- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 11-04-2022

- EUR/GBP steadies around 0.8350 as investors await the release of multiple economic indicators.

- The UK’s Unemployment Rate may remain stable while Average Earnings are expected to elevate.

- The ECB may prefer an interest rate hike despite flat German HICP.

The EUR/GBP pair is auctioning in a narrow range of 0.8349-0.8353 on Tuesday ahead of the release of multiple catalysts, which may guide the market participants for further direction. The cross is awaiting the release of the UK’s Unemployment Rate and Germany’s Consumer Price Index (CPI).

The quarterly UK jobless rate is likely to land at 3.9%, similar to its previous print. While, the Average Earnings Excluding Bonus may print at 4%, higher than the prior figure of 3.8%. Higher average earnings in a tight labor market advocate progress in achieving full employment. However, it would to interesting to watch the extent to which the increment in average earnings will be able to offset the soaring inflation in the UK.

Meanwhile, the shared currency is likely to remain uncertain on the release of Germany’s Harmonized Index of Consumer Prices (HICP). A preliminary estimate for yearly Germany’s HICP shows that the economic data will remain similar to the previous print at 7.6%. It is worth noting that the European Central Bank (ECB) has not raised its interest rates since the pandemic of Covid-19 while the Bank of England (BOE) has raised its interest rates by 25 basis points (bps) consecutively after a 15 bps rate hike in December. The BOE is expected to elevate its interest rates further to tackle the soaring inflation.

- USD/JPY is eyeing more upside amid rising US Treasury yields and Fed’s policy tightening expectations.

- A multi-year high preliminary estimate of US CPI at 8.5% will strengthen the greenback further.

- Apart from the US CPI, investors will also focus on Japan’s PPI.

The USD/JPY pair displayed a sheer upside move on Monday and continued its six-day winning streak. The pair have established firmly above 125.00 and is likely to extend its gains after overstepping Monday’s high at 125.77. Higher likely US Consumer Price Index (CPI) print and broader weakness in the Japanese yen have infused fresh blood into the asset.

The mighty greenback is performing strongly against Tokyo as the street is expecting a print of multi-decade high by the US inflation at 8.5%. The US Bureau of Labor Statistics reported the previous US CPI figure at 7.9%. Galloping inflation in the US economy has left no other option for the Federal Reserve (Fed) than to raise the interest rate significantly.

The latest Reuters poll of economists dictates a consecutive 50 bps interest rate hike for May and June, considering the likely fresh multi-decade high US inflation at 8.5%.

Meanwhile, the US dollar index (DXY) is struggling to balance above 100.00 amid uncertainty over the release of the US CPI. On the yield front, the 10-year US Treasury yields have climbed to near 2.80 on rising odds of a tightening monetary policy by the Federal Reserve (Fed).

Although, US CPI will remain the major driver investors will also focus on Japan’s Producer Price Index (PPI) data. The monthly and yearly Japan PPI data are likely to land at 0.9% and 9.3% respectively.

- The GBP/JPY began the week on the right foot, up some 0.90%.

- The 10-year bond differential between the UK – and Japan would keep the GBP/JPY underpinned to the upside.

- GBP/JPY Price Forecast: In a strong uptrend, but a higher RSI reading suggests the pair might consolidate before relaunching an attack towards 164.00.

On Monday, the GBP/JPY reached a fresh weekly high just short of the 164.00 mark but retreated towards the 163.20 area amid a downbeat market mood that put a lid on the GBP, despite a dismal session for the Japanese yen. As the Asian Pacific session begins, the GBP/JPY upticks 0.08% and trades at 163.44 at press time.

Meanwhile, US equities finished the day with losses, and Asian stock futures followed the lead, recording losses between 0.16% and 2.49%, except for the Nikkei 225, almost flat, up 0.03%. Global bond yields rose, led by US Treasury yields. In the case of the GBP/JPY, the UK 10-year Gilt rose ten basis points, sitting at 1.846%, while the 10-year JGB remains contained by the BoJ, around the 0.25% mark.

Overnight, the GBP/JPY rallied since the beginning of the Asian session and recorded a daily high at 163.84, followed by a retracement towards the 163.40s area.

GBP/JPY Price Forecast: Technical outlook

The GBP/JPY uptrend remains. The daily moving averages (DMAs) below the exchange rate have an upslope and signal that the uptrend is solid. Nonetheless, the Relative Strength Index (RSI) at 72.32, within overbought conditions, might suggest that the GBP/JPY is about to consolidate in the near term.

IF the GBP/JPY keeps trending up, the first resistance would be 164.00, which, once cleared, would open the door for further substantial gains. The next resistance would be November 2015 swing highs around 188.80, followed by June’s 2015 cycle highs around 195.88.

On the flip side, the GBP/JPY's first support would be March 29 resistance-turned-support at 162.71, then April 11 lows at 161.66, and then the 160.00 mark.

Technical levels to watch

- The formation of the Tweezer Tops candlestick pattern has underpinned the Swiss franc against the greenback.

- The trendline placed from 2021’s low is providing a cushion to the asset.

- An oscillation range of 40.00-60.00 by the RSI (14) is advocating a consolidation phase.

The USD/CHF pair has witnessed a steep fall after failing to sustain above the previous weeks’ high at 0.9374. The pair has been dragged lower sharply to near 20-period Exponential Moving Average (EMA), which is trading at 0.9300.

On a daily scale, USD/CHF has formed a ‘Tweezer Tops’ candlestick pattern that signals a bearish reversal amid facing intense selling pressure for two consecutive trading sessions at similar highs. The asset has faced barricades at around 0.9374. The pair is comfortably holding above the 200-EMA, which is at 0.9225 but a single upside filter lacks confidence. The trendline placed from 2021’s low at 0.8758, adjoining the 2022’s low at 0.9092, will continue to act as major support for the asset.

Meanwhile, the Relative Strength Index (RSI) (14) is oscillating in the 40.00-60.00 range, which signals a consolidation ahead.

A drop below the low of the Tweezer Tops formation at 0.9304 will drag the asset towards the March 9 low at 0.9250, followed by the round level support at 0.9200.

On the flip side, greenback bulls can dictate prices if the asset oversteps the previous week’s high at 0.9374. This will send the asset towards the round level resistance at 0.9400. Breach of the latter will drive the asset towards March’s high at 0.9460.

USD/CHF daily chart

-637853132675637584.png)

- The GBP/USD begins the week on the wrong foot but is trapped within Friday’s high/low of the day.

- Geopolitics, high bond yields, and mixed UK economic data kept the GBP/USD subdued.

- GBP/USD Price Forecast: Downward biased, but the formation of a “bullish harami” indicated selling pressure might be waning.

The British pound remains subdued and is forming a “bullish harami” candlestick pattern, meaning that the GBP/USD found a bottom around the 1.3000 mark and might consolidate in the near term. At the time of writing, the GBP/USD is trading at 1.3030.

Downbeat market mood, courtesy of high global bond yields, geopolitics, mixed UK data, and China’s covid-19 outbreak, weighed on the GBP

On Monday, global equity markets recorded losses amid a downbeat market mood. Russia-Ukraine’s woes, worldwide higher bond yields, and China’s Covid-19 outbreak shifted sentiment.

While the Russia-Ukraine crisis extended for the seventh consecutive week, the UK, US, Germany, and Slovakia stated that they would provide military equipment to Ukraine. Ukraine’s President Volodymyr Zelenskyy expressed that they should not lose the possibility of a diplomatic solution to the war. On the Russian side, wires reported that Russian President Vladimir Putin is believed to have set himself four weeks to achieve some “victory” in Ukraine before the big Russian victory day on May 9.

Of late, Ukraine’s President Zelenskyy crossed the wires and said that Russia could make use of chemical weapons and added that they would take that threat seriously.

Aside from geopolitical chatter, China’s Covid-19 outbreak in the regions of Shanghai and Guangzhou weighs on appetite and oil prices. Shanghai reported 25,173 new asymptomatic cases on April 10, contrary to only 914 symptomatic ones.

Meanwhile, the GBP/USD remained in a choppy trading session, seesawing on the release of mixed UK economic data, led by the Gross Domestic Product (GDP) for February, which came at 0.1% m/m, lower than the 0.3% estimated. Contrarily, the GDP three-month average rose by 1%, more than the 0.9% foreseen.

On Tuesday, traders’ attention would focus on UK’s job figures and US Consumer Price Index. A higher than expected US inflation reading might open the door for another retest of the 1.3000 mark,

GBP/USD Price Forecast: Technical outlook

The GBP/USD downward bias remains intact. However, Monday’s price action formed a “bullish harami” candlestick chart pattern, meaning that the pair might have bottomed and could aim towards a sideways environment. That scenario might be playing out as the Relative Strength Index (RSI) is at 35.16, in bearish territory but directionless.

If the GBP/USD edges high, the first resistance would be April 8, 1.3082 swings high. Once cleared, the next resistance would be 1.3100, followed by December’s 2021 swing lows-turned-resistance at 1.3160, followed by 1.3200.

On the flip side, the GBP/USD first support would be 1.3000. A breach of the latter would expose November’s 2020 pivot low at 1.2854, followed by September 2020 cycle low at 1.2675.

- The DXY has faced barricades above 100.00 multiple times, which can favor a reversal.

- FOMC member Evans sees an interest rate decision featuring 50 bps in May.

- The 10-year US Treasury yields have jumped near 2.77% ahead of a tight liquidity environment.

