- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 14-02-2023

- USD/CAD remains sidelined after reversing from two-week low.

- Bullish candlestick formation, clear bounce off 1.3270 support confluence lure buyers.

- November 2022 low adds to the downside filters.

USD/CAD treads water around 1.3330 during early Wednesday, following a volatile day that initially refreshed two-week bottom before bouncing off the 1.3270 support confluence to end the day near 1.3337. In doing so, the Loonie pair portrayed a bullish Doji candlestick on Tuesday.

Not only the candlestick and the recovery from the convergence of the 200-day Exponential Moving Average (EMA) and a three-month-old ascending trend line but steady RSI (14) and a lack of bearish MACD signals also underpin the bullish bias for the USD/CAD pair.

That said, the 21-day EMA level surrounding 1.3385 guards immediate USD/CAD rebound ahead of the 1.3400 round figure and the monthly peak of near 1.3475.

Following that, a run-up towards the January 19 swing high of 1.3520 and then to the previous monthly high near 1.3685 can’t be ruled out.

On the flip side, the aforementioned support confluence challenges the USD/CAD bears around 1.3270, a break of which will need validation from the lows marked in February 2023 and November 2022, respectively near 1.3260 and 1.3225, to convince Loonie pair bears.

Even so, the 1.3200 threshold could act as the last defense of the pair buyers.

Overall, USD/CAD is up for a short-term rebound but the buyers seek validation from the 21-day EMA.

USD/CAD: Daily chart

Trend: Recovery expected

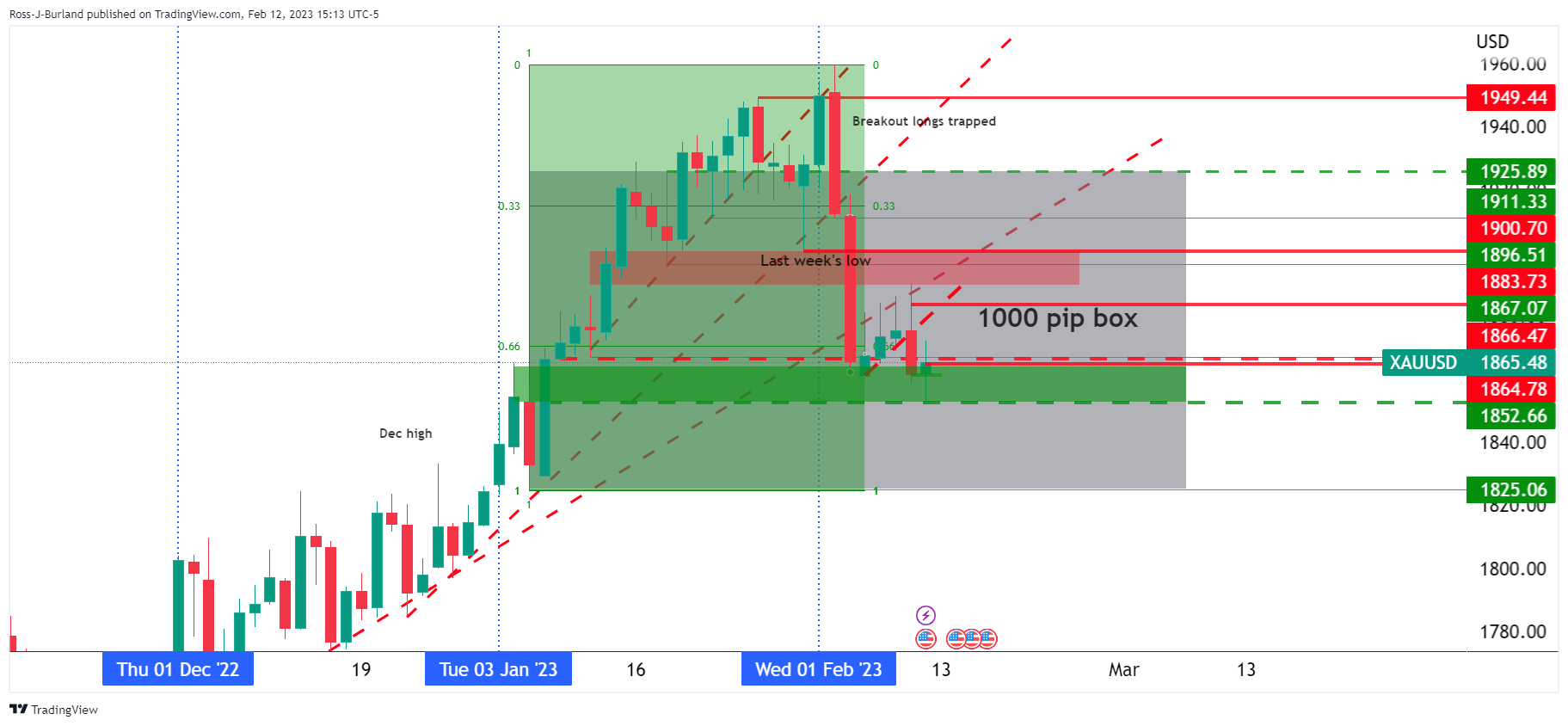

- Gold price remains depressed around six-week low after a volatile day.

- Federal Reserve officials remained hawkish on interest rates despite softer United States inflation.

- Fed talks weighed on XAU/USD via upbeat US Treasury bond yields, US Dollar.

- Risk catalyst, US Retail Sales eyed for fresh impulse.

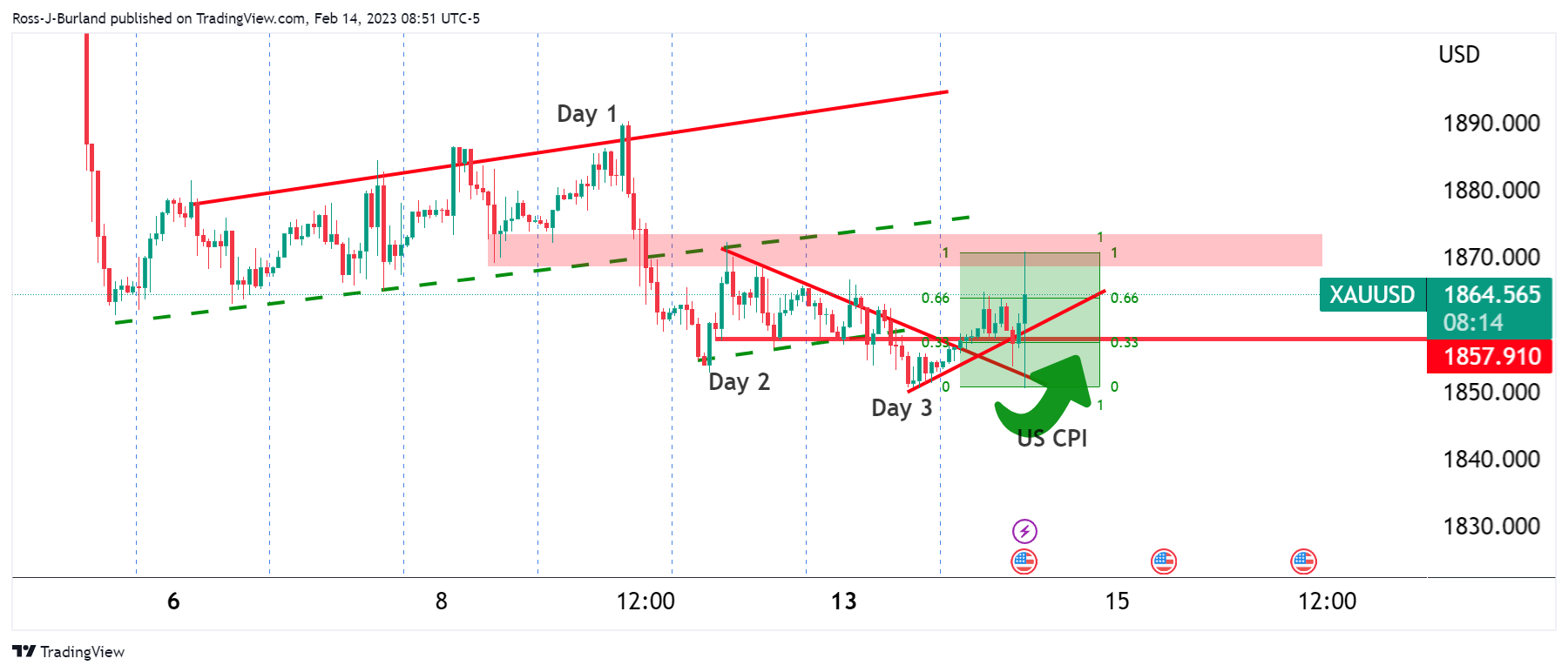

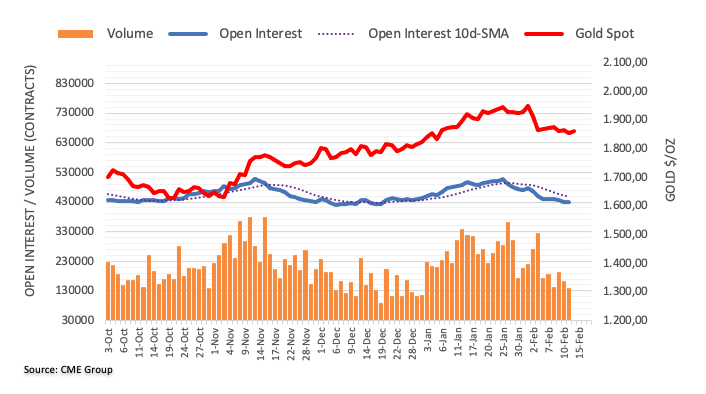

Gold price (XAU/USD) prints mild losses around the mid-$1,800s, fading the bounce off a 1.5-month low, as traders await more clues to extend the United States inflation-inflicted downside during early Wednesday. Even so, the hawkish Federal Reserve comments and technical breakdown keep the XAU/USD bears hopeful of keeping the reins ahead of the US Retail Sales.

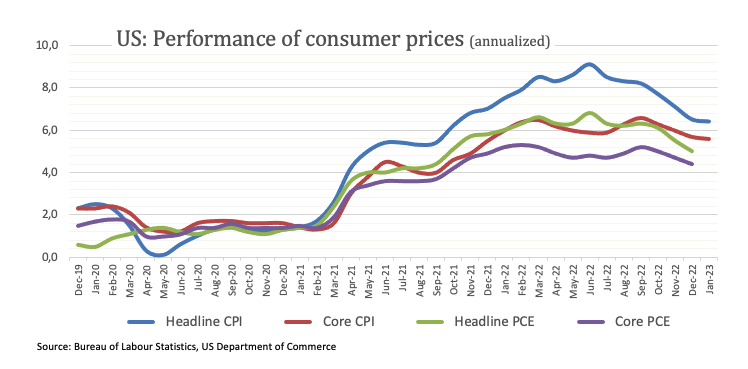

United States Inflation eased

The United States Consumer Price Index (CPI) rose past market expectations to 6.4% YoY but posted the slowest increase since 2021 while easing below 6.5% prior. More importantly, CPI ex Food & Energy, better known as the Core CPI, grew 5.6% YoY compared to 5.5% market forecasts and the 5.7% previous readings. Following the data, the US Dollar renewed its intraday low before the Federal Reserve (Fed) talks propelled the US Treasury bond yields and the US Dollar, which in turn weighed on the Gold price.

Federal Reserve hawks remain in the driver’s seat

Most of the Federal Reserve (Fed) policymakers were in favor of further rate hikes even as the United States inflation failed to match “positive surprise” hopes. The same propelled the US Treasury bond yields and US Dollar. That said, Dallas Fed President Lorie Logan stated that they must remain prepared to continue rate increases for a longer period than previously anticipated. On the same line was New York Fed President John Williams who noted that the work to control too high inflation is not yet done. Additionally, Philadelphia Fed President Patrick Harker signaled that they are not done (with lifting rates), but they are likely close.

