- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 14-02-2022

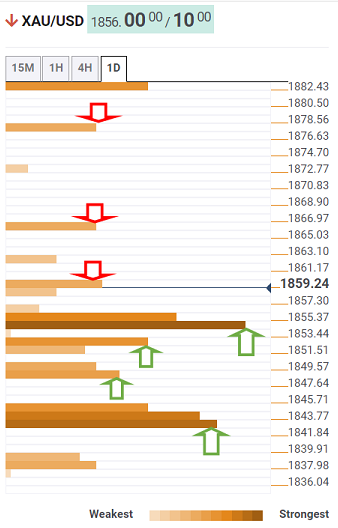

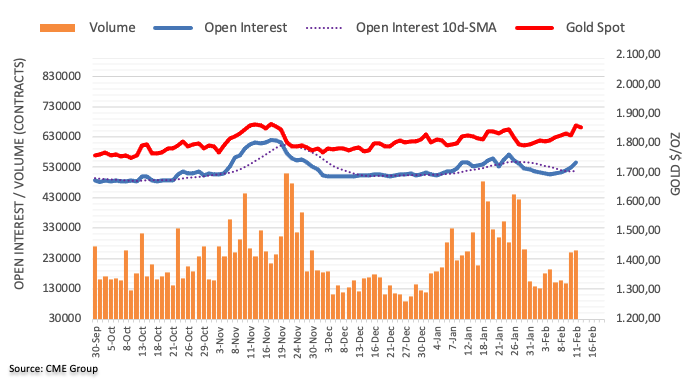

- Gold bulls stampede towards critical resistance on the heightened risk of a Russian invasion of Ukraine.

- US Federal Reserve will aggressively hike rates in coming months.

The price of gold rallied to the highest level since November 16 on Monday on growing worries about Russia-Ukraine tensions despite the call from St. Louis Federal Reserve President James Bullard for faster US Federal Reserve interest rate hikes. XAU/USD reached $1,874 on Monday in afternoon trading in the New York session, extending its gains from last week's close.

The markets are on high alert as the tensions surrounding the Russian military build up on the border of Ukraine is raising the probabilities of an imminent attack. Ukraine President Volodymyr Zelenskiy urged Ukrainians to fly the country's flags from buildings and sing the national anthem in unison on Feb. 16, a date some Western media have cited as the possible start of a Russian invasion.

However, the comments were interpreted as if the president of Ukraine had been officially informed that Wednesday would be the day of the attack. This led to a bout of risk-off in markets but Ukrainian officials said Zelenskiy was not predicting an attack on that date, but instead responding with scepticism to foreign media reports. Washington had said Russia could invade Ukraine "any day now," and British Prime Minister Boris Johnson on Monday called the situation "very, very dangerous."

Meanwhile, United Nations Secretary-General Antonio Guterres said he was deeply worried about "increased speculation" about a military conflict and has urged world leaders to step up diplomacy to calm the situation.

Gold technical analysis

As per the pre-open forecast for the week ahead, Gold, The Chart of the Week: $1,880's are eyed as last defence for continued upside, the $1,880's are calling the bulls as follows:

Gold, daily chart, prior analysis

Gold, live market

Typically, the price would be expected to correct at this juncture, but the ATR on the weekly chart is around $46.00 and it is early days in the week still. Gold has rallied $23.00 so far, so there is still room for higher.

- GBP/USD consolidates recent losses around one-week low, snaps two-day downtrend.

- UK trades more with US than France, Spain and Greece Combined in 2021 amid post-Brexit jitters.

- British Foreign Minister Truss warns over Russian invasion of Ukraine, UK reports 30% low covid infections in last seven days.

- UK jobs report, geopolitical and US PPI will entertain pair traders.

GBP/USD licks its wounds around 1.3530-35 with eyes on the key UK employment report during Tuesday’s Asian session. In doing so, the cable pair prints mild daily gains around a one-week low, after declining for the last two days.

The recent consolidation in the cable prices could be linked to the Brexit headlines and receding fears of an imminent war between Russia and Ukraine. However, inflation fears and Fed-rate-hike concerns join the indecision over the geopolitical issues to keep GBP/USD pressured.

The UK Express cites the latest trade numbers from the UK Office for National Statistics (ONS) to confirm that Britain did more trade with the US than France, Greece and Spain combined. The news adds to the British bargaining power while the Brexit talks are on. On a different page, British Foreign Minister Liz Truss warns Russia could launch Ukraine invasion ‘almost immediately’, per The Guardian.

On the same line, the Western leaders initially highlighted fears of Russia’s attack on Ukraine during this week before market chatters of February 16 to be the D-day. On the positive side were headlines covering Russian Foreign Minister Sergey Lavrov who told President Putin that the US had put forward concrete proposals on reducing military risks and that he could see a way to move forward with talks. Russia’s Lavrov also mentioned that EU and NATO responses have not been satisfactory, which in turn highlights risk-off mood despite easing fears.

Furthermore, a 30% reduction in the seven-day average infections and around 27.0% decline in the virus-led deaths highlight improving covid conditions in the UK and help GBP/USD buyers. However, British scientists keep flashing warnings over the virus variants.

Elsewhere, St. Louis Fed President James Bullard reiterated his call for 100 basis points (bps) in interest rate hikes by July 1 by citing the last four inflation reports which show broadening inflationary pressures.

Amid these plays, the US Treasury yields regained upside momentum after stepping back from a 2.5-year high on Friday whereas the Wall Street benchmark closed in the red, despite mildly positive week-start performance.

Moving on, UK employment figures will pave the way for the March rate hike by the Bank of England (BOE), making it important for the GBP/USD traders. That said, the headline Unemployment Rate is expected to remain unchanged at 4.1% whereas the Claimant Count Change needs to improve from -43.3K prior to keep the buyers hopeful.

Technical analysis

GBP/USD remains sidelined inside a 100-pip trading range between the 100-DMA and 1.3600. Given the recent rebound in the Momentum indicator, the pair buyers seem to flex muscles ahead of the key data/events.

- The New Zealand dollar falls on risk-off market mood against the safe-haven JPY.

- On Monday’s overnight session for North American traders dropped 100-pips.

- NZD/JPY is downward biased after failure at the 100-DMA, which spurred a fall of more than 150 pips.

The NZD/JPY slides for the second consecutive day courtesy of a risk-off market mood spurred by increasing geopolitical tensions between Russia and Ukraine, down 0.35%. At the time of writing, the NZD/JPY is trading at 76.40.

During the overnight session for North American traders, the NZD/JPY plunged close to 100-pips, towards 75.80, as the headline news of the Russian invasion of Ukraine, which dampened the market mood near last Friday’s close, caught Asian and European traders on the weekend. That said, the NZD/JPY reached a daily high at 76.86, followed by a fall towards 75.87.

NZD/JPY Price Forecast: Technical outlook

The NZD/JPY is downward biased from a technical perspective, sponsored by the daily moving averages (DMAs) residing above the spot price. That, alongside the failure of a daily close above the 100-DMA on February 10 at 78.37, exacerbated selling pressure on the NZD/JPY, threatening to push prices near August 2021 to swing low at 74.56.

Therefore, the NZD/JPY path of least resistance is tilted downwards. The cross-currency first support level would be the February 14 low at 75.87. Breach of the latter would expose February 3 daily low at 75.58, followed by January 28 pivot low at 75.23, and then the August 2021 swing low at 74.56.

Given the risk-off mood and firmer US Treasury yields, analysts at the key banks reiterate their bullish bias for the USD/JPY prices.

Recently, Goldman Sachs (GS) reiterated their forecast for higher US rates to convey upside risks for the yen pair while saying, “We continue to expect USD/JPY to move higher in the near-term towards our 3-month forecast of 117.”GS also adds, “And may overshoot a bit if the Fed tightens more rapidly than currently priced.”

While rejecting the bearish bias, the investment bank mentioned, “That said, as the Yen weakens further, the odds of JPY-related policy guidance are likely to increase, and, therefore, we do not expect to see a sustained depreciation trend.”

It’s worth noting that the USD/JPY grinds around 115.50 ahead of the key preliminary Q4 GDP for Japan.

Read: USD/JPY is thrown around on interpretations of Ukraine's Feb 16 Russian invasion

US inflation expectations, as measured by the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, keep reflation fears on the table with its latest jump to the highest levels since January 12.

That said. inflation gauge rise to 2.48% at the latest while extending the slow grind to the north triggered since late January before flashing a three-month low.

It’s worth noting that St. Louis Fed President James Bullard reiterated his call for 100 basis points (bps) in interest rate hikes by July 1 by citing the last four inflation reports which show broadening inflationary pressures.

On the same line is the CME FedWatch Toll that suggests around 61% probabilities for a 50-75 basis points (bps) of a rate hike during the March meeting.

With this, today’s US Producer Price Index (PPI) for January, expected 9.1% YoY versus 9.7% prior, will be important for short-term market moves.

- Silver grinds higher around three-week top on looming bullish moving average cross.

- Upbeat MACD signals keep buyers hopeful, 23.6% Fibonacci retracement guards immediate upside.

- Sellers remain unconvinced beyond $23.00, January’s peak lure bulls.

Silver (XAG/USD) buyers take a breather around three-week high, taking rounds to $23.85-90 during the initial Asian session on Tuesday.

In doing so, the bright metal bulls attack 23.6% Fibonacci retracement (Fibo.) of December-January upside.

That said, the 50-SMA stays ready to pierce the 200-SMA, suggesting a bull cross, amid price-positive signals from the MACD.

Hence, XAG/USD buyers are waiting for the $24.00 breakout to excel further, which in turn will highlight the previous month’s top near $24.70.

Following that, the $25.00 threshold and November 2021 peak surrounding $25.40 will be in focus.

Alternatively, pullback moves may aim for the 38.2% Fibo. level near $23.45 but a convergence of the 50-SMA and 200-SMA, as well as the 50% Fibonacci retracement, highlights $23.05, as the key support level.

