. The Dow, meanwhile, has swung between the 34.7-35.0K levels and currently trades in the 34.8K area, down about 0.3% on the day. The S&P 500 CBOE Volatility Index (or VIX) is about one point lower and has dipped back under 25.0 again. Attention remains very much on the geopolitical situation.

The US State Department said that more Russian forces, not fewer, are on the Ukraine border and they're moving concerningly into fighting positions. However, they say there is still room for diplomacy unless they make the decision to go in.

More to come...

Estonia's Chief of Foreign Intelligence Mikk Marran said on Wednesday that Russia is moving a further 10 battle groups towards an area near Ukraine where 100 battle groups have already been deployed. The Foreign Intelligence Chief added that Russia is "likely" to launch a "limited" assault against Ukraine, occupying chunks of territory, with an escalation of fighting in the Eastern breakaway provinces "highly likely". The Intelligence Chief warned that Russian success in Ukraine would encourage it to pressure the Baltic states.

Market Reaction

With markets primarily focused on the recent Fed minutes release at the moment, the latest negative geopolitical headlines haven't dampened sentiment yet, with the S&P 500 having jumped about 30 points over the last 30 or so minutes to now trade flat again on the day. While it might be risk on right now given the dovish minutes, warnings of continued Russian escalation could soon recapture the focus and weigh on sentiment once more.

- GBP/USD pops to session highs on less hawkish than expected minutes.

- US dollar lowest level since Friday, but Russian headlines coming through could support.

GBP/USD is reaching highs of 1.3594 on Wednesday following the release of the Federal Open Market Committee minutes that failed to portray a message of 50bps worth of hiking as soon as the March meeting.

This was a number touted by the most hawkish of Fed officials and was being priced in by the markets. Consequently, the US dollar is being sold off. DXY, an index that measures the greenback vs a basket of major rivals, has printed a fresh low for the day of 95.692. This is the lowest level since Friday, Feb.11.

Meanwhile, sterling was higher across the board on Wednesday after data showed inflation in Britain at a nearly 30-year high. Markets are pricing in the convergence between the Fed and Bank of England as they suspect that the BoE will hike interest rates again. The BoE has hiked twice since December. Rates have risen to 0.5% from 0.1%. Another hike to 0.75% or 1% on March 17 after the BoE's next meeting is expected.

The data showed that the Consumer Price Index on an annual basis climbed to 5.5% in January. This was the highest since March 1992, and above expectations from economists for it to hold at December's 5.4%.

Reuters explained that ''soaring inflation across many global economies has sparked a debate about how fast central banks should rein in stimulus deployed earlier in the COVID-19 pandemic to prop up businesses and consumers.''

Meanwhile, there are plenty of risk-off Russian headlines coming through that could lead to a safe-haven bid in the greenback and curb the FOMC minutes decline. The US State Department said that more Russian forces, not fewer, are on Ukraine border and they're moving concerningly into fighting positions.

Bank of Canada Deputy Governor Timothy Lane said on Wednesday that it was quite likely that the central bank will be "saying something" about quantitative tightening at its next policy meeting in March. Lane added that while the BoC does not have to move in step with the Fed on rate hikes, what the Fed does certainly has a big impact on the economic conditions in which the BoC makes its own decisions. If the trucker's blockade is to persist, it might have an impact on the broader Canadian economy, Lane said, saying that he hopes the blockade won't last long.

Market Reaction

There has not been any reaction to the latest comments from Lane, with FX markets instead focused on the Fed minutes.

The minutes of the 25-26 January FOMC meeting, released on Wednesday, said that most participants suggested that a faster pace of increases in the target rate for the Federal Funds rate than in the post-2015 period would likely be warranted.

Additional Takeaways

As summarised by Reuters...

- Participants continued to stress that maintaining flexibility to implement appropriate policy adjustments on the basis of risk-management considerations should be a guiding principle.

- Participants continued to judge that the committee's net asset purchases should be concluded soon.

- Many participants noted the influence on financial conditions of the committee's recent communications and viewed these communications as helpful in shifting private-sector expectations regarding the policy outlook.

- Most participants preferred to continue to reduce the committee's net asset purchases according to the schedule announced in December, thus bringing them to an end in early March.

- Participants emphasized that the appropriate path of policy would depend on economic and financial developments and their implications for the outlook and the risks around the outlook.

- Most participants noted that, if inflation does not move down as they expect, it would be appropriate for the committee to remove policy accommodation at a faster pace than they currently anticipate.

- Some participants commented on the risk that financial conditions might tighten unduly in response to a rapid removal of policy accommodation.

- Removal of policy accommodation in the current circumstances depended on the timing and pace of both increases in the target range of the Federal Funds rate and the reduction in the size of the Federal Reserve's balance sheet.

- A couple of participants stated that they favored ending the committee's net asset purchases sooner to send an even stronger signal that the committee was committed to bringing down inflation.

- A number of participants commented that conditions would likely warrant beginning to reduce the size of the balance sheet sometime later this year.

- Some participants commented on the risk that financial conditions might tighten unduly in response to a rapid removal of policy accommodation.

- A few participants remarked that this risk could be mitigated through clear and effective communication of the committee's assessments of the economic outlook, the risks around the outlook, and the appropriate path for monetary policy.

- Participants anticipated that it would soon be appropriate to raise the target range for the Federal Funds rate.

- Many participants commented that sales of agency MBS or reinvesting some portion of principal payments received from agency MBS into treasury securities may be appropriate at some point in the future.

- Participants agreed that uncertainty regarding the path of inflation was elevated and that risks to inflation were weighted to the upside.

- A few participants noted that asset valuations were elevated across a range of markets, raising concern that major realignment could contribute to a future downturn.

- A few participants pointed to the possibility that structural factors that had contributed to low inflation in the previous decade may reemerge after pandemic abates.

- Uncertainty about real activity was also seen as elevated.

