- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 15-02-2022

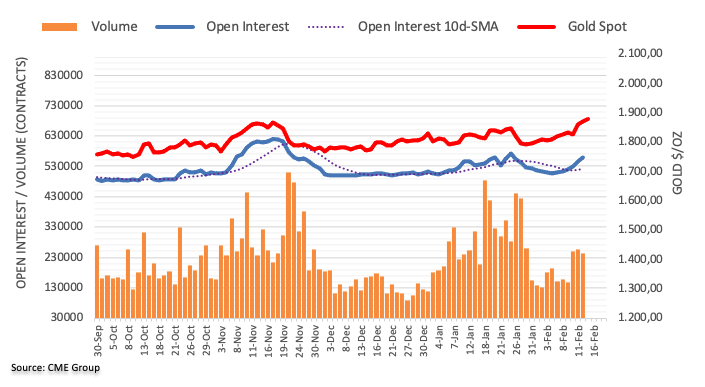

- Gold prices remain sidelined after reversing from fresh high in eight months.

- Receding pessimism over Russia’s invasion of Ukraine triggered the metal’s pullback, despite mixed updates.

- US Retail Sales for January, Fed Minutes will be watched for fresh impulse, in addition to qualitative catalysts.

- Gold Price Forecast: Corrective decline may continue once below 1,841.40

Gold (XAU/USD) seeks fresh clues while taking rounds to $1,850 during Wednesday’s initial Asian session, following a notable pullback from an eight-month high.

The yellow metal marked an uptick to refresh the multi-day high before posting the biggest daily loss in three weeks by the end of Tuesday’s North American session. In doing so, the bullion traders respected the change in market sentiment, mainly due to headlines concerning the Russia-Ukraine war.

Headlines suggesting the retreat of some Russian troops from borders could be cited as the key catalyst for the market’s latest shift in mood, from a negative tone that previously underpinned the gold buying. Though comments from Russian President Vladimir Putin and his US counterpart Joe Biden keep the geopolitical risk on the table and challenge gold sellers, despite getting lesser attention. That said, Russia’s Putin conveyed dissatisfaction with how negations are going over Ukraine’s NATO membership while US President Biden said, “Russian attack on Ukraine still very much a possibility.”

It’s worth noting that a jump in the US Treasury yields also weighed on the gold prices as the benchmark 10-year T-bond coupons rose 4.7 basis points (bps) to 2.043%. It’s worth noting that the Wall Street benchmarks closed positive the previous day.

Escalating odds of Fed’s 0.50% rate hike in March, as well as firmer US inflation expectations portrayed by the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, also weighed on the gold prices.

Talking about the US data, the US Producer Price Index (PPI) data showed a hot factory-gate inflation figure supporting the Fed’s rate-hike concerns. That said, the PPI rose past 9.1% YoY expectations to 9.7%, versus upwardly revised 9.8% prior, in January whereas the Producer Price Index ex Food & Energy, also known as Core PPI, rallied to 8.3% versus 7.9% market consensus. Additionally, NY Empire State Manufacturing Index eased below 12.15 forecasts to 3.1, compared to -0.7 previous readouts.

Looking forward, China’s headline inflation data for January, namely Consumer Price Index (CPI) and Producer Price Index (PPI), should be watched for immediate direction. Forecasts suggest the CPI will ease to 1.0% YoY from 1.5% whereas the PPI may drop to 9.5% versus 10.3% previous reading. Should the data matches downbeat expectations, AUD/USD may have a reason to consolidate recent gains. However, major attention will be given to January Retail Sales from the US and Federal Open Market Committee (FOMC) Minutes amid chatters of a 0.50% rate lift in March.

Read: FOMC Minutes Preview: Dollar selling opportunity? Doves set for a comeback after hawkish meeting

Technical analysis

Gold’s U-turn from the highest levels last seen during June 2021 portrays a double-top bearish formation on the daily chart. The hopes of further downside also gain support from the RSI divergence as the higher high in prices mismatches the oscillator’s performance.

However, a clear downside break of the previous month’s peak near $1,853, also the $1,850 round figure becomes necessary for the gold seller’s conviction.

Following that, the 61.8% Fibonacci retracement (Fibo.) of June-August 2021 downside, around $1,828, holds the key to the bullion’s further weakness towards the 200-DMA and a two-month-old support line, respectively around $1,807 and $1,796.

Alternatively, the corrective pullback may initially be challenged by the $1,870 level ahead of highlighting the double tops around $1,878-80.

Should gold buyers manage to keep reins past $1,880, the $1,900 threshold and mid-January 2021 high around $1,917 will be in focus.

Gold: Daily chart

Trend: Further weakness expected

As per the latest Reuters Tankan poll, published early Wednesday morning in Asia, “Japanese manufacturers' business confidence fell to an 11-month low in February as measures to contain the pandemic and high raw material costs hurt sentiment.”

Manufacturers were less optimistic about the three months ahead than they were in January, while service-sector firms' outlook held up, according to the poll that tracks the Bank of Japan's (BOJ) closely watched "tankan" quarterly survey, per Reuters.

Key quotes

The Reuters Tankan sentiment index for manufacturers fell to 6 in February from 17 in January, hitting its lowest since last March.

The service-sector index slipped for the first time in five months, to 3 from the prior month's 8.

The poll also showed companies continued to confront surging commodity costs, which have started to hurt firms at the lower end of the supply chain such as consumer staples makers and service providers.

Market implications

USD/JPY remains sidelined around 115.60, after mildly positive performances in the last two days.

Read: USD/JPY Price Analysis: Extends Monday’s bounce as buyers eye 116.00

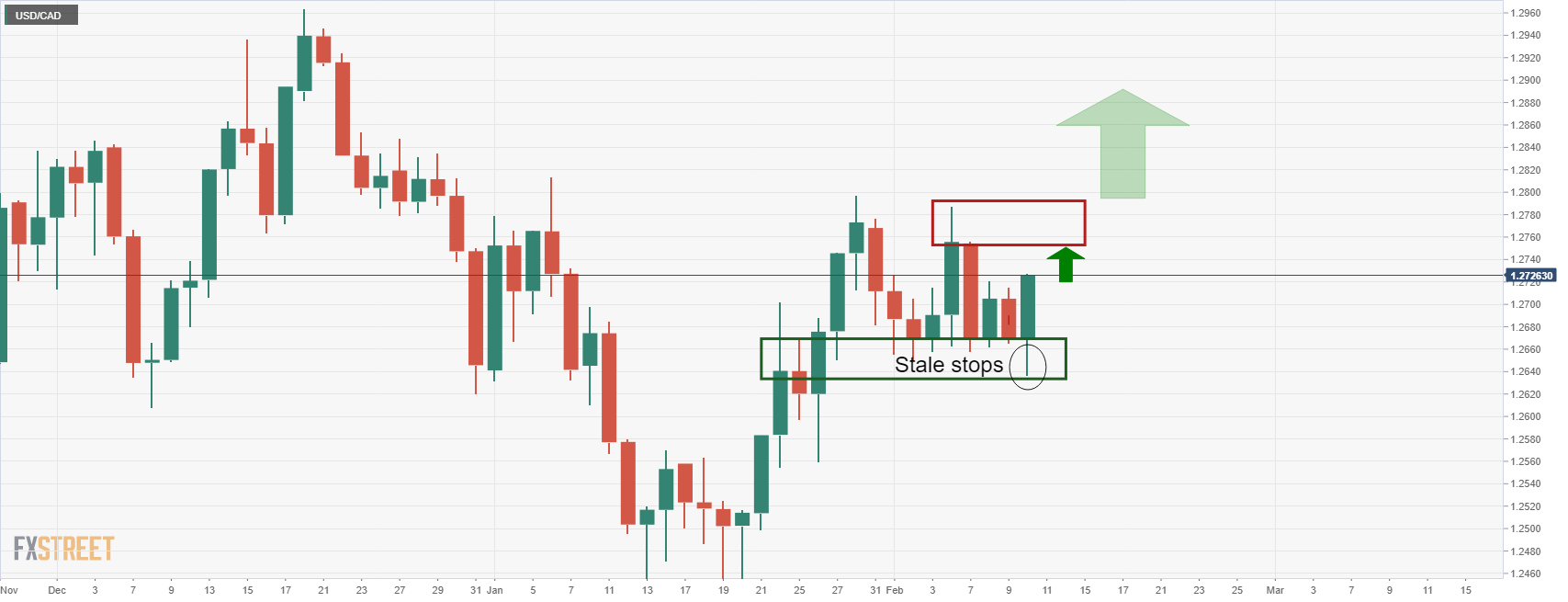

- USD/CAD remains pressured on breaking weekly support line after two-day downtrend.

- Steady RSI, failures to cross six-week-old resistance line keep bears hopeful.

- 200-SMA becomes the key support, 61.8% Fibonacci retracement adds to upside filters.

USD/CAD remains on the back foot around 1.2720 during Wednesday’s initial Asian session, keeping the previously downbeat tone with reservations.

After multiple failures to cross a downward sloping trend line from January 06, the Loonie pair broke a one-week-old rising support line the previous day. The bearish bias also gains support from the RSI line.

However, a clear downside break of the 50-SMA level, around 0.7115 by the press time, becomes necessary for the USD/CAD sellers.

Also acting as a downside filter is the 50% Fibonacci retracement (Fibo.) of December 2021 to January 2022 downside, around 1.2705, as well as the 1.2700 threshold.

Should the pair bears dominate past 1.2700, the 200-SMA level around 1.2650 will regain the market’s attention.

Alternatively, the corrective pullback may initially battle the support-turned-resistance line around 1.2730 ahead of challenging the 61.8% Fibo. level close to 1.2770.

Though, USD/CAD bulls remain unconvinced before witnessing a clear upside break of the aforementioned six-week-old resistance line, close to 1.2785.

USD/CAD: Four-hour chart

Trend: Further weakness expected

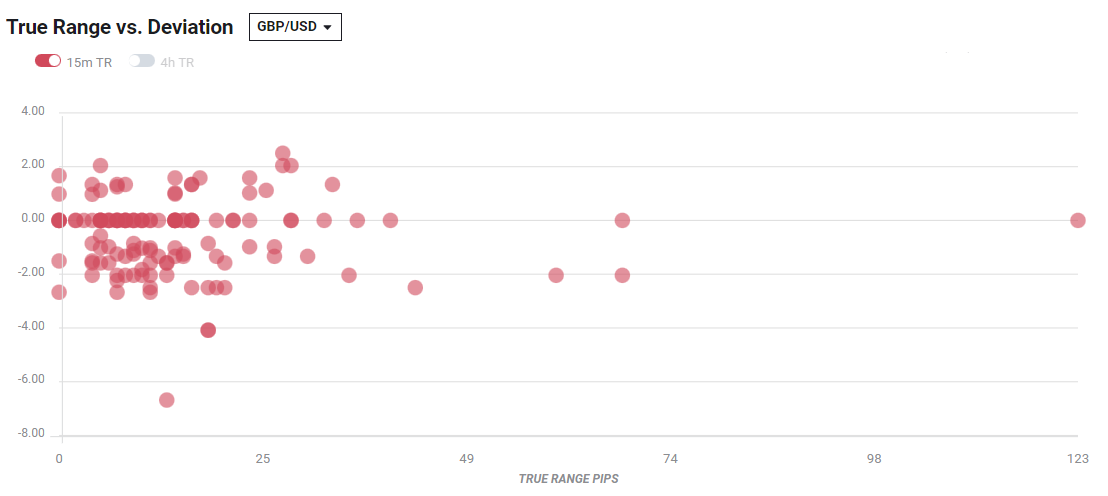

- The GBP/USD in the week is almost flat, down 0.07%.

