- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 11-02-2022

- The S&P 500, the Dow Jones, and the Nasdaq Composite fell between 1.43% and 3.07%.

- Ukraine/Russia conflict escalation points towards a Russia’n invasion as reported by US press, confirmed by the US Security Advisor.

- Market sentiment was dismal, as safe-haven flows like gold, the USD, and the yen dominated the end of the week.

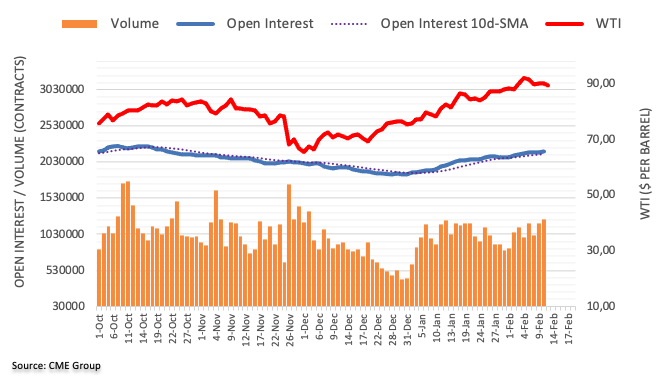

- Western Texas Intermediate finished the week above $93.10 per barrel as geopolitical tensions arose.

On Friday, US equities dropped sharply as recent geopolitical chatter linked to the Ukraine – Russia conflict. US news sources said that a Russian invasion of Ukraine was imminent, spurred a flight to safe-haven assets.

As the New York session ends, the S&P 500 drops 2.05%, at 4,410.85. The Dow Jones Industrial falls some 1.45%, at 34,729.63, and the tech-heavy Nasdaq Composite slides 3.17%, sits at 14.230.95.

Sector-wise, energy (boosted by rising oil prices) and utilities advance 2.79% and 0.01% each, while the biggest losers are technology, consumer discretionary, and communications, sliding 3.01%, 2.82%, and 2.54%, respectively.

US press wires report that Russia decided to invade Ukraine

Around 18:30 GMT, according to a PBS NewsHour reporter, “the US believes that Russian President Vladimir Putin has decided to invade Ukraine and already communicated those plans to the Russian military. Two Biden administration officials said they expect the invasion to begin as soon as next week.”

The reporter continued “that US defense officials anticipate a “horrific, bloody campaign” that begins with two days of bombardment and electronic warfare, followed by an invasion, with the possible goal of regime change. Reportedly, the North Atlantic Council was briefed on the new intel today.”

The US National Security Advisor confirms the rumors

Later in the day, rumors were confirmed by National Security Advisor Jake Sullivan. He said, “we are in the window where a Russian invasion of Ukraine could begin at any time and could happen during the Beijing winter Olympics.” Furthermore, he added that “the US continues to see signs of escalation at the border, and would respond decisively should Russia invade.”

Jake Sullivan urged all Americans in Ukraine to leave “as soon as feasible.” Moreover, Sullivan said, “we are not saying Putin has made a final decision, but Russia now has all forces it needs to conduct a major military action, but he did clarify a false flag operation is also possible by Russia.”

As Wall Street closed, it crossed the wires the news that the US President Joe Biden and Russia’s Vladimir Putin would talk over the phone on Saturday, per Via citing the Kremlin.

Putting the geopolitical jitters aside, the greenback got bid, with the US Dollar Index, advancing close to 0.50%, reclaiming 96.05, linked to safe-haven flows. US Treasury yields fell in the bond market, led by the 10-year yield down eleven basis points, below 2% at 1.916%, a tailwind for precious metals.

At the same time, gold rises 2% exchanges hands at $1864.44 a troy ounce, while US crude oil benchmark, WTI, hit $93.10 per barrel amid revived Ukraine invasion concerns going into the weekend.

In the FX Market, the EUR/USD got hammered by the crisis, trading at 1.1345, while the GBP/USD barely unchanged at 1.3550 got a boost from higher UK’s GDP numbers. Concerning safe-haven pairs, the USD/JPY failed to cling to the 116.00 figure influenced by safe-haven flows, trades at 115.31, while the USD/CHF finished at 0.9243.

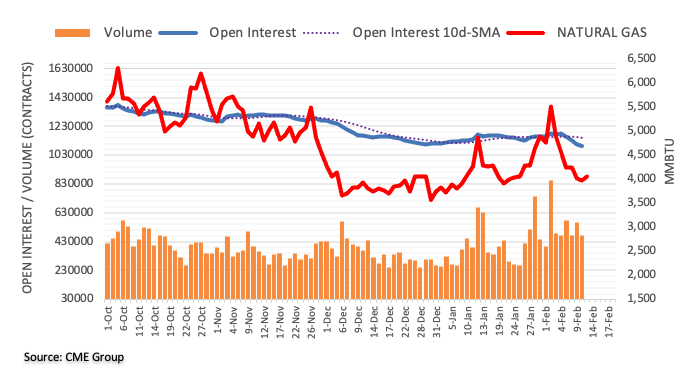

- WTI has ebbed back to the low $93.00s after spiking to the $94.60s on reports a Russian invasion of Ukraine is imminent.

- US National Security Advisor Sullivan pushed back against an earlier report that the admin thought Russia would invade next week.

- If Russia does attack next week as US press reported, many traders would expect a swift move above $100.

Front-month WTI futures saw an abrupt surge in recent trade from around the $92.00 per barrel level to as high as the $94.60s to print fresh highs since September 2014. The spike occurred as traders upped the amount of geopolitical risk premia embedded in oil prices in response to US press reporting that the US administration believes Russia President Vladimir Putin to have decided on invading Ukraine. The assault, according to PBS NewsHour, was to begin next week with a bombardment campaign and cyberattacks ahead of a ground invasion, perhaps with the intention to install a puppet regime.

WTI has since ebbed back to the low $93.00s after US National Security Advisor Jake Sullivan spoke to the press and pushed back against the PBS report. US intelligence has does not yet think Putin has made a final decision on whether to invade, he said, but urged Americans to get out of Ukraine while they can. The UK and EU are withdrawing embassy staff, separate reports suggested, while the US is mulling reducing numbers.

At current levels around $93.00 per barrel, despite now being more than $1.50 below earlier session highs, WTI is trading with on-the-day gains of about $3.0, which would mark the best such one-day performance since early December 2021. WTI is also now on course to end the week about $1.0 higher, stretching its winning streak to eight consecutive weeks. Next week, the theme of Russian military action against Ukraine will remain the dominant driver of price action. If PBS was right and Russia does attack, most traders would expect to see WTI swiftly move above $100 per barrel amid uncertainty as to the fate of Russia’s more than 6M barrels per day in oil exports.

US National Security Advisor Jake Sullivan pushed back against the earlier report via PBS that the US believes Russia President Vladimir Putin had decided to order an invasion of Ukraine. He said the report "does not accurately capture" what US intelligence believes, saying that they don't think a final decision has been made yet, though such a decision may come soon.

- EUR/JPY has been under intense selling pressure in recent trade as reports suggest Russia may invade Ukraine next week.

- The pair has slumped all the way to the 130.70 area and is down about 1.4% on the day.

- That would mark its worst one-day performance since March 2020.

EUR/JPY slumped to session lows well below the 131.00 level in recent trade as market participants dumped their euros and piled into the yen on reports that Russia is set to invade Ukraine as soon as next week. The PBS NewsHour reporter who broke the news on Twitter said that Russian President Vladimir Putin had already decided to invade and communicated plans to the Russian military. In the immediate aftermath of the reports breaking, news emerged that the UK and EU will be evacuating embassy staff and are urging citizens to leave as soon as possible. The US is also reported to be looking at reducing embassy staff and removing its observers to the OSCE mission to Ukraine.

EUR/JPY now trades in the 130.70 area, down some 1.4% on the day, putting the pair on course for its worst one-day performance since March 2020. The euro is being dumped given its economic vulnerability to a significant reduction in Russian gas imports, upon which the continent is reliant for its energy consumption. The yen is being bought as a result of its typical safe-haven status. EUR/JPY may well dip back to pre-hawkish ECB meeting levels under 130.00 next week and, if war begins, could head towards Q4 2021 lows in the 127.50 regions.

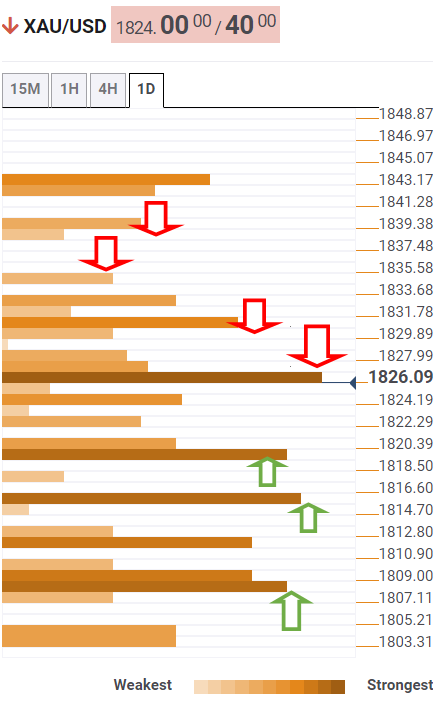

- Geopolitical developments sent the yellow metal skyrocketing above $1,860.

- XAU/USD threatens to break a nine-month-old downslope trendline around $1,850-60.

Gold (XAU/USD) approaches the weekend on the right foot, up 2.36% in the week at press time. At the time of writing, XAU/USD is trading at $1,850. Since around 18:30 GMT, geopolitical developments concerning the Ukraine – Russia conflicts spurred a jump of $20 since 18:35GMT from $1,840 to $1,860.

According to a PBS NewsHour reporter, “the US believes that Russian President Vladimir Putin has decided to invade Ukraine and already communicated those plans to the Russian military. Two Biden administration officials said they expect the invasion to begin as soon as next week.”

The reporter continued “that US defense officials anticipate a “horrific, bloody campaign” that begins with two days of bombardment and electronic warfare, followed by an invasion, with the possible goal of regime change. Reportedly, the North Atlantic Council was briefed on the new intel today.”

Putting this aside, the financial market mood is dismal, as US equities trade in the red, while the greenback underpinned by US Treasury yields up, climbs 0.28%, at 95.85.

Friday’s US economic docket was light in the North American session. The University of Michigan Consumer Sentiment Index for February came at 61.7, lower than the 67.5 estimated and trailed the January 67.2 figure. Concerning inflation expectations for 1 and 5 years, consumers expect it at 5.0% and 3.1%, respectively.

