- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 12-02-2022

The possibility of steeper interest rate hikes worried investors, and tensions between Ukraine and Russia escalated on Friday. This was sending markets into a state of flux with the usual risk assets and FX responding in kind; More on that below.

Meanwhile, there was news that a Russian attack on Ukraine could begin any day now and would likely start with an air assault, a White House national security adviser Jake Sullivan said on Friday. However, while the US says Russia has all the forces in place to launch military action, Russia has repeatedly said it has no such plans.

Ther BBC reports that ''Russia is adamant it has no plans to attack Ukraine: and foreign intelligence chief Sergei Naryshkin has condemned 'dangerous lies' being spread by the US and in Western capitals.''

Ukrainian President Volodymyr Zelensky said warnings of Russian aggression were stoking “panic” after the US national security advisor warned of an imminent Russian invasion.

''Ukraine is less convinced of the risk and its president has appealed to the West not to spread 'panic','' the BBC also wrote.

On the other hand, President Vladimir Putin has threatened "appropriate retaliatory military-technical measures" if what he calls the West's aggressive approach continues which could jeopardise Europe's entire security structure, in the least, so markets are paying close attention to weekend developmemts.

Putin told his French counterpart Emmanuel Macron Saturday that accusations Moscow plans to attack Ukraine were "provocative speculation" and could lead to a conflict in the ex-Soviet country.

"Conditions are being created for possible aggressive actions of the Ukrainian security forces in the Donbass," the Kremlin added.

Meanwhile, the US State Department is drawing down most of its staff at the US embassy in Kyiv because Russia has a “very capable” military and the US has to prepare for the worst scenario, according to a senior US official. “Prudence requires us to assume, to plan for and prepare for a worst-case scenario. And the worst-case scenario would obviously involve substantial Russian attacks on the Ukrainian capital,” the official told reporters during a phone call on Saturday morning.

US Secretary of Defense Lloyd Austin spoke with his Russian counterpart Sergey Shoyguon on Saturday and they discussed Russia's troop buildup in Crimea and around Ukraine, the Pentagon said. US President Joe Biden and Russia's Vladimir Putin also spoke by phone for an hour on Saturday and was completed at 12:06 p.m. ET, according to a White House official. Markets are now waiting for news of what was discussed after US equity benchmarks ended the week lower, with US stocks declining for a second consecutive session on Friday.

The S&P 500 ended lower by 1.9% to 4,418.64 and fell 1.8% for the week. The Nasdaq Composite lost 2.8% to 13,791.15 and declined 2.2% for the week and the Dow Jones Industrial Average pulled back by 1.4% to 34,738.06, ending the week 1% lower.

West Texas Intermediate crude oil surged by 4.5% to $93.93 a barrel and the global benchmark Brent crude was also advancing by 4.1% to $95.15 per barrel. This is a dangerous secenario for global markets considering the onset of uber high inflaiton readings of late and the proposed agressive resolve from global central banks. The blockbuster US Consumer Price Index report had already increased odds for a 50bp hike from the Federal reserve and talks of an emergency interest rate meeting and action before March's Federal Open Marlet Committee convenes to decide on the best course of aciton. However, energy prices would be tactically vulnerable to a deescalation in Russian-Ukrainian tensions.

Meanwehile, gold jumped on to a near two-month peak as concerns over surging inflation and the drums of conflict lifted demand for the safe-haven metal. Spot gold ended 1.77% higher to $1,858.98 per ounce and hit its highest level since Nov 2021. US gold futures settled up 0.3% at $1,842.1. Gold is considered a hedge against soaring inflation and is often used as a safe store of value during times of political and financial uncertainty. However, analysts at TD Securities argued that ''without sustained buying flow, gold prices are likely to succumb to the substantially higher real rates amid a hawkish regime at the Fed.''

Risk-FX on the backfoot

As for forex, the yen has picke dup a bid with the JXY index ending Friday 0.49% higher. The index that measures the strength of the JPY against a basket of other currencies. USD/JPY ended down 0.47% to 115.41 falling from a high of 116.17.

End off AUD bullish run?

AUD/USD was lower by 0.50% as well to 0.7130, with its bullish campaig potentially coming to a swift end at this juncture:

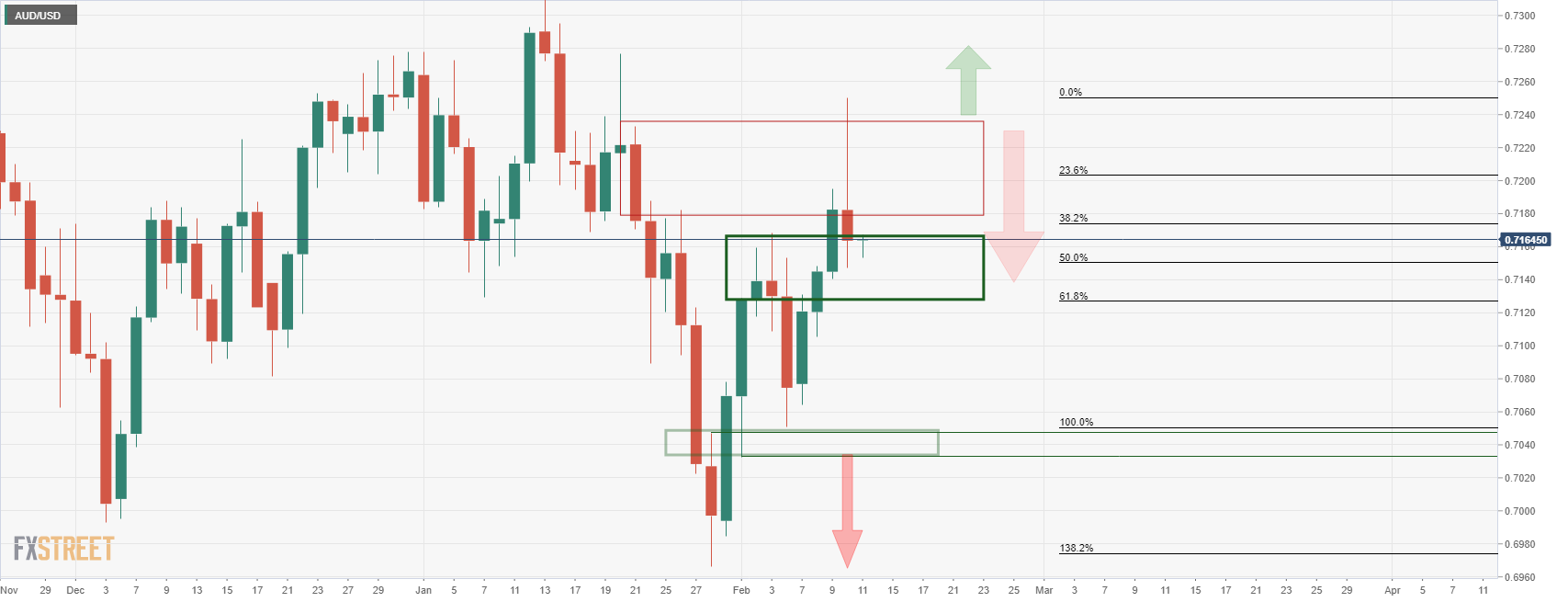

As per prior techncial analysis, the Aussie has price aciton has complied, helped along by teh Russian risk and a turn in US equities/risk-sentiment:

AUD/USD live market

For the the above scenario to play out, the price will need to break below the lows and close below the 61.8% ratio.

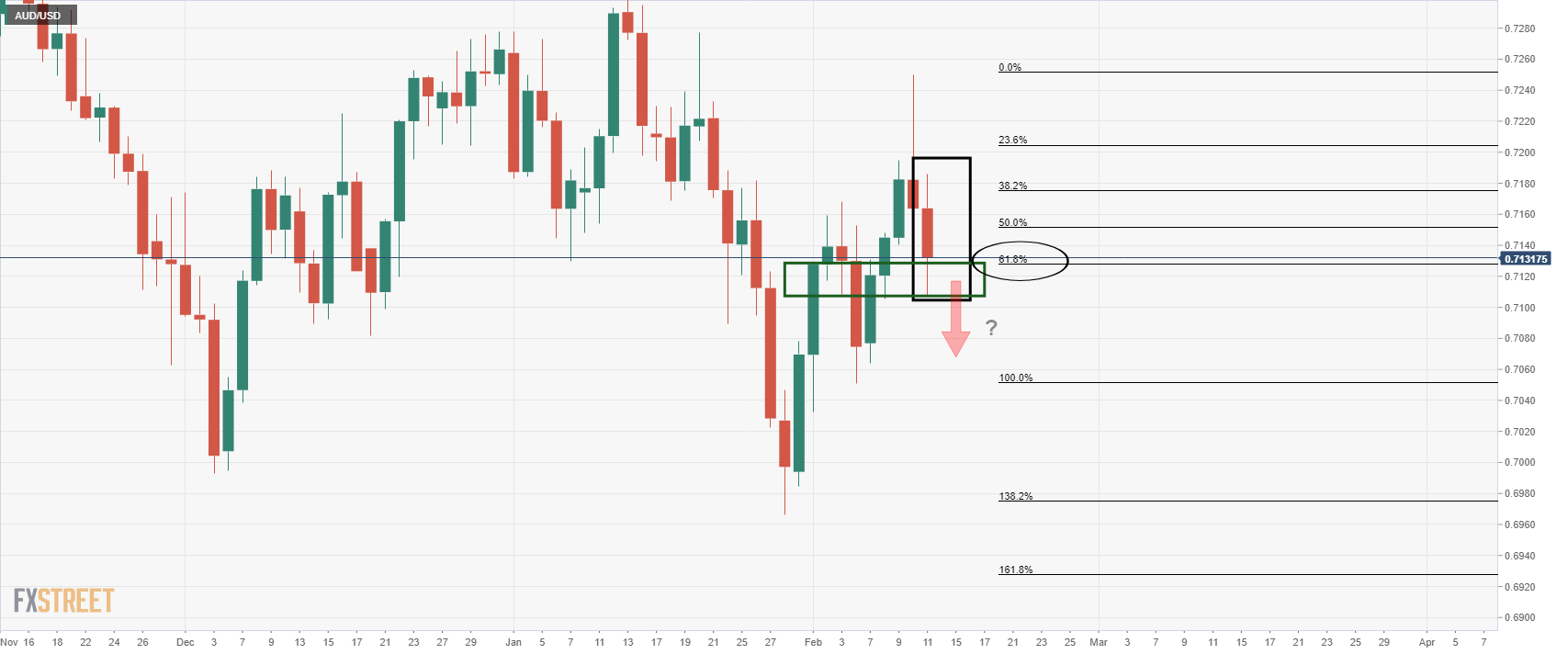

The hourly chart could play out as follows: A knee-jerk relief that there have been no conflict escaltionary headlines over the weekend, but the sistemic risks of conflict prevail for the days ahead nontheless:

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.