- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 12-07-2024

- AUD/JPY declines to 107.10 while holding just above the 20-day SMA support.

- A bearish outlook looms for the next few sessions, following a substantial dip from Thursday.

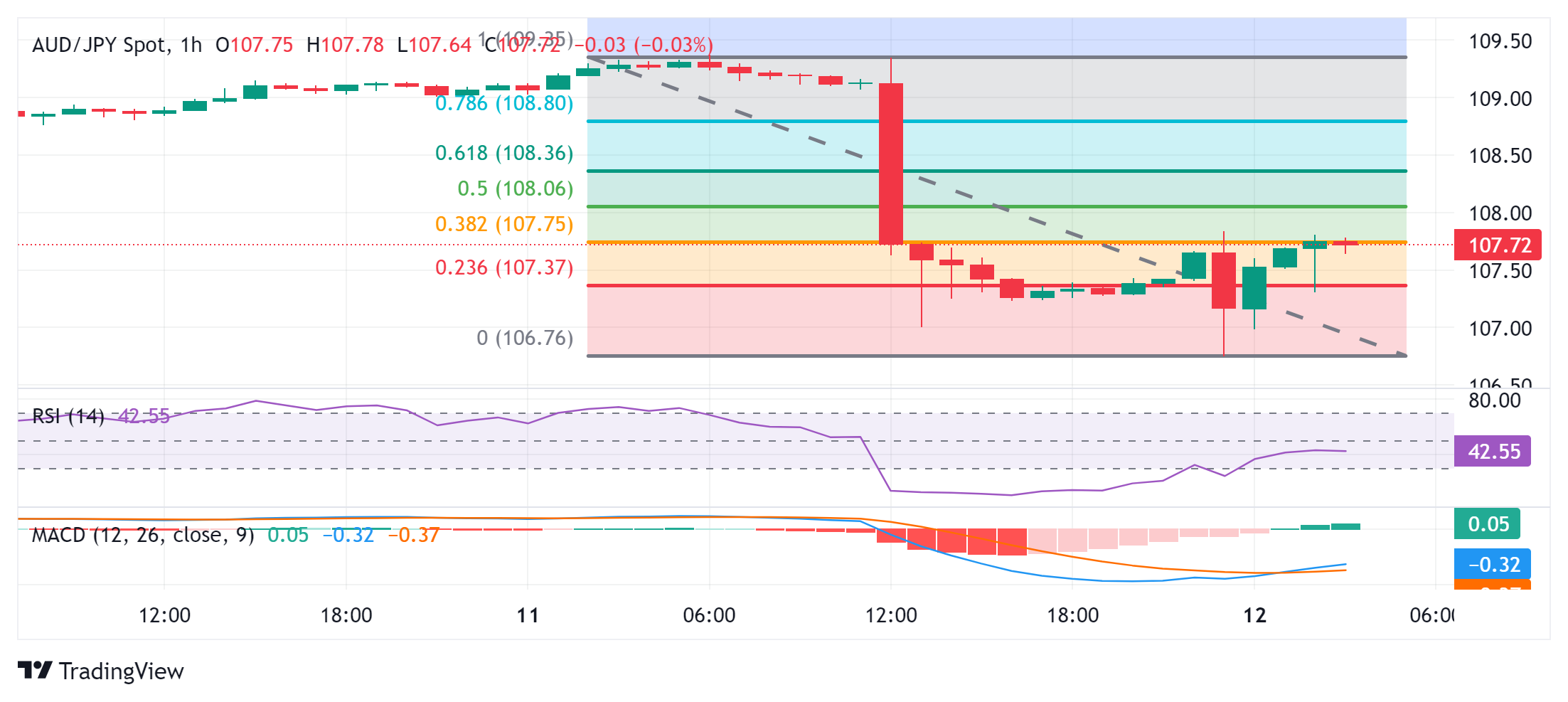

In Friday's trading session, a downward turn was observed for the AUD/JPY pair as it dipped by 0.23% to reach 107.10. This indicative decline marks a notable shift from the previous session's buoyancy, which saw the pair above the 109.00 mark. Present circumstances suggest a bearish outlook for the next few sessions, as it turns evident that the sellers have found their footing.

The daily Relative Strength Index (RSI) for the AUD/JPY marked a significant dip from Thursday's 79 to 54, drifting even near into negative territory. This trend shift hints at a weakening upward momentum, potentially signifying more bearish days ahead. In concert with this, the Moving Average Convergence Divergence (MACD) demonstrates rising red bars.

AUD/JPY daily chart

Looking at the broader perspective, the AUD/JPY still displays signs of possible bearish sentiment, given its position just slightly above the 20-day SMA support at 107.10. In case of further downward action, immediate support levels at 107.00 and 106.00 are key areas to watch. However, to avert further potential losses, buyers must target a recovery that extends towards the 108.00 barrier.

- EUR/USD climbed into a five-week peak amid broad-market Greenback selling.

- US PPI inflation rose faster than expected in June, but investors pin hopes on rate cuts.

- ECB rate cut looms ahead next week, US Retail Sales due next Tuesday.

Broad-market hopes for an accelerated pace of rate cuts from the US Federal Reserve (Fed) reached a fever pitch on Friday despite a notable upswing in US Producer Price Index (PPI) wholesale inflation. The Fiber extended into a third straight week of gains as investor risk appetite gets pinned to the ceiling.

Forecasting the Coming Week: Fed rate cut bets and the ECB should rule the sentiment

June’s core Producer Price Index (PPI) for wholesale inflation in the US rose to 3.0% YoY, surpassing the expected 2.5%. The previous period's figure was adjusted upward to 2.6% from the initial 2.3%. Despite the notable increase in producer-level inflation, market focus has shifted to the earlier decrease in Consumer Price Index (CPI) inflation, raising expectations for a rate cut.

The CME's FedWatch tool indicates a significant likelihood of a quarter-point rate cut at the Federal Open Market Committee's (FOMC) meeting on September 18. Rate traders are currently factoring in at least three rate cuts by 2024, more than the one or two cuts projected by the Fed by December.

Economic Indicator

Producer Price Index ex Food & Energy (YoY)

The Producer Price Index ex Food & energy released by the Bureau of Labor statistics, Department of Labor measures the average changes in prices in primary markets of the US by producers of commodities in all states of processing. Those volatile products such as food and energy are excluded in order to capture an accurate calculation. Generally speaking, a high reading is seen as positive (or bullish) for the USD, whereas a low reading is seen as negative (or bearish).

Read more.Last release: Fri Jul 12, 2024 12:30

Frequency: Monthly

Actual: 3%

Consensus: 2.5%

Previous: 2.3%

Source: US Bureau of Labor Statistics

In other US economic data released on Friday, the University of Michigan's Consumer Sentiment Index survey dropped to a seven-month low of 66.0, falling short of the expected increase to 68.5. This reflects increasing discouragement among US consumers about the economic outlook. Additionally, the University of Michigan's 5-year Consumer Inflation Expectations decreased slightly in July to 2.9% from the previous 3.0%. Long-term consumer inflation expectations remain significantly higher than the Fed's target annual inflation rate of 2.0%

US Retail Sales figures are on the docket for next Tuesday, and Euro traders will be buckling down for the wait to next week’s latest rate call from the European Central Bank (ECB), slated for early next Thursday. The ECB recently delivered a quarter-point rate trim in early June, but odds of a follow-up cut are looking unlikely, and markets are broadly forecasting a cautious hold in July.

