- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 10-04-2024

Japan's top currency diplomat, Masato Kanda, who will instruct the BoJ to intervene, when he judges it necessary, warned that he prepared to take necessary actions whenever possible to respond to the excessive weakness of the Japanese Yen (JPY).

Key quotes

“Recent yen moves are rapid.”

“Won't rule out any steps to respond to disorderly FX moves.”

“Prepared to take necessary actions whenever possible.”

“Won't comment whether overnight forex moves are excessive.”

“Excess FX moves could affect the economy.”

Market reaction

Following the above verbal intervention, USD/JPY was trading at 152.87, losing 0.19% on the day.

Japanese Yen FAQs

The Japanese Yen (JPY) is one of the world’s most traded currencies. Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors.

One of the Bank of Japan’s mandates is currency control, so its moves are key for the Yen. The BoJ has directly intervened in currency markets sometimes, generally to lower the value of the Yen, although it refrains from doing it often due to political concerns of its main trading partners. The current BoJ ultra-loose monetary policy, based on massive stimulus to the economy, has caused the Yen to depreciate against its main currency peers. This process has exacerbated more recently due to an increasing policy divergence between the Bank of Japan and other main central banks, which have opted to increase interest rates sharply to fight decades-high levels of inflation.

The BoJ’s stance of sticking to ultra-loose monetary policy has led to a widening policy divergence with other central banks, particularly with the US Federal Reserve. This supports a widening of the differential between the 10-year US and Japanese bonds, which favors the US Dollar against the Japanese Yen.

The Japanese Yen is often seen as a safe-haven investment. This means that in times of market stress, investors are more likely to put their money in the Japanese currency due to its supposed reliability and stability. Turbulent times are likely to strengthen the Yen’s value against other currencies seen as more risky to invest in.

- USD/JPY trades softer to 153.00 after reaching the July 1990 tops on Thursday.

- The US CPI inflation rose more than expected in March, triggering the Fed to delay rate cuts this year.

- The potential FX intervention from the BoJ might provide some support to the JPY.

The USD/JPY pair trades on a weaker note near 153.00 after retreating from the highest level since July 1990, nearly 153.24, on Thursday during the early Asian session. The uptick of the pair is supported by the upbeat US Consumer Price Index (CPI) data for March, which triggered investors to scale back bets on US interest rate cuts this year.

The US CPI inflation rose more than expected in March. The headline CPI figure rose 0.4% MoM in March, compared with the 0.3% increase expected. On a year-on-year basis, the CPI increased 3.5% YoY versus forecasts of a 3.4% rise, the Labor Department reported on Wednesday.

The Core CPI figure, excluding the volatile food and energy components, grew 0.4% MoM in March, compared with expectations of a 0.3% advance. Annually, the figure rose 3.8%, versus the expectation of a 3.7% increase. Following the CPI report, investors lowered their bets that the Federal Reserve (Fed) would cut interest rates in June to 17%, from 57% before the release of the data, according to the CME's FedWatch tool.

Additionally, Minutes of the last Fed meeting suggested that participants were worried about the persistence of elevated inflation and the recent data did not help the US central bank to gain confidence that inflation moved sustainably towards the 2% target. The officials emphasized the need to keep interest rates higher for longer, which boosts the Greenback and acts as a tailwind for the USD/JPY pair.

On the other hand, the Japanese Yen (JPY) has faced some selling pressure near a multi-decade low amid the Bank of Japan's (BoJ) cautious approach and uncertainties for future rate hikes. However, the possibility that the Japanese authorities will intervene in the foreign exchange (FX) market might support the JPY and cap the upside of the pair.

- Australian Dollar faces a significant downturn as US inflation figures outpace forecasts, boosting the US Dollar and Treasury yields.

- Traders adjust Fed rate cut projections based on new inflation insights, with a less aggressive easing strategy anticipated.

- Upcoming economic reports, includes China's inflation data and the US PPI.

The Australian Dollar posted losses of more than 1.50% on Wednesday against the US Dollar following the release of a hotter-than-expected inflation report in the United States (US). Traders have begun to price in fewer rate cuts by the US Federal Reserve, a bullish signal for the Greenback. Therefore, the AUD/USD trades at 0.6511, virtually unchanged, as Thursday’s Asian session commences.

AUD/USD falls sharply to 0.6511, reacting to US CPI data

Mach’s Consumer Price Index (CPI) in the US exceeded estimates of 0.3% MoM in headline and core, with both readings edging a tenth higher at 0.4%. Yearly figures clocked 3.5% YoY in general inflation, crushing February’s data, while core CPI was unchanged at 3.8%. Following the release, US Treasury yields soared, the Greenback rallied, and Wall Street plummeted.

Consequently, interest rate futures traders priced in just two rate cuts, as witnessed by data released by the Chicago Board of Trade (CBOT). The Fed funds rate is projected to end the year at 4.99%.

Later, the March minutes of the Federal Open Market Committee (FOMC) revealed that “almost all participants judged that it would be appropriate to move policy to a less restrictive stance at some point this year if the economy evolved broadly as they expected.”

On the Aussie’s front, the economic schedule remains scarce, though traders will watch China’s March inflation report. In the US, further inflation data will be scrutinized, as the Producer Price Index (PPI) is expected to dip, while the number of Americans filing for unemployment benefits is expected to slow down compared to the previous reading.