- Easing tensions in Eastern Europe improved the financial market mood.

- GBP/USD Technical Outlook: Neutral-upward biased, but caution is warranted as the 200-DMA lies on top of the exchange rate.

As the North American sesión ends, the British pound advances in the day amid an improved market mood, inferred by easing tensions in the Russia/Ukraine conflict in Eastern Europe. At the time of writing, the GBP/USD is trading at 1.3540.

Tuesday’s session witnessed a GBP/USD pair fluctuating in the tops/bottoms of the daily range. Late in the Asian session, the GBP/USD reached a daily high at 1.3566, followed by a drop in the early North American session, from 1.3547 towards 1.3488 on the back of a news headline of a Guardian Journalist that cited “Western officials” saying that there was no de-escalation and that “we see the opposite.”

Coinciding with the headline, the GBP/USD was meandering around the 100 and the 200-hour simple moving averages (SMAs), which were located above the spot price, as resistance levels. The GBP bull’s failure to overcome the latter sparked the downward move.

GBP/USD Price Forecast: Technical outlook

With that scenario in play, the GBP/USD is neutral-upward biased. The short time-frame daily moving averages (DMAs) reside below the spot price, while the 200-DMA lies near the 1.3700 figure.

The GBP/USD first resistance would be the 1.3600 figure. Breach of the latter would expose February 10 1.3643 daily high, followed by a ten-month-old fall slope trendline around 1.3655-70 area and then the 200-DMA at 1.3690.

- AUD/USD grinds higher after snapping three-day downtrend, bouncing off one-week low.

- Market sentiment improved on easing fears of Russian invasion.

- RBA Minutes conveyed policymakers’ caution while Aussie Treasury Secretary signaled tapering of fiscal support, US data came in mixed.

- China CPI, US Retail Sales and FOMC Minutes are the key data/events, risk catalysts are also important for clear direction.

AUD/USD treads water around mid-0.7100s during the early hours of Wednesday morning in Asia, after staging a notable rebound from a one-week low.

Having extended the risk-off during early Tuesday, amid escalating fears of a Russian invasion of Ukraine, the Aussie pair portrayed the recovery in market sentiment the previous day. The reason could be linked to headlines suggesting the retreat of some Russian troops from borders.

However, comments from Russian President Vladimir Putin and his US counterpart Joe Biden keep the geopolitical risk on the table and challenge the market’s optimism, despite getting lesser attention. That said, Russia’s Putin conveyed dissatisfaction with how negations are going over Ukraine’s NATO membership while US President Biden said, “Russian attack on Ukraine still very much a possibility.”

Elsewhere, RBA Minutes showed the policymakers’ hesitance in respecting the rate-hike concerns by citing the hopes of delay in economic recovery due to the covid. It should be noted that Australian Treasury Secretary Kennedy testified before the Australian parliament's Senate estimates committee and signaled tapering of fiscal support out of covid while saying, “Fiscal policy support has to be cut back, which will allow monetary policy to get back to more normal.” However, the diplomat also mentioned, “Premature tightening could prevent hitting full employment.”

On the other hand, the US Producer Price Index (PPI) data showed a hot factory-gate inflation figure supporting the Fed’s rate-hike concerns. That said, the PPI rose past 9.1% YoY expectations to 9.7%, versus upwardly revised 9.8% prior, in January whereas the Producer Price Index ex Food & Energy, also known as Core PPI, rallied to 8.3% versus 7.9% market consensus. Additionally, NY Empire State Manufacturing Index eased below 12.15 forecasts to 3.1, compared to -0.7 previous readouts.

Against this backdrop, the US 10-year Treasury yields rose 4.7 basis points (bps) to 2.043% whereas the Wall Street benchmarks also closed positive by the end of Tuesday’s North American session.

Moving on, AUD/USD traders will pay close attention to China’s headline inflation data for January, namely Consumer Price Index (CPI) and Producer Price Index (PPI), for immediate direction. Forecasts suggest the CPI will ease to 1.0% YoY from 1.5% whereas the PPI may drop to 9.5% versus 10.3% previous reading. Should the data matches downbeat expectations, AUD/USD may have a reason to consolidate recent gains. Though, major attention will be given to January Retail Sales from the US and Federal Open Market Committee (FOMC) Minutes amid chatters of a 0.50% rate lift in March.

Read: FOMC Minutes Preview: Dollar selling opportunity? Doves set for a comeback after hawkish meeting

Technical analysis

AUD/USD poses a recovery from the 38.2% Fibonacci retracement (Fibo.) of January 13-28 downturn, around 0.7100, with firmer MACD signals and steady RSI line signaling further advances.

However, the Aussie pair remains below the previous support line from January 28, suggesting the need for a 0.7185 break for the buyer’s conviction. Also acting as an immediate upside hurdle is the convergence of the 50-DMA and a descending trend line from January 20, close to 0.7170.

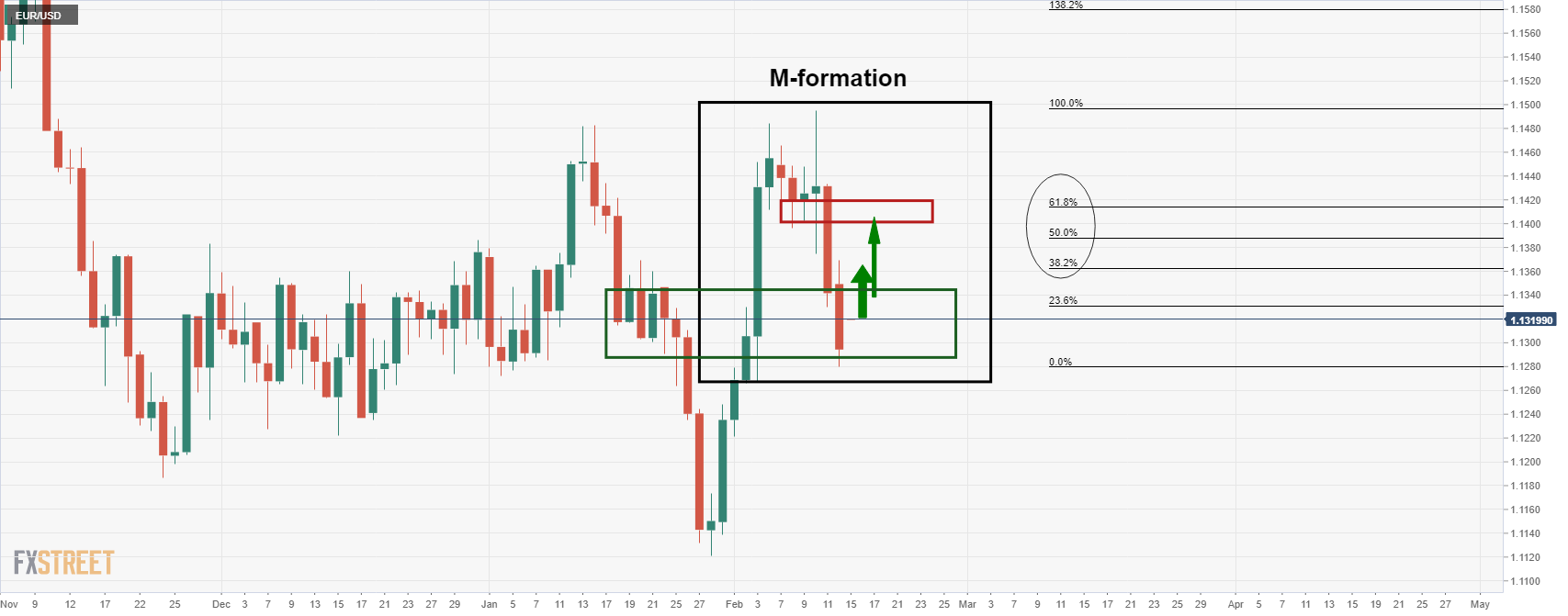

- EUR/USD bulls stay in control and target a deeper correction for the day ahead.

- The 61.8% ratio is within reach, but Russia remains a threat and the bulls are not out of the woods yet.

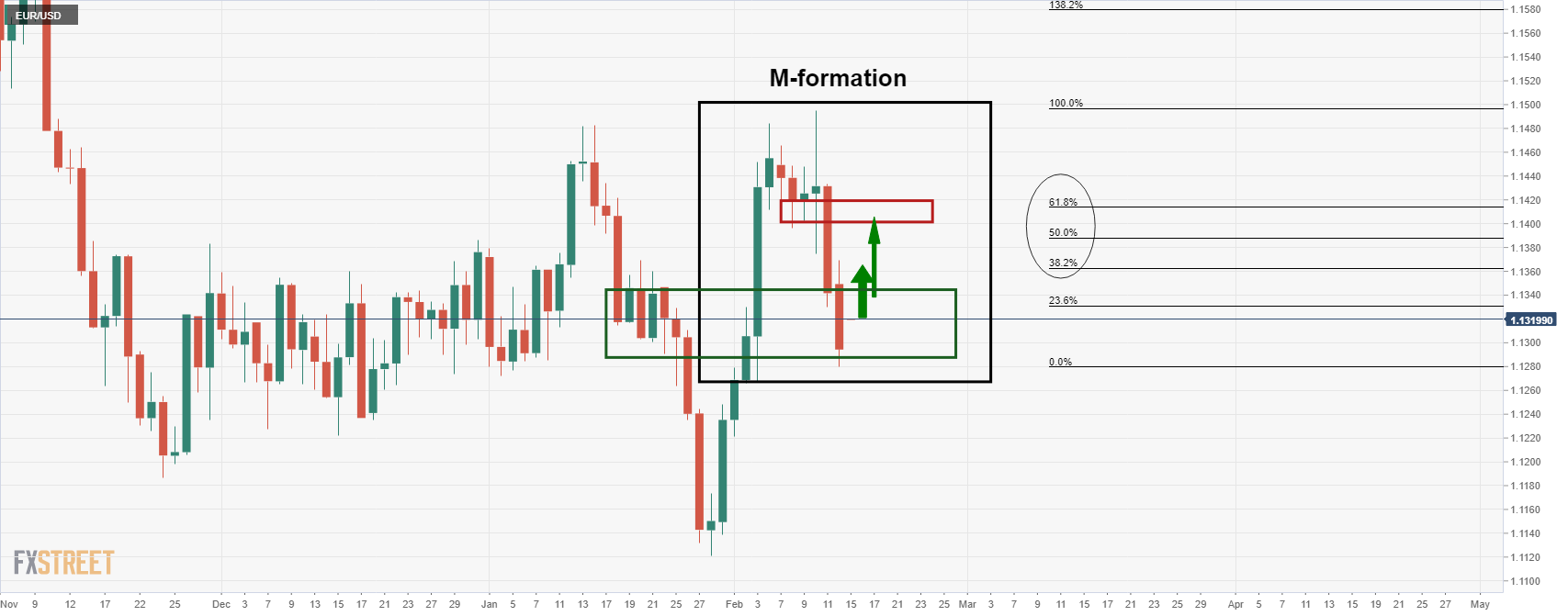

As per the prior day's pre-Europen analysis, EUR/USD bulls tread around with caution in a field of land mines and disruptive Russian headlines, whereby the euro was on a firmer footing and expected to continue higher, the price has moved in on the 38.2% ratio as follows:

EUR/USD prior analysis

It was stated prior to Tuesday's trading in Europe that ''with the price stabilising in a familiar support area, the M-formation is compelling especially as the neckline has a confluence with the 50% and 61.8% ratios.''

