- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 14-04-2022

- GBP/USD bears are lurking at key resistance levels.

- A downside correction can be expected for the days ahead.

GBP/USD's correction is starting to decelerate into the resistance that is marked by the 38.2% Fibonacci retracement level neat 1.3080. However, there is a confluence of the old structure next toward a 50% mean reversion of the European Central Bank sell-off and hourly bearish impulse. Either of these areas can ve considered resistance and a downside continuation can be expected for a lower low and fresh cycle lows in the longer-term time frames:

GBP/USD H1 chart

- EUR/USD has displayed a modest rebound to near 1.0820 after the carnage.

- The ECB kept its interest rate unchanged and provided dovish guidance.

- The US Treasury yields rebounded on advancing bets over a tight Fed policy.

The EUR/USD pair has witnessed a short-lived pullback after printing a fresh yearly low at 1.0757 on Thursday. An intense sell-off in the shared currency came after the European Central Bank (ECB) announced an unchanged interest rate policy, well in line with the market expectations.

Technically, the maintenance of a status quo by the ECB President Christine Lagarde was already in the expectation category, therefore dovish guidance sounded in the commentary forced the market participants to dump the euro. ECB’s Lagarde unfolded the guidance on the interest rates stating that an interest rate hike will arrive only after the end of the ‘Asset Purchase Program’ (APP), which will conclude in the third quarter.

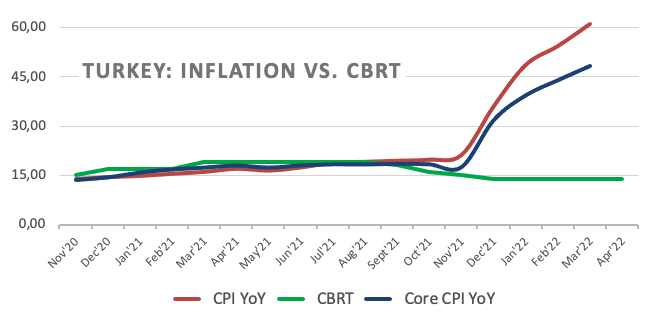

The dovish stance on further policy announcements is backed by a troublesome situation in Europe due to a higher inflation rate, which is 7.5%, and a slow growth rate amid the Ukraine crisis. The situation is going to get worsened for the ECB as the oil prices are set for the next upside move and energy bills will haunt the households in Europe.

Meanwhile, the US dollar index (DXY) has regained strength amid a firmer rebound in the US Treasury yields. The DXY is balancing above 100.00 and is likely to extend gains considering the long weekend uncertainty in the world markets. The 10-year US Treasury yields have recovered two-trading sessions losing streak and have reclaimed a three-year high at 2.83%. The US Treasury yields shoot higher on aggressive tightening plans of the Federal Reserve (Fed) as Fed President and FOMC member John Williams on Thursday cited that the Fed should reasonably consider a 50 basis point (bps) interest rate hike in May’s monetary policy.

- The DXY sees resumption in the rally after a minor pullback to 100.30 in late New York.

- Tightening bets from worldwide central banks have brought a rebound in the US Treasury yields.

- An unexpected improvement in the US Consumer Confidence pushed the mighty greenback higher.

The US dollar index (DXY) has witnessed a minor correction towards 100.34 in the late New York session from its yearly high at 100.76. Earlier, the DXY displayed a strong rebound from Thursday’s low at 99.60. It seems that the DXY traced the rebound in the 10-year US Treasury yields, which recovered its two-day losing streak and reclaimed a three-year high at 2.83%.

Tightening bets push yields higher

The campaigning of reducing liquidity in the economy to combat the risks of soaring inflation has pushed the US Treasury yields higher. Every other central bank is tightening its policy to corner the inflation mess. A 50 basis point (bps) elevation in the interest rates by the Reserve Bank of New Zealand (RBA) and Bank of Canada (BOC) has cleared the intention of war against inflation. Although the European Central Bank (ECB) has kept its interest rates unchanged, the indication of ending the ‘Asset Purchase Program’ has reflected its mindset of squeezing liquidity from the economy.

Higher-than-expected US Consumer Confidence strengthens DXY

A higher reporting of the Consumer Sentiment Index (CSI) by the University of Michigan has infused fresh blood into the DXY. The Michigan CSI has landed at 65.7 and has outperformed the market consensus of 59 and prior print of 59.4. Higher confidence of consumers in the US economic activities despite galloping inflation, uncertainty over the Ukraine crisis, and supply chain disruption has shocked the Fx domain and henceforth has strengthened the mighty greenback.

Key events next week: Building Permits, Housing Starts, Initial Jobless Claims, and S&P Global PMI.

Eminent issues on the back boiler: Russia-Ukraine Peace Talks, International Monetary Fund (IMF) meeting, and Bank of England (BOE) Governor Andrew Bailey speech.

- The CAD/JPY tested the YTD highs above the 100.00 mark.

- The cross-currency repair is in a choppy trading session, as the Asian Pacific session begins, up some 0.04%.

- CAD/JPY Price Forecast: Remains tilted to the upside, though RSI is within overbought conditions, are subject to a mean reversion move.

The CAD/JPY is barely down as the Asian session begins, but short of weekly highs reached on Thursday above the 100.00 mark, lastly tested on March 28. At the time of writing, the CAD/JPY is trading at 99.92.

On Thursday, the CAD/JPY seesawed in the 99.60-100.10 range throughout the day, while the Relative Strength Index (RSI) at 74.67 remained within the overbought area. It usually would mean that the CAD/JPY might be subject to a mean reversion move, but as its slope is almost horizontal, the pair is consolidating around current price levels.

CAD/JPY Price Forecast: Technical outlook

The CAD/JPY daily chart shows that risk remains skewed to the upside, the same as the other JPY crosses. The pair keeps trading within the 98.00-100 range for the last ten days, unable to break above/below its boundaries.

Meanwhile, the CAD/JPY 1-hour chart is also upward biased and remains trading above the 50-hour simple moving average (SMA) for the last three days, meaning that each time prices went down, the 50-SMA acted as a dynamic support. That said, the CAD/JPY first resistance would be the confluence of the April 14 cycle high and the R1 daily pivot around 100.10. A breach of the latter would expose the R2 pivot at 100.36 and then the R3 pivot at 100.62.

On the flip side, the CAD/JPY first support would be the 50-hour SMA at 99.72. Once cleared, it would open the door to significant demand zones, like the S1 daily pivot at 99.57, followed by the 100-hour SMA at 99.48.