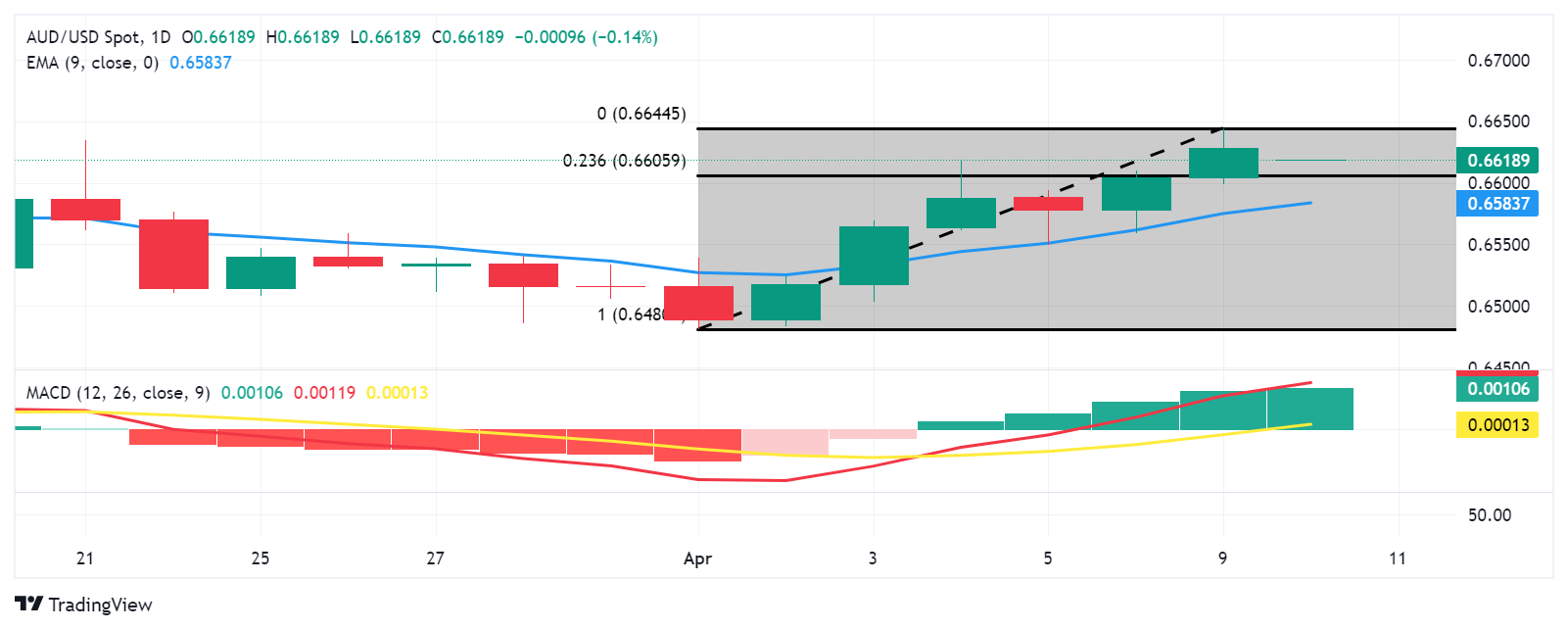

AUD/USD Price Analysis: Technical outlook

From a price action standpoint, the AUD/USD shifted bearish bias and will face first support at the 0.6500 psychological figure. The Relative Strength Index (RSI) turning bearish, along with the break of key support levels, suggests that further downside is seen.

The AUD/USD first support would be the April 1 low of 0.6481, followed by the February 13 swing low at 0.6443. If those two levels are cleared, the pair will be trading at lower levels for the new year-to-date (YTD), with sellers eyeing the 0.6400 figure.

In the event buyers move in and reclaim the 200-DMA at 0.6603, look for a test of the next supply zone at 0.6631.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

- The hourly chart indicators reveal a mounting selling pressure, hinting at a pause in bullish momentum.

- To maintain the current bullish momentum, it's essential for the pair to uphold its standing above the key SMA.

The NZD/JPY pair declined near the 91.33 mark, indicating a battle between optimism favoring a bullish market and mounting bearish pressure. The market trend leans towards the bullish side as the pair stays above critical Simple Moving Averages (SMAs) levels; however, a shift in momentum toward downward forces suggests impending consolidation.

On the daily chart, the Relative Strength Index (RSI) is in positive territory, indicating a mild bullish momentum. Despite a recent decrease, the prevailing trend remains largely positive. The Moving Average Convergence Divergence (MACD) reveals decreasing green bars, also suggesting a slight loss in positive momentum. However, the persisting positive RSI readings indicate that the majority of traders favor the buy side.

NZD/JPY daily chart

In the hourly analysis, the RSI hovers in the oversold territory, indicating strong selling pressure but as the downward movements are overextended an upward corrective move may be possible ahead of the Asian session. In addition, the MACD histogram prints red bars, adding arguments for the negative momentum.

NZD/JPY hourly chart

Inspecting the broader perspective, the NZD/JPY demonstrates a bullish trend with its current standing above the 20,100, and 200-day Simple Moving Averages (SMAs). However, the bears seem to be eyeing the 20-day SMA level of 91.00, which poses a significant turning point. A successful breach below this level could reinforce the arguments for the bears and the pair could see additional downside in the next sessions.

- 'Bearish engulfing' on GBP/JPY suggests growing bearish momentum.

- Break below Tenkan-Sen may lead to more declines, with key supports eyed.

- Resistance at 192.00, recent highs key for reversals; market sentiment watched.

The GBP/JPY retreats late on Wednesday during the North American session and is down 0.27% as the market sentiment shifts sour. Speculation that the Federal Reserve wouldn’t cut rates as expected spurred risk aversion, with traders seeking safety moving to the Japanese Yen, the Greenback, and the Swissie. The cross exchanges hands at 191.82.

GBP/JPY Price Analysis: Technical outlook

The picture shows the formation of a ‘bearish engulfing’ candle pattern, which suggests that bears are gathering momentum. However, to confirm that the GBP/JPY has peaked at around 192.94 as of today, sellers must push prices below the Tenkan-Sen level at 191.49. Once cleared, the next stop would be the Senkou Span A at 191.12, ahead of falling to the Kijun Sen at 190.74.

On the flip side, the GBP/JPY first resistance would be the 192.00 figure, followed by April’s 10 high at 192.95. The next resistance would be the current year-to-date (YTD) high at 193.53.

GBP/JPY Price Action – Daily Chart

An unexpected rise in the US CPI in March propelled the Greenback to yearly highs and kept the risk complex under renewed and strong downside pressure. There was no news from the FOMC Minutes, while the ECB is widely anticipated to leave its policy rates unchanged on Thursday.

Here is what you need to know on Thursday, April 11:

The Greenback rose markedly and pushed the USD Index (DXY) to fresh yearly highs north of the 105.00 barrier. On April 11, Producer Prices will take centre stage, seconded by weekly Initial Jobless Claims. In addition, Fed’s Williams, Collins, and Bostic are all due to speak.

EUR/USD retreated sharply and revisited the 1.0720–1.0730 band, challenging at the same time the area of monthly lows. The ECB meets on April 11 and is seen leaving its monetary conditions unchanged. President Lagarde will also hold her usual press conference after the bank’s decision.

GBP/USD traded well on the defensive and flirted with the 2024 low in the 1.2520 zone. In the UK, GDP prints are expected in the latter part of the week.

The stronger dollar and rising US yields motivated USD/JPY to surge to the boundaries of the 153.00 hurdle. In Japan, weekly Foreign Bond Investment readings are expected on April 10.

AUD/USD collapsed to multi-day lows and put the 0.6500 support to the test on the back of the robust bounce in the greenback. The Consumer inflation expectations are due on April 11.

Shrinking hopes of a ceasefire in the Middle East bolstered the daily uptick in WTI prices despite the unexpected build of US crude oil inventories.

Gold prices retreated from recent record highs on the back of the bid bias in the dollar and rising US yields. The same performance saw Silver prices come under selling pressure after hitting new peaks around $28.50 per ounce.

- US headline and core CPI exceeded expectations, rising to 3.5% and 3.8% respectively in March.

- FOMC minutes from March highlighted uncertainty about the persistence of high inflation and the efficacy of monetary policy.

The EUR/USD pair declined to 1.0739, representing a substantial decline of 1.1%. This decline has occurred following the release of hot inflation figures from the US which fueled hawkish bets on the Federal Reserve (Fed). The Federal Open Market Committee (FOMC) minutes from the March meeting didn’t trigger any reaction.

The US Bureau of Labor Statistics (BLS) revealed on Wednesday that the nation's inflation rate, reflected by the Consumer Price Index (CPI), increased from 3.2% in February to 3.5% in March on an annual basis. This outstripped the predicted market forecast of 3.4%. The yearly core CPI, which omits fluctuating food and energy costs, mirrored February's growth by rising 3.8%. Both the CPI and the core CPI climbed by 0.4% monthly, exceeding analysts' projection of 0.3%. As a reaction, US Treasury yields soared while the odds of a June Rate cut by the Fed declined to over 20%. The mix of hawkish bets as rising yields benefited the USD during the session.

On the other hand, the FOMC Minutes disclosed a general lack of assurance amongst participants concerning the persistence of high inflation rates, with recent data failing to bolster their trust in the economy cooling down and t in the inflation rate steadily reaching the 2% benchmark. With inflation running hot as well as the labor market, officials may change their language and slowly give up on the chances of a June rate cut by the Fed.

