- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 15-03-2022

US inflation expectations, as per the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, remain on the back foot for the second consecutive day by the end of Tuesday’s North American trading session.

In doing so, the inflation gauge dropped to 2.84% after refreshing the all-time high with a 2.94% figure on Friday.

Despite the latest pullback, the inflation expectations do suggest an upside risk and can push the US Federal Reserve (Fed) to rethink over 0.50% rate hike in today’s Federal Open Market Committee (FOMC).

Read: Fed Interest Rate Decision Preview: Is history a guide?

In addition to the Fed’s verdict, the peace talks between Russia and Ukraine in Turkey and China’s covid woes are also the key risk catalysts to watch for today.

- AUD/USD bears are lurking below the counter trendline.

- The M-formation on the daily chart is compelling as the price stalls around 0.7200.

AUD/USD is stalling with a bullish closing candle on Tuesday that could mark a meanwhile pause to the bearish breakout below the trendline support.

AUD/USD daily chart

The M-formation is a reversion pattern and the price would be expected to revert back to the neckline near 0.7250. If this level were to hold as resistance, then a downside continuation could come as a result:

As illustrated, the neckline area has a confluence with the 38.2% Fibonacci and 50% ratio that adds additional resistance.

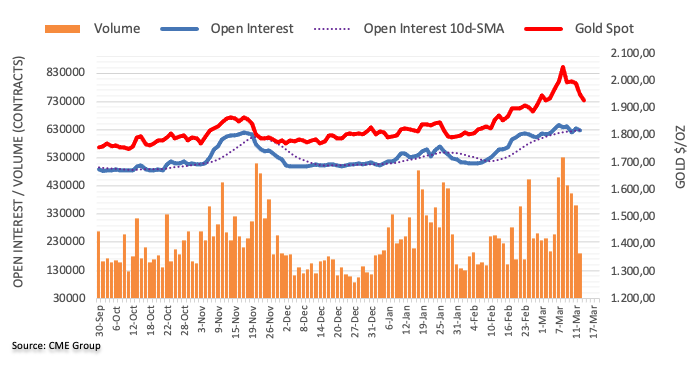

- Gold remains on the back foot around fortnight low, after three-day downtrend.

- Market sentiment dwindles amid pre-Fed anxiety, mixed clues over Ukraine-Russia and coronavirus resurgence in China.

- Treasury yields seesaw around mid-2019 peak, S&P 500 Futures differs from upbeat Wall Street close during sluggish Asian session.

- Fed March Preview: Gold needs a dovish Fed to regain traction

Gold (XAU/USD) portrays the fourth consecutive daily loss near $1,917 while poking the monthly low, despite being inactive during Wednesday’s Asian session. The yellow metal’s losses could be linked to the firmer US Treasury yields and the market’s anxiety ahead of the top-tier events.

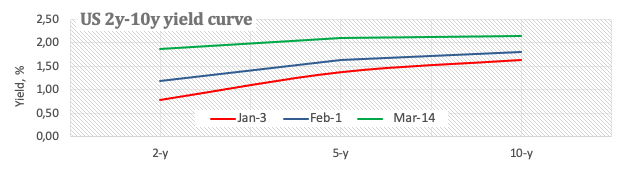

That said, the US 10-year Treasury yields ended Tuesday unchanged despite rising to mid-2019 levels during the initial day, down one basis point (bp) to 2.149% at the latest. On the same line, the five-year bond coupon also eases from the highest levels since May 2019 marked the previous day. Further, S&P 500 Futures print mild losses despite the positive performance of Wall Street.

Talking about the key catalysts, Russia-Ukraine tussles continue but a halt in further deterioration seems to cut the fears of late. global markets initially cheered hopes of the Ukraine-Russia peace, as signaled by Ukraine President Volodymyr Zelenskyy’s adviser, before Russian President Vladimir Putin said Kyiv is not serious about finding a mutually acceptable solution. Following that, Mykhailo Podoliyak, one of the representatives of Ukraine at Russian-Ukrainian negotiations cites room for compromise. It’s worth noting that the UK added more sanctions on Russia whereas Japan is up for removing Moscow from favored trade status. In return, Moscow banned Canadian PM from entering their country and levied sanctions on US President Joe Biden.

Further, China turned out as a fresh risk for the markets with a surge in the local covid numbers and lockdowns in multiple cities, the latest one being near to the capital Beijing.

It’s worth noting that the US Producer Price Index (PPI) matched YoY expectations of 10% growth whereas NY Empire State Manufacturing Index printed the biggest downside since May 2020, adding to the market’s pre-Fed anxiety. Also testing Fed hawks is the recently easing US inflation expectations from the record top, as signaled by the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data.

Moving on, gold traders will pay close attention to how the Fed battles inflation fears, which in turn will pave way for the short-term trend. Also important will be China’s covid headlines and Russia-Ukraine news as the risk-off mood may cushion the metal against the hard-hitting if the Fed manages to praise the USD bulls.

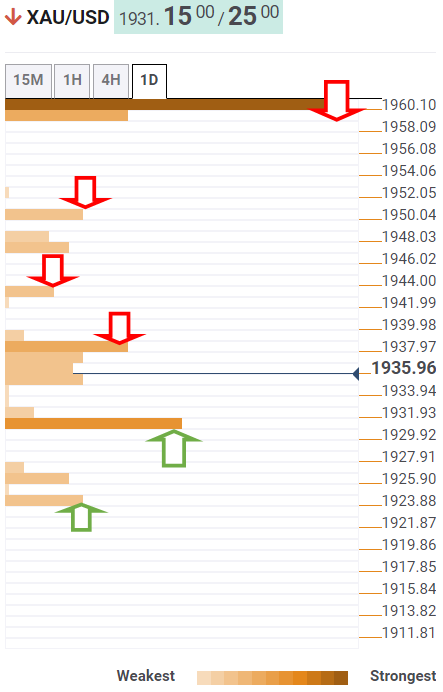

Technical analysis

Gold justifies a clear downside break of a six-week-old rising trend line and the 100-SMA, amid bearish MACD signals, around a two-week low.

Although oversold RSI conditions on the four-hour chart test the gold bears, 50% Fibonacci retracement (Fibo.) of January-March upside and the weekly resistance line challenge any corrective pullback around $1,925 and $1,942 respectively.

Even if the quote manages to rise past-1,942, the 100-SMA and the previous support line, close to $1,948 and $1,954 in that order, will act as additional upside filters before giving control to gold bulls targeting the $2,000 threshold.

Meanwhile, a convergence of the 200-SMA and 61.8% Fibo. near $1,890 is on the XAU/USD seller’s radar ahead of the monthly horizontal support near $1,877.

Gold: Four-hour chart

Trend: Bearish

It’s worth noting that the daily chart also highlights $1,877 as the key support, comprising tops marked during November 2021.

Gold: Daily chart

Trend: Further weakness expected

- USD/CHF is oscillating around 0.9400 ahead of the Fed’s policy meet.

- Investors are more focused on the extent of the interest rate hike by the Fed.

- The DXY is steady around 99.00 but may grind higher towards 100.00 amid a broader risk-aversion theme.

The USD/CHF pair is grinding higher amid a broader risk-aversion in the market. The major has witnessed a four-day winning streak and may continue the momentum if it manages to surpass Tuesday’s high at 0.9432.

The rising uncertainty over the interest rate decision from the Federal Reserve (Fed) is strengthening the greenback against the Swiss franc. The odds of a rate hike are at skyscrapers; however, investors are more focusing on the extent of the rate hike. Investors are in a dilemma whether the Fed will choose a 25 basis point (bps) and a ‘wait and watch approach for the monetary policies later this year or a 50 bps rate hike to tame the soaring inflation now.

If we consider the recent cues from Fed Chair Jerome Powell, a 25 bps rate hike is more likely as per his recent testimony. While recent print of the US Consumer Price Index (CPI) at 7.9% is dictating an aggressive hawkish story.

Meanwhile, the US dollar index (DXY) is gearing up for a fresh impulsive wave towards the psychological figure of 100.00 amid improving appeal for the safe-haven assets. The 10-year US Treasury yields have reclaimed 2.15% ahead of a likely tightening monetary policy on Wednesday.

Apart from the Fed Operation Market Committee (FOMC) meet, investors will also look for US Retail Sales, which are due on Wednesday. A preliminary estimate for the US Retail Sales is 0.4%, significantly lower than the prior print of 3.8%.

- The NZD/JPY would remain subject to market sentiment until Friday when the Bank of Japan would unveil its monetary policy,

- The cross-currency would trade in a narrow range ahead of the US Federal Reserve.

- NZD/JPY Price Forecast: Still upward biased but facing solid resistance around the 80.00 mark.

On Tuesday, the NZD/JPY finished the day with gains of 0.46% but fell short of reaching a new YTD high, retreating from 80.21 to 80.07, on a sudden shift in market sentiment. At the time of writing, the NZD/JPY is trading at 80.04.

NZD/JPY Price Forecast: Technical outlook

The NZD/JPY entered a consolidation phase, around the 79.50-80.00 area, ahead of the US Federal Reserve monetary policy meeting, as market players get ready. Most G8 currencies would remain in tight ranges unless a geopolitical event ignites violent shifts ahead of one of the most critical events in the calendar.

Noteworthy, the slope of the daily moving averages (DMAs), almost horizontal but below the spot price, suggesting the cross-currency pair might print another leg-up. However, the 200-DMA at 77.88 is trapped between the 100-DMA at 78.12 and the 50-DMA at 77.51.

If the NZD/JPY aims to go higher, the first resistance would be March 14, 80.26 high. Breach of the latter would expose the 81.00 mark, followed by a challenge of November 1, 2021, daily high at 82.21.

On the flip side, the NZD/JPY first support would be 79.57, March 7 daily high previous resistance-turned-support. Once cleared, the next support would be the 79.00 mark, followed by 78.83, January 13 resistance/support.

Early Wednesday morning in Asia, Reuters Tankan poll showed that Japanese manufacturers' business confidence improved for the first time in three months in March, to +8 versus +6 in February, as automakers became less pessimistic, though firms feared a fresh surge in energy prices due to the Ukraine crisis.

“The service-sector index extended a decline for the second month to a five-month low of minus 1, compared with the previous month's 3,” adds Reuters.

Additional details

Service-sector sentiment turned negative for the first time since October due to COVID-19 curbs and as global inflation squeezed corporate profits, according to the poll, which tracks the Bank of Japan's (BOJ) closely watched "Tankan" quarterly survey.

While the mood among manufacturers remained positive for the 14th straight month, managers voiced concerns about a wide array of downside risks that cloud the outlook for the world's third-largest economy, days before the BOJ's next policy meeting.

