- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 15-02-2023

January month employment statistics from the Australian Bureau of Statistics, up for publishing at 00:30 GMT on Thursday, will be the immediate catalyst for the AUD/USD pair traders.

Market consensus suggests that the headline Unemployment Rate may remain unchanged at 3.5% on a seasonally adjusted basis whereas Employment Change could rise by 20.0K versus the previous contraction of 14.6K. Further, the Participation Rate is expected to remain unchanged at 66.6% prior level.

It should be noted that Australia Consumer Inflation Expectations for February, expected to remain unchanged at 5.6%, could also entertain AUD/USD traders around 00:00 GMT on Thursday.

Considering the Reserve Bank of Australia (RBA) policymakers’ struggle to defend the hawkish bias, as well as the fears of higher inflation, today’s Aussie jobs report become crucial for the AUD/USD pair traders.

Ahead of the event, analysts at Westpac said,

Illness-related absences and a ‘catch-up’ in abnormally low summer leave should see employment growth print slightly below trend in January (Westpac forecast 15K, market 20K, rebounding from December’s -15K). With participation holding flat, Westpac expects the unemployment rate to hold at 3.5%, in line with consensus.

On the same, FXStreet’s Valeria Bednarik mentioned,

Indeed, sharp deviations one way or the other could trigger near-term volatile moves in AUD/USD. But after the dust settles, the pair will likely return to sentiment-related trading, with the focus on the US Dollar and whatever speculative interest believes about the United States Federal Reserve.

How could the data affect AUD/USD?

AUD/USD remains sidelined near 0.6900 while licking its wounds near the weekly low, following the biggest daily slump in a fortnight, as the Aussie pair traders await crucial jobs report amid sluggish market hours.

Although the pre-data anxiety probes AUD/USD bears amid hopes of upbeat Aussie data, the risk barometer pair is likely to remain depressed, after showing an initial reaction to the actual outcome, unless witnessing too optimistic Aussie employment numbers. The reason could be linked to comparatively more hawkish Federal Reserve (Fed) bets, backed by stronger US data.

Technically, a U-turn from the 3.5-month-old previous support line keeps AUD/USD bears hopeful but the 50-DMA and the 200-DMA challenge the Aussie pair’s further downside around 0.6885 and 0.6800 respectively.

Key Notes

Australian Employment Preview: Better figures in the docket, doubtful impact on RBA

AUD/USD licks its wounds near 0.6900 ahead of Aussie employment data

About the Employment Change

The Employment Change released by the Australian Bureau of Statistics is a measure of the change in the number of employed people in Australia. Generally speaking, a rise in this indicator has positive implications for consumer spending which stimulates economic growth. Therefore, a high reading is seen as positive (or bullish) for the AUD, while a low reading is seen as negative (or bearish).

About the Unemployment Rate

The Unemployment Rate released by the Australian Bureau of Statistics is the number of unemployed workers divided by the total civilian labor force. If the rate hikes, indicates a lack of expansion within the Australian labor market. As a result, a rise leads to weaken the Australian economy. A decrease of the figure is seen as positive (or bullish) for the AUD, while an increase is seen as negative (or bearish).

- EUR/USD seeks clear direction after falling the most in a week.

- US data renew hawkish Fed concerns and propel Treasury bond yields, US Dollar.

- ECB’s Lagarde reiterates the call for 50 bps rate hike in March.

- Second-tier data/events eyed for fresh impulse, risk catalysts are the key.

EUR/USD makes rounds to 1.0690 while struggling to extend the late Wednesday’s corrective bounce during early Thursday. That said, the major currency pair dropped the most in a week after the US data propelled the Fed bets and allowed the US Treasury bond yields, as well as the US Dollar, to refresh multi-day high. However, the recently hawkish comments from European Central Bank (ECB) President Christine Lagarde seemed to have put a floor under the prices.

That said, the US 10-year Treasury bond yields rose to a fresh six-week high and the US Dollar Index (DXY) also jumped to a 1.5-month top after the key US data hints at a further increase in the Federal Reserve’s (Fed) interest rates.

On Wednesday, US Retail Sales growth jumped to 3.0% YoY in January versus 1.8% expected and -1.1% prior. Further, The Retail Sales ex-Autos grew by 2.3% in the same period, compared to analysts' estimate of +0.8%. On the same line, the NY Empire State Manufacturing Index for February improved to a three-month high of -5.8 versus -18.0 expected and -32.9 market forecasts. Alternatively, the US Industrial Production marked 0.0% MoM figures for January, compared to analysts’ estimate of 0.5% and -0.7% previous readings, but failed to push back the hawkish bias surrounding the Federal Reserve’s (Fed) next move.

Following the data, the market’s bets on the Fed’s next moves, as per the FEDWATCH tool of Reuters, suggest that the US central bank rates are to peak in July around 5.25% versus the December Federal Reserve prediction of 5.10% top rate.

On the other hand, ECB’s Lagarde stated that even though most measures of longer-term inflation expectations currently stand at around 2%, these measures warrant continued monitoring. The policymaker mentioned, “Price pressures remain strong and underlying inflation is still high,” while showing her intention to lift rates by 50 basis points at the March meeting.

Amid these plays, Wall Street benchmarks closed with mild gains, following the day-end recovery, but S&P 500 Futures hesitate in following suit.

Looking forward, the ECB’s monthly bulletin and multiple ECB speakers can offer an entertaining day together with the second-tier US data concerning the housing market, industrial activity and producer prices.

Technical analysis

EUR/USD seesaws between the 21-day Exponential Moving Average (EMA) and the 50-day EMA, respectively near 1.0760 and 1.0680 as bears keep the reins.

“US Treasuries held by foreigners increased for a second consecutive month in December as yields started to decline from their peaks, becoming more attractive to offshore investors,” per the latest report from the US Treasury Department published on Wednesday reported Reuters.

Key quotes

Foreign holdings rose $7.314 trillion in December, up from $7.268 trillion in the previous month.

Treasury holdings in December, however, were 5.5% lower from the December 2021 level of $7.740 trillion.

Still, buying in both December and November paled in comparison to selling in October and September.

Japan remained the largest non-U.S. holder of Treasuries, with $1.076 trillion in December, down slightly from $1.082 trillion in the prior month.

Data also showed holdings of China, the second biggest non-U.S. holder of Treasuries, fell to $867.1 billion in December, from $870.2 billion in November.

China's holdings were the lowest since May 2010 when it had $843.7 billion.

Data also showed foreign inflows of $54.98 billion in US stocks in November, the largest since December 2020.

Market implications

The news backs the recent run-up in the US Treasury bond yields. That said, the US 10-year Treasury bond yields stay firmer around the six-week high, which in turn favors the US Dollar and weighs on the market sentiment.

Also read: Forex Today: US Dollar strength continues amid resilient American economy

- GBP/JPY bulls failed to conquer the 200-day EMA at 161.81 and erased their earlier gains.

- GBP/JPY Price Analysis: A bearish flag emerged at the 1-hour chart, which paved the way for further downside.

The GBP/JPY retreats after reaching weekly highs at 161.46 and drops beneath 161.30 as Thursday’s Asian Pacific session begins. Even though the GBP/JPY remains upward biased unless it breaks crucial support levels. At the time of writing, the GBP/JPY exchanges hands at 161.27, below its opening price by a minuscule 0.05%.

From a daily chart perspective, the GBP/JPY is neutral biased, though an uptick toward 161.81, which would put into play the 200-day Exponential Moving Average (EMA). A break of resistance and the 100-day EMA at 161.98 would be next, ahead of 162.00. Once all those supply areas are hurdled, the GBP/JPY would rally towards 163.00, ahead of the December 20 daily high at 167.02.

In the meantime, the GBP/JPY 1-hour chart suggests the pair as neutral biased, though slightly tilted downwards, as a bearish flag emerged. In addition, the Relative Strength Index (RSI) turned bearish, while the Rate of Change (RoC) depicted that buying pressure waned.

Hence, the GBP/JPY Is poised downwards. The first demand zone to be tested would be the 50-EMA at 161.04. A breach of the latter and the GBP/JPY pair would fall to the bottom of the bearish flag at 160.72. Once cleared, GBP/JPY prices would be driven toward the 100-EMA at 161.49, ahead of the 200-EMA At 159.95.

GBP/JPY 1-Hour chart

GBP/JPY Key technical levels

“US Treasury Department will exhaust its ability to pay all its bills sometime between July and September unless the current $31.4 trillion cap on borrowing is raised or suspended,” warned the US Congressional Budget Office (CBO) on Wednesday per Reuters.

The CBO released its annual budget outlook together with a report suggesting that a historic federal debt default could occur before July if revenue flowing into the Treasury in April - when most Americans typically submit annual income tax filings - lags expectations, reported Reuters.

“Over the long term, our projections suggest that changes in fiscal policy must be made to address the rising costs of interest and mitigate other adverse consequences of high and rising debt,” said CBO Director Phillip Swagel.

Key quotes

If the debt limit is not raised or suspended before the extraordinary measures are exhausted, the government would be unable to pay its obligations fully.

As a result, the government would have to delay making payments for some activities, default on its debt obligations, or both.

Annual US budget deficits will average $2 trillion between 2024 and 2033, approaching pandemic-era records by the end of the decade - a forecast likely to stoke Republican demands for spending cuts.

CBO estimated an unemployment rate of 4.7% this year, far above the current 3.4%.

Market implications

The news could be considered a catalyst for late Wednesday’s corrective bounce in the market sentiment. However, strong US data and hawkish Fed bets keep the risk barometer AUD/USD pair depressed.

Also read: AUD/USD licks its wounds near 0.6900 ahead of Aussie employment data

- GBP/USD consolidates the biggest daily loss in a fortnight around weekly low.

- Ascending trend lines from January and last November precede 200-DMA to challenge bears.

- U-turn from 50-DMA, bearish MACD signals favor sellers.

GBP/USD stays defensive around 1.2030, bouncing off the weekly low, as it licks the previous day’s wounds during early Thursday.

In doing so, the Cable pair rebounds from a six-week-old support line after falling the most in a fortnight. The recovery moves, however, remain elusive considering the quote’s sustained U-turn from the 50-DMA and the bearish MACD signals.

It’s worth noting, though, that the ascending support lines from early January and mid-November 2022, respectively around 1.2000 and 1.1985 in that order, restrict the short-term downside of the GBP/USD pair.

Following that, the 200-DMA level of 1.1940 gains the major attention of the bears targeting the mid-November 2022 bottom around 1.1760. However, the previous monthly low surrounding 1.1840 could offer an intermediate halt during the fall.

Meanwhile, GBP/USD rebound recovery remains elusive unless crossing the 50-DMA hurdle of near 1.2180.

In a case where the GBP/USD price remains firmer past 50-DMA, a one-month-old horizontal resistance near 1.2260 will be in focus as it holds the key for the Cable pair’s run-up toward the multiple tops marked since late 2022 around 1.2450.

Overall, GBP/USD is likely to remain depressed but the downside room appears limited.

GBP/USD: Daily chart

Trend: Limited downside expected

- AUD/USD consolidates the biggest daily loss in a fortnight at weekly low.

- Strong US data saw Treasury bond yields, US Dollar run-up.

- RBA’s Lowe fails to impress hawks despite signaling inflation fears.

- Australia employment data for January appears the key for immediate directions.

AUD/USD seesaws around 0.6900 as it struggles to defend late Wednesday’s corrective bounce off the weekly low ahead of the key Aussie jobs report. That said, the Aussie pair dropped the most in two weeks the previous day amid broad US Dollar strength, backed by upbeat data, as well as the Reserve Bank of Australia (RBA) Governor Philip Lowe’s failure to convince the policy hawks.

