- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 12-08-2014

(raw materials / closing price /% change)

Light Crude 97.28 -0.82%

Gold 1,309.50 -0.08%

(index / closing price / change items /% change)

Nikkei 225 15,161.31 +30.79 +0.20%

Hang Seng 24,689.41 +43.39 +0.18%

Shanghai Composite 2,221.59 -3.06 -0.14%

FTSE 100 6,632.42 -0.40 -0.01%

CAC 40 4,162.16 -35.54 -0.85%

Xetra DAX 9,069.47 -111.27 -1.21%

S&P 500 1,933.75 -3.17 -0.16%

NASDAQ 4,389.25 -12.08 -0.27%

Dow Jones 16,560.54 -9.44 -0.06%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3367 -0,13%

GBP/USD $1,6809 +0,14%

USD/CHF Chf0,9074 +0,11%

USD/JPY Y102,24 +0,06%

EUR/JPY Y136,67 -0,07%

GBP/JPY Y171,85 +0,19%

AUD/USD $0,9263 -0,01%

NZD/USD $0,8430 -0,31%

USD/CAD C$1,0923 +0,01%

(time / country / index / period / previous value / forecast)

00:30 Australia Westpac Consumer Confidence August +1.9%

01:30 Australia Wage Price Index, q/q Quarter II +0.7% +0.8%

01:30 Australia Wage Price Index, y/y Quarter II +2.6%

05:30 China Retail Sales y/y July +12.4% +12.5%

05:30 China Fixed Asset Investment July +17.3% +17.4%

05:30 China Industrial Production y/y July +9.2% +9.1%

06:00 Germany CPI, m/m July +0.3% +0.3%

06:00 Germany CPI, y/y July +0.8% +0.8%

06:45 France CPI, m/m July 0.0% -0.2%

06:45 France CPI, y/y July +0.5%

08:30United Kingdom Average earnings ex bonuses, 3 m/y June +0.7%

08:30 United Kingdom Average Earnings, 3m/y June +0.3% -0.1%

08:30 United Kingdom Claimant count July -36.3 -29.7

08:30 United Kingdom Claimant Count Rate July 3.1%

08:30 United Kingdom ILO Unemployment Rate June 6.5% 6.4%

09:00 Eurozone Industrial production, (MoM) June -1.1% +0.5%

09:00 Eurozone Industrial Production (YoY) June +0.5%

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) August 0.1

09:30 United Kingdom BOE Inflation Letter Quarter III

09:30 United Kingdom BOE Gov Mark Carney Speaks

12:30 U.S. Retail sales July +0.2% +0.2%

12:30 U.S. Retail sales excluding auto July +0.4% +0.4%

13:05 U.S. FOMC Member Dudley Speak

14:00 U.S. Business inventories June +0.5% +0.4%

14:30 U.S. Crude Oil Inventories August -1.8

22:30 New Zealand Business NZ PMI July 53.3

22:45 New Zealand Retail Sales, q/q Quarter II +0.7% +1.0%

22:45 New Zealand Retail Sales ex Autos, q/q Quarter II +0.8%

23:01 United Kingdom RICS House Price Balance July 53% 51%

23:50 Japan Core Machinery Orders June -19.5% +15.5%

23:50 Japan Core Machinery Orders, y/y June -14.3%

Stock indices closed lower as weak German economic sentiment weighed on markets. The ZEW Centre for Economic Research released its economic sentiment index for Germany and the Eurozone. The economic sentiment index for Germany plunged to 8.6 in August from 27.1 in July. That was the lowest level since December 2012. Analysts had expected a decline to 18.2.

The drop was driven by geopolitical tensions.

Eurozone's ZEW economic sentiment index fell to 23.7 in August from 48.1 in July. Analysts had expected a decrease to 41.3.

Tensions over Ukraine also weighed on markets. Russia sent 280 trucks carrying humanitarian aid to Southeast Ukraine.

Henkel AG shares dropped 5.2% as the company reported that earnings growth will slow in the second half due to tensions in Ukraine and the Middle East.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,632.42 -0.40 0.0%

DAX 9,069.47 -111.27 -1.2 %

CAC 40 4,162.16 -35.54 -0.8 %

The cost of oil futures fell sharply today, dropping at the same time below $ 104 per barrel, and the lowest level in nine months (grade Brent), as a stable supply dispelled concerns about potential disruptions from Iraq and Libya.