Elsewhere, Yomiuri came out with the news that Japan’s Prime Minister (PM) Fumio Kishida is expected to order the compilation of additional stimulus.

On a different page, “The most-favored nation designation of Russia will be revoked by Japan,” said NHK.

USD/JPY remains sidelined at five-year high

Given the pre-Fed anxiety and mixed concerns over Ukraine-Russia, USD/JPY stays mostly steady around the five-year high of 118.44.

Read: USD/JPY Price Analysis: Bears looking for a long squeeze to test 118.00/10 area

- The antipodean is underpinned against the Japanese yen after a pullback near 84.80.

- AUD/JPY has surpassed the 50-period EMA at 85.10, which adds to the upside filters.

- For more validation, the RSI (14) needs to violate 60.00 on the upside.

The AUD/JPY pair has witnessed some significant bids near 85.00 amid an expansion in the risk appetite of investors. The risk barometer ended Tuesday’s session on a positive note and is carry-forwarding Tuesday’s optimism on Wednesday.

On an hourly scale, AUD/JPY is trading in a rising channel in which every pullback towards the lower end is considered as a buying opportunity by the market participants. The upper end of the rising channel is placed from February 23 high at 83.84, while the lower end is marked from February 24 low at 82.01. The cross has found a pullback after a confluence of 200-period Exponential Moving Average (EMA) and lower end of the rising channel near 84.80.

The cross has breached a minor trendline placed from March 13 high at 85.82. The pair has also breached the 50-period EMA at 85.10 on the upside, which adds to the upside filters.

The Relative Strength Index (RSI) (14) is oscillating in a range of 40.00-60.00, which indicates a consolidation phase. For a bullish setup, the RSI (14) needs to violate 60.00. Should this occur, Aussie bulls will get validation from the RSI (14).

For more upside, the risk barometer needs to surpass Tuesday’s high at 85.37. The violation of Tuesday’s high will drive the cross towards March 11 high at 85.89, which will be followed by 21 October 2021 high at 86.25.

On the flip side, bears can dictate levels if the pair slip below Tuesday’s average traded price at 84.92 decisively, which will send the cross to March 15 low at 84.60. Breach of the latter will drag the cross towards March 9 low at 84.16.

AUD/JPY hourly chart

-637829819123137479.png)

- USD/CAD holds lower ground after reversing from three-week-old horizontal resistance.

- Downbeat MACD signals, RSI conditions also favor sellers.

- 200-SMA, fortnight-old ascending trend line restricts short-term declines.

USD/CAD licks its wounds around 1.2770 during early Wednesday’s Asian session, following the heaviest daily fall in a week.

The Loonie pair rose to the highest levels since the last Wednesday before reversing from a fortnight-long horizontal hurdle.

The pullback also gains support from descending RSI line, not oversold, as well as an impending bear cross, of the MACD line over the signal line.

With this, USD/CAD bears are on the way to testing the 1.2730 support confluence, including the 200-SMA and an ascending trend line from March 03.

However, any further downside will be challenged by a horizontal area comprising multiple levels marked since February 23, between 1.2680 and 1.2685.

Alternatively, recovery moves not only need to cross the aforementioned resistance-zone surrounding 1.2872-77 but also need to refresh the monthly low, currently around 1.2900, to convince USD/CAD bulls.

Following that, the year 2021 top near 1.2965 and the 1.3000 threshold will be in focus.

USD/CAD: Four-hour chart

Trend: Further weakness expected

“President Biden is expected to announce more than $1 billion in new military assistance to the Ukraine government as early as Wednesday, according to US officials,” said the Wall Street Journal (WSJ) early Wednesday morning in Asia.

The news sites, “Ukrainian President Volodymyr Zelensky is expected to make a plea to Congress for more aid to defend his country,” as a reason.

Key quotes

The money would come from the roughly $13.6 billion allotted for Ukraine in the omnibus budget bill Mr. Biden signed Tuesday.

While the White House is considering sending more troops to Europe to add to the roughly 15,000 deployed there since the Russia-Ukraine crisis began, Mr. Biden isn’t expected to deploy more troops now, U.S. officials said.

FX implications

The news adds to the already strained relations between the US and Russia and weighs on the market sentiment, which in turn pushes S&P 500 Futures to print mild losses despite Wall Street’s upbeat closing. That said, the US stock futures drop 0.15% intraday at the latest.

Read: Forex Today: Dollar up ahead of Fed and as fear rules

- The common currency gained 0.14% on Tuesday as the Asian session began.

- A mixed market mood increased the appetite for the safe-haven US dollar.

- EUR/USD Price Forecast: Failure to reclaim 1.1000 left the euro vulnerable to further losses.

The shared currency extended its weekly advance for two consecutive days but retraced from around 1.1000 as the Federal Reserve is set to embark on the beginning of its hiking cycle for the first time since 2018. The EUR/USD is trading at 1.0961 at the time of writing.

The EUR significantly influenced by Russia-Ukraine tussles

On Tuesday, the common currency began around the day’s lows at 1.0930, jumped near the 1.1020 area but broke downwards under the 1.1000 mark on a market sentiment shift. Elsewhere, Russia-Ukraine discussions, which had been reported as “positive” in the last couple of days, were downtoned by Russian President Vladimir Putin, saying that Kyiv is not serious about finding a mutually acceptable solution. The headline spurred a risk-off gust of wind, with the EUR/USD moving from 1.0976 to 1.0925.

Data-wise, on Tuesday, the Eurozone docket reported the German ZEW economic sentiment, which plunged from 54.3 to -39.3, showing that financial analysts expect Germany to hit a recession. The Eurozone ZEW Economic Sentiment also tumbled, falling from 48.6 to -38.7.

On the US front, prices paid to US producers (PPI) increased 10% y/y in February, adding to heightened inflationary pressures on the US economy, last seen in the 1980s. Along with the US consumer inflation expanding at an annual rate of 7.9% in February, that data makes a case for the Fed’s first rate hike to the Federal Funds Rate (FFR) in three years.

EUR/USD Price Forecast: Technical outlook

EUR/USD tested in the last two days, the 1.1000 mark, failing to record a daily close above it, exposing the shared currency to further losses beyond the YTD low at 1.0806. That said, the EUR/USD first support would be the 1.0900 mark. Once cleared, the next support would be the March 7 daily low at 1.0806, followed by 1.0727 April 2020 lows.

- NZD/USD fails to extend the first daily gain in three on mixed concerns, downbeat data at home.

- Equities improved as yields retreat from multi-day high, commodities remained pressured as well.

- Russian President Vladimir Putin dashes hopes of any solution from talks, Ukraine hints at compromise.

- China covid updates, Kyiv-Moscow news and US Retail Sales eyed ahead of Fed’s verdict for clear direction.

NZD/USD steps back to 0.6770 during early Wednesday morning in Asia, following a failed attempt to cross the 0.6800 during the previous day’s rebound.

The kiwi pair’s recovery on Tuesday could be linked to the cautious optimism over Ukraine-Russia talks, as well as strong data from China. However, pre-Fed anxiety joins recently mixed concerns over peace in Kyiv, not to forget downbeat New Zealand data to weigh on the NZD/USD prices of late.

That said, New Zealand’s Current Account for Q4 dropped to $-7.26B versus $6.213B expected and $-8.3B prior. Further, the Current Account – GDP Ratio for the stated period worsened to -5.8% compared to -5.6% market forecast and -4.6% previous readouts. On Tuesday, Business NZ PSI improved to 48.6 from 45.9 for February, preceding the upbeat prints of China Retail Sales and Industrial Production for the said month.

Elsewhere, global markets initially cheered hopes of the Ukraine-Russia peace, as signaled by Ukraine President Volodymyr Zelenskyy’s adviser, before Russian President Vladimir Putin said Kyiv is not serious about finding a mutually acceptable solution. Following that, Mykhailo Podoliyak, one of the representatives of Ukraine at Russian-Ukrainian negotiations cites room for compromise. It’s worth noting that the UK added more sanctions on Russia whereas Japan is up for removing Moscow from favored trade status. In return, Moscow banned Canadian PM from entering their country and levied sanctions on US President Joe Biden. Hence, the conditions relating to the Ukraine-Russia war aren’t clear but a halt in further deterioration seems to recede the fears of late.

It’s worth noting that China’s record covid numbers and lockdowns in multiple cities renew early pandemic woes and weigh on the NZD/USD prices.

Talking about the US data, the US Producer Price Index (PPI) matched YoY expectations of 10% growth whereas NY Empire State Manufacturing Index printed the biggest downside since May 2020.

Amid these plays, Wall Street benchmarks closed in the positive territory while the US Treasury yields ended Tuesday unchanged despite rising to mid-2019 levels during the initial day.

Looking forward, covid updates from China precede US Retail Sales for February, expected 0.4% from 3.8% prior, to entertain NZD/USD traders before directing them towards the Federal Open Market Committee (FOMC). Additionally, chatters surrounding Ukraine-Russia woes are also important for fresh clues.

Technical analysis

NZD/USD fades bounce off 50-DMA level of 0.6727 amid bearish MACD signals, suggesting another attempt to meet an upward sloping support line from late January, near 0.6720 by the press time. Meanwhile, 100-DMA around 0.6815 guards immediate upside.

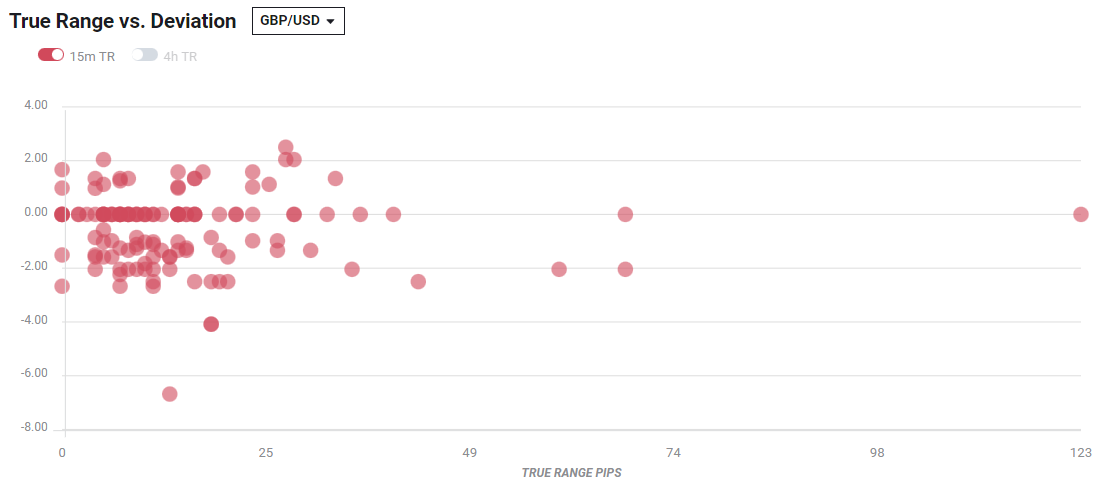

- A positive open-test drive session on Tuesday indicates a temporary bullish reversal.