That said, US Retail Sales growth jumped to 3.0% YoY in January versus 1.8% expected and -1.1% prior. Further, The Retail Sales ex-Autos grew by 2.3% in the same period, compared to analysts' estimate of +0.8%. On the same line, the NY Empire State Manufacturing Index for February improved to a three-month high of -5.8 versus -18.0 expected and -32.9 market forecasts. Alternatively, the US Industrial Production marked 0.0% MoM figures for January, compared to analysts’ estimate of 0.5% and -0.7% previous readings, but failed to push back the hawkish bias surrounding the Federal Reserve’s (Fed) next move.

At home, RBA’s Lowe Lowe said inflation is way too high and that it needs to come down. The policymaker also stated, “We're still unsure how far rates can go,” and added, “Rates have not yet reached their peak.”

It should be noted that the latest round of the US data, especially in the last two weeks, have been upbeat enough to renew the calls for a higher Fed rate, which in turn propel the US Treasury bond yields and the US Dollar. The same, however, exert downside pressure on the market’s sentiment and the riskier assets like the Australia Dollar and equities.

Amid these plays, Wall Street closed mild gains after the day-end recovery whereas the US 10-year Treasury bond yields stay firmer around the six-week high, which in turn portrays the risk-off mood and weighs on the AUD/USD price.

Given the US data backing the hawkish concerns surrounding the Federal Reserve (Fed) and the RBA’s inability to convince the policy hawks, AUD/USD traders will pay attention to January’s employment numbers for fresh impulse. That said, the headline Employment Change is likely to reverse the previous contraction of 14.06K with an addition of 20.0K while the Unemployment Rate is expected to remain unchanged at 3.5%. As a result, the Aussie pair may extend the latest corrective bounce in case the scheduled jobs report match or surpass the anticipated positive figures.

Technical analysis

Although a U-turn from the 3.5-month-old previous support line keeps AUD/USD bears hopeful, the 50-DMA and the 200-DMA challenge the Aussie pair’s further downside around 0.6885 and 0.6800 respectively.

- USD/CHF faced solid resistance at around 0.9260s, the top of a trading range.

- The USD/CHF pair is neutral-downward biased from a daily chart perspective.

- In the short term, the USD/CHF might fall to the bottom of the range, below 0.9200.

The US Dollar (USD) continued to strengthen vs. the Swiss Franc (CHF) on Wednesday, bolstered by US economic data that supported speculations for further aggression by the Federal Reserve (Fed). Also, Fed officials' hawkish commentary increased the likelihood of rates being hiked above the 5% threshold. Hence, the USD/CHF is trading at 0.9239 after hitting a daily low of 0.9209.

The USD/CHF pair daily chart portrays the major as neutral to downward biased, though it appears to have bottomed at around the YTD low at 0.9059, and since that day, the pair edged towards 0.9290. The USD/CHF traded sideways within the 0.9130-0.9260 range, unable to conquer the 0.9300 figure, which, once cleared, could open the door to test the long-term daily Exponential Moving Averages (EMAs) at around 0.9397, 0.9460.

In the short term, as shown by the 4-hour chart, the USD/CHF is range-bound, seesawing around the top of the range at 0.9260, with sellers leaning into that area. If the USD/CHF tumbles below the confluence of the 20/50-Exponential Moving Averages (EMAs) at 0.9214/21, that would send the USD/CHF pair sliding toward the 0.9200 figure before reaching the lows of February 14 at 0.9135. A decisive breach and the 0.9100 figure would be put into play.

USD/CHF 4-Hour chart

USD/CHF Key technical levels

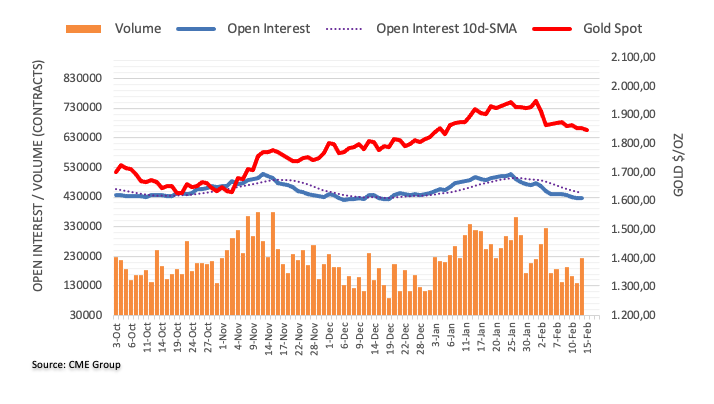

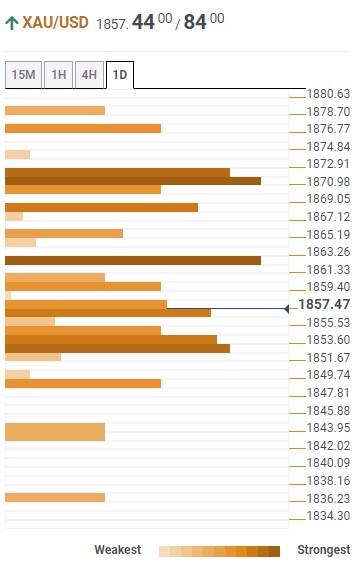

- Gold price sinks to fresh bear cycle lows and there could be more to come from the Gold price bears.

- US Dollar is on the bid following United States of America data that is firming.

- US Retail Sales, services and Consumer Price Index all came in hot in a series of releases of late, flipping the script on the Federal Reserve pivot narrative.

Gold price was pressured on a firmer US Dollar on Wednesday. The United States Retail sales jump 3% in January, smashing expectations despite an inflation increase that might have otherwise kept consumers' hands in their pockets. Gold price dropped, popped, dropped again and is now slowly correcting from the day's lows and has so far held in familiar post-data ranges around $1,835.

United States Retail Sales data

With the latest data showing that retail sales rebounded more than expected in January, and rose the most since March 2021, highlighting the strength of the economy, the US Dollar has still not been able to take off which is giving the Gold bulls a lifeline currently:

The data arrived as follows:

- US Retail Sales Advance (MoM) Jan: 3.0% (est 2.0%; prev -1.1%).

- US Retail Sales Ex Auto (MoM) Jan: 2.3% (est 0.9%; prev -1.1%).

- US Retail Sales Ex Auto And Gas Jan: 2.6% (est 0.9%; prev -0.7%).

- US Retail Sales Control Group Jan: 1.7% (est 1.0%; prev -0.7%).

The Retail Sales data suggest a healthy rise in Personal Consumption for the month, which is likely to be reflected in a more optimistic round of economists’ estimates for the United States of America's first quarter Gross Domestic Product. Manufacturing production also lifted 1.0% MoM in January, and the Empire Manufacturing index rose to -5.8 (-18.0 previously).

''It was not all good news today insofar as the US industrial production data for January recorded a worse than expected flat m/m, with a drop in utilities dragging down was otherwise a better picture for manufacturing,'' analysts at ANZ Bank said.

'' Even so,'' the analysts added, ''the disappointment of the production data has not been enough to put much more than a small dent in the strength exhibited in January US labour and the retail sales data, particularly given the robustness demonstrated in this week’s US January Consumer Price Index inflation report.''

Federal Reserve outlook

On Tuesday, the annual Consumer Price Index inflation rate in the US slowed slightly to 6.4% in January from 6.5% in December, the lowest since October 2021 but above market expectations of 6.2%. The latest Federal Reserve commentary also underpinned that Federal Reserve policymakers largely backed more rate increases, fueling a bid in the greenback after what was an indecisive show from markets around the inflation data initially. The markets are starting to have second thoughts as to whether there will be cuts in 2023.

Federal Reserve rates currently stand at 4.5% to 4.75% but Fed board members' median projection foresaw interest rates peaking at 5.1% this year. However, interest rate futures markets have still priced a peak above 5.2%, based on late Tuesday's prices.

Federal Reserve officials have been mostly consistent in their warnings that rates are set to be higher for longer. ''On the back of the inflation report yesterday, Fed futures have already adjusted higher to reflect the risk of more Fed rate hikes this cycle,'' analysts at Rabobank explained.

''It is our view that the top of the target band for Fed funds will be 5.5%. Given that the market had cut it long USD positions at the end of last year and into January, the risk of a higher peak for Fed funds is suggestive of the potential for further USD gains into the middle of the year,'' the analysts added.