Given the de-escalation type of rhetoric from the Russian president, Vladimir Putin, on Tuesday, the price has continued its approach towards the aforementioned confluence area as follows:

EUR/USD daily chart

Russian President Vladimir Putin on Tuesday said he was “ready” to work with the West on de-escalating tensions, the latest signal that the prospect of war with Ukraine could be receding. "We are ready to work further together. We are ready to go down the negotiations track," Putin said following talks with German Chancellor Olaf Scholz in Moscow.

However, the bulls are not out of the woods yet and the situation is on a knife's edge still. US President Joe Biden said "we have not yet verified the Russian military units are returning to their home bases. Indeed, our analysts indicate that they remain very much in a threatening position." The President also underscored that "Russia has more than 150,000 troops circling Ukraine and Belarus and along Ukraine's border, and invasion remains distinctly possible."

Markets can turn on a dime at the drop of a disruptive Russian headline, and the 1.11 area is by no means a distant possibility.

- GBP/JPY snaps two days of losses as buyers eye a second test of the YTD highs above 157.00.

- GBP/JPY Technical Outlook: The cross-currency pair is upward biased, as indicated by three technical signals.

The British pound recovers from two straight days of losses amid an improved market sentiment as the North American session winds down. At the time of writing, the GBP/JPY is trading at 156.52.

GBP/JPY Price Forecast: Technical outlook

The GBP/JPY upward move on February 10 fell short of breaking above the January 5 157.76 daily high, retreating under a five-month-old downslope trendline that passes around the 157.20-40 area. At the end, that left a candlestick with a larger wick on the top, indicating that selling pressure kept the GBP/KPY of printing a higher daily close which could have exacerbated a move to the upside.

Nevertheless, the daily moving averages (DMAs) are located below the exchange rate, indicating a bullish bias in the pair. That factor, alongside a Relative Strenght Index (RSI) at 58, aiming higher and a forming “bullish harami” candle pattern, could catalyst a move to the upside.

With that scenario in play, the GBP/JPY first resistance would be 157.00. Breach of the latter would expose January 5 157.78 daily high, followed by the psychological 158.00 level and finally the October 20 158.22 daily high.

- NZD/USD bulls let off as risk sentiment improves on the Russian pivot.

- The imbalance left between 0.6690's and the 0.6650's for the days ahead in focus.

NZD/USD is trading 0.37% higher on the day as markets suspect that an imminent Russian invasion has been averted which has enabled a recovery in risk appetite on Tuesday. Russia said it had withdrawn some of its troops from the Ukraine border. However, the announcement, the United States and NATO said they had yet to see evidence of a drawdown.

Nevertheless, the Kiwi is higher again, averting a sell-off from 4-hour resistance. However, there are still plenty of uncertainties within a very fluid situation surrounding Russia and Ukraine. Not least, the Federal Reserve could be a ticking time bomb for the forex space with regards to its next move at the March meeting.

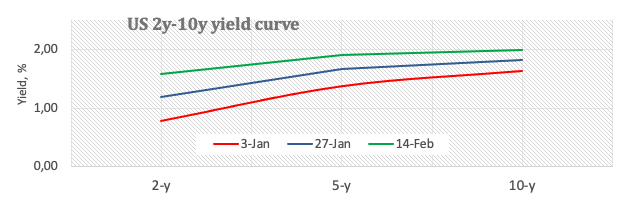

''Volatility remains the order of the day,'' analysts at ANZ bank argued. ''Higher US yields are battling things like higher commodity prices for attention; while rates have had less of an influence on FX of late, the knee-jerk reaction to higher US bond yields tends to be NZD-negative.''

US yields started the week off depressed from safe-haven flows but Federal Reserve's James Bullard’s continued hawkishness on Monday led to a complete turnaround. Bullard advocates for 100 bps of tightening by July. Bullard says that he is worried that the Fed is not moving fast enough as inflation is much higher than expected. On Wednesday, Bullards concerns were met by the US Producer Price Index data that arrived much hotter than anticipated for January at 9.7% YoY. Core PPI is now at 8.3% YoY indicating that inflation is running at a rampant pace.

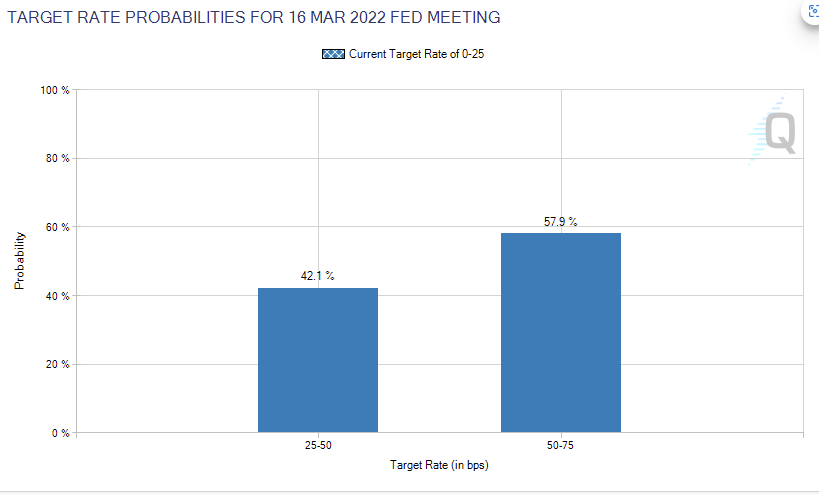

Fed tightening expectations

Meanwhile, Fed tightening expectations remain elevated and the following is noted by Brown Brothers Harriman:

WIRP suggests nearly 70% odds of a 50 bp move next month, up from 60% at the start of this week. Two 25 bp hikes May 4 and June 15 are still fully priced in that would take the rate up 100 bp by mid-year. Another 50 bp of tightening in H2 is fully priced in, with 60% odds of another 25 bp hike by year-end vs. over 40% odds at the start of the week. Looking further out, swaps market now sees a terminal Fed Funds rate around 2.25% and that should eventually move closer to 2.5% or even higher once this risk off episode ends.

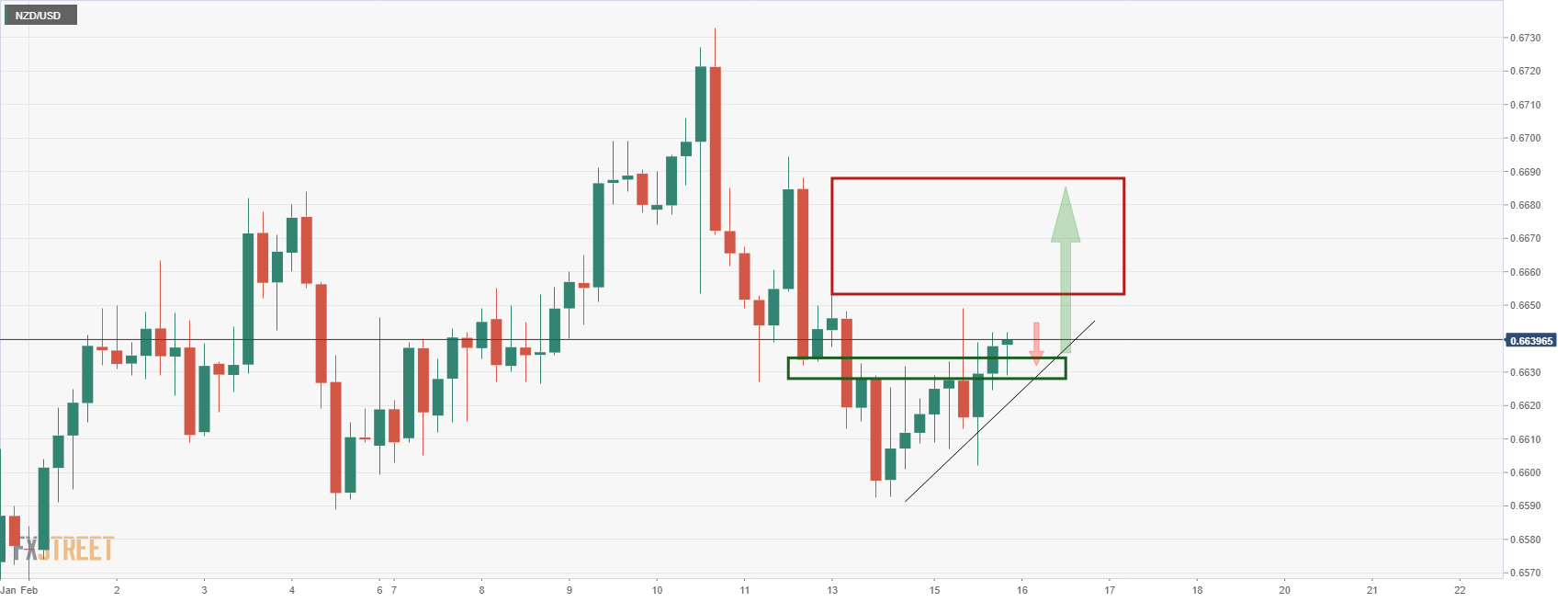

NZD/USD technical analysis

As per the prior analysis, NZD/USD Price Analysis: Trapped and consolidation is in play below bearish structure, it was noted that the price was respecting the prior 4-hour lows as resistance, but the daily support structure was menacing for the bears.

The price had been creeping in on the old support turned to resistance but the prospects of a downside continuation were thwarted in New York's trade when the price broke to fresh corrective highs:

This leaves the bulls in play and there are prospects of a surge into the imbalance left between 0.6690's and the 0.6650's for the days ahead.

European Central Bank executive board member Isabel Schnabel said on Tuesday, in an interview with the FT, that the bank must consider the "unprecedented" rise in house prices when it comes to assessing inflation and deciding on how fast monetary policy settings should be tightened. The FT framed her comments as the most hawkish yet by an ECB executive board member in the run-up to next month's meeting.

“If this [rise in house prices] were included, it would have a substantial effect on measured inflation, in particular on core inflation, where the weight of owner-occupied housing is larger" Schnabel told the UK paper. “It has to be part of our general considerations" she added.

Elsewhere, Schnabel warned that with Consumer Price Inflation having risen to a new Eurozone record high of 5.1% in January and with the unemployment rate having dropped to a Eurozone record low of 7.0% in December, “the risk of acting too late has increased." "Therefore," she continued, "we need a careful reassessment of the inflation outlook”. Schnabel warned that given the recent shift in the inflation outlook, the benefits of further QE purchases may not justify the additional costs and there is a growing argument for ending purchases altogether.