Recovery in US Treasury bond yields weighs on Gold price

Given the Federal Reserve (Fed) officials’ hawkish comments, despite unimpressive United States inflation, the US Treasury bond yields refreshed their monthly high and allowed the US Dollar buyers to return following an initial dip to refresh the weekly low. T

US 10-year Treasury bond yields seesaw around 3.75%, up three basis points (bps) after refreshing a six-week high whereas the two-year counterpart jumped to the highest level since early November 2022 by poking 4.62%. That said, the US Dollar Index (DXY) bounced off one week low to end the day on the positive side near 103.25. Further, Wall Street closed mixed even after the mostly upbeat performance of the Asian and European markets.

XAU/USD bears need validation from US data

Although the Fed hawks joined the technical breakdown to tease the Gold bears, the metal’s further downside hinges on how well the scheduled United States data can entertain the XAU/USD sellers. Among them, US Retail Sales for January, expected 1.8% versus -1.1% prior, will be closely watched for clear directions. Should the data manage to reverse the previous monthly contraction, the odds of witnessing further XAU/USD downside can’t be ruled out.

Other than the data, fears surrounding the US-China geopolitical ties and the Federal Reserve (Fed) talks will also be important for Gold traders to watch for clear directions.

Gold price technical analysis

Gold price portrays the first daily closing below the 50-DMA since early November 2022 and joins the bearish signals from the Moving Average Convergence and Divergence (MACD) to keep the sellers hopeful. Also favoring the downside bias is the Relative Strength Index (RSI) line, placed at 14, as well as a sustained break of the previous support line stretched from late November.

That said, the XAU/USD appears vulnerable to testing the 38.2% Fibonacci retracement level of the Gold price upside from September 2022 to February 2023, near $1,827. However, a six-month-old horizontal support region, around $1,805, could challenge the metal sellers afterward.

On the contrary, the 50-DMA and the multi-day-old previous support line, respectively near $1,860 and $1,878, can cap short-term XAU/USD rebound before highlighting the previous weekly top surrounding $1,890 as the hurdle for the Gold buyers.

It’s worth noting that the Gold price upside remains elusive unless the quote remains successfully above the $1,900 threshold.

Gold price: Daily chart

Trend: Further downside expected

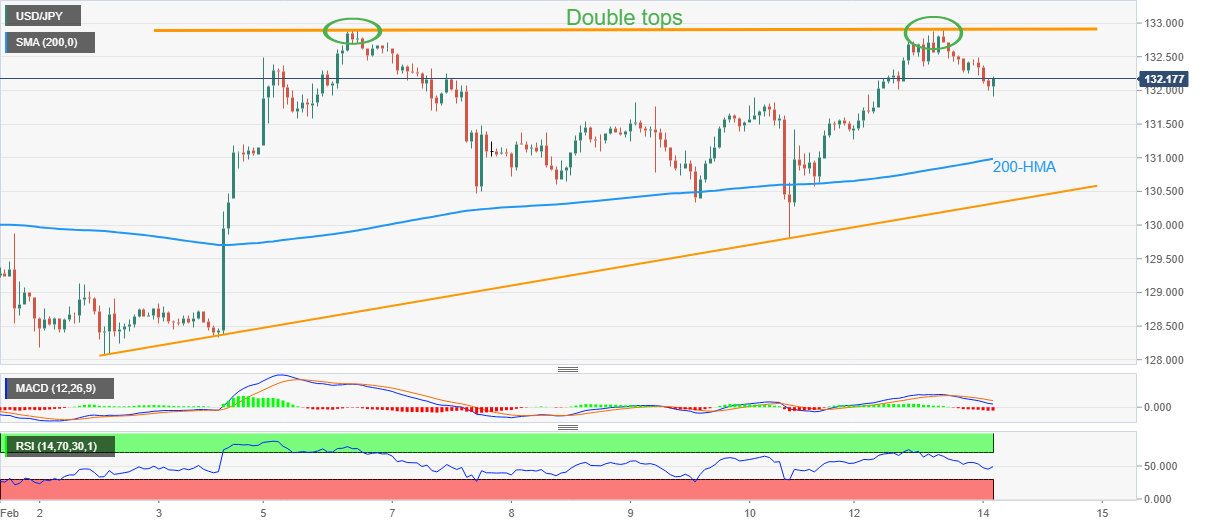

- USD/JPY bulls are in the market and pushing the price into the 133 area.

- US CPI supported the US Dollar while the new BoJ head stays the course with YCC.

USDJPY is flat in early Asia, consolidating the overnight volatility that occurred in a relatively standard range as the market continues to try to second-guess the Federal Reserve's next move based on the latest data. The pair rallied to a high of 133.31 from a low of 131.498.

First of all, the Yen was initially bid on the back of the surprise choice in the new Bank of Japan's governor Academic Kazuo Ueda who faces a rocky time. ''He is respected but as an outsider lacks factional support within the financial bureaucracy and faces an unpopular prime minister pushing an expensive agenda,'' reporters at Reuters wrote.

It was anticipated that Ueda would have to modify or abandon YCC given how much damage it is doing to the bond market and the BOJ’s balance sheet. But he is unlikely to start normalising rates straight away and he announced that the central bank will need to stick with the YCC. Speaking on Japanese TV, earlier in the week, Ueda remarked that it is important for the BoJ to keep easing for now. As a consequence, JPY gave back many of its initial gains ahead of the US Consumer Price Index on Tuesday.

''Assuming some relaxation in YCC, we see scope for a move to USD/JPY128 on a 3 month view. However, a hawkish Fed is likely to limit the scope for JPY appreciation,'' analysts at Rabobank said.

The annual inflation rate in the US, as measured by the Consumer Price Index, slowed only slightly to 6.4% in January from 6.5% in December, less than market forecasts of 6.2%, suggesting that getting inflation under control will take more time than expected.

The US Dollar index traded around 103.00 on Tuesday but posied higher due to the hotter-than-expected US inflation dashing hopes that the Federal Reserve will soon end its tightening campaign.

- EUR/JPY printed a fresh YTD high and approached the 143.00 mark.

- EUR/JPY Price Analysis: Turned bullish bias after cracking the February 13 daily high of 142.38.

The EUR/JPY extends its weekly gains to two straight days and hit a fresh YTD high at 142.94 before trimming some of Tuesday’s gains. As Wednesday’s Asian session begins, the EUR/JPY exchanges hands at 142.85, below its opening price by a minuscule 0.03%.

After the EUR/JPY failed to crack below the YTD low of 137.38, the EUR/JPY enjoyed a bounce, which lifted the pair towards its YTD high of 142.94. Even though it took almost one and a half months, the EUR/JPY pair shifted to a neutral-bullish biased, meaning that further upside is expected.

If the EUR/JPY clears 143.00, the next resistance would be the psychological 144.00 figure, ahead of the December 20 swing high at 145.83. As an alternate scenario, the EUR/JPY first support would be the February 13 daily high of 142.38, ahead of the 142.00 price level. A decisive break and the pair might fall towards a busy confluence area of the 100/50/20-day Exponential Moving Averages (EMAs), each at 141.73, 141.62, and 141.40, respectively, ahead of the 200-day EMA at 140.38.

Oscillators like the Relative Strength Index (RSI) aim higher, while the Rate of Change (RoC) indicates that buyers are gathering momentum. Therefore, the first above-mentioned scenario it’s most likely to pan out.

EUR/JPY Daily chart

EUR/JPY Key technical levels

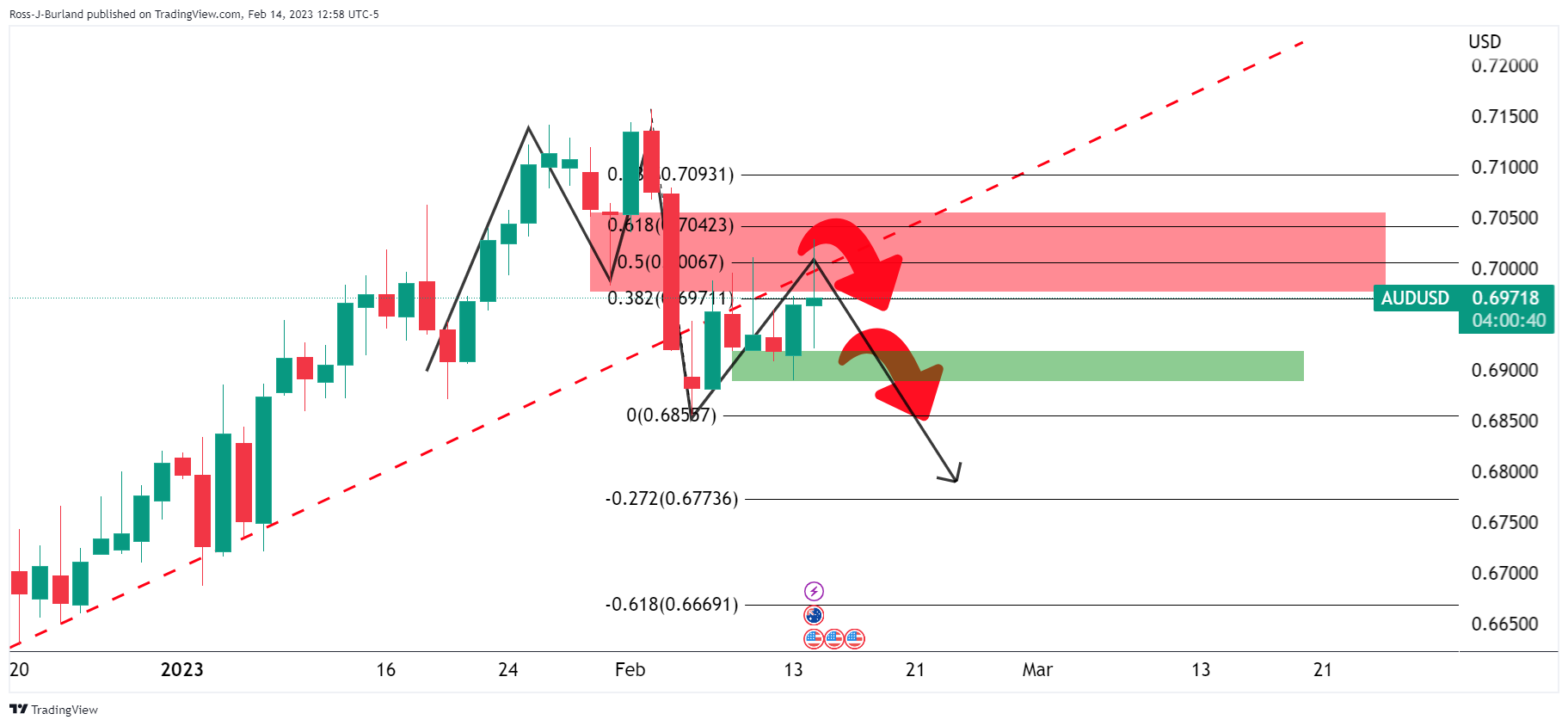

- AUD/USD fades upside momentum after refreshing one-week high, probes two-day winning streak.

- US Dollar traces yields to rebound despite softer US inflation data, hawkish Fed talks are the key.

- RBA’s Lowe should be observed amid hawkish rate hike and mixed monetary policy statement, as well as upbeat data.

- Strong US numbers could justify hawkish Fed and keep the Aussie bears hopeful.

AUD/USD prints mild losses around 0.6980, the first in three days, as market players await the next round of catalysts during early Wednesday after the US inflation data offered a volatile Tuesday. Other than the cautious mood ahead of the data/events, recently hawkish Federal Reserve (Fed) comments also weigh on the risk-barometer Aussie pair.

Most of the Fed policymakers were in favor of further rate hikes even as the US inflation failed to match “positive surprise” hopes. The same propelled the US Treasury bond yields and US Dollar. At home, upbeat Aussie data and cautious optimism allowed the quote to remain firmer before the US data.

That said, Australia’s NAB Business Confidence rose to 6.0 in January, from -1.0 prior and 1.0 expected while the NAB Business Conditions rallied to 18.0 compared to 8.0 expected and 12.0 prior. It’s worth noting that Australia’s Westpac Consumer Confidence, flashed earlier on Tuesday, dropped to -6.9% for February versus 5.0% prior.

On the other hand, US Consumer Price Index (CPI) rose past market expectations to 6.4% YoY but posted the slowest increase since 2021 while easing below 6.5% prior. More importantly, CPI ex Food & Energy, better known as the Core CPI, grew 5.6% YoY compared to 5.5% market forecasts and the 5.7% previous readings. Following the data, the US Dollar renewed its intraday low before the Federal Reserve (Fed) talks propelled the US Treasury bond yields and the US Dollar.

