- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 12-04-2011

Although the major equity averages are still down markedly for the day, stocks have spent the past few hours gradually paring their losses. The effort has stocks sitting at afternoon highs.

Financials have extended their rally into higher ground. The sector now sports a 0.2% gain.

Still, consumer staples stocks represent this session's top performing sector as they sport a 0.4% gain. This is the second straight session that consumer staples have outperformed. Colgate-Palmolive (CL 83.00, +1.39) and Procter & Gamble (PG 62.89, +0.70) are leaders in their space.

USD/CAD holds back around C$0.9600 area now after seeing morning high prints around C$0.9655. Traders say that C$ remains a buy on dips, along with other risk currencies, though USD bids likely on approach to C$0.9500.

NYMEX May light sweet crude holds at $106.00 per barrel, down from an earlier high of $110.24 as well as Monday's peak at $113.46, which was the highest level seen since Sept 2008. A close below $106.95, the prior 2011 high posted March 7 would be deemed bearish for the front contract.

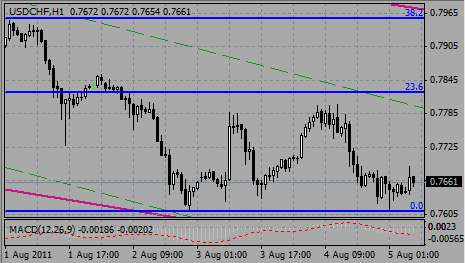

The yen and Swiss franc rose against most of their major counterparts after Japan raised the severity rating for the nuclear crisis that began last month and more earthquakes shook buildings in Tokyo, discouraging demand for higher-yielding assets.

“Yen-buying pressure may intensify against a backdrop of Japanese investors’ risk reduction and a worldwide equity downward correction,” said Junya Tanase, chief currency strategist at JPMorgan Chase & Co. in Tokyo. “We expect dollar- yen to decline towards 80 in coming several weeks.”

The IMF lowered its 2011 forecast for Japanese growth to 1.4 percent from 1.6 percent in its World Economic Outlook report yesterday, citing effects from the disaster.

Canada’s dollar slid versus the U.S. dollar after the Bank of Canada held its target rate for overnight loans between commercial banks at 1 percent, where it has been since September.

The pound slumped to its weakest against the euro in almost six months as the U.K.’s inflation unexpectedly slowed in March, discouraging the Bank of England from raising interest rates.

Consumer prices rose 4 percent from a year earlier, down from a 4.4 percent pace in February.

The U.S. trade deficit narrowed in February from a seven-month high as demand for imports decreased for the first time in four months.

The gap shrank to $45.8 billion from $47 billion in January, Commerce Department figures showed today in Washington.

Stocks continue to descend deeper into negative territory. The slide has taken both the S&P 500 and the Nasdaq Composite below their 50-day moving averages to new two-week lows. The Dow is also at an April low, but it has yet to come in contact with its 50-day moving average.

Although weakness is widespread, participants continue to make the most concerted push against energy stocks, which are now down 3.3%. There isn't a single stock in the sector that has managed to put together any kind of a gain.

"Exports and imports both fell significantly, with practically every major category of goods exports and imports down on the month." They est trade will cut Q1 real growth, now seen +1.5%. But Pierpoint says Q2 could rebound to +5% real growth.

Stocks have extended their morning slide so that the Dow is now down 100 points.

Energy stocks continue to cast the heaviest weight on broad market trade. The sector is now down 2.5% as integrated oil and gas plays like Dow components Exxon Mobil (XOM 83.35, -1.81) and Chevron (CVX 104.77, -3.01) and service plays like Baker Hughes (BHI 66.89, -2.42) and Schlumberger (SLB 86.64, -2.16) succumb to sharp selling pressure.

Of the major sectors, health care is a top performer. The sector's 0.2% gain is underpinned by strength in health care facilities stocks. Tenet Healthcare Corp (THC 6.70, +0.26) is actually up 4%.

U.S. stocks were headed for a weak open Tuesday, after Cisco announced impending job cuts, and Japanese officials raised the threat level at the Fukushima nuclear plant to the same as Chernobyl.

On Monday, U.S. stocks gave up an early advance and closed little changed, as investors look toward corporate reports due throughout the week.

Companies: Cisco Systems announced that it was taking a restructuring charge of $300 million, as it prepared to reduce its staff by 550 workers. Cisco (CSCO) shares dipped 1% on the news.

Alcoa (AA) kicked off earnings seasons with a first-quarter profit that beat estimates, but shares fell 3.3% in premarket trading, because the aluminum maker missed forecasts on revenue.

Economy: The Commerce Department released data on the U.S. trade balance for February, showing that the deficit narrowed to $45.8 billion, the gap was slightly more than expected.

Economists expected the report to show the trade deficit narrowed slightly to $45.7 billion, down from $46.3 billion in January.