Market Reaction

FX markets haven't reacted to Schnabel's latest remarks, but as volumes pick up during Asia Pacific trade and then into Wednesday's European session they might well lend the euro some support as traders price in a faster pace of QE taper.

US President Joe Biden said on Tuesday in an address to the nation that a Russian attack on Ukraine still very much remained a possibility, cautioning that the US hasn't yet verified Russian units returning home and an invasion remains possible. However, Biden continued, diplomacy should have every chance to succeed and there are real ways to address Russian security concerns.

The US is proposing new arms control and other measures to Russia, Biden said, adding that the US and NATO do not have plans to put missiles in Ukraine. The US and NATO are not a threat to Russia, Biden emphasised, saying directly to Russian citizens that "we are not your enemy". The US is not targeting Russian people or stability, Biden added.

If Russia attacks Ukraine, it would be without cause or reason and the human cost would be immense, Biden said. The US and its allies are ready to impose powerful sanctions and export controls on Russia if it invades, he continued, saying that the Nord Stream 2 pipeline would not go ahead. Biden reiterated that the US will defend every inch of NATO territory with the full force of American power, and the US will soon conduct military exercises with allies and partners.

A Russian invasion would have consequences for US citizens at home, Biden warned, saying there could be an impact on energy prices. If Russia attacks through cyber or other asymmetrical means, the US and its allies will respond, he noted. Biden closed his remarks by saying that if the US does not stand for freedom where it is at risk, we will pay the price tomorrow.

Market Reaction

FX markets did not react to Biden's latest comments, which served more as a reiteration of what US and NATO officials have been repeatedly saying in recent days.

- EUR/JPY saw a decent rebound on Tuesday as the geopolitical risk premia eased, propelling the pair into the mid-131.00s.

- In the scenario of continued de-escalation, a move back above 132.00 towards last week’s highs is on the cards.

EUR/JPY saw a decent rebound on Tuesday as the geopolitical risk premia that has weighed on the euro in recent days eased somewhat. The pair rallied back into the mid-131.00s and, at current levels in the 131.30s, is more than 1.0% above Monday’s near-130.00 lows with about 0.6% of that rally coming on Tuesday. Russia said it would partially withdraw troops from near the Ukraine border, as the nation continued to label Western warnings about potential military action against Ukraine as hysteria. Financial market participants read the move as de-escalating tensions somewhat, hence the more upbeat macro mood on Tuesday.

The general market theme was that stocks and risk-sensitive currencies rallied while safe-haven bonds and currencies underperformed, though the euro was a standout G10 performer on the day as traders assessed risks to the Russian gas import-dependent Eurozone as having lessened. That helped the euro shrug off weaker than expected German ZEW February survey results released in the European morning, while the second estimate of Eurozone Q4 GDP growth was unchanged from the first at 4.6% YoY and 0.3% QoQ.

Looking ahead, amid a lack of notable economic events on the Eurozone and Japanese economic calendars for the rest of the week, the main driver of EUR/JPY will remain geopolitics. If Friday arrives with no Russian military action having yet happened against Ukraine, EUR/JPY will have likely have continued to pare the losses it incurred last Friday on US warnings that war could break out as soon as this week. In the optimistic case where war does not happen and looks increasingly unlikely, EUR/JPY could likely rebounds back to the north of the 132.00 level and retest last week’s highs near 133.00.

- NZD/USD rebounded from the 0.6600 level to move higher on Tuesday, as the kiwi benefitted from strong risk appetite.

- Russia confirming intentions to withdraw some troops from the Ukraine border helped boost sentiment, aiding the kiwi.

- Geopolitics remains in focus, but attention also turns to a barrage of important upcoming US and NZ economic events.

NZD/USD found decent support at the 0.6600 level on Tuesday, rebounding from a dip towards the big figure shortly after the US cash open to current levels in the 0.6630s, where the pair trades about 0.3% higher on the day. That makes it one of the better performing G10 currencies alongside its Aussie counterpart, with the antipodean currencies boosted by a broad improvement in macro risk appetite on an apparent easing of immediate geopolitical risks in Eastern Europe.

Russia said it was partially withdrawing some of its troops from the border with Ukraine, easing fears about an imminent military incursion into the country. However, NATO officials cautioned that it was too soon to say that Russia has decided against invasions and some geopolitical strategists still view the possibility of a flare-up of tensions in the Eastern Ukraine Donbas region as highly likely.

The improvement in market mood was enough to see NZD/USD shrug off a much hotter than expected US Producer Price Inflation report that economists said strengthens the hand of hawkish Fed policymakers arguing for a faster pace of policy tightening. NZD/USD traders will now look ahead to US Retail Sales data and the release of the Fed minutes of the January policy meeting on Wednesday, followed by a barrage of Fed speak on Thursday and Friday. New Zealand Producer Price Inflation data for Q4 will also be in focus during Friday’s Asia Pacific session and will be viewed in the context of how it influences the chances of a 50bps rate hike at the RBNZ’s next meeting.

That might suggest some upside risk for the pair going forward, only that US data and Fed speak will be viewed the same way. Indeed, US money markets on Tuesday were pricing about a 60% likelihood of a 50bps rate hike from the Fed in March. Commentary from the likes of influential Fed policymakers Christopher Waller, John Williams and Lael Brainard on Friday could swing things either way, making for choppy NZD/USD price action.

What you need to know on Wednesday, February 16:

The market mood improved on Tuesday as market players rushed to price in a de-escalation of the Russia-Ukraine tensions after the Russian Minister of Defense announced that some of the troops at the border would return to their bases.

Nevertheless, comments from Russian President Vladimir Putin released during the American afternoon were not that encouraging. Putin said that he is not satisfied with assurances that Ukraine will not become a NATO member in the near future and wants the issue to be settled right now or soon through a negotiating process.

Also, German Chancellor Olaf Scholz is in Moscow undergoing diplomatic talks. A key gas line from Russia to Germany may come out of order in the event of a war. Finally, UK PM Boris Johnson noted Russia is giving mixed signals and continues preparation to respond to a Russian invasion.

Financial markets maintained the upbeat tone through the European and American sessions, and indexes in both continents posted substantial gains. Wall Street, however, retreated from intraday highs ahead of the close.

Demand for the dollar receded, but its decline was partially offset by renewed strength in government bond yields. The US 10-year Treasury note yielded as much as 2.05% on Tuesday.

The EUR/USD pair settled in the 1.1350 region, while the GBP/USD hovers around 1.3540. The AUD/USD pair recovered to 0.7150, while USD/CAD trades in the 1.2730 price zone.

Commodities gave up, with gold plummeting to the current $1,850 area. Crude oil prices shed a good bunch of their recent gains, with WTI currently trading at around $91.60 a barrel.

The focus now shifts to US Retail Sales and FOMC Meeting Minutes.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Crypto forms higher lows, begin new bull market

Like this article? Help us with some feedback by answering this survey:

- The USD/CHF advances some 0.15% during the North American session.

- The USD/CHF is range-bound at the 0.9220-60 regions.

- USD/CHF Technical Outlook: Consolidated amid the lack of a catalyst to break the range.

On Tuesday, the USD/CHF pares two days of losses courtesy of geopolitical jitters, which spurred a flight towards the safe-haven status of the Swiss franc to the detriment of the greenback. At the time of writing, the USD/CHF is trading at 0.9256.

USD/CHF Price Forecast: Technical outlook

The USD/CHF price action in the last week and a half witnessed that USD bulls have been unable to “decisively” break resistance above the 0.9260-80 area, with only one attempt on February 10, when the USD/CHF pierced 0.9296, followed by a close at 0.9254, a 40-pip drop by the end of the trading session.

That said, the USD/CHF is range-bound, in the 0.9220-60 area; although some “spikes” lie above the top of it, the large wicks left by the candlesticks show that intense selling pressure lies above that level.

Upwards, the USD/CHF first resistance level would be the 0.9260 area. A daily close above that level would expose the February 10 high at 0.9296, followed by November 24, 2021, a daily high at 0.9373.

On the flip side, the USD/CHF first support would be the 100-day moving average (DMA) at 0.9220. Breach of the latter confirmed by a daily close would expose the confluence of the 50-DMA and the psychological 0.9200 figure. Once that level is cleared, the next support would be 200-DMA at 0.9170.

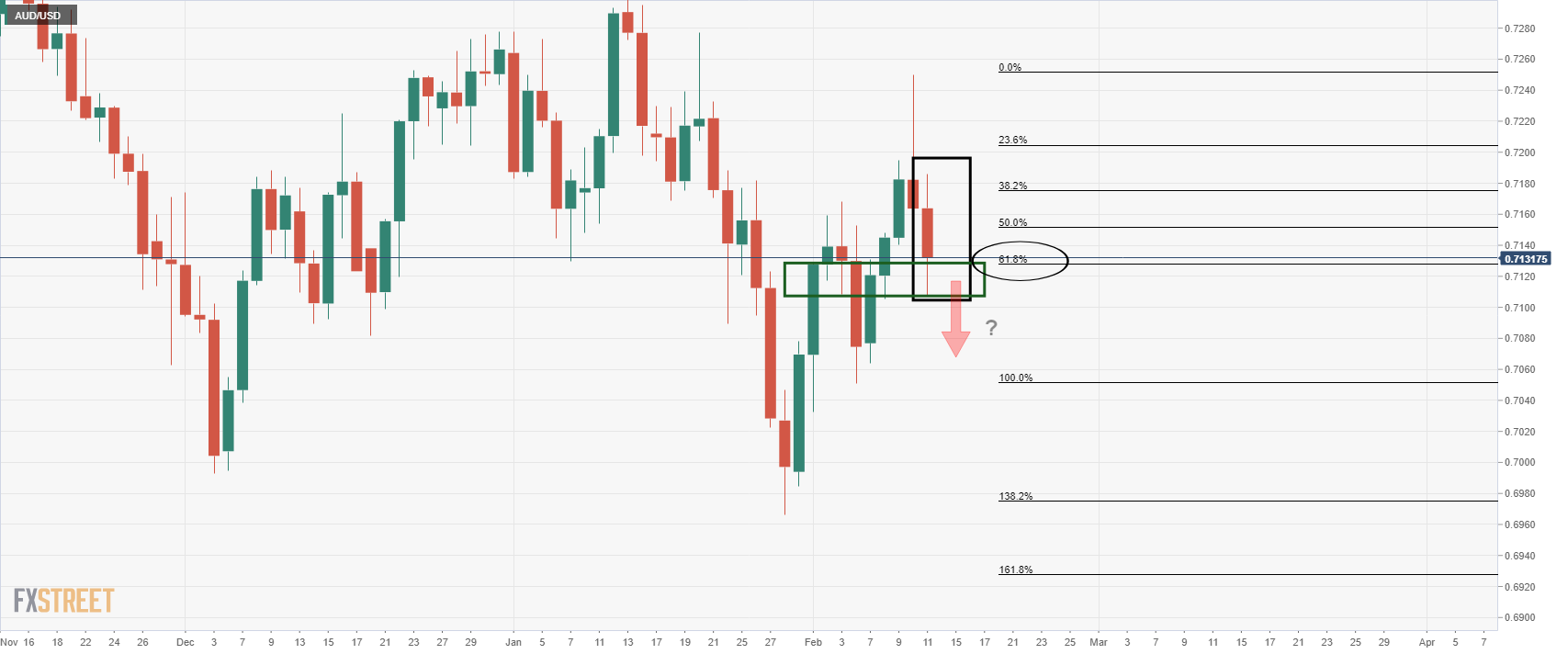

- AUD/USD bulls are on the move with eyes on 0.7180.

