- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 15-09-2014

(raw materials / closing price /% change)

Light Crude 92.75 -0.18%

Gold 1,234.00 -0.09%

(index / closing price / change items /% change)

Hang Seng 24,356.99 -238.33 -0.97%

S&P/ASX 200 5,473.45 -57.69 -1.04%

Shanghai Composite 2,339.14 +7.19 +0.31%

FTSE 100 6,804.21 -2.75 -0.04%

CAC 40 4,428.63 -13.07 -0.29%

Xetra DAX 9,659.63 +8.50 +0.09%

S&P 500 1,984.13 -1.41 -0.07%

NASDAQ Composite 4,518.9 -48.70 -1.07%

Dow Jones 17,031.14 +43.63 +0.26%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2940 -0,17%

GBP/USD $1,6226 -0,24%

USD/CHF Chf0,9353 +0,24%

USD/JPY Y107,18 -0,15%

EUR/JPY Y138,70 -0,32%

GBP/JPY Y173,91 -0,38%

AUD/USD $0,9033 -0,03%

NZD/USD $0,8176 +0,37%

USD/CAD C$1,1053 -0,33%

(time / country / index / period / previous value / forecast)

00:00 Australia RBA Assist Gov Kent Speaks

01:30 Australia RBA Meeting's Minutes

05:30 Japan BOJ Governor Haruhiko Kuroda Speaks

08:30 United Kingdom Retail Price Index, m/m August -0.1% +0.5%

08:30 United Kingdom Retail prices, Y/Y August +2.5% +2.5%

08:30 United Kingdom RPI-X, Y/Y August +2.6%

08:30 United Kingdom Producer Price Index - Input (MoM) August -1.6% -0.2%

08:30 United Kingdom Producer Price Index - Input (YoY) August -7.3% -6.6%

08:30 United Kingdom Producer Price Index - Output (MoM) August -0.1% -0.1%

08:30 United Kingdom Producer Price Index - Output (YoY) August +0.9% +0.9%

08:30 United Kingdom HICP, m/m August -0.3% +0.4%

08:30 United Kingdom HICP, Y/Y August +1.6% +1.5%

08:30 United Kingdom HICP ex EFAT, Y/Y August +1.8% +1.8%

09:00 Eurozone ZEW Economic Sentiment September 23.7 21.3

09:00 Germany ZEW Survey - Economic Sentiment September 8.6 5.2

12:30 Canada Manufacturing Shipments (MoM) July +0.6% +1.1%

12:30 U.S. PPI, m/m August +0.1% +0.1%

12:30 U.S. PPI, y/y August +1.7% +1.8%

12:30 U.S. PPI excluding food and energy, m/m August +0.2% +0.1%

12:30 U.S. PPI excluding food and energy, Y/Y August +1.6% +1.7%

13:00 U.S. Net Long-term TIC Flows July -18.7 24.3

13:00 U.S. Total Net TIC Flows July -153.5

16:45 Canada BOC Gov Stephen Poloz Speaks

20:30 U.S. API Crude Oil Inventories September -1.0

22:45 New Zealand Current Account Quarter II 1.41 -1.04

Stock indices closed mixed. Signs of slowdown in the Chinese economy weighed on markets. China's industrial production rose 6.9% in August, after a 9.0% in July. Analysts had expected an increase of 8.8%. That was the slowest pace since December 2008

Fixed-asset investment in China increased 16.5% in August, missing expectations for a 16.9% rise, after a 17.0% gain in July.

Investors are awaiting the Fed's interest rate decision on Wednesday. They expect the Fed will cut its asset purchase program by another $10 billion.

Eurozone's seasonally adjusted trade surplus declined to 12.2 billion euros in July from 13.8 billion euros in June.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,804.21 -2.75 -0.04%

DAX 9,659.63 +8.50 +0.09%

CAC 40 4,428.63 -13.07 -0.29%

West Texas Intermediate rebounded after the dollar slid from a 14-month high, increasing the appeal of oil as an investment. Brent erased losses after falling to a two-year low.

Futures rose as much as 0.4 percent in New York after the Bloomberg dollar index, which tracks the greenback against 10 major counterparts, fell from the highest level since July 2013.