Also acting as a downside filter is the $23.00 round figure, a break of which will welcome XAG/USD sellers targeting a monthly low of $22.00.

Silver: Four-hour chart

Trend: Further upside expected

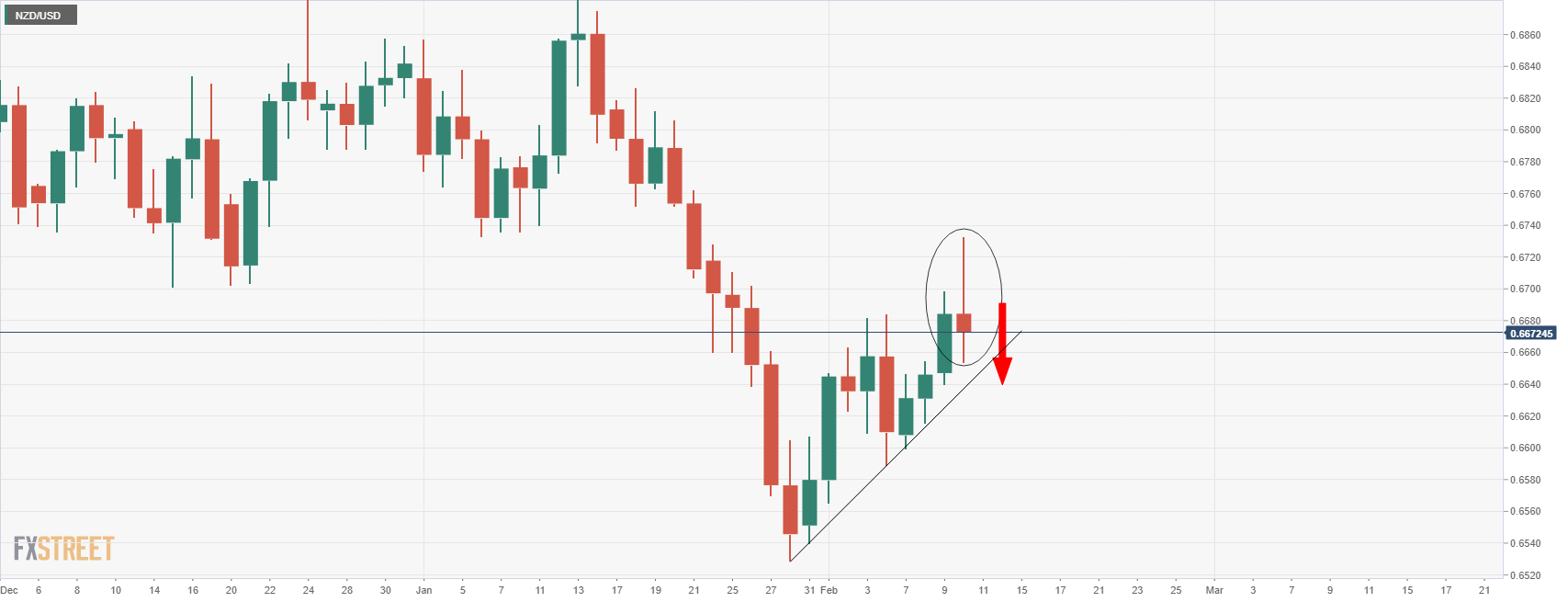

- NZD/USD fades bounce off one-week low, remains pressured after three-day downtrend.

- Anxiety over Russian invasion of Ukraine unpins safe-haven demand of gold, USD.

- Mixed NZ data, Fedspeak also play their role to keep bears in command.

- Geopolitical headlines, US PPI may entertain traders ahead of next week’s RBNZ.

NZD/USD buyers are unsure of their returns, mainly due to the risk-off mood, by staying defensive around 0.6615 during early Tuesday morning in Asia. Even so, the Kiwi pair pauses the previous three-day downtrend while taking rounds to the lowest levels since February 04 marked the previous day.

Global markets witnessed a shaky start of the week, portraying the risk-aversion wave, as fears of the Russian invasion of Ukraine keep fueling the safe-havens like the US dollar and gold while weighing on the Antipodeans. It’s worth noting that the US Treasury yields regained upside momentum after stepping back from a 2.5-year high on Friday whereas the Wall Street benchmark closed in the red, despite mildly positive week-start performance.

Talking about the Moscow-Kyiv story, the Western leaders initially highlighted fears of Russia’s attack on Ukraine during this week before market chatters of February 16 to be the D-day. On the positive side were headlines covering Russian Foreign Minister Sergey Lavrov who told President Putin that the US had put forward concrete proposals on reducing military risks and that he could see a way to move forward with talks. Russia’s Lavrov also mentioned that EU and NATO responses have not been satisfactory, which in turn highlights risk-off mood despite easing fears.

Elsewhere, St. Louis Fed President James Bullard reiterated his call for 100 basis points (bps) in interest rate hikes by July 1 by citing the last four inflation reports which show broadening inflationary pressures.

On the economic calendar, New Zealand’s Business NZ PSI eased in January whereas Food Price Index and REINZ House Price Index both improved during the stated month. Further, the Visitor Arrivals in December rose from 3.8% prior to 4.4% YoY.

Against this backdrop, analysts at ANZ said, “Despite slowing housing and risks to the activity outlook, the inflation impulse provides plenty of reason for the RBNZ to stay the course with OCR hikes.”

Looking forward, US Producer Price Index (PPI) for January, expected 9.1% YoY versus 9.7% prior, will join Empire State Manufacturing Index for February, market consensus 12 versus -0.7% previous readouts, to decorate the daily calendar and direct short-term NZD/USD moves. However, major attention will be given to the Fedspeak and risk catalysts.

Technical analysis

A clear downside break of a 12-day-old ascending trend line directs NZD/USD prices towards 2022 bottom surrounding 0.6530. However, February 04 low near 0.6590 may offer an intermediate halt during fall.

Alternatively, 21-DMA and the latest swing high, respectively around 0.6660 and 0.6670 in that order, will restrict corrective pullback of the Kiwi pair.

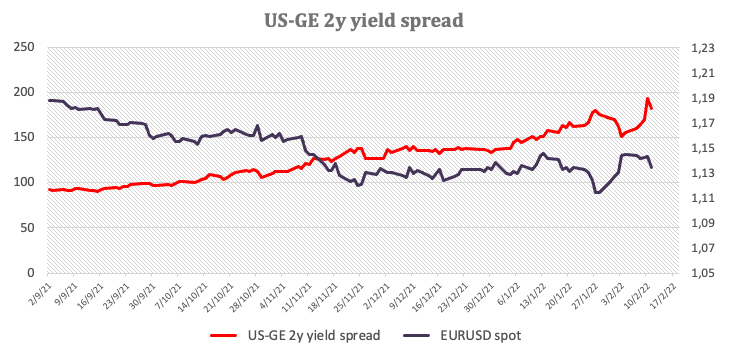

- The shared currency falls for the second straight day, weighed by geopolitical concerns and US dollar strength.

- The US Dollar Index gained some 0.23% at 96.30, underpinned by higher US Treasury yields.

- EUR/USD is downward biased, emphasized by EUR sellers reclaiming the 50-DMA.

The EUR/USD slides towards the 1.1300 figure amid renewed concerns of a Russian invasion of Ukraine, as risk-aversion gets to the highest level in some time. At the time of writing, the EUR/USD is trading at 1.1304.

As Wall Street closed, equities portrayed a gloomy market mood, except for the Nasdaq Composite, up 0.10%. The greenback ended higher against most G8 currencies in the FX market, boosted by its safe-haven status. The US Dollar Index, a gauge of the buck’s value, advanced some 0.23%, sitting at 96.30.

In the fixed income market, US Treasury yields led by the 10-year T-note rose four basis points, sat at 1.991%, underpinned the greenback, which weighed on the EUR/USD. Those factors, alongside the conflict in eastern Europe, triggered EUR weakness.

EUR/USD Price Forecast: Technical outlook

Despite the five-day rally post-ECB’s hold when ECB President Christine Lagarde muted on hiking rates in 2022, the EUR/USD is downward biased. However, the upward move stalled at resistance near the January 13 daily high at 1.1482, followed by last Friday’s drop of almost 100-pips. Furthermore, the EUR/USD got back inside the descending Pitchfork’s channel, and at the same time, EUR sellers reclaimed the 50-DMA.

Therefore, the EUR/USD path of least resistance is downwards. The EUR/USD first support would be 1.1300. Breach of the latter would expose the mid-line between the central-top trendline of Pitchfork’s channel around the 1.1220-30 range, followed by the YTD low at 1.1121 and then central trendline of Pitchfork’s near the 1.1000.