Today, the International Energy Agency (IEA) said that global oil demand in 2014 will grow more slowly than previously expected, amid worsening global growth prospects. In addition, due to the fall in the rate of growth in oil demand in the 2nd quarter to lows for more than two years. In a new monthly report, the agency lowered the growth forecast for global oil demand this year to 1 million barrels a day, down 180,000 barrels below the earlier forecast. In the IEA's reference to the fact that the demand for oil in the 2nd quarter of this year was lower than previously expected. The report also stated that the volume of oil production in the OPEC in July rose by 300,000 barrels per day to 5-month high of 30.44 million barrels per day. This increase was made possible by an increase in production in Saudi Arabia (at 230,000 barrels per day to 10.01 million barrels a day, the maximum in September) and some recovery in oil production in Libya (up to 430,000 barrels per day).

Market participants are also waiting for data on the reduction of hydrocarbon reserves in the United States, which may indicate an increase in demand for fuel. Economists estimate that the inventory of oil in the United States dropped the seventh week in a row, decreasing by 1.75 million barrels to 363.9 million. Previous week stocks finished at their lowest level since Feb. 28. However, the expected decline in stocks and gasoline - by 1.5 million barrels to 212.3 million. But distillate inventories probably increased by 200 thousand. Barrels for the week.

On the dynamics of trading also reflected posts by rating agency Moody's Investors Service. In the current review, the agency said a slowdown in global GDP growth to 2.8% (below the long-term trend). However, in 2015 the rate of increase of the world's GDP accelerated to 3.2%. In the United States economy will add 2% this year and 3% next year, the euro zone - 1% and 1.5% respectively, "- believe in the agency." Slowing export growth will put pressure on developing countries in 2014 and in 2015 , but in developed countries, the rise in the next year will increase due to the increase of investment companies "- experts said Moody's.

The cost of the September futures for the American light crude oil WTI (Light Sweet Crude Oil) fell to $ 97.26 a barrel and then dropped to $ 97.25 a barrel on the New York Mercantile Exchange (NYMEX).

September futures price for North Sea Brent crude oil mixture decreased by $ 1.2 to $ 103.33 a barrel on the London exchange ICE Futures Europe.

The U.S. dollar traded mixed to lower against the most major currencies after the JOLTS report in the U.S. The Bureau of Labor Statistics in the U.S. released the JOLTS report today. Job openings rose to 4.67 million in June from the 4.577 million job openings, missing expectations for an increase to 4.74 million job openings. That was the highest level since February 2001.

May's figure was revised down from 4.635 million job openings.

Investors continued to monitor closely the situation in Ukraine and Iraq. Russia sent 280 trucks carrying humanitarian aid to Southeast Ukraine.

Iraqi President nominated a new Prime Minister but Nuri al-Maliki, the current Prime Minister, has refused to go.

The euro declined against the U.S. dollar due to the weaker-than-expected economic sentiment from the Eurozone, but later recovered a part of its losses. The ZEW Centre for Economic Research released its economic sentiment index for Germany and the Eurozone. The economic sentiment index for Germany plunged to 8.6 in August from 27.1 in July. That was the lowest level since December 2012. Analysts had expected a decline to 18.2.

The drop was driven by geopolitical tensions.

Eurozone's ZEW economic sentiment index fell to 23.7 in August from 48.1 in July. Analysts had expected a decrease to 41.3.

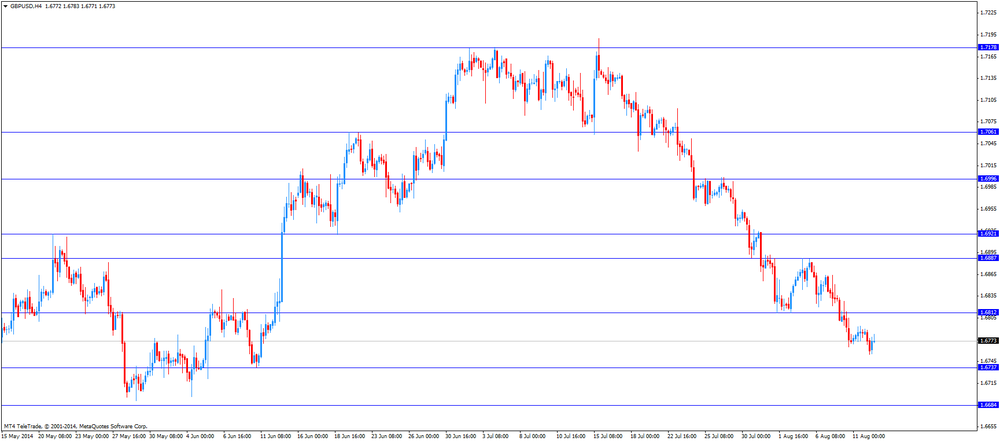

The British pound increased against the U.S. dollar in the absence of any major economic reports in the UK.

