- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 15-07-2014

Stock indices closed lower after Fed Chair Janet Yellen's testimony. She added that if the labour market continues to improve more quickly, the Fed will hike its interest rate sooner than expected, but weaker conditions will mean a longer period of low interest rate.

In the earlier trading session, stocks dropped due to the weaker-than-expected German ZEW economic sentiment index. The ZEW economic sentiment index for Germany declined to 27.1 in July from 29.8 in June, missing expectations for an increase to 33.4. That was the seventh straight decline in seven months.

The ZEW economic sentiment index for the Eurozone increased to 61.8 in July from 58.4 in June, missing expectations for a rise to 62.3.

Concerns over Portugal's bank Banco Espirito Santo SA also weighed on markets.

The Bank of England Governor Mark Carney said today that the timing of the first interest rate hike by the BoE would be "driven by the data".

Software AG shares slid 18.80% after lowering its full-year operating profit.

Banco Espirito Santo SA shares dropped 14.19% as its parent company faces a debt payment due today.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,710.45 -35.69 -0.53%

DAX 9,719.41 -63.60 -0.65%

CAC 40 4,305.31 -44.73 -1.03%

The U.S. dollar increased against the most major currencies after congressional testimony by Federal Reserve Chair Janet Yellen. The Fed Chair said the economy in the U.S. is continuing to improve but the recovery is not yet complete. She added that if the labour market continues to improve more quickly, the Fed will hike its interest rate sooner than expected, but weaker conditions will mean a longer period of low interest rate.

The U.S. Commerce Department released weaker-than-expected retail sales. The U.S. retail sales rose 0.2% in June, missing expectations for a 0.6% gain, after a 0.5% increase in May. May's figure was revised up from a 0.3% rise.

The retail sales in June was driven by weak sales at restaurants and auto dealers. Auto sales declined 0.3%.

Retail sales excluding automobiles in the U.S. increased 0.4% in June, missing expectations for a 0.5% rise, after a 0.4% gain in May. May's figure was revised up from a 0.1% increase.

The NY Fed Empire State manufacturing index climbed to 25.6 in July from 19.3 in June. Analysts had expected the index to decrease to 17.4.

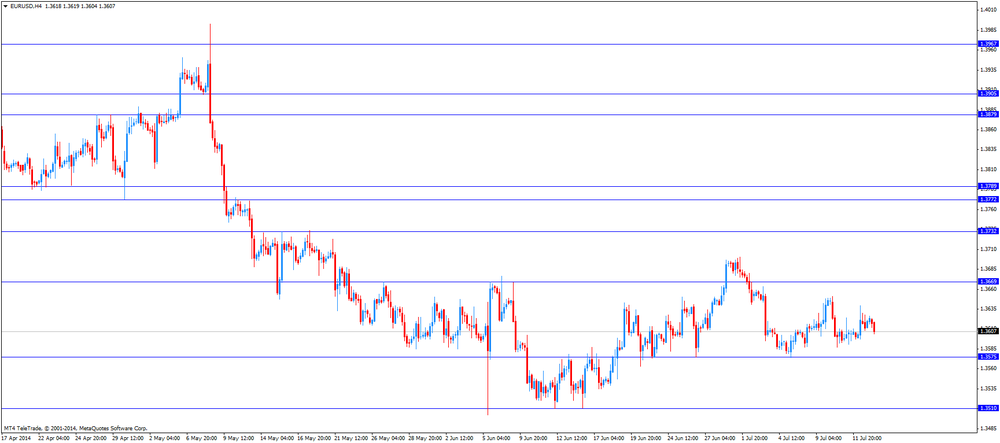

The euro declined against the U.S. dollar after congressional testimony by Federal Reserve Chair Janet Yellen. The ZEW economic sentiment index for Germany declined to 27.1 in July from 29.8 in June, missing expectations for an increase to 33.4. That was the seventh straight decline in seven months.

The ZEW economic sentiment index for the Eurozone increased to 61.8 in July from 58.4 in June, missing expectations for a rise to 62.3.

