- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 10-02-2022

- AUD/NZD bulls stay in control along with the medium term bullish trend.

- NZD inflation expectations will be a key event for Asia on Friday.

- RBA acknowledges the possibility of a need for a rate hike in 2022.

At 1.0735, AUD/NZD is flat on the session so far although it has moved between a low of 1.0719 and 1.0739 as the bulls step in to try and hold the price from sliding below the hourly structure. The pair has otherwise been gliding along an ascending trendline that had been established at the start of December 2021 as the Australian dollar finds support on central bank sentiment.

The Reserve Bank of Australia has been pushing back on the global push for rate hikes near term, but the markets expect that to change considering the prospects for higher global inflation risks. Moreover, the domestic labour market is hotting up. ''The sharp drop in preference-based underemployment underscores how tight the labour market is,'' analysts at TD Securities explained. ''Workers who would prefer and are available to work more hours is declining sharply. The risks highlighted above suggest the unemployment rate could hit 3% by the end of 2022, in line with the RBA's upside scenario.''

-

RBA Lowe: ''Plausible we could raise rates later this year''

Meanwhile, the Reserve Bank of New Zealand’s inflation expectations survey will be a key event for Asia today and it could post a 30-year high, analysts at Westpac explained. ''That could motivate markets to price even more into rates and the NZD, even though pricing is already quite full.''

''Multi-month, though, we continue to expect the USD to benefit from the Fed’s looming tightening cycle until around mid-2022. That should at least slow any NZD rallies, and could even cause a final dip to below 0.6500. The latter scenario could be a medium-term buying opportunity.''

AUD/NZD technical analysis

The 4-hour chart above shows the price hugging the ascending trendline support. While there are prospects of higher highs to come, 1.08 could be the limit when taking into account the daily resistance as follows:

The Reserve Bank of Australia's Phillip Lowe has said that it is ''plausible we could raise rates later this year depending on economy.'' He added that he hasn't said rates won't go up.

AUD could get a lift on such rhetoric, but there hasn't been any knee-jerk reaction thus far.

More to come...

Raising the European Central Bank's main interest rate now would not bring down record-high eurozone inflation and only hurt the economy, ECB President Christine Lagarde said in an interview published on Friday.

Key quotes

Raising rates would not solve any of current problems.

Highly unlikely that oil price will continue climbing at 2020-2022 pace.

Confident that inflation will fall back in the course of the year.

We are getting closer to goal, that would allow us to gradually withdraw some interventions.

We don’t want to choke off the recovery.

The greenflation debate is exaggerated.

In most euro area countries, including Germany, wage demands are very moderate.

EUR/USD drops

Following the downbeat comments from ECB President Lagarde, EUR/USD prices drop back to 1.1400.

Read: EUR/USD Price Analysis: Stays directed to 1.1500 despite recent pullback

- The lack of catalysts of the GBP/JPY would keep it subject to market mood.

- GBP/JPY traders beware of the developments of the GBP/USD as USD strength looms, courtesy of higher US Treasury yields.

- GBP/JPY is upward biased and would accelerate its uptrend if GBP bulls reclaim 158.00.

On Thursday, the GBP/JPY gained some 0.58%. The rally on the GBP/JPY was triggered by the GBP/USD price action, which jumped on the release of high US inflation, towards 1.3643, retreating later on the day, as money market futures have priced in a 100% chance of the US central bank hiking rates 50 bps, on the March meeting. At the time of writing, the GBP/JPY is trading at 157.35.

The market mood is risk-off. US equities recorded losses in the cash market, while Asian equity futures are headed towards a lower open, as market players flight towards safe-haven assets.

GBP/JPY Price Forecast: Technical outlook

Putting those factors aside, the GBP/JPY witnessed a rally of 200-pips. During the Asian session, the GBP/JPY was subdued, but as American traders got to their desks, alongside the overlap with European markets in full swing, spurred a jump near 158.00. Once GBP bulls struggled at 158.00, the cross-currency fell towards 157.33.

The GBP/JPY first resistance would be a five-month-old downslope trendline lying around the 157.45-65 region. Once cleared, the GBP/JPY next resistance would be February 10 daily high at 158.06, followed by October 20, 2021, daily high at 158.22.

On the flip side, the GBP/JPY first support would be 157.00, followed by a one-month-old downslope trendline broken on February 10, around 156.60-70, and February 10 daily low 156.19.

US President Biden: Things could get crazy rapidly in Ukraine

More to come

“We have scope to wait and see how the data develop and how some of the uncertainties are resolved,” said Reserve Bank of Australia (RBA) Governor Philip Lowe during a testimony at a virtual hearing before the House of Representatives Standing Committee on Economics on early Friday morning in Asia-Pacific region.

Key quotes

Estimate that GDP increased by around 5 percent over 2021 and are expecting GDP growth of around 4¼ per cent over 2022 and 2 percent over 2023.

Upswing in business investment is also under way.

The board is prepared to be patient.

Macroeconomic policy settings are supportive of growth.

We have scope to wait and see how the data develop and how some of the uncertainties are resolved.

I recognise that there is a risk to waiting but there is also a risk to moving too early.

Forward-looking indicators suggest further growth in jobs over the months ahead.

Moving too early could put employment goal at risk.

Main source of uncertainty about the outlook continues to be covid-19.

Stronger the economy and the more upward pressure on prices and wages, the stronger will be the case for an increase in interest rates.

Sharp pick-up in inflation in parts of the world, especially in the united states, has come as a surprise and is an additional source of uncertainty.

Too early to conclude that inflation is sustainably in the target range.

We expect a further lift in underlying inflation.

Further pick-up in overall wages growth is expected.

It is entirely possible that countries with higher inflation rates will need a bigger adjustment in interest rates than currently anticipated.

Official link to full statement

AUD/USD pays a little heed

AUD/USD keeps the latest pullback from three-week high following the downbeat statements from RBA’s Lowe. The risk barometer’s previous declines could be linked to the strong US inflation data.

Read: AUD/USD Price Analysis: Committed and late bulls were knocked down to size, eyes on RBA Lowe, 0.7200/0.7150

- EUR/USD bulls take a breather after refreshing 2022 peak.

- 50-SMA, 200-SMA defend short-term buyers, two-week-old previous support guards upside.

- Sluggish MACD, firmer RSI suggests slow grind to the north.

EUR/USD braces for a fresh upside, despite stepping back from a fresh yearly high to 1.1430 during early Friday morning in Asia.

The major currency pair bounced off 50-SMA to cross the short-term horizontal area following the hot US inflation release.

However, the support-turned-resistance from January 31, around 1.1505 at the latest, restricted the pair’s upside and pulled it back towards the aforementioned SMA level of 1.1385 by the press time.

Given the mostly steady MACD and RSI line beyond 50.00, EUR/USD prices are likely to portray another bounce off the SMA support, if not then the 200-SMA level near 1.1335 will offer another chance to the pair buyers.

It should be noted, however, that the quote’s weakness past 1.1335 will welcome EUR/USD bears targeting January’s bottom surrounding 1.1120.

Alternatively, a three-month-old horizontal area surrounding 1.1480-85 preceded the previous support line near 1.1505 to challenge the EUR/USD pair’s short-term upside moves.

Adding to the upside filters is the October 2021 bottom surrounding 1.1530.

Overall, EUR/USD braces for a bumpy road to the north.