The New Zealand dollar dropped to a 2-month low against the U.S dollar due to decreasing demand for risk-related assets as geopolitical tensions in Iraq and Ukraine weighed on markets. But the kiwi recovered a part of its losses in the European trading session.

Real Estate Institute of New Zealand released its housing price index on Tuesday. The index declined 0.7% in July, after a 0.3% fall in June.

The Australian dollar traded slightly higher against the U.S. dollar. The National Australia Bank's business confidence index climbed to 11 in July from 8 in June.

House price index in Australia increased 1.8% in the second quarter, exceeding expectations for a 1.1% rise, after a 1.5% gain in the first quarter. The first quarter's figure was revised down from a 1.7% increase.

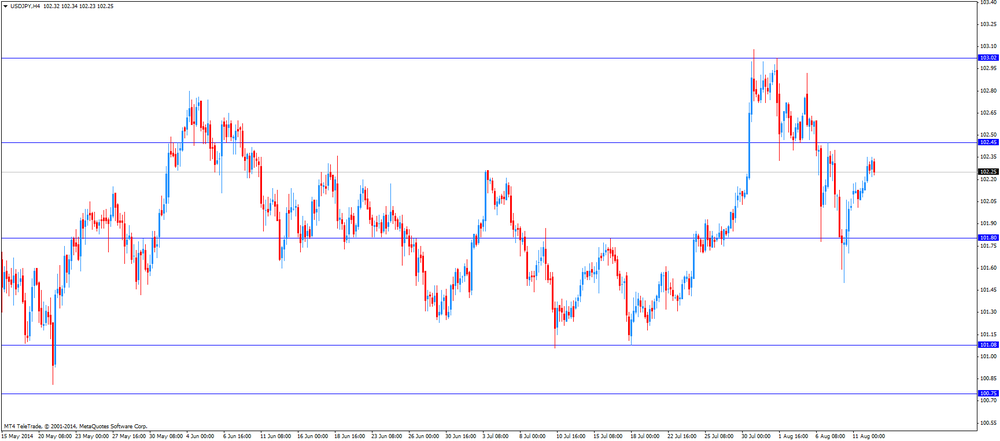

The Japanese yen traded higher against the U.S. dollar due to safe-haven demand. In the overnight trading session, some economic data was releases in Japan. Japan's industrial production decreased 3.4% in June, missing expectations for a 0.5% rise, after a 3.3% decline in May.

On a yearly basis, industrial production in Japan rose 3.1% in June, after a 3.2% increase in May.

Japan's corporate goods price index (CGPI) increased 4.3% in July from a year earlier. That was the 16th straight gain but the pace of rise slowed.

Gold prices increased significantly today, as market participants continue to follow the geopolitical events in Ukraine, Iraq and Gaza. The dynamics are also affected by lower bond yields to a minimum the United States over the past 14 months.

Recall also, on Monday, Haidar al-Abadi became the new Prime Minister of Iraq, instead of Nouri al-Maliki, who was in office the last eight years. However, Maliki refused to resign and has mobilized a task force in Baghdad. President Barack Obama said that the appointment of Abadi is an important step for Iraq against the militants of the Islamic state.

As for the Ukrainian events on Tuesday the Russian convoy of 280 trucks with humanitarian aid went toward Ukraine on the background of Western warnings against the use of aid as a pretext for invasion. Ukraine argues that the border is now the presence of Russian troops numbering 45 thousand., While NATO has warned that there is a "high probability" that Moscow will carry out military intervention in the east, where government troops close to the pro-Russian separatists.