Gold price technical analysis

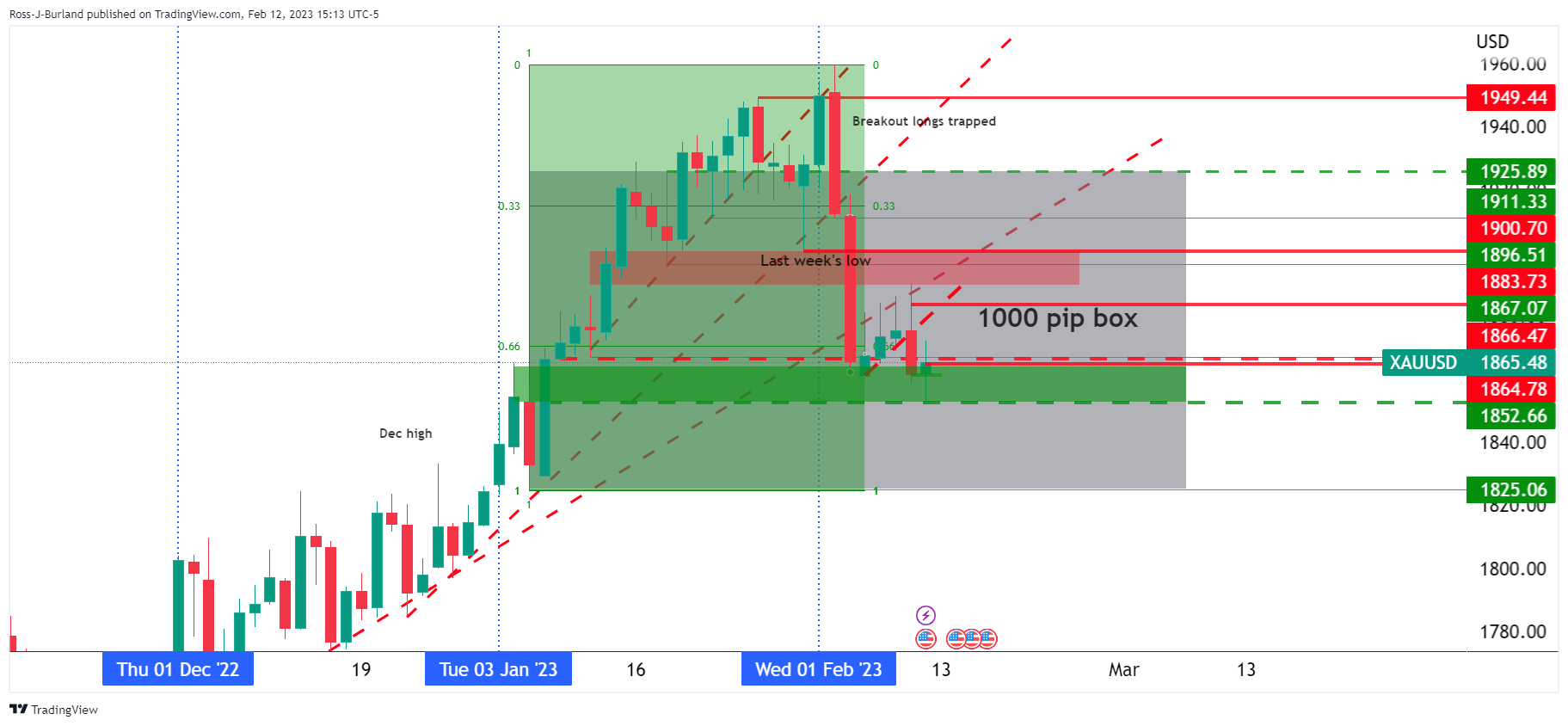

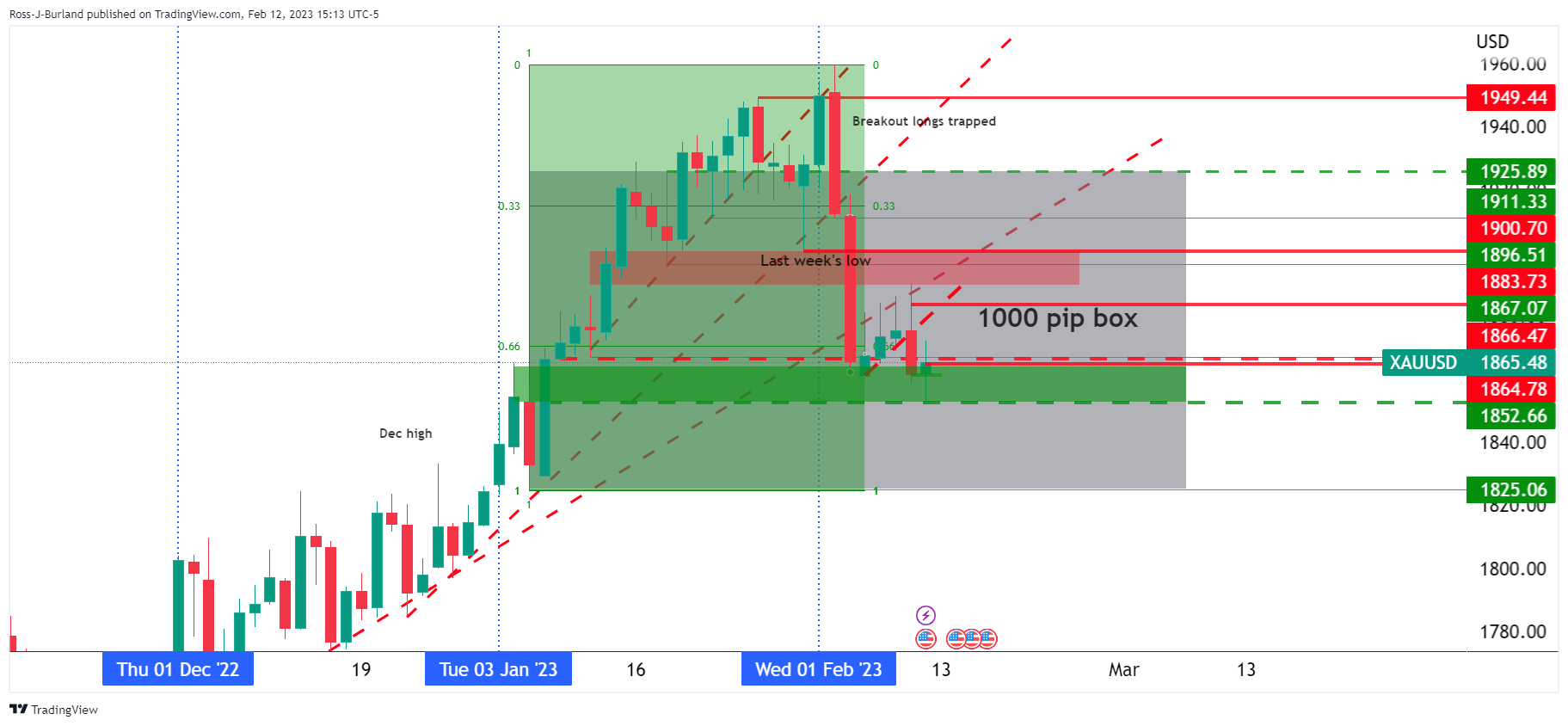

There is scope for a move in Gold price to the 1000 box destination this week as prior analysis has been targeting:

in prior Gold price analysis, it was stated that we were in the upper third of the 2023 range and on the backside of the first trendline that is broken and acting as a counter-trendline. A break of Gold price $1,925 was expected to open the risk of a move to test $1,896 and then $1,867 as the top of the lower third of the range that guarded a 1000 pip Gold price box low of $1,825:

The above chart was analysis drawn at the end of January and below is where we are up to date ahead of the week commencing 12 February open:

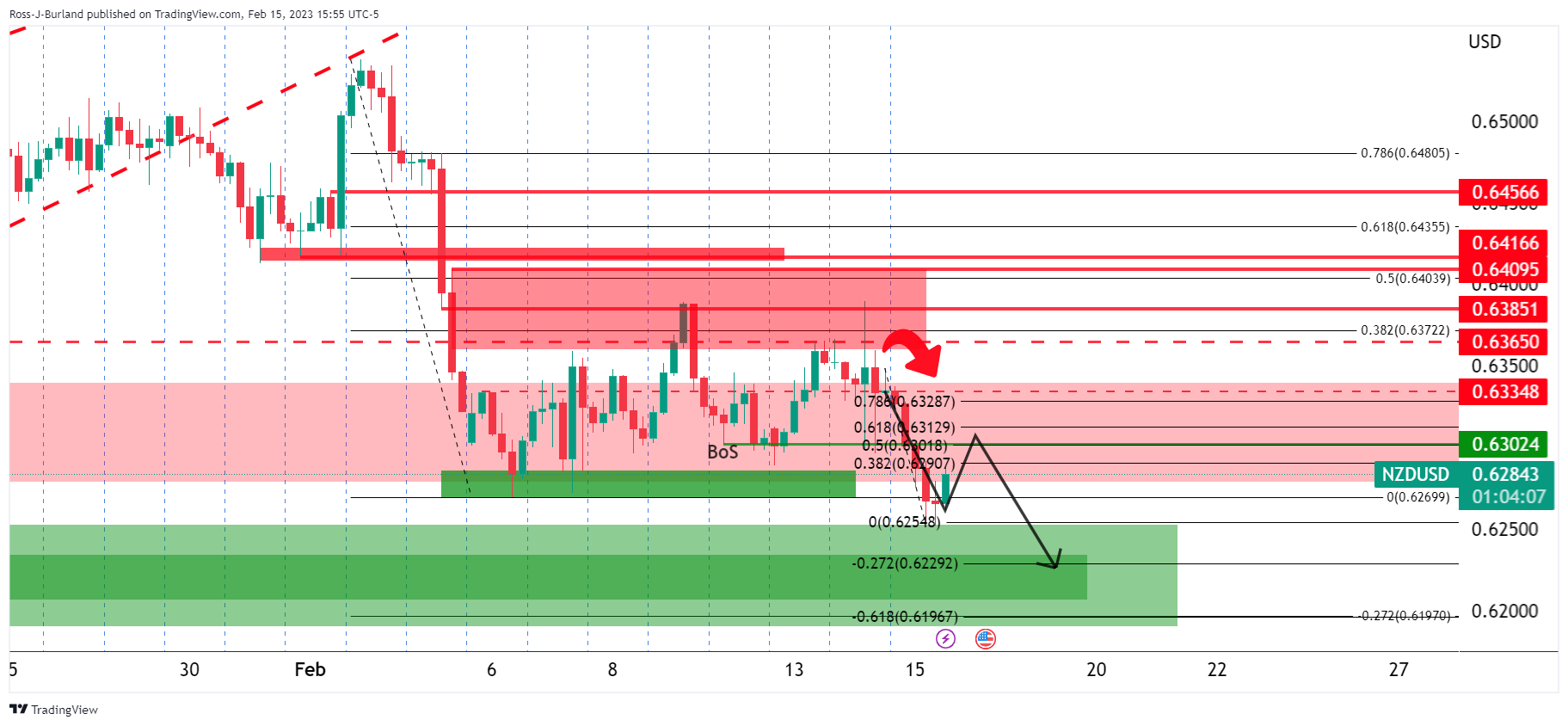

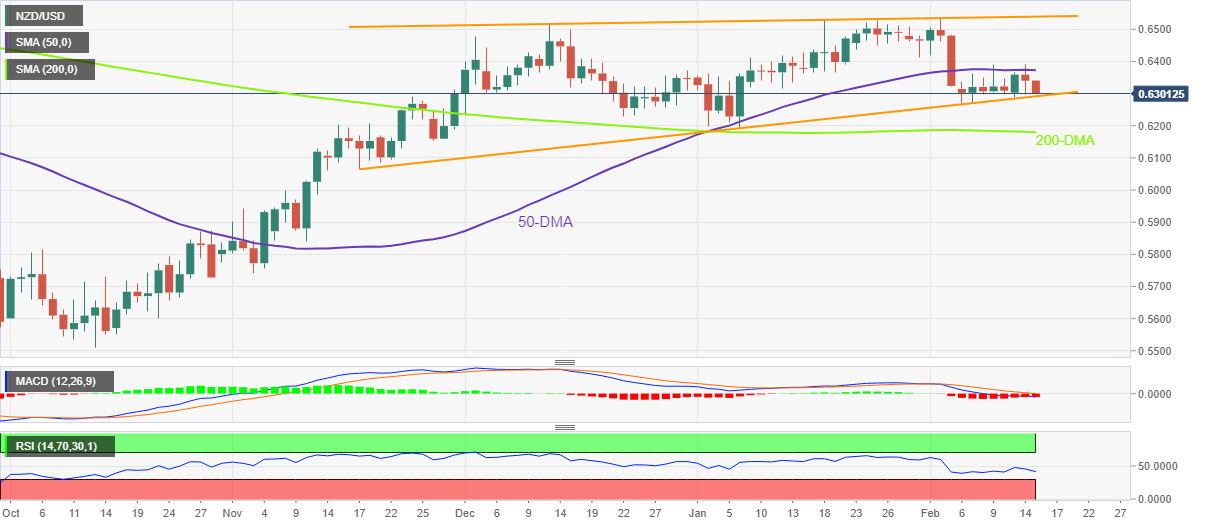

- NZD/USD bears target the low 0.62s following the break of structure.

- A bullish correction is in process currently, but if bears commit below 0.6300, then this correlates with near a 61.8% ratio.

NZD/USD is down on the day as we enter the end of the North American session as the markets tussle with the prospects of higher for longer inflation in the United States and watch the Fed pivot disappear over the horizon.

At the time of writing, NZD/USD is trading at 0.6280 and is down some 0.8% on the day after falling from a high of 0.6337 to a low of 0.6252. The US Dollar, as measured in the DXY index, broke to the topside in the wake of strong US Retail Sales on the back of the prior day's Consumer Price index. Both reports saw bond yields there ratchet up another notch which has played into the hands of risk-off assets and the greenback.

Analysts at ANZ Bank said, ''regular readers will be aware that we have for some time been worried that the USD might re-firm if interest rate expectations there started rising and expectations for late-2023 rate cuts were to fade, and that’s what seem to be playing out.''

''But at the same time, unlike last year’s USD surge, this time we don’t have other central banks going slow – with the European Central Bank and Reserve Bank of New Zealand both on track to hike by 50bp at their next meetings,'' the analyst explained further. ''That, and valuations, may cap (but perhaps not stop) USD upside, but counting on that could be risky.''

