- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 14-10-2020

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:00 (GMT) | Australia | Consumer Inflation Expectation | October | 3.1% | |

| 00:30 (GMT) | Australia | Unemployment rate | September | 6.8% | 7.1% |

| 00:30 (GMT) | Australia | Changing the number of employed | September | 111 | -35 |

| 01:30 (GMT) | China | PPI y/y | September | -2% | -1.8% |

| 01:30 (GMT) | China | CPI y/y | September | 2.4% | 1.8% |

| 04:30 (GMT) | Japan | Tertiary Industry Index | August | -0.5% | |

| 06:30 (GMT) | Switzerland | Producer & Import Prices, y/y | September | -3.5% | |

| 06:45 (GMT) | France | CPI, y/y | September | 0.2% | 0.1% |

| 06:45 (GMT) | France | CPI, m/m | September | -0.1% | -0.5% |

| 12:30 (GMT) | U.S. | Continuing Jobless Claims | October | 10976 | 10700 |

| 12:30 (GMT) | U.S. | Philadelphia Fed Manufacturing Survey | October | 15 | 14 |

| 12:30 (GMT) | U.S. | NY Fed Empire State manufacturing index | October | 17 | 15 |

| 12:30 (GMT) | U.S. | Initial Jobless Claims | October | 840 | 825 |

| 12:30 (GMT) | U.S. | Import Price Index | September | 0.9% | 0.3% |

| 13:45 (GMT) | Canada | Gov Council Member Lane Speaks | |||

| 15:00 (GMT) | U.S. | Crude Oil Inventories | October | 0.501 | -3.387 |

| 16:00 (GMT) | Eurozone | ECB President Lagarde Speaks | |||

| 21:00 (GMT) | U.S. | FOMC Member Kashkari Speaks | |||

| 21:30 (GMT) | New Zealand | Business NZ PMI | September | 50.7 |

FXStreet reports that

Economists at Rabobank expect to see a spike to the 0.93 region on the EUR/GBP pair on the event that no trade deal is signed by the EU and the UK.

“On the assumption that the UK and EU will find enough common ground to sign off on a trade deal this year we see scope for a half-heated GBP recovery to EUR/GBP 0.89 on a three-month view.”

“Given the risk that any deal will lack the comprehensiveness that many had hoped for when Johnson was elected last December and in view of the economic struggles that are implied by the COVID-19 crisis, we foresee various headwinds for the pound in the medium-term.”

“The economic impact of fresh COVID-19 related restrictions is likely to be a constraint on the pound. In the three months to August redundancies increased by a record 114K. A spike in the levels of jobless is expected when the UK’s furlough scheme ends this month. This week BoE Governor Bailey spoke of scarring to the economy with the second wave of the pandemic set to increase the long-term damage. This outlook suggests that the market will continue to perceive risk of a negative Bank rate, though this is not our central view. In view of these headwinds, we expect EUR/GBP to struggle to break below 0.89 in the early months of next year.”

- ECB needs clearly and genuinely symmetric price stability target and reaction function that is sufficiently forceful and equally effective in reacting to deviations in both directions

NFXStreet reports that the COVID-19 crisis with rising unemployment and excessive stocks has led to very low headline and core inflation in 2020, around 0%. This low inflation, together with the prospect of lower potential growth after the crisis than before, has revived the debate on the risk of deflation but economists at Natixis do not believe there is a risk of deflation.

“Financial markets expect inflation in the United States and the Eurozone to normalise in 2021, which is consistent with: the recovery in activity and the reduction in stocks; the upswing in commodity prices from the lows in 2020; the fact that companies will take advantage of the improvement in activity to pass part of their cost increases on to their prices."

- Economic data since May "surprisingly strong" though the outlook remains uncertain and dependent on the virus and successful mitigation efforts

- Service sector lags but rebound otherwise is broad across types of consumption goods, housing and investment

- New framework elevates the importance of keeping inflation expectations well-anchored at 2%

- Maximum employment may well be lower than we thought

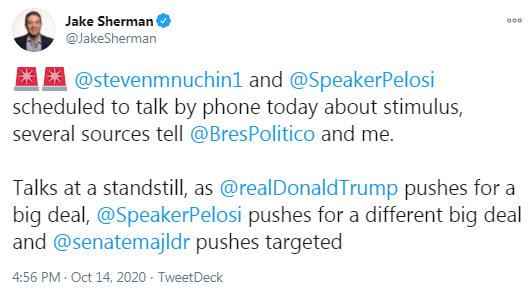

U.S. stock-index futures traded little changed on Wednesday as investors assessed a mixed bag of quarterly earnings reports from several big U.S. banks, while hopes for approval of the additional fiscal stimulus before the November 3 elections faded.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 23,626.73 | +24.95 | +0.11% |