Meanwhile, traders pay attention to data on economic sentiment in Germany and the euro area. Indicator of Economic Sentiment ZEW in Germany has dropped significantly in August 2014: the corresponding indicator lost 18.5 points and now stands at 8.6 points (long-term average of 24.6 points). Showing a decrease for the eighth time in a row, the indicator reached the lowest level since December 2012, and the current decline is the strongest since June 2012. Decline in economic sentiment, most likely due to the current geopolitical tensions that affected the German economy. In particular, the current figures on industrial production and incoming orders show a marked decrease in investment by German companies against the backdrop of uncertain sales prospects. As the economy in the euro zone is not gaining momentum, there are signs that economic growth in Germany in 2014 will be weaker than expected.

We also learned that the assets of the world's largest holder of gold investment institutions ETFs SPDR Gold Trust remained unchanged yesterday, after August 8, 2014. they decreased by 1.79 m and amounted to 795.86 tons (the lowest since June 30 2014goda).

The cost of the September futures contract for gold on COMEX today rose to $ 1314.40 per ounce.

U.S. stock futures were little changed amid speculation global crises from Ukraine to Iraq were easing.

Global markets:

Nikkei 15,161.31 +30.79 +0.20%

Hang Seng 24,689.41 +43.39 +0.18%

Shanghai Composite 2,221.59 -3.06 -0.14%

FTSE 6,621.79 -11.03 -0.17%

CAC 4,170.67 -27.03 -0.64%

DAX 9,114.35 -66.39 -0.72%

Crude oil $97.14 (-0.99%)

Gold $1315.10 (+0.53%)

(company / ticker / price / change, % / volume)

| Walt Disney Co | DIS | 87.51 | +0.01% | 13.7K |

| JPMorgan Chase and Co | JPM | 56.35 | +0.05% | 11.4K |

| Pfizer Inc | PFE | 28.28 | +0.11% | 2.4K |

| Chevron Corp | CVX | 127.89 | +0.14% | 0.2K |

| Boeing Co | BA | 120.98 | +0.15% | 1.4K |

| General Electric Co | GE | 25.83 | +0.16% | 8.7K |

| Verizon Communications Inc | VZ | 48.75 | +0.16% | 2.2K |

| McDonald's Corp | MCD | 93.75 | +0.24% | 0.3K |

| American Express Co | AXP | 87.17 | +0.25% | 0.1K |

| International Business Machines Co... | IBM | 188.00 | +0.28% | 0.6K |

| Intel Corp | INTC | 33.15 | +0.39% | 2.0K |

| AT&T Inc | T | 34.61 | +0.41% | 3.7K |

| Johnson & Johnson | JNJ | 101.16 | 0.00% | 0.2K |

| Microsoft Corp | MSFT | 43.20 | 0.00% | 25.4K |

| Cisco Systems Inc | CSCO | 25.19 | -0.16% | 8.3K |

| Wal-Mart Stores Inc | WMT | 74.01 | -0.47% | 0.4K |

| United Technologies Corp | UTX | 104.73 | -0.94% | 1.4K |

Upgrades:

Downgrades:

Other:

Walt Disney (DIS) target raised to $101 from $96 at Argus

Alcoa (AA) target raised to $16 from $12 at Cowen

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia National Australia Bank's Business Confidence July 8 11

01:30 Australia House Price Index (QoQ) Quarter II +1.7% +1.1% +1.8%

01:30 Australia House Price Index (YoY) Quarter II +10.9% +10.1%

02:30 New Zealand REINZ Housing Price Index, m/m July -0.3% -0.7%

04:30 Japan Industrial Production (MoM) (Finally) June -3.3% +0.5% -3.4%

04:30 Japan Industrial Production (YoY) (Finally) June +3.2% +3.1%

09:00 Eurozone ZEW Economic Sentiment August 48.1 41.3 23.7

09:00 Germany ZEW Survey - Economic Sentiment August 27.1 18.2 8.6

The U.S. dollar traded mixed to higher against the most major currencies. Investors monitor closely the situation in Ukraine and Iraq. Russia sent 280 trucks carrying humanitarian aid to Southeast Ukraine.

Iraqi President nominated a new Prime Minister but Nuri al-Maliki, the current Prime Minister, has refused to go.

The euro dropped against the U.S. dollar due to the weaker-than-expected economic sentiment from the Eurozone. The ZEW Centre for Economic Research released its economic sentiment index for Germany and the Eurozone. The economic sentiment index for Germany plunged to 8.6 in August from 27.1 in July. That was the lowest level since December 2012. Analysts had expected a decline to 18.2.

The drop was driven by geopolitical tensions.

Eurozone's ZEW economic sentiment index fell to 23.7 in August from 48.1 in July. Analysts had expected a decrease to 41.3.