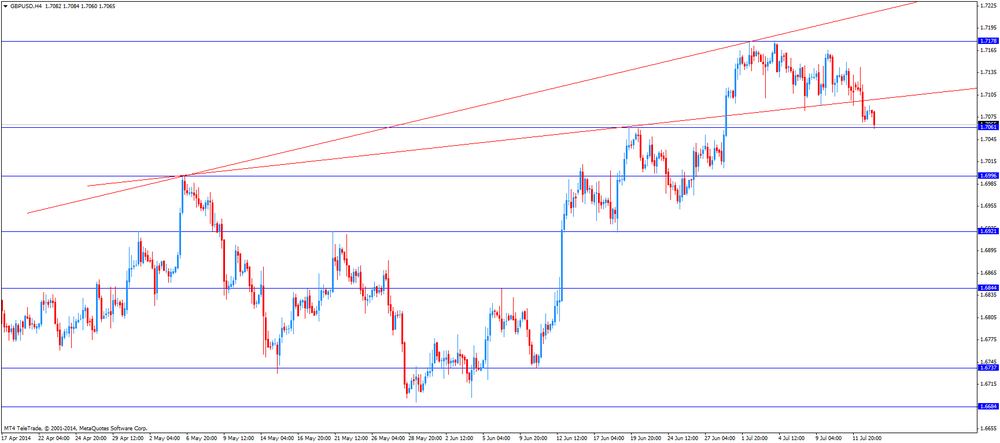

The British pound surged against the U.S. dollar after the inflation data from UK and testimony by the Bank of England Governor Mark Carney, but fell after congressional testimony by Federal Reserve Chair Janet Yellen. The consumer price index in the UK increased 0.2% in June, after a 0.1% decline in May.

On a yearly basis, UK consumer price index rose 1.9% in June, exceeding expectations for a 1.6% gain, after a 1.5% rise in May.

The house price inflation jumped to 10.5% in May from 9.9% in April.

The retail price index for the UK increased to 2.6% in June from 2.4% in May. Analysts had expected the index to remain unchanged at 2.4%.

The Bank of England Governor Mark Carney testified to parliament's Treasury committee. He said that the timing of the first interest rate hike by the BoE would be "driven by the data".

The Swiss franc traded lower against the U.S. dollar after congressional testimony by Federal Reserve Chair Janet Yellen. The producer & import prices in Switzerland were flat in June, missing forecasts of a 0.3% rise, after a 0.1% increase in May.

The New Zealand dollar traded lower against the U.S dollar after congressional testimony by Federal Reserve Chair Janet Yellen. No major economic reports were released in New Zealand.

The Australian dollar traded lower against the U.S. dollar after the Reserve Bank of Australia's minutes and congressional testimony by Federal Reserve Chair Janet Yellen. The RBA decided to keep unchanged its interest rate at 2.5%. The RBA said that low interest rate supports demand. Australia's central bank added that the Australian currency "remained high by historical standards".

Australia's new motor vehicle sales rose 1.7% in June, after a 0.4% growth in May. May's figure was revised up from a 0.3% rise.