- Various participants noted downside risks to the outlook, including a possible worsening of the pandemic, the potential for escalating geopolitical tensions, or a substantial tightening in financial conditions.

- A couple of policymakers judged prolonged accommodative financial conditions could be contributing to financial imbalances. A couple of others thought elevated asset valuations might prove to be less of a financial stability threat.

- Many participants commented that they viewed labor market conditions as already at or very close to those consistent with maximum employment.

- A couple of participants commented that, in their view, the economy likely had not yet reached maximum employment.

- Various participants cited developments that had the potential to place additional upward pressure on inflation, including real wage growth in excess of productivity growth and increases in prices for housing services.

- Some policymakers saw emerging risks to financial stability from the rapid growth of crypto assets and decentralized finance platforms.

- Participants generally expected inflation to moderate over the course of the year as supply and demand imbalances ease and monetary policy accommodation is removed.

- Some participants remarked that longer-term measures of inflation expectations appeared to remain well anchored.

- Policymakers saw widespread evidence that the labor market was very tight.

Market Reaction

The immediate market response to the latest minutes release has been a dovish one, with the US Dollar Index falling to lows of the day around the 95.70 level from above 95.80 prior to the release.

- USD/CHF slides some 0.26% during the North American session.

- The pair remains range-bound at the 0.9220-60 region.

- USD/CHF Technical Outlook: Consolidated amid the lack of a catalyst to break the range.

The USD/CHF retreats from 0.9260 top of the range-bound 0.9220-60, approaching the bottom of the range, courtesy of risk-off market mood. At the time of writing, the USD/CHF is trading at 0.9221.

On Wednesday's overnight session for North American traders, the USD/CHF consolidated around the 0.9240-60 area, followed by a break of the 0.9240 intraday support, which accelerated the downward move towards the bottom of the range mentioned above.

USD/CHF Price Analysis: Technical outlook

The USD/CHF is neutral biased, despite the location of the daily moving averages (DMAs) that lies below the exchange rate. As witnessed by the candlesticks, intense selling pressure lies around the 0.9250-0.9300 area, as portrayed by the last eight candles in the daily chart, which show long wicks above the real bodies.

Therefore, the USD/CHF is neutral-downwards. The first support would be the 100-DMA at 0.9211. Breach of the latter would expose the 50-DMA at 0.9200, followed by the 200-DMA at 0.9171.

Upwards, the first resistance would be 0.9250-65 area. A decisive break would expose December 16, 2021, a daily high at 0.9294, followed by January 31 daily high at 0.9343.

- EUR/GBP failed to hold above 0.8400 for a second successive session despite more hawkish recent ECB speak.

- The pair has pulled lower to the 0.8370s as another UK inflation surprise spurs bolsters BoE tightening bets.

- Traders are also watching Russia/Ukraine tensions, as a further increase could send EUR/GBP back under 0.8350.

EUR/GBP failed to reclaim the 0.8400 level again on Wednesday for the second time in two successive sessions, with the pair now trading down about 0.1% on the day in the 0.8370s and down about 0.3% versus earlier session highs. Another upside UK inflation surprise according to the latest ONS data released early during Wednesday’s European session has likely helped keep EUR/GBP a sell on rallies towards the 0.8400 level. The data keeps the pressure on the BoE to continue lifting interest rates in the near term.

However, concerns about longer-term UK growth as the country faces a much-publicised squeeze on incomes from April via higher taxes and energy bills, which is reflected in a UK yield curve getting ever closer to inversion, is dampening GBP’s appeal. That, combined with the increasingly hawkish lean to ECB speak from the likes of Isabel Schnabel and Francois Villeroy de Galhau in recent days is helping to prevent EUR/GBP from sliding back to test weekly lows in the 0.8350 area. Indeed, a drop to the 0.8360s attracted solid demand.

Ahead, the main driver of FX market sentiment, in general, is likely to remain geopolitics amid confusion about whether Russia is actually following through with its pledged partial withdrawal of troops from Ukraine’s border. Western/Ukrainian officials have been warning they do not see signs of de-escalation on the ground as of yet and further amping up of tensions could weigh on the euro again, sending it to fresh weekly lows under 0.8350.

Bank of Canada Deputy Governor Timothy Lane said on Wednesday that the central bank will be nimble and, if necessary, forceful in using its monetary policy tools to tackle inflation, according to Reuters. We are alert to the risk that inflation may again prove more persistent, he continued, adding that we must anticipate the possibility of more surprises before the pandemic ends. Currently, with inflation well above our target, Lane added, we are increasingly focused on countering the upside risks and, at different stages of the pandemic, we have changed our outlook and policy stance to respond to the uncertain and fast-changing situation. Lane reiterated that the BoC expects supply disruptions to ease and inflation to come down quickly in the second half of the year, adding that rates will need to be on a rising path.

Market Reaction

USD/CAD has not reacted to the latest hawkish leaning comments from BoC's Lane, which will do little to dampen speculation that the BoC could be tempted to lift interest rates by 50bps at its meeting next month.

- The AUD/USD extends its gains in the week, so far up 0.78%.

- Increasing tensions in the Russia/Ukraine conflict could not stop the rise of the risk-sensitive AUD.

- Fed’s Kashkari and Harker favor 25 bps “gradual” increases on fear of causing a recession.

- AUD/USD in the short-term is upward biased, but it would face strong resistance in the 0.7210-43 area.

During the North American session, the AUD/USD edges higher though barely short of weekly tops amid a risk-off market mood. At the time of writing, the AUD/USD is trading at 0.7186.

Failure of de-escalation in the Russia/Ukraine conflict dampened the market mood. Earlier in the European session, European bourses were trading in the green following Tuesday’s news that Russian troops were moving back, as reported by Russian authorities. However, the lack of confirmation by Western officials, led by US Secretary of State Blinken, who on Wednesday said that they continue to see critical Russian units moving towards the border and not away, shifted market participants’ sentiment.