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports in the UK.

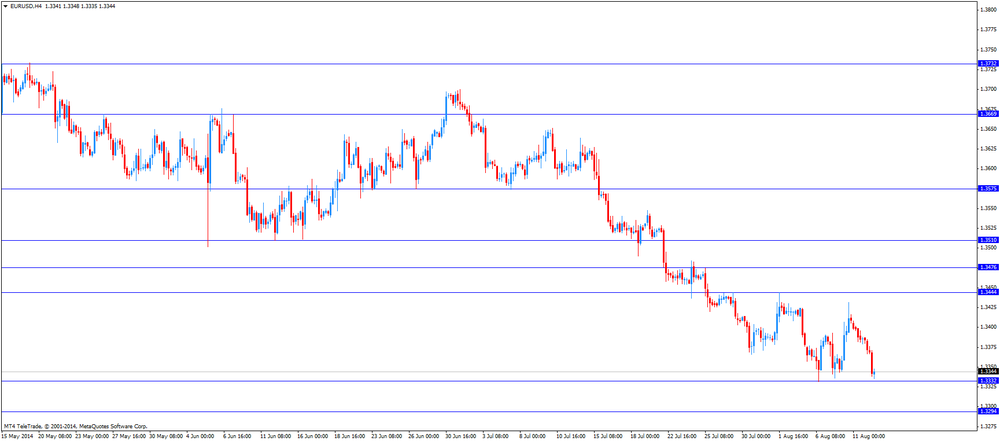

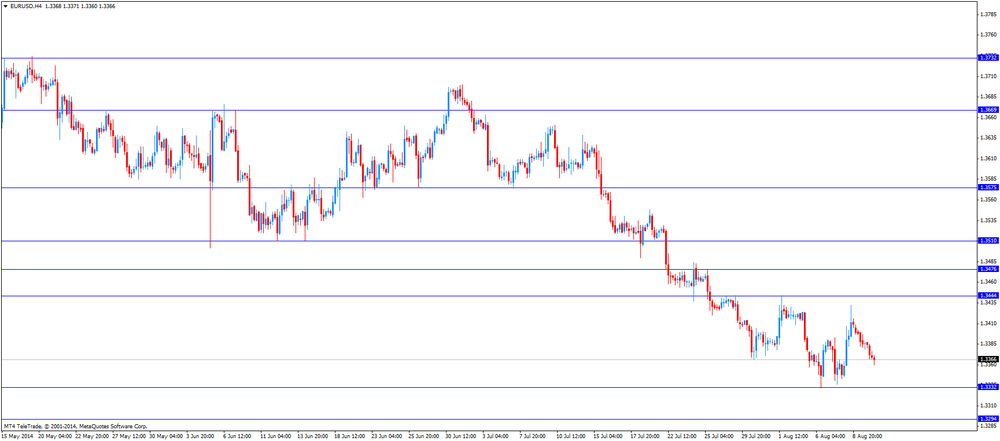

EUR/USD: the currency pair declined to $1.3335

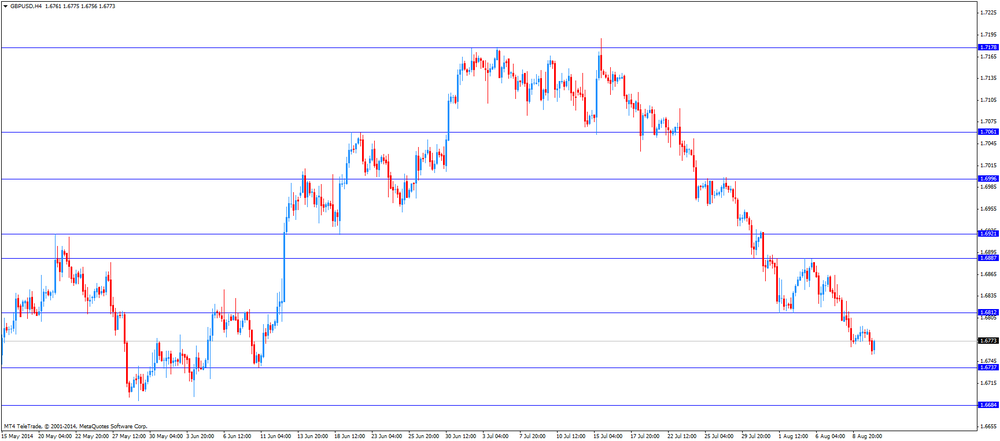

GBP/USD: the currency pair traded mixed

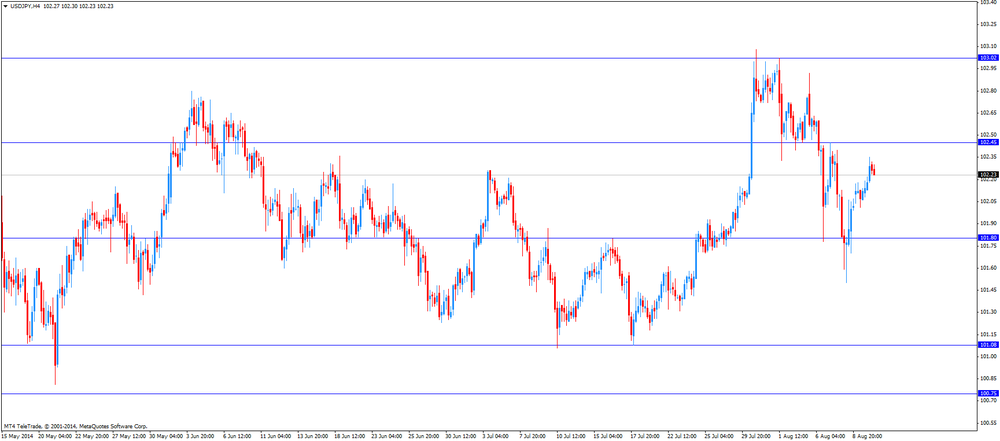

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

14:00 U.S. JOLTs Job Openings June 4635 4740

18:00 U.S. Federal budget July 70.5 -98.2

23:50 Japan Monetary Policy Meeting Minutes

23:50 Japan GDP, q/q (Preliminary) Quarter II +1.6% -1.7%

23:50 Japan GDP, y/y Quarter II +3.0%

EUR/USD

Offers $1.3500, $1.3475/85, $1.3445-50

Bids $1.3335-30, $1.3280/70

GBP/USD

Offers $1.6900, $1.6885-90, $1.6820-30, $1.6800

Bids $1.6750, $1.6700, $1.6693, $1.6665/60

AUD/USD

Offers $0.9350, $0.9315/20, $0.9300, $0.9285/90

Bids $0.9240, $0.9220/00, $0.9150

EUR/JPY

Offers Y137.50, Y137.20/25, Y137.00, Y136.75/80

Bids Y136.25/20, Y136.00, Y135.50, Y135.25

USD/JPY

Offers Y103.00, Y102.80/85, Y102.65/70, Y102.50

Bids Y102.00, Y101.80, Y101.50, Y101.20

EUR/GBP

Offers stg0.8010, stg0.8000

Bids stg0.7950

Stock indices traded lower due to growing tensions over Ukraine and the weak ZEW data from the Eurozone. Russia sent 280 trucks carrying humanitarian aid to Southeast Ukraine.