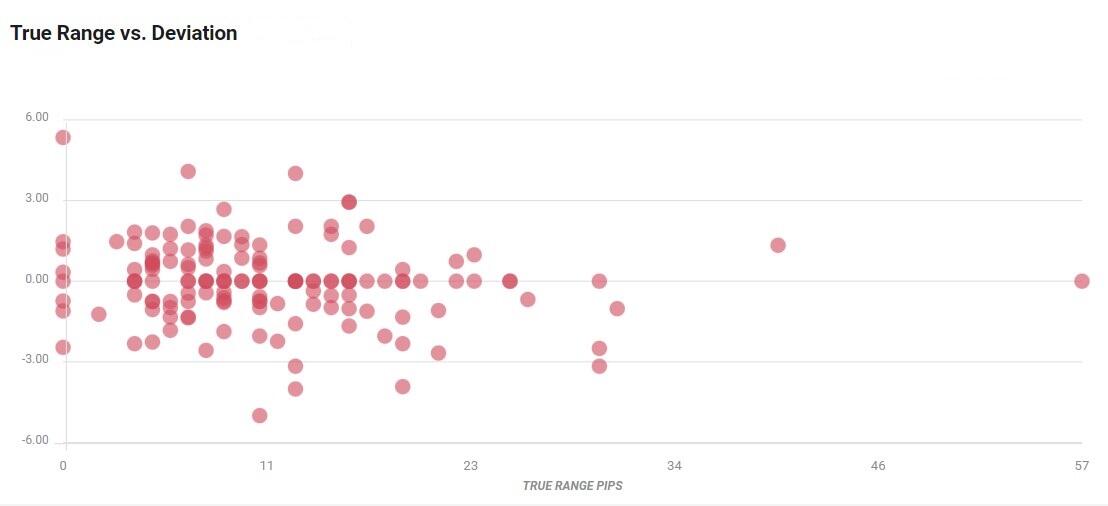

NZD/USD technical analysis

Meanwhile, there are seeing prospects of a move lower.

While below resistance, the odds are for a move into the low 0.62s following the break of structure. a correction is in process currently, but if bears commit, say below 0.6300, then a sell-off from the region of a 50%, 61.8% ratio could be on the cards for the day ahead.

- EUR/USD bulls are in play as they correct the recent slide.

- The dominant trend remains bearish while on the backside of the daily bullish cycle's support trend.

EUR/USD bears have been in play following a series of negative data for the pair on the US side. The pair fell this week in what has been a continuation trade for the shorts that broke the prior long-term trendline support:

EUR/USD daily chart

With the price now on the backside of the trendline, a bearish thesis is in play. The next target for the bears is in the 1.0670s with the 1.0520s eyed thereafter.

EUR/USD is building a case for such a move but a correction cannot be ruled out at this point:

EUR/USD H4 chart

On the four-hour chart, the price is correcting the recent slide and has come up to test the bear's commitments towards a 38.2% Fibonacci correction of the bearish impulse. The candle is strong and would be expected to be followed but a further higher low and closing high for the end of the day.

What you need to take care of on Thursday, February 16:

The US Dollar remained strong on Wednesday, with demand for the Greenback easing ahead of Wall Street's close as stocks bounced from their intraday lows.

The Greenback benefited from renewed concerns about the continued US Federal Reserve's monetary tightening spurring risk aversion. As American inflation eased just modestly in January, hopes for a Fed's pivot faded. The United States published Retail Sales on Wednesday, which surged by 3% MoM in January, much better than anticipated. The figure provided fresh impetus to the USD and kept stock markets on the back foot.

Earlier in the day, the UK reported that the annual CPI rose by 10.1% in January, easing from 10.5% in December, while core CPI was up 5.8% on a yearly basis from 6.3% previously. Easing inflation supports the case of an easIER path of tightening in the kingdom. GBP/USD is down to 1.2020.

European data missed expectations adding pressure on the Euro. Industrial Production contracted 1.7% YoY in December, while the Trade Balance in the same month posted a deficit of €18.1 billion. EUR/USD bottomed at 1.0660, now trading in the 1.0680 region

The AUD/USD pair fell to 0.6864 but recovered the 0.6900 threshold ahead of the close amid the stocks' bounce. Australian employment figures and inflation expectations coming up early Thursday.

USD/CAD trades at 1.3390, with the Canadian dollar benefiting from a crude oil prices comeback. WTI trades at $78.60 a barrel after falling to $77.25. The EIA reported a large build in US stocks, up to 16.283 million barrels in the week ended February 10.

USD/JPY trades at 134.15, sharply up in the day. Higher US government bond yields provided support alongside comments from Japan's Prime Minister Kishida earlier in the day. Kishida said that he expects the new Bank of Japan (BoJ) governor to keep the appropriate monetary policy, taking into account of economy, inflation and market situations.

Gold extended its February slide to $1,830.53 a troy ounce, now hovering around $1,836.

FTX bankruptcy judge rejects independent examiner appointment motion fearing $100 million loss

Like this article? Help us with some feedback by answering this survey:

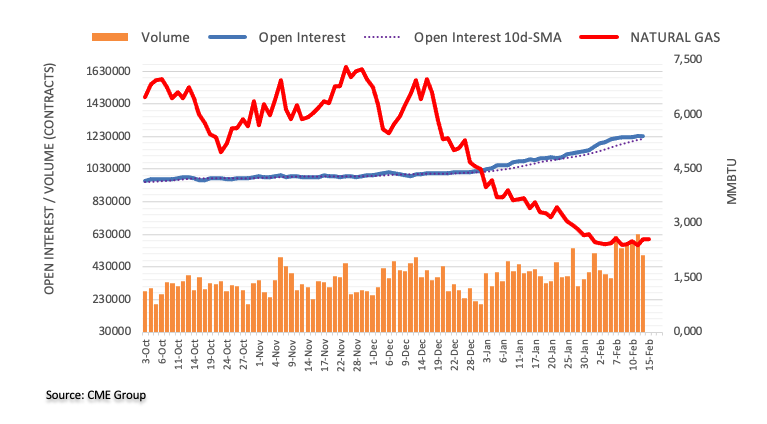

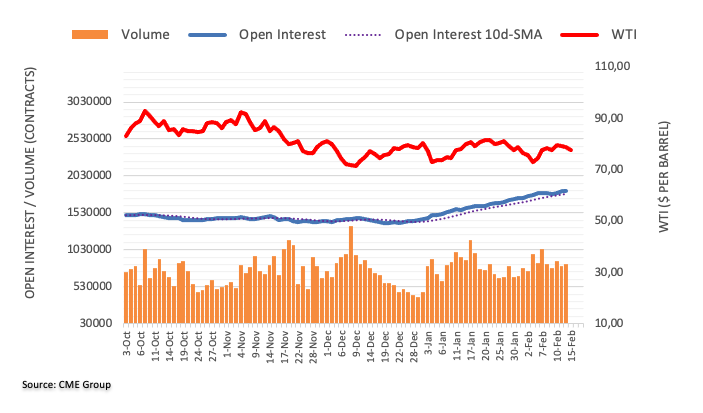

- WTI extended its losses to three consecutive days beneath $80.00 a barrel.

- US EIA reported that stockpiles had risen the most since June 2021.

- WTI Price Analysis: Subdued but it remains slightly tilted to the downside.

Western Texas Intermediate (WTI), the US crude oil benchmark, is extending its fall to three straight days of consecutive losses, weighed by crude oil inventories in the United States (US) jumping more than estimates. Speculations of further interest rate hikes by the US Federal Reserve (Fed) bolstered the greenback, a headwind for oil prices. At the time of writing, WTI is trading at $78.40.

WTI is climbing above the 50-day Exponential Moving Average (EMA) even though US crude oil inventories have risen the most since June 2021. The US Energy Information Administration (EIA) agency revealed that crude stockpiles increased by 16.3 million barrels, in the week of February 10, to 471.4 million barrels.

Crude inventories in Cushing, Oklahoma, a delivery hub for futures, jumped by 659K last week, while refinery crude fell by 383K barrels per day. Gasoline inventories advanced by 2.3 million barrels to 241.9 million, exceeding analysts’ estimates of a 1.5 million barrels rise. Distillate inventories which account for diesel and heating oil, dropped by 1.3 million to 119.2 million, vs. expectations for a 400K barrel increase.

Aside from this, US Retail Sales for January smashed expectations and exceeded estimates. Therefore, recent Fed hawkish commentary, following Tuesday’s CPI print and today’s data, sparked speculation that the Federal Reserve would continue to tighten conditions, a tailwind for the greenback.

WTI Technical analysis

Albeit WTI remains neutral to downward biased, it remains consolidated in the $77.30-$80.50 range. The Relative Strength Index (RSI) in the bullish territory is almost flat, portraying oil as rangebound. In contrast, the Rate of Change (RoC) portrays sellers gaining momentum. Therefore, mixed signals suggest caution is warranted.

For WTI to resume its uptrend, it will need to conquer $80.50, which would open the door to test the 100 and 200-day EMAs, each at $81.43 and $85.00. As an alternate scenario, oil prices would resume their downtrend, with a decisive break below $77.00, dragging prices towards the YTD Low at $72.30.