Euro PRICE This week

The table below shows the percentage change of Euro (EUR) against listed major currencies this week. Euro was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.62% | -1.35% | -1.74% | -0.07% | -0.50% | 0.31% | -0.19% | |

| EUR | 0.62% | -0.53% | -0.81% | 0.89% | 0.28% | 1.30% | 0.77% | |

| GBP | 1.35% | 0.53% | -0.33% | 1.44% | 0.81% | 1.79% | 1.30% | |

| JPY | 1.74% | 0.81% | 0.33% | 1.71% | 1.29% | 2.26% | 1.64% | |

| CAD | 0.07% | -0.89% | -1.44% | -1.71% | -0.46% | 0.37% | -0.08% | |

| AUD | 0.50% | -0.28% | -0.81% | -1.29% | 0.46% | 0.98% | 0.49% | |

| NZD | -0.31% | -1.30% | -1.79% | -2.26% | -0.37% | -0.98% | -0.48% | |

| CHF | 0.19% | -0.77% | -1.30% | -1.64% | 0.08% | -0.49% | 0.48% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

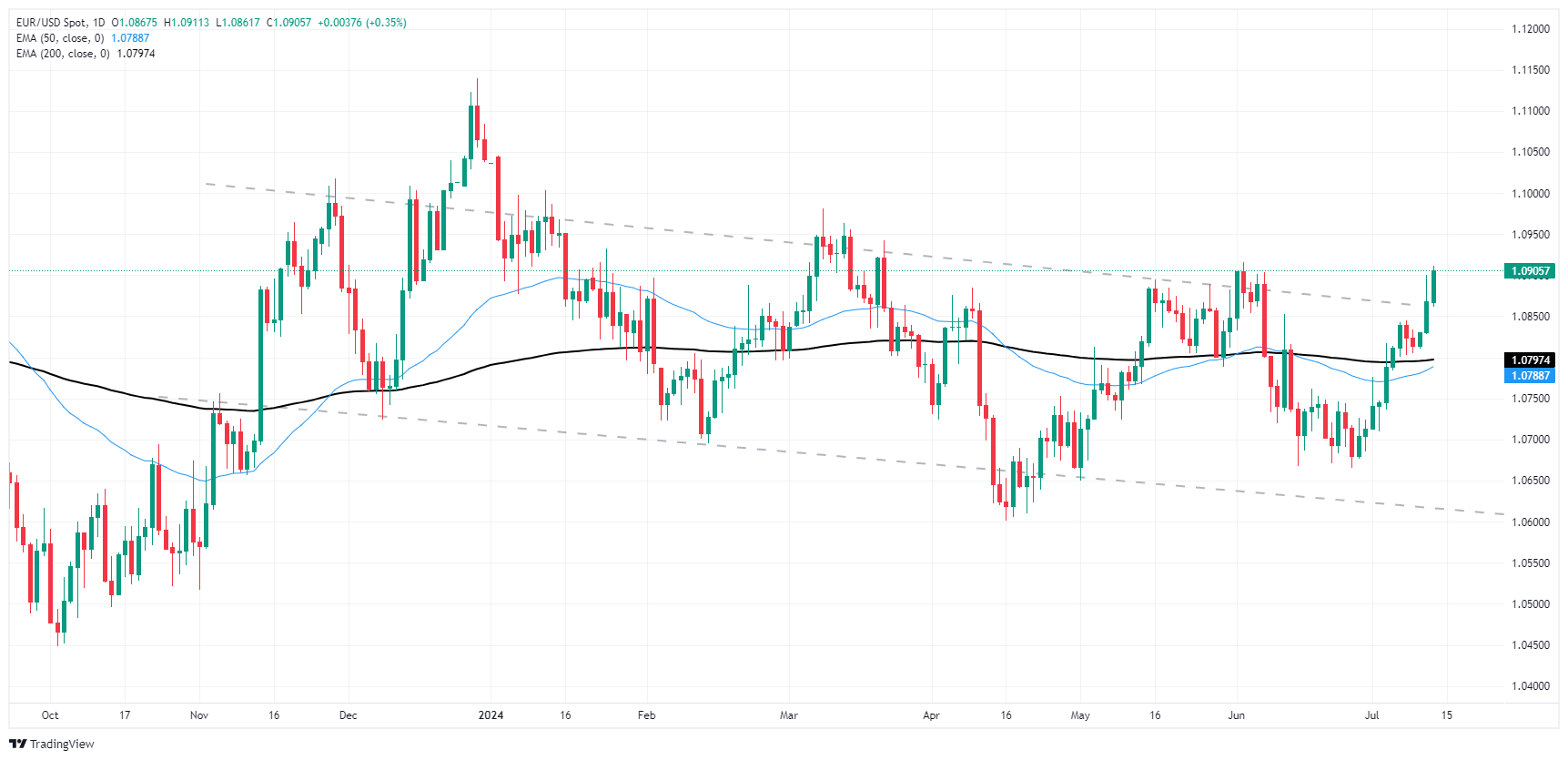

EUR/USD technical outlook

EUR/USD has chalked in a third straight week of gains, closing Friday a hair above the 1.0900 handle. The pair has risen 2.3% from late June’s swing low into 1.0666, and intraday price action is poised for a clash with technical resistance from June’s early peaks near 1.0920.

Fiber broken out of the topside of a rough descending channel on daily candlesticks. Despite closing in the green for all but two of the last twelve consecutive trading days, bullish momentum is poised to run out of gas and could see a bearish pullback to the 200-day Exponential Moving Average (EMA) at 1.0797.

EUR/USD hourly chart

EUR/USD daily chart

Euro FAQs

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- Silver retreats over 2% yet holds above $30.78 'double bottom' neckline.

- Downward momentum noted, but RSI in bullish range hints at potential rebound.

- Key support at $30.50; further levels at $30.00 and $29.82/79 zone.

- Resistance points at $31.00, $31.75, $32.15, aiming for the YTD high of $32.51.

Silver price reversed course and registered losses of more than 2% on Friday, though it remained above the ‘double bottom’ neckline, keeping the short-term uptrend alive. At the time of writing, the XAG/USD trades at $30.78 after hitting a daily high of $31.43.

XAG/USD Price Analysis: Technical outlook

Silver’s daily chart depicts the grey metal’s uptrend is in play, but Friday's price action hints that sellers stepped in aggressively, achieving a daily close near Thursday’s open at $30.79.

Momentum tilted to the downside, as depicted by the Relative Strength Index (RSI), which aimed lower but stood in bullish territory. Hence, XAG/USD could be headed for a pullback before the uptrend continues.

If XAG/USD drops below the psychological $30.50 figure, that could drive the spot price toward the $30.00 level. Once cleared, the next stop would be the confluence of the April 12 high and the 50-day moving average (DMA) at $29.82/79.

On the flip side, the XAG/USD first resistance would be $31.00. Once cleared, the next resistance would be $31.75, followed by the $32.00 psychological figures. Once surpassed, the May 29 peak of $32.15 emerges, ahead of the year-to-date (YTD) high at $32.51. Further gains are seen above the latter.

XAG/USD Price Action – Daily Chart

Silver FAQs

Silver is a precious metal highly traded among investors. It has been historically used as a store of value and a medium of exchange. Although less popular than Gold, traders may turn to Silver to diversify their investment portfolio, for its intrinsic value or as a potential hedge during high-inflation periods. Investors can buy physical Silver, in coins or in bars, or trade it through vehicles such as Exchange Traded Funds, which track its price on international markets.

Silver prices can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can make Silver price escalate due to its safe-haven status, although to a lesser extent than Gold's. As a yieldless asset, Silver tends to rise with lower interest rates. Its moves also depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAG/USD). A strong Dollar tends to keep the price of Silver at bay, whereas a weaker Dollar is likely to propel prices up. Other factors such as investment demand, mining supply – Silver is much more abundant than Gold – and recycling rates can also affect prices.

