- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 13-06-2011

Stocks head into the final hour of trade clinging to modest gains. Market supported by financials (+1.0%) and techs (+0.2%) with some pressure from energy (-1.2%).

EUR/CHF holds around Chf1.2085 area on the back of EUR/USD strength. Earlier rate printed lows around Chf1.2004. Area of Chf1.2000 still seen to hold a barrier, apparently well-defended, with stops sub Chf1.1980.

Stocks continue to recover and currently the blue chips hold around session highs. Financials have been a source of leadership in recent action (+1.0%). Energy stocks are off of their sesson lows, but the sector continues to be a drag (-1.0%).

Gold and silver refreshed session lows in the wake of the Greece ratings downgrade but have recovered slightly since then. Gold trades $1523.25, almost $2 off its low, silver trades at $35.15, a dime off its low.

The euro slid to a record low versus the Swiss franc as concern increased that European leaders may not be able to find common ground on a Greek bailout.

European Central Bank President Jean-Claude Trichet and German Finance Minister Wolfgang Schaeuble are at odds about whether Greek bondholders should be compelled to incur losses in the nation’s second bailout in 14 months.

The dollar dropped against most of its counterparts before a report this week forecast to show U.S. retail sales declined in May. Retail sales in the U.S. fell 0.5% in May, the first drop since June. The Commerce Department will release the report June 14.

Luxembourg’s Prime Minister Jean-Claude Juncker, who leads the group of euro-area finance ministers, said that any bailout for Greece must include “voluntary” investor participation. Juncker is trying to bridge the gap between Germany’s Schaeuble, who wants Greek bondholders to accept longer maturities of up to seven years on the debt, and Trichet, who said imposing losses on creditors would be akin to a default.

New Zealand’s dollar fell after its second-biggest city was struck by aftershocks of the February earthquake.

The yen weakened versus most of its major peers after a report showed Japan’s factory orders declined 3.3% in April from March, when they rose 1%, the Cabinet Office said today.

The Nasdaq recently retreated to the neutral line, but later it bounced off of. The Nasdaq's recent bounce has been led by the likes of Microsoft (MSFT 23.95, +0.25), Dell (DELL 15.63, +0.16), and Oracle (ORCL 31.56, +0.38). In contrast, Akamai (AKAM 29.13, -0.32) is a source of weakness; the stock's descent in recent weeks has left it to test its 52-week low.

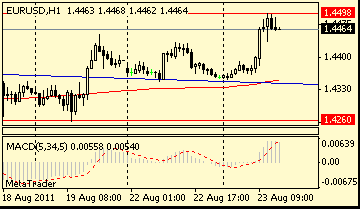

EUR/USD currently holds around $1.4377. Offers were mentioned arpound there, extending to $1.4405 with stops positioned above. Rate printed session high on $1.4403.

Having broken above intraday resistance at $1.0570 the pair is struggling to make any meaningful topside gains with next level of resistance at $1.0590/$1.0600. Traders report this level taking on significance having supported the rate three times in early June on the move lower. Stops sit above $1.0600.

Stocks are up solidly in the first few minutes of trade. Buying interest is relatively broad, but energy (+0.8%), industrials (+0.7%), and materials (+0.6%) are garnering the most interest. Utilities (-0.1%) and consumer staples stocks (unch.), both defensive oriented, are struggling to establish any upward momentum this morning.

Outside of equities, Treasuries are under pressure. As such, the yield on the benchmark 10-year Note is back at 3.00%. The TED spread is currently just shy of 0.2.

Meanwhile, the dollar continues to drift along with a 0.3% loss against a collection of competing currencies.

U.S. stocks were headed for a modestly higher open Monday, following a six-week losing streak that's been led by fears of an economic slowdown.

U.S. stocks tumbled Friday, with each of the three key indexes falling more than 1%, and the Dow ending below 12,000 for the first time in months. Overall, the Dow has fallen 3.7% since the beginning of June and the Nasdaq erased all of its gains for the year.

