- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 11-01-2022

- Gold prices retreat from two-month-old descending resistance line.

- Cautious sentiment ahead of crucial inflation, World Bank forecsts test gold buyers.

- Fed’s Powell backed rate hikes but balance sheet normalization, demand-supply issues drowned yields, USD.

- Gold Price Forecast: Gold picks up momentum on dollar’s weakness

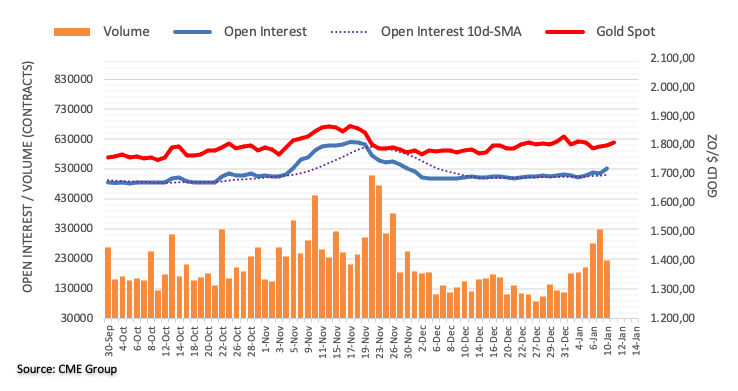

Gold (XAU/USD) bulls take a breather around the weekly top, recently easing to $1,820, amid an early Asian session on Wednesday. The yellow metal jumped the most since mid-December the previous day after the upbeat market sentiment drowned the US Treasury yields and US dollar.

Fed Chair Jerome Powell during testimony before the Senate Banking Committee could be cited as the major factor that favored the gold prices of late. However, the market’s anxiety ahead of the US Consumer Price Index (CPI) for December joins downbeat World Bank (WB) economic forecasts and virus woes to challenge the gold buyers.

Fed’s Powell showed readiness to hike interest rates to stop inflation from being entrenched but concerns over supply-demand mismatch and balance-sheet runoff weighed poured cold water on the face of US dollar bulls. The Fed Boss said that the balance sheet runoff could happen "perhaps later in the year," while also expecting that the supply crunch will ease somewhat and the economic impact of the Omicron variant will be short-lived.

Additionally, WB’s latest economic forecasts cited coronavirus woes to cut the global GDP expectations for 2022 to 4.1% from 4.3% previous estimations. The World Bank also trimmed economic forecasts for the US and China, by 0.5% to 3.7% and by 0.3% to 5.1% in that order.

Other than Powell’s testimony, US economic calendar was mostly silent with NFIB Business Optimism Index rising past 98.4 to 98.9 for December while IBD/TIPP Economic Optimism for January eased to 44.7 versus 48.4 previous readouts.

Elsewhere, record top daily covid infections in the US also tests the market sentiment and weigh on the gold prices. It’s worth noting, however, that Merck’s update, suggesting its covid treatment pill’s ability to tame coronavirus and all variants, placates the virus fears.

Against this backdrop, the US Dollar Index (DXY) dropped around 0.35% to poke December’s low around 95.60 whereas the Wall Street benchmarks cheered the second consecutive daily fall in the US 10-year Treasury yields by the end of Tuesday’s North American session. That said, S&P 500 Futures and the US Treasury yields remain sluggish at the latest.

Looking forward, US CPI will be crucial for gold prices as market players weigh on the Fed’s pace of rate hikes and balance sheet normalization. Should the headlines inflation figures match 7.0% YoY forecasts, versus 6.8% prior, the metal should extend the latest weakness.

Read: US Inflation Preview: Dizzying heights of 7% would cement a March hike, supercharge the dollar

Technical analysis

Although a clear upside break of the 200-DMA helped gold prices to jump the most in a month the previous day, a downward sloping trend line from mid-November, around $1,825, challenges bulls.

It should be noted, however, that the MACD remains sluggish but the higher low formation and recently improving RSI hints at the metal’s further upside past the immediate resistance line.

Following that, tops marked during July and September, close to $1,834, will be in focus ahead of directing gold buyers towards the $1,850 hurdle.

Meanwhile, a downside break of the 200-DMA level surrounding 1,802 will need validation from the $1,800 threshold to convince gold sellers.

Even so, an upward sloping support line from August, near $1,787 at the latest, will be a tough nut to crack for the gold bears.

To sum up, gold prices are likely to witness further upside, at least technically, but the fundamentals are far more important during the crucial day.

Gold: Daily chart

Trend: Further upside expected

- The Australian dollar grinds higher as the Asian Pacific session begins.

- AUD/JPY Technical Outlook: The downward move capped at the 200-DMA spurred the AUD surge above the 83.00 figure, so the pair is upward bias.

As the Asian Pacific session began and the New York session ended, the Australian dollar recovered some ground against the so-called safe-haven Japanese yen. At press time is trading at 83.19. US equity indices finished the Wall Street session in the green, recording gains between 0.51% and 1.47%, whereas Asian stock futures point to a higher open.

AUD/JPY Price Forecast: Technical outlook

On Tuesday, the cross-currency pair was subdued in the 83.50-90 range during the overnight session. But an improvement in the market mood late in the Asian session, early Europe, alongside a rebound from tech-stocks, spurred demand for risk-sensitive peers, benefitting the Antipodeans, alongside the CAD.

That said, the NZD/JPY broke the top of the trading range and reclaimed the 83.00 figure.

The NZD/JPY is bullish biased. The pair dipped to the 200-day moving average (DMA) but was rejected, rallying towards resistance above 83.00. The first resistance would be the January 10 daily high at 83.36. A clear break above it would expose a four-month-old downslope trendline drawn, from October 2021 highs, near the psychological 84.00 area.

Conversely, the immediate support would be 83.00. A breach of the latter could send the NZD/JPY tumbling to the 200-DMA at 82.65. Once the level gives way to JPY bulls, the next stop would be the confluence of the 100-DMA and the January 10 daily low around 82.33, followed by 82.00.

Morgan Stanley (MS) came out with hawkish expectations for the January monetary policy meeting of the Bank of Canada (BOC) while forecasting a surprise rate hike boosting the Canadian Dollar (CAD).

The investment bank highlights recently strong employment figures as the key factor behind the upbeat consensus. “The December employment report was very strong (headline employment, full-time vs. part-time jobs, and the regional breakdown indicated a robust labor market), which should contribute to a repricing in near-term rates and support CAD.”

On the same line is the Fed’s shift towards the tighter monetary policy as the MS said, “The Fed's ongoing shift towards a tighter policy stance should spill over to Canadian real yields - the 10y inflation-linked Canadian is at a post-COVID high. Higher real yields in Canada, in turn, should support CAD as oil prices continue to grind higher to our 3Q 22 $90bbl Brent oil forecast."

It’s worth noting the BOC’s first monetary policy meeting of 2022 is on January 26.

Read: USD/CAD Price Analysis: Bears to target 1.2480 on a breakout below daily H&S neckline

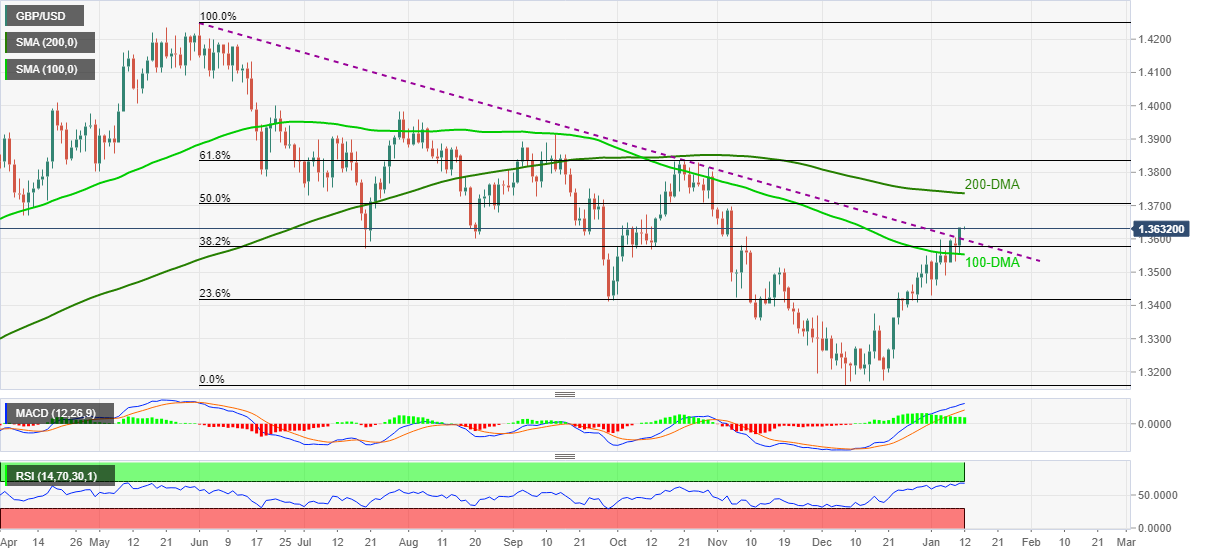

- GBP/USD bulls take a breather around multi-day top after rising the most in a fortnight.

- Clear break of the descending trend line from June joins bullish MACD signals to keep buyers hopeful.

- Overbought RSI tests further advances but 100-DMA adds to the immediate challenges for sellers.

GBP/USD seesaws near November highs after crossing the key resistance line to refresh multi-day peak the previous day. That said, the cable pair makes rounds to 1.3630-35 during the initial Asian session on Wednesday.

Although nearly overbought RSI challenges the pair buyers, a clear upside break of the seven-month-old resistance line, now support around 1.3595, hints at the pair’s further advances.

Even if the pullback move recalls the 1.3595, the 100-DMA level of 1.3550 and November 18 swing high near 1.3515 will challenge the GBP/USD sellers.

Should the quote drops below 1.3515, the 23.6% Fibonacci retracement (Fibo.) of June-December downside, near 1.3415, should return to the chart.

Alternatively, GBP/USD buyers are up for challenging the 50% Fibo. level surrounding the 1.3700 threshold. Though, the 200-DMA near 1.3740 will test the quote’s additional run-up.

Also acting as the upside filter is the 61.8% Fibonacci retracement level of 1.3835.

GBP/USD: Daily chart

Trend: Further upside expected

- NZD/USD grinds higher around weekly top as the key day begins.

- Powell’s Testimony weighed down the USD due to cautious comments over supply crunch, balance sheet normalization.

- US Treasury yields drops for the second day, equities rose despite World Bank cut global growth forecasts for 2022.

- Inflation figures from China, US will be crucial for fresh impulse.

NZD/USD stays on the way to 0.6800, taking rounds to weekly top surrounding 0.6785 during early Wednesday morning in Asia.

The kiwi pair witnessed a notable buying pressure amid a broad US dollar weakness, as well as the market’s rush towards the riskier assets, following the comments of Fed Chair Jerome Powell during testimony before the Senate Banking Committee. In doing so, the NZD/USD prices ignored downbeat growth forecasts from the World Bank (WB). However, the cautious sentiment ahead of the key inflation figures from China and the US, for December, seems to probe the bulls of late.

Although Fed’s Powell showed readiness to hike interest rates to stop inflation from being entrenched, concerns over supply-demand mismatch and balance-sheet runoff weighed down the US dollar. The Fed Boss said that the balance sheet runoff could happen "perhaps later in the year," while also expecting that the supply crunch will ease somewhat and the economic impact of the Omicron variant will be short-lived.

That said, the US Dollar Index (DXY) dropped around 0.35% to poke December’s low around 95.60 by the end of Tuesday’s North American session.

Elsewhere, the World Bank cut the global growth forecast for 2022 from 4.3% previous forecasts to 4.1%. The Geneva-based institute also trimmed China’s 2022 GDP expectations to 5.1% versus 5.4% earlier consensus.

Talking about data, US NFIB Business Optimism Index rose past 98.4 to 98.9 for December while IBD/TIPP Economic Optimism for January eased to 44.7 versus 48.4 previous readouts.

Amid these plays, the Wall Street benchmarks cheered the second consecutive daily fall in the US 10-year Treasury yields.

Moving on, new Zealand’s ANZ Commodity Price Index for December may offer immediate direction, expected 3.4% versus 2.8% prior but major attention will be given to Consumer Price Index (CPI) for the said month from China and the US. Forecasts suggest China’s headline CPI ease from 2.3% to 1.8% YoY while the Producer Price Index (PPI) may witness ease from 12.9% to 11.1% for the said month, suggesting a pullback into the NZD/USD prices. However, anticipated strength in the US CPI for December, to 7.0% YoY versus 6.8% prior, will be a crucial number to watch as higher inflation can renew the US dollar buying and weigh on the Kiwi prices.