On Thursday, the St. Louis Fed President, James Bullard, on an interview with Bloomberg, said that he favors 1% of rate increases to the Federal Funds Rate (FFR) by July 1st. When asked about a 50 bps increase in the March meeting, he said he does not want to “prejudge that meeting.”

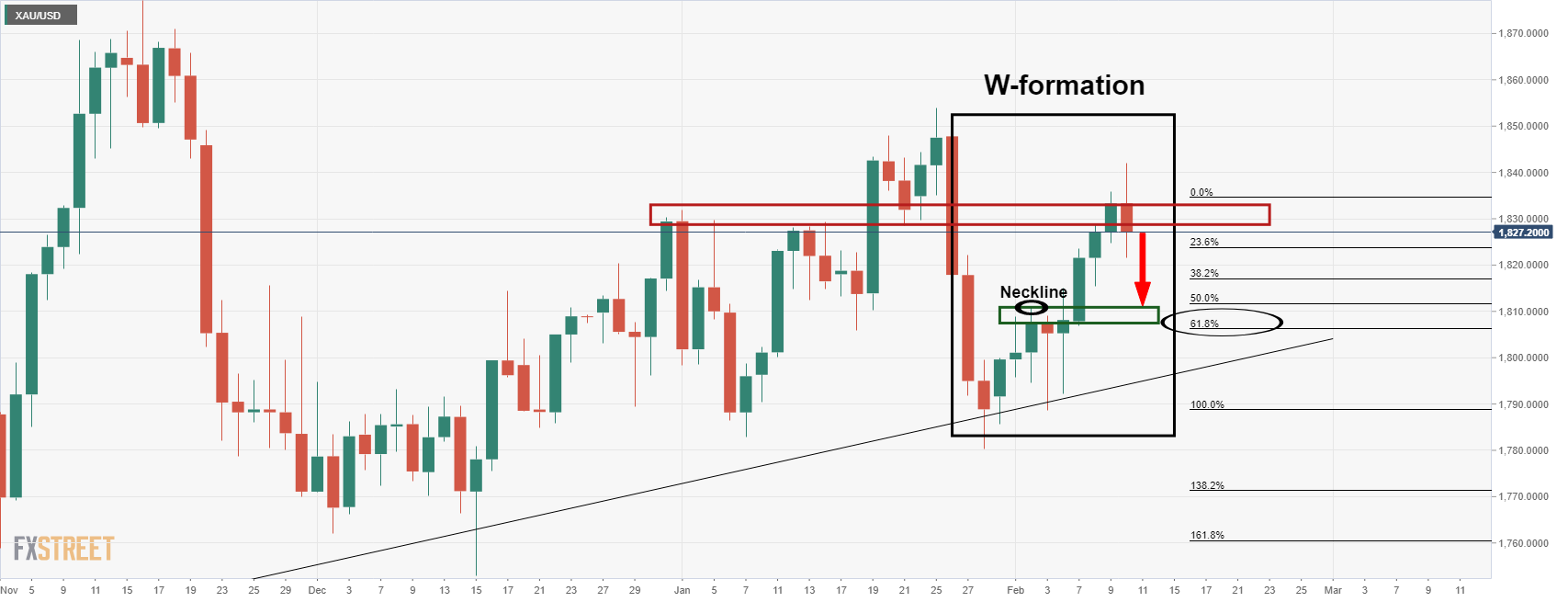

XAU/USD Price Forecast: Technical outlook

The XAU/USD is neutral biased, but geopolitical issues sent the yellow-metal surging towards a nine-month-old downslope trendline, around $1850-60 region, which, if it gives way, would expose the November 16th, 2021 high at $1,877, followed by June 1st, 2021 daily high at $1,916.61.

US National Security Advisor Jake Sullivan said on Friday that we are in the window where a Russian invasion of Ukraine could begin at any time and could happen during the Beijing winter Olympics, according to Reuters. The US continues to see signs of escalation at the border, he continued, saying that the US is ready to respond decisively should Russia invade. The response, Sullivan added, would include sanctions and changes to NATO force posture and, as a result, Russia's power would be diminished, not enhanced, by an invasion. Sullivan urged all Americans to leave within the next 24-48 hours.

Market Reaction

The risk-off reaction as a result of the news that an invasion could occur as soon as next week has continued in recent trade.

The US believes that Russian President Vladimir Putin has decided to invade Ukraine and already communicated those plans to the Russian military, said a PBS NewsHour reporter on Twitter. Two Biden administration officials said they expect the invasion to begin as soon as next week. The reporter continued that US defense officials anticipate a "horrific, bloody campaign" that begins with two days of bombardment and electronic warfare, followed by an invasion, with the possible goal of regime change. Reportedly, the North Atlantic Council was briefed on the new intel today.

The reports emerge shortly after the UK government advised against all travel to Ukraine and urged all British nationals to leave the nation as soon as possible while commercial means are still available. The UK government has also taken the decision to further withdraw embassy staff from Kyiv. Shortly after the UK made this announcement, the news emerged that the EU staff are also being evacuated, while the US is discussing the possibility of reducing staff numbers. The US will also pull its observers from the OSCE mission to Ukraine, sources told CNN.

Market Reaction

In reaction to the latest reports, markets have seen a classic "risk-off" move. Safe-haven assets such as gold and US bonds have been in demand, with the precious metal rallying from around $1840 to the $1850 area. The US 10-year yield, meanwhile, is now back below 2.0% and down about 4bps on the day from previously closer to 2.03%. Meanwhile, risk assets like equities have been experiencing sharp selling in recent trade, with the S&P 500 now down 1.3% and back below its 200-Day Moving Average at 4450, having previously traded above 4500.

In G10 currency markets, the euro has been hit the worst, likely due to the Eurozone's economic exposure to high gas prices (it depends on Russian imports for about 30% of gas consumption). Generally, risk-sensitive currencies in the G10 are also fairing badly while the yen is now doing the best and at the top of the performance table. The Russian rouble, meanwhile, has now depreciated by roughly 3.0% on the day versus the US dollar and is on course for its worst one day performance since March 2020.

- The shared currency ends the week lower, as the EUR/USD is down 0.48% in the week.

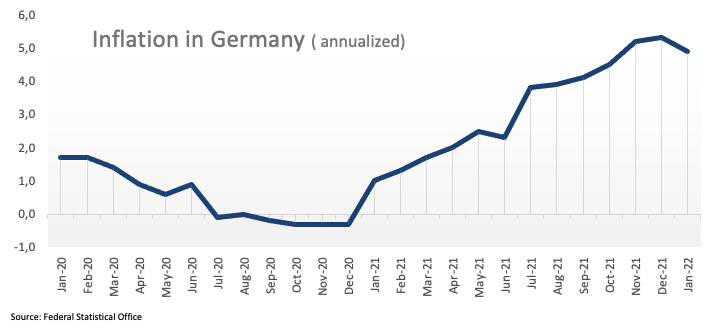

- German inflation came as expected, while US UoM Consumer Sentiment fell short of forecasts.

- ECB Lagarde’s pushed back against raising rates, while Fed’s Bullard eyes 1% increases by July 1st.

The EUR/USD seesaws around the 1.1400 figure as European traders get ready for the weekend amid a risk-off market mood. At the time of writing, the EUR/USD is trading at 1.1401.

The Friday session witnessed the EUR/USD fluctuating up and down, with a lack of direction, after some ECB and Fed speaking. Also, during the European session, German inflation figures for January were reported. The German HICP and the CPI increased by 5.1% and 4.9%y/y, both readings in line with expectations, causing a jump from the daily lows towards 1.1390, a 20-pip jump.

Meanwhile, the US economic docket is light in the North American session, with the University of Michigan Consumer Sentiment Index for February reported at 61.7, lower than the 67.5 estimated and trailed the January 67.2 figure. Concerning inflation expectations for 1 and 5 years, consumers expect it at 5.0% and 3.1%, respectively.

The EUR/USD bounced on the release towards the 1.1410 area, retreating afterward, and through the remainder of the day, is seesawing around the 1.1400 figure.

Central bank divergence could favor the greenback vs. the euro

Now that the macroeconomic data is in the rearview mirror, some ECB and Fed speaking entertained EUR/USD traders in the last two days.

On Thursday, ECB President Christine Lagarde said that raising rates would not solve any of the current problems and that they [ECB] don’t want to choke the recovery, and emphasized that she is confident inflation will fall back in the course of the year.

Across the pond, the St. Louis Fed President, James Bullard, on an interview with Bloomberg, said that he favors 1% of rate increases to the Federal Funds Rate (FFR) by July 1st. When asked about a 50 bps increase in the March meeting, he said he does not want to “prejudge that meeting.”

Therefore, the central bank policy divergence could witness some USD strength to the detriment of the EUR. It could be possible that the EUR/USD might be headed to the 1.1250-1.1350 area on a mean reversion reaction once Lagarde’s dovishness got back on the aforementioned headlines.

- GBP/USD is set to end the week near 1.3600 having bounced nearly 100 pips from intra-day lows.

- The pair was aided by not as bad as feared UK economic data, but was unreactive to bad UoM figures.

- Traders will have plenty of UK/US data to watch next week, as well as Fed speak and Fed minutes.

GBP/USD looks set to end Friday trade with gains of about 0.3%, making it amongst the best performing G10 currencies on the session, after not as bad as feared Q4 GDP and December activity data released during early European trade. The pair’s upside seems to have run out of steam at the 1.3600 level as FX flows die down ahead of the weekend, but GBP/USD nonetheless trades nearly 100 pips higher versus earlier session lows just above 1.3500.

Data out next week will play an important role in determining BoE tightening expectations for 2022 (currently, roughly a further 150bps of tightening is expected). The latest labour market data will be released on Tuesday and market participants will get a first look at how the UK labour market performed during the rapid spread of Omicron. January CPI data will then be released on Wednesday ahead of January Retail Sales figures on Friday.

Much weaker than anticipated US University of Michigan Consumer Sentiment survey data, which showed sentiment deteriorating to its worst levels since 2011, did not impact the pair much given that it isn’t seen as likely to deter Fed tightening. GBP/USD is thus on course to end the week around 0.5% higher, marking a second successive week of gains, during which time it has rallied about 1.8% from January lows.

It's unlikely that stronger than expected data next week could bolster BoE tightening expectations to be any more hawkish than they already are. Indeed, many analysts suspect the BoE will deliver far less tightening in 2022 than currently priced into money markets with the economy set to hit multiple speed bumps from Q2 onwards. These include tax hikes, energy price hikes and the prospect of higher borrowing costs and might dissuade the BoE from tightening so aggressively in H2 as inflation levels pull back from the more than 7.0% levels expected in April.

