- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 10-04-2022

- EUR/JPY bulls taking on the bears at key H4 resistance.

- Daily accumulation could be in play and a trend continuation could be on the cards.

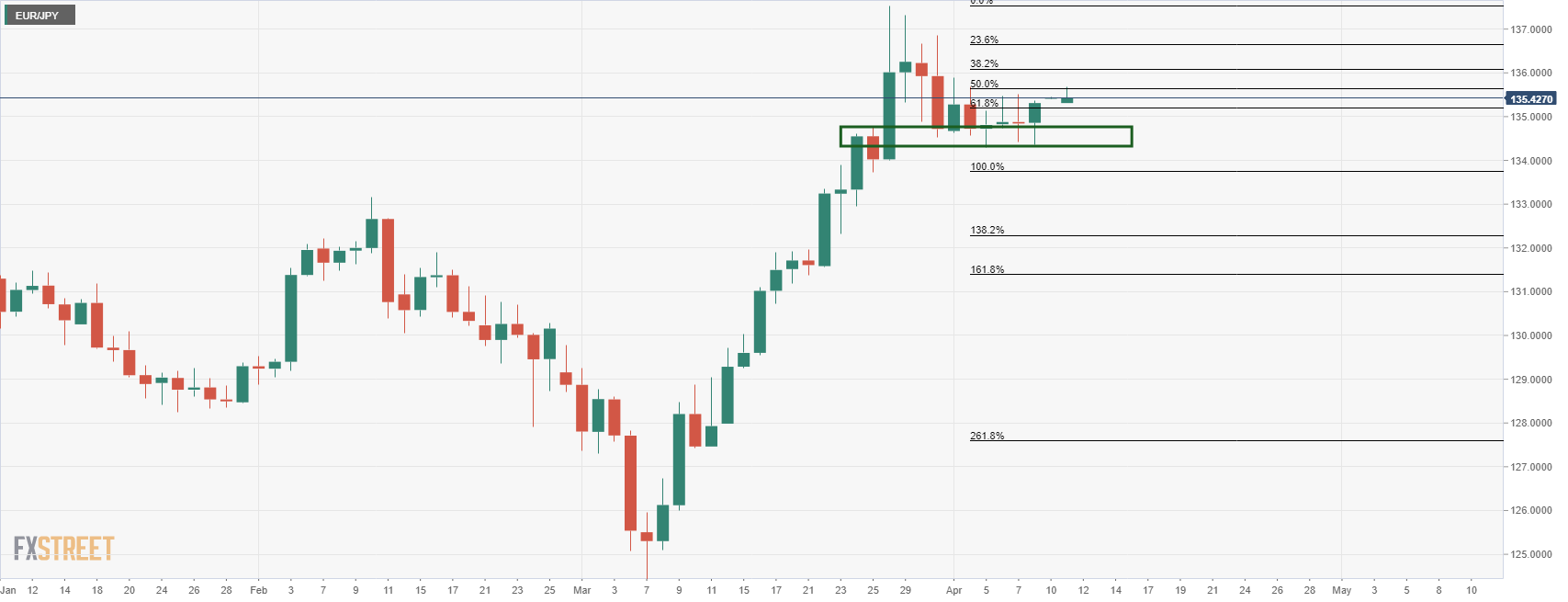

EUR/JPY is attempting to make a break for the topside and is climbing its way out of daily support following a corrective stage which could turn out to be a phase of reaccumulation. The following illustrates the market structure from a daily and 4-hour perspective:

EUR/JPY daily chart

The price made a deep correction from the daily highs and has spent a number of days in consolidation. However, the bullish price action, while encouraging, could be short-lived unless the bulls can crack the 4-hour resistance.