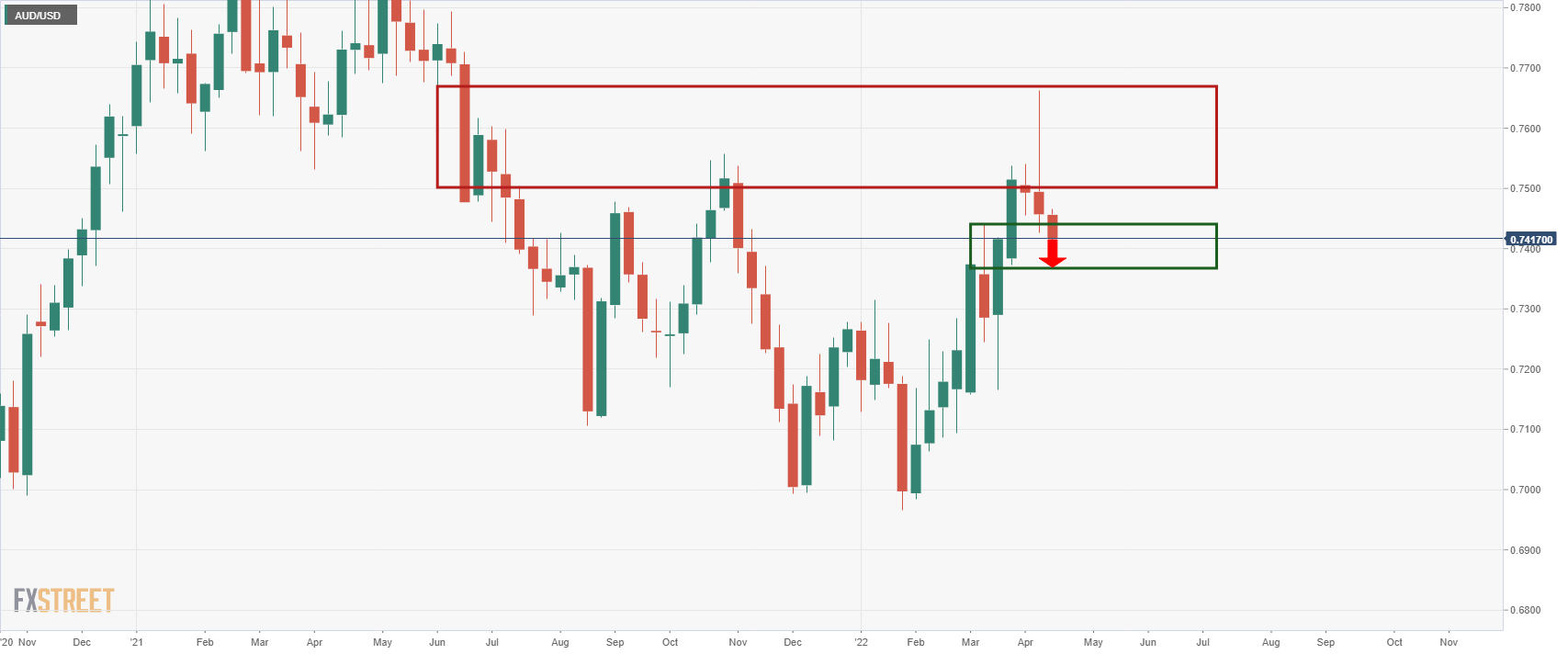

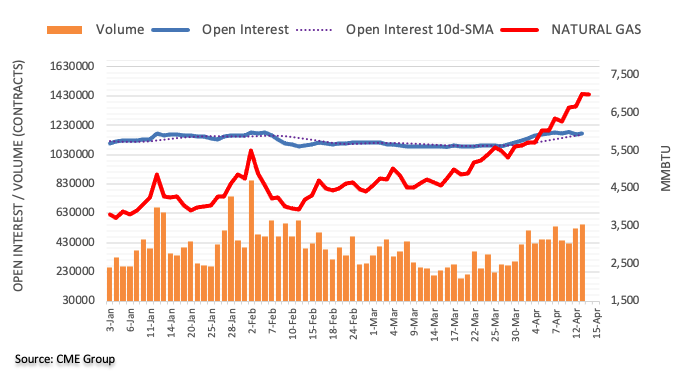

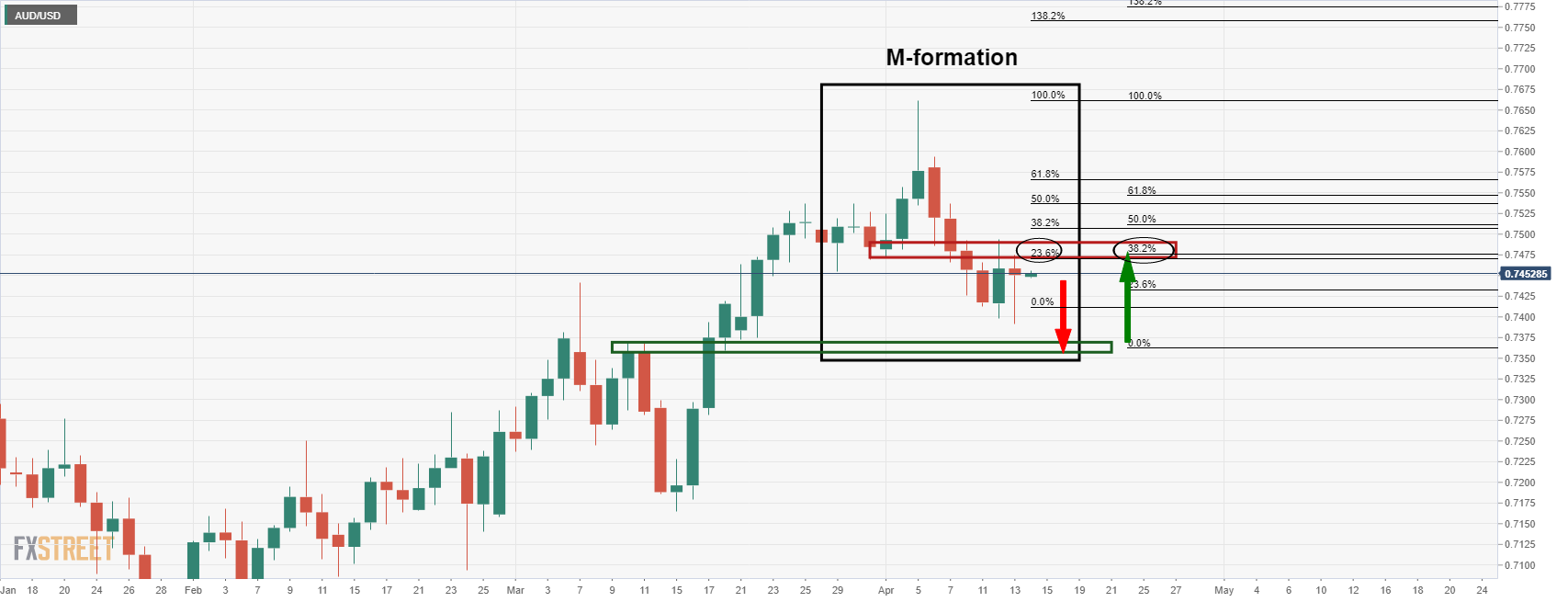

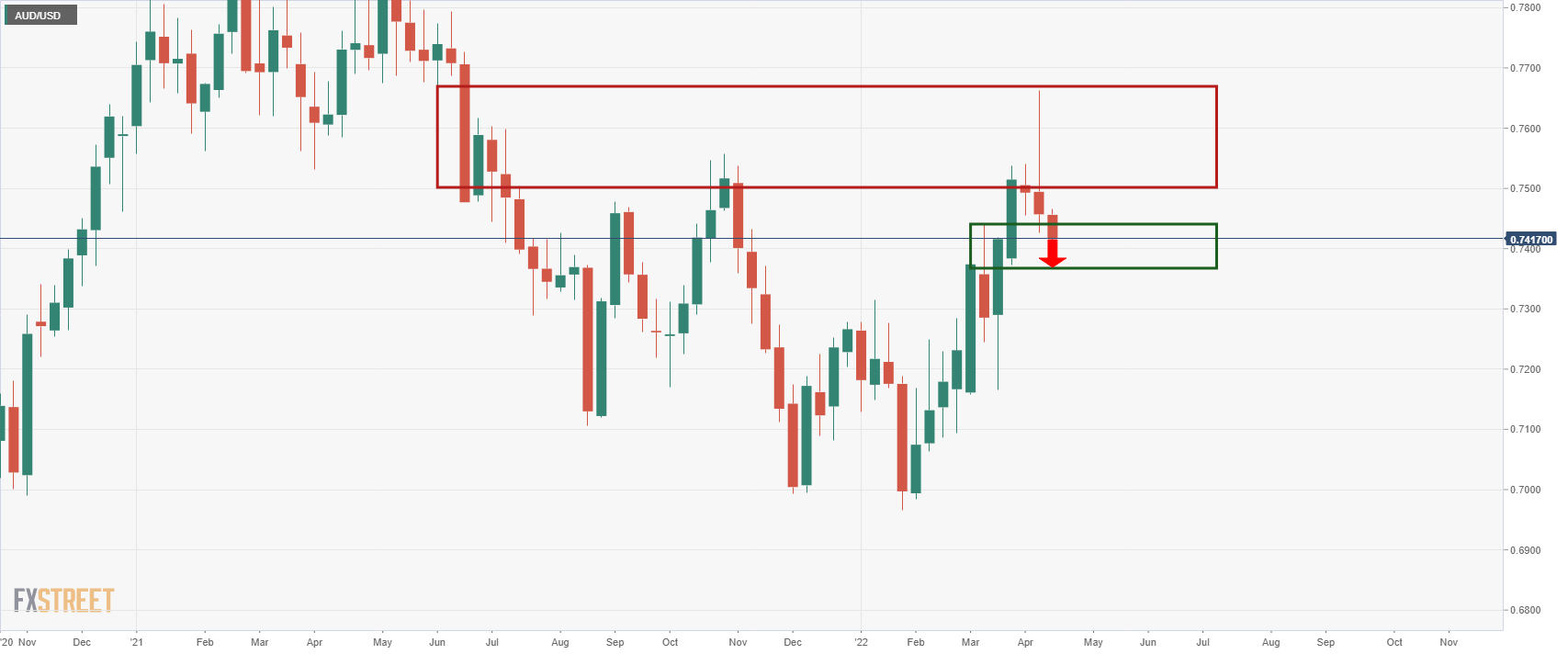

- AUD/USD bears are hungry for more and target the downside support area.

- The 38.2% Fibo has served as a resistance.

As per the prior analysis, AUD/USD Price Analysis: More to come from the bears? the price has continued to deteriorate, and the weekly support is targeted.

AUD/USD prior analysis

AUD/USD live market

As for the daily chart...

The price rallied into the 38.2% Fibonacci retracement area and has started to crumble again as the bears engage, hungry for a lower low and to target the liquidity in the prior resistance that meets with a dynamic trendline support area near the 0.7360s.

- A firmer breakout of the descending triangle pattern has underpinned the bulls.

- The RSI (14) has shifted into a bullish range that adds to the upside filters.

- A minor pullback towards $104.02 will present an optimal buying opportunity for the asset.

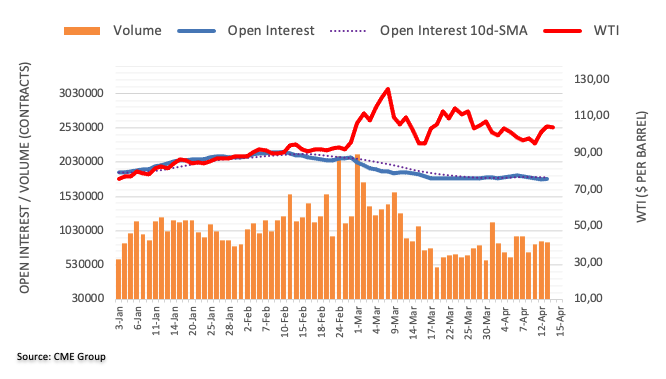

West Texas Intermediate (WTI), futures on NYMEX, have displayed a strong upside move after printing monthly lows of $92.79 on Monday. The black gold has defended its critical bottom of $92.37 printed on March 15. The asset has delivered a three-day winning streak and is likely to extend gains after overstepping Thursday’s high at $107.00.

On a four-hour scale, a breakout of a descending triangle has put the bulls in the driving seat. Usually, a descending triangle breakout is followed by wider ticks and high volumes. The horizontal support of the chart pattern is plotted from March lows at $92.37 while the descending trendline is placed from March high at $126.51, adjoining the March 24 high at $115.87.

A bull cross, represented by 20- and 200-period Exponential Moving Averages (EMAs), is advocating the control of bulls on the asset.

Meanwhile, the Relative Strength Index (RSI) (14) has shifted into a bullish range of 60.00-80.00 from 40.00-60.00, which are hinting at a fresh impulsive wave ahead.

A minor pullback towards Wednesday’s high at $104.02 will be an optimal opportunity for the buyers, which will send the asset towards the March 28 high at $109.78, followed by March 24 high to near $116.00.

On the flip side, bears may dictate the prices if the asset drop below the 20-EMA at $100.80. This will drag the asset towards the round level support and horizontal support at $95.00 and $92.37 respectively.

WTI four-hour chart

-637855704406003885.png)

- The USD/JPY extended its weekly gains, up some 1.29%.

- Russo-Ukraine tussles, Fed speaking, and expectations of an aggressive Federal Reserve rate hike boosted the greenback.

- USD/JPY Price Forecast: The uptrend is overextended, and negative divergence between price action/RSI suggests the pair is subject to a mean reversion move.

The USD/JPY barely advances during the day, as the Asian session is about to begin and extends its rally to two consecutive days, amidst a downbeat market mood, a firm US dollar, and higher US Treasury yields, which underpinned the USD/JPY. At the time of writing, the USD/JPY is trading at 125.89.

US equities finished the week with losses as traders prepared for a long weekend, while the 10-year benchmark note rose 12.5 basis points up to 2.827%, underpinning the greenback. The US Dollar Index, a gauge of the buck’s value against a basket of currencies, rose by 0.46%, sitting at 100.307.

Geopolitical jitters, rising global inflation, Fed speaking, and expectations of the Federal Reserve 50 bps rate hike at the May meeting, boosted the greenback on Thursday.

The Russo-Ukraine conflict worsens as the days advance, and a cease-fire seems unlikely. Albeit talks continued online, Ukraine’s Foreign Minister stated that there had not been any progress. On the Russian side, reports emerged that Ukraine’s struck a Russian warship in the Black Sea with missiles, while Russia’s Defense Minister added that the Moskva -its flagship fleet- had sunk, meaning escalation remains.

Aside from geopolitics, Fed speaking continued during the day, led by the New York Fed President John C. Williams. He said that a 50 bps increase in May is a “reasonable” option, but the pace of hikes will depend on the economy. Williams reiterated what Fed’s Governor Brainard said that the Fed needs to move “expeditiously” to more normal policy levels ad above neutral.

Meanwhile, as shown by Short-Term Interest Rates (STIRs), money market futures illustrate that the chances of a 50 bps rate hike to Federal Funds Rates (FFR) at the next FOMC meeting lie at 94% probability.

On Friday, the Japanese and US economic docket remains empty in the observation of Good Friday.

USD/JPY Price Forecast: Technical outlook

USD/JPY price portrays an inverted hammer followed by a regular hammer in an uptrend in the daily chart, meaning the uptrend is overextended. The Relative Strength Index (RSI) at 80.91 reached a lower high while the USD/JPY reached a new YTD high at 126.31, meaning a negative divergence is forming.

The USD/JPY first resistance would be 126.00. Once cleared, the following supply zone would be the YTD high at 126.31, followed by April 2015 cycle highs at 126.85.

If the pair corrects downwards, the USD/JPY’s first support would be the March 25 daily high at 125.10. A breach of the latter would expose 124.00, and then the April 5 daily high at 123.67.

- The Dow fell 113.36 points, or 0.33%, to 34,451.23.

- The S&P 500 fell 54 points, or 1.21%, to 4,392.59.

- The Nasdaq Composite lost 292.51 points, or 2.14%, to 13,351.08.

