- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 10-03-2022

The US Dollar Index (DXY) could extend its recent retracement if a more favourable Russia-Ukraine diplomatic backdrop continues to develop. Nonetheless, weakness is unlikely to extend beyond the mid-96s, according to economists at Westpac.

Fed likely to stay on a hawkish path

“DXY could extend its recent retracement if a more favourable Russia-Ukraine diplomatic backdrop continues to develop, though weakness likely does not extend beyond the mid-96s, the Fed likely to stay on a hawkish path.”

“100+ for DXY looks more likely than not in coming weeks.”

- GBP/USD turned positive for the second successive day amid subdued USD demand.

- The risk-on impulse was seen as a key factor that weighed on the safe-haven buck.

- Traders eye US CPI for a fresh impetus amid hopes for the Russia-Ukraine ceasefire.

The GBP/USD pair climbed to a three-day peak during the early European session, with bulls eyeing a move towards reclaiming the 1.3200 round-figure mark.

The pair attracted some dip-buying near the 1.3140 region on Thursday and might now be looking to build on its recovery from the lowest level since November 2020 touched earlier this week. Hopes for a diplomatic solution to end the war in Ukraine remained supportive of the risk-on mood. This, in turn, undermined the safe-haven US dollar and extended some support to the GBP/USD pair.

In fact, Russian Foreign Minister Sergey Lavrov and his Ukrainian counterpart Dmytro Kuleba have arrived in Turkey for talks – the first between the two officials since Russia's invasion of Ukraine. The latest development has raised hopes for a compromise to resolve the conflict and much-needed relief to investors. This was evident from a generally positive tone around the equity markets.

That said, the risk of a further escalation in tensions between Russian and Western powers could keep a lid on the optimistic move in the markets. Investors also remain concerned about a major inflationary shock and the rapidly deteriorating global economic outlook. This should act as a tailwind for the greenback and cap gains for the GBP/USD pair ahead of the latest US consumer inflation figures.

Hence, it will be prudent to wait for strong follow-through buying before confirming that the GBP/USD pair has formed a near-term base and positioning for any further appreciating move. Nevertheless, the pair, so far, has managed to hold in the positive territory for the second successive day and remains at the mercy of the USD price dynamics amid absent relevant economic releases from the UK.

Technical levels to watch

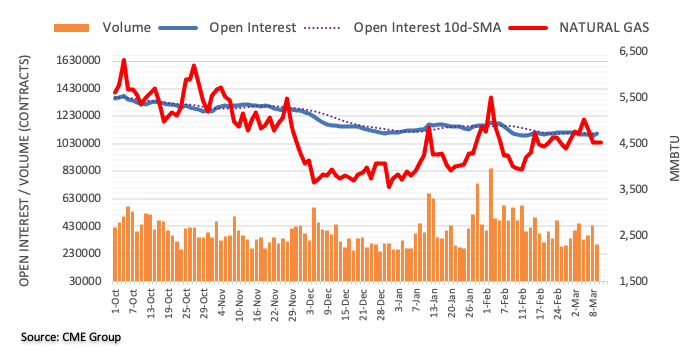

Considering advanced prints from CME Group for natural gas futures markets, traders added around 16.3K contracts to their open interest positions following two daily drops in a row on Wednesday. On the other hand, volume dropped by around 143.5K contracts after two straight daily builds.

Natural Gas remains supported by the 200-day SMA

Wednesday’s leg lower in prices of natural gas was accompanied by increasing open interest, which favours the continuation of this trend at least in the very near term. In the meantime, the 200-day SMA at $4.36 per MMBtu is expected to hold the downside for the time being.

The US Bureau of Labor Statistics will release the February Consumer Price Index (CPI) data on Thursday, March 10 at 13:30 GMT and as we get closer to the release time, here are the forecasts by the economists and researchers of 9 major banks regarding the upcoming US inflation data.

CPI and core CPI are expected to reach fresh 40-year highs at 7.9% and 6.4%.

Commerzbank

“We expect consumer prices to rise by 0.8% in February compared with January (consensus 0.8%). The YoY rate should climb to 7.9%.”

Nordea

“We expect the February CPI figures to show headline inflation surging to 8% YoY (consensus: 7.9%) and core inflation reaching 6.4% YoY (consensus: 6.4%). The Russian invasion of Ukraine adds more uncertainty to the future prints.”

ING

“We look for the annual rate of CPI to rise to 7.9%, but an 8% reading is certainly possible, which would be the fastest rate of inflation since January 1981.”

TDS

“Core prices likely eased on an MoM basis (0.5%), but the pace is expected to have stayed fairly strong. While inflation in used vehicles likely slowed, it was probably offset by continued strength in shelter prices. An expected 7% MoM surge in gasoline prices also likely added to headline pressures (0.7%). Our MoM forecasts imply 7.8%/6.4% YoY for total/core prices, up from 7.5%/6.0% in Jan.”

NBF

“We expect the core index to have gained 0.5% MoM. As a result, the annual core inflation rate could jump to a 40-year high of 6.4%. Headline prices could have increased at an even stronger pace (0.8% MoM), as seasonally adjusted gasoline prices surge upward. The headline annual rate could thus climb four ticks to 7.9%, the highest since January 1982.”

Deutsche Bank

“We expect YoY inflation to rise to +7.8% in February, the fastest in 40 years. This is the last reading before next Wednesday's FOMC conclusion with the committee now in a blackout period.”

CIBC

“Inflation is set to accelerate further in the US in February as higher energy prices combined with rising labor costs, and strong demand in core categories, will likely leave total inflation at 7.8%. The expected acceleration in core inflation to 6.4% will be magnified by a weak year-ago base reading, while its largest component, shelter, is set to gain momentum as leases continue to reset alongside the return of activity to cities. A normalization in behavior as Omicron faded could have also supported core service prices for transportation, as airport screenings rose.”