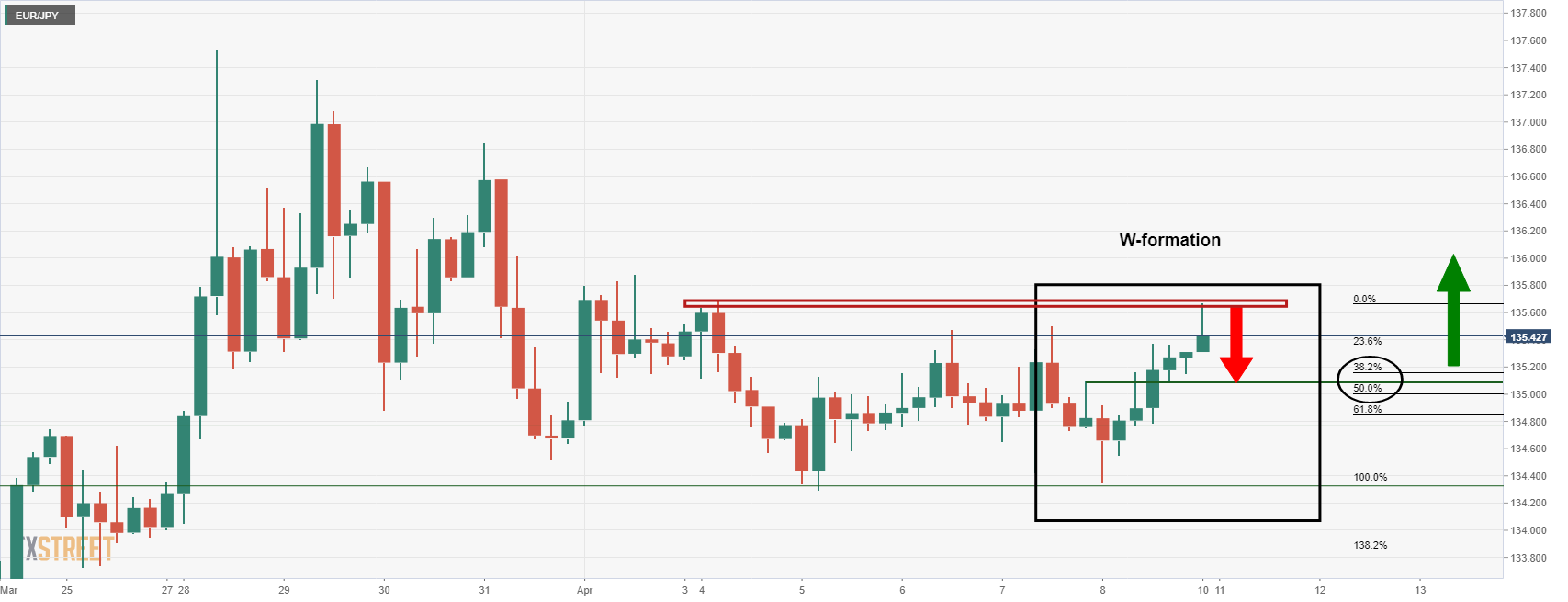

EUR/JPY H4 chart

EUR/JPY is meeting resistance near 135.50/60. The W-formation is a bearish feature as well, with the price expected to revisit the neckline of the pattern. Should this hold, then the bulls might be encouraged to move in at a discount with a view to taking on the bearish commitments again at resistance.

- USD/JPY is eyeing to reclaim a six-year high at 125.10 as investors await BOJ’s Kuroda speech.

- The DXY is uncertain ahead of the US CPI numbers, which are due on Tuesday.

- A bearish gap open has been capitalized by the market participants as a potential buying opportunity.

The USD/JPY pair is advancing towards the six-year high at 125.10, which was printed in March. The pair is driving higher sharply after a bearish gap opening on Monday. The asset is elevating sharply in early Tokyo, which resembles a bullish open-drive session going forward. A bullish open-drive session indicates optimism toward the asset by the market participants, right from the first auction of a trading session.

USD/JPY is following the footprints of the US dollar index (DXY) as the latter also has a bearish gap down opening and is looking to reclaim the psychological figure of 100.00. The reason behind the volatile move of the mighty greenback is the uncertainty over the US consumer Price Index (CPI), which will be reported by the US Bureau of Labor Statistics on Tuesday. Market estimates are on the higher side at 8.3%, which are indicating that the Federal Reserve (Fed) will adopt a tight policy environment along with a swift balance sheet reduction to contain the inflation mess.

Meanwhile, the speech from the Bank of Japan (BOJ)’s Governor Haruhiko Kuroda will be the major event on Monday, which will dictate the likely monetary policy action by the BOJ on April 28. It is worth noting that the BOJ kept its monetary policy unchanged in March amid lower inflation in Japan.

- GBP/USD has spiked from 1.3000 amid positive cues on the Russia-Ukraine peace talks.

- A bearish open gap by the DXY below 100.00 has underpinned the pound.

- UK’s Industrial Production and Manufacturing Production will remain the major events on Monday.

