- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 13-02-2023

Japan's Gross Domestic Product released by the Cabinet Office has been released as follows:

Japan's economy grew an annualised 0.6% in the final three months of 2022, government data showed on Tuesday, bouncing back from the previous quarter's contraction as the return of inbound tourists offset a slowdown in capital expenditure and exports, Reuters explained.

''The fourth-quarter growth of Japan's economy, the world's third-largest, compared with the median estimate of a 2.0% gain in a Reuters poll of 18 economists.''

Key notes

Japan's Oct-Dec annualised GDP+0.6% (poll: +2.0%).

Japan real GDP +0.2% QoQ (Reuters poll: +0.5%).

Japan Oct-Dec private consumption +0.5% QoQ (poll: +0.5%).

Japan Oct-Dec Capex -0.5% qtr/qtr (poll: -0.2%)

Japan Oct-Dec external demand contribution to GDP +0.3 pct point (poll: +0.4 pct pt).

Japan exports +1.4% qtr/qtr

Japan domestic demand contribution to GDP -0.2 pct point

Japan GDP deflator +1.1% YoY.

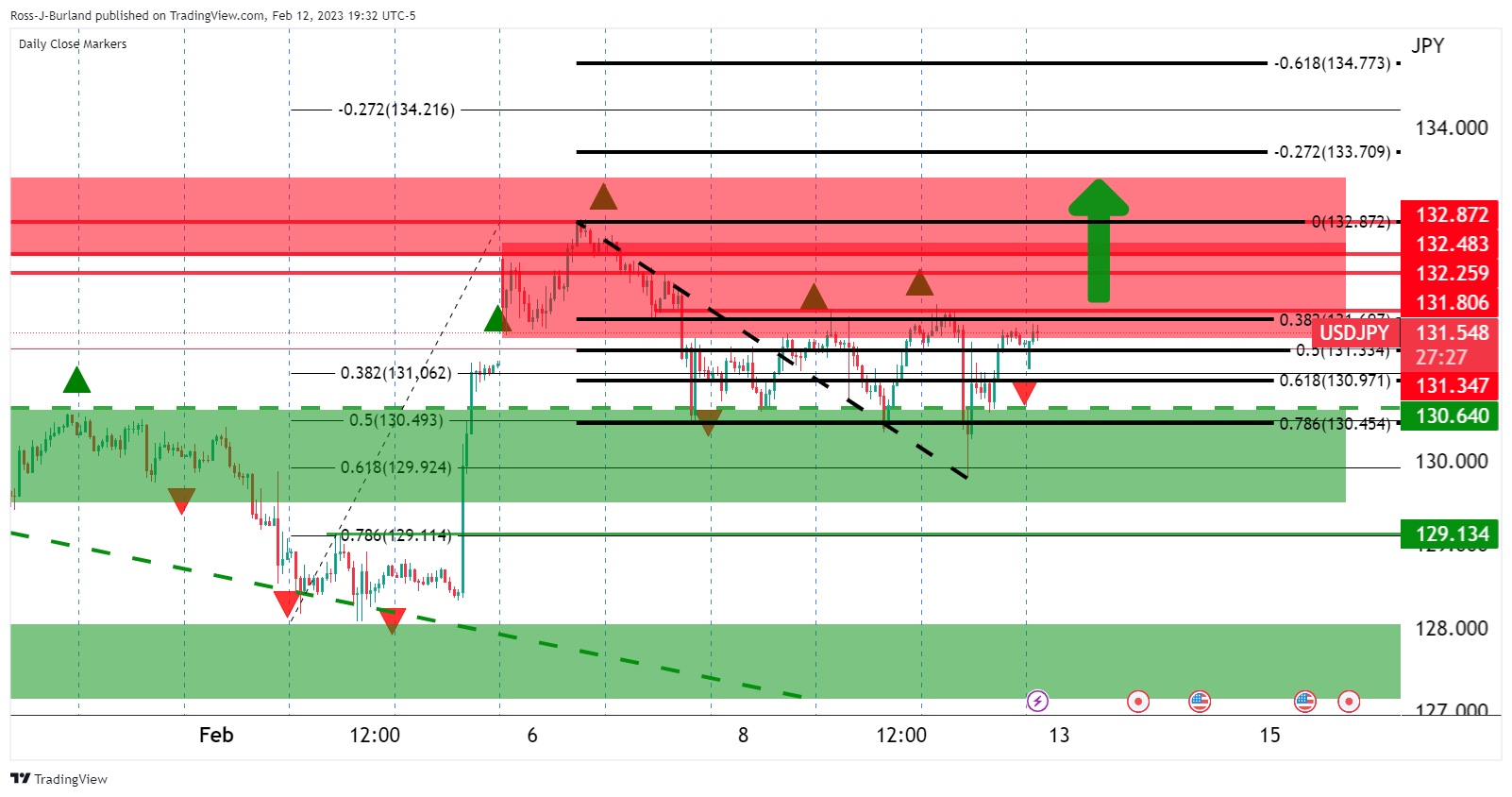

USD/JPY update

More to come...

About the Gross Domestic Product

The Gross Domestic Product released by the Cabinet Office shows the monetary value of all the goods, services and structures produced in Japan within a given period of time. GDP is a gross measure of market activity because it indicates the pace at which the Japanese economy is growing or decreasing. A high reading or a better-than-expected number is seen as positive for the JPY, while a low reading is negative.

- USD/CHF has shifted its auction below 0.9200 despite the cheerful market mood.

- The market sentiment could get dismal if the US inflation figure shows a U-turn after declining for three months.

- An increase in the Swiss CPI has bolstered the case of more interest rate hikes by the Swiss National Bank ahead.

The USD/CHF pair has shifted its business below the round-level resistance of 0.9200 in the early Asian session. The Swiss Franc asset is expected to deliver more losses as investors have ignored the consequences associated with the United States inflation, in case it delivers a surprise upside. The risk appetite of the market participants has improved dramatically and has provided support to the risk-sensitive assets.

S&P500 futures are looking to extend their upside as investors have also ignored the geopolitical fears linked to the airborne threats to the United States. The US Dollar Index (DXY) is struggling to reclaim the critical resistance of 103.00 amid the risk-on mood. Meanwhile, a recovery in the demand for US government bonds has dragged the 10-year US Treasury yields to near 3.70%.

Investors seem casual ahead of the release of the US Inflation, however, the market sentiment could get dismal if the inflation figure show a U-turn after declining significantly for the past three months.

Analysts at TD Securities have forecasted a firm 0.4% MoM gain in the core CPI series. In terms of the headline, we expect CPI inflation to register its firmest MoM gain since October, posting a strong 0.4% increase. Our MoM projections imply that inflation likely lost speed again on a YoY basis in January as we look for inflation to drop to 6.2% for the headline (after 6.5% YoY in December), and to ease to 5.5% YoY for the core series (after 5.7% in January).”

On the Swiss Franc front, an increase in the Consumer Price Index (CPI) has bolstered the case of more interest rate hikes by the Swiss National Bank (SNB) ahead. On Monday, the Swiss Federal Statistical Office reported a rise in the monthly CPI figure by 0.6% vs. the consensus of 0.4%. And, the annual inflation rate rose to 3.3% from the estimates of 2.9% and the former release of 2.8%.

SNB Chairman Thomas J. Jordan has already cleared that the inflationary pressures are beyond the control of the central bank. Therefore, the case calls for more interest rate hikes by the SNB ahead.

- US Dollar Index remains pressured after reversing from one-week high.

- Pullback in yields, market’s preparations for the key US CPI for January weigh on DXY.

- Hawkish Fed talks fail to put a floor under the price.

- Softer US inflation can renew Fed policy pivot talks and weigh on the US Dollar.

US Dollar Index (DXY) holds lower ground near 103.30 during early Tuesday morning in Asia, following a U-turn from the one-week high amid cautious optimism. In addition to the market’s mildly positive sentiment, the greenback’s gauge also declines as the DXY traders brace for the Consumer Price Index (CPI) for January amid mixed clues.

That said, the risk profile was mostly upbeat on Monday, after a downbeat start, as fears surrounding the unidentified flying objects near the United States and China, one of which was recently confirmed as like a metal ball, eased afterward on comments from the US General. That said, the US military authority turned down the fears while rejecting calls to believe that those flying objects were from China. Adding strength to the risk-on mood were upbeat US equities and a pullback in the US Treasury bond yields after multiple days of run-up.

It should be noted that sluggish US inflation expectations seemed to have weighed on the DXY as the 10-year and 5-year breakeven inflation rates from the St. Louis Federal Reserve (FRED) grind near monthly high, close 2.31% and 2.44% at the latest.

Even so, hawkish comments from the Fed policymakers and a lack of major positive headlines weigh on the Gold price. On Monday, Fed Governor Michelle Bowman said that the Federal Reserve will need to continue to raise interest rates in order to get them to a level high enough to bring inflation back down to the central bank's target rate, per Reuters. Before him, Philadelphia Federal Reserve President Patrick Harker pushed back the chatters of a Fed rate cut during 2023. However, the policymaker did mention, “Fed not likely to cut this year but may be able to in 2024 if inflation starts ebbing.” His comments were mostly in line with Fed Chair Jerome Powell’s cautious optimism and exerted downside pressure on the US Dollar.

Against this backdrop, Wall Street closed on the positive side while the US Treasury bond yields retreat after multiple days of run-up.

Moving ahead, the US CPI data for January appears the key as the recent Federal Reserve (Fed) comments appear light when suggesting more rate hikes. Also, the Fed policy pivot talks aren’t far from the table and hence any disappointment from the US inflation numbers won’t hesitate to drown the DXY.

Also read: US Consumer Price Index Preview: US Dollar vulnerable to violent crash, every 0.1% in Core CPI matters

Technical analysis

50-day Exponential Moving Average (EMA) guards the immediate US Dollar Index upside near 103.75.

- Gold price remains pressured around the lowest levels in five weeks.

- Markets preparations for United States Consumer Price Index for January weigh on XAU/USD price amid hawkish Federal Reserve talks.

- Risk-on mood, softer US Dollar failed to provide tailwind to the Gold price.

- Gold buyers need downbeat US CPI but inflation expectations are again on the move.

Gold price (XAU/USD) holds lower ground at the monthly bottom surrounding $1,855, following the slump to early January levels the previous day, as markets brace for the United States Consumer Price Index (CPI) for January. Also pausing the XAU/USD’s declines is the US Dollar pullback, as well as the firmer sentiment. However, hawkish comments from the Federal Reserve (Fed) officials and firmer US inflation expectations seem to keep the Gold bears hopeful ahead of the key data.

Hawkish Federal Reserve talks favor Gold bears

Federal Reserve (Fed) officials defend the rate hikes and are far from suggesting the policy pivot, which in turn keeps the market’s fears of tighter monetary policy actions moving forward and the same weighs on the Gold price. Fed Governor Michelle Bowman said on Monday that the Federal Reserve will need to continue to raise interest rates in order to get them to a level high enough to bring inflation back down to the central bank's target rate, per Reuters. Before him, Philadelphia Federal Reserve President Patrick Harker pushed back the chatters of a Fed rate cut during 2023. However, the policymaker did mention, “Fed not likely to cut this year but may be able to in 2024 if inflation starts ebbing.” His comments were mostly in line with Fed Chair Jerome Powell’s cautious optimism and exerted downside pressure on the US Dollar.

