- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 12-02-2023

- GBP/JPY has rebounded firmly from 158.50 but is still inside the woods.

- Bets look solid for the appointment of academician Kazuo Ueda for BoJ novel leadership.

- An increase in the UK labor cost index will escalate troubles for the BoE.

The GBP/JPY pair sensed the strength and scaled above 158.50 in the early Tokyo session. Despite a recovery move, the cross is still inside the woods as it is expected to display a volatility contraction move after wild swings reported on Friday. Rising odds for the appointment of academic Kazuo Ueda as the successor of Bank of Japan (BoJ) Governor Haruhiko Kuroda triggered immense volatility in the Japanese Yen.

The Nikkei Asian Review reported on Friday that the Japanese Cabinet is set to appoint Kazuo Ueda as the next BoJ Governor after Haruhiko Kuroda steps down in April. The reports also claimed that the Japanese government will nominate ex-FSA Chief Himino, ex-FSA Chief Himino, and BoJ Executive Director Shinichi Uchida for the new Deputy BoJ Governor.

The headlines resulted in a perpendicular upside move in the Japanese Yen, however, the move got fizzled out after Kazuo Ueda stated the current monetary policy as appropriate. Japan’s PM Fumio Kishida has been reiterating that the administration will consider an exit from the decade-long expansionary policy with novel BoJ leadership. And, a contrary monetary policy view from academic Kazuo Ueda faded expectations of exit from accommodative monetary policy.

On the economic data front, investors are keeping an eye on Japan’s Gross Domestic Product (GDP) (Q4) data, which will release on Tuesday. The economic data is seen to expand by 2.0% on an annual basis and 0.5% on a quarterly front.

Meanwhile, investors in the United Kingdom are waiting for Employment numbers to get further guidance about the Pound Sterling. The Unemployment Rate for three months is seen unchanged at 3.7%. While the Average Earnings excluding bonuses are expected to increase to 6.5%. This might create more troubles for the Bank of England (BoE), which is struggling to gain an upper hand in the battle against firmer inflation.

Over the UK inflation guidance, UK FM Jeremy Hunt is of the view that “If we stick to our plan to halve inflation this year, we can be confident of having amongst the best prospects for growth of anywhere in Europe.”

- NZD/USD stays pressured towards short-term key support after unimpressive weekly close.

- Sustained U-turn from 200-SMA, looming bear cross on MACD favor sellers.

- Late January low holds the key to the bear’s defeat.

NZD/USD holds lower grounds as sellers attack the 0.6300 round figure during Monday’s Asian session, following a lackluster weekly closing.

The Kiwi pair’s weakness could be seen in its inability to cross the 200-bar Simple Moving Average (SMA), as well as a clear downside break of the 61.8% Fibonacci retracement of its January-February upside, near 0.6325 by the press time.

Furthermore, a looming bear cross on the MACD adds strength to the downside bias about NZD/USD.

However, a clear break of the five-week-old ascending trend line, around 0.6285 by the press time, becomes necessary for the NZD/USD bear’s conviction.

Following that, the monthly low near 0.6270 and the previous monthly bottom of 0.6190 will be in focus.

On the flip side, the 61.8% and 50% Fibonacci retracement levels, respectively near 0.6325 and 0.6365, restrict short-term NZD/USD recovery ahead of the 200-SMA level surrounding 0.6390.

Should the Kiwi pair remains firmer past 0.6390, the 0.6400 round figure and the January 31 swing low, near 0.6415, will be crucial for the NZD/USD buyers to regain control.

Overall, NZD/USD is firmly on the bear’s radar but a trigger is important to activate the downside bias, which in turn highlights the aforementioned support line.

NZD/USD: Four-hour chart

Trend: Further downside expected

- USD/CHF is aiming to recover after a corrective move amid a risk-off market mood.

- The asset managed to extend its recovery move above the 23.6% Fibo retracement at 0.9291.

- An absence of a potential trigger is barricading the RSI (14) in crossing the 60.00 hurdle.

