- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 13-04-2022

- Pound bulls are witnessing wider ticks after exploding the consolidation formed in a 1.2982-1.3058 range.

- A double-bottom formation has driven the cable strongly to near 1.3120.

- The loud move on the RSI (14) is indicating a bullish bias ahead.

The GBP/USD pair is experiencing a strong upside after the successful re-test of its critical bottom at 1.3000. The cable has witnessed a vertical positive move after breaking out of the consolidation formed in a range of 1.2982-1.3058.

On a four-hour scale, GBP/USD has bounced sharply after a double bottom formation. Usually, the mentioned chart pattern indicates weak selling pressure on a critical bottom formed earlier. The pair has displayed a sheer upside after retesting March’s lows at around the psychological support of 1.3000. The trendline placed from March 3 high at 1.3418, adjoining the March 23 high at 1.3299 will continue to act as a major barricade.

The 20- and 50-period Exponential Moving Averages (EMAs) at 1.3045 and 1.3062 respectively have turned upside, which signals a firmer reversal.

Meanwhile, the Relative Strength Index (RSI) (14) has displayed a loud move as the momentum oscillator has climbed above 60.00, which indicates a bullish reversal.

A corrective pullback towards the 50-EMA at 1.3062 will be a bargain buy for the market participants. This will send the asset towards Thursday’s high at 1.3123, followed by April’s high at 1.3167.

However, a decisive plunge below Friday’s low at 1.2982 will trigger the greenback bulls, which will drag the asset towards the 2 November 2020 low and the round level support at 1.2854 and 1.2800 respectively.

GBP/USD four-hour chart

-637854905434348668.png)

- The DXY is balancing below 100.00 on multi-year high US PPI.

- Fed Waller has emphasized an aggressive stance but warns the adaptation of Volcker's way.

- The monthly US Retail Sales may get doubled to 0.6%.

The US dollar index (DXY) has witnessed a sheer downside after recording a fresh three-year high at 100.52 on Wednesday. The DXY ended its nine-day winning streak on Wednesday after investors shrugged off the hangover of the higher US Consumer Price Index (CPI). The US Bureau of Labor Statistics reported the yearly US inflation at 8.5% and also improved the certainty of a jumbo interest rate hike by the Federal Reserve (Fed) in May.

US PPI landed at a 12-year high of 11.2%

The US Labor Statistics agency reported the US Producer Price Index (PPI) on Wednesday. A print of 11.2%, remarkably higher than the market consensus of 10.6% and the prior figure of 10.3%. It is worth noting that the yearly print of 11.2% is the highest recorded since November 2010. A notable higher reading of the US PPI is going to hurt the corporate profits as the higher commodity prices will dampen the margins of the corporate and henceforth the pass on of higher input prices to the households will reduce their real income. This has weighed pressure on the DXY.

Fed Governor Christopher Waller's speech

Fed Governor Christopher Waller in his speech on Wednesday favored an aggressive interest rate hike going forward but aggressiveness should not be mixed with abruptness as it may lead the US economy into recession. "I don’t see value in trying to shock the markets also we are not in a Volcker kind of moment," Waller told CNBC. Investors should be aware of the fact that Fed Chair Paul Volcker shot the interest rates by 400 basis points at a time to battle the prolonged inflation.

Meanwhile, investors are shifting focus to the US Retail Sales data which is due on Thursday. The market consensus sees the monthly US Retail Sales getting doubled to 0.6% than the previous figure.

- USD/JPY has sensed a minor pullback after a decent correction from a six-year high at 126.32.

- The DXY ended its nine-day losing streak on higher than expected US PPI.

- BOJ’s Kuroda indicated fears of falling household income and corporate profits due to high energy bills.

The USD/JPY pair is experiencing a short-lived pullback after a steep fall from a six-year high at 126.32. The pair is likely to witness more downside as the mighty greenback loses strength. The US dollar index (DXY) has tumbled below the critical figure of 100.00 as the impact of higher inflation faded away.

On Wednesday, the DXY ended its nine-day winning streak after the US Bureau of Labor Statistics reported the yearly Producer Price Index (PPI) at 11.2%. The yearly US PPI has been significantly higher than the estimates of 10.6% and prior print of 10.3%. Also, the history dictates that the 52-week US PPI at 11.2% is the highest ever print since November 2010, which has raised the market expectations of a jumbo interest rate hike from the Federal Reserve (Fed) in May.

Earlier, the DXY was receiving bids on a higher US Consumer Price Index (CPI) at 8.5% as investors were expecting that the Fed has to shift the interest rates higher to tame the soaring inflation. A decent slippage in the DXY has underpinned the Japanese yen against the greenback.

Meanwhile, the speech from the Bank of Japan (BOJ)’s Governor Haruhiko Kuroda has emphasized the rising inflation and falling real income of households. The BOJ’s Kuroda dictated that the impact of the Covid-19 and the Ukraine crisis is hurting the economy. Higher energy and commodity prices are weighing on Japan’s economy by reducing households income and corporate profits.

Going forward, investors will focus on the US Retail Sales, which will release on Thursday. A preliminary estimate of the US Retail Sales claims a higher print at 0.6% against the prior figure of 0.3%.

- The AUD/JPY rallied late in the New York session and gained 0.16%.

- AUD/JPY Price Forecast: Upward biased, but RSI at overbought levels, and negative divergence between RSI/price action, might open the door for further losses.

The AUD/JPY edges slightly up as the North American session winds down, up 0.16% amid an upbeat market mood, as global bond yields fell. At the time of writing, the AUD/JPY is trading at 93.68, near the week and year-to-date highs.

On Wednesday, the AUD/JPY lifted from daily lows when the Reserve Bank of New Zealand (RBNZ) took the market by surprise, hiking rates by 50 bps to the Overnight Cash Rate (OCR). Due to its close ties with New Zealand, the Australian dollar reacted positively and edged higher against most G8 currency pairs. Nevertheless, during the North American session, some safe-haven flows and a “buy the rumor, sell the fact” reaction to the RBNZ’s decision weighed on the AUD/JPY, which fell towards daily lows around 93.00 flat.

AUD/JPY Price Forecast: Technical outlook

In the last few days, the price action has kept the AUD/JPY range-bound in the 92.40-93.80 area. Nevertheless, the cross-currency pair remains upward biased. However, the Relative Strength Index (RSI) at 73.79 within the overbought area further confirms the uptrend is overextended, a signal that might correct lower or probably would break towards fresh year-to-date highs.

Upwards, the AUD/JPY’s first resistance would be April 13 93.86 daily high. A breach of the latter might open the door towards the YTD high at 94.31, but first, AUD/JPY bulls would need to reclaim the 94.00 mark

On the flip side, the AUD/JPY first support would be the April 11 daily low at 92.42. A decisive break would expose the 92.00 mark, followed by March’s 31 90.76 daily low.

Technical levels to watch

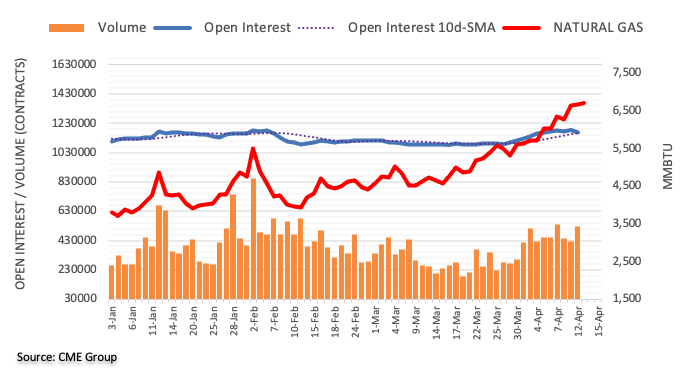

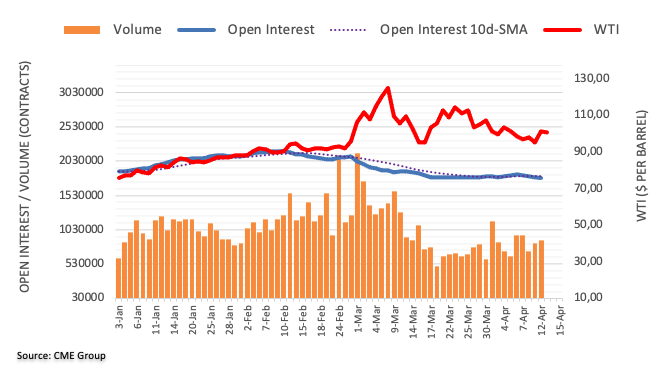

- West Texas Intermediate (WTI) crude oil rose on Wednesday.

- International Energy Agency (IEA) lowered its 2022 demand forecast on weak demand from China.

Despite a big rise in US inventories, West Texas Intermediate oil extended recent gains as the expectations of global supply deficits climb. At the time of writing, WTI down 0.73% after falling from high of $104.27 to a low of $103.51/bbls.

International Energy Agency (IEA) lowered its 2022 demand forecast on weak demand from China amid Covid-19 lockdowns. In its monthly Oil Market Report, the IEA said Russian production and exports continue to fall following on its invasion of Ukraine. The agency said 0.7-million barrels per day of Russian production has been shut in so far this month and it expects that to rise to 1.5 million bpd by month's end as buyer become scarce.

Analysts at ANZ Bank explained that ''the International Energy Agency said OPEC+ members have only managed to provide 10% of their promised supply increases for March. The agency also warned Russian production could drop 1.5mb/d in April as the country’s barrels struggle to find buyers.''