Meanwhile, the US calendar is dominated by Fed speak and the minutes of the last meeting, as well as January Retail Sales and Producer Price Inflation. GBP/USD may remain choppy as investors weigh up the outlook for BoE/Fed policy divergence and how the latest data/central bank releases (and commentary) influence this outlook. Technicians will note support in the 1.3500 area and resistance between 1.3600-1.3650.

As a result of the last European Central Bank meeting, analysts at Rabobank revised EUR/USD forecasts to the upside. Now they expect the pair to drop to 1.11 by mid-year down from their previous target of 1.10

Key Quotes:

“We have moderated our EUR/USD forecasts in light of the hawkish pivot at the ECB’s February policy meeting. However, we don’t see the USD’s bull run as being over yet. Previously, we were forecasting that EUR/USD would drop to 1.10 by mid-year as the Fed’s tightening commenced. In light of the ECB’s hawkish tilt we have revised this forecast up moderately to 1.11.”

“We have also brought forward our medium-term projections for the recovery in EUR/USD. We now forecast EUR/USD at 1.15 on a 1-year view from a previous forecast of 1.12.”

- The USD/JPY is barely flat during the day, as market mood conditions remain mixed.

- US Treasury yields advance, led by the 10-year above the 2% mark.

- USD/JPY bias is tilted upwards as USD buyers attack 116.00, followed by the YTD high.

The USD/JPY barely falls during the North American session, following Thursday’s volatile trading day, which witnessed the US economy printing a 7.5% inflation rate, the largest since 1982. As a result, US Treasury yields led by the 10-year note, pushed above the 2% mark, while the greenback seesawed, with the US Dollar Index, rising towards 96.00, falling to daily lows at 95.40s, to finally finish 0.25% up near 95.79. At the time of writing, the USD/JPY is trading at 115.88, down 0.14%.

On Thursday, St. Louis Federal Reserve President James Bullard crossed the wires. He said that he favors 1% of rate increases to the Federal Funds Rate (FFR) by July 1st. When asked about a 50 bps increase in the March meeting, he said he does not want to “prejudge that meeting.”

The Bank of Japan (BoJ) announced that it would purchase an unlimited amount of 10-year Japanese Government Bunds (JGBs) on February 14th, at 0.25%, to keep control of the Yield curve.

Sources cited by Reuters said that “By announcing its plan days in advance, the BOJ sought to discourage players from testing the 0.25% line and pre-empt any breach of that level - without actually having to purchase JGBs.”

In the meantime, the US 10-year Treasury yield reclaims the 2.03% threshold, almost flat a tailwind for the USD/JPY, which trimmed its 0.11% losses, down to 0.08%.

An absent Japan economic docket left USD/JPY players adrift to US macroeconomic data. On the US front, the University of Michigan Consumer Sentiment Index fell to 61.7, the lowest level since October 2011. Regarding inflation expectations for 1-year, rose to 5%, from 4.9% in January.

USD/JPY Price Forecasts: Technical outlook

The USD/JPY maintains the bullish bias in place. The upbreak of a one-month-old trendline accelerated the move towards 116.00, which was broken on Thursday, would be the first support level, as USD bulls prepare an attack towards the YTD high at 116.35.

That said, the USD/JPY first resistance would be 116.0. Breach of the latter would expose the YTD high at 116.35, followed by a challenge of a 24-month-old downslope trendline around 117.00. A clear break of that ceiling level would pave the way towards January 2017 swing high at 118.61.

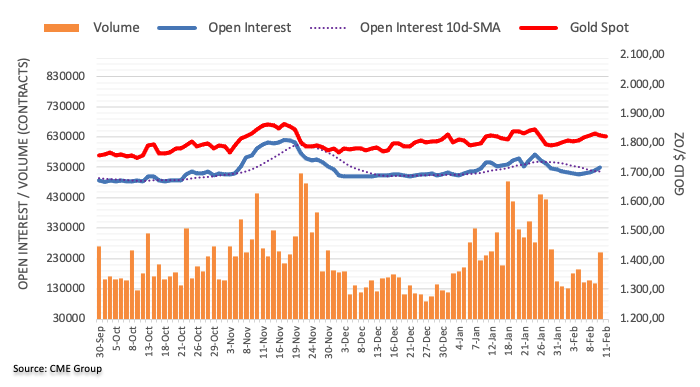

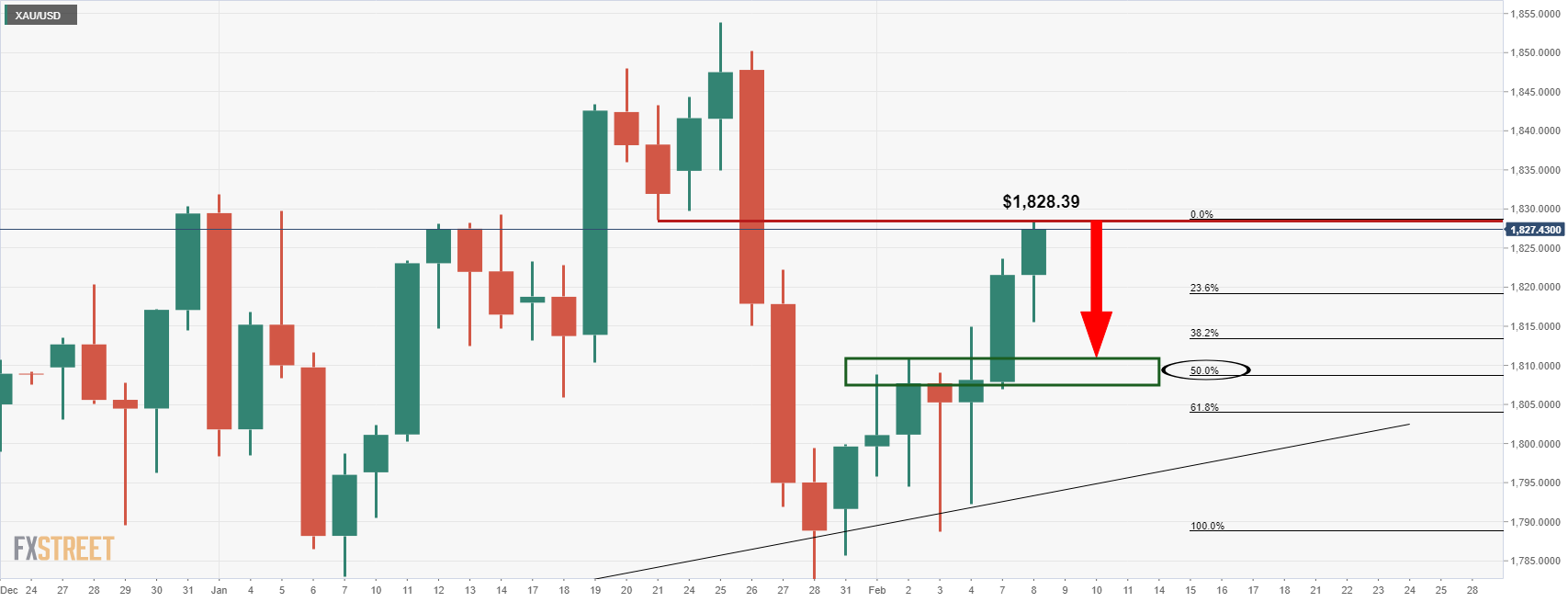

- Gold rises back above $1830, could post the highest week close since November.

- US dollar drops across the board after Thursday’s rally.

Gold rose further during the American session and climbed to $1836, reaching a fresh daily high. It remains near the top with a bullish tone. The upside move started after finding support again above $1820.

If XAU/USD ends at current levels, it will post the highest weekly close since November, with a gain of around $20.

Gold holding so far despite yields

The extreme volatility on Thursday proves that the road to the upside is bumpy and vulnerable for gold. Gold is holding relatively well, considering that yields on Thursday reached fresh multi-year highs. Although, yields look to warrant sharp and quick corrections.

Many analysts warn the outlook for gold is negative taking into account that US yields will continue to rise. But if gold holds at current levels, it could reflect some underlying strength.

Support at $1820

From a technical perspective, in the short-term, the immediate support stands at $1820; a break lower would point to a deeper slide toward $1800. A daily close below $1790 should point to further losses and to a potential decline toward $1750.

On the upside, the next barrier is seen at $1845/50. If XAU/USD rises above, the next target is seen at $1870.

Technical levels

Is gold finally regaining its inflation-hedge status? This week’s action suggests that the precious metal could be regaining its status as an inflation hedge and the technical outlook doesn’t show a buildup in bearish momentum, FXStreet’s Eren Sengezer reports.

Markets await FOMC Minutes to confirm or deny a 50 bps hike in March

“In case markets continue to price in an aggressive policy tightening, the US Dollar Index could gather bullish momentum and make it difficult for gold to extend its rally. Even if XAU/USD loses its traction, this week’s action showed that the yellow metal’s losses are likely to remain limited.”

“Investors will pay close attention to comments from Fed officials and look for confirmation of a 50 bps rate hike in March. Another leg higher in the 10-year US T-bond yield could cause gold bulls to move to the sidelines. On the other hand, a correction in yields should open the door for further gains in XAU/USD.”

“In order to target $1,850 (static level), gold needs to start using $1,830 as support and clear the interim resistance that seems to have formed at $1,840.”

“On the downside, $1,820 (20-day SMA, Fibonacci 38.2% retracement) aligns as the first support level. A daily close below that level could open the door for additional losses toward $1,810 (50-day SMA, 200-day SMA).”

See – Gold Price Forecast: XAU/USD to trade at $1,800 towards the end of Q1 2022 – ANZ

- USD/CHF is trading flat just above 0.9250, unmoved by the latest weaker than expected UoM sentiment data.

- Dollar bulls may be disappointed by the lack of post-hot CPI data upside, amid fears front-loaded tightening will hit growth.

Much weaker than expected University of Michigan Consumer survey data, which revealed sentiment to have broadly deteriorated to its worst levels since 2011, failed to shift USD/CHF out of intra-day ranges, with the pair for now remaining supported above 0.9250. The pair is currently trading flat, having come close to but failed to test 0.9300 for a second successive session. Dollar bulls might be disappointed at the lack of follow-through in terms of post-hot US Consumer Price Inflation data upside, despite the hawkish shift in Fed tightening expectations and subsequent sharp rise in yields across the US curve.