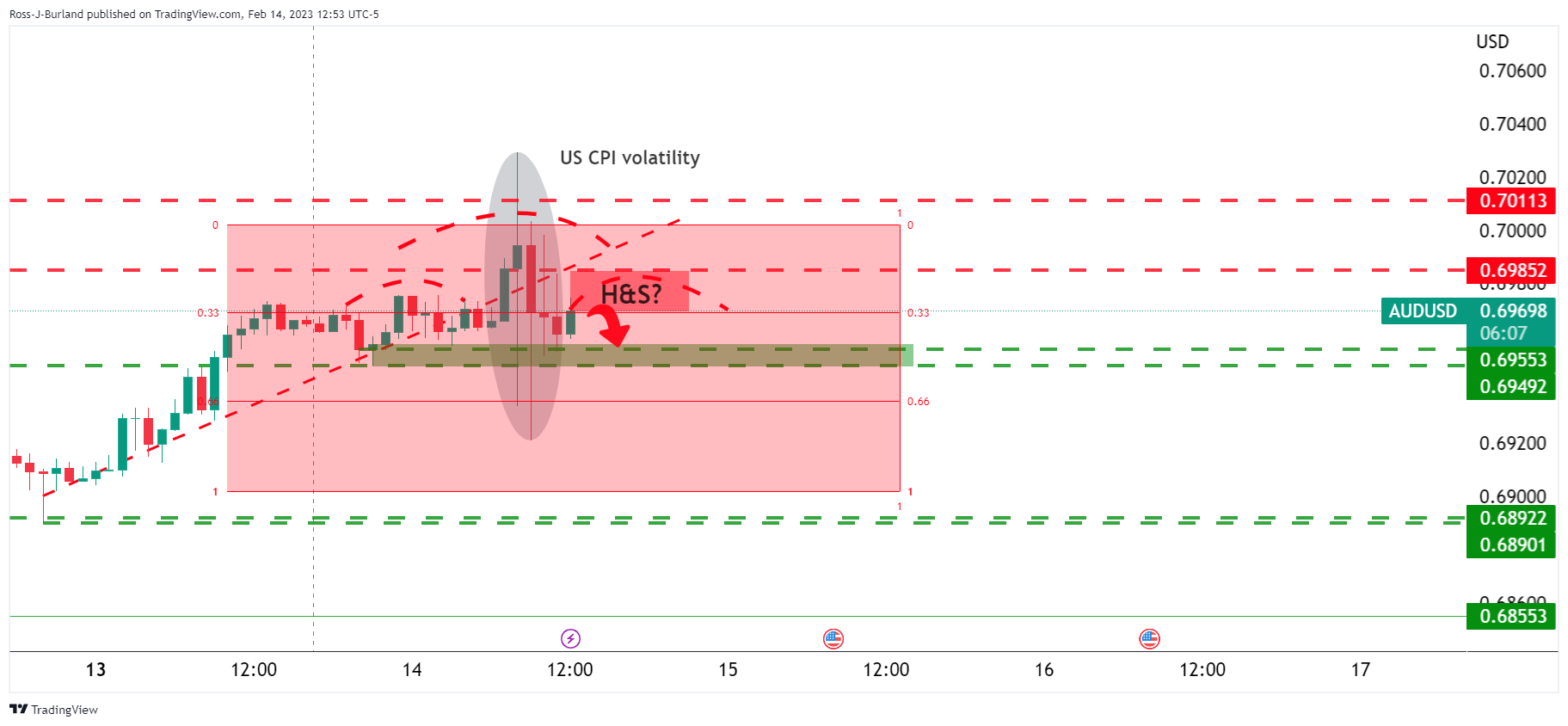

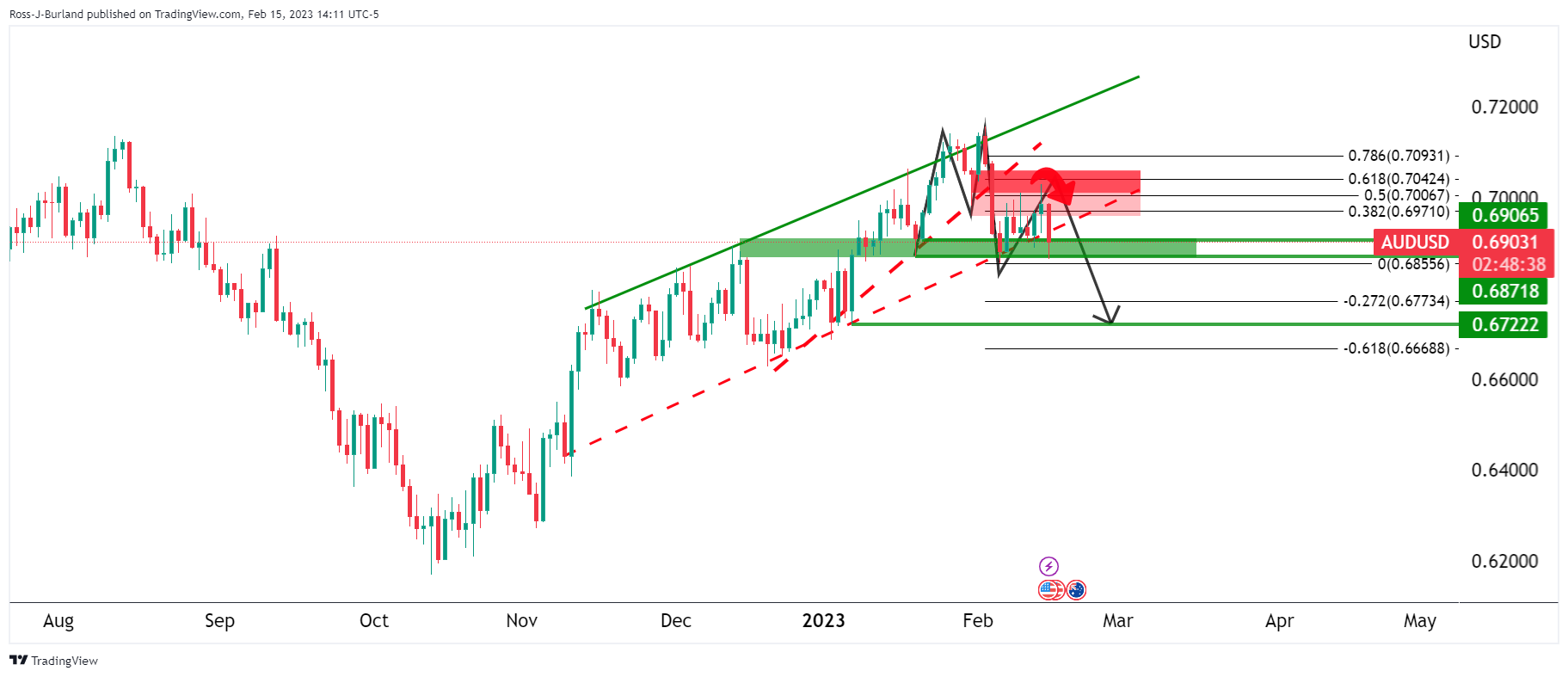

- AUD/USD bears are seeking a significant run to 0.6720 while the bulls need to get above 0.6920 and then 0.7000.

- 0.6870 is seen as a critical structure guarding the downside.

As per the prior analysis, AUD/USD Price Analysis: Bears are dominating the bias with eyes on break of 0.6900, the price is under water following the breakout below the hand and shoulder pattern that was identified on Tuesday on the hourly chart:

It was stated that a break below 0.6950 opened the risk of a test of 0.6900 again and from a daily perspective, this could have been the most probable outcome for the days ahead:

AUD/USD update

Zoomed in ...

AUD/USD H1 chart

As illustrated, the price fell and reached towards the prior peak formation near 0.6850

The price is now stalling despite a strong retail Sales number with 90% of the leg work already done in the Asian and European markets.

The risks are now tilted towards a period of consolidation above last week's lows near 0.6850 but a break of resistance and 0.6920 could start to form a bullish consensus on the charts for the days ahead:

With the price now being on the backside of the trend, the bulls could start to accumulate positions here and a move into the shorts could be on the cards.

However, should the bears commit below 0.6920:

There will be probabilities of a much deeper breakout with 0.6720 eyed at the extreme as per the daily chart.

- GBP/USD bears are moving in near the lows of the day.

- The British Pound is under pressure due to a series of bearish data for the currency.

GBP/USD is back under pressure in midday US trade after a series of data has kept a lid on attempts to correct the major sell-off that ensued following a round of negative data for cable. At the time of writing, GBP/USD is trading at 1.2005 and down 1.35%, pressured within the day's range of between 1.1989 and 1.2181, retreating from near two-week lows and on course for its sharpest one-day decline this month.

The pair has moved lower to break a seven-day rally against the euro, after a bigger-than-expected drop in UK inflation in January has led investors to believe that the Bank of England might curtail its interest rate hiking cycle. Inflation decelerated to an annual rate of 10.1% in January from 10.5% in December, compared to expectations of 10.3% in a Wall Street Journal survey of analysts.

Then to rub salt in the bull's wounds, the US Dollar climbed to a six-week high against a currency basket on Wednesday after hotter-than-expected US Retail Sales data last month that followed high Consumer Price Index data the prior day. Year-on-year, Retail Sales prices rose 6.4%. That was down from 6.5% in December but above economists' expectations of 6.2%Retail Sales rose 3% in January, easily topping the 1.8% estimate, the Commerce Department reported Wednesday.

''Today’s US Retail Sales data release support risks that the Federal Reserve will have to work harder to curtail demand and bring inflation under control,'' analysts at Rabobank said.

Investors are starting to have second thoughts as to whether there will be cuts in 2023. Rates currently stand at 4.5% to 4.75% but Fed board members' median projection foresaw interest rates peaking at 5.1% this year. However, interest rate futures markets have still priced a peak above 5.2%, based on late Tuesday's prices.

- USD/CAD rallied above 1.3400 after solid US economic data, putting pressure on the Federal Reserve.

- January’s Retail Sales in the United States smashed estimates, backing up Fed officials’ hawkish comments.

- Money market futures are pricing in two 25 bps rate hikes by the US Federal Reserve.

USD/CAD is still upward biased after hitting a daily high of 1.3440, though it retreated some of its gains but remains above its opening price. Data from the United States (US) sparked speculation that the Federal Reserve (Fed) would continue to tighten policy, with forecasts eyeing the Fed Funds Rate (FFR) at around 5.10%. At the time of writing, the USD/CAD exchange hand sat 1.3422 after hitting a low of 1.3331.

A positive Retail Sales report from the United States (US) bolstered the US Dollar (USD) on speculations that the Fed is ways to go to tame elevated inflation. The US Commerce Department revealed that Retail Sales in January increased significantly by 3.0% compared to the previous month, which exceeded the 1.8% growth predicted by analysts. This surge in sales followed two consecutive months of decline. The primary factor contributing to the increase in sales is the tight labor market, which has led to substantial wage growth. Additionally, higher gasoline prices might have tilted sales up.

After the data release, US Treasury bond yields, namely the US 2-year note rate, the most sensitive to changes in interest rates, peaked around 4.703%, reflecting that traders expect at least two additional rate hikes, as shown by futures data. Money market futures estimate that the FFR would hit the 5.0%-5.25% range, meaning 25 bps in March and May meetings are foreseeable.

Hence, the USD/CAD edged toward its daily high at 1.3428 before reversing course below 1.3400. However, the London Fix gave USD/CAD bulls a fresh impulse, with them eyeing a break above the 50-day Exponential Moving Average (EMA) at 1.3429.

On the Canadian side, Housing Starts fell by 13% in January “from the previous month 215,365 dwellings, well below the 240,000 units that economists had expected,” according to Reuters. Even though Canadian bond yields increased, falling oil prices weighed on the Loonie (CAD).

Of late, Industrial Production (IP) in the US remained unchanged, as reported by the US Federal Reserve (Fed), while output was weaker than foreseen, spurred by higher borrowing costs in the manufacturing sector.

USD/CAD Key technical levels

Europen Central Bank governor, Christine Lagarde has said that even though most measures of longer-term inflation expectations currently stand at around 2%, these measures warrant continued monitoring.

She says price pressures remain strong and underlying inflation is still high. She intends to lift rates by 50 basis points at the March meeting.

Lagarde says while confidence is rising and energy prices have fallen, we expect activity to remain weak in the near term.

EUR/USD update

Lagarde's comments are supporting EUR/USd at the time of writing. The Euro meanwhile, fell against the US Dollar on Wednesday after hotter-than-expected US Retail Sales data last month, coming a day after a report showing stubbornly high US consumer prices. EUR/USD is currently trading down some 0.6% after falling from a high of 1.0744 to a low of 1.0661 in the day's range so far.

- USD/JPY rallies above 134.00 after breaking above the 200-day EMA.

- USD/JPY Price Analysis: Upward biased, though a daily close above the 200-DMA could cement the uptrend.

The USD/JPY rallies more than 100 pips and clears the 134.00 mark, breaking north of the 200-day Exponential Moving Average (EMA) at 133.77, a bullish/bearish bias measure for an asset. Hence, the USD/JPY shifted bullish during the session, though a daily close above the 200-day EMA would keep bulls hopeful for further upside. At the time of writing, the USD/JPY exchanges hand at 134.28 after hitting a low of 132.54.

From a daily chart perspective, the USD/JPY shifted upward biased after dropping from last year’s high of 151.94 towards the YTD low of 127.21 on January 16. Nevertheless, the USD/JPY needs to clear the confluence of the 100-day EMA and the YTD high at 134.77 to cement the uptrend.

The Relative Strength Index (RSI) and the Rate of Change (RoC) show that buyers are gathering momentum. Hence, the USD/JPY might test the 135.00 psychological level in the near term.

The USD/JPY 4-hour chart depicts the pair as bullish biased after breaking from the 131.70-133.00 consolidation range, eyeing to test the YTD high at 134.77. Even though the RSI shifted overbought, as long as it stays below 80, it portrays the USD/JPY in a strong uptrend. The RoC shows buyers are in control and might continue to ride the trend.

Therefore, the USD/JPY first resistance would be the YTD high at 134.77. A breach of the latter and the pair might get to 135.00, followed by 136.00, and then the December 19 daily high of 137.47.

USD/JPY 4-Hour chart

USD/JPY Key technical levels

The labour market report, due for publication on Thursday at 00:30 GMT, is important for the Australian Dollar. Economists at Commerzbank discuss how employment figures could impact the Aussie.

AUD to come under pressure on signs of rising unemployment

“In December employment fell, but the unemployment rate remained at 3.5%. If it were to emerge that unemployment is beginning to rise the market might adjust its expectations for the key rate, which it currently expects to peak in the area of 3.75-4%, to the downside which would put pressure on AUD.”