United States Inflation Expectations also weigh on XAU/USD

Although the market forecasts hint at the easing of the United States Consumer Price Index (CPI) for January to 6.2% YoY from 6.5%, the US inflation expectations remain firmer around the monthly highs and underpin the hawkish Fed bias. That said, the US inflation expectations per the 10-year and 5-year breakeven inflation rates from the St. Louis Federal Reserve (FRED) remain firmer around the monthly highs, close 2.31% and 2.44% at the latest. It’s worth noting that the University of Michigan also lifted its one-year ahead inflation projections while keeping the five-year forecasts intact.

Easy sentiment, softer US Dollar fail to recall Gold buyers

The risk profile was mostly upbeat on Monday, after a downbeat start, as fears surrounding the unidentified flying objects near the United States and China, one of which was recently confirmed as like a metal ball, eased afterward on comments from the US General. That said, the US military authority turned down the fears while rejecting calls to believe that those flying objects were from China. Adding strength to the risk-on mood were upbeat US equities and a pullback in the US Treasury bond yields after multiple days of run-up.

It should be noted that the US Dollar Index (DXY) retreated from a one-week high on Monday, sidelined near 103.30 by the press time, as traders prepare for the key US data.

While the softer sentiment and the US Dollar’s pullback should put a floor under the Gold price, the metal failed to cheer any of it and remained depressed near the five-week low.

US CPI is the key

Gold traders should emphasize the US CPI data for January as the recent Federal Reserve (Fed) comments appear light when suggesting more rate hikes. Also, the Fed policy pivot talks aren’t far from the table and hence any disappointment from the US inflation numbers won’t hesitate to propel the Gold price.

Also read: Gold Price Forecast: $1,800 barrier not that far away

Gold price technical analysis

Following a downside break of the 200-Simple Moving Average (SMA), the Gold price forms a bearish triangle pattern while portraying consolidation of downside moves ahead of the key United States inflation.

That said, the 50-SMA pierces off the 200-SMA from above and prints a bearish moving average crossover called the “Death cross”, suggesting further weakness of the Gold price.

Also portraying the XAU/USD inaction are the recently sluggish Moving Average Convergence and Divergence (MACD) signals and the downbeat Relative Strength Index (RSI), placed at 14.

Even so, the lower line of the stated triangle, around $1,845 by the press time, restricts short-term XAU/USD downside before directing Gold bears towards a horizontal area comprising multiple levels marked since the last December, close to $1,825.

Alternatively, an upside clearance of the aforementioned triangle’s top line, close to $1,855 at the latest, could trigger a corrective bounce toward the 50-SMA hurdle surrounding $1,880. However, Gold buyers remain off the table unless witnessing successful trading beyond the 200-SMA resistance, close to $1,890 at the latest.

Overall, the Gold price flashes bearish signals as the key data/events loom.

Gold price: Four-hour chart

Trend: Further downside expected

- AUD/JPY is expected to extend its correction to near 92.00 as investors see the abolishment of the YCC by the BoJ.

- An abolishment of YCC will provide more returns on yen-denominated assets.

- The RBA has already hiked its interest rates to 3.35% and more hikes are in pipeline to contain the stubborn inflation.

The AUD/JPY pair has turned sideways after a marginal correction to near 92.20 in the early Tokyo session. The risk barometer is expected to deliver more losses as the novel Bank of Japan (BoJ) leadership might abolish the Yield Curve Control (YCC), as reported by Bloomberg, to allow bonds more freedom and more allowance to the central bank to purchase bonds.

Bloomberg reported, “With the nomination for the top BOJ job set to be announced Tuesday, bond traders are wagering on a further tweak to yield curve control sooner rather than later and pricing at an end to negative rates around the middle of the year.”

Earlier, BoJ Governor Haruhiko Kuroda announced a tweak in the YCC of 10-year Japanese Government Bonds (JGBs) yield to rise to 0.5% from the current 0.25%. The move was considered a step towards an exit from the decade-long ultra-expansionary monetary policy by the BoJ.

And, now the abolishment of the YCC by academician Kazuo Ueda after appointing him as a successor of BoJ Governor Haruhiko Kuroda, as expected, will accelerate the hopes that yen-denominated assets might generate more alpha for investors. This will strengthen the Japanese Yen further.

On the Australian Dollar front, investors are awaiting the speech from Reserve Bank of Australia (RBA) Governor Philip Lower for interest rate guidance, scheduled for Wednesday. Inflationary pressures in the Australian economy have not cooled down amid supply chain bottlenecks, which would compel RBA Lowe to sound hawkish for March monetary policy meeting. The RBA has already hiked its interest rates to 3.35% and more hikes are in pipeline to contain the stubborn inflation.

