- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 14-03-2022

- AUD/USD consolidates recent losses around two-week low, sidelined of late.

- Clear break of 100-DMA, downbeat MACD signals direct bears to six-week-old support line.

- Key Fibonacci retracement levels, 200-DMA add to the upside filters.

- RBA Meeting Minutes will precede China's Retail Sales, Industrial Production for February to direct immediate moves.

AUD/USD remains mildly bid around 0.7200 during Tuesday’s initial Asian session, following a two-day downtrend to a fortnight low.

Even so, the first daily closing below the 100-DMA in over two weeks and the most bearish MACD signals since early February keeps AUD/USD sellers hopeful.

That said, an upward sloping support line from late January, around 0.7180 at the latest, will challenge short-term sellers.

In a case where the AUD/USD prices drop below 0.7180, the early January’s low near 0.7130 and the 0.7100 threshold will be in the spotlight.

Alternatively, a clear upside break of the 100-DMA, at 0.7222 by the press time, will extend the corrective pullback towards the 50% Fibonacci retracement (Fibo.) of October 2021 to January 2022 downside, around 0.7265.

Following that, the 200-DMA and the 61.8% Fibo., respectively around 0.7310 and 0.7335, will entertain AUD/USD bulls before directing them to the monthly high of 0.7441.

AUD/USD: Daily chart

Trend: Further weakness expected

- NZD/USD treads water following a negative start to the week.

- Confluence of 50-DMA, 50% Fibonacci retracement of January-March upside lures bears.

- Market sentiment remains cautiously optimistic amid mixed concerns over Ukraine-Russia crisis, covid fears from China.

- Bears can have additional support if China Retail Sales, Industrial Production ease even before the covid resurgence.

Having begun the week on a negative note, NZD/USD bears take a breather around 0.6750 during Tuesday’s Asian session. While broad risk-off mood weighed on the Kiwi pair in the last few days, the latest inaction could be linked to the mixed updates from Ukraine and China.

Sputnik quoted an Adviser to Ukraine President Volodymyr Zelenskyy’s office, Oleksiy Arestovych, to raise expectations of a Moscow-Kyiv peace in as early as two weeks or before late May. However, reports of a Russian drone over Poland and sanctions on Moscow, as well as Russia-Belarus rejection to pay energy supplies in the USD, challenge the NZD/USD bulls.

On Monday, market sentiment soured after an initially positive mood as optimism surrounding the Ukraine-Russia peace ebbed, also joined by the news of coronavirus resurgence in China.

China reported the highest covid cases since May 2020 the previous day and drowned Antipodeans with its lockdown in epicenter cities. Recently, the dragon nation announced activity restrictions in Langfang city near Beijing.

Other than the geopolitical and covid risks, escalating hopes of the Fed’s faster rate-hike trajectory also weighed on the NZD/USD prices of late, by way of the firmer US Treasury yields.

Amid these plays, US 10-year Treasury yields rose 13 basis points (bps) to refresh 32-month high whereas the Wall Street benchmarks closed in the red despite an upbeat start by the end of Monday’s North American session. It should be noted that the S&P 500 Futures print mild gains by the press time.

Moving on, China’s Retail Sales and Industrial Production for February, expected 3.0% and 3.9% YoY versus 1.7% and 4.3% respectively, will be important for the NZD/USD prices due to China’s trade ties with New Zealand. Should the figures ease, the quote will have an additional reason to worry and may portray further downside.

Technical analysis

A daily closing below the 21-DMA, around 0.6765 by the press time, directs NZD/USD towards a convergence of the 50-DMA and 50% Fibonacci retracement of January-March advances, close to 0.6725.

- GBP/USD looks to settle below 1.3000 amid a souring mood in the market.

- Investors eye one more interest rate hike from the BOE this week.

- Fed’s monetary policy holds utmost importance for FX currencies this week.

The GBP/USD pair has been dumped heavily by the market participants on intensifying fears of China’s bailout to Russia. The US has told its allies that Russia has requested military assistance from China in the ongoing Russian invasion of Ukraine. Moreover, the latter has displayed its willingness to support the former in the future. The US has also stated that the dragon economy might be providing military assistance to Russia already.

Meanwhile, ''The Chinese embassy in the US on Sunday said it had no knowledge of any Russian request or positive Chinese response to Moscow. Russia on Monday also denied making any request to China.''

The situation has improved the appeal for safe-haven and investors have dumped the cable amid a broader risk-aversion theme.

Apart from the geopolitical tensions, interest rate decision from the Bank of England (BOE) is more in focus. The BOE have hiked their interest rates by 25 basis points (bps) twice in December and February. The BOE is more likely to follow the rate hike streak this time too and push the benchmark rates to 0.75%. Britain’s National Statistics will announce the Claimant Count Change (number of unemployed people in the UK) on Tuesday, which will have a significant impact on BOJ’s monetary policy.

Meanwhile, the US dollar index (DXY) is trading lackluster around 99.00 and is locating a trigger that could drive the DXY out of the woods. Monetary policy from the Federal Reserve (Fed) holds utmost importance this week as the stance from the dictation will help the market participants to initiate fresh positions.

- EUR/USD remains sidelined after stepping back from the key HMA resistance.

- Sluggish MACD, steady RSI also favors the continuation of recent weakness.

- Weekly support line holds the gate for further downside targeting 2022 low.

- 61.8% Fibonacci retracement level adds to the upside filters.

EUR/USD treads water around 1.0940 amid Tuesday’s initial Asian session, after a positive start to the week.

Even so, the major currency pair holds onto the previous day’s pullback from the 200-HMA, which in turn joins downbeat MACD and steady RSI to suggest the quote’s further grinding towards the south.

That said, an upward sloping trend line from March 07 will join the 23.6% Fibonacci retracement (Fibo.) of February 25 to March 07 downside to restrict short-term downside near 1.0915.

In a case where EUR/USD drops below 1.0915, the 1.0900 threshold may act as an intermediate halt ahead of directing the quote to the recent multi-month low of 1.0806.

Alternatively, recovery moves need to cross the 200-HMA level of 1.0975 to gain the market’s attention.

Following that, the 1.1000 round figure and the 61.8% Fibo. near 1.1095 will lure the EUR/USD bulls.

It’s worth noting, however, that a clear run-up beyond 1.1095 will help buyers to challenge the monthly high around 1.1235.

EUR/USD: Hourly chart

Trend: Bearish

- The DXY is struggling around 99.30 in the absence of any potential trigger that could bring an impulsive wave.

- Any Chinese aid to Russia may heighten the risk-aversion theme in the market.

- Fed’s interest rate policy will be the mega event that investors will look upon.

The US dollar index (DXY) is failing to claim 100.00 despite the tailwinds of escalating geopolitical tensions between Russia and Ukraine, Covid-19 cases in China, and an aggressive hawkish stance from the Federal Reserve (Fed) on Wednesday.

Status of geopolitical tensions between Russia and Ukraine

Three rounds of peace talks between Moscow and Kyiv have failed to bring any pause in the military activities by the nations. However, a safety corridor for the Ukrainian civilians has helped them to escape to some extent. Meanwhile, a negative development has taken place as the US has claimed that Russia has requested China for military support in the three-week-long invasion of Ukraine. The US believes that China is aiming to bail out Russia from sanctions imposed by the Western leaders. In response to that China has denied any knowledge regarding the request from Russia.

An aggressive hawkish stance from the Fed

The US CPI has climbed at 7.9% in February against the prior figure of 7.5%, which has raised the odds of a 50-basis point (bps) interest rate hike from the Fed. It is worth noting that the figure of 7.9% is untouched by the galloping prices of oil. Fed Chair Jerome Powell in his testimony declared a 25 bps rate hike is more likely but doors for an aggressive tightening policy are still open.

Covid-19 cases in China

Where the world economy is getting back to normal after the prohibition of using masks, China is witnessing rising cases of Covid-19 recently. On Sunday, the country reported 3,100 new locally transmitted cases in a single day, and a lockdown was announced in Shenzhen city. In response to the rising cases of Covid-19, Toyota announced a suspension of production in China’s Changchun city due to COVID-19 shutdown measures while Foxconn halted output at its iPhone site in Shenzhen city.

Major events this week: Producer Price Index, New York Empire State Manufacturing Survey, Retail Sales, Interest Rate Decision (most important), Initial Jobless Claims, Industrial Production, and Existing Home Sales.

Eminent issues on the back boiler: Russia-Ukraine war, and Bank of England (BOE) & Bank of Japan (BOJ) monetary policy.

Early Tuesday morning in Asia, Sputnik quotes an Adviser to Ukraine President Volodymyr Zelenskyy’s office, Oleksiy Arestovych.

The diplomat is reported to believe that a peace agreement with Russia in the ongoing special military operation can be reached within one to two weeks at the earliest, and at the latest in May.