EUR/USD technical analysis

On the daily chart, the Relative Strength Index (RSI) fell within negative territory, with the latest reading at 38. This deviation from a positive trend suggests a shift in market dominance towards the sellers. Along with the RSI, the Moving Average Convergence Divergence (MACD) displayed a fresh red bar, indicating negative market momentum.

In the broader outlook, the EUR/USD also exhibits a bearish trend as it is positioned below key Simple Moving Averages (SMAs). SMAs are tools used to smooth out significant price data fluctuations over specific time periods to discern market trends. Specifically, today it fell below the 200-day SMA, typically considered a long-term trend indicator.

- GBP/USD breaches key support levels as it loses more than 1%.

- US headline inflation defies the Fed’s intentions to cut rates and climbs.

- Technical outlook suggest that further GBP/USD downside is seen.

The Pound Sterling collapses late on Wednesday during the North American session, down by more than 1% against the US Dollar, following the release of US inflation data. Expectations for fewer rate cuts by the US Federal Reserve prompted a flight to the Greenback, which reached a new year-to-date (YTD) high via the US Dollar Index (DXY). The GBP/USD trades at 1.2534 after hitting a high of 1.2708.

The major drops below 1.2600, followed by the 200-DMA

The highlight of the day was that inflation in the US remains hotter than expected by the US central bank. The Consumer Price Index (CPI) rose by 0.4% on a monthly basis and 3.5% on an annual basis, exceeding expectations, a rise from the figures reported in the previous month. The core CPI also surpassed forecasts, maintaining a consistent rate of 0.4% MoM and 3.8% YoY in line with February's data.

That prompted investors to expect a less dovish Fed, as shown by Chicago Board of Trade (CBOT) data. December’s 2024 Federal funds rate (FFR) contract suggests that market players estimate the FFR to finish at 4.98%.

Recently, the latest Federal Open Market Committee Minutes revealed that policymakers would like to be more confident that inflation continues to decelerate before committing to ease policy. The minutes highlighted that almost all saw it appropriate to cut this year, though most saw upside risks in inflation.

GBP/USD Price Analysis: Technical outlook

The daily chart, suggests the GBP/USD has shifted neutral to downward biased, breaching key support levels, like the 200-day moving average (DMA) at 1.2585. Once surpassed, the next demand area would be the 1.2500 figure. A further downside is seen at .2448, the November 22 swing low, ahead of 1.2400. In the event of a bullish recovery, the 200-DMA is first resistance, followed by the 1.2600 mark. Once hurdled the GBP/USD, the next resistance would be the 50-DMA at 1.2661.

- Gold drops as US inflation data complicates Fed rate cut intentions.

- Investors rethink Fed's monetary approach amid persistent inflation as they now expect two rate cuts in 2024.

- US real yields rise above 2%, challenging Gold post-CPI release.

Gold price is on the defensive on Wednesday following the release of March inflation figures in the United States (US). The figures witnessed an uptick in monthly and annual readings and might dent the Federal Reserve’s (Fed) intentions of easing policy. Following the data release, US Treasury yields rose, the Greenback climbed, and US real yields overcame the 2% threshold, a headwind for the precious metal.

XAU/USD spot trades at $2,336 after losing 0.66% following the US Consumer Price Index (CPI) release. The US Bureau of Labor Statistics (BLS) announced that March’s CPI was hotter than expected, though unchanged in three of the four inflation readings compared to February’s data. Meanwhile, headline inflation jumped above the annual forecast and the prior month's reading.

Daily digest market movers: Gold loses its shine after hot US CPI report

- US Consumer Price Index (CPI) increased 0.4% monthly and 3.5% annually, surpassing expectations and marking an uptick from the previous month's figures.

- Core CPI, which excludes food and energy, also exceeded forecasts, remaining steady at 0.4% MoM and 3.8% YoY, mirroring February's data.

- Following this, US Treasury bond yields experienced a significant surge, particularly at the short end, with the 2-year Treasury note yield jumping by 20 basis points.

- The US Dollar Index (DXY) also witnessed a substantial increase, soaring over 1% to reach new YTD high of 105.27.

- Data from the Chicago Board of Trade (CBOT) suggests that futures traders expect just two cuts to the fed funds rate as they project the main reference rate to end the year at 4.98%.

- World Gold Consortium reveals that the People’s Bank of China was the largest buyer of the yellow metal in February, increasing its reserves by 12 tonnes to 2,257 tonnes.

Technical analysis: Gold’s advance stalls, prices tumble below $2,350

Gold’s retreat from all-time highs opened the door to form an Evening Star candlestick pattern. However, XAU/USD must close below the April 8 open of $2,329, which would pave the way for a deeper correction.

The XAU/USD first support would be the April 8 daily low of $2,303. Once surpassed, that could put downward pressure on the yellow metal and drive it to March’s 21-session high of $2,222. Further losses are seen at $2,200.

On the other hand, if XAU/USD resumes its rally, buyers are eyeing the $2,350 mark, followed by $2,400.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

- The daily RSI for EUR/JPY reveals a possible reduction in positive market momentum, signifying diminishing buyers' influence.

- The hourly indicators suggest a growing selling pressure.

The EUR/JPY pair is trading at 164.25 and has decreased by 0.30% in Wednesday’s session. Despite being positioned above its key Simple Moving Averages (SMAs), the pair is experiencing a potential shift in momentum from bulls to bears with technical indicators losing traction.

On the daily chart, the Relative Strength Index (RSI) for the pair is positioned in positive territory but points down. This, coupled with the sharp decrease in the green bars of the Moving Average Convergence Divergence (MACD), points to a possible reduction in positive market momentum. It indicates that the influence of buyers is potentially dwindling in the market. As such, the pair may start to cool off.

EUR/JPY daily chart

Zooming in, the hourly RSI value hovers mostly in the oversold region, with the latest value just above 30. Additionally, the MACD histogram on this timeframe presents rising red bars, showcasing an increase in negative momentum. This hints at a rise in sellers' dominance in the market.

EUR/JPY hourly chart

Inspecting the broader outlook, the EUR/JPY demonstrates considerably bullish signals. It stands above the 20-day, 100-day, and 200-day Simple Moving Averages (SMA). Such a position typically signifies a strong and resilient upward trend for both short-term and long-term scenarios. However, today's significant movements must be taken into account. Notably, the pair is challenging the 20-day SMA at the 163.72 mark. If the selling momentum grows and bears conquer the 20-day average, the pair may see further downside.

During the FOMC Minutes, participants expressed general uncertainty about the persistence of elevated inflation and indicated that recent data did not increase their confidence in inflation trending sustainably towards the 2% target.

In addition, officials deliberated over whether the greater risk lies in monetary policy remaining overly restrictive for an extended period or in the Fed easing prematurely and failing to achieve the 2% inflation target.

Some officials continued to argue that significant factors like housing inflation would begin to decelerate, with "several" suggesting that increases in productivity could enable robust economic growth while inflation continued to decline.

However, the minutes reflected a general apprehension regarding the status of the inflation battle, which appeared to be under control at the beginning of the year.

- Strong US CPI figures have sent the Aussie tumbling.

- US CPI accelerated 0.4% in March against expectations of a 0.3% reading. The yearly inflation jumps to 3.5% from 3.2% in the previous month

- AUD/USD is under pressure again, with support levels at 0.6480 and 0.6445 on the bears’ focus

Australian Dollar posted a strong reversal on Wednesday. The higher-than-expected US inflation levels have endorsed the Fed’s “higher for longer” stance, crushing risky assets like the Aussie.