Stocks on Wall Street closed lower on Thursday as traders went home to celebrate the long Easter weekend while bond yields resumed their northerly trajectory and investors contended with mixed earnings, the European Central Bank's dovishness and economic data.

All three major US stock benchmarks posted weekly losses ahead of the Good Friday holiday. Rising 10-year Treasury yields pressured growth stocks, sending the S&P 500 and the Nasdaq into deeper bearish levels on the charts. The Dow posted a more modest loss but it still fell 113.36 points, or 0.33%, to 34,451.23. The S&P 500 fell 54 points, or 1.21%, to 4,392.59 while the Nasdaq Composite lost 292.51 points, or 2.14%, to 13,351.08.

Looking forward, the first-quarter reporting season will be the focus that has started to get underway, albeit with only 34 of the companies in the S&P 500 having reported. ''Analysts now expect aggregate annual S&P 500 earnings growth of 6.3%, less optimistic than the 7.5% growth projected at the beginning of the year,'' Reuters reported.

Meanwhile, in currencies, the euro plunged to a two-year low against the greenback following comments from ECB President Christine Lagarde that have been taken as a signal to markets that there will be no hurry to raise interest rates. However, the ECB said it plans to cut bond purchases this quarter, and then end them at some point in the third quarter. The dollar index (DXY) climbed to a fresh cycle high of 100.761 with the euro falling to a low of 1.0757. The US benchmark 10-year yield has scored highs of 2.833%, currently 4.55% higher on the day following two days of declines.

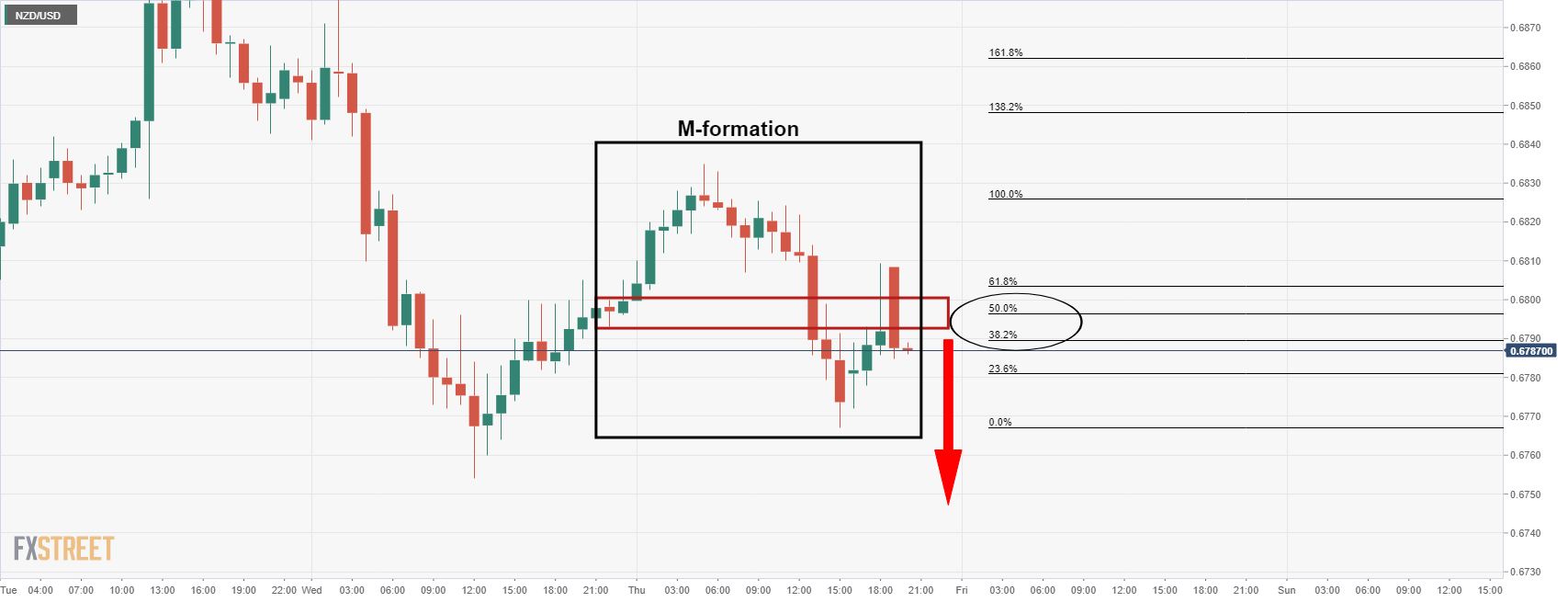

- NZD/USD bears are lurking at a level of resistance on the H1 time frame.

- Bulls struggle at a 38.2% Fibo as markets consolidate.

NZD/USD is testing a 38.2% Fibonacci retracement level and the bears could be lurking here with a view to take the price down for a fresh low. However, the M-formation is menacing as it is a reversion pattern whereby the price would be expected to move in on the neckline for a restest of old support turned resistance:

NZD/USD H1 chart

What you need to take care of on Friday, April 15:

The American dollar was once again firmly up, giving up some of its recent gains ahead of the close as speculative interest booked some profits ahead of the Good Friday holiday.

The EUR/USD pair plummeted to 1.0765, its lowest in two years, following the European Central Bank monetary policy decision. The ECB kept rates on hold as widely anticipated and repeated that it would end its bond-buying program in the third quarter of the year. Monthly net purchases will amount to €40 billion in April, €30 billion in May and €20 billion in June.

The statement was quite dovish, as it noted that Russia's aggression is affecting the economies in Europe and beyond. Higher energy and commodity prices are affecting demand and slowing production, which results in higher inflation. Also, trade disruptions are leading to new shortages of materials and inputs, another factor weighing on prices pressure. President Christine Lagarde said it was “premature” to discuss quantitative tightening, adding that rate hikes could begin “sometime after” the end of the APP program.

The GBP/USD pair settled around 1.3070, down for the day but off intraday lows. Commodity-linked currencies, on the other hand, finished the day near their daily lows against the greenback. AUD/USD trades in the 0.7410 price zone, while USD/CAD hovers around 1.2615. Finally, the USD/JPY pair settled around 125.90.

US Federal Reserve officials were on the wires. New York Federal Reserve President John Williams said that the central bank should reasonably consider hiking by 50 bps in May, while Cleveland Fed President Loretta Mester noted that the Fed aims to reduce policy accommodation at the pace necessary to control inflation whilst also sustaining economic activity.

Inflation-related concerns pushed US government bond yields towards their recent multi-year highs. The yield on the 10-year Treasury note peaked at 2.835%, now standing at 2.82%.

Wall Street kick-started the day with a positive tone but gave up ahead of the close. The three major indexes ended the day with losses.

Most financial markets will be closed until Monday amid the Good Friday Holiday.

Litecoin rebounds but stays below a downside resistance line

Like this article? Help us with some feedback by answering this survey:

- USD/CAD has reversed higher from the low 1.2500s to back above 1.2600 amid a broadly stronger US dollar.

- The buck perked up after a not as hawkish as expected ECB meeting, preventing higher oil prices from helping CAD.

USD/CAD reversed early session losses that saw it drop to fresh weekly lows below its 21-Day Moving Average around the 1.2520 mark and looks set to close out the day just to the north of the 1.2600 level. The FX market tone switched in wake of Thursday’s not as hawkish as anticipated ECB monetary policy announcement, with the US dollar picking up across the board, a trend also helped by a sharp rise in US yields on the day.

US economic data in the form of a mixed March Retail Sales report and a stronger than expected Michigan Consumer Sentiment survey didn’t seem to have much of an impact on the Fed tightening narrative, nor subsequently on FX market sentiment. Nor did remarks from influential FOMC member and NY Fed President John Williams, who threw his support behind the idea of 50 bps rate hikes at coming meetings.

Nonetheless, buck strength prevented the Canadian dollar from taking advantage of a further rise in global crude oil prices, and saw USD/CAD rally back to not that far below Wednesday’s pre-hawkish BoC meeting levels. To recap, the Canadian central bank lifted interest rates by 50 bps and initiated its QT programme (as of 25 April) as expected, but also signaled a risk of more 50 bps rate hikes ahead.

Though the US dollar remains strong across the board, as has been the case now for weeks, the backdrop of an even more hawkish BoC and resilience in global commodity prices suggests that the USD/CAD bears shouldn’t lose hope. With European and North American markets shut on Friday for Easter holidays, trading conditions volumes will be very low during the upcoming Asia Pacific session.

Cleveland Fed President and FOMC member Loretta Mester said on Thursday that the Fed aims to reduce policy accommodation at the pace necessary to control inflation whilst also sustaining economic activity, reported Reuters.

Mester added that the Fed aims to bring demand into better balance with supply, whilst also sustaining the health of the labour market. The US labour market is very tight, she added, commenting also that inflation is very elevated.

Market Reaction

FX markets did not react to the latest comments from Fed's Mester.

- EUR/USD bears are lurking near a 50% mean reversion.

- A fresh cycle low could be in the offing for the remainder of the week.

EUR/USD's correction is starting to decelerate into the resistance that is marked by old support and the 10-moving average on the hourly time frame that has bearishly crossed below the 50-MA.

The price has also corrected towards a 50% mean reversion of the European Central Bank sell-off and hourly bearish impulse. This is leaning towards a bearish bias for the rest of the week and opens the potential for a lower low and fresh cycle lows in the longer-term time frames:

EUR/USD H1 chart

EUR/USD weekly chart

From a weekly perspective, there is room for the price to extend lower before the week is out and in doing so, it will mitigate the imbalance of price between here and the April 2020 lows within the demand area. An M-formation, however, has been left as a bullish market structure. This is a high probability reversion pattern that would be expected to lure in the price towards the neckline in due course. The 50% mean reversion mark guards the 61.8% ratio and prospects of a bullish continuation thereafter.