- The 0.7300 target will be next in range as bulls take control.

As per the prior analysis at the start of the week, AUD/USD Price Analysis: Bears testing bullish commitments at critical support, AUD/USD bears indeed took on the bulls, but only momentarily.

The following illustrates a bullish perspective as the fundamentals tides turn in favour of the upside, at least from a meanwhile risk-on perspective.

AUD/USD prior analysis

AUD/USD live market, daily chart

As illustrated, the bears did move in but the price is back to stabilising around the 61.8% ratio on Tuesday. This leaves prospects of a bullish continuation on the cards for the rest of the week and the foreseeable future.

AUD/USD H4 chart

AUD/USD is breaking to the upside with the price now above H4 21-EMA which is an encouraging development for the bulls. Eyes will be on 0.7180s and then 0.73 the figure as a critical milestone in the pursuit of a higher daily high.

- The white metal drops sharply 2% on increasing market mood sentiment.

- Eastern Europe tensions diminished as Russia withdrew “some” troops as negotiations continued.

- XAG/USD Technical Outlook: Neutral biased, but the path of least resistance is downwards.

Silver (XAG/USD) follows gold’s footsteps during the North American session, plunging from a ten-month-old downslope resistance trendline towards the 100-day moving average (DMA), which lies at $23.20. At the time of writing, XAG/USD is trading at $23.38.

Geopolitical tensions abate between Russia, Ukraine, and NATO

On Tuesday, tensions between Russia/Ukraine appeared to abate after German chancellor Olaf Scholz met with Russian President Vladimir Putin. Putin told reporters that talks with Scholz were businesslike.

The meeting happened after last Friday’s announcement by the US press that according to US officials, Russias invasion of Ukraine was “imminent.” At the same time, the Kremlin denied those accusations. In fact, earlier news crossing the wires said that “some” Russian troops were returning home.

European and US equities took that as a positive development in the region, as all of the indices trade in the green. In the meantime, the US 10-year T-note yield rises four basis points sit at 2.035%., weighing on Silver’s non-yielding status.

Putting geopolitical matters aside, factors like the Federal Reserve tightening keep the non-yielding metal under selling pressure. On Monday, St. Louis President James Bullard reiterated his view that the US central bank would need to hike 100 bps by the July meeting. Also, he emphasized that the balance sheet reduction could begin in Q2 and wants discussions to get underway.

As of Tuesday, the FEDWATCh Tool has a 100% chance of a 25 bps rate hike, while a 57.9% chance of a 50 bps. The next Federal Reserve meeting would be in March but following the release of the US Consumer Price Index (CPI) of February, which could give clues regarding the possible outcome of the reunion.

Prices paid by producers in the US are 0.6% y/y higher than estimated

Meanwhile, the Department of Labor reported the Producer Price Index (PPI) for January, which came unchanged in line with the previous month, increasing by 9.7% y/y, higher than the 9,1% estimated. The so-called Core PPI rose to 8.3% y/y, two tenths lower than December’s but higher than 7.9% foreseen.

XAG/USD Price Forecast: Technical outlook

XAG/USD dropped $1.00 during the overnight session, on fundamental news, but also a ten-month-old downslope trendline around $23.65-70 area exacerbated the downward move that stalled near the $23.00 figure.

That said, XAG/USD is neutral biased. However, the path of least resistance is downwards, and its first support would be the 100-DMA at $23.24. Breach of the latter would expose the confluence of the figure and the 50-DMA at $23.00. Once that area gives way for USD buyers, the next challenge would be the February 3 daily low at $22.00.

- USD/CAD bulls are making progress on a daily time frame for a test of 1.2800.

- Oil markets are vulnerable to the Russian premium dissolving.

- All eyes will turn to Canadian inflation with hawkish sentiment at BoC brewing.

USD/CAD has been trading between 1.27 the figure and 1.2774 on Tuesday, thrown around within the range on headlines related to the risk of a Russian invasion of Ukraine. initially, CAD rose against the greenback as fears eased that Russia would invade Ukraine. However, as noted in an article in Asia, USD/CAD traders turn to oil prices for direction, energy markets are in the driving seat.

A pullback in oil prices has dented the performance of the CAD after prices fell off seven-year highs early on Tuesday. In a signal that Russia may be open to a diplomatic solution in order to avert heavy economic sanctions it would otherwise suffer if it were to invade its neighbour, markets are relieved and the premium in oil is bleeding out.

West Texas Intermediate crude for March delivery was last seen down US$2.51 to US$92.95 per barrel, while April Brent crude, the global benchmark, was down US$2.28 to US$94.20.

Reuters reported, in relation to news in the Guardian, that ''after meetings in Moscow Monday between Russian President Vladimir Putin and German Chancellor Olaf Scholz, Russia said it is returning some troops station on the Ukrainian border to base. However, NATO Secretary-general Jens Stoltenberg told reporters on Tuesday that the alliance has yet to see any significant de-escalation from Moscow.''

As for the impact in the oil markets, nearly 5-million barrels per day of Russian oil exports are at stake. Russia could also weaponize its energy exports to prevent severe sanctions. This has led to a colossal bid in oil of late, sending prices to their highest since the autumn of 2014. However, as analysts at TD Securities argue, In turn, energy prices still appear tactically vulnerable to de-escalation in Russian-Ukrainian tensions.''

As for domestic data, Canadian Housing Starts fell 3% in January compared with the previous month. This was a weight for the currency ahead of Canada's inflation report for January, due on Wednesday. This is expected to

give more clues on the outlook for Bank of Canada interest rate hikes. The CAD has been befitting from prospects a rate hike next month, a move that will break the status quo that has been in place at the BoC since October 2018. Subsequently, in the anticipation of a more hawkish outlook at the central bank, Canadian government bond yields remain higher across the curve, tracking the move in US Treasuries. The 10-year was up 3.1 basis points at 1.937%, after touching on Friday its highest level in nearly three years at 1.961%.

USD/CAD technical analysis

The outlook is bullish from an hourly perspective as follows:

The price has met a 50% mean reversion and is being held up at old resistance. This would be expected to lead to a fresh wave of demand to take the pair to fresh hourly highs.

From a more boarder perspective, as illustrated in the prior analysis as follows, the bulls still need to get over the line at 1.28 the figure:

USD/CAD bulls making progress

- GBP/USD has been choppy on Tuesday, swinging around the lower 1.3500s, with GBP subdued despite better risk appetite.

- Cable looks to have formed a descending triangle in recent weeks, implying a potential downside breakout towards recent sub-1.3400 lows.

GBP/USD has seen choppy, two-way trading conditions on Tuesday, swinging between session highs in the 1.3560s and sub-1.3500 session lows as the pair, for the most part, stuck to recent intra-day ranges. Despite a decent rebound in global equity markets on signs of easing Russia/Ukraine tensions and despite hotter than expected December UK wage growth figures which economists said bolsters the case for BoE tightening, GBP has been lackluster. At current levels near 1.3525, GBP/USD trades flat on the day.

Cable looks to have formed a descending triangle in recent weeks and the pair seemingly did not have enough conviction to mount a meaningful bullish breakout. Bearish technicians thus pay hope that GBP/USD breaks below support in the 1.3500 area and press lower towards last month’s sub-1.3400 lows. While easing geopolitical tensions may have knocked the US dollar in the short-term amid a weakened safe-haven bid, Producer Price Inflation figures on Tuesday came in hotter than expected, strengthening the argument of hawkish Fed policymakers like James Bullard.

Bullard has called for 100bps of tightening by July 1, meaning he likely supports a 50bps move in March. Other Fed policymakers have pushed back against this idea and said they would prefer a more measured policy shift. But markets seem to think the hawks will win this debate, with CME’s Fed Watch tool suggesting a roughly 60% chance of a 50bps hike in March versus just 25% one week ago (prior to the hot January Consumer Price Inflation report).

Looking ahead to the rest of the week, geopolitics will of course remain key to watch, but there is also plenty of US/UK data for GBP/USD traders to sink their teeth into. UK January CPI and US January Retail Sales figures and the Fed minutes of the last meeting are out on Wednesday. Thursday and Friday are then packed with Fed speak, while UK January Retail Sales figures are out on Friday.

- The USD/JPY buyers need a daily close above 115.60 to cement an attack towards the YTD high at 116.35.

- USD/JPY Technical Outlook: It is upward biased, confirmed by DMAs and RSI in bullish territory.

On Tuesday, the USD/JPY bounces off a two-month-old downslope trendline, the previous resistance-turned-support around the 115.00-15 area, at the same time reclaim above November 24, 2021, high at 115.51, a prior supply zone. At the time of writing, the USD/JPY is trading at 115.64.

USD/JPY Price Forecast: Technical outlook

The USD/JPY is upward biased, as depicted by the daily moving averages (DMAs) located well below the spot price. Additionally, a daily close above the January 28 daily high at 115.68 would further cement the upward bias, as USD/JPY buyers attempt to challenge the 116.35 daily low for the second time in the year. Further confirmation by the Relative Strength Index (RSI) at 59 aiming up has enough room before reaching overbought conditions.

That said, the USD/JPY first resistance would be 116.00. Breach of the latter would expose the YTD high at 116.35, followed by a challenge of a 24-month-old downslope trendline around 117.00. A clear break of that ceiling level would pave the way towards January 2017 swing high at 118.61.

On the flip side, the USD/JPY first support would be February 14 daily low at 115.00. A sustained break would expose the 50-DMA at 114.67, followed by the February 2 low at 114.14 and then the 100-DMA at 114.07.

Russian President Vladimir Putin said on Tuesday that he is not satisfied with assurances that Ukraine will not become a NATO member in the near future, wants the issue to be settled right now or soon through a negotiating process, reported the Washington Post.

Market Reaction

Markets have not reacted to the latest Putin comments, though the macro mood remains positive with Russian troops expected to be withdrawn from the Ukraine border and Putin instead expected to pursue the path of diplomacy, at least in the coming days.

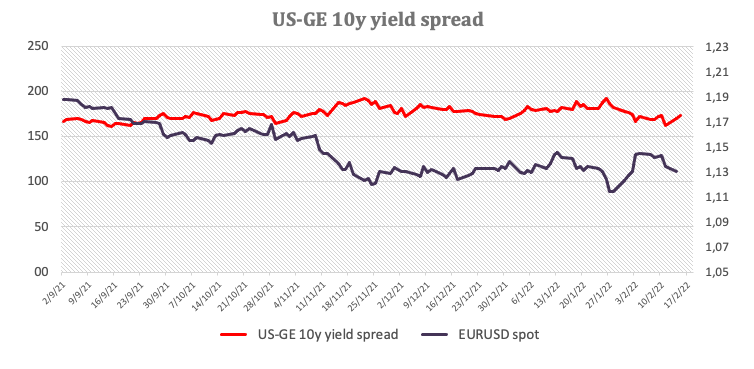

The bias for the EUR/USD is neutral, according to analysts at MUFG Bank. They see the pair in the 1.1050-1.1650 range over the next weeks. They warn the euro could weaken sharply if the Federal Reserve raises interest rates in larger increments than currently expected.