- The confluence of an oversold oscillator and the lower end of a falling channel may produce a pullback.

- The 20- and 50-period EMAs are trending lower, which adds to the downside filters.

The GBP/USD pair has witnessed a base formation around 1.3000 after a significant plunge from February 23 high at 1.3620. The cable has witnessed a positive open-test drive session on Tuesday as the pair opened 1.3003, slipped near round 1.3000, and found some significant bids that drove the major higher.

On the daily scale, GBP/USD is auctioning in a falling channel formation whose upper end is placed from 6 January 2021 high at 1.4249 and the lower end is marked from 24 January 2021 low at 1.3670. A tap near the lower end of the falling channel is considered a pullback by the market participants. It is more likely that the cable will find a pullback around 1.2965.

The 20-period and 50-period Exponential Moving Averages (EMAs) at 1.3243 and 1.3370 respectively, are trending lower, which indicates significant weakness ahead.

Meanwhile, the Relative Strength Index (RSI) (14) is oscillating in a range of 20.00-40.00, which indicates a bearish setup. However, a confluence of an oversold situation with the lower end of a falling channel may result in a potential pullback.

The cable may likely find significant bids near 1.2965, which will push the pair on the upside towards March 8 low at 1.3082 and 8 December 2021 low at 1.3160.

While bears can continue holding grip if the major slips below 2 November 2020 low at 1.2854. This will send the cable lower towards 30 September 2020 low at 1.2805 and 23 September 2020 low at 1.2675.

GBP/USD daily chart

-637829795254912516.png)

- AUD/USD holds steady as traders await the Fed.

- Markets were jittery on Tuesday but the Aussie holds near 0.7200.

AUD/USD is trading around flat on the day in early Asia after a quiet afternoon trade in North American markets with the price sticking to a narrow 10 pip range between 0.7188 and 0.7201. The Aussie is now caught between falling commodity prices and rising stocks as traders will turn to the labour market data later in the week and the FOMC meeting on Wednesday

On Tuesday, oil prices continued to fall, triggering a lift in US equities. However, as analysts at ANZ Bank explained, there has been ''little progress has been achieved in the talks between Ukraine and Russia with Putin accusing Ukraine of not being serious about finding a mutually acceptable solution.'

''But,'' the analysts said, ''there are hopes a nuclear deal with Iran may soon be concluded, which may bring some stability to the Middle East and shore up oil supplies. New sanctions on Russia were added by the UK, including banning luxury goods exports.''

Meanwhile, fears that coronavirus disruptions in China could hurt demand for commodities, just as Beijing is seeking to expand production at home, is a factor trader will be weighing up. Commodity prices were hit at the start of this week when Beijing locked down the city of Shenzen and imposed a movement ban on the province of Jilin. The daily number of coronavirus cases jumped sharply on Tuesday, raising the risk of more restrictions.

Reuters states that mainland China reported 3,602 new confirmed coronavirus cases on March 14, the national health authority said on Tuesday, compared with 1,437 a day earlier. This was a huge spike. ''Of the new cases, 3,507 were locally transmitted, the National Health Commission said, compared with 1,337 a day earlier. The number of new asymptomatic cases, which China does not classify as confirmed cases, stood at 1,768 compared with 906 a day earlier. There were no new deaths, leaving the death toll unchanged at 4,636.As of March 14, mainland China had confirmed 120,504 cases.''

Meanwhile, China’s government has ordered a province of 24 million people into lockdown as it tries to contain the new outbreak that has spread to multiple locations. The risk to markets is that the lockdowns could trigger shock waves across global supply chains.

A slowdown in China due to the virus would be an added complication for the Reserve Bank of Australia (RBA) as it wrestles with when to start raising interest rates. Minutes of its March meeting showed that the central bank was still prepared to be patient on policy. The RBA also noted the conflict in Ukraine and the resulting spike in some resource prices was a shock to the global economy that would lift inflation and drag on growth.

''Markets are wagering the inflationary impulse will be the stronger and force the RBA to hike the 0.1% cash rates as soon as June. Investors have also shifted to price in almost six rate rises this year, with December futures implying 1.39%,'' Reuters reported.

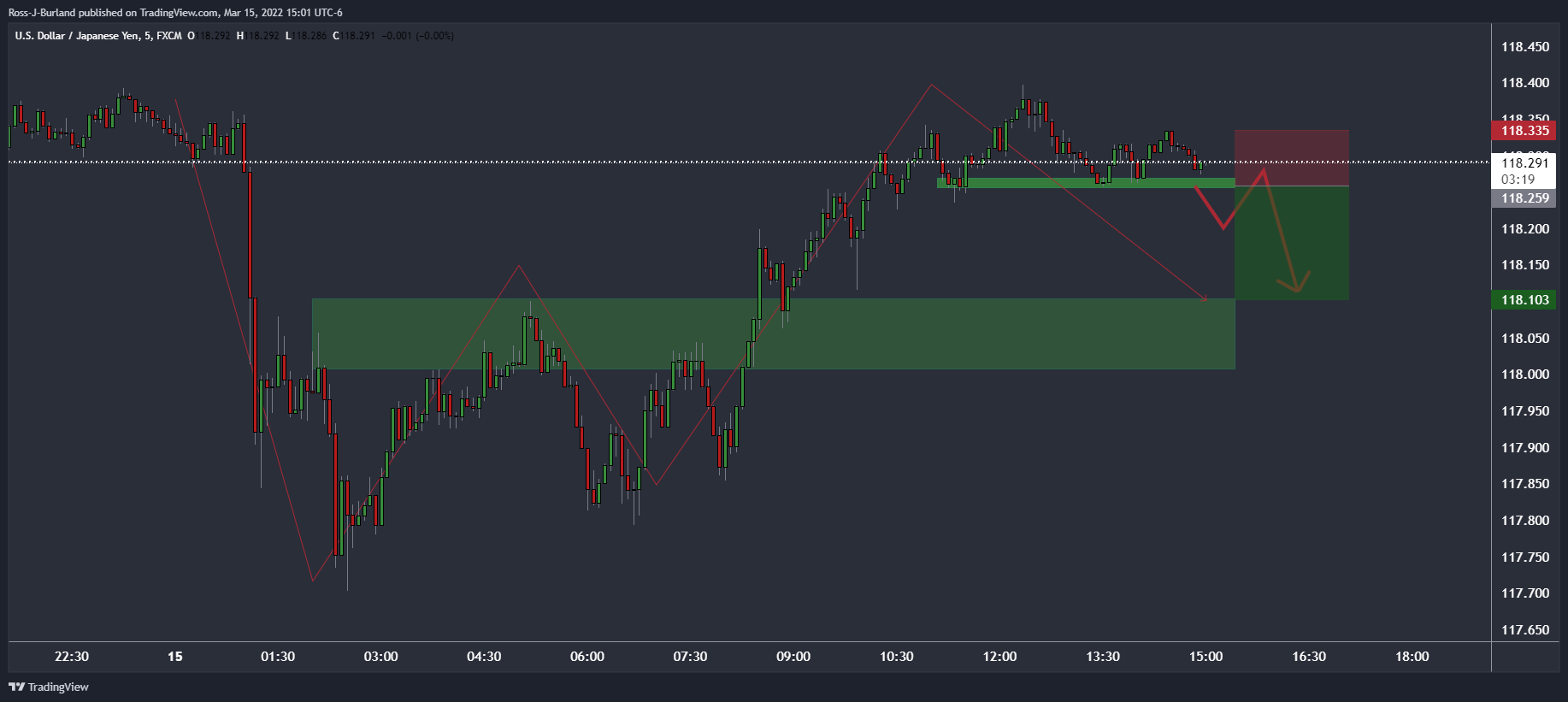

- The H1 W-formation is compelling as the price tires on the bid.

- USD/JPY is on the verge of a run towards 118 the figure.

The price of USD/JPY is slowing down as it reached the mid-point of the 118 area on Tuesday. From a lower time frame perspective, an intraday trade opportunity for the Asian session could come into play on the break of 118.25 as illustrated in the following analysis.

USD/JPY H1 chart

The W-formation is a reversion pattern whereby price would be expected to retrace back to test the neckline of the W. For catching an optimal entry, traders can move down the smaller time frames to monitor for bearish structure, as follows:

USD/JPY M5 chart

As illustrated, the price is bobbing along a short term support structure. However, a break of there, 118.25, the price would be expected to move lower to the neckline of the W-formation.

In doing so, there would be a high probability that before it reaches the 118.10/00 target area, the 118.25 level will be retested as resistance from where traders can enter short.

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 04:30 (GMT) | Japan | Industrial Production (MoM) | January | -1% | -1.3% |

| 04:30 (GMT) | Japan | Industrial Production (YoY) | January | 2.7% | |

| 09:00 (GMT) | France | IEA Oil Market Report | |||

| 12:30 (GMT) | Canada | Wholesale Sales, m/m | January | 0.6% | 3.9% |

| 12:30 (GMT) | U.S. | Retail sales | February | 3.8% | 0.4% |

| 12:30 (GMT) | U.S. | Retail Sales YoY | February | 13% | |

| 12:30 (GMT) | U.S. | Retail sales excluding auto | February | 3.3% | 0.9% |

| 12:30 (GMT) | U.S. | Import Price Index | February | 2% | 1.5% |

| 12:30 (GMT) | Canada | Consumer Price Index m / m | February | 0.9% | 0.9% |

| 12:30 (GMT) | Canada | Bank of Canada Consumer Price Index Core, y/y | February | 4.3% | 4.5% |

| 12:30 (GMT) | Canada | Consumer price index, y/y | February | 5.1% | 5.5% |

| 13:30 (GMT) | Canada | Wholesale Sales, m/m | January | 0.6% | |

| 14:00 (GMT) | U.S. | NAHB Housing Market Index | March | 82 | 81 |

| 14:00 (GMT) | U.S. | Business inventories | January | 2.1% | 1.1% |

| 14:30 (GMT) | U.S. | Crude Oil Inventories | March | -1.863 | -0.967 |

| 18:00 (GMT) | U.S. | FOMC Economic Projections | |||

| 18:00 (GMT) | U.S. | Fed Interest Rate Decision | 0.25% | 0.5% | |

| 18:30 (GMT) | U.S. | Federal Reserve Press Conference | |||

| 21:45 (GMT) | New Zealand | GDP y/y | Quarter IV | -0.3% | 3.3% |

| 21:45 (GMT) | New Zealand | GDP q/q | Quarter IV | -3.7% | |

| 23:50 (GMT) | Japan | Core Machinery Orders, y/y | January | 5.1% | 8.1% |

| 23:50 (GMT) | Japan | Core Machinery Orders | January | 3.6% | -2.2% |

- Silver slides as the North American session winds down.