The US dollar index (DXY) is continuously struggling to sustain above the mighty figure of 100.00 amid uncertainty over the US Consumer Price Index (CPI), which will release on Tuesday. It seems that the DXY is parting ways with the US Treasury yields as the former is performing lackluster while the latter is surging higher firmly. The 10-year benchmark US Treasury yields have climbed to near 2.77% as investors have started betting on an aggressive interest rate hike by the Federal Reserve (Fed) in May.

Chicago Fed President Charles Evans's speech

The speech from the Chicago Fed President and Federal Open Market Committee (FOMC) member Charles Evans emphasized rising prices in the US and their persistency for a longer period. FOMC member Evans believes that the Fed may tighten the interest rate by 200 basis points (bps) this year and will reach the neutral rates (which he sees between 2.25-2.50%) by this year only. Also, the 50 bps interest rate elevation is highly likely possible in May.

Preview of US CPI

Market estimates for the yearly US consumer Price Index (CPI) land at 8.3% higher than the previous print of 7.9%. This advocates for a material shift in volatility as a higher US CPI print will raise the odds of an aggressive interest rate hike significantly.

Meanwhile, the latest Reuters poll of economists advocates consecutive 50 bps interest rate hikes for May and June, considering the likely fresh multi-decade high US inflation at 8.3%.

Key events this week: Consumer Price Index (CPI), Producer Price Index (PPI), Initial Jobless Claims, Retail Sales, Michigan Consumer Sentiment Index (CSI), and Industrial Production.

Eminent issues on the back boiler: Russia-Ukraine Peace Talks, Reserve Bank of New Zealand (RBNZ) interest rate decision, European Central Bank (ECB) interest rate decision, and Bank of Canada (BOC) interest rate decision.

The Ukrainian president Volodymyr Zelenskyy has crossed the wires recently and said that the Russian forces could use chemical weapons and that they take that threat seriously. He does not say chemical weapons have already been used.

More to come...

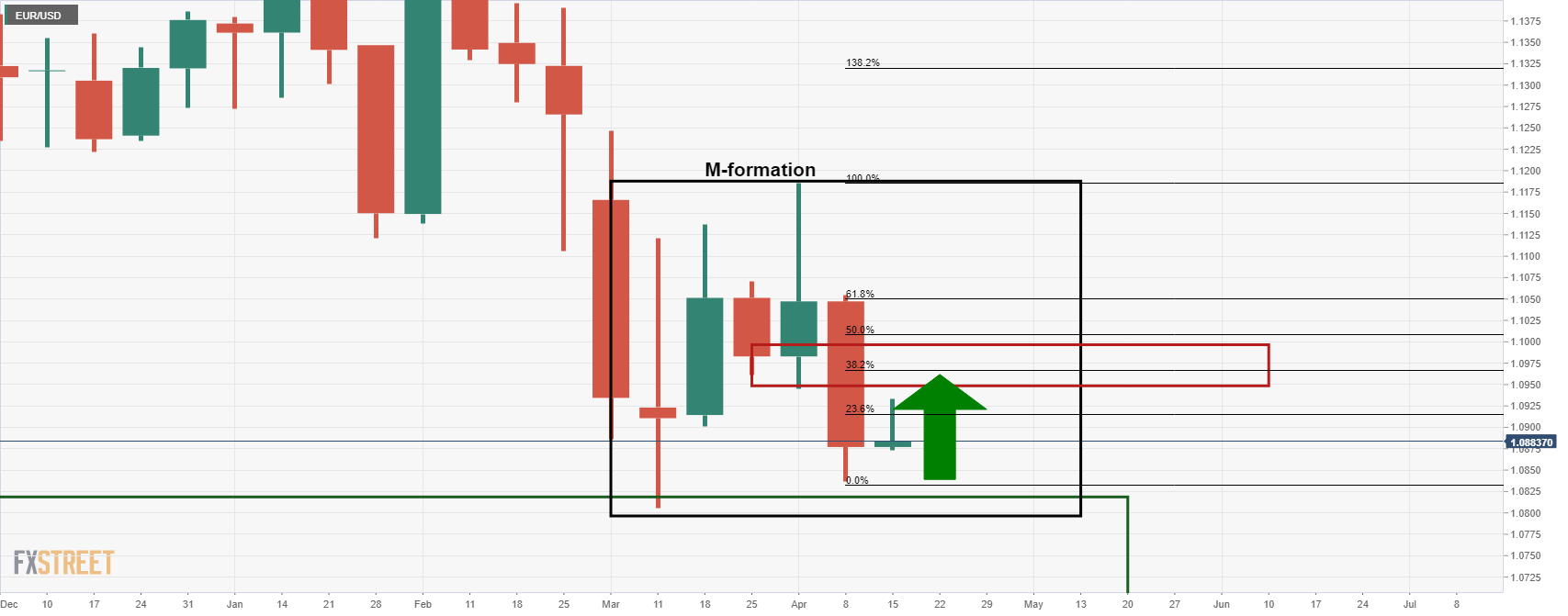

- EUR/USD bulls are moving in and eye the weekly M-formation.

- The accumulation phase is underway on the lower time charts.

EUR/USD is accumulating at the bottom of the bearish cycle and the weekly chart has an M-formation printed which is a reversion pattern that would be expected to see the price revert to test the neckline as resistance.

EUR/USD weekly chart

From a daily perspective, the 38.2% Fibonacci retracement level aligns with the prior support near 1.0950, an area of potential resistance:

EUR/USD daily chart

- It was a rough day for the yen as global yields shot higher on expectations of tighter central bank policy.

- AUD/JPY rallied to the 93.00 area and looks on course to post an on-the-day gain of about 0.4%.

- Bulls eye a test of recent highs in the 94.00 area if risk appetite can stabilise and yields keep pushing.

It was a rough day for the yen as yields across developed markets shot higher on expectations of tightened central bank monetary policy, Japanese yields remained anchored near zero with the BoJ over the weekend reiterating its ultra-dovish stance. The yen is very sensitive to changes in rate differentials, which as of late have been more of a driver of the currency than safe-haven flows. That meant that even though it was a risk-off day with tech stocks leading a rout in global equities, and even though the Aussie subsequently performed poorly against most of its G10 counterparts, AUD/JPY was able to rally.

AUD/JPY managed to reclaim the 93.00 level and looks on course to post an on-the-day gain of about 0.4%, though has pared back on a substantial portion of these gains, having been as high as the 93.60s earlier in the day. The bulls will be hoping for a stabilisation in sentiment in global equity and commodity space in the coming days, as that might be enough to propel AUD/JPY beyond recent highs in the 94.00 area.

That’s assuming that global yields continue to trade with an upside bias, which could very well be the case if US inflation data this week jumps as expected, thus solidifying/encouraging further global central bank tightening bets. Traders will also be watching Wednesday’s release of Australian labour market figures, which could help impact RBA tightening expectations. Currently, the bank is seen lifting rates for the first time in the post-pandemic era in June.

- USD/CAD is trading near the highs of the day towards the North American close.

- US oil continues to bleed out and correct the Ukraine crisis rally.

- Eyes will be on the US CPI data and the Bank of Canada this week.

At 1.2635, USD/CAD is higher by 0.51% and has travelled between 1.2562 and 1.2637 on the day so far as the price of oil slides to a fresh corrective low on the daily charts and the US dollar bounces back to life.

The Canadian dollar, which trades as a proxy to the price of oil, is pressured with US oil, WTI, losing some 3.4% at the time of writing as it trades at $94.60, $1.50c higher from the lows of $92.96. These were the lowest levels in more than six weeks due to how China has reported a record number of new Covid-19 infections, cutting into demand expectations for the world's largest crude oil importer.

China on Sunday reported more than 26.000 new Covid-19 infections despite the extended lockdown of Shanghai, a city of some 26-million continues. The rising new wave of the coronavirus in China is raising expectations the country's oil demand is slowing. In turn, the rally associated with Russia's invasion of Ukraine is being unwound.

Eyes turn to BoC and US CPI

Meanwhile, both economic and geopolitical risks continue to weigh on sentiment and this week's US Consumer Price Index data as well as the Bank of Canada meetings will be critical events for markets. ''We expect the Bank of Canada to hike by 50bps while announcing an end to reinvestment in a hawkish policy statement,'' analysts at TD Securities said. ''GDP and CPI are both tracking above the January MPR, and the Bank remains keenly focused on controlling LT inflation expectations. On QT, we expect the Bank to cease GoC purchases in the secondary market by May, but maintain primary market retention going forward.''

As far as US inflation goes, the Federal Reserve is behind the curve. Core prices likely stayed strong in March, advancing a firm 0.5% MoM and the 10-year yields are responding in kind. They have traded at a new cycle high near 2.793% on Monday and are on track to test the October 2018 high near 3.26%.

With inflation expectations remaining fairly steady, the real 10-year yield has risen to the highest since March 2020 and is poised to move into positive territory for the first time since before the pandemic. Additionally, the 2-year yield that tends to track the Fed sentiment the closest, is now trading near 2.60% and is on track to test the November 2018 high near 2.97%, moving in the US dollar’s favour.

''Between the likely return of risk-off impulses and the even more hawkish Fed outlook for tightening, we believe the dollar uptrend remains intact,'' analysts at Brown Brothers Harriman said.