Citibank

“US February CPI MoM – Citi: 0.7%, median: 0.8%, prior: 0.6%; CPI YoY – Citi: 7.8%, median: 7.9%, prior: 7.5%; CPI ex Food, Energy MoM – Citi: 0.5%, median: 0.5%, prior: 0.6%; CPI ex Food, Energy YoY – Citi: 6.4%, median: 6.4%, prior: 6.0%. In the final, highly anticipated CPI report ahead of the March FOMC meeting, we do not expect to see notable signs of slowing in the monthly pace of inflation. While not yet visible in February data, higher oil prices and further supply chain disruptions resulting from recent geopolitical developments could put further upward pressure on various goods prices in particular.”

ANZ

“We expect US core CPI to increase by a heady 0.6% MoM in February, matching recent monthly out turns. Surging energy and food prices should see headline rise by 0.8% MoM. On an annual basis, core and headline inflation are expected to reach fresh 40-year highs of 6.5% YoY and 7.9% YoY respectively.”

Aussie’s price action became more two-way this week, after five straight weekly gains. Economists at Westpac look for USD to find renewed support, leaving AUD/USD rallies stalling around 0.7400 and downside risks to 0.7245 support.

Commodities still supportive but RBA’s caution on rates should be starkly contrasted with the FOMC

“LNG is Australia’s #3 export, with #2 coal also soaring and #1 iron ore back above $160/t. This ramp-up in Australia’s resources export prices looks set to be sustained for some time, even though the most extreme prices should unwind partially.”

“The RBA’s view of Australian economic resilience should be reinforced by the labour force data. But the RBA’s caution on rates should be starkly contrasted with the FOMC next week.”

“We look for USD to find renewed support, leaving AUD/USD rallies stalling around 0.7400 and downside risks to 0.7245 support.”

- USD/CAD struggled to capitalize on its early uptick and was pressured by a combination of factors.

- The risk-on mood undermined the safe-haven USD and acted as a headwind amid rising oil prices.

- The focus will remain glued to the Russia-Ukraine conflict ahead of the US consumer inflation data.

The USD/CAD pair surrendered a major part of its modest intraday gains and was last seen trading just above the 1.2800 mark, up only 0.05% for the day.

The pair attracted some buying during the early part of the trading on Thursday, though a combination of factors held back bulls from placing aggressive bets and capped the upside. A generally positive tone around the equity markets weighed on the safe-haven US dollar. On the other hand, modest rise in crude oil prices underpinned the commodity-linked loonie and acted as a headwind for the USD/CAD pair.

The market sentiment improved drastically amid expectations for a diplomatic solution to end the war in Ukraine. In fact, Russian Foreign Minister Sergey Lavrov and his Ukrainian counterpart Dmytro Kuleba have already arrived in Turkey for ceasefire negotiations. This would be the first talk between the two officials since Russia's invasion of Ukraine and raised hopes for a compromise to resolve the conflict.

The latest development provided much-needed respite to investors and triggered a fresh wave of the global risk-on trade, which, in turn, drove flows way from traditional safe-haven assets. On the other hand, the Candian drew support from a further recovery in crude oil prices from the over one-week low touched the previous day. This was seen as another factor that capped gains for the USD/CAD pair.

That said, the risk of a further escalation in tensions between Russian and Western powers could keep a lid on the optimistic move in the markets. Moreover, worries of a major inflationary shock amid the rapidly deteriorating global economic should extend some support to the greenback and the USD/CAD pair. Hence, the market focus now shifts to Thursday's release of the latest US CPI report.

Apart from this, the incoming headlines surrounding the Russia-Ukraine saga will drive demand for the safe-haven USD and also influence oil price dynamics. This, in turn, should provide some impetus to the USD/CAD pair and allow traders to grab some short-term opportunities.

Technical levels to watch

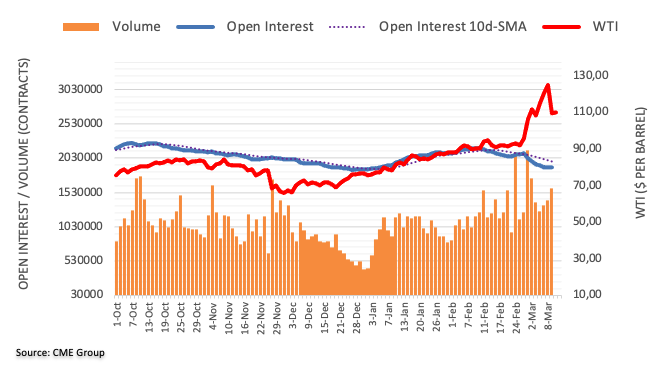

CME Group’s flash data for crude oil futures markets noted open interest shrank by more than 7K contracts on Wednesday. On the flip side, volume rose by around 185.6K contracts, reaching the third daily build in a row at the same time.

WTI appears supported around $100.00

Prices of the WTI plummeted on Wednesday and briefly tested levels below the $105 mark per barrel. The sharp daily drop was on the back of diminishing open interest, however, indicative that the continuation of the downtrend seems not favoured for the time being. In the meantime, the $100.00 neighbourhood now emerges as quite a decent contention area.

Here is what you need to know on Thursday, March 10:

The positive shift witnessed in risk mood weighed heavily on the greenback Wednesday and helped risk-sensitive assets recover sharply. The dollar is holding its ground against its major rivals early Thursday and markets turn cautious while awaiting headlines from Russian Foreign Minister Sergei Lavrov and his Ukrainian counterpart Dmytro Kuleba’s meeting. Later in the session, the European Central Bank (ECB) will announce its policy decisions and February Consumer Price Index (CPI) data will be featured in the US economic docket.

Bloomberg reported on Wednesday that the Ukrainian President's Deputy Chief Of Staff Zhovkva said that Ukraine was ready for a diplomatic solution while adding that there have to be security guarantees. Additionally, Ukrainian President Volodymyr Velenskyy told the German newspaper Bild that the aim of Thursday’s talks was to end the war and noted that Ukraine was prepared to make certain compromises if Russia were to make compromises too. On a negative note, Russia's state-run RIA media outlet said that Russia would not concede anything at the next round of peace talks with Ukraine.

Has the Ukraine war ended?