"The dollar deserves to come off a little bit with its recent strength," said Tariq Zahir, a New York-based commodity fund manager at Tyche Capital Advisors. "On the lack of any bullish news, oil will continue to trade sideways."

WTI for October delivery climbed 36 cents to $92.63 a barrel on the New York Mercantile Exchange at 10:49 a.m. Volume was 27 percent higher than the 100-day average.

Brent for October settlement, which expires today, rose 14 cents to $97.25 a barrel on the London-based ICE Futures Europe exchange. It earlier touched $96.21 a barrel, the lowest since July 2, 2012. The more active November contract gained 34 cents to $98.30. The volume of all futures traded was 11 percent below the 100-day average.

The U.S. dollar traded mixed to lower against the most major currencies after mixed U.S. economic data. The NY Fed Empire State manufacturing index rose to 27.5 in September from 14.7 in August, exceeding expectations for a gain to 15.0. That was the highest level since October 2009.

The U.S. industrial production declined 0.1% in August, missing forecasts for a 0.3% rise, after a 0.2% gain in July. July's figure was revised down from a 0.4% increase.

The U.S. capacity utilization rate decreased to 78.8% in September from 79.1% in August, missing expectations for an increase to 79.3%. August's figure was revised down from 79.2%.

The greenback remained supported on speculation the Fed will start to hike its interest rate sooner than expected. Market participants are awaiting the Fed's interest rate decision on Wednesday. They expect the Fed will cut its asset purchase program by another $10 billion.

The euro traded higher against the U.S. dollar. Eurozone's seasonally adjusted trade surplus declined to 12.2 billion euros in July from 13.8 billion euros in June.

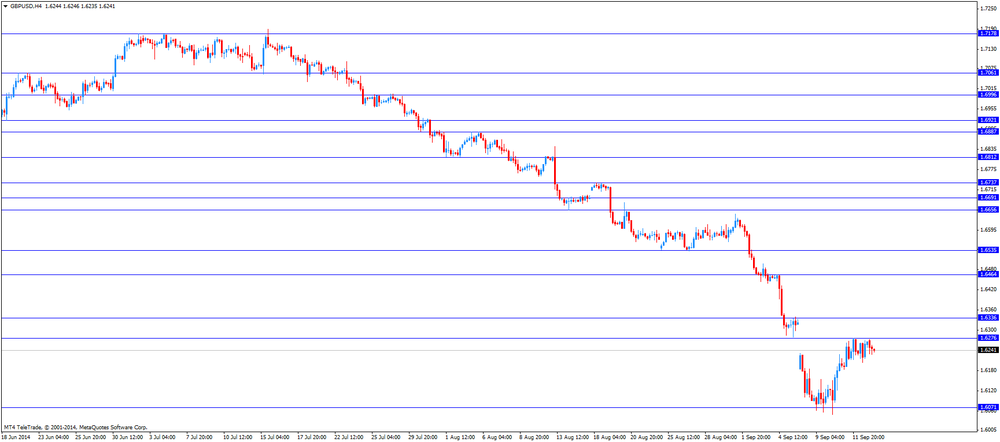

The British pound traded mixed against the U.S. dollar. Scotland's independence referendum on Thursday continued to weigh on the pound.

The Swiss franc traded higher against the U.S. dollar. Switzerland's producer price index (PPI) declined 0.2% in August, after a flat reading in July.

On a yearly basis, Switzerland's PPI fell 1.2% in August, after a 0.8% drop in July.

The New Zealand dollar traded higher against the U.S dollar in the absence of any major economic reports from New Zealand.

The weaker-than expected Chinese economic data weighed on the kiwi and the Australian dollar. China's industrial production rose 6.9% in August, after a 9.0% in July. Analysts had expected an increase of 8.8%.

Fixed-asset investment in China increased 16.5% in August, missing expectations for a 16.9% rise, after a 17.0% gain in July.

Retail sales in China climbed 11.9% in August, missing forecasts of a 12.1% rise, after a 12.2% increase in July.

China is a major trading partner of New Zealand and Australia.

