- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 11-08-2014

(raw materials / closing price /% change)

Light Crude 97.85 -0.23%

Gold 1,309.40 -0.08%

(index / closing price / change items /% change)

S&P/ASX 200 5,457 +21.69 +0.40%

TOPIX 1,252.51 +24.25 +1.97%

SHANGHAI COMP 2,224.6 +30.17 +1.38%

FTSE 100 6,632.82 +65.46 +1.00%

CAC 40 4,197.7 +49.89 +1.20%

Xetra DAX 9,180.74 +171.42 +1.90%

S&P 500 1,936.92 +5.33 +0.28%

NASDAQ 4,401.33 +30.43 +0.70%

Dow Jones 16,569.98 +16.05 +0.10%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3384 -0,19%

GBP/USD $1,6786 +0,08%

USD/CHF Chf0,9064 +0,14%

USD/JPY Y102,18 +0,16%

EUR/JPY Y 136,76 -0,04%

GBP/JPY Y171,52 +0,23%

AUD/USD $ 0,9264 -0,12%

NZD/USD $0,8456 -0,05%

USD/CAD C$1,0922 -0,45%

(time / country / index / period / previous value / forecast)

01:30 Australia National Australia Bank's Business Confidence July 8

01:30 Australia House Price Index (QoQ) Quarter II +1.7% +1.1%

01:30 Australia House Price Index (YoY) Quarter II +10.9%

04:30 Japan Industrial Production (MoM) June -3.3% +0.5%

04:30 Japan Industrial Production (YoY) June +3.2%

09:00 Eurozone ZEW Economic Sentiment August 48.1 41.3

09:00 Germany ZEW Survey - Economic Sentiment August 27.1 18.2

14:00 U.S. JOLTs Job Openings June 4635 4740

18:00 U.S. Federal budget July 70.5 -98.2

20:30 U.S. API Crude Oil Inventories August -5.5

23:50 Japan Monetary Policy Meeting Minutes

23:50 Japan GDP, q/q Quarter II +1.6% -1.7%

23:50 Japan GDP, y/y Quarter II +3.0%

Stock indices closed higher due to increasing demand for risk-related assets. Geopolitical concerns eased slightly as Russia have finished military exercises near Ukraine.

Stock markets came under pressure last week as investors preferred safe-haven assets due to geopolitical tensions in Iraq and Ukraine.

Bayerische Motoren Werke (BMW) AG shares increased 2.8%.

PSA Peugeot Citroen SA shares climbed 2.6%.

Valeo SA rose 3.4%.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,632.82 +65.46 +1.00 %

DAX 9,180.74 +171.42 +1.90 %

CAC 40 4,197.7 +49.89 +1.20 %

The cost of oil futures rose moderately, while rising above $ 105 per barrel (Brent), as traders await developments in Ukraine and the Middle East. While WTI expensive third consecutive session in anticipation of data on crude oil inventories in the United States. Economists estimate that the inventory of oil in the United States dropped the seventh week in a row, down 1.3 million. Barrels.

Recall the Russian Air Force and Air Defense Forces completed command post exercise, which took place on the territory of the Russian Federation from August 4, and Israel reached an agreement with the Palestinians on a temporary cease-fire in the Gaza Strip, which positively perceived by investors.

We also add that the United States inflicted air strikes on militant positions in northern Iraq, but said that a ground operation in this country will not. Market analysts predict that the American air strikes may reduce the risk of disruption of oil supplies from the country. Iraq produced about 3.5 million barrels a day of oil last month, making it the second-largest oil producer in OPEC after Saudi Arabia.

Meanwhile, on Monday, Iraqi President Fouad Maasum instructed to form a new government Haider al-Abadi, put forward earlier parliamentary bloc "Iraqi National Alliance" for the post of prime minister.