World markets:

Oil for May delivery fell 29 cents to $109.63 a barrel.

Gold futures for June delivery fell $1.50 to $1,466.60 an ounce.

The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 3.53% from 3.57% late Monday.

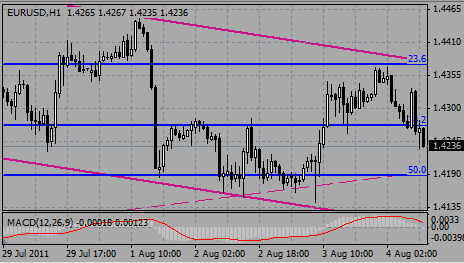

EUR/USD continues to flirt with $1.4500 area with option related supply ahead of the figure. Risk may be for stops atop $1.4500 followed by reported offers $1.4510/15 to make for choppy dealings.

Data released

06:00 Germany CPI (March) final 0.5% 0.5% 0.5%

06:00 Germany CPI (March) final Y/Y 2.1% 2.1% 2.1%

06:00 Germany HICP (March) final Y/Y 2.3% 2.2% 2.2%

08:30 UK Trade in goods (February), bln -6.8 -7.8 -7.8 (-7.1)

08:30 UK Non-EU trade (February), bln -2.9 -4.7 -4.2

08:30 UK HICP (March) 0.3% 0.6% 0.7%

08:30 UK HICP (March) Y/Y 4.0% 4.4% 4.4%

08:30 UK HICP ex EFAT (March) Y/Y 3.2% - 3.4%

08:30 UK Retail prices (March) 0.5% 0.5% 0.1%

08:30 UK Retail prices (March) Y/Y 5.3% 5.5% 5.5%

08:30 UK RPI-X (March) Y/Y - 5.5%

09:00 Germany ZEW economic expectations index (April) 7.6 11.5 14.1

The yen and Swiss franc rose after more earthquakes shook buildings in Tokyo and Japan raised the severity rating for the nuclear crisis that began last month, reviving demand for the safest assets.

The yen appreciated as officials said the accident at the Fukushima Dai-Ichi power plant may release more radiation than the 1986 Chernobyl disaster.

The IMF lowered its 2011 forecast for Japanese growth to 1.4 percent from 1.6 percent in its World Economic Outlook report yesterday, citing effects from the disaster. The forecast for next year was raised to 2.1 percent from 1.8 percent.

The euro rose as the International Monetary Fund and European Commission prepare to meet in Lisbon to discuss an 80 billion-euro ($116 billion) aid program for Portugal. The pound sank after data showed inflation slowed.

A report today showed German investor confidence fell more than economists forecast in April after the European Central Bank raised interest rates and Portugal become the third euro- region nation to seek a bailout.

The ZEW Center for European Economic Research said its index of investor and analyst expectations declined to 7.6 from 14.1 in March. Economists expected a drop to 11.3.

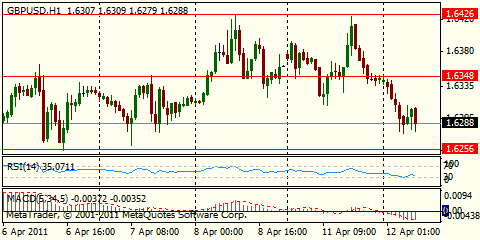

The pound slumped to its weakest against the euro in almost six months.

Statistics showed U.K. inflation unexpectedly slowed last month, weakening the case for the Bank of England to raise interest rates. Consumer prices rose 4% from a year earlier, down from the 4.4% pace in February.

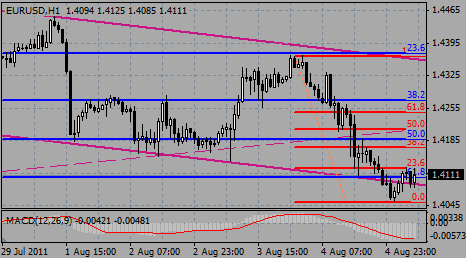

EUR/USD rose from $1.4380 to $1.4480 before retreated to current $1.4471.

GBP/USD fell after the weak UK data. Rate fell from $1.6320 to $1.6220 before recovered to $1.6280.

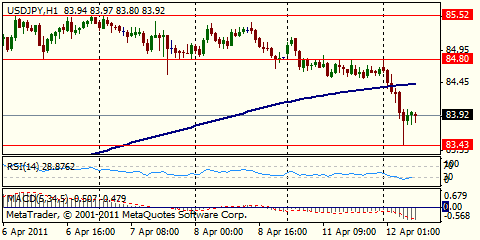

USD/JPY recovered from Asian lows around Y83.40 to Y84.40.

US data include International trade report for February with an expected deficit of -45.5 bln after -46.3 bln.

At 13:00 GMT BOC announces its rate decision. Analysts predict rate remains unch at 1.00%.