Consumer inflation accelerated in the US in March, with the headline figures accelerating to 0.4%, against expectations of a 0.3% reading. Year-on-year, consumer prices rose at a 3.5% pace from 3.2% in February. The Core inflation accelerated to 0.4% from 0.3% in the previous month, while the yearly rate remained steady at 3.8%.

These levels confirm that the Fed has still some work to do to push inflation towards their 2% target, and practically ditch the markets’ view of three rate cuts in 2024 starting in June.

Later today, the Fed monetary policy minutes will be looked at from a different perspective following the CPI data. On Friday the PPI will add further insight into the inflation picture, although Fed’s Bostic and Williams, both on the hawkish side of the committee, might attract investors’ attention.

The technical picture looks increasingly bearish as the pair is on track to post a strong negative candle today. The 0.6480-0.6500 area might support the pair ahead of the big downside target, 0.6445. Resistances are 0.6550 and 0.6635.

- Silver prices' decline is capped near $27.50 and remains practically flat on the day.

- US CPI endorses Fed's "higher for longer" stance and crushes risk appetite.

- XAG/USD's broader bullish trend remains intact with $28.53 high on the bull's focus

Silver Prices’ (XAG/USD) reversal following stronger-than-expected US inflation data has been contained at the mid-range of the $27.00’s. The metal is regaining some ground as the dust from the US data settles, with the daily chart practically flat.

Consumer prices accelerated unexpectedly in the US in March, with the headline inflation accelerating to 0.4% against expectations of a 0.3% reading, while the yearly rate rose to 3.5% from 3.2% in February. Likewise, the Core inflation accelerated to 0.4% from 0.3% in the previous month, while the yearly rate remained steady at 3.8%.

These figures confirm that price pressures remain stubbornly high at levels well above the Fed’s 2% target rate which has crushed hopes of monetary easing in the coming months.

US Treasury yields skyrocketed after the news, dragging the US Dollar up with them, although the negative impact on precious metals has been limited. Silver, in particular, has retraced most of the ground lost after the release and is trading near the daily opening.

XAU/USD Technical Analysis

The XAU/USD’s broader bullish trend remains intact, with no clear sign of a correction so far except for the bearish divergence in the RSI. Immediate support is at $27.57 and below here, at $26.85. Resistances are $28.53 and the $30,00 psychological level.

XAG/USD 4-hour Chart

- Mexican Peso weakens as higher-than-anticipated US inflation figures might deter Fed from easing policy

- Rising US Treasury yields and a strengthening US Dollar contribute to Peso depreciation.

- USD/MXN's ascent underscores heightened economic vigilance, with traders eyeing potential moves towards the 17.00 mark.

The Mexican Peso depreciated against the US Dollar following the release of an inflation report in the United States (US) on Wednesday. Prices in the largest economy in the world were higher than expected, prompting traders to price in two interest rate cuts instead of three in 2024 from the Federal Reserve (Fed). The USD/MXN trades at 16.50, a new two-day high, and gains 0.78%.

US data was the driver of price action in the USD/MXN pair. The US Bureau of Labor Statistics (BLS) revealed that March’s Consumer Price Index (CPI) was unchanged in three of the four inflation readings, while the headline CPI exceeded estimates and February’s number.

After the data, US Treasury yields rose, the Greenback climbed, and US equities tumbled. The Chicago Board of Trade’s (CBOT) fed funds rate futures have priced in two rate cuts throughout the full year, with December’s contract projecting the Fed will ease policy to 4.95%.

The USD/MXN jumped from around 16.30 and reached a daily high of 16.52 before stabilizing at current exchange rate levels. Therefore, the Mexican Peso remains pressured, and a daily close above 16.50 could pave the way for a correction to 17.00.

Daily digest market movers: Mexican Peso tumbles after US inflation report

- Mexico’s Consumer Price Index (CPI) was lower than estimated as the disinflation process continued. In the same tone, core CPI decelerated on a yearly and monthly basis, justifying the Bank of Mexico's (Banxico) decision to lower rates on March 21. However, not everything was good news for the central bank, as the yearly CPI exceeded estimates.

- Mexico’s CPI rose 0.29% MoM, according to the National Statistics Agency (INEGI). This was lower than the expected 0.36% increase and higher than the 0.09% rise noted in February. Core figures rose by 0.44%, which was lower than the 0.51% that economists had forecast and below the 0.49% increase in February.

- The US Consumer Price Index (CPI) increased 0.4% MoM and 3.5% YoY, exceeding estimates, with annual inflation also punching above the previous month’s number. The underlying CPI, which excludes volatile items like food and energy, was above projections but remained unchanged compared to February’s data at 0.4% MoM and 3.8% YOY.

- US Treasury bond yields skyrocketed, with the short end of the curve, namely the 2-year T-note, climbing 20 basis points.

- The US Dollar Index (DXY) is soaring more than 1%, standing at 105.27, at new year-to-date (YTD) highs.

- Traders are eyeing the release of the Minutes of the latest Fed meeting in March.

Technical analysis: Mexican Peso loses momentum as USD/MXN surges toward 16.50

After diving to a new nine-year low near 16.25, the USD/MXN recovered some ground as the pair aimed above 16.40 and approached the psychological 16.50 area. Once that level is cleared, further upside is seen at last year’s 16.62 mark, followed by the 50-day Simple Moving Average (SMA) at 16.85 and the 100-day SMA at 16.99.

Failure at 16.50 and the USD/MXN could tumble to October’s 2015 low of 16.32 before retesting the year-to-date (YTD) low of 16.25.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- Wall Street indexes plunge as US inflation dampens hopes of Fed rate cuts in June.

- All sectors are trading lower with Real Estate and Utilities the most affected.

- The Dow Jones Index is under increasing bearish pressure below 38,540 with scope to retest 38,035 area.

Equity markets are taking a blow on Wednesday as an unexpectedly strong US inflation report has hammered hopes that the Federal Reserve (Fed) may start lowering borrowing costs in the near term.

US Consumer Prices Index (CPI) accelerated at a 0.4% pace in March, against expectations of a slowdown to 0.3%, while the yearly rate increased to 3.5% from 3.2% in the previous month. These numbers confirm that price pressures remain stubbornly high and ditch the market’s roadmap of three rate cuts in 2024, starting in June.

The risk-averse reaction to CPI data has sent the main US indices tumbling. The Dow Jones leads losses, down 1.27% to 38,383, increasing its distance from March highs near 40,000. The S&P 500 and the NASDAQ index drop 1.13% each to 5,150 and 16,117, respectively.

Dow Jones news

All Wall Street sectors are posting losses on Wednesday. Real Estate is the most affected by higher-for-longer interest rates and falls 4.24%, followed by Utilities, down 2.05%, and Materials, which gives away 1.6%. The least- affected sectors are Energy, only 0.5% lower, and Communication Services with a 0.65% decline.

Home Depot (HD) is leading losses with a 2.88% drop to $351.05, followed by Boeing (BA), 2.75% lower to $173.29, and Intel (INTL), which is losing 2.65% to $38.31. Only Walmart (WMT) is in the green on Wednesday with a 0.7% advance to $60.20.

Dow Jones technical outlook

The Dow Jones index is on track to print a strong bearish candle on the daily chart, confirming the negative trend from the March top, right below 40,000.