''Russian President Vladimir Putin begged to differ, saying it will find new buyers for its energy exports. More than half of its Urals crude for April continued to flow to Europe, though the volume was much lower than usual as European refiners scale back purchases,'' analysts at ANZ Bank said.

Meanwhile, analysts at TD Securities are expecting supply risks to remain elevated as ''persistent underproduction from OPEC+ related to a decade of underinvestment, along with stretched global spare capacity and critically low inventories, provide little buffer for any further disruptions.''

''High food and energy prices may further lead to unrest across the globe, which could further disrupt production in line with historical precedents from the Arab Spring. In this context, we may look to re-engage topside.''

- NZD/USD is creeping back from the lows of the day.

- RBNZ hiked rates by 50bps, not traders will get set for next week's CPI.

At 0.6793, NZD/USD is back to being flat on the day after being thrown around in the aftermath of the Reserve Bank of New Zealand. The pair traded between a range of 0.6793 highs that were printed on the knee-jerk and the lows of 0.6788 made in afternoon London trade.

The RBNZ lifted the OCR by 50bps to 1.5% as the central bank moved aggressively to combat inflationary headwinds and to get ahead of the inflation curve. However, and as analysts at ANZ Bank noted, ''it’s been a wild 16 hours since the RBNZ hiked rates, with the Kiwi initially spiking sharply, only to completely unwind those gains and some as markets digested the idea that by going hard early, the RBNZ may not need to take the OCR as high later (certainly nowhere near the ~4.25% that was priced in by late 2023 yesterday morning).''

Meanwhile, traders will now look ahead to next week's Consumer Price Index. ''We think next week’s Q1 CPI data will robustly confirm that the 50bp hike was the right move. We estimate that headline annual CPI inflation rose to 7.4% in Q1, up from 5.9% in Q4,'' the analysts at ANZ Bank said.

Bullish for NZD/USD, the analysts went on to explain, ''the RBNZ noted they expected inflation to peak “around 7%” in the first half of this year – but we see that as being closer to 7.5%. And with non-tradables inflation picked to hit 6.5% in Q1 (5.3% previously), the RBNZ still has a job to do to rein in surging domestic inflation pressures. That speaks to another 50bp hike in May.''

NZD/USD daily chart

The price was testing a 38.2% Fibonacci retracement level before it dropped as markets repriced the prospects at the RBNZ. Depending now on the trajectory of the US dollar, the price could well continue lower towards the March 15 lows of 0.6729 in the coming sessions.

- A positive market mood, falling US bond yields, and a weaker buck, a tailwind for precious metals and commodities.

- Hotter than expected, US PPI inflation reinforces a 50-bps increase by the Fed.

- Silver Price Forecast (XAG/USD): Remains upward biased, and a daily close above $25.85 would open the door for bulls towards $26.00

Silver (XAG/USD) rallies for the sixth consecutive day, in the middle of an upbeat market mood, taking advantage of fallings US Treasury yields, high US inflation figures, and despite the continuation of hostilities between Ukraine-Russia. At the time of writing, XAG/USD is trading at $25.72 and continues to aim towards $26.00.

Risk appetite increased throughout the North American session, as portrayed by US equities gaining. US Treasury yields fell, with the 10-year clinging to the 2.70% threshold, while the greenback fell.

High US inflation lays the ground for a Federal Reserve 50 bps hike

The ongoing week US economic docket keeps traders entertained. On Wednesday, consumer inflation rose to 8.5% y/y, higher than estimations but within the range. At the same time, the so-called core Consumer Price Index (CPI) increased 6.5% y/y, though lower than the 6.7% expected, a signal that inflation might be about to peak.

Nevertheless, prices paid for producers sent the hopes over the board on Thursday. The Producer Price Index (PPI) expanded by 11.2%, higher than the 10.8% y/y estimations, while core PPI hit 9.2% y/y, substantially up than the 8.4% estimations.

With both reports in the rearview mirror reinforces pressure on the Federal Reserve to raise rates at a faster pace. Fed officials have opened the door for 50-bps rate hikes at its May meeting, while STIRs shows a 94% chance of a 0.50% lift to the Federal Funds Rate (FFR).

Elsewhere precious metals extend their gains in the week. Silver is up close to 4%, while Gold gains 1.5%, trading at $1976 a troy ounce.

The US economic docket would unveil Retail Sales, Initial Jobless Claims, and the University of Michigan Consumer Sentiment survey by Thursday.

Silver Price Forecast (XAG/USD): Technical outlook

Silver’s (XAG/USD) daily chart depicts the pair as upward biased. The daily moving averages (DMAs) below the spot price confirmed the previously mentioned, though it’s worth noting that the 200-DMA at $23.89 is trapped between the 50-DMA at $24.61 and the 100-DMA at $23.74.

Silver’s 1-hour chart bias is aligned with the daily chart, and the uptrend is intact. The price action of the last two candlesticks shows that the rally is overextended, further confirmed by the Relative Strength Index (RSI) at 61.63, close to reaching overbought conditions.

Upwards, the XAG/USD first resistance would be the confluence of the March 24 cycle high and the R1 pivot point around the $25.75-85 range. A breach of the latter would expose the psychological $26.00 mark, followed by the R3 pivot at $26.43.

On the downside, the XAG/USD first support would be the 50-hour simple moving average (SMA) at $25.37. Once cleared, the next support would be the confluence of March 31 and the 100-hour SMA around the $25.05-09 range, followed by the 200-hour SMA at $24.78.

- EUR/USD bulls attempting to correct the bearish phase, eye 1.0950.

- However, the hourly chart shows a build-up of failures that could result in a correction.

- EUR/USD bears need to get below the current support near 1.0870.

EUR/USD had been pressured to the March lows this month but it has recovered to almost 23.6% of the daily bearish impulse with sights on a 38.2% ratio retracement near 1.0950 for the days ahead.

EUR/USD weekly chart

The M-formation, a reversion pattern, is a compelling feature on the weekly chart with eyes on the neckline between 1.0920 and 1.0975.

EUR/USD daily chart

The price is facing some resistance on the daily chart currently but a break of it will be bullish for the foreseeable future.

EUR/USD H1 chart

The hourly chart shows a build-up of failures that could result in a correction, potentially as far as the old resistance at a 61.8% ratio once the current support near 1.0870 is broken.

What you need to take care of on Thursday, April 14:

Inflation, central banks and the Eastern European crisis remained in the eye of the storm and weighed on the market’s mood. The UK published the March Consumer Price Index, which jumped to a three-decade high of 7%, while the US reported that the March Consumer Price Index jumped to 11.2% YoY, both above anticipated.

The Bank of Canada increased benchmark interest rates by 50 bps to 1.00% and also announced plans to begin reducing the size of its balance sheet, starting April 25, given that it sees an increasing risk that expectations of elevated inflation could become entrenched.

Earlier in the day, the Reserve Bank of New Zealand decided to lift the official cash rate by 50 bps to 1.5% to combat inflationary headwinds pertaining to the Omricon disruptions and the Ukraine crisis.

On Thursday, it will be the turn of the European Central Bank to announce its monetary policy decision.

German government rejected the EU ban on Russian oil for now, while Moscow declared that US and NATO vehicles delivering weapons on Ukrainian soil would be considered legitimate military targets.

Wall Street shrugged off negative headlines and closed with substantial gains. Government bond yields, on the other hand, suffered a sharp U-turn during the American session, edging sharply lower and weighing on the greenback.

The EUR/USD pair trades at around 1.0880, while GBP/USD is just above the 1.3100 figure. The AUD/USD pair finished the day unchanged in the 0.7440 price zone, while USD/CAD ended the day in the red at 1.2565. The USD/JPY pair reached a fresh multi-year high of 126.31.

Spot gold maintains its bullish bias, trading near a fresh multi-week high of $1,981.57 a troy ounce. A generalized risk-averse mood alongside the dollar’s weakness during the American session maintained the metal bid throughout the day. Crude oil prices kept soaring, with WTI setting above $103.0 a barrel.

Bitcoin price rebounds after Terra’s LUNA Foundation Guard buys over $100 million in BTC

Like this article? Help us with some feedback by answering this survey:

- USD/CAD has continued to pullback post-50 bps BoC rate hikes, as the loonie benefits amid higher equity and oil prices.

- A softening of the US dollar amid fading US yields also helped.

- The pair is now probing its 21DMA in the mid-1.2500s, having pulled back from earlier highs in the upper 1.2600s.

USD/CAD has continued to press lower in recent hours and, as the end of the US session beckons, the pair is currently trading at session lows in the 1.2550s, down some 0.7% on the day. The US dollar is seeing a modest pullback no thanks to a slight drop in yields across the US curve, despite much hotter than expected US Producer Price Inflation data released earlier in the day and, more recently, a batch of hawkish remarks from Fed’s Christopher Waller.

Waller said he supports a 50 bps rate hike at the upcoming meeting and potentially the next two meetings after that, and that the data supports this course of action. But with a lot of Fed hawkishness already in the price, the buck did not respond. While US dollar weakness explains some of USD/CAD’s pullback from earlier highs above its 50-Day Moving Average in the 1.2670s, a more important catalyst was the latest BoC meeting.

The central bank lived up to the hype in delivering a 50 bps rate hike and also announcing the start of (passive) balance sheet runoff as of 25 April. The bank unsurprisingly signalled that more rate hikes lay ahead, potentially in 50 bps intervals. With uncertainty about the risk of a potential dovish BoC surprise gone, loonie bulls got the green light to pile in and push the Canadian currency higher to reflect strength in oil and stock prices.