On the dynamics of trade also continue to influence the message from OPEC. On Friday, OPEC reduced its forecast for world oil demand in 2014 to 30 thousand. Barrels a day - up to 1.1 million. Barrels per day. Demand for oil produced by OPEC in 2014, was reduced to 9.61 million. Barrel. / Day, which is 70 thousand. Below previous forecasts. The forecast for 2015 was left unchanged at 1.21 million. Bbl. / Day. In July, OPEC oil production, thanks to Libya, rose to 29.91 million. Bbl. / Day, or 170 thousand. Bbl. / Day higher than in June.

The cost of the September futures for the American light crude oil WTI (Light Sweet Crude Oil) rose to $ 98.29 per barrel and then declined to $ 97.25 per barrel on the New York Mercantile Exchange (NYMEX).

September futures price for North Sea Brent crude oil mixture rose 46 cents to $ 105.12 a barrel on the London exchange ICE Futures Europe.

The U.S. dollar traded mixed against the most major currencies in the absence of any major economic reports in the U.S.

The euro traded mixed against the U.S. dollar in the absence of any major economic reports in the Eurozone.

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports in the UK.

The Swiss franc traded mixed against the U.S. dollar after Swiss retail sales. Retail sales in Switzerland climbed 3.4% in June, exceeding expectations for a 0.7% increase, after a 0.5% fall in May. May's figure was revised up from a 0.6% decrease.

The Canadian dollar increased against the U.S. dollar due to the better-than-expected housing starts in Canada. The number of housing starts in Canada jumped to 200,100 units in July, beating expectations for a fall to 194,000 units, after 198,700 units in June. June's figure was revised up from 198,000 units.

The New Zealand dollar traded mixed against the U.S dollar as market sentiment recovered from risk aversion of investors. Investors preferred safe-haven assets last week as geopolitical tensions in Iraq and Ukraine weighed on markets.

No major economic reports were released in New Zealand.

The Australian dollar traded lower against the U.S. dollar. No major economic reports were released in Australia.

The Japanese yen traded mixed against the U.S. dollar. Japan's tertiary industry index declined 0.1% in June, after a 0.9% rise in May.

Consumer confidence in Japan rose to 41.5 in July from 41.1 in June, missing expectations for a gain to 42.3.

Japan's prelim machine tool orders increased 37.7% in July, after a 34.1% rise in June.

Gold prices declined moderately today, departing from the three-week high, as the tension in relations between Ukraine and Russia has declined, and investors pay attention to the growing global equities.

Late on Friday the Russian Defense Ministry announced the completion of military exercises in the south of Russia, who criticized the United States as a provocative step in a crisis in Ukraine.

Meanwhile, we add that over the weekend continued clashes between security forces and pro-Russian Ukrainian rebels in eastern Ukraine after Ukraine rejected the proposal rebels a ceasefire. Russian President Vladimir Putin, who was Ukraine, as well as its American and European allies have accused of supporting the rebels, said the fighting pose a threat to the humanitarian crisis and offered assistance. Experts believe that the invasion of the territory of Ukraine of Russian troops could lead to another increase in the price of gold. Otherwise, investors will continue to close long positions, thus supporting the formation of a downward movement.

Also note that on Sunday the United States again inflicted air strikes on militant positions of the insurgent group Islamic state in northern Iraq to protect Iraqi civilians from the uprising, as well as its soldiers, who are in the country. On Sunday, Israel and Hamas agreed to a fresh 72-hour cease-fire in the Gaza Strip after months of violence in the territory of Hamas.

The value of the precious metal also affect expectations that the Fed is still the United States in the near future to consider the possibility of starting a rate hike (assuming that the reports will indicate the continuing recovery of the economy).

The presented data also showed that the gold reserves in the SPDR Gold Trust, the world's largest gold exchange-traded fund, fell on Friday by 1.79 tons - up to 795.86 tons.

The cost of the September futures contract for gold on COMEX today dropped to $ 1305.90 per ounce.

Federal Reserve Vice Chairman Stanley Fischer said at Swedish Finance Ministry conference on Monday:

- Economic recovery in the US and in other countries has been "disappointing" and could have a permanent negative impact on economic growth;

- The decrease in the labour force largely reflects demographic factors;

- Quantitative easing program has been "largely successful".

