- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 10-02-2023

- AUD/USD finished the week above 0.6900, up 0.04%.

- Consumer Sentiment in the United States improved while inflation expectations rose.

- AUD/USD traders are eyeing RBA’s Governor speech alongside the Aussie employment situation.

- Next week’s US inflation and retail sales would dictate the faith of the US Dollar.

The Australian Dollar (AUD) is set to finish Friday’s session with minimal losses of 0.22%, ahead of a busy week in the United States (US) economic calendar, led by inflation data. Additionally, a mixed market sentiment bolstered appetite for the greenback, which finished the week with solid gains of 0.56%. At the time of writing, the AUD/USD is trading at 0.6918 after hitting a high of 0.6960.

Wall Street closed mixed, with the S&P 500 and the Dow Jones registering gains of 0.22% and 0.50%, each at 4,090.46 and 33,869.27, respectively. Contrarily, the Nasdaq 100 dived 0.61%, down to 11,718.12. Data reported in the US economic calendar witnessed the University of Michigan’s Consumer Sentiment, which exceeded expectations and reached 66.4, showing an improvement in financial conditions. Moreover, the projected inflation rate for the upcoming year has increased from 3.9%, as reported in January’s final reading, to 4.2%. On the other hand, the estimated inflation rate for a five-year span remains unchanged at 2.9%.

The AUD/USD reversed its course on the data and, from around 0.6949, ready to test the day’s highs, dropped back towards the 0.6919 area.

The US Dollar Index (DXY), which tracks the American Dollar (USD) performance against a basket of six currencies, finished the week at around 103.585, up 0.58%, a headwind for the AUD/USD.

On the Australian front, Australian bond yields rose, capping the Australian Dollar (AUD) fall against the greenback. Market participants ramped up expectations for additional interest rate increases by the RBA, which hiked rates by 25 bps on Tuesday, and stated that further tightening would be needed after lifting rates to the 3.35% threshold.

What to watch?

The week ahead, the Australian economic docket will feature two speeches by the Reserve Bank of Australia Governor Philip Lowe, alongside Employment data. On the US front, the calendar will release inflation data, Retail Sales, and Regional Federal Reserve Bank will reveal manufacturing conditions.

AUD/USD key technical levels

- USD/CHF jumped from weekly lows after forming a hammer at around the 0.9200 area.

- Near-term, the USD/CHF is upward biased and might test the 0.9300 figure.

The USD/CHF forged a base and climbed back to the 0.9200 area on Friday, following Thursday’s price action, which formed a hammer, that exacerbated the USD/CHF recovery, to current exchange rates. At the time of writing, the USD/CHF is trading at 0.9246, above its opening price by 0.35%.

Long-term, the USD/CHF remains neutral-to-downward biased, but it could print a leg-up and test the 50-day Exponential Moving Average (EMA) at 0.9294. The Relative Strength Index (RSI) entered bullish territory, suggesting that buying pressure is building, contrary to the Rate of Change (RoC), which is neutral.

Short term, the USD/CHF 4-hour chart is bottoming, though downside risks remain. At the time of typing, the USD/CHF is testing the 200-Exponential Moving Average (EMA) at 0.9247 after breaking away from the confluence of the 50/100/20-EMAs.

Oscillators like the Relative Strength Index (RSI) shifted bullish, while the Rate of Change (RoC) backed a bullish continuation, but key resistance areas need to be broken to further cement the USD/CHF upward bias.

Therefore, the USD/CHF first resistance would be the 200-EMA, followed by the 0.9300 figure. A decisive break could trigger a leg-up towards the January 12 high of 0.9360, ahead of the psychological 0.9400 figure.

USD/CHF 4-hour chart

USD/CHF key technical levels

- The US Dollar is set to finish the week with solid gains due to Fed’s hawkish comments and US data.

- US Consumer Sentiment improved, as reported by the University of Michigan.

- The UK avoided a recession in Q4 2022, though its forward economic outlook suggests a weaker British Pound.

- GBP/USD Price Analysis: A daily close below 1.2032 would resume a bearish continuation.

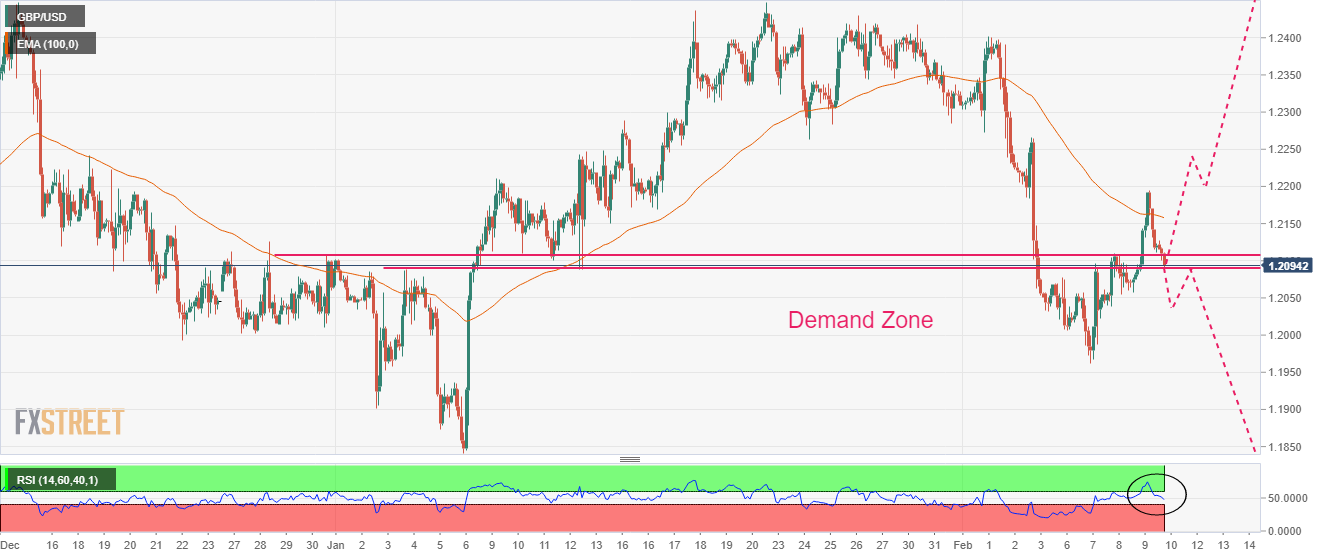

GBP/USD snaps three straight days of gains and drops as it tested the 50-day Exponential Moving Average (EMA) at 1.2126, as UK economic data showed the economy did not grow, while consumer sentiment in the US improved. At the time of writing, the GBP/USD exchanges hands at 1.2055.

Improvement in US consumer sentiment and weak UK GDP weighed on the GBP

The GBP/USD extended a leg down after data from the University of Michigan (UoM) reported that Consumer Sentiment surpassed predictions of 65 and increased to 66.4, indicating a better financial situation. In addition, the expected inflation rate for the year rose from 3.9% in January’s final reading to 4.2%, while the inflation estimations for a five-year period remained steady at 2.9%.

Therefore, the US Dollar Index (DXY), a measure of the greenback’s value vs. a basket of peers, advances 0.60%, up at 103.65, underpinned by US Treasury bond yields, which, affected by hawkish Federal Reserve’s (Fed) speakers commentary during the last week, broke the 3.70% threshold, at 3.728%.

During the European session, the UK economic docket revealed that GDP for the last three months of 2022 stood at 0% and avoided entering a recession, foresaw by the Bank of England (BoE). On a monthly basis, December’s GDP contracted by -0.5%, reported the Office for National Statistics (ONS).

In the meantime, a gloomy scenario in the UK suggests that the British Pound (GBP) would be under pressure as the BoE struggles to tame inflation which reached a 41-year high at 11.1% in October of 2022. The BoE’s latest monetary policy meeting revealed a split vote amongst its members. The BoE forward discussions and guidance would be interesting, which could reassure the central bank’s commitment to tackle inflation.

GBP/USD technical analysis

From a daily chart perspective, the GBP/USD would consolidate within the boundaries of the 50-day EMA at 1.2126 upwards and the 100-day EMA at 1.2032 downwards. However, the Relative Strength Index (RSI) entered the bearish territory, and the Rate of Change (RoC) turned neutral, making a case for a bearish continuation. Therefore, the GBP/USD next support would be the 100-day EMA at 1.2032, followed by the psychological 1.2000 figure. A decisive break could send the GBP/USD to test the YTD low of 1.1841.

- Gold price extended its losses in the session, down by 0.22%.

- The University of Michigan’s Consumer Sentiment improved, while inflation expectations jumped for 2023.

- Gold Price Forecast: Daily close below the 50-EMA could expose Gold to further selling pressure.

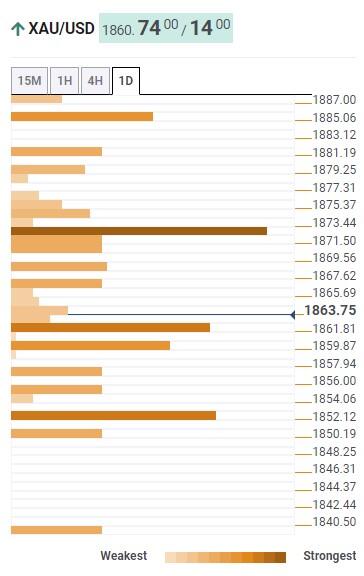

Gold price remains firm at around $1860 after hitting a week-to-date new low of $1852.45 on Friday due to speculations that the US Federal Reserve would raise rates by 25 bps in the next couple of meetings, as money market futures showed. A bid in the US Dollar and US Treasury bond yields reaching fresh 5-week highs capped Gold’s advancement. At the time of writing, XAU/USD is trading at $1858.68, above its opening price by 0.20%.

XAU/USD spiked toward its daily highs on US consumer sentiment

Wall Street continues to trade mixed, with the Nasdaq 100 being the outlier, losing more than 0.50%. A poll by the University of Michigan (UoM) reported that American Consumer Sentiment exceeded estimates of 65 and rose by 66.4, showing an improvement in financial conditions. Meanwhile, inflation expectations for a one-year horizon increased by 4.2% from 3.9% reported on January’s final reading, while for a 5-year horizon, it stood unchanged at 2.9%. XAU/USD’s reacted on the data, reaching as high as $1866.80, though retraced towards current prices.

Hawkish commentary by Fed officials, headwinds for XAU

Elsewhere a slew of Federal Reserve (Fed) officials during the week stated that more rate hikes are coming as the US central bank battles to curb inflation. New York Fed President John Williams commented on moving the Federal Funds rate (FFR) to 5%-5.25%. At the same time, Minnesota’s Fed President Neil Kashkari, a voter in the FOMC in 2023, said that the FFR needs to go as high as 5.4%.

