- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 14-06-2011

The dollar weakened against the majority of its most-traded counterparts as U.S. retail sales fell less than forecast, damping demand for haven assets.

The U.S currency rose against the yen and Swiss franc after the retail sales report, which followed data this month showing slowing manufacturing and rising unemployment. Currencies of commodity-exporting countries, such as the Canadian and Australian dollars, rose the most against major peers as raw material prices gained.

Retail purchases in the U.S. fell 0.2 percent in May, following a 0.3 percent increase in April, Commerce Department figures showed today in Washington. The median forecast of economists called for a 0.5 percent decrease.

Wholesale costs in the U.S. rose more than forecast in May, led by higher prices for fuel, plastics and the fastest rise in 30 years for apparel and textile costs.

“That the data is not negative actually has a big market impact; we’ve seen dollar-yen move higher,” said Jens Nordvig, a managing director of currency research in New York at Nomura Holdings Inc. “Better U.S. data is positive for U.S. growth and therefore supportive of Canada versus the dollar and supportive of Aussie versus the dollar.”

The Thomson Reuters/Jefferies CRB Index of commodities rose 0.2 percent and the Standard & Poor’s 500 Index gained 1.2 percent.

Earlier China reported increased retail sales and industrial output, spurring appetite for risk.

China’s retail sales rose 16.9 percent last month, while industrial production increased more than economists forecast, the statistics bureau reported. The 5.5 percent increase in China’s consumer-price index was the fastest in almost three years. Lenders were ordered to set aside more cash as reserves.

Today’s data offset concern the fastest-growing major economy is cooling. New loans in China tumbled in May and money supply grew at the slowest pace since 2008, the central bank reported yesterday.

“If you look at the trade numbers that came out of China they are still importing quite a bit,” said Kathy Lien, director of currency research with online currency trader GFT Forex in New York. “That means their demand remains strong and Aussie and kiwi are natural beneficiaries.”

The Swiss franc dropped versus all of its major counterparts as the government lowered its forecast for 2012 economic growth and said further currency appreciation poses risks to its outlook.

Shares of retailer Best Buy (BBY 30.22, +1.40) had gapped up at the open to their best level in more than a week, but the move was pressured so that gains were pared. The stock has since rebounded to reclaim gains, but it remains shy of its session high. Still, the stock remains one of this session's top performers, thanks largely to an upside earnings surprise in the company's latest quarterly report.

The rest of the retail space is also faring well. In fact, the SPDR S&P Retail ETF (XRT 50.83, +1.19) is on track for its best single session performance of the month.

The Nasdaq, which extended its year-to-date loss with a slip in the prior session, has rallied today. The strength of the move has actully given it a lead over its counterparts.

While many large-cap tech plays have underpinned the Nasdaq's strength this session, Cisco Systems (CSCO 14.94, -0.11) has been a laggard. The stock's latest loss, which marks an extension of a slide that began several weeks ago, comes in response to an analyst downgrade.

CRT says +0.8% Apr inventories was slightly lower than forecast "but with Mar revised up to 1.3% vs. 1.0% prior. Sales however were soft, increasing just +0.1% MoM vs. +2.4% March -- but are still +11% YoY. Inventories/Sales ratio upticked to 1.26x, adding to the modest disappointment."

EUR/GBP holding around stg0.8808 (below 55-dma and 50-dma levels at stg0.8810/11). Rate earlier printed highs of stg0.8826, where resistance between stg0.8825/30 comes. Support remains at stg0.8795/85, a break to allow for a deeper move toward stg0.8775/70 with stops below.

