- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 14-07-2014

Stock indices closed higher, recovering last week's losses. Concerns over the financial health of Banco Espirito Santo eased. Stocks were declined last week due to concerns over Portugal's banking sector. The parent company (Espirito Santo Financial Group) of Portugal's bank, Banco Espirito Santo SA, reported it didn't make the payments on short-term paper. Investors had concerns over of the banking sectors in Portugal as well as in Spain and Italy.

Eurozone's industrial production declined 3.3% in May, missing expectations for a 0.3% gain, after a 0.7% increase in April. April's figure was revised down from a 0.8 gain.

On a yearly basis, Eurozone's industrial production climbed 0.5% in May, missing expectations for a 1.1% rise, after a 1.4% gain in April.

Banco Espirito Santo shares dropped 8.1%.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,746.14 +55.97 +0.84%

DAX 9,783.01 +116.67 +1.21%

CAC 40 4,350.04 +33.54 +0.78%

Cost of oil futures fell slightly, being at the same time near three-month low, which was associated with the resumption of production of raw materials to the El Sharara field in Libya, which has increased the volume of oil production in the country.

Meanwhile, experts say that this week, prices could rise due to new problems in Libya and Iraq and fears that Iran will not be able to negotiate with the West over its nuclear program. Libya has increased oil production to 470,000 barrels per day, but the port of Brega is still closed due to protests guards. In addition, on Sunday held battles between rival factions for control of the main airport of Tripoli Libya, during which killed at least seven people. Six people were killed on Sunday in a bomb explosion in a suburb of the Iraqi capital Baghdad. Iraqi parliament delayed the formation of a new government until Tuesday against the backdrop of fighting with Islamists less than 80 kilometers from the capital.

The course of trade also influenced today's data for the euro area, which showed that industrial production fell by 1.1 percent on a monthly measurement, offset by an increase of 0.7 percent in April. Issue, according to expectations, had to grow by 0.3 percent.

Production of consumer durables and non-durables fell by 1.8 percent and 2.2 percent respectively. In turn, the production of intermediate goods fell by 2.4 percent, and production of capital goods decreased slightly by 0.5 percent. Partially offset by decrease in energy production (3 percent). On an annual basis, industrial output grew at a slower pace of 0.5 percent after rising 1.4 percent in April. Experts had expected growth of 1.1 percent.

Market participants are also waiting for the speech of the Federal Reserve Janet Yellen this week on the topic of monetary policy, as well as key data on U.S. retail sales in June.

According to technical analysis Oil N'Gold, the first resistance level WTI oil prices at around $ 101.10, and the second level is $ 101.55. At the same levels of support may include the following $ 100.75 and $ 100.00.

Cost of the August futures on U.S. light crude oil WTI (Light Sweet Crude Oil) fell to $ 100.63 a barrel on the New York Mercantile Exchange (NYMEX).

August futures price for North Sea Brent crude oil mixture fell to $ 106.53 a barrel on the London exchange ICE Futures Europe.

The U.S. dollar traded mixed against the most major currencies in quiet trade. No major economic reports will be released in the U.S. on Monday. Markets participants are awaiting the congressional testimony by Federal Reserve Chair Janet Yellen on Tuesday and Wednesday. They expect to hear new information on when the Fed could start to increase its interest rate.

The euro traded higher against the U.S. dollar ahead of testimony by European Central Bank President Mario Draghi later in the day. The euro strengthened after Portugal's central bank eased market fears over the financial health of Banco Espirito Santo.

Eurozone's industrial production declined 3.3% in May, missing expectations for a 0.3% gain, after a 0.7% increase in April. April's figure was revised down from a 0.8 gain.

On a yearly basis, Eurozone's industrial production climbed 0.5% in May, missing expectations for a 1.1% rise, after a 1.4% gain in April.

