- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 13-07-2011

Stocks continue to drift downward.

Other asset prices are also pulling back. Specifically, oil prices are back at $98 per barrel as they settle pit trade.

Even gold is trading lower in after-hours action. The yellow metal was last priced at $1579 per ounce, but had actually traded hands at a new record high of almost $1589 per ounce earlier in the day.

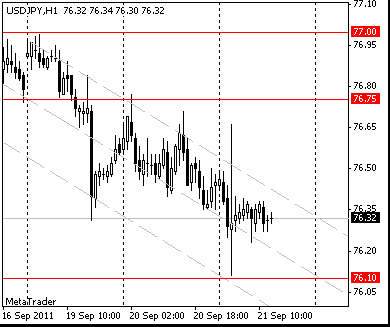

USD/JPY sets stable around Y79.00 after seeing an afternoon low around Y78.88 or so. Rate earlier printed at Y78.48 overnight. Bids eyed below around Y78.80.

Stocks are drifting lower in early afternoon trade. That has left the Dow and the S&P 500 with gains of less than 1%.

Energy stocks were up 2% earlier today, but they have since pulled back to trade with a 1.4% gain. Energy's easing comes even though oil prices are still up 1.0% at $98.40 per barrel.

Stocks have responded positively to comments from Fed Chairman Bernanke on monetary policy. Bernanke stated that the Fed remains prepared to adjust monetary policy in the event that economic developments warrant such a move.

Weakness in the dollar has helped stoke buying interest in commodities. That helped gold prices set a record high above $1580 per ounce. Meanwhile, oil prices are up 1.3% to $98.70 per barrel.

The dollar weakened against all major currencies after Federal Reserve Chairman Ben Bernanke reiterated that the central bank is ready to provide additional economic stimulus if needed and investor demand for higher-yielding assets increased.

“When we began this program, we certainly did not expect it to be a panacea for the country’s economic problems,” he said. Bernanke said Fed officials still believed the unemployment rate would decline to 8.6%-8.9% by the fourth quarter. The jobless rate reached 9.2% in June from 8.8% in March.

Earlier the Australian and New Zealand dollars advanced against the greenback after better-than-expected economic data on China.

The GDP growth of China, Australia's first largest and New Zealand's second-largest trading partner, rose at an annual pace by 9.5% between April and June, down from 9.7% in the previous quarter. But its data on industrial production (act. 15.1% vs. con.13.2% and prev. 13.3%) and retail sales (act. 17.7% vs. con.17.0% and prev. 16.39) appeared to be well above median forecasts.

The euro also found support from positive data from China’s National Bureau of Statistics as it weighed on haven demand for the dollar and on speculation that China’s foreign exchange reserves had reached a record $3,179bn.

Italian bonds gains for the second day, pushing the yield on the 10-year security down 12 basis points, weakening concern that EU debt crisis may spread to Italy.

The gold prices hit a record high after the Fed's meeting and currently is at $98.89 per ounce (+1.46%).

The energy sector has already rose 2.0%. The move has been led by Baker Hughes (BHI 75.40m +2.97) and Nabors Industries (NBR 24.88, +1.22). Even the sector's relative laggards, Sempra Energy (SE 27.22, +0.23) and ConocoPhillips (COP 75.17, +0.83), are sporting strong gains.

Gold rallied ahead of the US session, taken out the life-time high of $1575.79/oz, seen May 2 to post a high of $1578.50. Later, in the wake of Fed Chair Bernanke's remarks, the precious metal has posted a new life-high at $1584.04, before stabilising at current levels

near $1582.00. The next strong resistance is around $1600.00.

Stocks are up with solid gains in the early going. The buying effort has been broad, so far, but energy stocks (+1.0%), industrial stocks (+0.9%), and tech stocks (+0.8%) are leading the effort. In contrast, defensive-oriented plays like utilities (+0.1%) and consumer staples (+0.2%) are lagging.

Although market participants are showing an increased tolerance for risk, gold continues to glisten in the eyes of traders. The yellow metal currently boasts a 1.0% gain as it trades at $1579 per ounce, just a couple of dollars below the record high that it hit this morning.

In the backdrop, the dollar has fallen to a 0.6% loss against a basket of major foreign currencies.

Fed "remains prepared to respond" with addl policy support if econ weakens or deflationary risks emerge, but with exit if less accommodation warranted. Thus he does not rule out QE3 or being more explicit about defining extended period or reducing IOER to pressure short rates lower. Otherwise he sticks to script -- econ is recovering, weakness is temp, recent soft trajectory has moved up unemploy rate. Reiterates central tend ests see recovery strengthening in H2; will be watching consumer behavior ahead. Footnote calls attention to fact that these ests were prepared prior to June jobs report. Says recent rise in infl appears transitory. Reiterates idea Fed simply maintaining SOMA "should continue to put downward pressure on mkt int rates and foster" more accommodation. Overall, nothing new here other than the balanced estimate for future policy.