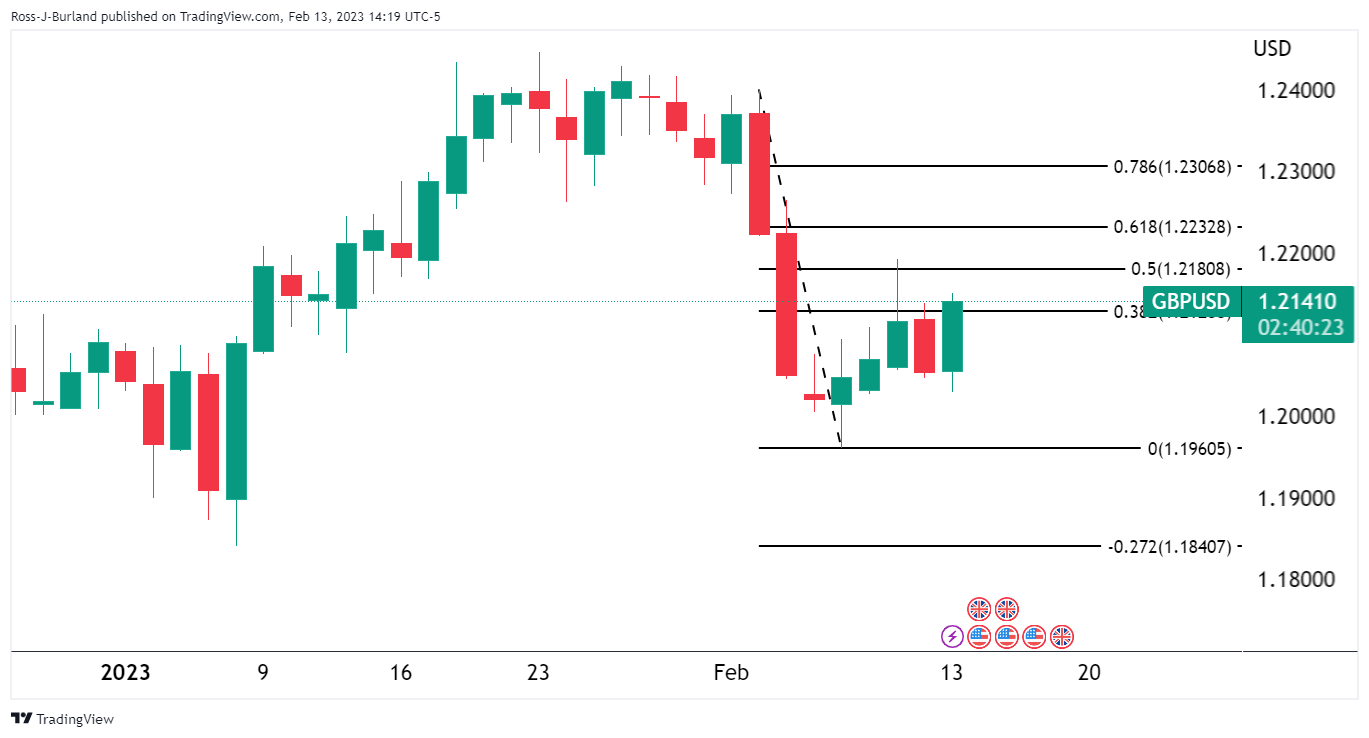

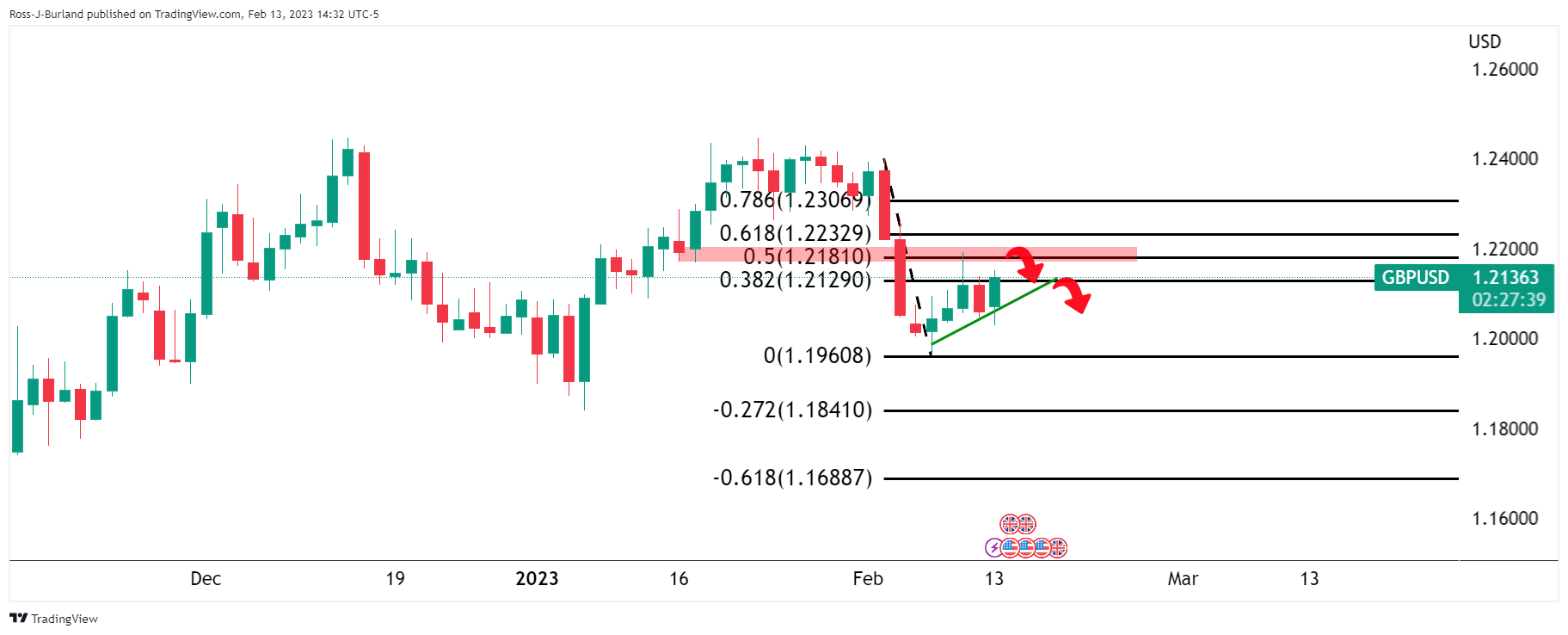

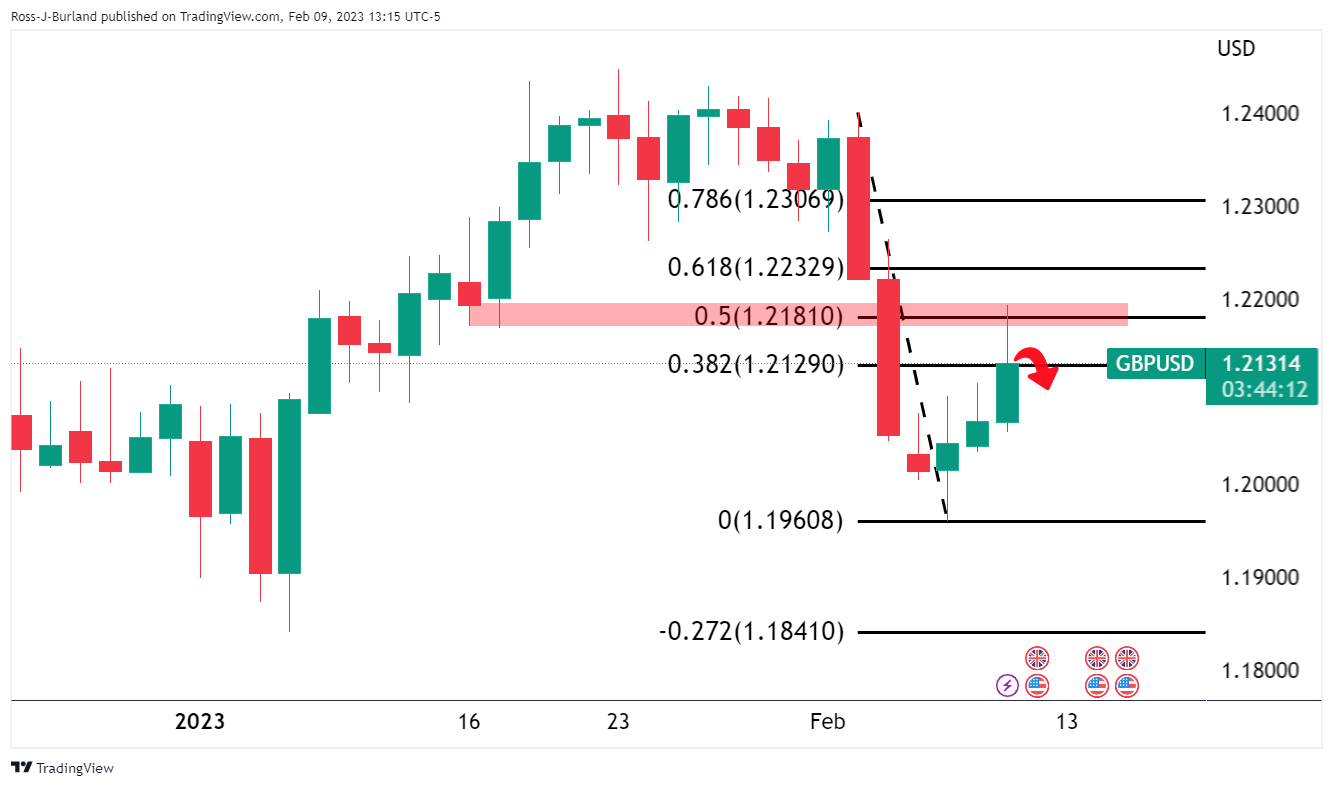

- GBP/USD grinds higher after posting the biggest daily jump in a month.

- Optimism surrounding an end to the UK’s labor strike, pullback in US dollar underpin Cable’s rebound.

- BoE’s Haskel appears cautious but Fed’s Bowman defends hawkish rate bias.

- UK jobs report appears important amid workers’ agitation, US CPI is the key.

GBP/USD marches towards 1.2150 while extending the week-start rebound from the key technical support to early Tuesday morning in Asia. In doing so, the Cable pair cheers the broad US Dollar pullback, as well as the risk-on mood, amid positive catalysts emanating from the UK. Adding strength to the quote’s recovery could be the trader’s preparations for the UK’s monthly employment data and the US Consumer Price Index (CPI) for January.

An end to the 20-day strikes by the London bus drivers and the British firms' readiness to inflate the workers’ pay by the most since 2012 seemed to have favored the GBP/USD buyers of late. The news becomes more important as Bank of England (BoE) policymaker Jonathan Haskel highlighted that further rate hikes will depend upon the incoming data.

BoE’s Haskel crossed wires while speaking in an interview with The Overshoot as he cited a rise in activity in the UK labor market. BoE’s Haskel also mentioned, “I would prefer to make policy with much more attention on the data flow over the next few months.”

It should be noted, however, that the British government is yet to seal a major victory over the labor issues and hence the same challenges the Cable buyers.

Elsewhere, the week began with a risk-off mood amid the US-China tensions surrounding the mystery objects that flew over their boundaries and allegations of spying. However, the US General turned down the fears while rejecting calls to believe that those flying objects were from China. Adding strength to the risk-on mood were upbeat US equities and a pullback in the US Treasury bond yields after multiple days of run-up.

That said, Fed Governor Michelle Bowman said on Monday that the Federal Reserve will need to continue to raise interest rates in order to get them to a level high enough to bring inflation back down to the central bank's target rate, per Reuters. Before him, Philadelphia Federal Reserve President Patrick Harker pushed back the chatters of a Fed rate cut during 2023. However, the policymaker did mention, “Fed not likely to cut this year but may be able to in 2024 if inflation starts ebbing.” His comments were mostly in line with Fed Chair Jerome Powell’s cautious optimism and exerted downside pressure on the US Dollar.

Looking ahead, the GBP/USD may remain firmer amid the US Dollar’s positioning for the key data. However, downbeat prints of the UK jobs report won’t hesitate to recall the pair sellers as the US inflation expectations have been firmer of late. As per the consensus, the UK’s Unemployment Rate is expected to remain unchanged at 3.7% for three months to December 2022. Further, the US CPI could ease to 6.2% YoY versus 6.5% prior.

Technical analysis

Although the 100-day Exponential Moving Average (EMA), around 1.2040 by the press time, puts a floor under the GBP/USD prices, the Cable pair’s further upside needs validation from the 200-day EMA, around 1.2140 at the latest.

- EUR/JPY is neutral to upward biased from a technical perspective, but caution is warranted due to fundamental news.

- Rumors of the appointment of Kazuo Ueda to be the new Governor at the Bank of Japan spurred speculations of a hawkish stance.

- Abandonment of the Bank of Japan Yield Curve Control could strengthen the Japanese Yen.

The EUR/JPY bounces from the 200-day Exponential Moving Average (EMA), and advances sharply toward the 142.00 area, breaking crucial resistance areas in the daily chart. However, it trimmed some of those earlier gains but remained above all the EMAs. At the time of writing, the EUR/JPY exchanges hands at 142.02.

From the daily chart perspective, the EUR/JPY is neutral-to-upward biased, though it remains capped by the YTD high at 142.84. A breach of the latter would resume the uptrend, and the EUR/JPY could rally towards its next supply zone, being a downslope resistance trendline, drawn from October highs that pass around 144.55-70, followed by the December 20 daily high at 145.83.

On the other hand, fundamental news surrounding the Bank of Japan (BoJ) could trigger a downward reaction in the event of an appreciation of the Japanese Yen (JPY). Speculations that Kazuo Ueda, which the Japanese PM Kishida would appoint as the new BoJ Governor, would lean towards a more hawkish stance had increased the likelihood of abandonment of the Yield Curve Control (YCC). Therefore, that would be bullish for the Japanese Yen.

In that event, the EUR/JPY could position itself towards the downside, though it would need to hurdle all the EMAs toward the 200-day EMA at 140.34. Break below, and the cross-currency pair would be exposed to the 137.91 January 19 daily low, ahead of the YTD low at 137.38.

EUR/JPY Daily chart

EUR/JPY Key technical levels

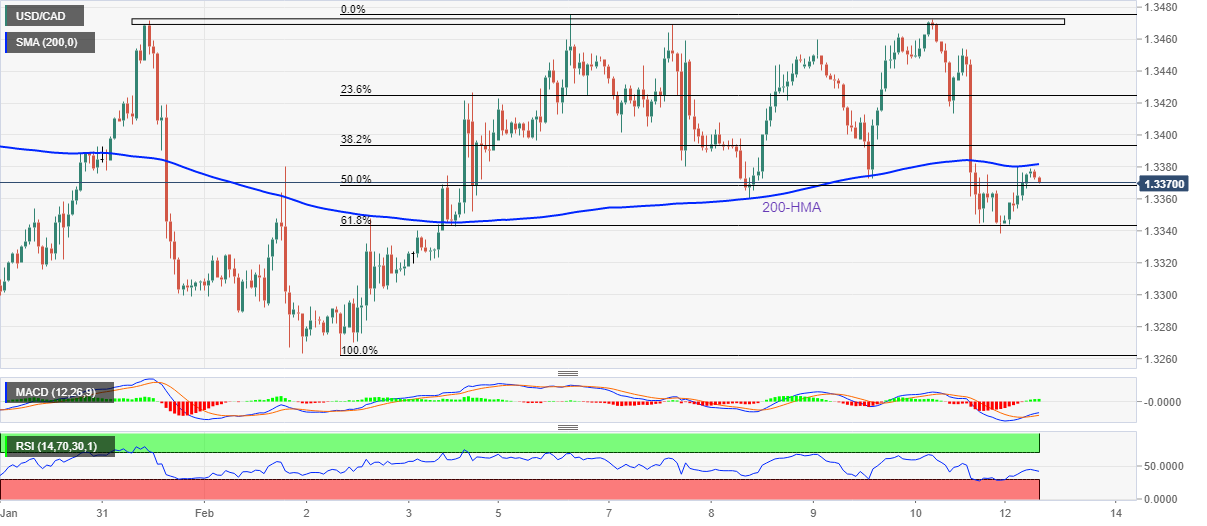

- USD/CAD is expected to deliver sheer weakness below 1.3330 amid the risk-off mood.

- A breakdown of the Ascending Triangle pattern has strengthened the Canadian Dollar.

- The Loonie is exposed to the horizontal support at 1.3226 after a breakdown of the RSI (14) into the 20.00-40.00 range.

The USD/CAD pair is hovering around the critical support of 1.3326 in the early Asian session. The Loonie asset is demonstrating signs of refreshing its eight-day low below 1.3326 as the risk appetite theme has gained sheer traction. The market mood has turned cheerful as investors have digested the consequences of a surprise rise in the United States inflation ahead.

The US Dollar Index (DXY) retreated after a pullback move to near the 103.00 resistance. S&P500 futures are showing immense strength despite the airborne threats to the United States after back-to-back unidentified flying objects near the US air base. Meanwhile, easing uncertainty for US Consumer Price Index (CPI) has pushed 10-year US Treasury yields lower to near 3.70%.

USD/CAD has delivered a downside break of the Ascending Triangle chart pattern formed on a four-hour scale. The upward-sloping trendline of the aforementioned chart pattern is placed from February 08 low at 1.3360 while the horizontal resistance is plotted from January 31 high at 1.3472. The major has slipped below the 50-period Exponential Moving Average (EMA) at 1.3385, indicating more weakness ahead.

Meanwhile, the Relative Strength Index (RSI) (14) has slipped into the bearish range of 20.00-40.00, which indicates that the downside momentum has been triggered.

