- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 12-04-2022

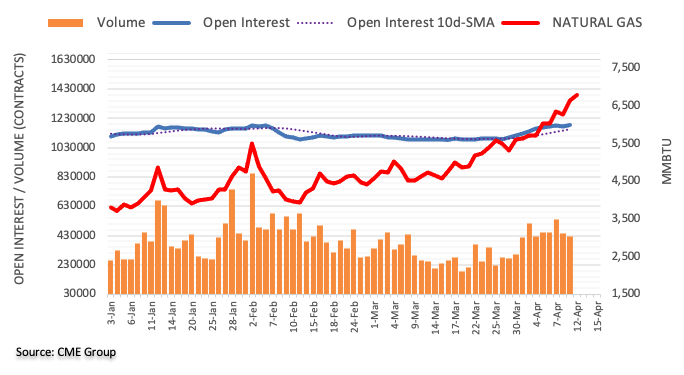

- WTI has retreated from $92.65 on easing demand worries in China.

- API has printed a solid build-up of US oil inventories at 7.8 million barrels.

- The impact of additional oil supply by the US and IEA seems to fade away.

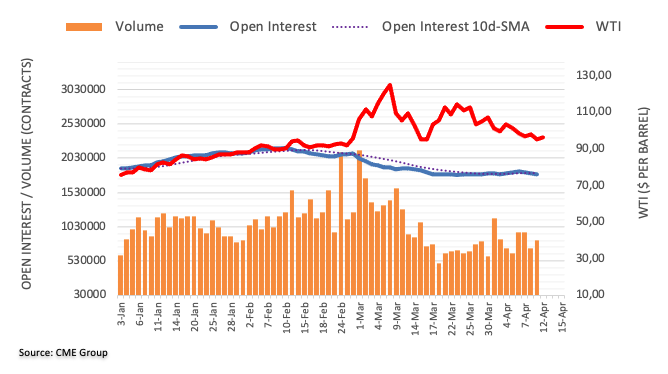

West Texas Intermediate (WTI), futures on NYMEX, has recaptured the $100.00 mark as the Chinese administration has lifted some of its lockdown curbs, which were imposed to contain the Covid-19 epidemic in Shanghai city. The black gold has witnessed a sheer upside after sensing a decent buying interest from Monday’s low at $92.65.

It seems that the announcement of additional oil supply by the US administration and International Economic Agency (IEA) out of their Strategic Petroleum Reserve (SPR) has faded away. Earlier, the US administration and IEA announced an oil supply of 180 and 60 million barrels respectively. To offset the cut of one million barrels of oil per day (bpd) from Russia due to sanctions imposed by Western leaders, the collective leakage of 1.3 million bpd by the US administration and IEA may bring price stability.

Also, the WTI bears failed to capitalize on the solid build-up of oil stocks reported by the American Petroleum Institute (API). On Tuesday, the API reported that the US oil inventories rose by 7.8 million barrels, outperforming the previous figure of 1.08 million barrels.

For further guidance, the oil inventory report from the Energy Information Administration (EIA) will hold significant importance. The oil inventories are likely to land at 1.367 million barrels against the previous print of 2.421 million barrels.

Reuters reported that the Russian Energy Minister Nikolai Shulginov told Izvestia newspaper that Moscow is ready to sell oil and oil products to "friendly countries in any price range", Interfax news agency said on Tuesday.

''Shulginov said crude prices in the range of $80 to $150 a barrel were in principle possible but said Moscow was more focused on ensuring the oil industry continues to function, Interfax said.''

Meanwhile, crude oil rallied on Tuesday after Russia vowed to continue its offensive in Ukraine.

President Vladimir Putin said on Tuesday that peace talks with Ukraine had hit a dead end. Instead, Putin promised that Russia would achieve all of its "noble" aims in Ukraine. "We have again returned to a dead-end situation for us," Putin told a news briefing during a visit to the Vostochny Cosmodrome 3,450 miles (5,550 km) east of Moscow.

"We don't intend to be isolated," Putin added. "It is impossible to severely isolate anyone in the modern world - especially such a vast country as Russia."

''This raises the spectre of continued risk of supply disruptions in the oil market,'' analysts at ANZ Bank said.

''Europe, Russia’s major customer of its crude exports, has been reluctant to implement sanctions due to its heavy reliance on the fuel. The Energy Information Administration added to the bullish sentiment by lowering its forecast for US crude output in 2022 and 2023 as shale producers grapple with higher production and labour costs''.

Reuters reports that the US Federal Reserve should quickly get interest rates up to a level where borrowing costs will no longer be stimulating the economy and should raise them further if high inflation proves persistent, Richmond Fed President Thomas Barkin said on Tuesday.

Key comments

"How far we will need to raise rates, in fact, won’t be clear until we get closer to our destination, but rest assured we will do what we must to address this recent bout of above-target inflation," Barkin said in remarks prepared for delivery to the Money Marketeers in New York.

"The best short-term path for us is to move rapidly to the neutral range and then test whether pandemic-era inflation pressures are easing, and how persistent inflation has become. If necessary, we can move further."

''If bouts of high inflation do become more common in the future than they were before the pandemic,'' Barkin said,

"Our efforts to stabilize inflation expectations could require periods where we tighten monetary policy more than has been our recent pattern."

''Doing that could create communication challenges as Fed policymakers explain why stabilizing prices may need to be balanced against costs to employment.''

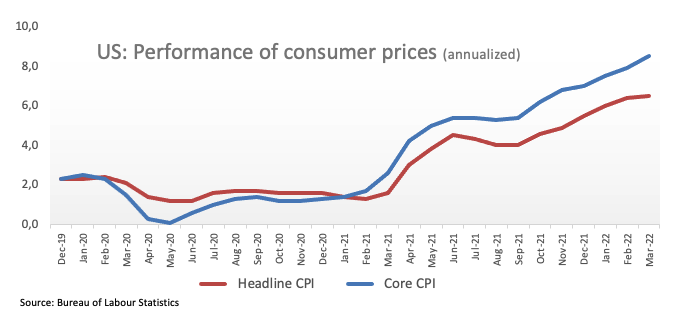

The comments followed today's volatility in the US dollar when the markets moved away from it following an unexpected miss in the Core Consumer Price Index.

Core CPI fell short of estimates, suggesting that the Federal Reserve might not need to be in such a hurry that the market has been pricing for. Core CPI, which excludes food and energy prices, moved up by just 0.3%, below the 0.5% expectations and the smallest increase since September.

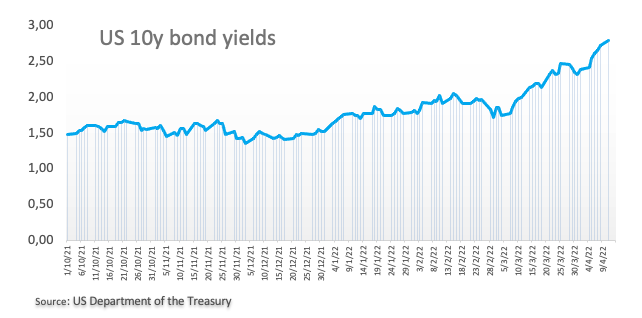

However, with inflation expectations remaining relatively steady, the dollar bounces back and went on to score fresh cycle highs in 100.333 DXY. If the 10-year yield continues higher beyond the 2.836% highs set this week, it could be on track to test the October 2018 high near 3.26%.

- Despite the positive correlation with US Treasury yields, the USD/JPY consolidates in the 125.30-70 range.

- USD/JPY Price Forecast: The bias remains upwards, but a doji near the YTD highs might open the door for lower prices.

USD/JPY is almost flat as the Asian Pacific session begins, up 0.05%, but short of the YTD highs around 125.77, as Tuesday’s price action forms a doji, which means indecision looms over the pair. At the time of writing, the USD/JPY is trading at 125.48.

On Tuesday, the USD/JPY meandered around the 125.45 area but slumped sharply on the release of mixed US inflation figures, albeit hotter than expected; the numbers were not far from the expectations.

USD/JPY Price Forecast: Technical outlook

The USD/JPY is upward biased, as depicted by the daily chart. However, a doji near the YTD highs might open the door for a correction lower.

Meanwhile, the USD/JPY 1-hour chart, depicts the pair has formed a double top, but as the USD/JPY broke above 125.35, the USD/JPY might consolidate in the 125.30-77 region.

Upwards, the USD/JPY first resistance would be 125.56. A breach of the latter would expose the confluence of the YTD high and the R1 daily pivot near the 125.77-80 area. Once cleared, the following line of defense for JPY bulls would be 126.00.

On the flip side, the USD/JPY first support would be the confluence of the 50-hour simple moving average (SMA) and the daily pivot around 125.28-30 area. A decisive break would open the door towards the S1 daily pivot at 124.81, followed by the 100-hour SMA at 124.64.

Technical levels to watch

- The cable is consolidating near the psychological support of 1.3000.

- The greenback bulls are firmly defending the 20-EMA.

- A bearish range shift in the momentum oscillators RSI (14) is indicating weakness in the counter.

The GBP/USD pair is witnessing a nasty consolidation of around 1.3000 since Friday. A failed bull’s attack at the 200-period Exponential Moving Average (EMA) brought an intense sell-off in the asst from March 23 high at around 1.3300.

On a four-hour scale, the cable is auctioning in a narrow range of 12982-1.3057. It is worth noting that the asset is consolidating near its critical bottom, which is March’s low at 1.3001. Usually, a decent consolidation near the previous bottom level, which is also a psychological figure, signifies a double bottom formation. However, a break below the consolidation is also a certainty and the asset could enter into a prolonged bearish trajectory. The trendline placed from March 23 high at 1.3300, adjoining the April 5 high at 1.3167 will act as a major barricade going forward.

Pound bulls are also failing to overstep the 20-EMA, which is trading at 1.3032. Meanwhile, the Relative Strength Index (RSI) (14) has shifted into a bearish range of 20.00-40.00, which indicates a continuation of bearish bias.

A decisive plunge below Friday’s low at 1.2982 will trigger the greenback bulls, which will drag the asset towards the 2 November 2020 low at 1.2854, followed by round level support at 1.2800.

On the flip side, pound bulls may dictate the prices if the asset surpass April 7 high at 1.3106 decisively. This will push the pair towards the April 4 high at 1.3137. Breach of the latter will drive the asset towards the round level resistance at 1.3200.