At current levels in the mid-1.2500s, USD/CAD is now probing its 21DMA (at 1.2543) one again. If oil continues to rally, if equity market sentiment continues to improve and if US yields continue their current consolidation below recent highs, USD/CAD is in with a shot of dropping back towards annual lows in the 1.2400 region.

Fed board of governors member Christopher Waller said on Wednesday that he supports a 50 bps rate hike at the upcoming May Fed meeting, and possibly more hikes of the same margin at the June and July meetings, reported Reuters citing comments made in a CNBC interview.

Additional Remarks:

- The high inflation in the latest Consumer Price Inflation (CPI) report was not surprising.

- The Fed will continue with its plan for rate hikes and reducing accommodation to get inflation under control.

- March CPI was "pretty much the peak".

- The Fed will start seeing some relief on inflation in the coming months, but that doesn't relieve the need for us to raise rates.

- "We want to get to above neutral in the later half of this year."

- "Higher mortgage rates will have a bite on how much people can pay for houses, so we will see downward pressure on prices in the coming months."

- It's completely feasible to avert a recession.

- "We can pull back demand for labor, and not have a big impact on jobs."

- "We can get prices down without causing a recession."

- "We are not in a Volcker moment."

- "We don't need to cause a shock, but we will do what it takes to get inflation back down, though we can do it in an orderly way."

- "This is a good time to do aggressive actions because the economy can take it."

- The Australian dollar remains defensive, struggling to capitalize on a weaker greenback trading session.

- Prices paid by producers in the US jumped to a 12-year high, above the 11% threshold.

- AUD/USD Price Forecast:

After reaching a daily high near the 0.7500 mark, the Australian dollar slides but clings to the March 7 swing high around 0.7441 amid a positive market mood, as portrayed by US equities. Meanwhile, in the FX space, the antipodeans are the laggards of the session; despite that, the RBNZ surprisingly hiked 50 bps the Overnight Cash Rate (OCR), which also boosted the prospects of the Aussie. In the New York session, the AUD/USD is trading at 0.7444.

AUD bulls remain defensive, despite a weaker US dollar

US equities remain in positive territory while falling US Treasury yields weighed on the greenback. The US 10-year T-note is plunging, from 2.788% to 2.685%, a ten basis point drop, a headwind of the buck, as shown by the US Dollar Index, down 0.29% sitting at 99.928, below the 100.000 mark. Albeit the previously mentioned, AUD bulls were unable to capitalize on the softer tone of the buck, despite an appetite for riskier assets.

The US economic docket featured the Producer Price Index (PPI) for March on Wednesday. The reading came at 11.4% y/y, much higher than expected, the most significant increase since 2010, emphasizing inflation is stickier than initially expected as producers get ready to pass costs to customers. At the same time, the so-called core PPI for the same period, which excludes volatile items like food and energy, expanded 9.2% y/y, higher than the 8.8% foreseen, in contrast to the last core CPI report, which showed that core consumer inflation might be near peaking.

Elsewhere, the Russo-Ukraine conflict continues. Ukraine’s forces stated that the Russian troops were preparing to attack Donetsk and Kherson regions. The Kremlin added that it would consider US and NATO vehicles carrying weapons on Ukrainian territory as legitimate military targets. Concerning peace talks, a Russian Foreign Ministry spokesperson stated that they continue online.

Later in the day, the Australian economic docket would feature Consumer Inflation Expectations and will report Employment Change alongside the Unemployment Rate.

AUD/USD Price Forecast: Technical outlook

The AUD/USD bias remains upwards. The last three days’ price action further supports the previously mentioned, but its fall on the RBNZ monetary policy decisions is courtesy of AUD weakness, more than a strong buck.

However, it’s worth noting that the pair lifted from daily lows around 0.7391 towards current levels but short of Pitchfork’s mid-line parallel line around 0.7470-80 range. That said, the AUD/USD first resistance would be the former, followed by the psychological 0.7500 figure. Once cleared, the next resistance would be the 0.7540-55 area, the confluence of March 28 and October 2021 cycle highs, followed by the 0.7600 mark.

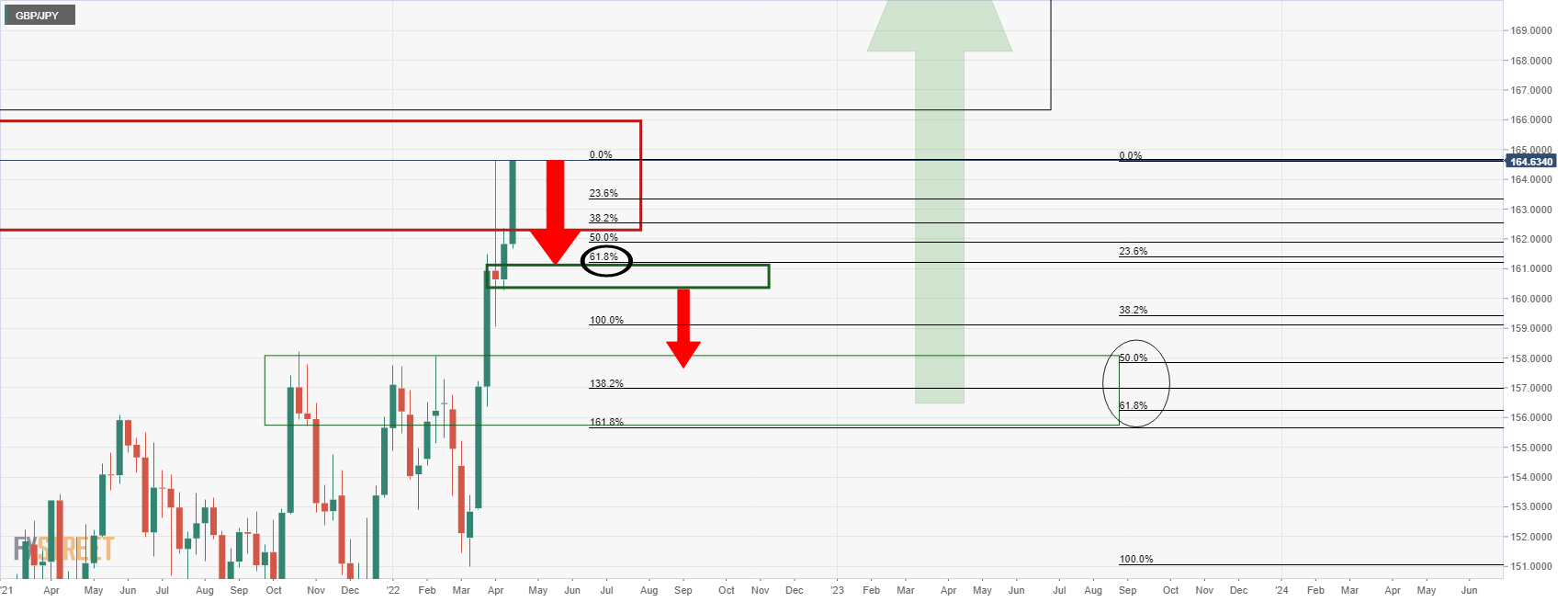

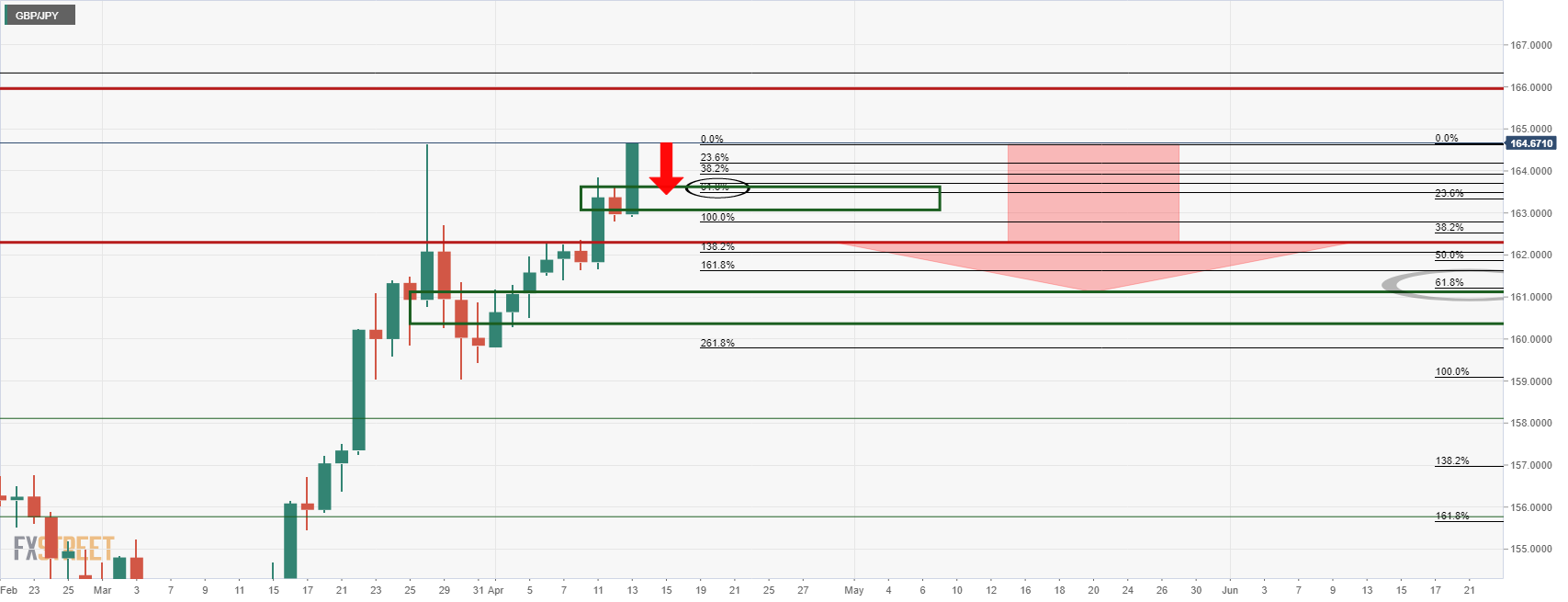

- GBP/JPY rallies into a prior monthly support area.