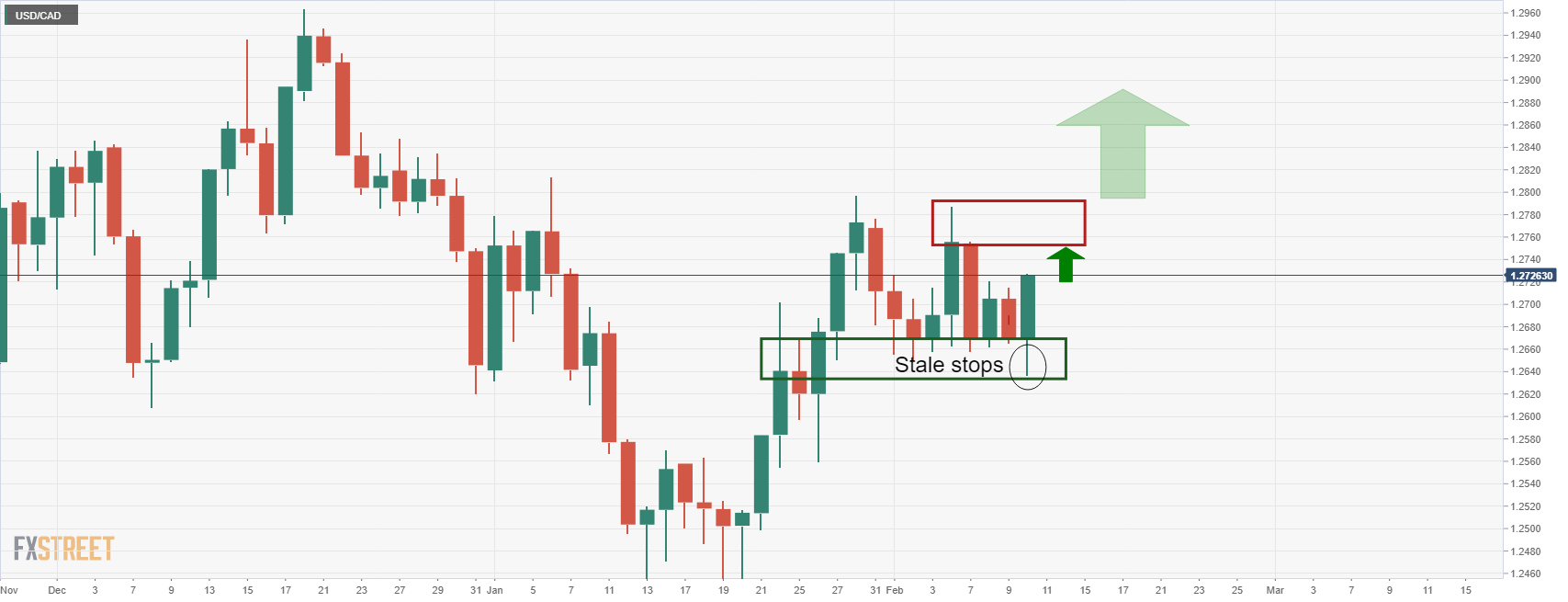

- USD/CAD is stuck in a sideways range awaiting geopolitical drivers.

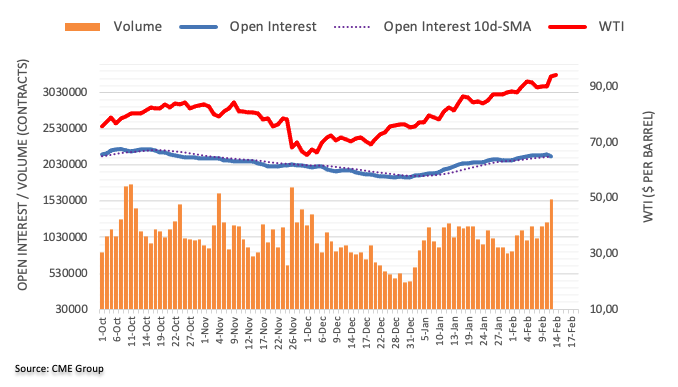

- The price has reached a key upside target, now drifting lower as oil prices surge.

USD/CAD remains in familiar territory as fundamentals fail to gain traction as the world waits on Russia's next move or for diplomacy to prevail and avert a catastrophe in geopolitics.

In the prior, USD/CAD Price Analysis: The 1.2780's are in focus now that bulls are back in control, it was note that ''the price had found stability in the hourly lows but it has carved out a lower low as follows:

and that ''the spike lower would have cleared out some of the stale sell stops below the daily support.''

This had resulted in a renewed bullish impulse on the daily chart as follows:

Eyes were on the 1.2780's and the Feb highs for the days ahead and the bulls have reached the target as follows:

The outlook at this juncture remains clouded by the geopolitical backdrop and the familiar ranges will likely remain in play until there is a resolve or escalation way or another. WTI will also be a key driver as it heads towards $100bbls, supportive of CAD.

- AUD/USD continues to trade with a downside bias as geopolitical angst keeps the dollar in demand.

- The economic calendar is busy, with RBA and Fed minutes and policymaker rhetoric, plus key data releases.

As markets remain skittish on the prospect of a potentially imminent Russian military incursion into Ukraine, macro sentiment remains on the defensive and, as such, AUD/USD continues to trade with a negative bias. The pair is down around 0.2% on the day in the 0.7125 area, having recovered somewhat from a brief dip underneath the 0.7100 level early during European trade, but having failed to recover back to the 0.7150 level.

The fast pace of developments on the Russia/Ukraine front remains confusing for investors to follow and difficult to predict what is coming next. Earlier in the day, Russia indicated a preference for continuing diplomacy, but Satellite imagery cited by US press shows that Russian troops near the Ukrainian border are moving into attack positions. Meanwhile, the Ukraine President “jokingly” referred to Wednesday as a possible date when Russia may attack, a statement which markets took seriously at first, but now are unsure what to make of.

All said, the state of heightened geopolitical risk ought to keep AUD/USD capped for now. The Aussies exposure to commodity prices, however, may prevent AUD from being the worst hit of risk-sensitive G10 currencies in the case of an all-out Russia/Ukraine war scenario. Energy prices have been surging and precious metals are up, both positives for the Aussie. Geopolitics will remain the main driver for AUD/USD this week, though traders should also keep an eye on a busy economic calendar that includes RBA and Fed minutes and policymaker commentary, plus US PPI, Retail Sales, regional Fed manufacturing surveys and Australia jobs data.

- The EUR/GBP pares some of its monthly gains, courtesy of risk-off market mood and technical barriers.

- The 100-DMA capped EUR/GPB rally, followed by a consolidation of three days.

- A daily close below 0.8358 would keep the EUR/GBP sellers in control as they prepare for an attack of 0.8300.

The shared currency losses ground for the third consecutive day against the British pound amid a risk-off market mood spurred by Russia/Ukraine conflict. That said, at press time, the EUR/GBP is trading at 0.8354.

The EUR/GBP price action on the last three days witnessed a fall in line with the overall trend of the daily moving averages (DMAs), lying above the spot price. However, when the BoE and the ECB revealed their monetary policy decisions, the pair rallied almost 200-pips, towards 0.8477, which pierced the 100-day moving average (DMA), retreating three days afterward.

EUR/GBP Price Forecast: Technical outlook

The EUR/GBP remains tilted to the downside. Last Friday’s price action triggered a leg-down as bears reclaimed the 50-DMA at 0.8413, which exacerbated a downward move beyond the 0.8400 figure, reaching a daily low at 0.8358.

During the overnight session for North American traders, the EUR/GBP bulls attacked February’s 11 daily low and printed a daily high at the daily pivot point at 0.8385, followed by a drop below 0.8358, where the EUR/GBP comfortably trades as the New York session end looms.

The EUR/GBP first support level would be 0.8345. Breach of the latter would expose January 31 low at 0.8304. Once that level is cleared, it would expose the YTD low at 0.8283 and then a probe of 0.8200.

- USD/JPY round turns on conflicting Ukraine headlines driving risk sentiment.

- World leaders will engage in high stake meetings this week over the threat of the Russian invasion.

- Fed sentiment coming through as hawkish Fed speakers advocate 50bps hike in March.

USD/JPY is back on the bid following a series of information that is crossing the wires with regards to the prospects of a Russian invasion. In recent trade, the President of Ukraine Volodymyr Zelensky was reported to have said that the Ukraine “has been informed” that Wednesday, February 16 “will be the day of the attack”. This sent the yen higher and financial markets into risk-off mode again:

-

Markets flip risk-off as Ukraine's President Zelensky cites 16 Feb. as day of Russia attack

However, as the chart illustrates above, the price turned on a dime when a senior Ukrainian official denied that President Zelensky was being literal when he said in an address to the nation that he'd been told a Russian attack would begin on February 16th. Mykhailo Podoliak, a Presidential adviser, said that Zelensky was being ironic. Meanwhile, the risk is very real and markets are on high alert and on tenterhooks. The yen stands to benefit from risk aversion, especially through crosses such as AUD/JPY. Traders will be waiting for leaders to meet, with the French president visiting Moscow and the US president meeting with the Zelensky at the White House on Wednesday.

As for other fundamental drivers, the US dollar index reached a two-week high on Monday, as St. Louis Federal Reserve President James Bullard reiterated calls for a faster pace of U.S. Federal Reserve interest rate hikes. Bullard on Monday also said that four strong inflation reports in a row warranted action. Last week's stronger-than-expected US Consumer Price index report has driven speculation the Fed might raise rates by a full 50 basis points in March.

- NZ House Prices rose 1.4% MoM in January on a seasonally adjusted basis.

- NZD did not see any reaction to the latest housing figures.

New Zealand House Prices rose at a MoM pace of 1.4% and 20.3% YoY in January on a seasonally adjusted basis, according to the latest data from Real Estate Institute of New Zealand (REINZ) released on Monday. However, the institute said that "compounding factors" are influencing a decrease in house prices and sales activity in New Zealand.

Market Reaction

NZD has not reacted to the latest data, with NZD/USD continuing to trade sideways just above the 0.6600 level.

What you need to know on Tuesday, February 15:

Tensions between Russia and Ukraine dominated financial markets on Monday, leading to some solid safe-haven demand. The catalyst was a statement from US President Joe Biden, who told his Ukrainian counterpart Volodymyr Zelensky on Sunday that the US would respond "swiftly and decisively" if Russia takes further steps toward invasion.

Early on Monday, Russian Foreign Minister Sergey Lavrov told President Putin that the US had put forward concrete proposals on reducing military risks and that he could see a way to move forward with talks, although he added that EU and NATO responses have not been satisfactory. Fears partially eased, although risk-off continues.

As the day comes to an end, there are no signs of progress in diplomatic talks, but on the contrary, the Ukrainian President Zelensky reported that he has suspects Russia will likely attack the country on Wednesday, February 16, declaring it a national holiday, the Day of Unity.

The American dollar and gold were the most benefited in a risk-averse environment, with the first further boosted by comments from US St Louis Fed President James Bullard, who reiterated his call for 100bps in interest rate hikes by July 1, citing the last four inflation reports which show broadening inflationary pressures.

