- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 15-03-2011

FOMC mentions oil (concerns about supply contributed to price run-up) but not Japan. Fed will continue to monitor outlook. Economic outlook section is more upbeat/worried. Again says unemployment is elevated, inflation low but seeing pressure from energy/commods. Infl effects should be "transitory" but economy now is on "a firmer footing." More attention to infl - "will pay close attention" to evolution of infl and infl expectations. HH and business are expanding. Vote 10-0. Warsh was not present.

The S&P 500 recently pushed up to the 1280 line, but it stalled at that point and has since pulled back almost five points. Its inability to extend its rally has hampered the Dow and Nasdaq.

Volatility has started to creep back up amid the stock market's most recent slip.

The yen rose against all of its major counterparts as risk in Japan of radiation leaks from crippled nuclear power stations boosted speculation that insurers will repatriate assets to pay for earthquake damages.

Stocks sank, with the Nikkei 225 index posting its biggest two-day drop since 1987. The MSCI World Index fell 2.9 percent while the Standard & Poor’s 500 Index lost 2 percent.

Currencies of commodity-exporting countries plunged as speculation increased the explosions at the nuclear power station will damp demand for raw materials.

“The yen is strengthening across the board,” said Michael Woolfolk, senior currency strategist in New York at Bank of New York Mellon Corp., the world’s largest custodial bank, with more than $20 trillion in assets under administration. “We’re seeing follow-through yen buying off of renewed risk aversion emanating from Japan.”

The Swiss franc advanced to a record against the dollar on demand for a refuge as Japan’s Prime Minister Naoto Kan said his government is doing everything it can to contain the radioactive leaks following last week’s earthquake and tsunami. The euro pared losses against the U.S. currency even as European Central Bank President Jean-Claude Trichet called “insufficient” a package of economic-oversight rules adopted by European Union finance ministers.

The Federal Reserve will release its interest rate decision at the end of its meeting today. Policy makers are almost certain to fulfill their plan to buy $600 billion in Treasuries. How they finish the purchases and what they do next is a matter of disagreement.

The Nasdaq is at a new session high, but it continues to trade with a considerable loss. Large-cap tech issues like Apple (AAPL 345.58, -7.98), Oracle (ORCL 30.83, -0.76), Intel (INTC 20.15, -0.69), and Microsoft (MSFT 25.31, -0.38) have been the heaviest drags on the Nasdaq. In contrast, Netflix (NFLX 216.45, +15.25) has staged an impressive advance in the face of widespread weakness. Its strength is largely owed to an upgrade by analysts at Goldman Sachs.

Stocks continue to contend with stong selling interest, but they have managed to recoup some of what was lost during this morning's gap down. In fact, the Dow has actually climbed more than 60 points from its session low.

All 30 stocks that make up the Dow are currently in the red. Pfizer (PFE 19.64, -0.17) has managed to limit its loss to less than 1%, which actually makes it a relative leader among blue chips.

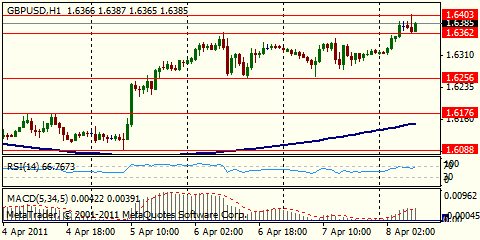

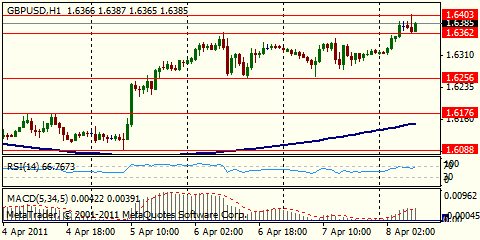

GBP/USD extends recovery to $1.6060 and holding firm. Key resistance remains up at $1.6087, with offers surrounding in the $1.6080/90 area. A break and clear above $1.6087 to relieve the underlying bearish tone, failure to push above will keep focus on the downside.

April WTI has fallen over $4 today from opening highs of $101.59 in early Asia to a low of $96.70, with recent rallies stalling into $98.20. A sustained break and close below $96.40 would be damaging to the recent run higher and point to a move below $92. But MENA tensions should be supportive for the oil price. Traders will be looking to tonight's API Data for direction on the WTI contract with analysts looking for a 2.1 million barrel build for the week ending 11 March. April crude trades around $97.47.