GBP/USD four-chart

-637854009896348749.png)

- The shared currency struggles at 0.8366 and drops below a bottom trendline of a descending channel, opening the door for further losses.

- A dismal market mood weighs more on the euro than the British pound.

- EUR/GBP Price Forecast: A break below 0.8307 would exacerbate a fall towards 0.8202.

The EUR/GBP slides for the second consecutive day in the week, and on its way down, the EUR/GBP broke the bottom trendline of a descending channel, exerting additional downward pressure on the already battered euro. At the time of writing, the EUR/GBP is trading at 0.8328.

A dismal market mood usually has favored the euro, but the conflict between Ukraine-Russia is taking place in Europe; it weighs on the shared currency. Furthermore, comments made on Tuesday by Russian President Vladimir Putin that talks with Ukraine are at a dead end, so the hopes of a cease-fire or truce seem farther now than before. Meanwhile, hostilities remain in the region of Donetsk as Russia regroups its troops as evacuations of the area continue.

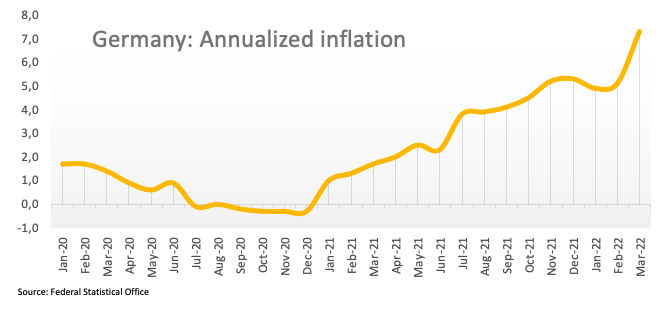

Another factor that accelerated the euro depreciation was the ZEW Economic Sentiment for Apri, which came worse than March’s reading in the Euro area and Germany. Furthermore, Germany reported inflation for March that rose by 7.3%, in line with expectations but much higher than the 5.1% February jump.

Elsewhere, the UK docket unveiled the jobs report. The Unemployment rate rose by 3.8% in line with forecasts, while Employment Change for January reported that the economy added just 10K jobs, lower than the 40K estimated. Albeit the report was mixed, the British pound has the upper hand as the Bank of England has already hiked rates, while the ECB is to finish first the Quantitative Easing by the summer of 2022.

Therefore, the EUR/GBP will keep falling unless the ECB turns more hawkish on Thursday, April 14, when the ECB unveils its Interest Rates Decision.

EUR/GBP Price Forecast: Technical outlook

The EUR/GBP remains downward biased, as shown by the daily moving averages (DMAs) located above the spot price, with a downslope. Furthermore, the EUR/GBP broke the bottom trendline of a descending channel, exacerbating a move towards March 07 swing low at 0.8202. Nevertheless, the cross-currency pair would need to overcome essential demand zones on its way south.

The EUR/GBP’s first support would be the April 12 0.8319 daily low. A decisive break would expose the April 7 daily low at 0.8307, followed by March 23 daily low at 0.8295. If that level gives way to EUR/GBP sellers, a move towards the YTD low at 0.8202 is on the cards.

- USD/CHF has sensed a minor sell-off at around 0.9330 as fears of US CPI wobble.

- US Treasury yields tumbled from 2.83% as investors have already discounted the higher US inflation print.

- This week, US Retail Sales will be a major trigger for further guidance.

The USD/CHF pair has attracted some offers at around 0.9328 in early Tokyo after the market participants shrug off the fears of higher US inflation. Considering Russia’s invasion of Ukraine and helicopter money infused by the Federal Reserve (Fed) since the pandemic of Covid-19 to spur the aggregate demand, a US inflation print at a multi-decade high was highly expected.

The US Consumer Price Index (CPI) has landed at 8.5%, higher than the estimates of 8.4%. This has triggered the need for a reign in on inflation by spurring the interest rates and balance sheet reduction. The announcement of the US CPI has brought a sell-off in the US Treasury yields. The 10-year US Treasury yields eased sharply after hitting a fresh-three-year high at 2.83%. It seems that investors have already priced in the higher print of US inflation.

Meanwhile, Fed Vice Chair Lael Brainard in her speech on Tuesday has emphasized more on moderation of inflation in the core goods segment. She also added that it is encouraging to see a fall in the unemployment rate in the last few months of labor market reports and that the improvement in the participation rate has more way to go.

Going forward, investors will focus on US monthly Retail Sales, which will be released by the US Census Bureau on Thursday. A preliminary estimate of the US Retail Sales claims a higher print at 0.6% against the prior figure of 0.3%.

- The DXY is marching towards 101.00 as higher US CPI has underpinned Fed’s tightening bets.

- US CPI Ex Food & Energy have landed at 6.5%, in mid of the estimates and previous figure.

- Weaponry assistance to Ukraine by UK and US has bolstered the risk-off impulse.

The US dollar index (DXY) has confirmed a fresh bullish rally after overstepping the previous week’s high at 100.19 decisively. The DXY bulls have got an adrenaline rush as the disclosure of US inflation has slightly crossed the estimates. The US Bureau of Labor Statistics has reported the yearly US Consumer Price Index (CPI) at 8.5%, mildly higher than the market forecast of 8.4% and significantly higher than the previous print of 7.9%. Multi-decade record-high inflation in the US is compelling the Federal Reserve (Fed) to elevate interest rates and initiate balance sheet reduction soon.

Meanwhile, the US CPI Ex Food & Energy has landed at 6.5%, in between the estimate of 6.6% and the prior figure of 6.4%, which indicates price pressures majorly in necessity products.

The US Treasury yields surrendered Monday’s gains in the American session as the market participants have already discounted the elevated print of US CPI. The 10-year US Treasury yields have tumbled to 2.73% after printing a three-year high at 2.83%.

US and UK agree to put pressure on Russia

US President Jo Biden and UK Prime Minister Boris Johnson have agreed to put pressure on Russian leader Vladimir Putin as Moscow has repositioned its rebels in the eastern Donbas region. The two administrations are planning to accelerate and bolster military and economic assistance to Ukraine.

Key events this week: Producer Price Index (PPI), Initial Jobless Claims, Retail Sales, Michigan Consumer Sentiment Index (CSI), and Industrial Production.

Eminent issues on the back boiler: Russia-Ukraine Peace Talks, Reserve Bank of New Zealand (RBNZ) interest rate decision, European Central Bank (ECB) interest rate decision, and Bank of Canada (BOC) interest rate decision.

- The EUR/JPY failure to reclaim 137.00 exposed the pair to selling pressure.

- EUR/JPY Price Forecast: A double top in the daily chart looms and targets 131.40.

After Monday’s price actions witnessed the EUR/JPY lifting to the 137.10s region and then dropping towards the 136.60s area, the EUR/JPY continues falling as a double-top chart pattern forms in the daily chart. At the time of writing, the EUR/JPY is trading at 135.73.

EUR/JPY Price Forecast: Technical outlook

The EUR/JPY daily chart depicts an upward bias in the cross-currency pair. However, price action since March 28, when the EUR/JPY printed a YTD high at 137.54, coincides with the Relative Strength Index (RSI) highest level reached at 73.27, within overbought conditions, the first signal that the pair might consolidate.

Then, on April 4, the EUR/JPY fell towards the 134.20s area and was range-bound in the 134.20-135.40 range before April 11, when the EUR/JPY exploded upwards, close to 190-pips, failing to reclaim 137.00, retreating afterward towards 136.65.

That said, the cross-currency pair formed a double top, and as it is headed south, it would find some hurdles on its way down. The EUR/JPY first support would be April 7 at 135.50. A breach of the latter would expose 135.00. Once cleared, the EUR/JPY bull’s following line of defense would be the neckline at 134.29, followed by the double-top target at 131.40.

Technical levels to watch

Reuters has reported that US President Joe Biden's administration is expected to announce as soon as Wednesday another $750 million in military assistance for Ukraine for its fight against Russian forces, two US officials familiar with the matter told Reuters.

''The equipment would be funded using the Presidential Drawdown Authority, or PDA, in which the president can authorize the transfer of articles and services from US stocks without congressional approval in response to an emergency.''

Meanwhile, President Vladimir Putin said on Tuesday that peace talks with Ukraine had hit a dead end. Instead, Putin promised that Russia would achieve all of its "noble" aims in Ukraine. "We have again returned to a dead-end situation for us," Putin told a news briefing during a visit to the Vostochny Cosmodrome 3,450 miles (5,550 km) east of Moscow.

"We don't intend to be isolated," Putin added. "It is impossible to severely isolate anyone in the modern world - especially such a vast country as Russia."

- USD/CAD bulls stepping on the gas into early Asian markets.

- Oil prices are elevated and yet the CAD struggles in the face of a firm US dollar and fresh cycle highs.

At 1.2641, USD/CAD is up 0.13% on the day, little changed although in recovery mode from its weakest level in nearly four weeks. This is despite a rally in the price of oil and US data that showed a measure of underlying inflation climbing less than expected in March. The US dollar has printed a fresh cycle high in the DXY.

While the initial readout came in slightly hotter than analysts expected, with the US Consumer Price Index (CPI) posting the biggest monthly rise in consumer prices in 40 years, the data showed some signs that inflation may have peaked.

Core CPI fell short of estimates, suggesting that the Federal Reserve might not need to be in such a hurry that the market has been pricing for. Core CPI, which excludes food and energy prices, moved up by just 0.3%, which was below the 0.5% expectations and the smallest increase since September.

However, we saw a turnaround in the greenback as US stocks sank, retracing the relief rally as money markets continue to price in a hawkish Fed. The US Treasury's 10-year auction hit a high yield of 2.72% on Tuesday, up from the 1.92% high in the previous month. With inflation expectations remaining fairly steady, if the 10-year yield continues higher beyond the 2.836% highs set this week, it will on track to test the October 2018 high near 3.26%.

This leaves the bias to the upside for the greenback and Fed officials are likely to remain hawkish. The expectations are for a 50 bp hike next month will potentially keep the US dollar on track for the March 2020 high near 103 as measured by the DXY. It has already printed a fresh cycle high on the day at 100.333.

