- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 14-08-2014

(raw materials / closing price /% change)

Light Crude 95.50 -1.92%

Gold 1,313.90 -0.05%

(index / closing price / change items /% change)

Nikkei 225 15,314.57 +100.94 +0.66%

Hang Seng 24,801.36 -88.98 -0.36%

Shanghai Composite 2,206.47 -16.41 -0.74%

FTSE 100 6,685.26 +28.58 +0.43%

CAC 40 4,205.43 +10.64 +0.25%

Xetra DAX 9,225.1 +26.22 +0.29%

S&P 500 1,955.18 +8.46 +0.43%

NASDAQ 4,453 +18.88 +0.43%

Dow Jones 16,713.58 +61.78 +0.37%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3363 +0,01%

GBP/USD $1,6683 -0,02%

USD/CHF Chf0,9065 -0,10%

USD/JPY Y102,47 +0,05%

EUR/JPY Y136,94 +0,07%

GBP/JPY Y170,95 +0,04%

AUD/USD $0,9313 +0,13%

NZD/USD $0,8487 +0,37%

USD/CAD C$1,0903 -0,09%

(time / country / index / period / previous value / forecast)

06:00 France Bank holiday

08:30 United Kingdom GDP, q/q Quarter II +0.8% +0.8%

08:30 United Kingdom GDP, y/y Quarter II +3.1% +3.1%

12:30 Canada Manufacturing Shipments (MoM) June +1.6% +0.5%

12:30 U.S. PPI, m/m July +0.4% +0.1%

12:30 U.S. PPI, y/y July +1.9% +1.8%

12:30 U.S. PPI excluding food and energy, m/m July +0.2% +0.2%

12:30 U.S. PPI excluding food and energy, Y/Y July +1.8% +1.6%

12:30 U.S. NY Fed Empire State manufacturing index August 25.6 20.3

13:00 U.S. Total Net TIC Flows June 19.4 27.3

13:00 U.S. Net Long-term TIC Flows June 35.5

13:15 U.S. Industrial Production (MoM) July +0.2% +0.3%

13:15 U.S. Capacity Utilization July 79.1% 79.2%

13:55 U.S. Reuters/Michigan Consumer Sentiment Index August 81.3 82.7

Stock indices closed higher despite the disappointing economic data from the Eurozone. Investors speculate the European Central Bank may add additional stimulus measures to support the economy in the Eurozone.

Eurozone's harmonized consumer price index declined 0.7% in July, missing expectations for a 0.6% decrease, after a 0.1% rise in June.

On a yearly basis, Eurozone's harmonized consumer price index rose 0.4% in July, in line with expectations, after a 0.4% increase in June.

Eurozone's preliminary gross domestic product was flat in the second quarter, missing expectations for a 0.1% rise, after a 0.2% gain in the first quarter.

On a yearly basis, Eurozone's preliminary gross domestic product climbed 0.7% in the second quarter, in line with expectations, after a 0.9% rise in the first quarter.

German preliminary GDP decreased 0.2% in the second quarter, missing forecasts of a 0.1% decline, after a 0.8% rise in the first quarter.

French preliminary GDP remained flat in the second quarter, missing forecasts of a 0.1% gain.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,685.26 +28.58 +0.43%

DAX 9,225.1 +26.22 +0.29%

CAC 40 4,205.43 +10.64 +0.25%

The cost of oil futures declined markedly today, being at the same time below $ 103 (brand Brent) and $ 97 (brand WTI), as weaker-than-expected data on the United States and Germany stressed the weak demand. However, the negative trend in oil quotations caused entrenched fears of oversupply of oil on the world market due to the fall in global energy demand.

Today's statistics showed that the German economy shrank in the second quarter for the first time in over a year, while France has lowered growth forecasts for this year and the next year after its economy has not grown in April-June.

Meanwhile, add that new applications for unemployment benefits in the United States rose last week but remained near eight-year lows. The number of initial claims for unemployment benefits rose by 21,000 and amounted to a seasonally adjusted 311,000 in the week ended August 9, the Labor Department said Thursday. It was more than 307,000 new applications for Economists, and reached its highest level since June.