What you need to take care of on Tuesday, April 12:

The market mood was sour at the beginning of the week, with the greenback initially falling but later recovering against its major rivals. Demand for safety pushed USD/CHF lower, to the 0.9300 region, and gold higher, as the bright metal trades around $1,950 a troy ounce.

However, soaring US government bond yields helped USD/JPY to reach a fresh multi-year high of 125.76, currently trading a handful of pips below the latter. Yields soared amid concerns related to skyrocketing inflation and the US Federal Reserve’s aggressive response to it. Recession sounds out loud, although there’s no particular sign that confirms such a downturn. The yield of the 10-year Treasury note peaked at 2.793%, while that on the 2-year note hit 2.594%.

Commodity-linked currencies were the worst performers, with AUD/USD down to the 0.7410 price zone and USD/CAD up to 1.2636.

The EUR/USD pair and GBP/USD ended the day little changed, at 1.0880 and 1.3020 respectively.

Chinese inflation rose in March, while the large lockdowns in the country exacerbate supply-chain issues, alongside the Eastern European crisis.

Meanwhile, US policymakers continued to pave the way towards a 50 bps rate hike in the May meeting. Central bankers from around the world are adopting more aggressive tightening stances, further weighing on the market’s mood.

Global indexes closed in the red, with Wall Street posting substantial losses, reflecting the dismal market mood. Asian indexes are poised to follow the lead, which may see the dollar appreciating further.

The US will publish March inflation figures on Tuesday, and the White House anticipated it would be “elevated.”

Why $39,000 could play a vital role on Bitcoin price trend

Like this article? Help us with some feedback by answering this survey:

- Silver reached a fresh two-week high at around $25.37 but fell on high US bond yields.

- Geopolitics, Fed tightening, and China’s PMIs showing its economy might slow dampen the market mood.

- Silver Price Forecast (XAG/USD): The white metal is upward biased and would aim towards $26.00 if XAG bulls reclaim $25.00.

Silver (XAG/USD) is gaining on Monday as the New York session progresses, but off highs after reaching a $25.37 daily high, pushing below the $25.00 mark on surging US Treasury yields amidst a negative market sentiment. At the time of writing, XAG/USD is trading at $24.99, up some 0.91%.

Falling US equity indices portray the abovementioned market sentiment. Factors like the Fed tightening monetary policy conditions amidst an elevating inflation environment weigh on market sentiment. The Russo-Ukraine tussles extending for the seventh-consecutive week and China’s Covid-19 outbreak in the second-largest economy keep investors on their toes.

US 20-year yield breaks the 3% threshold

Higher US Treasury yields put a lid on the white-metal rise. The 20-year US Treasury yield rose above the 3% threshold, while the US 10-year benchmark note sits at 2.780%, up to seven and a half basis points, a tailwind for the buck.

The US Dollar Index, a gauge of the greenback’s value against a basket of its rivals, is barely flat at 99.929, but it was above the 100.000 mark.

The US economic docket is absent on Monday, but on Tuesday, inflationary figures for March are expected to uptick, with the Consumer Price Index (CPI) rising towards 8.4%. Meanwhile, the so-called core CPI, which excludes volatile items, is estimated to increase by 6.6%.

Silver Price Forecast (XAG/USD): Technical outlook

XAG/USD remains upward biased, as shown by the daily chart. The daily moving averages (DMAs) below the spot price confirm the previously mentioned. The Relative Strenght Index (RSI) at 53.52 is aiming higher, cementing the uptrend.

That said, XAG/USD’s first resistance would be $25.00. a breach of the latter would expose the March 31 swing high at $25.09, followed by March 24 pivot high at 25.85, and then the $26.00 mark.

- NZD/USD has seen a subdued start to the week and remained capped below 0.6850.

- Traders await pivotal upcoming risk events, including US inflation (CPI and PPI) and the RBNZ rate decision.

- Any dovish RBNZ surprise would send the pair towards March lows in the 0.6725 area.

NZD/USD is trading a tad weaker on the first trading day of the week in a mixed start to the week for FX market trade, where the action has been dictated by a combination of moves in rate differentials and risk-off flows. Both of these factors have worked against the kiwi, hence its modest 0.1% drop versus the US dollar, with global equities on the backfoot amid geopolitical/China lockdown concerns and US yields rallying as markets up Fed tightening bets.

Currently, NZD/USD is trading in the 0.6830s, having been able to rally above the 0.6850 mark earlier in the session, although buying ahead of the round 0.6800 figure and 50-Day Moving Average just below it has been supportive. Technicians note that the pair has on Monday been testing a key uptrend that has been in play since the start of February and hasn’t yet mustered a convincing downside break.

The lack of conviction in Monday trade shouldn’t come as too much of a surprise ahead of key risk events this week. The highlights of the week are 1) US Consumer and Producer Price Inflation (CPI and PPI) data on Tuesday and Wednesday and 2) the RBNZ rate decision on Wednesday. Starting with the former; headline CPI is seen hitting a 40 year high at 8.4% and exerting further pressure on the Fed to get on with it regarding monetary tightening. This could spur further bond yield upside.

On the latter, analysts are split on whether or not the RBNZ will deliver a 25 or 50 bps rate hike, though money market pricing heavily favours the latter. That suggests the bigger risk for the kiwi is a large drop if the RBNZ fails to live up to hawkish expectations. In this case, a drop below 0.6800 would be highly likely, which would open the door to a run towards support in the form of the March lows at 0.6725.

- AUD/USD is pressured and down by some 0.4% on Monday s the US dollar bounces back to life and CNH is pressured.

- The economic calendar is full this week, including domestic Employment data.

At 0.7425, AUD/USD is under pressure, down by 0.45% in mid-to-late New York trade as the US dollar firms vs the commodity complex and the softer Chinese currency for which the Aussie tends to track. AUD/USD, as a consequence, fell from a high of 0.7425 to a low of 0.7413.

CNH weakened against the dollar on investor concern over capital outflow at the same time that the benchmark yield differentials between China and the United States turned negative. Yields on China's 10-year government bonds dropped below US Treasury yields for the first time in 12 years. Subsequently, USD/CNH has risen to a high of 6.3857 so far o the day as investors prepared for more monetary easing on the mainland.

To date, however, a surge in commodity prices has underpinned AUD’s outperformance dispute the recession narrative surrounding the global economy and risk-off themes pertaining to offshore geopolitics in Europe and middle Asia. The Ukraine crisis, on the contrary, has benefitted the Aussie for how distant the nation is to the prospect of local economic contagion risks. Moreover, the price of commodities has surged, further underpinning the demand for commodity-based currencies. Therefore, the positive correlation and high beta to global equities have started to break down.

Analysts a Rabobank have noted that the rolling one-year correlation of daily AUD returns with the MSCI global equity index is barely positive and well below its decade average. They also note, however, that AUD’s rolling one-year correlation with DXY actually turned slightly positive in early April, briefly hitting its highest levels since 2005. The index today is slightly in the green after recovering the opening bearish gap pertaining to the jump and relief rally in the euro on the back of the French presidential elections.

Eyes on data

For the week ahead, it will be a busy one on the data front. Domestically, the Aussie Employment report will be front and centre while a close eye will also be paid to its neighbouring central bank, the Reserve Bank of New Zealand. A 50% rate hike to the OCR could tip the balance of bids in favour of the antipodeans this week in the absence of any renewed uber hawkish reminders at the Federal Reserve. With that being said, US inflation data and Retail Sales will be eyed in that regard as well this week.

As for the Aussie Employment, ''we are expecting another strong headline print of +40k, reaffirming the RBA's message that the labour market outlook remains upbeat,'' analysts at TD Securities said. ''Consistent with this, we pencil in a small uptick in the participation rate from 66.4% to 66.5%. Despite this uptick in the participation rate, we forecast the unemployment rate will fall to a record low of 3.9%.''