A scarce macroeconomic calendar exacerbated risk-related trading, with not much in the docket until next Wednesday, when the US will publish Retail Sales and the FOMC Meeting Minutes.

The EUR/USD pair trades sub-1.1300, while GBP/USD hovers around 1.3520. Commodity-linked currencies are little changed vs the greenback amid soaring gold and oil prices.

Global indexes plunged, with Wall Street accelerating its decline ahead of the close. Government bond yields retreated, with that on the 10-year Treasury note now at around 1.96%.

Gold surged to a fresh 2022 high of $1,872.85 a troy ounce, holding nearby at the time being. Crude oil prices also soared, with WTI trading at $95.25 a barrel.

Shiba Inu struggles to hold support, SHIBA could retest prior range near $0.000020

Like this article? Help us with some feedback by answering this survey:

- USD/CHF remains subdued near 0.9250 despite choppy conditions elsewhere in FX markets/other asset classes as Russia prepares its Ukraine assault.

- Both the buck and Swiss franc are currently underpinned by a safe-haven bid, making for unpredictable trading conditions going forward.

Despite recent cross-asset choppiness after the Ukrainian President confirmed Russia will attack on Wednesday and after reports citing satellite imagery said Russian troops were now moving into attack positions, USD/CHF continues to trade in a relatively contained manner. The pair is currently flat on the day near 0.9250, having swung within thin 0.9240-70ish ranges on the first trading session of the week. The pair’s lack of notable volatility owes to the fact that both the US dollar and Swiss franc are viewed as safe-haven currencies in the context of elevated geopolitical uncertainty.

Technicians will note that the pair has in the last few days formed a pennant structure that suggests a breakout in either a bullish or bearish direction is likely. Recent upside in US bond yields amid further hawkish commentary from influential Fed policymaker James Bullard on Monday helped underpin the US dollar, safe-haven demand aside, against some of its G10 peers. Bullard’s remarks helped pump Fed tightening expectations. If economic events this week (Producer Price Inflation on Tuesday, Retail Sales and Fed minutes on Wednesday) further solidify expectations for a 50bps rate hike from the Fed in March, then that could favour an upside break.

In this instance, the immediate area of resistance to be watching is last week’s highs just under 0.9300 and then the annual highs near 0.9350 just above it. However, if war is on the brink of breaking out in Eastern Europe and associated sanctions on the Russian economy do risk causing another spike in global inflationary pressures, traders may continue to view CHF favourably. Inflation is structurally lower in Switzerland than elsewhere, as has been witnessed in the post-pandemic era. Amid a highly uncertain geopolitical backdrop, USD/CHF trading conditions will likely be unpredictable and it may be far to soon to call for a lasting breakout of the 0.9100 to upper-0.9300s range that has persisted for six months.

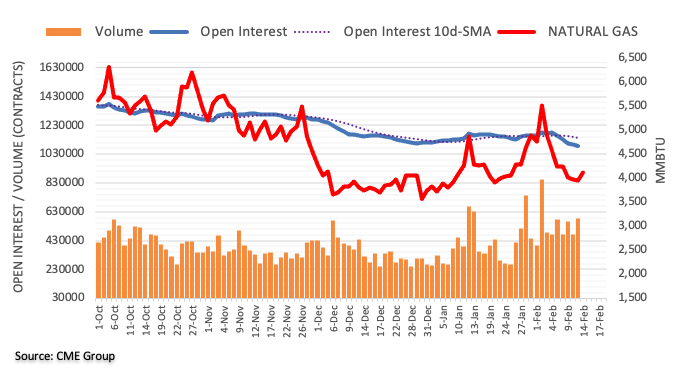

- Increasing tensions of a war between Ukraine/Russia keep oil prices rising, almost 2% in the day.

- Satellite images show Russian troops leaving assembly points – per CBS News.

- WTI Technical Outlook: Upward biased, as geopolitical tensions maintain oil bulls eyeing $100.

US crude oil benchmark, Western Texas Intermediate (WTI), barely advances, following Friday’s jump of 3.78%. At the time of writing, WTI is trading at $94.00, almost flat.

Geopolitical events dampened the market mood in the financial markets. Russia’s intentions of a possible invasion of Ukraine keep crude oil prices upward pressured, based on the fact that a war may trigger Russia’s sanctions to western countries, including cutting supplies of natural gas and oil. (Russia is the third-largest producer of natural gas and crude.)

Ukraine President Zelensky informed that February 16th would be the day of the attack, tensions elevate, and oil jumps

Around 18:50 GMT, crossed the wires that satellite images show Russian troops leaving assembly points and moving to attack positions, as reported by CBS News. Alongside that development, the Wall Street Journal reported that the US is closing its embassy in Kyiv and relocating its diplomatic operations to Western Ukraine. Furthermore, Ukraine President Zelensky said that Ukraine “has been informed” that Wednesday, February 16th “will be the day of the attack.”

WTI’s Reaction

At the headline, WTI’s jumped almost $2.00, and at 19:09, GMT is trading at $95.20 as tensions arise, despite efforts from finding a diplomatic way to end this conflict.

Meanwhile, OPEC Secretary-General Mohammad Barkindo told reports that “there’s no doubt that we are concerned with ensuring that the security of supply is also guaranteed.” However, emphasized that if demand continues to grow at the group projections, “the world will continue to be thirsty for oil for the foreseeable future,” Barkindo noted.

WTI Price Forecast: Technical outlook

WTI is upward biased and is trading above February’s 11 daily close at $93.88, though the upward move appears to stall at the mid-line between the top-central lines of Pitchfork’s uptrend channel, around $95.00, which once broken would expose $100.00.

Nevertheless, WTI’s would face some hurdles on its way north. The first resistance would be $95.00. A daily close above that level would expose August’s 2014 swing highs round 98.55, followed by a probe of $100.00, followed by the top-line of Pitchfork’s channel around $102.00

Ukraine's President Zelensky said that the Ukraine “has been informed” that Wednesday, February 16 “will be the day of the attack”, according to comments attributed to Zelensky accompanying a Facebook update to the nation.

He does not say who or what agency provided the information.

Nevertheless, the market is paying attention to each and every update. The 16th was a date US President Joe Biden told Western leaders about last week as a potential time when Russia will start a physical assault on Ukraine.

In an update, Russia has moved some long-range artillery and rocket launchers into firing position, threatening Ukraine, according to a US official. A bumper-to-bumper formation is seen in satellite photos — and are beginning to move into "attack positions," according to the official who said that the US believes Russia will attack Ukraine by the end of the week, although it's not yet certain what form it will take, the official said.

The US benchmarks are printing fresh lows with the S&P 500 now moving to 4,371 the low while AIUD/JPY drops from the corrective highs and challenges what may otherwise have been regarded as the formation of an inverse head and shoulders:

AUD/JPY technical analysis, H1 chart

As for the forex market's risk barometer, AUD/JPY, the price is breaking the right-hand shoulder to the downside and finding so, invalidates the inverse head and shoulders, putting the focus on the downside once again. 81.11 could become a strong level of resistance on a retest with 81.66 the next level of potential support.

- NZD/USD bulls tests bear commitments at 4-hour resistance at 0.6627.

- Bears look for a break of daily support at 0.6589 to engage fully from there.

As per the prior analysis, NZD/USD struggles in the face of a stronger US dollar despite hot RBNZ inflation expectations, there are bearish developments to take note of.

it was stated in the prior analysis, that ''the Doji candle, if followed by a bearish close on Friday, could set the case for a downside continuation for next week's business,'' as follows:

NZD/USD live market

The price action since the prior analysis has started to play out. The Doji was followed by a relatively strong bearish candle and today's, while yet to close, is also bearish.

The outcome of today's close could leave a Three Black Crows bearish candlestick formation on the daily chart. However, the candles should ideally be relatively long-bodied bearish candlesticks that close at or near the low price for the period. Nevertheless, the focus is on the downside from a longer-term perspective as illustrated in the following weekly chart:

NZD/USD H4 structure and scenarios

From a bullish perspective, the price could easily find support at the daily support structure. If the current tests at 4-hour resistance at 0.6627 fail but support remains firm, we will have a trapped scenario.

This could easily lead to a break of resistance and bullish market structure, leaving the focus back on the upside again for a deeper correction of the weekly chart's bearish impulse.

On the other hand, bears will be encouraged by a break of daily support at 0.6589 and might engage fully from there on the restest of the structure. This would be expected to act as a firm resistance and ultimately lead to a downside continuation of the weekly chart's bear trend.

- Gold remains stable during the North American session, up 0.41%.

- A dampened market mood spurred by geopolitical jitters witnessed flows towards the safe-haven status of gold.

- XAU/USD Technical Outlook: Upward biased, though a clear break above $1877 would put $1900 at reach.

The safest haven asset of all, gold, remains steady during the beginning of the week, despite a stronger US dollar across the board. However, it retreats from daily tops around $1,871 as geopolitical tensions appear to ease in the conflict between Russia and Ukraine. That said, XAU/USD is trading at $1,867, up some 0.43% at the time of writing.

Financial markets sentiment remains downbeat, as shown by global equities falling, except for the Nasdaq Composite in the US. US Treasury yields keep rising, led by the 10-year T-note yield, at 2.021%, up to ten basis points in the day, though the non-yielding metal remains stubbornly in the green, amid escalations in the eastern Europe conflict.

In the meantime, Russia / Ukraine geopolitical jitters are the leading indicator in the markets at press time. Earlier, as reported by CNN, the US intelligence is assessing Russian military plans, including the surrounding of Kyiv, within 24-48 hrs from the start of military action. Nevertheless, early messages from the Russian Foreign Minister Sergey Lavrov on Monday said Russia could move forward with talks, emphasizing that the west has failed to address Russia’s interests.

Those remarks appeared to ease the market mood, though they failed to reignite a rally in US equities.