- GBP/JPY bears are potentially looking for an opportunity in a reversion of the current bullish phase.

GBP/JPY has rallied by almost 1% on the day in an extension of the bullish breakout of the 2021 resistance as per the monthly chart. However, whether the price can continue into the next mitigation zone without a prior retest of the old resistance area is the question:

GBP/JPY monthly chart

As illustrated, the price has rallied into an old level of monthly support that would now be expected to act as a resistance area and guard the next imbalance of price which occurred when GBP/JPY fell in 2016 to below 175 the figure. In May 2016, the price recovered back to 164.03 for which the current cycle has returned to and slightly beyond in printing today's highs of 164.59.

If the bulls stay in control, then the next area of mitigation will be towards 175 the figure for the weeks and months ahead. However, if the bulls throw in the towel anytime soon, a 50% reversion could be on the cards first which is a touch below 158.00. However, the bears will need to get beyond the weekly support as follows:

GBP/JPY weekly chart

The price is meeting the March 28 highs and should it now turn south, then the 61.8% Fibonacci near 161.20 could be eyed where it meets the weekly structure. before there, however, the daily support will be challenged near 163.50:

GBP/JPY daily chart

- US equities advanced on Wednesday despite hotter than expected PPI and a mixed start to the Q1 earnings season.

- A continued pullback in US yields is giving big tech/growth stocks a lift.

- The S&P 500 was last up more than 1.0% and trading in the 4,440s, well within this week’s ranges.

Major US equity indices were undeterred by a larger than expected rise in MoM and YoY Producer Price Inflation in March, according to data released on Wednesday, and advanced across the board, with large-cap tech/growth stocks leading the charge amid a continued pullback in US yields. The S&P 500 was last up slightly more than 1.0% in the 4,440s and trading back to the north of its 50-Day Moving Average at 4,422, though still within this week’s 4,375-4,470ish ranges.

The tech-heavy Nasdaq 100 index was up around 1.8% and trading just below 14,200, with the bulls eyeing a test of its 50DMA at 14,300. The Dow, meanwhile, was up around 0.9% and trading back to the north of the 34,500 level. Wednesday marked the unofficial start of the Q1 2022 earnings season, which got off to a mixed start.

JP Morgan shares slumped after the bank reported a slide in Q1 profits, while Delta Airlines jumped after posting a smaller than expected Q1 loss and a forecast for a return to profit in Q2. Investors seemingly took a glass-half-full attitude to the first day of major earnings releases, with some analysts talking about how Delta’s earnings release highlighted the potential for post-pandemic “reopening” trade to come back into the swing.

But focus returns to the big US banks for the rest of this week, with the likes of Citigroup, Wells Fargo, Goldman Sachs, Morgan Stanley and Bank of America all reporting in the coming days. According to Refinitiv data cited by Reuters, analysts expect earnings to rise by roughly 6% YoY in Q1 versus a 32.1% YoY jump in Q4 2021, with Reuters analysts citing the hawkish Fed, rampant inflation and geopolitical uncertainties due to the Russo-Ukraine war as muddying the outlook.

- US prices paid by consumers and producers continue rising, further cementing the need for a 50 bps Federal Reserve hike.

- UK Inflation Rate at its highest in 30 years, hits 7%.

- GBP/USD Price Forecast: Double bottom near the YTD lows looms as cable rallies towards 1.3100.

The British pound rallies and recovers substantial ground, in the North American session, amidst an upbeat market mood, despite continuing fighting between Ukraine and Russia and a busy week for the US economic docket weighed by inflationary measurements weighing on the greenback. At the time of writing, the GBP/USD is trading at 1.3098.

The US docket witnessed the Consumer Price Index (CPI) on Tuesday, which rose above the 8.5% threshold for the first time since 1981, while inflation excluding food and energy, the so-called core CPI, rose by 6.5%, lower than the 6.7% estimated. The figures show that inflation is stubbornly high, but the core CPI showed that, in fact, prices easied in comparison with forecasts. That spurred a reaction in money market futures derivatives, as traders easied the 220 basis points Fed aggressive tightening to 200 by the end of the year.

In the meantime, on Wednesday, prices paid by producers (PPI) in March rose 11.4% y/y, the most since 2010, above all estimations and emphasizing inflation is stickier than expected, as producers are about to pass costs to customers. Excluding volatile items like food and energy, the so-called core PPI rose 9.2% y/y, higher than the 8.8% foreseen, in contrast to the last core CPI report, which showed that inflation might be near peaking.

Sources cited by Bloomberg said that “[D] despite the sigh of relief from yesterday’s core CPI reading, this is concerning,” and added that a “50 bps is starting to feel commonplace.”

Elsewhere, the UK economic docket also featured inflation figures, led by the Inflation Rate for March, which expanded by 7%, in line with expectations but higher than the March 6.2%, the highest in 30 years.

Money market futures have priced in a 25 bps rate hike by the Bank of England’s meeting on May 5. However, it’s worth noting that Deputy Governor Jon Cunliffe voted for no change at its last meeting, a move widely unexpected by investors, which weighed on the GBP prospects and pushed cable towards its YTD low around 1.2979.

GBP/USD Price Forecast: Technical outlook

The GBP/USD appears to have formed a double bottom in the daily chart, but as long as the daily moving averages (DMAs) reside above the exchange rate, the pair is downward biased. Nevertheless, it's worth noting the aforementioned.

If GBP/USD bulls lift prices above March 23 1.3298 swing high, then the double bottom could be confirmed and would target 1.3600.

The GBP/USD first resistance would be 1.3100. A breach of the latter would expose the December 2021, 1.3160 pivot low-now-resistance, followed by the 1.3200 figure. Once cleared, that would open the door towards 1.3298, March 23 cycle high.

- EUR/JPY rallied back above 136.50 on Wednesday as the yen failed to benefit from lower US yields.

- Bulls are eyeing a breakout towards annual highs in the 137.50 area if Thursday’s ECB meeting proves hawkish.

US yields continued their recent pullback on Wednesday, despite a worrying US Producer Price Inflation report that suggests inflationary pressures don’t look likely to ease any time soon, but this did not offer the battered yen much respite. Despite recent negative newsflow on the Russo-Ukraine front that would typically be seen as euro negative, EUR/JPY advanced on Wednesday to move back above the 136.50 mark.

The pair is now eyeing a retest of earlier weekly highs just above the 137.00 level, a break above which would open the door to a run towards recent multi-year highs in the 137.50 area. Recent commentary from Japanese fiscal and monetary policymakers has suggested that they are more worried about the rate of JPY depreciation in global FX markets, rather than targetting any specific levels.

That has come as a disappointment for those betting that some stronger jawboning might give the yen a near-term boost. EUR/JPY bulls will be hoping that Thursday’s ECB meeting might offer the pair some impetus in the form of, perhaps, a further shift in the bank’s tone regarding how worried it is about inflation, and how quickly it sees itself tightening monetary policy settings.

A break above 137.50 would see EUR/JPY trading at its highest levels since 2015 once again and the bulls would quickly turn their attention to the 140 level and June 2015 highs at 141.00.

The US is moving to significantly increase the intelligence it provides to the Ukrainian military so that they can target Russian forces in the Russian-occupied Donbas and Crimean regions and potentially take back territory, the WSJ reported on Wednesday citing sources.

The WSJ states that this new intelligence comes at a time when the US is already moving to significantly increase the flow of weapons into Ukraine. Russia is expected to mount a major new offensive in the south and east in the coming days.

- Oil prices gained for a second day, with traders citing the negative tone to recent Russo-Ukraine rhetoric/developments as bullish.

- WTI rallied towards its 21DMA in the $103.00s, with the bulls eyeing a push higher towards $110.

Bullish momentum in global crude oil markets continued for a second day on Wednesday, with front-month WTI futures pushing towards their 21-Day Moving Average in the $103.60s, after prices found decent support $100 per barrel area earlier in the day. At current levels just under $103.00, WTI trade with on-the-day gains of just under $2.0, taking its weekly gains to almost exactly $5.0/barrel.

Analysts cited the lack of signs of any progress towards peace in Ukraine as supportive for oil prices, pointing to recent commentary from Russian President Vladimir Putin, who on Tuesday referred to peace talks as at a dead-end, and to the continued build-up of Russian forces in Ukraine’s east as they prepare for an assault on the unoccupied portions of the Donbas oblast.

The International Energy Agency on Tuesday said it expects Russian oil output to have dropped by 1.5M barrels per day (BPD) this month, and to drop by 3M BPD in May. The lack of progress towards peace suggests that the Western sanctions that are the main catalyst of this large drop in Russian output won’t be lifted anytime soon.

Ongoing supply concerns helped oil markets shrug off the bearish impact of a much larger than expected more than 9M barrel build in US crude oil stocks, according to the latest weekly US Energy Information Agency data. Indeed, OPEC warned earlier in the week it would not be possible to make up for the shortfall in Russian output, and US output is only expected to rise a further 200K BPD by the end of 2022 (to 12M BPD from the current 11.8M BPD).