Silver is widely used in industry, particularly in sectors such as electronics or solar energy, as it has one of the highest electric conductivity of all metals – more than Copper and Gold. A surge in demand can increase prices, while a decline tends to lower them. Dynamics in the US, Chinese and Indian economies can also contribute to price swings: for the US and particularly China, their big industrial sectors use Silver in various processes; in India, consumers’ demand for the precious metal for jewellery also plays a key role in setting prices.

Silver prices tend to follow Gold's moves. When Gold prices rise, Silver typically follows suit, as their status as safe-haven assets is similar. The Gold/Silver ratio, which shows the number of ounces of Silver needed to equal the value of one ounce of Gold, may help to determine the relative valuation between both metals. Some investors may consider a high ratio as an indicator that Silver is undervalued, or Gold is overvalued. On the contrary, a low ratio might suggest that Gold is undervalued relative to Silver.

- NZD/USD gains momentum resuming back above the 20-day SMA.

- Bulls attempt to maintain control after Thursday's recovery transitioned the technical outlook towards a slightly bullish sentiment.

On Friday's session, the NZD/USD demonstrated renewed strength after recovering from a period of decline, resulting in a rise to around 0.6120.

Daily technical indicators present a cautiously optimistic picture. The Relative Strength Index (RSI) currently stands at 52 in positive territory. This rise signifies a strengthening bullish momentum, however, the market is still far from confirming a positive outlook. The Moving Average Convergence Divergence (MACD) prints decreasing red bars, indicative of slowing bearish momentum.

NZD/USD daily chart

On the upside, bulls will face a challenge at 0.6150 and 0.6200. Achieving a decisive close above these levels would signal a further establishment of control towards the bulls.

Downward, the first line of defense lies at the convergence of the 100 and 200-day SMAs at 0.6070. A bearish turn below this level would incline the outlook back to the bearish side, potentially triggering a corrective slide towards 0.6050 and then to the 0.6030 support levels.

- GBP/USD approaches 1.3900 for the first time in a year.

- US PPI producer-level inflation rose faster than expected in June.

- Despite inflation risks, markets have pinned hopes on a September rate cut.

GBP/USD wrapped up Friday on the high side of a two-week rally as the US Dollar broadly buckles under the weight of investors dog-piling into hopes of getting a rate cut from the Federal Reserve (Fed) in September. Markets are shrugging off an unexpected uptick in Producer Price Index (PPI) wholesale inflation, which accelerated faster than expected in June and could put pressure on key Fed inflation metrics looking forward.

Forecasting the Coming Week: Fed rate cut bets and the ECB should rule the sentiment

In June, the core Producer Price Index (PPI) for wholesale inflation in the US accelerated to 3.0% year-over-year, exceeding the expected 2.5%. Additionally, the previous period's figure was revised upward to 2.6% from the initial 2.3%. Despite the significant increase in producer-level inflation, the market's attention has turned to the decrease in Consumer Price Index (CPI) inflation earlier in the week, leading to heightened expectations of a rate cut.

According to the CME's FedWatch tool, there is a significant probability of a quarter-point rate cut at the Federal Open Market Committee's (FOMC) meeting on September 18. Rate traders are also currently pricing in at least three rate cuts in total for 2024, which is more than the one or two cuts projected by the Fed by December.

Economic Indicator

Producer Price Index ex Food & Energy (YoY)

The Producer Price Index ex Food & energy released by the Bureau of Labor statistics, Department of Labor measures the average changes in prices in primary markets of the US by producers of commodities in all states of processing. Those volatile products such as food and energy are excluded in order to capture an accurate calculation. Generally speaking, a high reading is seen as positive (or bullish) for the USD, whereas a low reading is seen as negative (or bearish).

Read more.Last release: Fri Jul 12, 2024 12:30

Frequency: Monthly

Actual: 3%

Consensus: 2.5%

Previous: 2.3%

Source: US Bureau of Labor Statistics

In other US economic data released on Friday, the University of Michigan's Consumer Sentiment Index survey dropped to a seven-month low of 66.0, falling short of the expected increase to 68.5. This reflects increasing discouragement among US consumers about the economic outlook. Additionally, the University of Michigan's 5-year Consumer Inflation Expectations decreased slightly in July to 2.9% from the previous 3.0%. It's worth noting that long-term consumer inflation expectations remain significantly higher than the Fed's target annual inflation rate of 2.0%.

Coming up next week, the Sterling will face down the UK’s own Consumer Price Index (CPI) inflation release, slated for next Wednesday. UK labor data and Retail Sales will follow up in the back half of the week, and on the Greenback side, US Retail Sales will drop earlier in the week on Tuesday.

British Pound PRICE This week

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.61% | -1.32% | -1.78% | -0.07% | -0.50% | 0.31% | -0.19% | |

| EUR | 0.61% | -0.52% | -0.86% | 0.86% | 0.27% | 1.27% | 0.77% | |

| GBP | 1.32% | 0.52% | -0.37% | 1.41% | 0.79% | 1.79% | 1.30% | |

| JPY | 1.78% | 0.86% | 0.37% | 1.74% | 1.32% | 2.29% | 1.68% | |

| CAD | 0.07% | -0.86% | -1.41% | -1.74% | -0.48% | 0.38% | -0.09% | |

| AUD | 0.50% | -0.27% | -0.79% | -1.32% | 0.48% | 1.00% | 0.50% | |

| NZD | -0.31% | -1.27% | -1.79% | -2.29% | -0.38% | -1.00% | -0.49% | |

| CHF | 0.19% | -0.77% | -1.30% | -1.68% | 0.09% | -0.50% | 0.49% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

GBP/USD technical outlook

Cable rallied back into 12-month highs on Friday, extending into a second straight week of firm gains and inching back toward the 1.3000 handle. GBP/USD has risen nearly 3% in July, climbing from the month’s early swing low to 1.2615.

GBP/USD has closed in the green for all but two of the last twelve consecutive trading days as the pair vaults upwards from the 200-day Exponential Moving Average (EMA) at 1.2620. Bulls will be looking to drag bids into 2023’s peak of 1.3142, while bearish pressure will be looking to drag price action back to the 50-day EMA at 1.2715.

GBP/USD hourly chart

GBP/USD daily chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, aka ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- NZD/JPY continued its significant decline in Friday's session.

- The bearish activity remains with the pair below the crucial 20-day SMA, suggesting persistent control by the bears.

- Indicators in negative terrain now signal a bearish short-term outlook for the pair.

During Friday's trading session, the NZD/JPY pair continued its substantial drop from Thursday, recording a further loss of 0.20% and settling at 96.65. The pair remains well below the 20-day Simple Moving Average (SMA) of 97.80, reinforcing the bearish outlook in the short term.

The daily chart signals sustained negative conditions. The Relative Strength Index (RSI) improved slightly from Thursday's session but still remains in the negative territory at 40, indicating a continued declining market momentum. The Moving Average Convergence Divergence (MACD) concurs with this scenario, printing rising red bars indicative of rising selling activity.

NZD/JPY daily chart

Bearing in mind the bearish momentum, immediate support levels lie at 96.50 96.00, and 95.50. Breaking these points would further validate the bearish perspective. On the other hand, resistance encounters are expected at past support levels of 97.00, 97.70 (20-day SMA), and the critical level of 98.00.

- Gold price sticks to key support level, set for third consecutive weekly gain on Fed rate cut expectations.