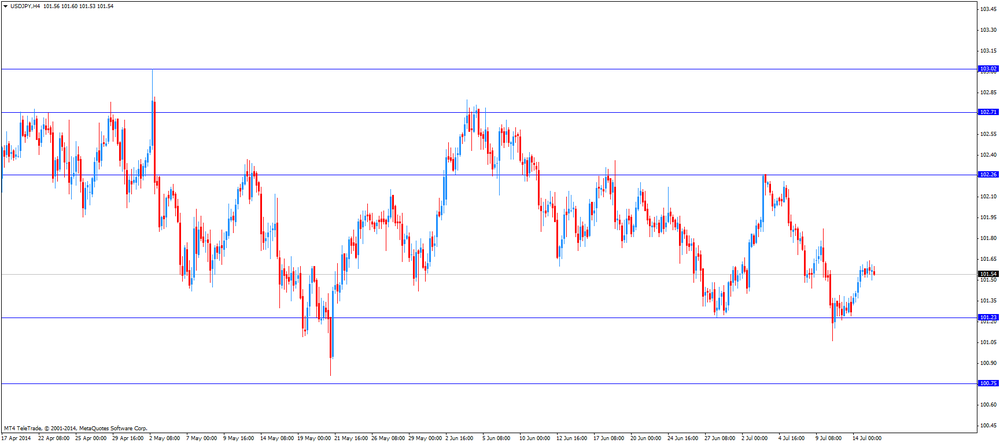

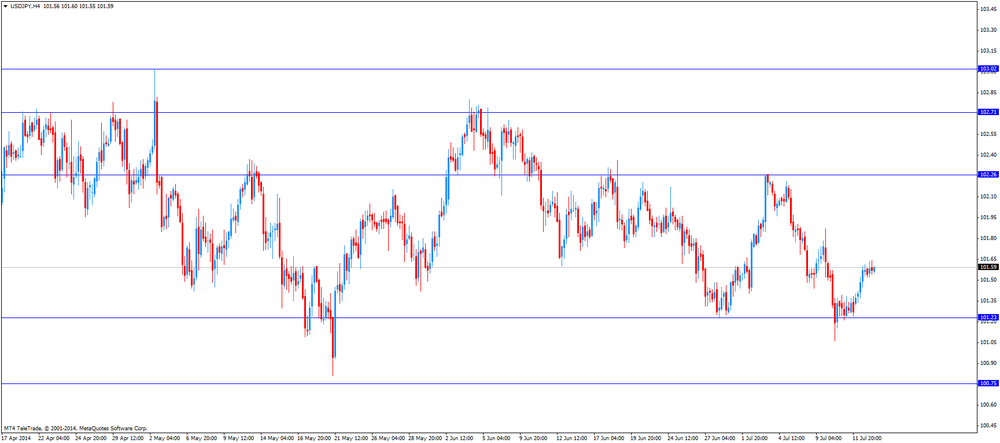

The Japanese yen traded slightly lower against the U.S. dollar after congressional testimony by Federal Reserve Chair Janet Yellen. The BoJ kept unchanged its interest rate. Japan's central bank will continue to expend the monetary base at an annual pace of about 60-70 trillion yen.

The BoJ lowered its growth forecast to 1.0% for the current financial year ending in March from the previous growth of a 1.1%.

Cost of oil futures dropped significantly, reaching at this three-month low, as weak demand and rising Libyan production offset concerns about rising tensions in the country.

Today, Acting Minister of Libya's oil, said that oil production in Libya has risen to 588,000 barrels per day, an increase of approximately 25 percent over the weekend, despite the resumption of fighting between the militias in the capital.

We add that the fighting in Iraq, the second largest producer of OPEC, has not yet spread to the south of the country where three-quarters of its concentrated production capacities.

According to some analysts, the supply of oil on the market enough, but it is likely that it would be excessive by the OPEC countries. World oil demand in 2015 will coincide with the growing supply from the U.S. and Canada. The main demand will be formed by the newly industrialized and developing countries.

"In the oil market now is a correction after the jump in prices in the wake of the Iraq crisis - said BNP Paribas analyst Harry Chilingiryan. - WTI is cheaper because, despite the very high workload refineries in the United States, their oil reserves are still high. "

Market participants expect a weekly report on the U.S. to measure the pace of oil demand from the largest consumer in the world. The American Petroleum Institute will release its report later today, while a government report to be presented Wednesday. Analysts predict that gasoline inventories increased by 900 thousand barrels last week - up to a maximum in March. Oil reserves are expected to have decreased by 2.5 million barrels - up to 380.1 million barrels, while distillate - increased by 2 million barrels.

Also had little impact on U.S. data that showed U.S. retail sales rose a seasonally adjusted 0.2% in June compared with the previous month, showing the weakest growth since January. This was stated by the Ministry of Commerce on Tuesday. Consumers stepped up spending on clothing, general merchandise and health foods, but cut spending on big ticket items such as furniture and cars. Excluding autos, sales rose 0.4%. Economists had forecast a 0.6% increase in total retail sales and an increase in sales excluding autos in June by 0.5%

Cost of the August futures on U.S. light crude oil WTI (Light Sweet Crude Oil) fell to $ 99.31 a barrel on the New York Mercantile Exchange (NYMEX).