A downside move below February 13 low at 1.3325 will drag the Loonie asset toward February 2 low at 1.3262. A slippage below the latter will expose the asset to the horizontal support plotted from November 15 low at 1.3226.

On the flip side, a break above February 7 high at 1.3469 will drive the asset toward January 19 high at 1.3521 followed by January 6 low at 1.3538.

USD/CAD four-hour chart

-638119250862147414.png)

Bloomberg came out with the analysis suggesting further challenges to the Bank of Japan’s (BoJ) easy money policy during the incoming Kazuo Ueda’s reign. The news initially said, “With the nomination for the top BOJ job set to be announced Tuesday, bond traders are wagering on a further tweak to yield curve control sooner rather than later and pricing in an end to negative rates around the middle of the year.”

Key findings (via Bloomberg)

Benchmark yields have been holding close to the BOJ’s 0.5% policy ceiling this month on concerns that Ueda will have to either tweak or completely abandon the curve-control program amid rising inflation.

Forward-dated swaps are pricing in a removal of the BoJ’s negative-rate policy in July followed by a series of hikes in short-term interest rates.

The yen has jumped more than 12% since the end of October, outperforming all of its Group-of-10 peers, thanks to a boost from the BOJ unexpectedly doubling its 10-year yield cap in December.

Three-month implied volatility for the Japanese currency has been elevated since October even as an equivalent gauge for the broader market declined, indicating that traders are on guard for another BOJ surprise.

Bets on an expected demise of yield-curve control and policy tightening overseas have necessitated an increase in central bank intervention to defend its yield cap.

The fragile state of the bond market provides further evidence that Kuroda’s unprecedented quantitative easing may have only a limited time left.

USD/JPY grinds higher

It should be noted that the Japanese government is up for formally announcing their nominations for the BoJ leadership on Tuesday, making Bloomberg’s piece important for the USD/JPY pair traders. Also highlighting the Yen pair is the presence of the first reading of Japan’s fourth quarter (Q4) Eurozone Gross Domestic Product (GDP).

That said, the USD/JPY pair remains mildly bid near 132.40 amid the market’s cautious optimism during early Tuesday morning in Asia.

Also read: USD/JPY Price Analysis: Rejected at 133.00 but remains firm at around 132.40s

- AUD/USD is facing soft barricades around 0.6970 ahead of the US Inflation data.

- A surprise rise in the US CPI figure could dampen the market mood

- RBA Lowe’s speech will guide about the likely monetary policy action in March.

The AUD/USD pair showed a firm recovery in Monday’s trading session as investors ignored the consequences of a surprise upside in the United States inflationary pressures and geopolitical tensions amid airborne threats to the US. The Aussie is struggling to extend gains above 0.6970 in the early Asian session, however, the upside looks favored considering the strength in the recovery movement.

The US Dollar index (DXY) was heavily offered by the market participants and surrendered the critical support of 103.00. The USD Index is facing hurdles in reclaiming the 103.00 resistance as the market mood is quite cheerful. S&P500 futures recovered dramatically and displayed strong gains, conveying that investors have digested the uncertainty ahead of the US Consumer Price Index (CPI) data. An improvement in the risk appetite of investors strengthened the risk-sensitive currencies.

After printing a fresh monthly high, the return generated on US Treasury bonds dropped firmly. The 10-year US Treasury yields slipped firmly to near 3.70%.

No doubt, the risk-perceived assets have shown resilience ahead of the US inflation data. However, the recovery move could be faded as a rebound in the inflationary pressures after recognizing a downside trend could dampen the market sentiment.

According to analysts from ING, core inflation is to rise to 0.4% MoM. A 0.4% MoM core CPI print (or possibly even 0.5%) would give the Federal Reserve (Fed) near-term ammunition to argue for a May rate hike. Nonetheless, we think that shelter and cars will contribute to inflation slowing sharply from a mid-second quarter, with weakening corporate pricing power also contributing to getting inflation down to 2% by year-end.”

Meanwhile, the Australian Dollar is likely to dance to the outcome of the speech from Reserve Bank of Australia (RBA) Governor Philip Lowe, which is scheduled for Wednesday. The speech from RBA’s Lowe will provide cues about the likely monetary policy action in March.

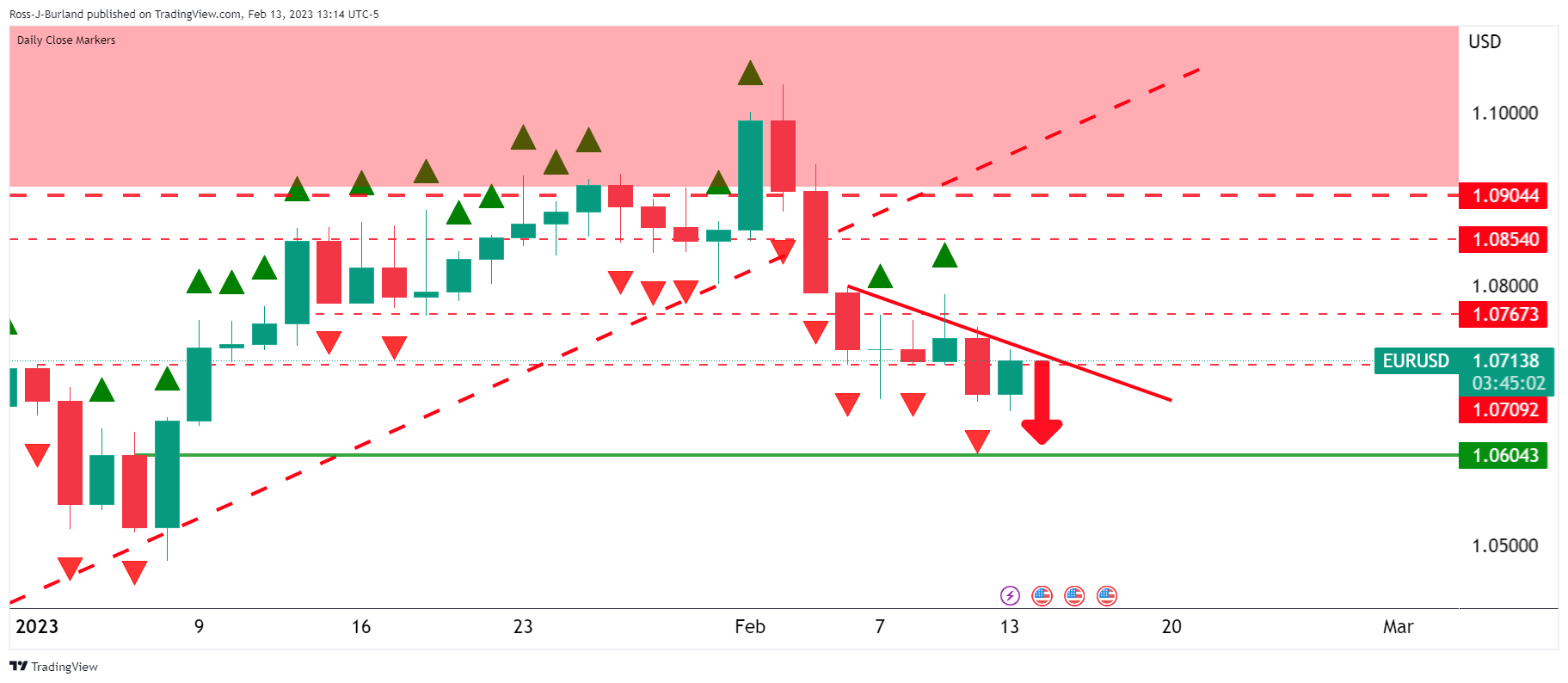

- EUR/USD bounces off 50-day EMA as US Dollar eases ahead of the key data.

- Risk sentiment improved on easing US-China fears despite “unidentified objects”.

- EC quarterly economic forecasts added strength to the Euro pair’s recovery.

- US inflation expectations hint at firmer print but Fed hawks need strong number to push back policy pivot talks.

EUR/USD holds onto the week-start gains from the five-week low around 1.0725-30 during early Tuesday morning in Asia. The major currency pair benefited from the improvement in market sentiment, as well as the broad Euro gains ahead of the key statistics from the Eurozone and the US.

The week began with a risk-off mood amid the US-China tensions surrounding the mystery objects that flew over their boundaries and allegations of spying. However, the US General turned down the fears while rejecting calls to believe that those flying objects were from China. Adding strength to the risk-on mood were upbeat US equities and data from the Eurozone, not to forget the market’s positioning ahead of the preliminary readings of the fourth quarter (Q4) Eurozone Gross Domestic Product (GDP) and the US Consumer Price Index (CPI) for January.

On Monday, the European Commission (EC) released its quarterly economic projections for the Eurozone wherein it revised up the economic growth forecast to 0.9% for 2023 from 0.3% previously expected, projecting 2024 growth unchanged at 1.5%. The EC, however, lowered the Eurozone inflation forecast for 2023 to 5.6% YoY from 6.1% earlier expected. Further, the EC also cut 2024 inflation predictions to 2.5% for 2024, versus 2.6% previously anticipated.

It should be noted, however, that the hopes of firmer European inflation contrasted with the mixed comments from the European Central Bank (ECB) officials to probe the EUR/USD bulls.

That said, according to economists polled by Bloomberg, Euro area inflation is still likely to loom above the European Central Bank (ECB) target of 2.0% heading further out in 2025.

Further, European Central Bank (ECB) Vice-President Luis de Guindos said on Monday, “Rate increases beyond March are to depend on data.” On the same line, ECB policymaker Mario Centeno said, “Inflation is going down faster than we expected,” while adding that smaller hikes would need mid-term inflation nearing 2%.

On the other hand, Fed Governor Michelle Bowman said on Monday that the Federal Reserve will need to continue to raise interest rates in order to get them to a level high enough to bring inflation back down to the central bank's target rate, per Reuters. Before him, Philadelphia Federal Reserve President Patrick Harker pushed back the chatters of a Fed rate cut during 2023. However, the policymaker did mention, “Fed not likely to cut this year but may be able to in 2024 if inflation starts ebbing.” His comments were mostly in line with Fed Chair Jerome Powell’s cautious optimism and hence challenged the US Dollar buyers.

Against this backdrop, Wall Street closed with gains while the US Treasury bond yields snapped a two-day uptrend.

Moving on, EUR/USD might remain lackluster moves ahead of the key EU Q4 GDP and the US CPI for January as policymakers at the ECB and the Fed appeared to have eased their hawkish bias. As a result, softer prints of the data may weigh on the respectively, with higher odds in favor of the Euro’s pullback than the US Dollar considering the early signals for the inflation number. That said, the first reading of the Eurozone Q4 GDP is expected to repeat 1.9% YoY figures while the US CPI could ease to 6.2% YoY versus 6.5% prior.

Technical analysis

EUR/USD rebounds from the 50-day Exponential Moving Average (EMA), around 1.0675 by the press time, to portray the latest recovery from the five-week low. However, the 21-day EMA and the previous support line from early November 2022, respectively near 1.0770 and 1.0925, appears important resistances to crack for the bulls to retake control.

- NZD/USD short squeeze is in full effect to start the week.

- NZD/USD bulls eye the 50% mean reversion for space in the 0.64s for the day ahead.

NZD/USD rallied at the start of the week, ending the US session some 0.8% higher near 0.6360 as a result of rapped bears being squeezed in the open. A rebound in global risk appetite and a slight pullback in the USD DXY index ahead of key US CPI later today influenced positioning also.