Regarding the economic docket, the Fed speaking in the likes of St. Louis President James Bullard, crossed the wires. He commented that he keeps his 1% threshold by July 1st at 1% concerning interest rates. While speaking of the balance sheet, he is worried that the Fed is not moving fast enough and would like to reduce the balance sheet in Q2.

XAU/USD Price Forecast: Technical outlook

Gold (XAU/USD) is trading above a nine-month-old, despite rising US T-bond yields and broad US dollar strength across the board. Furthermore, it is trading above the mid-line between the center-top Pitchfork’s uptrend channel, a confluence, which once broken, would expose the top of it, around the $1,872-75 area.

That said, the XAU/USD first resistance would be November’s 16 swing high at $1,877. Breach of the latter would expose the $1,900 psychological level, followed by June 1st swing high at $1,916.

Contrarily, in the event of XAU/USD moving downward, it would expose crucial support levels, like the mid-line between the top-central Pitchfork’s channel around the $1,850-55 regions, followed by the central trendline at the $1,832-35 area, followed by the confluence of the 50 and the 200-DMA at the $1,809-07 range.

- A break of the 156.00/10 structure to the downside would open the risk of an hourly continuation.

- Bulls note an inverse head & shoulders bullish chart pattern and a break of the neckline near 156.50.

As per the prior day's analysis, GBP/JPY Price Analysis: Bears move in on critical hourly support, the price broke to the downside on news relating to Russia but has since bounced back into the resistance area.

GBP/JPY prior analysis, 15-min chart

GBP/JPY live market, 15-min chart

The Russian headlines have been coming through thick and fast creating volatility in forex, especially in the yen. While the price has firmed, it is still within the bear's layer.

GBP/JPY prior analysis, H1 chart

From an hourly perspective, the bears are focused on the downside target towards the midpoint of the 154's.

GBP/JPY inverse H&S H1 chart

The price can easily be rejected at this juncture and a break of the 156.00/10 structure to the downside would open risk of a continuation towards the hourly 154.50's target.

On the other hand, given the inverse head & shoulders bullish chart pattern, a break of the neckline near 156.50 could open prospects of demand through the 156.80's and with a focus on the rising channel again and prospects beyond the 157.20's.

- USD/JPY rebounded from 115.00 as USD became the safe-haven of choice amid ongoing geopolitical concerns on Monday.

- Hawkish commentary from Fed’s Bullard spurred upside in US yields, reducing the yen’s appeal and boosting the dollar.

USD/JPY rebounded from the 1.1500 level during US trade on Monday, having failed on multiple occasions since last Friday to break below the key level. The pair is now trading close to highs of the day in the 115.60s, up about 0.2% and is eyeing a retest of the 116.00 level and last week’s highs in the 116.30s. Though geopolitical tensions remain elevated in the throes of what feels like the final diplomatic push to avoid a Russia/Ukraine military conflict, the yen’s safe-haven bid has been easing as the US dollar becomes the FX haven of choice.

That is likely due to a surge in US government bond yields on Monday (the 2-year +9bps and back above 1.60% and the 10-year +6bps and back above 2.0%) as markets amp up Fed tightening bets once more. Spurring the move were comments from FOMC member James Bullard who doubled down on his calls for the Fed to hike interest rates by 100bps by July 1 and pledged to try to bring round other Fed colleagues to his view.

USD/JPY remains highly sensitive to US /Japan bond yield differentials, particularly at the long end. With the BoJ having pledged to buy JGBs in unlimited size to prevent the Japan 10-year yields from rallying above 0.25% (and having succeeded thus far), the further 10-year US yields rise, the more upward pressure will be exerted on USD/JPY. Data and Fed speak this week will be viewed in the context of how it influences the chances of a 50bps rate hike from the Fed in March and the pace of subsequent tightening. It’s a busy week on the economic calendar, with January Producer Price Inflation and Retail Sales data, as well as February regional Fed manufacturing surveys out.

- The USD/CAD rises some 0.01% in the North American session.

- Russia-Ukraine conflict tensions “appear” to ease, but mixed news keeps traders nervous.

- USD/CAD remains range-bound amid the lack of a catalyst to guide the pair.

The USD/CAD begins the week on the right foot extends its gains for the third straight day amid a risk-off market mood, spurred by the Russia-Ukraine conflict jitters. At the time of writing is trading at 1.2735, above last Friday’s highs.

Risk-aversion looms the financial markets, as developments since last Friday’s when news that a Russian invasion of Ukraine was “imminent” spurred erratic movements in all the assets classes. In the FX market, safe-haven peers rose and found follow through on Monday, as the USD is the strongest, followed by the JPY.

In the case of the USD/CAD, the Loonie got a boost from rising oil prices. Concerns of not enough supply caused the jump since Friday, as Russia is the third-largest producer of natural gas and oil. So, any escalations and the invasion of Russia to Ukraine could weigh on oil prices and put a lid on the USD/CAD price. At press time, WTI is trading at $94.56 power barrel, up 0.49%

The latest development of the Ukraine-Russia conflict keeps showing mixed messages from western and Ukrainian sources

Earlier in the day, as reported by CNN, US intelligence indicates that Russia continues to build up forces around Ukraine “in preparation for possible military action this week,” a senior US official briefed on the intelligence, per CNN.

However, as reported by Interfax, a Ukrainian official said that the country sees no full-scale of Russian attack in the coming days.

Concerning central bank policy, the expectations of a Federal Reserve “aggressive” tightening looms, as US inflation for January rose to 7.5, while the Core CPI that exclude volatile items jumped to 6%, spurred reactions of the more “hawkish” member of the Fed. On Friday, St. Louis President James Bullard backpedaled from what he said at the beginning of the month, emphasizing that he would favor a 50 bps increase to the Federal Funds Rate (FFR) and expect it to be at 1% by July. Those remarks increased the demand for greenback.

On Monday, the Canadian and US economic docket are absent. On Tuesday, the Canadian docket would feature Housing Starts for January. On the US front, prices paid for producers, with the Producer Price Index (PPI), followed by the Redbook.

USD/CAD Price Forecast: Technical outlook

The USD/CAD is neutral-upward biased, as shown by the daily moving averages (DMAs) above the exchange rate. As previously mentioned, the USD/CAD is range-bound, unable to break the 1.2650-1.2780 range, with only false breakouts upwards/downwards, amid the lack of a catalyst or the convergence of central bank monetary policy conditions.

That said, the USD/CAD resistance levels are the February 11 high at 1.2753, followed by January 31 at 1.2776, and then the January 28 swing high at 1.2796. On the flip side, the first support would be February 10 daily high previous resistance-turned-support at 1.2727, followed by the 50-DMA at 1.2701 and then February 10 daily low at 1.2635.

The AUD/USD pair tested levels under 0.7100 on Monday. Analysts at Danske Bank see the pair at 0.71 on a three-month perspective, at 0.70 in six months and at 0.69 in a year.

Key Quotes:

“The rally in commodity prices has supported AUD since late January as broad USD strengthening took a step back. Continuing easing from China is especially supportive for Australia’s key export commodity, iron ore.”

“The outlook for commodities remains uncertain, as the global recovery and Chinese easing have supported demand, but more aggressive Fed tightening and broad USD strength should limit the rise in prices.”

“The Reserve Bank of Australia ended its QE purchases in February. RBA highlighted the risks of more persistent inflationary pressures, but also noted that near-term rate hikes remain unlikely. Labor market conditions have tightened, but data released so far does not yet point towards a pickup in wage inflation. First rate hike seems likely in H2 this year, but with the very hawkish market pricing, relative rates remain a drag on AUD.”

On Wednesday, the January retail sales report is due in the US. According to analysts at Wells Fargo, sales likely rebounded rising 2.1%, a number above the 1.6% increase of market consensus.

Key Quotes:

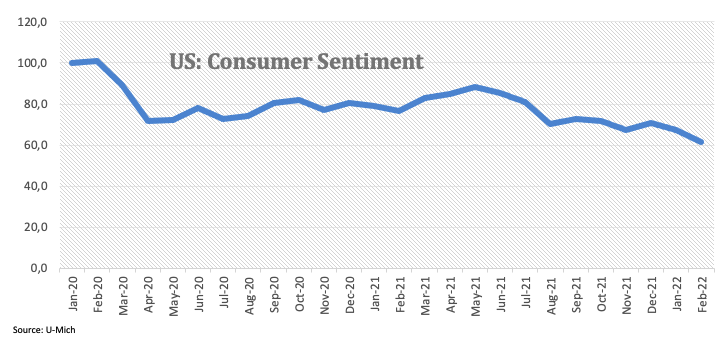

“Retail sales declined sharply to end 2021. During December, total sales fell 1.9%, a drop that was more severe than consensus expectations. The decline was broad-based across most store types. Excluding spending on autos and gas, sales fell 2.5%. While it is tempting to blame December's drop on intensifying inflation and the Omicron surge, the weakness during the month was more a reflection of early holiday shopping and pulled-forward demand. That is not to say inflation is not a concern moving forward. Inflationary headwinds to consumer activity are likely to pick up throughout 2022, as evidenced by the recent deterioration in consumer sentiment.”

“Another factor that may affect spending this year is that, as the economy emerges from the latest Omicron wave, it doesn’t have the same fiscal support it had previously. In terms of COVID, consumers continue to become desensitized to rising case counts with each passing wave of the virus. In addition, households remain in solid financial shape today, which should support overall consumer spending in the months ahead.”

“We look for retail sales to bounce back and rise 2.1% in January.”

The USD/CAD pair will likely move to the upside over the next months according to analysts at Danske Bank. They forecast the pair at 1.36 in a twelve-month horizon.

Key Quotes:

“CAD has over the last month risen on the global setback to risk and Bank of Canada (BoC) disappointing market expectations. At the January meeting markets priced a higher than 50% likelihood of a rate hike yet BoC kept its guidance that the first hike will come in the “middle quarters” of 2022. While we cannot rule out a hike at the interim March meeting we still think the big meeting in April is the most likely time for the first hike.”