Hang Seng | 24,667.09 | +17.41 | +0.07% |

Shanghai | 3,340.78 | -18.97 | -0.56% |

S&P/ASX | 6,179.20 | -16.50 | -0.27% |

FTSE | 5,942.69 | -27.02 | -0.45% |

CAC | 4,940.47 | -7.14 | -0.14% |

DAX | 13,014.18 | -4.81 | -0.04% |

Crude oil | $40.31 | +0.27% | |

Gold | $1,911.70 | +0.90% |

FXStreet notes that AUD/USD saw a mild correction overnight, which however managed to hold above the uptrend from late September at 0.7152. Despite the current modest correction, analysts at Credit Suisse look for an eventual resumption of the core bull trend with resistance seen at 0.7235/43.

“The correction in AUD/USD on Tuesday managed to hold above the uptrend from late September, currently at 0.7152, keeping the market in a rangebound environment. With daily MACD momentum also still pointing higher, we keep our bias for an eventual resumption of the core bull trend.”

“Resistance moves initially to 0.7174, then 0.7218 and 0.7235/43, above which would see 0.7254 next. Removal of here would subsequently see a move back up to 0.7324 – the beginning of a key price resistance area, which stretches up to 0.7345 – where we would expect to see fresh sellers at first. Beyond here though should see a renewed test of the current year high at 0.7414 and eventually beyond over the medium-term.”

- Unemployment adjusted for the drop in participation is around 11%

- Downtrend in participation by prime-age women may limit the rebound

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 166.4 | -0.23(-0.14%) | 850 |

ALCOA INC. | AA | 12.78 | 0.06(0.47%) | 12783 |

ALTRIA GROUP INC. | MO | 39.53 | 0.15(0.38%) | 20091 |

Amazon.com Inc., NASDAQ | AMZN | 3,453.17 | 9.54(0.28%) | 40014 |

American Express Co | AXP | 104.9 | -0.11(-0.10%) | 2945 |

Apple Inc. | AAPL | 121.17 | 0.07(0.06%) | 1676579 |

AT&T Inc | T | 27.77 | 0.02(0.07%) | 68465 |

Boeing Co | BA | 162.42 | 0.28(0.17%) | 83862 |

Chevron Corp | CVX | 73.25 | -0.15(-0.20%) | 4096 |

Citigroup Inc., NYSE | C | 43.58 | -0.10(-0.23%) | 162677 |

Deere & Company, NYSE | DE | 234.65 | -2.57(-1.08%) | 1243 |

E. I. du Pont de Nemours and Co | DD | 58.5 | 0.18(0.31%) | 1066 |

Exxon Mobil Corp | XOM | 34.15 | -0.07(-0.19%) | 271340 |

Facebook, Inc. | FB | 277.03 | 0.89(0.32%) | 55284 |

FedEx Corporation, NYSE | FDX | 274.3 | 1.56(0.57%) | 5946 |

Ford Motor Co. | F | 7.75 | -0.01(-0.13%) | 269090 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 16.8 | -0.02(-0.12%) | 34123 |