The GBP/USD pair has attracted some significant bids to nearly 1.3000 amid optimism over a ceasefire between Russia and Ukraine. The comments from the Kremlin on Friday that Russia's special operation in Ukraine could be completed in foreseeable future given aims are being achieved and work is being carried out by the military and peace negotiators," as per Reuters have triggered a sense of optimism in the cable.

After Moscow ceases to be a member of the United Nations (UN) Human Rights Council, a sense of isolation in Russia is elevating fears of financial instability for a prolonged period in their region. 93 out of 175 members of the UN Human Rights Council favored the removal of Russia from the membership after Ukraine President Volodymyr Zelenskyy accused Russia of war crimes in the largest part of Kyiv. This has also exerted pressure on those countries to remain hawkish towards Russia, which chose a neutral stance on the latter.

Meanwhile, the US dollar index (DXY) has displayed a bearish open on Monday amid positive market sentiment. The DXY has tumbled below the psychological figure of 100.00 and is likely to be gripped in volatility ahead of the US Consumer Price Index (CPI), which will release on Tuesday. The street is estimating a print of 8.3% against the prior figure of 7.9%. This may elevate the expectation of a 50 basis point (bps) interest rate decision by the Federal Reserve (Fed).

While the UK’s docket will report Industrial Production and Manufacturing Production on Monday. The yearly Industrial Production and Manufacturing Production are likely to land at 1.4% and 2.5% respectively.

- EUR/GBP is back into the 0.8350s following a fade of the opening gap.

- French elections have been in focus, Macron leads.

EUR/GBP is 0.16% higher on the day so far after running up to test 0.8373 at the start of the day due to the market's favouritism towards the incumbent French President Emmanuel Macron who is leading in the polls of the presidential elections.

- French elections: Macron leads 54% to le Pen 46%, EUR likes it

''I'm ready to invent something new to gather diverse convictions and views in order to build with them a joint action," he said. He vowed to "implement the project of progress, of French and European openness and independence we have advocated for."

Meanwhile, as the dust settles, the focus will switch back to monetary policy at the European Central Bank that meets on 14 April.

''We expect a dramatic shift from the ECB, with the announcement of an early end to QE (in May) and setting the groundwork (but not quite committing to) a June hike via a change to its forward guidance (yet again),'' analysts at TD Securities said. ''Inflation has jumped well above where the ECB thought it would be just one month ago, and the ECB has said it would adjust the APP to reflect major shocks.''

As for the pound, it can draw support from the OIS pricing that continues to embed 5+ rate hikes by the end of this year by the Bank of England. However, the Deputy Governor, Jon Cunliffe, remains at the dovish end of the spectrum and recently said that “while I recognize the risk of second-round effects and that further tightening of monetary policy might be necessary, I am not at present convinced that we will inevitably have to lean heavily and constantly against an embedding of an inflationary psychology as we progress through this challenging period and as the impact of higher commodity prices on real household incomes depresses activity.” Nevertheless, he was the lone dissent last month in favour of steady rates so his comments shouldn't be too surprising.

- XAU/USD is marching towards $1,960.00 as DXY has slipped amid uncertainty over the release of the US CPI.

- Fed’s Mester stated that inflation will remain at elevated levels even next year.

- Moscow’s positive comments on the Russia-Ukraine peace may underpin the risk-on impulse going forward.

Gold (XAU/USD) is firmly advancing towards $1,960.00 as the US dollar index (DXY) has failed to sustain above the psychological resistance of 100.00. The latter has witnessed a bearish gap open on Monday ahead of the rising uncertainty over the release of the US Consumer Price Index (CPI) on Tuesday.

A preliminary reading of the US CPI at 8.3% indicates that the Federal Reserve (Fed) will paddle the interest rate decision in May’s monetary policy to contain the inflation. Apart from that, the balance sheet reduction will also be driven faster to restrict liquidity in the economy. In an interview on CBS’s Face the Nation on Sunday, Cleveland Fed President Loretta Mester cited that Inflation will remain high this year and next even as the Fed moves steadily to lower the pace of price increases. This indicates that a tight policy environment is here to stay more than usual.

Meanwhile, the market sentiment is likely to turn positive amid de-escalation in the Russia-Ukraine war. Moscow’s spokesperson on Friday stated that "Russia's special operation in Ukraine could be completed in foreseeable future given aims are being achieved and work is being carried out by the military and peace negotiators," as per Reuters.