Market reaction

The news adds strength to the market’s consolidation of Monday’s losses, helping AUD/USD to print 0.20% intraday gains while piercing 0.7200 at the latest.

Read: AUD/USD falls below 0.72 the figure as Ukraine crisis risk-off themes weigh

It’s worth noting, however, that the risk-off mood isn’t eloped as chatters over Russia’s default loom large.

Read: US Treasury Official: Bond default would add to Russia's economic pain

“A default on Russia's sovereign debt would add further pain to Russia's economy and financial system, making it harder for Moscow to find new lending sources and raising future borrowing costs, a US Treasury official said on Monday,” per Reuters.

The official also told Reuters, per the news, “The Treasury believes there are limited direct exposures in the U.S. financial system to Russian sovereign bonds and the main impact would fall on a Russian economy already reeling under the weight of US sanctions.”

FX implications

Markets paid a little heed to the news during the initial hours of the Asian session on Tuesday. Even so, the Antipodeans pared some of the latest losses at the latest.

Read: Forex Today: Dollar on the rise amid mounting tensions with Russia

- USD/CAD bulls take a breather after snapping three-day downtrend, prices grind higher of late.

- Yields propel USD, oil renews two-week low on easing fears of supply crunch, chatters surrounding receding demand.

- Uncertainty surrounding Russia-Ukraine joins China’s covid breakout and hopes of faster monetary tightening to fuel USD/CAD.

- China Retail Sales, Industrial Production to provide immediate direction ahead of second-tier US/Canada economics, risk catalysts are the key.

USD/CAD hovers in a tight range above 1.2800 during early Tuesday morning in Asia, following the upbeat start to the week. The Loonie pair rose the most in one week the previous day, before the latest sidelined performance, as softer oil prices and strong US Treasury yields offered a double boost to the quote.

Market sentiment remained sour, despite the upbeat start of the week, as optimism surrounding the Ukraine-Russia peace ebbed by the end of Monday’s North American session. The latest updates suggest more European sanctions for Russia and the US allegations that China is up for providing military help to Moscow. Additionally, a halt in the peace talks, as well as news that Russia Belarus won’t pay for energy supplies in the US dollar also signaled that the three-week-old geopolitical event isn’t likely to end soon.

Other than the Moscow-Kyiv updates, China’s escalated measures to tame the Omicron spread, after witnessing the biggest daily infections since May 2020 also weighed on the market’s risk appetite.

Other than the risk catalysts that weighed on the commodities and underpinned the US dollar’s safe-haven demand, escalating hopes of the Fed’s faster rate-hike trajectory also propelled USD/CAD prices. As per the latest CME FedWatch Tool reading, there are over 90% probabilities for a 0.50% rate-lift during this week’s Federal Open Market Committee (FOMC).

That said, WTI crude oil, Canada’s main export item dropped over 6.0% to poke March 01 levels, around $102.30 by the press time. The black gold refreshed its 14-year high in the last week before closing in the red as concerns over the supply crunch eased.

Amid these plays, US 10-year Treasury yields rose 13 basis points (bps) to refresh 32-month high whereas the Wall Street benchmarks closed in the red despite an upbeat start.

Looking forward, USD/CAD traders may pay attention to China’s Retail Sales and Industrial Production data for February for immediate directions. However, major attention will be given to headlines from Russia and Ukraine.

Technical analysis

Sustained recovery from the 50-DMA level surrounding 1.2690 enables USD/CAD to regain the 1.2900 threshold. However, the pair’s further upside will be challenged by an ascending resistance line from late January, close to 1.2935 by the press time.

- AUD/JPY has slipped below 85.00 as investors await fresh impetus from China’s aid to Russia.

- Japan’s economy is hurting from galloping commodity prices.

- Investors will focus on BOJ’s interest rate decision later this week.

The AUD/JPY pair has slipped below the round level of 85.00 as investors are waiting for the Reserve Bank of Australia (RBA)’s minutes from March’s meeting. The minutes from the RBA’s March meet will display the rationale behind the status quo maintained by the RBA’s Chair Philip Lowe and his colleagues. The risk barometer has performed well in the past few trading sessions on Japan’s pain due to the rising prices of commodities.

The escalation in the Russia-Ukraine war has drifted the prices of oil, metals, and grains. This has significantly hurt the Japanese yen against the aussie. The former is a major importer of all these mentioned commodities and its fiscal policy is facing the heat of rising prices. While, the antipodean is a major exporter of iron ore, coal, and other metals and expensive commodities are bringing more flows for it.

It is worth mentioning that the RBA has not followed the footprints of other central banks and is holding its cash rate at a record low of 0.1% for the 15th month in a row during its March 2022 meeting. Meanwhile, the monetary policy from the Bank of Japan (BOJ) is due later this week. The BOJ is more likely to keep the interest rate unchanged at 0.1% despite the rising prices of commodities.

Apart from the events associated with BOJ and RBA, investors will focus on the story of China’s support to Russia. The US has claimed that Russia has requested China to provide military support against Ukraine. Although, China has denied any kind of intimation by Moscow regarding the military aid. Any positive development over the headlines will hurt the antipodean as Australia is a leading trading partner of China.

- AUD/USD starts a new forex day below 0.72 the figure.

- Risk-off markets pertaining to the Ukraine crisis is weigh on high beta currencies, such as AUD.

AUD/USD is opening in early Asia offered after breaking below 0.72 the figure. Markets were trading risk-off at the start of the week and AUD/USD fell from a high of 0.7193 to a fresh daily low of 0.7187. Investors eyed Russia-Ukraine peace talks, while major central bank meetings this week.

The AUD fell at the same time that commodities retraced some of their recent gains on news from Russia-Ukraine talks. US stocks lost more ground and the S&P 500 dropped 0.74% and the Nasdaq Composite slumped around 2% while the Dow Jones Industrial Average was little changed at 32,945.24. The 10-year US Treasury yield jumped by 14 basis points to 2.142% and the Aussie yield crossed the 2.5%, printing its highest level since 2018 to 2.53%.

Russia’s attack on Ukraine is keeping flows moving towards the relative safety of US dollars. The two sides concluded a meeting on Monday to no avail while Russia launched a flurry of strikes on Kyiv. Talks will resume on Tuesday but there are little signs of a resolve.

Taking to Twitter, Ukrainian President Volodymyr Zelenskyy's aide Mykhailo Podolyak said: "Again. Negotiations go non-stop in the format of video conferences. Working groups are constantly functioning. A large number of issues require constant attention."

A report from the Financial Times was also weighing on risk sentiment. In an article, the FT said that Russia had made a request to China for military assistance at some point after the start of the now three-week invasion of Ukraine.

''The US has told allies that China signalled its willingness to provide military assistance to Russia, according to officials familiar with American diplomatic cables on the exchange.''

''The cables, which were sent by the US state department to allies in Europe and Asia, did not say whether China had signalled that it would help Russia in the future or if it had already started providing military support. Nor did they say at which point in the conflict Beijing appeared open to offering the help.''

The news comes at the same time that US National Security Adviser Jake Sullivan began talks with China's Communist Party Politburo member Yang Jiechi, Bloomberg reported, citing people familiar with the matter.

"We do have concerns about China's alignment with Russia at this time and the national security adviser was direct about those concerns and the potential implications and consequences of certain actions," the official was quoted by CNN as saying. This came as CNN reported Russian airstrikes hit a large Ukrainian military base near the border of Poland, a NATO member.

Looking ahead, the central banks will be a meanwhile distraction. The Reserve Bank of Australia will release its minutes and traders will be looking for insight with regards to inflation risks.

''The RBA’s preference is to “take the time to assess the incoming information and review how the uncertainties are resolved.” It thinks it has more scope to do so than some other central banks because of the “starting points for wages growth and underlying inflation in Australia.” The reference to underlying inflation highlights the RBA’s preference to look through spikes in headline inflation,'' analysts at ANZ Bank said. ''But its willingness to do so will depend on the psychology of inflation. If it shifts, the RBA’s “scope” for patience will quickly narrow.'

Other data will be eyed in the Employment report. ''We anticipate a strong labour market print for Jan as economic activity continues to pick up amid loose restrictions and robust labour demand,'' analysts at TD Securities wrote. ''We forecast 50k for the headline and for the participation rate to edge higher to 66.4% which brings the unemployment rate to 4.1%, levels last seen since Mar 2008. We also see a rebound in hours worked after the 8.8% m/m decline in Jan.''

As for the Federal Reserve, market rates implied a 99.8% probability policymakers will increase the Fed funds rate by a quarter of a percentage point Wednesday from the current range of zero to 0.25%, according to the CME Group's Fed Watch Tool.

- USD/CHF is addressing a corrective pullback from 0.9386, may resume an upside journey soon.

- A broader risk-aversion theme has supported the major to record a fresh 11-month high at 0.9390.