The USD/CHF pair has corrected after facing barricades around 0.9250 in the early Asian session. The Swiss Franc asset has dropped, however, the expectations of a recovery move look favored amid the weak risk appetite of the market participants. The asset is likely to display volatility ahead of the Swiss Consumer Price Index (CPI) (Jan) on Monday. On a monthly basis, the economic data is seen to expand by 0.3% vs. a deflation of 0.2%. The annual data is seen lower at 2.7% versus 2.8% released earlier.

The mega event of this week will be the United States inflation data, which will release on Tuesday. The US Dollar Index (DXY) is expected to remain in action as investors are expecting an acceleration in the inflation figures by 0.4% on a monthly basis. The return provided on the 10-year US Treasury yields has scaled above 3.74%, the highest in a one-month period.

USD/CHF has managed to extend its recovery move above the 23.6% Fibonacci retracement (placed from February low at 0.9051 to February 6 high at 0.9291 on a two-hour scale. The asset is now approaching the supply zone placed in a 0.9280-0.9290 range.

The 20-period Exponential Moving Average (EMA) at 0.9227 is acting as major support for the US Dollar bulls.

Meanwhile, the Relative Strength Index (RSI) (14) is struggling to extend into the bullish range of 60.00-80.00, which indicates an absence of a potential trigger for fresh impetus.

For a fresh upside, the Swiss Franc asset needs to deliver a confident break above the aforementioned supply zone, which will drive the asset towards January 12 high at 0.9363 followed by January 6 high at 0.9410.

In an alternate scenario, a breakdown below February 9 low at 0.9161 will drag the asset toward the round-level support at 0.9100. A slippage below the latter will drag the asset toward February low at 0.9051.

USD/CHF two-hour chart

-638118406887851095.png)

- USD/CAD steadies after dropping the most in five weeks the previous day.

- Strong Canada jobs report, firmer Oil price allowed Loonie bears to sneak in.

- Hawkish Fed talks, upbeat US data challenge pair sellers ahead of the key US CPI.

USD/CAD seesaws around the mid-1.3300s during the early hours of Monday’s Asian session, after falling the most in five weeks the previous day. In doing so, the Loonie pair portrays the market’s consolidation ahead of the key US Consumer Price Index (CPI) data amid mixed clues from the United States.

The Loonie pair dropped the most since early January on Friday after a strong Canada jobs report joined upbeat prices of WTI crude oil, Canada’s key export.

That said, WTI crude oil refreshed its monthly high to $80.48 the previous day, around the same level by the press time, amid markets chatters that Russia will cut its Oil output by 500,000 barrels in March to counter European sanctions.

Elsewhere, Canada’s Net Change in Employment grew past 15K expected and 69.2K prior (revised) to 150K for January. Further, the Unemployment Rate also reprinted 5.0% versus 5.1% expected.

The firmer Canada jobs report makes it harder for the Bank of Canada (BoC) to pause its rate hike trajectory, as signaled by the dovish comments from BoC Governor Tiff Macklem, which in turn favored USD/CAD bears.

On the other hand, the preliminary readings of the US University of Michigan (UoM) Consumer Sentiment for February rose to 66.4 versus 65.0 expected and 64.9 prior. Further, the UoM noted that the year-ahead inflation expectations rebounded to 4.2% this month, from 3.9% in January and 4.4% in December. “Long-run inflation expectations (5-year) remained at 2.9% for the third straight month and stayed within the narrow 2.9-3.1% range for 18 of the last 19 months,” Stated UoM. Further, the US Bureau of Labor Statistics announced on Friday that it revised the monthly Consumer Price Index (CPI) for December to +0.1% from -0.1%, based on updated seasonal adjustment factors.

It should be noted that the recently mixed comments from Richmond Federal Reserve (Fed) President Thomas Barkin and the US-China tussles over the ‘unidentified’ objects seem to challenge the sentiment and favor the US Dollar (USD) due to its haven appeal.

Amid these plays, S&P 500 Futures print mild losses and the US Treasury bond yields grind higher, which in turn favor the US Dollar and the USD/CAD buyers ahead of the key US inflation data.