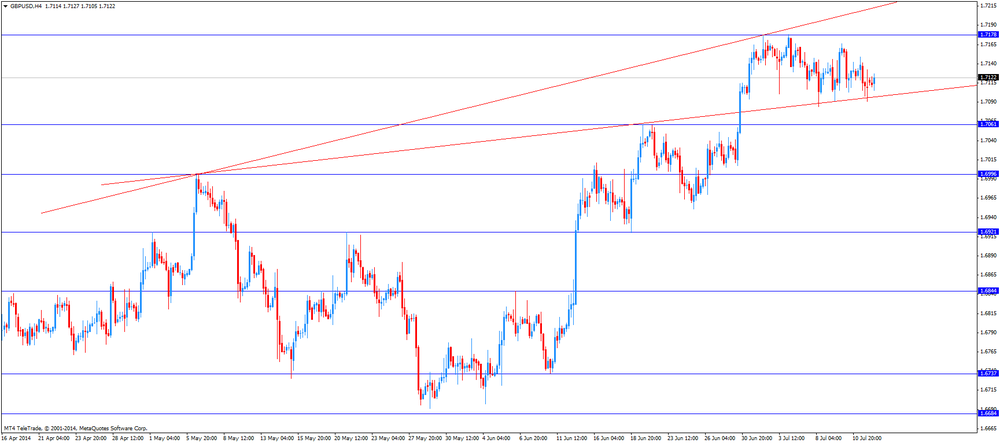

The British pound traded lower against the U.S. dollar in the absence of any major economic reports in the UK.

The Canadian dollar traded higher against the U.S. dollar, recovering a part of Friday's losses. The Canadian currency dropped on Friday due to the weaker-than-expected Canadian labour market data. Canadian unemployment rate climbed to a seasonally adjusted 7.1% in June from 7.0% in May. The Canadian economy unexpectedly lost 9,400 jobs last month.

The New Zealand dollar traded slightly lower against the U.S dollar. The REINZ housing price index declined 0.3% in June, after a 1.2% decrease in May.

The Australian dollar traded mixed against the U.S. dollar in the absence of any major economic reports in Australia.