Read: US Inflation Preview: Dizzying heights of 7% would cement a March hike, supercharge the dollar

Technical analysis

NZD/USD battles a convergence of the 100 and 200-SMA around 0.6790-95, following a bounce off the monthly horizontal support near 0.6730 the previous day. Given the bullish MACD signals and firmer RSI, not overbought, the Kiwi pair is likely to cross the immediate hurdle to challenge a downward sloping resistance line from January 03, close to 0.6810. Should the NZD/USD bulls keep reins past 0.6810, then the prices will rise towards an area comprising multiple levels marked since September, around 0.6855-60.

Alternatively, a clear downside break of 0.6730 will highlight the 2021 bottom surrounding the 0.6700 threshold ahead of the 61.8% Fibonacci Expansion (FE) of the pair’s moves between November 15 and December 24, around 0.6650.

- The NZD/JPY climbs from weekly lows around 77.80s as market mood improves.

- NZD/JPY Technical Outlook: The pair is upward biased, but downside risks remain as the 200-DMA is near to the current spot price.

The NZD/JPY jumps from weekly lows on Tuesday as the New York session finishes. At the time of writing, the cross-currency is trading at 78.25. The market mood remains upbeat, as portrayed by US equities finishing in the green. Meanwhile, Asian stock futures point to a higher open, led by the Nikkei 225 and the Australian ASX/S&P, up some 0.81% and 0.86%, respectively.

NZD/JPY Price Forecast: Technical outlook

On Tuesday, the NZD/JPY pair dipped to 77.84 but gained traction immediately as the market mood improved. The NZD/JPY is mainly used as a pure market sentiment play. Any risk-off mood propels investors towards the security of the low-yielder Japanese yen, thus depreciating the NZD and risk-sensitive currencies.

So the pair bounced off weekly lows, reaching a daily high at 78.34, though it failed to gain traction, towards an attempt of the 1-hour 200-simple moving average (SMA), retreating to current price levels.

The NZD/JPY daily chart depicts an upward bias, as Tuesday’s price action broke above the 200-day moving average (DMA). However, the presence of the 50 and the 100-DMA above the spot price could exert downward pressure on the pair. To the upside, the first resistance would be the 50-DMA at 78.43. A decisive break of that level would expose the 100-DMA at 78.65, followed by a three-month-old downslope trendline around the 78.75-90 area.

Conversely, the first line of defense for NZD bulls would be the 200-DMA at 78.15. A crucial break would open the door for further downward pressure. The following support would be 78.00, followed by the January 10 pivot low at 77.58, and December 20, 2021, daily low at 76.02.

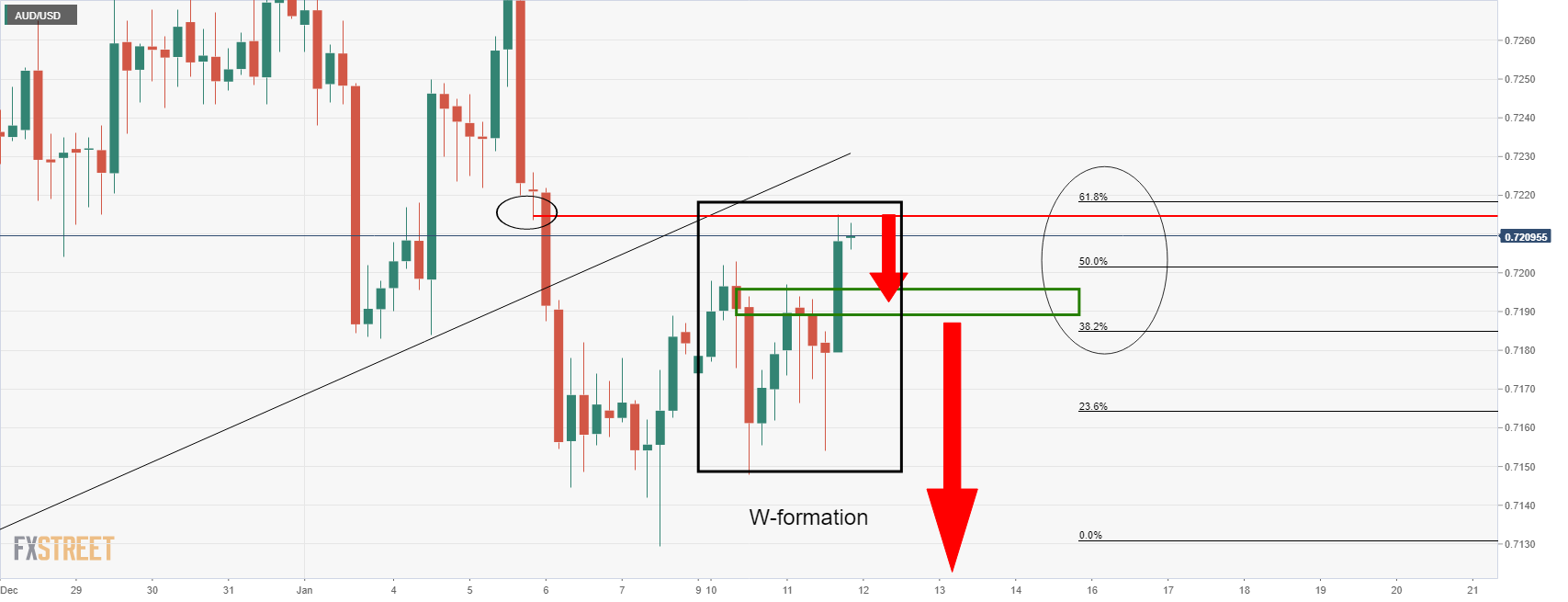

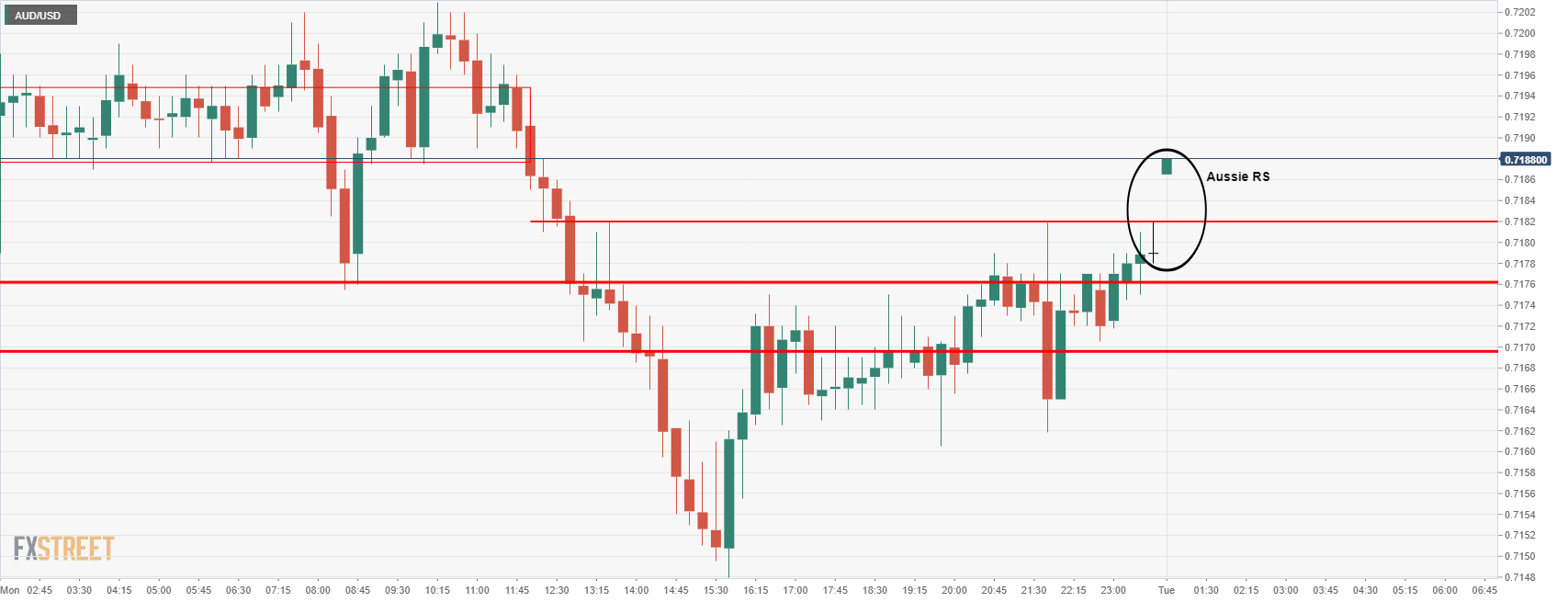

- AUD/USD has been moving in on the higher liquidity mid-week.

- Bears need a break below 0.7190 for downside prospects.

As per the start of the week's analysis, AUD/USD Price Analysis: Bears moving in, eyes for restest of H1 lows, the price is moving in on higher liquidity as follows:

Prior analysis, AUD/USD H4 chart

In the above chart from yesterday, the liquidity near the 61.8% ratio was identified and has been tested in price action today as follows:

The W-formation might be expected to pull in the price to the neckline and if the bears take over there, then the downside will be to play for.

- The USD/CHF losses some 0.39% in the New York session.

- Tuesday’s retracement could be an opportunity for USD bulls if that is the case, as the DMAs remain below the spot price.

- USD/CHF Technical outlook: The pair is upward biased, as long as it remains above 0.9167,

On Tuesday, the USD/CHF trims some of its weekly gains, retreating from daily highs, as Fed Chief appeared at a hearing for his renomination as the head of the US central bank. At the time of writing, the USD/CHF is trading at 0.9236.

USD/CHF Price Forecast: Technical outlook

The USD/CHF fluctuated between gains and losses in the overnight session, dropping from weekly highs around 0.9270 to the 0.9230s region amid a weak demand of US dollars.

Nevertheless, the USD/CHF is upward biased, so the pullback on Tuesday’s trading session could be an opportunity for USD bulls to re-enter the market if that is the case, supported by the daily moving averages (DMAs), which although seesawing in the last trading days around the spot price, reside below of it.

To the upside, the USD/CHF’s first ceiling would be December 15, 2021, cycle high at 0.9294, close to the psychological 0.93 handle, and a tenth-month-old downslope trendline. The breach of that area would open the door towards the psychological 0.9400 figure, followed by April 1, 2021, daily high at 0.9475.

Conversely, if the USD weakens, the USD/CHF’s first support would be the 0.9200 figure. Once that floor is broken, the next stop for CHF bulls would be the confluence of a one-year-old upslope trendline and the 200-DMA at 0.9167, followed by December 31, 2021, pivot low at 0.9202.

- EUR/JPY recovered back above 131.00 on Tuesday and is testing a key bullish trend channel that it broke below on Monday.

- The pair was supported as risk appetite improved after Powell refrained from offering further hawkish Fed surprises.

Strength in risk assets on Tuesday after Fed Chair Jerome Powell refrained from giving markets any further price in Fed tightening in 2022 weighed on the safe-haven yen and helped catapult EUR/JPY back above 131.00. Powell, who testified at a Senate hearing for his renomination as Fed Chair, stuck to the script and reiterated the main takeaways from last week’s hawkish Fed minutes. This was taken as a green light by US equity investors to continue buying the recent dip helped to also spur strength in commodities and US bonds. This prompted currency markets to adopt a distinctly risk-on posture, with risk-sensitive G10 currencies (NOK, SEK, CAD and AUD for example) to outperform whilst the US dollar and yen underperformed.

As a result, EUR/JPY has been able to recapture the lion’s share of Monday’s losses that sent it as low as the 130.10s and saw the pair close under 130.50. As noted, the pair has been able to rally all the way from Tuesday’s opening levels all the way under 130.50 to current levels above 131.00, a near-0.5% rally on the day. The pair is now retesting the upwards trend channel that it broke to the south of at the start of the week. Whilst EUR/JPY traders would do well to keep an eye on Eurozone November Industrial Production data out on Wednesday, Japanese Machine Orders on Thursday and December PPI numbers on Friday risk appetite will remain the main driver of the pair.