- The DXY is underpinned by escalating war tensions, upcoming Fed policy, and renewed Covid-19 fears.

The USD/CHF pair has witnessed some long liquidation after registering a fresh 11-month high at 0.9390 amid a broader risk-aversion theme in the market. The major has been rallying higher from the last three trading sessions as investors are underpinning the greenback against the Swiss franc ahead of the interest rate decision from the Federal Reserve (Fed).

The geopolitical tensions between Russia and Ukraine have escalated further as the US told the Western leaders that China is aiming to provide military assistance to Russia after being a neutral voter. It is worth noting that China has close ties with Russia earlier. Therefore, the US believes that China is attempting a bail-out to Russia post the sanctions imposed by the Kremlin after Russia’s invasion of Ukraine.

In response to that China has denied any kind of request from Moscow. Moreover, Russia has also denied making any request to China.

On the dollar front, the US dollar index (DXY) is awaiting a decisive trigger to claim the 100.00 mark. Despite a lot of positive triggers such as Russia-Ukraine war escalation, renewed Covid-19 fears in China, and likely aggressive monetary policy dictation from the Fed Chair Jerome Powell, the DXY is failing to locate a fresh impulsive wave that could drive the DXY at 100.00.

Meanwhile, the 10-year US Treasury yields have surpassed 2.41% on rising expectations of a 50 basis points (bps) interest rate hike by the Fed.

- GBP/USD bulls in anticipation of a bullish correction.

- The weekly M-formation is a compelling feature on GBP/USD charts.

GBP/USD is testing the 1.30 psychological figure in risk-off market conditions. There is room for lower, according to the weekly chart, with eyes on 1.2850. However, the bulls are waiting in the flanks for a bullish weekly close that could signal the end of the current bearish cycle with a focus on a reversion towards 1.3380.

GBP/USD weekly chart

The M-formation is mature and bulls will be in anticipation of a correction starting from within the demand area, as illustrated don the weekly chart above. A weekly bullish close is required to signal the prospects of the leg higher.

- Progress in discussions between Russia-Ukraine improved market sentiment but later shifted to risk-off market mood.

- China’s willingness to supply Russia with military assistance dampened sentiment.

- Rising US Treasury yields ahead of the Fed underpin the US dollar.

- XAG/USD Price Forecast: Remains bullish but goes through a correction that could further extend towards $24.50 before resuming upwards.

Silver (XAG/USD) plunges 3.17% on Monday, during the North American session, despite a risk-off market mood, which usually would boost appetite for precious metals and commodities amid uncertainty around the Russia-Ukraine conflict which gave positive signals in the early Asian session. At press time, XAG/USD is trading at $25.05.

Russia-Ukraine discussions progressed

On the Russia-Ukraine front, officials from both countries expressed that talks indeed have progressed, suggesting there could be positive results within days. Moreover, the US Deputy Secretary of State Sherman confirmed the aforementioned, commenting that Russia showed signs of willingness to engage in substantive negotiations.

The market reacted positively, sending European indices higher, which in fact, closed in the green. Contrarily in the US, indexes record losses due to a sudden shift in sentiment, linked to rumors of China’s willingness to provide military assistance to Russia, according to officials familiar with American diplomatic cables on the exchange.

US Treasury yields “finally” underpin the greenback

Despite the previously mentioned above, hostilities persist, which could spur another leg-up in the non-yielding metal. Meanwhile, the US Treasury yields rallied at the beginning of an FOMC week, with the 10-year T-note yield rising thirteen and a half basis points, sitting at 2.142%, a headwind for precious metals, with silver and silver gold down 3.17% and near 2%, respectively.

The US Dollar Index, a gauge of the greenback’s value vs. six peers, pare its earlier losses, down 0.03%, reclaimed the 99.00 mark.

The US economic docket was absent, but on Tuesday would feature the Producer Price Index (PPI), the New York Empire State Manufacturing Index, and on Wednesday, Retail Sales and the monetary policy decision of the Federal Reserve.

XAG/USD Price Forecast: Technical outlook

Silver is still upward biased, despite the ongoing correction, which stalled at the 61.8% Fibonacci golden ratio, at $25.03, though downside risks remain. In the case of a “deeper correction,” the following support for XAG/USD would be the 78.6% Fibonacci at $24.50, which is $0.50 up of the 200-day moving average(DMA), an area in which XAG/USD bulls lean before launching another test towards $27.00.

Upwards, the first resistance would be the 50% Fibonacci retracement at $25.39, once cleared, would open the door towards the 38.2% at $25.76, and then the $26.00 mark.

- NZD/USD sinks as risk appetite suffers in the face of the latest Ukraine crisis headlines.

- The Fed will move into the spotlight as the next major risk for forex.

NZD/USD has moved in on a critical area of potential demand in the lows made in recent trade. At the time of writing, NZD/USD is trading at 0.6747, a few pips shy of the lows at 0.6745 as risk-off sentiment takes hold of the forex market.

-

US tells allies China signalled openness to provide Russia with military support

There are reports that the US has told allies that China signalled its willingness to provide military assistance to Russia, according to officials familiar with American diplomatic wires on the exchange. This has weighed on risk appetite evident in the moves lower in US stocks as a choppy session draws towards a bearish close for the start of the week.

''The Kiwi continued its decline overnight and is in the midst of extending losses as we go to print this morning. While the move wasn’t particularly outsized, it is over a cent off highs and the drivers appear to be softer commodity prices, late weakness in US equities, and Chinese economic growth concerns, all of which has knocked the AUD too.,'' analysts at ANZ Bank explained.

''So, the week hasn’t gotten off to a good start for the Kiwi, and although there is some domestic data coming up this week (which should be pretty good and which we think might be more influential) global events continue to dominate sentiment. Technically, the break of 0.6775 about 2hrs ago doesn’t bode well, and the sharp rise in US bond yields might keep the USD bid. Markets remain very skittish and more volatility seems likely.''

Eyes on the Fed

Meanwhile, the probability that policymakers at the Federal Reserve will increase the Fed funds rate to 0.25%-to-0.5% on Wednesday from the current zero-to-0.25% is 99.8%, according to the CME Group's Fed Watch Tool. The probability for a 25 basis-point increase was below 40% a month ago, and the chances for a 50 basis-point jump was more than 60%. ''We continue to believe that the terminal Fed Funds rate will have to be much higher. If and when the market comes around to our view, U.S. rates at the short end should continue to rise,'' analysts at Brown Brothers Harriman argued, in favour of a strong US dollar.

What you need to take care of on Tuesday, March 15:

Market players tried to be optimistic about a diplomatic solution to the Russia-Ukraine conflict but were unable to do so. The positive sentiment diluted as the day went by, with Wall Street ending the day in the red after a strong opening.

The latest round of peace talks was paused, according to Ukraine’s negotiator Mikhail Podolyak, and will resume on Tuesday. A Kremlin spokesperson noted that “all the plans of Russia in Ukraine will be fulfilled in full and in the time frames outlined.” Also, news hinted that Russia may halt wheat, corn, rye and barley exports, while Moscow and Belarus will stop paying for energy supply in US dollars, according to the latter’s Prime Minister.

At the same time, the EU Commission announced another wave of sanctions against Russian oligarchs and entities. The US, on the other hand, reported to its NATO allies that China is willing o provide military and economic support to Russia.

The greenback is up against most major rivals, although EUR/USD is marginally higher for the day, trading at around 1.0960. The GBP/USD pair pressures the 1.3000 threshold after reaching a fresh multi-month low of 1.3008.

Commodities edged lower, with gold falling down to $1,949.57 a troy ounce and finishing the day nearby. Crude oil prices were down, with WTI now trading at around $101.40 a barrel.

The risk-averse sentiment and easing gold and oil prices undermined demand for commodity-linked currencies. The AUD/USD pair pierced the 0.7200 level, while USD/CAD trades at around 1.2820.

The USD advanced against safe-haven rivals on the back of soaring US government bond yields. The yield on the 10-year Treasury note peaked at 2.145% and currently hovers around 2.13%. The USD/JPY pair trades at around 118.10, its highest since January 2017.

Top 3 Altcoins to Watch: XinFin, KuCoin, and TheGraph

Like this article? Help us with some feedback by answering this survey:

- Gold is lower despite risk-off themes at the start of the week.

- Russia was on Ukraine is driving the sentiment and the US dollar higher.

- Gold to extend downward correction on hawkish Fed

As US yields rally to their highest levels since July 2019, the gold price is weakening in early afternoon US trade and is losing some 1.85% at the time of writing. XAU/USD has fallen from a high of $1,988.52 to a low of $1,949.74 so far, despite a risk-off theme at the start of the week.

-

US tells allies China signalled openness to provide Russia with military support

The focus remains on the Russian invasion of Ukraine. There are reports that the US has told allies that China signalled its willingness to provide military assistance to Russia, according to officials familiar with American diplomatic cables on the exchange.