Key Quotes:

“Higher yields in Europe should help provide more support for the EUR and could prove to be an important game changer for future performance. Short EUR positions in recent years have been built up on the anticipation that ECB policy will remain loose which will be more seriously challenged going forward. Low yields in Europe prompted record portfolio outflows into foreign debt by European investors over the past year. A reversal of those flows could help to lift the EUR more than expected.”

“The Fed is expected to raise rates by over 150bps by the end of this year with a larger 0.50 point hike now seen as the most likely outcome from the upcoming FOMC meeting on 16th March. Without the ECB’s hawkish policy pivot, EUR/USD would likely be trading closer to the 1.1000-level.”

“Risks for the EUR are more balanced now. The EUR could weaken more sharply than expected if the Fed raises rates in larger increments and starts shrinking their balance sheet sooner and faster than expected to bring policy back to neutral sooner. The EUR could come under more selling pressure initially as well if Russia launches a full on invasion the Ukraine with the aim to take control of the whole country and restricts energy supply to Europe in retaliation for sanctions. On the other hand, the EUR could strengthen more than expected if the ECB outlines plans in March to end QE sooner than Q3 and talks up the possibility of multiple rates hikes which would bring an end to negative rates in Europe.”

Republican Senator Pat Toomey said on Tuesday that the Senate Banking Committee should not proceed with a vote on Fed nominee Sarah Bloom Raskin unless she answers questions on her role as a director of Reserve Trust. Reserve Trust is a fintech company that obtained a Fed master account while Raskin was serving as a board member. "We've asked basic questions and she's refused to provide answers" he said. Toomey will instruct Republican voters to sit out a vote on Tuesday, denying the Democrats of the quorum needed to move forward with a vote on Raskin's nomination. Toomey added that if Senate Banking Committee Chair Sherrod Brown proceeds on a vote on the other Fed nominees without Raskin, the Republicans will attend and vote.

Market Reaction

FX markets did not react to the latest developments.

- Gold’s $20+ fall, courtesy of an improved market mood, stalled at November 2021 daily high.

- Russia/Ukraine conflict tensions appear to abate, weighing on Gold’s safe-haven status.

- XAU/USD Technical Outlook: Upward biased but faces strong resistance around $1,855-60.

Gold (XAU/USD) plunges $20 during the North American session as Russia/Ukraine conflict tensions ease a tone as investors move from the non-yielding metals towards riskier assets. At the time of writing, XAU/USD is trading at $1849.25.

Eastern Europe geopolitical tensions subside

As portrayed by European and US equities rise, the market sentiment remains positive, as easter Europe tension abate some after German chancellor Olaf Scholz met with Russian President Vladimir Putin. Putin told reporters that talks with Scholz were businesslike.

The reunion happened after the US warned of a possible Russian attack on Ukraine, as the US press said an invasion was “imminent.” Meanwhile, officials in Moscow repeatedly denied the aforementioned. Moreover, updates crossing the wires that some Russian troops are returning to the base weighed on the safe-haven status of Gold.

Putting geopolitical matters aside, factors like the Federal Reserve tightening keep the non-yielding metal under selling pressure. On Monday, St. Louis President James Bullard reiterated his view that the US central bank would need to hike 100 bps by the July meeting. Also, he emphasized that the balance sheet reduction could begin in Q2 and wants discussions to get underway.

US hot fees paid per producer increases the odds of a bigger rate hike

On Tuesday, the Department of Labor reported that prices paid by producers for January were unchanged in line with the previous month, increasing by 9.7% y/y, higher than the 9,1%, though unchanged vs. the December number. The so-called Core PPI rose to 8.3% y/y, two tenths lower than December’s but higher than 7.9% foreseen.

In the meantime, the US 10-year Treasury yield advances five basis points sits at 2.04%, weighs on the non-yielding metal, which fell from daily tops around $1,877 down to $1,849 a $24 in a matter of hours. Worth noting that the 10-year TIPS, a proxy for real yields, sits at -0.45%, one basis point down.

XAU/USD Price Forecast: Technical outlook

On Tuesday, the XAU/USD free-fall helped USD bulls to reclaim under a nine-month-old trendline, broken two days ago and pushed under the mid-line between the top-central Pitchfork’s uptrend channel. That said, the confluence of both trendlines around the $1,855-60 range would be resistance, that in the event of being broken, could exacerbate a move towards $1,900. A break of the former would expose November 16, 2021, a daily high at $1,877.14, followed by the latter $1,900.

However, despite that XAU/USD is upward biased, the $20 drop appears to be a profit-taking move unless USD bulls push for a daily close under the January 25 $1,853.88 daily high. In that event, the first support would be July 15, 2021, high at $1,834, followed by the mid-line between the bottom-central Pitchfork’s channel at $1,815-20 area.

- AUD/USD has recovered some ground on Tuesday and is now probing the 0.7150 level.

- The pair is getting a boost as risk appetite improves on easing geopolitical tensions, having shrugged off dovish RBA minutes.

The dovish tone to Tuesday’s RBA minutes release, which confirmed the view espoused at the last policy meeting that the central bank is in no rush to start tightening monetary policy settings, has failed to hobble the Aussie. Indeed, AUD/USD has been trading with a positive bias on Tuesday having found good buying interest upon dips towards the 0.7100 level, though for now, the pair remains capped by resistance in the 0.7150 area. At current levels in the 0.7140s, AUD/USD is about 0.25% stronger on the day, making the Aussie the second-best performing G10 currency on the day after the euro.

Risk appetite has improved on Tuesday with Russian government officials, including President Vladimir Putin, confirming that troops will be partially withdrawn from the Ukrainian border. Geopolitical tensions remain elevated and the risk of a new Russia/Ukraine conflict high, but generally speaking, risk-sensitive assets have been doing well, which partially explains AUD strength. The latest much hotter than expected US Producer Price Inflation figures, though strengthening the argument of more hawkish Fed members calling for a 50bps hike in March, did not impact FX markets much.

Looking ahead, AUD/USD will continue to focus on geopolitical developments amid as risks of an escalation of tensions between Russia and Ukraine over the latter’s breakaway Eastern provinces rise. Otherwise, there will also be plenty of US/Aussie data releases for traders to sink their teeth into. US Retail Sales and Fed minutes are due on Wednesday, Australian employment data, US weekly jobless claims and Philly Fed survey data plus Fed speak are due on Thursday and a further barrage of Fed speak is due Friday.

Analysts at MUFG Bank have a positive outlook for the USD/JPY pair. They forecast it will trade in the range 113.00-118.00 over the next weeks. They see the pair is in the final period of the move higher.

Key Quotes:

“With the USD/JPY spot rate close to realising new closing highs the risks are certainly more skewed to the upside. Yen selling could be further reinforced on a break of 117.00 which we believe is an important long-term resistance point technically. As stated here before, yield spreads cannot be relied upon over the timeframe of the impending Fed tightening cycle – that correlation eventually breaks down. But there appears scope for that influence to play a role, perhaps into the first rate increase by the Fed on 16th March.”

“We are in the final period of the move higher in USD/JPY. Yield spreads will lose their influence given how much is now priced into the US curve while the overall withdrawal of monetary accommodation will result in more challenging financial market conditions that will likely benefit the yen. Our PPP estimates point to USD/JPY overvaluation approaching 20%.”

“The more elevated risks associated to possible conflict between Russia and Ukraine is the primary risk to USD/JPY advancing further higher from here. The newsflow is fluid and changes rapidly but at the time of writing the pullback of Russian troops from Ukrainian border areas is a positive development. Higher yields more generally globally that cause asset price corrections is the second primary risk to USD/JPY but this risk feels further away than the imminent threat related to Russia.”

- EUR/USD bottoms at 1.1319 and redounds back to the 1.1355 area.

- US dollar mixed across the board, on risk aversion and higher yields.

- Wall Street extends gains, S&P 500 up by 1.50%.

The EUR/USD recovered quickly from a drop to 1.1320 and rose back to the 1.1350 area. It holds a bullish tone and is trading at daily highs at 1.1361.

EUR/USD gains on stronger euro, mixed dollar

Stocks prices are up across the globe. In Europe, main indices finished up by 1.25% on average. On Wall Street, the Dow Jones gains 1.31% and the Nasdaq 1.90%. The rally was triggered by easing tensions on Ukraine’s borders.

The improvement in risk sentiment pushed bond prices to the downside. Eurozone and Treasury yields rose significantly boosting the euro particularly. EUR/GBP is up by more than 40 pips, trading near 0.8400, while EUR/JPY rose toward 131.50.

The US dollar is falling modestly across the board, although it is up versus the yen supported by higher yields. The US 10-year yield rose from 1.97% to 2.05%. It peaked after the release of US data that showed an increase of the Producer Price Index in January above expectations. On Wednesday, the retail sales report is due.

Short-term outlook

If the EUR/USD extends the rally, the next resistance might be seen at the 1.1375 zone, followed by 1.1400 and 1.1425. The positive tone will likely remain while the pair holds above 1.1330 (20-hour moving average); a break lower should weaken the euro, exposing the 1.1320 support.

Technical levels

- US equities are up sharply on Tuesday as investors breathe a sigh of relief amid apparently easing geopolitical tensions.

- News of Russian troop withdrawals from Ukraine’s border helped distract equities from ugly PPI and NY Fed survey data.

- The S&P 500 was up about 1.5%, the Nasdaq 100 up nearly 2.0% and the Dow about 1.3%.

The S&P 500 opened Tuesday trade sharply higher and currently trades to the north of the 4450 level, up about 1.5% on the day. Russia has confirmed it is moving troops away from the Ukrainian border, easing concerns about imminent military action, hence the rebound in not just US but global equities. But as NATO and Western leaders caution that Russia remains in a position where it could swiftly take military action against Ukraine and as Russia looks on the verge of recognising the independence of breakaway regions in Eastern Ukraine, tensions remain high.

Recognition of the independence of these regions, coupled with Russia’s talking up of how Ukraine is committing a “genocide” against Russian speakers in its East could form the pretext for a reignition of open hostilities, investors continue to fear. While there remains a huge amount of uncertainty as to how the geopolitical situation in Eastern Europe will unfold, one thing is for sure; for the time being, headlines pertaining to Russia/Ukraine will remain a key driver of equity market sentiment.

The seeming de-escalation of imminent war risk amid Russian troop withdrawal helped distract/shield US equities from some pretty ugly US economic data out prior to Tuesday’s open. The latest Producer Price Inflation report came in significantly hotter than expected, with both the MoM and YoY metrics coming in well above expectations for both the headline and core. With the Fed split over whether to go big with a 50bps rate hike in March, such data will strengthen the argument of the hawkish camp. NY Fed Manufacturing survey data for February also didn’t make for pretty reading, coming in significantly weaker than expected.

The data, despite putting upwards pressure on US bond yields, was not enough to dampen appetite for growth and big tech stocks, gains in which have helped propel the Nasdaq 100 index to a near 2.0% on-the-day gain. The tech-heavy index now trades back to the north of the 14.5K level, while the Dow has been able to recover back to 35K, up about 1.3% on the day. The CBOE S&P 500 Volatility Index, often referred to as the VIX, was down about 2.5 points to back below 26.00, a now more than 6.0 point drop from Monday’s highs above 32.0.