The Australian dollar traded higher against the U.S. dollar. In the overnight trading session, the Aussie fell against the greenback due to the weak economic data from Australia. New motor vehicle sales in Australia fell by 1.8% in August, after a 1.3% decline in July.

On a yearly basis, new motor vehicle sales in Australia dropped by 3.5% in August, after a 0.4% fall in July.

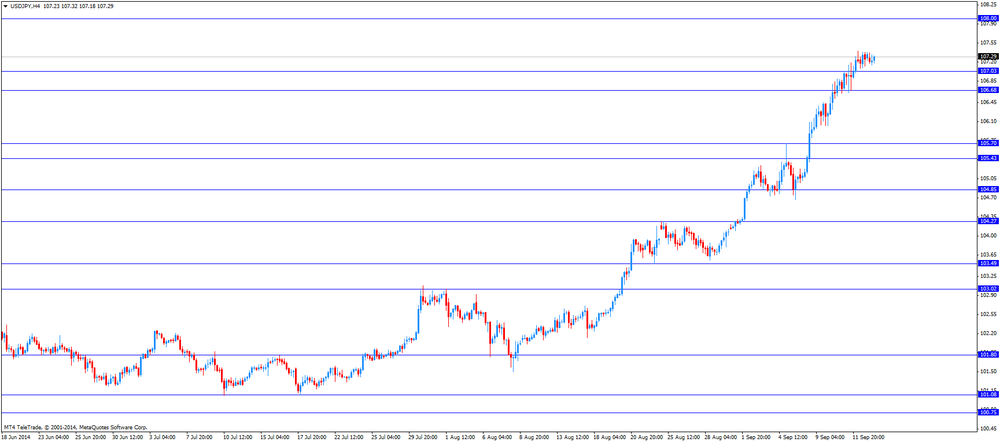

The Japanese yen traded mixed against the U.S. dollar in the absence of any major economic reports from Japan. Markets in Japan were closed for a public holiday.

The yen dropped to the lowest level since September 2008 against the U.S. dollar last week as the Bank of Japan (BoJ) Governor Haruhiko Kuroda said to the Japan's Prime Minister Shinzo Abe on Thursday that the central bank is ready to expand monetary easing measures to reach 2 percent inflation target.

Gold prices rebounded from an eight-month low after the growth index of manufacturing activity in New York in September was the highest in four years.

Federal Reserve Bank of New York said that the business activity index rose this month to 27.5 from 14.7 in August. Analysts had expected the index to rise only to 15.0 in September. On the index, a reading above 0.0 reflect the increase in activity, below - its decline.

Optimistic data added to speculation that the Fed is already in the upcoming meeting this week may give a hint of an early increase in interest rates.

The dollar was strong demand amid speculation that Fed officials are taking a more aggressive stance, perhaps, not to mention the intention to keep rates low for "an extended time."

The Central Bank is expected to reduce the amount of the asset purchase program by another $ 10 billion on its way to full completion in October and higher interest rates in mid-2015.

For storage of gold funds are required, and it is inferior to the competition with earning assets when interest rates rise.

The cost of the October gold futures on the COMEX today rose to 1238.00 dollars per ounce.

EUR/USD: $1.2945(E120mn), $1.3000-05(E486mn), $1.3050(E484mn), $1.3075(E200mn)

GBP/USD: $1.6250(stg112mn), $1.6300(stg225mn), $1.6320(stg120mn)

EUR/GBP: stg0.7950(E225mn), stg0.7975(E510mn), stg7980(E112mn)

USD/CHF: Chf0.9385($300mn)

AUD/USD: $0.9000(A$621mn), $0.9030(A$219mn), $0.9160(A$349mn)

NZD/USD: $0.8375(NZ$303mn)

AUD/NZD: NZ$1.1250(A$813mn)

USD/CAD: C$1.1000($523mn), C$1.1070-80($336mn), C$1.1100($162mn)

U.S. stock-index futures were little changed as investors assessed regional manufacturing data to help gauge the timing of any Federal Reserve rate increase.