More specifically, with markets now expecting decisive policy tightening from the Fed in 2022 to the tune of four rate hikes and the start to quantitative tightening, the question is whether US equities can weather whats seems likely inevitably higher yields. US December Consumer Price Inflation and Retail Sales data, more Fedspeak from regional Federal Reserve Bank Presidents and a Fed Vice Chair nomination hearing for Fed’s Lael Brainard will all be worth watching as potential catalysts. If US data/Fed rhetoric this week suggests recent hawkish Fed bets have been on the excessive side, recent gains in US tech stocks and downside in yields may continue, which may support further upside for EUR/JPY. Bulls would be eyeing a retest of recent highs in the 131.50s area.

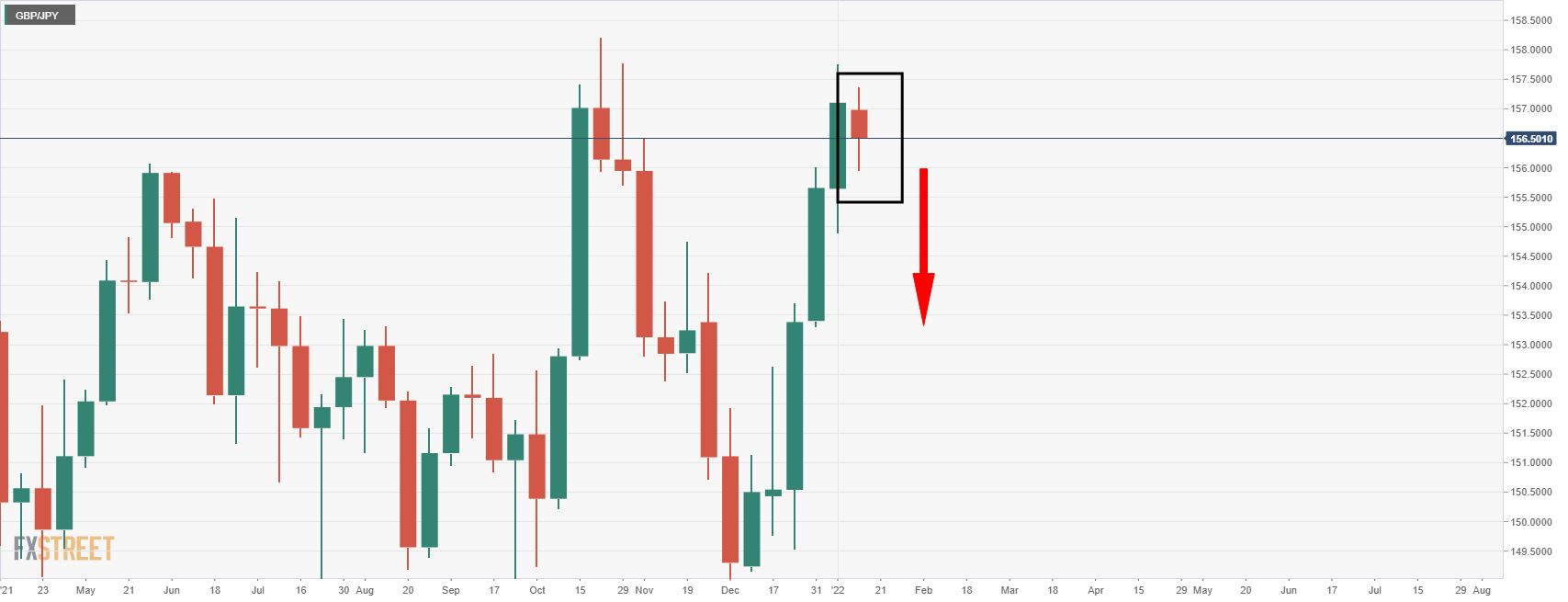

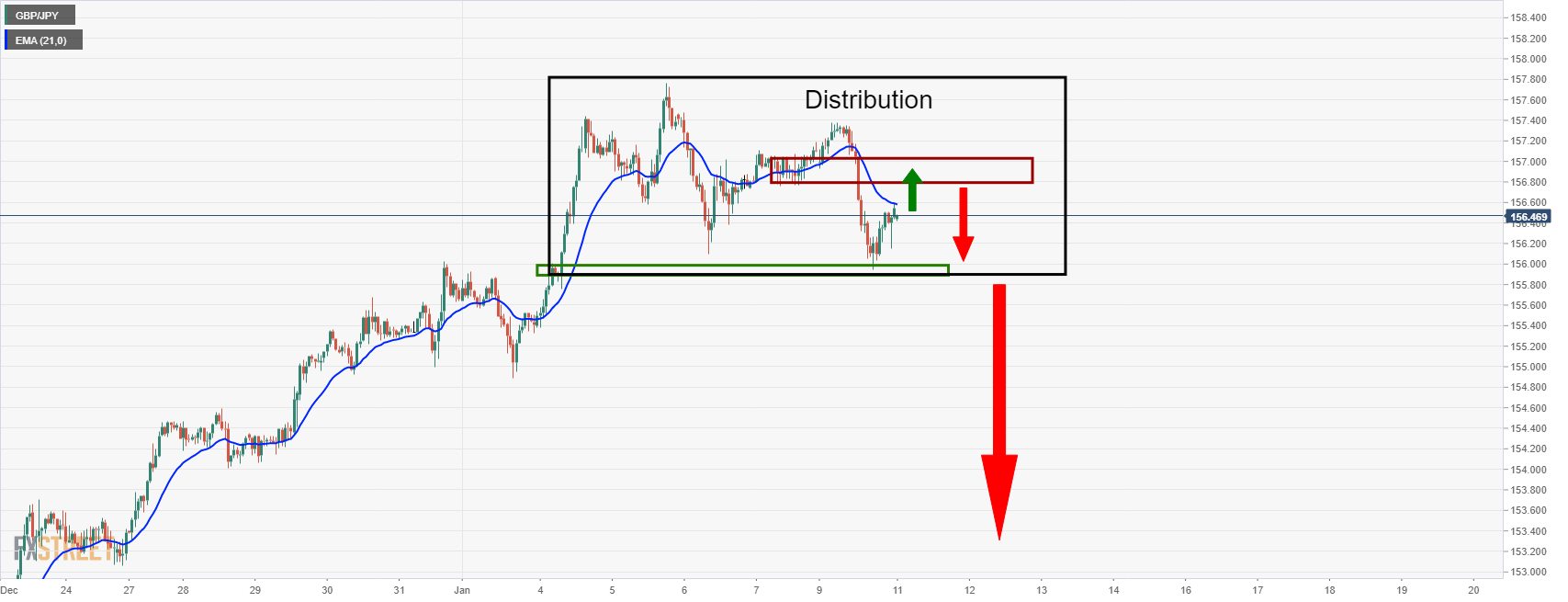

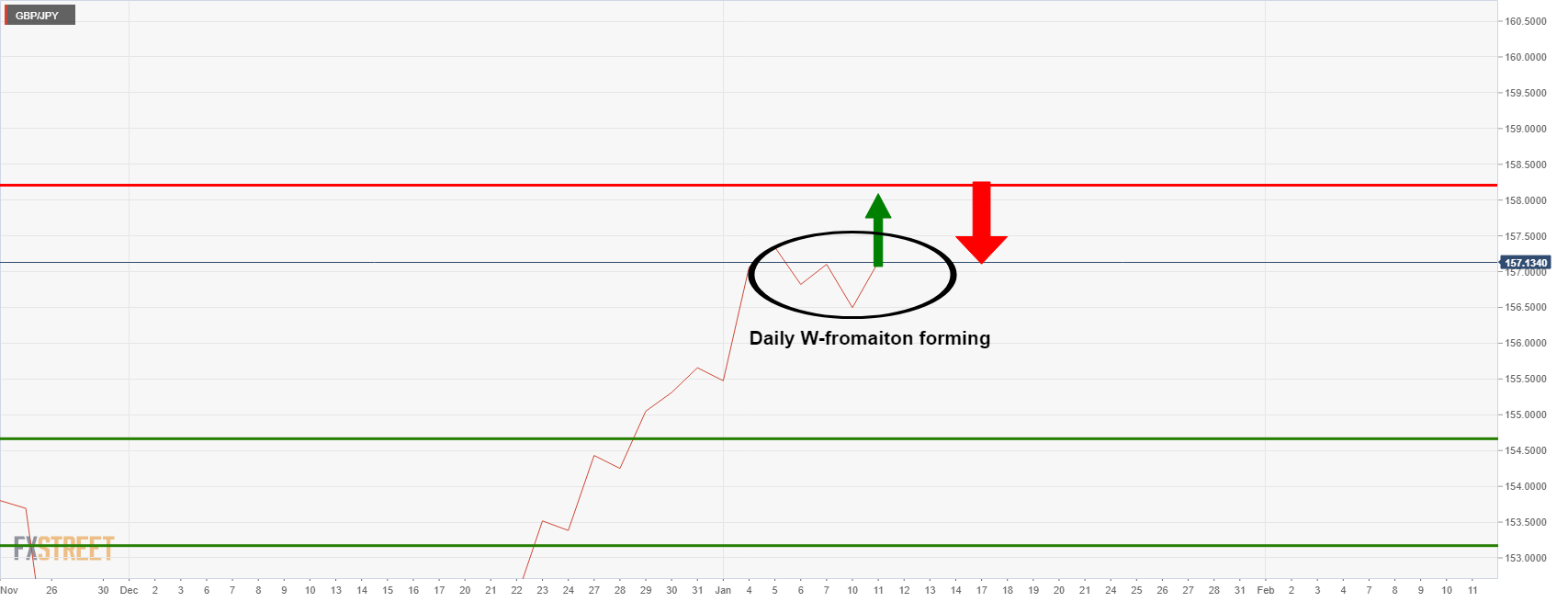

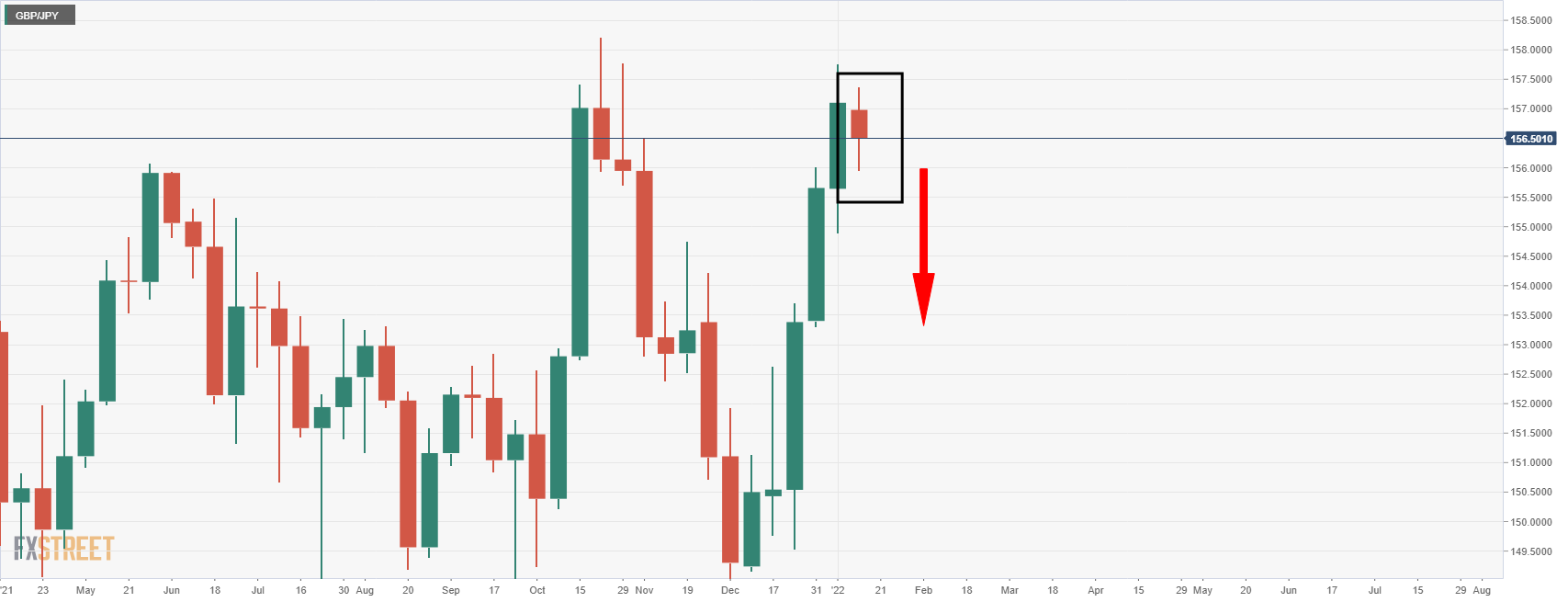

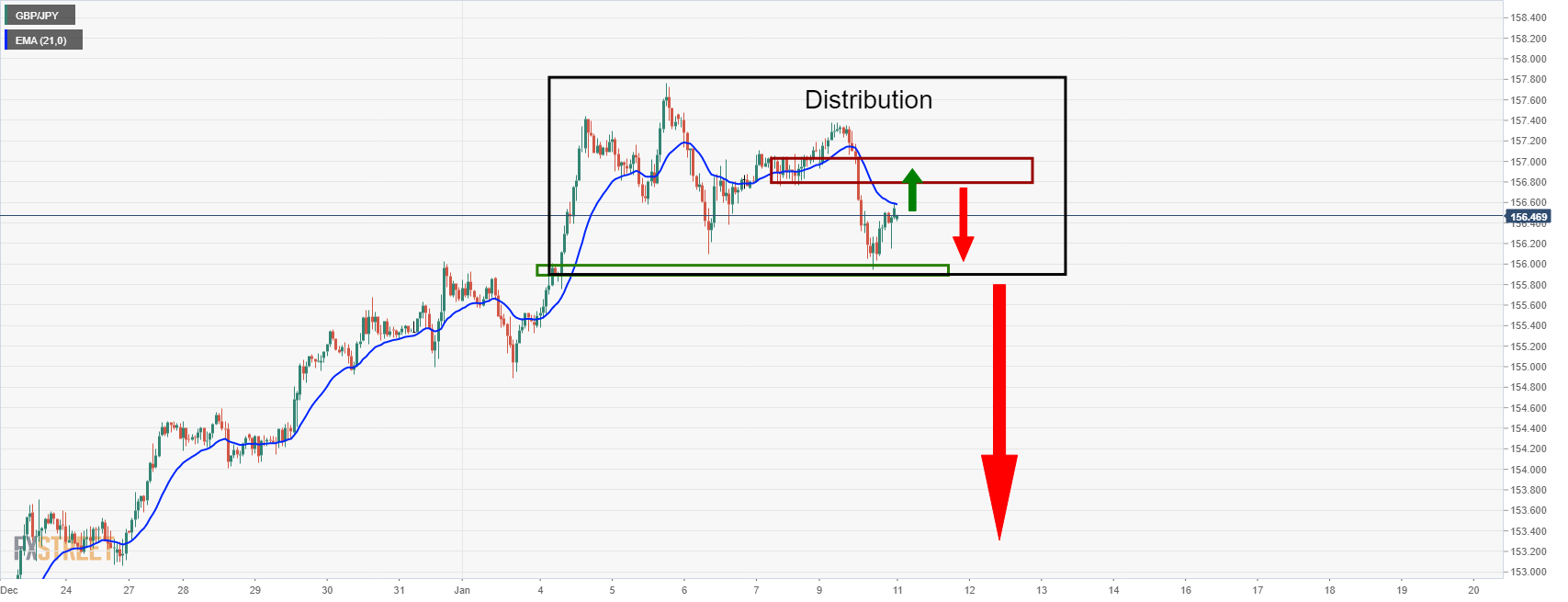

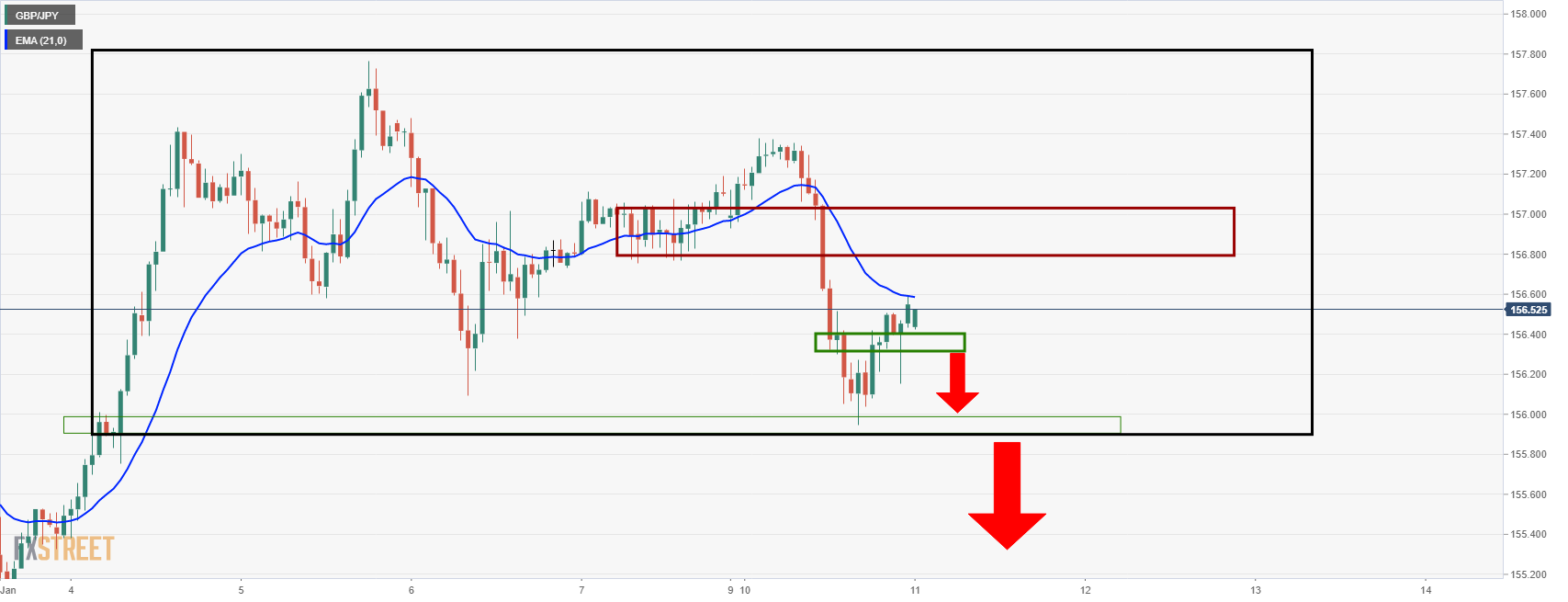

- GBP/JPY bulls seeking meanwhile restest of daily highs near 157.80.

- Bears keeping weekly targets in sight as per weekly W-formation.

Due to the latest price action, we are now back to needing to consider more upside from this pair before a move to the downside.

In Monday's analysis, GBP/JPY Price Analysis: Weekly W-formation remains in play, the price was starting to correct to the downside which was encouraging a bearish focus due to the W-formation on the weekly chart:

This led to an analysis of the lower time frames where a period of distribution was drawn up on the hourly chart as follows:

However, in subsequent trade, the price has broken the first layer of resistance in a much stronger correction than what might have been anticipated:

If this is a phase of distribution, then there could be a lot more sideways consolidation to play out yet. While the weekly chart's W-formation remains a compelling reversion pattern, should the bull's take charge beyond 157.40, then a last-ditch effort could see the price test the prior weekly highs of 158.22 first:

As illustrated, if the price were to move in on the prior highs prior to a run lower, then this would leave the 38.2% and 50% ratios aligned with the prior structure as targets.

There is also a daily W-formation now belong formed that is worth noting:

- The S&P 500 has reclaimed 4700 on Tuesday amid broad US equity market upside as tech recovers post-Powell remarks.

- That means the index has recovered more than 2.8% from Monday’s sub-4600 lows.

- The lack of any fresh hawkish surprises seemed to give the green light for a technical reversal of recent moves.

Having managed to convincingly clear its 21-day moving average to the upside, the S&P 500 continues to march higher as the end of Tuesday’s session draws closer and has recently crept back above the 4700 level. That means the index is trading with a gain of about 0.8% on the day and is up more than 2.8% versus Monday’s sub-4600 lows. The upside in US equities, which has been disproportionately concentrated in the recently heavily hit tech sector, was spurred in tandem with a reversal lower in US real and nominal bond yields after remarks from Fed Chair Jerome Powell. Speaking at a hearing with the Senate Banking Committee for his renomination as Fed Chair, Powell stuck to the script and reiterated the main takeaways from last week’s hawkish Fed minutes.