The dynamics also affect expectations of the opening of Libya's largest oil export terminal. According to the Libyan National Oil Corp., the country's largest oil terminal, located in the port of Essaouira, Cider, will resume in the coming days. Currently in Libya operate all other terminals except Az Zuvaytiny where operations are suspended due to a labor dispute.

Market participants also evaluated yesterday's data from the United States Department of Energy, which showed that the country's oil reserves rose last week by 1.4 million barrels to 367 million barrels. Meanwhile, analysts expect a reduction of 2.05 million barrels.

"Energy data indicated a significant increase in oil inventories in the United States - said VTB Capital analyst Andrey Kruchenkov in London. - As the end of summer and the end of the driving season, with the macro-economic indicators and data on economic activity in the country are beginning to weaken. "

The cost of the September futures for the American light crude oil WTI (Light Sweet Crude Oil) fell to $ 96.30 a barrel and then dropped to $ 97.25 a barrel on the New York Mercantile Exchange (NYMEX).

September futures price for North Sea Brent crude oil mixture rose $ 1.45 to $ 102.43 a barrel on the London exchange ICE Futures Europe.

The U.S. dollar traded lower against the most major currencies after the number of initial jobless claims in the U.S. The number of initial jobless claims in the week ending August 9 rose by 21,000 to 311,000 from 290,000 in the previous week. The previous week's figure was revised down from 289,000.

Analysts had expected the number of initial jobless claims to increase by 17,000 to 307,000.

The U.S. import price index declined 0.2% in July, in line with expectations, after a 0.1% increase in June.

The euro traded higher against the U.S. dollar despite the weaker-than-expected economic data from the Eurozone. Eurozone's harmonized consumer price index declined 0.7% in July, missing expectations for a 0.6% decrease, after a 0.1% rise in June.

On a yearly basis, Eurozone's harmonized consumer price index rose 0.4% in July, in line with expectations, after a 0.4% increase in June.

Eurozone's preliminary gross domestic product was flat in the second quarter, missing expectations for a 0.1% rise, after a 0.2% gain in the first quarter.

On a yearly basis, Eurozone's preliminary gross domestic product climbed 0.7% in the second quarter, in line with expectations, after a 0.9% rise in the first quarter.

German preliminary GDP decreased 0.2% in the second quarter, missing forecasts of a 0.1% decline, after a 0.8% rise in the first quarter.

French preliminary GDP remained flat in the second quarter, missing forecasts of a 0.1% gain.

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports in the UK.

The Swiss franc traded higher against the U.S. dollar. Switzerland's producer price index was flat in July, in line with expectations, after 0.0% in June.

On a yearly basis, Switzerland's producer price index fell 0.8% in July, after a 0.8% decline in June.

The Canadian dollar traded higher against the U.S. dollar after the Canadian new housing price index. The index climbed 0.2% in June, in line with expectations, after a 0.1% gain in May.

The New Zealand dollar traded higher against the U.S dollar after the weaker-than-expected number of initial jobless claims in the U.S. Retail sales in New Zealand climbed 1.2% in the second quarter, exceeding expectations for a 1.0% rise, after a 0.8% gain in the first quarter. The first quarter's figure was revised up from a 0.7% increase.

Core retail sales, excluding automobiles and gas stations, jumped 1.2% in the second quarter, beating expectations for a 1.1% gain, after 1.0% in the first quarter. The first quarter's figure was revised up from a 0.8% increase.

The increase of retail sales in New Zealand was driven by automobile sales and parts retailing industry.

The Business NZ Performance of Manufacturing Index declined to 53.0 in July from 53.4 in June. June's figure was revised up from 53.3.

The Australian dollar traded higher against the U.S. dollar due to the weaker-than-expected number of initial jobless claims in the U.S. The Melbourne Institute released its consumer inflation expectations for Australia. The consumer inflation expectations dropped to 3.1% in July from 3.8% in June.