EUR/USD: Four-hour chart

Trend: Further upside expected

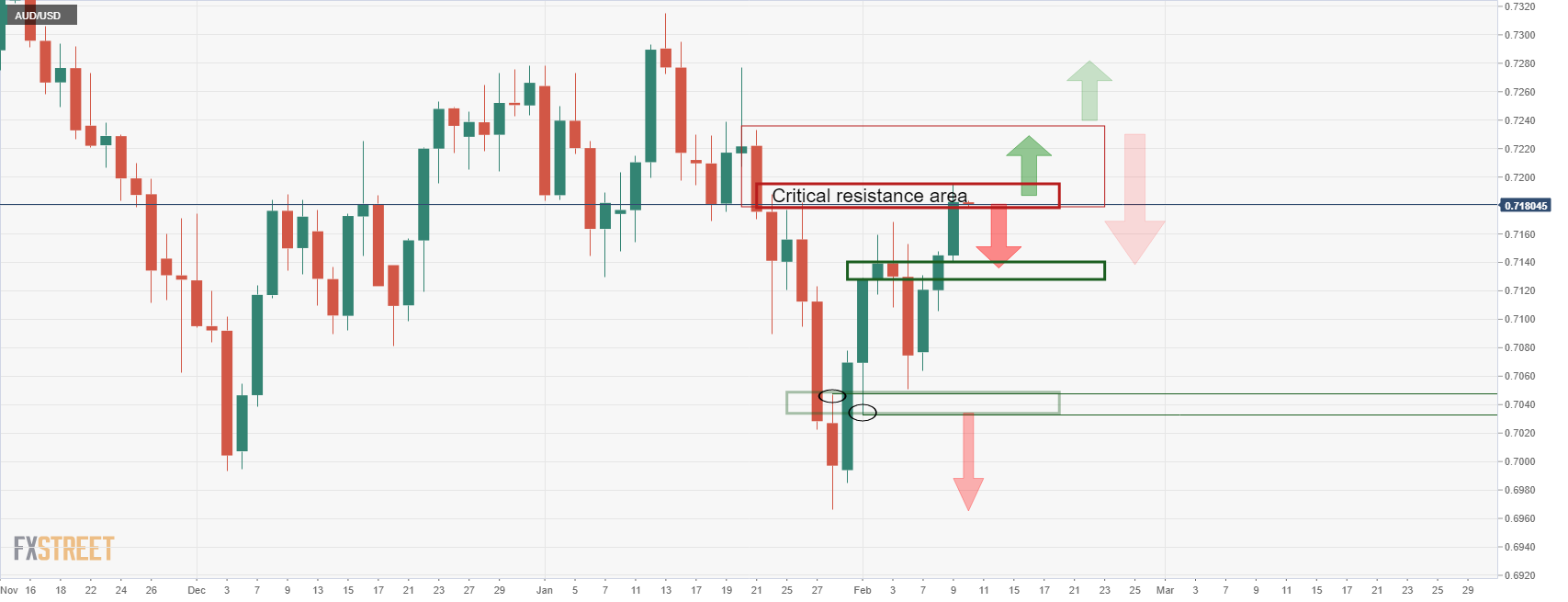

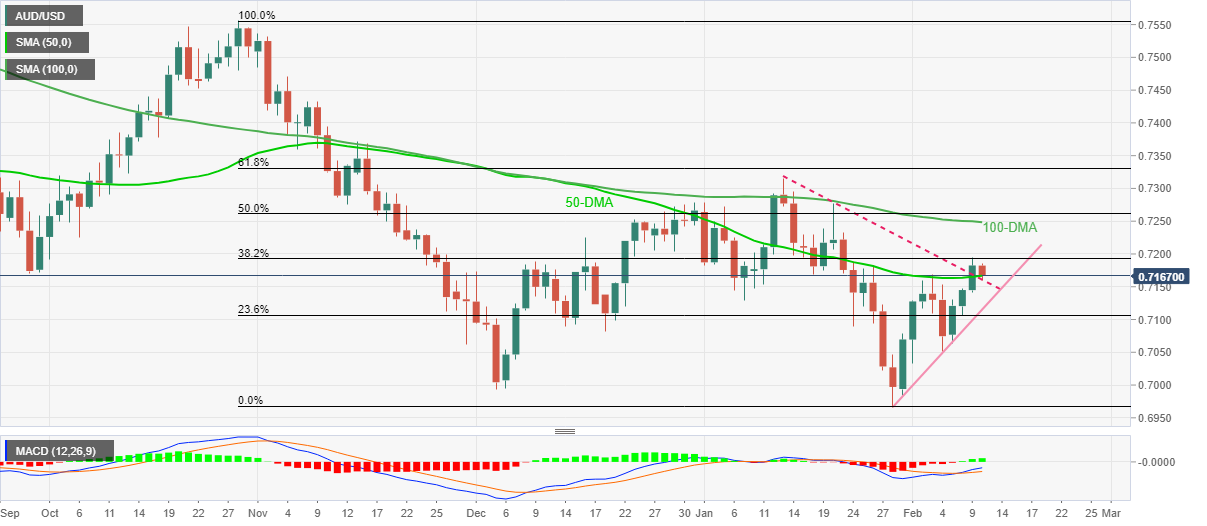

- AUD/USD bulls have been thrown back by the bears as the US dollar firms.

- The price of AUD/USD is now in a phase of consolidation.

- RBA Lowe is speaking at the top of the hour.

governor Philip Lowe is speaking at the top of the hour which could be some further volatility into the pair in what has already been a turbulent time for the Aussie. Lowe is appearing before the House of Representatives Committee on Economics which could give some insight into the path of rate hikes to come from the central bank.

AUD/USD H1 chart

0.7200 and 0.7150 are key levels for the rest of the week.

Meanwhile, as per the pre-US inflation data analysis from the prior session, AUD/USD Price Analysis: Bulls eye a break of 0.72 the figure, the price has followed suit, initially testing the 0.72 figure before crashing back into the bear's layer again, as follows:

AUD/USD prior analysis

The price broke the critical resistance area as follows:

However, the W-formation was always going to be problematic for the bulls as explained in the prior analysis. The price has subsequently fallen back into the old highs where it would be expected to consolidate as traders muddle through the various implications of sky-high inflation on a macro scale.

Bar any fundamental shock, such as an emergency rate hike from the Federal Reserve or some coordinated agreement between global central banks, the greenback would still be expected to remain underpinned. With that being said, the commodity currencies could fare well against the higher inflationary backdrop.

- The NZD/JPY advances as the North American session winds down, up some 0.25%.

- The market sentiment is downbeat, as US equity indices finished in the red.

- NZD/JPY upward move stalled at the 200-DMA, but NZD bulls remain in charge.

The NZD/JPY retreats from weekly tops after inflation in the United States reaches 7.5%, a level last seen in August 1982, causing a sell-off in the US equity markets amid a risk-off market mood. Despite the aforementioned, the NZD/JPY clings to gains, trading at 77.41 at the time of writing.

During the North American session, financial markets have been volatile. High elevated prices, reported by the US Labor department, increased the odds of the US central bank’s 50 bps rate hike. Initially, the US Dollar Index, a gauge of the greenback’s value against its peer, shot through the roof, followed by a fall to the 95.40 area for a 0.20% loss.

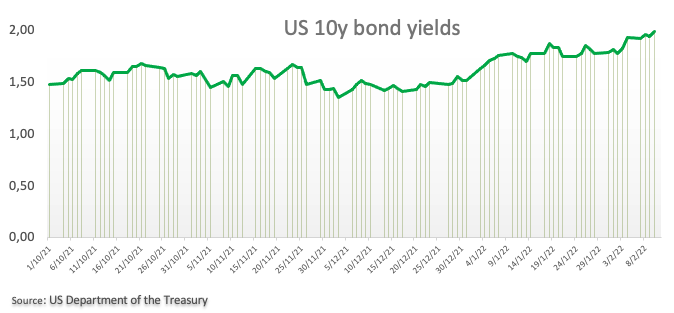

However, in the last hour, the DXY rebounded, sitting at 95.60, aligned with higher US Treasury yields, led by the 10-year benchmark note at 2.052%, a gain of twelve basis points.

NZD/JPY Price Forecast. Technical outlook

Putting those factors aside, the NZD/JPY initially broke upwards, but the move stalled at the 200-day moving average (DMA) at 77.98, followed by a drop to the February 9 daily high at 77.30.

That said, the NZD/JPY first resistance would be the 200-DMA at 77.98. Breach of the latter would expose the 100-DMA at 78.36, followed by the January 5 swing high at 79.22.

On the flip side, the NZD/JPY first support is 77.30. Once cleared, the next support would be the 77.00 figure, followed by the February 9 daily low at 76.65.