Global markets:

Hang Seng 24,356.99 -238.33 -0.97%

Shanghai Composite 2,339.14 +7.19 +0.31%

FTSE 6,808.07 +1.11 +0.02%

CAC 4,432 -9.70 -0.22%

DAX 9,668.14 +17.01 +0.18%

Crude oil $91.46 (-0.88%)

Gold $1234.30 (+0.23%)

(company / ticker / price / change, % / volume)

| Visa | V | 214.06 | +0.01% | 0.4K |

| McDonald's Corp | MCD | 93.36 | +0.02% | 0.5K |

| Procter & Gamble Co | PG | 83.28 | +0.02% | 0.6K |

| UnitedHealth Group Inc | UNH | 86.24 | +0.07% | 0.2K |

| Verizon Communications Inc | VZ | 48.45 | +0.10% | 1.8K |

| Wal-Mart Stores Inc | WMT | 75.91 | +0.18% | 0.2K |

| AT&T Inc | T | 34.57 | +0.20% | 2.0K |

| American Express Co | AXP | 88.40 | +0.87% | 0.8K |

| Pfizer Inc | PFE | 29.43 | 0.00% | 0.6K |

| International Business Machines Co... | IBM | 191.25 | -0.02% | 0.5K |

| The Coca-Cola Co | KO | 41.45 | -0.02% | 3.2K |

| Merck & Co Inc | MRK | 59.51 | -0.07% | 3.4K |

| General Electric Co | GE | 25.85 | -0.08% | 2.8K |

| Boeing Co | BA | 126.83 | -0.09% | 0.8K |

| Intel Corp | INTC | 34.59 | -0.09% | 1.1K |

| Walt Disney Co | DIS | 89.58 | -0.10% | 2.4K |

| Chevron Corp | CVX | 122.44 | -0.18% | 0.9K |

| Exxon Mobil Corp | XOM | 95.61 | -0.18% | 1.3K |

| Goldman Sachs | GS | 182.73 | -0.24% | 0.8K |

| Cisco Systems Inc | CSCO | 25.сен | -0.28% | 6.9K |

| Home Depot Inc | HD | 88.53 | -0.35% | 1K |

| JPMorgan Chase and Co | JPM | 59.80 | -0.38% | 0.1K |

| Microsoft Corp | MSFT | 46.50 | -0.42% | 2.0K |

| Caterpillar Inc | CAT | 104.42 | -0.57% | 2.7K |

Upgrades:

Barrick Gold Corp (ABX) upgraded to Neutral from Underweight at HSBC Securities

Downgrades:

Other:

FedEx (FDX) target raised to $172 from $168 at Oppenheimer

Wal-Mart (WMT) initiated with a Neutral at Citigroup, target $83

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Japan Bank holiday

01:30 Australia New Motor Vehicle Sales (MoM) August -1.3% -1.8%

01:30 Australia New Motor Vehicle Sales (YoY) August -0.4% -3.5%

07:15 Switzerland Producer & Import Prices, m/m August 0.0% -0.2%

07:15 Switzerland Producer & Import Prices, y/y August -0.8% -1.2%

09:00 Eurozone Trade Balance s.a. July 13.8 12.2

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. economic data. The NY Fed Empire State manufacturing index is expected to climb to 15.0 in September from 14.7 in August.

The U.S. industrial production is expected to rise 0.3% in August, after a 0.4% gain in July.

The greenback remained supported on speculation the Fed will start to hike its interest rate sooner than expected. Market participants are awaiting the Fed's interest rate decision on Wednesday. They expect the Fed will cut its asset purchase program by another $10 billion.

The euro traded lower against the U.S. dollar. Eurozone's seasonally adjusted trade surplus declined to 12.2 billion euros in July from 13.8 billion euros in June.

The British pound traded mixed against the U.S. dollar. Scotland's independence referendum on Thursday continued to weigh on the pound.

The Swiss franc traded lower against the U.S. dollar. Switzerland's producer price index (PPI) declined 0.2% in August, after a flat reading in July.

On a yearly basis, Switzerland's PPI fell 1.2% in August, after a 0.8% drop in July.