The Japanese yen declined against the U.S. dollar after the disappointing core machinery orders from Japan, but later recovered its losses as the number of initial jobless claims in the U.S. rose. Core machinery orders in Japan rose 8.8% in June, missing expectations for a 15.5% gain, after a 19.5% decline in May.

On a yearly basis, core machinery orders in Japan decreased 3.0% in June, after a 14.3% fall in May.

Gold prices declined slightly, departing from the one-week high, which was a reaction to the comments of Russian President Vladimir Putin on the conflict in the Ukraine. However, the decline in the dollar and weak American and European data limited the losses.

Putin said he was committed to peace and does not seek to isolate Russia, urged citizens to labor mobilization against the backdrop of war, sanctions and the West and pledged to promote peace in the Ukraine.

"Geopolitics, a weak dollar and weak economic data do not give a price drop, but also to grow, it can not, because $ 1.316- $ 1,320 it is now very hard barrier that we have tested several times in the last month," - said an analyst at Societe Generale Robin Bhar .

Meanwhile, today's statistics showed that the German economy shrank in the second quarter for the first time in over a year, while France has lowered growth forecasts for this year and the next year after its economy has not grown in April-June.

As for the data on the United States, they showed new applications for unemployment benefits rose last week but remained near eight-year lows. The number of initial claims for unemployment benefits rose by 21,000 and amounted to a seasonally adjusted 311,000 in the week ended August 9, the Labor Department said Thursday. It was more than 307,000 new applications for Economists, and reached its highest level since June.

Treatment for the previous week were revised slightly to 290 000 The four-week moving average of claims, which smooths weekly volatility, rose by 2000 and reached 295,750, but is still far below the average level of applications in the past year. Report on Thursday showed that the number of people continuing to receive unemployment benefits rose by 25,000, reaching a seasonally adjusted 2.544 million in the week ended 2avgusta.

Also today it was announced that the assets of the world's largest holder of gold investment institutions ETFs SPDR Gold Trust at the end of the day on August 13 fell by 0.26 m and amounted to 795.60 tons - the lowest since June 30, 2014.

"In the absence of tangible physical demand or renewed inflows into safe-haven assets, the market will continue to be in the range until the end of the week" - said in VTB Capital.

The cost of the September futures contract for gold on COMEX today dropped to $ 1312.20 per ounce.

Statistics New Zealand released retail sales data on Thursday. Retail sales in New Zealand climbed 1.2% in the second quarter, exceeding expectations for a 1.0% rise, after a 0.8% gain in the first quarter. The first quarter's figure was revised up from a 0.7% increase.

Core retail sales, excluding automobiles and gas stations, jumped 1.2% in the second quarter, beating expectations for a 1.1% gain, after 1.0% in the first quarter. The first quarter's figure was revised up from a 0.8% increase.

The increase of retail sales in New Zealand was driven by automobile sales and parts retailing industry. Automobile sales and parts retailing industry were up 3.6%, while food and beverage services were up 2.7%.

The industry with the largest was fuel retailing, down 3.3%.

EUR/USD $1.3350-60(E440mn), $1.3400(E967mn)

USD/JPY Y101.45-50($1.0bn), Y101.65-75($500mn), Y101.95($620mn), Y102.00($1.1bn), Y102.05($250mn)

GBP/USD $1.6635(stg179mn), $1.6850(stg286mn)

EUR/GBP stg0.8045(E195mn)

EUR/CHF Chf1.2150(E458mn)

AUD/USD $0.9275(A$687mn), $0.9320(A$330mn), $0.9333(A$229mn)

NZD/USD $0.8550(NZ$271mn)

USD/CAD C$1.0880($410mn), C$1.0920-25($532mn), C$1.0990

U.S. stock index-futures were little changed amid speculation the crisis in Ukraine won't escalate and as investors weighed corporate earnings.