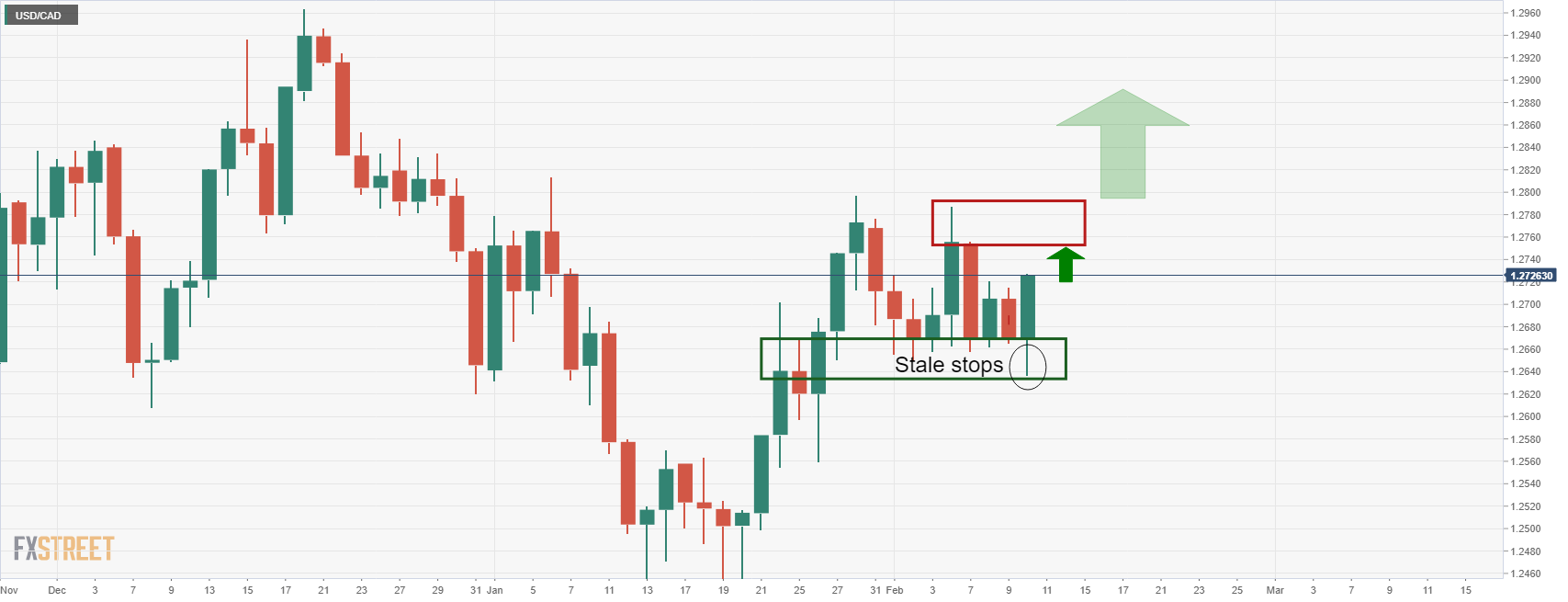

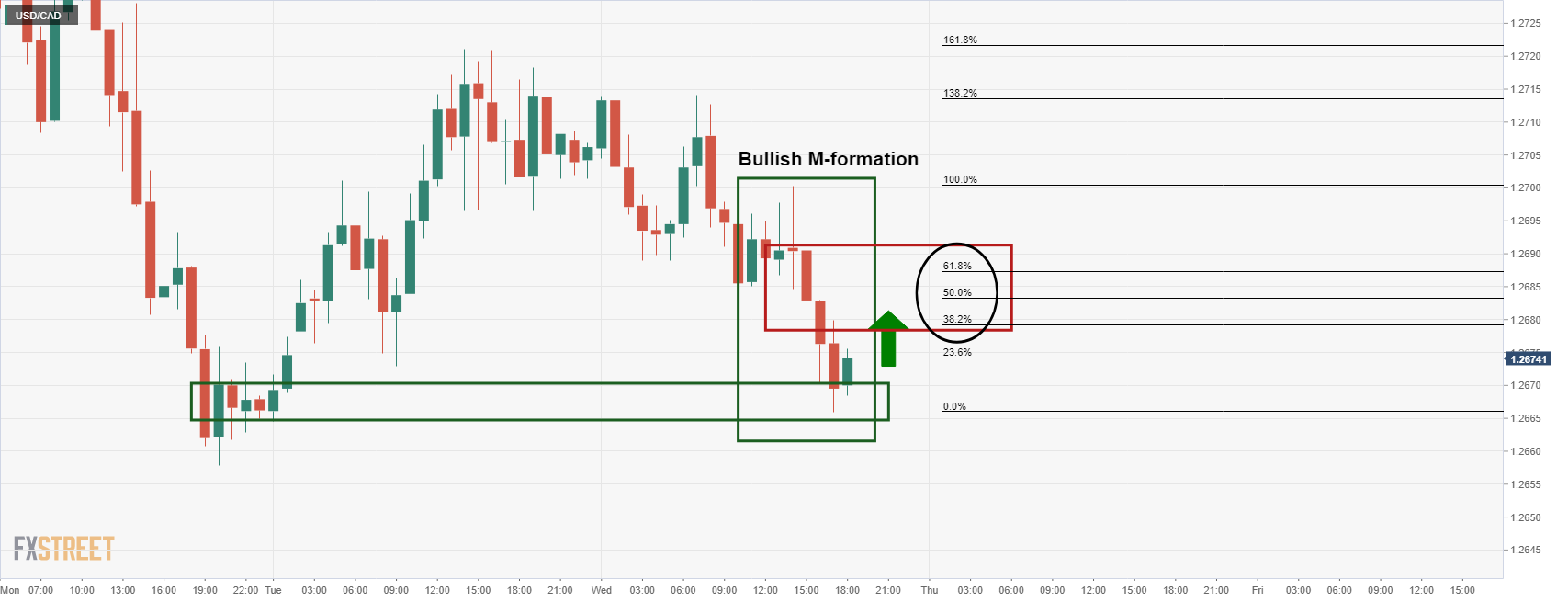

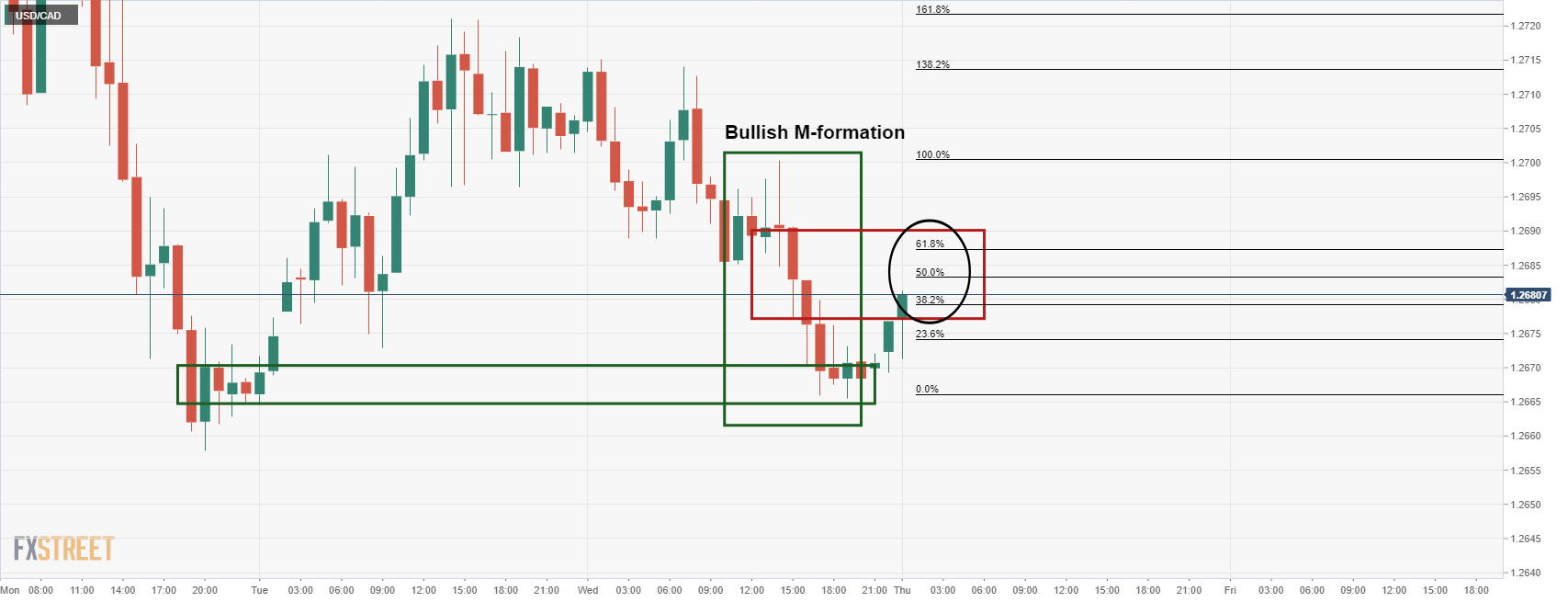

- USD/CAD bulls eye the 1.2780's for the days ahead.

- The bulls are back in control within the daily sideways channel.

USD/CAD has been thrown left right and centre on the day in the aftermath of the US inflation data. In the prior day's analysis, USD/CAD Price Analysis: Bulls are moving in at critical H1 support, and

USD/CAD bulls correcting to the 38.2% Fibo, traders are in anticipation of US CPI, the price had found stability in the hourly lows but it has carved out a lower low as follows:

The spike lower would have cleared out some of the stale sell stops below the daily support which has resulted in a renewed bullish impulse on the daily chart as follows:

The buyers picked up a bargain below the lows and added length back into the structure to take out the prior hourly resistance. This has resulted in a break of daily highs with eyes on the 1.2780's and the Feb highs for the days ahead.

- The cross-currency is almost flat during the day, as both currencies are the main gainers in the FX complex.

- The EUR/GBP is trapped between the 50 and the 100-DMA, a 36-pip range.

- EUR/GPB is neutral biased but could shift neutral-upwards with an upbreak of the 100-DMA.

The EUR/GBP is barely down during the North American session. At the time of writing, the EUR/GBP is trading at 0.8413.

A risk-off market mood looms the global financial markets. The US Department of Labor reported that US inflation for January rose 7.5% more than estimated, spurring a sell-off in US equity markets. In the FX complex, the history is different. The gainers are the EUR and the GBP, while the laggards are the CAD and the JPY.

That said, the EUR/GBP Thursday’s price action was confined to a 36-pip trading range, as investors’ eyes were on US macroeconomic data.

EUR/GBP Price Forecast: Technical outlook

Since the last week, the EUR/GBP jumped from under 0.8350 towards 0.8478, following the Bank of England (BoE’s) rate hike, and the European Central Bank (ECB) pivot forwards a tilted “hawkish” monetary policy stance.

At press time, the EUR/GBP sits comfortably between the 50-day moving average (DMA) at 0.8413 and the 100-DMA at 0.8449, suggesting the pair as neutral biased. Nevertheless, an upside break of the 100-DMA would shift the trend to neutral-upwards because the 200-DMA resides above the exchange rate, resting at 0.8501. In that outcome, the first resistance would be the 200-DMA at 0.8501. Breach of the latter would expose December 20, 2021, high at 0.8550, followed by a nine-month-old downslope trendline around the 0.8590-0.8600 range.