Traders were seemingly enthused by the lack of surprises/any fresh hawkish rhetoric to spur further hawkish Fed bets, hence the tech-led reversal higher in equities and lower in yields. Recall that long-term nominal and real yields had, prior to Tuesday, seen a massive rally since the start of 2021 that had hit long-term interest-sensitive equity sectors such as tech hard. On Monday, JP Morgan’s chief global markets strategist Marko Kolanovic had said that the recent pull-back in risk assets such as US tech was “arguably overdone” and that it presented investors with a buying opportunity. Market participants agreed on Monday, powering the Nasdaq 100 nearly 3.0% higher from intra-day lows under 15,200 to above the 15,600 mark, and the rebound has continued on Tuesday, with the index now above 15,800, up a further 1.3%.

Amid a surge in crude oil prices that has seen WTI rally more than $3.0 intraday to above $81.00 per barrel, the energy sector is up more than 3.0% on the day. Most other sectors in US equity markets are also trading in the green, even financials despite the pullback in US yields (10-year -3.5bps to under 1.75%). The only S&P 500 GICS sectors in the red on Tuesday are the more defensive ones; consumer staples (-0.5%), utilities (-1.0%) and real estate (-0.25%). Amid the broad positive performance across US equity sectors, the Dow is up slightly more than 0.5% on the day to the 36,250 area. Ahead, Fed speak will remain a prominent market driver this week, as will US data, most notable of which is Wednesday’s December Consumer Price Inflation report and Friday’s Retail Sales report. Friday also marks the unofficial start to earnings season with big US banks reporting Q4 results.

What you need to know on Tuesday, January 12:

The dollar fell sharply on Tuesday, following comments from US Federal Reserve chief Jerome Powell. In the hearings before the Senate amid his nomination for a second term, the leader of the US central bank mixed a hawkish view of the economy with a cautious approach to the reduction of the balance sheet.

Powell noted that the economy is growing at its fastest rate in years, while the labour market is "robust." Also, he said the Fed would stop higher inflation from getting entrenched, cooling down the market's concerns. At the same time, he said that the balance sheet runoff could happen "perhaps later in the year," cooling expectations for an aggressive tapering.

Meanwhile, US Fed Vice-Chair Richard Clarida stepped down on Monday after failing to report stocks' trading just a few days before the Fed announced emergency financial measures to shore up markets in the middle of the coronavirus pandemic. Fed vice-chair said his failure to report those trades was the result of "inadvertent errors."

Wall Street advanced on relief, with the three major indexes holding on to gains ahead of the close. US government bond yields eased as the yield on the 10-year Treasury note retreated to 1.75%.

The EUR/USD pair advanced to 1.1374, holding nearby as the day comes to an end, while GBP/USD trades at 1.3625, its highest since November.

Safe-haven currencies advanced modestly against the greenback, with USD/JPY now trading at 115.40. Commodity-linked currencies strengthened, with AUD/USD trading at 0.7210 and USD/CAD down to 1.2570.

Gold is up to $1,820 a troy ounce, while crude oil prices also got a boost from a weaker dollar, with WTI currently trading at $81.40 a barrel.

The focus now shifts to US inflation figures. The country will publish on Wednesday the December Consumer Price Index, foreseen at 7% YoY.

Top 3 Price Prediction Bitcoin, Ethereum, XRP: Majority of crypto market to experience relief rally

Like this article? Help us with some feedback by answering this survey:

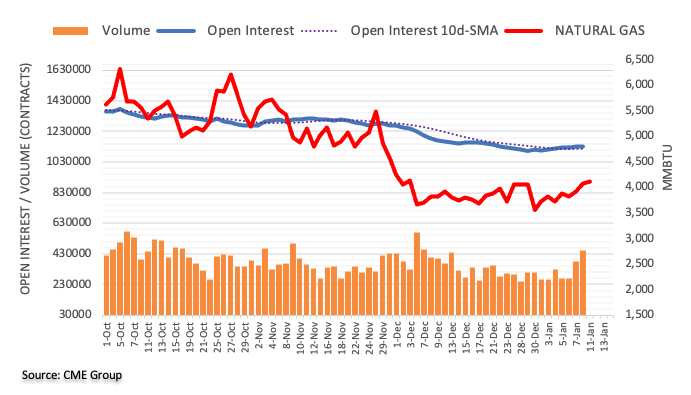

- WTI bulls step in despite the risks of covid spreading like wildfire.