Global markets:

Nikkei 15,314.57 +100.94 +0.66%

Hang Seng 24,801.36 -88.98 -0.36%

Shanghai Composite 2,206.47 -16.41 -0.74%

FTSE 6,680.79 +24.11 +0.36%

CAC 4,198.36 +3.57 +0.09%

DAX 9,209.91 +11.03 +0.12%

Crude oil $97.42 (+0.04%)

Gold $1319.40 (+0.37%)

(company / ticker / price / change, % / volume)

| Home Depot Inc | HD | 83.14 | +0.02% | 3.5K |

| Verizon Communications Inc | VZ | 48.95 | +0.06% | 7.7K |

| General Electric Co | GE | 25.85 | +0.08% | 15.4K |

| Exxon Mobil Corp | XOM | 99.18 | +0.09% | 0.7K |

| McDonald's Corp | MCD | 94.05 | +0.10% | 11.6K |

| 3M Co | MMM | 142.00 | +0.14% | 0.3K |

| Visa | V | 211.77 | +0.16% | 1.1K |

| Boeing Co | BA | 122.20 | +0.18% | 1.1K |

| Walt Disney Co | DIS | 87.80 | +0.23% | 5.7K |

| Johnson & Johnson | JNJ | 101.98 | +0.24% | 0.9K |

| Procter & Gamble Co | PG | 81.69 | +0.26% | 0.2K |

| American Express Co | AXP | 87.66 | +0.30% | 3.0K |

| JPMorgan Chase and Co | JPM | 56.98 | +0.46% | 3.6K |

| United Technologies Corp | UTX | 106.90 | +1.27% | 0.1K |

| Merck & Co Inc | MRK | 58.72 | +1.50% | 1.5K |

| Caterpillar Inc | CAT | 105.16 | 0.00% | 0.1K |

| Intel Corp | INTC | 34.10 | 0.00% | 25.6K |

| The Coca-Cola Co | KO | 39.94 | 0.00% | 1.1K |

| Goldman Sachs | GS | 172.24 | -0.08% | 4.6K |

| International Business Machines Co... | IBM | 187.61 | -0.18% | 0.6K |

| Microsoft Corp | MSFT | 44.00 | -0.18% | 6.8K |

| AT&T Inc | T | 34.60 | -0.26% | 0.3K |

| Wal-Mart Stores Inc | WMT | 73.80 | -0.31% | 120.5K |

| Cisco Systems Inc | CSCO | 24.98 | -0.87% | 32.1K |

Upgrades:

Downgrades:

Freeport-McMoRan Inc (FCX) downgraded to Hold from Buy at Stifel

Other:

Tesla (TSLA) initiated with a Outperform at Credit Suisse, target $325

Ford Motor (F) initiated with a Neutral at Credit Suisse, target $18

General Motors (GM) initiated with a Underperform at Credit Suisse, target $33

Cisco Systems (CSCO) reiterated at Buy at Stifel, target raised from $28 to $30

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:00 Australia Consumer Inflation Expectation August +3.8% +3.1%

05:30 France GDP, q/q (Preliminary) Quarter II 0.0% +0.1% 0.0%

05:30 France GDP, Y/Y (Preliminary) Quarter II +0.7% +0.1%

06:00 Germany GDP (QoQ) (Preliminary) Quarter II +0.8% -0.1% -0.2%

06:00 Germany GDP (YoY) (Preliminary) Quarter II +2.5% +1.2%

06:45 France Non-Farm Payrolls (Preliminary) Quarter II -0.1% -0.1% +0.1%

07:15 Switzerland Producer & Import Prices, m/m July 0.0% 0.0% 0.0%

07:15 Switzerland Producer & Import Prices, y/y July -0.8% -0.8%

08:00 Eurozone ECB Monthly Report August

09:00 Eurozone Harmonized CPI July +0.1% -0.6% -0.7%

09:00 Eurozone Harmonized CPI, Y/Y (Finally) July +0.4% +0.4% +0.4%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y July +0.8% +0.8% +0.8%

09:00 Eurozone GDP (QoQ) (Preliminary) Quarter II +0.2% +0.1% 0.0%

09:00 Eurozone GDP (YoY) (Preliminary) Quarter II +0.9% +0.7% +0.7%

The U.S. dollar traded lower against the most major currencies ahead of the number of initial jobless claims in the U.S. The number of initial jobless claims in the U.S. is expected to rise by 18,000 to 307,000.