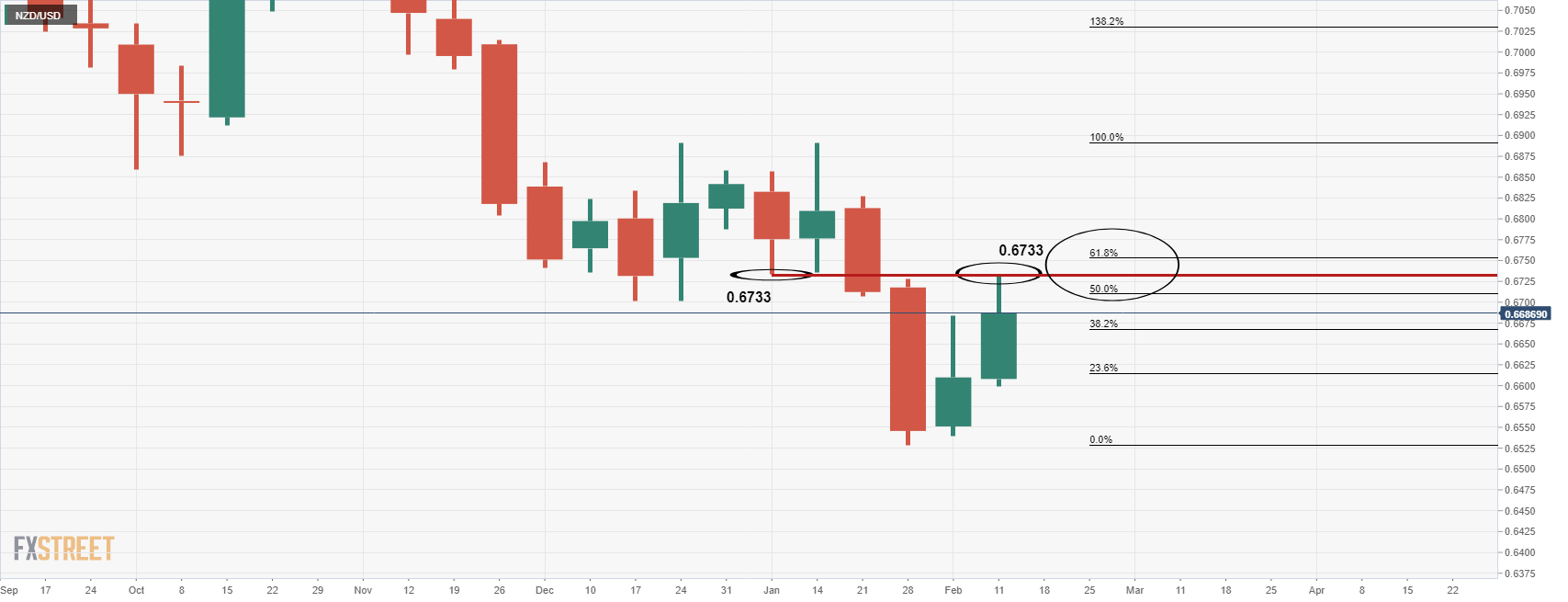

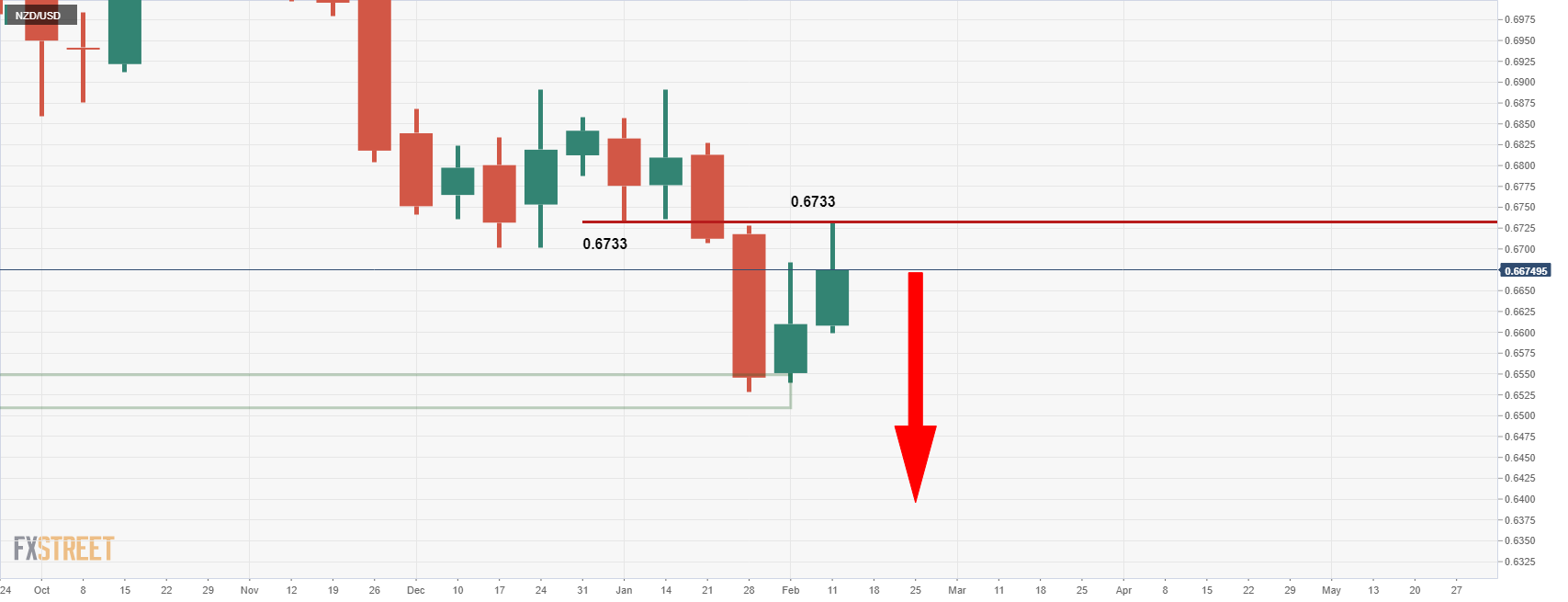

- NZD/USD pressured as Fed speakers play up the hawkish outlook following hot US CPI.

- NZD/USD bulls meet a wall of resistance and suffer heavy supply.

- The bears could be encouraged to move in for a test of critical support on the daily time frame.

NZD/USD traders were taken on a ride of volatility on Thursday as the markets positioned for macro inflationary pressures which flows made their way through every facet of the forex space. The commodity complex was bid on the inflation hedge play which initially supported the kiwi after the knee-jerk bid in the greenback before it was met with heavy supply again in midday trade.

At 0.6685 during the time of writing, NZD/USD is around flat on the day after travelling between a low of 0.6652 and a high of 0.6732 in the final hours of Wall Street's trade. The bird spiked lower after the Federal Reserve James Bullard spoke out over the hot US inflation data, commenting that the central bank could be considering meeting rate hikes. He has said that he favours a 50bp hike in March and 10bps by July.

''Volatility remains the order of the day. Higher US yields are battling things like higher commodity prices for attention; while rates have had less of an influence on FX of late, the knee-jerk reaction to higher US bond yields tends to be NZD-negative,'' analysts at ANZ Bank explained.

NZD/USD technical analysis

As per the prior analysis, whereby it ws noted:

The ''NZD/USD bulls are taking charge in a significant correction,'' that was moving ''in on old lows near 0.67 the figure and towards the neckline of the M-formation near 0.6733,'' the price reache dthe target on Thursday.

This resided between the 50% mean reversion and the 61.8% ratio as follows:

NZD/USD prior and live analysis

NZD/USD daily chart

The Doji candle, if followed by a bearish close on Friday, could set case for a downside continuation for next week's business:

NZD/USD weekly chart

What you need to know on Friday, February 11:

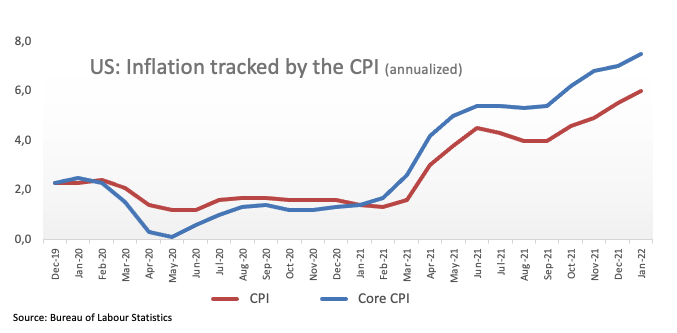

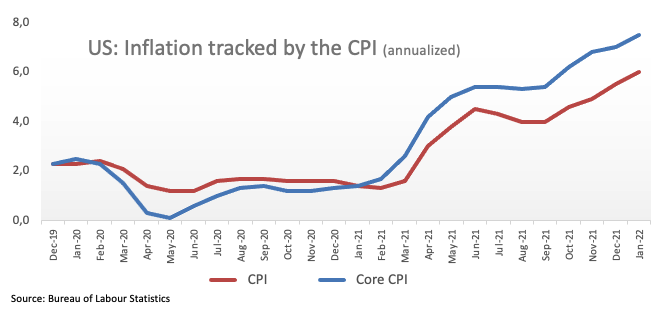

Major pairs were quite volatile on Thursday following the release of US inflation figures. The US Consumer Price Index soared to 7.5% YoY in January, higher than the 7.3% expected. The core reading printed at 6%, also above the market’s forecast. The headline spurred a short-lived dollar’s rally, although the greenback quickly changed course and moved from daily highs to fresh weekly lows against most of its major rivals.

The EUR/USD pair peaked at 1.1394, a fresh 2022 high, stabilizing at the 1.1460 price zone. Earlier in the day, the European Commission raised its inflation expectations for this year from 3.5% but is still expecting it to decline in 2023, seeing it at 1.7%. Prices pressure was blamed on supply disruption and the energy crisis, exacerbated by geopolitical tensions between Russia and Ukraine. Also, Bundesbank Governor Joachim Nagel indicated that the European Central Bank might raise rates later this year.

The GBP/USD pair holds on to intraday gains just above the 1.3600 region after hitting a monthly high of 1.3643.

Commodity-linked currencies were unable to hold on to intraday gains. The AUD/USD pair is marginally higher at around 0.7180, while USD/CAD is up for the day, trading at around 1.2700.

RBA Governor Philip Lowe will testify at a virtual hearing before the House of Representatives Standing Committee on Economics and may refer to the monetary policy.