Despite the unimpressive increase in inflation, Dallas Federal Reserve President Lorie Logan stated that they must remain prepared to continue rate increases for a longer period than previously anticipated. On the same line was New York Fed President John Williams who noted that the work to control too high inflation is not yet done. Additionally, Philadelphia Fed President Patrick Harker signaled that they are not done (with lifting rates), but they are likely close.

Against this backdrop, US 10-year Treasury bond yields seesaw around 3.75%, up three basis points (bps) after refreshing a six-week high, which in turn allowed the US Dollar to bounce off one week to end the day on a positive side. Further, Wall Street closed mixed even after the mostly upbeat performance of the Asian and European markets.

Looking ahead, Reserve Bank of Australia (RBA) Governor Philip Lowe is up for a testimony before the Senate Economics Legislation Committee and will need to justify the latest hawkish monetary policy actions to push back the AUD/USD bears. Following that, US Retail Sales for January, expected 1.8% versus -1.1% prior, will be closely watched for clear directions.

Technical analysis

Although the 21-DMA hurdle surrounding 0.7010 restricts the AUD/USD pair’s immediate upside, recently improving RSI (14) and sustained trading beyond the 50-DMA, around 0.6885 at the latest, seem to keep the Aussie pair buyers hopeful.

The Hong Kong Monetary Authority has intervened in the market and this has sent the Hong Kong Dollar higher within its permitted trading range as follows:

Hong Kong uses a linked exchange rate system, trading since May 2005 in the range US$1:HK$7.75–7.85

British Prime Minister Rishi Sunak and finance minister Jeremy Hunt are considering a deal to end a wave of strikes among Britain's public sector workers that would backdate next year's pay rise, the Financial Times (FT) reported on Tuesday per Reuters.

Developing story

- Silver price stumbles below the 200-day EMA at $21.95, shifting its bias to neutral-downwards.

- XAG/USD Price Analysis: Shifted neutral-to-downwards, though two more closes below the 200-DMA would cement its downward bias.

Silver price continues to trade beneath the bottom-trendline of a megaphone formation and below the 200-day Exponential Moving Average (EMA) at 21.95, a bearish signal for the white metal. It should be said that a daily close below the latter would pave the way for further downside. At the time of writing, XAG/USD exchanges hands at $21.84 a troy ounce after hitting a daily high of $22.03.

After dropping below the bottom-trendline of a megaphone formation, the XAG/USD has failed to regain the $22.50 mark and exposed the 200-day EMA. A daily close is needed to further cement a change on the neutral bias to neutral-downwards, and it will expose untested support areas since December of 2022.

If that scenario plays out, the XAG/USD first support would be the November 28 daily low of $20.87, followed by the November 21 swing low of $20.59. Once cleared, the psychological level of $20.00 would be up for grabs.

In an alternate scenario, the XAG/USD first resistance would be the 200-day EMA at $21.94, ahead of the $22.00 figure. Once broken, Silver could aim inside the megaphone formation, but firstly it needs to crack the bottom trendline at $22.20.

It should be said that oscillators like the Relative Strength Index (RSI) suggest a bearish continuation, but the Rate of Change (RoC), confirms that sellers are losing momentum. Hence, the XAG/USD might consolidate around the $21.60-$22.00 area, awaiting a fresh catalyst before determining its direction.

XAG/USD Daily chart

XAG/USD Key technical levels

- EUR/USD remains steady after a volatile day, positive on the week so far.

- US inflation data came in better than forecast but came in below previous readings in January.

- Hawkish Fed talks propelled US Treasury bond yield and US Dollar.

- An absence of hawkish tone in Lagarde’s speech, upbeat US data needed for further downside.

EUR/USD seesaws around 1.0730 after a volatile Wednesday that initially refreshed the weekly top before posting a 100-pip fall and then bouncing off 1.0706. In doing so, the major currency pair struggles for clear directions but defends the policymakers’ hawkish bias for the Federal Reserve (Fed) rates, despite unimpressive US and European data, mainly the US inflation.

That said, the US Consumer Price Index (CPI) rose past market expectations to 6.4% YoY but posted the slowest increase since 2021 while easing below 6.5% prior. More importantly, CPI ex Food & Energy, better known as the Core CPI, grew 5.6% YoY compared to 5.5% market forecasts and the 5.7% previous readings. Following the data, the US Dollar renewed its intraday low before the Federal Reserve (Fed) talks propelled the US Treasury bond yields and the US Dollar.

While considering the data, Dallas Federal Reserve President Lorie Logan stated that they must remain prepared to continue rate increases for a longer period than previously anticipated. On the same line was New York Fed President John Williams who noted that the work to control too high inflation is not yet done. Additionally, Philadelphia Fed President Patrick Harker signaled that they are not done (with lifting rates), but they are likely close.

On the other hand, the preliminary readings of the Eurozone fourth quarter (Q4) Gross Domestic Product (GDP) matched 0.1% QoQ and 1.9% YoY forecasts while reprinting the previous figures.

Following the data, European Central Bank (ECB) Governing Council member Gabriel Makhlouf said, “ECB could raise rates above 3.5% and hold them there for the remainder of the year,” per the Wall Street Journal (WSJ). Earlier on Tuesday, ECB policymaker Mario Centeno said that the full impact of rate hikes may not reach the European economy.

Amid these plays, US 10-year Treasury bond yields seesaw around 3.75%, up three basis points (bps) after refreshing a six-week high, which in turn allowed the US Dollar to bounce off one-week to end the day on a positive side. Further, Wall Street closed mixed even after the mostly upbeat performance of the Asian and European markets.

Moving on, ECB President Christine Lagarde’s speech and monthly prints of the US Retail Sales for January, expected 1.8% versus -1.1% prior, will be closely watched for clear directions. Given the recent risk-off mood and firmer yields, the EUR/USD sellers are likely to return to the table in case the scheduled data/events allow.

Technical analysis

Although failure to provide a daily close beyond the 21-day Exponential Moving Average (EMA), around 1.0770, appears elusive for EUR/USD bears unless the quote breaks the 50-day EMA support, near 1.0680 by the press time.

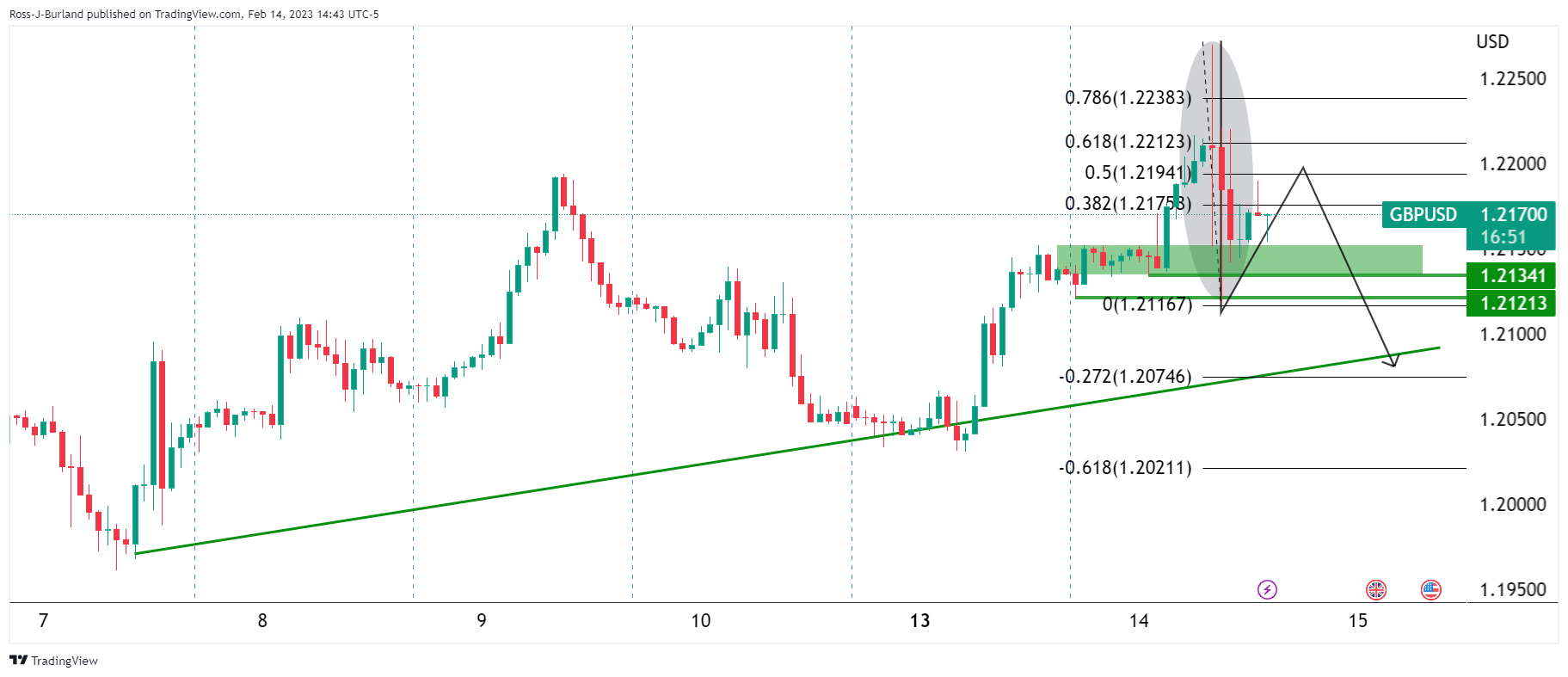

- GBP/USD bulls stay the course and eye a higher high for Wednesday.

- US Retail Sales are the next major news on the calendar.

GBP/USD rallied early on Tuesday after data showed British wages rose faster than expected in the last three months of 2022. The data raised the prospects of a more hawkish Bank of England as the inflation battle consumes sentiment in markets. In that regard, the US Consumer Price Index was the next key event for the pair with the data underpinning the outlook for further rate hikes from the Federal Reserve.

At the time of writing, GBP/USD is trading near 1.2170 and between the day's range of 1.2116 and 1.2269, a high reached as investors read that there are signs that price and wage rises are becoming entrenched, something that would typically boost the pound.

''Pay growth over recent months has still been strong enough, in our view, to justify another 25bp hike by the Bank of England at its March meeting, though of course, we’ll have had another labour market report by then (and two CPI prints,'' analysts at Nomura explained. Meanwhile, a Reuters poll of analysts that the Bank of England will hike by another 25 basis points on March 23, taking the main rate to 4.25%, and then pause.

As for the New York session, US inflation data hit the screens and caused two-way price action with the US dollar whipsawed around the numbers as investors tried to digest and draw conclusions from a mixed report. the data ultimately will help the Federal Reserve to decide on its interest rate plans for the coming months, and subsequently would be expected to drive markets globally for the coming days.

The annual inflation rate in the US, as measured by the Consumer Price Index, slowed only slightly to 6.4% in January from 6.5% in December, less than market forecasts of 6.2%, suggesting that getting inflation under control will take more time than expected. As a consequence, the US Dollar index traded in a volatile fashion around 103.00 but was posied higher due to the hotter-than-expected data that was regarded to be dashing hopes that the Federal Reserve will soon end its tightening campaign.

For Wednesday's key data in the US, analysts look for a strong rebound in retail sales following December's sharp contraction, with a surge in auto sales playing a significant role after consecutive declines in Nov-Dec. ''Importantly, control group sales likely also jumped owing to a strong showing in online spending. We also look for sales in bars/restaurants to have advanced (firmly) for the first time in three months.''