The U.S. import price index is expected to decline 0.2% in July, after a 0.1% increase in June.

The euro traded higher against the U.S. dollar despite the weaker-than-expected economic data from the Eurozone. Eurozone's harmonized consumer price index declined 0.7% in July, missing expectations for a 0.6% decrease, after a 0.1% rise in June.

On a yearly basis, Eurozone's harmonized consumer price index rose 0.4% in July, in line with expectations, after a 0.4% increase in June.

Eurozone's preliminary gross domestic product was flat in the second quarter, missing expectations for a 0.1% rise, after a 0.2% gain in the first quarter.

On a yearly basis, Eurozone's preliminary gross domestic product climbed 0.7% in the second quarter, in line with expectations, after a 0.9% rise in the first quarter.

German preliminary GDP decreased 0.2% in the second quarter, missing forecasts of a 0.1% decline, after a 0.8% rise in the first quarter.

French preliminary GDP remained flat in the second quarter, missing forecasts of a 0.1% gain.

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports in the UK.

The Swiss franc traded higher against the U.S. dollar. Switzerland's producer price index was flat in July, in line with expectations, after 0.0% in June.

On a yearly basis, Switzerland's producer price index fell 0.8% in July, after a 0.8% decline in June.

The Canadian dollar rose against the U.S. dollar ahead of the Canadian new housing price index. The index is expected to climb 0.2% in June, after a 0.1% gain in May.