General Electric Co | GE | 6.74 | 0.02(0.30%) | 342051 |

General Motors Company, NYSE | GM | 32.09 | 0.22(0.69%) | 15426 |

Goldman Sachs | GS | 214.8 | 3.99(1.89%) | 536461 |

Google Inc. | GOOG | 1,579.48 | 7.80(0.50%) | 5123 |

Home Depot Inc | HD | 290 | -0.36(-0.12%) | 5056 |

HONEYWELL INTERNATIONAL INC. | HON | 171.17 | -0.38(-0.22%) | 2211 |

Intel Corp | INTC | 54.12 | 0.29(0.54%) | 57205 |

International Business Machines Co... | IBM | 125.2 | 0.10(0.08%) | 4638 |

International Paper Company | IP | 44 | -0.01(-0.02%) | 432 |

Johnson & Johnson | JNJ | 148.84 | 0.48(0.32%) | 12861 |

JPMorgan Chase and Co | JPM | 100.41 | -0.37(-0.37%) | 80625 |

McDonald's Corp | MCD | 227.73 | 0.38(0.17%) | 4784 |

Merck & Co Inc | MRK | 80.33 | -0.38(-0.47%) | 3547 |

Microsoft Corp | MSFT | 223.44 | 0.58(0.26%) | 103188 |

Nike | NKE | 129.3 | 0.10(0.08%) | 5342 |

Pfizer Inc | PFE | 36.97 | 0.07(0.19%) | 43311 |

Procter & Gamble Co | PG | 143.85 | -0.36(-0.25%) | 3467 |

Starbucks Corporation, NASDAQ | SBUX | 90.3 | 0.14(0.16%) | 2453 |

Tesla Motors, Inc., NASDAQ | TSLA | 450.4 | 3.75(0.84%) | 585541 |

Travelers Companies Inc | TRV | 112.79 | -0.10(-0.09%) | 288 |

Twitter, Inc., NYSE | TWTR | 47.25 | 0.25(0.53%) | 24403 |

UnitedHealth Group Inc | UNH | 334 | 2.58(0.78%) | 30089 |

Verizon Communications Inc | VZ | 59.3 | -0.06(-0.10%) | 9906 |

Visa | V | 204.28 | -0.04(-0.02%) | 6221 |

Wal-Mart Stores Inc | WMT | 146.5 | 0.27(0.18%) | 15956 |

Walt Disney Co | DIS | 129 | 0.04(0.03%) | 17761 |

Yandex N.V., NASDAQ | YNDX | 62.99 | 0.30(0.48%) | 15396 |

Microsoft (MSFT) resumed with a Buy at UBS; target raised to $243

Oracle (ORCL) resumed with a Neutral at UBS; target raised to $62

The Labor

Department reported on Wednesday the U.S. producer-price index (PPI) rose 0.4

percent m-o-m in September, following an unrevised 0.3 percent m-o-m gain in August.

For the 12

months through September, the PPI increased 0.4 percent after an unrevised 0.2

percent decline in the previous month. That was the first advance since the 12

months ended in March.

Economists had

forecast the headline PPI would increase 0.2 percent both on m-o-m basis and

over the past 12 months.

According to

the report, nearly two-thirds of the September rise in prices for final demand was attributable to a 0.4-percent m-o-m advance in the index for final demand

services. Prices for final demand goods also went up 0.4 percent m-o-m.

Excluding

volatile prices for food and energy, the PPI rose 0.4 percent m-o-m and 1.2

percent over 12 months. Economists had forecast gains of 0.2 percent m-o-m and

0.9 percent y-o-y.

The Mortgage

Bankers Association (MBA) reported on Wednesday the mortgage application volume

in the U.S. decreased 0.7 percent in the week ended October 9, following a 4.6

percent jump in the previous week.

According to

the report, refinance applications fell 0.3 percent, while applications to

purchase a home dropped 1.6 percent.

Meanwhile, the

average fixed 30-year mortgage rate dropped from 3.01 percent to a fresh record-low

of 3.00 percent.

“Applications

for government mortgages offset some of the overall decline by increasing 3%,

driven by a solid gain in government purchase applications and an 11% jump in

VA refinance applications,” noted Joel Kan, MBA’s associate vice president of

economic and industry forecasting. “Housing supply is a challenge for many

aspiring buyers, but activity should continue to stay strong the rest of the

year.”

Wells Fargo (WFC) reported Q3 FY 2020 earnings of $0.42 per share (versus $0.92 per share in Q3 FY 2019), missing analysts’ consensus estimate of $0.48 per share.

The company’s quarterly revenues amounted to $18.862 bln (-14.3% y/y), beating analysts’ consensus estimate of $17.872 bln.

WFC fell to $24.31 (-1.74%) in pre-market trading.

FXStreet notes that gold (XAU/USD) consolidation extends as expected by strategists at Credit Suisse but with new highs eventually expected next year. On Wednesday, the yellow metal’s rebound remains capped below the $1900 mark, consolidating Tuesday’s 2% slide.

“Gold extends its consolidation/correction following the move to our base case objective of $2075/80 in August but is still holding flagged support at $1837, the 38.2% retracement of the rally from March. We look for this to continue to hold to maintain the sideways range ahead of a break above $1993 for a fresh look at $2075.”