“We still regard relative rates to be a positive for USD/CAD and we pencil in more topside to the cross from our view on the external environment.”

“We still like to treat USD/CAD as a low beta version of USD/NOK, We now forecast USD/CAD at 1.29 in 1M (from 1.25), 1.31 in 3M (from 1.29), 1.33 in 6M (1.32) and 1.36 in 12M (1.33).”

ECB President Christine Lagarde on Monday said that the bank will take action at the right time to achieve its 2.0% inflation goal over the medium term. In the near term, she added, inflation is likely to remain high and bottlenecks will still persist for some time. There are some signs these bottlenecks might be starting to ease, she said, saying that in the medium-term, the ECB views the risks to the economic outlook as broadly balanced. However, in the near term, Lagarde continued, risks to the outlook for inflation are tilted to the upside, although while the near-term outlook is uncertain, inflation is expected to decline over the course of the year. Finally, Lagarde noted that the solid anchoring of long-term inflation expectations in the euro area near the 2.0% level is reassuring.

Market Reaction

Lagarde's latest remarks do not add anything new to what she said last week or the week before in her post-ECB press conference, thus, the euro has not reacted.

- US dollar holds onto gains amid risk aversion and higher yields.

- Euro fails to recover ground, continues under pressure.

- EUR/USD head for lowest close in two weeks.

The EUR/USD printed a fresh weekly low under 1.1300 during the American session as the US dollar remains strong supported by risk aversion and higher US yields. The pair botomed at 1.1288, before rebounding modestly.

EUR/USD back under the 20-day SMA

The correction from last week top near 1.1500 has turned into a potential reversal. Now EUR/USD is hovering around 1.1300, back under the 20-day simple moving average (1.1330) about to post the second-lowest daily close of the current months. The pair is back into the 1.1250/1.1360 range.

A recovery above 1.1370 should put the euro back on track for 1.1400 and more. The next resistance stands at 1.1450; above attention would turn to the 1.1480/90 area that capped the upside last week and also in January.

Higher yields despite risk aversion

Equity prices in Wall Street failed to hold onto positive territory. The Dow Jones is falling 0.65% and the S&P 500 by 0.21%, the Nasdaq is the exception as it gains 0.85%. Caution still prevails across financial markets supporting the demand for the dollar.

US yields also gave a boost to the greenback. The US 10-year rebounded from 1.90% (1-week low) and climbed back above 2.01%, while the 30-year rose from 2.21% to 2.32% in a few hours.

Market participants’ attention continues to be on Russian/Ukraine tensions and also on comments from Federal Reserve and European Central Bank officials. After a quiet day on Monday regarding economic data, on Tuesday data to be released includes GDP, employment and the ZEW survey in the Eurozone, while in the US, the key number will be the Producer Price Index.

Technical levels

- Silver is on the front foot and trading in the $23.80 area, despite a stronger buck and higher US yields.

- XAG/USD has been underpinned by a safe-haven bid as traders fret about the imminent prospect of a Russia/Ukraine war.

Despite the stronger US dollar and a sharp rise in US government bond yields across the curve in wake of the latest remarks from hawkish Fed policymaker James Bullard, spot silver (XAG/USD) prices have been on the front foot. Spot prices run out of steam and were unable to test the $24.00 per troy ounce level, but at current levels around $23.80, continue to trade about 0.9% or more than 20 cents higher on the day. For reference, Bullard, who is St Louis Fed President and a voting FOMC member in 2022, doubled down on his call for 100bps in Fed tightening by July 1. That gave Fed tightening bets a pump (money markets now price a more than 60% chance of a 50bps hike in March versus closer to 50% prior to his remarks), exerting upwards pressure on yields and the buck.

But precious metals have escaped the negative impact of higher yields, which increase the opportunity cost of holding non-yielding assets, and a stronger buck, which makes them more expensive to non-USD holding buyers, due to a continued safe-haven bid. Indeed, while Russian Foreign Minister Sergey Lavrov on Monday advised Russian President Vladimir Putin to continue with diplomacy for now, fears of imminent Russian military action against Ukraine remain elevated. US press, citing US intelligence, have been furiously reporting in recent days that an invasion could come as soon as this week.

Of course, when military tensions between Russia, who want to ensure Ukraine never joins NATO, and the West, who want to ensure Russia doesn’t invade Ukraine, rise, familiar fears about escalation towards a nuclear conflict arise. While a Russian invasion into Ukraine, a non-NATO member, wouldn’t directly trigger Russia/NATO conflict, there is a risk that conflict could spill across Ukraine’s borders to neighboring NATO countries (like Poland). Otherwise, and perhaps a more important reason why traders might be piling into precious metals, is the risks to the global economy that a Russia/Ukraine war presents.

If the West was to hit Russia with massive economic sanctions, Russia could hit back by restricting natural resource exports (oil, gas, industrial metals, ammonia for fertiliser) that could severely damage the global economy and create inflation. In that sense, silver/other precious metals might make sense as a sort of global “stagflation” hedge. An outbreak of war could easily see XAG/USD hit annual highs to the north of $24.50. Fed speak and US data (PPI, Retail Sales) will play a secondary role to this theme this week.

- WTI has stabilised just under multi-year highs in the $93.00s as traders monitor Russia/Ukraine/NATO tensions amid elevated fears of war.

- Tight global market conditions amid continued OPEC+ undersupply versus their own output quotas is another factor supporting prices.

Crude oil markets stabilised on Monday after printing fresh seven-year highs earlier in the day, supported by the ongoing tense geopolitical backdrop in Eastern Europe and continued tight global oil market conditions. Front-month WTI futures, which have swung between multi-year highs near $95.00 and session lows just above $92.00, currently trade in the $94.00 are and are close to flat on the day. The situation surrounding Russia/Ukraine/NATO tensions and the prospect of military action by the former against Ukraine remains highly uncertain and confusing.

For now, diplomacy continues, with Western powers and Ukraine eager to remain and Russian Foreign Minister Sergey Lavrov on Monday recommending to Russian President Vladimir Putin that he continue with negotiations for now. Citing US intelligence, US press has been reporting in recent days that a Russian attack against Ukraine could come as soon as this week. With German Chancellor Olaf Scholz visiting Moscow to meet with Putin on Tuesday, most see an attack prior to then as unlikely.

“Market participants are concerned that a conflict between Russia and Ukraine could disrupt supply,” said analysts at UBS. They added that this is of particular concern to markets because global oil inventories and producer spare capacity are already very low. Indeed, OPEC+ undersupply that has drained global inventories has been one of the major factors behind WTI’s stunning near 25% rally on the year. The group was revealed to have missed its January output quota by 900K barrels per day and International Energy Agency head Fatih Birol on Monday urged the cartel to close this gap.

“If Russia invades Ukraine, crude oil and natural gas prices can be expected to surge significantly… Brent would probably exceed $100 per barrel” said analysts at Commerzbank. Elsewhere in notable geopolitical themes for oil markets to take note of, indirect US/Iran talks are ongoing, though there are no signs of any breakthrough just yet, with talks having now nearly stretched out for one year. A deal could release well over 1M barrels per day in exports to global markets, which could offer some welcome easing to the current massive global supply deficit.

- US dollar holds onto daily gains as Wall Street turns red.

- AUD/USD drops for the third consecutive day in a row, corrects further last week peak.

The recovery of AUD/USD from the weekly low it hit during the European session at 0.7084 found resistance around the 0.7130 area. As of writing, it trades at 0.7115, in negative territory for the day, on its way to the lowest close in ten days, amid a stronger US dollar.

The greenback found buyers on the back of risk aversion. The AUD/USD moved off lows amid a recovery in equity prices but during the American session, US stocks turned negative hitting fresh lows and weakened again the pair.

If the slide in equity prices continues, AUD/USD will likely drop to test 0.7100. Below the next support stands at 0.7085 (daily low) followed by 0.7070 and 0.7050. On the upside, the aussie needs to recover 0.7130 to alleviate the bearish pressure. The next resistance stands at 0.7150 followed by 0.7167.

In Wall Street, the Dow Jones is falling by 0.95% and the S&P 500 0.58% but the Nasdaq gains 0.25%. Concerns about Russian-Ukraine tensions weigh on market sentiment. US yields are rising despite the demand for safe-haven assets. The US 10-year bounced from a weekly lot at 1.90% back to 2%. The move helped the dollar secure daily gains.

On Tuesday the economic calendar shows key events. The Reserve Bank of Australia will release the minutes of it latest meeting while in the US the Producer Price Index is due. Attention will also continue on diplomacy.

Technical levels

- The British pound begins the week on the wrong foot, spurred by geopolitical jitters and Brexit.

- The market mood is downbeat as Ukraine-Russian tensions keep arising.

- Odds of the BoE’s hiking 50 bps are at 50%, per money market futures.

- Money market futures have priced in 100 bps of rate hikes of the Federal Reserve.

The GBP/USD snaps two days of gains and begins the week on the wrong foot amid increasing geopolitical tensions in eastern Europe. At the time of writing, the GBP/USD is trading at 1.3528.

The market sentiment is downbeat, depicted by European bourses falling, while US futures point to a lower open. The Ukraine – Russia tensions still weigh on market players’ risk appetite, as uncertainty in talks, and mixed messages crossing the wires, keeps some investors at bay, while others have turned to safe-haven assets. In the FX market, the gainers are the USD, JPY, and CHF.

An absent UK economic docket left GBP/USD traders adrift to geopolitical events and Fed speakers on Monday.

Ukraine / Russia conflict eases, but uncertainty looms

In the meantime, around 12:37, GMT crossed the wires that Russian Foreign Minister Lavrov told Russian President Vladimir Putin that responses from the EU and NATO have not been satisfactory. Furthermore, he added that the US had put forward concrete proposals on reducing military risks. Nonetheless, Lavrov said he could see a way to move forward talks. That said, the GBP/USD bounced from 1.3500 to 1.3546.