Echoing some of their comments was Lisa D. Cook, who said that it’s appropriate to move in “smaller steps” while the Fed assesses the effects of cumulative tightening. Later the Richmond Fed President Thomas Barkin said that the Fed is “unequivocally” hitting the brakes on the economy.

Gold weakens as US Treasury bond yields and the USD rise

In the meantime, US Treasury bond yields continued to underpin the US Dollar (USD). The 10-year benchmark note rate is up six bps, at around weekly highs of 3.728%, a headwind for XAU’s prices. The US Dollar Index (DXY), which tracks the buck’s value vs. a basket of peers, advances 0.37% daily, up at 103.57.

Gold technical analysis

XAU/USD’s daily chart portrays the yellow metal as neutral-to-downward biased, though the consolidation around $1860 and a subsequent break could pave the way for further losses. However, the 50-day Exponential Moving Average (EMA) at $1856.50 could cap Gold’s fall. Next support lies at the December 27 high-turned-support at $1833.29, followed by the 100-day EMA at $1816.91.

GBP/USD briefly dropped below the 1.20 level earlier this week. Economists at Rabobank expect the pair to see further dips below 1.20 in the coming months.

EUR/GBP seen at 0.90 around the middle of the year

“We expect to see further dips below GBP/USD 1.20 in the coming months.”

“While EUR/GBP has dropped back from its recent highs, it remains in an ascending channel, and we retain our forecast for a move to 0.90 around the middle of the year.”

“On March 15, Chancellor Hunt is due to present his spring budget. Hunt has provided reassurances to the market that he will not be pulling any rabbits from the hat next month, given the need to reduce inflation. This may avoid any crisis for the gilt market, but it suggests the potential for little change in the prevailing economic gloom. This is likely to leave GBP on the back foot.”

Silver has dropped back again this year. But strategists at Commerzbank expect increasing Gold prices to lift Silver too.

Supply deficit likely to shrink on Silver market

“Global demand is likely to decrease as compared with its record high last year. Growing supply is anticipated at the same time: mining production is expected to reach its highest level since 2016 and the supply of scrap Silver to post the highest level in a decade.”

“As these two effects combined will probably mean that the supply deficit this year will not be even half as high as it was last year, the Silver Institute sees little potential for pronounced price rises this year. With its cautious prediction of an average price of $23 this year, it is more sceptical than we are.”

“We expect rising Gold prices in the second half of the year to pull up the Silver price too.”

Strategists at Rabobank analyze the path of Brent Crude Oil for the next months. In their view, a slump in prices is unlikely to last.

Brent will appreciate and average $90 for Q3 and Q4 2023

“Brent prices could see the $60s very briefly in a financial sell-off caused by an official recession. This is unlikely to last, as we believe that there are multiple levels of support in the $70s and our expectations are that Brent will appreciate and average $90 for Q3 and Q4 2023.”

“On the products side, we expect ULSD to average $3.01/gal for the year and gasoil $865/mt off the continuing shortage of global diesel inventories.”

Emerging markets have continued to lag so far in 2023. But economists at UBS now see a much more favorable backdrop for emerging markets.

Emerging markets well-positioned to be early beneficiaries of the three inflection points

“Emerging markets are closely linked to the fortunes of the Chinese economy, which should rebound as the country opens up.”

“Easing financial conditions and a weaker US Dollar have historically been linked with strong emerging market performance.”

“Valuations are appealing on a relative basis and corporate fundamentals are turning the corner.”

The Mexican central bank (Banxico) surprisingly opted to raise its policy rate by 50 bps. The MXN reacted sharply appreciating. However, the Peso could still come under pressure if Banxico does not remain hawkish, economists at Commerzbank report.

Banxico maintains pace and sends MXN soaring

“Banxico surprised with a 50 bps rate hike to now 11%, sending the MXN soaring.”

“Banxico is proving to be an inflation fighter after the departure of central bank member Gerardo Esquivel, who was considered a big dove, which should in principle help the Peso.”

“The big question now is where the peak in the interest rate cycle will be, since core inflation in particular shows no signs of easing yet, which makes it important for Banxico to remain hawkish. Otherwise, it risks that the MXN will ultimately be punished after all.”

- UoM Consumer Confidence Index rose more than expected in February's flash estimate.

- US Dollar Index clings to daily gains near 103.50.

Consumer sentiment in the US improved in early February with the University of Michigan's (UoM) Consumer Confidence Index rising to 66.4 from 64.9 in January. This reading came in better than the market expectation of 65.

"Year-ahead inflation expectations rebounded to 4.2% this month, from 3.9% in January and 4.4% in December," the UoM noted in its publication. "Long-run inflation expectations remained at 2.9% for the third straight month and stayed within the narrow 2.9-3.1% range for 18 of the last 19 months."

Market reaction

The US Dollar preserves its strength after this report and the US Dollar Index was last seen rising 0.28% on the day at 103.48.

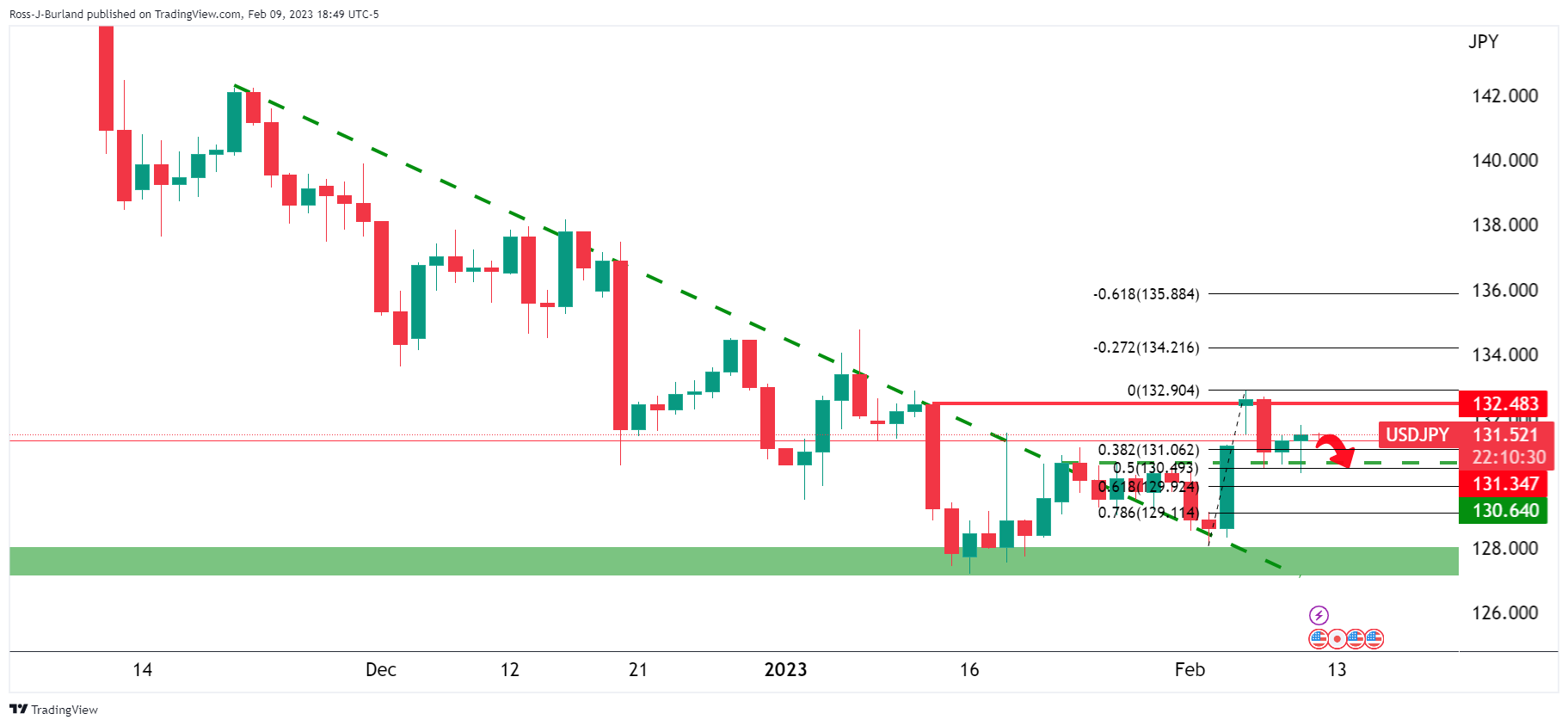

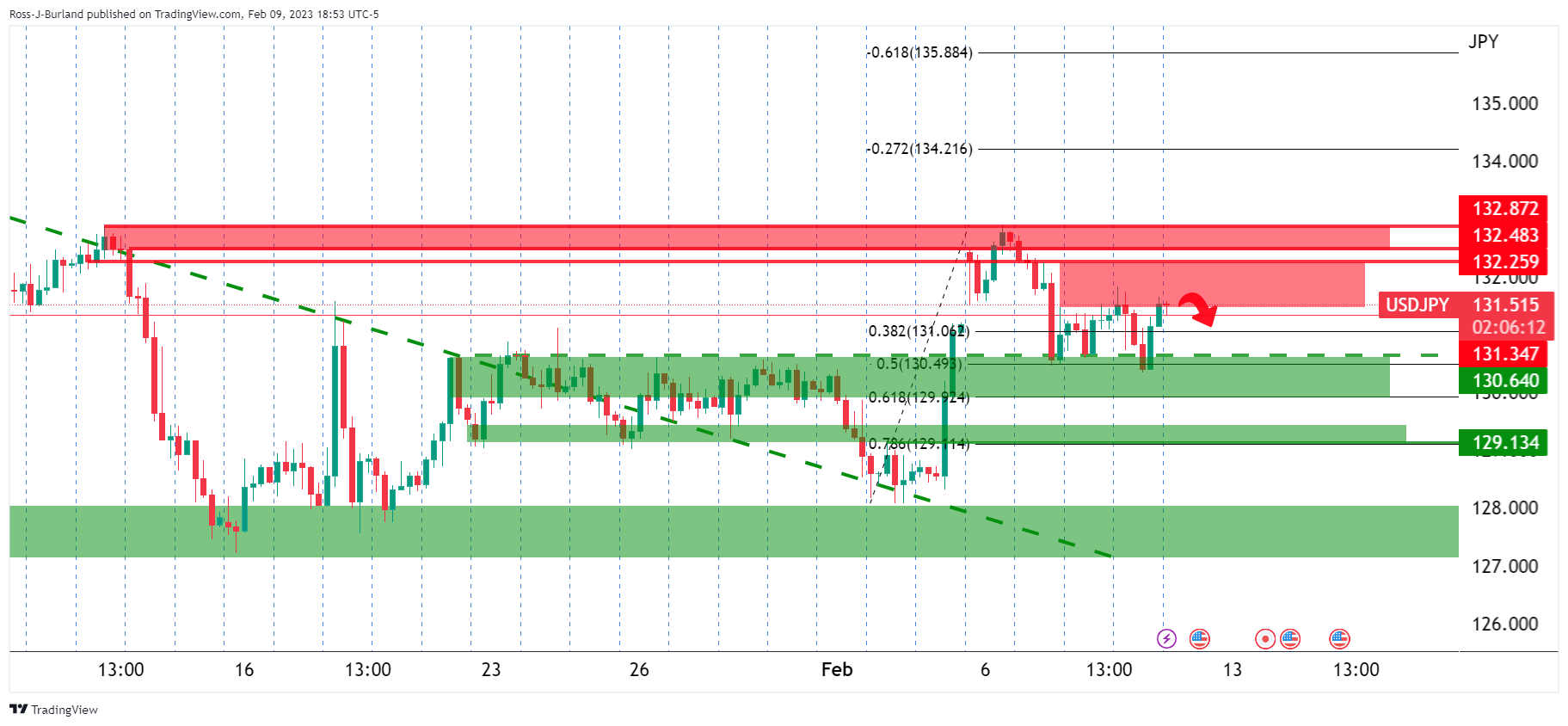

- The USD/JPY 1-hour chart falling wedge was invalidated by a price violation on BoJ’s Ueda news.