Meanwhile, Canada's central bank is expected to raise interest rates by a half-percentage point on Wednesday, its first hike of that magnitude since May 2020. It could also start to shrink its bloated balance sheet which would likely support the CAD, especially in the face of recovering oil prices.

The price of crude oil, being one of Canada's major exports, settled up 6.7% at $100.60 a barrel as Russian oil production fell to 2020 lows. OPEC also warned it would be impossible to replace potential supply losses from Russia. Additionally, Shanghai begins to ease mobility restrictions which are likely to continue giving relief to the price of oil.

- NZD/USD bulls moving in on critical daily resistance and the counter trendline

- RBNZ will be the focus now that the markets have traded the US CPI.

At 0.6857, NZD/USD is up some 0.5% and has travelled from a low of 0.6805 to a high of 0.6889 so far. However, the Us dollar has firmed in recent trade owing to a recovery in US yields and the hawkish narrative surrounding the Federal Reserve.

The US dollar, as measured by the DXY index, is above the 100 level again after being below it at 99.74 the low for the start of the trading session. It is now printing fresh session highs of 100.332 as traders in the money markets rethink the outlook for the Federal Reserve despite the Core Consumer Price Index. The market was priced for a beat but the core moved up by just 0.3%, which was below the 0.5% expectations and the smallest increase since September.

Nevertheless, the greenback did not stay down for long and US Treasury's 10-year auction hit a high yield of 2.72% on Tuesday, up from the 1.92% high in the previous month has helped to support a hawkish sentiment in markets. The bid to cover ratio for the auction was 2.43, down from the 2.47 ratio in March and the 10-year yield is recovering from the lows of the day.

Overall, US inflation expectations remain elevated and if the US 10-year yield moves beyond the 2.836% high, it will on track to test the October 2018 high near 3.26%. Additionally, Fed officials are likely to remain hawkish and given the market, expectations are still for a 50 bp hike next month, the US dollar has embarked on fresh cycle highs, on track for the March 2020 high near 103.

RBNZ in focus

Meanwhile, the Reserve Bank of New Zealand is meeting this week and has much work to do, according to analysts at TD Securities. ''We suspect the Board realises this too. However, hiking in 25bps increments at consecutive meetings won't fit the bill. The Bank now needs to hike in 50bps increments at its next two meetings. We see no compelling reason for the Bank to await incoming data before deciding to act more aggressively.''

NZD/USD technical analysis

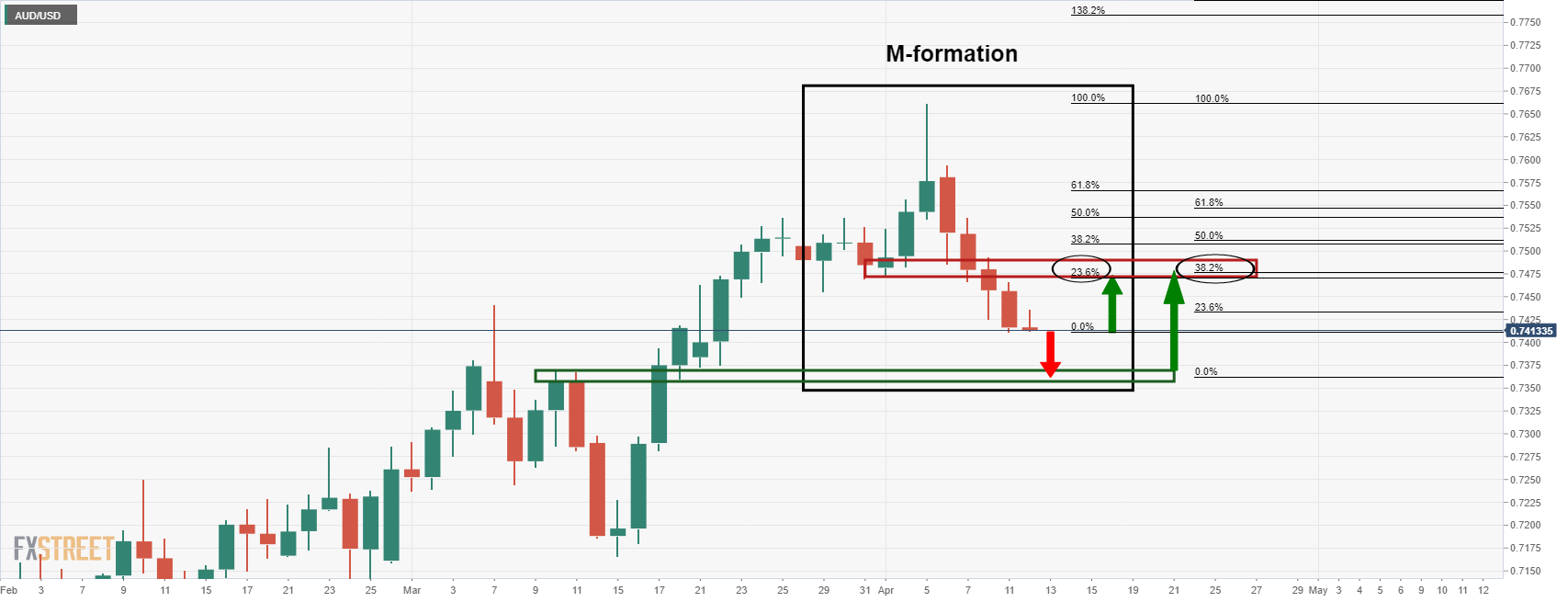

The M-formation is a reversion pattern and the price is embarking on a restest of the prior support in a 38.25 Fibonacci retracement near 0.69 the figure. Given the break of the dynamic trendline support, the bias is to the downside from a medium-term perspective, but it may be a little premature to expect such a trajectory for now. Instead, the price perhaps needs to stay with the bulls for a little while longer, at least into the RBNZ meeting.

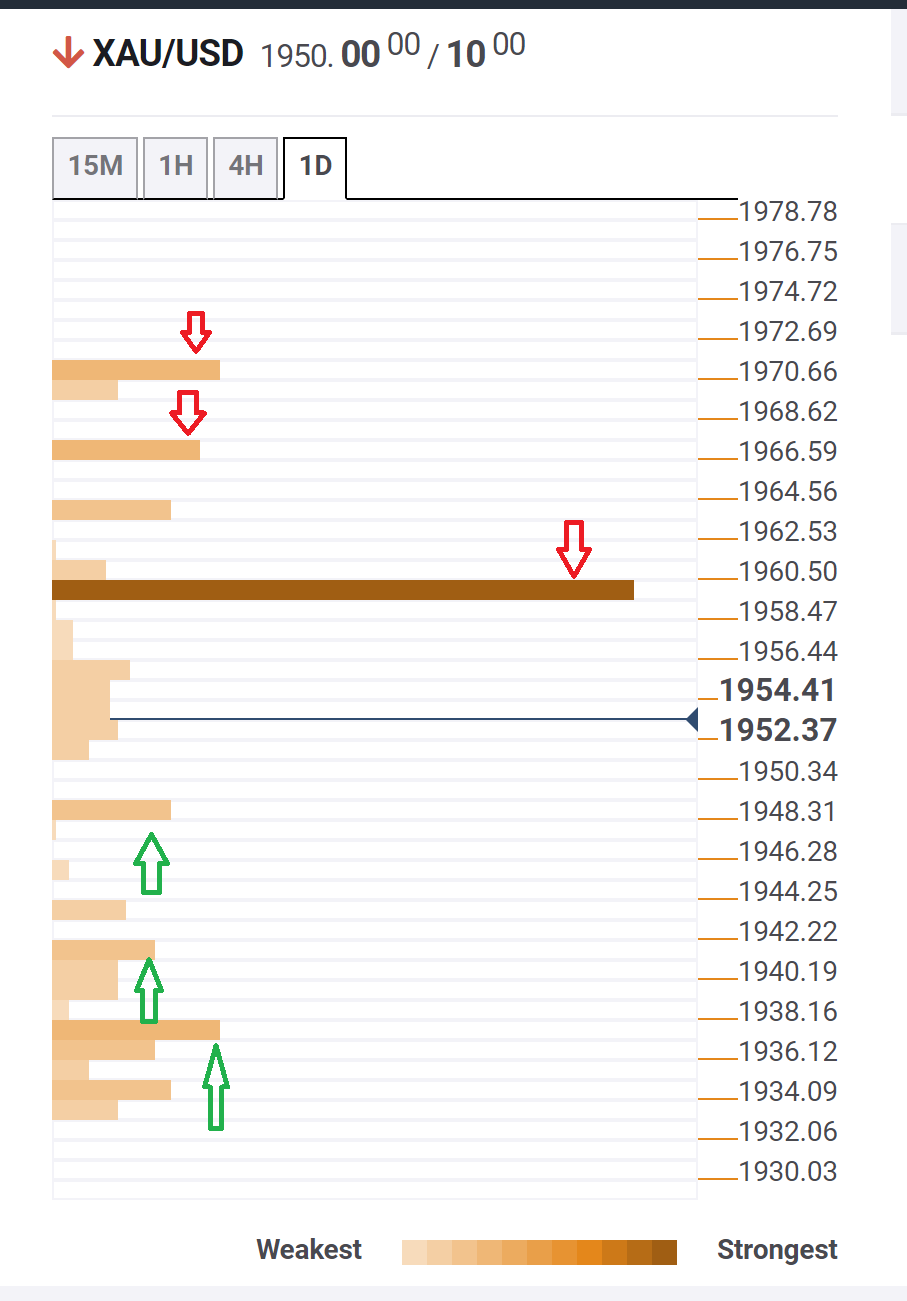

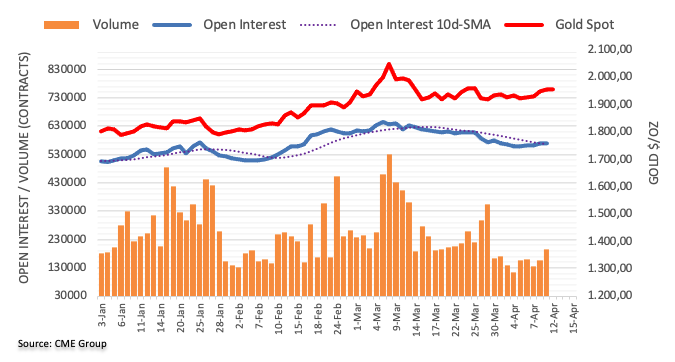

- Gold hit near one-month highs on Tuesday at just under $1980 and is on course for healthy on-the-day gains.