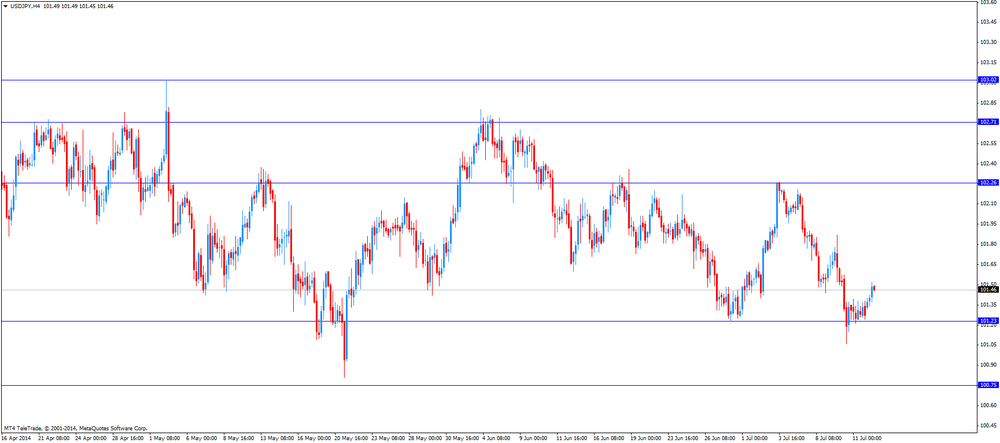

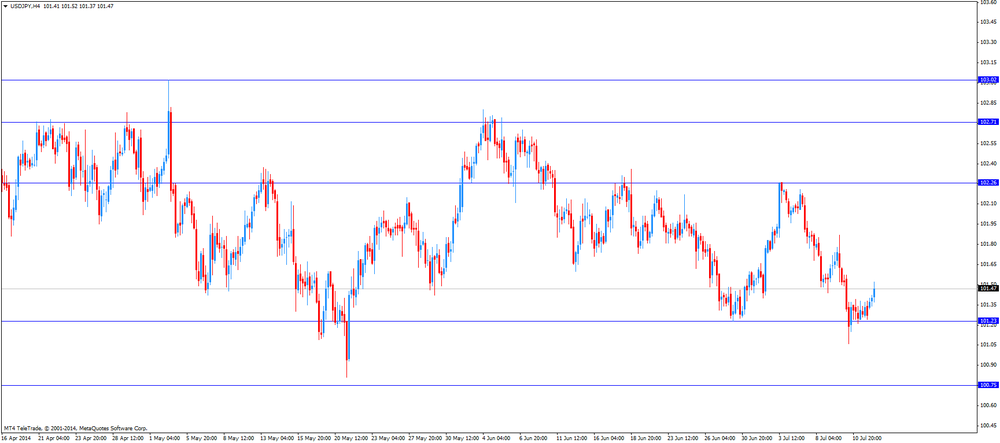

The Japanese yen declined against the U.S. dollar due to decreasing demand for safe-haven yen after Portugal's central bank eased market fears over the financial health of Banco Espirito Santo.

Japan's industrial production rose 1.0% in May, after a 0.8% increase in April. Analysts had expected a 0.5% increase.

On a yearly basis, Japan's industrial production climbed 0.7% in May, after a 0.5% rise in April.

Gold prices fell sharply today, losing more than 2 percent, which was associated with fading concerns about Portugal's largest public bank Banco Espirito Santo. Analysts also point out that the cause of the fall was also the fact that some traders believed the rise in prices to the level of excessive four-month high, and also want to get a distinct view when American politicians may start raising interest rates. This week, investors are waiting for speeches in Congress Fed Chairman Janet Yellen to get fresh hints on the future direction of monetary policy after the last week of June Fed meeting minutes gave little idea of when they can begin to grow tender.

Meanwhile, adding that demand in the physical market in Asia remains weak due to high prices.

"Demand in China, India and other countries in Southeast Asia was low the last few weeks. If in the near future will not be a sharp decline in prices, one can hardly expect support from the physical markets, "- said a dealer in Singapore.

Experts World Gold Council (WGC) estimated that half of the gold in 2014 I showed a higher yield than most other instruments. Gold for the first half increased in price by 9.2%. Better shown themselves only certain goods (such as grain, nickel and palladium), shares of Indian companies (in the background change the ruling party in India) and U.S. real estate investment trusts REIT. Height gold surprised many market participants, wrote in his report WGC. Most analysts predicted lower prices. Some investors took advantage of price correction in the past year to buy gold, but investment demand remains weak.

Also today it was announced that the U.S. mining company in April of this year, gold production decreased by 3% compared to the same period a year earlier to 17.6 tons. From the beginning of this year, gold production amounted to 69.1 tons, which is 5% lower than for the same period in 2013. The average price of the precious metal bullion by Engelhard in April of this year amounted to 1 301.12 an ounce, up 37.73 dollars below the March price. So, the past month gold lost 2.8%. In the period from January to April, the U.S. imported 101 tonne gold. U.S. exports of gold for I quarter of 2014 amounted to 186 tons.

The cost of the August gold futures on the COMEX today dropped to $ 1309.00 per ounce.

EUR/USD $1.3500, $1.3550, $1.3600, $1.3650

USD/JPY Y101.00, Y101.60, Y102.00

GBP/USD $1.6925

USD/CHF Chf0.8850, Chf0.8890

AUD/USD $0.9400

NZD/USD $0.8650

USD/CAD C$1.0615, C$1.0700

U.S. stock futures advanced on better-than-forecast earnings from Citigroup Inc.