''Arguably the biggest threat to the Kiwi lies in US bond yields, which could keep rising if markets shy away from cuts,'' analysts at ANZ Bank argued.

''But that might be a lengthy process, and local bond yields are also rising. So it’s more balanced, but we do think it makes sense to plan for volatility given the higher than normal degree of uncertainty.''

Meanwhile, the technicals played out as follows:

NZD/USD daily chart

We have a bullish inverse head and shoulders shaping up on the daily chart but the price is being resisted by a dominant trendline.

NZD/USD H1 chart

Meanwhile, we had three days of shorts in the market and Monday trapped the ones that joined the party late only to be ushered out of the door by the bulls from the off. Bulls eye the 50% mean reversion for space in the 0.64s for the day ahead.

- The GBP/JPY rallied more than 200 pips on Monday, ahead of the release of US inflation data.

- GBP/JPY Price Analysis: Short term, could challenge 158.00; otherwise, a rally to 162.00 is on the cards.

The GBP/JPY breaks above the top of a trading range, advancing sharply toward the top-trendline of a descending triangle in a downtrend, at 161.19, the day’s high, but retraced some of its gains. Hence, the GBP/JPY is trading at 160.66, above its opening price by 1.43%.

After reaching the day’s high in the session, the GBP/JPY did not hold to its gains above the 50-day Exponential Moving Average (EMA) at 160.78. That would have opened the door to challenge the confluence of the 200 and 100-day EMAs, each at 161.81 and 162.00. However, the symmetrical triangle top trendline capped the advancement as bears piled in, dragging prices lower.

In the short term, the GBP/JPY four-hour chart portrays the cross-currency as range-bound based on the EMAs residing beneath the spot price. Nevertheless, as the Relative Strength Index (RSI) turned overbought but exited from that territory, the GBP/JPY dropped from around daily/weekly highs.

If the GBP/JPY edges downwards, it will face a solid support area. Firstly the 200-EMA at 160.03, which, once cleared, could pave the way towards the 159.14/32 area, the confluence of the 20/50/100 EMAs. A decisive break will send the GBP/JPY diving towards the ascending triangle bottom trendline at around 158.18.

On the flip side, if the GBP/JPY reclaims 161.80, it will open the door to challenge 162.00.

GBP/JPY 4-Hour Chart

GBP/JPY Key technical levels

- Gold price bulls eye the 50% mean reversion as a resistance area that could hold.

- Gold price bears seek a break of $1,850 for the continuation to the $1,825 1000 pip target.

- US CPI is a critical event for the Gold price this week.

Gold price was choppy in New York but decisively bearish as per the technicals and failures to rally even on US Dollar weakness as the session got going around the London fix and Wall Street's cash open. Gold price is currently trading at $1,850 and at the bottom of a new box that was formed in Friday's sell-off. The yellow metal dropped on Monday in a continuation of that move and from the day's high set in Asia at $1,866.59.

US Consumer Price Index key for Gold Price

Gold is pressured as investors get set for a very heavy week of data in the United States where we start on Tuesday, with what could be a robust 6.2% annualized Consumer Price Index outcome for the prior month. When combined to the unexpectedly strong January jobs report released earlier this month, in the Nonfarm Payrolls, this data could really kick off a storm in markets that are otherwise front-running the Federal Reserve and are pricing in a picot for later in the year.

Analysts at TD Securities explained that ''core prices likely stayed strong in January with the index rising 0.4% MoM (matching Dec's upward-revised gain), as we look for the recent relief from goods deflation to come to an end.''

''Shelter inflation likely remained the key wildcard, while a rebound in gasoline prices will be the main driver of non-core CPI prices. Our MoM forecasts imply 6.2%/5.5% YoY for total/core prices.''

However, there are mixed outlooks for the CPI data with some analysts anticipating a hawkish outcome while others a dovish one.

For instance, while some analysts anticipate a more benign outcome from the data, analysts at Brown Brothers Harriman argued that a move higher in US Treasury yields of late, (10-year rose from Thursday's low of 3.334% to a recent high of 3.755%), coincides with renewed inflation concerns and a reprising of Fed tightening expectations.

''WIRP suggests 25 bp hikes March 22 and May 3 are nearly priced in, while the odds of a third hike in June or July top out near 45%,'' the analysts said. ''Strangely enough, an easing cycle is still expected to begin in Q4 but we believe that will be corrected in the next stage of Fed repricing, which may come after CPI and Producer Price Index data this week,'' they argued.

On the other side of the narrative, analysts at TD Securities said that they anticipated a dovish outcome that will be underscoring the prospects that the recent pain trade starts to reverse.''

''The latest USD correction was inspired mostly by extreme positioning and short-term risk premium, which has also started to correct,'' they noted. ''Plus, the strong employment numbers did little to rattle the Fed, which has helped reinforce the soft-landing narrative.''

''The upshot is that if CPI complies with our forecasts this week, that should kick-start a new round of broad US selling,'' the analysts at TD argued, paving the way for bullish prospects of the euro that is negatively correlated to US selling.

Meanwhile, the Federal Reserve speaker Governor Michelle Bowman said the following at the start of the week:

"I expect we'll continue to increase the federal funds rate because we have to bring inflation back down to our 2% goal and in order to do that we need to bring demand and supply into better balance," Bowman said during an American Bankers Association conference in Florida.

Once at a sufficiently restrictive level, interest rates will then need to be held for "some time" to restore price stability, she added.

Bowman rounded off by saying that a very strong labour market alongside moderating inflation meant a so-called economic 'soft landing' remains possible.

Gold technical analysis

The breaks of the structures have occurred over the past couple of days and shorts are building, penetrating deeper territories. However, a correction could be on the cards as follows:

The 50% mean reversion is a resistance area that could hold and result in a downward continuation with $1,850 eyed. This guards a move to the 1000 pip box target of $1,825 made in prior analysis:

What you need to take care of on Tuesday, February 14:

Tensions between the US and China weighed on the market mood at the weekly opening, with the Greenback making the most out of it. However, a better market mood during European trading hours pushed the US Dollar into the red across the FX board.

Still, the absence of relevant macroeconomic releases and the upcoming US Consumer Price Index update limited the intraday US Dollar slide. Market players await the release of the January United States Consumer Price Index (CPI). Inflation is foreseen raising at an annualized pace of 6.2%, easing from 6.5% YoY in December. The core reading, excluding volatile food and energy prices, is expected at 5.5%. Although the US Federal Reserve does not base its decision on this particular figure, it has a high impact on financial markets, as it reflects price pressures in the country.

The EUR/USD pair bottomed at 1.0655, bouncing towards the 1.0720 price zone. The pair retains gains in early Asia, despite ignoring early headlines. The European Commission released the quarterly Economic Growth Forecasts report. Economic growth in the Euro Zone has been upwardly revised, now seen at 0.9%. Additionally, inflation forecasts have been downwardly revised to 5.6% for this year and 2.5% in 2024.

The British Pound was among the best performers, advancing vs its American rival to 1.2144, retreating modestly ahead of the close. The UK will publish its latest employment figures on Tuesday.

The AUD/USD pair currently trades at around 0.6960, while USD/CAD is down to the 1.3330 region, with commodity-linked currencies benefiting from the better tone of Wall Street. US indexes pulled back from their intraday highs but anyway ended the day with gains.

Government bond yields seesawed across the day, appreciating during Asian trading hours but shedding some ground at the end of the day amid a better mood. However, the yield on the 2-year Treasury note advanced, while that on the 10-year note finished the day pretty much unchanged.

Spot gold eased and trades at fresh February lows just above $1,850 a troy ounce. Crude oil prices, on the other hand, followed equities with WTI up to $80 a barrel.

Like this article? Help us with some feedback by answering this survey:

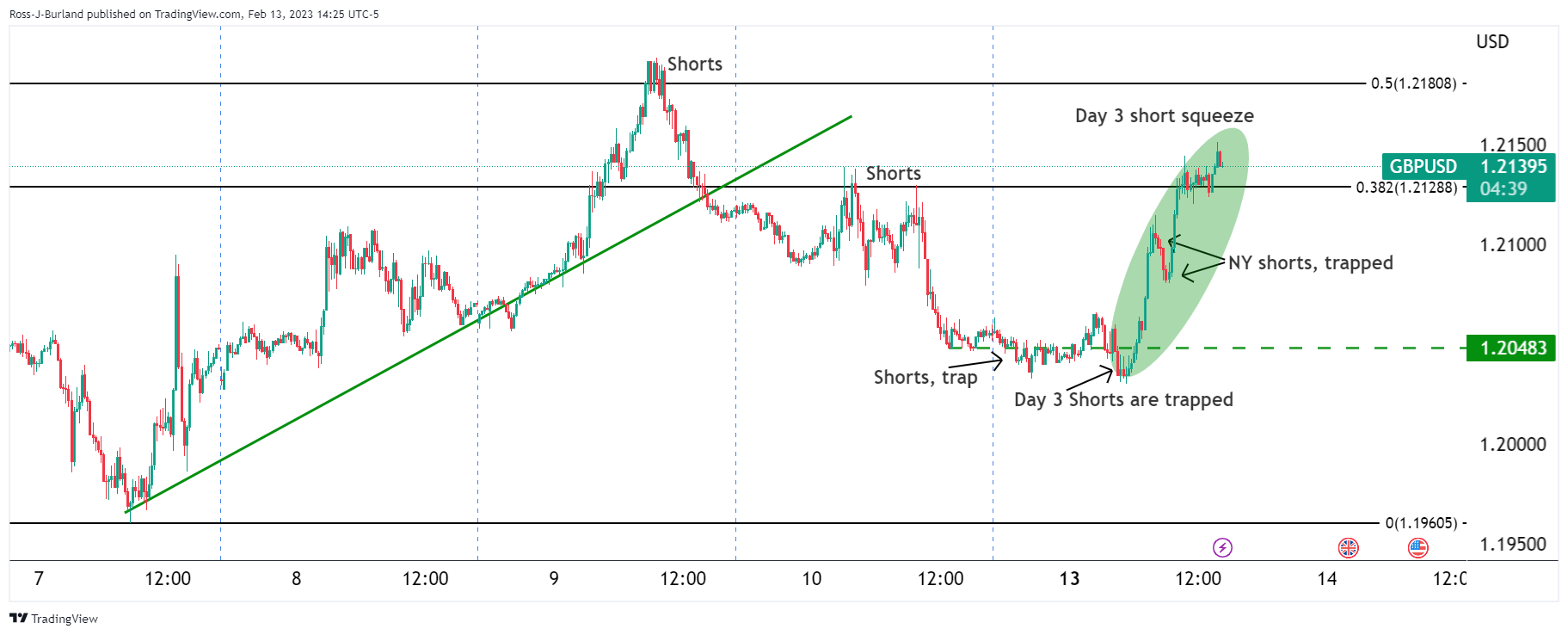

- GBP/USD short squeeze takes out the weaker hands start of the week.

- GBP/USD downside thesis on the daily chart is still valid around the US CPI event.

GBP/USD has been on a tear as it pulls away from the start of the day's trapped shorts that were seeking a break below 1.2050 for the initial balance for the week. At the time of writing, GBP/USD is trading at 1.2140 and up 0.8% on the day.