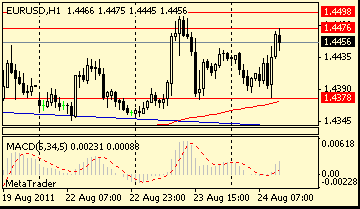

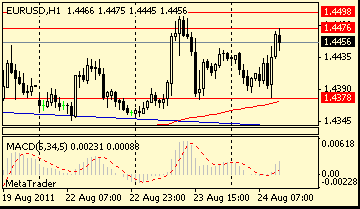

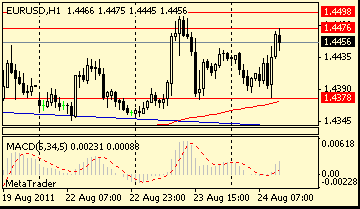

EUR/USD $1.4400, $1.4535, $1.4600

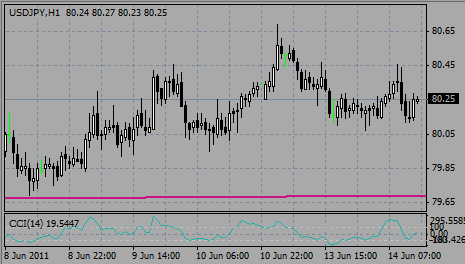

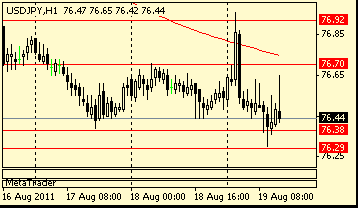

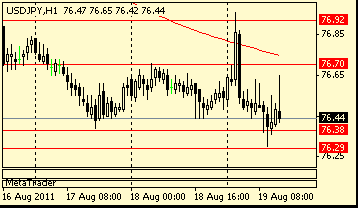

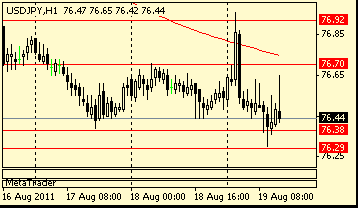

USD/JPY Y80.20, Y80.50, Y80.75, Y80.90, Y81.00

EUR/JPY Y118.00

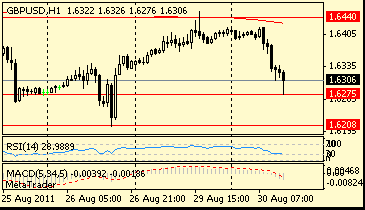

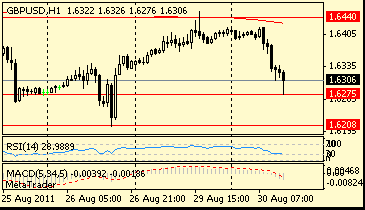

GBP/USD $1.6500

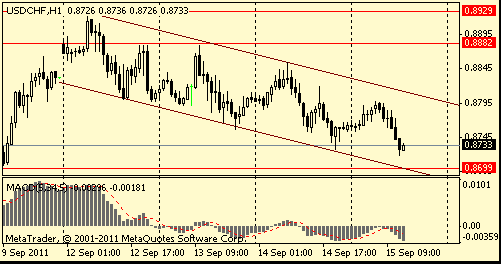

USD/CHF Chf0.8285

EUR/CHF Chf1.2000

AUD/USD $1.0570, $1.0645, $1.0685

U.S. stocks were headed for a higher open Tuesday, following better-than-expected retail sales and manufacturing data.

The first round of economic data this week helped set the stage for an early rally.

Economy: The Commerce Department said retail sales slid 0.2% in May. While it was the first decline in 11 months, it was much less of a decline than economists had expected.

Additionally, the Labor Department issued a brighter report on the producer price index. The PPI rose 0.2% in May, slightly better than the 0.1% that economists had forecast.

U.S. stock futures were higher all morning, on the heels of positive data out of China. The country released a report on industrial production that beat expectations.

Companies: Smartphone makers Apple (AAPL, Fortune 500) and Nokia (NOK) agreed to settle their long-running patent dispute early Tuesday. Apple will pay Nokia a one-time sum, and ongoing royalties will go to Nokia. Shares of Nokia jumped 4% in premarket trading, while shares of Apple edged up less than 1%.

Meanwhile, Honda (HMC) released its full-year forecast Tuesday, announcing that it expects a 63.5% drop in 2011 profit. Shares of Honda slid 1.7%.

Shares of Best Buy (BBY, Fortune 500) climbed more than 5%, after the consumer electronics retailer reported first-quarter results that beat expectations.

USD/CAD broke under C$0.9700 after exposing stops on C$0.9715. Rate fell to a new session lows around C$0.9695 before recovered to current C$0.9705.

EUR/USD holds around $1.4450 after the better than expected US retail sales data. Meanwhile, rate still holds below $1.4470, where offers mentioned too.

Data released:

08:30 UK HICP (May) 0.2% 0.2% 1.0%

08:30 UK HICP (May) Y/Y 4.5% 4.5% 4.5%

08:30 UK HICP ex EFAT (May) Y/Y 3.3% 3.4% 3.7%

08:30 UK Retail prices (May) 0.3% 0.4% 0.8%

08:30 UK Retail prices (May) Y/Y 5.2% 5.3% 5.2%

08:30 UK RPI-X (May) Y/Y 5.3% 5.3% 5.3%

The yen, the dollar and the Swiss franc fell against most of their major counterparts after reports showed China’s retail sales and industrial production increased, sapping demand for the safest currencies.

The U.S. currency declined against the euro for a second day before data that may show retail sales fell.

“Fears about a global slowdown seem to have been calmed by the improved industrial production data out of China,” said Bjarke Roed-Frederiksen, an analyst at Nordea Markets.

China’s statistics bureau said retail sales rose 16.9% last month, while industrial production increased more than economists projected. The 5.5% acceleration in China’s consumer-price index was in line with economists’ forecasts.