Reflecting the risk-on market environment, the S&P 500 gained more than 2% on Wednesday and the benchmark 10-year US Treasury bond yield rose 4%. Finally, the barrel of West Texas Intermediate (WTI) lost 12% before settling between $108 and $109 early Thursday. In the meantime, US stock index futures are posting small losses heading into the European session.

The US Dollar Index, which fell 1.1% on Wednesday, moves sideways near 98.00. The annual CPI in the US is expected to rise to a fresh multi-decade high of 7.9% in February from 7.5% in January.

EUR/USD stays relatively quiet around 1.1050 after gaining nearly 200 pips on Wednesday. The ECB is widely expected to keep its policy settings unchanged but market participants will pay close attention to the revised growth and inflation projections. ECB President Christine Lagarde’s comments on the policy outlook amidst the Russia-Ukraine crisis could trigger a significant market reaction as well.

ECB Preview: More pain for the euro as doves may strike back amid Ukraine crisis, stagflation risks

GBP/USD staged a decisive rebound on Wednesday but lost its bullish momentum before testing 1.3200.

Gold erased all the gains it recorded on Tuesday in the second half of the day on Wednesday in a dramatic turnaround. XAU/USD stays on the back foot early Thursday and trades below $1,990.

Despite the broad-based selling pressure surrounding the greenback, USD/JPY climbed above 116.00 fueled by the rising US T-bond yields.

Bitcoin gained 8% and climbed above $42,000 before erasing the majority of its gains during the Asian trading hours on Thursday. BTC/USD was last seen trading below $40,000 losing 6% so far on the day. Ethereum stays under bearish pressure and trades deep in negative territory near $2,600 after posting gains in the previous two days.

- EUR/JPY challenges the one-month-old downtrend around weekly high, sidelined of late.

- Euro bulls expected ECB to utter plans to battle stagflation fears even as monetary policy isn’t expected to change.

- Nikkei 225 posts biggest jump in 19 months amid hopes of overcoming Russia-Ukraine crisis.

- ECB, Kyiv-Moscow talks join US CPI for February to entertain momentum traders.

EUR/JPY grinds higher around weekly top, up 0.11% intraday near 128.35 heading into Thursday’s European session.

In doing so, the cross-currency pair rises for the third consecutive day while keeping the previous day’s upside break of a one-month-old descending resistance line, now support.

Also underpinning the bullish bias is the market’s cautious optimism over the Russia-Ukraine peace talks, as well as hopes that the European Central Bank (ECB) will sound hawkish alarms even if the benchmark rate and bond purchases are likely to remain unchanged.

Risk appetite improved as Ukraine’s retreat from NATO joined readiness to compromise on certain goals, if Russia does the same hinted an immediate solution to the grim conditions in Kyiv. Though, Moscow’s rejection to concede anything joins the West versus Moscow tussles, via Kyiv, to weigh on the mood of late.

Even so, a stellar rally by Japan’s Nikkei 225, the biggest daily jump since June 2020, joins easy US Treasury yields to weigh on the yen’s safe-haven demand. Elsewhere, stock futures in the US and Europe fail to track Wall Street gain amid anxiety over the key issues.

That said, diplomats from Ukraine and Russia will meet in Turkey on Thursday. Given the recently increasing hopes of a diplomatic solution, a disappointment will have higher chances of roiling the EUR/JPY uptrend. Also, the ECB is likely to utter hawkish words as it battles fears of stagflation, which in turn highlights the monetary policy decision despite the unexpected change in the key measures.

Read: ECB Preview: More pain for the euro as doves may strike back amid Ukraine crisis, stagflation risks

It should be noted that the monthly prints of the US Consumer Price Index (CPI) for February, likely rising to 7.9% from 7.5% prior, will also act as an important catalyst.

Read: US February CPI Preview: Will hot inflation force Fed’s hand?

All in all, Thursday is set to become another active day for the global markets, not just for EUR/JPY.

Technical analysis

A daily closing above the monthly resistance line, at 128.00 by the press time, joins steady RSI and receding bearish bias of MACD to direct EUR/JPY bulls towards a convergence of the 50-DMA and the 100-DMA around 129.80-85.

According to FX Strategists at UOB Group, EUR/USD is now seen navigating between 1.0870 and 1.1180 in the next weeks.

Key Quotes

24-hour view: “We did not anticipate the outsized surge that sent EUR rocketing to a high of 1.1094 yesterday. The swift and sharp rise appears to be running ahead of itself and EUR is unlikely to strengthen much further. For today, EUR could consolidate and trade between 1.1000 and 1.1100.”

Next 1-3 weeks: “We first turned negative on EUR more than weeks ago. In our latest narrative from Monday (07 Mar, spot at 1.0875), we highlighted that EUR is still weak and the next level to focus on is at the long-term support at 1.0805. EUR subsequently dropped to 1.0804 before rebounding. Yesterday (09 Mar), EUR lifted off and rocketed to 1.1094 before closing higher by a whopping 1.61% (NY close of 1.1075), its largest 1-day advance since Jun 2016. The break of our ‘strong resistance’ at 1.1000 indicates that the weak phase has come to an end. Despite the outsized advance, it appears to soon to expect a major reversal. Further volatility would not be surprising and EUR could trade between 1.0870 and 1.1180 for now.”