The following is an illustration of the price action and thesis for a long in the New York session ahead of this week's critical US Consumer Price Index and Retail Sales data the following day.

GBP/USD daily chart

at first glance prior to the day, the market was appearing to be set up for a downside continuation given the correction to the 50% mean reversion and strong rejection from the bears. However...

The bulls put on a short squeeze as illustrated above.

GBP/USD M15 chart

As illustrated, the market was overwhelmed with sellers and the bulls took advantage of this to start the week. On Thursday, an influx of supply came on and Friday had more shorts coming into the market. On Monday, the bears attempted to get on board with what appeared to be a downside extension and breakout opportunity below 1.2050. However, there was a break of structure to the long side as follows:

GBP/USD bears still in play

Nevertheless, the downside thesis on the daily chart is still valid around the US CPI event with the price still below the 1.2200 psychological level and a 50% mean reversion resistance that has a confluence with prior support looking left:

- USD/JPY advanced sharply toward 132.40 on Monday, spurred by a risk-on impulse.

- The daily chart suggests the pair as neutral-upwards biased.

- Short term, the USD/JPY 4-hour chart, depicts the pair would trade within 131.80-133.00.

The USD/JPY climbs as the New York session progresses, up by 0.77%, hitting a new six-week high at 132.90. Nevertheless, the major failed to hold to its gains and was rejected toward the 132.40 area. At the time of writing, the USD/JPY is trading at 132.44.

From a daily chart perspective, the USD/JPY climbed and pierced the last week’s high around 132.90 to retreat to 132.50s. The USD/JPY retracement was spurred by the 50-day Exponential Moving Average (EMA) At 132.66; albeit broken, the USD/JPY pair slid beneath the latter. Although the pair is trading off the day’s high, the USD/JPY bias in the near term is tilted to the upside.

Zooming into the 4-hour chart, after the USD/JPY consolidated during the last week in the 130.30-131.80 area, it broke the top of the range, but solid resistance around 133.00, capped the USD/JPY rally. Nevertheless, the USD/JPY might begin trading in a higher range, within the 131.80-133.00 area, ahead of US inflation data to be revealed on Tuesday, around 13:30 GMT

If the report shows that inflation continues to edge lower, the USD/JPY could aim toward the 200-EMA at 131.49, ahead of the 131.00 figure. Once those demand areas are cleared, the 100-EMA would be exposed at 130.84.

Conversely, higher-than-expected inflation would pave the way for further upside. Therefore, the USD/JPY first resistance would be 133.00. Break above, and the 134.00 figure is next, followed by the January 6 high at 134.77.

USD/JPY 4-hour chart

USD/JPY Key technical levels

- EUR/USD has run up high in a short squeeze as traders look ahead to US CPI.

- Beares are lurking with eyes on 1.0600 on the downside.

EUR/USD has been testing a critical high in the midday session on Wall Street following what had been a positive start for the day for the US Dollar. At the time of writing, EUR/USD is trading up high for the day at 1.0727 and has gained 0.4% so far following a rally from the Asian lows of 1.0655 within a 93 pip Average True Range (ATR).

Fundamentally, it's all about the Federal Reserve and positing in front of the key data event for the week ahead in the United States of America's Consumer Price Index with Retail Sales as a sideshow the following day. There are mixed outlooks for the CPI data with some analysts anticipating a hawkish outcome while others a dovish one.

Federal Reserve speakers have already been out of the gate this week with hawkish rhetoric. Fed Governor Michelle Bowman said the following:

"I expect we'll continue to increase the federal funds rate because we have to bring inflation back down to our 2% goal and in order to do that we need to bring demand and supply into better balance," Bowman said during an American Bankers Association conference in Florida.

Once at a sufficiently restrictive level, interest rates will then need to be held for "some time" to restore price stability, she added.

Bowman rounded off by saying that a very strong labour market alongside moderating inflation meant a so-called economic 'soft landing' remains possible.

Meanwhile, analysts at Brown Brothers Harriman argued that a move higher in US Treasury yields of late, (10-year rose from Thursday's low of 3.334% to a recent high of 3.755%), coincides with renewed inflation concerns and a reprising of Fed tightening expectations.

''WIRP suggests 25 bp hikes March 22 and May 3 are nearly priced in, while the odds of a third hike in June or July top out near 45%,'' the analysts said. ''Strangely enough, an easing cycle is still expected to begin in Q4 but we believe that will be corrected in the next stage of Fed repricing, which may come after CPI and Producer Price Index data this week,'' they argued.

On the other side of the narrative, analysts at TD Securities said ''TD anticipates a dovish CPI report this week, underscoring the prospects that the recent pain trade starts to reverse.''

''The latest USD correction was inspired mostly by extreme positioning and short-term risk premium, which has also started to correct,'' they noted. ''Plus, the strong employment numbers did little to rattle the Fed, which has helped reinforce the soft-landing narrative.''

''The upshot is that if CPI complies with our forecasts this week, that should kick-start a new round of broad US selling,'' the analysts at TD argued, paving the way for bullish prospects of the euro that is negatively correlated to US selling.

EUR/USD technical analysis

Meanwhile, we have the hourly chart's key resistance being tested:

We have a couple of bearish breaks of structures, BoS, on Friday and the start of the week before the move up into the shorts that had gathered over the last couple of days:

In a short squeeze, the price has burst into a new 100-pip box on the upside but this could just be a momentary pause and correction before the next major move lower.

EUR/USD daily charts

While on the front side of the trend, there are p[prospects of a move lower to test the 1.0600 level for the day (s) ahead.

- AUD/USD encountered support at around 0.6890 and climbed back above 0.6950.

- Inflation in the United States is estimated to cool down, as CPI and Core CPI will be revealed on Tuesday.

- Per the New York Fed, inflation expectations for one year are estimated at around 5%.

- Traders are eyeing the release of Aussie’s Consumer Sentiment and Business Confidence reports.

The AUD/USD edges high in the North American session by 0.75%, spurred by a risk-on impulse, ahead of the release of US inflation data on Tuesday, which is expected cool down, according to a news sources poll. Nevertheless, the jump was capped by Federal Reserve (Fed) Governor Bowman’s hawkish commentary, keeping the major within familiar levels. At the time of writing, the AUD/USD exchanges hands at 0.6966.

US equities continued to climb in the mid-New York session. Inflation expectations in the United States remained firm, as reported by the New York Federal Reserve poll. Data showed that Americans estimate inflation to remain steady at 5%, while for three years, they observe inflation at around 2.7%, down from 2.9% in December. For a five-year horizon, inflation is estimated at 2.5%, vs. 2.4% in the previous month.

AUD/USD is still aiming higher in the day, nearby the highs of the day, underpinned by risk appetite. Traders are awaiting inflation figures from the United States (US), with January’s Consumer Price Index (CPI) foreseen at 6.2% YoY, down from December’s 6.5%, while core data is estimated at 5.5% YoY, from 5.7% in the prior month.

Elsewhere, Federal Reserve (Fed) officials continued to cross wires. Fed Governor Michelle Bowman commented that the Federal Funds Rate (FFR) would need to increase to bring inflation towards its 2% target. She added that the US central bank needs to bring supply and demand into balance.

What to watch?

The Australian economic docket will feature Consumer Sentiment and the NAB Business Confidence report. On the US, the docket will reveal the already mentioned inflation data, along with further Fed speakers, led by Lorie Logan of the Dallas Fed and the NY Fed President John Williams.

AUD/USD Key technical levels

hnical levels

- Gold dives to five-week lows at around $1850 as bears eye the 100-DMA beneath $1820.

- Market participants are eyeing Tuesday’s US CPI data, which could reaffirm the disinflation process has already started.

- XAU/USD Price Analysis: A daily close below $1850 would pave the way toward $1820.

Gold price retreated from last Friday’s highs of $1872.22 and dropped toward the $1850 area on Monday despite the US Dollar (USD) fall, ahead of a vital inflation report from the United States (US). Additionally, US Treasury yields, albeit edging down, remain at around five-week highs. At the time of writing, the XAU/USD is trading at $1852.88.

Gold retraces to $1850 weighed by a risk-on mood

XAU/USD remains pressured, while the US Dollar Index, a measure of the buck’s value vs. a basket of peers, drops 0.18%, down at 103.391, undermined by the US 10-year Treasury bond yield, with the 10-year benchmark not dropping one and a half bps to 3.726%.

Investors are awaiting a report from the Bureau of Labor Statistics (BLS) on Tuesday, revealing the Consumer Price Index (CPI) for January, estimated at 6.2% YoY, lower than the 6.5% in December. The core CPI excludes volatile items like food and energy, which is foreseen at 5.5% YoY, from 5.7% in the previous month.

In the meantime, Fed hawkish commentary continued with the Fed Governor Michell Bownman, who said that the Federal Reserve (Fed) needs to continue to raise rates to get the Federal Funds Rate(FFR) to a sufficiently restrictive level, as the US central bank battles high inflationary pressures.

Of late, the US Federal Reserve of New York revealed inflation expectations for the year hold steady at 5%. For a three-year horizon, the poll showed that inflation would stand at 2.7%, down from December 2.9%, while for a five-year span, it was projected at 2.5%, vs. 2.4 in the prior month.

XAU/USD Technical analysis

Technically speaking, XAU/USD remains neutral to slightly downward biased. At the time of typing, the yellow metal falls beneath the 50-day Exponential Moving Average (EMA) At $1856.58, exacerbating further selling pressure. On the downside, the following support levels would be the December 26 daily high of 1833.29 turned support, followed by the 100-day EMA at 1817.77, and the confluence of the 200-day EMA, and the figure at $1800.

The Federal Reserve Bank of New York's monthly Survey of Consumer Expectations showed on Monday that the US consumers' one-year inflation expectation stayed unchanged at 5% in January.

Further details of the publication showed that the three-year ahead expected inflation declined to 2.7% from 2.9% in December and the five-year ahead expected inflation edged higher to 2.5% from 2.4%.

On a concerning note, the expected household income growth for the year ahead dropped to 3.3% from 4.6%, marking the biggest decline in the survey's history.

Market reaction

The US Dollar Index stays under modest bearish pressure following this report and it was last seen losing 0.17% on the day at 103.40.

The US Bureau of Labor Statistics will release the Consumer Price Index (CPI) figures for January on Tuesday, February 14 at 13:30 GMT and as we get closer to the release time, here are the forecasts by the economists and researchers of 12 major banks regarding the upcoming US inflation print.

The annual CPI is expected to decline to 6.2% from 6.5% in December while the Core CPI, which excludes volatile food and energy prices, is seen at 5.5% from 5.7%. On a monthly basis, the CPI is forecast at 0.5% while the Core CPI is expected at 0.4%.

Commerzbank

“We expect consumer prices to rise by 0.4% from December, and by 0.3% excluding energy and food (core rate). The respective YoY rates would then fall from 6.5% to 6.2% and from 5.7% to 5.4% (core rate).”

ANZ

“We expect US core CPI to have risen by 0.3% MoM in January, while higher energy prices should see headline CPI inflation up by 0.5%. Fed guidance is likely to remain hawkish until it gets a clearer picture that core services excluding housing inflation and tightness in the labour market are beginning to moderate. On a YoY basis, we expect January core CPI would result in core easing to 5.4% from 5.7% and headline to 6.2% from 6.5%.”