Global markets:

Nikkei 15,296.82 +132.78 +0.88%

Hang Seng 23,346.67 +113.22 +0.49%

Shanghai Composite 2,066.65 +19.69 +0.96%

FTSE 6,745.58 +55.41 +0.83%

DAX 9,754.34 +88.00 +0.91%

Crude oil $100.67 (-0.12%)

Gold $1314.00 (-1.75%)

(company / ticker / price / change, % / volume)

| McDonald's Corp | MCD | 100.49 | +0.12% | 0.2K |

| Microsoft Corp | MSFT | 42.15 | +0.14% | 2.8K |

| Cisco Systems Inc | CSCO | 25.57 | +0.20% | 0.6K |

| International Business Machines Co... | IBM | 188.39 | +0.21% | 2.1K |

| Verizon Communications Inc | VZ | 50.44 | +0.24% | 46.7K |

| AT&T Inc | T | 35.85 | +0.25% | 24.5K |

| E. I. du Pont de Nemours and Co | DD | 65.07 | +0.28% | 0.3K |

| Home Depot Inc | HD | 79.84 | +0.29% | 0.2K |

| Exxon Mobil Corp | XOM | 102.14 | +0.39% | 2.8K |

| Chevron Corp | CVX | 129.00 | +0.41% | 0.4K |

| Johnson & Johnson | JNJ | 105.64 | +0.51% | 0.1K |

| General Electric Co | GE | 26.69 | +0.53% | 43.8K |

| United Technologies Corp | UTX | 114.75 | +0.54% | 0.6K |

| Walt Disney Co | DIS | 87.39 | +0.58% | 0.1K |

| Caterpillar Inc | CAT | 110.63 | +0.61% | 0.2K |

| Intel Corp | INTC | 31.44 | +0.61% | 24.7K |

| Visa | V | 218.49 | +0.69% | 2.8K |

| Boeing Co | BA | 129.13 | +0.81% | 0.9K |

| Goldman Sachs | GS | 166.89 | +1.27% | 6.9K |

| JPMorgan Chase and Co | JPM | 56.53 | +1.31% | 40.5K |

| Merck & Co Inc | MRK | 58.42 | -0.03% | 0.2K |

| Procter & Gamble Co | PG | 80.96 | -0.25% | 1.2K |

Upgrades:

Apple (AAPL) upgraded to Overweight from Equal Weight at Barclays, target raised to $110 from $95

Downgrades:

eBay (EBAY) downgraded to Sector Perform from Outperform at Pacific Crest

Wells Fargo (WFC) downgraded to Neutral from Overweight at JP Morgan, target lowered to $52 from $54.50

Other:

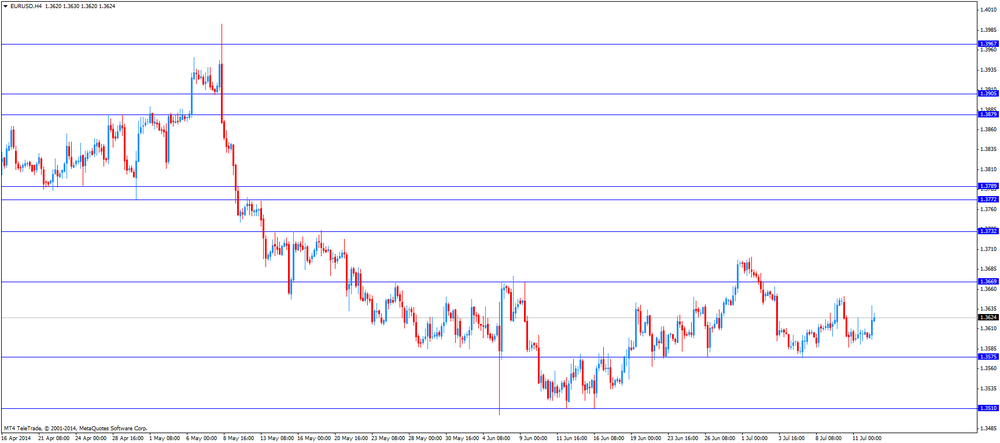

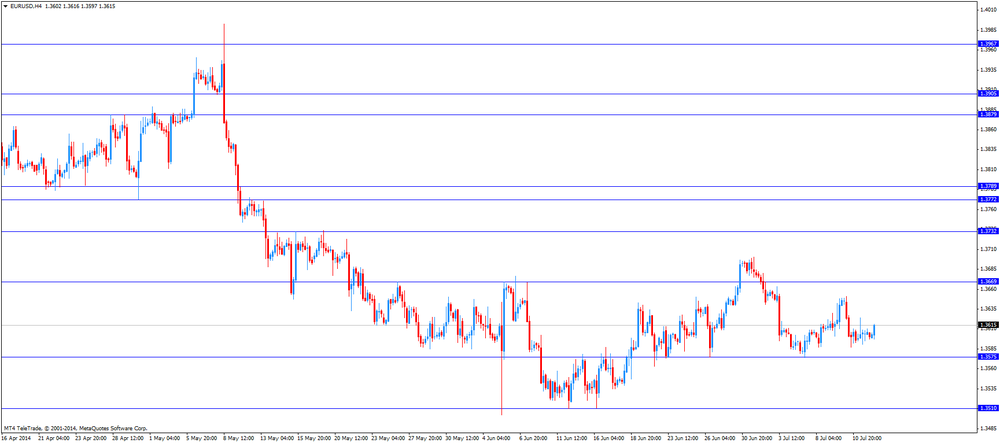

EUR/USD

Offers $1.3700-20, $1.3680/85

Bids $1.3589-88, $1.3576, $1.3570/60, $1.3550/40

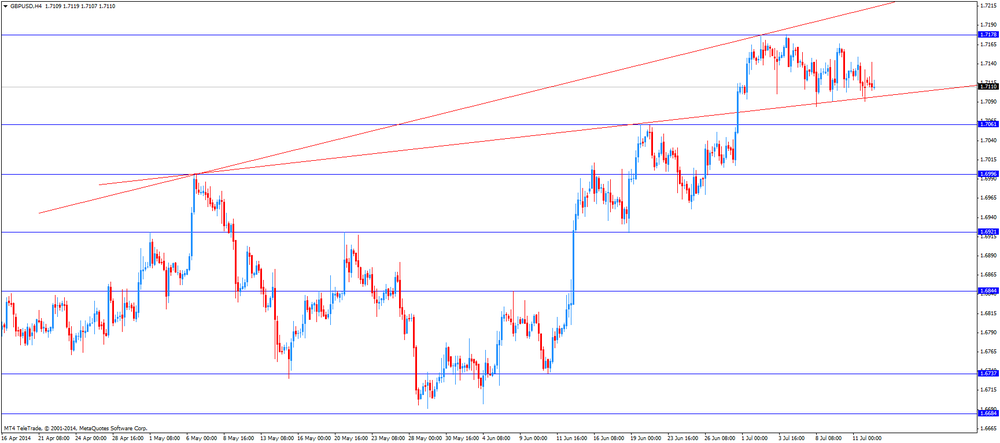

GBP/USD

Offers $1.7200, $1.7180

Bids $1.7040/30

AUD/USD

Offers $0.9480, $0.9450

Bids $0.9350, $0.9320, $0.9300

EUR/JPY

Offers Y139.50, Y139.00, Y138.50

Bids Y138.00, Y137.50, Y137.20, Y137.00, Y136.80/70

USD/JPY

Offers Y102.00, Y101.80, Y101.60

Bids Y101.20, Y101.00, Y100.80, Y100.50

EUR/GBP

Offers stg0.8000, stg0.7980

Bids stg0.7905-890

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

04:30 Japan Industrial Production (YoY) (Finally) May +0.8% +0.8% +1.0%

04:30 Japan Industrial Production (MoM) (Finally) May +0.5% +0.5% +0.7%

06:00 France Bank holiday

09:00 Eurozone Industrial production, (MoM) May +0.7% +0.3% -1.1%

09:00 Eurozone Industrial Production (YoY) May +1.4% +1.1% +0.5%

The U.S. dollar traded mixed against the most major currencies in quiet trade. No major economic reports will be released in the U.S. on Monday. Markets participants are awaiting the congressional testimony by Federal Reserve Chair Janet Yellen on Tuesday and Wednesday. They expect to hear new information on when the Fed could start to increase its interest rate.

The euro rose against the U.S. dollar ahead of testimony by European Central Bank President Mario Draghi later in the day. The euro strengthened after Portugal's central bank eased market fears over the financial health of Banco Espirito Santo.

Eurozone's industrial production declined 3.3% in May, missing expectations for a 0.3% gain, after a 0.7% increase in April. April's figure was revised down from a 0.8 gain.

On a yearly basis, Eurozone's industrial production climbed 0.5% in May, missing expectations for a 1.1% rise, after a 1.4% gain in April.

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports in the UK.

EUR/USD: the currency increased to $1.3639

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair was up to Y101.52

The most important news that are expected (GMT0):

17:30 Eurozone ECB President Mario Draghi Speaks

23:01 United Kingdom BRC Retail Sales Monitor y/y June +0.5%