- USD/JPY Price Analysis: Long-term is still downward biased unless it breaks resistance around 133.00.

USD/JPY remains pressured by rumors that Kazuo Ueda will be appointed as the new Bank of Japan (BoJ) Governor, sending the USD/JPY diving to its weekly low of 129.79. Nevertheless, the USD/JPY recovered some ground, exchanging hands at around 130.90, slightly above the 20-day Exponential Moving Average (EMA).

From a daily chart perspective, the USD/JPY remains downward biased, but buyers reclaiming the 20-day EMA at 130.72 could put into play the psychological 131.00 level. The Relative Strength Index (RSI) suggests that a bearish continuation is likely, while the Rate of Change (RoC) shifted neutral.

Intraday, the USD/JPY one-hour chart portrays the pair as downward biased. On Thursday’s analysis, I wrote, “the formation of a falling wedge, suggesting a bullish continuation, which could lift prices towards 131.60 and the January 11 high at 132.87,” and added mixed signals between the RSI and the RoC, suggesting that caution is warranted. Hence, BoJ’s news invalidated the chart pattern and opened the door for further losses.

For USD/JPY to resume its upward bias, it must clear the day’s high at 131.87, followed by the weekly high at 132.90. On the other hand, and in the most probable scenario, the USD/JPY could retest the week’s low. Therefore, the USD/JPY first support would be the S1 daily pivot at 130.64. A breach of the latter will expose the psychological 130.000 level, followed by the lows of the week/session at 129.79.

USD/JPY One-hour chart

USD/JPY key technical levels

The Australian Dollar has been a solid performer in recent months and is up 11% from its October 2022 low. Economists at Wells Fargo believe this positive trend can continue and forecast AUD/USD at 0.7800 by mid-2024.

Resilient Australian growth and favorable RBA monetary policy dynamics versus the Fed

“Given our outlook for Australia to enjoy a reasonably steady expansion over time and avoid recession, our base case remains for some further monetary policy tightening before a pause in rate hikes.”

“We believe resilient Australian growth and favorable RBA monetary policy dynamics versus the Fed are the main factors that should be supportive of the Australian Dollar over the medium term.”

“We have adopted a more constructive medium-term outlook for AUD/USD, targeting an exchange rate of 0.7800 by mid-2024. We expect the Aussie to be an outperformer among G10 currencies during this period.”

The Canadian Dollar was the third best performing currency in G10 in January. Economists at ING expect the USD/CAD pair to dip below 1.30 in the second quarter.

Some silver linings from CAD after BoC pause

“The BoC most likely hit the peak of its tightening cycle, as it brought rates to 4.5% and signalled more hikes are not on the cards for now. The dovish shift by the BoC was not a sudden move and had been largely priced in, which means that CAD can now potentially benefit from the fact that a lower peak rate means less economic impact and above all less pain for the troubled housing market.”

“CAD is not our favourite commodity currency for 2023 given a deteriorating domestic and US economic outlook, but can still count on respectable rate attractiveness and high-beta to risk sentiment.”

“A move below 1.30 in USD/CAD looks likely by the second quarter.”

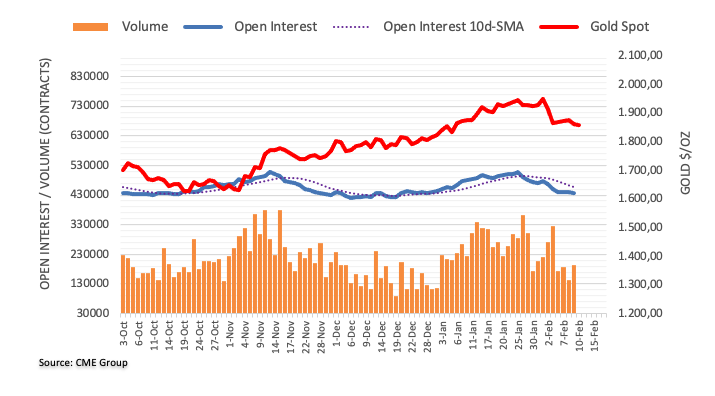

Gold has been virtually unable to recover from its setback. Economists at Commerzbank expect the yellow metal to struggle for the time being.

Previously very optimistic investors more cautious

“Gold lacks the strength to match the correction. The extent to which speculative investors are to blame for this, having previously topped up their net long positions noticeably, remains to be seen.”

“The CFTC has still not published any data following the cyberattack. However, we have pointed out repeatedly that there is a lack of support from ETF investors with a more long-term investment horizon. This would probably require more clarity about the future course of US monetary policy.”

The main economic data release was the release of the latest GDP data from the UK although it has had a limited impact on the Pound. Economists at MUFG Bank point out the next support levels in the GBP/USD pair.

Weak end to the year for UK economy narrowly avoiding technical recession

“The UK contracted more sharply than expected in December by -0.5%. As a result, the UK economy recorded flat growth for Q4 as a whole just narrowly avoiding two consecutive quarters of negative growth.”

“The continued weak growth outlook will support expectations that the BoE is close to the end of their rate hike cycle.”

“The recent dovish shift in policy guidance from the BoE has weighed on Pound performance which alongside the hawkish repricing of Fed policy has dragged Cable back down towards support at the 1.2000 level. The 200-Day Moving Average also comes in at 1.1950 which is the next level of support.”

The US Bureau of Labor Statistics announced on Friday that it revised the monthly Consumer Price Index (CPI) for December to +0.1% from -0.1%, based on updated seasonal adjustment factors.

For the same period, the Core CPI, which excludes volatile food and energy prices, got revised higher to +0.4% from +0.3%, as reported by Reuters.

Market reaction

The US Dollar preserves its strength following this announcement. As of writing, the US Dollar Index was trading at 103.40, where it was up 0.2% on a daily basis.

- USD/CAD adds to its heavy intraday losses and drops back closer to the weekly low.

- Bullish oil prices, the upbeat Canadian jobs report boost Loonie and exert pressure.

- Hawkish Fed expectations, recession fears underpin the USD and should limit losses.

The USD/CAD pair extends its intraday retracement slide from the vicinity of the weekly high, around the 1.3475 region and continues losing ground through the early North American session. The downward momentum picks up pace in reaction to the upbeat Canadian employment details and drags spot prices to the 1.3370 area, or the lower end of the weekly range.

Statistics Canada reported that the number of employed people rose 150K in January, surpassing even the most optimistic estimates. Adding to this, the unemployment rate held steady at 5% against expectations for a modest uptick to 5.1%. This, along with the prevalent bullish sentiment surrounding crude oil prices, underpins the commodity-linked Loonie and exerts heavy downward pressure on the USD/CAD pair.

The US Dollar, on the other hand, stands tall near a one-month high and should limit losses, at least for now. Against the backdrop of the recent hawkish commentary by several FOMC members, a weaker tone around the equity markets - amid looming recession risks - is seen underpinning the safe-haven buck. This, along with the divergent Fed-BoC policy outlook, could lend support to the USD/CAD pair.

Investors seem convinced that the Fed will stick to its hawkish stance to tame inflation. In contrast, the Bank of Canada is expected to be the first major central bank to pause the policy-tightening cycle following eight rate hikes in the past 11 months. This, in turn, supports prospects for the emergence of some dip-buying around the USD/CAD pair, warranting some caution for bearish traders.

Technical levels to watch

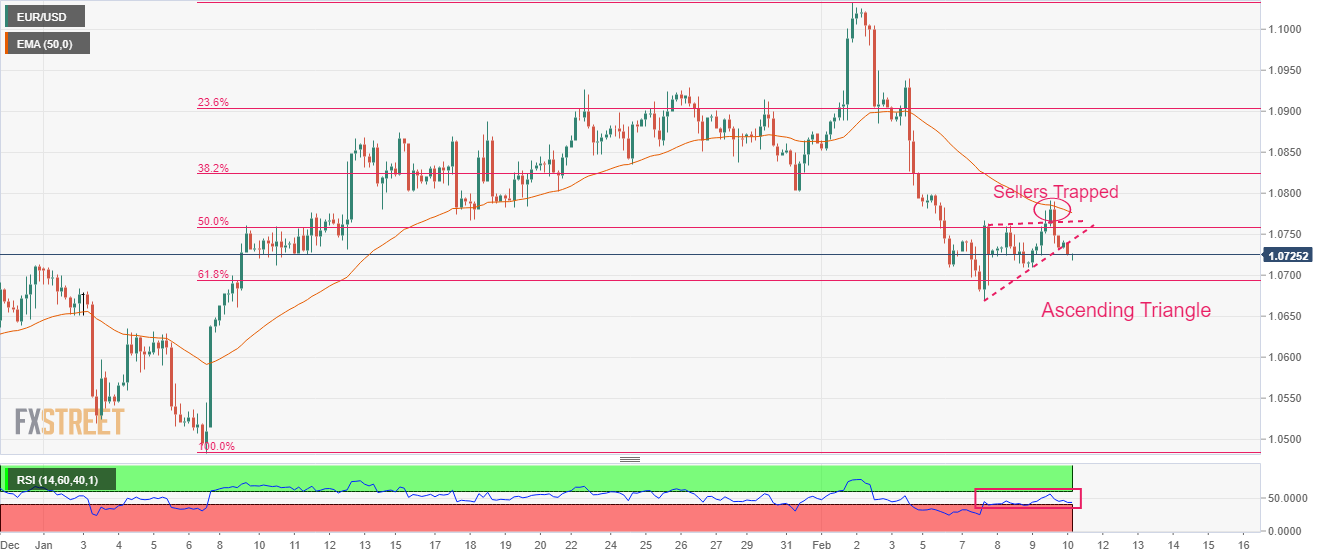

- EUR/USD resumes the downside following Thursday’s decent uptick.