EUR/USD $1.3700, $1.3750, $1.3790, $1.3800, $1.3950, $1.3965

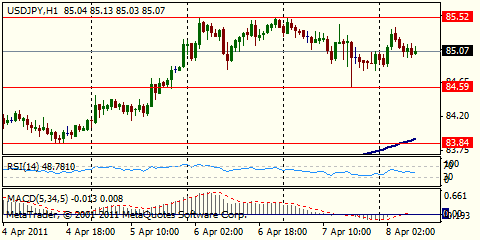

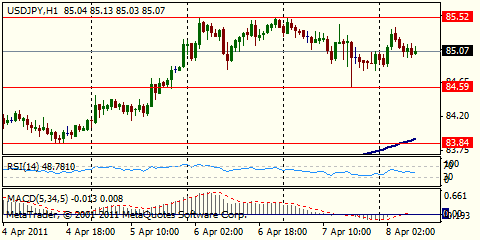

USD/JPY Y80.60, Y81.00, Y81.50, Y82.00, Y82.30, Y82.50, Y83.00

GBP/USD $1.6300

USD/CHF Chf0.9210, Chf0.9320

AUD/USD $0.9950

AUD/JPY Y83.20, Y83.30

AUD/CHF Chf0.9265

U.S. stocks were headed for a major sell-off at the start of trading Tuesday, following an 11% drop in Japan's leading index in the wake of a nuclear crisis caused by last week's earthquake.

Japan's Nikkei index ended down nearly 11%, as the crisis at the Fukushima Daiichi nuclear power plant deepened. The index was down as much as 14% during the session before recovering at the close.

Japanese Prime Minister Naoto Kan said the risk of radioactive material leaking from the crippled plant was very high, and a government spokesman warned people within 18 miles of the facility to stay indoors.

Among the U.S. stocks getting hammered during premarket trading, shares of General Electric (GE, Fortune 500) fell more than 4.6% after dropping earlier nearly 9%. The Japanese nuclear plant that exploded on Saturday is equipped with a GE-designed reactor.

"The U.S. market is pricing in a worst-case scenario with the nuclear situation," said Mark Luschini, chief investment strategist at Janney Montgomery Scott. "The concerns about radiation, and what that could mean for loss of life, could make this a more globalized crisis rather than a centralized disaster," he added.

Advanced Micro Devices, (AMD, Fortune 500) Motorola Mobility (MMI), AIG (AIG, Fortune 500), US Bancorp (USB, Fortune 500) and Capital One (COF, Fortune 500) were the biggest U.S. decliners in premarket trading.

Economy: In the United States, the Federal Reserve is scheduled to release its policy statement in the afternoon.

The central bank's Federal Open Market Committee is not expected to discuss any changes to interest rates or its asset purchase program, according to analysts at Brown Brothers Harriman.

After trading starts, investors will get a report on the housing market from the National Association of Home Builders.

Overnight, the Nikkei 225 fell 10.55% at 8605.15, after posting a low of 8227.63 at one point (was off 14.5% at the lows), with a massive 4.16 billion shares changing hands. The Nikkei is now down 15.9% year-to-date and is back at levels last seen in early April 2009.

On March 10, 2009 a few days after the S&P 500 bottomed at 666.92 March 6, 2009, the Nikkei posted a low of 7021.28, which is seen as the next larger support level for the index.

Gold continues to collapse as large scale liquidation takes place following the break of $1400. As a result the metal sinking to $1381. Spot currently trades around $1385.

Data released

06:30 France CPI (February) unadjusted 0.5% 0.5% -0.2%

06:30 France CPI (February) unadjusted Y/Y 1.7% 1.7% 1.8%

06:30 France HICP (February) Y/Y 1.9% 1.9%

10:00 Germany ZEW economic expectations index (March) 14.1 15.5 15.7

The yen rose against most of its major counterparts as increased risk in Japan of radiation leaks from a crippled nuclear power station boosted speculation investors there will bring home overseas assets.

The dollar and Swiss franc advanced on demand for a refuge as Japan’s Prime Minister Naoto Kan said his government is doing everything it can to contain the radioactive leak at Tokyo Electric Power Co.’s Fukushima Dai-Ichi plant following last week’s earthquake and tsunami.

The euro remained lower versus the dollar as German investor confidence unexpectedly fell. The ZEW Center for European Economic Research said its index of German investor and analyst expectations dropped to 14.1 this month from 15.7 in February. Economists had expected a gain to 15.9.

“Sentiment, not only for Japan but for the whole of Asia, is weak at this stage,” said Daisuke Uno, chief strategist in Tokyo at Sumitomo Mitsui Banking Corp.

Japan’s stricken Dai-Ichi nuclear power plant was rocked by two further explosions and a fire today as workers struggled to avert the risk of a meltdown.

A hydrogen blast hit the plant’s No. 4 reactor, where Tokyo Electric Power Co. earlier reported a blaze, Japan’s Chief Cabinet Secretary Yukio Edano said at a briefing. Four of the complex’s six reactors have been damaged by explosions after cooling systems failed when they were wrecked by the magnitude 9 earthquake and deadly tsunami.

“Foreign investors are very sensitive to the nuclear issue,” said Kengo Suzuki, a currency analyst at Mizuho Securities Co. “People are buying the dollar as a safe haven and may seek a refuge in the Swiss franc too.”

Further gains in the yen may be limited as the Bank of Japan pumps more money into financial markets, according to analysts at BNP Paribas SA.

The BOJ added 5 trillion yen to the financial system in a one-day operation today. BOJ Governor Masaaki Shirakawa has pledged to keep pouring cash into the economy to stabilize markets. The bank injected 15 trillion yen ($6 billion) yesterday and doubled its asset-purchase program to 10 trillion yen, an increase that’s about one-tenth the size of the Fed’s program of buying Treasuries.