- The precious metal was supported as US yields pulled back in wake of evidence of easing Core CPI pressures.

- Gold bulls will now be eyeing a test of the $2000 level.

Spot gold (XAU/USD) prices are set to end the day firmly on the front foot just to the south of the $1970 level, having jumped to fresh near one-month highs earlier in the session near $1980. XAU/USD is currently trading with on-the-day gains of about 0.7%, taking weekly gains to more than 1.0%.

Powering the move higher was a pullback in US yields in wake of a not as hot feared US Consumer Price Inflation report that, although showing headline price pressures hitting a four-decade high at 8.5% YoY in March, showed some evidence of a slow down in core price pressures. Lower yields reduce the “opportunity cost” of holding non-yielding assets like gold.

Though Fed Vice Chair Lael Brainard followed up the release of the inflation data a message that the Fed would be pressing ahead with monetary tightening anyway, markets seem to have dialed back on expectations for the pace of Fed tightening in the latter half of this year.

Meanwhile, gold also derived support from geopolitics, after Russian President Vladimir Putin referred to Russo-Ukraine peace talks as being at a dead-end, dampening hopes of a ceasefire. Now that spot gold prices have broken convincingly above late March highs in the $1960s, the gold bulls will set their sights on the $2000 level once again.

But further Fed commentary this week and US Producer Price Inflation data on Wednesday could present downside risks, particularly if Fed policymakers continue the hawkish chatter and producer prices don’t also moderate as expected. That might send US yields higher, which could stymie gold’s advances, though traders note that gold has been unusually resilient in the face of rising yields in recent weeks.

What you need to take care of on Wednesday, April 13:

The American dollar shed ground ahead of the release of US inflation figures, later recovering ground to close the day unevenly. It is stronger against the shared currency, as EUR/USD trades around 1.0830, not far from the year low at 1.0805.

The GBP/USD pair battles around 1.3000, despite upbeat UK employment-related data. The ILO Unemployment Rate edged lower to 3.8% in three months to February from 3.9% previously, slightly better than the 3.9% expected. Also, the Average Earnings Including Bonus rose by 5.4%, compared to 4.8% in January, as expected. Finally, the number of job vacancies in the UK from January to March 2022 increased to a new record of 1,288,000.

Commodity-linked currencies spent most of the day up against their American rival, trimming some gains ahead of the close as Wall Street was unable to hold on to early gains. US indexes edged modestly lower.

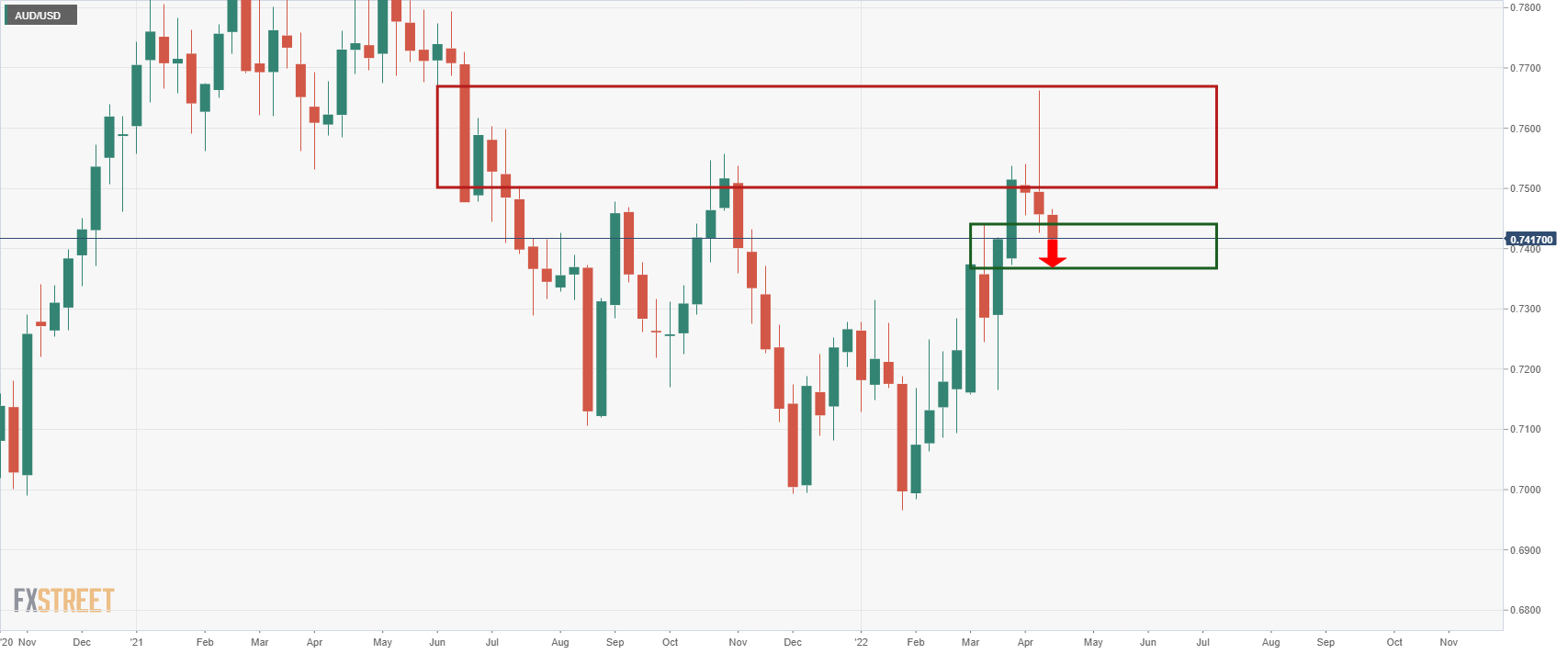

AUD/USD trades around 0.7450, partially helped by soaring gold prices, as the bright metal reached a fresh multi-week high of $1,978.59 a troy ounce.

USD/CAD stands at 1.2640, despite oil prices soaring. WTI trades above $100.00 a barrel after the OPEC cut this year’s oil demand growth also its supply forecast. Oil suffered a short-lived knee-jerk after Iran’s Iran supreme leader said that nuclear talks “are going well.”

Generally speaking, trading was sluggish in stocks markets. Asian indexes edged lower, while European and US ones posted modest losses. Wall Street spent most of the day in the green after US inflation data proved less concerning than anticipated.

US government bond yields soared ahead of US data, later retreating. The yield on the 10-year US Treasury note peaked at 2.836%, now standing at 2.72%.

The dismal mood was exacerbated by comments from Russian President Vladimir Putin, who said that talks with Ukraine are at a dead-end, claiming that the latter has deviated from the agreements achieved at talks in Istanbul, Turkey. Putin added that the news reporting war crimes in Bucha were fake.

Meanwhile, news coming from China are a red flag. The country said that the latest coronavirus wave in Shanghai is not under effective control. Lockdowns continue in the country, and the world wonders whether a new, unknown strain will soon spur globally and how it could affect economic growth.

Dogecoin Price Prediction: DOGE hints at a 30% rebound

Like this article? Help us with some feedback by answering this survey:

- The shared currency aims to test the YTD low around 1.0806 after dropping below the 1.0900 mark.

- The US inflation broke the 8% threshold, a level last seen in 1981, which cements a 50 bps rate hike of the Fed at its May meeting.

- EUR/USD Price Forecast: Bears are aiming to hit the raising wedge target of 1.0727.

The EUR/USD drops to fresh monthly lows and aims towards the YTD low at 1.0806, following a mixed US inflation report, which does not change the scenario of the Federal Reserve hiking rates for the second time in the year, though a 50 bps increase is expected. At the time of writing, the EUR/USD is trading at 1.0831.

Late in the New York session, the market sentiment turned sour. US equities record falls between 0.14% and 0.23%, while US T-bond yields jumped off lows, above the 2.70% threshold but well below the 2.832% daily highs. Meanwhile, the US Dollar Index (DXY) extends its weekly rally and is set to print a new YTD high above the 100 mark. At press time is up 0.31%, sitting at 100.283.

US inflation broke the 8% threshold, a 40 year high as the Fed prepares to hike 50 bps

Before Wall Street opened, the US Department of Labor revealed US inflation figures for March. The Consumer Price Index (CPI), a general view of inflation, rose by 8.5%, higher than the 8.4% y/y estimates. The so-called core CPI, excluding food and energy volatile items, rose by 6.5%, lower than the 6.7% expected.

“The price increase in March was mainly due to more expensive energy. For example, the price of gasoline increased by 18.3% compared with February. Otherwise, inflationary pressure tended to ease somewhat. Used car prices, for example, fell by 3.8%, after having pushed up inflation last year. Overall, goods prices outside energy and food fell by 0.4%,” analysts at Commerzbank expressed in a note.

They added that whether the inflation rate peaked in March, they said it would “depend above all on the further development of oil and gasoline prices. If the oil price remains at the current level of around $100 per barrel of Brent and does not rise again, March probably was the high in the inflation rate.”

Additionally to the abovementioned, money market futures, as shown by STIRs, depicts that investors have priced in a 94% chance of the Fed raising rates by 0.50% up to 1%.

Elsewhere, the conflict between Russia and Ukraine also summed up the dampened market mood of late. Earlier in the North American session, the Russian President Vladimir Putin said that talks with Ukraine are at a dead end, a signal that he would carry on until the objective is achieved, as he said previously to the former.

EUR/USD Price Forecast: Technical outlook

The EUR/USD keeps treading water after breaking below the 1.0900 mark. The daily chart shows that the pair remains downward biased and is set to hit the “rising wedge” target at 1.0727, but it would find some hurdles on its way south.

The EUR/USD first support would be the YTD low at 1.0806. A breach of the latter would expose 1.0727. Given way to 1.0727, it might open the door towards the psychological 1.0700 level.

- USD/JPY has stabilised in the low 125.00s in recent hours as traders digest Fed commentary and the day’s US CPI.

- The pair is flat, having pulled back from earlier levels above 125.50 after US yields fell.