“If, on the other hand, the labour market does not display any signs of easing, the market is more likely to feel confirmed in its view that the RBA will have to do more, which should principally support AUD.”

See – Australian Employment Preview: Forecasts from six major banks, a January rebound

Economists at Danske Bank forecast the USD/CAD pair at 1.35 in three-months and at 1.37 in six-months.

Energy prices to remain elevated, but broad USD effect is set to dominate

“Bank of Canada has clearly expressed that they now believe to have reached the peak in policy rates amid signs of a slowing labour market and concerns as to the level of private debt in the economy. Our call is in line with these signals, which in turn means that relative rates look set to be a positive for the cross in the months ahead.”

“We still have a higher USD/CAD as our base case and although we expect energy prices to remain elevated we believe the broad USD effect is set to dominate – especially on a 3-6M horizon.”

“Forecast: 1.34 (1M), 1.35 (3M), 1.37 (6M), 1.38 (12M).”

- Silver drops below the 200-day EMA, extending its losses to two straight days.

- Stronger-than-estimated Retail Sales augmented appetite for the US Dollar.

- XAG/USD Price Analysis: Turned bearish once it distanced from the 200-day EMA, eyeing the $21.00 mark.

Silver price extended its losses for the second consecutive day and distanced from the 200-day Exponential Moving Average (EMA) resting at $21.50, as US economic data from the Commerce Department revealed that Retail Sales improved. Therefore, the US Dollar (USD) it’s making its case for a comeback. At the time of writing, the XAG/USD exchanges hands at $21.50 after hitting a high of $21.87.

US economic data warrants further tightening by the Federal Reserve

The XAG/USD continues to dive, weighed by the strength of the greenback, which, underpinned by rising US Treasury bond yields, advances 0.64%, at 103.93, per the US Dollar Index. The 10-year US Treasury bond yield is up three and a half bps, up at 3.772%, a headwind for the non-yielding metal.

US Retails Sales for January jumped by an astonishing 3.0% MoM vs. estimates of 1.8% by analysts after two consecutive months of shrinkage. The increase in sales it’s mainly attributed to a tight labor market, which continues to generate strong wage growth, while higher gasoline prices might have inflated receipts at service stations.

Of late, Industrial Production (IP) in the US remained unchanged, as reported by the US Federal Reserve (Fed), while output was weaker than foreseen, spurred by higher borrowing costs in the manufacturing sector.

Given the backdrop, the US Federal Reserve might continue to tighten monetary conditions, with markets estimating two additional rate hikes of 25 bps, which would drag the Federal Funds Rate (FFR) to the 5.0%-5.25% range. On Tuesday, a slew of Fed policymakers commented that the Fed is not done hiking rates and emphasized what Fed Chair Powell said, that interest rates would remain “higher for longer.”

Hence, Silver prices would remain pressured, as a strong greenback would continue to hurt the white metal prospects. With the Federal Reserve set to cut rates until 2024, the white metal could see a bounce once the Fed pauses its tightening cycle. Nevertheless, a hawkish Fed would bolster the US Dollar prospects in the short term.

XAG/USD Technical analysis

After dropping beneath the 200-day EMA, XAG/USD might extend its fall toward the November 28 swing low at $20.87, followed by November 21 at $20.59. A breach of those demand areas, and Silver, might head to the $20.00 psychological barrier, followed by the November monthly low of $19.42. Backing the previously mentioned are oscillators, with the Relative Strength Index (RSI) remaining at bearish territory, while the Rate of Change (RoC) suggests that sellers are gathering momentum.

Senior Economist Julia Goh and Economist Loke Siew Ting at UOB Group assess the latest performance of FX reserves and foreign portfolio in Malaysia.

Key Takeaways

“Foreigners bought more MYR denominated debt securities in the first month of the year (Jan 2023: +MYR0.5bn, Dec 2022: -MYR0.9bn) mainly concentrated in government bonds. However, foreigners remained net sellers of equities for the 5th straight month albeit by a smaller quantum (Jan 2023: -MYR0.3bn, Dec 2022: -MYR1.4bn). Taken together, foreigners turned net buyers of Malaysian portfolio instruments by a marginal MYR0.2bn in Jan 2023 (Dec 2022: MYR2.2bn).”

“Foreign holdings of government bonds rose by MYR2.7bn to MYR228.9bn (or 22.1% of total outstanding). This was due to higher net buying of Malaysian Government Securities (MGS, +MYR1.3bn) and Government Investment Issues (GII, +MYR1.4bn). Foreigners sold more Malaysian Treasury bills, including Islamic T-bills (-MYR1.7bn) and conventional T-bills (-MYR0.5bn).”

“Bank Negara Malaysia (BNM)’s foreign reserves rose by USD0.5bn in Jan 2023 to USD115.2bn. This marks the highest FX reserves level since Mar 2022. It is sufficient to finance 5.3 months of imports of goods and services and is 1.0 time of the total short-term external debt. BNM’s net short position in FX swaps widened by USD0.4bn to USD26.4bn (or 23.0% of FX reserves) as at end-Dec 2022, its highest level on record.”

January saw a partial reversal of DXY’s decline, although it remains 9% off its peak. While inflation risks are likely to persist to mid-year, thereafter the US Dollar down-trend will gather momentum and sustain through to end-2024, according to economists at Westpac.

Euro to lead the way

“We remain of the view that the US Dollar will move materially lower than its current level, although likely not for some months. The reason for this is that inflation risks linger in the US and other developed markets; and there remains a view amongst market participants that the country most able to navigate this period is the US, thanks to the strength of their labour market and the FOMC’s willingness to do ‘what it takes’.”

“By the middle of 2023, not only will US disinflation broaden to services, but job creation will throttle back while wage growth continues to slow. The market’s focus from that point on will be growth differentials, with the Euro Area and Canada to outperform the US, and the UK to outperform current expectations of market participants.”

- EUR/USD drops to 2-day lows near 1.0660 on Wednesday.

- ECB C.Lagarde is due to speak later in the day.

- US Retail Sales surprised to the upside in January.

The now strong rebound in the greenback puts the risk universe under further pressure and forces EUR/USD to trade at shouting distance from the monthly lows on Wednesday.

EUR/USD: Selling pressure picks up pace on US data

EUR/USD saw its daily knee-jerk pick up pace after the greenback’s rebound gathered further steam on Wednesday.

Indeed, the selling pressure keeps the pair’s price action depressed and near the February low around 1.0650, particularly following solid prints from US Retail Sales for the month of January, while further upside in US yields across the curve also prop up the dollar.

Additional releases in the US calendar saw the NY Empire State Manufacturing Index improve to -5.8 for the month of February, while Industrial Production expanded 0.8% in the year to January and came in flat vs. the previous month.

Next on tap will be the NAHB index as well as Business Inventories.

What to look for around EUR

Despite the recent rebound to the 1.0800 region, EUR/USD remains within the multi-day consolidative phase and decently supported near 1.0650 for the time being.

In the meantime, price action around the European currency should continue to closely follow dollar dynamics, as well as the potential next moves from the ECB after the bank has already anticipated another 50 bps rate raise at the March event.

Back to the euro area, recession concerns now appear to have dwindled, which at the same time remain an important driver sustaining the ongoing recovery in the single currency as well as the hawkish narrative from the ECB.

Key events in the euro area this week: EMU Balance of Trade, Industrial Production, ECB Lagarde (Wednesday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle amidst dwindling bets for a recession in the region and still elevated inflation. Impact of the Russia-Ukraine war on the growth prospects and inflation outlook in the region. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is retreating 0.57% at 1.0680 and a drop below 1.0655 (weekly low February 13) would target 1.0481 (2023 low January 6) en route to 1.0324 (200-day SMA). On the flip side, the next up barrier aligns at 1.0804 (weekly high February 14) seconded by 1.1032 (2023 high February 2) and finally 1.1100 (round level).

UOB Group’s Senior Economist Julia Goh and Economist Loke Siew Ting comment on the publication of the GDP results in Malaysia.

Key Takeaways

“Malaysia’s real GDP growth moderated to 7.0% y/y in 4Q22 (3Q22: 14.2%) as low base effects wane. However, growth surpassed ours (6.3%) and Bloomberg consensus (6.7%), as well as the long-term average (5.1%). On a seasonally adjusted basis, real GDP contracted 2.6% q/q (3Q22: +1.9% q/q) which marks the first decline in five quarters as support from stimulus effects wane. Full-year GDP growth came in at 8.7% for 2022 (vs 3.1% in 2021) which was higher than our estimate of 8.6% and the official forecast (6.5%-7.0%).”

“Growth uplift in 4Q22 was mainly attributed to robust private consumption and steady rise in investments. All sectors expanded with strong support from services, mining and construction. Domestic demand was the key driver of growth while net exports provided further support because of slower imports relative to exports. This helped to widen the current account surplus to MYR25.7bn (or 5.5% of GDP) in 4Q22, marking the highest quarterly surplus since 3Q20.”

“BNM reiterated they do not expect a recession this year. We concur and remain cautiously optimistic and maintain our 2023 GDP growth forecast of 4.0% (official est: 4.0%-5.0%). More restrictive global monetary policy settings, potential escalation of geopolitical tensions, weaker-than-expected global demand, ongoing global tech down cycle, and domestic policy changes are key downside risks to the country’s economic outlook ahead, while being weighed down by high year-ago base effects.”

- Industrial Production in the US remained unchanged on a monthly basis in January.

- US Dollar Index clings to strong daily gains at around 104.00.

Industrial Production in the US unchanged in January following December's 1% contraction, the US Federal Reserve reported on Wednesday. This reading came in weaker than the market expectation for an increase of 0.5%.

"In January, manufacturing output moved up 1.0% and mining output rose 2.0% following two months with substantial decreases for each sector," the Fed further noted in its publication. "Capacity utilization declined 0.1 percentage point in January to 78.3%, a rate that is 1.3 percentage points below its long-run (1972–2022) average."

Market reaction

The US Dollar preserves its strength after this report and the US Dollar Index was last seen rising 0.65% on the day at 103.95.

- Gold price was initially reluctant to move lower on big surprise in US retail Sales.

- Gold price bears are slowly emerging again as the dust settles.

The United States Retail sales jump 3% in January, smashing expectations despite an inflation increase that might have otherwise kept consumers' hands in their pockets. Gold price has so far held in familiar pre-data ranges around $1,835.

The data arrived as follows:

- US Retail Sales Advance (MoM) Jan: 3.0% (est 2.0%; prev -1.1%).

- US Retail Sales Ex Auto (MoM) Jan: 2.3% (est 0.9%; prev -1.1%).

- US Retail Sales Ex Auto And Gas Jan: 2.6% (est 0.9%; prev -0.7%).

- US Retail Sales Control Group Jan: 1.7% (est 1.0%; prev -0.7%).

The US Dollar index strengthened to almost 104 on Wednesday, the highest in nearly five weeks after a stronger-than-expected US CPI report bolstered expectations the Federal Reserve will need to keep pushing interest rates higher to bring down inflation. It moved to below 104 into the New York session as traders got set for the Retail Sales data which kept Gold bulls in the game ahead of the data.

On Tuesday, the annual inflation rate in the US slowed slightly to 6.4% in January from 6.5% in December, the lowest since October 2021 but above market expectations of 6.2%. The latest Fed commentary also showed that policymakers largely backed more rate increases, fueling a bid in the greenback after what was an indecisive show from markets around the inflation data initially.