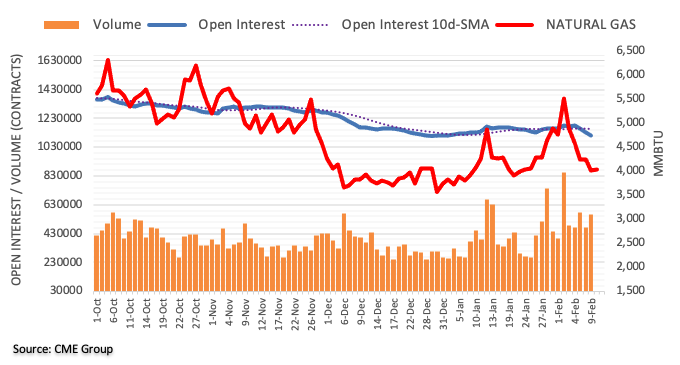

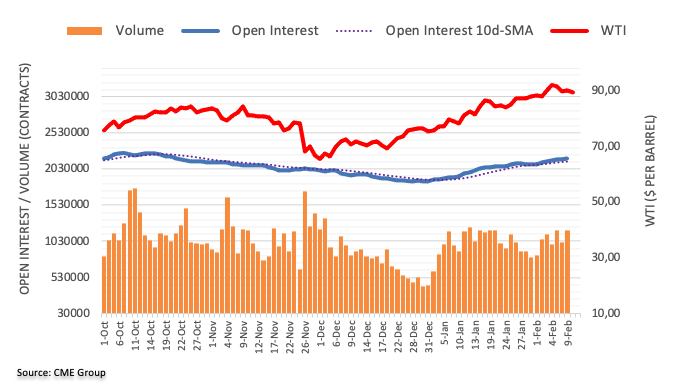

Crude oil prices ended the day little changed. The OPEC boosted its forecast for 2022 crude demand by 100K barrels per day but reported that output rose by 64K bpd in January, lagging the pledged increase by OPEC+. WTI trades at $89.60 a barrel.

Gold jumped to $1,841.83 a troy ounce but retreated towards the current 1,830 region.

Wall Street edged lower, with the DJIA shedding over 500 points. The poor tone of equities helped the greenback to recover some ground ahead of the daily close.

US Treasury yields soared. The yield on the US 10-year Treasury note soared to 2.02% above the 2% threshold for the first time since 2019, while the 2-year note yielded as much as 1.51%. Following the release of inflation data, the chances of a rate hike of 50 basis points in March rose to nearly 50%.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Cryptos set for fireworks this weekend

Like this article? Help us with some feedback by answering this survey:

- The USD/JPY rallied towards 116.33, but USD bulls failed to sustain the rally, eases to high 115.00s.

- US Treasury yields advance, but the greenback bucks the trend, as it falls 0.10% during the day.

- USD/JPY keeps upward biased, confirmed by the upbreak of a month-old trendline.

Following the US inflation report that showed that prices rose by 7.5% y/y in January, the USD/JPY advances 0.31% in the North American session. At the time of writing, the USD/JPY is trading at 115.86.

The financial market mood dampened as the New York session progressed. US equity indices are recording losses after the US Labor Department noted that the Consumer Price Index (CPI) increased to levels last seen in August 1982. The core CPI reading, which excludes volatile items like food and energy, expanded above the 6% threshold (y/y), a tenth higher of expectations.

The US Dollar Index, a gauge of the greenback’s performance against a basket of six currencies, edges lower 0.10%, sitting at 95.40, failing to track the rise of US Treasuries, led by the 10-year benchmark note, sitting at 2.012%, gaining seven basis points.

USD/JPY Price Forecasts: Technical outlook

The USD/JPY keeps the upward bias intact. The upbreak of a one-month-old trendline accelerated the move towards 116.00, which was broken after the release of US CPI, though it fell short of piercing the YTD high at 116.35.

As USD bulls take a breather, after a steeper trip over 116.00, the USD/JPY sits comfortably above November 24, 2021, daily high at 115.52. That said, the USD/JPY first resistance would be 116.0. Breach of the latter would expose the YTD high at 116.35, followed by a challenge of a 24-month-old downslope trendline around 117.00. A clear break of that ceiling level would pave the way towards January 2017 swing high at 118.61.

Banxico hikes overnight rate by 50bps to 6%, as expected, as it sought to keep price pressures in check with inflation running hot.

The central bank explained that the board was not unanimous on rate decision with 4 board members that voted to hike the key rate to 6.0% with1 board member that voted to hike the key rate to 5.75%.

The central banks said inflationary pressures have been greater and have lasted longer than anticipated and that the board will closely watch inflationary pressures in upcoming monetary policy meetings.

The inflation expectations for 2022 and 2023 increased again, while medium-term expectations decreased slightly and those for longer terms have remained stable at levels above the target.

The forecasts for headline and core inflation were revised upwards, especially for 2022 and the first quarter of 2023.

The central bank says that the balance of risks for the trajectory of inflation within the forecast horizon remains biased to the upside.

The central bank says it evaluated magnitude, diversity of shocks that have affected inflation and its determinants, along with the risk of medium - and long-term inflation expectations and price formation becoming contaminated.

USD/MXN is unchanged on the move whereby the US inflaiton data has played a bigger role in the currency pair's volatility on the day. USD/MXN has ranged between a low of 20.3492 and a high of 20.57.5740.

- The EUR/USD reaches a new YTD high at 1.1495, 5-pips near 1.1500.

- The market sentiment is mixed due to the higher than expected US inflation number.

- Money market futures show a 71% chance of the US central bank hiking 50bps following Fed’s Bullard remarks.

- EUR/USD is neutral-upward biased, but it would need a daily close above February 7 daily high.

Following a higher than expected January’s US inflation report, the EUR/USD is rallying in the North American session. At the time of writing, the EUR/USD is trading at 1.1476.

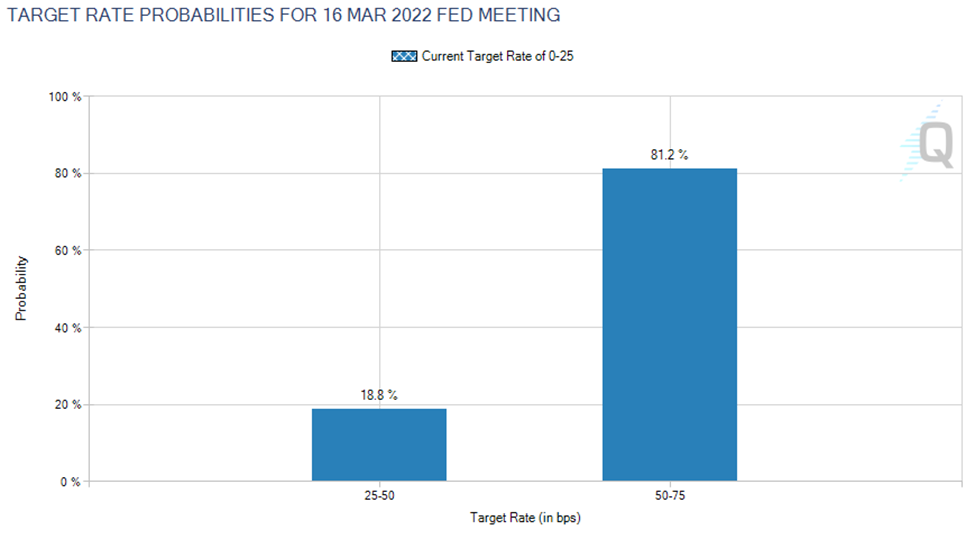

Financial markets mood is mixed after the US Department of Labor revealed that the Consumer Price Index (CPI) rose to 7.5% y/y, a level last seen in August 1982. Additionally, the core CPI, which excluded food and energy, pierced the 6% threshold on an annual-based figure. Both readings were higher than estimations, further cementing the case of a Federal Reserve rate hike in the March meeting.

The CME FEDWATCH Tool, a gauge of market players’ expectations of the Federal Funds Rate (FFR), has fully priced in a 25 bps increase to it. Furthermore, there is a 71% chance of a 50 bps increase, which appears aggressive, as base effects could ease some.

Nevertheless, on March 10, the US economic docket would feature CPI for February, which could significantly influence Federal Reserve policymakers of hiking more aggressive than expected.

At press time, crossing the wires, St. Lous Fed President James Bullard said that “I’d like to see 100 basis points in the bag by July 1,” as reported per Bloomberg.

Meanwhile, the Eurozone economic docket was pretty light, though it featured the European Central Bank (ECB) Chief Economist Philip Lane. Lane said that “since bottlenecks will eventually be resolved, price pressures should abate and inflation return to its trend without a need for a significant adjustment in monetary policy.”

Furthermore, he noted that “since monetary policy steers domestic demand, a tightening of monetary policy in reaction to an external supply shock would mean that the economy would be simultaneously confronted with two adverse shocks....”

EUR/USD Price Forecast: Technical outlook

At the release of the US CPI number, the EUR/USD initially broke below the 1.1400 thresholds, reaching a daily low of around 1.1380, followed by a jump of 120-pips near 1.1495, a YTD high. The EUR/USD has retreated from YTD high in the last hour, hovering above the February 7 daily high, a support level at 1.1464.

That said, the EUR/USD first resistance would be 1.1500. Breach of the latter would open the door towards November 9, 2021, daily high at 1.1609 and then the 200-DMA at 1.1664.

On the flip side, the February 7 daily high at 1.1464 is the first support level. Once cleared, the following demand area would be the 100-DMA at 1.1416 and the 1.1400 psychological level.

Federal Reserve Bullard says that he favours the first half-point rate hike since 2000 and defers to chair Jerome Powell on a potential for a 50bps rate hike in March.

He favours 100bps rate hikes by July and for the balance sheet reduction start in in the second quarter.

He explained that the balance sheet reduction may require asset sales and that he is concerned about the January inflation print. He said that the Fed should be open to considering an inter-meeting increase.

More to come...