EUR/USD $1.3350, $1.3370, $1.3400, $1.3435, $1.3450, $1.3500, $1.3535

USD/JPY Y101.50-60, Y101.75-85, Y101.90-102.00, Y102.45, Y102.50

EUR/JPY Y136.25-30

EUR/GBP stg0.8000, stg0.8075

EUR/CHF Chf1.2165

EUR/SEK Sek9.2100

AUD/USD $0.9250, $0.9300-10, $0.9325, $0.9350

NZD/USD $0.8600

USD/CAD C$!.0915, C$1.0920, C$1.0970

U.S. stock-index futures rose amid optimism that tension between Russia and Ukraine will ease, while U.S. jets struck at Islamic State forces.

Global markets:

Nikkei 15,130.52 +352.15 +2.38%

Hang Seng 24,646.02 +314.61 +1.29%

Shanghai Composite 2,224.65 +30.23 +1.38%

FTSE 6,624.94 +57.58 +0.88%

CAC 4,191.2 +43.39 +1.05%

DAX 9,168.87 +159.55 +1.77%

Crude oil $97.73 (+0.10%)

Gold $1309.30 (-0.14%)

(company / ticker / price / change, % / volume)

| E. I. du Pont de Nemours and Co | DD | 65.10 | +0.09% | 0.1K |

| Verizon Communications Inc | VZ | 48.78 | +0.16% | 12.6K |

| Walt Disney Co | DIS | 87.07 | +0.25% | 0.3K |

| Exxon Mobil Corp | XOM | 99.35 | +0.30% | 1.6K |

| Procter & Gamble Co | PG | 81.20 | +0.31% | 5.0K |

| Pfizer Inc | PFE | 28.43 | +0.32% | 1.5K |

| Chevron Corp | CVX | 128.30 | +0.34% | 2.8K |

| Goldman Sachs | GS | 172.91 | +0.38% | 0.2K |

| The Coca-Cola Co | KO | 39.60 | +0.38% | 2.3K |

| Boeing Co | BA | 121.15 | +0.43% | 10.3K |

| Home Depot Inc | HD | 82.80 | +0.45% | 0.2K |

| Cisco Systems Inc | CSCO | 25.15 | +0.48% | 4.9K |

| International Business Machines Co... | IBM | 187.52 | +0.48% | 0.2K |

| Johnson & Johnson | JNJ | 101.57 | +0.48% | 1.0K |

| JPMorgan Chase and Co | JPM | 56.62 | +0.50% | 0.2K |

| United Technologies Corp | UTX | 106.50 | +0.51% | 1.6K |

| General Electric Co | GE | 25.80 | +0.55% | 18.9K |

| Microsoft Corp | MSFT | 43.45 | +0.58% | 1.6K |

| American Express Co | AXP | 88.00 | +0.61% | 0.1K |

| AT&T Inc | T | 34.68 | +0.61% | 4.2K |

| Intel Corp | INTC | 32.80 | +0.61% | 11.6K |

| Caterpillar Inc | CAT | 103.95 | +0.65% | 0.3K |

| Nike | NKE | 77.76 | +0.91% | 3.7K |

| McDonald's Corp | MCD | 93.52 | -0.03% | 1.7K |

| Wal-Mart Stores Inc | WMT | 74.20 | -0.63% | 0.5K |

Upgrades:

Tesla (TSLA) upgraded to Buy from Hold at Deutsche Bank

Freeport-McMoRan (FCX) upgraded to Buy from Hold at Argus

Downgrades:

Other:

McDonald's (MCD) target lowered to $97 from $103 at Telsey Advisory Group

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

05:00 Japan BoJ monthly economic report August

05:00 Japan Consumer Confidence July 41.1 42.3 41.5

06:00 Japan Prelim Machine Tool Orders, y/y July +34.1% +37.7%

07:15 Switzerland Retail Sales Y/Y June -0.6% +0.7% +3.4%

07:15 U.S. FED Vice Chairman Stanley Fischer Speaks

The U.S. dollar traded mixed against the most major currencies in the absence of any major economic reports in the U.S.