GBP/USD technical analysis

The price has picked up two days of longs in the market and tomorrow could be pulling in additional bullish bets as the bulls hunt down the 1.22 area. This could be offering the bears an opportunity on Wednesday:

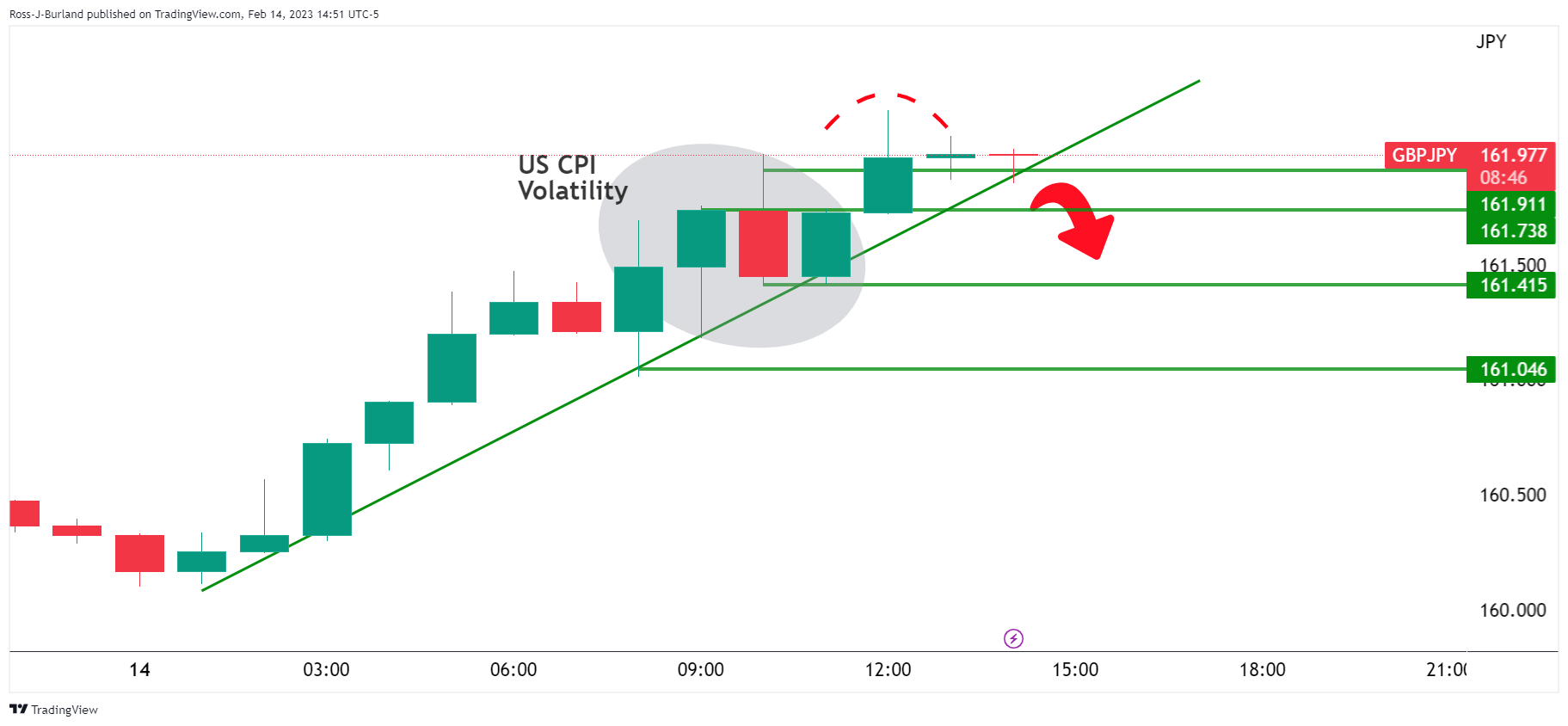

- GBP/JPY is a complicate mix between USD/JPY and GBP/USD.

- There are prospects of a move higher rin GBP/JPY as per the bull flag, but bears are lurking.

As per the prior analysis on the Yen, USD/JPY Price Analysis: Bullish fundamentals meet a technically bullish chart bias, the Japanese currency has indeed weakened and that is playing out through the crosses such as GBP/JPY.

USD/JPY daily charts, before & after

As seen, the Yen fell and USD/JPY is now above an old resistance. However, the W-formation is a reversion pattern sp this could keep the pair hamstrung, stalling the advance. Also, there has been as surprise pick in Kazuo Ueda who was nominated as the Bank of Japan's next governor and market chatter suggests he’s a pragmatist rather than a hawk or a dove.

Meanwhile, the following illustrates the bias at this point for a move lower given how far the Pound has rallied and Yen has fallen.

GBP/JPY H1 chart

a break of the trendline support opens risks of a move lower below 162.00.

GBP/JPY M15 chart

We have a potential topping pattern but the price needs to close sharply lower or it may otherwise be regarded as a bullish flag:

The 78.6% Fibonacci near 161.50 could be the trap door that the bears will want to break through to invalidate the bull flag thesis.

GBP/USD Price Analysis

Looking to GBP/USD, if the bears commit, then we could see a move below support and that could trigger a deep correction in GBP/JPY.

What you need to take care of on Wednesday, February 15:

Financial markets traded with an optimistic yet cautious tone throughout the first half of the day, as investors awaited the release of US inflation figures. The United States Consumer Price Index rose at an annualized pace of 6.4% in January, better than the previous 6.5% but missing the 6.2% expected.

Financial markets struggled with the figures, as inflation eased, but at a slower-than-anticipated pace. That means the US Federal Reserve could keep tightening the monetary policy until achieving its 2% target. Markets moved away from high-yielding assets, with Wall Street edging sharply lower and the US Dollar surging.

Comments from Dallas Federal Reserve President Lorie Logan added pressure on stocks, as she noted that “we must remain prepared to continue rate increases for a longer period than previously anticipated. Also, Federal Reserve Bank of New York President John Williams hit the wires and noted that the work to control too high inflation is not yet done. Finally, Philadelphia Fed President Patrick Harker reinforced the idea by saying they are not done, but they are likely close.

Across the pond, European Central Bank (ECB) Governing Council member Gabriel Makhlouf said on Tuesday that the ECB could raise rates above 3.5% and hold them there for the remainder of the year.

EUR/USD traded between 1.0700 and 1.0800 to finally settle at around 1.0730. GBP/USD peaked at 1.2268 but ended the day around 1.2160. The USD/JPY pair surged to end the day above 133.00.

AUD/USD hovers around 0.6980 as market players await Reserve Bank of Australia Governor Philip Lowe’s testimony before the Senate. USD/CAD trimmed early losses and stands in the 1.3340 region.

Spot gold dipped to 1,843.22 but ended the day above $1,850 a troy ounce. Crude oil prices are little changed on a daily basis, with WTI changing hands at $79 a barrel.

Like this article? Help us with some feedback by answering this survey:

- USD/CAD snapped two days of losses and rose towards 1.3350s on US inflation data.

- The US Consumer Price Index for January was mixed, with MoM aligned with estimates, while YoY figures were above forecasts.

- USD/CAD Price Analysis: Set for higher prices as a bullish engulfing pattern forms.

The USD/CAD braces to its early gains in the day, though it retreated after hitting a daily high of 1.3390 on news that inflation edged down, though it was above expectations. That increased demand for the greenback, which has remained bid, during the New York session. Hence, the USD/CAD is trading at 1.3352 after hitting a low of 1.3273

The US Bureau of Labor Statistics (BLS) reported that the Consumer Price Index (CPI) for January increased by 6.4% compared to the same period last year, which was higher than the predicted rate of 6.2%. Similarly, the core CPI rose by 5.6% year-on-year, above the estimated figure of 5.5%. Month-over-month data readings were consistent with the predicted values.

Following the release of the US inflation report, a slew of Federal Reserve (Fed) policymakers had crossed newswires. Officials expressed that the US central bank is not done hiking rates while emphasizing that inflation is high and that further tightening is needed. They stressed that higher-for-longer is their playbook and are not expecting to cut rates in 2023.

Given the backdrop, the USD/CAD remained on the front foot and was bolstered by falling US crude oil prices, with WTI dropping 1.53%. Money market futures estimate the Federal Reserve will hike above the 5% threshold, expecting the first rate cut by December 2023.

Aside from this, even though the Bank of Canada (BoC) is foreseen to raise rates further, the interest rate differential between both countries would benefit the US Dollar (USD). Therefore, further upside is expected on the USD/CAD pair.

What to watch?

The Canadian docket will feature housing and manufacturing data. The US economic calendar will unveil Retail Sales, the NY Fed Manufacturing Index, and Industrial Production.

USD/CAD Technical analysis

The USD/CAD daily chart suggests an upward reversion is forming, as Tuesday’s price action is engulfing the previous day. Therefore, a bullish engulfing candle pattern might open the door for further upside though solid resistance remains. The 20-day Exponential Moving Average (EMA), at around 1.3386, would be the bears’ first line of defense. A breach of the latter and 1.3400 is up for grabs, closely followed by the 100 and 50-day EMAs, each at 1.3408 and 1.3430.

Federal Reserve Bank of New York President John Williams has crossed the wires with a hawkish tone. He said on Tuesday that inflation remains too high and central bank action aimed at cooling price pressures will exact some unavoidable pain on the economy.

Reuters reported as follows:

Over the last year the Fed “has taken strong actions to bring inflation down,” Williams said in a speech prepared for delivery before a bankers’ group in New York. But, “although we have seen some moderation in recent months, the inflation rate remains far too high at 5%," and underlying rates of inflation are also too high, he said.

“We must restore balance to the economy and bring inflation down to 2% on a sustained basis,” Williams said, "Our work is not yet done," he said, adding "we will we stay the course until our job is done."

''Williams did not offer any firm guidance about the rate actions ahead of the Fed but he said the path the central bank must pursue “will likely entail a period of subdued growth and some softening of labor market conditions.”

''Williams said in his remarks that he believes core price pressures as measured by the core personal consumption expenditures price index could fall to 3% this year and to 2% over the next few years. ''

''Williams also said in his remarks that growth will likely come in at a tepid 1% this year. What is currently a 3.4% jobless rate will likely rise to between 4% and 4.5%, he said. He added the job market is currently “extremely tight” and wage gains are elevated.''

US Dollar update

The US Dollar index traded around 103.00 on Tuesday but posied higher due to the hotter-than-expected US inflation dashing hopes that the Federal Reserve will soon end its tightening campaign.

The annual inflation rate in the US, as measured by the Consumer Price Index, slowed only slightly to 6.4% in January from 6.5% in December, less than market forecasts of 6.2%, suggesting that getting inflation under control will take more time than expected.

The US labour demand will weaken on rising interest rates, south-dominated jobs recovery, Fitch Ratings has reported:

Fitch Ratings expects the US labor market to weaken as aggregate demand stagnates over the course of the year in response to the lagged effects of higher interest rates, according to a new Fitch report.

"The 517K payroll growth number for January 2023 was an upside surprise that is likely not going to be sustained." said Olu Sonola, Head of U.S. Regional Economics. "Job growth has decelerated in five of the last six months. U.S. labor market conditions are still very strong, but they look set to continue the cooling trend in 2023."

''Employment recovery in 2022 was dominated by the South, particularly in high wage industries, such as information, and professional and business services. Four states in the South (Texas, Florida, North Carolina and Georgia) accounted for approximately 50% of job growth in the information, and professional and business services sectors, relative to pre-pandemic levels. Weakness in these sectors in 2023 will likely be a drag on job growth in these four states.''

The note follows today's annual inflation rate in the US, as measured by the Consumer Price Index, slowing only slightly to 6.4% in January from 6.5% in December, less than market forecasts of 6.2%, suggesting that getting inflation under control will take more time than expected.