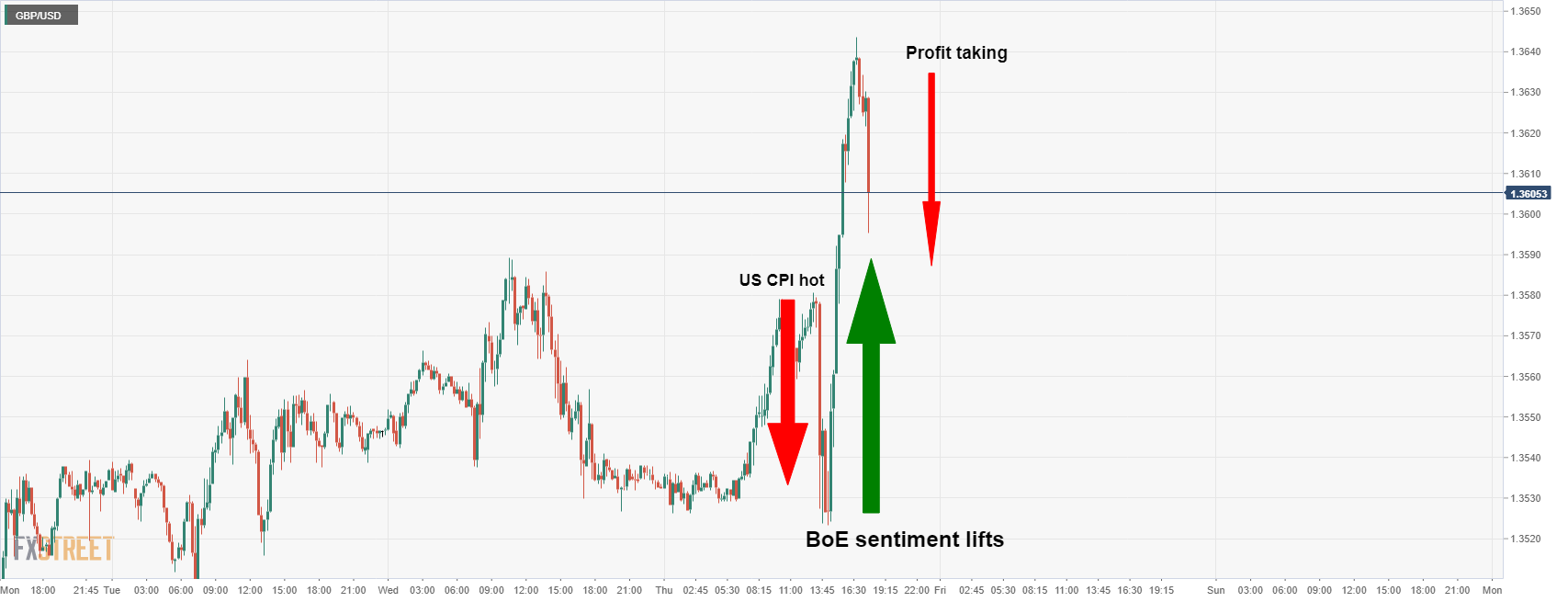

- GBP/USD volatility is creating trading opportunities for both the bulls and bears.

- US CPI data came in hot, driving money markets into a frenzy.

GBP/USD has made a break for it on the upside as the US dollar turns on a dime in high volatility in the forex markets driven by hot inflation data and re-pricing of global central banks.

The moves are creating trading opportunities and cable is considered one of the most volatile pairs in the space. Following the US Consumer Price Index data, the price fell to 1.3523 over the space of 3 fifteen minute candles only to then rally over the following ten 15-min candles to score a high of 1.3644.

The rally was parabolic so the price would be expected to see a reversion in the coming hours. We are still some way off from the market close and profit-taking could continue to ensure for the remainder of the day. At the time of writing, the price is now falling as follows:

More to come...

- Silver broaden its weekly gains, up so far 5.17%.

- US inflation reached levels last seen in August 1982, above 7% for the second consecutive month.

- Money market futures have priced in an 80% chance of a 50 bps increase on the Fed’s March meeting.

- XAG/USD is neutral biased, but bulls get ready to attack the 200-DMA at $24.20.

Silver (XAG/USD) expands its rally to five straight days following a hot US inflation report that reached levels not seen since the 1980s. At the time of writing, XAG/USD is trading at $23.70.

An hour before the US cash equity markets opened, the Bureau of Labor Statistics (BLS) revealed that the Consumer Price Index (CPI), the inflation indicator in the US in January, reached 7.5% y/y, more than the 7.3% estimated by analysts. The so-called core CPI, which excludes volatile items like food and energy, rose to 6%, higher than the 5.9% estimated.

According to analysts at RBC, they noted that “near-term inflation is driven by higher home rent and vehicle prices.· Further added that inflation pressures are broadening “as majority of the consumer basket is seeing +2% growth in inflation.”

Following the data release, market players have fully priced in a 25 basis point increase to the Federal Funds Rate (FFR) by the Federal Reserve. However, there is an 80% chance of a 50 basis point increase, as reported by the CME FEDWATCH Tool, as of February 10, 2022, at press time.

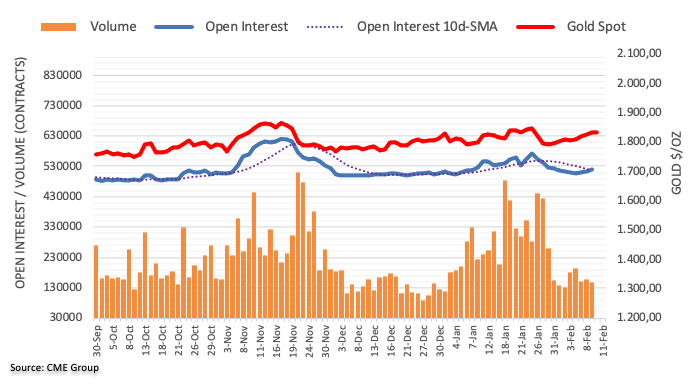

Source: CME Group

In the meantime, the US Dollar Index, a gauge of the greenback’s value against a basket of peers, slide 0.27%, currently at 95.26. The US 10-year Treasury yield rises eight basis points sits at 2.024%, which usually would derail the white metal from pushing for higher prices, but appears to be ignored by investors.

Alongside the inflation report, the US economic docket featured the Initial Jobless Claims for the week ending on February 5 rose to 223K, better than the 230K forecasted by analysts while Continuing Jobless Claims stayed unchanged at 1621K compared to the revision of the previous week.

XAG/USD Price Forecast: Techincal outlook

XAG/USD is neutral-upward biased, as shown by the daily charts. Silver’s Thursday price action left the 100-day moving average (DMA) as support at $23.21, and following the US CPI release, broke the January 3 daily high resistance level at $23.40, which now turned support.

Once those levels cleared, XAG/USD’s next resistance would be a 10-month-old downslope trendline lying around $24.20, but first, XAG/USD bulls will need to crack down the $24.00 psychological figure. If the $24.00-20 region gives way, there would be nothing in the path towards $25.00.

Data released on Thursday showed higher-than-expected inflation numbers with the annual CPI hitting the highest level since 1982. The upside surprise, even as areas like energy goods and autos cooled as expected, illustrates that inflation continues to carry plenty of momentum, and any meaningful slowdown remains elusive, explained analysts at Wells Fargo.

Key Quotes:

“The inertia in inflation looks increasingly difficult to break.”

“We continue to believe that inflation will cool somewhat in the coming months beyond the year-ago base effects. As total spending growth slows and shifts toward services, goods inflation is likely to ease from the dizzying rates witnessed this past year. The moderating effect on the headline should be amplified by the relative importance of core goods having increased with the new weights introduced in today's report.”

“The FOMC has strongly signaled it plans to begin tightening policy at its March 15-16 meeting. How much it may raise the fed funds rate is more uncertain. Today's report keeps the door open to a 50 bp rate increase in March, but FOMC members will get an additional look at inflation with the February CPI report, released on March 10. If, as we expect, it shows the peak in inflation has likely been reached, we anticipate the FOMC will take a more measured approach, opting to raise the fed funds rate by 25 bps in March but signaling additional hikes will be right on its heels.”

- Despite US inflation reaching the highest level since 1982, the greenback weakens.

- AUD/USD traders faded the downward reaction followed by a 90-pip rally, from 0.7140 to 0.7250.

- Treasury yields rise, led by the 10-year benchmark note, piercing the 2.00% threshold.

The AUD/USD advances sharply following the release of US inflation data, which rose the highest since 1982. At the time of writing, the AUD/USD is trading at 0.7237 for a gain of 0.77%.

Before Wall Street opened, the Department of Labor unveiled the January Consumer Price Index (CPI), which increased 7.5%, higher than the 7.3% foreseen on annual figures. Excluding volatile items like food and energy, the so-called Core CPI broke the 6% threshold, higher than the 5.9% estimations.

Market’s reaction

On the release, the AUD/USD dipped as low as the S1 daily pivot at 0.7147, followed by a jump of 80-pips so far, approaching the 100-day moving average (DMA) at 0.7247. The US 10-year Treasury yield reached the 2% mark, advancing six basis points.

In the meantime, the US Dollar Index, a gauge of the greenback’s value against a basket of its peers, falls 0.17%, sitting at 95.33.

During the Asian Pacific session, the Australian economic docket featured Building Permits on its monthly reading for December, alongside Consumer Inflation Expectations for February. The former came at 8.2%, as foreseen by market players, while the latter arrived at 4.6% with no forecast.

In the US, alongside inflation figures, Initial Jobless Claims for the week ending on February 5 rose to 223K, better than the 230K forecasted by economists, while Continuing Jobless Claims stayed unchanged at 1621K compared to the revision of the previous week.

AUD/USD Price Forecast: Technical outlook

Now that US CPI is in the rearview mirror, the AUD/USD is neutral biased, despite the 90-pip jump in the session. The 50-DMA at 0.7166 is under the spot price, while the 100-DMA and the 200-DMA reside above the spot price, suggesting that the AUD/USD is tilted to the downside.

However, worth noting that at press time, a five-month-old downslope trendline, a resistance around 0.7220, witnessed a break, which a daily close above the latter could confirm.