With the latest data showing that retail sales rebounded more than expected in January, and rose the most since March 2021, highlighting the strength of the economy, the US Dollar has still not been able to take off which is giving the Gold bulls a lifeline currently:

Gold technical analysis

From a daily perspective, the price would be expected to fulfil a 1000 pip move to $1,825 whereby traders were trapped long at the start of the month. In prior analysis, it was stated that we were in the upper third of the 2023 range and on the backside of the first trendline that is broken and acting as a counter-trendline. A break of $ $1,925 was expected to open the risk of a move to test $1,896 and then $1,867 as the top of the lower third of the range that guarded a 1000 pip box low of $1,825:

The above chart was analysis drawn at the end of January and below is where we are up to date ahead of the week commencing 12 February open:

Australia is set to report its January employment figures on Thursday, February 16 at 00:30 GMT and as we get closer to the release time, here are forecasts from economists and researchers at six major banks regarding the upcoming employment data.

Australia is expected to have added 20K jobs vs. -14.6K in December, while the unemployment rate is expected to remain steady at 3.5%.

ING

“After last month’s decline in part-time work, we will probably see that part of the survey moderate, combined with perhaps a smaller increase in full-time jobs of about 10K to deliver a total employment change of 15-20,000. If that is broadly right, we may see the unemployment rate edge up to 3.6% – still very low by historical standards.”

ANZ

“We will be watching the labour market results closely next week to confirm that the 15,000 drop in employment in December was a one-off. Our labour market outlook is still very strong through 2023 given elevated job vacancies and ongoing difficulty to find labour, though a turn in business conditions and very low business confidence may be an early sign the tide is turning here. We expect the unemployment rate to be steady at 3.5%.”

Westpac

“Our forecast 15K gain in employment is enough to hold the unemployment rate at 3.5%.”

SocGen

“We expect January labour-market data to show a slight rebound in employment (15K) from the dip observed in December, which would mean that the underlying employment recovery momentum has continued despite the contraction seen at the end of last year. This likely gain should almost recoup the loss in December. We forecast unemployment and participation rates matching those in December, showing that labour-market conditions remain tight. The number of hours worked is also likely to have increased after contracting in November and December. In conclusion, labour-market data should confirm the growth in economic activity and inflation pressures from the labour market, which will support the RBA’s tightening campaign.”

Citibank

“Citi unemployment rate forecast; 3.5%, Previous; 3.5%; Citi employment change forecast; 5K, Previous; -14.6K; Citi participation rate forecast; 66.5%, Previous; 66.6%. Overall, risks to the labor force report are likely skewed to the downside. However, given the survey sample period and a larger than usual number of people on holidays, there’s a risk that the January LFS could be noisy.”

Wells Fargo

“Given the reopening of China's economy, we believe Australia's economy will avoid recession this year. And while the January labor market report won't be definitive, a solid report would nonetheless provide some reassurance that the soft patch seen late in 2022 is likely to be temporary. The consensus forecast is consistent with a solid labor market outcome for January, with employment expected to rebound by 20K and the unemployment rate forecast to remain steady at 3.5%. Such an outcome would, we believe, keep the RBA moving along its monetary tightening path in the immediate months ahead.”

- AUD/USD drops back closer to the monthly low amid strong follow-through USD buying.

- The upbeat US macro data reaffirms hawkish Fed expectations and boost the Greenback.

- The prevalent risk-off mood also benefits the buck and weighs on the risk-sensitive Aussie.

The AUD/USD pair maintains its heavily offered tone through the early North American session and drops back closer to the monthly low in reaction to the upbeat US macro data. The pair is currently trading around the 0.6885-0.6880 area, with bears now awaiting a sustained break below the 50-day SMA before placing fresh bets.

The US Census Bureau reported that monthly Retail Sales grew by 3% in January, beating estimates for a 1.8% by a big margin. Furthermore, core retail sales, excluding autos, jumped 2.3% during the reported month, up sharply from the 0.9% decline (revised higher) recorded in December. Separately, the New York Fed's Empire State Manufacturing Index also surpassed expectations and improved to -5.8 in February from -32.9 previous.

The data cemented bets for further policy tightening by the Fed and provides a fresh lift to the US Dollar, which, in turn, exerts downward pressure on the AUD/USD pair. Meanwhile, worries about economic headwinds stemming from rapidly rising borrowing costs take its toll on the global risk sentiment. This is evident from a sea of red across the equity markets and is seen as another factor weighing on the risk-sensitive Aussie.

From a technical perspective, the AUD/USD pair now seems to have confirmed a bearish breakdown through an upward-sloping trend-line extending from October 2022 swing low. Some follow-through selling below the 50-day SMA will reaffirm the negative bias. This should pave the way for an extension of the recent pullback from the highest level since June 2022, around the 0.7155-0.7160 area touched earlier this month.

Technical levels to watch

- NY Fed Empire State Manufacturing Index rose in February but stayed in negative territory.

- US Dollar Index clings to strong daily gains slightly below 104.00.

The headline General Business Conditions Index of the Federal Reserve Bank of New York's Empire State Manufacturing survey recovered to -5.8 in February from -32.9 in January. This reading came in better than the market expectation of -18.

"Delivery times shortened, and inventories edged higher," the NY Fed noted in its publication. "Employment levels declined for the first time since early in the pandemic, and the average workweek shortened for a third consecutive month"

Regarding inflation-related developments, "both input and selling price increases picked up. Looking ahead, firms expect business conditions to improve somewhat over the next six months," the NY Fed said.

Market reaction

The US Dollar Index preserves its bullish momentum after this data and was last seen rising 0.6% on the day at 103.85.

- Retail Sales in the US at a stronger pace than expected in January.

- US Dollar Index continues to push higher toward 104.00 after the upbeat data.

Retail Sales in the United States rose by 3% to $697 billion in January, the US Census Bureau reported on Wednesday. This reading followed December's decrease of 1.1% and came in better than the market expectation for an increase of 1.8%.

Retail Sales ex-Autos expanded by 2.3% in the same period, compared to analysts' estimate of +0.8%.

"Total sales for the November 2022 through January 2023 period were up 6.1% from the same period a year ago," the publication further read. "Retail trade sales were up 2.3% from December 2022, and up 3.9% above last year."

Market reaction

The US Dollar gathered strength with the initial reaction and the US Dollar Index was last seen rising 0.65% on the day at 103.93.

EUR/USD slips after failing to extend through 1.08. Economists at Scotiabank expect the pair to test the Monday low near 1.0660.

ECB comments ahead

“ECB officials continue to manage rate expectations astutely, with rhetoric supporting the outlook for more tightening. ECB President Lagarde speaks today. Comments are likely to reaffirm the outlook for another 50 bps hike in Mar and more data dependent hikes (i.e., a likely downshift to 25 bps hikes) thereafter.”

“The EUR’s failure and rejection (via a bearish outside range signal on the 6-hour chart) against noted resistance around 1.08 yesterday seals the near-term technical outlook for the single currency and targets a retest of the Monday low near 1.0660. A break below here targets a drop to 1.05.”

- GBP/USD dives back closer to the weekly low and is pressured by a combination of factors.

- The softer-than-expected UK CPI print weighs on the pair amid broad-based USD strength.

- Bearish traders now look forward to the US economic data for some meaningful impetus.

The GBP/USD pair comes under intense selling pressure on Wednesday and extends the previous day's late pullback from over a one-week high. The downfall remains uninterrupted through the mid-European session and drags spot prices back closer to the weekly low, around the 1.2035 region in the last hour.

The British Pound weakens across the board in reaction to softer-than-expected UK consumer inflation figures. This comes on the back of a dovish assessment of the Bank of England's policy decision and suggests that the current rate-hiking cycle might be nearing the end. Apart from this, a strong follow-through buying around the US Dollar contributes to the GBP/USD pair's steep intraday decline of nearly 150 pips.

In fact, the USD Index, which tracks the Greenback against a basket of currencies, stands tall near a multi-week high amid expectations for further policy tightening by the Fed. The bets were lifted by the US CPI report and hawkish comments by several FOMC members on Tuesday. Adding to this, the prevalent risk-off mood - as depicted by a generally weaker tone around the equity markets - further underpins the safe-haven buck.

With the latest leg down, the GBP/USD pair reverses its weekly gains and seems poised to depreciate further. Some follow-through selling below the weekly low, around the 1.2030 area, will reaffirm the negative bias. This, in turn, should pave the way for a slide further below the 1.2000 psychological mark, towards challenging a technically significant 200-day SMA support, which is currently pegged near the 1.1935 region.

Next on tap is the US economic docket, highlighting the release of Retail Sales figures and the Empire State Manufacturing Index. Traders will further take cues from the broader risk sentiment, which will influence the USD price dynamics and provide a fresh impetus to the GBP/USD pair. Nevertheless, the aforementioned fundamental backdrop favours bearish trades and suggests that the path of least resistance for spot prices is to the downside.

Technical levels to watch

The CAD is down nearly half a percent on the day against the generally firm USD. USD/CAD may retest mid/upper-1.34s, according to economists at Scotiabank.

USD/CAD holds range

“Weak risk sentiment and generally softer commodities are headwinds for the CAD but spot remains within recent trading ranges and we expect scope for losses remains relatively limited for the moment at least.”

Canada releases Jan Housing Starts, Dec Manufacturing Sales (expected down 1.5%) and Jan Existing Home Sales. Soft data may add to pressure on the CAD in the short run, pushing spot towards the mid/upper-1.34s where the USD peaked last week.”

The US Dollar is trading firmer following yesterday’s US CPI. Economists at Scotiabank expect the greenback to remain resilient amid positive US data.

USD gains supported by rising yields

“Higher terminal rate pricing – the implied peak in the Fed cycle vias swaps has extended to a little above 5.25% – is reason to think the USD can remain firm in the short run at least.”

“Retail Sales are expected to rise a solid 2.0% (ax-autos +0.9%). The Feb Empire survey’s Jan weakness is expected to moderate somewhat. Jan IP is forecast to post a 0.5% m/m rise. Business Inventories are called 0.3% higher MoM while the Feb NAHB housing market index is expected to improve modestly from Jan’s 35 reading. Firm US data prints should add to USD underpinning in the near term.”

See – US Retail Sales Preview: Forecasts from seven major banks, noticeable increase

US Monthly Retail Sales Overview

Wednesday's US economic docket highlights the release of monthly Retail Sales figures for January, due later during the early North American session at 13:30 GMT. The headline sales are expected to rebound sharply after declining by 1.1% in December and post strong growth of 1.8% during the reported month. Excluding autos, core retail sales probably climbed by 0.8% in January, up from the 1.1% fall recorded the previous month.

According to analysts at NBF: “Car dealers likely contributed positively to the headline number, as auto sales surged during the month. Gasoline station receipts could have increased as well judging from a rise in pump prices. All told, headline sales could have jumped 2.1% in the month. Spending on items other than vehicles may have expanded a bit less, advancing 1.0%.”

How Could it Affect EUR/USD?

Ahead of the key release, the US Dollar stands tall near a multi-week high amid expectations that the Fed will stick to its hawkish stance for longer in the wake of stubbornly high inflation. A stronger-than-expected US macro data will reaffirm hawkish Fed expectations and provide a fresh lift to the Greenback. Conversely, any disappointment from the US Retail Sales figures is more likely to be offset by bets that interest rates are going to remain higher for longer. This, in turn, suggests that the path of least resistance for the EUR/USD pair is to the downside and any attempted recovery could be seen as a selling opportunity.

Meanwhile, Eren Sengezer, Editor at FXStreet, offers a brief technical outlook and writes: “EUR/USD failed to hold above the 50-period Simple Moving Average (SMA) on the four-hour chart despite having tested this level several times on Tuesday. Additionally, the Relative Strength Index (RSI) indicator on the same chart retreated below 50, suggesting that buyers remain on the sidelines.”