Stock indices traded higher as concerns over the financial health of Banco Espirito Santo eased. Stocks were declined last week due to concerns over Portugal's banking sector. The parent company (Espirito Santo Financial Group) of Portugal's bank, Banco Espirito Santo SA, reported it didn't make the payments on short-term paper. Investors had concerns over of the banking sectors in Portugal as well as in Spain and Italy.

Eurozone's industrial production declined 3.3% in May, missing expectations for a 0.3% gain, after a 0.7% increase in April. April's figure was revised down from a 0.8 gain.

On a yearly basis, Eurozone's industrial production climbed 0.5% in May, missing expectations for a 1.1% rise, after a 1.4% gain in April.

Banco Espirito Santo shares dropped 6.4%.

Current figures:

Name Price Change Change %

FTSE 100 6,738.51 +48.34 +0.72%

DAX 9,738.46 +72.12 +0.75%

CAC 40 4,341.88 +25.38 +0.59%

EUR/USD $1.3500, $1.3550, $1.3600, $1.3650

USD/JPY Y101.00, Y101.60, Y102.00

GBP/USD $1.6925

USD/CHF Chf0.8850, Chf0.8890

AUD/USD $0.9400

NZD/USD $0.8650

USD/CAD C$1.0615, C$1.0700

Most Asian stock indices rose after Portugal's central bank eased market fears over the financial health of Banco Espirito Santo.

Stocks were also supported by gains of telecommunications and health-care shares.

Japan's industrial production rose 1.0% in May, after a 0.8% increase in April. Analysts had expected a 0.5% increase.

On a yearly basis, Japan's industrial production climbed 0.7% in May, after a 0.5% rise in April.

Indexes on the close:

Nikkei 225 15,296.82 +132.78 +0.88%

Hang Seng 23,346.67 +113.22 +0.49%

Shanghai Composite 2,066.65 +19.69 +0.96%

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

04:30 Japan Industrial Production (YoY) (Finally) May +0.8% +0.8% +1.0%

04:30 Japan Industrial Production (MoM) (Finally) May +0.5% +0.5% +0.7%

06:00 France Bank holiday

The U.S. dollar traded mixed against the most major currencies ahead of congressional testimony by Federal Reserve Chair Janet Yellen on Tuesday and Wednesday. Markets participants are awaiting new information on when the Fed could start to increase its interest rate.

The New Zealand dollar traded mixed near 3-year highs against the U.S dollar. The REINZ housing price index declined 0.3% in June, after a 1.2% decrease in May.