Upwards, the AUD/USD first resistance would be the 100-DMA at 0.7247. A break of that ceiling would expose the January 13 daily high at 0.7313, followed by the 200-DMA at 0.7366.

Consumer prices exceeded expectations in January, rising a strong 0.6% MoM. In the view of economists at TD Securities, a strong CPI print will keep that 50bp hike for next month alive. That should leave the USD on its front-foot for now and, with EUR/USD at risk of re-testing 1.13.

New US inflation highs heaps pressure on the Fed

“Another strong CPI report, with consumer prices exceeding expectations. Total/core prices rose 0.6% MoM each, above the 0.4%/0.5% consensus, respectively. The YoY pace reached new multi-decade highs at 7.5%/6.0% for headline and core CPI inflation, respectively.”

“The stronger than expected January CPI report increases the odds of a firmer monetary policy response by the Fed. We continue to expect the FOMC to raise rates by 25bp at its March meeting, but another solid print in February will likely encourage the Fed to accelerate the pace of hikes in 2022 and hasten both the timing and pace of balance sheet runoff.”

“The next ECB meeting comes a few days ahead of the Fed, which leaves us biased for a retest of 1.13 in EUR/USD, before looking for a more meaningful move topside. Meanwhile, we think USD/JPY is destined higher (118), especially with the BOJ still very far away from any sort of normalization this year. We expect this CPI print to place pressure in equities, and that will weigh on the antipodes.”

- US CPI data above expectations triggers volatility across financial markets.

- Metals tumble and then rebound, erasing losses.

- XAU/USD back above $1830, still capped by the $1835 area.

Gold prices bounces sharply on a volatile session. Following CPI data, XAU/USD tumbled to $1821, hitting a two-day low. A few minutes later, it rebounded above $1830, approaching weekly highs. The rebound suggests some underlying strength, but it needs to break firm above $1835 to open the door to more gains.

USD soars, and then tumbles

Economy data from the US showed the annual CPI rate rose to 7.5% in January, the highest level since 1982, and above the 7.3% expected. The numbers reinforced rate hike expectations from the Federal Reserve and boosted the dollar across the board.

After the opening bell at Wall Street, the greenback reversed and erased all gains, as stocks also moved back to the upside. US yields pulled back after the post CPI spike to fresh month monthly highs.

The “buy the rumor, sell the fact” patterns favoured gold prices. XAU/USD is trading back above $1830. It still faces resistance at $1835, and a break higher could lead to more gains and a move toward $1850. If it fails to hold above $1830 on Thursday, then a corrective move seems likely. The initial support is seen at $1820, followed by $1815 and $1808.

Technical levels

- DXY moves higher and flirts with the 96.00 barrier.

- US headline CPI rose 7.5% YoY in January.

- US Initial Claims increased by 223K WoW.

The US Dollar Index (DXY), which tracks the greenback vs. a bundle of its main competitors, leaps to fresh tops in the boundaries of the 96.00 zone on Thursday.

US Dollar Index stronger after hottest CPI in 4 decades

The index quickly climbed to multi-day highs after US inflation figures rose at the fastest pace in 40 years at 7.5% in January. In the same line, core prices – excluded energy and food costs – rose to 6.0% over the last twelve months.

The strong CPI print immediately morphed into further upside in US yields across the curve, where the 10y benchmark note tested – albeit ephemerally – the psychological 2.00% yardstick.

Further results from the US docket showed Initial Claims also coming in above expectations after rising 223K in the week to February 5.

The move higher in US yields responded to now rising speculation of a potential 50 bps interest rate hike at the FOMC event in March. That said, and according to CME Group’s FedWatch tool, the probability of such a raise next month is now just above 50% (from 24% on February 9).

What to look for around USD

Higher-than-expected US inflation figures lent extra oxygen to the greenback and propelled DXY back to the 96.00 neighbourhood. However, the extent and duration of this improvement in the dollar remains to be seen, as much of the current elevated inflation narrative was already priced in by market participants as well as the probability (bigger now) of a 50 bps rate hike by the Fed (instead of the more conventional 25 bps move). Looking at the longer run, and while the constructive outlook for the greenback appears well in place for the time being, recent hawkish messages from the BoE and the ECB carry the potential to undermine the expected move higher in the dollar in the next months.

Key events in the US this week: Flash Consumer Sentiment (Friday).

Eminent issues on the back boiler: Fed’s rate path this year. US-China trade conflict under the Biden administration. Debt ceiling issue. Escalating geopolitical effervescence vs. Russia and China.

US Dollar Index relevant levels

Now, the index is gaining 0.26% at 95.80 and a break above 96.00 (weekly high Feb.10) would open the door to 97.44 (2022 high Jan.28) and finally 97.80 (high Jun.30 2020). On the flip side, the next down barrier emerges at 95.28 (100-day SMA) followed by 95.13 (weekly low Feb.4) and then 94.62 (2022 low Jan.14).

- The USD/CAD appears to fade the US inflation report, which came higher than estimated.

- US Treasury yields rise, led by the 10-year benchmark note at 2%.

- USD/CAD Technical Outlook: Neutral biased, confined to the 1.2650-1.2790 range.

The USD/CAD pares Wednesday’s losses as the US inflation in January grinds higher, reaching a 40-year high, while the US central bank prepares to begin its tightening cycle. At the time of writing, the USD/CAD is trading at 1.2693.

On Thursday, the Department of Labor reported that January’s inflation rose by 7.5%, higher than the 7.3% estimated annually based. Excluding volatile items like energy and food, also called Core Consume Price Index (CPI), broke the 6% threshold, higher than the 5.9% expected, the most witnessed since 1982.

Market’s reaction

The USD/CAD initial reaction was upwards, from 1.2670s region to 1.2714, though stalled around February0s 9 daily high. Meanwhile, the US 10-year Treasury yield reached the 2% mark in the bond market, rallying more than five basis points after the US inflation report.

An absent Canadian economic docket left USD/CAD traders adrift to US macroeconomic data. On the US front, alongside the inflation figures, Initial Jobless Claims for the week ending on February 5, increased 223K, lower than the 230K estimated by economists, while Continuing Jobless Claims stayed unchanged at 1621K compared to the revision of the previous week.

USD/CAD Price Forecast: Technical outlook

The USD/CAD is confined to the 1.2650-1.2790 area. The 50-day moving average (DMA) at 1.2703 above the spot price is resistance, capping moves since Monday, while the 100 and the 200-DMA at 1,2616 and 1.2519 are almost “horizontal” well below the exchange rate.

That said, the USD/cad first resistance would be the aforementioned 50-DMA. Breach of the latter would expose the January 28 cycle high at 1.2796. Once that is broken, the USD/CAD will have a clear path towards December’s 2021 swing high at 1.2963.

Wall Street's main indexes came under strong bearish pressure on Thursday after the data from the US showed that inflation continued to rise at the beginning of the year.

The S&P 500 Index was last seen losing 1.15% at 4,535, the Dow Jones Industrial Average was losing 0.75% at 35,500 and the Nasdaq Composite was falling 1.4% at 14,285.

The US Bureau of Labor Statistics reported that inflation, as measured by the Consumer Price Index (CPI), jumped to 7.5% on a yearly basis in January from 7% in December. This reading surpassed the market expectation of 7.3%. Additionally, the Core CPI, which strips food and energy prices, climbed to 6% from 5.5%, compared to analysts' estimate of 5.9%.

Meanwhile, the benchmark 10-year US Treasury bond yield is up nearly 3% on the day at 2% and the CME Group FedWatch Tool shows that markets are pricing a 50.2% probability of a 50 basis points Fed rate hike in March.

- USD/JPY rallied hard and shot to over one-month high during the early North American session.

- Stronger US CPI prints pushed the US bond yields higher and provided a strong lift to the USD.

- Technical buying above the 115.70 region and the 116.00 mark contributed to the momentum.

The USD/JPY pair caught fresh bids during the early North American session and surged past the 116.00 mark, hitting over a one-month high in reaction to stronger US CPI.

Data released by the US Bureau of Labor Statistics reported this Thursday showed that the headline CPI in the US edged higher to 0.6% in January as against 0.5% expected and the previous. Moreover, the yearly rate jumped to a fresh multi-decade high and accelerate to 7.5% during the reported month. This was above consensus estimates pointing to a rise to 7.3% from the 7% recorded at the end of 2021.

Additional details revealed that the core CPI, which excludes food and energy prices, climbed 6.0% from a year ago as against 5.5% in December and 5.9% anticipated. The data lifted market bets for a 50 bps Fed rate hike in March. This, in turn, pushed the yield on the 2-year US government bond, which is more sensitive to rate hike expectations, to the highest level since February 2020, around 1.434%.

Adding to this, the yield on the benchmark 10-year US note shot back closer to the 2.0% threshold, or the highest level since August 2019 touched earlier this week. This prompted aggressive short-covering around the US dollar and provided a strong boost to the USD/JPY pair. The momentum confirmed a bullish breakout through the 115.70 area and took along some trading stops near the 116.00 round figure.

Sustained break through the mentioned hurdle might have already set the stage for additional gains and supports prospects for a move towards testing 2021 high, around the 116.35 region. Some follow-through buying will be seen as a fresh trigger for bullish traders and pave the way for an extension of the recent appreciating move witnessed since the beginning of this month.

Technical levels to watch

- EUR/USD reverses the initial optimism and breaches 1.1400.

- US CPI rose 7.5% YoY in January. Core CPI gained 6.0% YoY.

- US Initial Claims rose by 223K in the week to February 5.

The sudden bout of strength in the greenback forced EUR/USD to give away earlier gains and break below the 1.1400 support on Thursday.