- A deeper decline could see the monthly low near 1.0670 retested.

EUR/USD keeps the weekly range bound theme unchanged and now breaks below the key 1.0700 support on Friday.

In case losses gather extra impulse, then the pair could rapidly challenge the so far February low at 1.0669 (February 7). The loss of the latter could pave the way for further retracement to the 2023 low at 1.0481 (January 6).

In the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0321.

EUR/USD daily chart

- AUD/USD comes under some selling pressure on Friday amid some follow-through USD buying.

- Hawkish Fed expectations push the US bond yields higher and continue to underpin the buck.

- Looming recession risks also benefit the safe-haven USD and weigh on the risk-sensitive Aussie.

The AUD/USD pair fades an intraday uptick to the 0.6960 area and retreats to the lower end of its daily range heading into the North American session. The pair is currently placed around the 0.6925-036920 region and remains at the mercy of the US Dollar price dynamics.

A combination of supporting factors assists the US Dollar to stand tall near a one-month high, which, in turn, is seen exerting some downward pressure on the AUD/USD pair. Against the backdrop of hawkish signals from Fed officials, a fresh wave of the global risk-aversion trade provides a goodish lift to the safe-haven buck.

In fact, several FOMC policymakers, including Chair Jerome Powell, earlier this week stressed the need for additional interest rate hikes to fully gain control of inflation. The prospects for additional policy tightening by the Fed push the US Treasury bond yields higher, which, in turn, continues to act as a tailwind for the USD.

Investors, meanwhile, remain worried about economic headwinds stemming from rapidly rising borrowing costs. Adding to this, the deeply inverted US Treasury yield curve point to growing concerns about looming recession risks. This is seen as another factor that contributes to driving flows away from the risk-sensitive Aussie.

The downside for the AUD/USD pair, however, remains cushioned in the wake of a more hawkish outlook by the Reserve Bank of Australia (RBA). The minutes of the latest RBA policy meeting signalled further rate increases will be needed to ensure that inflation returns to target. This, in turn, warrants some caution for bearish traders.

Next on tap is the release of the Preliminary US Michigan Consumer Sentiment Index. This, along with a scheduled speech by Fed Governor Christopher Waller, might influence the USD demand and provide some impetus to the AUD/USD pair. Traders will further take cues from the broader risk sentiment to grab short-term opportunities.

Technical levels to watch

USD/CAD stays relatively quiet near the upper-limit of its weekly range at around 1.3450. Economists at Société Générale discuss the pair’s technical outlook.

A short-term rebound towards 1.3520/1.3540 is on the cards

“The USD/CAD pair appears to be forming a base.”

“A short-term rebound is not ruled out towards 1.3520/1.3540 and December high of 1.3700. This must be overcome to affirm the next leg of uptrend.”

“Only if 1.3260/1.3220 gets violated, would there be a risk of a deeper pullback.”

See: USD/CAD to dip under 1.34 if Canada jobs data surprise to the upside – BofA

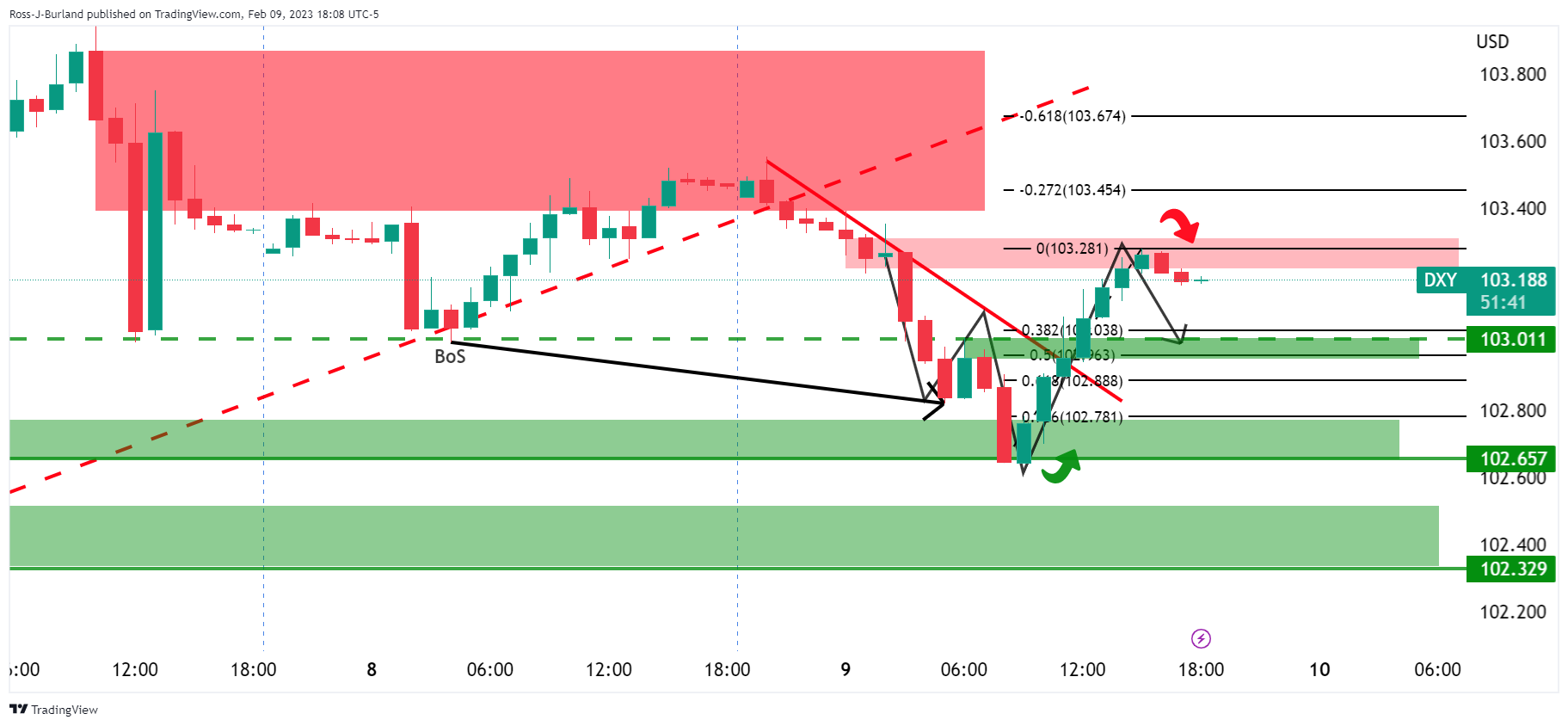

- The index maintains the choppiness unchanged this week.

- Further side-lined trading is likely in the short term.

DXY reverses Thursday’s decline to weekly lows and regains the area well north of the 103.00 barrier on Friday.

The recent price action leaves the door open to the continuation of the consolidative phase for the time being. Against that, the upper end of the range appears capped by the vicinity of the 104.00 mark, while weekly lows near 102.60 seem to emerge as a decent initial contention.

In the longer run, while below the 200-day SMA at 106.45, the outlook for the index remains negative.

DXY daily chart

EUR/USD has drifted back to the 1.07 area. Economists at Scotiabank note that the pair could fall to the 1.05/06 region.

Bearish

“Intraday weakness below the 1.0730/35 support zone (now minor resistance intraday) risks seeing EUR losses extend somewhat more as spot’s recent consolidation range has broken down.”

“EUR/USD support is 1.0670/80 (55-Day Moving Average which held losses earlier this week at 1.0682). EUR losses could extend to the 1.05/1.06 range below there.”

See – EUR/USD: Lower end remains the more vulnerable one – Commerzbank

- EUR/JPY comes under further pressure below the 200-day SMA.

- The continuation of the downtrend could see the 138.00 region revisited.

EUR/JPY reverses the recent 2-day bounce and drops to 3-week lows in the 139.50 zone at the end of the week.

While the cross is expected to maintain the side-lined theme in the short term, a convincing breakdown of the 200-day SMA at 141.03 should open the taps to extra weakness with the immediate target at the contention zone around 138.00.

In the meantme, below the 200-day SMA, the outlook for the cross is expected to remain bearish.

EUR/JPY daily chart

- Gold price struggles to gain traction and seesaws between tepid gains/minor losses.

- A stronger US Dollar, Federal Reserve’s hawkish signals seem to cap the XAU/USD.

- Looming recession risks lend some support to the metal and help limit the downside.

Gold price meets with some supply near the $1,872 region, or the 100-hour Simple Moving Average (SMA), and stalls its modest intraday recovery from over a one-month low touched this Friday. The XAU/USD is currently placed in neutral territory, just above the $1,860 level, and is influenced by a combination of diverging forces.

Stronger US Dollar acts as a headwind for Gold price

The US Dollar (USD) stands tall near its highest level since January touched earlier this week amid the prospects for further policy tightening by the Federal Reserve (Fed). This, in turn, is seen acting as a headwind for the US Dollar-denominated Gold price. That said, the prevalent risk-off environment - as depicted by a generally weaker tone around the equity markets - lends some support to the safe-haven XAU/USD and helps limit the downside, at least for the time being.

Federal Reserve’s hawkish signals also cap Gold price

Investors now seem convinced that the Fed will stick to its hawkish stance and the expectations were reaffirmed by a slew of Federal Open Market Committee (FOMC) members this week. In fact, policymakers, including Fed Chair Jerome Powell, stressed the need for additional interest rate hikes to fully gain control of inflation. This, in turn, pushes the US Treasury bond yields higher, which underpins the Greenback and further contributes to capping the non-yielding Gold price.

Recession fears help limit losses for safe-haven XAU/USD

Market participants, meanwhile, remain concerned about economic headwinds stemming from the continuous rise in borrowing costs. Recession fears are further fueled by the deeply inverted US Treasury yield curve. In fact, the difference between two-year and 10-year US Treasury notes was the widest since the early 1980s on Thursday. This, in turn, tempers investors' appetite for riskier assets and lends some support to Gold price, warranting caution before positioning for further losses.

Focus shifts to consumer inflation figures from United States

Traders might also refrain from placing aggressive bets and prefer to move to the sidelines ahead of the latest consumer inflation figures from the United States (US), due for release next Tuesday. In the meantime, the Preliminary US Michigan Consumer Sentiment Index, along with a scheduled speech by Fed Governor Christopher Waller, could provide some impetus to Gold price. Nevertheless, the XAU/USD seems poised to settle nearly unchanged for the week, just above the 50-day SMA.

Gold price technical outlook

From a technical perspective, acceptance below the $1,855 region (50-day SMA) will be seen as a fresh trigger for bearish traders and pave the way for deeper losses. Gold price could then slide to the next relevant support near the $1,830 area en route to the $1,818-$1,817 zone and the $1,800 round figure. On the flip side, momentum beyond the $1,875 hurdle is likely to meet with a fresh supply ahead of the $1,900 mark. The latter should act as a pivotal point, above which a bout of a short-covering could lift the Gold price to the $1,925-$1,930 congestion zone.