Ukraine President Zelenskiy confirmed the headline above around 17:25 GMT, saying he doesn’t see Russian troops pull back.

Fed’s Kashkary and Harker favor “gradual” interest rates hikes

Around 16:00 GMT, Minnesota Fed’s President Neil Kaskari said that the US central bank could soften demand by hiking rates, but that won’t address the supply-side issues. He favors gradual rate hikes, and he sees inflation at 3% by the end of the year, in line with most forecasts. Kashkari sees a risk of recession if the Fed hikes too aggressive.

Later on the day, Philadelphia Fed President Patrick Harker said he supported a 25 bps increase to the Federal Funds Rate (FFR) in the March meeting. He said that “we need to do what we need to do to curb inflation but not overreact and possibly dampen an economy that is, in some ways, doing very well.”

Before Wall Street opened, the US economic docket featured Retail Sales for January. The headline came at 3.8% m/m higher than the 2% estimations, while the so-called core sales, which exclude gasoline and cars, rose by 3.3% m/m, crushing the 0.8% foreseen. Furthermore, US Industrial Production rose 1.4% m/m, better than the 0.4%, and Capacity Utilization jumped 77.6% from 76.60%, the highest jump in December 2021.

At 19:00 GMT, AUD/USD traders turn their attention to the FOMC monetary policy minutes, followed at 23:30 GMT, by the release of the Australian Employment report, which could shed some clues about what the RBA is going to do next.

AUD/USD Price Forecast: Technical outlook

On Wednesday, the AUD/USD has risen steadily since the beginning of the Asian session. Geopolitical headlines caused a minor dip, though at press time is trading at new daily highs, near the 0.7200 figure.

The AUD/USD is neutral biased but upwards in the short-term. The AUD/USD first resistance would be 0.7200. Breach of the latter would expose a three-month-old downslope trendline around 0.7210, followed by the 100-day moving average (DMA) at 0.7243.

We are still in a window where an attack by Russia against Ukraine could come at any time, the White House warned on Wednesday. An attack could be preceded by a false flag operation or misinformation as a pretext. The White House said it had no new information on attribution for the Ukraine cyber-attack and that the door continues to be open for diplomacy with Russia. The US has a range of options at its disposal if Luhansk is recognised as an independent republic, the White House added.

Market Reaction

There was no notable reaction to the latest comments from the White House as markets await the release of Fed minutes at 1900GMT.