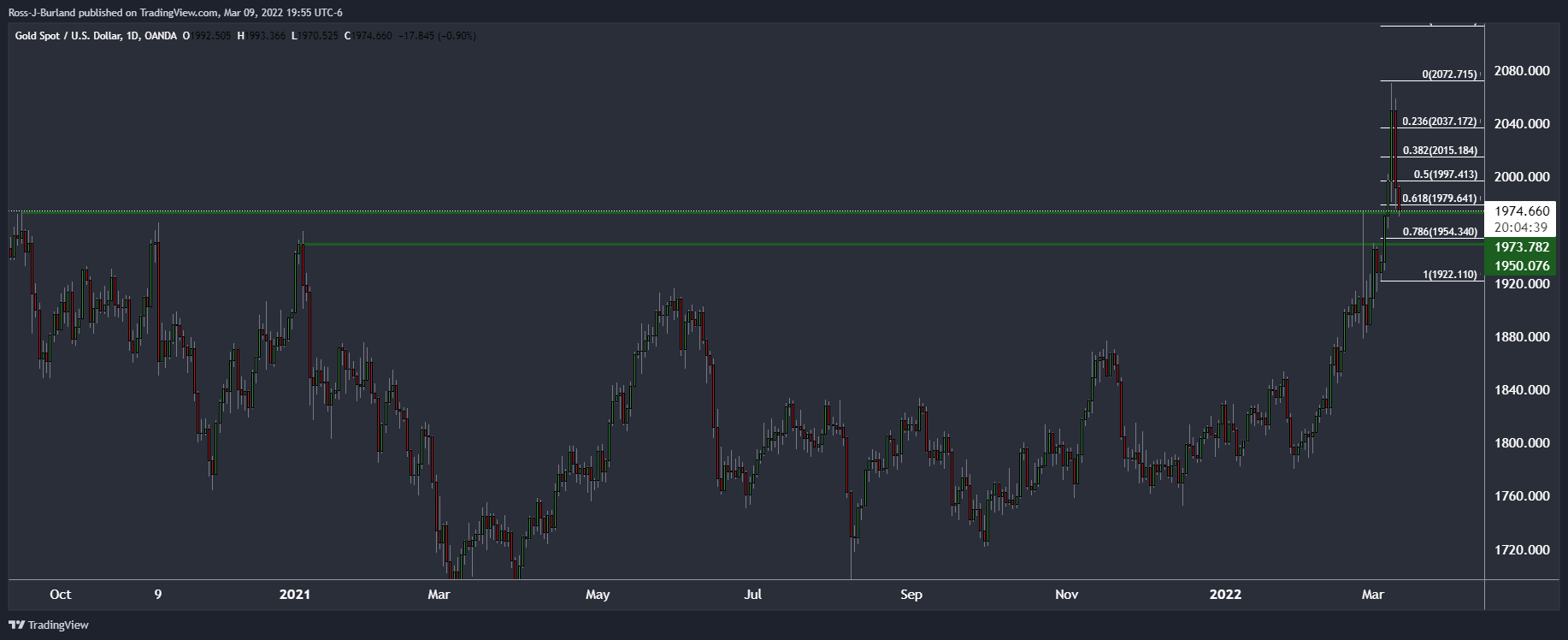

Gold price surrendered all of Tuesday’s gains, eroding $60 amid a sharp correction. Is the XAU/USD correction over yet? $1,960 is a make-or-break point for buyers, FXStreet’s Dhwani Mehta reports.

Warranting caution for bulls

“There remains some room for sellers to test the critical support at $1,960, which is the confluence of the ascending 50-Simple Moving Average (SMA) and rising trendline support. Four-hourly candlestick closing below the latter will initiate a fresh downswing towards the bullish 100-SMA at $1,930. Further south, the $1,900 round level will come to the rescue of gold bulls.”

“If the upside resumes traction, then the immediate hurdle is seen at the $2,000 psychological mark. The next bullish target is envisioned at the horizontal 21-SMA at $2,006, above which bulls could attempt a fresh run-up towards $2,050. The record highs of $2,075 still remain a tough nut to crack for XAU buyers.”

See – Gold Price Forecast: XAU/USD to post new record highs towards $2,285/2,300 – Credit Suisse

- Asian stock markets have carry-forwarded a two-day winning streak on Thursday.

- Carnage in oil prices has underpinned the Asian equities.

- The DXY has slipped near 98.00 amid the improvement in the risk appetite of investors.

Markets in the Asia domain are on an adrenaline rush after Ukrainian President Volodymyr Zelenskyy agreed to withdraw its membership appeal for NATO. This will lead to a higher expectation of a ceasefire between Russia and Ukraine. However, the headline of a truce has been digested by the market participants as we have witnessed a firmer bullish move in the trading sessions of Tuesday and Wednesday.

While a strong bullish drive move on Thursday should be tagged to the carnage at the oil prices. US President Joe Biden urged the oil producers to expand their output. After acknowledging the appeal, the OPEC member UAE endorse more pumping to fix the galloping deviation in the demand-supply mechanism.

"We favor production increases and will be encouraging OPEC to consider higher production levels," tweeted by the UAE Embassy in Washington.

The UAE will encourage the cartel players who have spare capacity to explore more oil, which can ease the impact of a ban on the Russian oil supply. This has brought a sell-off in the oil prices, which have tumbled near $106.00, an almost 16% low from its recent highs at $126.51.

Oil prices hold a serious impact on the equities. The rising oil prices affect the cost of manufacturing and transportation activities and eventually the operating margins of the enterprises. Therefore, a serious plunge in the oil prices has sent the Asian equities higher to the rooftop.

Meanwhile, the US dollar index (DXY) is settling around 98.00 on fading safe-haven appeal and uncertainty over the US inflation numbers, which are due on Thursday. While the 10-year US Treasury yields are aiming for 2% amid the rising bets over an aggressive interest rate decision by the Federal Reserve (Fed) in the monetary policy meeting next week.

- USD/CHF grinds higher inside a bullish chart pattern.

- 100-HMA adds strength to the triangle’s support, MACD also favor buyers.

USD/CHF buyers flex muscles around 0.9280, up 0.17% intraday heading into Thursday’s European session.

In doing so, the Swiss currency (CHF) pair remains on a front foot while recently poking the upper line of a three-day-old descending triangle.

Given the bullish MACD signals and the quote’s sustained trading beyond key HMAs, USD/CHF is likely to cross the 0.9285 immediate hurdle.

With this, the pair buyers can aim for the 0.9345 theoretical target. However, the 0.9300 threshold and the latest peak of 0.9306 may act as intermediate halts during the rise.

Alternatively, the 100-HMA level of 0.9247 acts as an extra challenge for the USD/CHF bears, in addition to the stated triangle’s support line.