- US PPI rises above estimates; University of Michigan Consumer Sentiment drops, inflation expectations moderate.

- CME FedWatch Tool indicates 94% chance of September rate cut; US Dollar Index falls over 0.40% to 104.09.

Gold’s price clung above $2,400 on Friday after hitting a daily low of $2,391. The golden metal is set to extend its gains for the third consecutive week on speculation that the Federal Reserve (Fed) might begin its easing cycle in September. Data from the US Department of Labor showed that factory prices rose above estimates, though they failed to underpin the Greenback, a tailwind for the precious metal.

The XAU/USD trades at $2,415, virtually unchanged. The US Bureau of Labor Statistics on Friday revealed that the Producer Price Index (PPI) jumped modestly in June, above analysts’ estimates. The University of Michigan Consumer Sentiment preliminary July reading deteriorated, but inflation expectations have tempered.

According to the CME FedWatch Tool, traders are pricing a 94% chance that the Fed might cut rates a quarter of a percentage point in September.

Hence, US Treasury bond yields are dropping, a tailwind for the non-yielding metal, which benefits from low yields. The US 10-year Treasury note coupon is yielding 4.19%, two basis points below its opening price.

Sources cited by Barron’s stated, “Inflation is coming down, but it is not going to disappear. Gold and gold miners are attractive inflation hedges.”

Meanwhile, Fed officials have remained cautious regarding monetary policy shifts. Chicago Fed President Goolsbee noted that recent inflation data is "favorable" and could shorten the Fed's journey toward its inflation goals.

St. Louis Fed President Alberto Musalem stated that the current interest rate level is appropriate for the current conditions and expects the economy to grow between 1.5% and 2% this year.

Meanwhile, the US Dollar Index (DXY), which tracks the Greenback against a basket of six currencies, plummeted more than 0.40% to 104.09.

Daily digest market movers: Gold price flatlines post US PPI

- June US Producer Price Index (PPI) increased by 0.2% MoM, exceeding the expected 0.1% and higher than May's 0%. Core PPI rose by 0.4% MoM, surpassing the forecast of 0.2%.

- On an annual basis, PPI ticked up from 2.4% to 2.6%, beating the forecast of 2.3%. Underlying inflation increased to 3%, up from 2.6%.

- UoM Consumer Sentiment dropped from 68.2 in June to 66.0 in July. Inflation expectations for one year were as expected at 2.9%, down from 3%.

- US Dollar Index (DXY), which tracks the value of a basket of six currencies against the US Dollar, fell more than 0.30% to 104.12.

- According to the CME FedWatch Tool, the odds of a September rate cut are 88%, up from 85% on Thursday.

- December 2024 fed funds rate futures contract implies that the Fed will ease policy by 49 basis points (bps) toward the end of the year, up from 39 a day ago.

- Bullion prices retreated slightly due to the People's Bank of China (PBoC) decision to halt gold purchases in June, as it did in May. By the end of June, China held 72.80 million troy ounces of the precious metal.

Technical analysis: Gold buyers take a respite, Gold price hovers above $2,400

Gold price consolidates above $2,400 for the second straight day after decisively breaking the Head-and-Shoulders neckline. Momentum favors buyers, though as depicted by the flat Relative Strength Index (RSI), they’re taking a respite before testing higher prices.

That said, the path of least resistance is to the upside. The XAU/USD’s first resistance would be the year-to-date high of $2,450, ahead of the $2,500 mark. Conversely, if Gold slides below the $2,400 figure, the next demand zone will be July 5 high at $2,392. If cleared, XAU/USD would continue to $2,350.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

- Dow Jones climbed 450 points to set a fresh all-time peak above 40,200.00.

- Markets are broadly shrugging off an acceleration of US PPI wholesale inflation.

- US consumer sentiment surveys worsened, but 5-year inflation expectations eased.

The Dow Jones Industrial Average (DJIA) soared over 450 points on Friday as markets pile back into renewed hopes for rate cuts from the Federal Reserve (Fed) in September even as US Producer Price Index (PPI) wholesale inflation accelerated faster than expected in June. Markets have entirely buried the needle on rate cut forecasts, pricing in three rate cuts in 2024 and a 95% chance of a rate trim on September 18.

June’s US core PPI wholesale inflation accelerated to 3.0% YoY, entirely eclipsing the forecast 2.5%, and the previous period’s print also saw an upside revision to 2.6% from the initial 2.3%. Despite the sharp uptick in producer-level inflation, markets are instead refocusing on a decline in Consumer Price Inflation (CPI) inflation earlier in the week in order to lean firmly into rate cut hopes.

According to the CME’s FedWatch tool, rate market bets of at least a quarter-point rate trim at the Federal Open Market Committee’s (FOMC) September 18 rate call. Rate traders are also now pricing in at least three rate cuts in total for 2024, a step above the Fed’s own projected one or two rate cuts by December.

Elsewhere in US data on Friday, the University of Michigan’s Consumer Sentiment Index survey stumbled to a seven-month low of 66.0 from the previous 68.2, undercutting the forecast uptick to 68.5 as US consumers turn increasingly discouraged about the economic outlook. UoM 5-year Consumer Inflation Expectations eased slightly in July, ticking down to 2.9% from the previous 3.0%, but markets are putting significant effort into ignoring how much higher long-run consumer inflation expectations are compared to the Fed’s target annual inflation rate of 2.0%.

Dow Jones news

Dow Jones soared on Friday, rising a scorching 450 points and is set to chalk in one of the index’s best three-day performances for the year. All but four of the Dow Jones’ constituent securities are in the green on Friday, with losses led by JPMorgan Chase & Co. (JPM), which declined -0.94% to $205.50 per share. Despite posting better-than-expected second-quarter earnings, the stock is still sliding after trading into all-time highs ahead of Q2 earnings. JPM notched in QoQ profits of 18.1 billion, bringing EPS to $6.12, handily beating the forecast estimates of $5.88.

On the high side, Intel Corp. (INTC) rose nearly 5%, climbing over $35.00 per share as the AI market rush continues. Intel Chief Technology Officer Greg Lavender noted recently that he anticipates Intel to reach $1 billion in annual subscription revenue from AI-related cloud computing subscriptions by fiscal year end of 2027. While the growth projection in AI services revenue is nothing short of stellar, and is helping to bolster Intel stock even higher, the figure is still dwarfed by Intel’s main semiconductor business, which routinely pulls in revenue in excess of $50 billion annually.

Dow Jones technical outlook

Dow Jones tapped into a fresh all-time high of 40,260.24 on Friday, climbing over 400 points as broader markets surge higher. DJIA climbed over a full percent through the last session of the trading week, and the Dow Jones is now up over 6% from the last notable swing low into the 38,000.00 handle in late May.

The Dow Jones index, posting fresh record peak bids, is now up 6.82% in 2024, and has climbed an impressive 24.59% from the index’s swing low into 32,300.00 in late 2023. Daily candles are trading well above the 200-day Exponential Moving Average (EMA) at 37,733.00, and bidders will be looking to put distance between bids and the nearest technical floor priced in at the 50-day EMA near 39,095.00.

Dow Jones five minute chart

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.

- AUD/USD remains at highest level since January near 0.6800.

- Hot PPI data didn’t stop the pair in its upward trend.

- Monetary policy divergence between RBA and Fed stir the pair.

The Australian Dollar (AUD) upheld its positive trajectory against the USD in Friday's session, rising by 0.30% to 0.6780. The AUD resumed its gains with market participants adjusting their stakes on the Federal Reserve (Fed) after the release of US inflation figures. Hot Producer Price Index (PPI) figures form the US didn’t trigger a recovery in the Greenback.