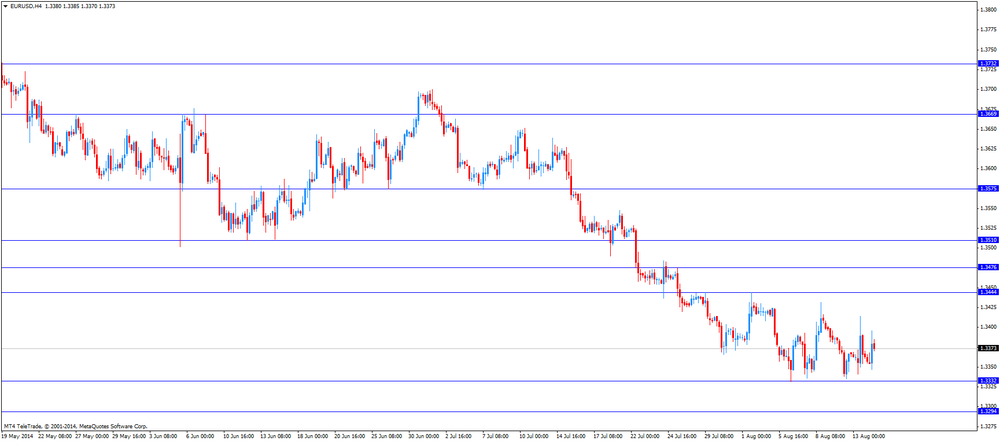

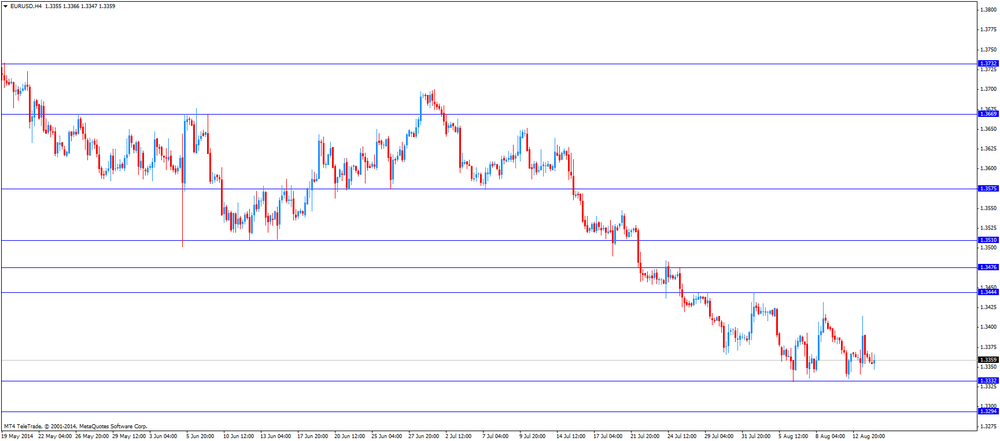

EUR/USD: the currency pair rose to $1.3396

GBP/USD: the currency pair traded mixed

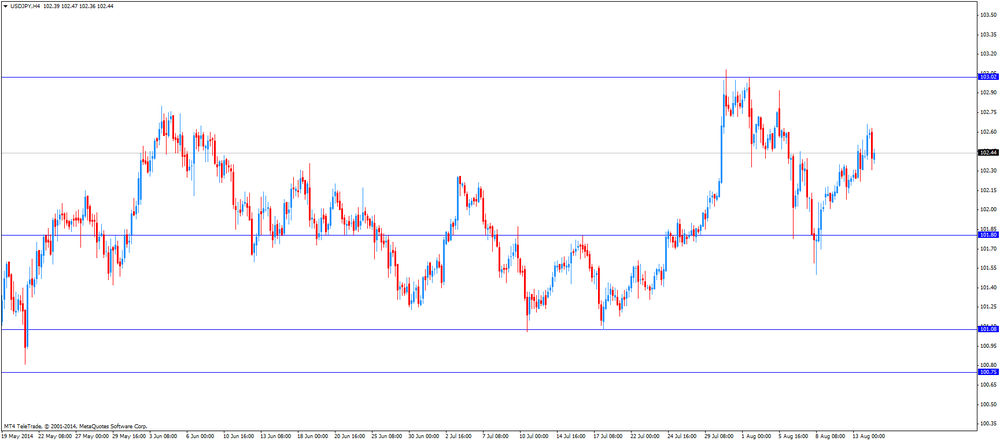

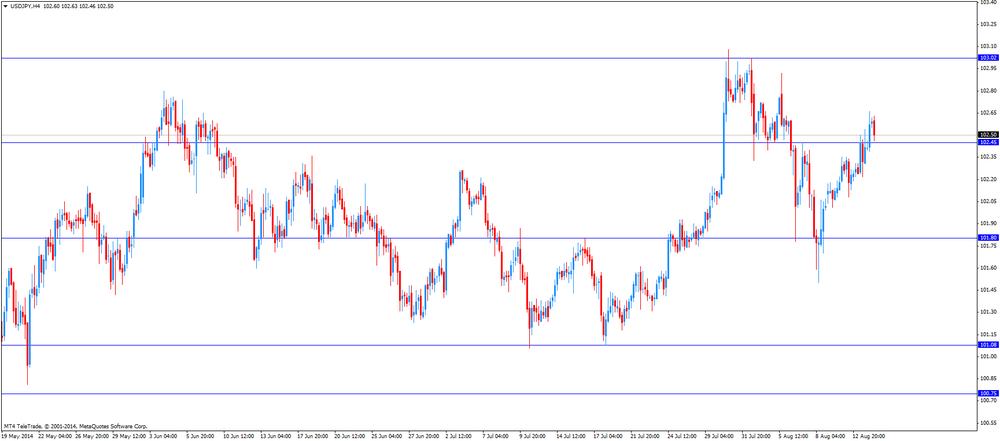

USD/JPY: the currency pair decreased to Y102.31

The most important news that are expected (GMT0):