August futures price for North Sea Brent crude oil mixture fell $ 2.06 to $ 104.74 a barrel on the London exchange ICE Futures Europe.

The Federal Reserve Chair Janet Yellen testified before the Senate Banking Committee today. She said:

- The economy in the U.S. is continuing to improve but the recovery is not yet complete;

- There's no formula when the Fed will begin to increase its interest rate;

- Interest hike will based on a variety of indicators;

- If the labour market continues to improve more quickly, the Fed will hike its interest rate sooner than expected, but weaker conditions will mean a longer period of low interest rate;

- The Fed will continue to boost economic activity;

- Inflation remained below the Fed's 2% target;

- Monetary policy remains appropriate.

Gold prices fell markedly, being at the same time near the lowest level in nearly four weeks, due to statements made by the Federal Reserve Janet Yellen before the U.S. Congress. During his speech, Yellen said that the Fed should continue implementation of accommodative monetary policy. "Although the economic situation continues to improve, the recovery is not yet complete," - she said. In particular, Yellen noted weakness of the U.S. labor market. She also once again emphasized that the economic forecasts involve substantial uncertainty, and the Fed's decision on interest rates will depend on the macroeconomic data. According to the head of the Fed, the U.S. Central Bank may raise interest rates sooner than the market expects. Much will depend on the pace of recovery. "If the situation on the labor market will improve faster than the Fed suggests that lead to more rapid progress toward our dual objectives, the target of increasing the rate on federal credit facilities may occur earlier and go faster than currently expected," - Yellen said.

Meanwhile, traders note that increasing the risk of further decline, especially given the price fall below $ 1,305. Concerned that even after the price reduction at $ 30 physical demand has not grown substantially, it can also increase the pressure on prices. We add that the quotes in the Chinese market, the world's largest consumer of gold, below the world price, which is a sign of weak demand in the physical market.

The attention of investors is also drawn to the unstable situation in the Middle East and Ukraine. Problems leading financial institutions in Portugal have temporary support of precious metals, which acts traditional safe haven.

Little impact on today's trading also had U.S. data that showed retail sales rose a seasonally adjusted 0.2% in June compared with the previous month, showing the weakest growth since January. This was stated by the Ministry of Commerce on Tuesday. Consumers stepped up spending on clothing, general merchandise and health foods, but cut spending on big ticket items such as furniture and cars. Excluding autos, sales rose 0.4%. Economists had forecast a 0.6% increase in total retail sales and an increase in sales excluding autos 0.5%.

Meanwhile, it was reported that the world's largest reserves secured gold exchange-traded fund SPDR Gold Trust on Monday rose by 8.68 tonnes to 808.73 tonnes.

The cost of the August gold futures on the COMEX today dropped to $ 1294.00 per ounce.

The Bank of England Governor Mark Carney testified to parliament's Treasury committee today:

- The timing of the first interest rate hike by the BoE would be "driven by the data";

- Carney is concerned that "asset price volatility has gone down";

- The UK housing market is a biggest risk to the durability of the economic recovery.

The U.S. Commerce Department released retail sales. The U.S. retail sales rose 0.2% in June, missing expectations for a 0.6% gain, after a 0.5% increase in May. May's figure was revised up from a 0.3% rise. But despite the weak rise, that was the fifth straight increase since January 2014.

The retail sales in June was driven by weak sales at restaurants and auto dealers. Auto sales declined 0.3%.

Retail sales excluding automobiles in the U.S. increased 0.4% in June, missing expectations for a 0.5% rise, after a 0.4% gain in May. May's figure was revised up from a 0.1% increase.

EUR/USD $1.3550, $1.3600, $1.3675

USD/JPY Y101.65/70, Y102.00

AUD/USD $0.9365, $0.9375, $0.9400

USD/CAD C$1.0675, C$1.0750

NZD/USD NZ$0.8725

EUR/GBP stg0.7900, stg0.7950

The Bank of Japan (BoJ) released its interest rate decision today. The Bank of Japan kept unchanged its interest rate. Japan's central bank will continue to expend the monetary base at an annual pace of about 60-70 trillion yen.