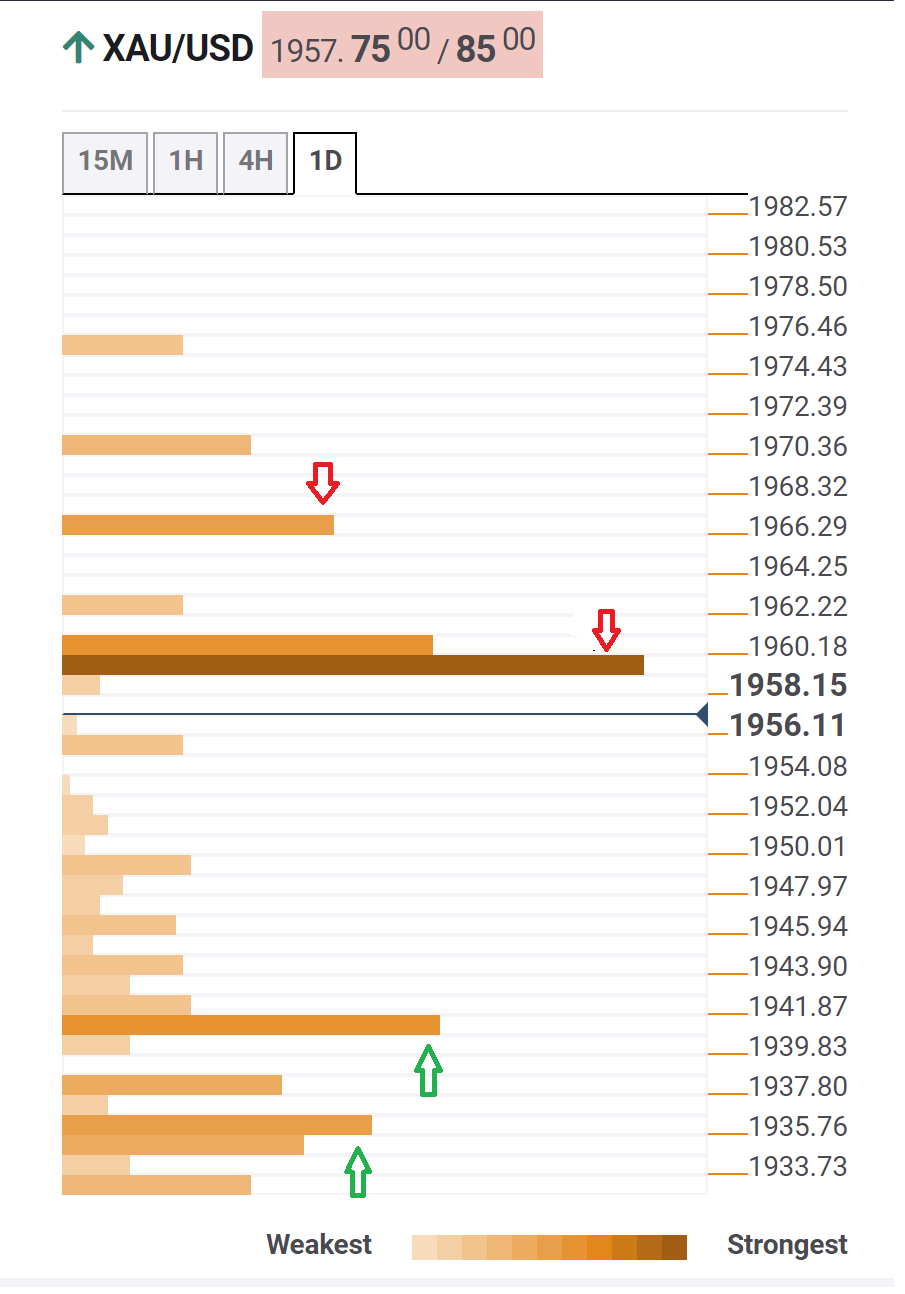

- Bulls take on critical resistances of $1,950 and $1,970 at the start of the week.

- Support is located in and above the $1,930s with 'blue skies' in the $2,000s eyed.

- Will XAU/USD continue to ignore rising US yields?

At $1,947, the gold price is underwater in mid-New York Trade. The price hs range traded between a high of $1,970.02 and a low of $1,940.03 on the day so far. The week is young but we have already seen good volatility in financial and commodity markets owing to the French elections, the ongoing crisis in Ukraine and central bank jitters. Meanwhile, it is going to be a busy week ahead and gold could be on the verge of a breakout.

The gold price has been range-trading since mid-March, potentially accumulating the 2022 rally and ripening for a bullish continuation. This is despite the hawkish narrative surrounding the Federal Reserve. ''All the shorts have been wiped out and ETF inflows have slowed as the fear trade subsides,'' analysts at TD Securities said.

''In turn, either gold bugs are sleepwalking towards a significant drawdown as inflows could subside alongside an increase to short positioning, or the resilience in prices is reflecting a different set of information. In this context, the gold market could be incorporating some scepticism that the neutral rate required to tame inflation is significantly higher given the inflationary shock is driven by the supply-side, while increasing recession fears offer further support to the gold bulls.''

With this in mind, economic events will be critical this week, and there is an array of the goings-on in this regard that could turn out to be catalysts for the gold price. UK Employment, US Consumer Price Index on Tuesday will be the first major economic data to help unveil the health of the global economy.

The US inflation data will likely supersede on the day, with strong prices for March reinforcing the hawkish outlook at the Fed, potentially supportive of the US dollar and weight for the price of gold. On the other hand, analysts at Rabobank have warned that the Fed could be hiking into recession.

''The Fed’s main policy error was to ignore the rise in inflation last year and get blindsided. This has set in motion a wage-price spiral that will be very difficult to reverse without hiking the economy into recession.''

Other key events for the week that could move the needle of the gold price include the Reserve Bank of New Zealand's rate decision, UK inflation and the Bank of Canada's rate decision on Wednesday. Then, the Australia jobs report, European Central Bank rate decision, and US Retail Sales will all fall on Thursday.

Gold technical analysis

The bulls are moving in s they take on critical resistances of $1,950 and $1,970 at the start of the week. The price is forming a bullish structure on the 4-hour chart in and above the $1,930s. If this holds the test of time, then the bis will stay with the bulls for the foreseeable future with 'blue skies' in the $2,000s eyed.

- The Japanese yen weakenest to its lower level in the year, as shown by the USD/JPY rising to 125.77.

- US Treasury yields keep advancing in the session as market players prepare for Fed’s aggressive tightening.

- USD/JPY Price Forecast: Negative divergence between price action/oscillators might open the door for a leg-down.

On Monday, the USD/JPY recorded a new YTD high at 125.77 though short of June’s 2015 125.85 high and extended its gains for the seventh straight day up to some 1.04% in the North American session. The USD/JPY is trading at 125.51 at press time.

Elevated US Treasury yields weigh on the Japanese yen

A risk-off market mood has increased the appetite for safe-haven assets. In the case of the USD/JPY, the rise of US Treasury yields keeps the Japanese yen downward pressured amidst the Bank of Japan’s pledge to an accommodative stance as it aims to achieve a 2% inflation target.

The US 10-year Treasury yield is gaining six basis points up at 2.784%, underpinning the greenback. The US Dollar Index, which measures the buck’s value against a basket of six rivals, advances 0.04%, and sits at 100.025.

Overnight, the USD/JPY opened around 124.00 and surged more than 100-pips, breaking the 125.00 mark, followed by the breach of the previous YTD high at 125.10.

USD/JPY Price Forecast: Technical outlook

The USD/JPY rally recorded a new cycle high, but traders need to be aware of the Relative Strength Index (RSI). The RSI remains in overbought conditions, but the USD/JPY jump towards 125.77 failed to push the RSI above 87.29, a level reached at the previous 2022 YTD high at 125.10, meaning a negative divergence between the price action and oscillators would open the door for losses.

If that scenario plays out, the USD/JPY first support would be March 28 cycle high at 125.10. A decisive break would expose the April 5 daily high at 123.67, followed by March 24 daily high at 122.41.

If the pairs continue upwards, the first resistance would be June 2015 cycle highs at 125.86. Once cleared, the next resistance would be 126.00, followed by April 2001 pivot high at 126.85.

- US equities fell on Monday, led by a decline in large-cap tech/growth stocks as US yields continued to surge.

- The S&P 500 was last down just over 1.0% in the 4440 area and flirting with its 50DMA.

- Ahead, investors are braced for US CPI on Tuesday and the unofficial start of the Q1 earnings season on Wednesday.

Major US equity indices fell on Monday, led by a decline in large-cap tech/growth stocks as US yields continued to surge as bond market participants upped their Fed tightening bets. The S&P 500 was last down slightly more than 1.0% on the day in the 4440 area and flirting with its 50-Day Moving Average to the downside at 4427. The tech-heavy Nasdaq 100 index was last down over 1.5% near 14,100, having now broken below its 50DMA in the 14,300s, while the less bond yield sensitive Dow was down about 0.7% in the 34,500 area and still above its 50DMA.

Stocks whose valuation is more heavily weighted towards expectations for future earnings growth rather than current earnings (thus, these stocks have high price/earnings multiples), including many large-cap tech names, are more vulnerable to an increase in “opportunity cost” that a rise in bond yields represents. Some analysts said that downside in equities on Monday represents nerves ahead of the release of key US Consumer Price Inflation (CPI) data on Tuesday.

The median economist expectation is for the annual rate of headline CPI to reach 8.4% in March. This will not go down well at the Fed, and may encourage them to continue their recent shift in preference towards much more aggressive monetary tightening, a key worry for equity investors right now.

Elsewhere, China lockdown concerns are rising and this is triggering fears of longer-lasting global supply chain snags given China’s integral position as a major goods exporter/processor. Meanwhile, recent Russo-Ukraine updates are bleak, with Russia preparing to up the intensity of its assault in the eastern Donbas region, with no peace deal expected any time soon.

Another key risk this week is the unofficial start of the Q1 2022 earnings season. Big US banks start reporting results from Wednesday, and are expected to show a sharp slowdown in the YoY rate of earnings growth. Analysts caution that without any signs yet of slowing inflation, or peace in Europe, the prospect for major US indices to push back to recent late March highs and above looks slim.

Chicago Fed President and FOMC member Charles Evans on Monday said that high prices in the US will persist for longer than he originally though, though will not be permanent, reported Reuters. The Fed has to reposition itself in its response, he said, noting that supply chain pressures are more intense than he had expected.

Evans added that by the end of the year, the Fed will know a lot more about how persistent inflation is going to be and, hopefully, it will be receding. Moreover, by the end of the year, the Fed will be able to make choices about more or less restrictive policy, he commented.

The Fed needs to reposition monetary policy much closer to neutral, Evans added, which he sees as around 2.25% to 2.5% (for the Federal Funds rate). Evans stated that he had thought the Fed would reach neutral by March 2023, but caveated that if the Fed arrives at neutral by this December that would be ok. In other words, Evans said he is ok with the Fed pressing ahead with a further 200 bps of tightening in 2022.