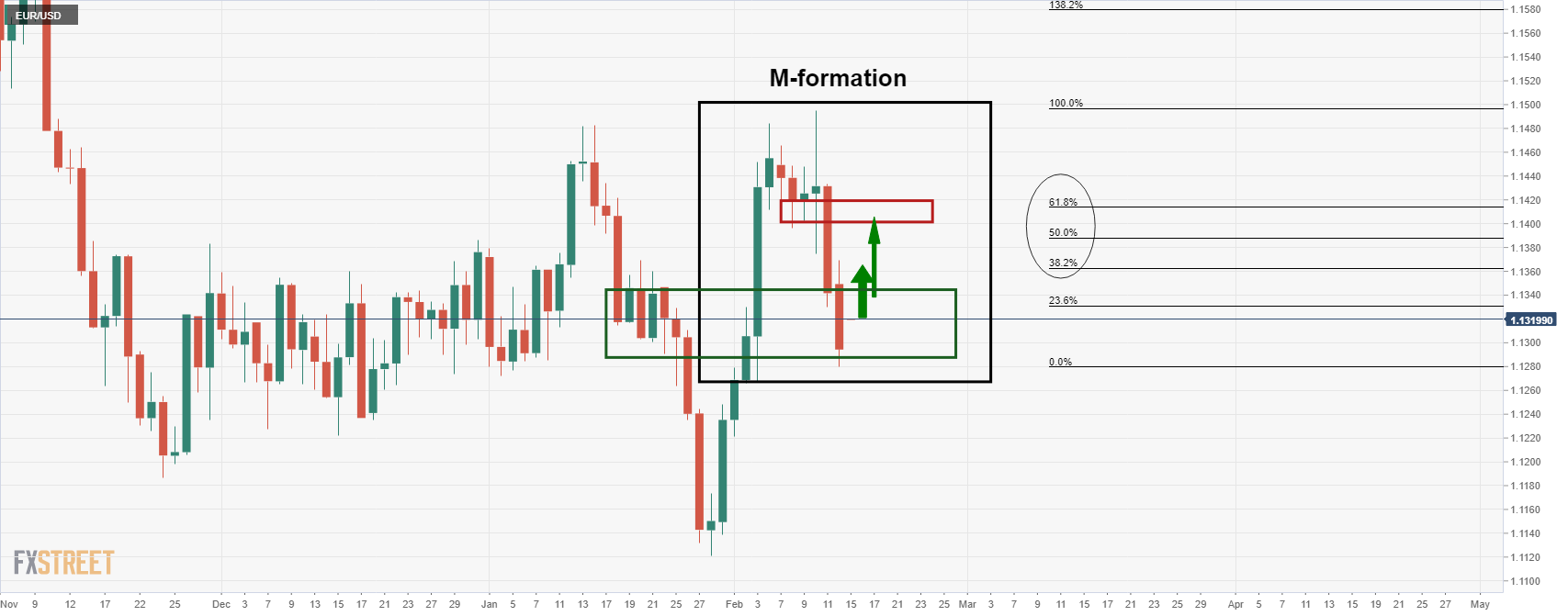

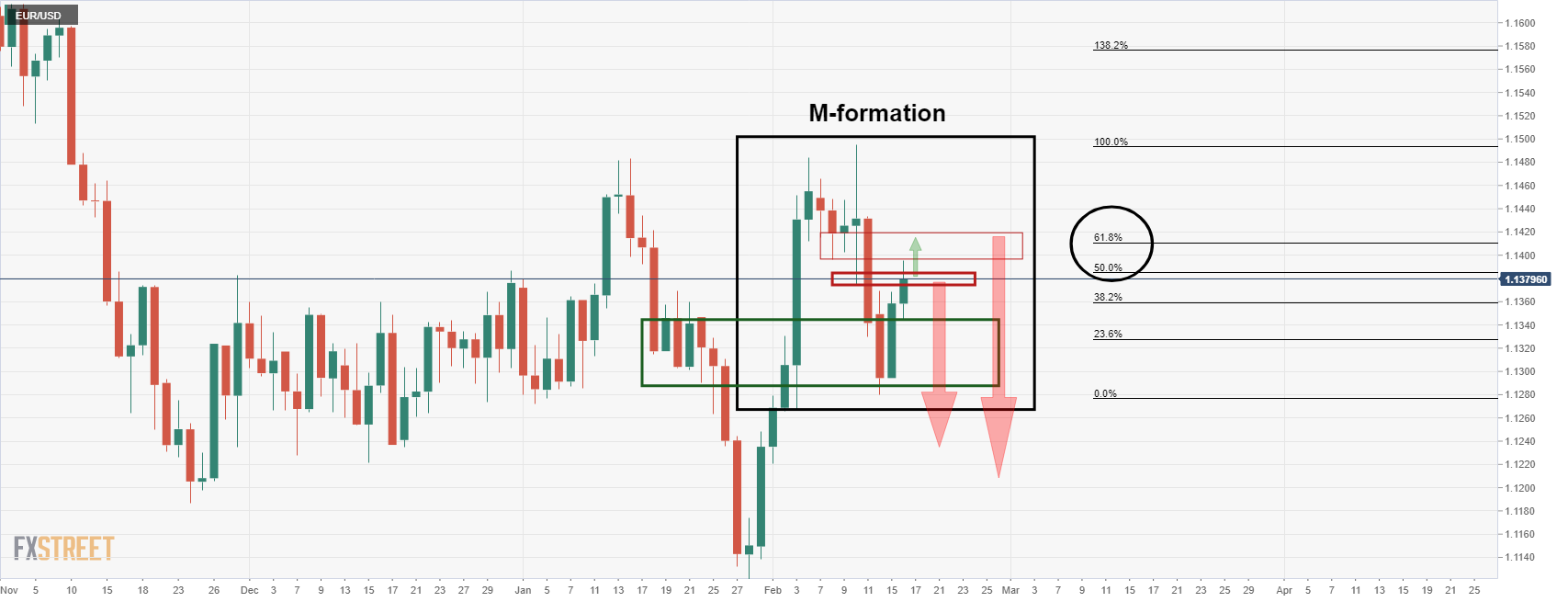

- EUR/USD bulls taking on bearish commitments as euro defies gravity.

- The 61.8% ratio is within earshot, but bears are lurking.

As per a series of analyses this week, EUR/USD Price Analysis: Bulls eye 61.8% golden ratio, but bears are in the slipstream, and EUR/USD bulls tread around with caution in a field of land mines and disruptive Russian headlines, the price stays on course as follows:

EUR/USD prior analysis

The M-formation was regarded as a reversion pattern with the price expected to correct towards the neckline of the 'M'...

While technical, the above prior analysis had also taken into account the improved, yet tentative, risk sentiment reverberating around global markets following prospects of the de-escalation of an imminent Russian invasion of Ukraine ...

EUR/USD live market

The price has reached a 50% mean reversion in recent trade and the tip of the M-formation's neckline wick, a prior daily low at 1.1396. The 61.8% ratio is near 1.1413 but the Russian headlines are a major distraction from the technicals. The bias, considering global inflationary pressures, a hawkish Federal Reserve, bets on front-loaded tightening could keep losses to a minimum. Therefore, the path of least resistance at this juncture is weighed to the downside, as illustrated in the above analysis.

EUR/USD H4 chart

Bears will be monitoring for signs of exhaustion in the correction from lower time frames. A break below 1.1345 on the H4 chart could be the signal:

However, so long as the 10 EMA threatens a bullish cross-up above the 21-EMA, there are prospects of an upside continuation as overall momentum is in the hands of the bulls still. This would eventuate in a test through 1.14 the figure, moving in on the 61.8% ratio as illustrated above. Nevertheless, unless there is a diplomatic breakthrough between leaders of NATO and Russia, (unlikely that this can be resolved so soon), then the euro will remain vulnerable.

The latest Ukrainian intelligence report on Wednesday showed no evidence of any withdrawal of Russian troops from near Ukraine's border, Ukrainian Defence Minister Oleksii Reznikov told Reuters. Russian and separatist forces amassed at Ukraine's borders continue to amount to about 140,000, he added. This week's massive cyber-attack did not damage Ukraine's Defence Command Control system, Reznikov added.

Market Reaction

There has not been any notable market reaction to the latest comments, but they do add to the broad skepticism shared by Western leaders, government officials and intelligence officials of Russia's alleged withdrawal. Recall that on Tuesday, Russian officials said that the country would partially pull back troops from Ukraine's borders following the completion of military exercises.

Minneapolis Federal Reserve President and FOMC member Neel Kashkari said on Wednesday that it is appropriate to normalise policy and "take the foot off of the gas" in order to address the risk that high inflation gets embedded. However, Kashkari said that his caution to his colleagues was to not overdo it, given that if the Fed raises rates too aggressively, there is a risk the economy could be sent into recession. In the longer run, Kashkari said, there is more of a risk that the Fed ends up back in a low inflation environment.

The Fed will be watching the data over the next six months to make sure inflation is coming back down, Kashkari proclaimed. Most forecasters see inflation falling to about 3.0% YoY by the end of 2022, he noted, saying that his guess was that, by the end of the year, the Fed won't be back at its 2.0% inflation target, but will be well on its way there.