EUR/USD $1.4000, $1.4100

USD/JPY Y79.50

AUD/USD $1.0600, $1.0750

NZD/USD $0.8250

"While we expect Bernanke's Humphrey Hawkins testimony will broadly stick with the script laid out in the minutes, his discussion of the growth outlook may have an even more cautious tone."

Recovery off pullback lows at $1.4030 seen meeting resistance around $1.4070. A break here to allow for a move toward $1.4095/00 ahead of earlier highs at $1.4110. Stronger offers noted around $1.4120. Support remains at $1.4030.

U.S. stocks were poised for gains before the opening bell Wednesday, after robust Chinese growth numbers calmed investors.

China's economy grew at an annual pace of 9.5% between April and June, the National Bureau of Statistics said Wednesday. That marks a slight slowdown from the first quarter, but the reported growth was higher than economists expected.

Economy: Fed chairman Ben Bernanke will begin his semi-annual testimony to Congress about monetary policy and the economy on Wednesday. Bernanke will appear before the Committee on Financial Services of the House of Representatives.

The Energy Department's weekly oil inventories report comes out in the morning.

Companies: Late Tuesday, Electronic Arts (ERTS) announced it is buying mobile game maker PopCap Games for $750 million in cash and stock.

After the closing bell Wednesday, fast food company Yum! Brands (YUM, Fortune 500) and hotel chain Marriott (MAR, Fortune 500) will report quarterly earnings.

World markets:

Oil for August delivery dropped 36 cents to $97.07 a barrel.

Gold futures for August delivery rose $10.80 to $1,572.90 an ounce. Earlier Wednesday, the precious metal hit an intraday record of $1,579.70 an ounce. The previous intraday record was $1,577.40, set on May 2.

The precious metal hit a record high close Tuesday, after the minutes from the Fed's June policy meeting indicated the central bank might be open to more monetary stimulus.

Bonds: The price on the benchmark 10-year U.S. Treasury dropped, pushing the yield up to 2.94% from 2.88% late Tuesday.

The dollar and the Swiss franc weakened against the euro for the first time in four days as stocks rose and Treasuries declined amid renewed demand for higher-yielding assets.

The U.S. currency slid against the Australian and New Zealand dollars after China’s economic growth exceeded analysts’ estimates and minutes from a Federal Reserve meeting showed some policy makers felt additional stimulus may be needed. The euro was stronger against 14 of its 16 major peers as Italian and Spanish bonds rose for a second day. The yen weakened versus the 17-nation currency amid speculation Japan will sell its currency to support exporters.

China’s gross domestic product increased 9.5% in the second quarter from a year earlier, the statistics bureau said in Beijing. The median estimate was 9.3%. Industrial output advanced 15.1% in June, the most since May 2010.

“We saw broadly better-than-expected Chinese data and that has given the market a little bit of comfort,” said Sara Yates, a foreign exchange strategist in London at Barclays Plc. “For the U.S., interest-rate hikes are a long way into the future. We still look for the euro to grind higher but there are still significant risks.”

Italian bonds rallied for a second day, pushing the yield on the 10-year security down 12 basis points, and easing concern that the region’s debt crisis may spread beyond Greece, Ireland and Portugal to larger economies.

- Question of getting ahead of events in EMU zone;

- Hope we have done enough to contain EMU crisis.

EUR/USD $1.3850, $1.3900, $1.4000, $1.4100, $1.4150, $1.4200

USD/JPY Y79.50, Y80.00, Y81.00, Y81.25

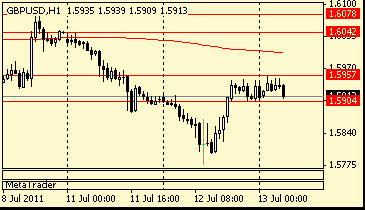

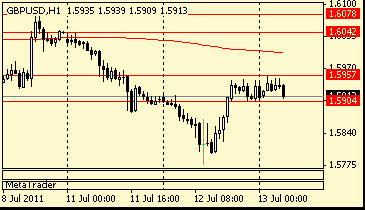

GBP/USD $1.5855, $1.6080

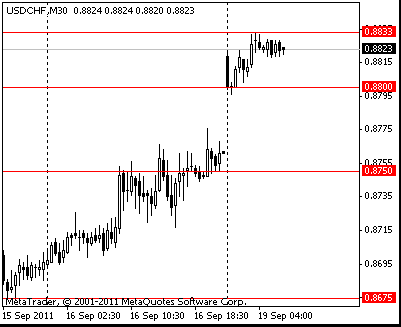

USD/CHF Chf0.8400

AUD/USD $1.0600, $1.0750

AUD/JPY Y86.65

NZD/USD $0.8250

Test bids to a session low Y79.20/15. Support seen at Y78.80 with larger bids at Y78.50.