The Reserve Bank of Australia (RBA) is poised to be among the last G10 nations' central banks to initiate rate cuts, a factor that could extend the AUD's gains.

Daily market movers: AUD may extend gains as RBA delays cuts and markets grow confident in a more dovish Fed

- On the economic data front, the Producer Price Index (PPI) for final demand in the US rose 2.6% YoY in June, according to data published by the US Bureau of Labor Statistics on Friday.

- This result was higher than the forecasted 2.3%, surpassing the previous 2.2% rise in May. Core PPI also exceeded market expectations at 3%.

- However, sentiment data from the University of Michigan came in below expectation at 66.0, compared to the predicted 68.5 and the previous 68.2.

- CME Fedwatch Tool predicts more than 80% chance for 25 bps cut in September.

- On the other hand, speculation is growing that RBA might delay the global rate-cutting cycle or even raise interest rates again as a result of high inflation in Australia. This view compels RBA to maintain its hawkish stance.

- Furthermore, China, one of Australia's closest trade partners, has announced its Trade Balance data for June showing a trade surplus of $99.05 billion, a significant increase from the previous figure of $82.62 billion.

Technical analysis: AUD/USD maintains highs, signs of looming correction

The AUD/USD maintains a bullish stance, retaining the heights reached in January. However, the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) indicate that they are nearing overbought terrain, suggesting a possible impending correction.

Buyers are looking to maintain the 0.6760-0.6780 range and surpass the 0.6800 area if possible. Conversely, the 0.6670, 0.6650 and 0.6630 levels are set as support ranges in case of a correction.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

- Mexican Peso extends gains as USD/MXN reaches 17.68 after hitting five-week low of 17.62.

- Mexico’s Industrial Production rebounds in May, indicating resilience amid economic slowdown.

- Banxico minutes suggest potential rate adjustments, while US producer inflation rises and consumer sentiment deteriorates.

The Mexican Peso extended its rally for the ninth consecutive trading day against the Greenback on Friday following the release of Mexico’s Industrial Product figures and June’s US inflation data on the producer side. The USD/MXN trades at 17.68, refreshing five-week lows of 17.62.

Despite the annual weakening, Mexico’s Industrial Production showed resilience by recovering in May, following April’s plunge in monthly figures. This recovery underscores a positive outlook amidst the country’s ongoing economic slowdown.

In the meantime, the latest Bank of Mexico (Banxico) minutes revealed that the disinflation process has evolved and may spark discussions to adjust interest rates at upcoming meetings. The board acknowledged the labor market's strength, yet stated that growth has shown signs of weakness.

Meanwhile, Jose Luis Ortega, CIO of Black Rock Mexico, commented that inflation in Mexico wouldn’t return to Banxico’s 3% goal by the end of 2025. He added that Banxico’s easing cycle will be gradual, though adjustments will continue.

Across the border, further inflation data revealed by the US Bureau of Labor Statistics (BLS) showed that prices paid by producers picked up above economists' estimates, while US Consumer Sentiment revealed by the University of Michigan (UoM) deteriorated.

In the meantime, Federal Reserve (Fed) officials grabbed the headlines and remained cautious in regard to monetary policy shifts. Chicago Fed President Goolsbee said that recent inflation data is “favorable” and might shorten the Fed’s last mile on inflation.

St. Louis Fed President Alberto Musalem said that the current interest rate level is appropriate for current conditions and sees the economy growing between 1.5% and 2% this year.

Daily digest market movers: Mexican Peso prolongs its gains, despite Banxico's dovish tilt

- Banxico board members project growth to be lower than expected, as Mexico’s economic activity has been weak since the end of 2023. Most policymakers mentioned that inflation will converge toward the target in the last quarter 2025.

- They added that services inflation does not show a clear downward trend, which was one of the reasons for keeping rates unchanged at the June meeting.

- Mexico’s Industrial Production (IP) in May came at 0.7% MoM, higher than April’s -0.4% and estimates of 0.4%. In the 12 months to May, IP was 1%, which fell sharply from 5.1% in April and missed the 1.2% projected.

- Mexico’s June inflation figures were higher than expected due to a rise in food prices when most economists expect Banxico to resume lowering interest rates.

- June US Producer Price Index (PPI) expanded by 0.2% MoM, higher than the 0.1% expected and above May’s 0%. Core PPI was hotter than the 0.2% foreseen, at 0.4% MoM.

- Annually based, PPI ticked up from 2.4% to 2.6%, above forecasts of 2.3%. Underlying inflation was 3%, up from 2.6%.

- UoM Consumer Sentiment declined from 68.2 in June to 66.0 in July. Inflation expectations for one year came as expected at 2.9%, down from 3%.

- US Dollar Index (DXY), which tracks the value of a basket of six currencies against the US Dollar, tumbled more than 0.30% and is down at 104.12.

- According to the CME FedWatch Tool data, the odds for a September cut are 88%, up from 85% on Thursday.

Technical analysis: Mexican Peso capitalizes USD weakness as USD/MXN drops below 17.70

The USD/MXN continues to slip further, with traders eyeing a test of the 17.50 psychological level. Momentum remains on the seller's side, as depicted by the Relative Strength Index (RSI), though key support levels in the exotic pair will be tested soon.

If USD/MXN drops below 17.60, the next support would be the confluence of the December 5 high and the 50-day Simple Moving Average (SMA) near 17.56/60, followed by the 200-day SMA at 17.28. Further losses would test the 100-day SMA at 17.20.

Conversely, USD/MXN buyers need to clear the June 24 cycle low of 17.87, which has turned into resistance, before challenging the 18.00 figure. Further upside potential is seen above the July 5 high at 18.19, followed by the June 28 high of 18.59, allowing buyers to aim for the YTD high of 18.99.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- The Canadian Dollar backslid on Friday as CAD traders retreat for the weekend.

- Canada revealed another sharp contraction in new building permits.

- US PPI wholesale inflation accelerated, but markets are trying to shrug it off.

The Canadian Dollar (CAD) shed weight on Friday, falling to the bottom as one of the poorest-performing major currencies for the last session of the trading week. Broader markets are shaking off an unexpected acceleration of US Producer Price Index (PPI) wholesale inflation, instead focusing on cooling Consumer Price Index (CPI) inflation from earlier in the week.

Canada posted 2024’s second-steepest contraction in Building Permits in May, hobbling the CAD further and setting the Canadian Dollar up to churn on the low side as traders await next Tuesday’s Canadian CPI inflation print.

Daily digest market movers: Canadian Dollar stumbles on bad housing data

- Canadian Building Permits contracted 12.2% in May, the second-steepest decline in 2024.

- US core PPI wholesale inflation accelerated notably in June, rising to 3.0% YoY compared to the expected 2.5%.

- The previous period’s print was also revised higher to 2.6% from the initial 2.3%.

- MoM core US PPI rose 0.4% MoM, double the forecast 0.2% while the previous month’s print was likewise revised upwards to 0.3% from the initial 0.0%.

- The University of Michigan Consumer Sentiment Index for July declined to a seven-month low of 66.0 from the previous 68.2, reversing the forecast uptick to 68.5.

- Despite the upswing in producer-level inflation, markets are broadly leaning into the bullish side, focusing on Thursday’s cooler-than-expected CPI inflation print.