The BoJ's maintained its inflation projections. According to the BoJ's board, Japan's economy the economy would continue recovering moderately.

The BoJ lowered its growth forecast to 1.0% for the current financial year ending in March 2015 from the previous growth of a 1.1%.

The BoJ Governor Haruhiko Kuroda said that Japan's economy was only halfway to reaching the 2% inflation target. He added the central bank would maintain its stimulus measures until the 2% target was met.

Mr. Kuroda also said that he doesn't think consumer inflation will fall below 1%.

(company / ticker / price / change, % / volume)

| McDonald's Corp | MCD | 100.50 | +0.03% | 0.9K |

| Nike | NKE | 78.00 | +0.06% | 1.1K |

| General Electric Co | GE | 26.68 | +0.08% | 11.4K |

| Walt Disney Co | DIS | 86.84 | +0.09% | 0.7K |

| Verizon Communications Inc | VZ | 50.61 | +0.16% | 3.1K |

| Home Depot Inc | HD | 79.60 | +0.18% | 0.2K |

| Cisco Systems Inc | CSCO | 25.51 | +0.28% | 0.1K |

| Johnson & Johnson | JNJ | 105.68 | +0.28% | 32.1K |

| Visa | V | 221.80 | +0.35% | 1.1K |

| Intel Corp | INTC | 31.61 | +0.38% | 31.4K |

| Microsoft Corp | MSFT | 42.37 | +0.55% | 4.5K |

| Boeing Co | BA | 130.24 | +0.56% | 1.6K |

| Goldman Sachs | GS | 170.03 | +1.81% | 69.4K |

| JPMorgan Chase and Co | JPM | 57.73 | +2.56% | 1.2M |

| AT&T Inc | T | 35.86 | 0.00% | 0.4K |

| Exxon Mobil Corp | XOM | 102.68 | 0.00% | 0.2K |

| International Business Machines Co... | IBM | 189.86 | 0.00% | 0.2K |

| The Coca-Cola Co | KO | 42.35 | -0.07% | 1.1K |

| Pfizer Inc | PFE | 30.21 | -0.10% | 5.7K |

| Chevron Corp | CVX | 129.02 | -0.19% | 0.2K |

Upgrades:

Twitter (TWTR) upgraded to Neutral from Underperform at Macquarie

Downgrades:

Other:

Apple (AAPL) target raised to $115 from $104 at Susquehanna

Citigroup (C) target raised to $68 from $67 at Oppenheimer

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia RBA Meeting's Minutes

01:30 Australia New Motor Vehicle Sales (MoM) June +0.3% +1.7%

01:30 Australia New Motor Vehicle Sales (YoY) June -2.0% -2.2%

03:00 Japan BoJ Interest Rate Decision 0.10% 0.10% 0.10%

03:00 Japan Bank of Japan Monetary Base Target 270 270 270

03:00 Japan BoJ Monetary Policy Statement

07:15 Switzerland Producer & Import Prices, m/m June +0.1% +0.3% 0.0%

07:15 Switzerland Producer & Import Prices, y/y June -0.8% -0.8%

07:30 Japan BOJ Press Conference

08:30 United Kingdom Retail Price Index, m/m June +0.1% +0.2%

08:30 United Kingdom Retail prices, Y/Y June +2.4% +2.4% +2.6%

08:30 United Kingdom RPI-X, Y/Y June +2.5%

08:30 United Kingdom Producer Price Index - Input (MoM) June -0.9% +0.3% -0.8%

08:30 United Kingdom Producer Price Index - Input (YoY) June -5.0% -4.4%

08:30 United Kingdom Producer Price Index - Output (MoM) June -0.1% +0.1% -0.2%

08:30 United Kingdom Producer Price Index - Output (YoY) June +0.5% +0.2%

08:30 United Kingdom HICP, m/m June -0.1% +0.2%

08:30 United Kingdom HICP, Y/Y June +1.5% +1.6% +1.9%

08:30 United Kingdom HICP ex EFAT, Y/Y June +1.6% +1.7% +2.0%

09:00 Eurozone ZEW Economic Sentiment July 58.6 62.3 61.8

09:00 United Kingdom BOE Gov Mark Carney Speaks

09:00 Germany ZEW Survey - Economic Sentiment July 29.8 33.4 27.1

The U.S. dollar traded mixed against the most major currencies ahead of congressional testimony by Federal Reserve Chair Janet Yellen today. Markets participants are awaiting new information on when the Fed could start to increase its interest rate.