Evans did note that not going too far too quickly is important for optionality going forward. Nonetheless, 50 bps rates hikes at coming meetings are worthy of consideration, he said, and are possibly even highly likely. The real discussion for Evans, he said, is where you want rates to be positioned by the end of the year.

"I don't at the moment expect to see the need for restrictive policy to rein in inflation," he noted, adding that there remains a risk.

- A sharp rise in UK (and global) yields has hit the yen hard on Monday, with GBP/JPY subsequently rallying 1.0%.

- The pair has risen into the mid-163.00s despite risk-off flows being observed in other asset classes (equities).

- That’s because the higher yield environment plus more dovish BoJ commentary prevented the yen from benefitting from safe-haven flows.

Weaker than expected UK GDP figures for February, even though they may contribute to dissuading the BoE from raising interest rates as aggressively over the coming quarters, did not deter the GBP/JPY bulls on Monday. Indeed, as UK bond yields rode a wave of rising yields across major developed economies on the first day of the week, widening rate differentials have helped the pair lurch nearly 1.0% higher, where it now trades above 163.50.

That marks a more than 150 pip rally from last Friday’s closing levels at 162.00 and a nearly 200 pip rally from intra-day lows in the 161.60s. For reference, UK 10-year yields have rallied nearly 10 bps on Monday to hit 1.85%, their highest since January 2016, all while Japanese 10-year yields remain capped below the upper bounds of the BoJ’s -0.25% to 0.25% range.

Not helping the yen’s cause on Monday was dovish commentary from the BoJ to kick off the week, with the bank reiterating the need for its ultra-dovish policies to remain in place. Central bank/yield divergence has meant that the yen has been unable to benefit from safe-haven demand on Monday, even though global equities have been falling amid geopolitical/China lockdown woes.

Should the trend of higher yields across the globe continue this week, GBP/JPY stands a very good chance of testing and breaking above its March highs in the upper 164.00s. GBP/JPY traders will also have plenty of data to keep an eye on, including UK Consumer Price Inflation and labour market figures. These would likely play second fiddle to broader macro trends (such as rising yields).

- The EUR/USD reached a daily high at 1.0933 but gave back its gains.

- High global yields, France’s elections, Russo-Ukraine jitter, and China’s coronavirus outbreak dampened investors’ sentiment.

- EUR/USD Price Forecast: Macron’s lifted the pair to 1.0933, followed by a drop below 1.0900 as bears re-enter, aiming to achieve a daily close below 1.0865.

The EUR/USD found some support from Friday’s dragonfly-doji but retreated from daily highs of 1.0933, blamed on a dampened market mood spurred by high US Treasury yields, the Ukraine-Russia conflict, and China’s Covid-19 outbreak. At the time of writing, the EUR/USD is trading at 1.0879.

Global equities fall as global yields elevate, French election results lifts the euro, and China Covid-19 outbreak weighs on risk appetite

Elevating global bond yields weighed on market mood, a reflection of the aforementioned are European and US equity indices falling. The US 10-year Treasury yield is rising five basis points, sitting at 2.771%, above March 2019 cycle high, a tailwind for the buck. At press time, the US Dollar Index, a gauge of the buck’s value vs. a basket of six peers, rises 0.15%, up at 99.940, short of the 100 mark.

In geopolitics, the Russo-Ukraine tussles exerted pressure on market sentiment. As hostilities continued for the seventh consecutive week, the UK, US, Germany, and Slovakia stated that they would provide additional military equipment to Ukraine. Meanwhile, Ukraine President Zelenskyy said that they should not lose the possibility of a diplomatic solution to the war. On the Russian side, wires reported that Russian President Vladimir Putin is believed to have set himself four weeks to achieve some “victory” in Ukraine before the big Russian victory day on May 9.

China’s Covid-19 outbreak in the regions of Shanghai and Guangzhou is another factor that dampened the market sentiment. Shanghai reported 25,173 new asymptomatic cases on April 10, contrary to only 914 symptomatic ones.

Macron’s victory in France boosted the EUR

On Sunday, French President Emmanuel Macron gained the first round of voting in France and would face Marine Le Pen for the second time in five years. Macron’s achieved 27.6% of the votes against 23.4% of Marine Le Pen’s and would face her in the second round by the end of the month.

Analysts at ING said that while Macron’s victory was better than expected, it would not be seen as a secure victory in the second round. They added, “t[T]his shouldn’t lull investors into a false sense of security. Macron is the favorite to win, but the two weeks heading into the runoff will be characterized by higher volatility, in our view, so long as polls put both candidates neck and neck and within the margin of error.”

EUR/USD Price Forecast: Technical outlook

Overnight, the EUR/USD rallied above 1.0933 as a relief to French elections results but gave its gains, and traders are treading water as the pair probes April 7 cycle low at 1.0864. That said, the EUR/USD downtrend remains intact unless EUR buyers reclaim the 1.1000 mark.

The EUR/USD first support would be 1.0864. A breach of the latter would expose the April 8 cycle low at 1.0836, followed by the YTD low at 1.0806.

Analysts at Wells Fargo point out that a tighter monetary policy from the Reserve Bank of India is likely not enough to prevent rupee weakness. They continue to forecast modest rupee depreciation through the end of 2022.

Key Quotes:

“Despite a view for higher policy rates we continue to believe the rupee can weaken against the U.S. dollar going forward. Even if the RBI delivers 25 bps of rate hikes in June, the central bank will still be lagging the pace of tightening in the United States. Our U.S. economics team believes the Federal Reserve is likely to raise interest rates 50 bps in May and also begin shrinking its balance sheet. In our view, Fed actions should result in broad-based capital flows toward the U.S. dollar and place depreciation pressure on most emerging market currencies, including the rupee despite a newly hawkish RBI.”

“In addition, financial markets are currently priced for 69 basis points of RBI tightening over the next 3 months. We believe current RBI pricing is too aggressive, and as markets scale back the magnitude of tightening, the rupee should weaken. With that said, we believe any rupee weakness will be rather gradual as the RBI would likely utilize its stockpile of foreign exchange reserves to limit rupee volatility.”

“Going forward, we expect the USD/INR exchange rate to reach INR76.75 by the end of 2022, a weakening in the rupee of a little over 1% from current levels.”

- Gold loses momentum after a sharp rally and trims gains.

- Yellow metal up for the third consecutive day, but off highs.

- Key data ahead: US inflation on Tuesday.

Gold is rising on Tuesday for the third consecutive day although it trimmed gains during the last hour, creating doubts about the sustainability of the current rally. The price peaked at $1969.70, the highest since March 14 and then dropped to as low as $1945.60. As of writing, it is hovering around $1952, up six dollars from Friday’s close.

Volatility in metals jumped on Monday. Silver also trimmed losses. XAG/USD peaked earlier at 25.37 and is back below 25.00.

The correction from the new top in gold took place probably amid some profit-taking and as US yields moved further to the upside. The US 30-year yield stands at 2.81%, the highest since May 2019. Sharp moves to the upside in XAU/USD are likely to remain unstable or vulnerable to relevant corrections, while the trend in US yields is positive.

Also, a stronger US dollar contributed to gold’s pullback. The DXY is back above 100.00, up 0.20%, on it way to the highest daily close since May 2020. US stocks are down, with the Dow Jones falling 0.51% and the Nasdaq losing 1.75%.

The short-term bias in gold is positive, not as strong as it was hours ago. A daily close above $1960 should reinforce the bullish outlook. On the contrary, a decline under $1943, would expose the 20-day Simple Moving Average at $1932. The critical support is the $1915 zone.

Technical levels

- Swiss franc rises across the board during the American session.

- DXY is still in positive ground supported by higher US yields.

- USD/CHF drops ending a six-day positive streak.

The USD/CHF dropped during the last hour more than 30 pips, with a particular trigger, and bottomed at 0.9305, the lowest level since last Wednesday. The pair remains near the lows, testing the 0.9300/05 area.

The move lower in USD/CHF took place amid a broad-based strength in the Swiss franc. At the same time, EUR/CHF dropped to 1.0138, hitting a fresh daily low.

In Wall Street, the Dow Jones is falling 0.60% and the Nasdaq drops by 1.80%. European markets are falling 0.45% on average. US yields printed fresh cycle highs on Monday, the 10-year yield at 2.786% and the 30-year at 2.80%.

The DXY is up 0.09% at 99.92, supported by the sell-off in Treasuries, slightly below last week's high. On Tuesday, key inflation data is due in the US.

USD/CHF back below the 20-SMA

The USD/CHF is falling 30 pips compared to Friday’s close. It is the worst performance in more than a week. Price is back under the 20-day Simple Moving Average that is turned south, suggesting some weakness ahead. The next support level is seen at 0.9290.

On the upside, a daily close above 0.9350 should open the doors to more gains, particularly if the dollar breaks the 0.9375 resistance area.

Technical levels

- The market mood is downbeat, courtesy of high global yields, Russia-Ukraine’s woes, and China’s coronavirus outbreak.

- The Australian dollar is falling due to its status as a risk-sensitive currency amid an absent economic docket.

- AUD/USD Price Forecast: Remains bullish, but price action and RSI support the scenario of printing a leg-down before resuming the uptrend.

The Australian dollar begins the week on the wrong foot, extending its losses to four consecutive days amidst a risk-off market sentiment. The weakening of the Aussie is courtesy of rising worldwide yields, as global central banks look forward to tackling inflation amid a geopolitical crisis between Ukraine-Russia, which has prompted elevated energy prices. At the time of writing, the AUD/USD is trading at 0.7426.