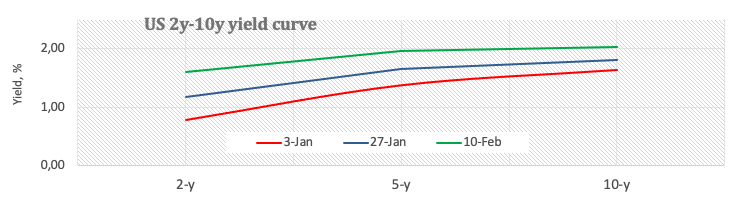

The US dollar’s reluctance to stage a more meaningful rally, which for USD/CHF would likely look like a move above 0.9300 and a test of H2 2021 and 2022 highs around 0.9350, has perplexed analysts. Some have pointed to the pronounced, ongoing flattening of the US yield curve which on Friday saw the 2-year 10-year spread drop to its lowest in over 18 months at under 40bps. A flatter curve is seen by many as indicative of softer long-term growth expectations.

The hawkish shift in Fed tightening expectations of recent months has been the major driver of the flattening and likely speaks to a fear that by tightening rates earlier and more aggressively, the Fed may cap long-term growth prospects. This fear may be the major factor holding USD/CHF back from moving up a gear and charging back above 0.9300. For the pair to challenge post-pandemic highs in the upper 0.9400s, long-term US yields are likely going to need to see further upside and thus the US curve perhaps steepens a little to reflect greater confidence in long-term US growth.

- Mexican peso among top performers the day after Banxico rate hike.

- USD/MXN having worst week since early December.

The USD/MXN is falling on Friday, erasing all of Thursday’s gains. It is trading at 20.39, at the lowest level of the day, on its way to the lowest daily close in a month the day after a new rate hike from Banxico.

The US dollar is lost momentum on Friday after rising sharply on Thursday on the back of CPI data and comments from Fed’s Bullard about the pace of rate hikes. Also emerging market currencies are recovering helped by a recovery in equity prices in Wall Street.

The Mexican peso is among the top performers on Friday. On Thursday the Bank of Mexico hiked the key interest rate by 50 bp to 6% as expected. One member of the board dissented, asking for a smaller hike. Banxico rose inflation forecast, keeping the doors open to another rate hike at the next meeting March 24.

“The Governing Board may be increasingly concerned with the developments in inflation expectations, though there was little material change in the forward looking component of their policy statement. This leaves some degree of uncertainty as to the probability of an equivalent hike at the next meeting, though we see that the dissent from Esquivel is now for a hike (of only 25bps), which leads us to believe that we'll get a further 50bps hike”, explained analysts at TD Securities.

The Mexican peso did not react to the upside on Thursday after Banxico but is gaining momentum on Friday. The USD/MXN peaked at 20.63 before turning to the downside. The consolidation below 20.40 could lead to a test of the 200-day moving average that stands at 20.32. On the upside, a break above 20.70 should strengthen the dollar.

Technical levels

The US 10-year bond yield has hit 2%. It may well pause here in a narrow range around 2% for a bit, but beyond that analysts at ING view a rise to the 2.25% area as likely, as the real rate journies out of deep negative territory.

What the Fed does in March matters hugely

“We think the US 10yr is heading for 2.25%. Then, a Fed that delivers 50bp in March is more likely to be getting ahead of the curve which would help contain the 10yr cycle peak to the 2.25% area.”

“A tame 25bp hike with no bite could leave the market at least pondering a path towards 3% on the 10yr. We may not even get close, but on the table it is.”

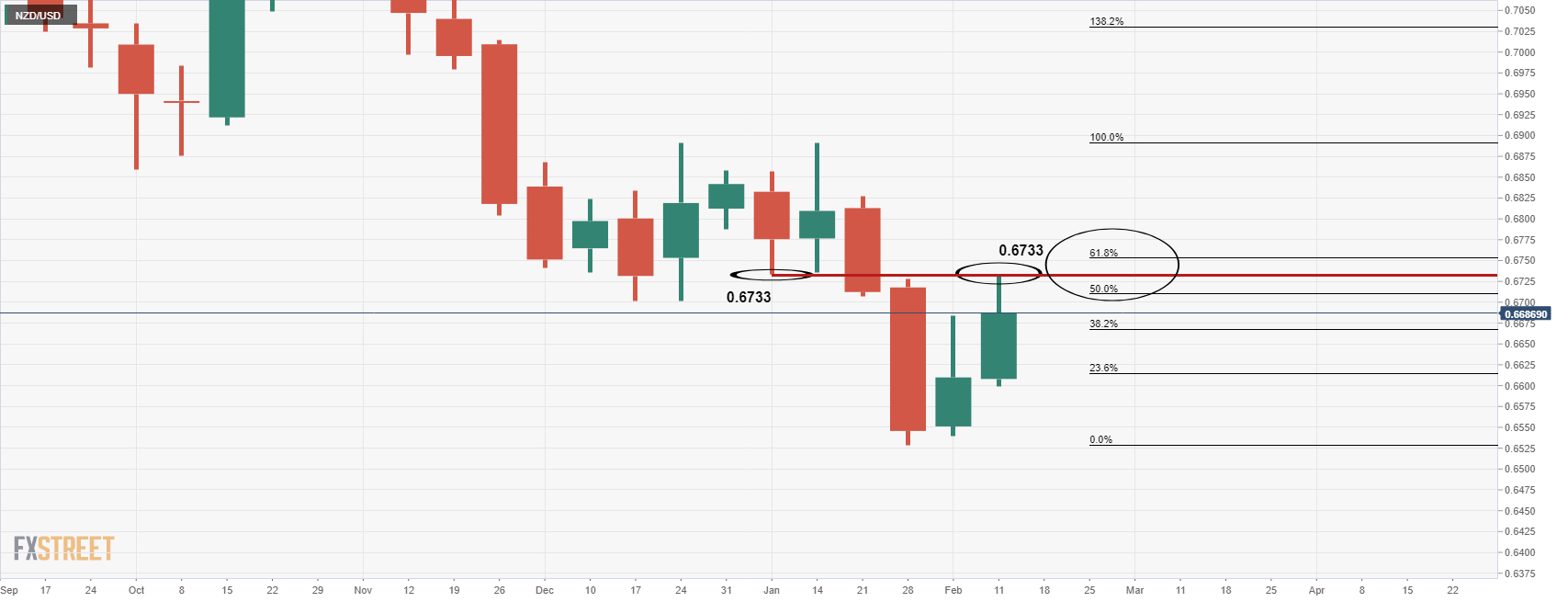

- A mixed market mood did not stop the NZD from advancing vs. a “firmer” greenback.

- Fed’s Bullard favors a 50 bps rate hike and would like 1% increases by July 1. – BBG.

- NZD/USD Technical Outlook: The path of least resistance is tilted to the downside, as the uptrend stalled near the 50-DMA.

As market players get ready for the weekend, risk-off market mood looms the financial markets, to the detriment of the risk-sensitive New Zealand dollar. However, the NZD/USD so far hangs to its gains, trading at 0.6688 at the time of writing.

On Thursday, a hotter US inflation report spurred a jump in US Treasury yields, with the 10-year moving above the 2% threshold while US equities sold off. At the same time, the US Dollar pared some of its earlier losses, while the NZD/USD seesawed, closing 0.15% down in the day.

Friday’s story is slightly different. US Treasury yields, even though higher, ease a tone, with the 10-year down three basis points at 1.996%. Europan stock indices are mixed, while US equity futures are trending up. In the FX complex, the greenback is firm, with the DXY up 0.27%, at 95.76.

St. Louis Fed Preident James Bullard favors a 1% FFR by July 1

Meanwhile, ST. Louis Fed President James Bullard crossed the wires on Thursday, following the release of US CPI. Bullard said that based on the US CPI figure, he favors a 1% rate increase “in the bag” by July 1. When asked about a 50 bps increase by the March meeting, he said, “I [he] just don’t want to prejudge that meeting. There was a time when the committee would have reacted to something like this by just having a meeting right now and doing 25 basis points right now.”

Finally, Bullard added that he expects the balance-sheet runoff to start in the second quarter.

The economic docket is light on the day. The New Zealand docket featured the Business NZ PMI for January came at 52.1, shorter than the “revised” 53.8. Across the pond, the US docket featured the University of Michigan Consumer Sentiment Index (Prel) for February, which came at 61.7 vs. 67.5 estimated, also trailing the 67.2 of January. Further, Inflationary expectations rose to 5%, up from a previous 4.9%.

NZD/USD Price Forecast: Technical outlook

The NZD/USD so far in the week remains positive, +1.10%, but stalled its uptrend near the 50-day moving average (DMA) at 0.6742. Thursday’s price action left an inverted hammer candlestick, suggesting that selling pressure mounted around the 0.6700-30 area and will be challenging to overcome by NZD bulls.

Therefore, the NZD/USD path of least resistance is tilted downwards. The NZD/USD first support would be February 9 daily low at 0.6640. Breach of the latter would expose the February 4 swing low at 0.6588, followed by the January 28 low at 0.6529.

- USD/TRY extends the boring mood around 13.50.

- Turkey End Year CPI Forecast revised up to 34.06%.

- Turkey Retail Sales contracted 2.7% MoM in December.

The Turkish lira gives away part of the recent gains and now pushes USD/TRY to the 13.50 region, posting decent gains for the day.

USD/TRY remains side-lined around 13.50/60

USD/TRY advances modestly after three consecutive daily pullbacks, always against the backdrop of the broader consolidative phase well in place since mid-January.

The lira sheds some ground despite results in the domestic docket fell on the positive camp on Friday. Indeed, the Current Account deficit widened less than forecast to $3.84B in December, while the End Year CPI Forecast ticked higher to 34.06% in February (from 29.75%). In addition, Retail Sales contracted at a monthly 2.7% in December and expanded 15.5% from a year earlier.

In the meantime, Turkish finmin N.Nebati defended once again the new economic model based on prioritizing exports and production in a context of lower borrowing costs. He also pledged to bring inflation to single digits (by May 2023) and keep the currency stable, while preventing further dollarization of the economy.

The Turkish central bank (CBRT) will meet on February 17 and consensus expects the One-Week Repo Rate to remain unchanged at 14.00%.

What to look for around TRY

The pair keeps its multi-week consolidative theme well in place, always within the 13.00-14.00 range. While skepticism keeps running high over the effectiveness of the ongoing scheme to promote the de-dollarization of the economy – thus supporting the inflows into the lira - the reluctance of the CBRT to change the (collision?) course and the omnipresent political pressure to favour lower interest rates in the current context of rampant inflation and (very) negative real interest rates are a sure recipe to keep the domestic currency under pressure for the time being.

Key events in Turkey this week: End Year CPI Forecast, Current Account, Industrial Production, Retail Sales (Friday).