USD/JPY has stabilised in the low 125.00s in recent trade and currently trades unchanged on the day, having slipped back from earlier high to the north of 125.50 in tandem with a pullback in US yields following US inflation data. Though the annual pace of headline Consumer Price Inflation hit a four-decade high at 8.5%, a tad above expected, core measures (particularly the MoM) missed expectations, resulting in the market paring back on some Fed tightening bets.

But the most recent batch of comments from Fed Vice Chair Lael Brainard suggests that, while the Fed is relieved to see some early signs of a slowdown in core inflation, the bank remains committed to normalising policy quickly. Brainard talked about deciding on a balance sheet reduction plan in May for runoff to then start in June, and noted that normalising policy to a significant degree by the end of the year remains the appropriate policy path.

Brainard's remarks have helped the dollar recover its poise in recent trade and the DXY recover back to multi-month highs in the 100.30 region. US yields are yet to recover back to pre-US CPI data levels, with the US 10-year still down about 8bps on the day just above 2.70%, hence why USD/JPY has been unable to recover back above 125.50.

But the USD/JPY bulls will likely remain highly confident. Further Fed speak throughout the rest of this week will likely reinforce Brainard’s message that the bank will press ahead with tightening plans. Meanwhile, US Producer Price Inflation data out on Wednesday may yet offer an upside surprise. Risks thus remain tilted towards the upside for the pair.

- AUD/USD bulls back off as the US dollar firms up again.

- Aussie jobs will be a key event for this week, as will the RBNZ.

At 0.7458, AUD/USD remains in bullish territory, higher by some 0.6% but is losing steam as the greenback recovers in afternoon New York trade. The US dollar, as measured by the DXY index, is above the 100 level again after being below it at 99.74 the low for the start of the trading session.

We have seen a strong turnaround in the US dollar as money markets rethink the outlook for the Federal Reserve despite the Core Consumer Price Index, which excludes food and energy prices, that moved up by just 0.3%, which was below the 0.5% expectations and the smallest increase since September.

The US Treasury's 10-year auction hit a high yield of 2.72% on Tuesday, up from the 1.92% high in the previous month. The bid to cover ratio for the auction was 2.43, down from the 2.47 ratio in March and the 10-year yield is recovering from the lows of the day.

Therefore, with inflation expectations remaining fairly steady, the US yield can continue higher and if it moves beyond the 2.836% high, it will on track to test the October 2018 high near 3.26%. This would leave the bias to the upside for the greenback as Fed officials are likely to remain hawkish. the market expectations are still for a 50 bp hike next month and this will potentially keep the US dollar on track for the March 2020 high near 103.

Domestically, it is an important week for the antipodeans. For AUD, the Aussie Employment report will be key, but a close eye will also be paid to its neighbouring central bank, the Reserve Bank of New Zealand. A 50% rate hike to the OCR could tip the balance in favour of AUD again, especially given the miss in the Core CPI data for the US today.

As for the Aussie Employment, ''we are expecting another strong headline print of +40k, reaffirming the RBA's message that the labour market outlook remains upbeat,'' analysts at TD Securities said. ''Consistent with this, we pencil in a small uptick in the participation rate from 66.4% to 66.5%. Despite this uptick in the participation rate, we forecast the unemployment rate will fall to a record low of 3.9%.''

- GBP/USD sinking to test 1.30 the figure again as the US dollar firms up.

- Markets are volatile following a mixed day in sentiment with the US CPI data at the core of the moves.

- Uk data this week so far has been underwhelming and has weighed on the pound.

Trading at 1.3017, GBP/USD is slightly underwater in the mid-day New York session, down 0.1%. Sterling has been tested by the bears to below 1.30 the figure once again on Tuesday when it traded at a low of 1.2993 in the London session after sliding from a high of 1.3030. Cable has since rallied to a high for the day at 1.3053 but has since started to slide again, back below Monday's closing price.

It has been a day driven by flows through the US dollar rather than anything domestic-related to the pound. The greenback initially fell on Tuesday after US inflation data showed consumer prices rose by 8.5% in March compared to a year ago, boosted by oil and soaring gasoline prices.

While the initial readout came in slightly hotter than analysts expected, with the US Consumer Price Index (CPI) posting the biggest monthly rise in consumer prices in 40 years, the data showed some signs that inflation may have peaked. Core CPI fell short of estimates, suggesting that the Federal Reserve might not need to be in such a hurry that the market has been pricing for.

The US seasonally adjusted Consumer Price Index climbed 1.2% in March, as expected in markets. The gauge climbed from 0.8% in February, the Bureau of Labor Statistics said Tuesday. The CPI surged 8.5% year on year, the biggest annual gain since 1981. Gasoline prices soared more than 18% in March and accounted for more than half of all items' monthly increases. Core CPI, which excludes food and energy prices, moved up by just 0.3%, which was below the 0.5% expectations and the smallest increase since September. Core CPI was up 0.5% in February.

Consequently, Wall Street's benchmarks climbed after government bond yields fell as money market traders pondered as to whether price increases have peaked at multi-decade highs. The US 10-year yield slumped by 7.4 basis points to 2.71%, falling back from a three-year high marked-up at the start of the week. The dollar index DXY fell 0.146% and reached a low of 99.74.

US dollar bulls move in again

However, we have seen a strong turnaround in the US dollar since. DXY is now 0.3% higher on the day and trades at fresh highs of around 100.275.

Money markets are having a rethink with the US Treasury's 10-year auction hitting a high yield of 2.72% on Tuesday, up from the 1.92% high in the previous month. The bid to cover ratio for the auction was 2.43, down from the 2.47 ratio in March. US stocks are also back under pressure and the 10-year yield is recovering from the lows of the day.

With inflation expectations remaining fairly steady, if the yield continues higher beyond the 2.836% highs, it will on track to test the October 2018 high near 3.26%. This leaves the bias to the upside for the greenback and Fed officials are likely to remain hawkish. Market expectations for a 50 bp hike next month will potentially keep the US dollar on track for the March 2020 high near 103.

Meanwhile, the UK began its monthly data dump on a soft note with February Gross Domestic Product falling in at 0.1% MoM vs. 0.2% expected and 0.8% in January, Industrial Production fell in at -0.6% MoM vs. 0.3% expected and 0.7% in January.

''It appears that the UK economy is already slowing ahead of the upcoming hikes in the payroll tax and the cap on household energy costs,'' analysts at Brown Brothers Harriman said. As for the Labor market data, this too showed signs of growth losing momentum, despite very strong job vacancies.

''The UK economy faces headwinds from here, as was clear from the labour market data (and yesterday's trade figures). So, GBP/USD remains vulnerable to a more convincing break below 1.30,'' analysts at Societe Generale said.

Consumer Price Index data will be reported Wednesday.

Nomura analysts said that they ''see UK inflation peaking in spring 2022. Further energy price rises mean a further (slightly lower) peak in the autumn.''

''We see 25bp Bank of England rate hikes in May, August and November this year and February next, for a terminal rate of 1.75%.''

There are no BOE speakers scheduled for this week.

- Gold prices rose in the North American session by close to 1%.

- Geopolitics, mixed US inflation data, and China’s Covid-19 lockdowns affect oil prices, which lifted XAUUSD.

- Gold Price Forecast (XAUUSD): Remains upward, and a daily close above $1966, might exacerbate a move towards $2000.

Gold (XAUUSD) surges above March 24 high at $1966, and It aims to get back to the $2000 mark after US consumer inflation rose to levels last seen in 1981, amidst a mixed sentiment, courtesy of high global inflation, the Ukraine-Russia conflict, and China’s Covid-19 lockdowns. At the time of writing, XAUUSD is trading at $1967.93 a troy ounce.

Reflection of the market’s sentiment is European and US equities, fluctuating between gainers and losers. The US Department of Labor reported that the Consumer Price Index (CPI) for March rose by 8.5%, higher than 8.4%, while the so-called core CPI, which excludes volatile items like food and energy, expanded by 6.5%, lower than the 6.7%.

The greenback reacted negatively to the news, dropping below the 100.000 mark, while XAUUSD broke above the $1966 threshold as US bond yields fell.

Of late, the US Dollar Index, a measurement of the buck vs. six currencies, reclaimed the 100.00 mark, edges up 0.26%, while the US 10-year Treasury yield is twelve basis points down from the 2.836% highs, towards 2.710%, a tailwind for the non-yielding metal prices, as high inflationary scenarios boosts appetite for the yellow metal.

Aside from this, the Ukraine-Russia conflict extends for the seventh straight week. Ukraine’s President Volodymyr Zelenskyy reported that Russia could make use of chemical weapons, as social media reports emerged that Russia made use of them in Mariupol. However, journalists have not confirmed it, and the US Pentagon Press Secretary Kirby said that the US is aware and will monitor the situation.

Regarding peace talks, Russian President Vladimir Putin said that talks with Ukraine are at a dead end, and there is no doubt that the military operation in Ukraine will achieve its objective.

Gold Price Forecast (XAUUSD): Technical outlook

XAUUSD’s bias is upwards, but since March 16, is trapped in the $1900-66 range. On Tuesday, mixed Us inflation data boosted Gold prospects, as XAUUSD reacted upwards and broke above the top of the range, reaching a daily high at $1978.53, though of late, it is testing the $1966 level as support.

Upwards, XAUUSD’s first resistance would be $1978.53. A breach of the latter would expose the R2 daily pivot at $1984 and then the R3 pivot point at $1998, short of the $2000 mark.

- AUD/JPY rallied on Tuesday as the Aussie benefitted from risk-on flows, rising commodity prices and strong domestic data.

- The pair hit fresh weekly highs at 93.80 and bulls are eyeing a test of annual highs above 94.00.

A significant improvement in the market’s appetite for risk which has seen US and global equity markets turn higher in wake of the latest not as hot as feared US inflation figures has given the Aussie in recent trade. AUD/JPY recently pushed to a fresh weekly high to the north of Monday’s highs in the 93.60s to briefly touch 93.80.

At current levels in the 93.60s, it trades with gains of around 0.7%, having already seen a healthy rebound from earlier session sub-93.00 lows, with the Aussie benefitting from strength across global commodity markets and in the afterglow of strong business survey data released during the Asia Pacific session.

For reference, NAB’s Business Conditions index in March jumped to 18 from 9 in February, its highest since July 2021, while the Business Confidence index rose to 16 from 13. The improvement in risk appetite and upside in commodity prices has got some bulls eyeing a breakout above recent highs just above 94.00.