12:30 Canada New Housing Price Index June +0.1% +0.2%

12:30 U.S. Initial Jobless Claims August 289 307

12:30 U.S. Import Price Index July +0.1% -0.2%

EUR/USD

Offers $1.3475/85, $1.3445-50

Bids $1.3335-30

GBP/USD

Offers $1.6800/10, $1.6700

Bids $1.6650, $1.6620, $1.6600

AUD/USD

Offers $0.9400, $0.9380, $0.9350

Bids $0.9285/80, $0.9240, $0.9220/00

EUR/JPY

Offers Y138.20, Y138.00, Y137.50, Y137.20/25

Bids Y136.50, Y136.25/20, Y136.00

USD/JPY

Offers Y103.50, Y103.00, Y102.80/85, Y102.65/70

Bids Y102.25/20, Y102.00, Y101.80, Y101.50

EUR/GBP

Offers stg0.8100, stg0.8030-50

Bids stg0.8000, stg0.7985/80

Stock indices traded higher despite the disappointing economic data from the Eurozone. Stock indices advanced as ThyssenKrupp AG and Royal Boskalis Westminster NV shares rose.

Eurozone's harmonized consumer price index declined 0.7% in July, missing expectations for a 0.6% decrease, after a 0.1% rise in June.

On a yearly basis, Eurozone's harmonized consumer price index rose 0.4% in July, in line with expectations, after a 0.4% increase in June.

Eurozone's preliminary gross domestic product was flat in the second quarter, missing expectations for a 0.1% rise, after a 0.2% gain in the first quarter.

On a yearly basis, Eurozone's preliminary gross domestic product climbed 0.7% in the second quarter, in line with expectations, after a 0.9% rise in the first quarter.

German preliminary GDP decreased 0.2% in the second quarter, missing forecasts of a 0.1% decline, after a 0.8% rise in the first quarter.

French preliminary GDP remained flat in the second quarter, missing forecasts of a 0.1% gain.

Royal Boskalis Westminster NV shares rose 8.4% after the company said it will buy back shares.

ThyssenKrupp AG shares increased 1.2% after reporting better-than-forecasted quarterly earnings.

Current figures:

Name Price Change Change %

FTSE 100 6,688.36 +31.68 +0.48%

DAX 9,245.19 +46.31 +0.50%

CAC 40 4,212.24 +17.45 +0.42%

Asian stock indices traded mixed. Investors were focused on corporate earnings.

Chinese stocks traded lower as investors began to take profit, and as they weighed yesterday's disappointing economic data from China. Concern is growing that stimulus measures by the Chinese government will be insufficient.

Investors speculated yesterday that the government in China will add stimulus measures to support the economy.

Core machinery orders in Japan rose 8.8% in June, missing expectations for a 15.5% gain, after a 19.5% decline in May.

On a yearly basis, core machinery orders in Japan decreased 3.0% in June, after a 14.3% fall in May.

Indexes on the close:

Nikkei 225 15,314.57 +100.94 +0.66%

Hang Seng 24,801.36 -88.98 -0.36%

Shanghai Composite 2,206.47 -16.41 -0.74%

EUR/USD $1.3350-60(E440mn), $1.3400(E967mn)

USD/JPY Y101.45-50($1.0bn), Y101.65-75($500mn), Y101.95($620mn), Y102.00($1.1bn), Y102.05($250mn)

GBP/USD $1.6635(stg179mn), $1.6850(stg286mn)

EUR/GBP stg0.8045(E195mn)

EUR/CHF Chf1.2150(E458mn)

AUD/USD $0.9275(A$687mn), $0.9320(A$330mn), $0.9333(A$229mn)

NZD/USD $0.8550(NZ$271mn)

USD/CAD C$1.0880($410mn), C$1.0920-25($532mn), C$1.0990

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:00 Australia Consumer Inflation Expectation August +3.8% +3.1%