European stocks pare early losses and rose on Wednesday as Chinese macro data boosted mining shares and offset losses in consumer-related stocks after poor figures from Carrefour (CARR.PA) and L'Oreal (OREP.PA).

- Ireland is making good progress on overcoming crisis;

- Portugal's fiscal adj program ambitious but realistic;

- EMU GDP won't accelerate much coming quarters; uneven;

- progressive demand broadening to support EMU recovery;

- EMU govt debt to decline, deficit at 3.5%/GDP by 2012

- EFSF rules wld allow bond buybacks;

- Greek solution will be coordinated with ECB;

- Need Greek solution by mid-September at latest;

- Looking at greek options without taboos;

- It's clear there will be PSI in Greek aid.

- EFSF rules wld allow bond buybacks;

- Greek solution will be coordinated with ECB;

- Need Greek solution by mid-September at latest;

- Looking at greek options without taboos;

- It's clear there will be PSI in Greek aid.

- EFSF rules wld allow bond buybacks

- Greek solution will be coordinated with ECB

- Need Greek solution by mid-September at latest

- Looking at greek options without taboos

- It's clear there will be PSI in Greek aid.

Moves above $1.4090 and looking set now to challenge resistance at $1.4100. More stops above the figure, which if triggered expose next resistance area between $1.4120/25 ($1.4121 38.2% $1.4580/1.3837).

EUR/USD $1.3850, $1.3900, $1.4000, $1.4100, $1.4150, $1.4200

GBP/USD $1.5855, $1.6080

USD/CHF Chf0.8400

AUD/USD $1.0600, $1.0750

AUD/JPY Y86.65

UNZD/USD $0.8250

May Average Weekly Earnings +2.3%

May Average Weekly Earnings ex bonuses +2.1%

UK Mar-May ILO Unemployment Rate 7.7%

- Sees 2012 avg non-OPEC supply +1.7% (+0.9 mbd) to 54 mbd

- Sees 2012 avg OPEC call/stocks at 30.7 mbd, +100 kbd y/y

- Hikes avg 2011 global demand fcst by 200 kbd to 89.5 mbd

- Cuts avg 2011 non-OPEC supply fcst by 200 kbd to 53.1 mbd

- Hikes avg 2011 OPEC call/stocks fcst 400 kbd to 30.6 mbd

- Hikes 3Q 2011 OPEC call/stocks fcst 600 kbd to 31.3 mbd

- Part of 3Q 2011 call seen covered by June reserve release

- June global oil supply up 1.2 mbd m/m to 88.3 mbd

- June OPEC crude output up 0.85 mbd m/m to 30.03 mbd

- Welcomes OPEC rise,'but market still more needs oil in 3Q

- June non-OPEC supply up 0.4 mbd m/m to 52.5 mbd

- OECD may ind stocks up 23.9 mb m/m;June stocks seen lower

02:00 China Retail Sales (YoY) (Jun) 17.7%

02:00 China Industrial Production (YoY) (Jun) 15.1%

02:00 China Gross Domestic Product (YoY) (Q2) 9.5%

04:30 Japan Industrial Production (YoY) (May) -5.5%

04:30 Japan Industrial Production (MoM) (May) 6.2%

05:00 Japan Bank of Japan Monthly Economic Survey

The 17-nation currency pared losses against its major counterparts after Luxembourg Finance Minister Luc Frieden said selective default on Greek debt isn’t an option “envisaged” by euro-region finance ministers and Italian government bonds reversed losses. The yen reached its strongest level against the dollar since the Group of Seven nations jointly intervened to weaken the currency.

The euro earlier dropped to the lowest level in four months versus the yen and the dollar after a meeting of European Union finance ministers failed to defuse the region’s escalating debt crisis.

The dollar erased gains versus the pound, Canadian dollar and Swedish krona after U.S. stock markets advanced after falling as much as 0.3 percent. The Standard & Poor’s 500 Index traded 0.2 percent higher.

The U.S. currency fell for a third day versus the yen before the Federal Reserve releases minutes today from its June meeting amid signs the nation’s recovery is faltering.

Minutes outline possible exit procedures but immediately backtrack by saying Fed is "prepared to make adjustments to its exit strategy if necessary in light of economic and financial developments" - and indeed key data has weakened since the meeting. Bernanke's testimony Wed-Thur should explain this; note that prior released central-tends already showed weaker outlook.

Resistance 3: Y80.20 (high of european session on Jul 12)

Resistance 3: Chf0.8520 (high of July)

Resistance 3: $ 1.6040 (Jul 12 high)

Resistance 3: $ 1.4230 (Jul 11 high)

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.