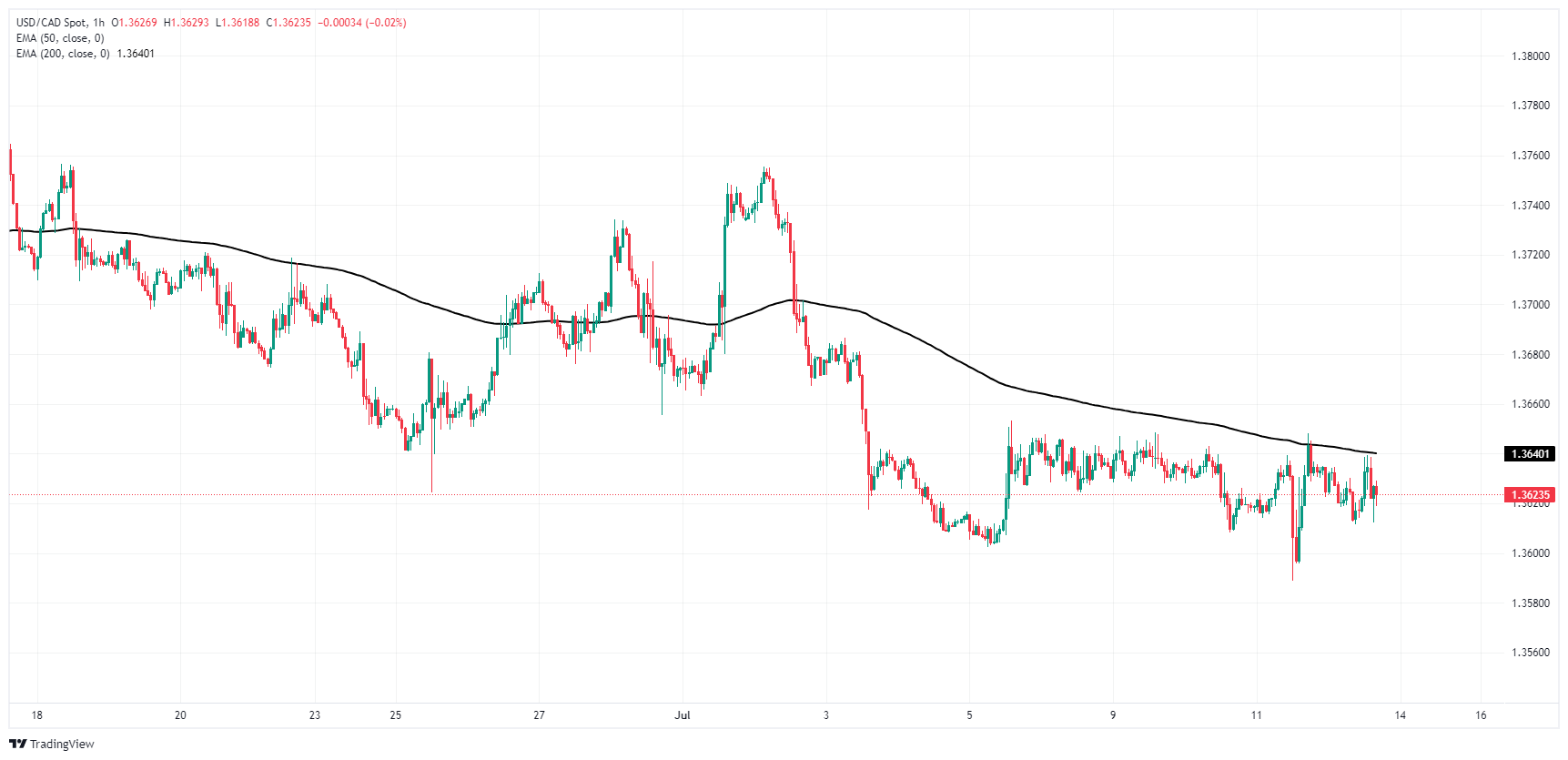

Technical analysis: USD/CAD swamped out in near-term midrange

The Canadian Dollar (CAD) is one of the poorest-performing currencies on Friday, shedding weight across the board and struggling to develop any meaningful momentum against the US Dollar. USD/CAD is stuck in a lurch just above the 1.3600 handle, and threatening to spiral out into a longer-running consolidation phase as the pair finds little reason to push too far in either direction.

Intraday bidding remains capped below the 200-hour Exponential Moving Average (EMA) at 1.3640, and tests to the low side are unable to find a foothold below 1.3600. Daily candlesticks are bolstered by the 200-day EMA at 1.2594, keeping a lid on downside pressure while a supply zone priced in above 1.3750 caps off any bullish attempts.

USD/CAD hourly chart

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- US Dollar continues losing ground in light of weak CPI figures and UoM data.

- Markets still foresee a September rate cut.

- Despite hot PPI data, US Treasury yields are falling, diminishing allure of USD.

The US Dollar Index (DXY) remains weak on Friday, sitting at April lows. This is largely a response to the soft US Consumer Price Index (CPI) figures on Thursday, combined with softer University of Michigan (UoM) sentiment data, both supporting the prospect of a Federal Reserve (Fed) rate cut in September.

Although the market's confidence in a pending rate cut is growing, Fed officials have maintained a careful approach, emphasizing their dependence on rigorous data analysis before initiating such substantial changes.

Daily digest market movers: DXY wanes despite rising PPI

- US Producer Price Index (PPI) for final demand rose to 2.6% YoY in June, an increase from 2.2% last month, as revealed by the US Bureau of Labor Statistics (BLS) on Friday. This outcome exceeded market expectations of 2.3%.

- Annual core PPI increased by 3% during the same period, surpassing both the previous month's rise and the anticipated market figure of 2.3%.

- On a monthly basis, PPI and core PPI escalated by 0.2% and 0.4%, respectively.

- Despite positive PPI data, soft CPI figures and softer UoM sentiment data (reported at 66.0 versus the forecast of 68.5 and the previous value of 68.2) continue to bolster the argument for a September rate cut.

- CME FedWatch Tool now shows an 86% probability of a 25-basis-point cut in September, and some investors bet on a 50-basis-point cut

DXY technical outlook: Bearish sentiment worsens as DXY breaches 200-day SMA

The DXY Index's breach of its 200-day Simple Moving Average (SMA) has intensified the negative outlook for the USD, with indicators including the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) still deep in a negative trajectory.

The index now trades at its lowest level since April, amplifying the bearish sentiment. But after losing more than 0.80% in just two sessions, a slight upward correction may be possible. However, the overall technical outlook remains bearish.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

Speculative investors’ short Japanese Yen (JPY) positions are close to a record. USDJPY could see bouts of pullbacks if US data continues to point to a soft landing, UBS FX strategists note.

Short Yen positions are close to a record

“The Japanese Yen jumped as much as 3% against the US Dollar (USD) after the US CPI print pushed the Treasury yield lower, and as Japanese officials appeared to have conducted another round of intervention with yen purchases.”

“While we only expect US-Japan yield differentials to narrow more meaningfully by year-end, we advise against chasing USD/JPY higher or taking JPY loan exposure. Given that speculative investors’ short Yen positions are close to a record, we think that USDJPY could see bouts of pullbacks if US data continues to point to a soft landing.”

“For investors with existing short USDJPY trades, we favor using short-term pullbacks to reduce or exit these positions.”

The Australian Dollar (AUD) should appreciate against the US Dollar (USD) and the New Zealand Dollar (NZD) amid sticky core inflation, UBS FX strategists note.

AUD to turn bullish against USD and NZD

“Following the stronger-than-expected inflation data for May, we think a robust labor report and higher quarterly CPI for the second quarter will likely lead to a rate hike by the Reserve Bank of Australia (RBA) in August. This underpins our recommendation to sell the downside price risks of AUD/USD.”