May WTI retreats from recent highs after a strong morning rally when prices rose from an Asian low of $107.85 to $110.22. Support is now seen at $107.85 and $107.08 with resistance at $110.69 and $111.34. Market currently trades $109.62/65.

EUR/JPY printed session high on Y122.14 as dollar-yen finds headwinds above Y84.40 and drifts back to Y84.20/25. Cross retreated back under the figure and holds currently around Y121.71. Resistance above seen towards Y122.41 (Asian high) ahead of Y123.33 (Mon high).

NZD/USD rallied from the overnight lows of $0.7746 to a new 2011 highs on $0.7860 after triggering stops on $0.7850. Resistance ahead now seen at last Nov 10 high of $0.7874. Kiwi trades $0.7850.

EUR/USD printed hourly high on $1.4483 before retreated to current $1.4465. Offers had been expected to emerge around the recent highs of $1.4485/89, with further sell interest positioned ahead of a suggested barrier at $1.4500. Support now seen at $1.4440 with stops below.

Gold prices back off the earlier Asian lows with a strong pull back up to $1464.50 on a general rally in commodities led by crude oil. Silver has also recovered strongly to $40.84.

The yen gained sharply on Tuesday as profit-taking. Like the yen, the U.S. dollar found some speculators locked in profits in favour of the euro and commodity plays like the Australian dollar, though traders said both the yen and the dollar looked set to resume sliding after the profit-taking had run its course.

"When there are uncertainties, you just close your positions. At the moment, what a lot of people have is yen short positions so the yen is being bought back. But I don't see any change in the yen's downtrend," said a trader at a U.S. bank.

"Aftershocks in Japan hampered overall risk sentiment helping JPY to be the top performer overnight, even amid reports that the estimate of the severity of the Fukushima accident could be increased," said David Watt, strategist at RBC.

Japan raised the severity of its nuclear disaster to the highest level on Tuesday, citing accumulated levels of radiation released.

The IMF lowered its 2011 forecast for Japanese growth to 1.4 percent from 1.6 percent in its World Economic Outlook report yesterday, citing effects from the disaster. The forecast for next year was raised to 2.1 percent from 1.8 percent.

The Centre for European Economic Research's Survey on Economic Sentiment (ZEW) resulted in an index reading of 19.7 in April. The index deteriorated from a 31.0 print in March. The slide overwhelmed a market-based forecast at 29.8 on the index.

The pound fell against the dollar and the euro after a report showed U.K. retail sales dropped by a record in March, weakening the case for the Bank of England to raise interest rates from a record low. Sales at stores measured by value fell 1.9 percent from a year earlier, the British Retail Consortium said. That’s the biggest drop since the series began in 1995.

Pound retreated after weaker than expected inflation figures in the UK, which eases pressure on the BoE to hike interest rates. Consumer Prices Index slowed down to 0.3% advance in March and a 4.0% increase year-on-year, below the 0.7% and 4.4% respective increases in February, and the 0.6% and 4.4% readings forecasted by market analysts.

EUR/USD extends recovery to $1.4465 after reports that China will continue to buy Spanish govt debt. Next resistance seen at recent highs of $1.4485/89, with offers noted from this area through to a suggested barrier at $1.4500.

- Germany strong growth seems to leave little improvemt room

- Risks seen from Japan, Arab world for global economy

- Considerable risks may come from rising commodity prices

- 2nd-rd effects cld force ECB to more restrictive mon pol

USD/JPY Y83.80, Y84.15, Y84.50, Y85.00, Y85.50, Y82.45, Y82.10

EUR/JPY Y120.80, Y118.25

GBP/USD $1.6350

EUR/CHF Chf1.3150

AUD/USD $1.0475, $1.0500, $1.0550, $1.0300

Hang Seng -1.34% 23,976.37

The main EMU release for Tuesday is the 0900GMT release of German ZEW data for April, which is expected to see the current situation data edge to 85.0 from 85.4 and the economic sentiment index slip to 11.6 from 14.1 in March.

US data: the weekly Redbook Average is due at 1255GMT, while at 1400GMT, the latest IBD/TIPP Economic Optimism Index is released. Later, at 1800GMT, the US Treasury is expected to post a $189.0 billion

budget gap in March, much larger than the $65.4 billion gap in March 2010 due to a significant drop off in personal tax receipts.

- higher Japan 2011 demand to offset weaker non-oecd demand

- March non-OPEC supply up 200 kbd m/m to 53.3 mbd

- effective OPEC spare capacity 3.91 mbd, incl saudi 3.2 mbd

- hikes 2011 avg non-OPEC supply fcst 100 kbd to 53.7 mbd

- trims 2011 avg OPEC call/stocks fcst 100 kbd to 29.8 mbd

- 2q global crude run projection cut 270 kbd due Japan

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.