The WTI bulls will be hoping that recent gains over the past two days represent a break out of the downtrend that has engulfed oil markets since March 24 (when WTI was trading above $110. They will be hoping for a break above the 21DMA, which could open the door to a run back towards $110.

On Wednesday, the Bank of Canada, as expected, increased the key interest rate by 50 bps to 1% and also announced the beginning of quantitative tightening. Analysts at RBC, point out the BoC doesn’t provide an expected path for policy rates but they consider Governor Macklem gave some guidance at his press conference, “noting Canadians should expect the overnight rate to rise toward the bank’s assumed 2-3% neutral range.”

Key Quotes:

“The Bank of Canada accelerated its tightening cycle today, building on March’s 25 bp rate hike with a larger, 50 bp move that lifts the overnight rate to 1%. The bank also said it will begin quantitative tightening (QT) later this month, shrinking its balance sheet by ceasing reinvestment of maturing GoC holdings. With 40% of its holdings maturing in the next two years, QT will reduce the size of the bank’s balance sheet relatively quickly. That move has been well telegraphed, though, and increases in the overnight rate—which the BoC emphasized is its main policy tool—will be more impactful for financial conditions going forward.”

“Today’s 50 bp move, the first hike of that magnitude in 22 years, suggests the BoC has lost the patience it demonstrated back in January when it took a pass on raising rates.”

“Our forecast assumes more standard, 25 bp hikes going forward—until the overnight rate hits 2% in October—though we think another 50 bp increase will be an option on the table in June.”

“While today’s meeting suggests upside risk to our forecast for the BoC to halt its tightening cycle at 2%, we continue to think the market is over-priced for rate hikes in 2023 when the bank will have to balance growth risks (which we view to the downside relative to today’s forecast) with inflation that should be moving toward its target, if not quite fast enough.”

Ukraine's Armed Forces Command said on Wednesday that Russian forces are ready to attack in the eastern Donetsk and southern Kherson regions of the country, reported Reuters. Russia recently pulled forces out of Ukraine's north, in essence giving up on its efforts to take Ukraine's capital Kyiv and is now switching its focus to securing the rest of the eastern Donbas region (of which Donetsk is a part), as well as more territory in the south.

The US and its NATO allies have in recent days pledged to send additional arms to Ukraine to aid them in their defense against Russia, though Russia on Wednesday threatened to attack any such US/NATO convoys transporting weapons in Ukraine.

- The USD/CHF cuts some of Monday’s losses amidst a mixed market sentiment.

- Falling US Treasury yields weigh on the greenback, which losses against most currencies except the Swiss franc.

- USD/CHF Price Forecast: Range-bound within 0.9300-70 amid the lack of a fresh impulse.

The USD/CHF advances for the second consecutive day and is about to trim Monday’s losses amid a mixed market mood as portrayed by European and US equities fluctuating between gainers and losers as global bond yields fall. In the FX space, safe-haven peers remain the laggards, while the greenback remains defensive against most peers but the Swiss franc. At the time of writing, the USD/CHF is trading at 0.9333.

Meanwhile, US Treasury yields remain downward pressured, with the 10-year benchmark note down from 2.788% highs to 2.672%, a headwind for the greenback, as the US Dollar Index, a gauge of the buck’s value vs. six currencies, edges down 0.25%, sitting at 100.069.

USD/CHF Price Forecast: Technical outlook

Overnight, the USD/CHF was subdued In the Asian Pacific session, but in the European one, it edged up above the R1 daily pivot, lying at 0.9353, forming a tweezer-top candlestick chart pattern, which dragged the USD/CHF down towards the 100-hour simple moving average (SMA) at 0.9332.

Meanwhile, the USD/CHF daily chart depicts the pair as upward biased, but it has remained consolidated in the 0.9300-70 area since April 6, amidst the lack of a catalyst.

Upwards, the USD/CHF’s first resistance would be the March 28 daily high at 0.9381. A breach of the latter would expose the psychological 0.9400 level, followed by the YTD high at 0.9460. On the downside, the USD/CHF first support would be 0.9300. A decisive break would expose the 50-day moving average (DMA) at 0.9270, followed by the 100-DMA at 0.9234 and the 200-DMA at 0.9213.

Technical levels to watch

- EUR/USD turns positive as the US dollar corrects lower.

- DXY drops for the first time in nine trading days.

- On Thursday, the ECB will announce decisions on monetary policy.

The EUR/USD rebounded sharply during the last hours and climbed from 1.0820 to 1.0878, reaching a fresh daily high. The move higher took place amid a decline of the US dollar across the board. The greenback lost momentum as US yields turned to the downside.

The US 10-year yield fell from 2.75 to 2.65%, reaching the lowest level since Friday, while the 30-year dropped from the multi-year high at 2.87% to 2.76%. The recovery in Treasuries weighed on the greenback.

The DXY is falling by 0.28%, ending an eight-day positive streak. It is hovering around 100.00. It is the first strong sign of a pause on the greenback’s rally. Under that scenario, EUR/USD could benefit, but a risk event for the euro is ahead.

On Thursday, the European Central Bank (ECB) will announce its decision on monetary policy. A more aggressive approach toward inflation is expected. Analysts at TD Securities see a “sharp hawkish pivot from the ECB this week, with an announcement that the APP will conclude at the end of May, and a clear signal that rate hikes will follow.” They still see the euro under pressure and look for near-term rallies to fade.

Supported by 1.0800

The EUR/USD again, like last month, found support above 1.0800 and is rebounding. Despite moving away from that critical area, risks remains tilted to the downside. A break under 1.0800 should clear the way to more losses.

If the move to the upside gains momentum, the next resistance might be seen at 1.0900 and above a more important barrier at 1.0940. A daily close above 1.0940 should alleviate the bearish pressure.

Technical levels

Bank of Canada Governor Tiff Macklem, in the post-BoC monetary policy decision announcement press conference, said that the bank is prepared to move s forcefully as needed to tackle inflation and took an important step in this fight on Wednesday, reported Reuters. The BoC needs to ensure that inflation expectations remain moored, and that was a key part of Wednesday's decision, he explained.

Oil prices have gone up a lot, partly as a result of the war, though many producers are expecting lower prices when the war ends, he noted. When asked about the level of the Canadian dollar, Macklem said that he would leave it to markets to determine its value, though he did note that the interest rate differential with the US may be weighing on the loonie a tad.

The BoC's 50 bps rate hike sends a message that monetary policy needs to be normalised reasonably quicky, Macklem said.

- Kiwi is among the weakest G10 currencies despite the RBNZ rate hike.

- The US dollar remains strong, supported by US inflation data.

- NZD/USD heads for the lowest close in a month.

The NZD/USD trimmed losses during the American session; however, it still heads toward the lowest daily close in a month. The pair bottomed at 0.6750 before rising toward 0.6780 amid a correction of the greenback across the board.

The kiwi is among the worst performers even after the Reserve Bank of New Zealand (RBNZ) announced early on Wednesday a 50bps rate hike, surpassing expectations to 1.50%. “The RBNZ is clearly looking to get ahead of the inflation curve and the more aggressive action was justified on the 'least regrets' approach to policy decisions”, explained analysts at TD Securities. They forecast a 50bps May hike, and 25bps hikes at each RBNZ meeting this year in July, August, October and November.

The US dollar peaked on Wednesday after the release of the March Producer Price Index that, rose to 11.2%, from 10.3%, above the 10.6% of market consensus. Despite the number, US yields turned to the downside during the American session and weighted don the US dollar. The DXY is falling 0.12% for the first time in nine days.

Despite the recovery, NZD/USD remains under 0.6800, at the 55-day Simple Moving Average (0.6780) with a negative perspective. The bias should change if the pair rises above 0.6910/15 (20 and 200-day SMA).

Technical levels

In his post BoC monetary policy announcement press conference on Wednesday, Governor Tiff Macklem said that if demand responds quickly to higher rates and inflationary pressures moderate, it may be appropriate to pause hikes once we get closer to the neutral rate, reported Reuters.

Additional Remarks:

- On the other hand, the BoC may need to take rates modestly above neutral for a period to bring demand and supply back into balance and inflation back to target.

- Canadians should expect rates to continue to rise towards more neutral settings and the current estimate is that this is between 2% to 3%.

- "We need higher interest rates," he said, adding that the economy can handle them and reiterating that the BoC will act forcefully if need be.

- The impact of the Russo-Ukraine war on growth in Canada is likely to be small.

The European Central Bank (ECB) will announce its decision on monetary policy on Thursday, April 14 at 11:45 GMT and as we get closer to the release time, here are the expectations as forecast by the economists and researchers of 12 major banks.

ECB is widely expected to leave key rates unchanged. Additionally, the central bank is set to signal tighter policy in response to higher inflation.

TDS

“The ECB is likely to announce that its APP programme will end in May, and prepare markets for a June rate hike. An ECB pivot would anchor a possible low for EUR/USD, though a break of the 1.12 high requires settlement on the US terminal rate pricing. That said, a more active ECB is likely to reinforce the lows in EUR/CHF and would favor buying EUR/GBP dips towards 0.83.”

ING

“Staying put and continuing with the announced reduction of net asset purchases looks like the only viable option for now. However, given the latest market pricing of future ECB rate hikes and unclarity about the ECB’s exact reaction function in these times of high uncertainty, ECB President Christine Lagarde could be forced to somewhat limit the ECB’s optionality to a few options.”