The Australian dollar traded mixed against the U.S. dollar in the absence of any major economic reports in Australia.

The Japanese yen traded slightly lower against the U.S. dollar due to decreasing demand for safe-haven yen after Portugal's central bank eased market fears over the financial health of Banco Espirito Santo.

Japan's industrial production rose 1.0% in May, after a 0.8% increase in April. Analysts had expected a 0.5% increase.

On a yearly basis, Japan's industrial production climbed 0.7% in May, after a 0.5% rise in April.

EUR/USD: the currency pair

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair

The most important news that are expected (GMT0):

09:00 Eurozone Industrial production, (MoM) May +0.8% +0.3%

09:00 Eurozone Industrial Production (YoY) May +1.4% +1.1%

17:30 Eurozone ECB President Mario Draghi Speaks

23:01 United Kingdom BRC Retail Sales Monitor y/y June +0.5%

EUR / USD

Resistance levels (open interest**, contracts)

$1.3674 (2712)

$1.3655 (635)

$1.3632 (77)

Price at time of writing this review: $ 1.3604

Support levels (open interest**, contracts):

$1.3581 (370)

$1.3563 (1927)

$1.3538 (3261)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 23686 contracts, with the maximum number of contracts with strike price $1,3800 (3718);

- Overall open interest on the PUT options with the expiration date August, 8 is 32266 contracts, with the maximum number of contracts with strike price $1,3500 (7635);

- The ratio of PUT/CALL was 1.36 versus 1.36 from the previous trading day according to data from July, 11

GBP/USD

Resistance levels (open interest**, contracts)

$1.7401 (1025)

$1.7303 (1460)

$1.7205 (1384)

Price at time of writing this review: $1.7115

Support levels (open interest**, contracts):

$1.6995 (2094)

$1.6897 (1895)

$1.6799 (989)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 15876 contracts, with the maximum number of contracts with strike price $1,7250 (2204);

- Overall open interest on the PUT options with the expiration date August, 8 is 20206 contracts, with the maximum number of contracts with strike price $1,7000 (2094);

- The ratio of PUT/CALL was 1.27 versus 1.28 from the previous trading day according to data from Jule, 11

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

(raw materials / closing price /% change)

Light Crude $100.49 -0.34%

Gold $1,337.40 -0.01%

(index / closing price / change items /% change)

Nikkei 225 15,164.04 -52.43 -0.34%

Hang Seng 23,233.45 -5.54 -0.02%

Shanghai Composite 2,046.96 +8.62 +0.42%

FTSE 100 6,690.17 +17.80 +0.27%

CAC 40 4,316.5 +15.24 +0.35%

Xetra DAX 9,666.34 +7.21 +0.07%

S&P 500 1,967.57 +2.89 +0.15%

NASDAQ 4,415.49 +19.29 +0.44%

Dow Jones 16,943.81 +28.74 +0.17%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3606 0,00%

GBP/USD $1,7109 -0,13%

USD/CHF Chf0,8920 -0,04%

USD/JPY Y101,27 -0,04%

EUR/JPY Y 137,77 -0,06%

GBP/JPY Y173,19 -0,21%

AUD/USD $0,9390 0,00%

NZD/USD $0,8812 -0,03%

USD/CAD C$1,0732 +0,75%

(time / country / index / period / previous value / forecast)

01:50 New Zealand REINZ Housing Price Index, m/m June -1.2%

07:30 Japan Industrial Production (YoY) May +0.8% +0.8%

07:30 Japan Industrial Production (MoM) May +0.5% +0.5%

09:00 France Bank holiday

12:00 Eurozone Industrial production, (MoM) May +0.8% +0.3%

12:00 Eurozone Industrial Production (YoY) May +1.4% +1.1%

20:00 Eurozone ECB President Mario Draghi Speaks

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.