- The Russia-Ukraine conflict and Federal Reserve monetary policy decision boosts US Treasury yields, weighs on silver.

- XAG/USD Price Forecast: Upward biased but price action on Wednesday is set to be tight, ahead of the FOMC.

Silver (XAG/USD), even though it remains trading with losses, bounced off the 78.6% Fibonacci retracement, a solid buying zone, and pushed XAG/USD shy of the $25.00 area, which also confluences with the 61.8% golden ratio. At the time of writing, XAG/USD is trading at $24.87, down some 0.67%.

Geopolitical jitters and FOMC monetary policy meeting boost the greenback

Following XAG/USD’s last week rally, which witnessed a jump from $25.00 to YTD highs around $26.94, it was expected that silver would register a mean reversion move that could push the white metal towards a renewed re-test of 2022 highs. Meanwhile, Russia-Ukraine talks, although had been reported as “positive” in the last couple of days, were downtoned by Russian President Vladimir Putin, saying that Kyiv is not serious about finding a mutually acceptable solution.

XAG/USD’s jumped on the headline, from $24.70 towards daily highs around $25.05, but stabilized around the $24.80-90 area, as the Federal Reserve monetary policy looms.

The US Federal Reserve to hike 25 bps on Wednesday

US Treasury yields pared earlier losses and finished in the green, with the 10-year T-note yield at 2.149%, barely flat, but reflecting Fed’s first rate hike.

On Wednesday, the US central bank is widely expected to hike rates for the first time in three years, which would leave the Federal Funds Rate at 0.25%. It would be followed by Fed’s Chair Jerome Powell’s press conference, in which he would be questioned about the Russia-Ukraine impact on the US economy.

Worth noting that the Fed would reveal the Summary of Economic Projections (SEP) and the update of the so-called dot-plot, which reflects the monetary policy projections of the board.

XAG/USD Price Forecast: Technical outlook

On Tuesday, silver visited the 78.6% Fibonacci retracement, a solid demand level for the white metal, just short of intersecting with the January 20 high previous resistance/support around $24.70. Noteworthy that XAG/USD spot price is above the daily moving averages (DMAs), and while the 50-DMA sits between the 200 (top) and the 100-DMAs (bottom), it is accelerating towards crossing above the 200-DMA, which could cause a golden-cross.

That said, XAG/USD bias is upwards, and its first resistance level would be $25.00. A decisive break would expose the confluence of the 50% Fibonacci level and November 25, 2021 high at $25.39, followed by the $26.00 mark.

Mykhailo Podoliyak, one of the representatives of Ukraine at Russian-Ukrainian negotiations, has said, ''we'll continue tomorrow. A very difficult and vicious negotiation process. There are fundamental contradictions. But there is certainly room for compromise. During the break, work in subgroups will be continued...''

Meanwhile, the Wall Street Journal reported that ''Russia lobbed more missiles into Kyiv, amid heightened fighting in the city’s outskirts as a delegation of European leaders headed to the embattled Ukrainian capital to meet with President Volodymyr Zelensky.

''One missile destroyed a building associated with an arms maker in central Kyiv in a predawn strike, blowing the windows out of buildings in a one-block radius. In a second strike, two rockets hit apartment buildings, setting fire to one of them.''

''Two residents died in the apartment complex and dozens were taken to a nearby hospital to be treated for smoke inhalation. There were no fatalities in the other strike, officials said.''

''Fox News cameraman Pierre Zakrzewski was killed on assignment covering the war in Ukraine.''

What you need to take care of on Wednesday, March 16:

The dollar started the day on the back foot but managed to recover the ground lost during US trading hours. The EUR/USD pair is trading at around 1.0940, while GBP/USD changes hands at 1.3035.

President Vladimir Putin said Kyiv is not serious about finding a mutually acceptable solution. The news cooled hopes for a diplomatic agreement. Earlier in the day, Ukraine President Volodymyr Zelenskyy’s adviser said they were confident they could reach a diplomatic solution in the next few weeks.

Beyond sanctions, Russia submitted a request to leave the Council of Europe after being suspended on February 25. Additionally, Moscow announced a series of sanctions on US authorities, including President Joe Biden and banned Canadian Prime Minister Justin Trudeau from entering the country.

European Central Bank President Christine Lagarde spoke at the WELT Economic Summit and noted that the uncertainty surrounding the economic outlook had increased dramatically, as the war would reduce growth and create inflation due to increasing energy and commodities costs. She also said that inflation is still forecast to decline gradually and settle near the central bank’s 2% target by 2024.

China announced record coronavirus contagions and put over 17 million people into strict lockdown, dampening economic growth expectations. Stocks and commodities were on the back foot amid concerns related to decreased demand throughout the first half of the day.

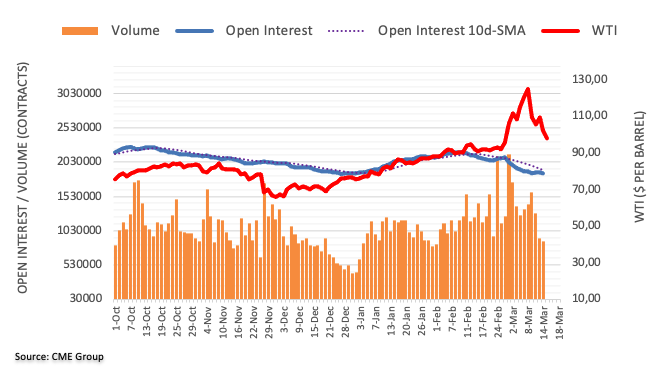

Gold bottomed at $1,907.04 a troy ounce, bouncing modestly ahead of the close to settle around $1,920 a troy ounce. Crude oil prices extended their latest decline, and WTI ended the day at $96.50 a barrel.

The AUD/USD pair spent the day inside a tight range, ending the day little changed sub-0.7200. The Canadian dollar benefited from falling oil prices and soaring commodities, resulting in USD/CAD falling to 1.2766.

Wall Street posted substantial gains despite mounting concerns related to the Russia-Ukraine crisis. US government bond yields were up, with the yield on the 10-year Treasury note reaching a multi-week high of 2.169%, finishing the day nearby.

The market’s focus shifts now to the US Federal Reserve, as the US central bank will announce its monetary policy decision on Wednesday and is expected to trigger a rate hike of at least 25 bps.

Top 3 Price Prediction Bitcoin, Ethereum, XRP: Crypto bulls continue to hold, but for how long?

Like this article? Help us with some feedback by answering this survey:

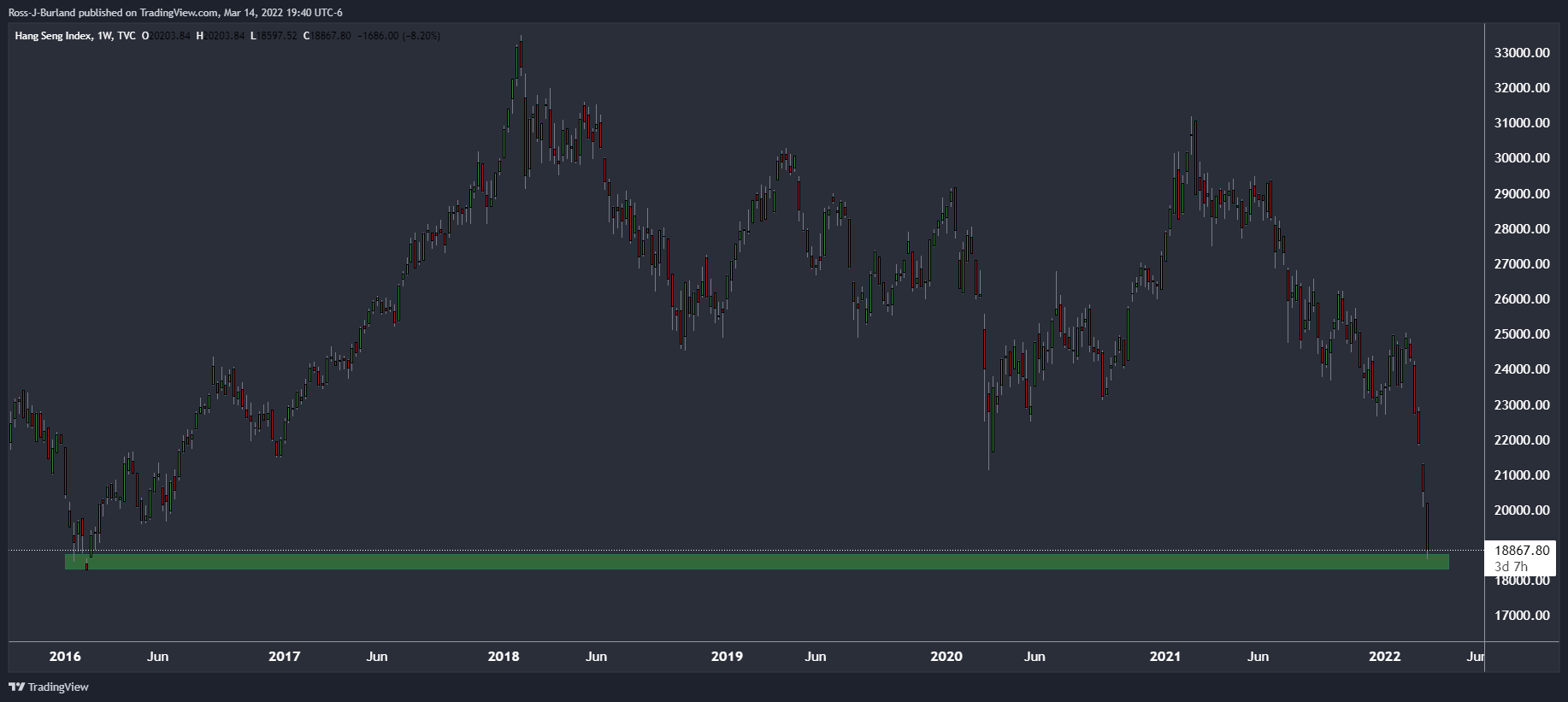

- Gold is on the backfoot and trading in the bear's lair.