Nomura

“With no new forecasts to announce, few hard data to confirm the precise extent of the impact of the war on the euro area economy, and with there being another meeting before the end of Q2 at which the ECB could make its decisions on an APP wind-down, we do not believe the ECB needs to – nor will – announce any major adjustments to its guidance at its April meeting. This is, after all, the flexibility with regard the path of monetary policy that the ECB has craved. The focus instead, we believe, will be on any nuances that ECB President Lagarde reveals in the press conference following the decision. We expect the ECB to announce, at its June meeting, an end to its asset purchases in September with the first 25bp Deposit Rate hike coming in December this year. Thereafter, we expect a further three quarter-point rate hikes to +0.50% by end-2023 – a total tightening of 100bp. We expect a cessation of ECB tightening from the end of 2023, as at that point inflation could already be in retreat, and a slowing US economy could be leading the global economic cycle downwards once again.”

Nordea

“We think the ECB will decide on the end date for net asset purchases only at the June meeting, but the decision could be taken already at this meeting. Markets continue to price in a more aggressive rate path than we think is warranted based on the ECB’s signals. ECB monetary policy account suggests the more hawkish tones within the ECB have gained the upper hand.”

Danske Bank

“We now look for a 25bp rate hike in both September and December 2022. Beyond that, we do not look for a prolonged hiking cycle into 2023 at the current stage. Yet another challenging meeting awaits this week. While the official decision is expected to be broadly unchanged, we expect Lagarde to keep the door open for a potential rate hike after summer, while she will continue to repeat the flexibility, optionality and data dependency. We believe markets will react to this, speculating about a potential rate hike in July. Upside risks to the EUR/USD on the day, but downside risks persist.”

Commerzbank

“Due to the unclear situation, there is unlikely to be any decisions at Thursday's meeting, with one possible exception. The central bank could decide to increase the part of excess reserves that is exempt from interest at the prevailing deposit rate. Although we do not expect any decisions for Thursday's meeting apart from the tiered interest rate, the discussion on the normalisation of monetary policy is likely to continue in the Council. However, it remains uncertain whether this current increasing willingness to raise interest rates will be followed by action later in the year. After all, the willingness of many Council members is based on the expectation that the economy will continue to grow steadily despite significantly higher energy prices. However, in the event of a complete boycott of Russian energy supplies, for example, a recession would probably be unavoidable.”

Rabobank

“We expect only minor policy changes at the April meeting. Larger shifts, including a decision on APP after Q2, will be made when the ECB has new staff projections in June. Lagarde’s explanation of the new forward guidance on rates seems inconsistent with Lane's, and clarification during the Q&A session could potentially shift rate hike expectations. We expect the ECB to confirm that the TLTRO-III discount will not be extended after June. Simultaneously, we expect the tiering multiplier to increase to c. 10 times minimum reserves. Both policy rates and APP will probably be left unchanged. We expect the ECB to announce the end of net purchases in June and currently assume zero net purchases in Q3.”

Deutsche Bank

“We are not expecting much change to the ECB’s message. Instead, they think that when the new staff forecasts are available in June, they’ll announce that APP purchases will end in July, ahead of liftoff in the policy rate in September, so an underlying direction of travel that’s becoming clear. Our view is that the risks are tilted towards a more hawkish, rather than a less hawkish tone though, and as a reminder, we changed our call last week to expect a more aggressive ECB exit given the deteriorating inflation outlook, and now see the terminal rate reaching 2% by end-2023, which is 250bps higher than at present.”

SocGen

“No major changes expected but a clear communication that all options are possible, depending on the data. ECB is likely to stress the importance of anchoring inflation expectations and sound more concerned about too high inflation than the downside risks to growth. New staff forecasts will not be available, and there is not a lot of new data since the March meeting. However, the ECB should acknowledge that the data in many cases have been better than what could have been expected, while inflation again has been higher than expected. Risks to inflation are still to the upside, while risks to growth are to the downside.”

Citibank

“Policy Rate (Deposit Facility Rate): Citi Forecast -0.5%, Prior -0.5%. Net asset purchases are set to continue at least until the end of June, rate hikes can only happen thereafter and TLTROs carry on until end-2024. However, nothing is set in stone and every meeting is live. A fixed end-date to net asset purchases, signals on pace or step-size of rate hikes could trigger a market reaction.”

Wells Fargo

“Despite a softer growth outlook, Eurozone headline inflation has moved sharply higher. Core inflation has also trended higher but to a lesser extent as it does not include volatile price components such as energy and food. But, even with core inflation slightly more modest, we still expect ECB policymakers to respond to elevated headline inflation. In that sense, we do not expect interest rate settings to change meaningfully but do expect ECB policymakers to taper asset purchases; however, we do now expect the ECB to lift interest rates 25 bps at the September 2022 meeting. We also expect steady interest rate hikes over the remainder of this year as well as into 2023.”

UOB

“We recognise that the situation remains very fluid. How the war evolves and the impact that has on energy prices will be crucial. But we are still not expecting any changes in key interest rates for now. Rather, any policy tightening by the ECB this year, will solely be in terms of ending its QE programs.”

- The Bank of Canada (BoC) lifts rates to the 1% threshold and will begin Quantitative Tightening on April 25.

- The USD/CAD plummeted as volatility increased, reaching a daily low at 1.2625 on its initial reaction.

- USD/CAD Price Forecast: The pair is upward biased, but BoC Governor Tiff Macklem’s press conference will trigger more volatility in the pair; caution is warranted.

The Canadian dollar soared after the Bank of Canada raised the interest rate policy from 0.50% to 1% and announced it would begin its Quantitative Tightening by April 25. At the time of writing, the USD/CAD is seesawing around the 1.2630-40 area as market participants digest the BoC monetary policy report.

Market’s Reaction

The USD/CAD nose-dived towards 1.2625, followed by an upward reaction to 1.2675, followed by a retracement to the mid-level between 1.2600-1.2700, settling around those levels.

Summary of the Bank of Canada statement

The BoC Governing Council judges that rates need to rise further and emphasizes that interest rates would be the bank’s primary tool for setting monetary policy. The BoC reiterated that they would guide the timing and pace of further rate hikes, as the BoC remains committed to achieving the 2% inflation target.

Regarding Quantitative Tightening (QT), the BoC said it would begin on April 25, halting the reinvestment phase. The BoC added that “Maturing Government of Canada bonds on the Bank’s balance sheet will no longer be replaced and, as a result, the size of the balance sheet will decline over time.”

Concerning Ukraine, the BoC said that elevated prices in oil, natural gas, and commodities are adding to global inflation. Supply chain constraints, a consequence of the war, weigh on activity and would be the primary drivers of “substantial upward revision to the Bank’s outlook for inflation in Canada.”.

The BoC added that Canada’s economy is strong and is moving into excess demand. The bank emphasized that labor markets are tight, and businesses report they have difficulty meeting demand, passing higher input costs to customers. Furthermore, the central bank added that growth looks to have been stronger in Q1 than projected in January and is likely to pick up in the second quarter.

Therefore, the interest rate differential so far benefits the Canadian dollar. However, in the mid to long-term, Fed’s hawkish expectations could favor the greenback, as money market futures expectations show a 94% chance of the Federal Reserve hiking rates to the 1% threshold, the same level reached by the BoC in April.

Later at 15:00 GMT, the Bank of Canada would have its press conference, led by Governor Tiff Macklem and Carolyn Rogers, Senior Deputy Governor.

BOC Press Conference: Governor Macklem speech live stream – April 13

USD/CAD Price Forecast: Technical outlook

The USD/CAD 1-hour chart is upward biased, and on the BoC rate decision, the USD/CAD reacted downwards, piercing below the 50-hour Simple Moving Average (SMA) and the daily pivot, each lying at 1.2634 and 1.2630, pushing the pair towards the 1.2620s area.

Upwards, the USD/CAD first resistance would be the R1 daily pivot at 1.2680. A breach of the latter would expose the psychological 1.2700 mark, followed by the R2 daily pivot at 1.2710. On the flip side, the USD/CAD first support would be the 50-hour SMA and the daily pivot at the 1.2634-1.2630 area. A decisive break would expose the 100-hour SMA at 1.2611, followed by the S1 daily pivot right at the 1.2600 mark.

US Treasury Secretary Janet Yellen said on Wednesday that it will be "a long time, if ever" before the US dollar is replaced as the key currency for the global economy. The impact of sanctions on Russia show the importance of the US dollar and euro, as well the US' partnership with its allies. The US dollar's dominance as a means of exchange is due to the strength of the US economy, financial system and confidence in US financial markets, Yellen added.

Following the Bank of Canada's (BOC) decision to hike the policy rate by 50 basis points to 1% in April, Governor Tiff Macklem will deliver his remarks on the policy outlook and respond to questions from the press. Macklem's presser will start at 1500 GMT.

"The Canadian economy moving into excess demand, labor market conditions are tight; the economy is starting to operate beyond its productive capacity," the BOC said.

In its quarterly Monetary Policy Report, the bank also revised the inflation forecast for 2022 to 5.3% from 4.2% previously.

Breaking: BoC hikes interest rates by 50 bps to 1.00% as expected, to start QT from 25 April.

The Bank of Canada announced on Wednesday that it had increased benchmark interest rates by 50 bps to 1.00% from 0.50%, as widely expected by analysts. The central bank also announced plans to begin reducing the size of its balance sheet, also known as Quantitative Tightening (QT), from 25 April, given that it sees an increasing risk that expectations of elevated inflation could become entrenched. Interest rates will need to rise further and higher rates should moderate growth in domestic demand, the bank noted.