Even if the pair defies the bullish chart pattern, the 200-HMA level of 0.9224 will test the downside targeting a two-week-long horizontal support zone near 0.9165.

USD/CHF: Hourly chart

Trend: Further upside expected

- Platinum is auctioning inside an inverted flag formation.

- Bears are firmer on a bearish crossover of the 50-period and 100-period EMAs.

- Oscillation of the RSI (14) in a 20.00-40.00 range validates a bearish setup.

Platinum (XPT/USD) is oscillating in a range of $1,070.04-1,089.85 in the Tokyo session. The bullion has witnessed a firmer plunge after violating the trendline placed from the March 7 low of $1105.90, adjoining the March 8 low at $1,119.76. After skidding below the trendline placed, Platinum has found the ground near $1,070.

On an hourly scale, Platinum price is forming an inverted flag pattern, which signals a directionless move after a steep fall and leads to a further downside if consolidation breaks lower decisively.

Generally, a consolidation phase denotes the placement of offers by the market participants who didn’t capitalize upon the initial rally or those investors place bids, which prefer to enter in an auction once the bearish stage sets in.

The 20-period Exponential Moving Average (EMA) at $1,096.55 will act as a major resistance for the asset going forward.

The 50-period and 100-period EMAs have given a fresh bearish crossover at $1,116.73, which adds to the downside filters.

The Relative Strength Index (RSI) (14) has shifted its trading range from 40.00-60.00 to 20.00-40.00, which validates a bearish setup.

For more downside, Platinum needs to skid below Thursday’s low at $1,070.04, which will drag it lower to March 2 low at $1,053.04. Breach of the latter will send the pair towards February 28 low at $1,036.35.

On the flip side, bulls can take the driving seat if the Platinum violates March 4 high at $1,094.13. This will bring some significant bids and the Platinum price can shift higher near March 7 low of $1105.90, followed by a 50-period EMA at $1,116.73.

Platinum hourly chart

-637824833261613650.png)

- USD/INR rebounds from weekly low, prints first daily gains in three.

- Fears of inflation in India, abroad joins market’s anxiety over Russia-Ukraine talks to favor bulls.

- Uncertainty over fuel prices battle Indian PM Modi’s optimism, polls suggest further upside pressure on inflation.

- US CPI, Russia-Ukraine talks will be the key catalysts to watch for fresh impulse.

USD/INR picks up bids to renew intraday high around 76.40 as Indian markets open for Thursday. In doing so, the rupee (INR) snaps a two-day rebound while easing from a one-week top.

Doubts over the petrol prices, after a four-month halt to daily fixing, joins fears of higher inflation to trigger the USD/INR pair’s latest rebound. “State-run fuel retailers may resume daily price adjustments of petrol and diesel shortly, after a four-month pause, executives of the oil marketing companies said, amid soaring energy prices worldwide,” said Reuters while quoting Mint.com.

That said, Reuters’ latest poll hints that Indian retail inflation likely slipped marginally in February, thanks to lower food prices, but economists also warned that surging oil prices will push inflation much higher in the coming months.

Elsewhere, India’s Prime Minister (PM) Narendra Modi addressed the plenary session of Post-Budget Webinar and mentioned, “Indian economy is once again picking up momentum after once-in-a-century pandemic and this is reflection of our economic decisions and strong foundation of economy,” said EUCLID Procurement per Reuters.

On a broader front, market sentiment remains dwindled amid cautious mood ahead of the key Ukraine- Russia peace talks in Turkey, as well as the US Consumer Price Index (CPI) for February, likely rising to 7.9% from 7.5% prior.

However, softer oil prices and hopes of a positive outcome, due to Ukraine’s recent retreats, seem to underpin equities in Asia-Pacific markets. As a result, India’s BSE Sensex rises around 3.0% intraday by the press time even as the S&P 500 Futures struggle to match Wall Street gains.

Moving on, risk catalysts are likely to keep the reins and the moves of oil prices will be crucial for USD/INR due to the nation’s reliance on crude imports and record deficit.

Technical analysis

The USD/INR pair’s latest bounce-off 10-day EMA, around 76.13 by the press time, eyes the December 2021 high of 76.60. However, any further upside will be challenged by the 77.00 threshold and the recent top surrounding 77.20. Meanwhile, the mid-February peak of 75.70 will act as an additional downside filter for the pair.

Indonesia's Retail Sales improved further to 15.2% on the year in January vs. a 13.8% rise seen in December, the latest survey conducted by Bank Indonesia (BI) showed on Thursday.

On Wednesday, the country’s Consumer Confidence Index deteriorated to 113.1 in February when compared to 119.6 booked in January.

FX implications

USD/IDR is bouncing off fresh two-week lows of14,270, despite strong Indonesian data.

At the press time, USD/IDR is trading at 14,313, down 0.22% on a daily basis, looking to recapture 14,400. The US dollar rebound across the board is saved the day for USD/IDR bulls.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 113.09 | -13.01 |

| Silver | 25.78 | -2.54 |

| Gold | 1992.5 | -2.81 |

| Palladium | 2918.99 | -8.6 |

- USD/RUB fades the previous day’s recovery moves but prints three-week uptrend.

- Ukraine shows readiness to compromise but Moscow doesn’t want to concede anything.

- A ceasefire may trigger notable south-run while disappointment won’t hesitate to refresh all-time high.

- US CPI, ECB are also important but nothing more than talks in Turkey.

USD/RUB portrays the market’s cautious sentiment ahead of the key negotiations in Ankara. That said, the Russian ruble (RUB) pair seesaws around 136.00 during Thursday’s Asian session, following a notable rebound the previous day.

The quote’s latest inaction could be linked to the fears concerning a deadlock over the Russia-Ukraine ceasefire. Underpinning the cautious mood are the latest comments from Moscow and the White House. While the Russian office refrained from conceding anything, the Biden administration argued with Moscow over the usage of chemical or biological weapons.

Previously, Ukraine’s readiness to compromise, if Russia does the same, joined retreat from the NATO plans and the start of the human corridor to raise the hopes of a solution to the stand-off.