Danske Bank

“We forecast core CPI at 0.4% MoM. An upside surprise to 0.5% or above would in our view mark a clear upturn in the broader underlying inflation pressures and could take EUR/USD another leg lower.”

ING

“We expect core inflation to rise to 0.4% MoM. A 0.4% MoM core CPI print (or possibly even 0.5%) would give the Fed near-term ammunition to argue for a May rate hike. Nonetheless, we think that shelter and cars will contribute to inflation slowing sharply from mid-second quarter, with weakening corporate pricing power also contributing to getting inflation down to 2% by year-end.”

TDS

“We forecast a firm 0.4% MoM gain in the core CPI series. In terms of the headline, we expect CPI inflation to register its firmest MoM gain since October, posting a strong 0.4% increase. Our MoM projections imply that inflation likely lost speed again on a YoY basis in January as we look for inflation to drop to 6.2% for the headline (after 6.5% YoY in December), and to ease to 5.5% YoY for the core series (after 5.7% in January).”

BofA

“We forecast headline CPI increased by 0.4% MoM in January, which would be an acceleration from the recent pace. We also expect the YoY rate to fall from 6.5% to 6.1%. Meanwhile, we look for core CPI to increase by 0.3% MoM and for the YoY rate to fall from 5.7% to 5.4%.”

Deutsche Bank

“Higher gas prices should boost headline MoM CPI (+0.42% DB forecast). Core MoM should be stable (DB +0.36%). The YoY rates should fall around two-tenths each to 6.2% and 5.5%, respectively.”

RBC Economics

“We expect CPI growth edged down to 6.2% in January from 6.5% in December (YoY). Food price growth likely also continued to slow, albeit from very high levels. By contrast, we expect energy price growth to tick up for the first time in 7 months – though to an 8% rate that is still well below a June peak of 42%. We look for core inflation to slow further in January, coming in at 5.4% YoY, down from 5.7% in December. All told, recent inflation reports have pointed to a relatively broadly-based easing in price pressures.”

NBF

“The energy component likely rebounded in the month, helping the headline index to advance 0.5%. If we’re right, the YoY rate should come down from 6.5% to 6.2%. The core index, meanwhile, may have continued to be supported by rising rent prices and advanced 0.3% on a monthly basis. This would translate into a three-tick decline of the 12-month rate to 5.4%.”

CIBC

“There’s still scope for a deceleration in the core component in January to a 0.3% monthly pace, however, as wage growth decelerated, and shelter prices are set to decelerate imminently, in line with the typical lags associated with new leases that are resetting at lower rates. That could provide an offset to any slowdown in the pace of disinflation in goods prices, as industry measures of used car prices climbed in January. When adding gasoline and food prices back into the mix, total prices likely increased by a stronger 0.5% on the month. We’re below the consensus on core CPI, which could slightly weigh on bond yields and the USD.”

Citibank

“US January CPI MoM – Citi: 0.5%, prior: -0.1%; CPI YoY – Citi: 6.3%, prior: 6.5%; CPI ex Food, Energy MoM – Citi: 0.4%, prior: 0.3%; CPI ex Food, Energy YoY – Citi: 5.6%, prior: 5.7%. After three months of an apparent slowing in core CPI increases from October through December, we expect CPI to pick back up to a 0.4-0.5% pace with a 0.43% MoM rise in January core CPI. However, an eventual moderation in shelter prices should help moderate core CPI by mid-year.”

Wells Fargo

“We expect to see a 0.4% MoM increase in the CPI. Rising gasoline prices and a pause in the downward trend of used car prices are part of the reason we believe that January will see faster price growth compared to December. That said, the underlying pace of inflation still appears to be gradually slowing, and we expect the year-ago inflation rate to register another decline. We look for YoY CPI inflation to be 6.2% in January. If realized, this would be the slowest pace of CPI inflation since October 2021.”

Gold’s bullish momentum has been fading. A further sell-off could confirm prices falling below $1,800 in the short-term, strategists at ANZ bank report.

Fading bullishness

“Gold hit a high of $1,960 in the first week of February, but strong US labour data led to a sharp correction of 4%. While this correction looks normal after a 20% price rally, the bullishness seems to be waning.”

“Further fall in Gold prices could trigger more technical sell-offs in the short-term.”

“The key supports are $1,800 and $1,730.”

“On the upside, immediate resistance lies at $1,900. Should the price break above $1,930, it would confirm a continuation of the uptrend.”

- Long-term, the USD/MXN remains downward biased, as it got rejected at the 50-hour EMA.

- USD/MXN, on an intraday basis, formed a falling wedge, suggesting that buyers are gathering momentum.

The USD/MXN recovered some ground on Monday after last week’s Banxico decision to raise rates by 50 basis points (bps) interest rates to the 11% threshold spurred a bid in the Mexican Peso (MXN). At the time of writing, the USD/MXN exchanges hands at 18.6517, above its opening price by a slight margin of 0.03%.

From a daily chart perspective, the USD/MXN is still downward biased, as the daily moving averages (MAs) remain above the spot price. Even though the USD/MXN paired some of last Friday’s losses, the USD/MXN pair remains under selling pressure, and it could shift neutral if the USD/MXN breaks resistance at the 50-day Exponential Moving Average (EMA) at 19.0805.

Oscillators like the Relative Strength Index (RSI) point downwards and in bearish territory, so further downside is expected.

On an intraday basis, the USD/MXN 1-hour chart suggests the pair might consolidate in the 18.50-19.00 area, unable to crack support/resistance levels.

A falling wedge is forming as the pair bottoms at around the $18.60 area, which would exacerbate an upward move in the USD/MXN, though there are some key resistance levels that buyers need to battle, to lift the USD/MXN exchange rate towards $19.00.

A break above the 20-period Exponential Moving Average (EMA) at 18.6768 would send the USD/MXN pair toward 18.7336., which, once cleared, would open the door for further gains toward the 100-EMA at 18.7945 and the 200-EMA at 18.8273.

USD/MXN 1-Hour chart

USD/MXN Key technical levels

Seasonal bias favouring the US Dollar has not been in evidence in 2023 yet, as economists at MUFG Bank note.

Balance of risks for the Dollar is shifting

“Momentum is turning more USD positive, most of all versus GBP and next for EUR.”

“It might not take much from here for investors to starting considering the risk of the US terminal rate ending higher than the level currently flagged by the FOMC (5.00%-5.25%) and any disappointment tomorrow after months of good inflation news could trigger an outsized move in rates and a further rebound for the Dollar. That seems the greater risk following the jobs report.”

“Don’t forget the seasonal bias favouring the Dollar at this time of the year too – January and February is one of the two best periods for the greenback throughout the year and we haven’t seen much of that since the start of the year.”

The UK is the only G7 economy with output below its pre-pandemic level. Economists at Rabobank expect the British Pound to remain under downward pressure over the coming months.

UK is the only G7 economy not to have recovered its pre-pandemic levels

“Currently, the UK is the only G7 economy not to have recovered its pre-pandemic levels. In addition to weak growth, its fundamentals are characterised by high inflation, low productivity, weak investment growth, post-Brexit trade frictions and a current account deficit.”

“We continue to expect EUR/GBP to edge to 0.90 by the middle of the year and see scope for further dips below GBP/USD 1.20.”

The rally in the S&P 500 finally stalled at 4195 following the strong payroll report and a setback is underway. The index is expected to see further near-term consolidation but with weakness still viewed as corrective for now, in the opinion of analysts at Credit Suisse.

S&P 500 to see an eventual test of 4312/26

“With daily MACD threatening to cross lower, we see scope for further near-term weakness, but our bias, for now at least, remains to view this as a temporary pullback.”

“Support is seen next at the 38.2% retracement of the rally from the late December low at 4031 and then more importantly at the back of the broken medium-term downtrend and price support at 4016/09, with better buyers expected to show here. We suspect we need to see a move below 3886 to make the argument that we may have seen a more important peak.”

“Resistance is seen at 4112/15 initially, with a move above 4154/56 needed to clear the way for a retest of 4195/4203. An eventual break above here should see a test of the 61.8% retracement of the 2022 fall and summer 2022 high at 4312/26.”

Federal Reserve (Fed) Governor Michelle Bowman said on Monday that they still see a very strong labor market but added that there isn't much moderation in inflation as they would like, as reported by Reuters.

"It is possible we will still be able to achieve a soft landing," Borman added and said that she expects the Fed will continue to raise interest rates, pointing out there will be a lot of data releases between now and the next policy meeting.

Market reaction

These comments don't seem to be having a significant impact on the US Dollar's performance against its major rivals. As of writing, the US Dollar Index was up marginally on the day at 103.65.

Antje Praefcke, FX Analyst at Commerzbank, would not go straight for the first data publication this week even if it might have a Dollar-negative effect in case the result comes in below market expectations.

Do not go straight for the first set of data

“As no important publication is on the agenda for today we are likely to see a quiet trading day. The next heavy-weight is not due until tomorrow in the shape of the US inflation data.”

“Even if inflation was going to ease more significantly than the market expects that does not necessarily mean that the market will immediately switch to a Dollar-negative view again. I think that would require a bigger set of data that illustrates an overall picture of a more pronounced economic slowdown caused by the past rate hikes and might dampen Fed hopes of a soft landing. Only at that stage would it be justified in my view for the market to increasingly rely on the Fed moving in its direction, which would then put pressure on the Dollar.”

“If tomorrow’s inflation data comes in below market expectations, I would expect a short dip in the Dollar but I would be cautious about expecting this to continue all week.”

- USD/CAD quickly reverses an intraday dip to over a one-week low.

- Sliding crude oil prices undermines the Loonie and acts as a tailwind.

- Hawkish Fed expectations limit the USD downside and lend support.

The USD/CAD pair recovers a few pips from over a one-week low touched during the early North American session and is currently placed around the 1.3350-1.3355 area, up less than 0.10% for the day.

A modest downtick in the US Treasury bond yields, along with an intraday turnaround in the equity markets, prompt some selling around the safe-haven US Dollar and exerts pressure on the USD/CAD pair. That said, a combination of factors helps limit any further losses and assists spot prices to attract some buyers near the 1.3325 region.

Crude oil prices once again fail near a technically significant 200-day SMA and kick off the new week on a weaker note. This, in turn, is seen undermining the commodity-linked Loonie. Apart from this, the prospects for further policy tightening by the Fed act as a tailwind for the greenback and contributes to limiting losses for the USD/CAD pair.

Investors seem convinced that the US central bank will stick to its hawkish stance and the bets were fueled by the risk of higher US inflation print for January. Hence, the focus will remain glued to the crucial US CPI report, due for release on Tuesday, which will influence the Fed's rate-hike path and drive the USD demand in the near term.

Ahead of the key data risk, the US bond yields and the broader risk sentiment will play a key role in influencing the greenback in the absence of any relevant market-moving economic data. Apart from this, traders will take cues from oil price dynamics to grab short-term opportunities around the USD/CAD pair.

Technical levels to watch

- GBP/USD rebounds swiftly from a multi-day low touched earlier this Monday.

- A recovery in the risk sentiment undermines the USD and offers some support.

- Hawkish Fed expectations could help limit the USD downside and cap the pair.

The GBP/USD pair builds on its goodish intraday bounce from the 1.2030 area, or a multi-day low touched earlier this Monday and scales higher through the mid-European session. Spot prices climb back above the 1.2100 mark in the last hour and reverse a major part of Friday's downfall amid the emergence of some US Dollar selling.