The euro dropped against the U.S. dollar after the weaker-than-expected German ZEW economic sentiment index, but later recovered its losses. The ZEW economic sentiment index for Germany declined to 27.1 in July from 29.8 in June, missing expectations for an increase to 33.4. That was the seventh straight decline in seven months.

The ZEW economic sentiment index for the Eurozone increased to 61.8 in July from 58.4 in June, missing expectations for a rise to 62.3.

The British pound surged against the U.S. dollar after the inflation data from UK and testimony by the Bank of England Governor Mark Carney. The consumer price index in the UK increased 0.2% in June, after a 0.1% decline in May.

On a yearly basis, UK consumer price index rose 1.9% in June, exceeding expectations for a 1.6% gain, after a 1.5% rise in May.

The house price inflation jumped to 10.5% in May from 9.9% in April.

The retail price index for the UK increased to 2.6% in June from 2.4% in May. Analysts had expected the index to remain unchanged at 2.4%.

The Bank of England Governor Mark Carney testified to parliament's Treasury committee. He said that the timing of the first interest rate hike by the BoE would be "driven by the data".

The Swiss franc traded mixed against the U.S. dollar. The producer & import prices in Switzerland were flat in June, missing forecasts of a 0.3% rise, after a 0.1% increase in May.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair i

USD/JPY: the currency pair

The most important news that are expected (GMT0):

12:30 U.S. Retail sales June +0.3% +0.6%

12:30 U.S. Retail sales excluding auto June +0.1% +0.5%

12:30 U.S. NY Fed Empire State manufacturing index July 19.3 17.4

12:30 U.S. Import Price Index June +0.1% +0.5%

14:00 U.S. Business inventories May +0.6% +0.6%

14:00 U.S. Federal Reserve Chair Janet Yellen Testifies

22:45 New Zealand CPI, q/q Quarter II +0.3% +0.5%

22:45 New Zealand CPI, y/y Quarter II +1.5%

Stock indices slid after the weaker-than-expected German ZEW economic sentiment index. The ZEW economic sentiment index for Germany declined to 27.1 in July from 29.8 in June, missing expectations for an increase to 33.4. That was the seventh straight decline in seven months.

The ZEW economic sentiment index for the Eurozone increased to 61.8 in July from 58.4 in June, missing expectations for a rise to 62.3.

Concerns over Portugal's bank Banco Espirito Santo SA also weighed on markets.

Software AG shares slid 18% after lowering its full-year operating profit.

Banco Espirito Santo SA shares dropped 15% as its parent company faces a debt payment due today.

Current figures:

Name Price Change Change %

FTSE 100 6,728.39 -17.75 -0.26%

DAX 9,727.92 -55.09 -0.56%

CAC 40 4,322.12 -27.92 -0.64%

Most Asian stock indices rose ahead of congressional testimony by Federal Reserve Chair Janet Yellen today. Markets participants are awaiting new information on when the Fed could start to increase its interest rate.

The Bank of Japan (BoJ) kept unchanged its interest rate. Japan's central bank will continue to expend the monetary base at an annual pace of about 60-70 trillion yen.

The BoJ lowered its growth forecast to 1.0% for the current financial year ending in March from the previous growth of a 1.1%.