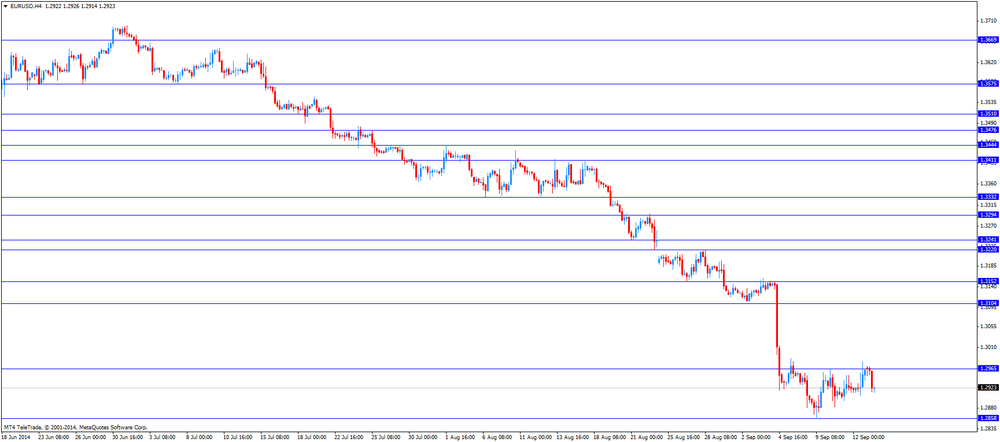

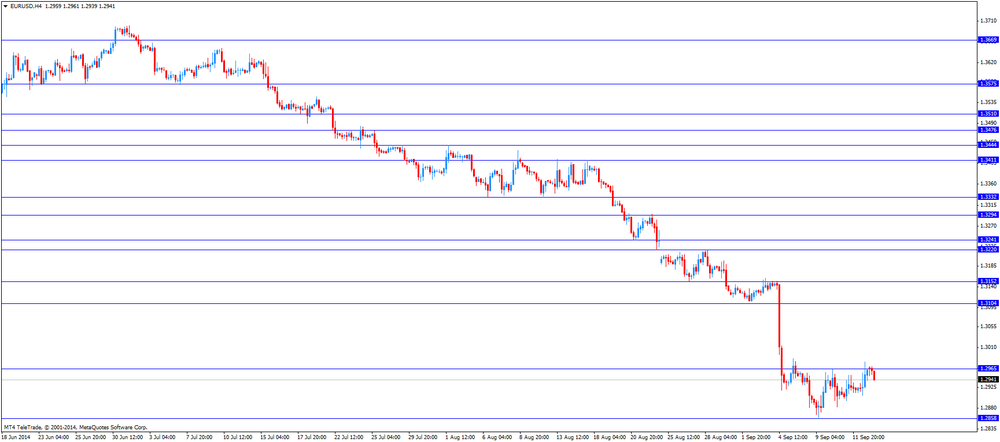

EUR/USD: the currency pair fell to $1.2914

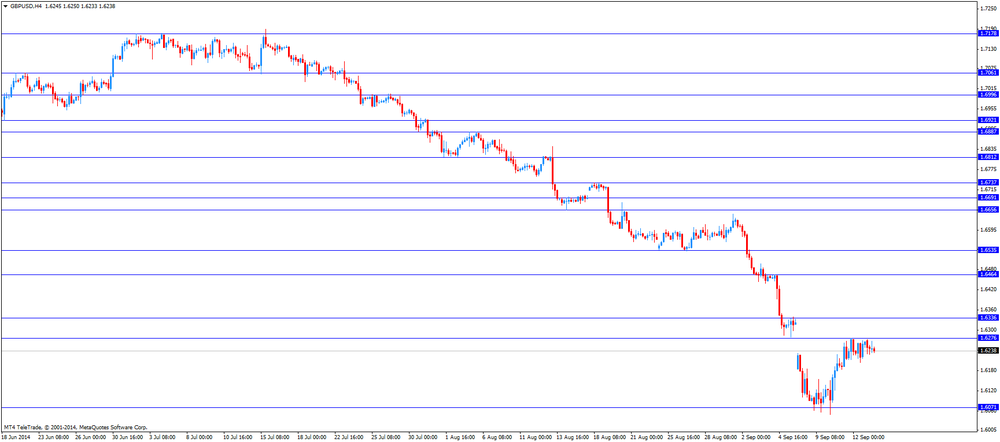

GBP/USD: the currency pair traded mixed

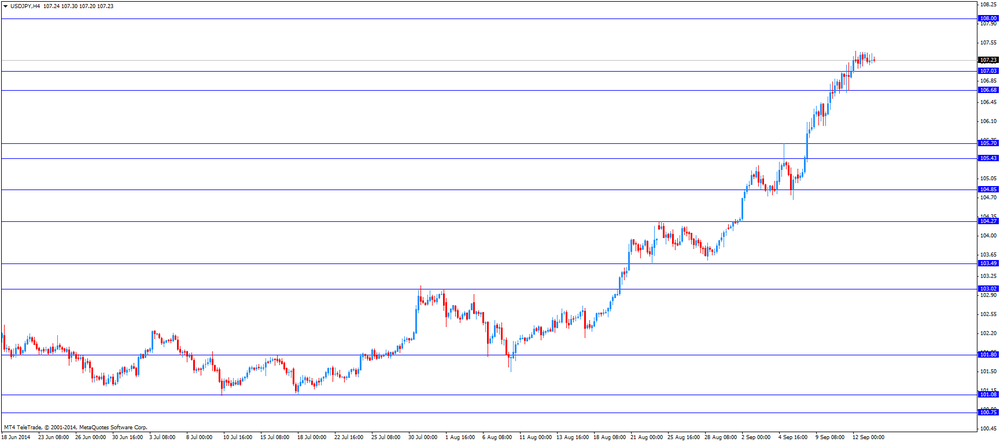

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 U.S. NY Fed Empire State manufacturing index September 14.7 15.0

13:15 U.S. Industrial Production (MoM) August +0.4% +0.3%

13:15 U.S. Capacity Utilization September 79.2% 79.3%

EUR/USD

Offers $1.3070, $1.3050, $1.3000/10

Bids $1.2880/74, $1.2860/50, $1.2800

GBP/USD

Offers $1.6350, $1.6290-300

Bids 1.6195/85, $1.6125/20

AUD/USD

Offers $0.9250/60, $0.9220, $0.9110, $0.9100

Bids $0.8900, $0.8800

EUR/JPY

Offers Y140.00, Y139.50, Y139.20

Bids Y138.30, Y138.00, Y138.50

USD/JPY

Offers Y108.00, Y107.40-50

Bids Y106.70/65, Y106.50, Y106.05/95, Y105.50, Y105.20

EUR/GBP

Offers stg0.8100, stg0.8000, stg0.7980

Bids stg0.7940, stg0.7900

Stock indices traded little changed as signs of slowdown in the Chinese economy weighed on markets. China's industrial production rose 6.9% in August, after a 9.0% in July. Analysts had expected an increase of 8.8%. That was the slowest pace since December 2008

Fixed-asset investment in China increased 16.5% in August, missing expectations for a 16.9% rise, after a 17.0% gain in July.

Eurozone's seasonally adjusted trade surplus declined to 12.2 billion euros in July from 13.8 billion euros in June.

Current figures:

Name Price Change Change %

FTSE 6,792.15 -14.81 -0.22%

DAX 9,664.13 +13.00 +0.13%

CAC 40 4,432.57 -9.13 -0.21%

Asian stock closed mixed as Chinese weaker-than-expected data weighed on markets. China's industrial production rose 6.9% in August, after a 9.0% gain in July. Analysts had expected an increase of 8.8%.

Fixed-asset investment in China increased 16.5% in August, missing expectations for a 16.9% rise, after a 17.0% gain in July.

Retail sales in China climbed 11.9% in August, missing forecasts of a 12.1% rise, after a 12.2% increase in July.

Markets in Japan were closed for a public holiday.