A modest recovery in the global risk sentiment - as depicted by a turnaround in the equity markets - exerts some downward pressure on the safe-haven buck. Apart from this, a softer tone around the US Treasury bond yields further undermines the Greenback, which, in turn, is seen as a key factor lending some support to the GBP/USD pair.

That said, rising bets for further policy tightening by the Federal Reserve (Fed) should help limit the downside for the USD and cap gains for the GBP/USD pair. Investors now seem convinced that the US central bank will stick to its hawkish stance for longer amid the risk of higher inflation print for January, due for release on Tuesday.

The speculations were fueled by the revision of the previous month's data, which showed that consumer prices rose in December instead of falling as estimated previously. Furthermore, the University of Michigan survey's one-year inflation expectations climbed to 4.2% this month from 3.9% in January. This, in turn, favours the USD bulls.

Apart from this, a dovish assessment of the Bank of England (BoE) decision last week warrants some caution before placing aggressive bullish bets around the GBP/USD pair. In the absence of any relevant market-moving economic releases, traders now look to Fed Governor Michelle Bowman's speech for some impetus ahead of the UK jobs data on Tuesday.

Technical levels to watch

USD/CAD holds last week’s losses to the mid-1.33s. The pair needs to crack 1.3295 to see further falls, economists at Scotiabank report.

Resistances align at 1.3380/90, then 1.3420

“USD/CAD closed net lower on the day Friday, forming a bearish outside range day. That should see spot put a little pressure on the downside in the next day or so but whether losses can extend to test trend support at 1.3295 remains to be seen.”

“The prior week’s price action was USD-bullish (weekly outside range) which rather means that the CAD will have to better the early Feb low at 1.3262 to rally more sustainably.”

“We spot minor resistance at 1.3380/90 intraday ahead of 1.3420.”

The EUR is trading flat against the USD. Economists at Scotiabank expect the EUR/USD to head lower towards the 1.05/06 region.

EU revises up GDP for 2023

“The EU revised its growth outlook to 0.9% this year (from 0.3%), which puts the Eurozone more or less in line with North American rates of growth.”

“Weakness below support in the low 1.07s last week weakened the EUR’s short-term technical picture at least. But weekly price action turned less supportive at the start of the month and EUR losses below the 55-day MA (now resistance at 1.0690) keep the near-term focus on the downside and towards a retest of the 1.05/1.06 range.”

The S&P 500 dropped back below the 4,100 level, which served as resistance back in September and twice in December. Economists at Charles Schwab expect the index to move within a 3,800-4,100 range over the next couple of months.

Fairly rich forward P/E of 19 on the S&P 500

“One of the problems which may be making another ‘leg up’ in the S&P 500 is valuation – the forward P/E on the S&P is currently roughly 19 and it doesn't look like the ‘E’ is growing in the near-term to help support a higher multiple.”

“We could be in for a period of sideways trading for the next couple of months in this index, perhaps ~3,800-4,100 (or maybe as high as 4,300, depending on rates/inflation data).”

- Silver attracts some buyers near the 100-day SMA support, though lacks follow-through.

- The setup favours bearish traders and supports prospects for a further depreciating move.

- A sustained move beyond the $23.00 mark is needed to negate the near-term bearish bias.

Silver manages to defend the 100-day SMA support and stage a modest bounce from its lowest level since late November, around the $21.80 region touched earlier this Monday. The white metal, however, lacks any follow-through buying and struggles to capitalize on the recovery move beyond the $22.00 mark.

From a technical perspective, last week's break and acceptance below the 38.2% Fibonacci retracement level of the recent rally from October 2022 favours bearish traders. Furthermore, oscillators on the daily chart are holding deep in the negative territory and are still far from being in the oversold zone. This, in turn, supports prospects for an extension of the recent sharp pullback from the $24.65 area, or over a nine-month high touched on February 2.

Some follow-through selling below the 100-day SMA, currently around the $21.75 region, will reaffirm the near-term bearish outlook. The XAG/USD would then turn vulnerable to test to the 50% Fibo. level, around the $21.35 area. The downward trajectory could get extended further towards the $21.00 level en route to the 61.8% Fibo. level, around the $20.60-$20.55 zone. The commodity could eventually drop towards challenging the $20.00 psychological mark.

On the flip side, any meaningful recovery beyond the $22.15 area - the 38.2% Fibo. support breakpoint - is more likely to attract fresh sellers near the $22.60-$22.70 supply zone. This, in turn, should cap the XAG/USD near the $23.00 mark, representing the 23.6% Fibo. That said, a convincing break through the latter could offset the negative outlook and shift the near-term bias in favour of bullish traders, paving the way to reclaim the $24.00 round figure.

Silver daily chart

Key levels to watch

The British Pound has started the week on a softer footing. Economists at OCBC Bank expect the GBP/USD pair to trade within a range of 1.1950-1.2180 for the time being.

Sideways trade likely

“Support here at 1.1950 (200-Day Moving Average, 23.6% fibo retracement of 2022 low to high), 1.1850 (100-DMA).”

“Resistance at 1.2190 (50-DMA), 1.2260 (21-DMA) and 1.2450 levels (double top).”

“Sideways trade still likely. Range of 1.1950-1.2180 within a wider range of 1.1850-1.2250.”

See: EUR/USD to rise to 1.10 by Q2 – Deutsche Bank

Following Friday's volatile action, USD/JPY gathered bullish momentum early Monday. But with Yield-Curve-Control still set to end, upward pressure on the Yen will remain, in the opinion of economists at MUFG Bank.

YCC is still set to end

“The prospect of higher JGB yields appears to us to be at least partially priced into the FX markets and the choice of Ueda as Governor, if confirmed, will not change that expectation, and there is a risk that it strengthens the expectations further. But we do not see the choice of Ueda as necessarily hugely different to Amamiya, in terms of the course of monetary policy this year.”

“Our bias was for the Yen to strengthen and that remains the case.”

“We still believe YCC is likely to end and we see Ueda as a credible alternative to Amamiya who will adopt changes to monetary policy with credibility given his time at the BoJ preceded Abenomics.”

EUR/USD lost over 100 pips last week and stays in a consolidation phase below 1.0700 on Monday. Economists at OCBC Bank note that the pair remains under bearish pressure.

Initial support aligns at 1.0660

“Bearish momentum on daily chart intact while RSI fell. Downside risks remain.”

“Support at 1.0660, 1.0610 and 1.0490 levels.”

“Resistance at 1.0680 (23.6% fibo retracement of September low to February high), 1.0760 and 1.0830 (21 DMA).”

See: EUR/USD could test the 1.0500 support on a strong US CPI read – ING

The US Dollar has started the week on a firmer tone after closing higher for a second consecutive week. Tomorrow’s US Consumer Price Index (CPI) data should offer some guidance on USD direction in the near term, economists at OCBC Bank report.

Risks modestly skewed to the upside for now

“If disinflation trend in US shows signs of slowing (even if it is temporary), then risk sentiment could come under pressure and the USD may find further support. However, if disinflation trend proves entrenched instead of bumpy (i.e. CPI comes in softer than expected), then a resumption of USD softness could return.”

“Daily momentum is bullish while RSI shows signs of resuming its rise. Risks modestly skewed to the upside for now.”

“Resistance here at 103.60 (50 DMA), 104.10 (23.6% fibo retracement September peak to February low) and 105.”

“Support at 102.50 (21 DMA), 101.60 and 100.80.”

The reopening in China has continued to support AUD in early 2022, but relative rates have been a headwind. Economists at Danske Bank expect the AUD/USD pair to move gradually lower over the coming months.

AUD is well positioned to gain support from Chinese reopening

“We still think AUD is well positioned to gain support from Chinese reopening and the less negative global growth outlook.”

“Higher commodity prices are supportive for AUD all else equal, but they also increase the risk of the Fed turning more hawkish.”

“We continue to look for modestly lower AUD/USD in 12M in line with our view of broad USD strength, but AUD could still gain vis-à-vis other cyclically sensitive currencies, like EUR.”

“Forecast: 0.69 (1M), 0.68 (3M), 0.67 (6M), 0.67 (12M).”

- EUR/USD remains depresed near a one-month low amid a modest USD strength.

- Hawkish Fed expectations and looming recession risks underpin the greenback.

- Bets for additional jumbo rate hikes by the ECB help limit losses for the major.

The EUR/USD pair consolidates its recent downfall to over a one-month low and oscillates in a narrow range through the first half of the European session on Monday. The pair is currently placed around the 1.0675-1.0680 region and seems vulnerable to prolonging its sharp retracement from the highest level since April 2022 touched earlier this month.

The US Dollar stands tall near a five-week high amid the prospects for further policy tightening by the Fed and turns out to be a key factor acting as a headwind for the EUR/USD pair. In fact, a slew of FOMC members, including Fed Chair Jerome Powell, stressed the need for additional interest rate hikes this week to fully gain control of inflation. The bets were reaffirmed by the Labor Department's annual revisions of CPI, which showed that consumer prices rose in December instead of falling as previously estimated.

Furthermore, the University of Michigan survey's one-year inflation expectations climbed to 4.2% this month from the 3.9% previous. This raises the risk of higher inflation print for January and dashes hopes for an imminent pause in the Fed's rate-hiking cycle. This, along with the prevalent cautious market mood and looming recession risks, continues to lend support to the safe-haven buck. Apart from this, signs of easing inflationary pressure in the Eurozone undermine the Euro and keep a lid on the EUR/USD pair.

That said, bets for additional jumbo rate hikes from the European Central Bank (ECB) in the coming month lend some support to the shared currency. Traders also seem reluctant to place aggressive bets ahead of the crucial US CPI report on Tuesday, which further contributes to limiting the downside for the EUR/USD pair, at least for now. Nevertheless, Friday's breakdown below the 50-day SMA could be seen as a fresh trigger for bearish traders and supports prospects for an extension of the near-term depreciating move.

Technical levels to watch

In the midst of the Dollar's upward correction, the Euro has also lost its idiosyncratic bullish momentum. Economists at ING expect the EUR/USD to test 1.05 support on a strong US Consumer Price Index (CPI) report.

Lacking the domestic push

“Our medium-term view is still one of EUR/USD appreciation over the course of 2023, but we don’t see clear drivers for a EUR/USD rebound this week, especially from the eurozone side.”

“It would probably require a rather low US CPI figure to send the pair sustainably back above 1.0800-1.0850. We see a greater chance of the pair coming under some additional pressure, and a strong US CPI read could mean the 1.0500 support (1.0490 is the 2023 low) is tested.”

“President Christine Lagarde will speak on Wednesday: expect another attempt to build market expectations around more tightening, although other ECB members have already gone a long way communication-wise and we don’t see her speech as a big risk event for the Euro.”

Economists at ANZ Bank expect the US Dollar to remain resilient ahead of the US Consumer Price Index (CPI) report tomorrow. However, the greenback could see some selling pressure following the release.

USD to be supported at the current range around 103

“January US CPI is the key event for the DXY, with Core Services Excluding Housing in focus. On a YoY basis, we expect January core CPI would result in core easing to 5.4% from 5.7% and headline to 6.2% from 6.5%.”

"Based on our forecasts of a slight decline in YoY figures, some easing in USD strength could be expected following the release.”

“Ahead of CPI, we expect the USD to be supported at the current range around 103.”