The strong reaction to the US inflation data has pushed the Index below the 38,540 support level, with the bearish cross between the 4-hour 50 and 100 Simple Moving Averages (SMAs) giving hope to bears. Below here, the next target is 38,033.

The previous support at the mentioned 38,540 is likely to offer some resistance, and above there, an order block, right below 39,000, will challenge a potential bullish attempt.

Dow Jones Index 4-Hour Chart

Risk sentiment FAQs

In the world of financial jargon the two widely used terms “risk-on” and “risk off'' refer to the level of risk that investors are willing to stomach during the period referenced. In a “risk-on” market, investors are optimistic about the future and more willing to buy risky assets. In a “risk-off” market investors start to ‘play it safe’ because they are worried about the future, and therefore buy less risky assets that are more certain of bringing a return, even if it is relatively modest.

Typically, during periods of “risk-on”, stock markets will rise, most commodities – except Gold – will also gain in value, since they benefit from a positive growth outlook. The currencies of nations that are heavy commodity exporters strengthen because of increased demand, and Cryptocurrencies rise. In a “risk-off” market, Bonds go up – especially major government Bonds – Gold shines, and safe-haven currencies such as the Japanese Yen, Swiss Franc and US Dollar all benefit.

The Australian Dollar (AUD), the Canadian Dollar (CAD), the New Zealand Dollar (NZD) and minor FX like the Ruble (RUB) and the South African Rand (ZAR), all tend to rise in markets that are “risk-on”. This is because the economies of these currencies are heavily reliant on commodity exports for growth, and commodities tend to rise in price during risk-on periods. This is because investors foresee greater demand for raw materials in the future due to heightened economic activity.

The major currencies that tend to rise during periods of “risk-off” are the US Dollar (USD), the Japanese Yen (JPY) and the Swiss Franc (CHF). The US Dollar, because it is the world’s reserve currency, and because in times of crisis investors buy US government debt, which is seen as safe because the largest economy in the world is unlikely to default. The Yen, from increased demand for Japanese government bonds, because a high proportion are held by domestic investors who are unlikely to dump them – even in a crisis. The Swiss Franc, because strict Swiss banking laws offer investors enhanced capital protection.

- Inflation measured by the CPI in the US accelerated in March.

- Following the hot figures, the odds of a rate cut in June plummeted.

- Hawkish bets on Fed, soaring US Treasury yields benefit USD.

The US Dollar Index (DXY) rallied to 105.20, up by nearly 1%, on Wednesday. The Greenback gained strength on hot inflation figures in the US Consumer Price Index (CPI) for March, which made markets start giving up hope for a June rate cut by the Federal Reserve (Fed).

Following a blockbuster labor market report and hot inflation figures for March, Fed officials may start signaling that they require additional evidence of the economy cooling down. In that sense, US Treasury yields may continue rising, which will benefit the USD.

Daily digest market movers: DXY gains strength on rising inflation figures, hawkish Fed bets

- March CPI showed that headline inflation increased to 3.5% YoY in March, up from 3.2% in February and beating the 3.4% expected.

- The Core CPI measurement, excluding volatile food and energy costs, reflected February's increase with an annual rise of 3.8% in March. Both the headline and core CPI experienced a 0.4% MoM rise, beating analyst estimates of 0.3%.

- The odds of a Fed cut in June plummeted to 20%.

- US Treasury bond yields rallied with the 2-year yield at 4.93%, the 5-year yield at 4.56%, and the 10-year yield at 4.51%. All three yields rose more than 2%.

DXY technical analysis: DXY bulls step in and recover ground

The technical indicators on the daily chart reflect that the buyers are gaining momentum. The Relative Strength Index (RSI) is on a positive slope, well within positive territory, which hints at underlying bullish strength. The Moving Average Convergence Divergence (MACD) follows suit with rising green bars, further validating the positive sentiment hovering over DXY.

Focusing on the Simple Moving Averages (SMAs), the DXY continues to be stationed above its 20, 100 and 200-day SMAs. This essentially suggests a higher ground captured by the bulls against the bears and adds weight to an overall positive prospect.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

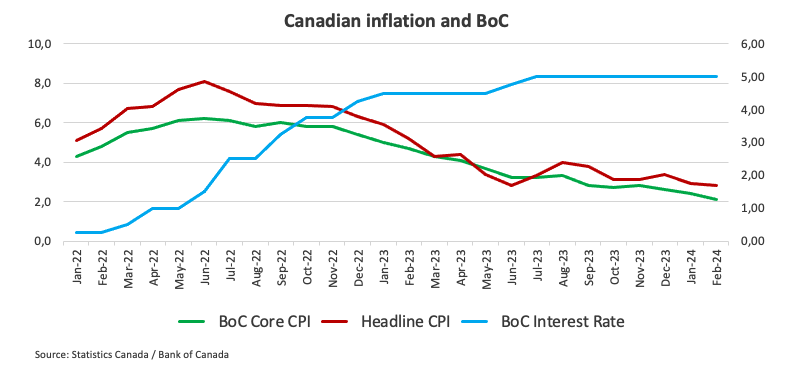

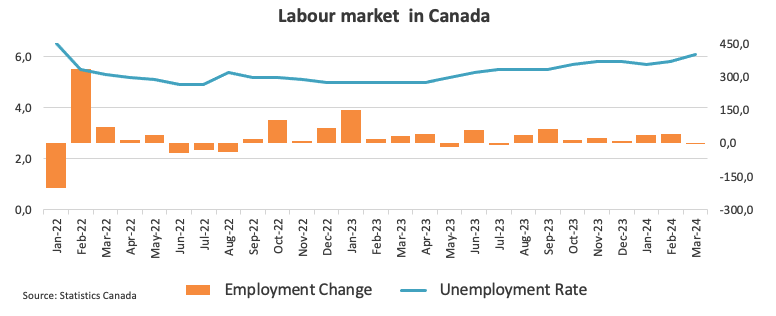

- Canadian Dollar dives as US Dollar rallies after strong US CPI data.

- Bank of Canada keeps rates on hold but hints at rate cut, probably in June.

- Bets on Fed cut in June drop from 50% to 17% following US inflation figures.

The Canadian Dollar (CAD) has tumbled nearly 0.8% in Wednesday’s early North American session to reach the lowest levels this year so far. US Consumer Prices Index (CPI) figures for March confirmed that inflation remains stubbornly high, sending US Treasury yields and the US Dollar to fresh multi-month highs.

Price pressure remains sticky at levels well above the Federal Reserve’s (Fed) 2% core inflation target as last week’s strong employment and steady price growth data suggested. These figures back the Fed’s hawkish side and practically ditch its plan for three rate cuts, which was devised in January. This is expected to underpin the US Dollar in the near term.

In Canada, the Bank of Canada (BoC) kept interest rates unchanged, as widely expected, but noted a downward trend in core inflation. The market has observed those comments as a hint toward a rate cut in June, which has increased downside pressure on the CAD.

Daily digest market movers: USD/CAD rallies as US CPI figures cast doubt on Fed cuts

- Canadian Dollar trades at five-month lows, weighed down by strong US CPI data and dovish-tilted BoC statement.

- US headline inflation rises at 0.4% pace in March against market expectations of 0.3% increase. The YoY rate accelerates to 3.5% from 3.2% in February.

- Core CPI shows similar picture with 0.4% monthly increase, above market consensus of 0.3%, with the yearly rate steady at 3.8%.