“We also see an opportunity to go long the AUD versus NZD, as the Reserve Bank of New Zealand (RBNZ) made a surprise pivot this week noting deteriorating economic activity and easing inflation.”

“We now expect the RBNZ to cut rates in August, instead of November, and believe the NZD may underperform other G10 currencies.”

Swiss National Bank (SNB) seems to be near the end of its easing cycle, and the Swiss Franc (CHF) should appreciate against both the US Dollar (USD) and the Euro (EUR), UBS FX analysts note.

USD/CHF to fall back toward 0.87

“We believe the Swiss National Bank (SNB) policy rate is now closer to its terminal value after two cuts this year amid a decrease in underlying inflationary pressure, with one final cut likely in September.”

“This means the CHF should appreciate against both the US dollar and EUR over the next 12 months as the Fed and the European Central Bank (ECB) ramp up monetary policy easing.”

“The narrowing rate differential between the US and Switzerland should allow USD/CHF to fall back toward 0.87, from around 0.896 at present, while political uncertainty and fiscal consolidation in Europe should support safe-haven flows to the franc.”

The US dollar (USD) came under further pressure after the consumer price index for June showed underlying inflation rising at its slowest pace in three years. The Dollar Index (DXY), which tracks the Greenback against six major currencies, fell as much as 0.9% on Thursday right after the data release, though it rebounded slightly during Asia morning trade on Friday, UBS FX analysts note.

USD to trend lower to 103–104 in the coming days

“With headline CPI registering the first monthly decline (–0.1%) since December 2022, and the core measure advancing by the smallest in three years (+0.1%), the report added to confidence that a pivot from the Federal Reserve is getting closer. It is also the latest in a series of soft data that have weighed on the US dollar in recent weeks. Since late June, the DXY index has fallen 1.4%.

“The door now appears wide open for the Federal Reserve (Fed) to begin cutting interest rates, in our view. We expect Fed to use the FOMC meeting at the end of the month to signal that it is prepared to cut at the September meeting as long as the data continues on its recent trend. This means that the USD should continue to trend lower to 103–104 in the coming days.”

“We continue to advocate selling USD upside for a yield pickup in the coming months, as market expectations of a deeper Fed rate-cutting cycle and fears about the size of the US fiscal deficit are headwinds for the greenback in the near future and over the long term.”

- GBP/USD rises, with eyes on the crucial 1.3000 mark.

- Bullish technical outlook continues; RSI suggests potential for more gains, nearing overbought territory.

- Support levels to watch if rejection happens: 1.2900, 1.2894 (March 8 peak), and 1.2860 (June 12 high).

The Pound Serling rallied sharply against the US Dollar on Friday, up by more than 0.50% even though US inflation data on the producer front was slightly higher than expected, contrary to consumer prices revealed on Thursday. The GBP/USD trades at 1.2981 after bouncing off daily lows of 1.2901.

GBP/USD Price Analysis: Technical outlook

The uptrend on the GBP/USD continues, as it hits a new year-to-date (YTD) high and targets last year’s July 27 high of 1.2995, which is an inch of the 1.3000 figure.

From a momentum standpoint, bulls are in charge. The Relative Strength Index (RSI), despite being at overbought conditions due to aggressive price action, hasn’t reached the most extreme level used by traders, 80. Hence, there is some room to spare, and the 1.3000 would be up for grabs.

A rejection at the 1.3000 mark could pave the way for range-bound trading within the 1.2900-1.3000 range. However, a fall below 1.2900 would lay the path to test the March 8 peak turned support at 1.2894, ahead of June 12’s high at 1.2860.

GBP/USD Price Action – Daily Chart

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.31% | -0.55% | -0.66% | -0.04% | -0.37% | -0.39% | -0.18% | |

| EUR | 0.31% | -0.23% | -0.29% | 0.26% | -0.06% | -0.09% | 0.11% | |

| GBP | 0.55% | 0.23% | -0.06% | 0.49% | 0.16% | 0.13% | 0.33% | |

| JPY | 0.66% | 0.29% | 0.06% | 0.57% | 0.28% | 0.23% | 0.45% | |

| CAD | 0.04% | -0.26% | -0.49% | -0.57% | -0.32% | -0.36% | -0.16% | |

| AUD | 0.37% | 0.06% | -0.16% | -0.28% | 0.32% | -0.03% | 0.17% | |

| NZD | 0.39% | 0.09% | -0.13% | -0.23% | 0.36% | 0.03% | 0.21% | |

| CHF | 0.18% | -0.11% | -0.33% | -0.45% | 0.16% | -0.17% | -0.21% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Gold (XAU/USD) traded strong Thursday, commodity trading advisors (CTAs) are unwinding a portion of their length. As for Silver (XAG/USD) top Shanghai Futures Exchange (SHFE) funds promptly reduced their net position by 9k lots, TDS commodity traders note.

Asian demand is set to remain strong

“Despite the strong move yesterday in Gold, CTAs are unwinding a portion of their length, needing to see prices comfortably above $2,437/oz to add back more length. While some money managers may be taking profits near all-time highs, the below-expected inflation data and softer employment data bolstered expectations of a September start to the Fed cutting cycle.”

“The first evidence of renewed interest is starting to show as ETF positions continue to rise in July, after June saw the first monthly increase since May 2023. While Chinese Gold reserves were flat for a second consecutive month amid their noted pause in buying, top traders on the SHFE have added back to their net positions, highlighting Asian demand is set to remain strong.”

“As for Silver, after the noted sizable build in positioning, top SHFE funds promptly reduced their net position by 9k lots overnight, while CTAs could also turn sellers below $30.78/oz.”

Base metals have held strong as stimulus optimism gets baked in, however there’s an increasing level of bearishness on the ground in China, TDS com

Base metals see their longs liquidated

“With the upcoming plenum in China gaining plenty of market focus, base metals have held strong as stimulus optimism gets baked in. However, our tracking of top Shanghai Futures Exchange (SHFE) traders highlights an increasing level of bearishness on the ground in China.”

“Traders add nearly 5k lots short and liquidated longs in Copper, seeing their net short position grow to roughly the largest it has been since the start of the year. Likewise, in Aluminium, Chinese traders have added 8k lots short and cut longs, seeing their position flip net short after holding a notable long position. Zinc also saw a heavy 8k lots worth of long liquidations.”

“Pressures are building on the industrial metals as our gauge of global commodity demand continues to weaken. Any disappointment on potential Chinese stimulus will likely see continued liquidations of bloated positioning. As upside momentum fails to manifest, CTAs have turned recent sellers of the Red Metal, while Aluminium could also be in the crosshairs in the near-term.”

- NZD/USD gains to near 0.6120 as the US Dollar faces severe selling pressure.

- The US Dollar declines as Fed rate-cut bets soar.

- Weak Business NZ PMI boosts RBNZ’s rate-cut hopes.

The NZD/USD pair moves higher to 0.6120 in Friday’s New York session. The Kiwi asset gains as the US Dollar (USD) remains in the bearish trajectory due to strong expectations that the Federal Reserve (Fed) will start reducing interest rates from the September meeting.

The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, slumps to near the crucial support of 104.00. Meanwhile, the market sentiment remains cheerful amid firm Fed rate cut prospects. The S&P 500 has posted significant gains in the opening session, exhibiting strong risk-appetite of investors. 10-year US Treasury yields have retreated to near 4.19%.

According to the CME FedWatch tool, 30-day Federal Fund Futures pricing data shows that rate cuts in September is a done deal. The data also shows that the central bank will cut interest rates further in November or December meeting.