Market Reaction

The more cautious tone of Fed's Kashkari, who wants the Fed not to overdo it with monetary tightening or else risk sending the US economy into a recession, may have weighed somewhat on the US dollar in recent trade. The DXY has recently slipped back to test session lows in the 95.80 area.

Data released on Wednesday showed Industria Procuidn in January increased 1.4% above the 0.4% of market consensus. Analysts at Wells Fargo explained that “a 9.9% surge in utility output amid the big chill in January explains the beat.” They argue “manufacturing output recorded a 0.2% increase after a scant decline in December as manufacturers contend with the ongoing supply chain crisis.”

Key Quotes:

“The recent manufacturing data makes it clear that things continue to slowly make their way back to normal, but with resilient demand production could be even better if supply wasn't a problem. The ISM manufacturing survey for January signaled that while delivery times remain historically long, wait times for inputs have improved somewhat. Difficulty finding qualified labor, however, remains a top concern for manufactures and continues to limit the overall pace of production.”

“Even with a comparatively modest gain in manufacturing, the 1.4% overall increase in January, the level of industrial production today is 2.1% above its pre-pandemic level in February 2020. Capacity is coming back online sharply as well and at 77.6%, it is 1.3 percentage points above its February 2020 rate.”

“It is a long way back to normal, but with some incremental improvement in supply chains means American manufacturing is able to put its factories to work in way that they have been struggling to do for almost two years. Since the demand environment is so much stronger today, the frustration is that production output could be much higher still if factories, mines and utilities had all the material and people they needed to really get back to work.”

- Failure of USD/JPY buyers to print a daily close above 115.60 exacerbated a downward move towards 115.40s.

- USD/JPY Technical Outlook: Neutral-upward biased, but in the short-term downward as geopolitical headlines dominated market mood.

On Wednesday, the USD/JPY edges lower as the North American session progresses, as market sentiment fluctuates between risk-on/off. At the time of writing, the USD/JPY is trading at 115.48.

USD/JPY Price Forecast: Technical outlook

During the overnight session, for North American traders, the USD/JPY reached a daily high of 115.80. However, as risk-aversion increased, courtesy by US Secretary of State Blinken remarks saying that they continue to see critical Russian units moving towards the border and not away, tilted market players’ mood.

The USD/JPY is upward biased, as depicted by the daily moving averages (DMAs) located well below the spot price. Tuesday’s failure to achieve a daily close above the January 28 daily high at 115.68 exacerbated a downward move, as shown by Wednesday’s price action, which tilted the USD/JPY as downward biased in the near term.

That said, the USD/JPY first support would be February 14 daily low at 115.00. A sustained break would expose the 50-DMA at 114.70, followed by the February 2 low at 114.14 and then the 100-DMA at 114.11.

Upwards, the USD/JPY first resistance would be 116.00. Breach of the latter would expose the YTD high at 116.35, followed by a challenge of a 24-month-old downslope trendline around 117.00. A clear break of that ceiling level would pave the way towards January 2017 swing high at 118.61.

The Canadian Consumer Price Index (CPI) rose in January 0.9% above the 0.6% of market consensus, showed data released on Wednesday. Analysts at the National Bank of Canada point out that annual inflation continues to rise with widespread price increases despite the slowdown in economic activity in January.

Key Quotes:

“The January 2022 release of inflation in Canada proves that economic weaknesses do not always coincide with disinflation, as despite the economy stumbling due to sanitary measures in January, prices rose sharply during the month.”

“Geopolitical tensions pushed up oil prices and consequently gasoline prices (+4.8%), while food prices were up 1.4%, a pace not seen since 2016. This pushed annual inflation to its highest level since the early 1990s.”

“The CPI excluding food and energy also rose noticeably during the month (+0.4%), recording its largest increase in four months. On an annual basis, all eight major categories exceeded the central bank's target range of 1% to 3%, the second occurrence since seasonally adjusted data began being compiled (1992).”

“This generalized nature of inflationary pressures is what has led us to say for some time that the economy no longer needs a policy rate at the effective lower bound, especially given the lag in the transmission of monetary policy. We expect inflation to moderate somewhat over the next 12 months, but to remain around 3% (the central bank's upper range) given the current supply chain disruptions and labor shortages.”

Retail Sales in the US rose 3.8% in January, the biggest gain since March 2021. Analysts at Wells Fargo, point out the increase handily exceeded consensus expectations and was only partly a function of higher prices. They suspect that part of the increase “may have to do with certain merchandise finally becoming available.”

Key Quotes:

“Consumer spending may have lost some momentum in the final months of 2021, but today's retail sales report for January says that consumers have swaggered into 2022 undaunted by soaring inflation and soaring COVID cases that month. Our consumer dashboard below is consistent with some improvement in January, but this report shows spending that was suspiciously strong.”

“Gains were broadly based, but concentrated in a few key categories and control group sales, which factor into GDP and exclude food services, auto dealers, building materials stores and gasoline stations jumped 4.8%, that too was the largest monthly increase since stimulus payment went out last March.”

“We still believe the factors that propelled strong growth in consumer spending last year are shifting and, in some cases, have reversed altogether. The biggest factor of all, in our view, is inflation. Most consumers have never seen anything like it, and it is weighing on sentiment and could force some difficult spending decisions for consumers this year. The Fed is well aware of the inflation struggles, and as the Fed removes policy support in a deliberate effort to keep a lid on prices, it will weigh on growth in consumer demand by design.”

Minneapolis Federal Reserve President and FOMC member Neel Kashkari said on Wednesday that the Fed is going to do what is needed to bring "thing" (the economy) back into balance. Some of the inflation should fade on its own as stimulus fades and people switch to buying services, he added.