Key levels to watch

USD/JPY has been subjected to a bout of volatility on reports that Kazuo Ueda will be the next BoJ Governor. But economists at Rabobank stick to their USD/JPY forecast.

Scope for a move to USD/JPY 128 on a three-month view

“Given what is known so far, a Bank of Japan with Ueda at the helm has not altered our view of BoJ policies. We continue to expect a very cautious outlook to prevail with conditions building for a modest withdrawal of accommodation this year. We expect this would commence with an adjustment to YCC.”

“Bearing in mind that other central banks are already edging towards peak interest rates and could be cutting rates in 2024, there may only be a limited time-frame for the BoJ to tighten policy without causing undue stress on the JPY exchange rate.”

“Assuming some relaxation in YCC, we see scope for a move to USD/JPY 128 on a three-month view. However, a hawkish Fed is likely to limit scope for JPY appreciation.”

Senior Economist Julia Goh and Economist Loke Siew Ting at UOB Group, assess the lates labour market report from Malaysia.

Key Takeaways

“Malaysia’s labour market conditions remained broadly stable in Dec 2022, with both unemployment rate and labour force participation rate holding unchanged at 3.6% and 69.8% respectively. This was aligned with full operation of all economic activities for nearly one year amid persistent scaring effects of the COVID-19 pandemic on the economy. For the full year of 2022, unemployment rate averaged 3.9% (2021: 4.6%), remaining above the pre-pandemic 2015-2019 long term average of 3.3%.”

“Total employment recorded the smallest gain in 17 months of 21.8k or 0.1% m/m to 16.13mn in Dec (Nov: +27.1k or +0.2% m/m to 16.11mn), the highest level on record. The slower gain was mainly driven by all economic sectors, led by services and manufacturing sectors.”

“The latest performance of all labour market indicators continued to affirm our view of a slower recovery momentum in Malaysia’s labour market since Jul 2022. Although China’s reopening from 8 Jan 2023 has spurred optimism for Southeast Asia including Malaysia’s tourism sector and growth recovery this year, the impact may be more gradual in 1H23 amid capacity constraints and inflation risks. Taking this and other lingering economic headwinds into consideration as well as pending additional job-related initiatives from the 2023 budget that will be re-tabled on 24 Feb, we keep our year-end jobless rate forecast at 3.2% for 2023 (vs official est: 3.5%-3.7%, end-2022: 3.6%).”

The S&P 500 finished lower as the index posted a -0.88% loss. It was the first back-to-back -1.0% days for the S&P 500 since mid-December. The index could suffer a deeper fall on failure to hold above 4000/3930, economists at Société Générale report.

A pullback is underway

“S&P 500 broke out above a multi-month trend line resulting in extension of its rebound. It recently approached intermittent resistance of 4218 representing previous bearish gap.”

“Currently, a pullback is underway. However, the trend line and the 200-DMA near 4000/3930 should be a short-term support zone. A break below this would be essential to affirm an extended down move.”

Friday's Canada jobs report for the month of January could drag the USD/CAD pair down if data surprise to the upside, economists at Bank of America Global Research report.

CAD/USD has had a strong positive correlation with Canada employment data surprises

“We find over the past two years, the CAD/USD exchange rate has had a strong positive correlation with Canada employment data surprises.”

“Our economists and consensus forecast both look for Canada to add 15K employment for Jan 2023. The risk may be to the upside, given two recent large surprises for Oct and Dec 2022, respectively leading to immediate 0.57% and 0.72% CAD/USD rallies in the two hours after the data release.”

“In the event that CA employment data indeed surprises to the upside this Friday, we would expect some tailwind for CAD and for USD/CAD to fall below the 1.34-handle.”

See – Canadian Employment Preview: Forecasts from five major banks, little if any gain

Economists at ING think there are more downside risks to NZD compared to AUD over the course of 2023.

NZD less attractive than AUD

“An ultra-hawkish Reserve Bank of New Zealand is good from a carry perspective, but has already generated a large slump in house prices. This trend may accelerate and pose serious threats to the economic outlook.”

“We think the RBNZ will underdeliver and fall well short of their projected 5.5% peak rate to save the property market.”

“The resignation of the NZ prime minister does not have major implications for now, but might add a little uncertainty along the way.”

“AUD/NZD to break through 1.10 soon.”

UOB Group’s Head of Research Suan Teck Kin, CFA, reviews the latest interest rate decision by the RBI.

Key Takeaways

“The Reserve Bank of India (RBI) at its Feb 2023 Monetary Policy Committee meeting lifted the benchmark repo rate as widely expected, by 25bps to 6.50%. This followed the downshifting to 35bps hike (to 6.25%) at the Dec 2022 MPC after three consecutive rounds of 50bps move. The current repo rate is at a level last seen in Jan 2019, just before RBI entered its policy accommodative phase.”

“Inflation pressure remains RBI’s overriding concern and the main policy objective, as core inflation rate stayed above the upper band of the target inflation rate (4%+/-2%) for the second straight month in Dec 2022, despite overall inflation trending below the 6% level for the second consecutive month. RBI noted that core inflation “remains sticky” but expected inflation to moderate in 2023-24 and “to rule above” the 4% target.”

“Outlook – With RBI’s policy priority on containing inflation pressures while being mindful of the ongoing pass-through of input costs, and that the stickiness of core inflation is “a matter of concern”, the central bank’s hawkish tone signals that its job is not done yet. This is also reinforced by RBI’s comments that overall monetary conditions “remain accommodative”. Based on the above factors, the RBI is unlikely to be taking a pause anytime soon. We thus pencil in one final interest rate rise of 25bps, to 6.75%, at the next MPC meeting (3-6 Apr 2023).”

In the view of Antje Praefcke, FX Analyst at Commerzbank, positive data from the United States has the potential to lift the greenback.

Price and labour market data will have even more potential to move USD

“The Fed drives at the sight and is basing its decisions very much on the data. That means that presumably any data – in particular price and labour market data – will have even more potential to move the Dollar in the foreseeable future.”

“The Dollar will appreciate more significantly in case of good US data than it eases in case of negative data. That means the lower end in EUR/USD remains the more vulnerable one.”

The Dollar is struggling to find clear direction in the current market environment. Economists at ING think the greenback may lack clear direction until next week’s inflation data.

The waiting game is on

“We suspect key Dollar crosses will stay rangebound until the next key data releases. Next week’s CPI is the real risk event. And if the general risk environment proves resilient for another session today, the Dollar should still find a floor on the back of some defensive positioning ahead of next week’s inflation data, as happened in the run-up to the Fed meeting.”

“Fed communication remains important, but secondary to data. Additional policy remarks from the Fed’s Christopher Waller and Patrick Harker today are not likely to be a game changer for the Dollar.”

“DXY may keep hovering around the 103 handle into next week’s CPI report.”

UOB Group’s Economist Lee Sue Ann and Markets Strategist Quek Ser Leang expect the current upside momentum in USD/CNH to remain intact above the 6.7400 level.

Key Quotes

24-hour view: “Yesterday, we held the view that the bias for USD is to the upside. However, USD traded between 6.7765 and 6.8049 before closing unchanged at 6.7970. The underlying tone still appears to be a tad firm and USD is likely to edge higher today. However, any advance is unlikely to break 6.8150. Support is at 6.7880, followed by 6.7765.”

Next 1-3 weeks: “On Monday (06 Feb, spot at 6.8200), we highlighted that while short-term conditions are deeply overbought, as long as the ‘strong support’ level, currently at 6.7400 is not breached, USD could rise further to 6.8500, as high as 6.8800. We continue to hold the same view.”

- USD/JPY attracts fresh buying following a sharp intraday fall to the 129.80 area, or the weekly low.

- Dovish remarks by the possible BoJ governor candidate weigh on the JPY and lend some support.

- Hawkish Fed expectations, rising US bond yields underpin the USD and provide an additional boost.

The USD/JPY pair rebounds nearly 140 pips from the weekly low touched during the first half of the European session on Friday and now trades just above the 131.00 mark.

Reports that the Japanese government is likely to appoint Kazuo Ueda as the next Bank of Japan (BoJ) governor boost the domestic currency and prompt aggressive intraday selling around the USD/JPY pair. The initial market reaction, however, fades rather quickly after the possible BoJ governor candidate Ueda said that the current policy is appropriate and added they need to continue the easy policy. This, in turn, undermines the Japanese Yen (JPY), which, along with the emergence of fresh US Dollar buying, assists the pair to rebound swiftly from the 129.80 region.

The USD continues to draw support from diminishing odds for an imminent pause in the Fed's policy tightening cycle. The expectations were lifted by the recent hawkish remarks by several FOMC officials, including Fed Chair Jerome Powell, stressing the need for additional interest rate hikes this week to fully gain control of inflation. This, in turn, pushes the US Treasury bond yields higher, which, in turn, benefits the greenback. That said, looming recession risks lend some support to the safe-haven JPY and keep a lid on further gains for the USD/JPY pair.

Even from a technical perspective, failure to find bearish acceptance below the 130.00 psychological mark and the subsequent bounce warrant caution before positioning for any further decline. That said, a strong follow-through buying is needed to support prospects for an extension of the recent recovery from the 127.20 area, or a multi-month low touched in January. Traders now look to the Preliminary Michigan Consumer Sentiment Index from the US, which, along with Fed Governor Christopher Waller's speech, might provide some impetus to the USD/JPY pair.

Technical levels to watch

The Canadian labour market data due for publication today is likely to attract the utmost attention. Economists at Commerzbank how could the employment report impact the Canadian Dollar (CAD).

Eyes on Canada jobs report

“A surprisingly strong labour market report today is likely to support rate expectations and thus the Loonie only somewhat.”

“A significant surprise to the downside on the other hand will likely put pressure on the Canadian Dollar.”

See – Canadian Employment Preview: Forecasts from five major banks, little if any gain

Kazuo Ueda, the academic the Japanese government is reportedly planning to nominate as the next Governor of Bank of Japan (BOJ), said on Friday that the BOJ's current policy is appropriate and added they need to continue the easy policy.

"It's important to make decisions logically and explain clearly," Ueda responded when asked how he would conduct policy if he were to become the next BoJ Governor, per Reuters.

Market reaction

USD/JPY rebound from daily lows with the initial reaction and was last seen trading at around 131.00, where it was down 0.4% on a daily basis.

FX option expiries for Feb 10 NY cut at 10:00 Eastern Time, via DTCC, can be found below.