Additional Takeaways as summarised by Reuters:

- BoC will use monetary policy tools to return inflation to target and keep inflation expectations well-anchored.

- The BoC will end reinvestment in Canadian government bonds - maturing bonds will no longer be replaced and the balance sheet will thus decline over time.

- QT will complement increases in the policy rate, which is the bank's primary monetary policy instrument.

- The housing market in Canada, which has been exceptionally high, is expected to moderate.

- The Russian invasion of Ukraine is causing new economic uncertainty, such as commodity price spikes and price disruptions and these are the main drivers for higher inflation forecast.

Economic forecasts and commentary in the new MPR

- The BoC hiked the outlook for Canadian inflation, which is now expected to average just below 6% through H1 2022, above the forecast in the January Monetary Policy Report (MPR), when the bank said it would be close to 5% in H1 2022.

- Inflation will remain well above the 1-3% control range until the end of 2022 and will steadily decline to around 2.5% in H2 2023 and 2% in 2024, the bank forecast.

- The Canadian economy is moving into excess demand, labor market conditions are tight and the economy is starting to operate beyond its productive capacity.

- The BoC said it is paying attention to how inflation expectations are evolving and noted that long-term inflation expecations remain anchored on target, while near-term expectations have risen.

- The effects of the Ukraine war to add 0.7% to CPI in 2022

- Overall, 2022 inflation is seen at 5.3% (vs previous estimate of 4.2%), 2023 inflation is seen at 2.8% (vs previous estimate of 2.3%) and 2024 inflation is seen at 2.1%.

- Risks to the inflation outlook are roughly balanced but upside risks are of greater concern because inflation is very high.

- The BoC projects 2021 Canada GDP growth was 4.6%, 2022 GDP growth is seen at 4.2% (vs previous estimate of 4.0%), 2023 GDP growth is seen at 3.2% (vs previous estimate of 3.5%) and 2024 GDP growth is seen at 2.2%.

- The output gap in Q1 was between -0.25% and +0.75%, higher than the Q4 estimate of -0.75% to +0.25%.

- Potential output growth is assumed to average about 2% a year over 2022-2024 vs the January forecast of 1.6% a year over 2021-2023.

- Total ownership of Canadian government bonds outstanding has dipped to 43% from 45% in January, while the value of total assets in Canadian government bonds has remained constant at C$430B.

- The BoC has updated its estimated range of nominal neutral interest rate to 2%-3%, 0.25% higher than in the April 2021 reassessment.

Market Reaction

The loonie saw a choppy reaction to the latest BoC policy announcement and MPR and currently trades a tad lower versus pre-announcement levels in the 1.2640s, where it is now flat on the day.

- Silver is on course for a sixth successive session of gains amid ongoing demand for inflation protection.

- XAG/USD bulls are eyeing a test of late March highs at $25.85 and a push towards annual highs near $27.00.

US yields, particularly at the front end of the curve, are falling on Wednesday, even though just released Producer Price Inflation data showed a fresh spike in inflationary pressures, and this, combined with demand for inflation protection, is helping precious metals gain ground. Spot silver (XAG/USD) bulls have their sights set on a test of late March highs in the $25.80s per troy ounce area, a break above which could open the door to a run above $26.00 and to annual highs near $27.00.

At current levels in the $25.60s, XAG/USD is trading higher by about 1.0% on the day, taking on the week gains to nearly 3.5%, with the precious metal on course for a sixth successive session of gains. For now, the demand for protection against inflation which continues to heat up (see the latest UK and US CPI and PPI numbers) is outweighing concerns about tighter monetary policy.

Indeed, the recent push higher may suggest that investors don’t deem the Fed’s stance as sufficiently hawkish to prevent a prolonged spike in inflation. But further hawkish policy shifts remain a downside risk to the precious metal, if further substantial upside in bond yields is triggered.

St Louis Fed President James Bullard is calling for the Fed to take interest rates into decisively contractionary territory (i.e. well above the neutral rate at 2.0-2.5%) to combat inflation, and if there is growing evidence of other members coming around to this view, yields could rocket yet further higher, weighing heavily on silver. Traders should caution against chasing silver higher, in other words.

- AUD/USD dropped to over a three-week low on Wednesday amid sustained USD buying.

- The setup supports prospects for an extension of the recent pullback from the YTD peak.

- Sustained strength back above the 0.7500 mark is needed to negate the bearish outlook.

The AUD/USD pair dropped to over a three-week low during the early North American session on Wednesday and is now looking to extend the downward trajectory further below the 0.7400 mark.

The US dollar stood tall near its highest level since May 2020 and remained supported by expectations that the Fed will tighten its monetary policy at a faster pace to curb soaring inflation. The bets were further boosted by the US Producer Price Inflation, which surpassed estimates and accelerated to 11.2% YoY in March from 10.0% in the previous month.

Investors also remain concerned about the potential economic fallout from the war in Ukraine, which was evident from the prevalent caution mood around the equity markets. This was seen as another factor that benefitted the greenback's relative safe-haven status and drove flows away from perceived riskier currencies, including the Australian dollar.

From a technical perspective, the overnight attempted recovery move faltered just ahead of the 0.7500 psychological mark. The subsequent decline - for the fifth day in the previous six - favours bearish traders. This, in turn, supports prospects for an extension of the recent sharp pullback from the 0.7660 region, or the YTD peak touched earlier this month.

That said, spot prices, so far, have been showing resilience below the 50% Fibonacci retracement level of the 0.7165-0.7662 strong rally. This is closely followed by the 200-period SMA on the 4-hour chart, around the 0.7385 region, which should now act as a pivotal point for short-term traders and help determine the next leg of a directional move.

A convincing break below should pave the way for a slide towards testing the 61.8% Fibo. level, around mid-0.7300s. This is closely followed by the lower end of an ascending trend-line extending from sub-0.7000 levels, around the 0.7330-0.7325 region, which if broken decisively will be seen as a fresh trigger for bearish traders.

Given that technical indicators on the daily chart have just started drifting into negative territory, the AUD/USD pair could then accelerate the downfall towards the 0.7300 mark. Some follow-through selling would make the pair vulnerable to extending the downward trajectory towards the 0.7240 region en-route the 0.7200 mark and the 0.7175-0.7170 support.

On the flip side, the daily swing high, around the 0.7475 region, which coincides with the 38.2% Fibo. level now seems to act as an immediate strong resistance ahead of the 0.7500 mark. Sustained strength beyond would suggest that the corrective pullback has run its course and shift the bias in favour of bulls, setting the stage for the resumption of the prior uptrend.

AUD/USD daily chart

-637854545901770298.png)

Key levels to watch

- DXY hovers around the area of recent highs near 100.50.

- US yields reverse the earlier positive start.

- US Producer Prices rose 1.4% MoM, 11.2% YoY in March.

The rally in the greenback gives no sign of exhaustion so far and lifts the US Dollar Index (DXY) to new peaks around 100.50 on Wednesday.

US Dollar Index stays supported by Fed, geopolitics

The index trades on a positive footing for the second week in a row so far and now looks to consolidate the recent breakout of the psychological 100.00 barrier.

Wednesday’s positive performance of the dollar comes despite US yields reversed the earlier optimism and resumed the downside, adding to Tuesday’s post-CPI retracement at the same time.

In the US data space, MBA Mortgage Applications contracted 1.3% in the week to April 8 and headline Producer Prices rose at a monthly 1.4% in March and 11.2% from a year earlier.

What to look for around USD

The dollar extends the march further north of the 100.00 mark to levels last seen nearly two years ago. So far, the greenback’s price action continues to be dictated by the likeliness of a tighter rate path by the Fed and geopolitics. In addition, the case for a stronger dollar remains well propped up by the current elevated inflation narrative, higher US yields and the solid performance of the US economy.

Key events in the US this week: MBA Mortgage Applications, Producer Prices (Wednesday) – Retail Sales, Initial Claims, Business Inventories, Flash Consumer Sentiment (Thursday) – Industrial Production, TIC Flows (Friday).

Eminent issues on the back boiler: Escalating geopolitical effervescence vs. Russia and China. Fed’s rate path this year. US-China trade conflict. Future of Biden’s Build Back Better plan.

US Dollar Index relevant levels

Now, the index is advancing 0.09% at 100.40 and a break above 100.55 (monthly high May 14 2020) would aim to 100.86 (high April 24 2020) and finally 100.93 (monthly high April 11 2020). On the downside, initial contention is seen at 97.68 (weekly low March 30) seconded by 96.94 (100-day SMA) and then 95.67 (weekly low February 16).

EUR/USD crawls towards 1.08 with little help coming from the European Central Bank (ECB) tomorrow. Economists at Scotiabank expert the world's most popular currency pair to sustain further losses on unchanged guidance from the ECB.

Early runoff polls show Macron defeating Le Pen

“With three weeks until the Fed’s May meeting where it will likely roll out a 50bps hike, unchanged guidance from the ECB tomorrow will result in a continued risk of EUR losses over the coming days particularly ahead of the second round of French presidential elections on the 24th.”

“Early runoff polls show Macron defeating Le Pen 54% to 46% according to Opinionway and 52.5% vs 47.5% according to Ifop, but momentum can quickly change until the vote; particularly following the televised debate on the 20th.”