Eren also outlines important technical levels to trade the EUR/USD pair: “On the downside, 1.0700 (psychological level, Fibonacci 61.8% retracement of the latest uptrend) aligns as key support. A four-hour close below that level could trigger another leg lower toward 1.0645/50 (static level) and 1.0600 (psychological level).”

“Interim resistance for the pair is located at 1.0730 (50-period SMA) ahead of 1.0760 (Fibonacci 50% retracement). In case the pair rises above the latter resistance, it is likely to face another strong hurdle at 1.0775, where the 200-period SMA is located,” Eren adds further.

Key Notes

• US Retail Sales Preview: Forecasts from seven major banks, noticeable increase

• EUR/USD Forecast: Euro closes in on key support

• EUR/USD: Buying dips below 1.06 targeting 1.0950 – Credit Suisse

About US Retail Sales

The Retail Sales released by the US Census Bureau measures the total receipts of retail stores. Monthly per cent changes reflect the rate of changes in such sales. Changes in Retail Sales are widely followed as an indicator of consumer spending. Generally speaking, a high reading is seen as positive (or bullish) for the USD, while a low reading is seen as negative (or bearish).

- EUR/USD gives away part of the recent 2-session gains on Wednesday.

- Further downside lies ahead once the monthly low is breached.

EUR/USD could not sustain Tuesday’s bull run to levels just beyond the 1.0800 barrier, sparking a corrective decline soon afterwards.

If the selling pressure gathers extra impulse, the pair could dispute the February low at 1.0655 (February 13) in the near term. Against that, the breach of this level could expose further weakness to the next support of note at the YTD low at 1.0481 (January 6).

In the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0324.

EUR/USD daily chart

Sterling got a lift last week from some relative optimism about growth. However, economists at Société Générale expect the EUR/GBP pair to advance nicely on forecasts of extended economic stagnation.

It is all about growth (and stagnation)

“The release of softer-than-feared inflation data in the UK has turned the currency around today, but the growth story will be more important in the end.”

“Unfortunately, replacing the fears of the gloomiest UK forecasts with expectations of lengthy stagnation is about as much as can be hoped for. The slow climb in EUR/GBP is set to last all year.”

In the view of UOB Group’s Economist Lee Sue Ann, the Bank Indonesia (BI) could raise its key rates by 25 bps at the upcoming gathering on Thursday.

Key Takeaways

“The end of the current hiking cycle is imminent as we have alluded to before.”

“We keep our BI rate forecast for a terminal rate of 6.00% that is likely to occur this month, though there is an increasing risk that Jan’s rate hike might be the last one for the current hiking cycle.”

- The index maintains the erratic activity around 103.00 so far.

- The monthly high near 104.00 continues to cap the upside.

DXY reverses the recent 2-day retracement and regains the 103.60 region on Wednesday.

The ongoing price action leaves the door open to the continuation of the consolidative note for the time being. Occasional bouts of strength, however, are expected to remain limited by the proximity of the 104.00 zone, or February highs (February 7).

In the longer run, while below the 200-day SMA at 106.45, the outlook for the index remains negative.

DXY daily chart

Gold price is trading at its lowest level since early January below $1,850. Recent repricing of market expectations around the Fed tightening could create a short-term headwind for the yellow metal, strategists at ANZ Bank report.

Central banks purchases to remain resilient this year

“We expect Gold to experience short-term volatility as the market’s rates expectations diverge from the Fed’s outlook. Unemployment is historically low, and inflation is persisting above the Fed’s target range. This could keep the Fed hawkish.”

“The market for physical Gold is softening as demand in India and China remains lacklustre. Central bank buying should remain strong

but could retreat from record-high levels. Therefore, investment demand needs to be strong to clear the market this year.”

“We are not changing our 12-month price target of $1,900.”

Lee Sue Ann, Economist at UOB Group, sees the BSP raising its policy rate by 25 bps at its meeting on February 16.

Key Takeaways

“We think that the slower-than-expected headline inflation outturn in Dec is less likely to throw BSP off its rate-hike path. But, the softer inflation reading coupled with gloomier global growth prospects will allow BSP to continuously embark on a slower rate hike path in the coming months.”

“We are thus sticking to our BSP call for two more 25bps hikes in 1Q23 before taking a pause at 6.00% thereafter.”

- EUR/JPY advances to new 2023 high past 143.00 on Wednesday.

- Extra strength could revisit the December 2022 high near 146.70.

EUR/JPY adds to the weekly recovery and surpasses the 143.00 hurdle to clinch new YTD peaks on Wednesday.

While the cross looks broadly side-lined for the time being, a convincing break above the 143.00 region could trigger a move higher to, initially, the December 2022 top at 146.72 (December 15).

In the meantime, while above the 200-day SMA, today at 141.11, the outlook for the cross is expected to remain positive.

EUR/JPY daily chart

Economist at UOB Group Ho Woei Chen reviews the latest release of inflation figures in the Chinese economy.

Key Takeaways

“Headline inflation was in line with consensus forecast at 2.1% y/y in Jan, led by a jump in food prices while non-food inflation remained modest. China’s Producer Price Index (PPI) remained in deflation in Jan for the fourth consecutive month at -0.8% y/y.”

“Despite the modest gains in non-food inflation, there are some segments that experienced larger price pressures. As a result of the easing of China’s COVID19 measures, demand for travel and entertainment consumption increased sharply in Jan.”

“We maintain our forecast for headline inflation at 2.8% this year (2022: 2.0%) with stronger pick-up in inflation to slightly above 3% in 2H23. Meanwhile, the deflation trend for PPI is likely to continue through 1H23 as a result of a high base of comparison and weaker global demand. For the full year in 2023, PPI could be slightly negative at -1.0% after rising 4.1% in 2022 and 8.1% in 2021.”

Economists at HSBC anticipate two phases to the USD’s decline this year. The USD is going through the “chop” phase now. The second phase is categorised as the “flop” when the broader USD resumes weakening.

Choppiness, followed by broader weakness

“The USD is going through the ‘chop’ phase now, as the market reassesses its view on the Federal Reserve (Fed) and other risks that can temper the recent optimism in markets. Compared to the end of January.”

“Once the Fed actually stops hiking, alongside China’s recovery gaining ground, and perhaps the global economy shows signs of bottoming out, then the next phase to the USD decline should occur – the ‘flop’, which we expect to start in late 1Q/2Q23 and persist into 2024. In the ‘flop’ phase, we also think the behaviour of exchange rates could change and become less USD-centric.”

- USD/CAD gains strong positive traction on Wednesday and climbs to a fresh weekly high.

- Sliding crude oil prices undermine the Loonie and lend support amid sustained USD buying.

- A break through the trend-channel hurdle is needed to support prospects for additional gains.

The USD/CAD pair builds on the overnight late recovery from the 1.3275 area, or a one-and-half-week low and gains strong follow-through traction on Wednesday. Spot prices climb to a fresh weekly high during the first half of the European session, with bulls now looking to extend the momentum beyond the 1.3400 round-figure mark.

Crude oil prices prolong this week's rejection slide from the 100-day SMA and remain depressed for the third successive day. This, in turn, undermines the commodity-linked Loonie. Apart from this, broad-based US Dollar strength, bolstered by expectations for additional rate hikes by the Fed and the risk-off mood, acts as a tailwind for the USD/CAD pair.

From a technical perspective, some follow-through buying above the 1.3430 area, or a resistance marked by the top end of over a two-month-old descending trend channel, will set the stage for further gains. The USD/CAD pair might then accelerate the momentum towards testing the 1.3470-1.3475 supply zone, which if cleared will mark a fresh bullish breakout.

The subsequent move-up should allow the USD/CAD pair to surpass the 1.3500 psychological mark and test the 100-day SMA, currently around the 1.3520 region. A sustained move beyond the latter could allow the bulls to reclaim the 1.3600 mark. The momentum could get extended to the 1.3645-1.3650 hurdle en route to the December swing high, around the 1.3700 round figure.

On the flip side, any meaningful pullback might now attract fresh buyers near the 1.3330 area. This is followed by the 1.3300 mark and the overnight swing low, around the 1.3275 region. Failure to defend the said support levels will make the USD/CAD pair vulnerable to weaken further towards the November 2022 swing low, around the 1.3230-1.3225 region.

Spot prices could eventually drop to the 1.3200 round figure and continue the downward trajectory towards challenging the descending channel support, currently near the 1.3125 zone.

USD/CAD daily chart

Key levels to watch

Economists at Westpac expect the USD/JPY to move gradually lower and fall to 124 by the end of 2024.

USD/JPY is only forecast to ease to 129 by end-2023

“It seems most appropriate to expect the Yen to, more or less, follow the US Dollar trend over the forecast period given the turn in sentiment against the USD; Japan’s robust growth prospects; and its exposure to the Asian region, where momentum and opportunity are clearly building.”

“USD/JPY is only forecast to ease to 129 by end-2023. However, as rate cuts are delivered in the US and the rate differential narrows, the down-trend is expected to accelerate, with 124 the target for end-2024.”

According to UOB Group’s Economist Lee Sue Ann and Markets Strategist Quek Ser Leang, chances for USD/CNH to break above the 6.8500 level have been on the rise as of late.

Key Quotes

24-hour view: “We expected USD to trade within a range of 6.8050/6.8350 yesterday. USD swung between 6.8062 and 6.8400 in NY trade before settling at 6.8369 (+0.20%). Despite the volatile price actions, the underlying tone has firmed somewhat and USD is likely to edger higher. That said, a break of the major resistance at 6.8500 is unlikely today. Support is at 6.8260, followed by 6.8130.”

Next 1-3 weeks: “There is not much to add to our update from Monday (13 Feb, spot at 6.8275). As highlighted, upward momentum is beginning to build and the likelihood of USD breaking above 6.8500 has increased. The next resistance level above 6.8500 remains at 6.8800. Overall, only a break of 6.7800 (no change in ‘strong resistance’ level) would indicate that 6.8500 is not coming into view.”

US January Consumer Price Index (CPI) data released yesterday were the week’s highlight. Economists at Credit Suisse continue along the path they have been on this year following the inflation figures.

USD/JPY to move only slowly towards 125 rather than collapsing

“USD strength isn’t especially impressive. The constructive risk environment, muted interest rate differentials and unhelpful terms of trade shifts are likely factors behind the lackluster upward USD momentum.”

“This leads us to continue along the path we’ve been on this year, which in effect is range trading EUR/USD, aiming to buy dips below 1.0600 targeting 1.0950, looking for USD/JPY to move only slowly towards 125 rather than collapsing through that level quickly, selecting specific currencies like AUD that have some grounds for outperformance while also sticking to long-held carry plays like MXN.”

The upside bias in USD/JPY looks firm for the time being, comment UOB Group’s Economist Lee Sue Ann and Markets Strategist Quek Ser Leang.

Key Quotes

24-hour view: “We expected USD to trade sideways between 131.50 and 133.00 yesterday. However, USD chopped between 131.50 and 133.31 before closing at 133.11 (+0.54%). Upward momentum has firmed slightly but while USD is likely to edge higher, the major resistance at 134.00 is unlikely to come into view today (there is another resistance level at 133.50). Support is at 132.40, followed by 132.00.”

Next 1-3 weeks: “Two days ago (13 Feb, spot at 131.50), we highlighted the outlook for USD is mixed and we expected it to trade in a broad range of 130.00 and 133.00. Yesterday, USD rose to a high of 133.31 before closing at 133.11 (+0.54%). Upward momentum appears to be building and there is room for USD to edge higher. That said, the major resistance at 134.00 might not come into view so soon. On the downside, a break of 131.40 would indicate that the build-up in momentum has fizzled out.”

- USD/JPY scales higher for the third straight day and climbs to a fresh multi-week high.