Kashkari said that the Fed can soften demand by raising rates and tightening financial conditions, but that won't address supply-side issues. He also noted that his own recent experience with Covid had suggested to him that it will be a while until we can be comfortable living with the virus, before supply chains come back and before workers on the side-line can come back to work.

Market Reaction

There has not been any reaction to Kashkari's latest remarks, which haven't added anything new. Market attention is currently focused on the upcoming Fed minutes release and geopolitical developments regarding Russia/Ukraine.

- Spot silver is subdued in the mid-$23.50s as traders await the upcoming minutes release of the January Fed meeting.

- Traders will gauge the support for a larger 50bps move, though following recent inflation surprises, the minutes are somewhat stale.

- Geopolitics remains the main near-term driver for XAG/USD, amid ongoing confusion over Russia’s alleged partial troop withdrawal from Ukraine’s border.

Having largely shrugged off the latest mixed US Retail Sales report, spot silver (XAG/USD) prices are consolidating in the $23.50 region as focus turns to the upcoming release of the minutes of the January Fed meeting at 1900GMT. At current levels just under the $23.50 mark, the precious metal is trading with on-the-day gains of about 0.5%.

Traders will be looking for clues as to the level of support on the FOMC for a larger 50bps rate hike in March, something which Fed Chair Jerome Powell refused to rule out in the post-meeting press conference. The minutes are somewhat stale, however, as opinion on the committee might have shifted in a hawkish direction following recent Consumer and Producer Price Inflation data surprises.

That implies that markets might not be too fussed if the minutes come across a little more dovish compared to recent more hawkish Fed commentary, most notably from St Louis Fed President and 2022 voting FOMC member James Bullard. He has been calling for 100bps of rate hikes by the end of Q2, as well as the start of passive balance sheet run-off. The risk of volatility in wake of the minutes to silver and other precious metals is thus perhaps somewhat lessened versus prior Fed meeting minute releases.

Geopolitics will likely remain the main driver of precious metal market sentiment. XAG/USD was weighed on heavily by Russian proclamations that it would be partially withdrawing troops from its border with Ukraine, pulling back sharply from February highs near $24.00 per troy ounce. But Western leaders, as well as government and intelligence officials have been warning that they have not yet seen any actual evidence of de-escalation and troop withdrawal, making for heightened confusion.

A further build-up of tensions could easily send spot silver prices back towards a test of weekly highs, and to a potential breakout towards long-term downtrend resistance in the mid-$24.00s.

Thursday’s release of Australia’s January labour report can be expected to inject fresh life into the debate regarding the likelihood of a Reserve Bank of Australia (RBA) rate hike during the course of 2022. Strong data could lift the aussie to the 0.72 level, according to economists at Rabobank.

Scope for AUD/USD to inch higher towards 0.74 on a 12-month view

“The market median for the Australian January unemployment rate stands at 4.2%. Any strength in the labour market report over and above market expectations is likely to increase the pressure on the RBA to widen the scope for a rate hike this year. Strong data are likely to put AUD/USD 0.72 back in view assuming no surge in safe-haven demand for the USD near-term.”

“Given the strength of commodity prices and a healthy economic outlook in Australia, we see scope for AUD/USD to edge moderately higher to the 0.74 region on a 12-month view.”

- Cable rises to the 1.3580 area as the pound strengthens.

- Dollar weaker despite steady yields and lower equity prices.

- Critical event ahead: FOMC minutes at 19:00 GMT.

The GBP/USD gained momentum and climbed to 1.3583, reaching the highest level since Friday. It is hovering above 1.3565, with a positive tone ahead of the release of the FOMC minutes.

The pound also strengthened versus the euro during the American session. EUR/GBP tested earlier on Wednesday levels above 0.8400 and recently printed fresh daily highs under 0.8370.

Earlier on Wednesday, data showed inflation hit the highest level in more than thirty years in the United Kingdom in January. The consumer price index (CPI) increased from 5.4% to 5.5%, slightly above expectations. The pound held relatively steady after the report.

In the US, retail sales jumped 3.8% in January, the best month since April 2021. The dollar initially appreciated but then pulled back. A different report showed Industrial production in January rose 1.4%, above the 0.4% of market consensus.

The key event on Wednesday will be the release of the FOMC minutes of the last meeting at 19:00 GMT. “A March hike is pretty much a done deal but markets will be looking for clues at the likely pace of tightening as well as when balance sheet runoff might be seen and what might trigger outright asset sales vs. simple runoff from maturing securities”, explained analysts at Brown Brother Harriman.

Testing levels above 1.3570

The GBP/USD is trading around 1.3575. The momentum will favor the pound while above 1.3570, with a test of 1.3600 on the cards. The next resistance stands at 1.3620. On the flip side, a slide back under 1.3545 should point to further weakness in cable exposing the next support at 1.3525.

Technical levels

- WTI rebounded around $2.0 on Wednesday to back above $94.00 amid confusion over whether Russia is actually withdrawing troops.

- Geopolitics aside, many commodity strategists remain bullish and predict $100 per barrel as market conditions remain tight.

Crude oil prices have seen substantial upside in recent trade as market participants fret amid confusion over whether Russia is actually withdrawing some troops from its border with Ukraine as is said it would on Tuesday. Western leaders, government and intelligence officials have been loudly warning, including remarks most recently from US Secretary of State Anthony Blinken in an interview with MSNBC, that there is not yet any evidence of Russian withdrawal. On the contrary, they said, Russia continues to add to its attack capabilities, they said.

Associated fears as investors continue to weigh the prospect of a Russia/Ukraine military conflict and associated disruptions to global oil supply have propelled front-month WTI futures roughly $2.0 higher on Wednesday from session lows under $92.00 to above $94.00. That means prices are now back to within $2.0 of last Friday’s seven-year highs near the $96.00 level and have now rebounded roughly $3.50 from Monday’s mid-$90.00 lows. Weekly Private US crude oil inventory figures out on Tuesday showed that crude oil, gasoline and distillate stocks all drew last week, with the upcoming official US inventory report at 1530GMT expected to show the same and lending to the idea that oil markets remain tight.