Indeed, looking at AUD/JPY price action over the last few weeks, it does seem to be forming an ascending triangle, which typically signals an upcoming bullish breakout. But a downturn in yields in the US in wake of the latest inflation report is offering the yen some respite.

For AUD/JPY to break above 94.00 and hit fresh year-to-date highs, yields may have to regain some of their recent upside bias, alongside a continuation of the current more risk-friendly flows in equities and commodities. Domestic Australian fundamentals could also be a catalyst for upside; the March labour market report is out during Thursday’s Asia Pacific session and, if sufficiently strong, could further boost conviction that the RBA will begin hiking by the end of H2 2022.

- On Tuesday, the white metal rose close to 2% in a mixed market mood.

- Geopolitics, mixed US inflation data, and China’s Covid-19 outbreak boost Silver.

- Silver Price Forecast (XAG/USD): Upward biased but about to reach overbought levels.

Silver (XAG/USD) extended its rally in the North American session, trading above the April 11 cycle high of $25.37, amid a mixed market mood, courtesy of the Russian-Ukraine crisis, hotter than expected US inflation, and China’s coronavirus outbreak. XAG/USD is trading at $25.58.

Russo-Ukraine tussles, hot US inflation, and China’s Covid-19 outbreak lifts precious metals

Global equities are trading mixed, with European bourses down while their US counterparts rise. Overnight, Ukrainian President Zelenskyy reported that Russia could make use of chemical weapons, while the US Pentagon Press Secretary Kirby said that the US is aware of this but it would continue to monitor the situation. On the Russian side, President Vladimir Putin said that there is no doubt that the military operation in Ukraine will achieve its objectives. Furthermore, earlier in the North American session, Russian President Putin added that talks with Ukraine are at a dead end.

Meanwhile, China’s Covid-19 outbreak helped to ease oil prices but kept close to 25 million people in lockdown.

Aside from this, the US economic docket reported US inflation for March. The headline figure rose by 8.5% y/y, higher than the 8.4% estimated by analysts, while the so-called Core CPI, which excludes volatile items, expanded by 6.5%, lower than the 6.7% foreseen

The market’s initial reaction was that the greenback fell below the 100.000 mark, while US Treasuries edged lower as investors assessed that March’s reading could be the peak of US inflation.

Meanwhile, money market futures keep their aggressive forecasts of the Federal Reserve hiking at 0.50%. The odds show a 94% chance that the Federal Reserve would lift the Federal Funds Rate (FFR) to 1% in its May meeting.

Silver Price Forecast (XAG/USD): Technical outlook

XAG/USD’s daily chart confirms that Silver has an upward bias. The daily moving averages (DMAs) reside below the spot price, though it’s worth noting that the 200-DMA at $23.90 is trapped between the 50-DMA at $24.56 and the 100-DMA at $23.72.

Silver’s 1-hour chart bias is aligned with the daily chart, and the uptrend is intact. The price action of the last two candlesticks shows that the rally is overextended, further confirmed by the Relative Strength Index (RSI) at 67.92, close to reaching overbought conditions.

Upwards, the XAG/USD first resistance would be the confluence of the March 24 cycle high and the R2 pivot point around the $25.75-85 range. A breach of the latter would expose the psychological $26.00 mark, followed by the R3 pivot at $26.12.

On the downside, the XAG/USD first support would be the R1 daily pivot at $25.40. Once cleared, the next support would be the confluence of March 31 and the daily pivot at the $25.09-05 range, followed by the 50-hour simple moving average at $24.97. A decisive break would expose a solid support area near the confluence of the 100, the 200-hour SMAs, and the S1 pivot point around $24.68-72.

UK PM Boris Johnson and US President Joe Biden agreed on the need to continue joint efforts to ratchet up the economic pressure on Russian President Vladimir Putin over his invasion of Ukraine, a Downing Street statement on Tuesday said, reported Reuters. The two leaders discussed the need to accelerate and bolster military and economic assistance to Ukraine, the statement noted.

Ahead of an expected increase in the intensity of fighting in Ukraine's eastern Donbas region as Russia repositions its military, Ukraine has been demanding more support in the form of weapons from its Western allies.

The balance sheet runoff could be worth two or three additional rate hikes through its entire course, Fed Vice Chair Lael Brainard said on Tuesday according to Reuters. The balance sheet will play an important role in the removal of monetary policy accommodation, she noted, but estimates as to exactly how much are uncertain.

Additional Remarks:

"I would not hang my hat on any particular number, but the reduction in the balance sheet will contribute to tightening."

The health of US economy bodes well for bringing inflation down without causing recession.

"I remain attentive to the shape of the yield curve."

"I think there are different parts of the yield curve that are information and the forward part really doesn't signal anything of concern."

"The later part of the yield curve is what I am watching very carefully."

"I am also watching inflation expectations and economic activity as I judge the pace of removal of accommodation."

Fed Vice Chair Lael Brainard said on Tuesday that, moving forward, she is going to be very cautious about making predictions and that she is watching core inflation very carefully, reported Reuters.

Additional Remarks:

- The Fed's goal is to bring inflation down while sustaining economic recovery.

- The very high inflation we are seeing is a result of a series of shocks.

- A tightening in financial conditions will help moderate demand, particularly in areas such as durable goods.

- "We're in a period of very high uncertainty."

- "We saw a moderation in core inflation this month."

- "Those kinds of developments will give me confidence we'll achieve 2% inflation, but the timeline is unclear."

- Today's economy is shaped by a unique set of circumstances."

- "We still have well-anchored longer-term inflation expectations."

- That will be enormously helpful to us going forward on inflation.

- There is quite a bit of capacity for labor demand to moderate by reducing job openings without the need for layoffs.

Fed Vice Chair Lael Brainard said on Tuesday that reductions in the size of the Fed's balance sheet could come as soon as June, after a decision is made in May, reported Reuters. The Fed is tightening methodically as well as expeditiously, she commented, echoing recent remarks from Fed Chair Jerome Powell, noting that the Fe will tighten through a series of rate increases. In terms of the pace of rate increases meeting to meeting, the Fed doesn't want to focus on that, she cautioned. Nonetheless, the added, the combined effect will bring policy to a more neutral rate expeditiously later this year, she noted.

Additional Remarks:

- "I don't have a stopping rule per se on interest rates."

- "I don't want to be too rigid in the appropriate course of policy this year and next."

- "I expect the combined effect of moving policy to a more neutral rate and reducing the balance sheet of bringing inflation down and moderating demand."

- "By moving expeditiously it gives us more options in the future."

- It is too early to have great confidence in what the post-pandemic, post-war new normal will be for the US economy.

- In terms of the neutral rate, there are good reasons to think it will continue to be at quite low levels historically.

- "We need to see how the economy evolves."

- The Fed is committed to bringing inflation back to our 2% goal.

- "We are committed to keeping inflation expectations anchored."

- "We can anticipate inflation will return to our 2% goal over time."

- It will take more time than anybody would have thought for employment to go back to pre-pandemic norms.

Fed Vice Chair Lael Brainard said on Tuesday that Russia's invasion of Ukraine skews risks to the upside on inflation and to the downside on economic activity, and that China's "zero Covid' policy has the potential to lengthen out supply chain constraints, reported Reuters.

Additional Remarks:

- Russia's invasion of Ukraine is an important contributor to inflation pressures.

- There are likely to be knock-on effects on global supply chains from the war.

- The longer the war persists, the greater the potential risks to the upside on inflation and to the downside on growth.

- This is just another set of inflationary shocks that are hitting the economy.

Fed Vice Chair Lael Brainard said on Tuesday that it is welcome to see some moderation in the rate of core goods inflation and that getting inflation down is the Fed's most important task, reported Reuters. Brainard said that she would be looking to see if we continue to see a moderation in inflation in the months ahead, and that she is most focused on core inflation for assessing the path of monetary policy.

Russia's invasion of Ukraine is driving the topline of inflation, Brainard stated, pointing to the jump in energy prices in March. The labour market and the economy overall have seen very strong demand, she added, though she said she expects this demand to moderate. Brainard said it is encouraging to see a rebound in the participation rate in the last few months of labour market reports and that the improvement in the participation rate has room to run.

Additional Remarks:

- There will be spillover from slower growth abroad and less stimulus from the fiscal side.

- The recovery can be sustained even as we bring inflation down.

- Fading fiscal support will be a substantial drag this year.

- Financial conditions will bring demand down to more sustainable levels.

- As the pandemic lifts, we should see more demand for services and less pressure in durables.

- On the supply side, we expect to see continued improvements in labor force participation.

- As we move policy to more neutral levels, I expect to see labor demand coming down.

- There is plenty of room for businesses to reduce the number of job openings.

On Thursday, the European Central Bank will have its monetary policy meeting. Market consensus sees no change in rates. Most analysts look for the ECB to start responding to elevated inflation levels. At Wells Fargo, analysts now look for a rate hike in September.

Key Quotes:

“The Eurozone economy has had a tough start to 2022. A surge in COVID cases and uncertainties tied to the Russia-Ukraine conflict have weighed on overall activity. Consumer excess savings and spending power also seem to be softer now than previously, which we believe can further contribute to a slowdown in activity. Against this backdrop, we recently lowered our Eurozone GDP forecast and now expect the economy to grow only modestly over 3% this year.”

“Despite a softer growth outlook, Eurozone headline inflation has moved sharply higher. Core inflation has also trended higher but to a lesser extent as it does not include volatile price components such as energy and food. But, even with core inflation slightly more modest, we still expect ECB policymakers to respond to elevated headline inflation.”

“We do not expect interest rate settings to change meaningfully next week but do expect ECB policymakers to taper asset purchases; however, we do now expect the ECB to lift interest rates 25 bps at the September 2022 meeting. We also expect steady interest rate hikes over the remainder of this year as well as into 2023.”

On Wednesday, the Bank of Canada (BoC) will announce its decision on monetary policy. A rate hike of 50 bp is widely expected. According to analysts from TD Securities, the most likely scenario is a 50 bp hike and the beginning of quantitative tightening in May. They see the central bank revising to the upside GDP and inflation forecasts. They look for a “hawkish” policy statement.

Key Quotes:

“We look for the BoC to lift rates by 50bps, announce QT beginning in May, and signal that more hikes will be needed. We also look for material upward revisions to 2022 GDP and inflation forecasts.”