- EUR/USD: EUR amounts

- 1.0500 500m

- 1.0525 500m

- 1.0700 203m

- USD/CHF: USD amounts

- 0.9045 240m

- EUR/GBP: GBP amounts

- 0.8800 425m

- USD/JPY: USD amounts

- 130.00 250m

A brief rally failed to propel EUR/USD back above 1.0800 yesterday. Economists at ING see the pair rangebound for now.

Ability of ECB speakers to lift the Euro appears diminished

“The pair may mostly trade in the 1.07-1.08 range until next week’s data offers clearer direction to the Dollar.”

“Despite an improved risk environment helping the pro-cyclical Euro, below-consensus inflation in Germany yesterday may have made investors more cautious about another EUR rally. In this sense, the ability of European Central Bank speakers to lift the Euro appears diminished.”

- USD/CAD retreats from the 1.3475 supply zone and is pressured by a combination of factors.

- Crude Oil prices jump to a two-week high and underpin the Loonie amid a modest USD slide.

- The divergent Fed-BoC outlook, recession fears lend support ahead of the Canadian jobs data.

The USD/CAD pair continues with its struggle to make it through the 1.3475 resistance zone and attracts some intraday selling on Friday. The intraday downfall drags spot prices to a fresh daily low, around the 1.3430 area during the first half of the European session and is sponsored by a combination of factors.

Crude Oil prices regain strong positive traction and jump back closer to the 100-day SMA resistance, hitting a two-week high. This, in turn, is seen underpinning the commodity-linked Loonie, which, along with a modest US Dollar pullback, exerts some downward pressure on the USD/CAD pair. That said, any meaningful downside seems elusive, warranting some caution for bearish traders before positioning for any further intraday depreciating move.

Worries about a deeper global economic downturn could act as a headwind for the black liquid and keep a lid on any optimism in the markets. Apart from this, expectations for further policy tightening by the Fed favour the USD bulls and support prospects for the emergence of some dip-buying around the USD/CAD pair. In fact, a slew of FOMC members, including Fed Chair Jerome Powell, stressed the need for additional rate hikes to tame inflation.

The Bank of Canada (BoC), on the other hand, is expected to be the first major central bank to pause the policy-tightening cycle following eight rate hikes in the past 11 months. The divergent Fed-BoC outlook on future rate hikes adds credence to the positive bias. Traders, however, might refrain from placing aggressive directional bets around the USD/CAD pair and prefer to wait for the release of the latest Canadian monthly employment details.

Investors will further take cues from the release of the Preliminary Michigan Consumer Sentiment Index from the US. This, along with Fed Governor Christopher Waller's speech and the broader risk sentiment, might influence the USD. Apart from this, Oil price dynamics should contribute to producing short-term trading opportunities around the USD/CAD pair. Nevertheless, spot prices seem poised to end in the positive territory for the second successive week.

Technical levels to watch

- EUR/USD revisits the 1.0740 area following Thursday's advance.

- The greenback attempts a tepid bounce after the recent pullback.

- Italy’s Industrial Production, ECB’s Schnabel next on tap.

The European currency trades in a vacillating fashion and motivates EUR/USD to hover around the 1.0730/40 band at the end of the week.

EUR/USD remains supported near 1.0670

EUR/USD looks to extend Thursday’s recovery north of 1.0700 the figure on the back of the generalized consolidative mood in the global markets and the lack of direction in the dollar.

In the meantime, the pair remains side-lined in the lower end of the weekly range and appears to have finally digested the steep decline in the wake of the FOMC and ECB gatherings during the previous week.

In the domestic docket, Industrial Production in Italy expanded at a monthly 1.6% in December and 0.1% from a year earlier. Later in the session, Germany will publish the Current Account figures.

In the US, the preliminary Michigan Consumer Sentiment will take centre stage later in the NA session.

What to look for around EUR

EUR/USD seems to have embarked in a consolidative phase following the recent drop to the 1.0670 region, although the resistance line around 1.0800 continues to cap occasional bullish attempts for the time being.

In the meantime, price action around the European currency should continue to closely follow dollar dynamics, as well as the potential next moves from the ECB after the central bank delivered a 50 bps at its meeting last week.

Back to the euro area, recession concerns now appear to have dwindled, which at the same time remain an important driver sustaining the ongoing recovery in the single currency as well as the hawkish narrative from the ECB.

Key events in the euro area this week: Italy Industrial Production (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle amidst dwindling bets for a recession in the region and still elevated inflation. Impact of the Russia-Ukraine war on the growth prospects and inflation outlook in the region. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is gaining 0.01% at 1.0741 and is expected to meet the next up barrier at 1.1032 (2023 high February 2) followed by 1.1100 (round level) and finally 1.1184 (weekly high March 31 2022). On the flip side, a drop below 1.0681 (55-day SMA) would target 1.0669 (monthly low February 7) en route to 1.0481 (2023 low January 6).

Riksbank’s hawkish surprise motivated to strengthen the Krona. Antje Praefcke, FX Analyst at Commerzbank expects the SEK to enjoy further gains this year.

Riksbank makes a U-turn

“The Riksbank did exactly what it had to: it produced a hawkish statement and thus illustrated that it continues to take decisive action against price risks. In my view that was a job well done! The market is appreciating this decision and is trading SEK at higher levels after it had questioned for some time whether the Riksbank really will dare take this step.”

“Riksbank has proven itself determined in its fight against inflation. The bank itself puts it very well: It is ’important for monetary policy to act when inflation is too high’. I, therefore, stick to my view that the market is trading SEK at excessively low levels and that it should appreciate over the course of the year.”

- Unemployment Rate is forecast to tick up to 5.1%, within a slower Canadian labor market.

- Canadian Dollar has been bullish for most of 2023, needs a stronger-than-expected labor market to keep rallying.

- Bank of Canada future path on monetary policy depends on employment and inflation figures.

The Canadian employment report, published by Statistics Canada, will be published on Friday, February 8 at 13:30 GMT. The Unemployment Rate is expected to rise a tad to 5.1% in January from 5% in December as the Canadian economy is forecast to have added only 15K jobs, way lower than the 104K in the previous month.

As the Bank of Canada (BoC) closes in on the end of its tightening cycle, the labour market data could influence the Canadian Dollar’s (CAD) performance against its rivals. A stronger than expected growth in payrolls and wage inflation, as measured by the Average Hourly Earnings, could help the CAD gather strength against its rivals in the near term. On the other hand, the currency is likely to have a hard time finding demand if the jobs report reveals loosening conditions in the labour market.

Unemployment in Canada could rise a bit, will this affect Bank of Canada plans?

Earlier in the week, the Market Participants Survey for the fourth quarter of 2022 published by the Bank of Canada showed that the median of responses for the monetary policy rate by end-2023 stood at 4%, forecasting a 50 bps cut from the current level. Following the January policy meeting, the BoC hiked its policy rate by 25 basis points to 4.5% and noted that it is likely to hold the interest rate at this level while assessing the impact of cumulative rate increases on the economy.

A cooldown in the jobs market could definitely allow BoC policymakers to start considering a policy pivot and weigh on the Canadian Dollar. Market expectations for the January Labor Force Survey report are indeed notably lower than the December figures, as economists expect a relatively small job growth (market consensus at 15K) and lightly higher Unemployment Rate (5.1%).

In its policy statement, the Bank of Canada noted that it is prepared to increase the policy rate further if needed to return inflation to 2% target; continuing the quantitative tightening program. In December, annual wage inflation, represented by the Average Hourly Earnings, stood at 5.2%. A significant increase in that component is likely to be assessed as a factor that would limit the decline in consumer inflation. In that scenario, investors could refrain from betting on further Canadian Dollar weakness.

RBC Economics analysts agree with the market consensus on the release:

“The record squeeze on Canadian labour markets is unlikely to have loosened much in January. We look for a small increase in employment (roughly 5K workers) to add to the 176K surge in positions that played out over the prior four months. We also expect a tick up in the unemployment rate, to 5.1% – still just off multi-decade lows earlier in the summer.”

Will January Canada Unemployment Rate trigger USD/CAD rally?

The Canadian Unemployment Rate for January will be released within the publication of the Labor Force Survey on Friday, February 10 at 13.30 GMT. The market expects softer figures than in December throughout all the key indicators, which could play into the hands of USD/CAD bulls, who have recovered some ground in the past week, as the US Dollar (USD) rallied across the board after the super strong Nonfarm Payrolls data.

Zooming out a bit, USD/CAD has declined since the beginning of the year amid the broad-based selling pressure surrounding the US Dollar. The pair’s losses, however, were limited as the impressive January jobs report from the US revived expectations for two more 25 bps Fed rate increases in March and May, helping the USD regather its strength.

The pair faces strong support at 1.3300 (psychological level, static level) ahead of 1.3230, where the 200-day Simple Moving Average (SMA) aligns. A daily close below the latter could be seen as a significant bearish development and open the door for an extended slide toward 1.3250 (former resistance, static level). For that type of reaction to occur, though, the jobs report needs to offer surprisingly strong figures in wages and payrolls to revive hawkish BoC monetary policy expectations.

On the upside, 1.3500 (50-day SMA, static level, psychological level) forms interim resistance before 1.3540 (100-day SMA). In case USD/CAD rises above that hurdle and starts using it as support, it could target 1.3700 (static level, psychological level) next.

Canada unemployment report related content

- Canada Employment: Room for a pronounced CAD impact from a data surprise – ING.

- Canadian Employment Preview: Forecasts from five major banks, little if any gain.

- USD Index remains consolidative in the low-103.00s ahead of data, Fedspeak.

About the Employment Change

The Net Change in Employment is a measure of the change in the number of employed Canadians, provided in Statistics Canada's Labor Force Survey report. In general, an increase in this metric is favorable for consumer spending and it encourages economic expansion. A high rating is therefore viewed as favorable or bullish for the Canadian Dollar, whereas a low reading is viewed as unfavorable or bearish.

About the Unemployment Rate

The number of jobless employees divided by the entire civilian labor force yields the Unemployment Rate, posted by Statistics Canada. It serves as one of the main Canadian economy leading indicators. If the rate is higher, there hasn't been much growth in the Canadian labor market. As a result, a surge typically results in the Canadian Dollar depreciating. Otherwise, a decline in the number is typically considered favorable (or bullish) for the CAD.

- EUR/GBP gains some traction and snaps a four-day losing streak to over a one-week low.

- A rather unimpressive UK GDP report remains supportive of the modest intraday uptick.

- Signs of easing inflationary pressures in the Eurozone keep a lid on any further gains.

The EUR/GBP cross attracts some buyers on Friday and for now, seems to have snapped a four-day losing streak to over a one-week low, around the 0.8840-0.8835 region touched the previous day. The cross sticks to a mildly positive bias through the early part of the European session and is currently placed around the 0.8860-0.8865 area.

The British Pound's relative underperformance comes on the back of a rather unimpressive UK GDP report, which showed that the economy contracted more than anticipated, by 0.5% in December. Furthermore, the economy stagnated during the final three months of 2022. This, to a larger extent, overshadows better-than-expected UK Manufacturing and Industrial Production figures and offers some support to the EUR/GBP cross.