OPEC’s secretary general Mohammed Barkindo on Wednesday said that current levels of oil supply are not enough, but warned that this was due to underinvestment from oil companies and cautioned that there would be no immediate cure for high prices. Many commodity strategists continue to believe that oil markets are headed back towards $100 per barrel or more, regardless of geopolitical developments in Eastern Europe, as smaller OPEC+ members continue to struggle to lift output in line with quota increases.

- US Retail Sales came higher than expected, but Canadian inflation elevated above the 5% threshold.

- The market sentiment shifted to risk-off on US Secretary of State Blinken’s remarks that Russia moves troops to the Ukraine border.

- USD/CAD is neutral-upward biased, but USD/CAD buyers need to reclaim 1.2700.

In the North American session, the USD/CAD extend its weekly losses, following positive economic data from the US and Canada. At the time of writing, the USD/CAD is trading at 1.2690.

The financial markets are on a rollercoaster, as market mood swings between risk-on/off. Before US macroeconomic data crossed the wires, US equity futures pointed to a higher open. However, around 13:50 GMT, US Secretary of State Blinken said they continue to see critical Russian units moving towards the border and not away, causing a shift in market players’ mood.

It is worth noting that geopolitical headlines are the market movers since last Friday’s putting aside macroeconomic data.

US Retail Sales better than expected while Canada inflation breaks the 5% threshold

Before Wall Street opened, the US Retail Sales in January rose 3.8% m/m, higher than the 2% estimated by analysts, recovering from December’s reading which showed a 2.5% (revised lower) m/m contraction. Excluding autos and gas, sales jumped 3.8% m/m, north of the -3,2% (revised) December’s figure.

At the same time, the Canadian economic docket released inflation figures, with the Consumer Price Index (CPI) for January jumping 5.1% y/y, hotter than the 4.8% estimated, as reported by Statistics Canada. The so-called Core CPI rose 4.3% y/y, higher than the 4% in December.

Later on the day, at 18:30 GMT, the Bank of Canada (BoC) Governor Lane would cress the wires, followed 30 minutes after by the release of Federal Open Market Committee (FOMC) January meeting minutes, which could give clues regarding the Fed’s path towards tightening monetary conditions.

USD/ CAD Price Forecast: Technical outlook

Since the beginning of the week, the USD/CAD failed to break above the 1.2800 thresholds, accelerating the downward move. On its way south, CAD buyers reclaimed the 50-day moving average (DMA) that lies at 1.2704, but the pair is neutral-upward biased despite the aforementioned.

That said, the USD/CAD first resistance would be the confluence of the 1.2700 figure and the 50-DMA. Breach of the latter would expose February 11 1.2754 daily high, followed by 1.2800.

- The upside in DXY stays capped by the 96.00 region.

- US Retail Sales surprised to the upside last month.

- FOMC Minutes takes centre stage later in the session.

The US Dollar Index (DXY), which gauges the greenback vs. a bundle of its main competitors, meets some decent support near 95.70 midweek.

US Dollar Index offered pre-FOMC Minutes

The index trades on the defensive for the second straight session, although it managed to bounce off earlier 3-day lows in the 95.80/75 band.

Persistent risk-on sentiment continues to put the buck under pressure in a context dominated by declining yields in the global markets, while market participants continue to assess the developments coming from the Russia-Ukraine front.

In the US docket, better-than-expected Retail Sales lent some initial support to the dollar, although the optimism faded away later with another set of mixed results after the NAHB Index ticked lower to 82 in February, Business Inventories matched estimates after expanding 2.1% MoM in December, Capacity Utilization improved to 77.6% in January and Industrial Production expanded at a monthly 1.4% also during last month.

US Dollar Index relevant levels

Now, the index is losing 0.08% at 95.90 and a break above 96.43 (weekly high Feb.14) would open the door to 97.44 (2022 high Jan.28) and finally 97.80 (high Jun.30 2020). On the flip side, the next down barrier emerges at 95.76 (weekly low Feb.16) seconded by 95.17 (weekly low Feb.10) and then 95.13 (weekly low Feb.4).

- Spot gold found good support in the $1850 area and has advanced on Wednesday in the run-up to Fed minutes.

- Geopolitical angst regarding Russia/Ukraine remains elevated, underpinning gold, which is also being supported by technical factors.

As US/NATO officials continue to question the veracity of Russian claims that the country is now withdrawing troops from its border with Ukraine, markets remain nervous about the prospect of a flare-up in military tensions in the region. This is helping to keep spot gold (XAU/USD) prices supported above key support at the $1850 level. At current levels in the mid-$1860s, XAU/USD is trading with on-the-day gains of about 0.5%, unfazed by the latest US Retail Sales figures, which were much stronger than expected for January, though also saw hefty negative revisions to the December numbers.

As gold traders keep one eye on geopolitical developments in Eastern Europe, focus is increasingly shifting towards Wednesday’s release of the minutes from the January Fed policy meeting. Fed Chair Jerome Powell refused to rule out the possibility of a larger 25bps rate hike in March. In wake of recent Consumer and Producer Price Inflation data surprises as well as hawkish comments from some Fed policymakers (like James Bullard), US money markets have been increasingly leaning towards a 50bps move next month. The minutes will thus be scrutinised for any indications as to FOMC support for a larger 50bps rate hike.

The fact XAU/USD found solid support at the $1850 level on Wednesday is positive from a technical perspective. The precious metal recently broke to the north of a long-term pennant structure and in finding support at $1850, XAU/USD found support at the retest of the pennant. Technicians might thus now view a move back to multi-month highs in the $1880 area as highly likely and perhaps even a push on towards mid-2021 highs in the $1920 area. Should the geopolitical situation in Eastern Europe further soar, that would lend fundamental impetus to such a move.