Worldwide stocks fall as global yields rise; China reported more than 25K Covid-19 asymptomatic cases

Global equities remained on the back foot overnight, while US stocks further confirmed the dismal mood, trading with losses. The 10-year US Treasury yield is rising three basis points, and at one time during the session, pierced March 2019 swing high at 2.77%, underpinning the greenback, as the US Dollar Index gains 0.13%, currently at 99.969.

Aside from this, the crisis between Ukraine-Russia, signals the continuation of hostilities, as peace talks faltered to provide any fresh, positive impetus. Ukrainian President Volodymir Zelenskyy said that they should not lose the possibility of a diplomatic solution to the war. At the same time, Minister Stefanishyna expects Ukraine to be given EU candidate country status in June while emphasizing that Ukraine would move fast in its application to join the EU.

Meanwhile, the US, UK, Germany, and Slovakia will provide additional military equipment to Ukraine’s forces, as a diplomatic ending seems far to be achieved.

On the Russia front, President Putin is believed to have set himself four weeks to achieve some “sort of” victory in Ukraine before the big Russian victory day on May 9.

China’s Covid-19 outbreak in the regions of Shanghai and Guangzhou is another factor that dampened the market sentiment. Shanghai reported 25,173 new asymptomatic cases on April 10, contrary to only 914 symptomatic ones.

An absent Australian economic docket left the pair leaning on US economic data and the market mood. On the US front, Fed speakers led by Regional Fed Presidents Bostic, Evans, and Governor Bowman, will cross wires.

AUD/USD Price Forecast: Technical outlook

The AUD/USD retreated under March 7 daily high at 0.7441, extending its fall from around 0.7600. The Relative Strength Index (RSI) at 50.5, due to its slope, seems poised to drop further. However, it’s worth noting that the 50-day moving average (DMA) just crossed over the 200-DMA, each lying at 0.7309 and 0.7295, respectively, which means that the AUD/USD fall is a dip that would resume the uptrend later.

That said, the AUD/USD first support would be 0.7400. A breach of the latter would expose March 21 at 0.7373, followed by the 50-DMA at 0.7309.

- WTI has recovered from earlier near $93.00 lows to the $95.00s, where it still trades nearly $2.50 lower.

- The dip to $93.00 marked WTI’s lowest since late February

- Uncertainties regarding Chinese demand as Covid-19 infections in locked-down Shanghai continue to surge were the main factor weighing on sentiment.

After hitting its lowest level since late February in earlier trade near $93.00 per barrel, front-month WTI futures have rebounded over the last few hours and are now trading back in the $95.00s. That still leaves prices down about $2.50 on the day, with global oil markets reeling in wake of an uptick in China lockdown fears over the weekend. China’s 26-million-person strong city of Shanghai, the country’s financial hub, remains in a state of absolute lockdown after Covid-19 infections hit fresh record highs over the weekend.

Oil market participants fear that the virus will spread to other cities, triggering equally strict lockdowns across the country as China continues to pursue it “zero Covid-19” strategy that was successful in the initial stages of the pandemic. However, analysts have questioned the sustainability of this strategy given new variants of the virus are much more transmissible. China is the world’s largest oil consumer (over 14M barrels per day) and widespread lockdowns could leave a significant dent in demand.

Uncertainty about the extent to which Chinese demand will be affected by lockdowns in the coming months has eased worries about an acute near-term oil shortage given disruptions to Russian exports as a result of the Russo-Ukraine war. This is the major factor weighing on the oil complex on Monday, but comes against the backdrop of a historic oil reserve release announcement from International Energy Agency member nations last week. The US and its allies will be releasing 240M barrels of crude oil over the next six months.

Recent updates have led to some major financial institutions scaling back on their bullish bets for how high oil prices might have gone this summer. Bank of America said they now don’t see Brent (currently near $100) moving back above $120 per barrel this summer and UBS said their forecast for Brent in June was now $115 (versus $125 before).

- Japanese yen drops across the board, even as markets remain cautious.

- Euro modestly higher following French presidential elections.

- EUR/JPY heads for highest daily close since February 2018.

The EUR/JPY broke to the upside after trading in a range for more than a week. The cross broke 135.50 and jumped to 137.13, reaching the highest level since March 29. It then pulled back finding support above 136.50.

Yen under pressure

The rally of USD/JPY boosted the EUR/JPY. The Japanese yen remains under pressure as US yields continue to rise. The US 10-year and the 30-year hit fresh cycle highs earlier on Monday at 2.78% and 2.80% respectively.

At the same time, the euro rose modestly following the French election. A runoff between Macron and Le Pen will be held on April 27. If polls start showing Le Pen ahead, some negative euro pressure seems likely.

The EUR/JPY is again near the 2022 top and if it ends the day around current levels it will post the highest daily close since February 2018. If the euro recovers and holds above 137.00, a test of the 137.55 highs seems likely. On the negative front, a decline back under 135.30 would alleviate the pressure. A daily close below 134.50 should clear the way for more losses.

EUR/JPY daily chart

- GBP/USD has flatlined in the 1.3030s on Monday despite weak UK GDP figures, as traders eye upcoming risk events.

- A rise in UK yields relative to their US counterparts is helping support the pair despite risk-off flows elsewhere.

Weaker than expected February UK GDP growth figures did not have a lasting impact on GBP/USD, which continues to trade sideways in the 1.3030 area, with the pair finding support in the form of last week’s sub-1.3000 lows. Last week’s lows marked the first time that cable had traded sub-1.30 since November 2020. GBP/USD’s resilience at the start of the week is somewhat surprising given the drop seen in global equities as a result of geopolitical/China lockdown worries. Normally a drop in other risk assets weighs on pound sterling.

GBP/USD is likely finding support from a jump in domestic UK yields, which are tracking their continental counterparts higher, narrowing the US/UK rate differential. Subdued trading conditions may also have something to do with caution ahead of an upcoming barrage of UK and US risk events. First up, a few Fed policymakers are expected to give remarks later on Monday’s session and it should be a busy week for Fed speak thereafter.

But the most important events for GBP/USD traders to monitor this week are economic data releases. UK jobs data is released on Tuesday ahead of the release of US Consumer Price Inflation figures, followed by UK Consumer Price Inflation and US Producer Price Inflation numbers on Wednesday. Focus remains on the US with the release of the latest Retail Sales report on Thursday, ahead of a UK public holiday on Friday, where trading conditions should be much quieter.

The German Foriegn Minister on Monday said that EU Foreign Ministers had agreed that weapon deliveries to Ukraine would be intensified and noted that Ukrainians can only be defended with weapons, reported Reuters.

The US Bureau of Labor Statistics will release the March Consumer Price Index (CPI) data on Tuesday, April 8 at 12:30 GMT and as we get closer to the release time, here are the forecasts by the economists and researchers of 12 major banks regarding the upcoming US inflation print.

CPI and Core CPI are forecast to have risen by 8.4% and 6.6 % year-over-year, respectively, the fastest pace since 1981.

Commerzbank

“We expect consumer prices to rise by 1.2% in March compared with February (consensus 1.2%). This would take the year-on-year rate from 7.9% to 8.5%. Whether this is the peak depends mainly on whether energy prices continue to rise. For the core rate, which excludes energy and food prices, we expect an increase from 6.4% to 6.6%. There is a very good chance that this will be the peak, even though the core rate should remain above 5% until the end of the year, a far cry from price stability.”

Nordea

“We expect March CPI figures to show headline inflation surging towards 8.5% YoY (consensus: 8.4%) and core inflation reaching 6.6% YoY (consensus: 6.6%). The base effect will be moderate for the March print, but down the road base effects will see year-on-year headline inflation falling. Nonetheless, energy prices defying the oil-future curve, rents surging and evidence of more broad-based service inflation suggest we will see more stubbornly high inflation in H1, which will support 50bp hikes from the Fed at the next meetings.”

ING

“We look for the headline rate to reach 8.6% YoY and the ex-food and energy core figure to hit 6.7%. This would be the highest headline inflation rate since December 1981 and the highest core rate since August 1982, which will heap more pressure on the Fed to hike interest rates.”

TDS

“Core prices likely stayed strong in March, advancing a firm 0.5% MoM. While inflation in used vehicles likely fell, it was probably offset by continued strength in shelter inflation. An expected 18% MoM surge in gasoline prices likely added to headline pressures again. Our MoM forecasts imply 8.5%/6.6% YoY for total/core prices, which are likely to be the peak of the cycle.”

Deutsche Bank

“We are expecting that the monthly gain in headline CPI of +1.3% will push the YoY rate up to +8.6%, which hasn’t been seen since 1981. That said, we think that March is likely to be the peak in the YoY rates for both headline and core, since the base effects from last year’s surge in used car prices will begin rolling off in the April data.”

RBC Economics

“March US CPI data will reinforce those inflation concerns with the headline rate likely to increase to the 8.3% range, driven by skyrocketing gasoline prices following the Russian invasion of Ukraine. But gas isn’t the only thing to see faster YoY price growth. And pressures are broadening as strong consumer demand bumps up against production capacity limits and extremely tight labour markets.”

SocGen

“US CPI is expected up 1.1% in March due to a surge in gasoline prices. Gasoline prices are expected up 17% MoM on a seasonally-adjusted basis. The result is a contribution from motor fuels or nearly 0.7pp to the monthly increase. The core rate is expected up 0.4% MoM.”