- Treasury yields for the US 10-year note reach key 4.5% level for first time this year. The 2-year yield jumped 25 basis points to hit levels right below 5%.

- Bets for Fed cut in June have plunged from about 50% to 17% following the release of US COPI data, according to CME Group FedWatch Tool.

- BoC left interest rates unchanged at 5%, but Governor Macklem revealed that the committee discussed the possibility of cutting rates.

- Later on Wednesday, the minutes of the last Fed meeting will be observed under a new perspective following March’s inflation data.

Canadian Dollar price today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the strongest against the Australian Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.98% | 0.87% | 0.70% | 1.55% | 0.63% | 1.18% | 0.98% | |

| EUR | -1.01% | -0.12% | -0.25% | 0.57% | -0.34% | 0.23% | -0.02% | |

| GBP | -0.85% | 0.10% | -0.12% | 0.69% | -0.24% | 0.31% | 0.12% | |

| CAD | -0.72% | 0.24% | 0.15% | 0.81% | -0.09% | 0.48% | 0.22% | |

| AUD | -1.58% | -0.57% | -0.65% | -0.84% | -0.91% | -0.34% | -0.58% | |

| JPY | -0.63% | 0.35% | 0.25% | 0.05% | 0.93% | 0.59% | 0.35% | |

| NZD | -1.19% | -0.24% | -0.37% | -0.46% | 0.33% | -0.61% | -0.24% | |

| CHF | -0.99% | 0.03% | -0.09% | -0.27% | 0.59% | -0.32% | 0.24% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Technical analysis: USD/CAD breaks above channel top, next resistance at 1.3740

The US Dollar has broken above the last two months’ channel top as the strong US inflation data dampened hopes of a rate cut in June. Bulls have taken control, sending the pair to levels near 1.3700 so far.

The Relative Strength Index (RSI) is nearing overbought levels, which may lead to some correction. In that case, the reverse trendline might provide support on the path toward the 78.6% Fibonacci retracement at 1.3740 and 1.3770. The measured target of the broken channel is the mid-November high at 1.3845. Supports are the mentioned channel top, at 1.3650 and 1.3545.

USD/CAD 4-Hour Chart

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

Tiff Macklem, Governor of the Bank of Canada (BoC), explains the BoC decision to leave the interest rate unchanged at 5% after the April policy meeting and responds to questions from the press.

Key quotes

"We did discuss when to reduce rates, there was clear consensus to hold it at 5%."

"There is some diversity of views in the Governing Council as to when we're going to see what we're looking for."

"Overall, C$ has been reasonably stable, if it does move we'll take that into account."

"Gas prices tend to go up and down. So that's one reason why we're particularly focused on core inflation."

Market reaction

USD/CAD clings to strong gains following these comments and was last seen trading at 1.3675, rising 0.75% on the day.

- USD/CAD pulls back after the BoC strikes a dovish tone in its policy statement.

- BoC sees signs of inflation easing accompanied by higher growth.

- USD/CAD continues broadly rising within a strict ascending channel.

USD/CAD has pulled back about two tenths of a percentage point on Wednesday, following the Bank of Canada’s (BoC) decision to leave its key overnight interest rate unchanged at 5.0%, in line with analysts’ expectations.

The pair is trading in the 1.3660s at the time of writing, maintaining its overall bullish tone after the US Dollar rallied following the release of hotter-than-expected US Consumer Price Index data for March.

USD/CAD is in a rising channel which is forecast to continue evolving higher in the absence of evidence to the contrary.

USD/CAD 4-hour Chart

Policy Announcement

In the accompanying statement to its meeting, the BoC said that it would continue with quantitative tightening and had noticed signs of inflation easing.

“Governing Council decided to hold the policy rate at 5% and to continue to normalize the Bank’s balance sheet. While inflation is still too high and risks remain, CPI and core inflation have eased further in recent months.

Although core inflation has eased, the BoC said “shelter price inflation is still very elevated, driven by growth in rent and mortgage interest costs.”

According to the statement, the BoC expects inflation to fall to its (2.0%) target in 2025.

“..3-month annualized rates are suggesting downward momentum. The Bank expects CPI inflation to be close to 3% during the first half of this year, to move below 2½% in the second half, and reach the 2% inflation target in 2025,” said the BoC.

The Bank added that “The Council will be looking for evidence that this downward momentum is sustained.”

In particular it would be paying close attention to, “the evolution of core inflation.. the balance between demand and supply in the economy, inflation expectations, wage growth, and corporate pricing behavior,” the statement added.

Higher growth from population increase

The BoC expects higher growth in Canada compared to its January forecasts.

“Overall, the Bank forecasts GDP growth of 1.5% in 2024, 2.2% in 2025, and 1.9% in 2026,” it said in its statement.

In the accompanying Policy Report, the BoC stated it had revised up its forecasts for growth and revised down its forecasts for inflation in Canada (as well as the US and the world).

“The outlook for growth in Canada has been revised up, and inflationary pressures have been easing somewhat faster than anticipated in the January Report,” said the BoC in its Monthly Report.

The BoC forecasts real GDP to grow by 2.1% year-over-year in 2024 compared to a prior forecast of 1.6%. It expected much higher growth of 1.0% YoY in Q1 of 2024 compared to 0.2% in the January report.

It forecasts CPI inflation at 2.2% YoY in 2024 compared to the 2.4% forecast in its January report. It still sees inflation at 2.1% in 2025.

The BoC said the higher growth was as a result of increased population growth due to immigration.

“Growth in consumption spending is stronger over the near term largely because of higher population growth,” said the report.

In addition, export growth had been boosted by “higher foreign demand” and “new fiscal measures announced in provincial budgets.”

The BoC said it had revised down CPI inflation forecasts by 0.2% in 2024 but left it roughly unchanged in 2025.

Inflation in goods excluding food, communications and energy had all been lower than expected.

Tiff Macklem, Governor of the Bank of Canada (BoC), and Senior Deputy Governor Carolyn Rogers explain the BoC decision to leave the interest rate unchanged at 5% after the April policy meeting and respond to questions from the press.

Key quotes

"June rate cut is within the realm of possibilities."

"Decline we've seen in momentum is very recent."

"With gasoline prices rising, CPI is likely to remain around 3% in the coming months."

"BoC is increasingly confident that inflation will continue to come down gradually even as economic activity strengthens."

"We expect core inflation to continue to ease gradually."

"Shelter cost inflation is still very high and some other services remain persistently high."

Market reaction

USD/CAD preserves its bullish momentum and was last seen trading at its highest level since November at 1.3670, rising 0.72% on a daily basis.

- USD/JPY ascends following a US inflation report indicating reacceleration, challenging levels that might prompt intervention.

- Rising inflation figures push Treasury yields higher and boost the US Dollar.

- Market anticipates future Fed actions with keen interest in upcoming monetary policy minutes.

The USD/JPY rallied to an almost 34-year high after a hotter-than-expected inflation report in the United States (US) sent US Treasury yields soaring. Consequently, the major climbed past the 152.00 figure, seen as a level that could trigger intervention, which so-far hasn’t happened. At the time of writing, the pair trades at 152.70, gains 0.90%.