It’s worth noting that the West favors Kyiv and keeps the hard stand against Moscow ahead of the key talks. “US Secretary of State Antony Blinken and Ukrainian Foreign Minister Dmytro Kuleba, in a phone call on Wednesday, discussed additional security and humanitarian support for Ukraine after Russia's invasion, the State Department said in a statement,” said Reuters. The statement adds, per Reuters, “Blinken and Kuleba also discussed Russia's ‘unconscionable attacks harming population centers’.”

Amid these plays, the US 10-year Treasury yields retreat while the S&P 500 Futures also fail to track Wall Street gains. However, Japan’s Nikkei 225 snaps a four-day losing streak to rebound from the lowest levels since November 2020, up 3.5% around 25,560 by the press time. Additionally, WTI crude oil drops around 2.0% to $105.50 by the press time whereas gold trims another 1.0% to $1,971, after nearly losing $90.00 the previous day.

Moving on, USD/RUB traders will pay close attention to the Ukraine-Russia talks in Turkey for a clear direction amid hopes of a positive outcome. Should that happen, the pair may witness further downside while an otherwise outcome won’t hesitate to refresh the record high. Also important will be the US Consumer Price Index (CPI) for February, likely rising to 7.9% from 7.5% prior, as well as the monetary policy meeting of the European Central Bank (ECB).

Technical analysis

USD/RUB recovery from 10-DMA, around 117.45 by the press time, directs the quote towards Monday’s peak, also the all-time high, around 155.00.

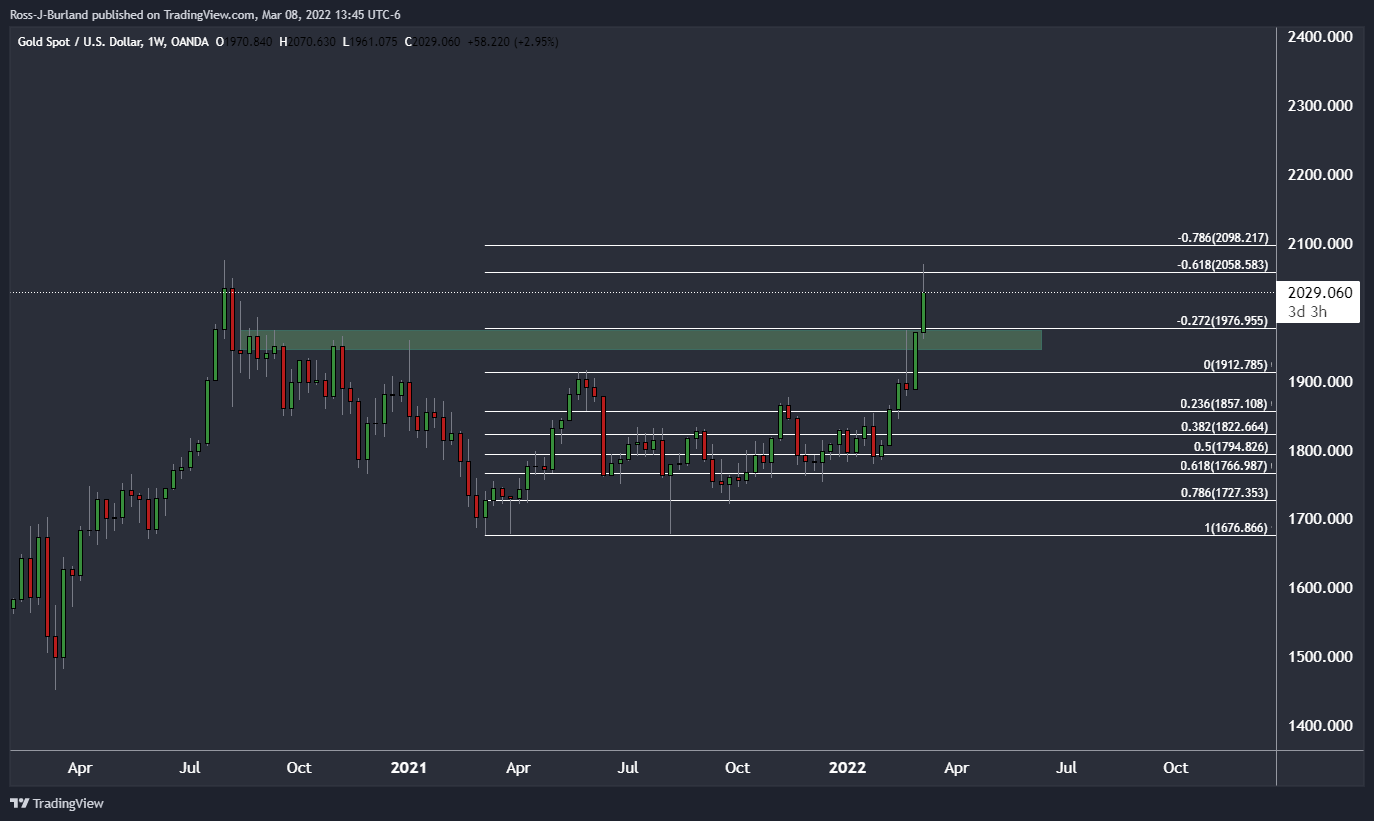

- Gold consolidates the mid-week volatility, holding below $2,000.

- The gold price fell from a significant level on the weekly chart.

- Eyes are now on US CPI data as the next potential catalyst and Ukraine crisis developments.

Gold suffered heavily amid better risk sentiment on Wednesday. The precious metal fell back below $2,000/oz after it had reached a 19-month high at the start of the week.

Spot gold fell 3.3% to $1,976 per ounce, snapping a rally that took it near the August 2020 all-time high. U.S. gold futures settled down 2.7% at $1,988.20. The reversal was driven by profit-taking as well as a sharp drop in oil prices that gave the green light for buyers to pick up bargains in the stock markets on stocks that had otherwise been hammered by concerns over sanctions on Russia.