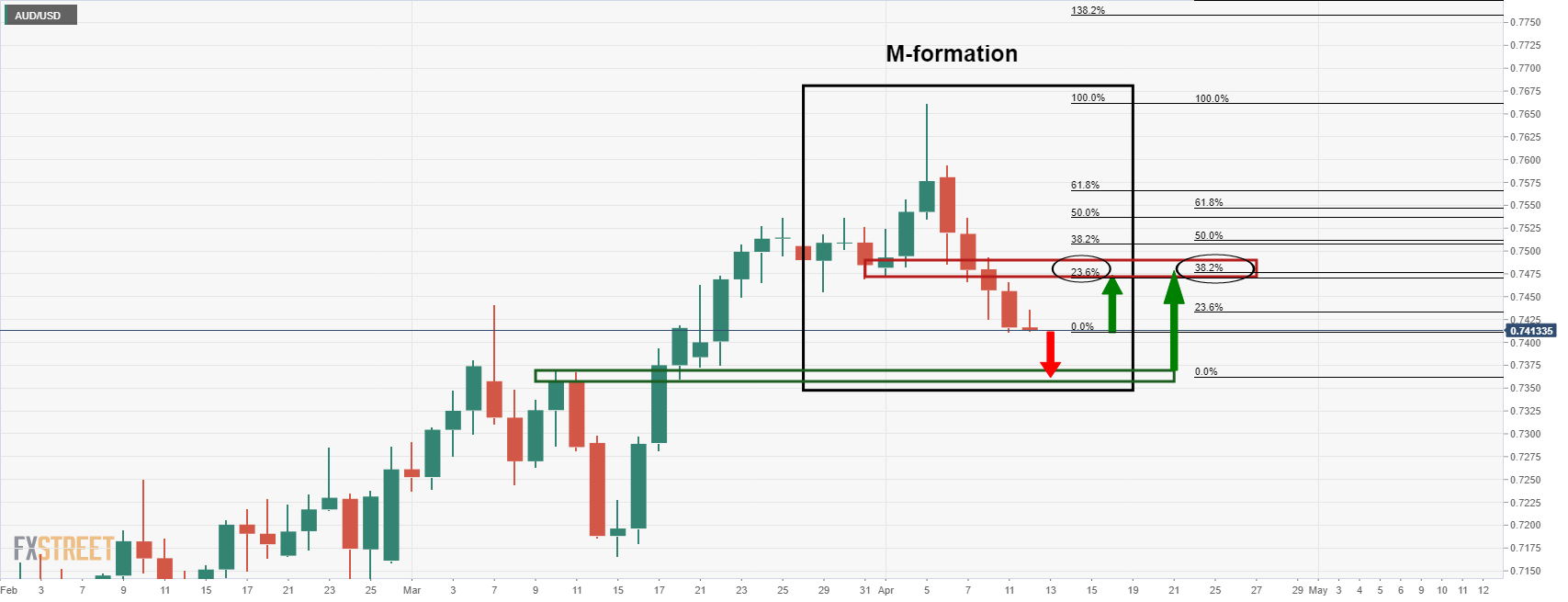

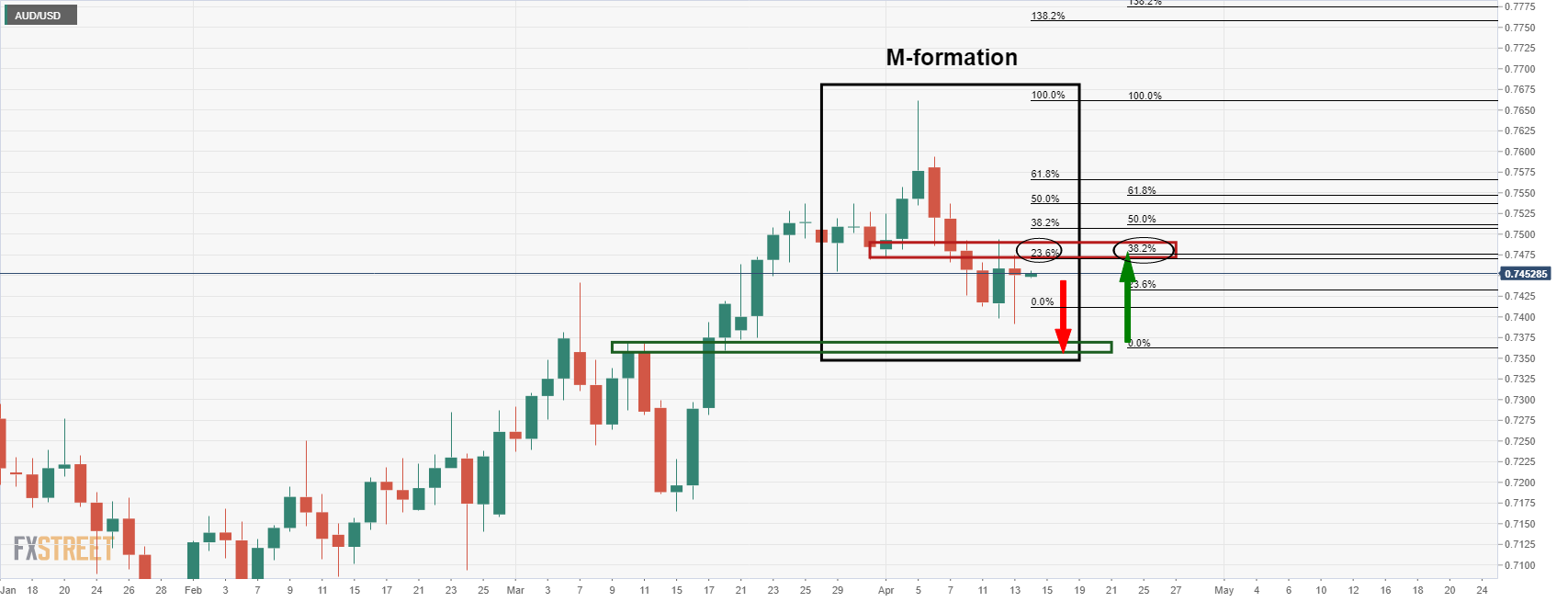

- The AUD/USD is set to finish the week with losses, down 0.58%.

- Risk aversion, broad US dollar strength, and a “decent” Australian jobs report weighed on the AUD.

- AUD/USD Price Forecast: Remains range-bound amid the lack of catalyst as RSI turns horizontal.

On Thursday, as traders prepare for a long weekend, the AUD/USD treads water, sliding 0.35% in the North American session, and is trading at 0.7417 at the time of writing.

A risk-off market mood and a buoyant US dollar maintained the Australian dollar on the defensive, alongside mixed US economic data. Russo-Ukraine jitters and China’s Covid-19 outbreak in Shanghai cloud the global economic outlook.

Mixed US macroeconomic data boosts the greenback

Before Wall Street opened, some US economic data crossed wires. Retail sales in March rose 0.5% m/m, lower than estimations, but it is worth noting that February was revised up to 0.8%. At the same time, Initial Jobless Claims for the last week ending on April 9 jumped to 185K from 171K expected, as data showed on Thursday.

Late in the day, the University of Michigan (UoM) Consumer Sentiment rose to 65.7, higher than the 59.4 foreseen, despite the high inflationary scenario in the US. Furthermore, consumer inflation expectations remained at 5.4% over the next year.

In the case of the Australian docket, employment figures were good but lower than expectations. The Australian economy added just 17.9K new jobs, lower than the 40K estimated, while the Unemployment rate ticked up to 4%, higher than the 3.9%.

Now that data is in the rearview mirror, it’s worth noting what the next week would bring for AUD/USD traders. The Australian docket will feature RBA Minutes and the Consumer Price Index. Across the pond, the US docket will reveal US Building Permits, Housing Starts, Existing Home Sales, and Flash PMIs.

AUD/USD Price Forecast: Technical outlook

Given that the AUD/USD is trading below the 0.7500 figure, it is downward pressured. So far in the week, the AUD/USD is down 0.58%, but the positive is that it remains above the April 13 cycle low at 0.7391. If that was not the case, the AUD/USD might be headed towards March’s 15 pivot low around 0.7165; however, it remains trapped in the 0.7400-0.7500 range.

Upwards, the AUD/USD’s first resistance would be the April 13 daily high at 0.7474. Once cleared, the next resistance would be 0.7500. A decisive break would send the AUD/USD towards the confluence of October 2021 and March 28 around the 0.7535-55 area.

On the flip side, the AUD/USD first support would be 0.7400. A breach of the latter would expose the April 13 cycle low at 0.7391, which, once broken, would expose the March 21 daily low at 0.7373, followed by an upslope trendline around the 0.7330-45 area.

- Major US equity indices were mixed on Thursday, with large-cap tech stocks underperforming as US yields soured.

- The S&P 500 was last down about 0.9% as investors digested the latest bank earnings ahead of the long weekend.

Major US equity indices were mixed on Thursday, with the S&P 500 last down about 0.6% and probing the 4,400 level, weighed primarily by downside in large-cap tech stocks as US yields soured. The heavily tech-weighted Nasdaq 100 was thus the underperformer of the major US indices, trading down about 1.9% and dropping back below the 14,000 level and eyeing a test of weekly lows just above 13,900.

Meanwhile, amid a strong performance in energy, consumer staple, material and industrial stocks (aided by strength in commodity prices and the market’s defensive mood), the Dow was last trading flat. US economic data in the form of a mixed March Retail Sales report and a stronger than expected Michigan Consumer Sentiment survey didn’t seem to have much of an impact on the Fed tightening narrative, nor subsequently on equity market sentiment.

Nor did remarks from influential FOMC member and NY Fed President John Williams, who threw his support behind the idea of 50 bps rate hikes at coming meetings. Meanwhile, All four of the major US banks that reported on Thursday, including Goldman Sachs, Citigroup, Morgan Stanley and Well Fargo, beat analyst earnings forecasts.

However, just as JP Morgan earnings had shown a day earlier, all showed a steep drop in the YoY rate of earnings growth in Q1 2022 compared to Q4 2021 and, at the time of writing, the S&P 500 Financials sector was down 0.6%, despite the steep rise in US bond yields on the day. Equity investors are braced for a barrage of further earnings releases in the coming week. US markets are closed on Friday for Easter festivities.

- The European Central Bank disappointed investors expecting a hawkish tilt, kept rates unchanged, and the APP to end after June.

- An upbeat market mood also weighs on the low-yielding euro, as shown by losses in the EUR/USD and the EUR/GBP.

- The divergence between the BoE and the ECB favors the GBP.

On Thursday, the shared currency weakened against the British pound after the European Central Bank (ECB) unveiled its monetary policy decision and guided market players regarding the end of its Asset Purchasing Program, also known as APP. At the time of writing, the EUR/GBP is trading under the 0.9300 mark at 0.8278.

US equities portray a downbeat market sentiment, despite the European ones finished with gains. Meanwhile, the EUR/USD edges down 0.69% during the day, while the GBP/USD follows the former, sliding 0.45%. Nevertheless, the current central bank divergence, meaning that the Bank of England (BoE) is already hiking rates while the ECB is about to end its QE program, favors the GBP in the near term.

The ECB keeps rates unchanged and will end the QE after June, weighing on the euro

In the European session, the European Central Bank (ECB) decided to keep rates unchanged, while forward-guided investors, regarding the last three bond purchases of the APP. The ECB said that the monthly net purchases under the APP would amount to €40 billion in April, €30 billion in May, and €20 billion in June.

Market players perceived the statement as dovish amid the lack of commitment toward future tightening. The EUR/USD broke towards new YTD lows at 1.0757, while the EUR/GBP dropped to fresh month lows at 0.8249.

In the meantime, ECB President Christine Lagarde’s press conference did not provide further clarification regarding raising rates, which further extended the shared currency losses in the day. Lagarde said that risks to the inflation outlook are tilted to the upside in the near term and added that the APP is very “likely” to end in Q3. The ECB’s President stated that inflation is being driven by energy prices and has intensified across many sectors. She foresees that growth would have remained weak in Q1 2022.

Also read:

- ECB’s Lagarde: Risks to the inflation outlook tilted to the upside in the near-term

- ECB’s Lagarde: APP very likely to end in Q3, though open minded about when in Q3 this occurs

An absent UK economic docket left EUR/GBP traders leaning on Wednesday’s high UK Inflation rate, which topped 7%, and would likely trigger another Bank of England rate hike.

Technical levels to watch

- GBP/USD bulls are correcting the ECB related sell-off.

- The divergence between ECB and Fed is driving forex flows.

- The focus will switch to the BoE next week.

At 1.3069, GBP/USD is attempting to correct the London sell-off that followed the European Central Bank announcements that sank the euro and enabled the embattled US dollar to bounce back. GBP was caught up in the flows and extended a fall from a high of 1.3146 to a low of 1.3032 on the day.

The euro plunged to a two-year low against the greenback following comments from ECB President Christine Lagarde that have been taken as a signal to markets that there will be no hurry to raise interest rates. However, the ECB said it plans to cut bond purchases this quarter, then end them at some point in the third quarter.