The pair advances to 152.70, as US CPI data prompts a sharp yield increase, fueling speculation about Fed's rate path–

US economic data revealed by the Bureau of Labor Statistics (BLS) showed that inflation is reaccelerating. The Consumer Price Index (CPI) rose by 0.4% MoM and 3.5% on the yearly figure, exceeding estimates, with the latter also the previous reading. Underlying CPI, which excludes volatile items like food and energy, was above projections but remained unchanged compared to February’s data at 0.4% MoM and 3.8% YoY.

That triggered a reaction in the financial markets, as US Treasury bond yields skyrocketed, with the short end of the curve, namely the 2-year T-note, climbing 20 basis points. Consequently, the Greenback refreshed the year-to-date (YTD) highs of 105.10 yet retreated somewhat, as shown by the US Dollar Index (DXY). The DXY is up 0.81%, at 104.95.

Following the inflation report, the Chicago Board of Trade (CBOT) Fed funds futures estimate just two rate cuts by December 2024, with speculators projecting interest rates to end at around 4.97%.

The USD/JPY rose sharply and hit a multi-year high of 152.73, a level last seen in June 1990, ignoring intervention threats by Japanese authorities that include Finance Minister Shunichi Suzuki, who said that he was watching the market with a high sense of urgency and wouldn’t rule out any steps to address excessive moves.

Ahead in the calendar, market players are eyeing the latest Federal Reserve monetary policy minutes' release.

USD/JPY Price Analysis: Technical outlook

From a technical standpoint, the USD/JPY is trading at levels that were seen in the 1990s. With the major extending its gains past 152.00, that exposes as the next resistance level, the June 1990 highest peak at 155.78, followed by the 1990’s high at 160.32. On the flip side, the first support would be the psychological 152.00 level, followed by the Tenkan-Sen at 151.77 and the April 5 low of 150.81.

- Silver price plummets to $27.85 as speculation for Fed pivoting to rate cuts erode.

- Hot US inflation data dent Fed rate cut prospects for June.

- Uncertainty over Fed’s three rate cut projections by the year-end deepens.

Siver price (XAG/USD) retreats from fresh two-year high of $28.36 after the United States Bureau of Labor Statistics (BLS) reported that the consumer price inflation turns out sticky. Hot inflation figures combined with strong payroll data for March have dented market expectations for the Federal Reserve (Fed) to begin lowering interest rates from the June meeting.

The annual headline Consumer Price Index (CPI) accelerated to 3.5% from expectations of 3.4% and the prior reading of 3.2%. Annual core inflation that excludes volatile food and energy prices rose steadily by 3.8%. Economists expected the most sought-after inflation measure to decelerate to 3.7%.

Fed policymakers have been reiterating that it is not appropriate to reduce interest rates until they get convinced that inflation will return sustainably to the 2% target. For inflation to return to 2%, the monthly inflation should increase at a pace of 0.17%. In March, both headline and core CPI rose steadily by 0.4% against expectations of 0.3%.

Going forward, traders are expected to shift their bets for the Fed beginning to reduce interest rates in the third quarter this year. Stubbornly higher inflation is expected to deepen uncertainty over three rate cut projections for this year as anticipated by Fed policymakers in the latest dot plot.

Hot CPI figures have led to a sharp increase in yields on interest-bearing assets, such as US bonds. 10-year US Treasury yields have risen to 4.48%. The US Dollar Index (DXY) rallies to the crucial resistance of 105.00.

Silver technical analysis

Silver price delivers a stalwart rally after a breakout of the Ascending Triangle chart pattern formed on a daily timeframe. The strength of the breakout will be tested if the white metal corrects to the horizontal resistance of the above-mentioned chart pattern plotted from 14 April 2023 high at $26.09. Upward-sloping 20-day Exponential Moving Average (EMA) at $26.00 suggests that the near-term demand remains upbeat.

The 14-period Relative Strength Index (RSI) drops after reaching 76.00, indicating that oscillators are cooling after turning extremely overbought.

Silver daily chart

- The Fed will release the minutes of the March policy meeting on Wednesday.

- Jerome Powell and co’s discussions surrounding the policy pivot will be scrutinized.

- Markets see a nearly 50% probability of another Fed policy hold in June.

The Federal Reserve (Fed) will release the minutes of the March policy meeting on Wednesday. Investors will pay close attention to comments regarding the inflation outlook and the possible timing of a policy pivot.

Fed faces a tough policy decision in June

The Fed left unchanged its monetary policy settings following the March 19-20 policy meeting as expected. The revised Summary of Economic Projections, also known as the dot plot, showed that policymakers were still projecting a total of 75 basis points (bps) reduction in the policy rate in 2024.

In the post-meeting press conference, Federal Reserve Chairman Jerome Powell repeated that they need “greater confidence” of inflation moving toward the 2% target in a sustainable way before starting to cut interest rates. Although markets saw a strong probability of a policy pivot in June, hawkish comments from Fed officials since the March meeting and the impressive labor market data caused investors to reassess the rate outlook.

Atlanta Fed President Raphael Bostic noted that he was expecting the US central bank to lower the policy rate once this year, most likely in the last quarter. On another note, “I believe it’s much too soon to think about cutting interest rates,” Dallas Fed President Lorie Logan said, citing upside risks to inflation. Additionally, Minneapolis Fed President Neel Kashkari said that he pencilled in two interest rate cuts this year and added: "If we continue to see inflation moving sideways, then that would make me question whether we need to do those rate cuts at all."

Meanwhile, the US Bureau of Labor Statistics (BLS) reported that Nonfarm Payrolls rose 303,000 in March, beating the market expectation for an increase of 200,000 and highlighting the persistent strength of the labor market.

Following the hawkish Fed commentary and March jobs report, the probability of a June rate cut declined toward 50% from above-60% earlier in the week, according to the CME FedWatch Tool.

Previewing the March Federal Open Market Committee (FOMC) Minutes “the FOMC opted again for patience at its March meeting as it continues to look for evidence that provides ‘greater confidence’ around inflation moderation. Fed officials also stuck with their median projection of 3 rate cuts for this year, despite upgrading most macro projections for 2024,” TD Securities analysts said in a note. “Debates about the short-term policy outlook and QT tapering will garner most attention,” they added.

When will FOMC Minutes be released and how could it affect the US Dollar?

The Fed will release the minutes of the March policy meeting at 18:00 GMT on Wednesday. Although investors are likely to pay close attention to this publication, its impact on the USD’s valuation could remain limited because the BLS will release the Consumer Price Index (CPI) data for March earlier in the day, which is likely to have a more significant effect on the market pricing of the Fed’s policy outlook.

Nevertheless, in case the FOMC Minutes show that some policymakers remain optimistic about the inflation outlook and still favor a rate cut in June regardless of the stronger-than-expected CPI data for January and February, the USD could face some bearish pressure. On the other hand, the USD is likely to gather strength against its rivals with the immediate reaction if the publication suggests that officials are likely to delay a rate cut as long as labor market conditions remain tight.

Eren Sengezer, European Session Lead Analyst, shares a brief technical outlook for the USD Index:

“The 200-day Simple Moving Average (SMA) aligns as key support for the USD Index (DXY) at 103.80. In case the index falls below that level and starts using it as resistance, 103.40 (100-day SMA) could be seen as next support before 102.35 (March 8 low). On the upside, the Fibonacci 61.8% retracement of the October-December downtrend aligns as first resistance at 104.70 before 105.00 (static level) and 105.80 (Fibonacci 78.6% retracement).”