“Our high-frequency fair value framework pegs USDCAD at 1.25, underscoring the anchor of the current range. We prefer to fade extreme moves on both sides, where a bounce towards 1.28 would offer selling opportunities. For now, CAD crosses offer better opportunities, and we maintain our short NZDCAD exposure.”

- The Mexican peso rises for the fourth consecutive day on Tuesday versus the US dollar.

- USD/MXN is approaching oversold readings but has no significant signs of consolidation.

- Bearish bias prevails, a daily close under 19.80 is likely to trigger more losses.

The USD/MXN moved further to the downside on Tuesday and hit weekly lows at 19.77 before rising back above 19.80. A daily close below should point to further weakness in the pair.

The RSI Index in is oversold territory in the four-hour chart. In the daily chart, however, the index still shows some room for further losses before reaching 70. The Mexican peso needs to make a clear break from the 19.80 area.

The next strong support area might be seen at 19.70, followed by 19.60. The area at 19.50/55 should cap the downside if reached in the next sessions, favouring a rebound, initially to 19.70.

On the upside, at 19.97/20.00 is the immediate resistance. Above the next level stands at 20.10 (20-day Simple Moving Average). A recovery above 20.20 should negate the bearish bias in the short term, adding support to the US dollar for a more significant recovery.

USD/MXN daily chart

-637853750060244890.png)

- Major US equity indices were higher across the board on Tuesday as investors breathed a sigh of relief post-US CPI.

- Core measures weren’t as hot as feared, allowing yields to pull back and tech to lead the US equity recovery.

- The S&P 500 was last up nearly 1.0% in the 4,450 area.

Major US equity indices were higher across the board on Tuesday as investors breathed a sigh of relief after US Consumer Price Inflation (CPI) data revealed price pressures rising broadly in line with expectations in March. Though the headline rate of annual CPI hit a four-decade high at 8.5%, core measures came in lower than expected, which investors interpreted as easing pressure on the Fed to lift interest rates as high in the coming years.

As markets dialed down their hawkish Fed bets, US yields have dropped across the curve, leading to outperformance in yield-sensitive tech/growth stocks. As a result, the Nasdaq 100 is the best performing of the major US indices, trading up about 1.4% in the 14,200 area after Monday’s sub-14,000 close, though is still below its 50-Day Moving Average at 14,320.

Meanwhile, the S&P 500 currently trades with gains of about 1.0% just above the 4,450 mark and is back above its 50DMA at 4,425 after closing near 4,410 on Monday. The Dow is trading 0.8% higher near the 34,600 level where it probes its 21DMA, having also rebounded back to the north of its 50DMA in the 34,2300s.

Sectors that typically don’t perform as well in an environment of falling yields (financials) and risk-on (health care) are acting as a slight weight to the Dow, though big gains in energy names after WTI lept back above $100 per barrel is more than offsetting this. Looking ahead, attention returns to the topic of inflation on Wednesday with the release of March Producer Price Inflation figures, though investors will likely be much more focused on earnings, with big US banks unofficially kicking off the earnings season.

- The Australian dollar found support around 0.7400 and is trimming four-day losses.

- Geopolitics, US mixed inflation report, and falling US bond yields lifted the AUD/USD.

- AUD/USD Price Forecast: After reclaiming the 0.7441, opened the door for a re-test of 0.7500.

AUD/USD snaps four days of consecutive losses, advances some 0.91% in the North American session amidst a mixed market mood, courtesy of geopolitics jitters, elevated inflation, high US T-bond yields, and mixed economic data. At the time of writing, the AUD/USD is trading at 0.7491.

Global equities have traded mixed. Europen stocks drop, contrarily to US equities rising, as US inflation figures were reported. The Consumer Price Index (CPI) for March in the US rose to 8.5% y/y, higher than the 8.4% expected, a level last seen in 1981. Meanwhile, the so-called Core CPI increased by 6.5%, lower than the 6.7% y/y foreseen, a signal that inflation could be peaking, as shown by monthly figures.

The monthly readings missed expectations, with CPI expanding by 1.2%, higher than the 1% estimations, while Core CPI came at 0.3%, lower than the 0.6%. The market’s initial reaction was that the greenback fell below the 100.000 mark, US Treasuries edged lower and US stocks rallied, as investors assessed that March’s reading could be the peak of US inflation.

Meanwhile, the AUD/USD lifted from 0.7460s to the 0.7490 area, as the appetite for riskier assets, increased.

Elsewhere, money market futures keep their aggressive bets that the Federal Reserve would hike 0.50% at its next meeting. The odds show a 94% chance that the Federal Reserve would lift the Federal Funds Rate (FFR) to 1% by May.

The Australian docket featured the NAB Business Confidence, which came at 16, higher than its previous reading, while Business Conditions also improved, as the index rose by 18 vs. 9 on the last figure.

AUD/USD Price Forecast: Technical outlook

The AUD/USD fell below March 7 0.7441 daily high and achieved a daily close around 0.7414, which would expose the pair to the 0.7400-41 area. However, mixed US economic data lifted the Aussie above the former and is aiming towards the 0.7500 mark, so the AUD/USD bias remains upwards.

The AUD/USD first resistance would be 0.7500. Once cleared, the next resistance would be the 0.7540-55 area, the confluence of March 28 and October 2021 cycle highs, followed by the 0.7600 mark.

- GBP/JPY is currently trading flat in the 163.20 area, as a fall in global yields post-US CPI supports the yen.

- The pair wasn’t reactive to mixed UK jobs data on Tuesday, and focus now shifts to Wednesday’s UK CPI release.

GBP/JPY has stabilised in the lower-163.00s on Tuesday, after mixed UK labour market data didn’t give pound sterling much impetus, and with a pullback in global yields from recent highs in wake of not as hot as forecast US inflation easing pressure on the yen. The pair has swung between 162.80-163.60ish levels and is currently trading flat on the day in the 163.20 area, FX market focus more on 1) outperformance in commodity-sensitive currencies like NOK, AUD and NZD and 2) underperformance in USD post the release of US inflation figures.

Speaking of, even though the headline rate of Consumer Price Inflation hit a new four-decade high at 8.5%, core measures of price pressures weren’t as hot as feared, leading markets to wind in some recently built-up hawkish Fed bets. As a result, US bond yields are pulling back from multi-year highs hit earlier in the day and weighing on yields in the Eurozone, UK and other developed markets.

This is handing the yield-sensitive yen some respite, with the currency having been battered by widening rate differentials in recent weeks. Looking ahead to the rest of the week, traders will be keeping an eye on whether the pullback in yields has further legs. If so, a dip back towards 162.00 is likely for GBP/JPY.

But UK CPI data is out on Wednesday and if it surprises to the upside, could be a bullish catalyst for sterling. Whether that would be enough to see the pair test March highs in the mid-164.00s is another question.

The MoM rate of inflation according to the CPI came in at 1.2%. Core Consumer Price Inflation came in at 0.3% MoM, below expectations for 0.5%. This print should not materially change price action in the currency space, according to economists at TD Securities. They think the EUR and especially the JPY remain inferior to the USD.

CAD and AUD should find modest support as the need for tightening remains

“Consumer prices came on top of expectations in March, rising an eye-popping 1.2% MoM. The core index, however, rose a less strong 0.3%, surprising expectations to the downside. The 12-month changes in the overall and core CPI rose to new multi-decade highs, but we expect March to represent the peak of the cycle.”

“The need for the Fed to deliver a series of 50bp hikes remains in place. Inflation prints will be consequential for terminal rate pricing, which will matter more for the USD from a cyclical point of view.”

“We think USD/JPY will remain elevated around 125 (unless terminal rate pricing moderates substantially).”

“EUR/USD is unlikely to budge until we get past the ECB meeting this week (in what could be a far more hawkish event) and perhaps until the outcome of the French elections is known.”

“A moderation in US inflation should be more supportive for commodity currencies, as the need for tightening persists there but they continue to benefit from a tailwind arising from the terms of trade. We see USD/CAD more fairly priced towards 1.25, while AUD/USD dips are a strategic buy on dips.”

The annual rate of inflation climbed to 8.5% in March, the highest level since 1981. Analysts at Wells Fargo point out that despite wide-ranging price increases again in March, they believe this likely marks the peak in post-COVID inflation. They expect demand for goods to waver as spending pivots back toward services, and this transition should temper goods inflation.

Key Quotes:

“The headline consumer price index surged 1.2% in March, the largest monthly increase since September 2005. About 70% of March's increase can be tied to higher energy prices following Russia's invasion of Ukraine, but energy was not the only source of pain for households.”

“The squeeze on households' from skyrocketing prices for necessities is very real. However, underneath the surface there are signs that pandemic-related inflation is beginning to ease. Core goods inflation fell by the most since April 2020, led by a decline in used auto prices, while core services inflation gathered steam amid higher prices for airfare, lodging away from home and other "reopening" categories. This rotation away from goods and toward services inflation has been long anticipated, and although widening lockdowns in China are a risk to this transition, today's data are an encouraging sign that goods inflation is finally rolling over.”

“Despite another month of wide-ranging price increases in March, we believe this likely marks the peak in post-COVID inflation. Upcoming monthly gains will be set against the eye-popping inflation of last spring's reopening, when prices rose 0.6%-0.9% per month from April to June.”

“Inflation remains a long way off from returning to the Fed's target. With inflation so far above target, we expect the Fed to expedite tightening and hike the fed funds rate by 50 bps at both the May and June FOMC meetings, in addition to beginning to wind-down the balance sheet in May.”

- US dollar tumbles after US inflation data, DXY back under 100.00.

- US CPI climbs to 8.5% in March, the highest since December 1981.

- USD/CAD slides to 1.2580 as crude oil soars and the dollar tumbles.

The USD/CAD retreated further from the highest level in almost a month above 1.2650 following the release of US inflation data. The pair printed a fresh daily low at 1.2580 and it remains with a negative bias, hovering around 1.2600.

Price up, dollar down

The slide of the USD/CAD intensified after data showed the US CPI in March rose 1.2%, in line with expectations, with the annual rate reaching the highest level since December 1981 at 8.5%.

The US dollar weakened after the report. The DXY turned negative and dropped back under 100.00, ending an eight-day positive streak. The key driver of dollar’s weakness was a recovery in Treasuries. The US 10-year yield dropped from multi-year highs at 2.83% to 2.70%, the 30-year pulled back under 2.80%.