The dollar index (DXY) rose to a fresh cycle high of 100.761 with the euro falling to a low of 1.0757. The US benchmark 10-year yield has scored highs of 2.833%, currently 4.55% higher on the day following two days of declines.

The US Federal Reserve is expected to be raising interest rates by a half percentage point at its next meeting in May, and New York Fed President John Williams advocated this again on Thursday, in a further sign even more cautious policymakers at the central bank are on board with a bigger rate hike.

BoE moving back into focus

Meanwhile, sentiment around the Bank of England has taken a back seat of late, with no BoE speakers this week, but at the March meeting, the BoE changed its tone from being very hawkish to being more cautious. That said, we could see some more interest in the pound as we head closer to the May BoE meeting with speakers slated for next week. This in particular holds as with the next 25bps hike the BoE will reach the critical 1 % trigger to "consider" QT.

Governor Bailey speaks twice on the economy, with both providing a strong platform to discuss his dovish views on the BoE's policy stance. Thursday's discussion at PIIE is likely to be the most important, analysts at Td Securities said. ''He'll address inflation on an IMF panel on Friday as well. External MPC member Mann speaks on decision-making under uncertainty earlier Thursday as well.''

There will also be key data with the UK PMIs. The analysts at TDS said that they look for a decline in the UK PMIs in April, and for the manufacturing index to fall to a 21-month low while the services index likely reversed last month's upward revision. ''Price pressures and lower sentiment will likely weigh on the two sectors, but the return to offices and further pickup in services consumption should offer some support to the services index.''

- GBP/JPY hit fresh more than six-year highs on Thursday, eclipsing Wednesday’s 164.84 peak by about one pip.

- But the pair was unable to sustain a breakout towards 165.00 despite higher global yields, instead pulling back amid profit-taking.

GBP/JPY hit fresh more than six-year highs on Thursday, eclipsing Wednesday’s 164.84 peak by about one pip. However, despite a sharp rise in US, UK and global developed market bond yields (apart from in Japan), the pair was not able to muster a convincing bullish break towards 165.00. Rather, the pair on Thursday slipped back to test the 164.00 level once again and at current levels in the 164.40s, trades with losses of about 0.2% on the day.

The lack of bullish momentum could have something to do with the risk-off tone to US equity market trade – typically, GBP/JPY is correlated to other risk assets like US stocks. It could have something to do with the fact that, since the start of the month, GBP/JPY has already put in a solid nearly 3.0% rally from the sub-160.00 levels, and was thus due some profit-taking/consolidation.

It could have something to do with currency trading volumes dropping off somewhat on Thursday ahead of a long week in North American and European markets, which are closed on Friday for Easter festivities. Whatever the reason, Thursday’s consolidation is unlikely to be the start of a broader reversal back towards recent lows in the 160.00 area.

Most developed market central banks, including the BoE, remain in inflation-fighting mode, which means the trajectory for short-term interest rates and government bond yields likely remains to the upside. Japan, with its still very low inflation, remains the exception, keeping the yen vulnerable to widening yield differentials and BoJ/rest of G10 central bank policy divergence.

For sure, this week’s robust UK labour market data and spicy UK Consumer Price Inflation reports keep the BoE very much on track for more rate hikes in the near term. When proper trading flows come back next week, GBP/JPY is likely to have a go at pushing above 165.00.

- The USD/CHF reaches a fresh monthly high at 0.9433.

- The greenback got boosted by an upbeat market mood, high US Treasury yields

- USD/CHF Price Forecast: The rise above 0.9400 opens the door for further upside.

USD/CHF is rallying during the North American session, courtesy of a mixed market sentiment portrayed by US equities fluctuating, US Treasury yields paring Wednesday’s losses, and the greenback strengthened across the board. The USD/CHF is trading at 0.9415, a 90-pip gain on Thursday at the time of writing.

In the meantime, US Treasury yields surged, as shown by the 10-year benchmark note up 17 bps, sitting at 2.804%, underpinning the buck. The US Dollar Index, a measurement of the greenback’s value vs. a basket of six peers, edges up 0.51%, currently at 100.356.

Aside from this, during the Asian session, the USD/CHF was subdued in the 0.9330-50 region, unable to trade beyond those boundaries. Nevertheless, early as the North American session began, the USD/CHF firstly jumped towards March 28 0.9380 cycle high and then breached the 0.9400 mark for the first time since March 17.

USD/CHF Price Forecast: Technical outlook

The USD/CHF rise above 0.9400 would open the door for further gains, though to firmly cement the previously-mentioned, the USD/CHF needs a daily close above the 0.9400 mark.

That said, the USD/CHF first resistance would be March’s 15 and 16 cycle highs, each at 0.9431 and 0.9460. A decisive break of that area would expose 0.9500, followed by the 200-week simple moving average (W-SMA) at 0.9522.

On the flip side, the USD/CHF first support would be 0.9400. Once cleared, the pair’s next demand zone would be March 28, cycle high at 0.9381, followed by the 0.9350 mark.

Key levels to watch

Data released on Thursday, showed retail sales increased 0.5% in March; February’s numbers were revised higher. The March retail data still suggest real goods spending is tracking to rise at around a 2.5% annualized pace in the first quarter, according to analysts at Wells Fargo.

Key Quotes:

“Predictably gas stations saw the largest percentage increase from February, posting an 8.9% increase on the month. The fact that gas prices rose a lot more than that suggests consumers are combining trips or taking advantage of work-from-home flexibility if they are able to. Supply chain constraints still weigh on sales activity for auto dealers, where sales fell 1.9% in March. E-commerce posted the largest monthly decline with a 6.4% drop.”

“Adjusting these nominal sales estimates for the recent run up in prices has become all the more important as consumers battle the highest inflation in 40 years. Once adjusting for higher prices, we estimate real retail sales declined 1.6% in March.”

“Inflation is not going away, but it will likely stop getting worse and that means less of a headwind for spending. The March retail data still suggest real goods spending is tracking to rise at around a 2.5% annualized pace in the first quarter.”

Preliminary data showed an unexpected increase in the University of Michigan's consumer confidence index. Analysts at WEll Fargo point out that a reprieve in gas prices was "immediately recognized" by consumers in the report. They noted inflation remains the top threat to consumer spending.

Key Quotes:

“Despite high inflation, ongoing supply chain disruption and uncertainty associated with war, consumer sentiment unexpectedly improved in April. The preliminary reading from the University of Michigan's survey consumer sentiment came in at 65.7, up more than five points from March. The expectations component rose by almost 10 points to 64.1 from 54.3 in the prior month. Still, one robin does not make it spring, and while the improvement in sentiment is welcome, the actual level is still lower than what it has been for much of the past decade. Current economic conditions barely budged at 68.1. That is up slightly from 67.2 in March but below where it was in the first two months of the year.”

“The slight relief in energy prices may have deterred consumers' inflation expectations for the next year from climbing higher, as the median expectation remained at 5.4%. Households across the board cannot escape paying for necessities such as food and shelter.”

“Earlier in this cycle, supply chain disruption was the biggest challenge for the sales of autos and appliances. That scarcity amid robust demand has contributed to the inflation problems that make these items even harder to afford. As policymakers at the Federal Reserve endeavor to get prices in check by raising interest rates, the cost of financing for autos and appliances will rise as well. That may mean that buying conditions will remain low for some time until inflation eventually settles down.”

The European Central Bank (ECB) kept its monetary policy unchanged after the Board meeting, as expected. According to analysts from Rabobank, in contrast to some of its peers, which are no longer taking their chances with inflation, the ECB showed that it still intends to run its own show, in its own pace and on its own terms. The overall ‘well-considered and balanced’ tone of the press conference does further expose it to marketbased risks, notably a weaker currency and/or higher inflation expectations, they explained.

Key Quotes:

“The Council’s assessment of the impact of the war has clearly -and logically- evolved since the March meeting. Although it wasn’t said in so many words, the assessment that President Lagarde presented today suggests that the ECB has at least mentally updated its main scenario from the March baseline to an outlook that is more in line with what it then still called the ‘adverse’ scenario.”

“It looks like the Council will continue with its ‘normalisation’, but today suggests that this will not happen at the pace that the market expected to see. The ECB is still trying to take a considered approach, and trying to find the right balance between growth and inflation risks.”

“Despite the markets’ disappointment, we do believe that today’s meeting was designed to further instil the notion that the end of net asset purchases will be announced in June. In fact, it sounded like the decision to end purchases was all but made, and that mainly the exact end date was still up for discussion.”

“We therefore bring forward our expectations for rate hikes to September and December, albeit somewhat reluctantly if we look at today’s indecisiveness. That said, whether the ECB starts its lift off in September or December, we still believe that too much tightening has been priced into money markets between now and end2023.”

- NZD/USD has slipped back under 0.6800 and is eyeing Wednesday’s post-RBNZ lows near 0.6750 amid broad US dollar strength.

- Concerns about peak RBNZ hawkishness despite the bank’s 50 bps hike on Wednesday are weighing on the kiwi.

- Short-term bears are eyeing a test of the March lows near 0.6725.

NZD/USD has slipped back below the 0.6800 level since the start of US trade and is eyeing a test of Wednesday’s post-RBNZ lows just above 0.6750. The US dollar is on the front foot across the board after the latest batch of US data (Retail Sales and Michigan Consumer Sentiment results) failed to dent the narrative of US economic strength and commentary from influential FOMC member and NY Fed President John Williams threw his support behind 50 bps rate hikes at coming Fed meetings.

The pair’s most recent US dollar-driven downturn has seen it not only relinquish its grip on the 0.6800 level but also slip back under its 50-Day Moving Average just above it. Even though the RBNZ hiked interest rates by 50 bps on Wednesday to solidify its position as the most hawkish central bank in the G10, the kiwi failed to derive lasting impetus.

Traders pointed to a pullback in RBNZ tightening bets further out, which they said indicated growing concern about how central bank tightening would impact the New Zealand housing market and economy. Analysts at Capital Economics said “the market reaction suggests that investors are already starting to think about the end of the tightening cycle.”

"We think higher rates will bring down house prices and lead to an economic slowdown, so we would not be surprised if expected interest rates struggle to rise much further,” they added. If expectations regarding RBNZ tightening have now peaked, but continue to rise in the US, that could be a bearish recipe for NZD/USD. In the near term, traders will be looking fr a test of March lows in the 0.6725 area.

- US dollar rises across the board in American hours.

- USD/JPY heads for highest daily close in years.

The USD/JPY broke to the upside during the American session amid higher US yields. After moving during hours around 125.35, the pair gained momentum and printed a fresh daily high at 126.00. As of writing, it is hovering around 125.85/90, and could post the highest daily close since 2002.

Higher US yields contribute to the stronger greenback across the board. The US 10-year yield climbed to 2.79% and the 30-year jumped from 2.81% to 2.89%, the highest level since 2019. At the same time, the DXY also hit multi-year highs above 100.50.

Economic data from the US came in mixed. Retail sales rose 0.5% in March after a positive revision to February’s figures. Initial Jobless Claims rose to five-week highs at 185K. The preliminary reading of the consumer sentiment index from the University of Michigan improved against expectations to 65.7 in April.

Rally goes on

The outlook for USD/JPY remains positive supported by the divergence between the Fed and the Bank of Japan. Since early March, it gained 1000 pips and it is starting to consolidate above a long-term resistance area seen around 125.00.

The main risk for the bullish outlook is market sentiment. A deterioration could lead to sharp losses in equity markets boosting Treasuries, that should weaken USD/JPY.