The ZEW Centre for Economic Research released its economic sentiment index for Germany and the Eurozone. The economic sentiment index for Germany plunged to 8.6 in August from 27.1 in July. That was the lowest level since December 2012. Analysts had expected a decline to 18.2.

The drop was driven by geopolitical tensions.

Eurozone's ZEW economic sentiment index fell to 23.7 in August from 48.1 in July. Analysts had expected a decrease to 41.3.

Henkel AG shares dropped 6.5% as the company reported that earnings growth will slow in the second half due to tensions in Ukraine and the Middle East.

Current figures:

Name Price Change Change %

FTSE 100 6,630.76 -2.06 -0.03%

DAX 9,143.8 -36.94 -0.40%

CAC 40 4,179.7 -18.00 -0.43%

Most Asian stock closed higher and extend gains for second day as tensions over Ukraine and Iraq eased.

Japanese stocks were supported by the weaker yen.

Japan's industrial production decreased 3.4% in June, missing expectations for a 0.5% rise, after a 3.3% decline in May.

On a yearly basis, industrial production in Japan rose 3.1% in June, after a 3.2% increase in May.

Japan's corporate goods price index (CGPI) increased 4.3% in July from a year earlier. That was the 16th straight gain but the pace of rise slowed.

Chinese stocks traded mixed. Investors are awaiting the release of industrial production, retail sales and fixed asset investment in China on Wednesday.