“An eventual move above $2075 stays looked for a resumption of the core bull trend with resistance seen next at $2175, then $2300, although we continue to believe this will not be seen until next year.”

Goldman Sachs (GS) reported Q3 FY 2020 earnings of $9.68 per share (versus $4.79 per share in Q3 FY 2019), beating analysts’ consensus estimate of $5.50 per share.

The company’s quarterly revenues amounted to $107.000 bln (+28.6% y/y), beating analysts’ consensus estimate of $9.395 bln.

GS rose to $216.06 (+2.49%) in pre-market trading.

- We have seen some progress on the trade deal but there is still a lot of distance to be covered

- At this stage, another summit would not be justified

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 08:00 | France | IEA Oil Market Report | ||||

| 08:00 | Eurozone | ECB President Lagarde Speaks | ||||

| 09:00 | Eurozone | Industrial Production (YoY) | August | -7.1% | -7.2% | -7.2% |

| 09:00 | Eurozone | Industrial production, (MoM) | August | 5% | 0.8% | 0.7% |

| 11:00 | Eurozone | ECB's Yves Mersch Speaks |

GBP rose against most other major currencies in the European session on Wednesday, supported by reports that the UK will continue negotiations with the EU on their future relationship beyond the October 15 deadline, imposed by the British Prime Minister (PM) Boris Johnson. According to a source close to the negotiations, the UK's PM Johnson will decide whether to end talks after the EU leaders meet on Thursday and Friday for a summit. It also added that UK's officials still believe the deal with the EU is possible as long as both sides enter into a period of intense negotiation in the coming days.

The UK's Prime Minister Boris Johnson and the head of the European Commission, Ursula von der Leyen, will discuss the progress of the Brexit talks later today. Earlier, Johnson threatened to walk away from the negotiations if there was no clear progress by the EU leaders' summit on October 15.

The top Brexit negotiators of the EU and the UK, Michel Barnier and David Frost, acknowledged earlier this week that they are moving towards the deal, but important gaps remain on level playing field issues, fishing and governance.

The EU 27 leaders are reportedly to conclude at their two-day meeting in Brussels that progress in talks with the UK is “still not sufficient” for an agreement to be reached.

- Advice I have to day is that regional lockdowns can bring down virus spread

- Aim is to try to avoid the 'misery' of another national lockdown

Bank of America (BAC) reported Q3 FY 2020 earnings of $0.51 per share (versus $0.75 per share in Q3 FY 2019), beating analysts’ consensus estimate of $0.50 per share.

The company’s quarterly revenues amounted to $20.300 bln (-11.6% y/y), missing analysts’ consensus estimate of $20.883 bln.

BAC fell to $24.46 (-1.96%) in pre-market trading.

FXStreet reports that GBP/USD has failed at its corrective target at 1.3070 and is extending Tuesday’s sell-off. The cable trades just above the 1.29 mark and Karen Jones, Team Head FICC Technical Analysis Research at Commerzbank, expects to see further losses to 1.2445 and eventually targets 1.2250/00.

“GBP/USD has reached its corrective target and failed as expected. We will therefore assume another leg lower is in the offing and we should see further losses to 1.2445 and then 1.2250/00.”

“Only above the 1.3083 level would somewhat neutralise our outlook."

- Minimum vaccination rate should be around 55% to 65%

FXStreet notes that USD/CNY is gapping sharply lower as the market reinforces its major top. Economists at Credit Suisse expect the pair to post another leg lower with the next support awaiting at the 2019 low of 6.6691.

“USD/CNY’s corrective strength in September found a cap as expected at the ‘neckline’ to its large ‘double top’, gapping sharply lower and resuming its clear medium-term downtrend. We, therefore, maintain our downside bias and see scope for a more significant move lower, with support seen next at the 2019 low at 6.6691.”

“Bigger picture, the ‘measured top objective’ can be found much lower at 6.4965.”

UnitedHealth (UNH) reported Q3 FY 2020 earnings of $3.51 per share (versus $3.88 per share in Q3 FY 2019), beating analysts’ consensus estimate of $3.08 per share.

The company’s quarterly revenues amounted to $65.115 bln (+7.9% y/y), beating analysts’ consensus estimate of $63.967 bln.

The company also issues in-line guidance for FY 2020, projecting EPS of $16.50-16.75 (versus analysts’ consensus estimate of $16.56), up from prior guidance of $16.25-16.55.