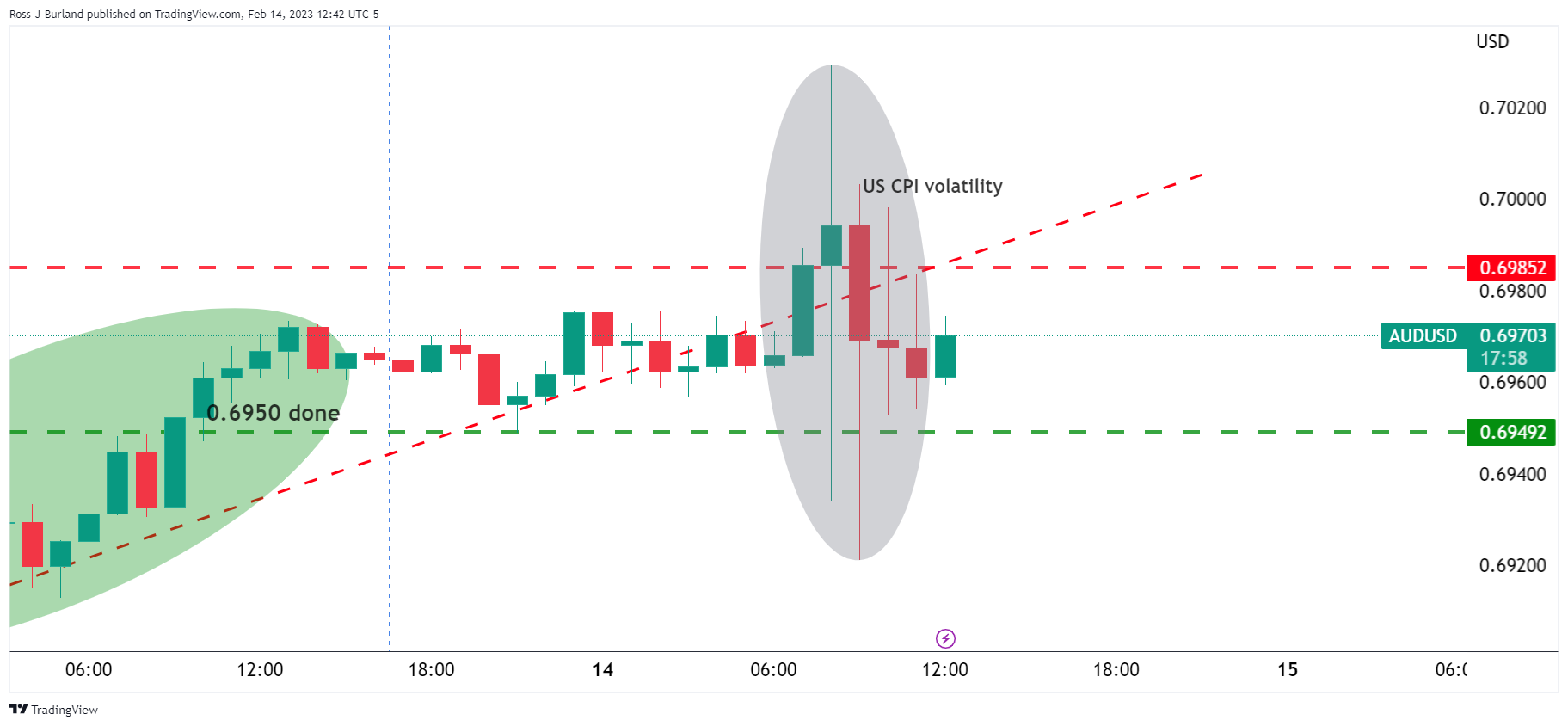

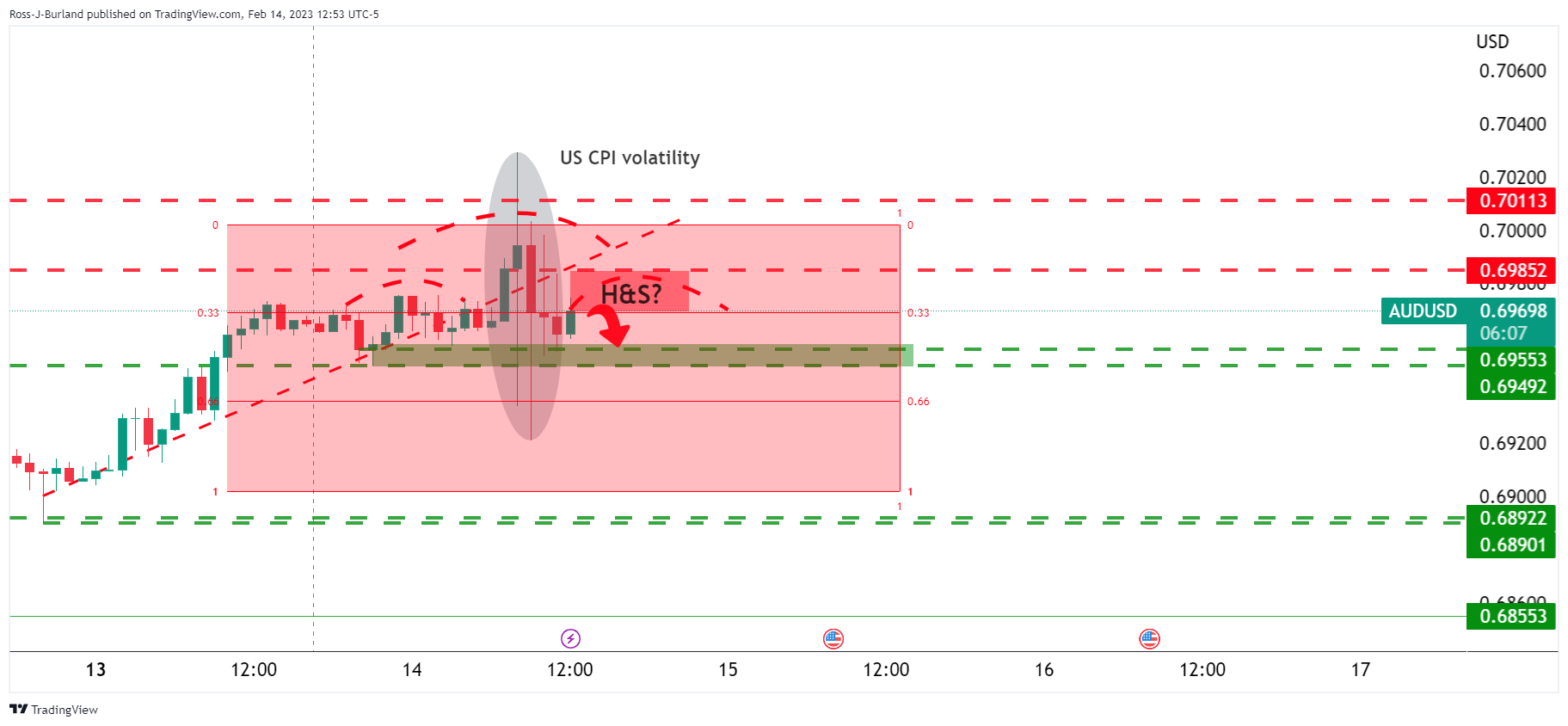

- AUD/USD bears are gathering with volume up high within the recent range.

- A breakout could be imminent and 0.6950/00 is the key.

In the opening article for the week on AUD/USD, AUD/USD Price Analysis: Key support in play with eyes on 0.6900/50 for the opening range, it was stated that on the hourly chart, ''we have 0.6950 to clear before a bullish thesis can be solidified, so it is a case of seeing how the opening range on Monday develops.''

However, while holding above the trendline and said support, there were prospects of a short squeeze to test 0.6950 for Monday and p[prospects of a move into low-hanging fruit below 0.6900 and into the 0.6880s beforehand:

AUD/USD updates

The target areas were done as illustrated above ahead of US CPI volatility on Tuesday:

The market was essentially stuck in a range into the data so picking which side to bias one way or the other was a task of improbable outcomes unless hedging your bets. However, with the dust settling, the price is up high in the consolidative range and there could be a bearish thesis drawn as follows:

We have a possible bearish head and shoulders up high within the range:

A break below 0.6950 opens risk of a test of 0.6900 again and from a daily perspective, this could be the most probable outcome for the days head:

There has already been a move to test the neckline of the M-formation neckline and a test of the 61.8% Fibonacci retracement level. We also have a W-formation which is also a bearish feature as follows:

- USD/MXN dropped to a new YTD low at 18.4975 during the session.

- The US Dollar is extending its losses after a mixed US inflation report.

- USD/MXN Price Analysis: To resume its downward bias if it achieves a daily close below $18.50.

The Mexican Peso (MXN) extended its gains against the US Dollar (USD) on Tuesday following the release of US inflation data, which showed that prices in the United States are slowing down. Therefore, speculators pricing in a less hawkish Fed sold the greenback vs. the peso. At the time of writing, the USD/MXN exchanges hand at 18.5115, below its opening price by 0.27%.

Technically speaking, the USD/MXN would continue to aim lower, as portrayed by the daily chart. After spiking to its daily high of 18.6729, the USD/MXN resumed its downtrend, which witnessed the pair dropping to fresh four and a half year low at 18.4975, a level last seen in August 2019. However, a bounce in that area trimmed some of the pair’s losses, sitting at around 18.50.

If the USD/MXN achieves a daily close below 18.50, that will exacerbate a fall towards August 7, 2018, at 18.4047, followed by a test of the $18.00 figure. In an alternate scenario, the USD/MXN’s first resistance would be the February 13 daily high of 18.7284. Break above would expose the 20-day Exponential Moving Average (EMA) at 18.8133, followed by the psychological barrier at 19.0000.

Oscillators, like the Relative Strength Index (RSI), suggest a bearish continuation, though a positive divergence is in the making, indicating that a reversal could be around the corner. The Rate of Change (RoC) portrays that although sellers are in control, momentum is fading.

USD/MXN Daily chart

USD/MXN Key technical levels

Philadelphia Fed President Patrick Harker said on Tuesday that in his view,'' we are not done yet … but we are likely close," Harker said in prepared remarks at an event in Philadelphia.

"At some point this year, I expect that the policy rate will be restrictive enough that we will hold rates in place and let monetary policy do its work."

"I do think we will see a very slight uptick in unemployment, probably topping out modestly above 4 percent this year. It's an underrated advantage that the Federal Reserve is taking on inflation from a position of such labor market strength," Harker said.

US Dollar update

The US Dollar index traded around 103.00 on Tuesday but posied higher due to the hotter-than-expected US inflation dashing hopes that the Federal Reserve will soon end its tightening campaign.

The annual inflation rate in the US, as measured by the Consumer Price Index, slowed only slightly to 6.4% in January from 6.5% in December, less than market forecasts of 6.2%, suggesting that getting inflation under control will take more time than expected.

- USD/JPY registers gains of 0.50%, above the 133.00 mark.

- US inflation data, albeit mixed, spurred a jump in US Treasury bond yields, a tailwind for the USD/JPY.

- USD/JPY Price Analysis: Daily close above 133.00 would pave the way for further gains.

The USD/JPY reached a new YTD high of 133.13, though it failed to cling to those gains, retracing beneath last week’s high of 132.90 after the release of US economic data, spurring a retracement. Therefore, the USD/JPY consolidates within the 132.70-133.00 area. At the time of writing, exchanges hands at 133.06.

Fundamentally speaking, the Department of Labor (DoL) revealed that inflation in the United States (US) cooled down annually but came slightly above estimates. The Consumer Price Index (CPI) for January rose by 6.4% YoY, above forecasts of 6.2%, while core CPI jumped to 5.6% YoY, against data estimated at 5.5%. Monthly basis readings were in line with estimates.

On the Japanese front, the confirmation of the Bank of Japan’s (BoJ) new Governor, Kazuo Ueda, sparked speculations that the BoJ would abandon the Yield Curve Control (YCC) imposed under Governor Haruhiko Kuroda’s term. Thar should be considered bullish for the Japanese Yen (JPY), which has extended its losses in the North American session so far.

Elsewhere, Federal Reserve (Fed) officials continued to express the need to hike rates for longer than expected, according to Dallas Fed President Lorie Logan. She echoed some earlier comments of Richmond’s Fed President Thomas Barkin, who said that inflation risks still outweigh others.

USD/JPY Technical analysis

After hitting a daily low of 131.49, the USD/JPY encountered some buyers around the latter, rallying sharply towards 133.00, underpinned by the US 10-year Treasury bond yield. To further extend its gains, the USD/JPY needs to clear the 200-day Exponential Moving Average (EMA) at 133.76, which would pave the way to 134.00. In an alternate scenario, the USD/JPY struggling to hold above 133.00 would open the door toward the 50-day EMA At 132.67, ahead of the 132.00 figure.

"We must remain prepared to continue rate increases for a longer period than previously anticipated, if such a path is necessary to respond to changes in the economic outlook or to offset any undesired easing in conditions," Dallas Federal Reserve President Lorie Logan said on Tuesday, as reported by Reuters.

Additional takeaways

"Even after pausing rate hikes, need to stay flexible, tighten further if conditions call for it."

"Need continued gradual rate hikes until see convincing evidence inflation falling to 2% in sustainable, timely way."

"Tightening policy too little is top risk."