Moving on, the USD/CAD traders should pay attention to the risk catalysts ahead of Tuesday’s US Consumer Price Index (CPI) for January, especially due to the policy pivot talks at the Fed.

Technical analysis

Unless breaking a convergence of the three-month-old ascending trend line and a 200-day Exponential Moving Average (EMA), around 1.3270 by the press time, USD/CAD bears off the table.

China government mentioned that it has spotted an unidentified object flying over the waters near northern port city Qingdao, after Pentagon shot down an alleged Chinese unidentified object. The authorities also mentioned that they’re ready to shoot it down.

The ‘object’ story gained momentum after Pentagon shot down an object during the weekend by saying that it appeared to have traveled near US military sites and posed not just a threat to civilian aviation but also as a potential tool for surveillance.

“It was the fourth unidentified flying object to be shot down over North America by a U.S. missile in a little more than a week,” said Reuters.

The news also adds, “On President Joe Biden's order, a U.S. F-16 fighter shot down the object at 2:42 p.m. local time over Lake Huron on the U.S.-Canada border, Pentagon spokesperson Patrick Ryder said in an official statement.”

Also read: Chinese spy-baloon (s) updates

FX implications

The news appears exerting downside pressure on the risk-barometer AUD/USD prices, down 0.12% near 0.6910 by the press time.

Also read: AUD/USD Price Analysis: Key support in play with eyes on 0.6900/50 for the opening range

- GBP/USD is expecting further downside to near 1.2000 ahead of US Inflation.

- Fears of an upside surprise in US inflation and back-to-back Pentagon events are portraying a risk-off impulse.

- UK FM Jeremy Hunt is confident that the UK inflation will be halved if the administration sticks to its plan.

The GBP/USD pair is displaying a sideways action around 1.2050 in the early Asian session. The Cable is expected to display further downside as the odds of a policy tightening pause by the Federal Reserve (Fed) have vanished entirely and more interest rate hikes are expected to continue its battle against stubborn inflation.

Renewed concerns of more policy tightening by the Fed and disappointed quarterly earnings forced S&P500 to settle last week with the highest losses since December. This has strengthened the risk-aversion theme further. Also, the Pentagon shot down an unidentified object over Alaska on Saturday. This is the second event in less than a week after the Pentagon shot down the spy Chinese balloon, which was later identified as a civilian by the Chinese administration. The events are portraying more traction for the risk-off impulse.

The US Dollar Index (DXY) looks set to add gains above 103.35 ahead of the United States Consumer Price Index (CPI) data, scheduled for Tuesday. A Reuters poll expects further upside in the monthly headline and core inflation by 0.4%.

Philadelphia Fed President Patrick Harker reiterated his view that the central bank will continue hiking interest rates to above 5%. The Fed policymaker has favored a small interest rate hike and sees no recession ahead. Also, the expression of a rate cut is unlikely this year.

On the United Kingdom front, preliminary Gross Domestic Product (GDP) data for Q4 remained stagnant as expected by the market participants. Also, the annual GDP matched expectations of 0.4% expansion vs. the former release of 1.9%. The Manufacturing and Industrial Production remained negative but managed to deliver less contraction than expected.

UK Finance Minister Jeremy Hunt said “The fact the UK was the fastest growing economy in the G7 last year, as well as avoiding a recession, shows our economy is more resilient than many feared." He further added, “If we stick to our plan to halve inflation this year, we can be confident of having amongst the best prospects for growth of anywhere in Europe.”