Economic Indicator

FOMC Minutes

FOMC stands for The Federal Open Market Committee that organizes 8 meetings in a year and reviews economic and financial conditions, determines the appropriate stance of monetary policy and assesses the risks to its long-run goals of price stability and sustainable economic growth. FOMC Minutes are released by the Board of Governors of the Federal Reserve and are a clear guide to the future US interest rate policy.

Read more.Last release: Wed Feb 21, 2024 19:00

Frequency: Irregular

Actual: -

Consensus: -

Previous: -

Source: Federal Reserve

Minutes of the Federal Open Market Committee (FOMC) is usually published three weeks after the day of the policy decision. Investors look for clues regarding the policy outlook in this publication alongside the vote split. A bullish tone is likely to provide a boost to the greenback while a dovish stance is seen as USD-negative. It needs to be noted that the market reaction to FOMC Minutes could be delayed as news outlets don’t have access to the publication before the release, unlike the FOMC’s Policy Statement.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

- AUD/USD has entered into a sideways range on the short-term charts.

- The pair has just formed a bearish candlestick at the range highs and is looking poised to weaken.

- A move back down is possible towards the range lows at 0.6420.

AUD/USD is trading in the 0.6620s on Wednesday, ahead of key US data. The pair has entered a sideways trend on the 4-hour chart which is used to assess the direction of the short-term trend.

AUD/USD 4-hour Chart

At the beginning of April price touched the bottom of the range low at 0.6480 and bounced. After that it started climbing back up to the top of the range.

On Tuesday AUD/USD formed a bearish Shooting Star candlestick pattern at the top of the range in the 0.6640s. Although the following bar was green and therefore did not confirm the Shooting Star, it was nevertheless a negative sign. The pair has since been trading sideways in the 0.6620s.

Given AUD/USD has been rejected at the range high and formed a bearish candlestick pattern at the same time, there is a risk of a reversal, and the price starting to move back down towards the range lows again, continuing the sideways trend.

Both the Moving Average Convergence Divergence (MACD) and Relative Strength Index (RSI) momentum indicators are showing bearish divergence at the April 4 and April 9 peaks. Whereas price rose up and made a higher high between that period, both indicators failed to follow suit, indicating weakness.

RSI has just exited the overbought region which is a further bearish sign. It recommends short-term bullish traders close their long bets and open short positions.

A break below 0.6495 would help provide confirmatory evidence of a new move lower within the range, with a possible target back down at the 0.6420 range lows.

The cluster of major Moving Averages are likely to provide support at around 0.6450, and could slow the pace of the sell-off.

A break above the April high at 0.6645 would negate the bearish view and could indicate a breakout, with an initial target at the 0.6668 March highs.

- The US Dollar trades flat at 104.00, with stakes being high for the Greenback ahead of the release of the March inflation data.

- Traders see this US CPI print for March as key to gauge the chances of a Fed policy pivot this year.

- The US Dollar Index orbits around 104.00 and could move substantially in either direction.

The US Dollar (USD) trades broadly unchanged on Wednesday as the Greenback faces one of its most crucial moments of 2024 so far. With the release of the US Consumer Price Index (CPI) data for March, markets will finally get some idea on whether the US Federal Reserve (Fed) is right on the money or is facing one of its biggest policy mistakes in decades. Whatever the outcome, this is the only moment ahead of the US presidential elections for the US Dollar Index to finally snap out of that 5% range which is keeping the DXY chained for 2024 thus far.

Some additional insights reveal that markets are tilted to a decline, which fits with the narrative in the CME Fedwatch Tool, which points that markets are still pricing in a few interest-rate cuts this year. Headline monthly inflation is expected to fall to 0.3% in March from 0.4% in February, with the survey ranging between 0.5% on the upside and 0.2% on the downside. Core monthly inflation is also expected to come in at 0.3% from 0.4%, with the topside expectation at 0.4% and the downside at 0.2%. Any print below the lowest expectation could see ample US Dollar weakness, while any figure above the highest expectation will mean a repricing in the number of rate cuts, likely leading to substantial US Dollar strength.

Daily digest market movers: The end of low volatility

- At 11:00 GMT, this eventful Wednesday will kick off with the Mortgage Bankers Association (MBA) numbers. The MBA Mortgage Applications for the week ending on April 5 will be released. The previous reading for the week ending on March 29 was at -0.6%. No forecast is available.

- At 12:30 GMT, the US Consumer Price Index for March will be released:

- Monthly headline inflation is expected to fall to 0.3% against 0.4% in February.

- Yearly headline inflation is seen accelerating to 3.4% from 3.2%.

- Monthly core inflation is expected to slow to 0.3% from 0.4%.

- Yearly core inflation is expected to come down to 3.7% from 3.8%.

- At 14:00 GMT, Wholesale Inventories data for February will be released, with a steady 0.5% increase expected.

- Federal Reserve Bank of Chicago President Austan Goolsbee will be speaking around 16:45 GMT.

- The Federal Open Market Committee (FOMC) will release its recent March meeting Minutes around 18:00 GMT. Traders will be looking for clues or clearer evidence for the timing of when the Fed will start cutting its interest rates.

- Asian equities are very much dispersed with only the Chinese Hang Seng Index being up near 2%. All other Asian indices are in the red. European and US equities are mildly in the green ahead of US inflation release.

- According to the CME Group’s FedWatch Tool, expectations for the Fed’s May 1 meeting are at 97.4% for keeping the fed funds rate unchanged, while chances of a rate cut are at 2.6%.

- The benchmark 10-year US Treasury Note trades around 4.36%, which is lower ahead of US inflation.

US Dollar Index Technical Analysis: This is it, the moment markets have been waiting for

The US Dollar Index (DXY) has been consolidating since the first days of 2024. Although the trading range looks to be around 5% from the beginning of this year, it has been even limited to only 3% most of the time. Volatility is nowhere and short-lived, if any, so this US CPI print on Wednesday is crucial as it could be the last possible data point confirming if the Fed is good to start reducing borrowing costs in June, or might not cut rates until after summer or not at all for 2024.

The first pivotal level for the DXY comes in at 104.60, which was broken last week on Wednesday to the downside, though broken up again from below on Friday. Further up, 105.12 is the key point after the DXY failed to break that level last week. Once above those levels, 105.88 is the last resistance point before the Relative Strength Index (RSI) enters overbought levels.

Support from the 200-day Simple Moving Average (SMA) at 103.81, the 100-day SMA at 103.43, and the 55-day SMA at 103.90 showed their importance last week on Wednesday. Further down, the 103.00 big figure looks to remain unchallenged for longer with ample support thus standing in the way.

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

- NZD/USD marches toward 0.6100 as RBNZ’s hawkish interest rate outlook strengthens the Kiwi dollar.

- The RBNZ kept its OCR steady at 5.5% for the sixth time in a row.

- Investors await the US Inflation data that will influence expectations for Fed pivoting to rate cuts.

The NZD/USD pair advances toward the round-level resistance of 0.6100. The Kiwi asset exhibited strength in Wednesday’s European session as the Reserve Bank of New Zealand (RBNZ) delivered hawkish guidance after keeping its Official Cash Rate (OCR) unchanged at 5.50%.

The RBNZ hold its OCR steady at 5.50% for the sixth time in a row. The RBNZ commented that the monetary policy will remain restrictive to maintain downward pressure on inflationary pressures. The New Zealand economy is going through a rough phase as it remained in a technical recession in the second-half of 2023. Though the RBNZ needs to make a balance as annual inflation at 4.7% is significantly higher than the desired range between 1% and 3%.