Technical levels

European Central Bank policymakers see a July rate hike as still possible after Thursday's meeting, sources told Reuters on Thursday. ECB policymakers backed Thursday's decision unanimously the sources, added, noting that they did differ on risks.

Market Reaction

The latest Reuters report of commentary from ECB sources bigging up the prospect of a July hike is helping the euro recover from lows. EUR/USD is now trading back to the north of the 1.0800 level as a result and may now eye a push back into the upper 1.0800s.

Some traders might interpret the timing and tone of the latest "sources" as representative of the fact that ECB members were not happy with the market's reaction to the latest meeting and are seeking to cushion euro downside. Euro downside is a problem for the ECB, after all, as it makes the import of commodities like energy more expensive, worsening the Eurozone's inflation problem.

- WTI has fallen slightly into the $103.00s in quite pre-long weekend trade.

- For now, WTI above $100 seems to make sense amid expectations of tight global market conditions amid Russia supply outages.

Trading conditions have been fairly thin in global oil markets on Thursday amid a slowdown in relevant newsflow and as traders wind down ahead of a long weekend in major North American and European markets. Front-month WTI futures have dipped a tad to trade in the $103.00s, a little below Wednesday’s peaks for the week in the $104.00s.

For now, the 21-Day Moving Average at $104.15 is acting as a ceiling to the price action and this is likely to remain the case for the remainder of the week. For now, traders seem to view crude oil slightly above the $100 level as broadly making sense. Market conditions are expected to remain tight over the coming months as global oil markets adjust to significant disruption to Russian exports as a result of sanctions over the country’s invasion of Ukraine.

The International Energy Agency (IEA) earlier in the week forecast a loss of 3M barrels of Russian crude oil per day from May (roughly 3% of global supply) as a result of sanctions and buyers voluntarily shunning Russian crude oil grades. This is the major reason why dips back into the $90s per barrel in WTI continue to be bought.

However, the outlook for a return to last month’s peaks in the $120s has been dampened by recent announcements by IEA members nations of a historic crude oil reserve release amounting to 240M barrels over the next six months. Other factors to consider are the potential for a return to the market of more than 1M barrels per day (BPD) in Iranian supply if the US and Iran can hash out a new nuclear pact to ease sanctions.

For now, though, talks remain deadlocked, with traders also monitoring the prospect for increased output from the US, Venezuela and OPEC+ nations, who for now are sticking to their policy of 400K BPD/month output quota hikes. Other factors on oil traders radars include the demand side as global growth slows and the threat of wider lockdowns in China remains ever-present.

The European Central Bank (ECB) reinforced its message that net bond purchases are set to end in Q3, and the first rate hike will take place some time after that. Despite the ECB's foot dragging today, economists at TD Securities like EUR/CHF upside in the months ahead while EURUSD is set to maintain the 1.08-1.12 range, which should hold through early Q2.

ECB confirmed it remains on course to end net asset purchases in Q3

“The ECB left its messaging virtually unchanged from March, committing to end the APP sometime in Q3 and hike rates ‘some time after’. We now expect lift-off in September, with sequential quarterly hikes through to the end of next year.”

“EUR/USD is likely to maintain the 1.08 to 1.12 range, with lingering downside risks to the lower-end.”

“We see a lot of upside in EUR/CHF and EUR/GBP, though the latter might require a bit more time (we prefer buying near 0.83). As the ECB container ship turns, EURCHF upside looks quite attractive, especially as CHF is the most expensive currency on our dashboard.”

“We note that inflationary pressures are much higher in EUR relative to CHF, suggesting the need for currency strength to manage them. A diversification of global equity flows would also benefit EUR over CHF, reflecting longer-term valuations between the pair.”

The preliminary estimate of the University of Michigan's (UoM) Consumer Sentiment Index for April rose to 65.7 from 59.4 last month, above the expected reading of 59.0, data released on Thursday showed. The Consumer Expectations Index was also significantly stronger than expected at 64.1 versus forecasts for a reading of 54.2 and up from last month's 54.3 reading, while the Current Conditions Index came in at 68.1 a tad above the expected 68.0 and up from last month's 67.2 reading.

1-year inflation expectations were 5.4%, unchanged from last month, while 5-year inflation expectations were at 3.0%, also unchanged versus the previous month.

Market Reaction

The stronger than expected UoM survey data didn't have much of an impact on the US dollar, with the DXY recently rallying to fresh year-to-date highs above 100.50 amid post-dovish ECB euro weakness.

- AUD/USD turned lower for the second successive day amid resurgent USD demand.

- The technical setup favours bearish traders and supports prospects for further losses.

- Sustained weakness below the 0.7400 mark is needed to confirm the negative outlook.

The AUD/USD pair extended its steady intraday descent through the early North American session and dropped to a fresh daily low, around the 0.7415 region in the last hour.

The US dollar made a solid comeback on Thursday amid the post-ECB downfall in the shared currency and modest bounce in the US Treasury bond yields. This, in turn, was seen as a key factor that dragged the AUD/USD pair lower for the second successive day, though the risk-on impulse could help limit losses for the perceived riskier aussie.

From a technical perspective, the pair's inability to capitalize on the overnight goodish rebound from over a three-week low and the emergence of fresh selling favours bearish traders. That said, repeated failures to find acceptance below the 0.7400 round-figure mark warrant some caution before positioning for any further depreciating move.

The aforementioned handle also marks confluence support comprising the 200-period SMA on the 4-hour chart and the 50% Fibonacci retracement level of the 0.7165-0.7662 strong rally. A convincing break below will be seen as a fresh trigger for bearish traders and make the AUD/USD pair vulnerable to testing the 61.8% Fibo. level, around mid-0.7300s.

This is closely followed by an ascending trend-line extending from sub-0.7000 levels, or the YTD low touched in January. The said support is currently pegged around the 0.7330 region, which if broken decisively should pave the way for an extension of the recent sharp pullback from the YTD peak, around the 0.7660 region touched earlier this month.

Given that technical indicators on the daily chart have just started drifting into negative territory, the AUD/USD pair could then accelerate the downfall towards the 0.7300 mark. Some follow-through selling would make the pair vulnerable to extending the downward trajectory towards the 0.7240 region en-route the 0.7200 mark and the 0.7175-0.7170 support.

On the flip side, the daily swing high, near the 0.7465-0.7470 region, which coincides with the 38.2% Fibo. level should act as an immediate strong resistance ahead of the 0.7500 mark. Sustained strength beyond would suggest that the corrective pullback has run its course and shift the near-term bias back in favour of bullish traders.

AUD/USD 4-hour chart

-637855409966574112.png)

Key levels to watch

- DXY bounces off weekly lows near 99.60.

- US yields reverse course and now trade with modest gains.

- US Retail Sales expanded at a month 0.5% in March.

The greenback quickly left the area of weekly lows around 99.60 and climbed past the 100.50 level to record new highs when gauged by the US Dollar Index (DXY) on Thursday.

US Dollar Index returns above 100.00 on ECB

The index fades Wednesday’s moderate pullback after the ECB disappointed those who were expecting a convincing hawkish message, which eventually motivated the euro to give away earlier gains and extend the drop to fresh YTD lows below the 1.0800 mark.

In the US docket, headline Retail Sales expanded 0.5% MoM in March, a tad below estimates, while core sales surprised to the upside by expanding 1.1% from a month earlier. In addition, Initial Claims rose by 185K in the week to April 9. Later in the session, Business Inventories is due seconded by the flash Consumer Sentiment for the current month.

What to look for around USD

The dollar’s rally resumed the upside and advances to new cycle peaks past 100.50 in line with the resumption of the bullish bias in US yields on Thursday. So far, the greenback’s price action continues to be dictated by the likeliness of a tighter rate path by the Fed and geopolitics. In addition, the case for a stronger dollar also remains well propped up by high US yields and the solid performance of the US economy.

Key events in the US this week: Retail Sales, Initial Claims, Business Inventories, Flash Consumer Sentiment (Thursday) – Industrial Production, TIC Flows (Friday).

Eminent issues on the back boiler: Escalating geopolitical effervescence vs. Russia and China. Fed’s rate path this year. US-China trade conflict. Future of Biden’s Build Back Better plan.

US Dollar Index relevant levels

Now, the index is advancing 0.67% at 100.51 and the breakout of 100.55 (monthly high May 14 2020) would open the door to 100.86 (high April 24 2020) and finally 100.93 (monthly high April 11 2020). On the downside, the initial support comes at 97.68 (weekly low March 30) followed by 96.96 (100-day SMA) and then 95.67 (weekly low February 16).

EUR/USD slipped below a key area of support in the form of the March lows at 1.0806 in recent trade and has subsequently gone on to slide under the psychologically important 1.0800 level for the first time since May 2020. At current levels around 1.0790, the pair is trading with on the day losses of around 0.9%, having reversed more than 1.30 pips lower (or 1.2%) from earlier session highs in the 1.0920s.

The drop in EUR/USD is a result of euro weakness after the ECB failed to live up to hawkish expectations ahead of Thursday's policy announcement. Markets had clearly been expecting that, given the recent worsening of the inflation outlook in the Eurozone, the ECB might signal intentions to accelerate the pace of QE tapering and intentions to perhaps lift interest rates a few months sooner (i.e. in Q3 rather than Q4).

But in its statement on monetary policy, the bank did not signal any such policy change, a message that ECB President Christine Lagarde reinforced in the post-meeting press conference. Eurozone money markets subsequently readjusted and pared back on tightening bets.

As of one hour ago, the implied probability of a 25 bps hike from the ECB in July had fallen back to around 50% from closer to 75% prior to the meeting. Meanwhile, the total number of rate hikes seen but the year's end was pared back to 63 bps from 70 bps.

- GBP/USD has dipped back under 1.3100 as it weakens in tandem with the euro post-dovish ECB policy announcement.

- The pair remains at risk of falling to sub-1.3000 levels amid the risk of more BoE/Fed policy divergence.

Though the currency hasn’t been weighed as badly as its euro counterpart, the dovish lean to the ECB’s latest policy update has put a dampener on pound sterling, which has been weakening in sympathy with the single currency in recent trade. GBP/USD, which nearly changed hands as high as the 1.3150 mark earlier in the day, has now reversed lower to the 1.3080 area where it now trades lower by about 0.3% on the day.

Again, the 21-Day Moving Average (currently at 1.3117) appears to have acted as a ceiling for cable. The pair has tried on multiple occasions in recent weeks but has been unable to muster a meaningful break above the 21DMA since late February. Analysts continue to cite positive dollar fundamentals, including increasingly hawkish Fed policy rhetoric and the recent rise in US yields, as well as negative UK fundamentals, including the comparatively weaker economy and likely to be much more dovish BoE, as capping the pair’s upside.

This week’s US jobs, inflation and GDP data has only reinforced existing narratives about the UK economy; that the labour market is strong, but that consumers are being badly squeezed amid sky-high inflation, a big risk to growth going forward. Meanwhile, this week’s US inflation data has reinforced expectations for rapid monetary policy tightening from the Fed, which is keeping the dollar well supported. GBP/USD remains at risk of slumping under 1.3000.

- USD/CAD staged a goodish intraday bounce from over a one-week low set earlier this Thursday.

- Weaker oil prices undermined the loonie and extended support amid resurgent USD demand.

- Bulls seemed rather unaffected by the disappointing release of the US Retail Sales figures.