Indexes on the close:

Nikkei 225 closed

Hang Seng 24,356.99 -238.33 -0.97%

Shanghai Composite 2,339.14 +7.19 +0.31%

EUR/USD: $1.2945(E120mn), $1.3000-05(E486mn), $1.3050(E484mn), $1.3075(E200mn)

GBP/USD: $1.6250(stg112mn), $1.6300(stg225mn), $1.6320(stg120mn)

EUR/GBP: stg0.7950(E225mn), stg0.7975(E510mn), stg7980(E112mn)

USD/CHF: Chf0.9385($300mn)

AUD/USD: $0.9000(A$621mn), $0.9030(A$219mn), $0.9160(A$349mn)

NZD/USD: $0.8375(NZ$303mn)

AUD/NZD: NZ$1.1250(A$813mn)

USD/CAD: C$1.1000($523mn), C$1.1070-80($336mn), C$1.1100($162mn)

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Japan Bank holiday

01:30 Australia New Motor Vehicle Sales (MoM) August -1.3% -1.8%

01:30 Australia New Motor Vehicle Sales (YoY) August -0.4% -3.5%

07:15 Switzerland Producer & Import Prices, m/m August 0.0% -0.2%

07:15 Switzerland Producer & Import Prices, y/y August -0.8% -1.2%

The U.S. dollar traded mixed to higher against the most major currencies on speculation the Fed will start to hike its interest rate sooner than expected. Market participants are awaiting the Fed's interest rate decision on Wednesday.

Market participants expect the Fed will cut its asset purchase program by another $10 billion.

The New Zealand dollar slightly lower against the U.S dollar in the absence of any major economic reports from New Zealand.

The weaker-than expected Chinese economic data weighed on the kiwi and the Australian dollar. China's industrial production rose 6.9% in August, after a 9.0% in July. Analysts had expected an increase of 8.8%.

Fixed-asset investment in China increased 16.5% in August, missing expectations for a 16.9% rise, after a 17.0% gain in July.

Retail sales in China climbed 11.9% in August, missing forecasts of a 12.1% rise, after a 12.2% increase in July.

China is a major trading partner of New Zealand and Australia.

The Australian dollar declined against the U.S. dollar due to the weak economic data from Australia. New motor vehicle sales in Australia fell by 1.8% in August, after a 1.3% decline in July.

On a yearly basis, new motor vehicle sales in Australia dropped by 3.5% in August, after a 0.4% fall in July.

The Japanese yen traded mixed against the U.S. dollar in the absence of any major economic reports from Japan. Markets in Japan were closed for a public holiday.

The yen dropped to the lowest level since September 2008 against the U.S. dollar last week as the Bank of Japan (BoJ) Governor Haruhiko Kuroda said to the Japan's Prime Minister Shinzo Abe on Thursday that the central bank is ready to expand monetary easing measures to reach 2 percent inflation target.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

09:00 Eurozone Trade Balance s.a. July 13.8

12:30 U.S. NY Fed Empire State manufacturing index September 14.7 15.0

13:15 U.S. Industrial Production (MoM) August +0.4% +0.3%

13:15 U.S. Capacity Utilization September 79.2% 79.3%

EUR / USD

Resistance levels (open interest**, contracts)

$1.3077 (4572)

$1.3030 (424)

$1.2998 (162)

Price at time of writing this review: $ 1.2956

Support levels (open interest**, contracts):

$1.2901 (4888)

$1.2881 (7041)

$1.2857 (3933)

Comments:

- Overall open interest on the CALL options with the expiration date October, 3 is 48696 contracts, with the maximum number of contracts with strike price $1,3000 (4572);

- Overall open interest on the PUT options with the expiration date October, 3 is 56882 contracts, with the maximum number of contracts with strike price $1,3000 (7041);

- The ratio of PUT/CALL was 1.17 versus 0.67 from the previous trading day according to data from September, 12

GBP/USD

Resistance levels (open interest**, contracts)

$1.6505 (1917)

$1.6409 (1254)

$1.6314 (1385)

Price at time of writing this review: $1.6236

Support levels (open interest**, contracts):

$1.6185 (1175)

$1.6089 (2785)

$1.5991 (1835)

Comments:

- Overall open interest on the CALL options with the expiration date October, 3 is 25859 contracts, with the maximum number of contracts with strike price $1,6500 (1917);

- Overall open interest on the PUT options with the expiration date October, 3 is 35596 contracts, with the maximum number of contracts with strike price $1,6300 (4509);

- The ratio of PUT/CALL was 1.38 versus 0.95 from the previous trading day according to data from September, 12

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.