- Supply risk remains a key driver, all eyes on OPEC+ group's effective spare capacity.

Oil trades much higher early on Tuesday with West Texas Intermediate, WTI, up over 3.5%bbls at the time of writing after a rally from $78.39nnls that reached $81.56bbls. The rally comes despite the spread of the Covid-19 omicron variant and the return of supply from Libya.

Libya has begun to normalize after a militia group agreed to resume output at the country's largest oilfield while pipeline repairs were completed. However, there have been reports that the nation's biggest export terminals are shuttered due to poor weather conditions.

As for Omricon, the World Health Organization has warned that 50% of Europeans could be infected with Covid-19 over the next two months. China has also increased lockdown measures to lower cases ahead of next month's Winter Olympics. In the US, cases have climbed to a record. However, markets are preferring to stick with the sentiment that the variant results in more mild cases.

Elsewhere, and despite rising inventories today, the EIA boosted its price forecast for Brent crude, expecting it to average US$74.95 per barrel this year, up from its December estimate of US$70.60. WTI is forecast to average US$71.32 per barrel this year, an increase from the December estimate of US$67.87.

Nonetheless, ''supply risk remains a key driver with the OPEC+ group's effective spare capacity effectively concentrated between just a few nations, as operational risks mount following a decade of underinvestment,'' analysts at TD Securities argued.

''In the meantime, while the Omicron variant's higher transmissibility has correlated with mobility restrictions, resilient driving mobility and factory activity are providing an offset for energy demand. In this context, energy supply risks continue to rise despite the OPEC+ group's decision to raise output,'' the analysts added.

''US production is still recovering at a slow clip, with capital expenditure budgets for the new year still suggesting that capacity will also remain capped. With that said, the bar is extremely low for CTA trend followers to add to their longs across the complex.''

- The NZD rises in tandem with risk-sensitive peers like the AUD and the GBP, the US dollar weakened.

- Fed’s Chief Powell: “If we have to raise interest rates more over time, we will.”

- NZD/USD is neutral-bearish biased, as the pair faces the confluence of the 50, 100, and 200 SMAs in the 4-hour chart.

The New Zealand dollar surges slightly 0.53% in the North American session, as the US central bank head, Jerome Powell, testifies against the US Senate Banking Committee on his renomination bid. At the time of writing, the NZD/USD is trading at 0.6790.

The market sentiment improved since the beginning of Chair Powell’s hearing, with US equity indices gaining between 0.15% and 1.01%. In the meantime, the US dollar shed its weekly gains, down 0.28%, sitting at 95.718.

In the bond market, US Treasuries fall, with the 10-year T-bond note fall to 1.768%, a headwind for the greenback.

Summary of Jerome Powell remarks

Federal Reserve Chief Jerome Powell said earlier at his appearance at the US Senate Banking Committee that the US central bank would use its tools to get inflation to the bank’s target. Powell said that “If we have to raise interest rates more over time, we will.” Further, he said that the US economy no longer needs to be accommodative and that the central bank should focus more on inflation than on the maximum employment goal.

An absent New Zealand economic docket left the NZD/USD pair leaning on US Fed speaking and market sentiment dynamics.

Atlanta’s Fed President Raphael Bostic said he penciled three hikes on December’s meeting on Tuesday. Furthermore, coincided with his colleagues, Cleveland and Kansas City presidents Loretta Mester and Esther George, respectively, that the balance sheet should be reduced sooner than later.

NZD/USD Price Forecast: Technical outlook

The NZD/USD pair is neutral-downward biased. The 4-hour simple moving averages (SMAs) with a bearish slope, confluence around the 0.6790-95 area, a strong resistance level would be difficult to overcome for NZD bulls.

In the event of breaking above the area mentioned above, NZD bulls would challenge the 0.6800 figure, which once broken would expose the January 5 daily high at 0.6837, followed by 50-DMA at 0.6872.

On the flip side, the NZD/USD pair’s first line of defense would be the 0.6700 figure. A break under that figure exerts downward pressure on the pair. The following support would be October 2020 cycle lows around 0.6553.

- Silver has rallied alongside other asset classes recently hit by Fed hawkishness after Powell’s remarks didn’t offer any surprises.

- XAG/USD has rallied to the $22.75 area, clearing its 21DMA and key short-term resistance in the $22.60s.

The fact that Fed Chair Jerome Powell didn’t add any further fuel to the fire regarding the market’s recent hawkish repricing of Fed policy expectations seems to have been taken as a green light for some reversal of recent moves. Powell’s remarks were very much in line with the contents of last week’s minutes from the December 2021 meeting, with Powell endorsing the need for the Fed to lift interest rates and begin the process of quantitative tightening in 2022. In response to his remarks made before the Senate Banking Committee at his renomination hearing, US equity markets are enjoying a tech/growth-stock led rally, US yields are falling and the US dollar has been coming under pressure.

Given their negative correlation to the buck and real yields, the net result for precious metals markets has been positive, with spot silver (XAG/USD) prices currently up more than 1.0% on the day. Spot prices had been struggling to get back above their 21-day moving average at $22.60 in the run-up to Powell’s testimony but have since broken higher to the $22.75 area. In doing so, spot silver has also managed to clear key resistance in the $22.60s in the form of recent lows from the beginning of last week and the week prior.

Some strategists had been warnings that the recent moves observed in US real yields had been overdone and Tuesday’s retracement is overdue. To recap, US 10-year TIPS yields nearly hit -0.70% on Monday, up from -1.1% at the start of the year. On Tuesday, it has pulled back to under -0.80%, with an even larger move lower being seen on the day in 5-year TIPS yields. Lower real yields lowers the opportunity cost of holding non-yielding precious metals, hence the negative correlation. But taking a longer-term view, it does seem likely that as the Fed unwinds stimulus via rate hikes and quantitative easing throughout the duration of the year, risks are tilted to the upside. That could mean that traders continue to view XAG/USD as a sell on rallies.

That would especially be the case if the US dollar, which has weakened in wake of Powell’s remarks likely as a result of position adjustment, starts strengthening broadly. Speculators have built up heavily long-dollar positions in recent weeks, so some further dollar downside as some of the weaker hands are flushed out may see dollar downside continue. But any dollar/real yields weakness fuelled rally back towards recent highs in the $23.50 area may be viewed as an attractive short-entry by the longer-term silver bears.

- EUR/USD bulls step in as markets think twice about a long dollar.

- An overcrowded trade in the greenback is vulnerable and cracks are forming.

EUR/USD is firm on the day and higher by some 0.35% at the time of writing. The greenback is suffering a phase of disinterest in what might be an overcrowded trade as investors tread cautiously on the Fed's uber hawkish path.

At the time of writing, EUR/USD is trading at 1.1365 and has moved higher within the 1.1312 and 1.1368 range thus far on the day. Attention has been on the pace for which the Fed intends to taper and the timings of the first and subsequent rate hikes.

''Since the start of November, the Fed has not only announced a plan to taper the pace of its QE programme, but it has subsequently upped the pace to allow a potentially earlier start to rate rises. In addition, it has introduced the likelihood of forthcoming balance sheet reduction,'' analysts at Rabobank explained.

We have seen plenty of demand for the greenback because of this and US yields shoot higher. However, despite more of the same from the Fed this year, with very hawkish minutes, the greenback has not been able to capitalise much on it. The greenback is down around 0.9% as per the DXY for 2022 so far. The DXY is an index that measures the US dollar vs a basket of major rival currencies, the largest of which is the euro making up over 57% of the components of the index.

''Insofar as there is already a lot of hawkish news in the price, the USD may need to see some pullback and fresh news on the interest rate front before finding direction, '' the analysts at Rabobank said.

Earlier today, Federal Reserve's chairman, Jerome Powell, had been testifying to The Senate., Powell said the Fed would stop higher inflation from getting entrenched and this has tamed the rates markets, sending the US 10-year yield a touch lower from 1.7830% to 1.7370% on the day so far on the day, further dampening demand for the greenback.

Then, taking into account covid, the greenback was regarded as a safe bet in this regard. However, given that the Omricon variant is not expected to cause as much damage to global growth, the US dollar could also lose out on this front. The US dollar had otherwise been expected to benefit from safe-haven flows away from risk.

The analysts at Rabobank explained that, for G10 markets, ''the prospects of economic recovery and faster economic growth could allow for some currency strength and re-direct some flows away from the greenback during the course of the year.''

''Given that there is currently a lot of good news in the price, we expect that the USD may continue to struggle to find its feet in the near-term.,'' the analysts added.

''During the latter part of this year, expectations regarding rate hikes in other G10 central banks and the possibility that CPI inflation in the US will start moving back towards the Fed’s target could sap the outlook for the USD. We expect EUR/USD to start edging higher in H2 and through 2023.''

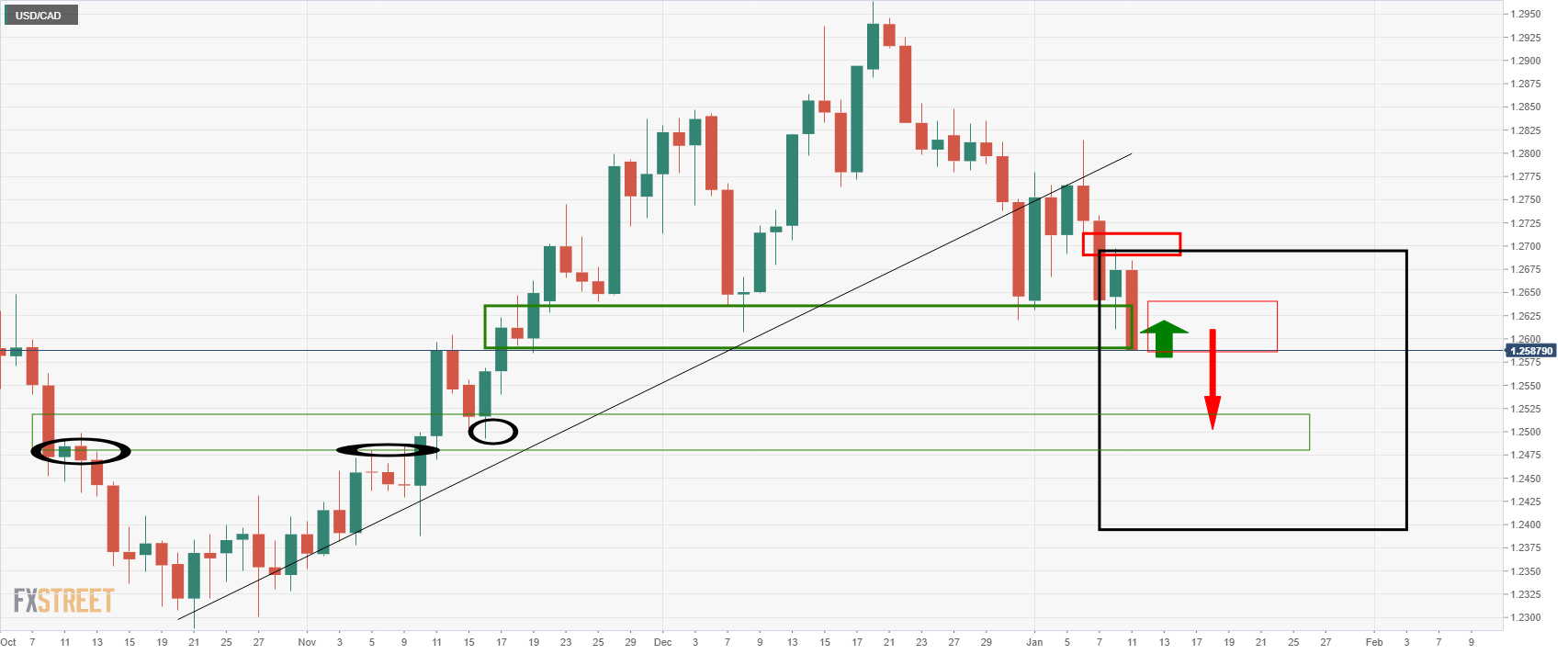

- USD/CAD bears are taking on the 1.26 area with a fresh cycle low at 1.2588.

- The longer-term outlook will be significantly bearish should the price break 1.2580 on a daily closing basis.

USD/CAD has been steadily carving out a bearish head and shoulders pattern on the daily time frame for the start of 2022, as per the following original analysis: USD/CAD Price Analysis: Bears line up for their discounts

Tracking the performance of the pair at the start of this week, the following analysis noted the M-formation: USD/CAD Price Analysis: The bearish playbook is unfolding, daily M-formation in focus

The price was leaving an M-formation on the chart as illustrated above and was drawing the bulls into the neckline.