Indexes on the close:

Nikkei 225 15,161.31 +30.79 +0.20%

Hang Seng 24,689.41 +43.39 +0.18%

Shanghai Composite 2,221.59 -3.06 -0.14%

EUR/USD $1.3340-50, $1.3400, $1.3425

USD/JPY Y101.25, Y102.00-05, Y102.15, Y102.25

EUR/JPY Y136.20, Y136.50

GBP/USD $1.6900

EUR/GBP stg0.7940, stg0.7965, stg0.0.8050

AUD/USD $0.9240, $0.9300, $0.9370-75

USD/CAD C$1.0930-35, C$1.0950, C$1.0970-75, C$1.1000

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia National Australia Bank's Business Confidence July 8 11

01:30 Australia House Price Index (QoQ) Quarter II +1.7% +1.1% +1.8%

01:30 Australia House Price Index (YoY) Quarter II +10.9% +10.1%

02:30 New Zealand REINZ Housing Price Index, m/m July -0.3% -0.7%

04:30 Japan Industrial Production (MoM) (Finally) June -3.3% +0.5% -3.4%

04:30 Japan Industrial Production (YoY) (Finally) June +3.2% +3.1%

The U.S. dollar traded higher against the most major currencies. Geopolitical tensions in Iraq and Ukraine weighed on markets.

The New Zealand dollar dropped to a 2-month low against the U.S dollar due to decreasing demand for risk-related assets as geopolitical tensions in Iraq and Ukraine weighed on markets.

Real Estate Institute of New Zealand released its housing price index on Tuesday. The index declined 0.7% in July, after a 0.3% fall in June.

The Australian dollar traded mixed against the U.S. dollar after the better-than-expected economic data from Australia. The National Australia Bank's business confidence index climbed to 11 in July from 8 in June.

House price index in Australia increased 1.8% in the second quarter, exceeding expectations for a 1.1% rise, after a 1.5% gain in the first quarter. The first quarter's figure was revised down from a 1.7% increase.

The Japanese yen traded slightly lower against the U.S. dollar after the economic data from Japan. Japan's industrial production decreased 3.4% in June, missing expectations for a 0.5% rise, after a 3.3% decline in May.

On a yearly basis, industrial production in Japan rose 3.1% in June, after a 3.2% increase in May.

Japan's corporate goods price index (CGPI) increased 4.3% in July from a year earlier. That was the 16th straight gain but the pace of rise slowed.

EUR/USD: the currency pair decreased to $1.3370

GBP/USD: the currency pair fell to $1.6770

USD/JPY: the currency pair rose to Y102.35

The most important news that are expected (GMT0):

09:00 Eurozone ZEW Economic Sentiment August 48.1 41.3

09:00 Germany ZEW Survey - Economic Sentiment August 27.1 18.2

14:00 U.S. JOLTs Job Openings June 4635 4740

18:00 U.S. Federal budget July 70.5 -98.2

23:50 Japan Monetary Policy Meeting Minutes

23:50 Japan GDP, q/q (Preliminary) Quarter II +1.6% -1.7%

23:50 Japan GDP, y/y Quarter II +3.0%

EUR / USD

Resistance levels (open interest**, contracts)

$1.3480 (4367)

$1.3446 (618)

$1.3428 (37)

Price at time of writing this review: $ 1.3372

Support levels (open interest**, contracts):

$1.3358 (1968)

$1.3333 (4422)

$1.3303 (3302)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 50923 contracts, with the maximum number of contracts with strike price $1,3600 (4401);

- Overall open interest on the PUT options with the expiration date September, 5 is 55800 contracts, with the maximum number of contracts with strike price $1,3100 (6073);

- The ratio of PUT/CALL was 1.10 versus 0.94 from the previous trading day according to data from August, 8

GBP/USD

Resistance levels (open interest**, contracts)

$1.7002 (1363)

$1.6904 (886)

$1.6808 (521)

Price at time of writing this review: $1.6761

Support levels (open interest**, contracts):

$1.6694 (2781)

$1.6596 (1418)

$1.6498 (1644)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 20409 contracts, with the maximum number of contracts with strike price $1,7300 (1534);

- Overall open interest on the PUT options with the expiration date September, 5 is 27225 contracts, with the maximum number of contracts with strike price $1,6800 (3253);

- The ratio of PUT/CALL was 1.33 versus 1.27 from the previous trading day according to data from August, 8

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.