No major U.S. economic data is on tap Monday, but two corporate deals announced before the opening bell could drive early gains.

The rest of the week brings a data-heavy schedule with retail sales and consumer prices reports among the bigger drivers.

Companies: VF Corp. (VFC, Fortune 500), the maker of Wrangler and The North Face brands, said early Monday it is buying Timberland Co. (TBL) for $43 per share, creating a $10 billion apparel and footwear company. Shares of Timberland climbed more than 40% in premarket trading.

Shares of Wendy's/Arby's Group (WEN) jumped nearly 7% after the restaurant chain agreed to sell Arby's to a private equity group led by Roark Capital Group. Wendy's will retain an 18.5% ownership interest in the Arby's business.

Meanwhile, Honeywell (HON, Fortune 500) announced plans to acquire EMS Technologies (ELMG) for $491 million in cash.

New York Attorney General Eric Schneiderman has launched a new probe into Bank of America's (BAC, Fortune 500) mortgage securities and related foreclosures, the Huffington Post reported Monday.

Investors appeared to shrug off the news. Shares of Bank of America edged higher in premarket trading as did other banks, including JPMorgan Chase (JPM, Fortune 500), Goldman Sachs (GS, Fortune 500) and Wells Fargo (WFC, Fortune 500).

Shares of Gilead Sciences (GILD, Fortune 500) fell more than 3% after the company disclosed late Friday that the Department of Justice was investigating certain manufacturing and quality practices.

World markets:

Oil for July delivery slipped $1.03, or 1%, to $98.26 a barrel.

Gold futures for August delivery fell $1.20 to $1,528 an ounce. Silver and copper prices both declined more than 1% as well.

The price on the benchmark 10-year U.S. Treasury edged slightly lower, pushing the yield up to 2.99% from 2.97% late Friday.

The euro slid to a record low versus the Swiss franc and stayed within a cent of its weakest level this month against the dollar on concern European leaders may be unable to find common ground on a Greek bailout.

European Central Bank President Jean-Claude Trichet and German Finance Minister Wolfgang Schaeuble are at odds over whether Greek bondholders should be compelled to incur losses in the nation’s second bailout in 14 months.

“The focus has returned to Greece, which brings up a number of downside risks to the euro due to all the uncertainty about the bailout package,” said Chris Walker, a foreign- exchange strategist at UBS AG in London. “The euro will get some support from rate-hike expectations over the longer term, but we’re likely to see some weakness in the next few weeks.”

Luxembourg’s Prime Minister Jean-Claude Juncker, who leads the group of euro-area finance ministers, said in an interview on Radio Berlin-Brandenburg today that any bailout for Greece must include “voluntary” investor participation. Juncker is trying to bridge the gap between Germany’s Schaeuble, who wants Greek bondholders to accept longer maturities of up to seven years on the debt, and Trichet, who says imposing losses on creditors would be akin to a default.

President Trichet speaking at the LSE today at 14:00 GMT.

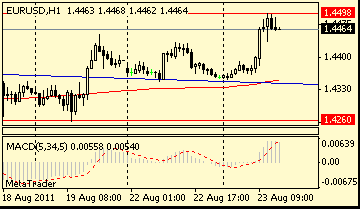

EUR/USD:

Offers: $1.4400/05, $1.4420/25, $1.4450, $1.4500

Bids: $1.4350, $1.4325/20, $1.4300, $1.4280, $1.4250

Breaks above $1.63 and extends recovery to $1.6320. The move seen meeting sell interest placed between $1.6320/25. A break here to open a move on toward $1.6350

JPM reminds US government fiscal consolidation is coming due to deficits and "The outcome of any fiscal consolidation will partly depend on movement in the dollar and interest rates." JPM calls for a mid-year rebound in manufacturing and says this will boost the budget and economy.