UNH closed Tuesday's trading session at $331.42 (+0.44%).

FXStreet reports that FX Strategists at UOB Group notes that USD/JPY is predicted to keep trading within the 105.00-106.00 range in the short-term horizon.

24-hour view: “USD traded in a relatively quiet manner yesterday (between 105.26 and 105.62). The price actions offer no fresh clues and USD could continue to consolidate for now, likely within a 105.30/105.75 range.”

Next 1-3 weeks: “USD popped above 106.00 last Thursday, 08 Oct (high of 106.10) but was unable to maintain a foothold above this level... From here, USD could trade between 105.00 and 106.00 for a period of time.”

FXStreet reports that the Credit Suisse analyst team informs that EUR/JPY remains below its 55-day average at 124.79, keeping the immediate risk lower.

“EUR/JPY remains under pressure after its failure to clear the 55-day average, currently seen at 124.79.”

“Support is seen next at 123.28/24 ahead of the early October spike low at 123.03, which we look to try and hold to define the lower end of a near - term range. A break though would warn of a move back to retest the 122.38 late September low, with key retracement supports seen at 122.27/23 – including the 38.2% retracement of the entire rally from the May low – which we continue to look to remain a stronger floor.”

Reuters reports that the International Energy Agency (IEA) said on Wednesday that global oil stocks which rose during the height of the pandemic are being steadily reduced, but a second wave is slowing demand and will complicate efforts by producers to balance the market.

"There is only limited headroom for the market to absorb extra supply in the next few months," the IEA said in its monthly report. "Those wishing to bring about a tighter oil market are looking at a moving target."

The IEA said "the efforts of the producers have shown some success", noting relatively stable oil prices and a strong draw on storage, with implied global stocks falling by 2.3 million bpd in the third quarter and by a predicted 4.1 million bpd in the fourth.

However, the agency added that a demand rebound over the summer was now slowing due to a second wave of coronavirus cases and new movement restrictions.

According to the report from Eurostat, in August 2020, a month marked by some relaxation of COVID-19 containment measures in many Member States, the seasonally adjusted industrial production rose by 0.7% in the euro area and by 1.0% in the EU, compared with

July 2020. Economists had expected a 0.8% increase in the euro area. In July 2020, industrial production rose by 5.0% in the euro area and by 4.9% in the EU.

In August 2020 compared with August 2019, industrial production decreased by 7.2% in the euro area and by 6.2% in the EU.

In the euro area in August 2020, compared with July 2020, production of durable consumer goods rose by 6.8%, intermediate goods by 3.1% and energy by 2.3%, while production of both capital goods and non durable consumer goods fell by 1.6%. In the EU, production of durable consumer goods rose by 5.7%, intermediate goods by 2.9% and energy by 1.6%, while production of non-durable consumer goods fell by 0.6% and capital goods by 1.1%.

Reuters reports that Germany's leading economic research institutes forecast that Europe's largest economy will recover more slowly from the coronavirus pandemic than originally predicted.

The institutes expect the economy will shrink by about 5.4% in 2020, a bigger decline than the 4.2% they forecast in April.

The institutes' forecast, which forms the basis for the government's own economic predictions, expects a rebound of 4.7% in 2021, also more pessimistic than their April forecast for 5.8% growth. They expect growth of 2.7% in 2022.

The institute said the recovery was being held back by sectors particularly hard hit by social distancing restrictions such as restaurants, tourism, events and air travel.

FXStreet reports that all eyes remain on the key Brexit meeting between PM Boris Johnson and European Commission President Ursula von der Leyen on the ongoing negotiations due later today, as per MUFG Bank.

“PM Johnson is scheduled to have a call with Ursula von der Leyen today and at this stage of intense negotiations we would view this as a positive sign.”

“What is important to emphasise in explaining why we do not believe GBP will get a sustained lift if/when a deal is reached is that there is still likely to be significant disruption at borders even if a deal is done.”

“There is set to be considerable disruption and frictions on trade that may well still be under-estimated by the markets that will likely curtail the period of GBP appreciation following a likely deal over the coming weeks.”

Reuters reports that Germany's 10-year bond yield fell to its lowest since May and its Italian equivalent hit a new record low, as investors awaited key speakers from the ECB and bond sales from Germany and Portugal.

Expectations of further European Central Bank stimulus to support Europe's coronavirus-hit economy have supported bond markets in recent weeks.