- The Fed is expected to come with a hawkish tone and the US dollar could be supported.

- Little progress has been achieved in the talks between Ukraine and Russia.

- Gold to extend downward correction on hawkish Fed

The gold price is down 1.5% at the time of writing after falling from a high of $1,954.72 to a low of $1,907.08, slipping below a critical level on the daily chart with the downside now fully exposed. The price of oil has been falling and markets are volatile ahead of tomorrow’s US Federal Reserve decision.

This offers something for both the bulls and bears in the gold market, but little progress has been achieved in the talks between Ukraine and Russia with Putin accusing Ukraine of not being serious about finding a mutually acceptable solution. This can lend support to the price of gold. However, the hopes of a nuclear deal with Iran can keep the optimism alive and weigh on the yellow metal, for oil has been a major contributor to the risk-off sentiment of late that had been supporting price higher.

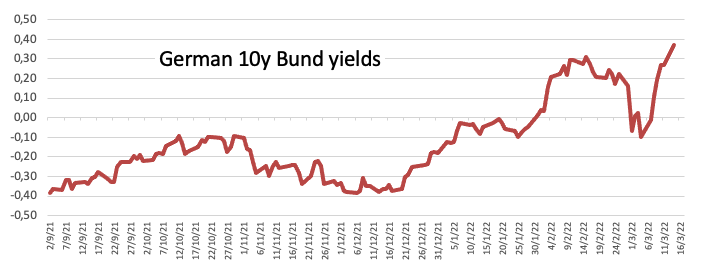

For that matter, US stocks rose midday Tuesday while the slump in crude oil deepened. S&P 500 had lifted 1.8% by 19.00GMT. European equity markets were weaker, however, with the Euro Stoxx 50 down 0.1% while the FTSE 100 fell 0.2%. The US yield on the US 10-year note lifted just 1.6bps to 2.149% while the German bond yield fell 4bps.

US Producer Price inflation eased more than forecast on the eve of a likely rate increase by the Federal Reserve where it is expected to him interest rates. Last week, the Fed's Chairman, Jerome Powell gave a green light for a 25bp liftoff in March during his testimony before Congress.

The central bank would be now expected to convey the message that despite the ongoing conflict between Russia and Ukraine, the Fed is ready to continue with its process of monetary policy normalization during the rest of the year. That would be expected to support the greenback

As for the trajectory of the gold price, it has already shown its cards in the recent break of $1,914, the March 2 low. While this area is acting as support with the price back to $1,920, the bearish commitments could see a strong daily close below there in the coming days that could catalyze a substantial selling program.

''If the market has started to discount a future in which the growth shock could fade at a faster pace than the inflation shock, as we exected, then gold prices could be especially vulnerable to a more hawkish Fed profile, opening the door to a deeper consolidation,'' analysts at TD Securities explained.

Gold technical analysis

The price is breaking the trendline and has printed an M-formation on the daily chart. A reversion to test the counter trendline and neckline of the pattern could be in order prior to the next leg lower.

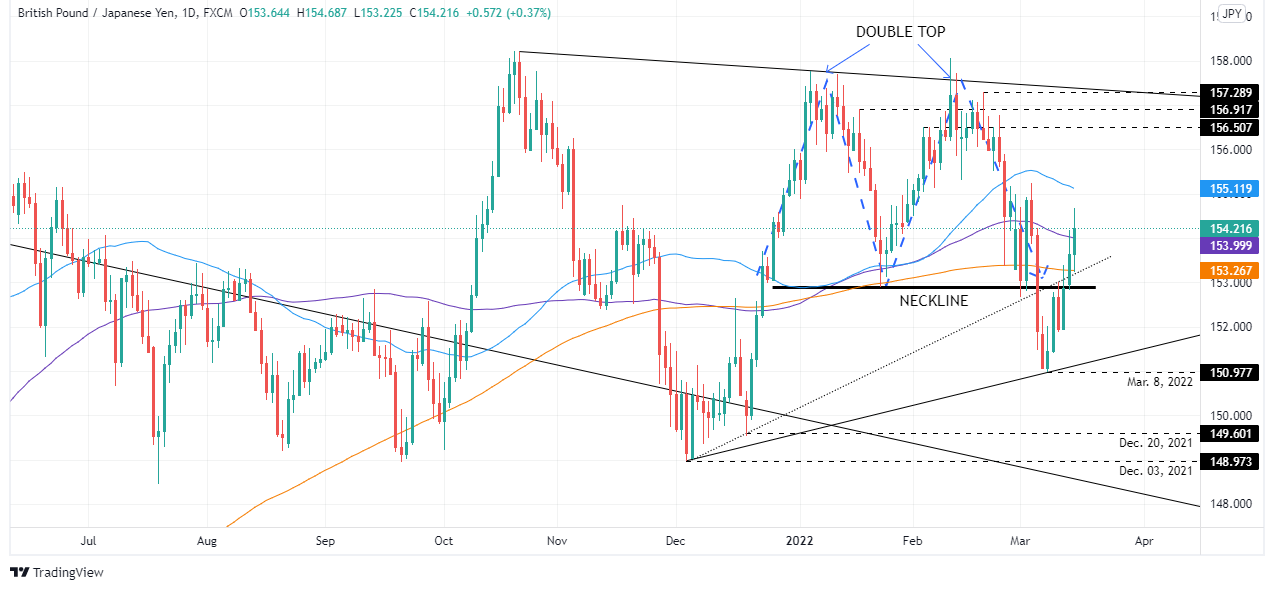

- The British pound rally continues vs. the Japanese yen.

- Positive UK labor data and GDP further cement a BoE’s rate hike.

- GBP/JPY Price Forecast: Neutral-upward biased, but downside risks remain due to solid resistance around the 154.60-155.00.

GBP/JPY extends its rally to three straight days, thus negating the double-top chart pattern, as the cross-currency pair turns bullish on a positive UK employment report amid a mixed market mood. At the time of writing, the GBP/JPY is trading at 154.21.

Late in the New York session, the market mood is “somewhat” positive, as portrayed by US equities trading with gains. In the FX space, safe-haven peers trade softer as the trading day progresses.

Goodish UK data and a “hawkish” BoE to lift the pound

Data-wise, the UK reported employment figures, which beat expectations, thus raising the prospects of the GBP. Along with last Friday’s solid GDP data, those figures and the Bank of England (BoE) third rate hike on Thursday would keep the GBP buoyant against the JPY.

Overnight, the GBP/JPY climbed near the 154.50 area but plunged 100-pips, though recovered on risk-appetite near the 154.50 area, which is a strong resistance level, difficult to break for GBP/JPY bulls.

GBP/JPY Price Forecast: Technical outlook

The GBP/JPY is neutral-upward biased. The longer time-frame daily moving averages (DMAs) like the 100 and the 200-DMAs reside below the spot price, a sign of bullishness in the pair. Contrarily the 50-DMA is at 155.11, above the spot price, and due to the last couple of candles, the 154.60-155.00 area would be a solid resistance area to overcome.

Upwards, the GBP/JPY first resistance would be March 15 high at 154.68. Breach of the latter would expose the 155.00 mark but beware of a possible consolidation in the 154.60-155.00 range. Nevertheless, a decisive break of the former would expose 156.00.

- US dollar pulls back to 1.2780 from 1.2870 highs.

- The Canadian dollar appreciated favored by a brighter market mood.

- USD/CAD is now testing trendline support at 1.2780.

The US dollar’s recovery from last Friday’s lows sub-1.2700 has found resistance at 1.2870 highs earlier today. The pair has dropped about 0.7% over the European and US sessions, to hit intra-day highs at 1.2780 so far.

The loses ground as risk sentiment improves

The USD has lost ground on Tuesday, with the lonie favored by the moderate market sentiment improvement. Investors’ hopes of seeing some progress in the peace talks between Russia and Ukraine have lifted the market mood, buoying the Canadian dollar in spite of the sharp decline in oil prices.

Marker sentiment, however, has been shattered during the US session after Russia’s President, Putin, affirmed that the Ukrainians are not being serious to find a mutually acceptable solution. These comments supported the US dollar, which seems to have firmed up to tick up to levels near 1.2800.

USD/CAD: testing support trendline at 1.2780

The hourly chart shows the pair attempting to bounce at short-term trendline support, from March 11 lows at 1.2695.

A confirmed breach of that level would increase bearish pressure on the US dollar, pushing the pair towards 1.2730 intra-day level before testing the support area at 1.2680/95 (March 4, 7, and 11 lows).

On the upside above 1.2800, the pair might find resistance at 1.2840 (March 10 high) and intra-day high at 1.2870.

USD/CAD hourly chart

Technical levels to watch

- Australian dollar's recovery halts at 0.7225, the pair returns below 0.7200.

- The Aussie loses steam as market sentiment worsens.

- Back below 0.7200, the AUD/USD maintains its near-term bearish bias intact.

The aussie has erased previous gains during Tuesday’s US trading session, pulling back below 0.7200 after hitting intra-day highs at 0.7225. The pair remains flat on the daily chart, tr4ading at 0.7185 at the time of writing.

USD regains lost ground as market sentiment sours

The risk-sensitive Australian dollar has lost ground as hopes of progress about the Russia – Ukraine peace talks faded for the second consecutive day. The fragile market optimism has been shattered after Russia’s President Vladimir Putin’s accused Ukrainian representatives of not being serious to find a mutually acceptable solution.

The market has been rattled by these comments. US stock markets have pulled back from session highs and the US dollar bounced up on safe-haven demand. Beyond that, the Federal Reserve is widely expected to hike rates for the first time in the last three years on Wednesday which is contributing to keeping US dollar weakness in check.

Earlier today, the AUDUSD has attempted to pare losses, after the last two days’ sell-off. The positive Chinese data, with industrial production and retail sales beating expectations in February, and a somewhat softer greenback had been buoying aussie’s demand.

AUD/USD capped below 0.7225 resistance

From a technical point of view, the pair maintains its near-term bearish bias intact as the upside correction has been limited at the 0.7225 area, where previous intra-day support meets the 100-day SMA.

On the downside, below 0.7200 the pair eyes the aforementioned two-week low at 0.7165 before the February 28 low at 0.7140.

On the contrary, another bullish reaction should breach 0.7225, before aiming towards 0.7245 (March 8 low) and the 200-day SMA, at 0.7310 before aiming towards the March 10, 11 highs at 0.7365.

Technical levels to watch

- GBP/USD holds in a key area of support on the weekly chart.

- The Fed and BoE are both meeting this week, expected to raise interest rates.