Fighting continued as a Russian airstrike badly damaged a children's hospital in the besieged Ukrainian port city of Mariupol on Wednesday. However, risk sentiment improved as oil prices fell heavily after the United Arab Emirates said the OPEC member would support boosting output. Brent oil plunged from $131.50bbls to a low of $105.91bbls. At the start of the week, the price had reached a high of $138.03bbls in a market in disarray due to the supply disruptions caused by sanctions imposed on Russia as a result of the conflict.

Peace talks that could crack the door open to a permanent cease-fire

On Thursday, Foreign Minister Sergey V. Lavrov of Russia is expected to meet his Ukrainian counterpart, Dmytro Kuleba, in Turkey, in the highest-level talks between the two countries since the war began on Feb. 24.

The New York Times reported that ''in recent days, the language has shifted, with the Kremlin signaling that Mr. Putin is no longer bent on regime change in Kyiv. It is a subtle shift, and it may be a head-fake; but it is prompting officials who have scrambled to mediate to believe that Mr. Putin may be seeking a negotiated way out of a war that has become a much bloodier slog than he expected.''

President Recep Tayyip Erdogan of Turkey, whose top diplomat has held a total of 10 calls with Mr. Lavrov and Mr. Kuleba since the start of the war, said on Wednesday that the meeting between Sergey V. Lavrov and Dmytro Kuleba could “crack the door open to a permanent cease-fire.”

Oil price key for gold

The rally in oil has been a massive cause for concern as markets assess whether the global economy is in for either a stagflationary or inflationary shock. ''The war in Ukraine has significant and obvious implications for commodities prices. But, will implications for inflation be more persistent than for growth? Certainly, global central banks fear one channel of self-reinforcing inflation in particular — inflation expectations could be de-anchored if the shock permeates into the world's psyche,'' analysts at TD Securities explained in that regard.

''Direct implications of the conflict on growth are more limited in the US, but indirect implications could be more relevant as ongoing disruptions to supply chains could have a spillover effect, while inflation is also likely to act as a tax on consumers,'' the analysts added.

''If the shock simultaneously dents consumer sentiment, the Fed will have to walk a tight-rope between its unemployment and inflation targets. In turn, for the time being the market has concluded that the Fed will remain nimble as to not tip the US economy into a recession, but the subsequent rate path and the path for quantitative tightening are less clear.''

''In this context, gold bugs are more likely to benefit from a subsequent rise in central bank demand for gold, having observed the events unfold as potential vulnerabilities for national accounts.''

Gold technical analysis

The price of gold has fallen to a familiar area of resistance that is currently acting as support. While the drop was of a magnitude on a single day that could not have been predicted, it did fall from a level previously marked as being significant:

Gold Price Forecast: XAU/USD holds below a key technical -61.8% golden ratio

Gold weekly chart

''The weekly chart shows that the price has reached a -61.8% golden ratio of the 2021 range.''

- USD/JPY refreshes monthly top during four-day winning streak.

- Nikkei 225 rises the most in six years as oil prices drop, Japan PPI improves.

- Cautious optimism over Russia-Ukraine talks favor bulls ahead of US CPI.

USD/JPY rises for the fourth consecutive day to print the highest level in a month around 116.00 during the initial hours of Thursday’s Tokyo open.

In doing so, the yen pair portrays the market’s positive mood amid hopes of a ceasefire between Russia and Ukraine during today’s peace talks in Turkey.

Also favoring the USD/JPY prices is the run-up in Japan’s equity benchmark Nikkei 225. That said, the key equity gauge of Tokyo snaps a four-day losing streak to rebound from the lowest levels since November 2020, up 3.5% around 25,560 by the press time. It should be noted, however, that the US 10-year Treasury yields retreat while the S&P 500 Futures also fail to track Wall Street gains.

Furthermore, a 9.3% YoY print of Japan’s Producer Price Index (PPI) for February, versus 8.7% expected and 8.6% prior, also favored the USD/JPY bulls. Following the factory-gate inflation release, an anonymous BOJ official said, per Reuters, “Further increases in crude oil and grain prices are likely to push up Japanese wholesale prices with a several-month lag.”

Headlines from Ukraine, suggesting readiness to compromise, if Russia does the same, seemed to have boosted the market’s mood on Wednesday. However, Russian State Media mentioned that the Russian delegation at peace talks with Ukraine will not concede anything. Furthermore, the White House (WH) confronted the allegations that the US used chemical or biological weapons in Ukraine.

Elsewhere, US inflation expectations also retreat from record top and tease US dollar hawks as markets stay divided over the Fed’s 0.50% rate hike in March. The inflation gauge, as per the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, refreshed record top to 2.9% before stepping back to 2.84% by the end of Wednesday’s North American trading session.

Apart from the Russia-Ukraine talks and the US Consumer Price Index (CPI) for February, likely rising to 7.9% from 7.5% prior, the monetary policy meeting of the ECB will also be important to watch for the USD/JPY traders.

Technical analysis

A clear rebound from the 100-DMA, around 114.50 by the press time, directs USD/JPY towards the 116.35 hurdle that was tested twice so far in 2022.

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:00 (GMT) | Australia | Consumer Inflation Expectation | March | 4.6% | |

| 12:45 (GMT) | Eurozone | ECB Interest Rate Decision | 0.0% | 0% | |

| 13:30 (GMT) | U.S. | Continuing Jobless Claims | February | 1476 | |

| 13:30 (GMT) | U.S. | Initial Jobless Claims | March | 215 | 216 |

| 13:30 (GMT) | Eurozone | ECB Press Conference | |||

| 13:30 (GMT) | U.S. | CPI, m/m | February | 0.6% | 0.8% |

| 13:30 (GMT) | U.S. | CPI excluding food and energy, m/m | February | 0.6% | 0.5% |

| 13:30 (GMT) | U.S. | CPI excluding food and energy, Y/Y | February | 6% | 6.4% |

| 13:30 (GMT) | U.S. | CPI, Y/Y | February | 7.5% | 7.9% |

| 19:00 (GMT) | U.S. | Federal budget | February | 119 | |

| 21:30 (GMT) | New Zealand | Business NZ PMI | February | 52.1 | |

| 21:45 (GMT) | New Zealand | Food Prices Index, y/y | February | 5.9% | |

| 21:45 (GMT) | Australia | RBA's Governor Philip Lowe Speaks | |||

| 22:15 (GMT) | Australia | RBA's Governor Philip Lowe Speaks | |||

| 23:30 (GMT) | Japan | Household spending Y/Y | January | -0.2% | 3.6% |

| 23:50 (GMT) | Japan | BSI Manufacturing Index | Quarter I | 7.9% |

- NZD/USD has bounced after successfully testing the demand area in a range of 0.6800-0.6810.