Eminent issues on the back boiler: Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Much-needed structural reforms. Growth outlook vs. progress of the coronavirus pandemic. Earlier Presidential/Parliamentary elections?

USD/TRY key levels

So far, the pair is advancing 0.44% at 13.6296 and a drop below 13.3226 (55-day SMA) would expose 13.2327 (monthly low Feb.1) and finally 12.7523 (2022 low Jan.3). On the other hand, the next up barrier lines up at 13.9319 (2022 high Jan.10) followed by 18.2582 (all-time high Dec.20) and then 19.0000 (round level).

- UoM's Consumer Sentiment Index fell to its lowest since October 2011 at 61.7 in February, a much larger than expected drop.

- FX markets did not see any notable reaction to the latest poor data.

According to the University of Michigan's preliminary February Consumer survey, the Consumer Sentiment Index fell to 61.7 in February, well below expectations for a slight rise to 67.5 from 67.2 in January. That marked the lowest such reading since October 2011. The Current Conditions Index fell to 68.5 from 72.0 in January versus forecasts for a small rise to 73.0, its lowest reading since August 2011. The Consumer Expectations Index fell to 57.4 from 64.1 in January, it's lowest such reading since November 2011. The one-year Inflation Expectations Index rose to its highest since July 2008 at 5.0% from 4.9% in January.

Market Reaction

Poor Consumer Sentiment data has failed to shift the dial for the US dollar, with the DXY continuing to trade sideways in the 95.80s, where it trades broadly flat on the session.

GBP/USD holds modest gains. But economists at Scotiabank expect the cable to slide towards the 1.34 level as the market is too aggressive pricing the next hikes by the Bank of England (BoE).

Governor Bailey is in favour of a measured approach in hiking

“We think markets are set to be disappointed as Governor Bailey and Pill, the bank’s chief economist, are in favour of a more measured approach in hiking.”

“The 2% BoE rate that markets are seeing by end-2022 is also excessive, we think, as it could have too much of a dampening impact on demand-side dynamics.”

“The GBP is at risk of a test of 1.34 soon as markets re-price some of these lofty expectations.”

- Wall Street trades largely in the green on Friday, with the S&P 500 currently about 0.4% higher in the 4520s.

- Uncertainty over the Fed’s monetary tightening plans will remain the main driver ahead of the bank’s next policy decision.

Wall Street started Friday’s session positive, with the S&P 500 at the time of writing trading in the 4520s and up about 0.4%, having found support around 4500. While the index saw a sharp pullback on Thursday and is about 1.5% below earlier weekly highs, it still remains on course to end the week slightly in the green. Technicians might note that the index appears to have forged out a mid-4400s to 4600 ish range since the start of February. Some traders might be tempted to play this range in the near term as they await more clarity on central bank policy.

US government bond yields took a breather after Thursday’s post-hot-US inflation data/hawkish Fed commentary surge, with the 10-year yield dropping 2bps back to the 2.0% level, easing pressure on duration-sensitive equity market sectors. As such, big tech and growth names, the biggest losers on Thursday, were close to flat on Friday. The Nasdaq 100 was subsequently trading about 0.2% higher near the 14.75K level and despite a more than 2.0% pullback from earlier weekly highs, remains on course to end the week broadly flat. The Dow, meanwhile, was trading about 0.5% higher in the 35.4K area and on course for a small weekly gain of about 0.9%.

The major equity market theme remains the timing and pace of Fed monetary tightening. In wake of Thursday’s January inflation figures, which showed the headline rate of US Consumer Price Inflation hitting a near-40 year high at 7.5%, as well as hawkish comments from Fed policymaker James Bullard, who called for 100bps of tightening by July, a 50bps hike in February has become the market’s base case. But some analysts have pushed back against this notion, citing more cautious commentary from other Fed policymakers in wake of the CPI data. This uncertainty is likely to keep equities choppy in the coming weeks ahead of the Fed’s next meeting.

EUR/USD dips under 1.14. A weekly close below this level would leave the pair at risk of suffering further falls as the technical picture worsen, economists at Scotiabank report.

1.14 stands as key resistance

“1.14 stands as key resistance; 1.1420 and the mid-figure zone follow.”

“The EUR may still be maintaining the outlines of a bullish flag pattern and a breakout toward a test of 1.16 is still in the cards, but a close under 1.14 on the week leaves the technical picture looking less positive.”

“Below 1.1370, support is the mid-figure area and the 50-day MA of 1.1328.”

- EUR/USD comes under pressure after recent tops near 1.1500.

- The 5-month support line holds the downside around 1.1390.

EUR/USD reverses the recent strength and dropped to fresh lows around 1.1370, managing to rebound afterwards.

In the meantime, further gains in the pair remains on the table while above the 5-month line in the 1.1390 area. Above this zone, EUR/USD should be able to attempt another visit to the 2022 high at 1.1494 (February 4) just ahead of the 200-week SMA at 1.1496. Between 1.1500 and 1.1600 there are no resistance levels of note, leaving the October 2021 top at 1.1692 as a potential longer-term target.

In the longer run, the negative outlook remains in place while below the key 200-day SMA at 1.1660.

EUR/USD daily chart

The S&P 500 has seen a more decisive rejection of key resistance at 4591/95. Analysts at Credit Suisse expect to see an important cap here in line with theirr broader 4200/4600 ranging view, looking for a retest and then break below key price and 200-day moving average support (DMA) at 4453/51.

Broader risk to turn lower again in line with a 4200/4600 ranging view

“S&P 500 has seen a fresh and what looks to be decisive rejection of key flagged resistance at 4591/95. With the market also still below its falling 63-DMA at 4623, our bias remains to view recent strength as corrective only and for this to remain a major barrier and for the broader risk to then turn lower again in line with our broader 4200/4600 ranging view.”

“Key support stays seen at the 200-day average and price pivot at 4453/51. A close below here should add weight to our view to mark a more important turn lower with support then seen next at 4414/09 ahead of 4365 and eventually we think a retest of 4223/13.”

“Resistance is seen at 4533 initially, with 4591/95 ideally continuing to cap. A close above the 63-day average at 4623 would instead suggest the recovery can extend further with resistance seen next 4663/65 and potentially the 78.6% retracement of the January sell-off at 4691.”

- Spot silver dipped back towards $23.00 on Friday, a second day of losses after Thursday’s hot US CPI.

- The data prompted a further hawkish shift in Fed tightening bets and a surge in US bond yields.

- Traders also cited hawkish comments from Fed’s Bullard as weighing on silver, though some think markets might be over-interpreting his remarks.

Spot silver’s (XAG/USD) sharp-post hot US Consumer Price Inflation (CPI) data reversal from highs in the upper $23.00s per troy ounce continued on Friday, with spot prices dropping back to test the $23.00 level. At one point, the precious metal dipped as low as the $22.80s, but has since bounced to trade near the big figure, down about 0.7% or roughly 15 cents on the day. Thursday’s hot CPI, which saw the headline YoY rate of US inflation hit 7.5%, its highest since 1982, sparked a further hawkish shift in market-based measures of expectations for Fed tightening in 2022.

This shift was exaccerbated by hawkish remarks from St Louis Fed President James Bullard, who after the data on Thursday remarked that he wanted to see 100bps of tightening by the start of H2 2022. According to US money market-implied probability, a 50bps rate hike in March is now strongly the base case, while 175bps of tightening are expected by end-2022. Higher interest rates damped the appeal of non-yielding assets such as silver, hence its no surprise to see prices move lower over the past two days.

But some analysts think that markets have gone too far in pricing near-term Fed tightening and placed too much weight on Bullard’s remarks. In a recently published article, CNBC’s Steve Liesman articulated this viewpoint, arguing that, despite hot inflation, the Fed is likely to take a measured approach to rate hikes (i.e. 25bps at a time). He cited remarks from Fed policymakers Mary Daly, Thomas Barkin and Raphael Bostic in wake of the inflation data which push-back against the idea of a 50bps move.

The dollar’s failure to rebound substantially this week may be a reflection of fears that the Fed might not live up to the market’s very hawkish expectations for policy tightening. The DXY remains stuck under 96.00, helping XAG/USD remain on course for a weekly gain of about 2.5%, despite the sharp rise in yields across the US curve this week. Dollar weakness/silver resilience may also reflect recent flattening of the US yield curve, which is suggestive of a weakening economic outlook. The 2-year 10-year spread recently fell under 40bps for the first time in over 18 months.

- DXY extends the recovery in the second half of the week.

- The index faltered once again around the 96.00 region.

DXY now alternates gains with losses after failing to surpass the key barrier at 96.00 earlier in the session.

The inability of the index to garner convincing upside traction, ideally in the short term, could prompt sellers to return to the market. That scenario should force the dollar to initially retest the so far monthly low at 95.13 (February 4) ahead of the 2022 low at 94.62 (January 14).

In the near term, the 5-month line near 95.20 is expected to hold the downside for the time being. Looking at the broader picture, the longer-term positive stance in the dollar remains unchanged above the 200-day SMA at 93.59.