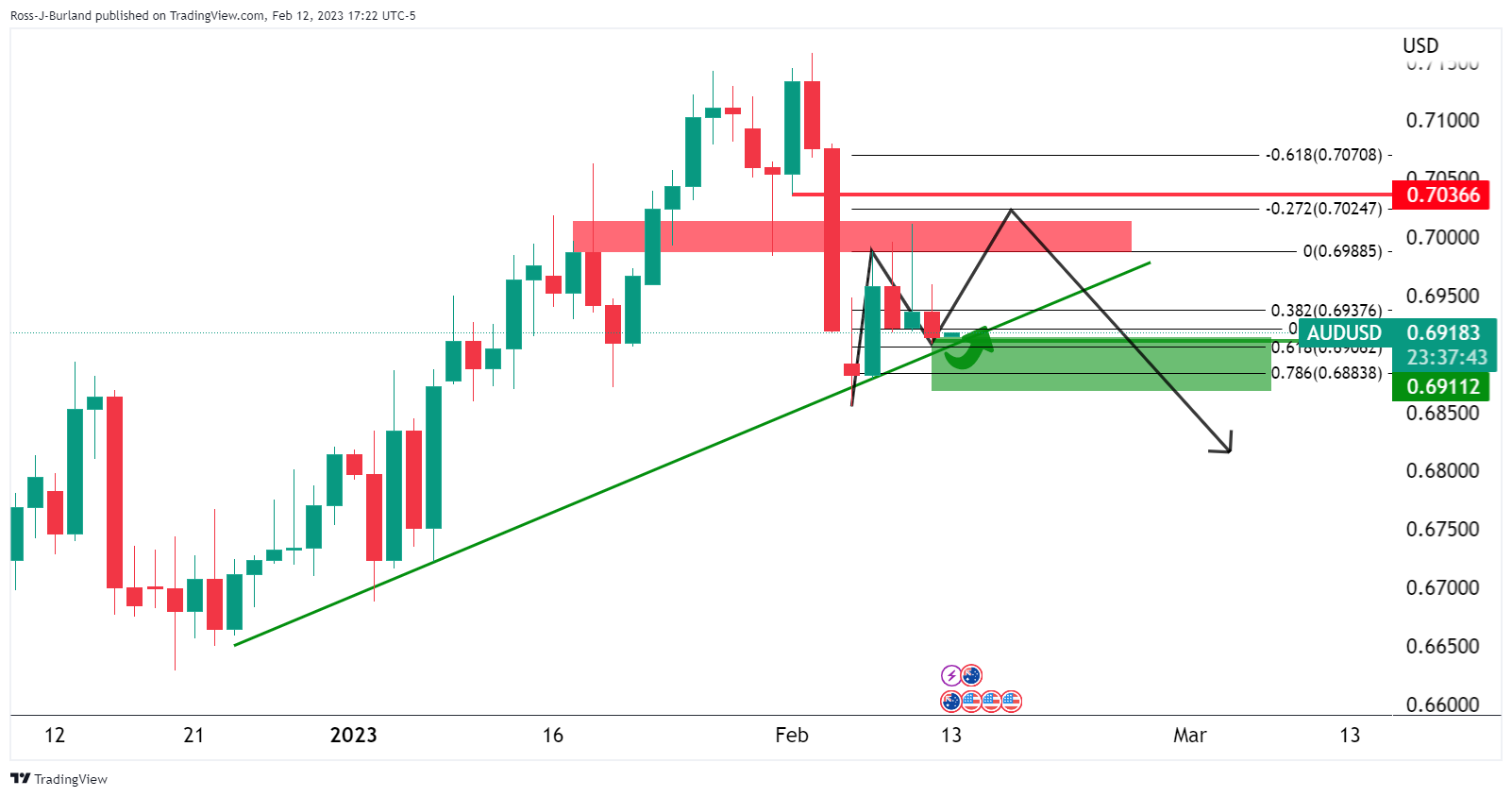

- On the hourly chart, 0.6950 is a key level that if broken, could seal a bullish thesis for the days ahead.

- Bears eye a move to test key structure around 0.6920/00.

AUD/USD bears were unconvincing on Friday and we have seen little in the way of a commitment so far in the open on Monday, albeit in very early days in an illiquid open.

With that being said, we are down low in the 100 pip box between 0.6900 and 0.7000 and we may continue to work the lows for some time until the bulls make their major move, if at all.

The following illustrates an upside bias due to the daily M-formation and major support zone:

AUD/USD daily chart

We have already seen moves towards the neckline but they were faded pretty fast. However, arguably, this only makes for a stronger case to move up again as the initial tests have created a pool of liquidity.