The expectations for Fed rate cuts have been propelled by cooling inflationary pressures. The United States (US) Consumer Price Index (CPI) report for June showed that progress in the disinflation process has resumed after a one-time blip in the first quarter.

On the contrary, US Producer Price Index (PPI) rose at a stronger pace than expected in June. Annually, headline and core PPI accelerated to 2.6% and 3.0%, respectively.

On the Asia-Pacific front, the New Zealand Dollar (NZD) remains weak due to poor Business NZ PMI data for June. The PMI data came in at 41.1, contracted significantly from the prior release of 46.6. This has dampened the NZ economic outlook and has improved expectations of early rate cuts by the Reserve Bank of New Zealand (RBNZ).

Economic Indicator

Business NZ PMI

The Business NZ Performance of Manufacturing Index (PMI), released by Business NZ on a monthly basis, is a leading indicator gauging business activity in New Zealand’s manufacturing sector. The data is derived from surveys of senior executives at private-sector companies. Survey responses reflect the change, if any, in the current month compared to the previous month and can anticipate changing trends in official data series such as Gross Domestic Product (GDP), industrial production or employment.The index varies between 0 and 100, with levels of 50.0 signaling no change over the previous month. A reading above 50 indicates that the manufacturing economy is generally expanding, a bullish sign for the New Zealand Dollar (NZD). Meanwhile, a reading below 50 signals that activity among goods producers is generally declining, which is seen as bearish for NZD.

Read more.Last release: Thu Jul 11, 2024 22:30

Frequency: Monthly

Actual: 41.1

Consensus: -

Previous: 47.2

Source: Business NZ

- USD/CAD remains in a tight range above 1.3600 despite US PPI turning out hotter than expected.

- Market speculation for Fed rate cuts in September remains firm.

- The weak Canadian job market boosts prospects of more rate cuts by the BoC.

The USD/CAD pair doesn’t move much from its current range above 1.3600 in Friday’s American session even though the United States (US) Bureau of Labor Statistics (BLS) has reported that the producer inflation rose at a faster-than-expected pace in June.

The Producer Price Index (PPI) report showed that the core factory-gate inflation grew at a robust pace of 3.0% than the estimates of 2.5% and the prior release of 2.6%, upwardly revised from 2.3%. Also, the underlying inflation rose strongly by 0.4% from the consensus of 0.2% and the former reading of 0.3%, upwardly revised from its unchanged position.

Hotter-than-expected producer inflation has raised doubts over strong market speculation for the Federal Reserve (Fed) to begin reducing interest rates from the September meeting, which were prompted by softer-than-projected consumer inflation and easing labor market strength.

The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, has declined further to near 104.00. The opening of the S&P 500 on a positive note indicates a higher risk appetite of market participants. 10-year US Treasury yields surrender their intraday gains and fall back to near 4.20%.

Meanwhile, the Canadian Dollar remains on the backfoot amid expectations that the Bank of Canada (BoC) will cut interest rates again. Market speculation for back-to-back rate cuts by the BoC rose due to weak Canadian labor market conditions. The BoC started reducing its key borrowing rate from the June meeting after maintaining a restrictive interest rate framework for more than two years.

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- USD/CHF is correcting back after the rally in late June and early July.

- It is currently unfolding the wave C of an ABC corrective pattern.

USD/CHF is declining in what looks like the wave C of a three-wave ABC correction. The correction is from the rally that took place between the June 18 lows at 0.8827 up to the July 3 peak at 0.9051.

USD/CHF Daily Chart

The pair has not yet reached the end of wave C and could still fall further, however, it has reached the conservative target for C, which is the Fibonacci 0.618 ratio of the length of wave A.

If USD/CHF falls further it could find support at the 200-day Simple Moving Average (SMA) at 0.8883.

Alternatively, a close above the July 10 high and the 50-day SMA at 0.9007 would probably signal a reversal higher, with the next target at 0.9051, the July 3 high.

- Producer inflation in the US rose at a stronger pace than expected in June.

- US Dollar Index stays below 104.50 following the PPI data.

The Producer Price Index (PPI) for final demand in the US rose 2.6% on a yearly basis in June, the data published by the US Bureau of Labor Statistics showed on Friday. This reading followed the 2.2% increase recorded in May and came in above the market expectation of 2.3%.

The annual core PPI rose 3% in the same period, coming in above April's increase and the market expectation of 2.3% and 2.5%, respectively. On a monthly basis, the PPI increased 0.2%, while the core PPI rose 0.4%.

Market reaction

The US Dollar Index edged slightly higher with the immediate reaction to the producer inflation data and was last seen losing 0.12% on the day at 104.37.

The Dollar index (DXY) is trading lower for the third straight day near 104.32 as markets digest the double whammy of good inflation data and surprise BOJ intervention, BBH FX strategists note.

DXY trades lower near 104.32

“DXY is trading lower for the third straight day near 104.32 after good US inflation data and surprise Bank of Japan (BOJ) intervention. The BOJ did not get much bang for the buck as USD/JPY has already recouped nearly half of yesterday’s losses and trading back above 159. The Euro (EUR) is trading higher near $1.0890 against the US Dollar, while the Pound Sterling (GBP) is trading higher near $1.2960.”

“Recent softness in the U.S. data is challenging our view that the backdrop of persistent inflation and robust growth in the U.S. remains largely in place. Indeed, more Fed officials are voicing concern about labor market weakness.”

“However, we continue to believe that weaker data in many of the major economies will feed into more dovish central banks, underscoring that the relative story should continue to support the dollar.”

- The US Dollar trades mixed on the quote board on Friday.

- Markes digest the recent disinflationary CPI print while Biden drops the ball at a crucial moment.

- The US Dollar index stabilizes after its sharp decline on Thursday.

The US Dollar (USD) trades very mixed on Friday, with markets looking for direction as a clear rotation is taking place in the equity markets. With an interest rate cut from the US Federal Reserve (Fed) being a near certainty in September, investors are shifting away from the big tech names and are heading into smaller stocks and blue chips that represent more niche sectors that should see demand pick up with more disposable income freed up once rates get cut. Meanwhile, concerns about US President Joe Biden increased after he called Russian President Vladimir Putin to Ukraine President Volodymyr Zelensky during a high-stakes NATO summit, which could mean the final straw for some of his financial donors.

On the economic front, a nice schedule ahead with the Producer Price Index (PPI) for June, where traders can assess if prices for producers and resellers are on the same disinflationary path as for the Consumer Price Index (CPI). Later this Friday, the University of Michigan will release its preliminary readings for July on Consumer Sentiment and inflation expectations. Expect some choppy action, with further easing numbers that might clash with Dollar bulls.

Daily digest market movers: Now it gets tricky

- US President Joe Biden dropped the ball in what several media outlets deemed as the make-or-break moment for the President. Unfortunately, President Biden dropped the ball yet again by calling Vice President Trump to his Vice President Camilla Harris and mixing up Ukraine President Volodymyr Zelensky with Russian President Vladimir Putin. It was painful to watch them shaking hands just after President Biden made the mistake.

- At 12:30 GMT, June’s Producer Price Index (PPI) numbers will come out:

- Monthly headline PPI is expected to tick up to 0.1% from -0.2%.

- Monthly core PPI should also tick up to 0.2% from 0.0%.

- Annual headline PPI is expected to increase marginally to 2.3% from 2.2%.

- Annual core CPI is expected to grow by 2.5% from 2.3%.

- At 14:00 GMT, the University of Michigan will release its preliminary reading for July:

- Consumer Sentiment is expected to tick up to 68.5 from 68.2.

- 5-year consumer inflation expectations are expected to remain at 3%.