NBF

“We expect the core index to have gained 0.5% MoM. As a result, the annual core inflation rate could jump to a 40-year high of 6.6%. Headline prices could have increased at an even stronger pace (+1.2% MoM), as seasonally adjusted gasoline prices surged upward. The headline annual rate could thus climb four ticks to 8.4%, the highest since January 1982.”

ANZ

“We expect US core CPI to rise by 0.5% MoM in March and headline to rise by 1.3%, boosted by surging food and energy prices. On a YoY basis, core and headline inflation should hit fresh 40-year highs of 6.6% and 8.5% respectively. Sticky price inflation is rising. This is a troubling development for the Fed as it could lead to an unanchoring of longer-term inflation expectations. With March CPI inflation expected to be north of 1% MoM, we expect the Fed to hike by 50bps at its 3-4 May meeting.”

CIBC

“Inflation will be driven higher by gasoline prices in March, with total CPI inflation set to reach 8.5% YoY. While used car prices eased off according to industry data, shelter prices and higher wages will prop up core prices, likely seeing that group accelerate to 6.6% YoY. While March was likely the peak for inflation, as the index will be lapping some strong year-ago readings that took place during the previous reopening ahead, the Fed will still be inclined to take rates up by 50bps at the next FOMC given elevated price pressures in cyclical factors, and the impending surge in demand for services.”

Citibank

“US March CPI MoM – Citi: 1.3%, prior: 0.8%; CPI YoY – Citi: 8.6%, prior: 7.9%; CPI ex Food, Energy MoM – Citi: 0.4%, prior: 0.5%; CPI ex Food, Energy YoY – Citi: 6.5%, prior: 6.4%. We expect a 0.42% MoM increase in core CPI in March with risks tilted slightly to the upside, although with a notable downside risk as well. The latter will be very important to assess in the event of a possible downside surprise to core CPI in March.”

Wells Fargo

“We expect headline CPI to rise 1.1% in March (up 8.4% YoY). Excluding food and energy, which tend to be volatile on a month-to-month basis, we expect the core CPI to rise 0.5% (up 6.6% YoY). Oil prices have retreated in recent weeks and signs that vehicle prices are starting to ease has led us to pare back our near-term expectations. However, ination's descent will remain painfully slow for consumers, businesses and policymakers alike. Services ination, which includes housing, shows no signs of abating anytime soon.”

- A combination of supporting factors assisted USD/CAD to regain positive traction on Monday.

- Sliding crude oil prices undermined the loonie and extended support amid modest USD strength.

- The technical set-up favours bullish traders and supports prospects for additional near-term gains.

The USD/CAD pair held on to its strong intraday gains through the early North American session and was last seen trading around the 1.2610 region, near the multi-week high touched on Friday.

Crude oil prices dropped to the lowest level since March 17 and undermined the commodity-linked loonie. This, in turn, was seen as a key factor that offered some support to the USD/CAD pair amid the underlying bullish sentiment surrounding the US dollar. Despite the supporting factors, bulls, so far, have struggled to make it through the very important 200-day SMA. The said barrier has been capping the USD/CAD pair over the past three trading sessions and coincides with a descending tren-line support breakpoint.

Oscillators on the daily chart have just started gaining positive traction and support prospects for an eventual breakout through the aforementioned confluence. The USD/CAD pair could then climb to mid-1.2600s, or the 50% Fibonacci level of the 1.2901-1.2403 fall. Some follow-through buying will suggest that the USD/CAD pair has formed a temporary bottom near the 1.2400 mark and pave the way for additional gains. The momentum could then push spot prices towards the 1.2700 mark en-route the 61.8% Fibo. level, around the 1.2715 region.

On the flip side, the 1.2555 region now seems to protect the immediate downside ahead of the 23.6% Fibo. level, around the 1.2525 region. A convincing breakthrough, leading to subsequent weakness below the 1.2500 psychological mark, will shift the bias in favour of bearish traders. The USD/CAD pair would then turn vulnerable to slide back to challenge the YTD low, around the 1.2400 mark, with some intermediate support near the 1.2465 zone.

USD/CAD daily chart

-637852812898792083.png)

Key levels to watch

First-round presidential election in France saw far-right candidate Le Pen fall short of incumbent Macron. Economists at Scotiabank believe that the EUR/USD pair could nosedive to test the covid low of 1.0636 if second-round polls show a narrower gap between the two candidates.

Firm opposition to Le Pen from the far-left candidates should help the EUR trade back above 1.10

“Pres Macron took an estimated 27.6% of the vote compared to about 23.4% for Le Pen. Far-left Melenchon came in a strong third place with 22% of the vote and Macron will hope that a large share of his supporters does not turn to Le Pen in two weeks’ time in an anti-establishment drive.”

“Le Pen’s euro-skeptic message would threaten the stability of the EU at a moment when relations among the 27 members are in solid standing following a coordinated approach to the pandemic and the economic recovery, as well as a (mostly) united front against Russia for its invasion of Ukraine.”

“If second-round polls tilt significantly in Le Pen’s favour, it is safe to expect the EUR to touch its pandemic-shock low of 1.0636 in coming days or weeks, while firm opposition to Le Pen from the far-left candidates (especially Melenchon) could help turn votes toward a Macron re-election that eases anxieties in markets – and, all else equal, should help the EUR trade back above 1.10.”

- Gold is trading on the front foot on Monday and recently hit multi-week highs at $1970.

- Safe-haven demand amid risk-off flows in equities thanks to geopolitics and China lockdown concerns is shielding gold from higher yields.

- Ahead, Fed speak and US inflation will be key themes to monitor this week.

Ahead of commentary from Fed policymakers Christopher Waller, Michelle Bowman and Raphael Bostic, who are all partaking in a “Fed Listens” event slated to kick off at 1430BST, spot gold (XAU/USD) prices have been trading on the front foot. About an hour ago, gold prices pushed as high as $1970 per troy ounce, taking them to their highest level since mid-March. Prices have since fallen back to the low $1960s, but XAU/USD still trades with healthy on-the-day gains of about 0.8%.

The gains come despite a further rise in global bond yields, which have seemingly picked up where they left off with things last week. That raises the “opportunity cost” of holding non-yielding assets like gold. However, the precious metal is seemingly being shielded from this headwind amid demand for safe-haven assets as global equities and other risk assets fall amid ongoing worries about the Russo-Ukraine conflict and lockdowns in China.

Ahead, gold traders will be focused on both of these themes, as well as the aforementioned Fed event, where policymakers are likely to reiterate a hawkish message. Fed speak will remain in focus for the rest of the week, but the release of US inflation data on Tuesday and Wednesday will likely steal the limelight. Another big jump could trigger further support on the Fed for rapid policy tightening, a downside risk for gold.

S&P 500 remains under pressure with daily MACD momentum threatening to turn lower. Key remains a cluster of supports including the 63-day average and 38.2% retracement of the February/March rally at 4455/38, below which can see a more bearish tone emerge again, economists at Credit Suisse report.

Break above 4520/25 needed to ease the immediate downside bias

“With daily MACD momentum now threatening to cross lower, downside pressures look to be building again.”

“A close below 4438 would be expected to see bearish pressures increase further with support seen next at 4434 ahead of the 50% retracement at 4376. Whilst we would look for an initial hold here, below in due course should see a move to the 61.8% retracement at 4314.”

“Resistance is seen at 4506 initially, with a break above 4520/25 needed to ease the immediate downside bias for strength back to 4559/61, then the recent high and potential downtrend at 4593 and 4610, respectively.”

GBP/USD is marginally stronger. Economists at Scotiabank believe that the pair could reach the 1.31 level if it manages to surpass the 1.3050 region.

Support after the 1.30 zone and does not come in until psychological mid-1.29s zone

“The GBP’s recovery from sub-1.30 stopped in the mid-1.30s that will continue to act as resistance with limited obvious resistance markers between this zone and the 1.31 area.”

“Support after the 1.30 zone and ~1.2980 does not come in until psychological support at the mid-1.29s and more clearly at the 1.29 figure area.”

Gold has continued to churn higher despite a decisively hawkish Federal Reserve. Even the expected more aggressive hikes will not be sufficient to turn interest away from the yellow metal, strategists at TD Securities report.

Increasing recession fears offer further support to gold bulls

“All the shorts have been wiped out and ETF inflows have slowed as the fear trade subsides. In turn, either gold bugs are sleepwalking towards a significant drawdown as inflows could subside alongside an increase to short positioning, or the resilience in prices is reflecting a different set of information.”

“Gold market could be incorporating some skepticism that the neutral rate required to tame inflation is significantly higher given the inflationary shock is driven by the supply-side, while increasing recession fears offer further support the gold bulls.”

NZD/USD has broken short-term support at 0.6876/65, which suggests a corrective move lower. However support at 0.6782/80 is expected to hold, analysts at Credit Suisse report.

NZD/USD extends the decline

“Whilst the falling daily MACD hints toward the deteriorating near-term picture, we continue to view the current weakness as corrective only within the context of the upmove from the 2022 low.”

Only a break below 0.6782/80 would challenge this premise and warn of a deeper setback to 0.6728/22 and then potentially to 0.6631.”

“Resistance moves to 0.6854/64, next to 0.6892/6910 and then to 0.6947. Above here would see scope to challenge the YTD high at 0.7030/34, though only a stable move above the mid-November high and the 2021 downtrend at 0.7050/53 would signal further medium-term strength.”