DXY daily chart

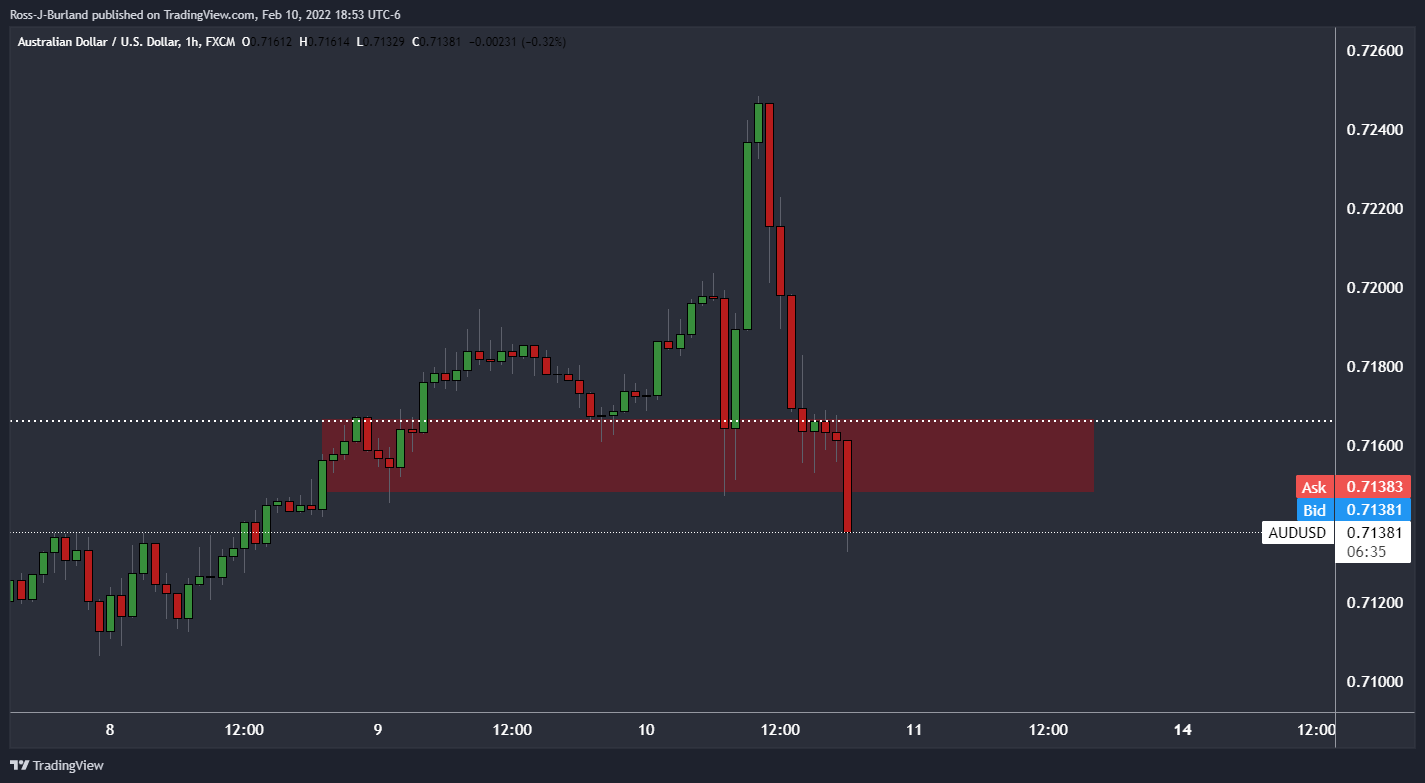

- AUD/SUD attracted some dip-buying near the 0.7100 mark on Friday amid modest USD pullback.

- Retreating US bond yields turned out to be a key factor that prompted some intraday USD selling.

- The cautious market mood, hawkish Fed expectations should limit the USD losses and cap the pair.

The AUD/USD pair recovered its intraday losses and climbed to a fresh daily high, around the 0.7170 region during the early North American session.

The pair attracted fresh buying near the 0.7100 mark on Friday and for now, seems to have stalled the overnight sharp retracement slide from a three-week high, around the 0.7250 region. As investors digested Thursday's release of red-hot US consumer inflation figures, the US dollar witnessed some intraday selling amid modest pullback in the US Treasury bond yields. This, in turn, was seen as a key factor behind the AUD/USD pair's goodish intraday bounce of over 60 pips.

The upside, however, remains capped amid the prevalent cautious market mood, which acted as a headwind for the perceived riskier aussie. Apart from this, the prospects for a faster policy tightening by the Fed should help limit the downside for the US bond yields and the buck. This warrants caution before placing fresh bullish bets around the AUD/USD pair and positioning for the resumption of the recent strong recovery move from the lowest level since June 2020.

The red-hot US CPI report on Thursday reinforced market expectations that the Fed would adopt a more aggressive policy stance to combat high inflation. Adding to this, St. Louis Fed President James Bullard called for a 100 bps rate hike over the next three FOMC policy meetings. This boosted bets for a 50 bps rate hike in March, which, in turn, favours the USD bulls and supports prospects for the emergence of fresh selling around the AUD/USD pair at higher levels.

Nevertheless, the pair remains on track to post the second successive weekly gains. Traders now look forward to the release of the Prelim University of Michigan US Consumer Sentiment Index. This, along with the US bond yields, will influence the USD price dynamics and provide some impetus to the AUD/USD pair. Apart from this, traders will take cues from the broader market risk sentiment to grab some short-term opportunities on the last day of the week.

Technical levels to watch

- WTI prices are up on Friday and back above $91.00, though remain set for their first weekly decline in eight.

- US/Iran negotiations, Fed tightening fears and pressure on the Saudis/UAE to pump more is holding back the bull market.

Oil prices trade high on the final trading day of the week, with front-month WTI futures having moved back to the north of the $91.00 level in recent trade. At current levels around $91.20 per barrel, WTI trade with on-the-day gains of slightly more than $1.0, though prices have remained within Thursday’s intra-day $89.00-$91.70ish range. Market commentators are citing a bullish monthly report from the Internation Energy Agency (IEA), which upgraded its 2022 demand forecast by 800K barrels per day (BPD). This was in part due to revisions to historical data, but markets took as a bullish sign given that the OPEC+ monthly report this week was also bullish on the demand recovery in 2022.

The IEA now expects oil demand to rise by 3.2M BPD by the end of 2022 versus the end of 2021, taking daily consumption to a record high 100.6M barrels. Despite the bullish forecasts, WTI still looks set to end the week slightly more than 50 cents lower. That would mark the first weekly decline for WTI in eight. Though prices have been well supported by dip-buying in the $88.00-$89.00 area, profit-taking after WTI hit seven-year highs above $92.00 per barrel last week has kept trade rangebound.

Analysts are citing a few worries/themes that are preventing a continuation of oil’s recent bullish run. Firstly, indirect US/Iran talks recommenced this week spurring the usual chatter about a potential deal being reached and north of 1M BPD in Iranian exports coming back online (there are no signs a deal is any closer, however). Secondly, as evidence of OPEC+'s struggles to keep up with their own output quota hikes builds, pressure is growing on the Saudis and UAE to make up for the shortfall.

The IEA’s report on Friday said that OPEC+ was underproducing relative to its allowed output under the current agreement by 900K BPD. The Agency called on Saudi Arabia and the UAE (the two OPEC+ nations with the sparest output capacity) to increase output in the short term. Finally, some traders are citing the dent to global equity market sentiment on Thursday after much hotter than expected US inflation figures stoked Fed tightening bets as weighing on risk appetite sensitive crude oil markets.

USD/CAD completed a bullish “key reversal day” on Thursday. Analysts at Credit Suisse expect the pair to see further gains towards the 1.2813/15 highs.

Upside bias while above 1.2638/32

“Resistance is seen at 1.2788 initially, above which should see strength back to the 1.2813/15 highs. Above here can add momentum to the rally, with resistance then seen next at 1.2848/54 and eventually back at the 1.2952/64 December high, which may prove a tough barrier again.”

“Support at 1.2638/32 now needs to hold to maintain an immediate upside bias in the broader range. Below can see a retreat back to 1.2581, but with 1.2560/54 ideally holding. More important support though is still seen at the 200-day average and uptrend at 1.2526/07.”

USD/JPY staged a strong move higher on Thursday. Analysts at Credit Suisse look for an eventual clear break above key price and trend resistance at 116.35/80 for a test of the 2018 highs at 118.61/66.

Initial support seen at 115.74

“Strength has already extended to retest the January YTD high and long-term downtrend from April 1990 at 116.35/80. Whilst a fresh rejection from here should be allowed for, we continue to look for an eventual clear break, with resistance seen next at the 2018 highs at 118.61/66.”

“A fresh pause would be expected to be seen at 118.61/66, but with a move toward the “measured base objective” at 122.90/123.00 expected over the longer-term.”

“Support is seen at 115.74 initially, then 115.55/45, with 115.32 ideally holding to keep the immediate risk higher.”

- USD/CAD witnessed fresh selling on Friday and was pressured by a combination of factors.

- An intraday uptick in crude oil prices underpinned the loonie and exerted some pressure.

- Retreating US bond yields weighed on the USD and also contributed to the intraday selling.

The USD/CAD pair extended its steady intraday descent through the mid-European session and slipped below the 1.2700 mark in the last hour.

A combination of factors failed to assist the USD/CAD pair to capitalize on its early uptick and prompted fresh selling in the vicinity of the weekly high, around the 1.2750 region. A fresh leg up in crude oil prices underpinned the commodity-linked loonie. Apart from this, modest US dollar pullback from over one-week high touched on Friday exerted some pressure on the major.

Oil prices continued drawing support from hopes that global supply would remain tight amid the post-pandemic recovery in fuel demand. In fact, the IEA raised its 2022 demand forecast by 800,000 bpd. This, along with the conflict between Russia and the West over Ukraine, helped offset concerns of a possible rise in supplies from Iran and acted as a tailwind for black gold.

On the other hand, the US Treasury bond yields retreated from the overnight post-US CPI swing high and attracted some sellers around the USD. This was seen as another factor that contributed to the USD/CAD pair's intraday pullback of over 50 pips. That said, the prospects for a faster policy tightening by the Fed should help limit any downside for the greenback and the major.

Investors now seem convinced that the Fed would adopt a more aggressive policy stance to combat high inflation and have been pricing in the possibility of a 50 bps rate hike in March. The market bets were further boosted by more hawkish comments from St. Louis Fed President James Bullard, calling for 100 basis points over the next three FOMC policy meetings.

Hence, it will be prudent to wait for a strong follow-through selling before positioning for deeper losses. Traders now look forward to the release of the Prelim University of Michigan US Consumer Sentiment Index. This, along with the US bond yields, will influence the USD. Apart from this, oil price dynamics might provide some impetus to the USD/CAD pair.

Technical levels to watch

- EUR/JPY retreats from Thursday’s new YTD highs past 133.00.

- Sellers might drag the cross to as low as the 131.60 area.

EUR/JPY partially reverses the recent advance to fresh tops further north of the 133.00 barrier (February 10).

Considering the recent price action, the ongoing corrective decline carries the potential to extend to the monthly high at 131.60 (January 5), which should offer initial contention. If breached, then the focus of attention should gyrate to a probable visit to the always relevant 200-day SMA, today at 130.47.

In the longer run, and while above the 200-day SMA, the outlook for the cross is expected to remain constructive.

EUR/JPY daily chart

- Technical selling on the break of a descending triangle and “dovish” comments from ECB’s Lagarde sent EUR/GBP back under 0.8400.

- As UK growth outlook fears mount, traders mull the prospect of tigther ECB policy, has EUR/GBP become a “buy-on-dips”?

EUR/GBP broke below a short-term descending triangle on Friday as the euro weakened on further dovish sounding rhetoric from ECB President Christine Lagarde and as pound sterling saw some relief after not as bad as feared December GDP figures. Though the pair had been consistently posting lower highs since the start of the week, support at 0.8410 had been holding firm. That support broke during the late Asia Pacific session/early European session trade, with EUR/GBP having now dipped back below the 0.8400 level to hit fresh lows since last Thursday.