- The NZD/USD eyes to break below 0.6600 amid tensions on the Russian/Ukraine conflict.

- The market mood is upbeat, as portrayed by risk-sensitive currencies.

- NZD/USD is downward biased, but it could shift to neutral if NZD buyers achieve a daily close above 0.6650.

The NZD/USD extends to four days of losses in the North American session, courtesy of the financial markets’ risk-off environment since Friday. At the time of writing is trading at 0.6605.

Risk appetite is back so far. Updates crossing the wires that some Russian troops are returning to the base provided a lift up on US equity futures, while European bourses are in the green. The Russia/Ukraine narrative shift towards a diplomatic exit boosted risk-sensitive currencies to the detriment of safe-haven peers, namely the USD and the JPY.

In the meantime, around 14:23 GMT, it crossed the wires that Russian President Vladimir Putin does not want war in Europe but reiterated that his proposals had not been answered and the decision about a partial withdrawal of troops has been taken.

US Producer Prices approach the 10% barrier

Before the Wall Street Open, the US Bureau of Labor reported that the Producer Price Index (PPI) for January rose by 9.7% y/y, unchanged per the December reading but higher than the 9.1% estimated by analysts. On Core PPI metrics, they came at 8.3% y/y, lower than the 8.5% from December but larger than the 7.9% foreseen.

In the Asian Pacific session, New Zealand and China modernized their 2008 free-trade agreement (FTA). The NZ Minister of Trade and Export Growth Damien O’Connor said that “our primary industry exports forecast to hit a record $50 billion this year alone.”

Meanwhile, the NZ economic docket featured Tourist Arrivals for December increased to 4.4%, from 3.8%, in the November reading.

NZD/USD Price Forecast: Technical outlook

The NZD/USD is downward biased, as depicted by recent price action in the daily chart. The location of the daily moving averages (DMAs) above the spot price confirms the aforementioned. Failure to reclaim the 50-DMA at 0.6742 on February 10 exerted downward pressure on the pair, retreating towards the 0.6500 area before reclaiming the 0.6600 figure, on improved risk market mood.

However, to shift the NZD/USD outlook to a neutral bias, NZD bulls would need to place a daily close above February 14 0.6650 daily high. In that event, the NZD/USD could probe the 0.6700 figure alongside the 50-DMA at 0.6734. Otherwise, the NZD/USD first support would be February 4 daily low at 0.6589, followed by January 28 daily low at 0.6529.

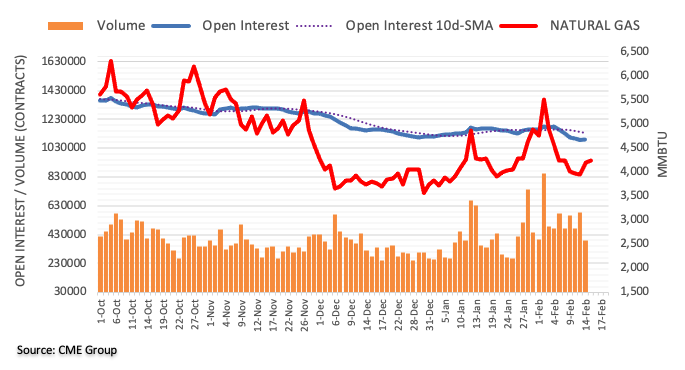

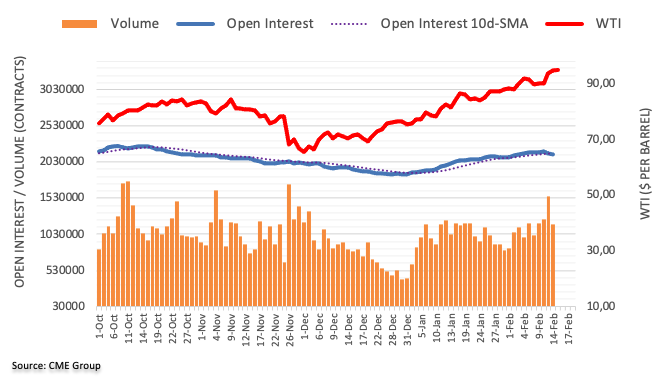

- WTI has pulled back sharply on Tuesday from Monday’s multi-year highs near $96.00 and is back in the $91.00s.

- Fears of an imminent Russian invasion into Ukraine have eased as Russia withdraws some troops, weighing on oil prices.

Oil prices have pulled back sharply from Monday’s multi-year highs, with front-month WTI futures now trading back to the south of the $92.00 level, down about $3.0 per day and more than $4.0 below Monday’s multi-year highs near $96.00. Press reports about a withdrawal of troops on the Ukrainian border to their bases has spurred a rebound in risk appetite and reduction in demand for safe havens on Tuesday.

Such flows could have further legs in wake of remarks from Russian President Vladimir Putin who just said that a decision on partial troop withdrawal had been taken. For oil, tentative signs of de-escalation have triggered profit-taking as geopolitical risk premia is reduced somewhat, though Western nations and NATO remain highly concerned that Russia maintains the option for a near-term attack.

One theme to watch is that Russian President Vladimir Putin might imminently recognise the independence of the Luhansk and Donetsk People’s Republics (LPR and DPR), both breakaway regions of Ukraine located in the East. Western officials have criticised Russia’s State Duma for voting in favour of the recognition, which would break the Minsk Agreement designed to implement a ceasefire in the Ukraine civil war.

Geopolitical strategists fear that Russia might create a false pretext for military action against Ukraine by rekindling violence in the East, with a recognition of LPR and DPR independence a potential step in this direction. For now, WTI traders will remain on tenterhooks and trading conditions will remain choppy/headline-driven.

Near-term WTI bears will likely eye an imminent test of an uptrend that has been supporting the price action for the whole of 2022 thus far in the $90.00s. A break below this could see oil prices swiftly move back under $90.00 and hit support in the form of last week’s lows in the mid-$88.00s. Aside from Eastern European geopolitics, oil traders will also be keeping an eye on upcoming private weekly US oil inventory data at 2130GMT, as well as indirect US/Iran nuclear negotiations, which continue to rumble on in the background.

Price action in the GBP/USD pair looks contained to a 1.35-1.36 range for the most part. While a move above 1.36 is not ruled out in the short-term, economists at Scotiabank expect cable to resume the downtrend towards the 1.34 level.

Intraday support aligns at 1.3525/30 followed by 1.3500/90

“The GBP’s range-trade of 1.35-1.36 is now going on two weeks, and while shorter-term price action suggests the next move will be a break above 1.36 and 1.3650, the GBP remains in a half-year downtrend that points to an eventual test of 1.34.”

“Intraday support is 1.3525/30 followed by 1.3500/90 and the mid 1.34s area.”

- USD/TRY adds to Monday’s gains and approaches 13.70.

- Turkey’s Budget Balance showed a TL30.0B surplus.

- Markets’ attention remains on the CBRT meeting on Thursday.

The Turkish currency extends the pessimism seen at the beginning of the week and is now pushing USD/TRY to new monthly peaks near 13.70 on Tuesday.

USD/TRY in multi-day highs

USD/TRY rises to levels last seen back in mid-January around the 13.70 zone in the first half of the week despite the greenback trading on the defensive vs. the majority of its currency peers in response to the better mood in the risk complex.

Indeed, positive news citing some de-escalation of the Russia-Ukraine effervescence puts the buck under pressure and allows some breathing room for risk-associated assets on Tuesday.

In the domestic calendar, the Turkish Treasury reported a TL30.0B surplus in the Budget Balance in the first month of the year, reversing the acute TL145.74B deficit recorded in December.

What to look for around TRY

The pair keeps its multi-week consolidative theme well in place, always within the 13.00-14.00 range. While skepticism keeps running high over the effectiveness of the ongoing scheme to promote the de-dollarization of the economy – thus supporting the inflows into the lira - the reluctance of the CBRT to change the (collision?) course and the omnipresent political pressure to favour lower interest rates in the current context of rampant inflation and (very) negative real interest rates are a sure recipe to keep the domestic currency under pressure for the time being.

Key events in Turkey this week: Budget Balance (Tuesday) – CBRT interest rate decision (Thursday) – Consumer Confidence (Friday).

Eminent issues on the back boiler: Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Much-needed structural reforms. Growth outlook vs. progress of the coronavirus pandemic. Earlier Presidential/Parliamentary elections?

USD/TRY key levels

So far, the pair is advancing 0.42% at 13.6449 and a drop below 13.4317 (weekly low Feb.11) would expose 13.2327 (monthly low Feb.1) and finally 12.7523 (2022 low Jan.3). On the other hand, the next up barrier lines up at 13.6746 (weekly high Feb.14) seconded by 13.9319 (2022 high Jan.10) and then 18.2582 (all-time high Dec.20).

Russian President Vladimir Putin said on Monday that Russia does not want war in Europe, which is why the country has set forth security proposals. A decision on a partial withdrawal of troops has been taken, he added, though he did criticise the Western response to security proposals as not constructive. However, Putin claimed that there is a "genocide" taking place in Eastern Ukraine's Donbass region and that the majority of Russians support the rebel-held regions of the country. We have to try and solve the problems of the Donbass, he continued, saying the solution should be based on the Minsk peace process.

Market Reaction

There hasn't been a notable reaction to Putin's latest remarks, as markets attempt to process the seemingly declining risk of a all-out invasion of Ukraine, but potentially rising risk of a rekindling of the conflict in Eastern Ukraine.

In the year to date, the Swedish krona is the second-worst performing G10 currency after the New Zealand dollar. However, economists at Rabobank expect the EUR/SEk to turn back lower towards 10.20 as the Riksbank ditches dovish stance.

ECB officials has capped upside potential for EUR/SEK

“The failure of the Riksbank to follow the ECB’s hawkish pivot this month boosted the upside trend in EUR/SEK. That said, ECB officials have subsequently been attempting to pare back market expectations about any forthcoming policy moves from the Governing Council. This has capped upside potential for EUR/SEK.”

“Assuming there is no escalation in Russian military operations, we see scope for EUR/SEK to turn lower on a three-month view on the assumption that the Riksbank will announce its own hawkish pivot in the coming months.”

“Our three-month EUR/SEK forecast stands at 10.20.”

See – EUR/SEK: Bearish krona trend to remain in place until bigger shift in Riksbank policy – MUFG

The USD/CAD is marginally lower on the session. According to economists at Scotiabank, a push under 1.2720 targets mid-1.26s.

Short-term price action is turning a little more CAD-positive

“The USD closed well off the intraday peak yesterday and the low close plus spot’s move under 1.2720 support has triggered a minor Head & Shoulders top on the intraday chart which points to USD losses extending to 1.2650/60 in the next 1-2 days.”

“We look for resistance intraday at 1.2720/30.”

EUR/USD technical picture is looking a touch more positive with today’s recovery from the 1.13 but it is still too early to call a clear change in direction while below the 1.1370/75 zone, in the opinion of economists at Scotiabank.

EUR/USD may resettle into the 1.12-1.14 range

“The EUR will have to move above the mid-figure zone followed by 1.1370/75 to suggest a clearer rejection of downward pressure – and possibly move back above 1.14.”