Turkey is reportedly considering raising the level of forex revenues that exporters must sell to the CBRT to as high as 50% from the current level of 25%, reported Reuters citing sources. Turkish authorities have reportedly not yet made a final decision on the matter and could leave the requirement unchanged at 25%, Reuters added.

Market Reaction

TRY saw some moderate initial strength against the US dollar in wake of the reports, as it could mean a welcome boost to the CBRT's levels of forex reserves. USD/TRY currently trades lower by about 0.5% on the day in the 14.60s.

The EUR’s gap to a test of the mid-1.09s was followed by steady selling back to below the 1.09 mark. Economists at Scotiabank highlight the key EUR/USD technical levels to watch out.

Resistance is located at the mid-1.09s

“Daily low of ~1.0875 now stands as support. Continued losses in the EUR should find an intermediate floor at ~1.0850 followed by Friday’s low of 1.0837 before firmer support comes in at the figure area.”

“Resistance is the mid-1.09s with a congestion area following until the next big figure.”

EUR/JPY is moving sharply higher again. A break above 136.85 should see a retest of medium-term resistance from the 2018 and recent highs at 137.50/54, analysts at Credit Suisse report.

EUR/JPY set to retest medium-term resistance at 137.50/54

“We look for a break above 136.85 to clear the way for a retest of medium-term resistance from the 2018 and recent highs at 137.50/54. A closing break above here would mark a further significant break higher to open up further medium-term upside, with resistance seen next at 138.17, ahead of what we look to be tougher initial resistance at the August 2015 highs at 138.86/139.03.”

Support is seen at 136.07 initially, then 135.79, with 135.51 ideally holding to keep the immediate risk higher. Below can see a setback to support next at 135.16, potentially the 13-day exponential average at 134.78/67, but with buyers expected to show here.”

Tomorrow’s US CPI release could lift the USD/CAD pair above the 1.26 level before markets turn their focus more clearly to the Bank of Canada’s policy decision on Wednesday, economists at Scotiabank report.

Additional CAD gains depend on the BoC signaling that it will again hike by 50bps

“US inflation data could leave the USD/CAD at risk of a firmer break above 1.26 if the print triggers bets for three consecutive 50bps hikes by the Fed.”

“Given that the BoC is widely expected to hike by 50bps, and markets see a very aggressive tightening cycle, additional CAD gains depend on the BoC signaling that it will again hike by 50bps at one of its June or July meetings.”

- USD/JPY caught aggressive bids on Monday and surged to a fresh multi-year peak.

- The momentum confirmed a bullish breakout through an ascending trend channel.

- Overbought oscillators warrant caution before positioning for any further move up.

The USD/JPY pair rallied over 175 pips from the vicinity of the 124.00 mark on Monday and jumped to the highest level since June 2015, around the 125.75 region during the mid-European session.

The Bank of Japan cut its assessment for most regional economies and Governor Haruhiko Kuroda warned of very high uncertainty over the fallout from the Ukraine crisis. Adding to this, the widening of the US-Japanese government bond yield differential drove flows away from the JPY and acted as a tailwind for the USD/JPY pair.

The prospects for a more aggressive policy tightening by the Fed, along with inflation fears, pushed the US Treasury bond yields to a fresh multi-year peak on the first day of a new week. Conversely, caution around the Bank of Japan's intervention to defend its 0.25% yield target limited the upside in the Japanese government bond.

This, to a larger extent, helped offset a generally weaker tone around the equity markets, which tends to underpin the safe-haven Japanese yen. On the other hand, the US dollar was seen consolidating its recent strong gains to the highest level since May 2020, albeit did little to hinder the USD/JPY pair's strong move up.

From a technical perspective, the momentum beyond the previous YTD peak, around the 125.10 area, was seen as a fresh trigger for bullish traders. A subsequent breakthrough an upward sloping channel extending from the March 31 swing low, around the 121.30-121.25 region, might have set the stage for additional gains.

Technical indicators, however, are already flashing extremely overbought conditions on hourly/daily charts and warrant some caution. Traders might also refrain from placing aggressive bullish bets and prefer to wait for a fresh catalyst from the latest US consumer inflation figures, scheduled for release on Tuesday.

Nevertheless, the bias seems tilted firmly in favour of bullish traders and supports prospects for an extension of the recent strong move up witnessed over the past one month or so. That said, it will be prudent to wait for some near-term consolidation or modest pullback before positioning for the USD/JPY pair's next leg up.

In the meantime, the 125.00 psychological mark now seems to protect the immediate downside. Failure to defend the said handle might trigger some long-unwinding trade and drag the USD/JPY pair back towards the 124.00 round-figure mark. The latter coincides with the aforementioned trend channel and should act as a strong base.

On the flip side, bulls are likely to target the 2015 high, around the 125.85 region, which is closely followed by the 126.00 round figure and resistance near the 126.20 area. Some follow-through buying will reaffirm the constructive outlook and set the stage for a move towards the 127.00 mark for the first since 2002.

USD/JPY 4-hour chart

-637852789495559985.png)

Key levels to watch

- EUR/USD is trading near 1.0900 after gapping higher after French President Macron’s solid first-round Presidential election performance.

- The pair is also being supported as Eurozone yields rally, though risk-off flows and upcoming US data/Fed speak are risks.

Pro-EU French President Emmanuel Macron’s solid performance in the first round of the French Presidential election on Sunday saw EUR/USD gap higher at the reopening of trade this week. EUR/USD opened at around 1.0920 and even went as high as the 1.0930s during European morning trade, but has since fallen back to test the 1.0900 mark, where it one again is eyeing session lows in the 1.0880 area.

At current levels, EUR/USD still trades about 0.25% higher on the day, though gains at highs earlier in the session were more than 0.5%. Macron’s first-round performance a tad better than expected and secured him a place in the runoff against his more anti-EU rival Marine Le Pen in the final runoff on 24 April. But polling between Macron and Le Pen remains very tight, meaning political uncertainty will continue to weigh on the euro in the coming weeks.

Elsewhere, Eurozone yields are sharply up on Monday (German 10-year +8bps), which has resulted in a narrowing of the US yields advantage, another factor offering support to the pair. But a barrage of upcoming Fed speak over the next few days and the release of US inflation figures on Tuesday and Wednesday could easily see this reverse. Indeed, against the backdrop of ongoing concerns over the Russo-Ukraine war and now lockdowns in China, both of which are dampening broad market sentiment, USD risks still seem tilted higher.

EUR/USD bears will be eyeing a retest of last week’s lows in the 1.0830s ahead of a potential test of annual lows at 1.0806. Some longer-term bears have set their sights on the 2020 lows in the mid-1.0600s. Unless the ECB surprises this week with another hawkish shift in its QE and rate guidance (not the market’s base case), things could well be headed that way in the coming weeks.

The euro bounced after the French election but remains heavy near 1.09. Economists at BBH note that the EUR/USD pair may test the March 7 low near 1.0805.

Run-off will be held between Macron and Le Pen

“Macron got 28% of the vote vs. 24% for Le Pen in the first round. One early poll shows Macron winning 54-46% in the second round, while another one is a lot closer at 51-49%. We warn of the so-called Bradley effect, which suggests that the polls will likely understate Le Pen’s support. If polls tighten up ahead of the runoff, we expect markets to become more jittery.”

“A break above 1.1050 is needed to signal a deeper correction towards the March 31 high near 1.1185.”

“A test of the March 7 low near 1.0805 is still in the cards.”

- EUR/GBP opened with a bullish gap on Monday, though lacked follow-through buying.

- The Ukraine crisis continued acting as a headwind for the euro and capped the upside.

- Some cross-driven strength benefitted sterling and collaborated to keep a lid on the cross.

The EUR/GBP cross maintained its bid tone through the mid-European session and was last seen trading around the 0.8370 region, just a few pips below the one-week high.

The first round of the French presidential elections showed the incumbent Emmanuel Macron held a slim lead in the polls over his far-right rival Marine Le Pen. This, in turn, offered some support to the shared currency and led to a bullish gap opening for the EUR/GBP cross.

Spot prices added to Friday's bounce from the 0.8300 neighbourhood, though lacked any follow-through buying or bullish conviction. Investors remain concerned that the European economy, which relies heavily on Russia to meet its energy needs, will suffer the most from the Ukraine crisis.

On the other hand, some cross-driven strength stemming strong intraday rally in the GBP/JPY cross benefitted the British pound and further collaborated to cap gains for the EUR/GBP cross. This, in turn, warrants some caution ahead of the European Central Bank meeting on Thursday.

This makes it prudent to wait for some follow-through buying before confirming that the recent sharp fall from levels just above the 0.8500 psychological mark, or the YTD peak has run its course. Nevertheless, the EUR/GBP cross, so far, has managed to stick to its gains above the mid-0.8300s.

In the absence of any major market-moving economic releases, fresh developments surrounding the Russia-Ukraine saga will influence the shared currency. This, in turn, should provide some impetus to the EUR/GBP cross, though traders might refrain from placing aggressive directional bets.

Technical levels to watch

USD/JPY spotlight turns back to long-term resistance at the 2015 highs at 125.29/86. A close above here would reinforce the view that the pair is seeing a secular break higher and the formation of a potential multi-year base, economists at Credit Suisse report.

Above 125.86, next resistance aligns at 127.33