Meanwhile, President Volodymyr Zelensky said his representatives were discussing a possible meeting with Russian leader Vladimir Putin, as negotiators noted some positive movement on issues of substance in recent days.

The fourth round of talks began on Monday morning, covering “peace, ceasefire, immediate withdrawal of troops [and] security guarantees”, according to Mykhailo Podolyak, an adviser to Zelensky. Podolyak later said the negotiations had been paused but would resume on Tuesday.

Taking to Twitter, Ukrainian President Volodymyr Zelenskyy's aide Mykhailo Podolyak said: "Again. Negotiations go non-stop in the format of video conferences. Working groups are constantly functioning. A large number of issues require constant attention."

However, diplomats remain sceptical about a breakthrough to end a war that has laid waste to Ukrainian cities, brought down devastating sanctions on Russia, and shaken world markets, ultimately sending the gold price to fresh cycle highs near $2,070/oz.

Meanwhile, weighing on risk sentiment further, China is facing its worst COVID crisis since early 2020, when the world first witnessed an entire population locked down to contain the coronavirus in Wuhan and its surrounding province. Two years on, it's now sending tens of millions of people into lockdown in the entire northeastern province of Jilin, where 24 million people live, and the southern cities of Shenzhen and Dongguan, with 17.5 million and 10 million, respectively.

Looking ahead this week, the US Federal Reserve is widely expected to raise interest rates at its meeting ending on Wednesday, with investors pricing in a 99% chance of a 25 basis point hike. The last commentary from the Fed Chairman Jerome Powell flagged multiple rate hikes this year considering surging inflation. These expectations for progressive Fed rate hikes this year suggest it is set to remain the greenback well supported going forward.

''Participants could also be expecting global central banks to ramp up their purchases following the West's aggressive sanctions on Russia, but official data have pointed to lacklustre flows in recent months,'' analysts at TD Securities said.

''Looking forward, the market has started to discount a future in which the growth shock could fade at a faster pace than the inflation shock, leaving gold prices vulnerable to a more hawkish Fed profile that could open the door to a deeper consolidation. For the time being, CTA trend followers still hold a substantial margin of safety for their length, but liquidations would be catalyzed below $1910/oz.''

Gold technical analysis

The trend is well established and the M-formation is a bullish reversion pattern that has formed on the daily chart. The neckline falls in near the highs of the day and would be expected to act as a resistance on a restest. However, should the bulls manage to overcome this area, there will be prospects of fresh highs for the foreseeible future. On the other hand, failures there will most probably lead to a restest of the current support in today's lows.

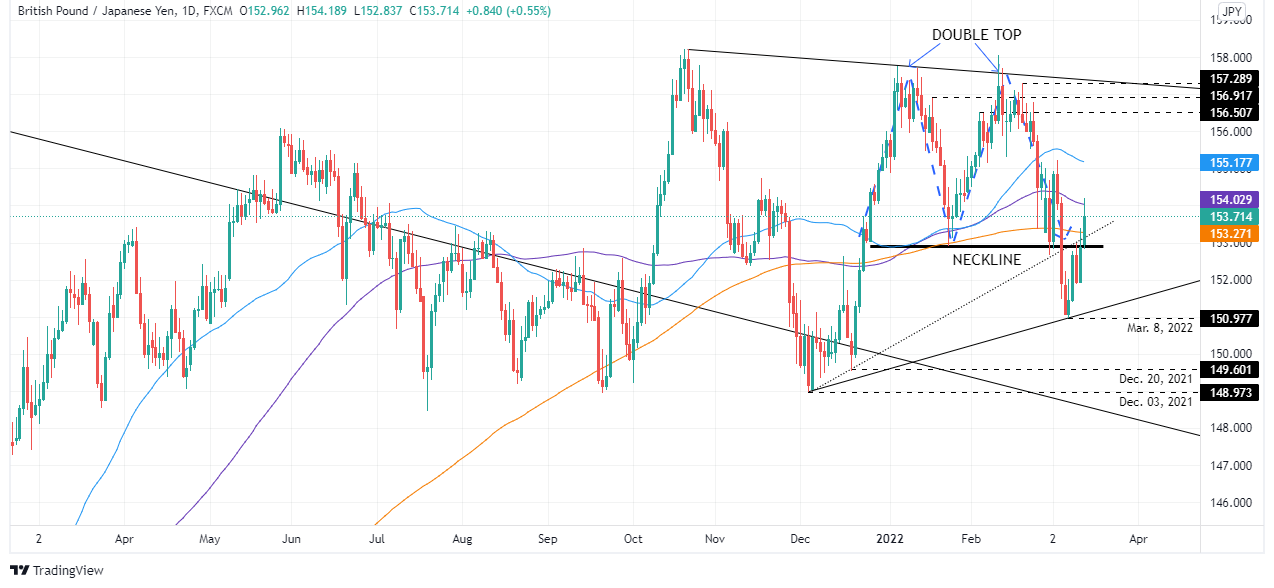

- The GBP/JPY advances as the Bank of England (BoE’s) third rate hike looms.

- As safe-haven peers dropped, a risk-off market mood was not an excuse for the British pound to climb.

- GBP/JPY Price Forecast: Shifts from a downward bias to a neutral though upside risks remain.

The British pound breaks above a double-top neckline around 152.94 and rallies sharply but stalled at the 100-day moving average (DMA) around 154.09, which appears to be a sudden shift in the market mood, from mixed to negative, as reflected by US equities. At press time, the GBP/JPY is trading at 153.71.

The risk-sensitive GBP rallies on positive market sentiment

Overnight, an upbeat market mood originated the rally of the GBP/JPY. Alongside market sentiment, the Bank of England (BoE) would hike rates for the third consecutive meeting, which would lift the bank’s rate from 0.50% to 0.75%, on Thursday, boosting sterling.

Analyzing the previous two-sessions price action, the GBP/JPY opened near the session’s lows and climbed steadily, reaching near the London Fix, the daily’s high at 154.18, retreating below the 154.00 mark afterward.

GBP/JPY Price Forecast: Technical outlook

The GBP/JPY shifted from a downwards to a neutral bias. Why? Failure of GBP/JPY bears to keep the spot under the neckline at 152.94 exacerbated an upward move, breaking on its way the 200 and 100-DMA, each at 153.07 and 154.03, respectively. However, if GBP/JPY bulls want to regain control, they need a daily close above the 100-DMA.

Upwards, the GBP/JPY first resistance would be the confluence of the 100-DMA and the 154.00 mark. Breach of the latter would expose the 155.00 mark, immediately followed by the 50-DMA at 155.17. Otherwise, the GBP/JPY first support would be the 200-DMA at 153.27. A sustained break would expose the double-top neckline at 1.52.94, near the 153.00 mark, followed by the 152.00 psychological level.

- Wall Street dips into the red as risk appetite fades.

- The disappointment on the Ukraine - Rusia talks and COVID-19 in China have soured sentiment.

US markets have dropped into negative territory after having opened with gains on Monday. The fragile appetite for risk witnessed during the European session seems to have faded as hopes of a cease-fire in Ukraine dissipate with the increment of COVID-19 cases in China raising alerts.

Expectations of any improvement in the Eastern European crisis have been hammered by the news that China is willing to supply arms to Russia, reported by a NATO official.

Furthermore, Russia has continued bombing Ukrainian cities and according to a local governor, killing nine civilians on an attack on a TV tower in Northern Ukraine.

Meanwhile, Chinese authorities have reported 3.400 new COVID-19 infections on Sunday. This is the largest outbreak in the last two years which is forcing to close schools and cancel activities, raising concerns about a new round of restrictions.

Against this backdrop, the S&P 500 Index dives 0.78% after having appreciated nearly 1% on early trading, the Nasdaq index drops 1.8% whole the Dow Jones ticks 0.2% down at the time of writing.

Technical levels to watch

- Euro recovery from 1.0900 area hits resistance near 1.1000.

- The euro has picked up amid a somewhat brighter market mood.

- EUR/USD might end the year at 1.1400 – Nomura.

The euro has pared losses on Monday after the previous two days’ decline. The pair has bounced up from 1.0900 lows to post a moderate advance on the day, yet lacking follow-through to break psychological resistance at 1.1000.

The higher appetite for risk has supported the euro

The common currency has been favored by a more positive market sentiment on Monday amid hopes of some progress on the peace talks between Ukraine and Russia. The brighter market sentiment has been reflected in the positive stock markets. In Europe, the German DAX, 2.21% higher, and the French CAC advancing 1.71% have lead gains.

In the US, however, the main indexes have turned lower after a solid opening with the Nasdaq Index 2% down while the S&P 500 and the Dow Jones Indexes are posting 0.6% and 0.1% declines at the time of writing.