GBP/USD is attempting to stabilise in Tuesday's US session following a weak start in the morning as the US dollar took off. The moves in the greenback are aligning with a rally in US yields, with the 10-year yield moving in again on the recent highs, up 0.5% at the time of writing.

Nevertheless, the pound has had some good news of late. A strong jobs report supported the prospect of a Bank of England rate hike for this month's meeting. The UK's Unemployment Rate fell more than expected to 3.9% in the three months to January, official figures showed, while vacancies hit a record high in the three months to February. meanwhile, money markets continue to fully price in a 25 basis points BoE interest rate hike on Thursday.

However, both the Federal Reserve and the BoE are expected to raise rates by 25 bps this week. What could weigh on the pound is the divergence in rhetoric between the two central banks. ''The MPC is likely to do so with far less enthusiasm,'' analysts at Rabobank said. ''A hike this week for the BoE would mark the third consecutive move and the voting pattern of MPC members is likely to illustrate far less conviction than in the February and December policy meetings.''

Meanwhile, there is a focus on Ukriane crisis for which cable has declined sharply since the start of the conflict. ''We expect the pound to remain on the back foot going forward,'' analysts at Rabobank said.

''Among the weekend news was the rallying headlines from both Ukrainian and Russian officials that progress in diplomatic talks between the two sides could be established in the coming days. This has led to a modest reduction in demand for safe-haven assets and allowed cable to pull away from its earlier lows.''

''That said, significant headwinds are facing the UK economy in the form of higher energy and tax bills and the Bank may already be running out of room to hike rates.,'' the analysts added further. ''Consequently, it is likely that relative to the Fed, the BoE will sound a more cautious note at this week’s policy meeting and this could weigh on cable. In our view, cable could remain mostly within a GBP/USD 1.30 to 1.33 range in the coming months.''

GBP/USD technical analysis

In the start of the week's analysis, it was stated that ''the M-formation is mature and bulls will be in anticipation of a correction starting from within the demand area, as illustrated don the weekly chart above. A weekly bullish close is required to signal the prospects of the leg higher. ''

- The New Zealand dollar snaps two days of consecutive losses, gaining 0.26%.

- The NZD/USD sits between the 50% and the 61.8% Fibonacci levels ahead of the FOMC.

- NZD/USD Price Forecast: Neutral-downward biased, though it appears to consolidate pre-Federal Reserve monetary policy announcement.

The NZD/USD trims some of Monday’s losses, bouncing off daily lows near the 50-day moving average (DMA), grinding higher during the North American session. At 0.6762, the NZD/USD does not reflect the market sentiment, which turned mixed on headlines out from Eastern Europe, as portrayed by European equities finishing with losses, while US bourses rise.

Russia-Ukraine tensions increase as Putin contradicting earlier news

Developments in Eastern Europe appointed to continuing talks between Russia and Ukraine, but the fighting remained. Elsewhere, the Ukrainian air force claimed that a Russian drone crossed into Poland before returning to Ukraine, it was shot down by air defenses, while Russia’n Minister of Defense reported that they had taken control of Kherson Ukraine, according to Sputnik.

However, in the last couple of hours, Russian President Vladimir Putin said that Kyiv is not serious about finding a mutually acceptable solution, contradicting with news in the couple of days, which appointed to progress in discussions between Russia and Ukraine.

In the Asian session, the New Zealand economic docket featured the Business NZ Performance of Services Index, which rose to 48.6 in February of 2022 from an upwardly revised 46 in the prior month, marking the seventh straight contraction for the Kiwi services sector and well below the long-term average of 53.6.

Across the pond, the US docket revealed the Producer Price Index (PPI) for February, which rose by 10%, matching market expectations and staying at levels not seen since 1981. The rise in US Consumer and Producer Price indexes would further cement the Federal Reserve case to increase rates on Wednesday, as money market futures have priced in at least a 25 basis points hike.

NZD/USD Price Forecast: Technical outlook

Overnight, the NZD/USD traded in the 0.6720-50 area, though late in the European session, witnessed a jump towards daily highs at 0.6792, short of the 0.6800 mark, as FOMC Wednesday’s meeting looms. Despite that, the New Zealand dollar showed some strength, in line with the US equity markets behavior, the pair is neutral downwards, with the 200 and the 100-day moving averages (DMAs) residing above the exchange rate.

That said, the NZD/USD first support would be the 61.8% Fibonacci retracement at 0.6743. Breach of the latter would expose the 50-DMA at 0.6724, followed by the 78.6 Fibonacci at 0.6693.

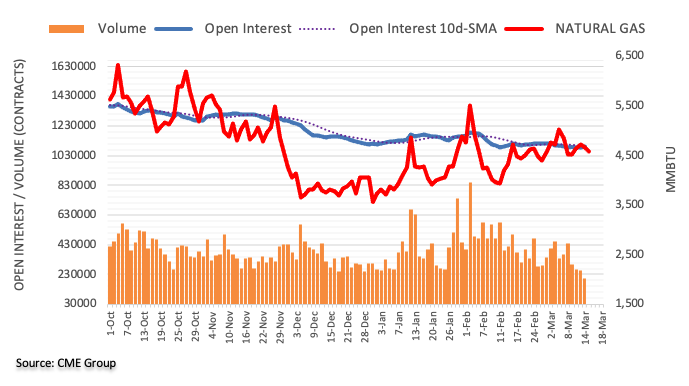

- WTI futures pick up to $98.00 from three-week lows at $93.40

- Oil prices plunge on easing supply concerns and COVID-19 cases in China.

- From a wider perspective, US oil futures remain biased lower.

The US benchmark crude oil futures are attempting a mild correction on Tuesday’s US trading session. Front-month West Texas Intermediate contracts have appreciated about $4 over the last two hours, returning to levels past $98.00 after hitting three-week lows at 93.45 earlier today

Oil prices dive on easing concerns about supply

Oil prices have plunged nearly 30% from early-March highs above $129.00. Market concerns about a global supply shortage on the back of sanctions on Russian oil seem to have eased on hopes that Saudi Arabia and the United Arab Emirates are ready to increase production.

Furthermore, the exponential increment of coronavirus infections in China, which has already imposed lockdowns in some cities, has triggered concerns about a decline in demand from the Asian giant which is contributing to cool prices.

WTI Oil is trading within a sharp downward trend

A look at the 4-hour chart shows oil futures trapped within a clear negative trend from early March highs. WTI futures are testing support right above the 50-day SMA, around $92.00, with the next potential targets on the downside, at $89.80 (February 25 low) and $86.40 (Jan. 28 and 31 lows)

On the upside, the pair is struggling to extend past $98.20. Above here, the next targets might be at $99.30 (intra-day high) and the $100.00 level.

Technical levels to watch

- The euro fails to break above 1.1000 for the second consecutive day.

- The US dollar is trimming daily losses with the focus shifting to the Fed's meeting.

- EUR/USD might decline towards 1.05 over the coming months – BofA.

The euro is losing ground on Tuesday’s US trading session after failing to extend beyond the 1.1000 level for the second day in a row. The pair is giving away earlier gains and remains barely changed on the daily chart, trading right above 1.0950.

The euro loses steam with all eyes on the Federal Reserve

The common currency is losing momentum with the greenback picking up as the market braces for Wednesday’s Federal Reserve’s monetary policy decision. With consumer inflation at levels not seen in decades, The Fed is poised to hike rates for the first time in three years, which is providing some support to the USD.

Earlier today, the euro has seen some positive price action, favored by the sustained reversal on oil prices and the moderate optimism regarding the Russia – Ukraine peace talks. The pair, however, has been capped right above 1.1000 before returning to the mid-range of 1.0900.

EUR/USD could extend its decline towards 1.05 – BofA

In the longer-term, the Bank of America Global Research sees the euro extending its downtrend over the coming months: “Initiation of Fed hiking cycles has typically not boded well for USD prospects, but a hawkish Fed tone amid high inflation risks could end up supporting the dollar for a while longer if terminal rate expectations continue to rise against the backdrop of persistent risk aversion and high commodity prices related to the war in Ukraine (…) We recently downwardly-revised our EUR/USD forecast to 1.05 and continue to see downside potential over a short to medium-term horizon.”

Technical levels to watch

- The shared currency retraces from weekly highs as tensions between Russia-Ukraine increase, to the detriment of the EUR.

- Market sentiment alongside the BoE hiking rates for the third consecutive meeting favors the GBP vs. the EUR.

- EUR/GBP Price Forecast: Neutral-downward biased, as long as the pair trades above 0.8359.

On Tuesday, the EUR/GBP retreats from weekly highs near the 0.8450 mark and breaks below the 0.8400 mark amidst a mixed market mood, spurred by geopolitical woes. At press time, the EUR/GBP is trading at 0.8396.

Russia-Ukraine tensions increase

The market sentiment is mixed, though it would likely shift towards a risk-off on Russian President Vladimir Putin’s saying that Kyiv is not serious to find a mutually acceptable solution, contradicting with news in the couple of days, which appointed to progress in discussions between Kyiv and Moscow.

Overnight, the EUR/GBP climbed towards 0.8400 from the 0.8400 figure. However, the Russia/Ukraine conflict and its influence on Europe increased demand for the British pound. Since the mid-European session, it has been appreciating vs. the shared currency, causing a move under the 0.8400 mark.

Therefore, EUR/GBP traders would need to be aware of central bank policy divergence, with the Bank of England (BoE) set to raise rates to 0.75% by Thursday, while the ECB could probably begin by the end of the year. That alongside market sentiment would be the main drivers for the pair, though, during the week, GBP strength could override some market mood vs. the EUR.

EUR/GBP Price Forecast: Technical outlook

The EUR/GBP depicts a neutral-downward bias, confirmed by the location of the daily moving averages (DMAs) above the spot price, except for the 50-DMA. Furthermore, Tuesday’s daily high, around 0.8455, failed to break above the last cycle high at 0.8478, extending the downtrend, which has been following the 100-DMA s direction since May of 2021.

That said, the EUR/GBP’s first support would be the confluence of the 50-DMA and the March 11 low around the 0.8355-0.8359. Breach of the latter would expose the bottom-trendline of a descending channel around 0.8340, followed by the February 21 daily low at 0.8309, short of the 0.8300 mark.

- The US dollar extends its rally to 11-month highs at 0.9425.

- A moderate risk appetite and Fed's tightening expectations are underpinning the USD.

- Above 0.9375 the pair aims to 0.9473 – Credit Suisse.

The US dollar found support at 0.9370 earlier today to resume its seven-day rally and break above 0.9400 for the first time since April 2021.

The US dollar picks up with the Fed on focus

The greenback is picking up during the US trading hours, following a weak performance on previous sessions. The positive Wall street opening seems to have spurred some dollar bids with the market awaiting the outcome of the Federal Reserve’s monetary policy meeting, due on Wednesday.