This was seen on the 4-hour time frame as in the following prior analysis:

Since the analysis, the price has indeed played out according to the 4-hour forecast as follows:

The price mitigated the imbalance into the daily M-formation's neckline near 1.2700/10 prior to the recent break to test 1.26 the figure.

At this juncture, the neckline of the daily head and shoulders would be expected to act as resistance near 1.2580/1.2610. Bears can look near to 1.25 the figure and 1.2480 as the next area of expected support:

USD/CAD daily chart

- AUD/USD is at session highs above its 21DMA and probing the 0.7200 area as the dollar weakens post-Powell comments.

- Powell’s remarks did not surprise market participants and the dollar seems to be suffering amid profit-taking.

AUD/USD has seen upside in recent trade and recently hit session highs a whisker below the 0.7200 level as the dollar suffers broad weakness in wake of remarks from Fed chair Jerome Powell. Powell’s remarks, made at his renomination hearing before the Senate Banking Committee, were broadly in line with the hawkish tone of the Fed minutes released last week, with Powell referencing plans to lift rates and begin balance sheet reduction in 2022. The lack of surprises seems to have triggered relief in US equities, with tech and rate-sensitive growth stocks the best performers, as well as triggering some profit taking on long dollar positions. Indeed, the market is heavily long USD versus most G10 currencies, including the Aussie - last week’s CFTC data (released every week) showed that speculator’s net short position in AUD/USD was close to a 52-week high.

Returning back to AUD/USD price action; the pair now trades higher on the day by about 0.4%, making it one of the better performing G10 currencies alongside with some its risk-sensitive peers including NZD and CAD. Strength in copper (+1.1%), gold (+0.7%), oil (+3.3%) and other commodity prices on Tuesday is helping AUD and its other commodity-sensitive peers, whilst the Aussie is also getting an independent boost from Tuesday’s strong retail sales report. The presence of the 21-day moving average in the 0.7190s is currently offering resistance, as has been the case over the past three sessions and a break above this area plus the 0.7200 mark could open the door to a prolonged move back towards recent highs in the 0.7275 area. Should the dollar continue to fail to benefit from hawkish Fed vibes and strong/hawkish US data this week, that could provoke further profit-taking and exacerbate recent upside.

- The British pound continues rallying for the third day in a row.

- A mixed-market mood and an absent UK economic docket were not an excuse for GBP bulls to push the pair higher, courtesy of a weaker US dollar.

- GBP/USD is upward biased, though a daily close above 1.3600 would cement the pair’s chances to reach 1.3700.

During the New York session, the GBP/USD climbs above the psychological 1.3600 figure, trading at 1.3618 at the time of writing. The market sentiment shifted from a risk-on mood to mixed as the Federal Reserve Chairman Jerome Powell testifies against the US Senate Banking Committee on his re-nomination to head the US central bank.

Federal Reserve policymakers agree on a balance sheet reduction

An absent UK economic docket that would be packed on Friday left the GBP/USD pair at the mercy of US dollar developments.

Before Wal Street opened, three Federal Reserve regional presidents crossed the wires. Atlanta’s Fed President Bostic said that he “penciled three hikes on the December meeting,” but as of today, he foresees that one more could be needed. Concerning reducing the balance sheet as soon as possible, he coincides with Cleveland’s and Kansas City Fed Presidents Loretta Mester and Esther George.

Jerome Powell, Federal Reserve president, is crossing the wires at press time. So far, he said that the Fed would use their tools to get inflation towards the central bank target and emphasize that the US economy no longer needs accommodation. Powell further noted that the US central bank needs to focus more on inflation than the maximum employment goal

Follow Jerome Powell's remarks in FXStreet’s live coverage here.

GBP/USD Price Forecast: Technical outlook

The GBP/USD is neutral-upward biased, despite trading below the 200-day moving average (DMA,) which sits at 1.3736, well above the spot price. At press time, it is trading above 1.3600, a level that was last seen on November 11, 2021, a signal that opens the door for a test of the 1.3700 figure, though there would be some hurdles on the way up.

The first resistance would be the R2 daily pivot at 1.3644. A breach of the latter would expose November 4, 2021, daily high at 1.3699, followed by the 200-DMA.

On Friday, the US retail sales report for December will be released. Analyst at Wells Fargo expected a rise of just 0.2%, which would be the slowest pace in four months.

Key Quotes:

“Consumers are feeling the pressure from inflation. Retail sales came in well-below expectations in November, rising just 0.3% over the month. Higher prices for necessities, such as food and gas, have forced hard choices in more discretionary categories, such as electronics & appliances and department stores during the holiday shopping season. However, we suspect at least some consumers' holiday shopping was pulled forward, heeding advice from well-publicized supply chain issues and aggressive messaging from retailers.”

“We expect spending to moderate further in December and forecast retail sales to rise 0.2% over the month, which would be the slowest pace in four months. It is important to note that sales are reported in nominal dollars, which means they are not adjusted for inflation. If price gains outpace spending increases, that implies a volume decline in sales.”

“On top of higher prices, the Omicron variant presents some downside risk to spending in December as well, particularly in the service sector.”

Fed Chair Jerome Powell, speaking at the Senate hearing for his renomination, said on Tuesday that the Fed is trying to get to a place where interest rates are more neutral for the economy and then to a place where they are "tight".

Additional Remarks:

"We haven't made any decisions regarding balance sheet reduction."

"We will talk again about it at the January meeting."

"Economy is in a completely different place to last tightening cycle."

"Reducing balance sheet this time will be 'sooner and faster'."

"We will reduce the balance sheet sooner and faster than last time."

"Balance sheet is far above where it needs to be."

"We will take two to four meetings to work through the balance sheet decision."

"We tend to take 2, 3, 4 meetings to make such decisions."

Market Reaction

Perhaps motivated by a lack of fresh surprises from Fed Chair Powell in his remarks over the course of the last hour, the US dollar has been weakening in recent trade, whilst risk assets such as the Nasdaq 100 that had recently been hit by fears over Fed hawkishness are gaining. The Nasdaq 100 index is now up 0.8% on the session, erasing early session losses.

After a poor performance of the South Korean won during 2021, analysts at MUFG Bank consider it looks now undervalue. They expect the USD/KRW pair to decline to 1145 by the fourth quarter of the current year.

Key Quotes:

“KRW depreciated 9.4% against the US dollar in 2021, the second worst performing currency among emerging Asia currencies last year. KRW’s sizeable depreciation was due to the worsened pandemic condition in the country. The Bank of Korea (BoK) raised the 7-day repo rate twice in 2021, with a 25bps hike to 0.75% on August 26th and another 25bps hike to 1.0% on November 25th.”

“In 2022, the engines for Korea’s growth will be better performance of the service sector, stronger private consumption as COVID conditions improve and continued fiscal stimulus. However, tighter financial conditions (50bps policy rate hike) due to its CB’s desire in managing financial risks amid indebted households, and lower exports growth will constrain South Korea’s pace of expansion.”

“The KRW is undervalued now in both effective exchange rate terms and bilateral terms against USD. With the pandemic becoming more controllable in 2022, a steadily economic recovery and better controlled pandemic condition in South Korea would help build confidence and a

Analysts at Rabobank consider the US dollar has the capacity to move EUR/USD to the 1.10 area this year, they are projecting this on a 6 month view based on the expectation that the Federal Reserve’s tightening cycle will be underway by then. Later they see the EUR/USD rebounding.

Key Quotes:

“The June FOMC was instrumental to the turnaround in USD sentiment last year since the movements in the dot plot at this meeting stimulated the debate about the prospects of a Fed rate rise in 2022. Even though Fed-related news this year has retained a hawkish tone, the USD is struggled to find its feet. Insofar as there is already a lot of hawkish news in the price, the USD may need to see some pullback and fresh news on the interest rate front before finding direction.”

“While we expect that the USD has the capacity to move towards the EUR/USD1.10 area this year, we are projecting this on a 6 month view based on the expectation that the Fed’s tightening cycle will be underway by then. Given that there is currently a lot of good news in the price, we expect that the USD may continue to struggle to find its feet in the near-term.”

“During the latter part of this year, expectations regarding rate hikes in other G10 central banks and the possibility that CPI inflation in the US will start moving back towards the Fed’s target could sap the outlook for the USD. We expect EUR/USD to start edging higher in H2 and through 2023.”

Fed Chair Jerome Powell, speaking at the Senate hearing for his renomination, reiterated on Tuesday that he expects the economy to be able to deal with the current and future Covid-19 outbreaks.

Additional Remarks:

"There may be lower hiring and pause in growth due to Omicron but should be short-lived."

"The next quarters could be very positive for the economy after Omicron has subsided."

"We are seeing an economy that functions during Covid waves."

"Risks on both sides on growth and potentially on inflation."

Fed Chair Jerome Powell, speaking at the Senate hearing for his renomination, said on Tuesday that inflationary pressures are set to remain elevated well into 2022.

Additional Remarks:

"If it does, our policy will continue to adapt."

"If inflation lasts longer, that would require a policy response."

"If inflation will last longer that would imply more risk of becoming entrenched, our policy will respond."

"This year I expect fed will raise interest rates, end asset purchases and perhaps later this year beginning to allow the balance sheet to shrink."

"We have to be humble and nimble."

"The Fed has not made any decisions on timing for any of normalization process."

"Will have to be open to changing environment, monetary policy will have to adapt."

"Monetary policy will have to adapt as we learn more about inflation."

Analysts at MUFG Bank point out that the weakens of the Japanese yen is reaching its limits. They forecast USD/JPY at 117.00 by the end of the first quarter and at 116.00 by the end of the second.

Key Quotes:

“The yen depreciated by 10.3% versus the US dollar in 2021, the worst performance amongst G10 currencies. Strong risk appetite resulting in impressive performances for global equity markets coupled with rising US yields helped fuel the gains. We see scope for this momentum to continue in the early part of this year. US yields look set to advance further and overall G10 central bank policy support will help keep financial market conditions favourable, especially if as expected Omicron continues to recede as a global risk. The breach of the key technical resistance around the 117.00 level (long-term trendline from 1990 and 2015 highs) could see a lurch higher and a move toward the key 120.00 level. If this scenario was to unfold, we believe it would mark the final phase of this move higher in USD/JPY.”

“As we approach the timing of the first rate increase in the US, the market is likely to be well priced (or overpriced) for Fed action and from that point we would see scope for a start of a reversal.”

“In BoJ REER (Real Effective Exchange Rate) terms, the yen has just broken below the 2015 low to reach levels last recorded way back in 1972. With greater financial market volatility this year, coupled with Japan’s large current account surplus and a relatively attractive real yield, we believe the depreciation of the yen will soon hit its limit.

Inflation data will be released on Wednesday in the US. Analysts at Nordea Markets, see the December core inflation reading to print in line with consensus at 5.4%, which is the highest number since 1991. They point out unresolved supply restrictions are still the reason behind the inflationary pressure.

Key Quotes:

“Contributions originate from the usual suspects – used vehicles and rent of shelter. Our models suggest that inflation in owner’s equivalent rent of shelter (OER) was above 4% in December, implying a contribution >1.2% to core inflation. 2021 has surely been the year of surging prices on used cars, a peculiar contributor to the broad index. We expect used car prices to accelerate with more than 2.5% from November, leading to y/y inflation above 35%.”

“Minutes from the December meeting revealed that the bottlenecks in supply chains and labor markets are more rigid than firstly anticipated by Fed officials, doubtlessly leading to an even higher inflation reading in December. However, Fed officials argue that bottlenecks are likely to ease soon which leads us to believe that inflation peaks in either the current or next print. The combination of reversed base effects, a larger supply, and weakening of foreign demand for American goods will lead to a downward pressure on prices, eventually easing inflation.”

“Our prospects of high readings tomorrow have us believe in a strong USD and a further increase in the long-dated Treasury yields. We still expect Fed’s lift-off to occur in March, three months early compared to most forecasters. Prepare accordingly.”

Fed Chair Jerome Powell, speaking at the Senate hearing for his renomination, said on Tuesday that the Fed at the moment needs to focus more on the inflation side of its mandate versus the employment side given that inflation is further from the Fed's target than employment.

Additional Remarks:

"This year we will in all likelihood normalize policy, including raising rates this year and may start balance sheet runoff later this year."

"Supply-side constraints have been very persistent, not seeing much progress on that."

"We have to achieve price stability, confident we will."

"We have to achieve price stability; am confident we will."

"This year will in all likelihood normalize policy."