Commenting on the growth figures, Britain's Finance minister Jeremy Hunt said that the economy was more resilient than expected, but still not clear of danger, which, in turn, fails to impress the GBP bulls. The shared currency, on the other hand, draws some support from rising bets for additional jumbo rate hikes from the European Central Bank (ECB) in the coming month. This further acts as a tailwind for the EUR/GBP cross.

That said, signs of easing inflationary pressure in the Eurozone keep a lid on any meaningful gains for the Euro, at least for the time being. Moreover, the lack of follow-through buying warrants some caution before confirming that the EUR/GBP pair's recent sharp pullback from the highest level since September 2022 has run its course.

Technical levels to watch

A test of the 133.30 region in USD/JPY now appears to be fizzling out, note UOB Group’s Economist Lee Sue Ann and Markets Strategist Quek Ser Leang.

Key Quotes

24-hour view: “We expected USD to edge higher yesterday. However, USD dropped to 130.33 before rebounding strongly to close at 131.56 (+0.14%). The advance could extend but a break of 132.20 is unlikely. Support is at 131.15, followed by 130.75.”

Next 1-3 weeks: “Our update from two days ago (08 Feb, spot at 130.90) still stands. As highlighted, while the outlook for USD is still positive, the prospect of it rising to 133.35 has decreased. Overall, only a breach of 130.20 (no change in ‘strong support’ level) would indicate that USD is not advancing further.”

The RBA updated its economic forecasts in its quarterly Statement of Monetary Policy (SoMP). Economists at TD Securities expect the central bank to take a breather at its April meeting. However, a May hike looks highly likely.

Further interest rate hikes ahead

“There are no significant surprises in the RBA's fresh set of forecasts. Inflation and Wage forecasts were revised up with little to no change in GDP and unemployment projections.”

“The RBA assumes a cash rate peak of 3.75% in H2'23. The risk is this peak is achieved earlier and/or exceeds the RBA's forecast, with a 4% cash rate.”

“The Bank is mindful of the lags in monetary policy but is acutely aware of the upside risks to wages/inflation. We expect the RBA to hike next month, pause in April and hike in May.”

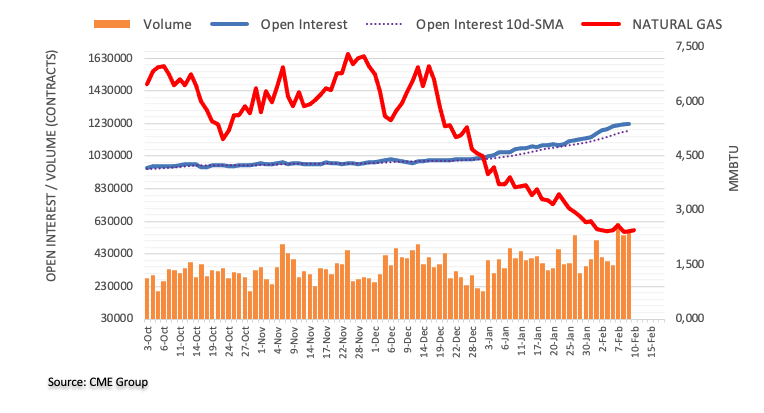

Open interest in natural gas futures markets prolonged the uptrend and rose by just 197 contracts on Thursday according to preliminary readings from CME Group. In the same line, volume extended the erratic performance and went up by around 26.6K contracts.

Natural Gas now moved into a consolidative phase

Prices of natural gas advanced marginally on Thursday. This uptick was accompanied by another increase in open interest and volume, exposing some extra gains near term. This view also appears reinforced by the current oversold conditions of the commodity.

In the opinion of UOB Group’s Economist Lee Sue Ann and Markets Strategist Quek Ser Leang, AUD/USD is now predicted to navigate within the 0.6865-0.7055 range in the short-term horizon.

Key Quotes

24-hour view: “We expected AUD to trade sideways between 0.6890 and 0.6970 yesterday. However, AUD rose to 0.7011 and then dropped quickly to end the day at 0.6937 (+0.18%). The sharp but short-lived swings have resulted in a mixed outlook. Further choppy trading is not ruled out, likely between 0.6900 and 0.6995.”

Next 1-3 weeks: “Our update from two days ago (08 Feb, spot at 0.6960) still stands. As highlighted, AUD appears to have moved into a consolidation phase and it is likely to trade between 0.6865 and 0.7055 for the time being.”

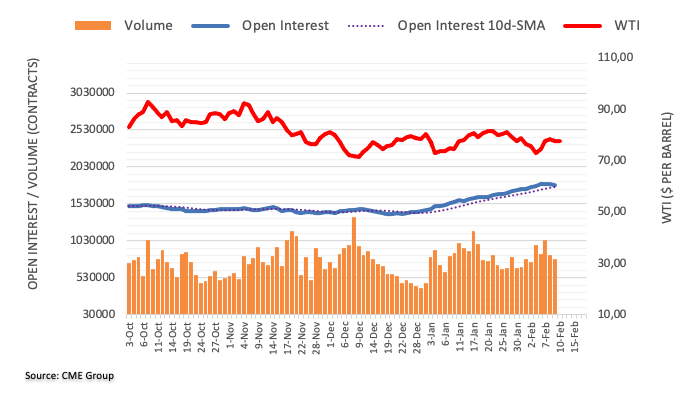

Considering advanced prints from CME Group for crude oil futures markets, open interest shrank by around 2.5K contracts on Thursday, reversing at the same time the previous daily build. Volume followed suit and dropped for the second session in a row, now by around 62.6K contracts.

WTI: Next on the upside comes $82.60

Prices of the WTI reversed a 3-session positive streak on Thursday. The downtick, however, came amidst declining open interest and volume, leaving the door open to the continuation of the upside momentum in the very near term and with the immediate hurdle at the 2023 peak at $82.60 (January 23).

- NZD/USD attracts some dip-buying near 0.6300 on Friday amid a modest USD pullback.

- A modest recovery in the equity markets further offers support to the risk-sensitive Kiwi.

- Hawkish Fed expectations, recession risks could limit the USD losses and cap the major.

The NZD/USD pair reverses an intraday dip to the 0.6300 neighbourhood and climbs to a fresh daily high during the early European session on Friday. The pair is currently placed around the 0.6340 region, up over 0.30% for the day, though remains well below the weekly top touched the previous day.

The US Dollar struggles to capitalize on its modest intraday gains and retreats from a one-month high, which, in turn, assists the NZD/USD pair to attract some dip-buying on the last day of the week. The USD pullback could be attributed to a sudden pickup in demand for the Japanese Yen, led by reports that the Japanese government plans to appoint Kazuo Ueda as the next Bank of Japan governor. Apart from this, a modest bounce in the US equity futures further undermines the safe-haven buck and benefits the risk-sensitive Kiwi.

That said, looming recession risks could keep a lid on any optimism in the markets. The market concerns about a deeper global economic downturn are reinforced by the deeply inverted US Treasury yield curve. Apart from this, the prospects for further policy tightening by the Fed should help limit losses for the Greenback and cap gains for the NZD/USD pair, at least for the time being. It is worth mentioning that several FOMC members, including Fed Chair Jerome Powell, stressed the need for additional rate hikes to tame inflation.

The aforementioned fundamental backdrop warrants some caution before confirming that the NZD/USD pair's recent slide from its highest level since June 2022 has run its course. Traders now look to the Preliminary Michigan Consumer Sentiment Index from the US, due later during the early North American session. This, along with Fed Governor Christopher Waller's speech, might influence the USD. Apart from this, the broader risk sentiment could further contribute to producing short-term trading opportunities around the major.

Technical levels to watch

Canadian jobs numbers have the potential of driving large CAD swings today, economists at ING report.

USD/CAD to test 1.3000 in the coming months

“Markets are pricing little to no chance of further rate hikes, but equally seem reluctant to factor in any rate cuts by year-end. This leaves some room on both ends for a pronounced CAD impact from a data surprise today.”

“A weak number could fuel easing bets (risk of cuts is higher than expected anyway, in our view), while a strong number – paired with the recent revision higher in Fed rate expectations – could encourage markets to contemplate one last hike by the BoC.”

“We still expect USD/CAD to test 1.3000 in the coming months, but the key driver may be USD weakness rather than Loonie outperformance.”

See – Canadian Employment Preview: Forecasts from five major banks, little if any gain

The uncertainty about the inflation outlook remains high in the UK. Next week’s data will be key to determine the next rate hikes of the BoE, causing volatility in GBP exchange rates, economists at Commerzbank report.

A rate hike in March is not off the agenda yet

“A rate hike in March is not off the agenda yet, seeing that upside risks for inflation are high. It will have to become clear for example how strikes by public sector workers affect wages. As the labour market also remains quite tight there is the risk of second-round effects.”

“In the end, the BoE has no choice but to wait for further data publication to get a better impression. There will be more opportunity to do that next week when labour market and inflation data is going to be published. Sterling is therefore likely to face a volatile week.”

GBP/USD seems to have now moved into a consolidative phase, likely between 1.2015 and 1.2260, suggest UOB Group’s Economist Lee Sue Ann and Markets Strategist Quek Ser Leang.

Key Quotes

24-hour view: “We did not anticipate the sharp rise in GBP to 1.2193 and the subsequent sharp pullback from the high (we were expecting GBP to trade in a range). Despite the advance, there is no significant improvement in upward momentum and GBP is unlikely to rise further. Today, GBP is more likely to trade sideways, expected to be between 1.2060 and 1.2175.”

Next 1-3 weeks: “Yesterday (09 Feb 2023, spot at 1.2070), we highlighted that there is still a slim chance for GBP to drop to 1.1845. GBP subsequently rose above our ‘strong resistance’ level of 1.2150 (high has been 1.2193). The breach of the ‘strong resistance’ indicates that the GBP weakness that started early this month (see annotations in the chart below) has ended. GBP appears to have entered a consolidation phase and it is likely to trade between 1.2015 and 1.2260 for now.”

- USD/JPY meets with a fresh supply on Friday and is weighed down by reviving demand for the JPY.

- A combination of factors boosts the safe-haven JPY and exerts some downward pressure on the pair.

- A modest USD strength lends some support and helps limit the downside, at least for the time being.

The USD/JPY pair struggles to capitalize on its modest gains recorded over the past two trading sessions and attracts fresh sellers following an early uptick to the 132.00 area on Friday. The intraday slide picks up pace during the early European session and drags spot prices to a fresh daily low, around the 130.60-130.55 region in the last hour.