"Tightening too much or too fast risks weakening labor market more than necessary."

"Should not lock in a peak Fed policy rate or precise rate path."

"Has been some progress on inflation, will need to see slower inflation in services."

"Little sign of improvement in core services ex housing inflation; symptomatic of tight labor market."

"Need better balance in labor market to bring inflation sustainably back to 2%."

"US job market is incredibly strong; likely to need substantially slower wage growth to reduce inflation."

Market reaction

The US Dollar Index showed no immediate reaction to these comments and was last seen trading flat on the day at around 103.30.

The US Census Bureau will release the January Retail Sales report on Wednesday, February 15 at 13:30 GMT and as we get closer to the release time, here are the forecasts of economists and researchers of seven major banks regarding the upcoming data.

Retail Sales in the US are expected to rise by 1.9% vs. -1.1% in December. Meanwhile, while sales ex-autos are expected at 0.8% vs. -1.1% in December. The so-called control group used for GDP calculations is expected at 0.8% MoM vs. -0.7% in December.

Commerzbank

“After the weak figures for November and December, there are signs of a countermovement. According to industry data, car sales have increased considerably. In addition, the renewed rise in gasoline prices is inflating nominal sales at service stations. Overall, we expect sales to increase by 1.3%.”

RBC Economics

“January US Retail Sales likely rose 1.9% from a 1.2% decline in December, thanks to an 18% surge in unit vehicle sales.”

NBF

“Car dealers likely contributed positively to the headline number, as auto sales surged during the month. Gasoline station receipts could have increased as well judging from a rise in pump prices. All told, headline sales could have jumped 2.1% in the month. Spending on items other than vehicles may have expanded a bit less, advancing 1.0%.”

CIBC

“Retail sales likely bounced back in January, as gas prices climbed and unit auto sales surged, which likely added to an increase in restaurant spending as the weather improved in many areas. Total retail sales likely rose by a robust 1.6%. Sales could have looked less impressive but still healthy elsewhere, with the control group (ex. gasoline, autos, restaurants, and building materials) likely posting a 0.5% increase. That would represent only a partial rebound from December’s decline, as spending on discretionary goods could have been squeezed by higher gasoline prices and spending on services.”

Citibank

“US January Retail Sales – Citi: 2.4%, prior: -1.1%; Retail Sales ex Auto – Citi: 1.4%, prior: -1.1%; Retail Sales ex Auto, Gas – Citi: 1.2%, prior: -0.7%; Retail Sales Control Group – Citi: 1.0%, prior: -0.7%. We expect total retail sales to rebound strongly by 2.4% MoM in January and expect a 1% MoM increase in control group sales with broad-based strength.”

TDS

“Retail Sales are expected to have rebounded significantly in January at 2% MoM after December's sharp contraction, with a surge in auto sales playing a significant role after consecutive declines in the final two months of 2022. Control group sales likely also jumped owing to a strong showing in online spending.”

Wells Fargo

“We expect to see glimmers of positive activity in the retail sales report for January. More muted inflation helps pump up real spending via higher real income growth. Real disposable personal income has risen for six consecutive months through December and is providing some support to consumers' purchasing power. This appears to have somewhat manifested itself in a rebound in durables purchases. Separately released data showed January vehicle sales were at their highest monthly level since May 2021. That should considerably flatter the headline growth rate, and we forecast overall retail sales rose 1.7%. Base effects of two disappointing months in a row prior may also help boost other retail categories. Excluding autos, we expect sales rose 0.5%.”

- The GBP/USD holds to its early gains in a volatile trading session.

- US inflation rose above estimates but cooled compared to December’s data.

- GBP/USD Price Analysis: It could resume its uptrend if it conquers 1.2200.

The GBP/USD dropped sharply in the North American session following the release of inflation data in the United States, which, although increased, initially sent the GBP/USD spiking towards its daily high at 1.2269 before reversing its course to the 1.2130 area. However, a late bounce sparked a recovery in the GBP/USD, trading at 1.2166, above its opening price.

US CPI cooled on an annual basis but was higher than forecasts

US inflation reported by the Department of Labor (DoL) showed that the Consumer Price Index (CPI) for January rose by 6.4% YoY, above estimates of 6.2%, while core CPI jumped to 5.6% YoY, against data estimated at 5.5%. Monthly basis readings were in line with estimates.

After the data release, US Treasury bond yields advanced, with the US 2-year Treasury bond yield edging towards 4.622%, as an initial reaction to the data, which warrants further tightening by the US Federal Reserve (Fed). Consequently, the greenback advanced, with the US Dollar Index (DXY) peaking at around 103.83 before reversing its course, toward the 103.09 area.

In the meantime, the swaps markets estimate the Fed would hike rates until the 5%-5.25% range, and then some cuts are expected by the end of the year.

Across the pond, data from the United Kingdom (UK), capped the Pound Sterling (GBP) fall vs. the US Dollar (USD). According to Reuters, wages in Britain grew quickly in the last quarter of 2022, keeping the Bank of England (BoE), pressured. Investors increased “slightly” their bets that the BoE would raise rates by 25 bps at their March meeting.

Elsewhere, Fed officials led by Thomas Barkin from the Richmond Fed are crossing the wires. Commented that the inflation report was “about as expected,” adding that inflation, although normalizing, it’s doing it slowly. Therefore, Barkin said there’s a good cause for leaving rates higher for a longer period.

GBP/USD Technical analysis

From a technical perspective, the GBP/USD daily chart suggests the pair is neutral to upward biased. Upward continuation will resume if the GBP/USD clears the 1.2200 figure, which could lift the major towards the February high of 1.2401. Firstly, it needs to hurdle the psychological 1.2300 barrier. On the flip side, a GBP/USD fall underneath the 20-day EMA at 1.2179 would expose the confluence of the 200/50-day EMA at 1.2136/1.2128, respectively, ahead of falling to 1.21000.

Brent Crude is trading at a similar level to the start of the year, around $85. But economists at UBS believe that the tightening of the oil market this year will eventually put prices on an upward trajectory.

Oil price recovery to gain traction as Russia cuts output

“We expect Russian crude production to fall below 9 million barrels per day in 2023 from levels above 10 mbpd at the start of 2022 and 9.77 mbpd in December.”

“We believe two-thirds of growth in oil demand this year will come from emerging Asia, led by China’s reopening – which we think will lift global oil demand to above 103 mbpd in the second half of the year.”

“We expect non-OPEC+ nations to provide only modest supply growth this year, adding 1.3 mbpd primarily from US oil production, but trailing oil demand growth of 1.6 mbpd this year.”

“We maintain our positive outlook on oil as we continue to expect Brent to rise to $110 and WTI to $107 this year.”

Economists at the Bank of America Global Research see scope for a mild recession this year in the United States and hold a bearish USD view.

Fed cuts to begin only in March 2024

“We expect a mild recession starting mid-2023 and Fed cuts to begin only in March 2024. For 2023, the market expects a much milder recession, with the Fed still hiking rate 1-2 more times before slightly cutting rates in second half of the year.”

“For now, we still hold a bearish USD view for the medium term; 2023 playing out in line with leading indicator historical precedents would increase the upside risk to our bearish USD outlook.”

- The index dropped to multi-session lows post-CPI.

- US inflation rose more than expected during January.

- FOMC’s Logan, Harker and Williams come next in the docket.

The USD Index (DXY), which gauges the greenback vs. a basket of its main competitors, manages to regain some composure and leaves behind earlier lows in the sub-103.00 region on turnaround Tuesday.

USD Index meets support near 102.60

After bottoming out in multi-day lows near 102.60, the index seems to have met some dip buyers and quickly regained the 103.00 barrier and beyond.

The dollar, in the meantime, now alternates gains with losses after US inflation figures tracked by the CPI rose more than initially estimated during January. On this, consumer prices rose 6.4% over the last twelve months and 5.6% when excluding food and energy costs.

Earlier in the session, the NFIB Business Optimism Index edged higher to 90.3 in January. Later in the session, Dallas Fed L.Logan (voter, centrist), Philly Fed P.Harker (voter, hawk) and NY Fed J.Williams (permanent voter, centrist) are all due to speak.

What to look for around USD

The dollar remains within a consolidative phase in the lower end of the recent range just above the 103.00 level against the backdrop of flat risk appetite trends.

The probable pivot/impasse in the Fed’s normalization process narrative is expected to remain in the centre of the debate along with the hawkish message from Fed speakers, all after US inflation figures for the month of January showed consumer prices are still elevated.

The loss of traction in wage inflation – as per the latest US jobs report - however, seems to lend some support to the view that the Fed’s tightening cycle have started to impact on the still robust US labour markets somewhat.

Key events in the US this week: Inflation Rate (Tuesday) – MBA Mortgage Applications, Retail Sales, Industrial Production, Business Inventories, NAHB Index, TIV Flows (Wednesday) – Building Permits, Housing Starts, Initial Jobless Claims, Philly Fed Index (Thursday) – CB Leading Index (Friday).

Eminent issues on the back boiler: Rising conviction of a soft landing of the US economy. Slower pace of interest rate hikes by the Federal Reserve vs. shrinking odds for a recession in the next months. Fed’s pivot. Geopolitical effervescence vs. Russia and China. US-China trade conflict.

USD Index relevant levels

Now, the index is retreating 0.11% at 103.18 and the breach of 100.82 (2023 low February 2) would open the door to 100.00 (psychological level) and finally 99.81 (weekly low April 21 2022). On the other hand, the next resistance level emerges at 103.96 (monthly high February 7) seconded by 105.63 (2023 high January 6) and then 106.45 (200-day SMA).

Economists at Deutsche Bank expect the S&P 500 Index to fall towards 3250 in the third quarter. However, the index is expected to move back higher to end the year at 4500.

Current bear market rally to continue through Q1 into Q2

“In the short term, we see the current bear market rally continuing through Q1 into Q2.”

“After a flat performance in Q2 as recession concerns build, equities will then fall significantly in Q3 as the recession begins, with the S&P 500 falling to 3250.”

“We expect the S&P to bottom half-way through the recession and recover the decline during Q4, reaching 4500 by 2023 year-end.”

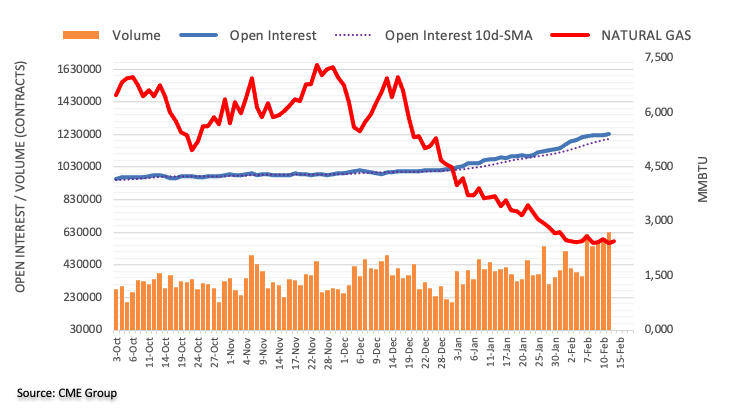

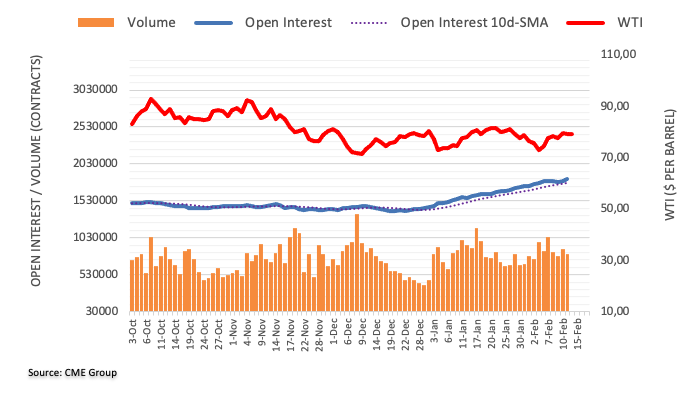

- WTI is falling into the abyss and eyes below $77.50 lows.

- US CPI sees the US Dollar catch a late bid.