Safe-haven German 10-year bond yields fell to their lowest since mid-May in early trade at -0.571%, last down 2 basis point on the day.

Italian 10-year bond yields dropped a similar amount, falling to a new record low at 0.652%

A number of ECB policy members are due to speak, with focus on the bank's president Christine Lagarde and chief economist Philip Lane from 0800 GMT.

FXStreet reports that in the view of economists at HSBC, the People’s Bank of China (PBoC) policy change is unlikely to reverse the downward trend in USD/CNY.

“On 10 October, the PBoC announced that the foreign exchange (forex) risk reserve ratio for forward forex trading will be reduced from 20% to zero, effective 12 October. The central bank said on the same day that it will continue to maintain flexibility in the CNY exchange rate and stabilise market expectations.”

“We expect that a removal of the policy tool should not reverse the downtrend by USD/CNY.”

“With the Fed expected to keep short-end US rates near zero for the next couple of years, the yield advantage of the CNY will likely remain. We also think China will continue to have a positive basic balance, given the larger current account surplus and foreign bond inflows. All in all, we expect the CNY to remain resilient over the medium-term.”

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 04:30 | Japan | Industrial Production (YoY) | August | -15.5% | -13.3% | -13.8% |

| 04:30 | Japan | Industrial Production (MoM) | August | 8.7% | 1.7% | 1.0% |

During today's Asian trading, the US dollar was almost unchanged against major currencies amid renewed concerns about the coronavirus vaccine. The lack of clarity about the timing of new stimulus measures in the US is fueling demand for safe assets.

Risk appetite weakened after US-based Johnson & Johnson on Tuesday said it had suspended testing of the COVID-19 vaccine due to an "unexplained illness" affecting a test participant. The pharmaceutical company Eli Lilly and Co also announced that it has suspended testing of the antibody-based drug.

Market participants continue to closely monitor the situation around the US election campaign. According to polls, democratic presidential candidate Joe Biden is leading, and his margin of victory over incumbent President Donald Trump is increasing.

The pound is cheaper due to concerns about weak progress in trade negotiations between the UK and the European Union and the likelihood of the Bank of England switching to negative interest rates. French foreign Minister Jean-Yves Le Drian warned on the eve of the likelihood that an agreement on the future relations of the European Union and the UK will not be concluded.

Brexit will be the central issue on the agenda of the European Council meeting on October 15-16 in Brussels.

eFXdata reports that MUFG Research adopts a neutral bias on EUR/USD ahead of the US November elections.

"The recent loss of upward momentum for the EUR has coincided with building concerns over rising COVID cases in Europe. The number of new cases in major European countries is now higher than in the US. A dynamic that could already be helping to ease bearish sentiment towards the USD in the near-term," MUFG notes.

"In these circumstances, we continue to expect the EUR to remain in a consolidation phase at higher levels ahead of the US election. The EUR’s recent loss of upward momentum brings some relief for the ECB although we still expect that policymakers will deliver further easing at next month’s meeting," MUFG adds.

Reuters reports that the Commissioner for the EU’s single market, Thierry Breton, told, the EU would prefer to have a Brexit deal, but it is ready in case no agreement can be reached.

Britain left the EU in January and has since been locked in painstaking talks with the world’s largest trading bloc to keep trade flowing freely.

EU leaders are holding a summit in Brussels on Thursday and Friday to assess progress, and British Prime Minister Boris Johnson has said he wants to know by Oct. 15 if a deal can be reached.

“We prefer a deal but not at any price and if there is no deal, we are ready,” Breton said.

FXStreet reports that FX Strategists at UOB Group see EUR/USD navigating within the 1.1680-1.1800 range in the next weeks.

Next 1-3 weeks: “EUR closed on a firm note last Friday (09 Oct) but gave up most of its gains yesterday (13 Oct) as it dropped sharply by -0.58% (1.1744), its biggest 1-day drop in about 2 months. The failure to maintain a foothold above 1.1820 coupled with the sharp drop yesterday indicates that EUR is still trading in a consolidation phase. In other words, EUR could trade between the two major levels of 1.1680 and 1.1820 for a while a more. That said, shorter-term downward momentum has improved and a test of 1.1680 would not be surprising.”

RTTNews reports that survey data from Westpac showed that Australia's consumer confidence improved sharply in October following the announcement of the federal budget and the ongoing success in containing the Covid-19 outbreak.