Gold Technical Analysis

On an hourly scale, XAU/USD is on the verge of exploding the consolidation, which is placed in a narrow range of $1,915.50-1,950.00. The 20- and 200-period Exponential Moving Averages (EMAs) at $1,940.00 and $1,931.45 respectively are scaling higher, which adds to the upside filters. The Relative Strength Index (RSI) (14) has shifted into a bullish range of 60.00-80.00, which indicates more upside ahead.

Gold hourly chart

-637852270384179810.png)

- EUR/USD is on the front foot to start the week, testing 1.09 territories.

- The French elections have kicked started bulls into gear.

- French President Emmanuel Macron is leading in the polls of the last round of the presidential elections.

EUR/USD is testing the 1.09 area at the start of the week following a recovery from the lows on Friday near 1.0840. The price rallied to a high of 1.0919 in the open as markets are relieved that the incumbent French President Emmanuel Macron is leading in the polls of the presidential elections.

-

French elections: Macron leads 54% to le Pen 46%, EUR likes it

''I'm ready to invent something new to gather diverse convictions and views in order to build with them a joint action," he said. He vowed to "implement the project of progress, of French and European openness and independence we have advocated for."

Meanwhile, the US dollar index on Friday posted its largest weekly percentage gain in a month. The focus has been on a more aggressive pace of Federal Reserve tightening to curb soaring inflation which is taking a momentary backseat to the elections on Monday.

The index had advanced to 100 for the first time in nearly two years, reaching as high as 100.19, the best level since May 2020. It was last little changed on the day at 99.822, and up 1.3% on the week, although the news of the election has sent the index on the back foot to 99.62 the lows for today so far.

Looking ahead for the week, the European Central Bank will be in focus.'' We expect a dramatic shift from the ECB, with the announcement of an early end to QE (in May) and setting the groundwork (but not quite committing to) a June hike via a change to its forward guidance (yet again),'' analysts at TD Securities explained.

''Inflation has jumped well above where the ECB thought it would be just one month ago, and the ECB has said it would adjust the APP to reflect major shocks.''

Emmanuel Macron and Marine Le Pen face each other in the final round of the French presidential election and the latest poll, Ipsos, has macron leading 54% to Le pen 46%.

The euro is bid on the proposed outcome, trading 0.25% in the open. Official results of the election are expected later that will decide whether Mr Macron stays in the Elysee for a second five-year term.

The incumbent has been calling on those from both the mainstream left and right to vote for him.

"I want to reach out to all those who want to work for France. I'm ready to invent something new to gather diverse convictions and views in order to build with them a joint action," he said.

He vowed to "implement the project of progress, of French and European openness and independence we have advocated for."

EUR/USD 15 min chart

- AUD/USD sees more downside to near 0.7400 on the Fed's expectation of a tight interest rate decision.

- A preliminary estimate for the US CPI at 8.3% may further raise bets on Fed’s tightening policy.

- The greenback bulls have been underpinned after the RBA kept monetary policy unchanged.

The AUD/USD pair has sensed a short-lived rebound at 0.7428 but is likely to extend losses to near 0.7400 amid elevation in expectation of an aggressive tight monetary policy by the Federal Reserve (Fed) next month.

Rising inflation and a tight labor market in the US economy are aiming for a healthy interest rate hike by the Fed in May’s monetary policy. The US Unemployment Rate has fallen to 3.6% and is been printing below 4% consistently for the last three months, which is indicating an achievement of full employment levels. While the US Consumer Price Index (CPI) will release on Tuesday. A preliminary estimate for the yearly US CPI at 8.3% against the previous figure of 7.9% will be an alarming situation for the market. This will not only elevate an interest rate hike by 50 basis points (bps) but will also force the Fed to act quickly on reducing the balance sheet.

The major witnessed a steep fall after printing a yearly high at 0.7662 last week after an unchanged monetary policy by the Reserve Bank of Australia (RBA) on Tuesday. An unchanged monetary policy by the RBA was highly expected along with a less-dovish stance as inflation in the world economy is soaring faster while the growth rate is not advancing proportionally, thanks to the Ukraine crisis. Also, the RBA policymakers dictated that they didn’t see any price pressure that should compel the central bank to elevate interest rates. Adding to that, the soft labor market is not allowing any requirement to gear up borrowing rates soon.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.