“Support after 1.13 is yesterday’s low of 1.1280 followed by the mid-1.12s.”

“EUR/USD may resettle into the 1.12-1.14 range where it traded through December and the first half of January.”

- Silver witnessed a dramatic turnaround from over a three-week high touched earlier this Tuesday.

- Slightly oversold RSI on the 1-hour chart might hold back bearish traders from placing fresh bets.

- Sustained strength back above the $23.55 region is needed for the resumption of the bullish trend.

Silver extended its sharp intraday pullback from the $24.00 mark, or over a three-week high touched earlier this Tuesday and continued losing ground through the early North American session. The white metal has now reversed its gains recorded over the past two trading sessions and was last seen trading just above the $23.00 round figure.

The aforementioned handle coincides with the 200-hour SMA, which is closely followed by the 50% Fibonacci retracement level of the $22.00-$23.99 strong move up. Technical indicators on the 4-hour chart have just started drifting into the negative territory and also retreated sharply on the daily chart, favouring bearish traders.

That said, RSI (14) on the 1-hour chart is already flashing slightly oversold conditions and warrants some caution before placing aggressive bearish bets. Hence, it will be prudent to wait for some intraday consolidation or a convincing break below the $23.00 mark before positioning for an extension of the intraday depreciating move.

The next relevant support is pegged near the $22.75 region, which coincides with the 61.8% Fibo. level. Some follow-through selling will be seen as a fresh trigger for bearish traders and pave the way for a slide towards the mid-$22.00 mark. The XAG/USD could eventually drop to challenge the double-bottom support, around the $21.40 region.

On the flip side, any meaningful move back above the 38.2% Fibo. level, around the $23.25 region, might now be seen as a selling opportunity and cap the XAG/USD near the $23.55 hurdle. The latter marks the 23.6% Fibo. level, which if cleared decisively will suggest that the corrective slide has run its course and set the stage for a fresh leg up.

Silver 1-hour chart

-637805301410728575.png)

Key levels to watch

- The headline NY Fed Index rose less than expected to 3.1 in February versus forecasts for a rise to 12.15.

- The dollar has been weakening in response to the data, perhaps more due to easing Core PPI price pressures (YoY).

The New York Fed's Empire State Current Business Conditions Index rose to 3.1 in February from -0.7 in January, well below the expected rebound to 12.15. The New Orders Index rose to 1.4 from -5.0 in January, the Prices Paid Index fell slightly to 76.6 from 76.7, the Employment Index rose to 23.1 from 16.1 and the Six-month Business Conditions Index rose to 28.2 from 35.1.

Market Reaction

The dollar has been weakening in recent trade, with the DXY recently dipping to session lows under 96.00, with weaker than forecast headline NY Fed data not helping, but likely mostly due to a drop in the YoY rate of Core Producer Price Inflation.

- Headline PPI rose at 9.7% YoY in January, unchanged from December and significantly above expected.

- Core PPI metrics were also hotter than expected, though the YoY rate fell versus December, prompting some modest USD weakness.

The headline US Producer Price Index (PPI) rose at an annual pace of 9.7% in January, according to the latest report from the US Bureau of Labor Statistics on Tuesday. That was well above the median economist forecast for 9.1% and was unchanged versus December's 9.7% reading. MoM, PPI came in at 1.0% in January, well above expectations for a 0.5% MoM gain. Core PPI metrics were also significantly hotter than expected, with the YoY rate falling less than expected to 8.3% in January from 8.5% the month prior against forecasts for a decline to 7.9% and the MoM rate rising to 0.8% from 0.6% in December, well above the expected 0.5% gain.

Market Reaction

Despite the much hotter than expected PPI metrics, the fact that the YoY rate of core PPI fell versus January levels seems to be weighing a tad on the US dollar. The DXY recently dipped to fresh session lows under 96.00.

- A combination of diverging forces failed to provide any meaningful impetus to USD/CAD.

- The technical setup seems tilted in favour of bulls and supports prospects for some upside.

- Bulls might still wait for a break through the 1.2785 barrier before placing aggressive bets.

The USD/CAD pair seesawed between tepid gains/minor losses through the early North American session and was influenced by a combination of diverging forces. A positive turnaround in the risk sentiment weighed on the safe-haven US dollar and acted as a headwind for the major.

That said, a sharp pullback in crude oil prices undermined the commodity-linked loonie and assisted the USD/CAD pair to attract some dip-buying near the 1.2700 mark. The pair, for now, seems to have stalled the overnight retracement slide from the 1.2780-1.2785 strong hurdle.

The latter marks the top boundary of a near three-week-old trading range and should act as a key pivotal point for short-term traders. Given that technical indicators on the daily chart are holding in the positive territory, the bias seems tilted in favour of bullish traders.

Hence, any subsequent slide below the 1.2700 mark could be seen as a buying opportunity. This, in turn, should help limit the downside near the 1.2660 horizontal support. This is followed by the monthly low, around the 1.2635 area, which if broken will negate the bullish bias.

The USD/CAD pair could then break below the 1.2600 mark and slide to the 1.2570-1.2560 support. Some follow-through selling would expose the very important 200-day SMA, around the 1.2520-1.2515 area, and the 1.2500 psychological mark before bears aim to challenge YTD low, around mid-1.2400s.

On the flip side, immediate resistance is pegged near the 1.2765 region ahead of the 1.2780-1.2785 strong barrier. A convincing breakthrough, leading to a subsequent move beyond the 1.2800 mark will reaffirm the bullish bias and lift the USD/CAD pair to the 1.2835 zone.

The momentum could further get extended towards reclaiming the 1.2900 round-figure mark, with some intermediate hurdle near the 1.2870-75 area.

USD/CAD daily chart

-637805285052062152.png)

Key levels to watch

- EUR/GBP rebounded from support in the 0.8350 area and is trading around 0.8375 amid euro outperformance as geopolitical tensions ease.

- EUR has underperformed recently on fears that a Russia/Ukraine war and associated sanctions might hurt the Russian gas import-dependent Eurozone.

- Strong UK wage growth is helping to keep the gains capped under 0.8400, with analysts also eyeing Wednesday UK CPI.

EUR/GBP has rebounded from support at the 0.8350 area to trade closer to 0.8375, up around 0.3% on the day, amid broad euro outperformance as Russia/Ukraine tensions seemingly ease. Reports suggested on Tuesday that Russian troops have been returning to their bases from attack positions, a move which financial market participants have interpreted as a de-escalation of the risk of imminent war. That has subsequently eased concerns about the Eurozone’s economic vulnerability to a Ukraine/Russia conflict and associated sanctions on the former given the bloc’s reliance upon Russian gas imports.

The pair continues to trade substantially below last Friday’s pre-geopolitical tension-related euro underperformance levels above 0.8400 and will likely struggle to rally to the north of the big figure in the absence of further signs of de-escalation. Another factor contributing to the likelihood that EUR/GBP’s gains will, for now, remain capped, was UK labour market data on Tuesday, which economists said strengthens the case for further tightening from the BoE in the coming months. The UK unemployment rate was 4.1% as expected in December, unchanged from November’s levels, though wage growth metrics came in substantially hotter than forecast.

“December's pick-up in wage growth will maintain the pressure on the MPC to hike the Bank Rate again at next month's meeting” said analysts at Pantheon Macroeconomics. With the latest remarks from ECB officials, including President Christine Lagarde on Monday, seeking to push back against expectations for excessively hasty policy tightening from the ECB, BoE/ECB divergence could weigh on EUR/GBP this week. Analysts flagged Wednesday’s release of UK January Consumer Price Inflation data as another risk event to keep an eye on that could further add to this narrative.

The S&P 500 is expected to continue to hold the 61.8% retracement of the January/February rally at 4365 for now. However, analysts at Credit Suisse maintain their broader negative bias for a clear break in due course and a retest of the 4223/4199 key support cluster.

Above 4451/53 to see a deeper rebound to 4484/86

“We look for some fresh consolidation above the 61.8% retracement of the January/February rally at 4365 for now but we maintain our broader negative view following the prior rejection from our recovery target and key resistance at 4491/95.”

“Post a pause, we look for a retest and then break below 4365 with support then seen next at 4292 and eventually the major support cluster at 4223/4199. Failure to hold here would mark a major top.”

“Resistance is seen at 4426 initially, then 4451/53, which we look to try and cap. Above can see a deeper rebound to the 13-day exponential average at 4484/86, but with this expected to now prove a tougher barrier.”

See: S&P 500 Index needs to recapture 4600 to extend up-move – SocGen

Financial crises occur following a period during which three types of imbalances combine. Macroeconomic imbalances, regulatory imbalances and behavioural imbalances. The three imbalances needed for the next financial crisis to take place are present today, according to analysts at Natixis.

Cause for concern

“There are again signs today of confluent macroeconomic, regulatory and behavioural imbalances. This is cause for concern, as the simultaneous presence of these three forms of imbalance has led to financial crises in the past.”

“Central banks are increasingly being caught in the same trap: in the wake of a crisis, they do not want to use policies to prevent the occurrence of a financial crisis and prefer to wait for the crisis to break out before responding. This explains the macroeconomic imbalance and some of the regulatory imbalance, as investors rotate into risky assets and risk premia are squeezed.”

- GBP/USD gained some positive traction on Tuesday, though the uptick lacked bullish conviction.

- The technical set-up seems tilted in favour of bulls and supports prospects for additional gains.

- A convincing break below the 1.3500-1.3490 area is needed to negate the near-term positive bias.

The GBP/USD pair retreated a few pips from the daily high and was last seen trading with modest intraday gains, just below mid-1.3600s heading into the North American session.

The British pound drew some support from mostly in-line UK monthly employment report released earlier this Tuesday. On the other hand, a positive turnaround in the global risk sentiment undermined the safe-haven US dollar and extended some support to the GBP/USD pair.

That said, expectations for a faster policy tightening by the Fed and rallying US Treasury bond yields helped limit any deeper USD losses. Apart from this, tensions over the Northern Ireland Protocol of the Brexit agreement capped any further gains for the GBP/USD pair.

Looking at the broader picture, the pair has been oscillating in a familiar trading range over the past two weeks or so. This points to indecision among traders over the near-term trajectory for the GBP/USD pair and warrants some caution before placing directional bets.

Technical indicators, however, are holding with a mild positive bias. Moreover, the GBP/USD pair has repeatedly shown some resilience below the key 1.3500 psychological mark. The set-up seems tilted in favour of bullish traders and supports prospects for additional gains.

Any subsequent move beyond the 1.3600 mark, however, could confront stiff resistance near a downward sloping trend-line extending from July 2021. The said hurdle, currently around the 1.3625 region, coincides with last week's swing high and should act as a pivotal point.

On the flip side, acceptance below the 1.3500-1.3490 area will be seen as a fresh trigger for bearish traders and make the GBP/USD pair vulnerable. The downward momentum could then drag spot prices towards the next relevant support near the 1.3435 region en-route the 1.3400 mark.

GBP/USD daily chart

-637805264022606334.png)

Key technical levels

- Gold has pulled back under $1850 after hitting fresh eight-month highs earlier in the session near-$1880.

- Signs of geopolitical de-escalation have eased nerves about an imminent Ukraine/Russia war, weighing on safe-haven assets like gold.