Higher equity and crude oil prices are helping the loonie. The WIT barrel is rising more than 6% while the Dow Jones climbs 0.48%.

In Canada, the focus is on the Bank of Canada (BoC) that will announce is monetary policy decision on Wednesday. A rate hike is expected. “We look for the BoC to lift rates by 50bps, announce it will end its balance sheet reinvestment program by the end of the month, and signal that additional rate hikes will be needed. We also look for material upward revisions to 2022 GDP and inflation forecasts. Suffice it to say, this should be hawkish”, mentioned analysts at TD Securities.

Technical levels

Ukrainian Presidential Advisor Mykhailo Podolyak, when asked about Russian President Vladimir Putin's earlier statement that talks with Ukraine were at a dead-end, said that negotiations continue, reported Reuters on Tuesday. Podolyak said that talks are very hard, but continue at the level of working sub-groups and said that Russia is trying to put pressure on peace talks with its public statements.

Russian President Vladimir Putin had said earlier in the day that talks with Ukraine had reached a dead-end and that Ukraine had deviated from the agreements achieved at talks in Istanbul.

- WTI rebounded back above $100 per barrel to test its 50DMA on Tuesday, gaining more than $5.0 on the session.

- Traders cited risk-on flows, easing China lockdown fears and geopolitics as bullish for the price action.

Oil prices have seen a strong rebound thus far this Tuesday, with front-month WTI futures retaking the $100 per barrel mark and testing the 50-Day Moving Average in the $100.50s. At current levels, WTI trades with gains of more than $5.0 on the day, easily making up for Monday’s slightly more than $2.50 loss, and is now nearly $7.50 higher versus Monday’s lows near $93.00.

Traders are citing a reduction in China demand concerns as Shanghai eases lockdown restrictions for some 7,000 residential units as supportive to the price action, as well as geopolitics after Russian President Vladimir Putin spoke negatively on Russo-Ukraine peace talks. There is also no doubt that an improvement in the market’s broader appetite for risk in recent trade that is seeing US equities rebound and the US dollar come under modest selling pressure is also helping crude oil.

The improvement in risk appetite was triggered by the latest US Consumer Price Inflation data showing that Core price pressures didn’t rise as much as feared last month. If WTI can break back to the north of 50DMA at $100.50, that would open the door to a run towards its 21DMA in the $103.00s.

Though fears of an acute near-term oil shortage as a result of sanctions-related disruptions to Russian exports after its invasion of Ukraine have eased in wake of recent reserve release announcements from the International Energy Agency, supply concerns linger. OPEC warned on Tuesday that it would be impossible to replace the loss of 7M barrels per day in Russian oil and oil product exports in case of sanctions or voluntary embargoes.

So far, Russia has been able to continue selling oil to major Asian customers, but India is showing signs of caving to US pressure to no longer buy Russian. Reportedly, the Indian Oil Corp (IOC) has removed Russia’s Ural grade crude oil from its tender list for its next major purchase. US President Joe Biden had spoken with Indian PM Narendra Modi on Monday and warned that buying Russian oil was not in India’s best interests.

Meanwhile, the EU is still buying Russian energy products (oil and gas) given its heavy reliance and leaders/lawmakers remain divided about whether to implement a full embargo. Oil traders should keep an eye on reports that Russian forces recently used chemical weapons in Mariupol. Western intelligence is yet to confirm these reports, but if they do, this will strengthen the argument for a full EU embargo, which should be bullish for crude.

Ahead, weekly US private API crude oil inventory figures are scheduled for release at 2130BST and could, as usual, lead to some short-term volatility in WTI. But traders are likely to remain more focused on the broader themes of geopolitics, China lockdowns and risk appetite.

GBP/USD has managed to resist a close under 1.30 over the previous two sessions as it recovered from under the figure. However, economists at Scotiabank expect cable to suffer further losses below the recent lows of 1.2990/80 towards the 1.2850 regions.

Solid resistance around the 1.3050 zone is set to prevent a material rebound

“Solid resistance around the mid-figure zone is set to prevent a material rebound in the GBP that would suggest a rejection of the bearish trend since the test of 1.33 about three weeks ago.”

“Price action continues to point to losses extending and holding below 1.30 and the recent lows between 1.2980 and 1.2990; the mid-1.28s and the figure follow as support.”

Gold has surged past the $1,965/oz mark following the US March CPI print. Above target inflation expectations are set to lift the yellow metal – a fact less robust Core CPI will not change, strategists at TD Securities report.

A more moderate Core CPI print spells good news for gold

“Headline inflation jumped to 8.5%. With US March consumer prices rising by the most since late 1981 and most components showing large y/y increases, many gold traders continue to believe that inflation will not be as transitory as policymakers hoped. But at the same time, core CPI has moderated, which likely prompted yields across the treasury curve to slump, lowering real yields.”

“Real rates, a key determinant of gold price levels, may not move up as quickly as if core inflation was accelerating as quickly as the headline.”

“If the stars continue to align for gold, $1,982/oz looks within reach in the not too distant future and the yellow metal could test the recent high of $2,070/oz.”

- USD/JPY witnessed aggressive selling following the release of the US consumer inflation figures.

- A sharp pullback in the US bond yields prompted USD profit-taking and exerted some pressure.

- The widening US-Japanese bond yield differential acted as a tailwind and helped limit losses.

The USD/JPY pair quickly reversed the post-US CPI low to a fresh daily low and was last seen trading in neutral territory, around the 125.25-125.30 region.

The pair retreated from the vicinity of the multi-year peak, around the 125.75 region and fell nearly 100 pips during the early North American session on Tuesday. The USD witnessed a typical "buy the rumour, sell the news" trade following the release of the US consumer inflation figures.

The headline CPI accelerated to 8.5% YoY in March from the 7.9% previous, while the core CPI missed expectations and rose 6.5% YoY during the reported month. The data was not as bad as feared and forced investors to scale back their expectations for a more aggressive policy tightening by the Fed.

This was evident from a sharp pullback in the US Treasury bond yields, which, in turn, prompted the USD bulls to take some profits off the table and exerted downward pressure on the USD/JPY pair. That said, a strong rally in the equity markets undermined the safe-haven JPY and helped limit losses.

Moreover, investors remain concerned that the recent surge in commodity prices would put upward pressure on already high consumer prices. This should act as a tailwind for the US bond yields ad supports the prospect of the emergence of some USD dip-buying and lend support to the USD/JPY pair.

Conversely, caution around the BoJ's intervention to defend its 0.25% yield target should cap the Japanese government bond. The resultant widening of the US-Japanese government bond yield differential suggests that any fall should continue to attract fresh buyers around the USD/JPY pair.

Technical levels to watch

EUR/USD weakens to mid-1.08s to trade unchanged for the week. Economists at Scotiabank expect the pair to test the Friday low of 1.0837.

Resistance aligns at 1.0875/85 followed by the big figure zone

“Price action points to a test of the Friday low of 1.0837 that stands as the sole support marker ahead of the big figure.”

“Resistance is ~1.0875/85 followed by the big figure zone and 1.0935.”

- EUR/USD resumes the downtrend, retests 1.0850 on Tuesday.

- Next on the downside comes the 2022 low at 1.0805.

EUR/USD fades the bull run to the 1.0900 zone soon after the release of US inflation figures.

Considering the ongoing price action, further decline remains in store for the pair in the short-term horizon. Against that, a break below the so far monthly low at 1.0836 (April 8) should open the door to a move to the YTD low at 1.0805 (March 7).

The medium-term negative outlook for EUR/USD is expected to remain unchanged while below the key 200-day SMA, today at 1.1450

EUR/USD daily chart

Gold is benefiting from large-scale Chinese purchases. However, the bright metal is set to come under pressure as the Federal Reserve is signaling its intent to reach neutrality by year-end and to start an aggressive QT regime, strategists at TD Securities report.

Breadth of traders short in gold is near its smallest levels on record

“Our tracking of the aggregate net positions held by Shanghai's largest traders long and short suggests that this cohort has increased their gold length to its highest levels in the past twelve months, supporting prices while Comex shorts have largely been wiped out and ETF inflows have slowed as the fear trade subsides. In fact, dry-powder analysis still highlights the breadth of traders short in gold is near its smallest levels on record.”

“A Fed that is signaling its intent to reach neutrality by year-end and to start an aggressive QT regime doesn't exactly stand out as a macro context in which gold inflows are expected to firm.”

“Either gold bugs are sleepwalking towards a significant drawdown as inflows could subside alongside larger short positioning, or the resilience in prices is a canary in the coal mine for a different macro regime on the horizon.”

- NZD/USD has rallied into the upper 0.6800s in wake of post-softer than expected US CPI US dollar profit-taking.

- Short-term bulls are eyeing a test of recent lows and the 21 and 200DMA at 0.6900.

- Focus has now turned to Wednesday’s RBNZ meeting.

After finding strong support above the 0.6800 level and its 50-Day Moving Average just below it earlier in the session, NZD/USD has now extended gains to the 0.6860s, where it now trades up about 0.6% on the day. The latest US Consumer Price Inflation report, which saw Core measures come in a little softer than expected, triggered a bout of profit-taking in USD long positions, hence the most recent bounce in NZD.

Short-term NZD/USD bulls will now be eyeing a retest of resistance in the 0.6900 area, which coincides with the 1 April low and the 21 and 200DMAs. Before that though, the pair is going to need to break back to the north of the 29 March lows at 0.6875, which for now, it has not been able to do. That shouldn’t come as too much of a surprise to traders.

NZD/USD is likely to trade in subdued fashion for the rest of Tuesday’s session ahead of the release of the RBNZ’s latest monetary policy decision during Wednesday’s Asia Pacific session. Market participants are debating whether the bank will lift interest rates by 25 or 50 bps and how aggressive subsequent rate guidance will be.

Any dovish surprise (i.e. a 25 bps move) would threaten the RBNZ’s status as the most hawkish G10 central bank and would weigh heavily on NZD/USD. A drop back to the 0.6800 area and the 50DMA, and potentially below it, would be on the cards. For now though, the pair seems highly likely to stick within a 0.6800-0.6900ish range.

- A combination of supporting factors pushed spot gold to a fresh multi-week high on Tuesday.