Given that we still have not had a breakdown of structure to the downside, below 0.6920/00, and confirmation that a break thereof was not just a stop hunt, (to say 0.6870 and reversal), a bullish thesis can still be valid for the opening balance of the week:

AUD/USD H1 chart

On the hourly chart, we have 0.6950 to clear before a bullish thesis can be solidified, so it is a case of seeing how the opening range on Monday develops. However, while holding above the trendline and said support, there are prospects of a short squeeze to test 0.6950 for the day ahead. That does not rule out a move into low-hanging fruit below 0.6900 and into the 0.6880s before hand.

- Gold price begins week’s trading with minor gains after mildly offered weekly closing.

- Firmer United States statistics, US Treasury bond yields help Federal Reserve hawks and weigh on Gold price.

- US-China tension contrasts with cautious economic optimism to challenge XAU/USD bears.

- US Consumer Price Index, China-linked headlines will be crucial to convince Gold sellers amid US Dollar rebound.

Gold price (XAU/USD) kick-start the key week with mild gains around $1,865 as traders brace for the key United States inflation data. Even if the yellow metal is up 0.09% intraday at the latest, the XAU/USD bears remain hopeful as the latest lot of the US statistics have been impressively favoring the hawkish Federal Reserve (Fed) officials. Also favoring the Gold bears are the US-China tension and the firmer US Treasury bond yields, not to forget the US Dollar rebound.

Upbeat United States economics lure Gold bears

Having witnessed a retreat in the US Dollar during the last 2022’s, the return of strong United States data teases the Gold sellers as markets prepare for the key US Consumer Price Index (CPI) data for January.

On Friday, the preliminary readings of the US University of Michigan (UoM) Consumer Sentiment for February rose to 66.4 versus 65.0 expected and 64.9 prior. Further, the UoM noted that the year-ahead inflation expectations rebounded to 4.2% this month, from 3.9% in January and 4.4% in December. “Long-run inflation expectations (5-year) remained at 2.9% for the third straight month and stayed within the narrow 2.9-3.1% range for 18 of the last 19 months,” Stated UoM.

It’s worth noting that the key US sentiment gauge jumped to the highest in over a year and has a likely strong positive impact on the US inflation data, which in turn can weigh on the Gold price, as the trends between confidence and spending are closely related.

Hawkish Federal Reserve officials weigh on XAU/USD price

As the recent United States Consumer Sentiment gauge and the inflation expectations join the previous employment numbers, the Federal Reserve (Fed) hawks are likely to reiterate their calls of “way to go” for policy pivot, even if Fed Chair Jerome Powell appears reserved of late.

Richmond Federal Reserve (Fed) President Thomas Barkin also joined Fed Chair Powell’s league to challenge the Gold bears, backed by higher US Jobless Claims, but the majority of others on the board are quite hawkish and can challenge the XAU/USD rebound.

It should be noted that Philadelphia Federal Reserve President Patrick Harker mentioned on Friday, “We want economy to keep growing, but also to get inflation under control, that's job one,” which in turn suggests hawkish bias at the Fed.

US-China tension, US policymakers’ optimism vs. recession woes probe Gold bulls

In nearly one week, the United States brought down three by air-to-air missiles and allege China of spying, which in turn renewed geopolitical fears among the world’s top two economies and weigh on Gold price. Adding strength to the XAU/USD bear’s confidence could be the US policymakers’ optimism, including US President Joe Biden and Treasury Secretary Janet Yellen, who ruled out recession woes and favor Federal Reserve (Fed) hawks to maintain their bias for higher rates. Additionally, the US Treasury bond yield curve inversion between the 10-year and two-year coupons also harms the Gold price. It's worth observing that the second consecutive weekly gain of the US Dollar Index (DXY) also weigh on the Gold price ahead of the key US data.