Indexes on the close:

Nikkei 225 15,395.16 +98.34 +0.64%

Hang Seng 23,459.96 +113.29 +0.49%

Shanghai Composite 2,070.36 +3.71 +0.18%

EUR/USD $1.3550, $1.3600, $1.3675

USD/JPY Y101.65/70, Y102.00

AUD/USD $0.9365, $0.9375, $0.9400

USD/CAD C$1.0675, C$1.0750

NZD/USD NZ$0.8725

EUR/GBP stg0.7900, stg0.7950

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia RBA Meeting's Minutes

01:30 Australia New Motor Vehicle Sales (MoM) June +0.3% +1.7%

01:30 Australia New Motor Vehicle Sales (YoY) June -2.0% -2.2%

03:00 Japan BoJ Interest Rate Decision 0.10% 0.10% 0.10%

03:00 Japan Bank of Japan Monetary Base Target 270 270 270

03:00 Japan BoJ Monetary Policy Statement

07:15 Switzerland Producer & Import Prices, m/m June +0.1% +0.3% 0.0%

07:15 Switzerland Producer & Import Prices, y/y June -0.8% -0.8%

07:30 Japan BOJ Press Conference

08:30 United Kingdom Retail Price Index, m/m June +0.1% +0.2%

08:30 United Kingdom Retail prices, Y/Y June +2.4% +2.4% +2.6%

08:30 United Kingdom RPI-X, Y/Y June +2.5%

08:30 United Kingdom Producer Price Index - Input (MoM) June -0.9% +0.3% -0.8%

08:30 United Kingdom Producer Price Index - Input (YoY) June -5.0% -4.4%

08:30 United Kingdom Producer Price Index - Output (MoM) June -0.1% +0.1% -0.2%

08:30 United Kingdom Producer Price Index - Output (YoY) June +0.5% +0.2%

08:30 United Kingdom HICP, m/m June -0.1% +0.2%

08:30 United Kingdom HICP, Y/Y June +1.5% +1.6% +1.9%

08:30 United Kingdom HICP ex EFAT, Y/Y June +1.6% +1.7% +2.0%

09:00 Eurozone ZEW Economic Sentiment July 58.6 62.3 61.8

09:00 United Kingdom BOE Gov Mark Carney Speaks

09:00 Germany ZEW Survey - Economic Sentiment July 29.8 33.4 27.1

The U.S. dollar traded mixed against the most major currencies ahead of congressional testimony by Federal Reserve Chair Janet Yellen on Tuesday and Wednesday. Markets participants are awaiting new information on when the Fed could start to increase its interest rate.

The New Zealand dollar traded slightly lower against the U.S dollar in the absence of any major economic reports in New Zealand.

The Australian dollar traded slightly lower against the U.S. dollar after the Reserve Bank of Australia's minutes. The RBA decided to keep unchanged its interest rate at 2.5%. The RBA said that low interest rate supports demand. Australia's central bank added that the Australian currency "remained high by historical standards".

Australia's new motor vehicle sales rose 1.7% in June, after a 0.4% growth in May. May's figure was revised up from a 0.3% rise.

The Japanese yen traded mixed against the U.S. dollar after the Bank of Japan's interest rate decision. The BoJ kept unchanged its interest rate. Japan's central bank will continue to expend the monetary base at an annual pace of about 60-70 trillion yen.

The BoJ lowered its growth forecast to 1.0% for the current financial year ending in March from the previous growth of a 1.1%.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 U.S. Retail sales June +0.3% +0.6%

12:30 U.S. Retail sales excluding auto June +0.1% +0.5%

12:30 U.S. NY Fed Empire State manufacturing index July 19.3 17.4

12:30 U.S. Import Price Index June +0.1% +0.5%

14:00 U.S. Business inventories May +0.6% +0.6%

14:00 U.S. Federal Reserve Chair Janet Yellen Testifies

22:45 New Zealand CPI, q/q Quarter II +0.3% +0.5%

22:45 New Zealand CPI, y/y Quarter II +1.5%

EUR / USD

Resistance levels (open interest**, contracts)

$1.3700 (3104)

$1.3675 (2804)

$1.3645 (296)

Price at time of writing this review: $ 1.3617

Support levels (open interest**, contracts):

$1.3591 (360)

$1.3572 (1924)

$1.3547 (3486)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 24354 contracts, with the maximum number of contracts with strike price $1,3800 (3703);

- Overall open interest on the PUT options with the expiration date August, 8 is 32782 contracts, with the maximum number of contracts with strike price $1,3500 (7751);