The recent move lower also saw EUR/GBP break below support in the form of its 50-Day Moving Average at 0.8410. Short-term bearish speculators may now target a test of the 21DMA at 0.8370. But the outlook for a return to multi-year lows pre-last week’s hawkish ECB meeting is weakened, some strategists have said. Whilst the BoE has/is expected to continue front loading monetary tightening, analysts fear this is very much “in the price” for sterling now. While money markets are priced for as much as another 150bps of tightening this year from the bank, analysts are fretting about the weak outlook for UK growth from Q2 onwards.

“The (UK) recovery will probably lose momentum in the course of the year” analysts at Commerzbank noted. “High inflation, tax increases in April and the BoE's interest rate hikes are a burden on the economy” they continued. The British Chambers of Commerce agrees. Its head of economics Suren Thiru stated that “the UK economy is facing a materially weaker 2022 as the crippling burden of rising inflation, soaring energy bills and higher taxes on consumers and businesses dampens activity.”

While these fears may continue to dampen the appeal of the pound, ECB President Christine Lagarde’s latest more dovish-leaning remarks have failed to dampen speculation that the ECB will accelerate its QE taper and start hiking interest rates in Q4. Reuters reported on Friday that, according to trading sources and industry data, investors are “piling” into derivatives linked to a rising euro. Analysts at Citibank told Reuters that the mentality of the euro as a “funding” currency is beginning to disappear. “The ECB decision was a game-changer for the euro” they noted, adding that “while we don't expect the euro and rest of the world yield differential to shrink dramatically, it is a big change in sentiment”.

The net result might be that EUR/GBP has finally become a “buy on dips” rather than a “sell on rallies”, at least as far as longer-term swing traders are concerned. The 50% Fibonnaci retracement back from this week’s multi-week highs in the upper 0.8400s to last week’s sub-0.8300 lows at 0.8380 might well be such a level where traders are enticed to buy the pullback. The rest of Friday’s session ought to be quiet amid a thin data calendar and pre-weekend low liquidity.

- Gold reversed an intraday dip and stalled the overnight pullback from over a two-week high.

- The risk-off mood was seen as a key factor that acted as a tailwind for the safe-haven metal.

- Retreating US bond yields prompted some USD selling and further benefitted the commodity.

- Rising bets for a 50 bps Fed rate hike in March should hold back bulls from placing fresh bets.

Gold attracted some dip-buying near the $1,821 region on Friday and for now, seems to have stalled the previous day's retracement slide from over a two-week high. Against the backdrop of geopolitical risks, a generally weaker tone around the equity markets acted as a tailwind for the safe-haven XAU/USD. Apart from this, concerns about the continuous rise in the US consumer prices further benefitted the precious metal's status as a hedge against inflation. In fact, data released on Thursday showed that the headline US CPI accelerated to a 40-year high in January.

The red-hot US inflation reinforced expectations that the Fed would adopt a more aggressive policy response to combat high inflation and bets for a 50 bps rate hike in March. Adding to this, St. Louis Fed President James Bullard called for 100 bps rate hikes over the next three FOMC policy meetings. This, in turn, pushed the yield on the benchmark 10-year US government bond beyond the 2% threshold for the first time since mid-2019. Adding to this, the 2-year note, which is highly sensitive to rate hike expectations, climbed to its highest level since January 2020.

The US bond yields, however, retreated a bit from the aforementioned highs, which prompted some intraday US dollar selling. This, in turn, was seen as a key factor that extended some support to the dollar-denominated commodity, though the uptick lacked bullish conviction. The prospects for a faster policy tightening continued acting as a headwind for the non-yielding gold and warrants some caution for aggressive bullish traders. Hence, it will be prudent to wait for a strong follow-through buying before positioning for the resumption of a two-week-old bullish trend.

Nevertheless, the metal has now moved into the positive territory and was last seen hovering near the daily high, just above the $1,830 level. Market participants now look forward to the US economic docket, featuring the release of the Prelim University of Michigan US Consumer Sentiment Index. This, along with the US bond yields, will influence the USD price dynamics and provide some impetus to gold prices. Apart from this traders will take cues from the broader market risk sentiment for some short-term opportunities around the XAU/USD on the last day of the week.

Technical outlook

From a technical perspective, any subsequent move up is likely to confront some resistance near the $1,832-$1,833 region ahead of the overnight swing high, around the $1,842 area. Some follow-through buying has the potential to push gold prices back towards the January swing high, around the $1,853 area. The latter nears a downward-sloping trend-line resistance, extending from June 2021. A convincing breakthrough will be seen as a fresh trigger for bullish traders and set the stage for a further near-term appreciating move for the metal.

On the flip side, weakness back below the $1,825 level might continue to attract some buying and remain limited near the $1,818 horizontal support. This is followed by the very important 200-day SMA, currently around the $1,807 region, which if broken decisively will negate any positive bias and shift the bias in favour of bearish trades. Gold would then turn vulnerable to weaken further below the $1,800 mark and test the next relevant support near the $1,790 region before eventually dropping to 2020 low, around the $1,780 area.

Gold daily chart

-637801793294677068.png)

Levels to watch

UOB Group’s Economist Ho Woei Chen, CFA, comments on the US-China Phase One Trade deal.

Key Takeaways

“We estimate that China has met around 61% of the goods purchase target and only 52% for services in 2020-21 under the Phase One trade agreement.”

“The structural imbalances have remained. US’ goods trade deficit with China widened to US$355.30 bn in 2021, up 14.5% from US$310.26 bn in 2020. This was the highest trade deficit since the record high of US$418.23 bn in 2018 before the trade tensions were ratcheted up.”

“China has lost market share in the US amidst the trade tensions even as it remained the largest import source for the US.”

“There is an avenue for bilateral evaluation and a process for dispute resolution under the agreement. For now, both sides have not announced any concrete steps for follow-up actions to address the shortfall in Phase One or a new trade deal but US-China trade relations will undoubtedly be marked by the race for technology supremacy in the coming years.”

The Central Bank of Russia announced on Friday that it raised its policy rate by 100 basis points to 9.5% from 8.5%. This decision came in line with the market expectation.

Key takeaways from policy statement

"Key rate decisions will be made taking into account actual and expected inflation movements relative to the target and economic developments over the forecast horizon as well as risks posed by domestic and external conditions and the reaction of financial markets."

"If the situation develops in line with the baseline forecast, the Bank of Russia holds open the prospect of a further key rate increase at its upcoming meetings."

"The Bank of Russia’s monetary policy stance is aimed to return inflation to 4%."

"Based on the Bank of Russia's forecast, given the monetary policy stance, annual inflation will reduce to 5.0-6.0% in 2022 to return to the target in the middle of 2023."

Market reaction

The USD/RUB pair showed no immediate reaction to this announcement and was last seen posting small losses on the day at 75.1010.

UOB Group’s Economist Enrico Tanuwidjaja reviews the latest monetary policy decision by the Bank Indonesia (BI).

Key Takeaways

“BI kept rates unchanged at its Feb meeting at 3.5%.”

“150bps RR hike is expected to start in March, to 5.0% from curent level of 3.5%.”

“We keep our view for BI to start hiking in mid-2022 to reach 4.5% by the end of this year.”

- EUR/USD regains downside traction and revisits 1.1370.

- The greenback looks bid across the board on mixed US yields.

- Final Germany CPI came at 4.9% YoY, 0.4% MoM in January.

The European currency extends the selling bias for the second session in a row and drags EUR/USD to the area of multi-session lows around 1.1370 on Friday.

EUR/USD weaker post-US CPI

After Thursday’s volatile session - where EUR/USD clocked new monthly peaks in levels just shy of 1.1500 the figure - sellers appear to have returned to the market and force the pair to shed more than a cent so far at the end of the week.

While market participants continue to digest the recent multi-decade high in US inflation in January, the mixed tone in yields in the US money markets see the short end of the curve extending gains and retesting the 1.60% mark vs. small retracements in both the belly and the long end. In Germany, yields of the key 10y Bund ease below 0.27% after trespassing the 0.31% on Thursday.

In the domestic calendar, Germany final CPI rose 4.9% in the year to January and 0.4% from a month earlier.

Across the pond, the only release of note will be the advanced Consumer Sentiment print for the current month.

What to look for around EUR

EUR/USD could not sustain the post-US CPI raise to the vicinity of the 1.1500 barrier, sparking a corrective move well south of 1.1400 soon afterwards and on the back of the renewed and quite strong bias towards the US dollar. Despite the ongoing knee-jerk, the improvement in the pair’s outlook appears underpinned by fresh speculation of a potential interest rate hike by the ECB at some point by year end, higher German yields, persevering elevated inflation and a decent pace of the economic activity and other key fundamentals in the region

Key events in the euro area this week: Germany Final January CPI (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the euro area. Speculation of ECB tightening/tapering later in the year. Presidential elections in France in April. Geopolitical concerns from the Russia-Ukraine conflict.

EUR/USD levels to watch

So far, spot is retreating 0.35% at 1.1388 and faces the next up barrier at 1.1494 (2022 high Feb.10) followed by 1.1496 (200-week SMA) and finally 1.1660 (200-day SMA). On the other hand, a break below 1.1370 (weekly low Feb.11) would target 1.1325 (55-day SMA) en route to 1.1121 (2022 low Jan.28).

- GBP/USD attracted dip-buying on Friday and reversed a dip back closer to the weekly low.

- Retreating US bond yields kept a lid on the USD gains and acted as a tailwind for the major.

- Rising bets for a 50 bps Fed rate hike in March should underpin the USD and cap the upside.

The GBP/USD pair recovered its early lost ground and was last seen trading in the neutral territory, around mid-1.3500s.

The pair witnessed some selling during the first half of the trading on Friday and dropped to the lower end of its weekly trading range amid a strong follow-through US dollar buying. Expectations that the Fed will tighten its monetary policy at a faster pace to combat high inflation continued acting as a tailwind for the greenback and exerted pressure on the GBP/USD pair.

The red-hot US consumer inflation figures released on Thursday reinforced market bets for a 50 bps Fed rate hike move in March. St. Louis Fed President James Bullard added to market speculations and called for 100 bps rate hikes over the next three FOMC policy meetings. This, along with a generally weaker tone around the equity markets, underpinned the safe-haven greenback.

The GBP/USD pair had a rather muted reaction to the release of mixed UK macro data, which showed that the economy expanded by 1% during the fourth quarter of 2021 as against 1.1% anticipated. Separately, the UK Industrial/Manufacturing Production and a larger than estimated traded deficit did little to impress bullish traders or provide any impetus to the GBP/USD pair.