The Fed is widely expected to hike interest rates for the first time in three years, in order to tame soaring inflation levels. These hopes have pushed US treasury bonds to multi-year highs, fuelling demand for the greenback.

Furthermore, a moderate optimism about the possibility of some progress on the Russia – Ukraine peace talks seems to have triggered a cautious optimism. Comments hinting at the possibility of an agreement in the coming weeks have cheered investors, offering support to the USD/CHF.

USD/CHF above 0.9375, next target is 0.9473 – Credit Suisse

The FX Analysis Team at Credit Suisse, confirmation above 0.9375 would increase bulls’ confidence and clear the path towards 0.9473: “Only a sustained break above 0.9367/75 would confirm the recent strength and raise a prospect of a fresh medium-term uptrend emerging clearing the way for strength back to the 0.9473 high of last year and likely higher we think in due course.”

- The Mexican peso holds steady versus the US dollar despite volatility.

- USD/MXN with a bearish bias, still holding above 20.852.

The USD/MXN holds a negative bias in the short-term but it needs to break the key short-term support at 20.85. A daily close below should open the doors to more losses, targeting 20.70 initially. An extension below could target the 20.50 zone.

So far, the Mexican peso has been unable to break firmly 20.85. It bottomed on Tuesday at 20.82, the lowest level since March 4 but quickly bounced to the upside amid a deterioration in market sentiment.

The first resistance is seen at 20.90, a downtrend line. Above, a test of 21.00 is expected. A break and a consolidation above 21.05 would add support to the dollar for an extension. The next strong barrier that should limit the upside is 21.30.

The main trend remains bullish but a daily close below 20.65 should turn the bias to neutral. Ahead of the FOMC meeting, with the war in Ukraine and global uncertainty, volatility is set to remain elevated.

USD/MXN daily chart

-637829568809906223.png)

Russia's President Vladimir V. Putin has said that Kyiv is not serious about finding a mutually acceptable solution, according to Bloomberg.

Markets have reacted negatively to the news, with stocks retreating from the highs and the safe-haven dollar and gold rising.

--more to come

- US dollar posts mixed results as the FOMC meeting begins.

- Loonie turns positive versus US dollar, holds in negative against AUD and NZD.

- USD/CAD: Bullish bias but limited by 1.2900.

The USD/CAD pulled back more than 50 pips from the daily highs and turned negative. The pair hit earlier on Wednesday a five-day high at 1.2871, and as of writing, it trades at 1.2799, the fresh daily low.

The retreat occurred amid an improvement in market sentiment and even as crude oil prices extended losses. The WTI barrel is falling almost 9%.

Economic data from the US showed an increase in the Producer Price Index to 10% (annual), the highest level in decades and a sharp decline in the Empire Manufacturing Index for February. The numbers had little impact on the greenback as market participants focused on the two-day meeting of the Federal Reserve and the war in Ukraine.

The FOMC is expected to raise the key interest rate for the first time since 2018, in a complex environment with high inflation, supply disruptions, a war in Ukraine and soaring crude oil prices. The tone of the statement and Chairman Powell's words will likely trigger volatility across the financial markets. Also, on Wednesday, inflation data from Canada is due.

The 1.2900 area still holds the key

A weekly close above 1.2900 should trigger more gains over the medium term, favoring a rally above 1.3000. The same chart shows a relevant support around 1.2700, the 20-week Simple Moving average, a consolidation below should weaken the dollar, exposing the next supports at 1.2580 and 1.2445.

Technical levels

-637829559779185731.png)

- US Stock markets open with gains as the oil reversal gathers pace.

- Easing concerns about supply shortages and COVID-19 in China are weighing energy markets.

- All eyes are on the outcome of the Federal Reserve's meeting.

US stock markets have opened in a moderately positive tone on Tuesday, with oil prices pulling back for the second consecutive day and all eyes on the US Federal Reserve’s monetary policy meeting.

The S&P 500 Index advances 1.25%, while the Nasdaq Technological Index and the Dow Jones Industrial Index are 1.93% and 0.99% up respectively at the time of writing.

Oil prices dive from highs on easing supply concerns

Concerns about an oil supply shortage on the back of sanctions to Russia seem to be fading on hopes that Saudi Arabia and the United Arab Emirates would be ready to increase production.

Beyond that, the fast-spreading COVID-19 outbreak in China, which has already forced to impose lockdowns in some cities, is contributing to pulling oil prices lower. The benchmark US West Texas Intermediate has dropped nearly 30% from last week’s highs at $126 per barrel to levels below $93 so far.

On the other hand, investors are awaiting the conclusion of the two-day monetary policy meeting, starting today. The Fed is widely expected to be hiking interest rates for the first time in three years aiming to bring inflation under control.

Down to sectors, Consumer Discretionary stocks, 2.7% higher and Technology, 1,96% up are leading gains with only Energy and Materials in the red with 4.62% and 0.08% respective declines.

Technical levels to watch

- The USD/JPY retraces from 118.45 YTD highs but clings to the 118.00 ahead of the FOMC.

- A mixed market sentiment keeps bourses seesawing while the US Treasury yields fall.

- USD/JPY Price Forecast: Tuesday’s price action is forming a doji, meaning indecision of bulls and bears.

The USD/JPY slides for the first time in seven days amid a mixed market mood as illustrated by global equities fluctuating between gainers and losers, courtesy of geopolitical jitters. In the FX space, the Japanese yen recovers some ground vs. most G8 currencies, except the risk-barometer AUD. At the time of writing, the USD/JPY is trading at 118.14.

Russia-Ukraine conflict persists, talks to continue

Latest developments in Eastern Europe appoint to continuing talks between Russia and Ukraine, though hostilities remain. Meanwhile, the Ukrainian air force claimed that a Russian drone crossed into Poland before returning to Ukraine, it was shot down by air defenses, while Russia’n Minister of Defense reported that they had taken control of Kherson Ukraine, according to Sputnik.

Yields of US Treasuries retrace and demand for the greenback diminishes

In the meantime, the USD/JPY is trading mostly flat in the day, underpinned by falling US Treasury yields, led by the 10-year T-note down three basis points, sitting at 2.110%. The greenback trades with losses, with the US Dollar Index under the 99 mark, at 98.79, down 0.21%.

An absent Japanese economic docket leaves USD/JPY traders leaning on US economic data. On the US front, the Producer Price Index (PPI) for February rose by 10%, matching market expectations and staying at levels not seen since 1981. The data further cemented the need for higher rates, as the Federal Reserve would unveil its monetary policy statement on Wednesday at 18:00 GMT, followed by Fed’s Chief Powell presser.

USD/JPY Price Forecast: Technical outlook

The USD/JPY depicts an upward bias, though Tuesday’s price action is forming a doji near the YTD highs, meaning that USD bulls fail to commit to higher prices as the US central bank’s first rate hike looms.

If the USD/JPY aims to move lower, the first support would be 118.00. Breach of the latter would expose the 24-year-old downslope trendline, around 117.00., which once clear would leave the January 4 high resistance/support at 116.35 as the next demand zone.

Upwards, the USD/JPY first resistance would be 118.45. A decisive break would push the pair towards 119.00, followed by the 120.00 mark.

- USD/TRY regains downside traction and revisits 14.50.

- The selling bias in the dollar helps the EM FX space.

- The CBRT is expected to hold rates later this week.

The Turkish lira appreciates further and drags USD/TRY to new 4-day lows in the 14.50 region on turnaround Tuesday.

USD/TRY looks to risk trends, geopolitics

USD/TRY retreats for the third consecutive session so far on Tuesday against the backdrop of the renewed and persistent offered stance in the US dollar, while the risk complex looks bolstered by hopes of a diplomatic solution to the war in Ukraine.

In addition, another strong decline in crude oil prices means to bring extra respite to the economic outlook for Turkey along with somewhat diminishing geopolitical concerns.

Moving forward, consensus around the next meeting by the Turkish central bank (CBRT) leans towards a steady hand, with no changes to the One-Week Repo Rate, currently at 14.00%.

On the docket, Turkey’s Budget surplus more than doubled in February to TL69.74B (from TL30.00B).

What to look for around TRY

The lira regained some poise in past sessions, leaving the area of YTD lows vs. the US dollar around the 15.00 zone (March 11). In the very near term, price action in the Turkish currency is expected to gyrate around the performance of crude oil, the broad risk appetite trends, the FOMC event and the progress of the peace talks in the Russia-Ukraine front. Extra risks facing TRY also come from the domestic backyard, as inflation gives no signs of easing, real interest rates remain negative and the political pressure to keep the CBRT biased towards low interest rates remain omnipresent.

Key events in Turkey this week: Budget Balance (Tuesday) – CBRT Meeting (Thursday).

Eminent issues on the back boiler: Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Earlier Presidential/Parliamentary elections?

USD/TRY key levels

So far, the pair is retreating 0.76% at 14.6529 and a drop below 13.7143 (low Feb.25) would expose 13.5091 (low Feb.18) and finally 12.4317 (low Feb.11). On the other hand, the next up barrier lines up at 14.9889 (2022 high Mar.11) seconded by 18.2582 (all-time high Dec.20) and then 19.00 (round level).

Citing Russia's foreign ministry, Reuters reported on Tuesday that Russia has decided to impose sanctions on US President Joe Biden and Secretary of State Anthony Blinken.

"Russian sanctions also apply to US Defense Minister, National Security Adviser, Chief of CIA and others," Reuters further added.

Market reaction

This development doesn't seem to be having a significant impact on risk sentiment. As of writing, the S&P 500 Index was up 1.3% and the Dow Jones Industrial Average was gaining 1%.

Meanwhile, the US Dollar Index stays in negative territory near 98.80.

- Australian dollar's recovery from 0.7160 lows extends beyond 0.7200.

- Upbeat Chinese data and a softer UD dollar are underpinning aussie's rebound.

- Above 0.7225, The AUD/USD might extend to 0.7245 and 0.7310.

The Australian dollar has been building up momentum on Tuesday’s European session. The pair’s recovery from a two-week low of 0.7170 has reached intra-day highs at 0.7225 so far.

Chinese data and a weaker US dollar have buoyed the AUD

The AUD/USD has managed to pick up about 0.7% on the day so far to regain lost ground after dropping about 2.5% over the previous two days. A set of upbeat Chinese macroeconomic figures and the US dollar’s downside correction are supporting Aussie’s rebound.

Earlier today, Chinese data has beaten expectations with industrial production growing at a 7.5% pace year-on-year and retail consumption expanding at a 6.7% yearly pace in February.