The euro traded lower against the U.S. dollar in the absence of any major economic reports in the Eurozone.

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports in the UK.

The Swiss franc traded mixed against the U.S. dollar after Swiss retail sales. Retail sales in Switzerland climbed 3.4% in June, exceeding expectations for a 0.7% increase, after a 0.5% fall in May. May's figure was revised up from a 0.6% decrease.

The Canadian dollar traded slightly higher against the U.S. dollar ahead of housing starts in Canada. The number of housing starts in Canada is expected to decline to 194,000 units in July, after 198,200 units in June.

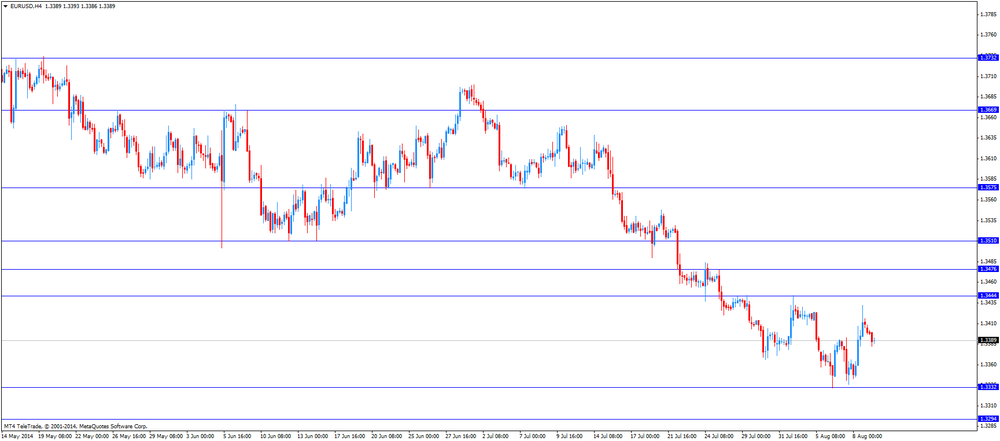

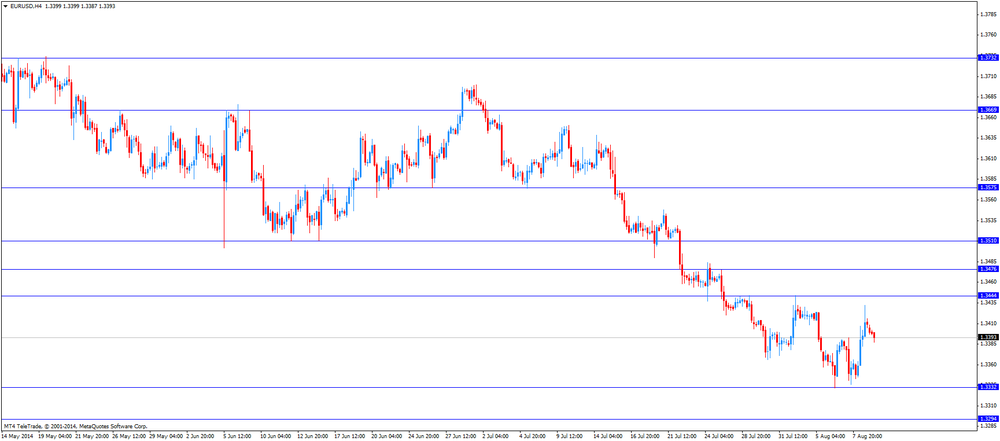

EUR/USD: the currency pair declined to $1.3382

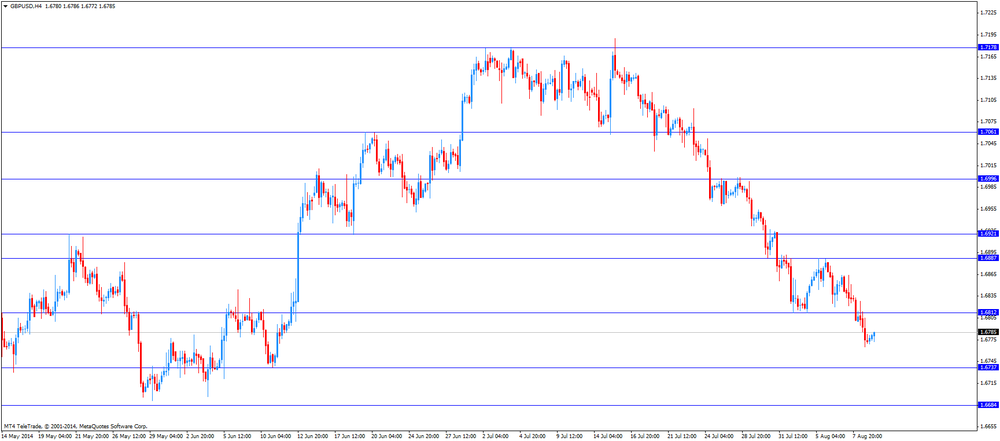

GBP/USD: the currency pair traded mixed

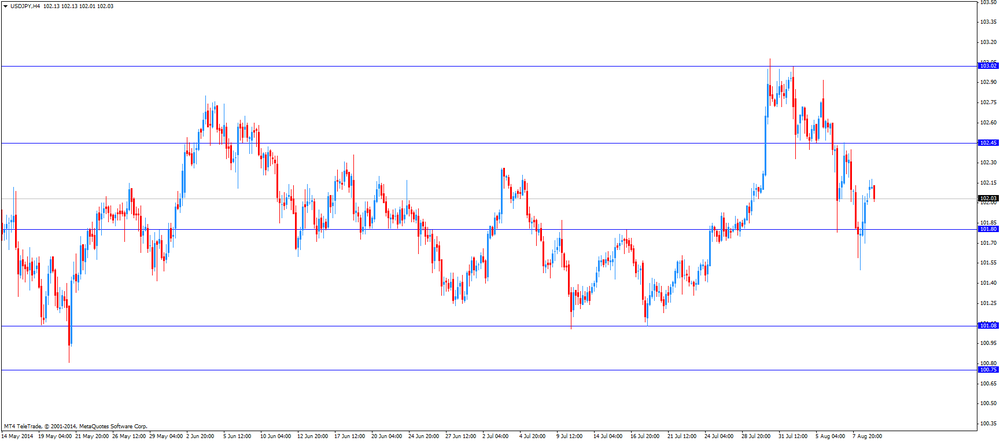

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:15 Canada Housing Starts July 198 194

EUR/USD

Offers $1.3500, $1.3475/85, $1.3445-50

Bids $1.3335

GBP/USD

Offers $1.6900, $1.6885-90, $1.6800