The Bank of Japan today kept the benchmark overnight rate unchanged in a range between zero percent and 0.1%.

EUR/USD failed to hold above session high on $1.4470 and retreated to $1.4420. Later rate tries to recover and rose to $1.4453.

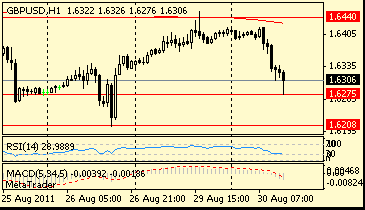

GBP/USD fell from session high on $1.6440 to lows around $1.6375. Currently rate holds around $1.6396.

USD/JPY weakened after challenging Y80.50. Rate fell to the lows near Y80.06. In general, rate trades tight.

The dollar also fell amid signs U.S. growth is slowing. Retail sales declined 0.5% in May, the first drop since June, according to a survey of economists. The producer-price index rose 0.1 percent in May after a 0.8 percent increase in April, another survey showed before today’s data.

EUR/GBP triggered corporate demand in the stg0.8810/05 area, and printed session lows around stg0.8793 before back to current stg0.8806.

The euro edged up across the board on Tuesday after a batch of Chinese economic data calmed some investor worries by showing inflation was not as bad as feared and growth still solid, giving a broad boost to risky assets.

The Australian dollar also gained after the Chinese reports showed industrial production and retail sales posting solid growth. Consumer prices accelerated to a 5.5% annual rate in May, slightly higher than the consensus forecast and the fastest in nearly three years.

The market is now turning its attention to inflation figures in other parts of the world, and most importantly the May data on U.S. retail sales for signs on whether the sudden slowdown in the economy is hampering household spending.

"We've just had some very negative surprises," said a trader at a U.S. bank. "Unless retail sales are worse than expected, maybe we'll have a nice bounce for equities and cross/yen."

The safe-haven Swiss franc held near a record high against the euro amid European debt crisis.

Talks about a second bailout for Greece are getting closer to conclusion as euro zone finance ministers meet later on Tuesday to finalise the details of a bailout.

On Monday, Standard & Poor's slashed Greece's rating to CCC, making the highly indebted country its lowest-rated in the world.

"The clock is ticking on a solution for the Greek debt crisis," BNP Paribas analysts say.

GBP/USD back to the $1.6400 after challenging bids on $1.6380. Further bids seen down to $1.6370 with stops below. A break here to open a deeper move toward $1.6350.

AUD/USD holds around $1.0647. Strong bids remain at $1.0620/30 levels. Resistance mentioned at $1.0700/05.

EUR/USD retreats with speculative longs seen paring back ahead of the NY open. Rate extends pullback off earlier highs at $1.4472 toward current levels around $1.4442. Support comes at $1.4415/10.

USD/JPY Y80.20, Y80.50, Y80.75, Y80.90, Y81.00

EUR/JPY Y118.00

GBP/USD $1.6500

USD/CHF Chf0.8285

EUR/CHF Chf1.2000

AUD/USD $1.0570, $1.0645, $1.0685

Data:

The euro slid to a record low versus the Swiss franc as concern increased that European leaders may not be able to find common ground on a Greek bailout.

European Central Bank President Jean-Claude Trichet and German Finance Minister Wolfgang Schaeuble are at odds about whether Greek bondholders should be compelled to incur losses in the nation’s second bailout in 14 months.

The dollar dropped against most of its counterparts before a report this week forecast to show U.S. retail sales declined in May. Retail sales in the U.S. fell 0.5% in May, the first drop since June. The Commerce Department will release the report June 14.

Luxembourg’s Prime Minister Jean-Claude Juncker, who leads the group of euro-area finance ministers, said that any bailout for Greece must include “voluntary” investor participation. Juncker is trying to bridge the gap between Germany’s Schaeuble, who wants Greek bondholders to accept longer maturities of up to seven years on the debt, and Trichet, who said imposing losses on creditors would be akin to a default.

New Zealand’s dollar fell after its second-biggest city was struck by aftershocks of the February earthquake.

The yen weakened versus most of its major peers after a report showed Japan’s factory orders declined 3.3% in April from March, when they rose 1%, the Cabinet Office said today.

It is a busy week for UK data, starting at 0830GMT today with inflation data for May. CPI looks set to continue at levels well over double the BOE's 2% target through into early 2012. Expected hikes in house hold energy tariffs will boost CPI up to annual rates close to 5% from the late summer.

Resistance 3: Y81.80 (May 31 high)

Resistance 3: Chf0.8540 (38.2 % FIBO Chf0.8890-Chf0.8330)

Resistance 3: $ 1.6550 (May 31 high)

Resistance 3: $ 1.4510 (50.0 % FIBO $1.4990-$ 1.4320)

02:00 China Producer Price Index (YoY) (May) 6.8% 6.5% 6.8%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.