EUR/USD $1.4300, $1.4335, $1.4500

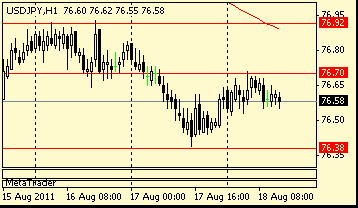

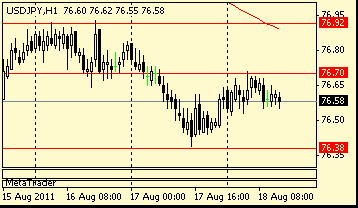

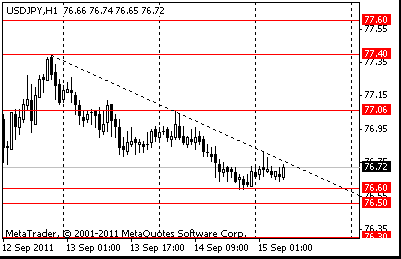

USD/JPY Y79.80, Y80.65, Y80.90, Y81.00, Y81.80

GBP/USD; $1.6300, $1.6485, $1.6500

EUR/GBP stg0.8840

USD/CHF Chf0.8500

AUD/USD $1.0615, $1.0600, $1.0400

Cable has met support on the approach to $1.6250, with bids seen around the 50% retrace of the recovery from Asian lows of $1.6215 to $1.6285. A break of $1.6250 to open a deeper move toward $1.6235/30 (76.4%) ahead of the overnight low at $1.6215. Resistance seen at $1.6285, a break to open a move toward $1.6300/20.

EUR/USD $1.4300, $1.4335, $1.4500

USD/JPY Y79.80, Y80.65, Y80.90, Y81.00, Y81.80

GBP/USD $1.6300, $1.6485, $1.6500

EUR/GBP stg0.8840

USD/CHF Chf0.8500

AUD/USD $1.0615, $1.0600, $1.0400

The yen fell to a one-week low against the dollar on speculation the Bank of Japan will introduce more stimulus measures to support economic growth.

Wall Street tumbled into its sixth consecutive week of losses, helped lower by financial stocks as investors continued to turn from risk assets on worries about the strength of the US economy.

The S&P 500 index was down 2.2 per cent over the five-day period, the sixth consecutive week of losses on the index. The last time there were six straight weeks of losses was in June and July 2008. The last time there were more than six in a row was in February and March 2001.

In corporate news, Goodyear Tire & Rubber, the largest tyre company in the world, agreed to sell its global wire business to Hyosung Corporation for $50m.

The news sent shares in the company down 6.7 per cent to $14.99, making it the worst-performing stock on the S&P 500 index.

This helped dip the Dow Jones Industrial Average below 12,000 for the first time in three months.

The index lost 1.4 per cent to 11,952.06, down 1.6 per cent over the week. The Nasdaq Composite fell 1.5 per cent to 2,643.73, retreating further into negative territory for the year. The index was down 3.3 per cent over the week and is 0.3 per cent lower for the year.

The S&P financial index was down 2.2 per cent over the week.

Bank of America fell 4.3 per cent over the week to $10.80 while Citigroup was down 4.8 per cent to $37.92.

Energy also had a roller-coaster ride over the week, rallying on Wednesday due to firmer oil prices as Opec failed to reach an agreement to raise output.

But overall, the sense that the global economy was slowing left the S&P energy index down 2 per cent despite higher energy prices.

Peabody Energy, the US coal group, was down 5.8 per cent to $55.33 while Hess fell 5.3 per cent to $72.85.

The energy sector has been the second-worst performing sector after financials over the last six weeks, falling 9.2 per cent.

Resistance 3: Y81.80 (May 31 high)

Resistance 3: Chf0.8610 (50.0 % FIBO Chf0.8890-Chf0.8330)

Resistance 3: $ 1.6380 (Jun 10 high)

Resistance 3: $ 1.4690 (61.8% FIBO $1.4990-$ 1.4320, Jun 10 high, Jun 6 low)

14:00 EMU ECB President Trichet Speaks

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.