US crude prices are adding to earlier declines, falling after the US Consumer Price index data and during the Wall Street cash open. West Texas Intermediate crude oil was down 1.4% on the day at the time of writing, slightly up from the lows of around $77.69 a barrel but well below the highs of USD79.80bbls.

The US inflation report came in a bit hotter than expected, raising some concerns about future oil and fuel demand in the world's top oil-consuming nation. However, overall, Fed swaps indicate that 2023's anticipated funds rates won't change much as a result and that had seen some softness in the US Dollar initially.

Ahead of the data, markets expected the Fed's target rate to peak at 5.188% in July, from a current range of 4.5% to 4.75%. Fed funds futures are now pricing in top-fed funds fund rate of 5.%-5.25% by July, vs earlier near-even odds seen of a higher fed funds rate. However, the US Dollar turned higher as markets started to digest the data which has also weighed don the oil price.

US Consumer Price Index has come out in line with expectations for the month-over-month data 0.4% vs 0.4% expected. Meanwhile, US January CPI for the year came in at +6.4% vs +6.2% expected.

It is also worth noting that analysts at TD Securities explained that ''CTA trend followers are marginally adding back their shorts in Brent crude after reports of congressionally mandated SPR sales soured sentiment in the energy complex.''

''RBOB gasoline is taking the brunt of the hit from CTAs, with current prices pointing to a substantial selling program equivalent to -9% of the cohort's maximum historical position size. Still, the trend in time spreads points to a tighter physical market on the horizon, as evidence of a demand boom from China's reopening is apparent in travel.''

WTI technical analysis

The price is falling to key support area that guards a move towards $77.00bbls. The ATR is $2.50 which gives room for some more to go to the downside.

US annual CPI data declined to 6.4% in January vs. 6.2% expected. Thus, economists at Commerzbank expect further rate hikes.

Fed will raise key rates by a total of 50 bps

“Inflation in the US is easing, but only slowly. This was confirmed by the January figures, with a slight drop from 6.5% to 6.4%. The Federal Reserve can therefore not yet be satisfied.”

“We continue to forecast that the Fed will raise key rates by a total of 50 bps, the upper bound of the target corridor would then be 5.25%.”

- Gold price has rallied on the back of US CPI.

- Federal Reserve expectations are little changed, fuelling the bid in the Gold price.

The Gold price is choppy as the markets digest the comprehensive inflation data that has been released from the United States of America. US Consumer Price Index has come out in line with expectations for the month-over-month data 0.4% vs 0.4% expected. Meanwhile, US January CPI for the year came in at +6.4% vs +6.2% expected.

Fed swaps indicate that 2023's anticipated funds rates won't change much as a result and that has seen some softness in the US Dollar which is helping to lift the Gold price. At the time of writing, Gold price is trading in the middle of the day's range at $1,860.

Fed expectations little changed

The market is likely to scale back its interest rate expectations, on this data which is allowing the gold price to rise as although bullion is considered an inflation hedge, it is highly sensitive to rising US interest rates, as they increase the opportunity cost of holding the zero-yield asset.

Ahead of the data, markets expected the Fed's target rate to peak at 5.188% in July, from a current range of 4.5% to 4.75%. Fed funds futures are now pricing in top-fed funds fund rate of 5.%-5.25% by July, vs earlier near-even odds seen of a higher fed funds rate.

Gold technical analysis

The Gold price has rallied and is moving towards a stronger test of resistance after a series of days of shorts in the market with eyes back on a move into the rising channel near $1,880.

- AUD/USD reverses swiftly from the daily low and rallies to over a one-week high in the last hour.

- The USD weakens despite a slightly higher-than-expected US CPI print and lends support to the pair.

- A softer risk tone helps turns out to be a key factor capping the upside for the risk-sensitive Aussie.

The AUD/USD pair rallies nearly 100 pips from the daily low touched in the last hour and spikes to over a one-week high following the release of the US consumer inflation figures. The pair is currently placed just above the 0.7000 psychological mark, though lacks any follow-through buying.

The US Dollar witnessed a typical "buy the rumour, sell the news" kind of trade after the US Bureau of Labor Statistics reported that the headline CPI rose by 0.5% in January. The reading was in line with market expectations and was accompanied by a higher-than-expected yearly rate, which ticked down to 6.4% from the 6.5% previous. More importantly, Core CPI, which excludes food and energy prices, came in at 0.4% MoM and 5.6% YoY.

Given that a stronger print was already priced in the markets, the USD weakens across the board in the absence of any major surprise to the upside from the US CPI. This, in turn, is seen as a key factor pushing the AUD/USD pair higher. That said, a generally softer tone around the equity markets seems to benefit the Greenback's relative safe-haven status and keeps a lid on any further gains for the risk-sensitive Aussie, at least for the time being.

From a technical perspective, repeated failures to find acceptance above the 0.7000 mark suggest that the AUD/USD pair's recent pullback from its highest level since June 2020 is still far from being over. Hence, it will be prudent to wait for a strong follow-through buying before positioning for any further appreciating move.

Technical levels to watch

- EUR/USD advances further north of the 1.0800 mark.

- Flash EMU Q4 GDP came in at 1.9% YoY, 0.1% QoQ.

- US inflation figures surprised to the upside in January.

EUR/USD picks up extra pace and trespasses the key barrier at 1.0800 the figure on Tuesday, or multi-session highs.

EUR/USD firmer post-US data

EUR/USD extends the uptick just beyond the 1.0800 mark in the wake of the release of US inflation figures for the month of January.

Indeed, the pair saw its ongoing weekly rebound gather extra impulse after US headline CPI rose at an annualized 6.4% in January and 5.6% when it comes to the Core CPI. The prints, albeit higher than previously estimated, keep showing a loss of momentum in consumer prices.

Earlier on Tuesday, flash EMU Q4 GDP saw the economy still expected to expand 1.9% YoY in the October-December period and 0.1% inter-quarter.

What to look for around EUR

EUR/USD seems to have embarked in a decent bounce following Monday’s drop to the 1.0650 region, although the resistance line above 1.0800 continues to cap occasional bullish attempts for the time being.

In the meantime, price action around the European currency should continue to closely follow dollar dynamics, as well as the potential next moves from the ECB after the central bank delivered a 50 bps at its meeting last week.

Back to the euro area, recession concerns now appear to have dwindled, which at the same time remain an important driver sustaining the ongoing recovery in the single currency as well as the hawkish narrative from the ECB.

Key events in the euro area this week: ECOFIN Meeting, EMU Flash Q4 GDP (Tuesday) – EMU Balance of Trade, Industrial Production, ECB Lagarde (Wednesday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle amidst dwindling bets for a recession in the region and still elevated inflation. Impact of the Russia-Ukraine war on the growth prospects and inflation outlook in the region. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is gaining 0.46% at 1.0767 and is expected to meet the next up barrier at 1.0804 (weekly high February 14) seconded by 1.1032 (2023 high February 2) and finally 1.1100 (round level). On the flip side, a drop below 1.0655 (weekly low February 13) would target 1.0481 (2023 low January 6) en route to 1.0323 (200-day SMA).

EUR/USD seems to have anchored itself in a 1.05-1.10 trading range. Economists at TD Securities see see much more upside than downside in the quarters ahead.

EUR/USD Q2 forecast at 1.15

“EUR/USD seems to have anchored itself in a 1.05-1.10 trading range. At current levels, we’re around the mid-point of that range, leaving us waiting for better levels to engage.”

“We see much more upside than downside in the quarters ahead, reflecting our Q2 forecast of 1.15. Still, we prefer to exercise patience, aiming to buy towards the lower end of the new range.”

Strong economic momentum points to a higher terminal rate in the United States. Economists at ANZ Bank have revised up their Fed Funds Rate forecast by 50 bps to 5.50%.

Cyclical components of inflation may stay high

“We have revised up our FFR forecast range by 50 bps to 5.25-5.50%. We now expect the FOMC will extend tightening through Q2 and anticipate 25 bps rate increases at the May and June FOMC meetings, in addition to the March hike that we already expected.”

“Economic momentum at the end of last year and in early 2023 has been stronger than anticipated. We have revised up our Q1 GDP forecast to 0.5% QoQ vs 0.3% QoQ, inferring resilient growth. Based on available and expected data, we have downgraded our near-term view of recession risks.”

“Whilst the increase in January Nonfarm Payrolls (517K) was way above “normal” and may not be repeated in coming months, there is no denying labour market strength. This implies cyclical components of inflation may stay high.”

“We think the FOMC will have to upgrade its GDP forecasts and reduce its unemployment forecasts when it publishes its Summary of Economic Projections in March. The risks to the median dot plot lie to the topside.”

- USD/CAD drifts into negative territory for the third successive day amid sustained USD selling.

- Sliding Crude Oil prices could undermine the Loonie and help limit the downside for the major.

- Traders might also refrain from placing aggressive bearish bets ahead of the key US CPI report.

The USD/CAD pair meets with a fresh supply following an early uptick to the 1.3355 region and turns lower for the third successive day on Tuesday. The pair drops to a one-and-half-week low, around the 1.3320 region heading into the North American session and is pressured by strong follow-through selling around the US Dollar.

In fact, the USD Index, which tracks the Greenback against a basket of currencies, extends the previous day's retracement slide from a multi-week high amid a further decline in the US Treasury bond yields. Apart from this, a mildly positive tone around the equity markets is seen as another factor weighing on the safe-haven buck. That said, weaker Crude Oil prices could undermine the commodity-linked Loonie and help limit the downside for the major, at least for the time being.

Traders might also refrain from placing aggressive bets and prefer to wait on the sidelines ahead of the release of the US consumer inflation figures. The US Labor Department's annual revisions of CPI data last Friday, which showed that monthly consumer prices rose in December instead of falling as previously estimated, raises the risk of a stronger US CPI print. This, in turn, supports prospects for further policy tightening by the Fed and favours the USD bulls.

Heading into the key US data risk, the aforementioned fundamental backdrop warrants some caution for bearish traders and before positioning for any further depreciating move for the USD/CAD pair. Hence, any subsequent slide is more likely to find decent support and remain limited near the 1.3300 mark. The said handle should act as a pivotal point for intraday traders, which if broken should pave the way for deeper losses and expose the monthly low, around the 1.3260 region.

Technical levels to watch

EUR’s rebound extends through low-1.07s. However, economists at Scotiabank do not expect the EUR/USD pair to extend its race higher.

Resistance should be firm at 1.0790/00

“We are not fully convinced the EUR rebound has staying power. Risk reversal pricing suggests markets bets are tilting towards renewed weakness in the near term, with 1m EUR risk reversal pricing slipping to -0.89%, reflecting relative higher demand for EUR puts over calls.”

“Trend signals are not aligned in a way that gives me confidence that the rally can extend much more at the moment and spot may simply be consolidating ahead of another push lower; resistance should be firm at 1.0790/00.”

“Intraday losses below 1.0730 will likely see renewed softness towards or below the figure.”

European Central Bank (ECB) Governing Council member Gabriel Makhlouf said on Tuesday that the ECB could raise rates above 3.5% and hold them there for the remainder of the year, the Wall Street Journal reported.

Earlier in the day, ECB policymaker Mario Centeno said that the full impact of rate hikes may not reach the European economy.

Market reaction

EUR/USD edged slightly higher with the initial reaction to Makhlouf's comments. As of writing, the pair was trading at 1.0760, where it was up 0.37% on a daily basis.

- NZD/USD meets with a fresh supply on Tuesday, though the downside remains cushioned.

- The ongoing USD retracement slide from multi-week high acts as a tailwind for the major.

- Traders also seem reluctant to place aggressive bets and keenly await the key US CPI data.

The NZD/USD pair attracts some sellers following an early uptick to the 0.6365 area and reverses a part of the previous day's positive move. The pair remains depressed heading into the North American session and is currently placed near the lower end of its daily range, just below mid-0.6300s.

The downside for the NZD/USD pair, meanwhile, remains limited amid strong follow-through selling around the US Dollar, which is seen extending the overnight pullback from a multi-week high. A further decline in the US Treasury bond yields, along with signs of stability in the financial markets, turn out to be a key factor weighing on the safe-haven Greenback. Traders, however, seem reluctant to place aggressive bets and keenly await the release of the latest US consumer inflation figures.