At press time crossed the wires, that UK Foreign Minister said that Russia could invade at any moment. Also, according to CNN, US Intelligence assesses that Russia continues to build up forces surrounding Ukraine in preparation for possible military action this week.

Back to the GBP/USD, Friday’s UK’s GDP figures alongside Brexit jitters seem to weigh on the British pound. Those factors, alongside the risk-off market sentiment in the financial markets, portrayed by global equities falling, spurred demand for the greenback and safe-haven peers.

Bank of England’s and Fed odds of increasing 50 bps at 50%

Concerning monetary policy, the Bank of England’s tightening expectations remains high. Money market futures suggest an increase of 25 bps in the March meeting is fully priced in, with over 50% odds of a 50 bps move.

On the US front, Federal Reserve money market futures odds from a 50 bps increase remain at 50% in March, down from 80% on Friday, on Bullard’s remarks, followed by two 25 bps hikes in May and June, leaving the Federal Funds Rate (FFR) at 1%, as St. Louis President Bullard’s expected.

The UK economic docket for Tuesday would reveal employment data, followed on Wednesday by January Consumer Price Index (CPI). Across the pond, on Tuesday, the Producer Price Index (PPI) for January is expected, followed by Retail Sales on Wednesday.

- USD/TRY reverses the recent weakness and regains 13.60.

- Turkey 10y benchmark bond yields drop below 21%.

- The CBRT meets on Thursday and is expected to keep rates on hold.

The Turkish lira starts the week on the negative footing and now pushes USD/TRY back to the 13.60 region.

USD/TRY cautious ahead of CBRT

USD/TRY regains upside traction after four consecutive daily pullbacks against the backdrop of the generalized buying bias in the greenback, geopolitical jitters and rising demand for the safe-haven space.

Indeed, increasing concerns around the Russia-Ukraine-US front have been sustaining the exodus from the EM FX universe and the broad-based risk complex as of late, all favouring the US dollar and the rest of the safer assets.

On the domestic space, the lira is expected to remain under scrutiny later in the week, as the Turkish central bank (CBRT) will meet on Thursday. On that, consensus among investors expects the central bank to keep the One-Week Repo Rate unchanged at 14.00% without major changes to the statement.

What to look for around TRY

The pair keeps its multi-week consolidative theme well in place, always within the 13.00-14.00 range. While skepticism keeps running high over the effectiveness of the ongoing scheme to promote the de-dollarization of the economy – thus supporting the inflows into the lira - the reluctance of the CBRT to change the (collision?) course and the omnipresent political pressure to favour lower interest rates in the current context of rampant inflation and (very) negative real interest rates are a sure recipe to keep the domestic currency under pressure for the time being.

Key events in Turkey this week: Budget Balance (Tuesday) – CBRT interest rate decision (Thursday) – Consumer Confidence (Friday).

Eminent issues on the back boiler: Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Much-needed structural reforms. Growth outlook vs. progress of the coronavirus pandemic. Earlier Presidential/Parliamentary elections?

USD/TRY key levels

So far, the pair is advancing 0.98% at 13.5859 and a drop below 13.4125 (55-day SMA) would expose 13.2327 (monthly low Feb.1) and finally 12.7523 (2022 low Jan.3). On the other hand, the next up barrier lines up at 13.9319 (2022 high Jan.10) followed by 18.2582 (all-time high Dec.20) and then 19.0000 (round level).

- US equities are trading mixed/on the defensive after hawkish Fed speak and as Russia/Ukraine/NATO tensions remain elevated.

- The S&P 500 is down 0.3%, the Nasdaq 100 up 0.3% and the Dow down 0.5%.

US equity markets opened this week’s trade mixed, with the S&P 500 down 0.3%, the Nasdaq 100 up 0.3% and the Dow down 0.4%. The S&P 500 CBOE volatility index remained elevated near the 30.0 level, up about 2.0 points on the day, with equity index futures trade prior to Monday’s US open choppy. Futures had initially been under pressure amid fears of further escalation in Russia/Ukraine/NATO tensions and the potential for war to break out as soon as later this week (according to the US press reports citing US intelligence).

S&P 500 futures had dipped as lower as the 4360s, where they traded down about 1.4% at the time. However, a Monday meeting between Russian President Vladimir Putin and Russian Foreign Minister Sergey Lavrov, where the latter recommended continuing with diplomacy, for now, seemed to ease fears somewhat, sending S&P 500 futures momentarily back into the green above 4420. Futures wouldn’t remain in the green for long, with comments from hawkish FOMC member (and 2022 voter) James Bullard upping Fed tightening bets and pushing futures back towards 4400, above which the index has found support during cash trade.

Bullard doubled down on the call he made last week for the Fed to lift interest by 100bps by July 1. According to the CME Fed Watch tool, the implied odds of a 50bps Fed rate hike rose to 66% from closer to 50% prior to his remarks. Other Fed members have pushed back against the idea of a larger 50bps move, seemingly expressing a preference for more measures 25bps moves. Upcoming US data out this week, including Tuesday’s January Producer Price Inflation report and Wednesday’s January Retail Sales figures will be scrutinized in the context of how it might impact expectations about the pace of Fed tightening. Wednesday’s FOMC minutes of the January meeting will also be closely watched.

But the main driver of broad risk appetite is likely to remain geopolitical tensions in Eastern Europe. A meeting between German Chancellor Olaf Scholz and Russian President Vladimir Putin in Moscow on Tuesday has been flagged as a key date. If the meeting doesn’t yield any progress towards a deal to de-escalate tensions, that could be a “green flag” for Russia to mount a military offensive against Ukraine, with US press having hinted an attack could begin later this week. A war involving Russia so close to NATO borders in Eastern Europe inevitably triggers fears of broader escalation into nuclear conflict and remains a downside risk to US equities.

GBP/USD follows peers lower to test 1.35. Economists at Scotiabank notes that a break under that level would open up losses towards the 50-day moving average (DMA) at 1.3468, then the 1.3450 and 1.3400 marks.

Near-term resistance seen at 1.3525/30

“1.3525/30 that marks resistance alongside the mid-figure zone; 1.3575 and the 1.36 area follow.”

“A re-test of 1.35 on the downside and a firm breach under the level opens up losses to a test of the 50-day MA of 1.3468, followed by the mid-1.34s and then the figure.”

See: GBP/USD to slide below 1.34 towards 1.32 on a Russian invasion of Ukraine – Scotiabank

GBP/USD has tested the 1.35 level ahead of key domestic data releases this week. Economists at Scotiabank believe that the cable could plunge to the 1.32 level if Russia makes a move into Ukrainian territory.

GBP to lose its footing as market reassess the outlook for BoE policy

“The ONS’s data on January payrolls and inflation should go a long way to confirming BoE hike expectations although we think that markets are overconfident in their assessment of a 50bps increase. OIS markets reflect an 80% chance of such a move and also expect the bank rate to reach 2% as soon as November, which is too steep of a hiking pace and too high of a terminal rate for the BoE to follow.”

“Rate hike bets may be getting stretched in the case of the Fed but, overall, we think there is more for disappointment from the BoE, which presents downside risks for the GBP.”

“A Russian invasion of Ukraine would likely trigger GBP losses under 1.34 with an eventual test of the 1.32 zone.”

Richmond Fed President and FOMC member Thomas Barkin said on Monday that he will be keeping a close eye on service prices in the months ahead. Barkin continued that he is nervous that labour supply might remain short in the decade ahead. Underlying demand is fundamentally strong, he continued, adding that it is, thus, now time for us to normalise.

EUR/USD is following the risk-averse mood in markets to a test of 1.13. The pair could nosedive to the 1.10 level on any further Russian aggression against Ukraine, in the opinion of economists at Scotiabank.

Upside momentum has been limited

“EUR/USD risks losses to 1.10 if Russia makes a move into Ukrainian territory in the coming days.”

“The 1.1275/00 zone may act as EUR support as it did through late-December/early January, followed by the mid 1.12s, to prevent a test of the next big figure.”

“Upside momentum today and on Friday has been limited, resistance is ~1.1350 and the overnight high of 1.1369 followed by the 1.14 area.”

Economist at UOB Group Barnabas Gan assesses the latest monetary policy meeting by the RBI.

Key Takeaways

“The Reserve Bank of India (RBI) kept its policy repo rate and reverse repo rate unchanged at 4.00% and 3.35% respectively in its Jan monetary policy meeting.”

“Policymakers have shifted from its relative positive tone seen in 4Q21 to a dovish and cautious one. RBI pencilled GDP growth of 7.8% for FY2022/23, as compared to the government forecast range of between 8.0% and 8.5% in the latest economic survey.”

“RBI views that headline consumer prices will only expand by 4.5% in FY2022/23, from Dec 2021’s 5.59% y/y climb. We think there is a substantial upside risk to the official outlook based on the higher oil prices to-date.”

“We think that GDP growth will stay resilient for the upcoming year, but the looming inflation risks in FY2022/23 will be a persuasive factor for RBI to finally jump on the hike wagon and introduce its first rate hike in 2Q22 to 4.25%, and by another 50bps for the rest of 2022 to bring the policy rate to 4.75%.”

A spate of UK economic data is due for release during the course of the week and this could be instrumental in providing fresh direction for the pound, according to economists at Rabobank. They see EUR/GBP at 0.85 on a three-month view.

GBP could be vulnerable if the market back tracks on BoE hikes forecasts

“The combination of this week’s UK economic releases is likely to set the tone for the pound near-term. Assuming the data come in close to market expectations the GBP may be able to claw back a little ground vs. the EUR near-term since ECB officials have been actively reinforcing the cautious, data-driven nature of their policy outlook.”

“By the middle of the year, we expect the GBP will have lost its footing as the money market reassess the outlook for BoE policy.”