Reports indicate that the Japanese government plans to appoint Kazuo Ueda as the Bank of Japan's (BoJ) next governor after Haruhiko Kuroda steps down. The report fuels speculations that high inflation may invite a more hawkish stance from the BoJ later this year. This, in turn, boosts the Japanese Yen and turns out to be a key factor behind the USD/JPY pair's latest leg down witnessed over the past hour or so.

Apart from this, the prevalent risk-off environment - as depicted by a generally weaker tone around the equity markets - also benefits the safe-haven JPY and exerts additional pressure on the USD/JPY pair. That said, a modest US Dollar strength, bolstered by the recent hawkish commentary by several FOMC members, lends some support to the major and helps limit the downside for the major, warranting caution for bears.

Hence, it will be prudent to wait for some follow-through selling below the weekly swing low, around the 130.35 area touched on Thursday, before positioning for any further depreciating move. Traders now look to the release of the Preliminary Michigan Consumer Sentiment Index from the US. This, along with Fed Governor Christopher Waller's speech and the broader risk sentiment, could provide a fresh impetus to the USD/JPY pair.

Technical levels to watch

Canada’s employment data for January will be reported by Statistics Canada on Friday, February 10 at 13:30 GMT and as we get closer to the release time, here are forecasts from economists and researchers at five major banks regarding the upcoming jobs figures.

The North American economy is estimated to have created 15K jobs in January as against a massive jobs growth of 104K reported in December. The Unemployment Rate, however, is seen rising a tick to 5.1% last month from December’s 5%.

TDS

“We look employment to rise by 5K for a deceleration from the recent trend, with services driving job growth, as the UE rate edges higher to 5.1% and wages decelerate to 4.3% YoY.”

RBC Economics

“The record squeeze on Canadian labour markets is unlikely to have loosened much in January. We look for a small increase in employment (roughly 5K workers) to add to the 176K surge in positions that played out over the prior four months. We also expect a tick up in the unemployment rate, to 5.1% – still just off multi-decade lows earlier in the summer.”

NBF

“We expect employment to have fallen 20K in the first month of 2023. Such a decline would translate into a two-tick increase in the unemployment rate to 5.2%, assuming the participation rate remained steady at 65.0% and the working-age population grew at a strong pace.”

Citibank

“We expect a solid 25K increase in employment in January and continue to see upside risks for employment figures in the near term. A strong 25K pace would put some downward pressure on the unemployment rate, although a more modest increase to 5.1% is more likely due to the rise in participation that could also be related to stronger immigration. We expect usual start-of-year wage increases to boost YoY wages of permanent employees to 4.8% – wage growth of 4-5% is not consistent with 2% inflation.”

CIBC

“We forecast a modest 5K gain in employment during January, which would be below the pace of labour force growth and see the unemployment rate tick up to 5.1%.”

UK Finance Minister Jeremy Hunt said that “the fact the UK was the fastest growing economy in the G7 last year, as well as avoiding a recession, shows our economy is more resilient than many feared."

Additional quotes

“We are not out the woods yet, particularly when it comes to inflation.”

“If we stick to our plan to halve inflation this year, we can be confident of having amongst the best prospects for growth of anywhere in Europe.”

Related reads

- UK Preliminary GDP stagnates in Q4 2022, as expected

- GBP/USD remains depressed near 1.2100 mark, moves little post-UK macro data

Gold price is sitting at the lowest level in five weeks near the $1,850 mark. As FXStreet’s Dhwani Mehta notes, XAU/USD looks south amid Bear Flag.

Further downside pressure

Gold price confirmed a Bear Flag on Thursday after closing the day below the rising trendline support at $1,871. The bearish continuation pattern has provided extra zest to Gold sellers, as they challenge the critical 50-Daily Moving Average (DMA) at $1,855.”

“The downside bias remains favored, with a sustained move toward the January 5 low of $1,825 eyed should the $1,850 support give way.”

“On the upside, any recovery attempts will need to recapture the bear flag support-turned-resistance at $1,871. The next stop for Gold optimists is seen at around the $1,885 level, the static resistance.”

The Nikkei Asian Review reported on Friday that the Japanese Cabinet is set to appoint Kazuo Ueda as the next Bank of Japan (BoJ) Governor after Haruhiko Kuroda steps down in April.

Additional takeaways

Japan govt to nominate ex-FSA Chief Himino as new Deputy BoJ Governor.

Japan govt to nominate ex-FSA Chief Himino as new Deputy BoJ Governor.

Japan govt to nominate BoJ Executive Director Shinichi Uchida as new Deputy BoJ Governor.

- The index regains some poise following Thursday’s strong sell-off.

- Further consolidation appears likely below the 104.00 region.

- The Flash Consumer Sentiment, Fed’s Waller, Harker come later.

The USD Index (DXY), which tracks the greenback vs. a bundle of its main rival currencies, navigates with humble gains in the 103.30 region ahead of the opening bell in the old continent on Friday.

USD Index bounces off 102.60

Following the strong knee-jerk to the 102.60 zone during the previous session, the index regains some balance and revisits the 103.20/30 band amidst flattish risk appetite trends at the end of the week.

In the meantime, US yields appear to be taking a breather following the marked uptick recorded on Thursday ahead of speeches by FOMC’s C.Waller (permanent voter, hawk) and Philly Fed P.Harker (voter, hawk).

In the meantime, the dollar – and the rest of the global assets – are expected to maintain a somewhat consolidative pace ahead of the publication of key US inflation figures on February 14, always amidst the persistent hawkish narrative from the Federal Reserve vs. investors’ perception that a pivot in the monetary conditions is imminent.

Other than Fed speakers, the US calendar will include the advanced Michigan Consumer Sentiment for the month of February.

What to look for around USD

The dollar remains within a consolidative phase in the upper end of the weekly range above the 103.00 mark against the backdrop of alternating risk appetite trends.

The idea of a probable pivot/impasse in the Fed’s normalization process now looks mitigated in favour of a tighter-for-longer narrative, which appears almost exclusively underpinned by the recent NFP prints. This view, however, is expected to take centre stage in the upcoming speeches by Fed’s rate setters.

The loss of traction in wage inflation, however, seems to lend some support to the view that the Fed’s tightening cycle have started to impact on the robust US labour markets somewhat.

Key events in the US this week: Flash Consumer Sentiment (Friday).

Eminent issues on the back boiler: Rising conviction of a soft landing of the US economy. Slower pace of interest rate hikes by the Federal Reserve vs. shrinking odds for a recession in the next months. Fed’s pivot. Geopolitical effervescence vs. Russia and China. US-China trade conflict.

USD Index relevant levels

Now, the index is gaining 0.03% at 103.21 and faces the next resistance level at 103.96 (monthly high February 7) seconded by 105.63 (2023 high January 6) and then 106.45 (200-day SMA). On the other hand, the breach of 100.82 (2023 low February 2) would open the door to 100.00 (psychological level) and finally 99.81 (weekly low April 21 2022).

- GBP/USD meets with a fresh supply on Friday and snaps a three-day winning streak.

- A combination of factors pushes the USD to a one-month high and exerts pressure.

- Bulls seem rather unimpressed and largely shrug off the mixed UK economic data.

The GBP/USD pair extends the previous day's retracement slide from the vicinity of the 1.2200 mark, or the weekly high and remains under some selling pressure on Friday. Spot prices languish around the 1.2100 mark through the early European session and react little to the latest UK macro data.

The UK Office for National Statistics reported that the economy contracted by 0.5% in December, down from 0.1% growth reported in the previous month and missing estimates for a 0.3% fall. The Preliminary Q4 GDP print, meanwhile, matched expectations and showed that the economy stagnated during the October-December period as compared to a 0.3% decline in the third quarter. The slight disappointment, however, was offset by better-than-expected UK Manufacturing and Industrial Production figures.

Nevertheless, the mixed economic data fails to push back against market speculations that the Bank of England's rate-hiking cycle is nearing the end and undermines the British Pound. This, along with the prevalent US Dollar buying interest, contributes to the offered tone surrounding the GBP/USD pair. Against the backdrop of hawkish signals from Fed officials, a fresh wave of the global risk-aversion trade turn out to be a key factor that continues to underpin the safe-haven greenback.

The GBP/USD pair, for now, seems to have snapped a three-day winning streak, though the lack of follow-through selling warrants some caution for aggressive bearish traders. Traders now look forward to the US economic docket, featuring the release of the Preliminary Michigan Consumer Sentiment Index. This, along with a scheduled Fed Governor Christopher Waller's speech, the US bond yields and the broader risk sentiment, will drive the USD and provide some impetus to the GBP/USD pair.

Technical levels to watch

- GBP/JPY clings to mild losses following UK data dump.

- Preliminary readings of UK Q4 GDP matches 0.0% market forecasts.

- Yield curve inversion renews recession woes but BoJ talks defend pair buyers.

- Concerns surrounding the next BoJ leadership, economic slowdown fears are the key to follow for fresh impulse.

GBP/JPY stays sidelined near 159.30-20, paying little heed to the UK’s fourth quarter (Q4) Gross Domestic Product (GDP) during early Friday. In doing so, the cross-currency pair portrays the market’s indecision amid mixed signals and cautious mood ahead of the key US inflation precursors.

That said, the first readings of the UK Q4 GDP match forecasts on QoQ and YoY figures while declining more for December month. However, the improvement in Industrial Production and Manufacturing Production seemed to have probed the pair buyers.

Also read: Breaking: UK Preliminary GDP stagnates in Q4 2022, as expected

Earlier in the day, various Bank of Japan (BoJ) officials tried pushing back the hawkish expectations for the Japanese central bank and put a floor under the GBP/JPY price. Recently, Bank of Japan (BoJ) Deputy Governor Masayoshi Amamiya said that (It is) appropriate to maintain the current ultra-loose monetary policy. Before that, BoJ Governor Haruhiko Kuroda said, “The benefits of easing outweigh the costs of side effects.”

On the contrary, a pullback in the Treasury bond yields after renewing the recession fears seems to weigh on the GBP/JPY price. That said, the widest negative difference between the US 10-year and 2-year Treasury bond yields since 1980 amplified the recession woes the previous day. The yield curve inversion remains around the same level as both these key bond yields stay depressed near 3.66% and 4.48% respectively by the press time.

Looking forward, the cautious mood ahead of the next BoJ leadership announcements, up for publishing on Monday, could restrict the GBP/JPY moves. However, the fears of recession and a retreat in yield may weigh on the prices amid downbeat UK concerns, including Brexit and workers’ strikes.

Technical analysis

A daily closing beyond the previous resistance line from January 27, now support around 158.70, keeps the GBP/JPY buyers directed towards the 50-DMA hurdle surrounding 161.20.

The industrial sector activity showed no growth in December, the latest UK industrial and manufacturing production data published by Office for National Statistics (ONS) showed on Friday.

Manufacturing output arrived at 0% MoM in December versus -0.2% expectations and -0.6% registered in November while total industrial output came in at 0.3% MoM vs. -0.2% expected and 0.1% last.