Bids $1.6750, $1.6700, $1.6693, $1.6665/60

AUD/USD

Offers $0.9350, $0.9315/20, $0.9300, $0.9285/90

Bids $0.9250, $0.9220/00, $0.9150, $0.9100

EUR/JPY

Offers Y138.00, Y137.50, Y137.20/25

Bids Y136.50, Y136.25/20, Y136.00, Y135.50

USD/JPY

Offers Y103.00, Y102.80/85, Y102.50

Bids Y102.00, Y101.80, Y101.50, Y101.20

EUR/GBP

Offers stg0.8010, stg0.8000

Bids stg0.7900

Stock indices traded higher due to increasing demand for riskier assets. Geopolitical concerns eased slightly as Russia have finished military exercises near Ukraine.

Stock markets came under pressure last week as investors preferred safe-haven assets due to geopolitical tensions in Iraq and Ukraine.

Bayerische Motoren Werke (BMW) AG shares increased 2.43%.

PSA Peugeot Citroen SA shares climbed 2.4%.

Valeo SA rose 2.7%.

Current figures:

Name Price Change Change %

FTSE 100 6,614.64 +47.28 +0.72%

DAX 9,149.8 +140.48 +1.56%

CAC 40 4,181.84 +34.03 +0.82%

Asian stock closed higher as geopolitical concerns eased slightly. Stock markets came under pressure last week as investors preferred safe-haven assets due to geopolitical tensions in Iraq and Ukraine.