Investors' focus this week is on the outcome of the US Federal Reserve’s monetary policy meeting, due on Wednesday. The bank is widely expected to raise its benchmark interest rate to 0.5% from the current 0.25% in an attempt to tame inflation which might underpin the greenback.

EUR/USD might climb to 1.1400 by year-end – Nomura

From a wider perspective, the FX analysis team at Nomura sees the Euro bottoming in Q2, to appreciate towards 1.1400 by year-end: “There are three types of exposure that risk pushing EUR lower: 1) higher energy prices in a very Russian gas & oil dependent Europe; 2) higher food prices and; 3) the cost of sanctions for European banks. Given these risks, we revise down the profile of our EUR/USD forecast to 1.08 in Q2, but with a stronger recovery likely from Q3 to 1.10, 1.14 by year-end 2022 and 1.20 by end-2023.”

Technical levels to watch

- AUD/USD is breaking 0.7200 in risk-off markets.

- China is a theme in markets on Monday, weighing on risk sentiment.

AUD/USD is breaking the psychological 0.7200 level having fallen from a high of 0.7298 on the day so far. The US dollar is edging higher in the New York session near a 21-month high (99.415) that was hit last week, as investors eye Russia-Ukraine peace talks and major central bank meetings this week.

The dollar index (DXY), which measures the greenback against six major peers, was down 0.25% at 98.883 but was correcting in the North American market as risk appetite dies dwindles on Wall Street in choppy trade. The Dow Jones Industrial Average was lower by 0.15% and the S&P 500 was down 0.72%.

Tentative hopes of progress in peace talks between Ukraine and Russia have failed to support riskier currencies, such as the Aussie, on Monday. Investors are moving to the sidelines with central bank meetings in mind along with the concerns of more COVID-linked lockdowns in China that have curbed risk-taking.

The US Federal Reserve is widely expected to raise interest rates at its meeting ending on Wednesday, with investors pricing in a 99% chance of a 25 basis point hike. The last commentary from the Fed Chairman Jerome Powell flagged multiple rate hikes this year considering surging inflation. These expectations for progressive Fed rate hikes this year suggest it is set to remain the greenback well supported going forward.

Meanwhile, soaring commodity prices are offering the AUD support vs. the USD in the spot market in what has been a 5 straight weekly gain for the currency. In fact, commodity prices are off to the best start in over 20 years. ''The move reflects the supply/demand COVID hangover and the rapid acceleration in geopolitical stress,'' analysts at TD Securities said.

The moves equated to last Monday’s squeeze to 0.7441 in AUD/USD, making for the highest highs since November 2021. However, that was short-lived as Russia’s attack on Ukraine continued to roil markets, sending cash into the relative safety of US dollars.

The two sides concluded a meeting on Monday with little sign of progress, as Russia launched a flurry of strikes on Kyiv and 400,000 people remained trapped in Mariupol. Talks will resume on Tuesday. Taking to Twitter, Ukrainian President Volodymyr Zelenskyy's aide Mykhailo Podolyak said: "Again. Negotiations go non-stop in the format of video conferences. Working groups are constantly functioning. A large number of issues require constant attention."

Meanwhile, weighing on risk sentiment further, China is facing its worst COVID crisis since early 2020, when the world first witnessed an entire population locked down to contain the coronavirus in Wuhan and its surrounding province. Two years on, it's now sending tens of millions of people into lockdown in the entire northeastern province of Jilin, where 24 million people live, and the southern cities of Shenzhen and Dongguan, with 17.5 million and 10 million, respectively.

- The USD/JPY is trading above a 24-year-old resistance trendline.

- A risk-on market mood weighed on safe-haven peers, though high US Treasury yields dragged the USD/JPY up.

- USD/JPY Technical Outlook: Upward biased, though a pullback towards January 4 cycle low at 116.35 is on the cards.

The USD/JPY extends last Friday’s rally, above a 24-year-old downslope trendline broken on Friday, when the USD/JPY recorded a close at 117.27, and higher US Treasury yields underpin the USD/JPY pair. At the time of writing, the USD/JPY is trading at 117.99.

Financial markets mood remains fragile, as illustrated by European equities finishing with gains, contrarily to what’s happening in the US, where the main indexes are in the red, except for the Dow Jones. In the meantime, the US Dollar Index, a gauge of the greenback’s measurement against a basket of its rivals, fell from the 99.00 mark, down 0.28%, sits at 98,85. Meanwhile, the US 10-year T-note yield advances eleven basis points, sitting at 2.121%, as traders prepare for the US central bank first rate hike.

Overnight, the USD/JPY climbed steadily towards the 118.00 mark, opening near the session’s lows at 117.28. Then it kept grinding higher, stalling at 118.00 as bulls took a breather and prepared an assault towards January 2017 cycle high around 118.61.

USD/JPY Price Forecast: Technical outlook

The USD/JPY is still upward biased. Once the triple-bottom target was fulfilled, one could have expected a mean-reversion move towards the January 4 high at 116.35. However, as the US central bank is about to hike rates on Wednesday, alongside the market mood, it boosted the greenback.

That said, the USD/JPY first resistance level would be the 118.00 mark. Breach of the latter would expose January 2017 cycle high at 118.61, followed by 119.00 and the 120.00 mark.

- US dollar's rebound from 1.2690 extends to levels near 1.2800.

- The lonie loses ground as oil prices drop.

- Longer-term, the USD/CAD is expected to remain neutral to negative – ScotiaBank.

The greenback has bounced up against its Canadian counterpart on Monday to pare losses after the 1.3% reversal seen late last week.

Canadian dollar drops as oil prices dive

The Canadian dollar has opened the week on a weak footing, weighed by a sharp decline in oil prices. The US benchmark WTI has dropped more than 8% on the day amid hopes of a peace agreement between Ukraine and Russia and investors' concerns about another COVID-19 lockdown in China with contagion levels rising fast.

On the other hand, market expectations that the US Federal Reserve will hike rates after its monetary policy meeting, due on Wednesday, have boosted US Treasury Bonds, ultimately increasing bullish pressure on the USD.

USD/CAD: Key support seen at 1.2695 – Scotiabank

FX analysts at Scotiabank, however, are skeptical about the US dollar’s recovery and remain attentive to the 1.2695 support area: “The broader, neutral range persists despite a fair degree of chop around that point but the USD continues to attract fairly solid selling interest on rallies and we continue to see a bit more downside than upside risk to this market in the months ahead (…) Key support is 1.2695 and we would look for the pair to fall more materially below this point.”

Technical levels to watch

- The euro appreciates 1.5% on the day and approaches 130.00.

- Risk appetite and higher US yieldhs are crushing the yen.

- EUR/JPY aiming to test 129.80 resistance area.

The euro opened the week on a solid tone against the Japanese yen. The pair is rallying nearly 1.5% son far today on the back of a somewhat brighter market sentiment.

Risk appetite and higher US yields crush the JPY

The euro has extended the sharp recovery seen last week, with the pair bouncing from 124.35 lows, favoured by a broad-based JPY weakness.

A moderate improvement on market sentiment, after representatives from Ukraine and Russia hinted to some progress on the peace talks over the weekend, has buoyed stock markets on Monday, weighing on safe-havens like the yen.

Furthermore, US Treasury Bonds have rallied further, with the benchmark 10-year yield reaching nearly three-year highs at 2,1%, ahead of the Federal Reserve’s monetary policy meeting, due on Wednesday. With the Bank of Japan expected to maintain its ultra-expansive policy for the foreseeable future, the increasing interest rate differencial has pulled the yen to five-year lows against the greenback.

EUR/JPY aiming to test Fibinacci resistance at 129.80

From a technical point of view, the pair has confirmed above the trendline resistance from February 10 high -now around 128.00, with the pair eyeing 61.8% Fibonacci retracement of the February-March decline, at 129.80.

Above here, next potential targets would be 130.25 (February 25 and 28 highs) and 130.70 (February 28 high)

On the downside, a potential correction would look for support at 128.80 (March 2, 10 highs) before testing the mentioned trendline around 128.00 and 127.40 (March 10 low).

EUR/JPY daily chart

The Financial Times reported on Sunday that Russia had made a request to China for military assistance at some point after the start of the now three-week invasion of Ukraine.

The US has told allies that China signalled its willingness to provide military assistance to Russia, according to officials familiar with American diplomatic cables on the exchange.

''The cables, which were sent by the US state department to allies in Europe and Asia, did not say whether China had signalled that it would help Russia in the future or if it had already started providing military support. Nor did they say at which point in the conflict Beijing appeared open to offering the help.''

''The Russian offer and Chinese response have sounded alarm bells in the White House. US officials believe China is trying to help Russia while its top officials publicly call for a diplomatic solution to the war.''

''The Chinese embassy in the US on Sunday said it had no knowledge of any Russian request or positive Chinese response to Moscow. Russia on Monday also denied making any request to China.''