05:30 France GDP, q/q (Preliminary) Quarter II 0.0% +0.1% 0.0%

05:30 France GDP, Y/Y (Preliminary) Quarter II +0.7% +0.1%

06:00 Germany GDP (QoQ) (Preliminary) Quarter II +0.8% -0.1% -0.2%

06:00 Germany GDP (YoY) (Preliminary) Quarter II +2.5% +1.2%

06:45 France Non-Farm Payrolls (Preliminary) Quarter II -0.1% -0.1% +0.1%

07:15 Switzerland Producer & Import Prices, m/m July 0.0% 0.0% 0.0%

07:15 Switzerland Producer & Import Prices, y/y July -0.8% -0.8%

08:00 Eurozone ECB Monthly Report August

The U.S. dollar traded mixed against the most major currencies. Yesterday's disappointing U.S. retail sales weighed on the greenback. Retail sales were flat in July, missing expectations for a 0.2%rise, after a 0.2% increase in June.

Retail sales, excluding automobile sales, climbed 0.1% in July, missing expectations for a 0.4% rise, after a 0.4% gain in June.

The New Zealand dollar traded mixed against the U.S dollar after the better-than-expected retail sales in New Zealand. Retail sales in New Zealand climbed 1.2% in the second quarter, exceeding expectations for a 1.0% rise, after a 0.8% gain in the first quarter. The first quarter's figure was revised up from a 0.7% increase.

Core retail sales, excluding automobiles and gas stations, jumped 1.2% in the second quarter, beating expectations for a 1.1% gain, after 1.0% in the first quarter. The first quarter's figure was revised up from a 0.8% increase.

The increase of retail sales in New Zealand was driven by automobile sales and parts retailing industry.

The Business NZ Performance of Manufacturing Index declined to 53.0 in July from 53.4 in June. June's figure was revised up from 53.3.

The Australian dollar traded lower against the U.S. dollar after the consumer inflation expectations from Australia. The Melbourne Institute released its consumer inflation expectations for Australia. The consumer inflation expectations dropped to 3.1% in July from 3.8% in June.

The Japanese yen declined against the U.S. dollar after the disappointing core machinery orders from Japan. Core machinery orders in Japan rose 8.8% in June, missing expectations for a 15.5% gain, after a 19.5% decline in May.

On a yearly basis, core machinery orders in Japan decreased 3.0% in June, after a 14.3% fall in May.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair increased to Y102.65

The most important news that are expected (GMT0):

09:00 Eurozone Harmonized CPI July +0.1% -0.6%

09:00 Eurozone Harmonized CPI, Y/Y (Finally) July +0.4% +0.4%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y July +0.8% +0.8%

09:00 Eurozone GDP (QoQ) (Preliminary) Quarter II +0.2% +0.1%

09:00 Eurozone GDP (YoY) (Preliminary) Quarter II +0.9% +0.7%

12:30 Canada New Housing Price Index June +0.1% +0.2%

12:30 U.S. Initial Jobless Claims August 289 307

12:30 U.S. Import Price Index July +0.1% -0.2%

EUR / USD

Resistance levels (open interest**, contracts)

$1.3450 (5436)

$1.3408 (691)

$1.3386 (39)

Price at time of writing this review: $ 1.3365

Support levels (open interest**, contracts):

$1.3339 (1839)

$1.3294 (4029)

$1.3262 (4625)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 53883 contracts, with the maximum number of contracts with strike price $1,3400 (5436);

- Overall open interest on the PUT options with the expiration date September, 5 is 57027 contracts, with the maximum number of contracts with strike price $1,3100 (6052);

- The ratio of PUT/CALL was 1.06 versus 1.07 from the previous trading day according to data from August, 13

GBP/USD

Resistance levels (open interest**, contracts)

$1.7000 (3035)

$1.6901 (2209)

$1.6803 (1285)

Price at time of writing this review: $1.6680

Support levels (open interest**, contracts):

$1.6595 (1834)

$1.6498 (1883)

$1.6399 (702)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 26529 contracts, with the maximum number of contracts with strike price $1,7000 (3035);

- Overall open interest on the PUT options with the expiration date September, 5 is 28977 contracts, with the maximum number of contracts with strike price $1,6800 (4000);

- The ratio of PUT/CALL was 1.09 versus 1.19 from the previous trading day according to data from August, 13

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.