- Kiwi bulls need to violate 0.6853 for a fresh rally ahead.

- The RSI (14) needs to overstep 60.00 to validate a bullish setup.

The NZD/USD pair has witnessed a firmer rally after successfully testing the demand area, which is established in a range of 0.6800-0.6810. The demand area coincides with March 2 high and March 8 low at 0.6800 along with February 23, March 3, and March 4 highs at 0.6810. The major is hovering around the 20-period Exponential Moving Average (EMA), which is trading at 0.6830.

On a four-hour scale, NZD/USD has observed significant bids after validating the demand area. For now, the major is sensing barricades near Wednesday’s high at 0.6853, which also coincides with Tuesday’s highest traded price. The 50-period and 100-period EMAs are scaling higher, currently trading at 0.6805 and 0.6770 respectively, which add to the upside filters.

The Relative Strength Index (RSI) (14) is oscillating in a range of 40.00-60.00, which signals a consolidation phase. Kiwi bulls need to push the RSI (14) above 60.00 to validate a bullish setup.

For an upside, bulls need to overstep Wednesday’s high at 0.6853, which will send the pair towards March 07 high at 0.6926. Breach of the latter will expose the major to November 23 high at 0.6988.

On the flip side, bulls can lose control if the pair slips below the lower segment of the demand area at 0.6800. This will trigger the greenback bulls and the pair may drag towards the 100 EMA at 0.6770 and March 1 low at 0.6740.

NZD/USD four-hour chart

-637824710816127347.png)

- AUD/USD renews intraday low, pares the biggest daily gains in a fortnight.

- Australia Consumer Inflation Expectations rose 4.9% for March.

- US Treasury yields, S&P 500 Futures retreat amid anxiety over Russia-Ukraine talks.

- US CPI for February also gets interesting as inflation expectations ease from record top.

AUD/USD takes offers to renew intraday low around 0.7305 as market sentiment turned cautious during the mid-Asian session on Thursday, following the risk-on day.

The Aussie pair snapped a two-day downtrend by rising the most in two weeks the previous day as risk appetite improved on the headlines suggesting a diplomatic solution to the Ukraine-Russia crisis. However, the market’s anxiety ahead of the key event and the recently mixed headlines challenged the previous optimism and weigh on the AUD/USD pair, due to its risk-barometer status.

As a result, AUD/USD ignores upbeat Australia Consumer Inflation Expectations for March, 4.9% versus 4.6% expected and prior.

Although Ukraine showed readiness to compromise if Russia also do the same, Moscow said, “Will not concede anything”. The same joined the White House (WH) comments to turn down the allegations over the usage of chemical or biological weapons in Ukraine.

Also important to note is the recent strong US inflation expectations, as per the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, amid the fears of a 0.50% rate hike by the US Federal Reserve (Fed). The inflation gauge recently stepped back to 2.84% after refreshing the all-time high with a 2.90% figure the previous day.

At home, the market chatters that Australia Prime Minister (PM) Scott Morrison wants to spend A$38 billion to boost military forces were largely ignored amid the natural calamity at the Ease Coast.

Against this backdrop, the S&P 500 Futures and the US 10-year Treasury yields fail to extend the previous day’s gains by the press time.

That said, AUD/USD prices are likely to remain pressured heading into the key data/events. Among them, the progress on the peace talks becomes necessary for the pair to renew upside momentum. Otherwise, a firmer US Consumer Price Index (CPI) for February, likely rising to 7.9% from 7.5% prior, can favor the pair sellers.

Read: US February CPI Preview: Will hot inflation force Fed’s hand?

Technical analysis

Failure to stay beyond the 200-DMA, around 0.7315 by the press time, directs AUD/USD bears towards refreshing the weekly low. In doing so, the 100-DMA level of 0.7230 will be in focus.

- GBP/USD struggles to extend the bounce off 16-month low.

- Previous support from late January, two-week-old resistance line challenge recovery moves.

- Early October 2020 peak restricts downside ahead of the 1.3000 threshold.

- MACD conditions do favor further upside towards monthly high.

GBP/USD seesaws around 1.3180 after rising the most in a week amid market’s anxiety during Thursday’s Asian session.

The cable pair recovered from the lowest levels since November 2020 the previous day, backed by upbeat MACD signals.

However, a convergence of the six-week-old previous support line and a downward sloping trend line from February 23 offers a tough nut to crack for the GBP/USD bulls around 1.3230.

Should the quote rise past 1.3230, an upward rally targeting the monthly high of 1.3437 can’t be ruled out. However, the 200-SMA level of 1.3457 will challenge the quote’s additional upside.

Meanwhile, the 1.3100 round figure may act as immediate support during the further declines, ahead of the latest low near 1.3080.

It’s worth noting that the early October 2020 peak also adds strength to the 1.3080 support, a break of which will direct the GBP/USD bears towards the 1.3000 psychological magnet.

GBP/USD: Four-hour chart

Trend: Further upside expected

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.73205 | 0.77 |

| EURJPY | 128.289 | 1.77 |

| EURUSD | 1.1073 | 1.61 |

| GBPJPY | 152.724 | 0.77 |

| GBPUSD | 1.31829 | 0.64 |

| NZDUSD | 0.684 | 0.48 |

| USDCAD | 1.28062 | -0.62 |

| USDCHF | 0.92658 | -0.19 |

| USDJPY | 115.855 | 0.18 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.