The Consumer Sentiment advanced 11.9 percent to 105.0 in October from 93.8 in September. The indicator gained 32 percent over the last two months to the highest level since July 2018.

All components of the index were higher in October. The most striking improvements were around the outlook for the economy.

The 'economy, next 12 months' sub-index increased 24.2 percent, while the 'economy, next 5 years' sub-index was up by 14.1 percent.

Bill Evans, chief economist at Westpac said one of the likely factors behind the surge in sentiment this month is an expectation that the central bank is set to cut the overnight cash rate to 0.10 percent from 0.25 percent at the meeting scheduled on November 3.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1870 (4009)

$1.1843 (450)

$1.1820 (500)

Price at time of writing this review: $1.1744

Support levels (open interest**, contracts):

$1.1690 (908)

$1.1667 (1050)

$1.1640 (1769)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date November, 6 is 51575 contracts (according to data from October, 13) with the maximum number of contracts with strike price $1,1800 (4009);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3122 (2556)

$1.3074 (238)

$1.3036 (1681)

Price at time of writing this review: $1.2917

Support levels (open interest**, contracts):

$1.2820 (230)

$1.2795 (551)

$1.2738 (1815)

Comments:

- Overall open interest on the CALL options with the expiration date November, 6 is 31200 contracts, with the maximum number of contracts with strike price $1,3950 (3694);

- Overall open interest on the PUT options with the expiration date November, 6 is 22343 contracts, with the maximum number of contracts with strike price $1,2050 (2420);

- The ratio of PUT/CALL was 0.72 versus 0.72 from the previous trading day according to data from October, 13

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 42.13 | 1.59 |

| Silver | 24.08 | -3.99 |

| Gold | 1890.951 | -1.65 |

| Palladium | 2312.23 | -3.8 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 43.09 | 23601.78 | 0.18 |

| KOSPI | -0.58 | 2403.15 | -0.02 |

| ASX 200 | 63.8 | 6195.7 | 1.04 |

| FTSE 100 | -31.67 | 5969.71 | -0.53 |

| DAX | -119.42 | 13018.99 | -0.91 |

| CAC 40 | -31.68 | 4947.61 | -0.64 |

| Dow Jones | -157.71 | 28679.81 | -0.55 |

| S&P 500 | -22.29 | 3511.93 | -0.63 |

| NASDAQ Composite | -12.36 | 11863.9 | -0.1 |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 04:30 (GMT) | Japan | Industrial Production (YoY) | August | -15.5% | -13.3% |

| 04:30 (GMT) | Japan | Industrial Production (MoM) | August | 8.7% | 1.7% |

| 08:00 (GMT) | France | IEA Oil Market Report | |||

| 08:00 (GMT) | Eurozone | ECB President Lagarde Speaks | |||

| 09:00 (GMT) | Eurozone | Industrial Production (YoY) | August | -7.7% | -7.2% |

| 09:00 (GMT) | Eurozone | Industrial production, (MoM) | August | 4.1% | 0.8% |

| 11:00 (GMT) | Eurozone | ECB's Yves Mersch Speaks | |||

| 12:30 (GMT) | U.S. | PPI excluding food and energy, m/m | September | 0.4% | 0.2% |

| 12:30 (GMT) | U.S. | PPI excluding food and energy, Y/Y | September | 0.6% | 0.9% |

| 12:30 (GMT) | U.S. | PPI, y/y | September | -0.2% | 0.2% |

| 12:30 (GMT) | U.S. | PPI, m/m | September | 0.3% | 0.2% |

| 13:00 (GMT) | U.S. | FOMC Member Clarida Speaks | |||

| 14:30 (GMT) | Canada | Gov Council Member Lane Speaks | |||

| 21:45 (GMT) | Australia | RBA's Governor Philip Lowe Speaks | |||

| 22:00 (GMT) | U.S. | FOMC Member Kaplan Speak |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.71573 | -0.68 |

| EURJPY | 123.901 | -0.4 |

| EURUSD | 1.17434 | -0.58 |

| GBPJPY | 136.402 | -0.83 |

| GBPUSD | 1.29316 | -0.99 |

| NZDUSD | 0.66475 | 0.02 |

| USDCAD | 1.3134 | 0.2 |

| USDCHF | 0.91427 | 0.62 |

| USDJPY | 105.475 | 0.17 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.