The USD/CAD pair recovered nearly 70 pips from over a one-week low and jumped to a fresh daily high, around the 1.2585-1.2590 region during the early North American session.

A combination of supporting factors assisted the USD/CAD pair to attract some buying near the 1.2520 area on Thursday and stall the post-BoC slide from the four-week high touched the previous day. Crude oil prices came under some renewed selling pressure and undermined the commodity-linked loonie. This, along with an intraday pickup in the US dollar demand, acted as a tailwind for spot prices.

The US Energy Information Administration reported on Wednesday that oil stocks in the US rose by more than 9 million barrels last week, which, in turn, weighed on the black liquid. That said, worries that falling output in sanctions-hit Russia - the world's second-biggest exporter - will tighten supply limited the downside amid less active markets due to the long weekend in Europe and America.

On the other hand, the USD made a solid comeback and reversed a major part of the overnight pullback from a near two-week high amid the post-ECB downfall in the shared currency. Apart from this, the prospects for a more aggressive policy tightening by the Fed and rebounding US Treasury bond yields underpinned the greenback, allowing bulls to shrug off mostly disappointing US macro releases.

Data released by the US Census Bureau showed that the US Retail Sales rose by 0.5% MoM in March as against expectations for a 0.6% increase and the 0.8% growth recorded in the previous month. Adding to this, the Weekly Initial Jobless Claims climbed from 167K to 185K during the week ended April 8 and missed consensus estimates pointing to a reading of 171K, though did little to influence the USD.

Separately, Canadian Manufacturing Sales posted stronger than anticipated growth of 4.2% MoM in February, though was largely offset by an unexpected decline in Wholesale Sales by 0.4%. Thursday's US economic docket also features the release of the Prelim Michigan Consumer Sentiment Index, which, along with the US bond yields, might influence the USD. Traders will further take cues from oil price dynamics to grab some short-term opportunities around the USD/CAD pair.

Technical levels to watch

International Monetary Fund (IMF) Managing Director Kristalina Georgieva said on Thursday that the IMF will be downgrading the outlook for global growth for both 2022 and 2023, reported Reuters. She cited inflation, tightening of financial conditions and frequent Covid-19 lockdowns in China as weighing on activity.

Additional Takeaways:

- Since the IMF's January global growth forecast for 2022 of 4.4%, the outlook has "deteriorated substantially", largely due to the war in Ukraine.

- Net importers of food and fuel face growth downgrades, including in Africa, the Middle East, Asia and in Europe.

- Exporters of oil, gas and metals are to see higher growth prospects, but still face higher uncertainty.

- The Ukraine war will contribute to downgrades of 143 economies, accounting for 86% of global GDP.

- Higher energy and food prices are adding to inflation and are now a "clear and present danger" for many countries.

- The IMF projects that inflation is to remain elevated for longer than previously estimated.

- Food insecurity is a "grave concern" and, without action, will increase hunger, poverty and social unrest in fragile countries.

- The war on top of pandemic risks is eroding much of world's recent progress in climbing back from the Covid-19 pandemic.

- Fragmentation of the world economy into geopolitical blocs threatens global prosperity and would incur painful adjustments, as well as hurt poor countries.

- Fragmentation of global governance is the most serious challenge to the post-World War Two economic order, and is impairing work on crises such as climate change.

Economists at Scotiabank expect Bank of England's (BoE) Andrew Bailey not to reinforce rate expectations at his next Thursday speech. Subsequently, the GBP/USD pair could slide below the 1.30 level.

Mar retail sales and S&P PMIs next Friday to possibly weigh on the GBP further

“The UK data and events calendar does not pick up until next Thursday when BoE Gov Bailey’s speech at the PIIE may provide hints on the BoE outlook. As things stand, odds are he will not reinforce rate expectations and the GBP remains at risk of falling back under 1.30.”

“Mar retail sales and S&P (formerly Markit) PMIs next Friday will round out the week and possibly weigh on the GBP further.”

- EUR/USD decisively breaks below the 1.0900 level.

- The ECB left the policy rate unchanged on Thursday.

- Lagarde said inflation pressure have now intensified.

EUR/USD made a U-turn and now sinks further into the negative territory around the 1.0850/40 band on Thursday.

EUR/USD accelerates losses below 1.0900

Sellers have now regained the upper hand and drag EUR/USD well south of the 1.0900 mark as Lagarde’s press conference is under way.

In fact, Chair Lagarde acknowledged that inflation pressures have now intensified across many sectors, while disruptions in trade keep morphing into new shortages. She insisted that the APP should conclude in Q3 and that the bank will keep the optionality and flexibility well in place.

On inflation, Lagarde signalled that energy prices are still expected to remain high for some time and are seen as the main drivers of the elevated inflation. She also noted that wage growth remained muted.

Lagarde now sees increased downside risks to growth and ruled out any liquidity issues in the financial sector.

Lagarde also reiterated that a rate hike will occur once the bank completes the asset purchases.

EUR/USD levels to watch

So far, spot is down 0.40% at 1.0845 and the break below 1.0808 (monthly low April 13) would target 1.0805 (2022 low March 7) en route to 1.0766 (monthly low May 7 2020). On the flip side, the next up barrier aligns at 1.0933 (weekly high April 11) seconded by 1.1000 (round level) and finally 1.1120 (55-day SMA).

NY Fed President and FOMC member John Williams said on Thursday that as the Fed tightens its monetary policy settings, the underlying trend in inflation will peak soon and come down later in the year, according to an interview with Bloomberg TV.

Additional Remarks:

- The Fed has a 2% inflation goal and does not want it to be above that.

- It will be challenging to bring inflation down while keeping the labor market strong.

- Our monetary policy tool of interest rates is suited to current imbalances in the economy.

- We need to get job openings down to a level consistent with maximum employment and to take away "the froth".

- We can achieve a soft landing.

- The Fed is in a good place with monetary policy.

- "On the balance sheet, I do expect we will get reductions underway in June if we take a decision in May.

- A lot of tightening in financial conditions has already happened in expectation of future moves on the balance sheet and rates.

- Further down the road in the balance sheet runoff is when we'll contemplate whether we need mortgage-backed security sales or not.

In her usual post-European Central Bank policy meeting press conference, ECB President Christine Lagarde said that the bank's Asset Purchase Programme (APP), which is being tapered down to EUR 20B in purchases per month in Q2, is very likely to end in Q3, reported Reuters. However, Lagarde said she is open-minded about specifically when it ends in Q3.

When pressed on the ECB's current guidance that interest rate hikes could begin "some time after" the end of the APP, Lagarde said it could be anything between a week and several months.

In an interview on Bloomberg Television, NY Fed President and FOMC member John Williams said that the Fed needs to move expeditiously towards more neutral policy levels, but data will guide the timeline for this normalisation.

Additional Remarks:

- "We are seeing some early signs consumers shifting spending patterns."

- Consumers are shifting more to services.

- "I expect that pattern to continue this year."

- With very high inflation, the Fed needs to focus on bringing inflation down.

- The labor market is basically back to almost where it was pre-pandemic.

- The Fed needs to reverse policy actions from March 2020.

- The pace of rate hikes depends on the path of the economy, but a 50 bps at the next meeting is a reasonable option.

- "My baseline assumption is neutral rate is still in the low 2-2.5% range".

- The Fed has to keep focus on real interest rates.

- "We need to get real interest rates back to more normal levels by next year."

- "We may need to go a bit above that depending on inflation."

- Those decisions will be made as the economy evolves.

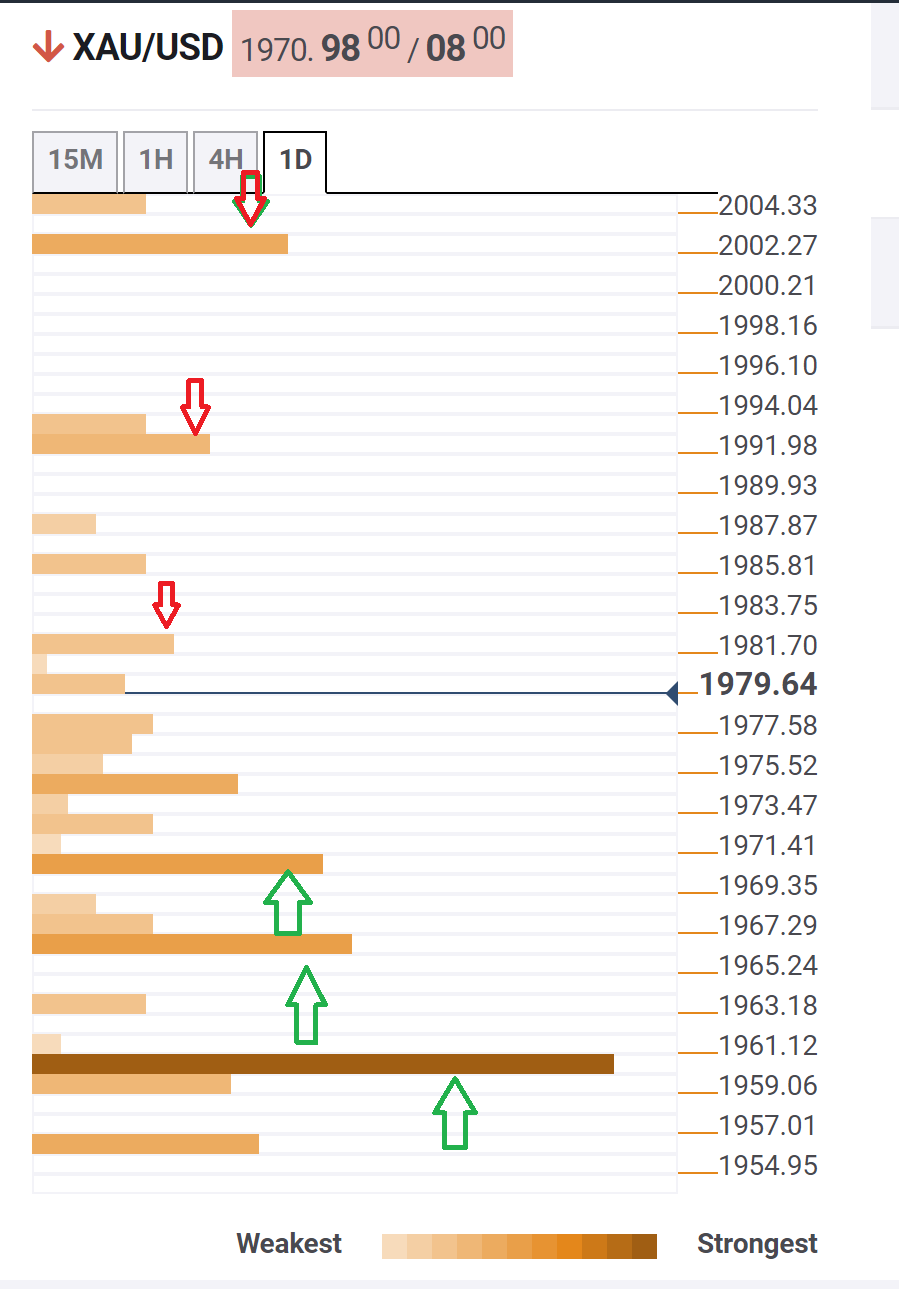

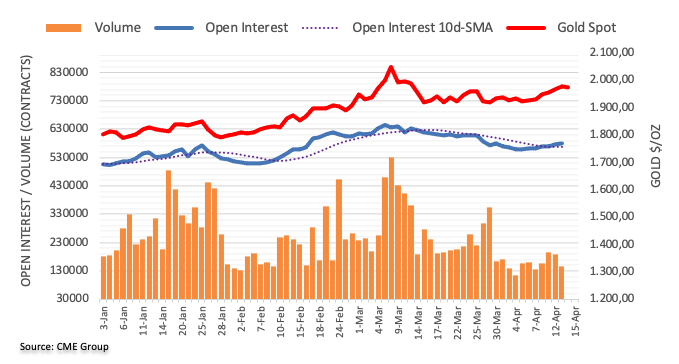

- Gold was seen consolidating its recent gains to the one-month peak.