BoC Monetary Policy Decision – Overview

The Bank of Canada (BoC) is scheduled to announce its monetary policy decision this Wednesday at 14:00 GMT. The Canadian central bank is widely expected to hike its benchmark interest rate by 50 bps for the first time since May 2000 and announce quantitative tightening (QT) to control spiralling inflation. It is worth recalling that Canadian CPI remained above the BoC's 1-3% range for the 11th consecutive month and accelerated to 5.7% in February. Moreover, the jobless rate is the lowest since at least the mid-1970s, leaving no room for any dovish surprise. Apart from this, investors will take cues from the accompanying monetary policy statement and the post-meeting press conference.

Analysts at Wells Fargo offered their take on the Canadian central bank's likely policy outlook: “We expect BoC policymakers to continue lifting interest rates and are likely to cite the overall strength of the economy as justication for tighter policy. We also expect the BoC statement to refer to a closing output gap, which should also provide policymakers with rationale to keep raising interest rates. Given the Fed is likely to pick up the pace of interest rate hikes in the near future, there is certainly a possibility the BoC opts to raise policy rates 50 bps at its next meeting. Consensus forecasts believe the Canadian economy is strong enough to handle a 50-bp hike, while financial markets are priced for around 45 bps of tightening. Given our view for a 25-bp hike, the Canadian dollar could weaken in the immediate aftermath of the decision.”

How Could it Affect USD/CAD?

Heading into the key event risk, the USD/CAD pair jumped to a near four-week high amid sustained US dollar buying interest. Given that a 50 bps rate hike and QT are fully priced in the markets, a more hawkish BoC commentary is needed to hinder the pair's ongoing recovery move from the 1.2400 mark, or the YTD low touched earlier this April. Conversely, a dovish hike - though seems unlikely - would be enough to weigh heavily on the Canadian dollar and provide an additional boost to the major. This, in turn, suggests that the path of least resistance for spot prices is to the upside.

Key Notes

• Bank of Canada Preview: Three CAD-shaking things to watch out for beyond the 50 bps hike

• BoC Preview: Forecasts from 10 major banks, hard to argue against a 50 bp hike

• USD/CAD Analysis: Pivots around 200-DMA, traders await BoC for fresh impetus

About the BoC Interest Rate Decision

BoC Interest Rate Decision is announced by the Bank of Canada. If the BoC is hawkish about the inflationary outlook of the economy and raises the interest rates it is positive, or bullish, for the CAD. Likewise, if the BoC has a dovish view on the Canadian economy and keeps the ongoing interest rate, or cuts the interest rate it is seen as negative, or bearish.

GBP/USD reached a new low since late 2020 this morning under 1.30 before meekly climbing back above the figure. Economists at Scotiabank expect cable to extend its slide towards 1.29 on failure to hold above the daily low of 1.2974.

Resistance aligns at 1.3025

“A firmer drop under 1.30 and the daily low of 1.2974 leaves little in terms of support until the next big figure and the mid-1.28.”

“Resistance is ~1.3025 and the mid-1.30s.”

EUR/USD’s break under support in the mid-figure area yesterday has opened up losses to a re-test of the 1.08 figure. A drop below here would clear the way towards the mid-107s, then the 1.07 mark, economists at Scotiabank report.

March 2020 low of 1.0636 stands as key support

“If the EUR fails to hold above the 1.08 level, continuing bearish pressure (note there’s still room to go until oversold on the RSI) would weigh on it toward the mid-1.07s and 1.07-figure zones as support.”

“The March 2020 low of 1.0636 stands as key support.”

“Resistance after ~1.0850 is the 1.09 area and ~1.0935.”

USD/INR remained well supported in the past month due to the firm USD and elevated oil prices. At its recent meeting, the Reserve Bank of India (RBI) signaled an intention to gradually withdraw excess liquidity over the coming year. This should alleviate downside pressure on the rupee.

RBI sets the stage to begin liquidity withdrawal

“The withdrawal of liquidity and prospects of RBI rate hikes in the second half of this year could provide some support for INR. It should at least mitigate INR’s weakness against the backdrop of further Fed rate hikes this year.”

“We see USD/INR holding within the 75-77 range near-term.”

- EUR/USD drops further and clinches new monthly lows.

- Next on the downside comes the 2022 low at 1.0805.

EUR/USD trades in an erratic fashion in the low-1.0800s so far on Wednesday.

In light of the ongoing price action, extra losses in the pair remain in the pipeline in the short-term horizon. Against that, a break below the so far monthly low at 1.0811 (April 13) should pave the way for a quick visit to the 2022 low at 1.0805 (March 7) before the May 2020 low at 1.0766 (May 7).

While below the 200-day SMA, today at 1.1445, the outlook for the pair is expected to remain negative.

EUR/USD daily chart

Economists at Commerzbank are seeing depreciation pressure for the Chinese currency over the coming year given the policy divergence between the People’s Bank of China (PBoC) and Federal Reserve (Fed)

A weakening bias for CNY

“The Chinese economy is set to slow further as the property softness and Covid-induced consumption weakens remain the key drag. The economic growth is expected to slow to 4.5% in 2022, down sharply from about 8% growth in 2021.”

“A strong dollar due to policy tightening is likely to the main theme in the coming years. After the PBoC's recent rate cuts, the narrowing US-China yield differentials would pose downside bias to the Chinese currency.”

“We forecast 6.7 and 6.8 for USD/CNY at year-end of 2022 and 2023 respectively.”

- GBP/USD seesawed between tepid gains/minor losses around the 1.3000 mark on Wednesday.

- Hot UK CPI report extended some support, though sustained USD buying interest capped gains.

- The Fed’s hawkish outlook, the Ukraine crisis continued underpinning the safe-haven greenback.

The GBP/USD pair witnessed good two-way price moves through the early North American session and for now, seems to have stabilized just above the 1.3000 psychological mark.

The pair did get a minor lift on Wednesday and touched an intraday high level of 1.3025 following the release of hotter-than-expected UK consumer inflation figures. The uptick, however, lacked bullish conviction amid the underlying bullish sentiment surrounding the US dollar and concerns about the potential economic fallout from the Ukraine crisis.

The USD prolonged its recent upward trajectory and shot to its highest level since May 2020 amid the prospects for a more aggressive policy tightening by the Fed. In fact, the markets seem convinced that the US central bank would hike interest rates at a faster pace to combat high inflation, which soared to the highest level since late 1981 last month.

Adding to this, the US Producer Price Inflation accelerated to 11.2% YoY in March, above expectations for a rise to 10.6% from 10.0% in February. The data indicated that there are pipeline costs that could put upward pressure on the already high consumer prices. This, in turn, remained supportive of elevated US Treasury bond yields and underpinned the buck.

Investors were also worried that the war in Ukraine could hit global growth, which was seen as another factor that benefitted the safe-haven greenback and acted as a headwind for the GBP/USD pair. That said, repeated failures to find acceptance below the 1.3000 mark warrants caution for aggressive bearish traders and positioning for any further depreciating move.

Nevertheless, the fundamental backdrop seems tilted firmly in favour of the USD bulls, suggesting that any attempted recovery move runs the risk of fizzling out rather quickly. The GBP/USD pair seems vulnerable to prolonging a three-week-old downtrend and aim to test the next relevant support near the 1.2900 round-figure mark.

Technical levels to watch

- The YoY rate of PPI rose to 11.2% in March, well above the expected rise to 10.6% from 10.0% in February.

- FX and bond markets didn't see a lasting reaction.

The annual rate of US Producer Price Inflation (PPI) rose to 11.2% in March, above expectations for a rise to 10.6% from 10.0% in February, data released by the Bureau of Labour Statistics and Department of Labour showed on Wednesday. The jump was powered by a 1.4% MoM rise in prices, according to the Producer Price Index, which was above the expected 1.1% rise.

Core PPI rose at an annual pace of 9.2%, well above the expected 8.4% reading and up from February's 8.4%. The MoM rate of Core PPI was 1.0%, above the expected 0.5% reading.

Market Reaction

The DXY saw a very small pop, but has not been able to rally back to session highs above the 100.50 mark. The US 10-year yield chopped around the 2.75% mark and did not seem to have a lasting reaction.

Russia will view US and NATO vehicles transporting weapons on Ukrainian territory as legitimate military targets, Russia's Deputy Foreign Minister said on Wednesday, reported Reuters citing Russia's Tass news agency.

USD/CAD has closed just above the important 200-day moving average (DMA) at 1.2623. However, economists at Credit Suisse give the downside the benefit of the doubt for now.

Bearish bias whilst below 1.2667

“USD/CAD has broken above its key 200-DMA, lessening conviction in our bearish outlook, but for now, we continue to give the downside the benefit of the doubt. Next key resistance is seen at 1.2653/67, which includes the 50% retracement of the 2021 fall and the 55-DMA.”

“We stay biased directly lower whilst below 1.2653/67, with a break below 1.2565 needed to reassert the downtrend for a move back to 1.2537/35 initially and then to 1.2481/79. Thereafter, a break below the YTD low at 1.2427/00 would trigger a move to our core objective at 1.2287, which is the October 2021 low.”

“A break above the 55-DMA at 1.2667 would reassert the rangebound environment and likely trigger further short-term strength, with next resistance at 1.2712.”

- USD/JPY rallied to the highest level since May 2002 during the early part of trading on Wednesday.

- The divergent Fed-BoJ monetary policy stance weighed heavily on the JPY and acted as a tailwind.

- Overbought conditions on intraday charts capped the upside amid concerns over the Ukraine crisis.

The USD/JPY pair retreated over 50 pips from a two-decade high touched earlier this Wednesday and was last seen trading below the 126.00 mark, still up nearly 0.40% for the day.