US inflation is the key

While a mixed bag of catalysts seems to challenge the Gold traders, this week’s United States Consumer Price Index (CPI) for January will be crucial as it will help clear the doubt over the Federal Reserve’s next moves. Given the hawkish expectations from the inflation numbers, the odds of witnessing two more Fed rate hikes and further downside for the Gold price can’t be ruled out. However, a surprise downtick in the CPI might new the Fed’s “policy pivot” talks and propels the XAU/USD price. It’s worth noting that the US Bureau of Labor Statistics announced on Friday that it revised the monthly Consumer Price Index (CPI) for December to +0.1% from -0.1%, based on updated seasonal adjustment factors.

Gold price technical analysis

A clear downside break of an ascending support line from November 2022, now immediate resistance near $1,875, joins bearish signals from the Moving Average Convergence and Divergence (MACD) indicator, to keep Gold bears hopeful. Adding strength to the downside bias is the steady Relative Strength Index (RSI) line, placed at 14.

However, a daily closing below the 50-day Exponential Moving Average (EMA), currently around $1,857, appears necessary for the XAU/USD sellers to retake control.

Following that, $1,825 may offer an intermediate halt before dragging the Gold price towards a four-month-old horizontal support zone near $1,805. It’s worth noting that the $1,800 round figure will act as an extra filter to the south.

Alternatively, an upside clearance of the support-turned-resistance line, near $1,875, needs to cross the previous weekly top surrounding $1,890 and January’s swing low of $1,900 to recall the Gold buyers.

In that case, a run-up towards $1,950 and the latest swing high surrounding $1,960 can’t be ruled out. However, the further upside appears difficult as the late March 2022 peak surrounding $1,966 could challenge the XAU/USD bulls afterward.

Gold price: Daily chart

Trend: Further downside expected

- EUR/USD is expected to display a downside below 1.0660 as the street fears a surprise rise in US inflation.

- Fed policymakers see interest rates higher for a more extended period as inflation is still elevated.

- ECB policymakers have been reiterating that Eurozone won’t face a deep recession, if it happens it will be shallow.

The EUR/USD pair has showed a pullback move to near 1.0680 in the early Tokyo session. The pullback move by the major currency pair seems to lack strength and is facing barricades in extending its gains. The shared currency asset is likely to display more weakness after surrendering the immediate support of 1.0660 as the risk-aversion theme is gaining more strength.

S&P500 showed recovery late Friday but ended the week on a bearish note amid fresh concerns of a further slowdown in economic activities ahead of the release of the United States Consumer Price Index (CPI), portraying a dismal market mood. Tuesday’s US inflation data will set the undertone for March’s monetary policy meeting by the Federal Reserve (Fed).

The US Dollar Index (DXY) refreshed its two-day high at 103.35 and is expected to deliver further upside amid the risk of a rebound in the declining US inflation trend. The demand for US government bonds remained extremely weak as the street is expecting a surprise upside in the US inflation after a bumper US Nonfarm Payrolls (NFP) report. This supported the 10-year US Treasury Yields to record a fresh monthly high at 3.74%.

A Reuters poll indicates that the monthly headline CPI and core inflation that excludes oil and food prices will escalate by 0.4%. This might force Fed chair Jerome Powell and his mates to look for more interest rate hikes ahead as the battle against inflation could get complex. Last week, Fed policymakers favored the context of higher interest rates for a more extended period as the inflationary pressures are still elevated as the healthy labor market could propel consumer spending.

On the Eurozone front, investors are awaiting the release of the Gross Domestic Product (GDP) (Q4) data, which will release on Tuesday. As per the consensus, the economic data for the quarter and on an annual basis is similar to its former releases at 0.1% and 1.9% respectively. This indicates that the Eurozone economy has not seen a recession in CY2022. Also, European Central Bank (ECB) policymakers have been reiterating that Eurozone won’t face a deep recession, if it happens it would be shallow as the signs of recovery are extremely solid.

The European Central Bank, ECB, Governing Council member Ignazio Visco, who is also the Bank of Italy's governor, was reported saying over the weekend by Reuters that the ECB must avoid pushing real interest rates too high, given the level of private and public debt in the euro area.

He also said he did not believe a recession was inevitable in order to reduce inflation.