- The Ukraine crisis, inflation fears continued lending some support.

- The Fed’s hawkish outlook, the risk-on mood capped the commodity.

Gold held steady near the one-month high set the previous day and continued drawing support from a combination of factors. Investors remain concerned about the potential economic fallout from the Ukraine crisis. This, along with broadening inflationary pressures, boosted the safe-haven metal's appeal as a hedge against rising prices. That said, expectations for a more aggressive policy tightening by the Fed and a generally positive tone around the equity markets kept a lid on any meaningful upside for the metal.

Gold: Key levels to watch

The Technical Confluences Detector shows that any subsequent move beyond the $1,981-$1,982 region (the overnight high) might confront resistance near the $1,992 area - Pivot Point one week R3. The next relevant hurdle is pegged just above the $2,000 psychological mark - the Fibonacci 38.2% one month. A convincing break through the said barriers would be seen as a fresh trigger for bullish traders and set the stage for a further near-term appreciating move.

On the flip side, the $1,974 zone - the Fibonacci 38.2% one day - seems to protect the immediate downside ahead of the $1,970 region - the Fibonacci 61.8% one day and Pivot Point one week R2. The next relevant support is pegged near the $1,960 area - the Fibonacci 61.8% one month. The latter should act as a pivotal point for intraday traders.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

In her usual post-ECB monetary policy meeting press conference, ECB President Christine Lagarde said on Thursday that risks to the Eurozone inflation outlook are tilted to the upside in the near term, reported Reuters.

Additional remarks in the opening part of the press conference:

- The Ukraine war has weighed heavily on confidence.

- Trade disruptions are leading to new shortages.

- Surging energy prices are reducing demand and production.

- The extent of these effects depends on the evolution of the conflict.

- The recovery of the economy has been boosted by fading of the Covid-19 pandemic.

- Inflation pressures have intensified across many sectors.

- Growth will have remained weak in Q1 2022.

- The ECB expects slow growth in the period ahead.

- New pandemic measures in Asia are contributing to supply chain issues.

- A reopening of sectors after the pandemic and the strong labour market will support incomes.

- Inflation is mainly being driven by energy.

- But inflation has become more widespread.

- The rise in core inflation is uncertain.

- The labour market is improving further.

- But wage growth remains muted overall.

- Initial signs of inflation expectations moving above target warrant monitoring.

- Risks to the economic outlook are tilted to the downside.

- Downside risks have increased substantially.

- EUR/USD fades the initial move north of 1.0900.

- Recent lows around 1.0800 emerge as the next contention area.

EUR/USD fades the pre-ECB uptick to the 1.0920 zone on Thursday.

In light of the ongoing price action, extra losses in the pair remain in the pipeline in the short-term horizon. Against that, a break below the so far monthly low at 1.0808 (April 14 should pave the way for a quick visit to the 2022 low at 1.0805 (March 7) before the May 2020 low at 1.0766 (May 7).

While below the 200-day SMA, today at 1.1440, the outlook for the pair is expected to remain negative.

EUR/USD daily chart

- Initial Claims were a tad higher than expected at 185K versus 171K forecasted.

- The DXY continues to strength as markets react post-ECB policy announcement.

There were 185,000 initial jobless claims in the US on the week ending on 9 April, the latest report from the US Depart of Labour showed on Thursday. That was a little above expectations for a rise to 171,000 from 167,000 one week prior. The four-week average number of initial jobless claims rose slightly to 172,250 from 170,2050 a week earlier.

Continued Jobless Claims fell in the week ending 2 April to 1.475M from 1.523M a week earlier, larger than the expected drop to 1.5M. The Insured Unemployment Rate was unchanged at 1.1% that week as a result.

Market Reaction

The DXY, already on the front foot amid a dovish reaction to the ECB policy announcement that led to the euro weakening against the US dollar, is extending gains to the upside and is eyeing a break back above 100 in wake of the latest US Retail Sales and jobless claims figures.

US Retail Sales rose at a pace of 0.5% MoM in March, a little less than the expected pace of 0.6% and a slowdown versus the previous month's 0.8% pace, data released by the US Census Bureau on Thursday revealed.

The MoM growth in Core Retail Sales was a little stronger than expected in March at 1.1% versus the forecasted 1.0% growth rate, an acceleration from the 0.6% pace of growth one month earlier.

The Retail Control group showed a MoM pace of growth of -0.1%, weaker than the 0.2% expected and comes after a 0.9% decline in February.

Market Reaction

The DXY, already on the front foot amid a dovish reaction to the ECB policy announcement that led to the euro weakening against the US dollar, is extending gains to the upside and is eyeing a break back above 100 in wake of the mixed Retail Sales figures.

What will happen on the electricity market? The war in Ukraine has caused prices on the European gas market to skyrocket because of the threat of massive shortfalls in Russian supply. Strategists at Commerzbank assume that the situation on the energy markets will ease towards the summer.

Expansion of renewable energies is only likely to ease prices in the medium-term

“If there is no embargo and gas prices fall in the summer as we expect, this should dampen electricity prices. This would probably also apply in the event that coal prices ease only gradually and the carbon price defends its high level. Previous price levels, however, remain a long way off. After all, importing non-Russian gas or coal is more expensive and the more of it is used in power generation, the higher the electricity generation costs.”

“The expected increased expansion of renewable energies is only likely to ease prices in the medium-term.”

Christine Lagarde, President of the European Central Bank (ECB), is scheduled to deliver her remarks on the monetary policy outlook at a press conference at 12:30 GMT.

Follow our live coverage of ECB's policy announcements and the market reaction.

Breaking: ECB leaves rates unchanged at -0.50% as expected, reiterates QE to end in Q3.

About ECB's press conference

Following the ECB´s economic policy decision, the ECB President gives a press conference regarding monetary policy. Her comments may influence the volatility of EUR and determine a short-term positive or negative trend. Her hawkish view is considered as positive, or bullish for the EUR, whereas her dovish view is considered as negative, or bearish.

US Monthly Retail Sales Overview

Thursday's US economic docket highlights the release of monthly retail sales figures for March, scheduled later during the early North American session at 12:30 GMT. The headline sales are estimated to have risen by a seasonally adjusted 0.6% during the reported month as against the 0.3% growth recorded in February. Excluding autos, core retail sales probably climbed by 0.2% in March, up from the 1.2% decline reported in the previous month.

How Could it Affect USD/JPY?

Ahead of the key release, a softer tone around the US Treasury bond yields kept the US dollar bulls on the defensive and dragged the USD/JPY pair further away from the two-decade high touched the previous day. That said, a generally positive tone around the equity markets, along with the divergence in the monetary policy stance adopted by the Fed and the Bank of Japan, weighed on the JPY and helped limit losses. Stronger US consumer spending data reaffirm bets for a more aggressive policy tightening by the Fed and push the US bond yields/USD higher. Conversely, any disappointment is unlikely to prompt any aggressive USD selling, suggesting that the path of least resistance for the USD/JPY pair is to the upside.

According to Joseph Trevisani, Senior Analyst at FXStreet: “Markets will react in a straight line with the strength of the sales figures. Better than expected results support Treasury rates and the dollar. Equities should be able to ignore the prospect of higher interest rates as strong sales mean an expanding economy. Weak or negative sales raise a host of problems about the second quarter but the immediate reaction will be lower Treasury yields, a lower dollar and fading equities. For the stock market, the prospect of a recession is more daunting than higher interest rates.”

Key Notes

• US Retail Sales March Preview: Waiting for the inflation hammer to drop

• USD/JPY finds a short-lived pullback from 125.40 ahead of the US Retail Sales

• USD/JPY could move close to the 126.25 closest overhead resistance level

About US Retail Sales

The Retail Sales released by the US Census Bureau measures the total receipts of retail stores. Monthly per cent changes reflect the rate of changes in such sales. Changes in Retail Sales are widely followed as an indicator of consumer spending. Generally speaking, a high reading is seen as positive (or bullish) for the USD, while a low reading is seen as negative (or bearish).

The European Central Bank (ECB) left its benchmark deposit rate unchanged at -0.50%. The central bank also reiterated its guidance that net asset purchases (Quantitative Easing or QE) should end in Q3. The euro saw a substantial drop in reaction. Economists at TD Securities expect EUR/USD to remain on the back foot for most of Q2.

ECB reiterates QE to end in Q3

“The ECB left its policy statement almost entirely unchanged from the March decision, with the APP still expected to conclude in the third quarter, and interest rates to rise ‘some time after’ the conclusion of the APP. With the APP not ending until July at the earliest, a rate hike before September now looks less likely.”

“Looking forward to the Press Conference, we look for clarification over why the ECB felt comfortable maintaining an outright easing stance through the next 3 or 4 months, despite the significant upside move in inflation, which we now expect to approach 9% by mid-year.”

“The ECB didn't offer much support to the EUR out the gate, especially as other central banks look quite reactive to fight inflation.”

“We think the EUR outlook is a matter of sequencing and think it is too early to trade a EUR pop against other currencies that offer active central banks, favorable terms of trade, carry, and positive growth momentum. That means EUR/USD is likely to remain on the back foot for most Q2.”

- Spot silver is pulling back a little after hitting one-month highs in the $25.80s amid profit-taking pre-US risk events.

- XAG/USD is back to trading in the $25.50s and on course to snap a six-day win streak.

Spot silver (XAG/USD) prices are subdued and trading in the red in the $25.50s per troy ounce the March US Retail Sales report at 1330BST, the preliminary US Michigan Consumer Sentiment survey at 1500BST and then more Fed speak later in the day. US bond yields and the US dollar continue to see some weakness, though profit-taking ahead of upcoming risk events and following the strong performance of recent days is preventing XAG/USD from further closing the gap to $26.00.

Indeed, the precious metal closed in the green for a sixth successive session on Wednesday, during which time it has rallied more than 6.5% from the low $24.00s to current levels in the upper $25.00s. Prices actually managed to hit one-month highs earlier in the day at $25.87, so traders shouldn’t be too surprised to see some profit-taking/consolidation at play.

In terms of the near-term outlook for silver, as long as the recent pullback in US yields and the dollar continues, the chances for a break above $26.00 remain good. Silver, as is also the case with other precious metals, will likely remain in demand for some time amid 1) elevated geopolitical risk premia and 2) elevated demand for inflation protection as inflation rates surge globally. That means, unless circumstances change drastically, XAG/USD should remain well supported above the $24.00 level, as has been the case in the last few weeks.

- EUR/GBP turned lower for the fourth straight day and dropped to over a one-month low.

- The euro weakened a bit after the ECB decided to leave its policy settings unchanged.

- Rising bets for more BoE rate hikes underpinned the GBP and added to the selling bias.

The EUR/GBP cross edged lower and dropped to its lowest level since March 8, around the 0.8280 region after the European Central Bank announced its policy decision.