''Jake Sullivan, US national security adviser, is expected to raise the issue in Rome today in a meeting with Yang Jiechi, China’s top foreign policy official. Before departing Washington on Sunday, Sullivan said he would warn the Chinese not to attempt to “bail out” Russia, including helping it survive the tough sanctions from the west.''

“We will ensure that neither China, nor anyone else, can compensate Russia for these losses,” Sullivan told NBC television on Sunday. “In terms of the specific means of doing that, again, I’m not going to lay all of that out in public, but we will communicate that privately to China.”

''China has portrayed itself as a neutral actor despite its increasingly close ties to Moscow. But Chinese media and diplomats have offered support for Russia’s justification for the invasion and blamed the US and Nato for the conflict.

Chinese media have also repeated unsubstantiated Russian claims that the US helped Ukraine build biological weapons labs''

Meanwhile, ''safe haven demand for USDs and expectations for progressive Fed rate hikes this year suggest it is set to remain well supported going forward, analysts at Rabobank said.

- Geopolitical developments in Eastern Europe calmed investors as oil dropped $8 of its price.

- Market sentiment remains fragile, though it is mixed, spurred by Russia-Ukraine and another Covid-19 outbreak in China, which weighed on WTI.

- WTI Price Forecast: Upward biased, but might consolidate as energy-related issues pending to be solved.

The US crude oil benchmark plunged on a “somewhat” improvement on risk sentiment and dropped earlier back under the $100 mark for the first time in two weeks. Russian-Ukraine officials reported progress in discussions, confirmed by US Deputy Secretary of State Sherman, commenting that Russia has shown signs of willingness to engage in “substantive negotiations.” At the time of writing, Western Texas Intermediate (WTI) is trading at $102.39.

The market sentiment is mixed, as European stock indices ended the session in the green, contrarily to the US, when the only gainer is the Dow Jones Industrial up 0.54%, at 33,123.14. Additionally to the geopolitical jitters in Eastern Europe, an outbreak in Covid-19 cases in China, in Shanghai and Shenzhen, weighed on the black-gold prices, as they are isolated into lockdown, according to China’s zero-tolerance stance.

Overnight, WTI’s traded within last Friday’s highs around $110 but briefly dropped under the $100 mark, around $99.78 on the diplomatic solution to the Russia-Ukraine conflict. Nevertheless, crude oil Is set to remain high unless there is an advance on Iran’s nuclear deal which would add 1 million BPD to the market, while the International Energy Agency (IEA) chief Fatih Birol urged oil-producing countries to pump more.

Late in the week, the Federal Reserve is expected to begin its tightening cycle for the first time since 2018, which should boost the greenback. In consequence, it could weigh on the dollar-denominated oil.

Therefore, US crude oil might head into consolidation, as geopolitical jitters, the Iran nuclear deal, and the US lifting sanctions to Venezuela, remain pending, relieving some pressure on the oil market.

WTI Price Forecast: Technical outlook

WTI’s remain upward biased, as shown by the daily chart. Worth noting that today’s price action pushed oil towards the confluence of the 61.8% Fibonacci retracement and the mid-parallel line between top-central Pitchfork’s parallel lines though short of reaching the $99.50 area, a problematic support level to challenged by oil bears.

That said, US crude oil’s first resistance would be the 50% Fibonacci retracement at $102.34. Once breached, the next supply zone would be the 38.2% level at $105.62, followed by Pitchfork’s top-trendline around $106.00.

- The sterling fails to regain 1.3100, remains near mid-term lows.

- Pound recovery falters despite BoE rate hike expectations.

- GBP/USD decline could extend to 1.2500 – ScotiaBank.

The pound sterling remains slightly positive on Monday, buoyed by a moderate risk appetite although its rebound from lows near 1.3000 has been capped below 1.3075.

Cable remains bearish at 16-month lows

The GBP/USD is trapped within a wider bearish trend following a three-week sell-off. The pair has depreciated nearly 5% from late February highs at 1.3640, to hit levels right above the 1.3000 psychological level for the first time since November 2020.

The sterling has seen a moderate increase on demand on Monday, favoured by a somewhat weaker dollar amid a mild sentiment improvement on the back of peace talks between Russia and Ukraine. Beyond that, investors’ expectations that the Bank of England’s will hike interest rates at next Thursday’s meeting has been supportive for the GBP.

GBP/USD might extend its decline towards 1.2500 – Scotiabank

Regarding the near-term expectations, the FX Analysis Team at Scotiabank sees the pound extending its downtrend: “Cable aims for a break under 1.30. Sterling faces no clear support until the mid-1.28s that marked the lows of Oct/Nov of 2020, with losses possibly mounting quickly toward 1.25.”

Technical levels to watch

Considering what the Federal Reserve and the Bank of England might do over the next months, analysts at Rabobank, see the GBP/USD pair likely to move sideways in a range above 1.30. Both central banks will have their policy meetings this week.

Key Quotes:

“Central bank meetings will be vying for some attention this week amid the headlines related to the war in Ukraine. These two topics can be broken down further. From Ukraine there have been both positive and negative headlines over the weekend which provide contrasting implications for the safe haven USD. On top of that, while the central bank meetings in the US and the UK are both expected to bring rate hikes, the tone from the respective policy makers is expected to differ considerably. Cable has declined sharply since the start of the conflict in Ukraine and we expect the pound to remain on the back foot going forward.”

“Both the Fed and the BoE are expected to raise rates by 25 bps this week. However, the MPC is likely to do so with far less enthusiasm. A hike this week for the BoE would mark the third consecutive move and the voting pattern of MPC members is likely to illustrate far less conviction than in the February and December policy meetings.”

“The indication of various central banks in the past couple of weeks is that pre-invasion plans for policy tightening remain mostly intact. Despite the inevitable impact on growth, central bankers are fearing that inflation expectations will become entrenched and that this could feed through into a stubborn wage/price spiral. The fact that the BoE was one of the first G10 central banks to tighten this cycle is suggestive of its commitment to avoid second order price pressures to gain too strong a foothold. That said, significant head-winds are facing the UK economy in the form of higher energy and tax bills and the Bank may already be running out of room to hike rates. Consequently it is likely that relative to the Fed, the BoE will sound a more cautious note at this week’s policy meeting and this could weigh on cable.”

“In our view cable could remains mostly within a GBP/USD 1.30 to 1.33 range in the coming months.”

- US dollar and US stocks indices mixed on Monday.

- Euro up versus dollar, British pound and Swiss franc.

- Investors are looking at Ukraine/Russia talks, before the FOMC meeting.

The EUR/USD found support above 1.0930 and climbed back toward the daily high it hit on European hours at 1.0989, boosted by a stronger euro and a mixed US dollar.

Conversations and the Fed

The key driver of price action continues to be the war in Ukraine. Volatility remains elevated, even among currencies. The economic calendar shows the US Producer Price Index due on Tuesday and on Wednesday, the critical event of the week: the Fed’s decision.

The FOMC is expected to hike the fed funds rate by 25 bps on Wednesday. If the Fed delivers as expected, it will be the first time since 2018, and attention would turn to signs about the future path of monetary policy. Analysts at Rabobank, see four consecutive rate hikes of 25 bps each in March, May, June and July. “We also expect that the impact of the Russian invasion of Ukraine and subsequent sanctions on global economic activity will be felt in the US more broadly in the second half of the year, inducing the FOMC to take a pause for the remainder of the year to make sure that a recession is avoided, before resuming the hiking cycle”.

Ahead of the FOMC meeting and also boosted by risk aversion, US yields are trading at monthly/yearly highs, supporting the greenback. In Europe, yields are also higher, keeping the EUR/USD far from the recent bottom.

Looking at 1.1000

The EUR/USD is holding onto daily gains, facing resistance at 1.1000, not only a round number, but also where the 20-Simple Moving Average stands in four-hour charts. A recovery above should add support to the euro, exposing the next resistance at 1.1035. Above the following resistance levels might be seen at 1.1070 and 1.1095.

If the pair fails to recover 1.1000 over the next hours, a potential decline back to 1.0935 should be considered. The area also contains the 20-hour SMA. Below attention would turn to 1.0895/1.0900, below the bearish pressure should intensify.

Technical levels

- The USD/CHF begins the week on the right foot up 0.12%.

- The Swiss franc was unable to capitalize on soft US dollar demand.

- USD/CHF Price Forecast: Neutral, but a daily close above 0.9373, would expose 0.9400 and 2021 yearly high around 0.9472.

The USD/CHF rallies and threatens November 24, 2021, daily high at 0.9373, amid a risk-off market mood. Broad safe-haven keeps the greenback buoyant, despite the fall of the US Dollar index, which is down 0.34%. At the time of writing, the USD/CHF is trading at 0.9358.