"At some point perhaps later this year will allow balance sheet to shrink."

- Falling US Treasury yields weigh on the US Dollar, boost the non-yielding metal.

- On Tuesday, a Fed speakers parade is crossing the wires.

- Federal Reserve Chief Powell appears at the Senate to speak about its renomination.

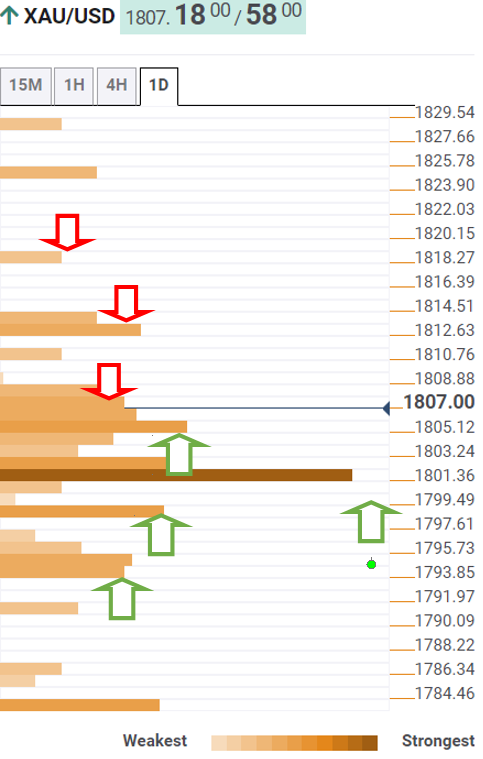

The yellow metal extends its rally, edges higher for the third consecutive day, while US Treasury yields, particularly the 10-year benchmark note rate, fall for the first day in three, sitting at 1.778%. At the time of writing, the gold spot (XAU/USD) advances 0.04%, is trading at $1,808 during the North American session.

The market sentiment is upbeat, as portrayed by US equity futures pointing towards a higher open. Despite the previous-mentioned, investors’ eyes would turn to Fed’s Chief Jerome Powell testify against the Senate Banking Committee to speak about its nomination. However, he would sustain a Q&A session with the US Senators, so beware of the speed of the lifting and balance sheet chatters.

Some of Powell’s remarks prepared for his appearance, he pledged to “prevent higher inflation from becoming entrenched.”

In the meantime, the US Dollar Index, which measures the greenback’s performance against a basket of six peers, slides some 0.03%, sits at 95.96, a tailwind for the non-yielding metal, which usually appreciates when the US Dollar weakens.

Meanwhile, on Monday, some US commercial banks led by Goldman Sachs noted that the Federal Reserve would hike four times in the year, beginning with the March 2022 monetary policy meeting.

Fed speakers parade begins

Earlier in the day, Atlanta’s Fed President Raphael Bostic said that he expects three rate hikes in 2022, with risks of an additional hike. He also noted that “the balance sheet should decline faster than in the last tightening cycle, perhaps by $100 billion.“

In the same tone of rate hikes, Cleveland’s Fed President Loretta Mester said that if the economy performs the same as today in March, she will support a rate hike in that meeting. Further noted that she “penciled in three rate hikes for 2022 at the December meeting” and would like a faster reduction of the balance sheet than in the previous cycle.

Following Mester, Kansas City Fed President Esther George said that it would be appropriate for the Fed to move earlier on running down its balance sheet compared to its last tightening cycle.

XAU/USD Price Forecast: Technical outlook

Gold has a neutral bias, as shown by the daily moving averages (DMAs) residing in the $1,792-$1,805 range, trendless and has been like that in the last three trading days.

To the upside, gold’s first resistance would be the January 6 daily high at $1,811.54. A breach of the latter would expose the January 3 daily high at 1832, followed by November 16, 2021, pivot high at $1,877.

On the flip side, the first line of defense for XAU bulls will be the psychological $1800. A decisive break of that level would expose the 100-DMA at $1,793, followed by the January 7 daily low at $1,783, and then December 15, 2021, cycle low at $1,753.

- Mexican peso remains strong versus US dollar, holds onto recent gains.

- USD/MXN keeps testing the 20.30/35 support area.

- Resistance emerges at 20.60, horizontal level and the 20-SMA.

The USD/MXN continues to be unable to recover ground. Recent runs higher were followed by a retracement back to the 20.35 zone. A stronger Mexican peso continues to push the price toward the 20.30/35 support. A break lower would clear the way to more losses, targeting 20.15. Below attention would turn to 20.00.

On the upside, the immediate resistance emerges at 20.50 and then comes a more significant barrier at 20.60. A daily close above would expose the next one at 20.85. A daily close above 20.90 would be a positive sign for the dollar.

Technical indicators are slightly biased to the downside, but most of them are now flat. The 55-day simple moving average is turning to the upside, and the 200-SMA awaits flat at 20.28.

USD/MXN daily chart

-637775120672703948.png)

Fed Chair Jerome Powell, speaking at the Senate hearing for his renomination, said on Tuesday that the US labour market is recovering "incredibly" rapidly and the US economy no longer needs highly accommodative policy.

Additional Remarks:

"Wages moving up is generally a good thing."

"We are watching wages carefully."

"The unemployment rate is doing very well."

"The economy no longer needs highly accommodative policy."

"Inflation so far above target is telling us the economy no longer needs our highly accommodative policy."

"This year will be moving policy closer to normal."

"It is really time for us to move away from emergency settings."

"Doing so should not have a negative impact on the labor market."

"We can't directly affect supply-side conditions."

Fed Chair Jerome Powell, speaking at the Senate hearing for his renomination, reiterated on Tuesday that the Fed will use its tools to get inflation back down.

Additional Remarks:

"We now have a mismatch between demand and supply."

"If we see inflation persisting longer than expected, then we will have to raise interest rates more over time."

"We will use our tools to get inflation back down."

"We want to promote a long expansion and for that, we need price stability."

"High inflation is a threat to that goal."

"We probably remain in an era of very low interest rates."

FOMC Chairman Jerome Powell will testify before the US Senate Committee on Banking, Housing, and Urban Affairs for his confirmation hearing on Tuesday, January 11, at 1500 GMT.

Related articles

Federal Reserve Jerome Powell testifies Tuesday, prepared remarks out.

Fed Chair Powell to offer hints about QT and lift-off timing – TDS.

About Jerome Powell (via Federalreserve.gov)

Jerome H. Powell took office as Chairman of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028.

- USD/TRY remains capped by the 14.00 hurdle.

- Turkey 10y yields edges higher to the 23.70% region.

- Turkey’s Current Account recorded a $2.68B deficit.

The Turkish lira gives away part of the recent gains and pushes USD/TRY back to the proximity of 13.90 on Tuesday.

USD/TRY: Upside still limited around 14.00

Trading range in USD/TRY has diminished considerably in the last sessions, while occasional bullish attempts in the spot remain well limited around the 14.00 neighbourhood for the time being.

The ongoing range bound theme in the lira comes in tandem with the persistent march higher in yields of the key Turkey’s 10y bond, which navigate record highs around 23.70%.

In the domestic calendar, Turkey’s Current Account slipped back into a $2.68B deficit in November. In addition, the Construction Cost Index rose by 48.87% YoY also in November and 7.94% vs. the previous month.

What to look for around TRY

The ongoing recovery in the pair seems to have met an initial tough resistance in the 14.00 area so far. The higher-than-expected inflation figures released at the beginning of the year put the lira under extra pressure in combination with some cracks in the confidence among Turks regarding the government’s recently announced plan to promote the de-dollarization of the economy. In the meantime, the reluctance of the CBRT to change the (collision?) course and the omnipresent political pressure to favour lower interest rates in the current context of rampant inflation and (very) negative real interest rates are forecast to keep the domestic currency under intense pressure for the time being.

Key events in Turkey this week: Current Account (Tuesday) - Industrial Production (Thursday).

Eminent issues on the back boiler: Progress (or lack of it) of the government’s new scheme oriented to support the lira. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Much-needed structural reforms. Growth outlook vs. progress of the coronavirus pandemic. Potential assistance from the IMF in case another currency crisis re-emerges. Earlier Presidential/Parliamentary elections?

USD/TRY key levels

So far, the pair is gaining 0.49% at 13.8429 and a drop below 12.7523 (weekly low Jan.3) would pave the way for a test of 12.1247 (55-day SMA) and finally 10.2027 (monthly low Dec.23). On the other hand, the next up barrier lines up at 13.9319 (YTD high Jan.10) followed by 18.2582 (all-time high Dec.20) and then 19.0000 (round level).

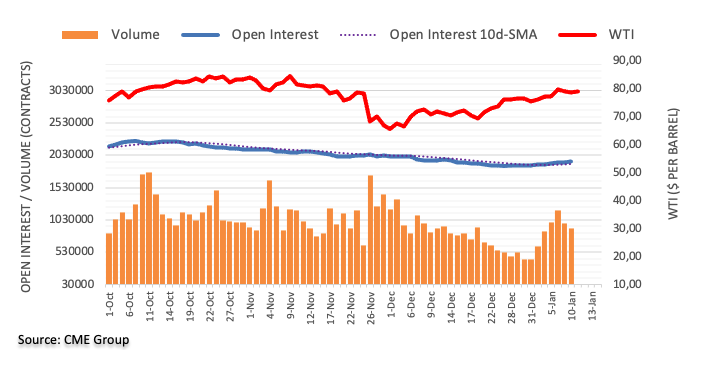

- WTI has pulled back from session highs above $80.00 as US equities come under selling pressure at the open.

- But oil may continue to fair better than equities, which are suffering from Fed hawkishness, if the demand outlook remains strong.

Amid US equities coming under some selling pressure at the Tuesday equity open, front-month WTI futures have pulled back from earlier session highs to the north of the $80 per barrel level and are now trading back in the $79.00 area. That still leaves WTI prices up more than 50 cents on the day and the oil bulls will still be eyeing a test of last week’s highs in the $80.50 area. Indeed, oil strategists continue to view the spread of the Omicron variant as not likely to leave a meaningful dent in near-term oil demand.

Meanwhile, despite the recent hawkish shift in market expectations for Fed tightening that has weighed on US and global equities, with four hikes now seen in 2022 coupled with quantitative tightening, the outlook for global growth in 2022 remains strong. This is what matters most for demand rather than financial condition-focused crude oil markets. The implication might be that, in the coming weeks/months, as long as Fed tightening isn’t seen as a “policy mistake” (i.e. that slows the economy unnecessarily), oil may remain a relatively safe risk asset even if Fed tightening expectations continue to weigh on equities.

OPEC supply woes remain in the headline and could also be offering some support to the price action. Libya has faced further setbacks in its efforts to bring production back to 2021 peak output levels of roughly 1.3M barrel per day (BDP). The country’s National Oil Corporation (NOC) said on Tuesday that it would be suspending oil exports from its Es Sider terminal due to bad weather and lack of storage. As a result, it's Waha Oil Co. (which exports oil through the Es Sider terminal) would be reducing production by 50K BPD and this could rise to as much as as 105K BPD. Despite this, the NOC said that output was back to 896K BPD from the 729K BPD reported last week.

Ahead, private US oil inventory data is scheduled for release at 2130GMT ahead of Wednesday official EIA US inventory report which is seen showing a seventh consecutive week of draws, with a further 2M barrel drop in stocks expected.

Federal Reserve Bank of Kansas City President Ester George said on Tuesday that it would be appropriate for the Fed to move earlier on running down its balance sheet when compared to the last tightening cycle, according to Reuters. George continued that her own preference would be to run down the balance sheet sooner rather than later.

The current very accommodative monetary policy stance of the Fed is "out of sync" with the economic outlook, she added, saying that the strength of economic fundamentals will continue to support solid consumption growth. On the impact of the surge in Omicron infections, George said that the surge is likely to weigh on the labour force participation rate and further delay the rotation in spending from goods to services. However, economic activity, she said, especially when it comes to spending, had become more resilient to spikes in Covid-19 infection rates and that the labour market looks tight.

Federal Reserve Bank of Cleveland President Loretta Mester said in an interview on Bloomberg Television on Tuesday that as long as the economy looks the way it does now in March, she would support a rate hike at that meeting.

Additional Remarks:

"The conomy is on a really good track and inflation is more persistent."

"Price increases have broadened."

"The case is really strong to begin to wind back accommodation."

"Penciled in three rate hikes for 2022 at the December meeting."

"Fed will have to see how the economy does over time before it knows how many rate increases are needed."

"Fed probably needs to recalibrate its policy stance because inflation is above where the Fed needs it to be."