"Today, disinflation is obviously needed, but given the levels of private and public debts that prevail in the euro area, we must be careful to avoid engineering an unnecessary and excessive rise in real interest rates," Visco told the Warwick Economics Summit.

"Indeed, I am convinced that the credibility of our actions is preserved not by flexing our muscles in the face of inflation, but by continually showing wisdom and balance."

Key quotes

Long persistence of inflation observed in many countries during the 1970s "is very unlikely".

I see no compelling reasons for inflation not to return to target, notwithstanding the still abundant (and excessive) liquidity present in the economic system.

Liquidity in the economic system will be gradually reduced through the actions of monetary policy.

There is no question that the restriction of the euro area monetary stance must continue.

Pace of any further rate hike will continue to be decided on the basis of incoming data and their impact on inflation outlook.

I am concerned about statements that seem to give a (much) higher weight to the risk of doing too little.

Given levels of private and public debts in euro area, we must be careful to avoid engineering an unnecessary and excessive rise in real interest rates.

I do not believe that a recession is inevitable for reducing inflation,

Visco told the Warwick Economics Summit.

Market implications

The ECB has raised interest rates by 3 percentage points since July and promised a 50 basis-point hike for March and dovish rhetoric such as this can hamstring the euro on bullish breakout attempts.

EUR/USD hit its highest in 10 months against the dollar earlier this month. However, the euro was on a second straight week of declines on Friday and closed lower by 0.57% at 1.0676.

Reuters reported that Philadelphia Federal Reserve President Patrick Harker said on Friday in the latest warning from a central banker over the debt ceiling that a default on US government debt triggered by political brinkmanship over federal borrowing limits and the budget deficit would be dire,

"Imagine us as a nation, the leading nation in the world, defaulting on our debt - that's hard to recover from," Harker said at a Global Interdependence Center conference in La Jolla, California. "And our competitors, our enemies, will cheer in the streets."

Key notes

Fed's keeping rates low meant hurdle rate for new investments was low, may have fostered crypto investments.

We want economy to keep growing, but also to get inflation under control, that's job one.

Will take time for inflation to get to 2%.

Consequences of a debt ceiling crisis would be dire.

A US debt default would be hard to recover from, our enemies would cheer in the streets.

We have issues in the federal budget, but debt ceiling brinkmanship is not the way to fix it.

Fed should not risk losing its independence.

Ultimate litmus test for central bank digital currency is if we need to do it to maintain trust in the US Dollar,

Harker was reported saying.

Chancellor Olaf Scholz’s Social Democrats lost the Berlin election on Sunday to the conservative Christian Democrats, failing to win the regional vote for the first time in nearly 25 years.

In the polls, the CDU was the strongest party with 27.5%, up from 18% in 2021. Support for the SPD dropped to 18.5% from 21%, its worst result ever, while the Greens were also on 18.5%, compared with 19%, the poll showed. This is the first time that the SPD has failed to come first in a Berlin regional election since 1999, when the CDU won with more than 40% of the vote.

The Guardian reported that the ''US and Canadian military are continuing to search by sea and land amid hostile weather conditions in a scramble to recover portions of three flying objects shot down over North American airspace in the past week.''

''The Democratic majority leader of the US Senate, Chuck Schumer, told ABC’s This Week on Sunday that he had been briefed by the White House and that officials were now convinced that all three of the flying objects brought down by air-to-air missiles this week were balloons. He put the finger of blame firmly on China.''

Related Headlines

US Representative Elissa Slotkin: Military has extremely close eye on object above Lake Huron;

- Update: Michigan Congressman Jack Bergman says US military has "decommissioned" an object over Lake Huron

Michael McCaul: Suspected Chinese spy balloon "did a lot of damage".

Canada's PM Trudeau: Unidentified object shot down over Northern Canada by Canadian and US aircraft.

Market implications

The markets are taking their geopolitical risks in their stride, focusing instead on sentiment surrounding the Federal Reserve and this week's US data including Consumer Price Index and Retail Sales.

On Friday, the US Dollar firmed and global equity markets dropped on Friday as rising interest rates and a slew of hawkish central bank officials who are concerned about persistent inflation risks.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.