Overnight, the USD/CHF began around the day’s lows, near 0.9330s, though weak demand for the US dollar pushed the pair near the 0.9360 area, where it currently stands. Worth noting that the 50-simple moving average (SMA) in the 1-hour chart, around 0.9320, acted as solid support, so in the case of aiming down, that would be a crucial demand level to overcome.

USD/CHF Price Forecast: Technical outlook

The USD/CHF bias is still neutral, slightly tilted upwards. To further cement the “neutral-upwards,” the pair need a daily close above 0.9373. IF that scenario plays out, the USD/CHF first resistance would be 0.9400. Once breached, the next resistance would be April 2021 swing high at 0.9472, followed by the 0.9500 mark, and June 30 cycle high at 0.9533.

- Wall Street advances on Monday amid an improved market sentiment.

- Hopes of progress in the Ukraine-Russia talks have lifted appetite for risk.

- Banks are leading gains as major central banks hint to higher rates.

US markets have opened the week on a moderately positive tone, following the trend observed in Europe. Investors’ hopes about some progress in the peace talks between Russia and Ukraine seem to have boosted expectations of a cease fire, triggering a certain risk-appetite revival.

The S&P 500 is trading 0.90% up one hour after the opening bell. Stock markets are welcoming the efforts to stop the Eastern European conflict after high representatives from both parties expressed their confidence on achieving some results over the coming days.

Market sentiment, however, remains fragile as Russia keeps bombing Ukrainian cities, with the world holding its breath after a Russian missile attack hit a military compund only 25 Kms. away from the NATO border.

Furthermore, the Dow Jones Index appreciates 1.25% at the moment of writing, while the Nasdaq Technical Index edges o.33% up after a hesitant opening.

Regarding sectors, financials are leading gains on Monday, advancing 2,71% buoyed by rate hike hopes in most of then major certral banks. On the negative side, the energy sector drops 2,5% with oil prices dropping sharlply on the back of the Ukraine – Russia peace talks and the increase of COVID-19 cases in China.

Technical levels to watch

Economists at Nomura identify three risk exposures pushing EUR/USD lower into Q2 2022. However, the pair is likely to recover towards 1.14 by the end of 2022.

EUR/USD to inch closer towards parity if fresh extremes in energy prices lead to factory closures

“There are three types of exposure that risk pushing EUR lower: 1) higher energy prices in a very Russian gas & oil dependent Europe; 2) higher food prices and; 3) the cost of sanctions for European banks. Given these risks, we revise down the profile of our EUR/USD forecast to 1.08 in Q2, but with a stronger recovery likely from Q3 to 1.10, 1.14 by year-end 2022 and 1.20 by end-2023.”

“EUR support ahead would likely emerge from an easing of the Russia-Ukraine conflict, a possible Iran nuclear deal or OPEC output surprise that helps to stabilise energy prices, a shift towards more positivity on the euro area growth outlook and increased expectations of ECB monetary policy normalization (a hike in December goes ahead).”

“The negative risks for EUR include an extended geopolitical crisis that intensifies further into Q3, which could lead EUR/USD even closer towards parity of around 1.02-1.03 if we see fresh extremes in energy prices lead to factory closures.”

- The Mexican peso holds onto recent gains versus the US dollar.

- Decline capped by the 20.85 support area.

- Emerging market currencies remains resilient despite market sentiment.

The USD/MXN dropped on Monday to 20.82, reaching the lowest level in ten days and extended the correction from the 21.50 area. The pair is hovering around the critical support area of 20.85.

On Monday, equity markets are posting gains supporting the demand for emerging market currencies. The strength is being offset by the correction in commodity prices. Crude oil falls more than 8%.

The war in Ukraine remains the key event. Market participants await the new conversations. Also relevant is the FOMC meeting. The Federal Reserve is expected to announce a rate hike on Wednesday. Banxico will likely do the same next week. US yields are rising significantly, with the 10-year yield at 2.09%, and the 30-year at 2.45%, both at levels not seen in months.

Among EM currencies, the Russian ruble is the best performer on Monday, followed by the Polish zloty. Latin American currencies are modestly higher.

USD/MXN testing support

The USD/MXN is trading around 20.85, a relevant support that, if broken should clear the way to an extension toward 20.70. Below, the next strong barrier is seen at 20.50. On the upside, a recovery back above 21.00/05 would give momentum to the US dollar. The next resistance at 21.30 seems far for the moment and it should hold initially if tested over the next session.

Technical levels

- The NZD/USD gave way to 0.6800 as market sentiment, and the Fed’s first rate hike looms.

- Geopolitics: Russia-Ukraine finally progressed in their talks, but attacks persist.

- NZD/USD Price Forecast: A daily close under 0.6800 would exacerbate a move towards 0.6700 and beyond.

The NZD/USD carried on last Friday’s sentiment as a risk-off market mood dented appetite for riskier assets, meaning commodity-linked currencies and high beta ones. At press time, the NZD/USD is trading just above last Friday’s 0.6797 low, but 0.07% down.

Risk-aversion in the financial market remains. Although news over the weekend indicates that Russia-Ukraine talks finally have progressed, the sentiment would remain fragile. Noteworthy that US Deputy Secretary of State Sherman commented that Russia showed signs of willingness to engage in substantial negotiations about ending the conflict. However, attacks on Ukraine still.

Furthermore, in the Asian session, the sharp pick-up of Covid 19 cases has put Shanghai and Shenzhen into lockdown, suggesting that Chinese authorities are not prepared to back away from their zero-tolerance posture.

Sentiment and the first-rate hike of the Federal Reserve in the middle of the week would keep the NZD/USD pressured. In the last week, US inflation peaked at around 7.9% y/y, its highest level in four decades, though in line with expectations and the previous reading. However, traders would need to be aware that the survey does not reflect the crude oil rally spurred by Russia’s invasion of Ukraine, which will be noted in the next month.

An absent New Zealand and US economic docket would keep traders adrift to market mood. Late in the Asian session, New Zealand would report the Services PMI, whilst the US docket would reveal Producer Price Index (PPI), and the New York Empire State Manufacturing Index.

NZD/USD Price Forecast: Technical outlook

The NZD/USD is downward biased, though trading near the 100-day moving average (DMA) at 0.6821. Overnight, the pair dipped towards the 50% Fibonacci level at 0.6778, though it jumped to near the 0.6800 mark. Since then, the NZD/USD has been seesawing up/down the figure.

IF NZD/USD bull would like to remain hopeful of higher prices, they would need to hold the NZD/USD above 0.6800. A breach of the latter would exacerbate a downward move, which could push the pair lower. The first support would be the 50% Fibonacci and today’s low at 0.6773. Once giving way, the next stop would be the 61.8% Fibonacci at 0.6743, immediately followed by the 78.6% retracement at 0.6693.

Economists at Wells Fargo expect a period of elevated volatility but ultimately a stable US dollar through the end of Q1-2022. Over time, as financial markets are priced for too much tightening abroad, the dollar should strengthen.

US dollar to move sideways in the first quarter of the year

“Through Q1-2022, we believe the US dollar will move sideways, although volatility will remain elevated as headlines surrounding the war in Ukraine evolve.”

“Over the longer-term, we maintain our view for a prolonged period of dollar strength. We believe the Fed will raise interest rates at a faster pace relative to foreign central banks, while financial markets may be priced too aggressively for tightening abroad.”

“As markets adjust to a slower pace of interest rate hikes abroad, the US dollar should strengthen against most G10 and emerging market currencies.”

The Russian invasion of Ukraine has sent oil prices soaring. Even if the war comes to an end in the near-term, strategists at Wells Fargo believe the West will continue to shun purchases of Russian oil for the foreseeable future. Consequently, they forecast that oil prices will remain elevated in coming quarters.

West will continue to shun purchases of Russian oil for the foreseeable future

“Even if the conflict comes to an end in the near term, we think the West will continue to shun purchases of Russian oil for the foreseeable future.”

“We have lifted our oil price forecast significantly and now look for the price of Brent Oil, a global benchmark, to average $140 per barrel in Q2-2022.”

“We forecast that the price will slowly recede in following quarters due to the combination of demand destruction from higher prices and a ramp-up in supply from other major oil-producing countries, including the United States.”

- USD/TRY reverses Friday’s losses and retests 14.90.

- Risk-on sentiment keeps weighing on the dollar.

- The CBRT is expected to leave rates unchanged this week.

The Turkish lira gives away initial gains and now pushes USD/TRY back to the proximity of the 15.00 mark on Monday.

USD/TRY: Upside capped by 15.00

USD/TRY leaves behind Friday’s inconclusive price action and resumes the upside despite the soft note in the greenback and the sharp decline in crude oil prices.

Indeed, the Turkish lira fails to capitalize the better mood in the risk complex and remains under pressure, retargeting at the same time the 2022 peaks around the 15.00 mark recorded on March 11.