"The Fed cannot ignore short run or medium term tightness in the labor market."

"The Fed should be able to run down the balance sheet much faster than it did last time."

"The economy is stronger now and the balance sheet is much larger."

"She would like to set a path for the balance sheet, which will reduce accommodation."

"It's really important the Fed take actions to bring inflation down given the environment."

- EUR/USD alternates gains with losses in the low-1.1300s.

- A break above the 4m resistance line exposes further recovery.

EUR/USD struggles for direction in the 1.1320/30 band on turnaround Tuesday.

If the pair manages to regain strength it should face the initial target at the 55-day SMA at 1.1364 ahead of the YTD high at 1.1386. Further up comes the 4m resistance line near the 1.1400 yardstick. The surpass of the latter should mitigate the downside pressure in the short-term horizon.

The broader negative outlook for EUR/USD is seen unchanged while below the key 200-day SMA at 1.1737.

EUR/USD daily chart

- A combination of factors assisted USD/JPY to regain positive traction on Tuesday.

- A positive risk tone undermined the safe-haven JPY and extended some support.

- Fed rate hike bets acted as a tailwind for the USD and also provided a modest lift.

The USD/JPY pair built on its steady intraday positive move and climbed to a fresh daily high, around the 115.65 region during the early North American session.

Having defended the key 115.00 psychological mark, the USD/JPY pair caught some fresh bids on Tuesday and has now reversed the previous day's losses to a one-week low. This marked the first day of a positive move in five sessions and was sponsored by a combination of supporting factors.

A generally positive tone around the equity markets undermined the safe-haven Japanese yen and acted as a tailwind for the USD/JPY pair. On the other hand, the prospects for a faster policy tightening by the Fed extended some support to the US dollar, which provided an additional lift to the pair.

It is worth mentioning that the money markets have fully priced in the possibility of an eventual Fed lift-off in March. The market bets were reinforced by comments from Atlanta Federal Reserve President Raphael Bostic, saying that March would be a reasonable time for the first-rate increase.

Bostic added that the runoff of the balance sheet could begin soon after and expects three rate hikes in 2022, with risks pointing towards a fourth on the possibility of higher inflation. Hence, the focus will remain on Fed Chair Jerome Powell's confirmation hearing before the Senate Banking Committee.

Investors will closely scrutinize Powell's remarks for clues about the likely timing and the pace of policy normalisation. Apart from this, Wednesday's release of the US consumer inflation figures will play a key role in influencing the USD and provide a fresh directional impetus to the USD/JPY pair.

Meanwhile, the fundamental backdrop seems tilted in favour of bullish traders and suggests that the recent corrective slide from a five-year high touched last week has run its course. Hence, some follow-through strength, towards reclaiming the 116.00 mark, remains a distinct possibility.

Technical levels to watch

- EUR/GBP hit multi-year lows for a second consecutive session under 0.8330 but has since rebounded back towards 0.8350.

- Analysts caution that there are a lot of positive in the price of GBP.

EUR/GBP hit multi-year lows for a second day running on Tuesday, briefly slipping below Monday’s 0.8332 low to bottom out at 0.8323 before rebounding in recent trade back towards 0.8350. At current levels in the 0.8340s, the pair trades flat on the day. ECB speak from President Christine Lagarde and Chief Economist Philip Lane was ignored on Tuesday as neither provided any more information on the policy outlook, enabling EUR/GBP traders to continue to focus on the overarching theme of ECB/BoE divergence. On which note, markets are pricing a strong likelihood that the latter will hike rates by 25bps in February thus further extending the UK’s rate advantage over the Eurozone, a theme which continues to weigh on the pair, FX strategists say.

Analysts at Commerzbank warn that while the prospect of interest rate hikes from the BoE has been supporting GBP, “quite a bit of it is likely to be priced in already so that the GBP rally could begin to run out of steam”. Analysts at Rabobank caution that the market, which has been expecting as many as four BoE rate hikes this year, may soo start to unwind some of the hawkish expectations, with pressure on real incomes in the UK likely to “become more obvious as the winter progresses”. For now, EUR/GBP bearish speculators will likely continue to target a test of late-2019/early 2020 lows in the 0.8280s area. The main data points to keep an eye on include Eurozone November Industrial Production figures on Wednesday and UK November GDP figures on Friday.

According to Robert Carnell – Regional Head of Research (Asia-Pacific) at ING – the development of a new Covid wave threatens both growth and India's sovereign ratings.

Key Quotes:

“The key metric for any downgrade is very simple - India’s fiscal position. Like most economies during the pandemic, India’s fiscal deficit worsened considerably as tax revenues slumped and government spending shot up to offset the crashing economy.”

“There are a variety of risks to the fiscal outlook. The 2021/22 budget outlook assumes a 14.4% nominal growth rate. Implicit within this is a real GDP growth rate that will not substantially dip below 10% assuming inflation runs somewhere around the middle of the RBI’s 4% +/- 2% target.”

“Rising debt-service costs are another risk given the global backdrop of tightening policies in the US and elsewhere. Revenues will also need to come in as predicted, and expenditures should not creep above budgeted amounts – slippage on fiscal targets is not uncommon in even the most prudent economy.”

“Monthly deficit figures are running at about -$20bn currently. Both export and import growth is good, and the recent decline in crude oil prices was certainly helpful. But the ongoing recovery will likely shift the balance of trade more in favour of imports, and we forecast the trade deficit further increasing in both $bn terms and as a percentage of nominal GDP.”

“The outlook for growth is tentatively positive but is maybe not as solid as some directional indicators suggest and may well be severely tested again by the Omicron Covid variant. And this is also where the biggest threat from a credit downgrade most likely lurks.”

Fed policymaker Richard Clarida announced on Monday that he would resign from his post as Vice Chairman of the FOMC on Friday, two weeks before his term on the central bank's board of governors had originally been scheduled to end. His announcement of early resignation follows a recent increase in public scrutiny over transactions he made in late February 2020, just as global equity markets had begun to crash as the Covid-19 pandemic embroiled the globe.

An initial public disclosure that first caught public attention last year showed Clarida had sold shares in three stock funds on 24 February. However, a more recent amendment to this disclosure showed that just three days on 27 February later he bought back one of these positions. That purchase came one day before an unscheduled announcement from Fed Chair Jerome Powell that the Fed was ready to cut interest rates to support the economy on 28 February.

Foreign portfolio inflows into the Malaysian economy rose to the highest level since 2012 in December, noted UOB Group’s Senior Economist Julia Goh and Economist Loke Siew Ting.

Key Takeaways

“Malaysia’s foreign portfolio flows turned positive in Dec 2021 (at MYR5.0bn; Nov: -MYR3.4bn), mainly due to a rebound of debt inflows (at MYR6.1bn; Nov: -MYR3.6bn) while foreign flows into equities turned negative. This brought the full-year foreign portfolio inflows to MYR30.4bn in 2021 (2020: -MYR6.3bn), with debt inflows totalling MYR33.6bn and equity outflows amouting to MYR3.2bn. This marks the highest foreign portfolio inflows since 2012.”

“Bank Negara Malaysia’s (BNM) foreign reserves jumped for the third month by USD0.2bn m/m to close the year 2021 at USD116.9bn, marking the highest level since Nov 2014. It is sufficient to finance 7.7 months of retained imports and is 1.2 times total short-term external debt.”

“Going forward, overtly hawkish US Fed and emerging new COVID-19 variants are top risk factors exacerbating volatility in emerging markets’ (EMs) capital flows including Malaysia. Domestically, rising debt level and policy uncertainty could weigh on Malaysia’s capital flows and currency outlook. We expect further USD strength with USD/MYR projected at 4.30 by end-2022.”

- DXY trades on the defensive below the 96.00 yardstick.

- A breach of 95.70 exposes a deeper retracement.

DXY bounces off recent lows in the vicinity of 95.75 and now looks to reclaim the key 96.00 barrier on Tuesday.

Further selling pressure should put the 95.70 region to the test, while a breach of this level exposes a potential drop to December’s low at 95.57 (December 31).

In the meantime, while above the 4-month support line (off September’s low) just above 95.00, further gains in DXY are likely. Looking at the broader picture, the longer-term positive stance remains unchanged above the 200-day SMA at 93.08.

DXY daily chart

- EUR/USD is subdued just under its 50DMA as traders await Fed speak from two hawks and Chairman Jerome Powell.

- Hawkish Fed speak could support the US dollar, says ING.

EUR/USD has continued its recent pattern of ranging within well-estabilished parameters so far this week. After rebounding on Monday from sub-1.1300 lows as the pair found support ahead of a test of recent lows in the 1.1280 area, EUR/USD rallied all the way back to test its 50-day moving average in earlier Tuesday trade in the 1.1340s. However, for the third time in as many weeks, EUR/USD has been unable to stage a meaningful rebound to the north of this level and is now back to trading in the 1.1330s, broadly flat on the session.

Commentary from senior ECB policymakers on Tuesday has for the most part gone under the radar. President Christine Lagarde emphasised the bank's “unwavering” commitment to its price stability mandate whilst also acknowledging the concern about inflation expressed by many citizens. ECB Chief Economist Philip Lane reiterated the banks current stance that Eurozone inflation is not seen remaining about 2.0% in the medium-term (recall the bank’s forecast for 2023 is for HICP inflation to fall back to 1.8% from an average of 3.2% in 2022). New Bundesbank President and ECB governing council member Joachim Nagel picked up where his predecessor Jens Weidemann left off with a warning in his first speech inflation may remain elevated for longer than currently expected, whilst also urging that the ECB must remain vigilant.

Fed speak incoming

A much more important driver of FX and indeed broader market sentiment in 2022 has been expectations for Fed tightening, which have grown increasingly hawkish after last week’s hawkish Fed minutes and strong labour market report. FX strategists have been surprised by the buck’s inability to muster a sustained rally despite numerous banks and analysts now calling for as many as four rate hikes in 2022 starting in March, as well as for balance sheet runoff to begin as soon as H2. But with Fed hawks Ester George and Loretta Mester speaking at 1400GMT and 1430GMT, followed shortly thereafter by Fed Chair Jerome Powell at 1500GMT ahead of Wednesday’s December Consumer Price Inflation report, there are plenty of potential USD bullish catalysts this week.

Powell is speaking at his Fed Chair renomination hearing before the Senate Banking Committee, with investors hoping for clues as to the timing of expected policy tightening. His remarks in a short initial statement have already been published and did not contain any commentary on the outlook for policy. But there will be a Q&A session where Powell may delve into more detail. Today’s appearance marks Powell’s first opportunity to say how the current outbreak of Omicron influences the outlook for policy – market participants will expect Powell to reiterate the stance laid out in December that it does pose a significant near-term risk to the economy and, if anything, may add to inflation risks. “Today also offers the first opportunity for Fed Chair Powell to comment on the tidal shift in market expectations following the revelations in the FOMC minutes last week” SocGen points out.

Meanwhile, ING warns traders to “expect markets to be particularly sensitive to any discussion on the reduction of the Fed's balance sheet, a topic that became particularly hot after the December FOMC minutes and may cause further fragility in the bond market (and offer more support to the dollar) down the road”. The bank adds that “any Powell-induced dollar strength would normally be channeled through weaker low-yielding FX, although the current soft environment for equities may also continue to weigh on the pro-cyclical sector – leaving the dollar itself as the only potential winner from the Fed’s hawkish message.”

- USD/CHF attracted some dip-buying on Tuesday and inched back closer to a multi-week high.

- Hawkish Fed expectations acted as a tailwind for the USD and extended support to the pair.

- Retreating US bond yields capped the USD and the major ahead of Powell’s Senate hearing.

The USD/CHF pair has managed to recover its early lost ground and was last seen trading around the 0.9265-70 region, just a few pips below a four-week high touched on Monday.

A combination of factors assisted the USD/CHF pair to attract some dip-buying near the 0.9240 region on Tuesday, with bulls now looking to build on its recent gains recorded over the past two weeks. The US dollar reversed modest intraday losses amid the prospects for a faster policy tightening by the Fed. Apart from this, a generally positive risk tone undermined the safe-haven Swiss franc and acted as a tailwind for the major.

It is worth mentioning that the money markets have fully priced in the possibility of an eventual Fed lift-off in March and anticipate four interest rate hikes in 2022. Atlanta Federal Reserve President Raphael Bostic reinforced market bets and said that March would be a reasonable time for the first-rate increase. Bostic expects three rate hikes in 2022, with risks pointing towards a fourth on the possibility of higher inflation.