-637806206434059826.png)

EUR/JPY has found a floor as expected above its rising 55-day moving average and 61.8% retracement of the January/February rally at 129.81/130.13. Analysts at Credit Suisse look for a retest of the top of the eight-month downtrend channel from June last year at 132.94.

Support at 129.81 to hold for an eventual retest of the top of the down channel at 132.94

“We look for a fresh move higher with resistance seen at 131.84/88 initially, with a break above 132.24/36 needed to clear the way for a move back to the top of the eight-month channel at 132.94.”

“A sustained move above the eight-month channel at 132.9 and then the 133.49 high of October last year should confirm a more important turn higher is underway, with resistance then seen next at the 2021 high at 134.14.”

“Support is seen at 130.88 initially, then 130.44/43, with 130.13/129.81 expected to remain a solid floor.”

GBP/USD’s broad price action remains range-bound. 1.35 and 1.36 are the levels to watch, according to analysts at Scotiabank.

Cable remains limited by 1.3600/10

“Rangebound trading looks set to remain unless the GBP makes a firm move under 1.35 – but it has quickly been bid under the figure on three separate occasions this month.”

“Intermediate support is the mid-figure area and ~1.3520.”

“On the upside, the pound remains limited by 1.3600/10, initially, followed by the mid-figure area; the 200-day MA, above which it hasn’t closed since last Sep, comes next at 1.3694.”

See: GBP/USD to post bullish technical signal on a move above 1.3710/1.3750 – SocGen

- EUR/USD fades the earlier advance to the 1.1400 area.

- US Retail Sales came above estimates in January.

- Markets’ attention now shifts to the FOMC Minutes.

Following an early climb to the proximity of 1.1400, EUR/USD now erodes part of that move and returns to the 1.1360 region so far on Wednesday.

EUR/USD capped by 1.1400, looks to FOMC

EUR/USD failed to extend the weekly rebound further north of the 1.1400 mark midweek, as better-than-expected results from the US docket sponsored a noticeable bounce in the buck.

Indeed, US Retail Sales crushed initial estimates after expanding at a monthly 3.8% in January. Core sales followed suit and rose 3.3% MoM. Earlier data showed Mortgage Applications shrinking 5.4% in the week to February 11 according to MBA.

In the meantime, the relief rally keeps sustaining the better mood in the risk complex despite there seems to be no further progress on the (apparent) de-escalation of tensions in the Russia-Ukraine front.

Later in the session, US Industrial Production, Capacity Utilization, Business Inventories and the NAHB Index are all due ahead of the release of the FOMC Minutes of the January event.

What to look for around EUR

EUR/USD now seems to have met decent resistance around the 1.1400 zone amidst some loss of momentum in the relief rally in combination with above-estimated results from the US docket. Looking at the broader scenario, the improvement in the pair’s outlook appears underpinned by fresh speculation of a potential interest rate hike by the ECB at some point by year end, higher German yields, persevering elevated inflation and a decent pace of the economic activity and other key fundamentals in the region.

Key events in the euro area this week: EMU Industrial Production (Wednesday) – Flash EMU Consumer Confidence (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the euro area. Speculation of ECB tightening/tapering later in the year. Presidential elections in France in April. Geopolitical concerns from the Russia-Ukraine conflict.

EUR/USD levels to watch

So far, spot is advancing 0.02% at 1.1360 and faces the next up barrier at 1.1395 (weekly high Feb.16) followed by 1.1491 (200-week SMA) and finally 1.1494 (2022 high Feb.10). On the other hand, a drop below 1.1326 (55-day SMA) would target 1.1279 (weekly low Feb.14) en route to 1.1186 (monthly low Nov.24 2021).

NZD/USD is undergoing another minor recovery following its decline from last week, which analysts at Credit Suisse anticipate will prove temporary. They still view the market as in a broader downtrend and would fade rallies like this one.

0.6701/10 to hold any further bounce

“With major resistance at the December 2021 lows at 0.6701/10 ideally serving as a ceiling for this upmove, we still look for NZD/USD to shift back lower again, with a closing break below 0.6601/6589 needed to reassert the downtrend and decrease the risk of further recoveries.”

“Below 0.6601/6589 would see scope for the YTD low at 0.6529 to be retested again, with break below here opening the door to our long-held objective at 0.6511/6488 – the August and September lows of 2020.

“Immediate resistance is seen at 0.6662, then at 0.6681/92 and eventually at the aforementioned December 2021 lows at 0.6701/10.”

“A sustained closing break above 0.6701/10 and then the 55-day moving average at 0.6734/40 would instead suggest that a broader sideways phase would arise.”

EUR/USD rebounds to the upper 1.13s but upside potential remains limited, according to economists at Scotiabank.

Break above 1.14 would mark a key bullish signal for the euro

“A break above 1.14 (where its 100-day MA of 1.1404 stands) would mark a key bullish signal for the EUR with resistance following at ~1.1450 and the figure area.”

“Support after the 1.1350 zone is ~1.1320 and 1.1300/80.”

“EUR/USD may rebound marginally on an easing of military tensions, but we think it remains challenged over the next few quarters by ultra-dovish monetary policy settings, which should weigh on it toward 1.10.”

US Secretary of State Anthony Blinken said on Wednesday in an interview on MSNBC that the US has not seen any pullback of Russian forces from the Ukrainian border.

- AUD/SUD gained traction for the second successive day amid modest USD weakness.

- Hawkish Fed expectations, upbeat US Retail Sales helped limit any further USD losses.

- Investors might prefer to wait on the sidelines ahead of the FOMC meeting minutes.

The AUD/USD pair retreated a few pips from the weekly high touched earlier this Wednesday and traded with modest intraday gains, around the 0.7165 region post-US macro releases.