That said, retreating US Treasury bond yields capped gains for the greenback and once again assisted the GBP/USD pair to attract some buying ahead of the 1.3500 psychological mark. The said handle should act as a pivotal point for short-term traders, which if broken decisively will set the stage for an extension of the previous day's sharp pullback from a three-week high.

Market participants now look forward to the US economic docket, featuring the release of the Prelim University of Michigan US Consumer Sentiment Index. This, along with the US bond yields and the broader market risk sentiment, will influence the USD price dynamics and produce some short-term trading opportunities around the GBP/USD pair.

Technical levels to watch

- AUD/USD witnessed heavy selling on Friday and moved further away from a three-week high.

- Rising bets for a 50 bps Fed rate hike continued underpinning the USD and exerted pressure.

- The risk-off mood also contributed to driving flows away from the perceived riskier aussie.

The AUD/USD pair recovered a few pips from the daily low and was last seen trading around the 0.7130-0.7125 region, still down over 0.50% for the day.

The pair extended the overnight sharp pullback from the vicinity of mid-0.7200s, or a three-week high and witnessed heavy follow-through selling on the last day of the week. The US dollar gained strong positive traction and remained well supported by firming expectations for a faster policy tightening by the Fed. This, along with the risk-off impulse, further weighed on the perceived riskier aussie and contributed to the heavily offered tone surrounding the AUD/USD pair.

The red-hot US consumer inflation figures released on Thursday reinforced speculations that the Fed will adopt a more aggressive policy stance and bets for a 50 bps rate hike in March. Adding to this, St. Louis Fed President James Bullard called for 100 bps rate hikes over the next three FOMC policy meetings. This, in turn, pushed the yield on the benchmark 10-year US government bond beyond the 2.0% threshold for the first time since August 2019 and underpinned the buck.

The selloff in the bond markets triggered a fresh bout of the global risk-aversion trade, which was evident from a generally weaker tone across the equity markets. This, in turn, forced investors to take refuge in traditional safe-haven assets and further benefitted the greenback. However, retreating US bond yields capped gains for the USD and assisted the AUD/USD pair to find some support near the 0.7100 round-figure mark, though the attempted recovery lacked follow-through.

Market participants now look forward to the US economic docket, featuring the release of the Prelim University of Michigan US Consumer Sentiment Index. This, along with the US bond yields, will drive the USD demand and provide a fresh impetus to the AUD/USD pair. Traders will further take cues from the broader market risk sentiment to grab some short-term opportunities.

Technical levels to watch

GBP/USD has managed to regain its traction before testing 1.3500. But as FXStreet’s Eren Sengezer notes, the pound stays vulnerable and needs to break above 1.3560 to alleviate downside pressure.

1.3520 aligns as the next bearish target

“In order to push higher toward 1.3600 (psychological level) and 1.3620 (static level), the pair needs to rise above 1.3560 (Fibonacci 23.6% retracement level of the latest uptrend) and start using that level as support.”

“On the downside, 1.3520 (Fibonacci 38.2% retracement, 100-period SMA) aligns as the next bearish target. In case a four-hour candle closes below that level, additional losses toward 1.3500 (psychological level, Fibonacci 50 retracement) and 1.3460 (Fibonacci 61.8% retracement) could be witnessed.”

EUR/RUB has pulled back after touching interim hurdle of 90.70/91.00. A break under 84.70/40 would open up the possibility of a deeper fall to 82.60, economists at Société Générale report.

Bounce towards last week's high of 87.80 on the cards while 84.40 holds

“The pair is now close to support of 84.70/84.40, the 61.8% retracement from October. Only if this gets violated will there be a risk of an extended pullback towards projections of 82.60.”

“Defending 84.40, a bounce is not ruled out towards last week's high of 87.80.”

USD/JPY has climbed above 116 for the first time since early January. Economists at Société Générale expect the pair to grind higher towards 117.10/117.40 on a break above 116.35.

Initial support located at 115.50

“Daily MACD has crossed above its trigger and is within positive territory which denotes upward momentum is still prevalent.”

“The pair is now once again probing the recent peak at 116.35. Signals of deeper downtrend are not yet visible. Beyond 116.35, the uptrend looks poised to extend towards next projections of 117.10/117.40 which is also the upper band of the channel since December.”

“Peak of November at 115.50 is first support.”

The 6.3400-6.3805 range is expected to prevail in USD/CNH for the time being, commented FX Strategists at UOB Group.

Key Quotes

24-hour view: “We expected USD to trade between 6.3590 and 6.3740 yesterday. USD subsequently traded within a wider range than expected (6.3520/6.3690) before closing largely unchanged at 6.3634 (+0.03%). Despite closing largely unchanged, the underlying tone appears to have firmed somewhat and USD could edge higher from here. That said, any advance is expected to face solid resistance at 6.3750. Support is at 6.3600 followed by 6.3550.”

Next 1-3 weeks: “There is no change in our view from Monday (07 Feb, spot at 6.3600). We continue to view the current movement as part of a consolidation phase and expect USD to trade between 6.3400 and 6.3805 for now.”

- DXY adds to Thursday’s post-CPI gains and revisits 96.00.

- US yields seem to be taking a breather after recent tops.

- Flash Consumer Sentiment gauge next of note in the docket.

The greenback, when tracked by the US Dollar Index (DXY), extends the post-US CPI rebound to the area just above the 96.00 barrier at the end of the week.

US Dollar Index bolstered by higher yields

The index advances for the second session in a row on Friday, although a convincing move above the 96.00 hurdle still looks elusive for USD bulls.

Following a very volatile session on Thursday, the dollar seems to have finally broken above its recent consolidative mood and shifted the attention to the 96.00 mark and beyond, always on the back of the strong rebound in US yields after inflation rose to its highest pace in the last 40 years in January (+7.5%).

The bull flattening of the US curve saw yields of the 2y note climbing to the vicinity of 1.65% level for the first time since December 2019, with the belly surpassing the 2.00% mark – levels last traded back in August 2019 – and the 30y note clocking 9-month peaks just above 2.35%.

Further support for the buck in past hours came after St.Louis Fed J.Bullard (new hawk?, voter) favoured a 100 bps interest rate hike by July. Supporting his idea, and following CME Group’s FedWatch tool, the probability of a 50 bps rate hike at the March meeting is now close to 95% (from nearly 34% just a week ago).

In the US data sphere, the salient event on Friday will be the advanced gauge of the Consumer Sentiment tracked by the U-Mich Index.

What to look for around USD

Higher-than-expected US inflation figures lent extra oxygen to the greenback and propelled DXY back above the 96.00 yardstick. However, the extent and duration of this improvement in the dollar remains to be seen, as much of the current elevated inflation narrative was already priced in by market participants as well as the probability (bigger now) of a 50 bps rate hike by the Fed (instead of the more conventional 25 bps move). Looking at the longer run, and while the constructive outlook for the greenback appears well in place for the time being, recent hawkish messages from the BoE and the ECB carry the potential to undermine the expected move higher in the dollar in the next months.

Key events in the US this week: Flash Consumer Sentiment (Friday).

Eminent issues on the back boiler: Fed’s rate path this year. US-China trade conflict under the Biden administration. Debt ceiling issue. Escalating geopolitical effervescence vs. Russia and China.

US Dollar Index relevant levels

Now, the index is gaining 0.12% at 95.90 and a break above 96.05 (weekly high Feb.11) would open the door to 97.44 (2022 high Jan.28) and finally 97.80 (high Jun.30 2020). On the flip side, the next down barrier emerges at 95.17 (weekly low Feb.10) followed by 95.13 (weekly low Feb.4) and then 94.62 (2022 low Jan.14).

- USD/CHF regained positive traction on Friday and inched back closer to the overnight swing high.

- Rising bets for a 50 bps Fed rate hike in March underpinned the buck and remained supportive.

- The risk-off impulse benefitted the safe-haven CHF and kept a lid on any further gains for the pair.

The USD/CHF pair maintained its bid tone through the first half of the European session and was last seen trading just a few pips below the daily high, around the 0.9275 region.

Following the overnight pullback from the vicinity of the 0.9300 mark, the USD/CHF pair caught fresh bids on Friday and inched back closer to the weekly high amid a broad-based US dollar strength. Firming expectations for a faster policy tightening by the Fed turned out to be a key factor that continued underpinning the greenback.

The US CPI report released on Thursday reinforced speculations that the Fed will adopt an aggressive policy stance to combat high inflation and boosted bets for a 50 bps rate hike in March. Moreover, St. Louis Fed President James Bullard said that the US central bank should hike rates by 100 basis points over the next three meetings.

This, in turn, pushed the yield on the benchmark 10-year US government bond beyond the 2% threshold for the first time since mid-2019. Adding to this, the 2-year note, which is highly sensitive to rate hike expectations, climbed to its highest level since January 2020, which further acted as a tailwind for the buck and the USD/CHF pair.

That said, the risk-off impulse – as depicted by a sea of red across the global equity markets – benefitted the Swiss franc's safe-haven status and capped the upside for the USD/CHF pair. Hence, it will be prudent to wait for some follow-through buying beyond the 0.9300 mark before positioning for any further appreciating move.

Market participants now look forward to the release of the Prelim University of Michigan US Consumer Sentiment Index. This, along with the US bond yields, will influence the USD price dynamics. Traders will further take cues from the broader market risk sentiment to grab some short-term opportunities around the USD/CHF pair.

Technical levels to watch

- GBP/JPY witnessed some selling on Friday and extended the overnight modest pullback.

- The risk-off impulse benefitted the JPY’s relative safe-haven status and exerted pressure.

- The BoE-BoJ policy divergence should help limit any meaningful downfall for the cross.

The GBP/JPY cross remained depressed through the early European session and was last seen trading just a few pips above the daily low, around the 157.00 mark.

The cross extended the overnight modest pullback from the 158.00 round figure, or the highest level since October 2021 and witnessed some selling during the first half of the trading on Friday. The risk-off impulse in the markets underpinned the Japanese yen's relative safe-haven status and exerted some pressure on the GBP/JPY cross.

Growing market acceptance that the Fed will adopt a more aggressive policy response to combat high inflation triggered a fresh bout of the global risk aversion trade. This was evident from a sea of red across the equity markets, which, in turn, forced investors to take refuge in traditional safe-haven assets and benefitted the JPY.

On the other hand, the British pound was weighed down by a broad-based US dollar strength and failed to gain any respite from mixed UK macro releases. The UK Office of National Statistics reported that the economy contracted less than anticipated, by 0.2% in December, and expanded by 1% during Q4 2021 as against expectations for the 1.1% increase.