Japanese stocks were supported by the weaker yen, and news reported that the Government Pension Investment Fund (GPIF) crapped its upper limit on domestic shareholdings.

Chinese stocks were supported by consumer price index, releases on August, 09. Chinese consumer index climbed 2.3% in July, in line with expectations.

Chinese producer price index declined 0.9% in July, beating expectations for a 1.0% fall, after a 1.1% decrease in June.

Sumco Corp. shares dropped 12% after missing net-income forecast.

Indexes on the close:

Nikkei 225 15,130.52 +352.15 +2.38%

Hang Seng 24,646.02 +314.61 +1.29%

Shanghai Composite 2,224.65 +30.23 +1.38%

EUR/USD $1.3350, $1.3370, $1.3400, $1.3435, $1.3450, $1.3500, $1.3535

USD/JPY Y101.50-60, Y101.75-85, Y101.90-102.00, Y102.45, Y102.50

EUR/JPY Y136.25-30

EUR/GBP stg0.8000, stg0.8075

EUR/CHF Chf1.2165

EUR/SEK Sek9.2100

AUD/USD $0.9250, $0.9300-10, $0.9325, $0.9350

NZD/USD $0.8600

USD/CAD C$!.0915, C$1.0920, C$1.0970

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

05:00 Japan BoJ monthly economic report August

05:00 Japan Consumer Confidence July 41.1 42.3 41.5

06:00 Japan Prelim Machine Tool Orders, y/y July +34.1% +37.7%

07:15 Switzerland Retail Sales Y/Y June -0.6% +0.7% +3.4%

07:15 U.S. FED Vice Chairman Stanley Fischer Speaks

The U.S. dollar traded mixed to higher against the most major currencies.

The New Zealand dollar traded mixed against the U.S dollar as market sentiment recovered from risk aversion of investors. Investors preferred safe-haven assets last week as geopolitical tensions in Iraq and Ukraine weighed on markets.

No major economic reports were released in New Zealand.

The Australian dollar traded mixed against the U.S. dollar as market sentiment recovered from risk aversion of investors.

No major economic reports were released in Australia.

The Japanese yen traded lower against the U.S. dollar due to decreasing demand for safe-haven currency as geopolitical concerns eased slightly.

Japan's tertiary industry index declined 0.1% in June, after a 0.9% rise in May.

Consumer confidence in Japan rose to 41.5 in July from 41.1 in June, missing expectations for a gain to 42.3.

Japan's prelim machine tool orders increased 37.7% in July, after a 34.1 rise in June.

EUR/USD: the currency pair decreased to $1.3400

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair climbed to Y102.18

The most important news that are expected (GMT0):

12:15 Canada Housing Starts July 198 194

EUR / USD

Resistance levels (open interest**, contracts)

$1.3505 (3183)

$1.3480 (4367)

$1.3446 (618)

Price at time of writing this review: $ 1.3400

Support levels (open interest**, contracts):

$1.3377 (4478)

$1.3358 (1968)

$1.3333 (4422)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 50923 contracts, with the maximum number of contracts with strike price $1,3600 (4401);

- Overall open interest on the PUT options with the expiration date September, 5 is 55800 contracts, with the maximum number of contracts with strike price $1,3100 (6073);

- The ratio of PUT/CALL was 1.10 versus 0.94 from the previous trading day according to data from August, 8

GBP/USD

Resistance levels (open interest**, contracts)

$1.7002 (1363)

$1.6904 (886)

$1.6808 (521)

Price at time of writing this review: $1.6781

Support levels (open interest**, contracts):

$1.6694 (2781)

$1.6596 (1418)

$1.6498 (1644)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 20409 contracts, with the maximum number of contracts with strike price $1,7300 (1534);

- Overall open interest on the PUT options with the expiration date September, 5 is 27225 contracts, with the maximum number of contracts with strike price $1,6800 (3253);

- The ratio of PUT/CALL was 1.33 versus 1.27 from the previous trading day according to data from August, 8

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.