The crucial US CPI report will play a key role in influencing the Fed's rate-hike path, which, in turn, should drive the USD demand and help determine the near-term trajectory for the NZD/USD pair. In the meantime, the risk of stronger US inflation data should help limit the USD losses. The expectations were fueled by the US Labor Department's annual revisions of CPI data last Friday, which showed that monthly consumer prices rose in December instead of falling as previously estimated.

Moreover, several Federal Open Market Committee (FOMC) policymakers, including Fed Chair Jerome Powell, recently stressed the need for additional interest rate hikes to fully gain control of inflation. Hence, any positive surprise from the US CPI print should allow the US central bank to stick to its hawkish stance for longer. This could trigger a fresh leg up for the USD and set the stage for an extension of the NZD/USD pair's recent pullback from its highest level since June 2022.

Technical levels to watch

- EUR/USD extends the weekly rebound well past the 1.0700 mark.

- The next hurdle of note aligns at the 3-month line near 108.30.

The upside bias in EUR/USD manages to gather extra impulse following the breakout of the key barrier at 1.0700 on Tuesday.

Further upside is initially focused on 1.0790 (daily high February 9), while the surpass of this level should motivate the pair to confront the 3-month resistance line in the 108.30 region. Beyond the latter, there are no hurdles of note until the 2023 peak at 1.1032 (February 2).

In the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0323.

EUR/USD daily chart

- The index remains on the defensive in the first half of the week.

- Next on the downside emerges the 102.60 zone.

DXY adds to the bearish note recorded on Monday and puts the 103.00 support level to the test on Tuesday.

The recent price action leaves the door open to the continuation of the consolidative phase for the time being. However, a drop below last week’s low at 102.64 (February 9) should open the door to a deeper pullback in the short term to, initially, the 3-month support line, today near 102.35.

In the longer run, while below the 200-day SMA at 106.45, the outlook for the index remains negative.

DXY daily chart

According to Markets Strategist Quek Ser Leang at UOB Group, USD/IDR could extend the upside bias further in the short-term horizon.

Key Quotes

“We highlighted last Monday (07 Feb, spot at 15,125) that ‘There is room for USD/IDR to rise to 15,190’. We added, ‘In view of the overbought short-term conditions, a sustained rise above this level is unlikely this week’. USD/IDR subsequently rose to 15,146, closed at 15,130 before surging above 15,190 in Asian trade today.”

“The price actions suggest USD/IDR is likely to advance further this week. Resistance levels are at 15,270, followed by a major level at 15,350. On the downside, support is at 15,130, a break of 15,050 would indicate that USD/IDR is not advancing further.”

The rebound for the Dollar has been relatively muted still. But economists at MUFG Bank expect a strong US Consumer Price Index (CPI) report to trigger a Dollar rally.

How the US equity market reacts to inflation data will be key for the Dollar

“The DXY is very close to the closing level from 3rd February and has barely advanced at all since. The lack of follow-through for the USD in part reflects the resilience of US equity markets and the reaction of the S&P 500 to today’s inflation print will be important as well. We would assume a stronger than expected CPI data today would prompt that resilience to give way more clearly as the rates market moves to price an additional 25 bps rate hike beyond May.”

“We certainly see a stronger CPI print as more disruptive for risk and that could be the catalyst for a more pronounced rally back for the Dollar than what we have seen since the initial reaction on 3rd February.”

- GBP/USD gains strong traction for the second straight day and rallies to over a one-week high.

- The upbeat UK jobs report lifts bets for another BoE rate hike and underpin the British Pound.

- The offered tone surrounding the USD provides an additional boost ahead of the US CPI report.

The GBP/USD pair builds on the overnight solid rebound from the 1.2030 area up and gains strong follow-through traction for the second successive day on Tuesday. Spot prices climb above the 1.2200 mark, hitting a one-and-half-week high during the mid-European session, with bulls looking to extend the momentum beyond the 50-day SMA.

The British Pound gets a boost in reaction to the upbeat UK labor market data, which, along with the prevalent US Dollar selling bias, act as a tailwind for the GBP/USD pair. The UK Office for National Statistics Office for National Statistics reported that the number of people claiming unemployment-related benefits unexpectedly fell by 12.9K in January. Furthermore, Average Earnings excluding bonuses were up 6.7% during the three months to December. This marks the fastest rise since records began in 2001, excluding the pandemic period, and could add pressure on the Bank of England (BoE) to deliver another interest rate hike next month.

The USD, on the other hand, extends the previous day's retracement slide from a multi-week high and is pressured by a further decline in the US Treasury bond yields. Apart from this, a generally positive tone around the equity markets further undermines the safe-haven Greenback and provides an additional lift to the GBP/USD pair. Any further move up, however, seems limited as traders keenly await the release of the latest US consumer inflation figures. The crucial US CPI report will play a key role in influencing the Fed's rate-hike path, which, in turn, will drive the USD demand and help determine the next leg of a directional move for the pair.

Nevertheless, a sustained strength beyond last week's swing high, which coincided with the 50-day SMA hurdle, and the 1.2200 mark might have already set the stage for additional gains. Hence, some follow-through strength, back towards reclaiming the 1.2300 round figure, looks like a distinct possibility. Traders, however, might refrain from placing aggressive bets and prefer to wait on the sidelines ahead of the US inflation data risk.

Technical levels to watch

- EUR/JPY adds to Monday’s uptick above the 142.00 barrier.

- Extra gains now target the resistance area around 143.00.

EUR/JPY pushes higher and surpasses the key barrier at 142.00 the figure on Tuesday.

While the cross looks broadly side-lined for the time being, further gains could prompt a test of the key 143.00 hurdle to re-emerge on the horizon ahead of the December 2022 high near 146.70.

A convincing breakout of the 200-day SMA, today at 141.08, should shift the outlook to a more constructive one.

EUR/JPY daily chart

If US data today and tomorrow exceeds expectations, GBP/USD could slump below the 1.20 level, analysts at Société Générale report.

An imminent return to early 2023 highs of around 1.2450 is implausible

“GBP/USD recovered from a decline below 1.20 for the first time in a month but a return below te psychological level cannot be ruled out this week if US CPI and/or retail sales surprise to the upside.”

“With the BoE nearer to pausing the tightening cycle than the Fed, an imminent return of GBP/USD to early 2023 highs of around 1.2450 is implausible.”

“The 200-DMA remains first support below 1.20 at 1.1944.”

Extra gains could encourage USD/MYR to challenge the key barrier at 4.4000 in the short term, suggests Markets Strategist Quek Ser Leang at UOB Group.

Key Quotes

“We highlighted last Monday (07 Feb, spot at 4.3000) that ‘the rapid increase in momentum is likely to lead to further USD/MYR strength towards 4.3250’. We added, ‘the next resistance at 4.3480 is likely out of reach this week’. Our view was not wrong as USD/MYR soared to 4.3300, closed at 4.3290 before rising above 4.3480 in early Asian trade. Not surprisingly, upward momentum has improved further and the risk for USD/MYR this week is still on the upside.”

“There is a strong resistance level at 4.3660, a break of this level could potentially trigger a rapid rise to 4.4000. In order to keep the momentum going, USD/MYR should not breach the strong support at 4.2950 (minor support is at 4.3290).”

Gold price dropped yesterday to $1,850, its lowest level since early January. Soft United States Consumer Price Index could scale back hawkish Federal Reserve bets, allowing the yellow metal to rise, strategists at Commerzbank report.

All eyes on the United States Consumer Price Index

“The US inflation figures that are due to be published today could result in some price movement.”

“Like our economists, the market expects the inflation rate in January to have fallen to 6.2%. If so, this would constitute the lowest increase in the CPI since October 2021. If the inflation rate turns out to be even lower, the market is likely to scale back its interest rate expectations again somewhat, allowing Gold to rise.”

The Japanese government named Kazuo Ueda to become the next governor of the Bank of Japan (BoJ). Economists at ING expect JPY volatility to remain elevated.

No indications that Uead will favour an abrupt end to BoJ’s ultra-dovish policy stance

“The Yen continues to see elevated volatility as markets struggle to assess the implications of the Bank of Japan appointing – now officially – Kazuo Ueda as next governor.”

“We expect JPY volatility to stay high as Ueda may refrain from offering clear direction on any policy shift before taking the role in April.”

“For now, there are no indications he will favour an abrupt end to the BoJ’s ultra-dovish policy stance.”

- USD/JPY edges lower on Tuesday, though the downside lacks strong follow-through.

- Speculations for a hawkish shift by the BoJ benefit the JPY amid sustained USD selling.

- The downside remains cushioned as traders seem reluctant ahead of the US CPI report.

The USD/JPY pair comes under some selling pressure on Tuesday and erodes a part of the previous day's strong gains to the 133.00 neighbourhood or a fresh monthly top. The pair, however, manages to recover a few pips during the first half of the European session and is now trading around the 132.15-132.20 region, down less than 0.20% for the day.

The US Dollar extends the overnight retracement slide from a multi-week high amid a further decline in the US Treasury bond yields. Furthermore, speculations that the new Bank of Japan (BoJ) governor candidate Kazuo Ueda will dismantle the yield curve control sooner rather than later underpins the Japanese Yen (JPY). This turns out to be a key factor exerting some downward pressure on the USD/JPY pair.

The downside, however, remains cushioned, at least for the time being, as traders seem reluctant to place aggressive bets ahead of the US consumer inflation figures. The crucial US CPI report is due for release later during the early North American session and will play a key role in influencing the Fed's rate-hike path. This, in turn, will drive the USD demand and provide a fresh directional impetus to the USD/JPY pair.

In the meantime, the risk of a stronger US CPI print should help limit the USD losses and continue to lend some support to the USD/JPY pair. The expectations were fueled by the US Labor Department's annual revisions of CPI data released last Friday, which showed that monthly consumer prices rose in December instead of falling as previously estimated. This, in turn, warrants some caution before positioning for further losses.

Technical levels to watch

US Consumer Price Index (CPI) report will be followed by Retail Sales tomorrow. Economists at Société Générale analyze how the upcoming data could impact the US Dollar.

Test of corrective February bond/FX trend

“We forecast a gain in headline of 0.4% MoM, the largest since October. A hot number that lends credibility to the repricing of the Fed outlook could mean more trouble for risk assets and high beta FX, accelerate the unwinding of bullish January trends which have characterised the first two weeks of February.”

“Underwhelming data will trigger short covering in bonds (lower yields, steeper curve) and could place the dollar back on a weakening trend.”

“Dollar bulls will be inclined to raise targets to 105 area for the DXY (+1.9%) if data today and tomorrow exceeds expectations. This would correspond to 1.05 in EUR/USD and 1.19 in GBP/USD.”

Markets Strategist Quek Ser Leang at UOB Group notes USD/THB faces a solid barrier at the 34.20 level.

Key Quotes

“Last Monday (07 Feb, spot at 33.62), we highlighted that ‘deeply overbought conditions suggest USD/THB could consolidate for a couple of days first before heading higher’. While USD/THB subsequently consolidated, it did not make any headway on the upside. That said, short-term upward momentum is beginning to build and the bias for USD/THB this week is tilted to the upside.”

“Overall, barring a breach of 33.35 (minor support is at 33.55), the chance of USD/THB breaking 34.00 is increasing. Looking ahead, the next resistance above 34.00 is at 34.20.”

Today's market highlight will be the US Consumer Price Index (CPI) print for January. Economists at ING suspect that a consensus 0.4% month-on-month read in core inflation may be enough to weigh on risk assets and support the Dollar.

A consensus reading may be enough to support the Dollar

“The market's reaction will likely be driven once again by the MoM figure, which we expect to match consensus expectations at 0.5% for the headline rate and 0.4% for core inflation. This should translate into YoY reads of around 6.2% and 5.5%, respectively.

Such a consensus read may be enough to weigh on risk assets and support the USD, as it should allow markets to fully price in 50 bps of additional tightening by the Fed and offer the chance to scale back rate cut expectations (around 50 bps priced in for 2H23).”

“Given that core inflation in December came in at 0.3%, a 0.2% print (or below) today should be enough to trigger a Dollar correction, and a 0.5% (or above) could trigger a Dollar rally.”

- Gold price regains positive traction on Tuesday amid the ongoing US Dollar retracement slide.

- Recession fears also benefit the safe-haven XAU/USD, though the uptick lacks follow-through.