Beyond that, the moderate reversal posted by the US dollar, with the Dollar Index about 0.5% down on the day on the back of retreating US Bond yields has contributed to the Australian dollar’s recovery.

AUD/USD testing resistance at 0.7225

From a technical point of view, the pair seems to be struggling to breach 0.7225area, where previous intra-day support meets the 100-day SMA.

Above here, the next potential targets might be 0.7245 (March 8 low) and the 200-day SMA, at 0.7310 before aiming towards March 10, 11 highs at 0.7365.

On the downside, a bearish reversal past 0.7200 would expose the mentioned two-week low at 0.7165 before eyeing Feb. 28 low at 0.7140 and Feb. 15, 24 lows at 0.7090/95.

Technical levels to watch

The US dollar is set to become potentially stronger for a bit longer, according to economists at Bank of America Global Research, who maintains a bullish bias on the USD over the coming weeks.

Hawkish Fed tone amid high inflation risks to supporting USD for a while longer

“Initiation of Fed hiking cycles has typically not boded well for USD prospects, but a hawkish Fed tone amid high inflation risks could end up supporting the dollar for a while longer if terminal rate expectations continue to rise against backdrop of persistent risk aversion and high commodity prices related to the war in Ukraine.”

"We recently downwardly-revised our EUR/USD forecast to 1.05 and continue to see downside potential over a short to medium-term horizon. However, downside risks should be contained absent a severe energy-shock-related recession in the euro-area preventing ECB normalization; or, alternatively, upside risks to the already-severe US inflation problem.”

Gold bugs could find themselves offloading length in a vaccuum. A break under the $1,914 mark would leave XAU/USD vulnerable to further downfalls, strategists at TD Securities report.

Massive impulse in gold demand could be coming to an end

“The massive impulse in gold demand from ETF and comex flows could be coming to an end, in line with historical analogs as safe-haven flows tend to be short-lived. However, the bar is also razor thin for substantial trend follower liquidations in gold, while consumer demand is now showing signs of weakness following the surge in prices.

“While a coordinated buying impulse from a broad group of gold traders had helped gold prices rise dramatically in past weeks, we could now see a coordinated reversal in flows. To start, a break below $1914/oz would catalyze a substantial selling program.”

“If the market has started to discount a future in which the growth shock could fade at a faster pace than the inflation shock, as we expected, then gold prices could be especially vulnerable to a more hawkish Fed profile, opening the door to a deeper consolidation.”

- EUR/USD gathers extra pace and surpasses the 1.1000 hurdle.

- Immediately to the upside aligns the weekly high at 1.1121.

EUR/USD adds to Monday’s advance and retakes the psychological barrier at 1.1000 the figure.

In case bulls remain in control, then EUR/USD could extend the rebound to the weekly top at 1.1121 (March 10) ahead of the temporary hurdle at the 20-day SMA at 1.1127. The selling pressure is seen alleviated once the pair clears the 6-month resistance line, today just below 1.1300.

The negative outlook for EUR/USD is expected to remain unchanged while below the key 200-day SMA, today at 1.1547.

EUR/USD daily chart

The Japanese yen has fallen 2.5% against the US dollar so far this year, with the bulk of the decline coming in the wake of Russia’s invasion of Ukraine. Beyond the clear USD advantage from nominal yield spreads, JPY faces other challenges. Subsequently, economists at Scotiabank expect the US/JPY to edge higher towards 120 in 2023.

JPY remains prone to weakness

“Rising US yields will likely draw more flows to US Treasury product from Japanese investors and support USD gains versus the JPY.”

“Aside from the direct implications of the war in Ukraine, we think that the risk of tenser China/Taiwan relations represents another potential headwind for the JPY in the future.”

“We are forecasting USD/JPY ending this year at 118 and at 120 in 2023 (compared with Bloomberg consensus estimates of 116 and 115 respectively). The risk to our forecast is clearly to the upside in the near to medium-term”

“The USD is looking overbought in the short run but we expect solid support on minor USD/JPY dips to the mid-116s and unless there is a clear reversal in the recent USD gains shortly, we think USD gains mean the technical path for the USD to push on towards 125 is becoming clearer.”

- GBP/USD staged modest recovery from the 1.3000 mark, or a fresh low since November 2020.

- Upbeat UK jobs report reaffirmed BoE rate hike bets and extended support to the British pound.

- Hopes for diplomacy in Ukraine, retreating US bond yields undermined the safe-haven greenback.

The GBP/USD pair added to its intraday recovery gains and climbed to a fresh daily high, around the 1.3075-1.3080 region during the early North American session.

A combination of factors assisted the GBP/USD pair to attract some buying near the 1.3000 psychological mark on Tuesday and stage a goodish rebound from the lowest level since November 2020. The British pound drew support from upbeat UK employment details, which cemented expectations that the Bank of England will hike interest rates at its meeting on Thursday. Apart from this, modest US dollar weakness provided an additional lift to the GBP/USD pair and contributed to the intraday positive move.

Despite the fact that the Russian bombardment of Ukrainian cities has intensified, the optimism over a diplomatic solution to end the war underpinned the global risk sentiment. This was evident from a generally positive tone around the equity markets, which, along with retreating US Treasury bond yields, weighed on the safe-haven greenback. That said, expectations for an imminent start of the policy tightening by the Fed should act as a tailwind for the buck and cap the GBP/USD pair.

The market seems convinced that the recent geopolitical developments might do little to hold back the US central bank from hiking its target funds rate to rein in inflationary expectations. This was seen as a key factor behind the recent sell-off in the US money markets, which pushed the yield on the benchmark 10-year government bond to its highest level since June 2019 on Monday. The fundamental backdrop favours the USD bulls and warrants caution before placing bullish bets around the GBP/USD pair.

On the economic data front, the US Bureau of Labor Statistics reported that the Producer Price Index (PPI) for final demand rose to 10% on a yearly basis in February from the 9.7% previous. Meanwhile, the annual Core PPI, which excludes food and energy prices, edged higher to 8.4% from 8.3% as against 8.7% estimated. Separately, the Empire State Manufacturing Index declined to -11.8 in March from 3.1 in February and missed the 7.25 expected by a big margin. The data failed to provide any meaningful impetus to the USD or the GBP/USD pair as the focus remains on fresh geopolitical developments.

Investors also seemed reluctant and might prefer to wait on the sidelines ahead of the key central bank event risks. The Fed is scheduled to announce the outcome of a two-day policy meeting during the US session on Wednesday. This will be followed by the BoE policy meeting on Thursday, which will play a key role in determining the next leg of a directional move for the GBP/USD pair. This further makes it prudent to wait for some follow-through buying before confirming that a near-term bottom.

Technical levels to watch

Downside pressure for the S&P 500 continues to increase. The index is expected to see a move below 4158 for a retest of the 4115 current cycle low, analysts at Credit Suisse report.

Initial resistance is seen at 4204

“We stay directly negative for a break of the 4158 recent low to clear the way for a retest of the late February low at 4115. Below here in due course can see support at the 38.2% retracement of the entire 2020/2021 bull trend at 3855/15.”

“Resistance is seen at 4204 initially, then 4248, with tougher resistance seen starting at the aforementioned 13-day moving average at 4274 and stretching up to the 4291/99 recent highs, which we look to continue to cap on a closing basis.”

EUR/USD is struggling to make much room through 1.10, stopping at 1.1020 to move back under the figure. Economists at Scotiabank note that the pair remains under pressure while below the 1.1050 area.

Support is seen at the 1.0930 daily low

“Since its test of 1.08, the EUR has been on an ascending trajectory, but the broader trend in the EUR remains negative and it may take a move past the mid-1.10s and more firmly a test of 1.11 to suggest a firmer reversal is in the cards.”

“The daily low of 1.0930 is support followed by a firmer floor at the figure.”

Analysts at Natixis seek to determine in what cases (for what origins of inflation) the central bank is justified in fighting inflation. They then seek to identify what this means for current monetary policy in the United States and the eurozone, especially after the sharp rise in commodity prices caused by the war in Ukraine.

What type of inflation should monetary policy respond to?

“Inflation is caused by: In the US, the decline in labour supply; insufficient production capacity for oil, metals, transport and semiconductors; rising profit margins; In the eurozone, only insufficient production capacity for commodities, transport and semiconductors; In both countries/regions, currently the war in Ukraine, ultimately the energy transition.”

“We see that the only valid reason for switching to a more restrictive monetary policy is the rise in profit margins in the US.”

- Silver continued losing ground on Tuesday and dropped to a two-week low, around mid-$24.00s.

- The technical set-up favours bearish traders and supports prospects for a further depreciating move.

- Any meaningful recovery back above the $25.00 mark could now be seen as a selling opportunity.

Silver added to the previous day's heavy losses and witnessed some follow-through selling for the third successive day on Tuesday. This also marked the third day of a negative move in the previous four and dragged spot prices to a fresh two-week low, around mid-$24.00s during the mid-European session.

The XAG/USD has now found acceptance below the key $25.00 psychological mark and seems vulnerable to extending its recent decline from the vicinity of the $27.00 mark or the highest level since June 2021. The outlook is reinforced by the fact that oscillators on the daily chart have been losing traction.

Some follow-through selling below the daily low, which coincides with the 50% Fibonacci retracement level of the $22.00-$26.95 strong move up, will reaffirm the bearish bias. The XAG/USD would then turn vulnerable to accelerate the downfall towards testing sub-$24.00 levels, or the 61.8% Fibo. level.

On the flip side, the 38.2% Fibo. level, around the $25.00 mark, now seems to act as immediate strong resistance. Any subsequent move up could be seen as an opportunity for bearish traders and runs the risk of fizzling out quickly near the $25.75-$25.80 region, or the 23.6% Fibo. level.

This is closely followed by the $26.00 round-figure mark, which if cleared decisively would shift the bias back in favour of bullish traders. The next relevant hurdle is pegged near the $26.40 region, above which the XAG/USD is more likely to make a fresh attempt to conquer the $27.00 mark.

Silver daily chart

-637829460115708560.png)

Levels to watch

- Russian invasion of Ukraine overshadows coronavirus-related jitters, which return to the table.

- US government bond yields on the rise fuel demand for the US dollar.

- Gold Price is technically poised to extend its decline in the upcoming sessions.

Gold Price has extended its slide to an almost two-week low of $1,920.51 a troy ounce, as hopes for an end to the Russia-Ukraine crisis weighed on commodity prices. At the same time, the US dollar is finding demand – helping the retracement on XAUUSD – on the back of soaring government bond yields ahead of the US Federal Reserve monetary policy decision on Wednesday. In turn, soaring yields undermine demand for high-yielding stocks.