“Our three-month EUR/GBP forecast is 0.85.”

- EUR/USD is hovering just above 1.1300 as traders eye Russia/Ukraine/NATO tensions and recent dovish ECB speak.

- A break below 1.1300 could generate bearish momentum towards 1.1200-1.1250, says ING.

- Aside from geopolitics, there are plenty of economic data and central bank speakers for EUR/USD traders to watch this week.

EUR/USD is hovering just to the north of the 1.1300 level as ongoing concerns about the Eurozone’s economic vulnerability to a Russia/Ukraine war plus recent more dovish-leaning remarks from ECB policymakers weigh on the euro. EUR/USD was sent tumbling below 1.1400 last week as US press, citing US intelligence, reported that a Russian military incursion into Ukraine could take place as soon as this week, sparking fears about the Eurozone’s dependence on Russian gas imports. At current levels just under 1.1320, the pair is about 1.5% below last week’s highs and is roughly back in line with its pre-hawkish ECB meeting levels from February 3.

According to ING, the “break below 1.1400 in EUR/USD last week is likely signaling that the European Central Bank members’ recent attempt to cool down excessive hawkish speculation has… got to the euro”. “Another break lower – below 1.1300,” the bank continued, “could generate some further bearish momentum in EUR/USD that could extend to the 1.1200-1.1250 area should markets scale back bets on summer tightening by the ECB”. Indeed, Irish Central Bank head pushed back strongly against the idea of summer tightening on Sunday, labelling money market pricing for a June rate hike “unrealistic”.

Whilst geopolitical tensions between Russia/Ukraine/NATO will likely remain the dominant driver of the pair this week, there is also plenty of central bank speak and US and Eurozone data to keep tabs on. Lagarde will be speaking at 1615GMT on Monday, ahead of the release of the February German ZEW survey and second estimate of Q4 2021 Eurozone GDP growth on Tuesday. Also on Tuesday, US January Producer Price Inflation figures and the February New York Fed Manufacturing survey are scheduled for release, ahead of the US January Retail Sales report and minutes of the last Fed meeting on Wednesday.

On Thursday, the ECB will release its Economic Bulletin, ahead of the release of the February Philadelphia Fed Manufacturing survey and week initial jobless claims report out of the US. There will also be remarks James Bullard and Loretta Mester, though the more important Fed speak comes on Friday, with “core” Fed policymakers Christopher Waller, NY Fed President John Williams and Fed Vice Chair Lael Brainard all on the wires.

- EUR/USD extends the bearish move to the 1.1300 region.

- Extra losses look likely while below the 5-month line near 1.1390.

EUR/USD loses further ground following last week’s 2022 tops in levels just shy of 1.1500 the figure.

In the meantime, further losses in the pair remains in the pipeline while below the 5-month line near 1.1390. While capped by the latter, EUR/USD is expected to remain under pressure with the immediate target around the 1.1300 neighbourhood ahead of the pre-ECB meeting low at 1.1266 (February 3).

In the longer run, EUR/USD is expected to keep the negative outlook as long as it trades below the key 200-day SMA, today at 1.1656.

EUR/USD daily chart

In opinion of Quek Ser Leang at UOB Group’s Global Economics & Markets Research, USD/IDR remains poised to trade between 14,288 and 14,400 for the time being.

Key Quotes

“Last Monday (07 Feb, spot at 14,400), we highlighted that USD/IDR ‘appears poised to break clearly above 14,405’. We added, ‘a clear break of this level is likely to lead to further USD/IDR strength’.”

“While USD/IDR subsequently rose to 14,408, the anticipated advance did not materialize as USD/IDR pulled back from the high. Upward pressure has dissipated and for this week, USD/IDR is likely to trade sideways between 14,288 and 14,400.”

- A combination of supporting factors pushed USD/CAD higher for the third successive day.

- Retreating oil prices undermined the loonie and remained supportive amid a stronger USD.

- Bulls, however, struggled to make it through an over two-week-old trading range resistance.

The USD/CAD pair built on last week's goodish recovery move from the 1.2635 area, or the monthly low and gained positive traction for the third successive day on Monday. The momentum pushed spot prices to over a one-week high and was sponsored by a combination of factors.

Despite escalating geopolitical tensions between Russia and the West over Ukraine, crude oil prices witnessed some profit-taking taking from a more than seven-year high. This, in turn, undermined the commodity-linked loonie and extended some support to the USD/CAD pair amid a broad-based US dollar strength.

Bulls, however, struggled to capitalize on the strength and the intraday positive move faltered near the 1.2780-1.2785 region. The said area marks the monthly high and the top end of a familiar trading range held over the past two weeks or so, which should now act as a key pivotal point for short-term traders.

Given that technical indicators on the daily chart have just started gaining some positive traction, a convincing breakthrough will be seen as a fresh trigger for bulls. Some follow-through buying beyond the 1.2800 mark will reaffirm the constructive outlook and pave the way for a further appreciating move.

The next relevant resistance is pegged near the 1.2835 region, above which the USD/CAD pair could extend the momentum towards the 1.2900 mark, with some intermediate hurdle near the 1.2870-75 area.

On the flip side, the 1.2700 mark now seems to protect the immediate downside ahead of Friday’s swing low, around the 1.2670-1.2665 region. This is followed by the 1.2635 area, or the monthly low, which if broken decisively will negate the near-term positive bias and make the USD/CAD pair vulnerable to slide further.

The downward trajectory could then drag spot prices below the 1.2600 mark, towards testing the 1.2570-1.2560 support and the very important 200-day SMA, around the 1.2520-1.2515 zone. This is followed by the key 1.2500 psychological mark, below which the USD/CAD pair could slide to the YTD low, around mid-1.2400s.

USD/CAD daily chart

-637804434351170152.png)

Key technical levels

St Louis Fed President and 2022 voting FOMC member James Bullard on Monday reiterated his call for 100bps in interest rate hikes by July 1, citing the last four inflation reports which show broadening inflationary pressures. The Fed's credibility is on the line, he continued, saying that the Fed needs to reassure the public that it is going to defend its 2.0% inflation target. Inflation reports since October have called into question the idea that price increases will moderate without Fed action, Bullard said, before cautioning that the Fed needs to act in a way that is not disruptive to markets. The timing of rate hikes would ultimately be up to Fed Chair Jerome Powell, Bullard added, though he did say that he thought his plan was a good one and now would try to persuade his colleagues.

The Fed will be in "a pickle" if inflation does not moderate as expected in the second half of the year, Bullard warned, adding that the bank needs to position for that eventuality now. Bullard noted that he would like to see the yield curve steepen from reducing the size of the Fed's balance sheet, a process he would like to kick off with passive run-off in Q2, with a "plan B" of asset sales if needed.

Market Reaction

Currency markets have not reacted to the latest remarks from Bullard, which were broadly in line with his hawkish post-hot US CPI data comments last week.

- GBP/JPY attracted some dip-buying on Monday and recovered a major part of its intraday losses.

- A turnaround in the risk sentiment undermined the safe-haven JPY and extended some support.

- The lack of any strong follow-through buying warrants some caution for aggressive bullish traders.

The GBP/JPY cross managed to rebound nearly 100 pips from the one-week low touched earlier this Monday and was last seen trading with only modest losses, around the 156.25 region.

The cross extended last week's retracement slide from the vicinity of 2021 high, or levels just above the 156.00 mark and witnessed heavy selling during the first half of the trading on Monday. Tensions over the Northern Ireland protocol of the Brexit agreement, along with Friday's disappointing UK GDP report turned out to be a key factor that undermined the British pound. This, along with the risk-off impulse in the markets, benefitted the safe-haven Japanese yen and exerted additional pressure on the GBP/JPY cross.

That said, a more hawkish Bank of England policy decision should help limit any deeper losses for sterling. It is worth recalling that the BoE raised the benchmark interest rate by 25 bps and the vote distribution showed that four out of nine MPC members backed a more aggressive 50 bps increase in borrowing costs. Apart from this, strong intraday recovery in the equity markets acted as a headwind for the JPY, which helped limit any deeper losses for the GBP/JPY cross and attract fresh buying near the 155.30 area.

The latest comments by Russia's Foreign Minister Sergey Lavrov helped ease worries about an imminent Russian invasion of Ukraine. Lavrov told Russian President Vladimir Putin in a meeting on Monday that the US had put forward concrete proposals on reducing military risks and that he could see a way to move forward with talks. He, however, warned that indefinite talks are not possible, but there was always a chance for agreement. This gave the market some comfort, which was evident from a turnaround in the risk sentiment.

It will now be interesting to see if bulls are able to capitalize on the move or the intraday uptick is seen as an opportunity to initiate fresh bearish positions around the GBP/JPY cross. Hence, it will be prudent to wait for strong follow-through buying before confirming that the recent corrective pullback has run its course. Market participants now look forward to Tuesday's release of the UK jobs report for a fresh impetus.

Technical levels to watch

- Spot gold is consolidating in the $1850-60 area after hitting fresh multi-month highs last Friday on geopolitical tensions.

- As concern about a potential Russian incursion into Ukraine mounts, risks seem tilted to the upside for gold.

- Technical developments also lean bullish after XAU/USD broke above a long-term pennant last week.

Having hit multi-month highs in the $1860s last Friday amid rising geopolitical concerns (as Russian military action against Ukraine, perhaps as soon this week, looks ever more likely) spot gold (XAU/USD) prices have been stabilising in an $1850-60 range. Russia/Ukraine/NATO tensions will be the main driver of market sentiment this week, meaning gold traders will be closely keeping an eye on meetings between Russian and Western politicians over the next two days. The most important of these meetings is a visit by German Chancellor Olaf Scholz to Kiev on Monday and then to Moscow on Tuesday. With US press suggesting that Russian could launch an assault as soon as the middle of the week, and Western leaders warning a Russian attack could come at any time, this meeting may be the last-ditch attempt to prevent war.