Moving forward, the lira is expected to remain under pressure considering the FOMC and the Turkish central bank (CBRT) events on Wednesday and Thursday, respectively. Against that, consensus keeps pointing to a 25 bps interest rate hike by the Fed, while the CBRT is seen keeping the One-Week Repo Rate unchanged at 14.00%.

What to look for around TRY

The lira resumed the downtrend in past sessions, leaving behind three months of consolidative behaviour. Further lira depreciation came in response to higher crude oil prices following the deterioration of the geopolitical landscape in Ukraine along with the view that the Fed will start hiking rates as soon as this week. Extra risks facing the Turkish currency also come from the domestic backyard, as inflation gives no signs of easing, real interest rates remain negative and the political pressure to keep the CBRT biased towards low interest rates remain omnipresent.

Key events in Turkey this week: Budget Balance (Tuesday) – CBRT Meeting (Thursday).

Eminent issues on the back boiler: Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Earlier Presidential/Parliamentary elections?

USD/TRY key levels

So far, the pair is gaining 0.20% at 14.8056 and a drop below 13.7143 (low Feb.25) would expose 13.5091 (low Feb.18) and finally 12.4317 (low Feb.11). On the other hand, the next up barrier lines up at 14.9889 (2022 high Mar.11) seconded by 18.2582 (all-time high Dec.20) and then 19.00 (round level).

Economists at Commerzbank expect the EUR/PLN pair to drift slightly lower to the 4.70 level during 2022. In 2023, the pair is likely to begin to trend down towards 4.65.

EUR/PLN to trade sideways from here

“Our base-case is that EUR/PLN will trade sideways at around the 4.70 level through to year-end. Even if the military situation were to calm down, monetary tightening by the Fed and ECB will leave its mark on EM assets, which will prevent a noticeable recovery of the zloty.”

“In 2023, we see EUR/PLN gravitate towards the 4.65 level assuming that the worst of the inflation cycle will come into view by then.”

Senior Economist at UOB Group Alvin Liew comments on the latest release of US inflation figures, which saw the CPI rise at the fastest pace since 1982 in February.

Key Takeaways

“US CPI data showed headline inflation surged further by 7.9% y/y in Feb, a new record pace in 40 years since Jan 1982 while core inflation also rose further to 6.4% y/y, highest since Aug 1982. Both inflation prints came exactly in line with Bloomberg estimates.”

“The headline and core CPI inflation not only acclerated but also remained broad-based with price pressures spreading further among the main categories within the CPI basket.”

“We are further upgrading our 2022 CPI inflation forecast to average 6% (from previous forecast of 5%) while the core CPI inflation forecast average is also higher at 5.5% (from previous forecast of 4.5%) due to the confluence of Omicron-related factors (in terms of material but temporary disruption to supply chains, worsening logjams and labor shortages) and commodity price spike. Subsequently, we expect both headline and core inflation to ease in 2023 to average 2.5% (from 2% previously).”

- EUR/USD looks firm and rebounds to the proximity of 1.1000.

- Immediately to the upside aligns the weekly low at 1.1121.

EUR/USD gathers some upside traction and bounces off earlier lows in the 1.0900 neighbourhood on Monday.

In case bulls regain the upper hand, then EUR/USD could extend the rebound to the weekly top at 1.1121 (March 10) prior to the interim barrier at the 20-day SMA at 1.1146. The selling pressure is seen alleviated once the pair clears the 6-month resistance line, today around 1.1300.

The negative outlook for EUR/USD is expected to remain unchanged while below the key 200-day SMA, today at 1.1553.

EUR/USD daily chart

- The Australian dollar extends losses to two-wek lows at 0.7230.

- Concerns about the Ukranian war are hurting the Aussie.

- AUD/USD likely to consolidae between 0.7200 and 0.7340 – UOB Group.

The Australian dollar has failed to regain footing and keeps pushing lower on Monday, extending the last two weeks’ negative trend. The pair attempted to bounce up from March lows at 0.7230 earlier today although it remains unable to extend beyond the 0.7250 area.

Geopolitical tensions are hurting the Aussie

The slightly brighter market sentiment has failed to lift the risk sensitive AUD, which has depreciated about 2.7% after peaking at 0.7440 last Monday.

Aussie’s demand remains weighed by concerns about the Eastern European conflict. The milder market optimism triggered by the talks between Russian and Ukrainian representatives, which have pushed European and most Asian markets into positive territory, has failed to alter AUD’s bearish trend so far.

In absence of key macroeconomic data today, all eyes will be on the release of the minutes of the Reserve Bank of Australia’s latest meeting, due on Tuesday, and the outcome of the US Federal Reserve’s monetary policy meeting, which are likely to set AUD/USD’s near-term path.

AUD/USD expected to consolidate above 0.7200 – UOB Group

From a slightly wider perspective, the FX Analysis team at UOB sees the pair bottoming near recent lows and capped below 0.7400 over the coming weks: “While 0.7250 is not breached, the build-up in momentum has more or less fizzled out. In other words, AUD is still likely in a consolidation phase and is expected to trade between 0.7200 and 0.7370.”

Technical levels to watch

NZD/USD is also to see further strength post the current setback. The kiwi should retest the 200-day moving average (DMA) at 0.6924/26, in the opinion of analysts at Credit Suisse.

Support at 0.6742/35 set to hold to prevent further setback

“NZD/USD closed last week lower and is showing further weakness on Monday. Our bias though is for this to be only a correction lower and we look for the 0.6775 support to ideally hold for a return back above the recent price high and the 50% retracement of the October down move at 0.6872/75.”

“Beyond 0.6872/75 should raise the risk back higher again for a renewed test of the moving 200-DMA and the YTD high at 0.6920/26. Above here, next formidable resistance is seen at the 50% retracement of the 2021/22 down move at 0.6993/97.

“Below 0.6775/73 can see weakness extend to the 55-DMA at .06742/35 but with a good floor still expected here. A close below here though would see the risk back lower again with support then seen next at the recent spike low at 0.6630/29, then 0.6601/6589.”

The GBP/USD pair remains on a clear downward trend. Economists at Scotiabank believe that the cable could nosedive as low as the 1.25 level.

GBP/USD may see a consolidation phase around the key 1.30 level

“Cable aims for a break under 1.30. Sterling faces no clear support until the mid-1.28s that marked the lows of Oct/Nov of 2020, with losses possibly mounting quickly toward 1.25.”

“The pound is back in oversold territory which may trigger a consolidation period around the key 1.30 figure level, while upward movement faces resistance at ~1.3050 followed by the 1.31 zone and ~1.3130.”

GBP/USD remains under pressure after seeing a clear break of medium-term support at 1.3172/21. Economists at Credit Suisse look for further weakness to 1.2855/29.

Downtrend to extend with next key support seen at 1.2855/29

“We see scope for a near-term bounce from Fibonacci projection support at 1.3011 but with strength seen as temporary ahead of further weakness in due course with support then seen next at the lower end of the nine-month channel at 1.2966.”

“Whilst a fresh hold at 1.2966 will be looked for our core outlook stays lower for an eventual fall to what we see as more meaningful support at the 50% retracement of the uptrend from 2020 and November 2020 low at 1.2855/29.”

“Resistance is seen at 1.3082 initially, then 1.3142, with resistance at 1.3195 ideally capping to keep the immediate risk lower.”

EUR/USD has bounced off the 1.09 level to reverse the bulk of Friday’s losses. However, economists at Scotiabank expect the pair to remain under pressure while below the 1.10 mark.

Technical picture remains decidedly bearish

“Despite today’s gains the EUR technical picture remains decidedly bearish.”

“The currency will need to at least test the 1.10 level shortly (after the intraday peak of 1.0990) or risk the broader downtrend continuing to weigh on it to a re-test of 1.08 in the coming days.”

“The mid-1.10s stand as resistance after the figure.”

“Support below 1.0940/50 is the 1.09 area followed by the 1.0850 zone.”

USD/CHF closed last week with a sharp move above the April downtrend at 0.9331/43 and is showing signs of further strength on Monday. In the opinion of analysts at Credit Suisse, a sustained break above 0.9367/75 is needed to signal a potential fresh medium-term uptrend.

Move above November 2021 high at 0.9375 needed raise prospects of fresh uptrend

“Although the break above 0.9331/43 has now turned the risk for a medium-term upmove back higher we wait to see whether the recovery can continue above the major medium-term resistance at the November high at 0.9367/75.”

“Only a sustained break above 0.9367/75 would confirm the recent strength and raise a prospect of a fresh medium-term uptrend emerging clearing the way for strength back to the 0.9473 high of last year and likely higher we think in due course.”

“Support at 0.9288 holding can keep the immediate risk higher. A break can see a move back to the middle of the short-term range at 0.9250/48, but with a move below here seen needed to turn the risk back lower again for a test of the mid-February lows at 0.9150/42.”

A Ukrainian negotiator said on Monday that official talks with Russia had been paused until Tuesday, as reported by Reuters.