- The ratio of PUT/CALL was 1.35 versus 1.36 from the previous trading day according to data from July, 14

GBP/USD

Resistance levels (open interest**, contracts)

$1.7302 (1447)

$1.7204 (1430)

$1.7107 (1957)

Price at time of writing this review: $1.7083

Support levels (open interest**, contracts):

$1.6994 (2227)

$1.6897 (1974)

$1.6798 (1188)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 15860 contracts, with the maximum number of contracts with strike price $1,7250 (2106);

- Overall open interest on the PUT options with the expiration date August, 8 is 21107 contracts, with the maximum number of contracts with strike price $1,7000 (2227);

- The ratio of PUT/CALL was 1.33 versus 1.27 from the previous trading day according to data from Jule, 14

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

(raw materials / closing price /% change)

Light Crude 101.01 +0.10%

Gold 1,308.10 +0.11%

(index / closing price / change items /% change)

Nikkei 225 15,296.82 +132.78 +0.88%

Hang Seng 23,346.67 +113.22 +0.49%

Shanghai Composite 2,066.65 +19.69 +0.96%

FTSE 100 6,746.14 +55.97 +0.84%

CAC 40 4,350.04 +33.54 +0.78%

Xetra DAX 9,783.01 +116.67 +1.21%

S&P 500 1,977.1 +9.53 +0.48%

NASDAQ 4,440.42 +24.93 +0.56%

Dow Jones 17,055.42 +111.61 +0.66%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3620 +0,10%

GBP/USD $1,7087 -0,13%

USD/CHF Chf0,8918 -0,02%

USD/JPY Y101,54 +0,27%

EUR/JPY Y138,29 +0,38%

GBP/JPY Y173,45 +0,15%

AUD/USD $0,9391 +0,01%

NZD/USD $0,8803 -0,10%

USD/CAD C$1,0710 -0,21%

(time / country / index / period / previous value / forecast)

02:01 United Kingdom BRC Retail Sales Monitor y/y June +0.5%

04:30 Australia RBA Meeting's Minutes

04:30 Australia New Motor Vehicle Sales (MoM) June +0.3%

04:30 Australia New Motor Vehicle Sales (YoY) June -2.0%

06:00 Japan BoJ Interest Rate Decision 0.10% 0.10%

06:00 Japan Bank of Japan Monetary Base Target 270 270

06:00 Japan BoJ Monetary Policy Statement

10:15 Switzerland Producer & Import Prices, m/m June +0.1% +0.3%

10:15 Switzerland Producer & Import Prices, y/y June -0.8%

10:30 Japan BOJ Press Conference

11:30 United Kingdom Retail Price Index, m/m June +0.1%

11:30 United Kingdom Retail prices, Y/Y June +2.4% +2.4%

11:30 United Kingdom RPI-X, Y/Y June +2.5%

11:30 United Kingdom Producer Price Index - Input (MoM) June -0.9% +0.3%

11:30 United Kingdom Producer Price Index - Input (YoY) June -5.0%

11:30 United Kingdom Producer Price Index - Output (MoM) June -0.1% +0.1%

11:30 United Kingdom Producer Price Index - Output (YoY) June +0.5%

11:30 United Kingdom HICP, m/m June -0.1%

11:30 United Kingdom HICP, Y/Y June +1.5% +1.6%

11:30 United Kingdom HICP ex EFAT, Y/Y June +1.6% +1.7%

12:00 Eurozone ZEW Economic Sentiment July 58.6 62.3

12:00 United Kingdom BOE Gov Mark Carney Speaks

12:00 Germany ZEW Survey - Economic Sentiment July 29.8 33.4

15:30 U.S. Retail sales June +0.3% +0.6%

15:30 U.S. Retail sales excluding auto June +0.1% +0.5%

15:30 U.S. NY Fed Empire State manufacturing index July 19.3 17.4

15:30 U.S. Import Price Index June +0.1% +0.5%

17:00 U.S. Business inventories May +0.6% +0.6%

17:00 U.S. Federal Reserve Chair Janet Yellen Testifies

23:30 U.S. API Crude Oil Inventories July -1.7

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.