EUR/USD fell from $1.3950 to $1.3852 before recovered to $1.3895. rate failed to break above $1.3900 again and retreated to current $1.3875.

GBP/USD fell from $1.6135 to $1.5972. Currently rate holds around $1.6010.

USD/JPY held within the Y81.20/Y82/00 range before eased further to Y81.15.

At 1230GMT the Empire State Index is scheduled to release and expected to increase to a reading of 16.0 in March after also rising in February.

At 1300GMT the latest Treasury International Capital System (TICS) data come.

The decision and statement from the latest FOMC meeting is due at 1815GMT.

Federal Reserve policy makers are almost certain to fulfill their plan to buy $600 billion in Treasuries, a survey of economists shows. How they finish the purchases and what they do next is a matter of disagreement as the Fed meets today.

“We only need some hawkish news out of the U.S., or some positive sentiment, for the dollar to turn around,” said Matthew Brady at JPMorgan Chase & Co. in Sydney. “In the medium term, I am positive for the U.S. dollar.”

- OPEC Feb crude output down 95 kbd m/m to 30.05 mbd

- Feb Libya supply down 200 kbd,partly offset by Gulf states

- OPEC spare capacity ex-Libya at two-year low of 4.08 mbd

- Hikes estimated 1Q oil demand by 300 kbd to 89.0 mbd

FTSE-100 suffered a minor test of the key 200-day moving average at 5,609.7 and Fibonacci level at 5,603.2 (38.2% of the July 2010 to Feb 2011 rally) before staging a bounce.

Both the CAC-40 and Xetra-DAX remain below their 200-day moving average's at 6,582 and 3,788.7, respectively.

Oil prices break through $98.00 as equities continue to get down and broad based dollar strength. April crude falls to $97.81 before bouncing back through $98.10. Support below lies at $97.00.

EUR/USD $1.3700, $1.3750, $1.3790, $1.3800, $1.3950, $1.3965

USD/JPY Y80.60, Y81.00, Y81.50, Y82.00, Y82.30, Y82.50, Y83.00

GBP/USD $1.6300

USD/CHF Chf0.9210, Chf0.9320

AUD/USD $0.9950

AUD/JPY Y83.20, Y83.30

AUD/CHF Chf0.9265

The yen rose against all of its 16 major counterparts as Japan’s Prime Minister Naoto Kan said the danger of further radiation leaks from a crippled nuclear power station is increasing, boosting speculation domestic investors will repatriate overseas assets.

The decision and statement from the latest FOMC meeting is due at 1815GMT although market expectations are for nothing major to come out of the meeting. MNI's Steve Beckner writes Monday there has been a subtle shift in Fed officials' thinking and commentary on the economy and inflation -- not just a more upbeat tone on the outlook for growth and jobs, but also slightly more acknowledgement of public inflation concerns.

The 17-nation currency rose for a second day against the dollar after regional leaders agreed during the weekend to widen the scope of a rescue fund aimed at resolving the debt crisis and cut the cost of loans to Greece.

The ECB’s governing council is scheduled to meet March 17.

The yen erased a gain against the dollar as Japan’s central bank said it will add 15 trillion yen ($183 billion) to the financial system and increase its asset-purchase program following last week’s earthquake.

BOJ Governor Masaaki Shirakawa and his board also doubled the facility that buys assets from government bonds to exchange- traded funds to 10 trillion yen. Besides the 15 trillion yen of emergency funds deployed, the central bank offered to buy 3 trillion yen of government bonds from lenders in repurchase agreements starting March 16.

Borrowing costs were cut near zero in 2008 as officials sought to revive growth and end deflation. Finance Minister Yoshihiko Noda said earlier today that he’s closely watching the foreign exchange, stock and Japanese bond markets.

Australia’s dollar slid. Traders have cut bets the Reserve Bank of Australia will raise interest rates over the next year.

The main EMU data release will be the German ZEW survey, at 1000GMT, where the expectations index is expected to edge up to a reading of 16.0 and the current conditions index is expected to edge up to 85.4.

US data starts at 1145GMT with the weekly ICSC-Goldman Store Sales data. This is followed at 1230GMT by the Import & Export Price Index as well as the Empire State Index, which is expected to increase to a reading of 16.0 in March after also rising in February. The Empire index has been lagging other manufacturing surveys which have been trending up. The weekly Redbook Average then follows, at 1255GMT, shortly followed at 1300GMT by the latest Treasury International Capital System (TICS) data. US data continues at 1400GMT with the NAHB Housing Market Index, while at the same time, US Treasury Secretary Tim Geithner testifies on the future of housing finance before the Senate Banking Committee in Washington.

The decision and statement from the latest FOMC meeting is due at 1815GMT although market expectations are for nothing major to come out of the meeting. MNI's Steve Beckner writes Monday there has been a subtle shift in Fed officials' thinking and commentary on the economy and inflation -- not just a more upbeat tone on the outlook for growth and jobs, but also slightly more acknowledgement of public inflation concerns.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.