EUR/USD weaker post-US CPI

EUR/USD drops to new multi-session lows after US inflation figures tracked by the CPI surprised to the upside in January, showing consumer prices rose 7.5% from a year earlier while prices excluding food and energy costs rose 6.0% also on a yearly basis.

The higher-than-expected US CPI gave extra wings to the buck and US yields and reinforce further the speculation of a more aggressive lift-off by the Fed at the March meeting.

Extra results from the US docket also saw weekly Claims bettering estimates after rising 223K in the week to February 5.

EUR/USD levels to watch

So far, spot is losing 0.12% at 1.1407 and faces the next up barrier at 1.1483 (2022 high Feb.4) followed by 1.1496 (200-week SMA) and finally 1.1664 (200-day SMA). On the other hand, a break below 1.1381 (weekly low Feb.10) would target 1.1323 (55-day SMA) en route to 1.1121 (2022 low Jan.28).

The S&P 500 has recovered strongly for a break above its downtrend from early January to retest of its early February high and 61.8% retracement of the January sell-off at 4591/95. We see scope for a move above the early February high and 61.8% retracement of the January sell-off at 4591/95 to test the 63-day moving average (DMA) at 4625, but with a fresh cap looked for here.

Close below 4453/50 to mark a more important turn lower again

“With daily MACD momentum having turned higher, there is a risk for a break above the early February high and 61.8% retracement of the January sell-off for a deeper recovery yet to test the falling 63-DMA, currently placed at 4625.”

“Our bias remains for the 4625 level to prove a major barrier and for the broader risk to then turn lower again in line with our broader ranging view.”

“We note though the continued similarities between now and 2018 and if we were to continue to repeat this path this suggests a move to the 78.6% retracement of the January collapse at 4691 cannot be ruled out.”

“Support is seen at 4548/47 initially, then the lower end of the price gap from yesterday morning at 4522. A close back below here can ease the immediate upside bias for a fall back the key price pivot and 20-DMA at 4453/50. A close below here is needed to mark a more important turn lower again.”

India’s Monetary Policy Committee (MPC) kept both the repo and the reverse repo rate unchanged and maintained its accommodative policy stance. In the view of analysts at Standard Chartered, RBI’s dovish rhetoric poses yet another headwind – they remain bearish on the INR.

Dovish RBI supports bearish INR view

“MPC maintains status quo on repo and reverse repo rates. We continue to expect the repo rate to be hiked from August; corridor normalisation likely by June vs our previous expectation of April.”

“We think the RBI’s dovish rhetoric relative to market expectations will act as another headwind for the INR, particularly at a time when major central banks are adopting a much more hawkish stance.”

“We maintain our targets for USD/INR at 75.50 by end-March and 77.50 by year-end.”

- Weekly Initial Jobless Claims in US declined by 16,000.

- US Dollar Index pushes higher toward 96.00 in the early American session.

There were 223,000 initial claims for unemployment benefits in the US during the week ending February 5, the data published by the US Department of Labor (DOL) revealed on Thursday. This reading came in better than the market expectation of 230,000.

Market reaction

The US Dollar Index pushes higher toward 96.00 in the early American session but the greenback seems to be receiving a boost from the hot inflation data.

Additional takeaways

"The 4-week moving average was 253,250, a decrease of 2,000 from the previous week's revised average."

"The advance seasonally adjusted insured unemployment rate was 1.2% for the week ending January 29, unchanged from the previous week's unrevised rate."

"The advance number for seasonally adjusted insured unemployment during the week ending January 29 was 1,621,000, unchanged from the previous week's revised level."

- GBP/USD dived over 50 pips in the last hour amid a strong pickup in the USD demand.

- Hotter-than-expected US CPI print boosted Fed rate hike bets and lifted the greenback.

- Bears might wait for sustained break below the 1.3500 mark before placing fresh bets.

the GBP/USD pair witnessed a dramatic turnaround in reaction to stronger US CPI prints and dived to a fresh daily low, around the 1.3525 region in the last hour.

Following a brief consolidation, the US dollar caught fresh bids during the early North American session following the release of the latest US consumer inflation figures. This, in turn, was seen as a key factor that attracted some selling around the GBP/USD pair and led to a sharp pullback of over 50 pips from the daily high, near the 1.3580 region.

According to the data released this Thursday, the headline US CPI edged higher to 0.6% in January as against expectations for a reading of 0.5%. Moreover, the yearly rate reached a fresh multi-decade high and accelerate to 7.5% during the reported month, up from 7% recorded at the end of 2021, against surpassing consensus estimates.

Adding to this, the core CPI, which excludes food and energy prices, rose 6.0% from a year ago as against 5.5% in December and 5.9% anticipated. The data boosted bets for a 50 bps Fed rate hike in March, which was evident from an uptick in the US Treasury bond yields. This, in turn, benefitted the USD and exerted pressure around the GBP/USD pair.

It will now be interesting to find if the pair is able to find some buying at lower levels or weakens further below the key 1.3500 mark, confirming a near-term bearish breakdown. Hence, it will be prudent to wait for a strong follow-through selling before traders start positioning for any further near-term depreciating move for the GBP/USD pair.

Technical levels to watch

Inflation in the US, as measured by the Consumer Price Index (CPI), rose to 7.5% on a yearly basis in January from 7% in December, the US Bureau of Labor Statistics reported on Thursday. This print surpassed the market expectation of 7.3%. On a monthly basis, CPI was up 0.6% in January.

Further details of the publication revealed that the Core CPI, which excludes volatile food and energy prices, climbed to 6% from 5.5% in December.

Market reaction

With the initial market reaction, the greenback started to gather strength against its major rivals and the US Dollar Index was last seen rising 0.25% on the day at 95.78.

Meanwhile, the benchmark 10-year US Treasury bond yield gained traction and reached its highest level since August 2019 at 1.98%.

Gold looks to be finding better support in its broader sideways range. But strategists at Credit Suisse notes that the yellow metal needs to break above $1,877 to see a sustained leg higher.

Break under $1,780 to ease upward bias

“Gold remains well supported in the converging range of the past year but needs to clear $1,854 to suggest the downtrend from early 2021 break and above $1,877 to suggest we are seeing a more sustainable move higher, for a test of $1,917 next.”

“Below $1,780 is needed to ease the immediate upward bias for a fall back to $1,759/54, but with a break below here needed to clear the way for a retest of key price and retracement support from the lower end of the range at $1,691/76.”

“Only below $1,691/76 though would see a major top established to mark an important change of trend lower.”

See – Gold Price Forecast: XAU/USD to trade at $1,800 towards the end of Q1 2022 – ANZ

- A combination of factors continued acting as a headwind for USD/CAD on Thursday.

- Bullish oil prices underpinned the loonie and capped the upside amid weaker USD.

- The downside remains cushioned as investors await the release of the US CPI print.

The USD/CAD pair extended its sideways consolidative price move through the early North American session and remained confined in a narrow trading band, around the 1.2670 region.

The pair struggled to gain any meaningful traction and remained below the 1.2700 mark amid the underlying bullish tone around crude oil prices, which tend to benefit the commodity-linked loonie. On the other hand, a generally positive risk tone weighed on the safe-haven US dollar and acted as a headwind for the USD/CAD pair.

The downside, however, remains cushioned, at least for the time being, as investors seem reluctant and preferred to wait on the sidelines ahead of the US consumer inflation figures. It is worth mentioning that investors have been pricing in a more aggressive policy response by the Fed to contain stubbornly high inflation.

Hence, the US CPI report for January would be looked upon for fresh clues about the pace of the Fed's policy tightening cycle. This, in turn, will play a key role in driving the near-term USD demand. This, along with oil price dynamics, would help investors to determine the next leg of a directional move for the USD/CAD pair.

From a technical perspective, bulls, so far, have managed to defend support near the 1.2450 region. This should now act as a pivotal point for short-term traders, which if broken decisively will set the stage for an extension of the recent pullback from the 1.2785 region, or the monthly high touched in reaction to the stellar NFP report last week.

Technical levels to watch

- EUR/USD extends the corrective climb to 1.1445/50.

- The 5-month support line holds the downside near 1.1400.

EUR/USD moves further north and reaches the mid-1.1400s ahead of the key US CPI release on Thursday.

In the meantime, further gains in the pair remains on the table while above the 5-month line, today around 1.1400. Beyond this area, EUR/USD should be able to attempt another visit to the 2022 high at 1.1483 (February 4) just ahead of the 200-week SMA, today at 1.1496. Between 1.1500 and 1.1600 there are no resistance levels of note, leaving the October 2021 top at 1.1692 as the potential longer-term target.

In the longer run, the negative outlook remains in place while below the key 200-day SMA at 1.1664.

EUR/USD daily chart

The Organization of the Petroleum Exporting Countries (OPEC) announced in its latest monthly report that it left the 2022 world oil demand growth forecast unchanged at 4.15 million barrels per day (bpd), as reported by Reuters.

Key takeaways

"OPEC sees upside potential in 2022 oil demand forecast due to strong economic recovery."

"OPEC keeps forecast for 2022 non-OPEC supply growth unchanged."

"OPEC boosts forecast of 2022 demand for its crude by 100,000 bpd."

"OPEC's oil output rose by 64,000 bpd in January to 27.98 million bpd, lagging pledged increase under OPEC+ deal."

"Saudi Arabia tells OPEC it boosted output by 123,000 bpd in January to 10.145 million bpd."

Market reaction

Crude oil prices showed no immediate reaction to this publication and the barrel of West Texas Intermediate was last seen posting small daily gains at $90.37.

- DXY adds to Wednesday’s losses around the 95.50 zone.

- Next on the downside comes the monthly low at 95.13.

DXY keeps the neutral/bearish mood unchanged around the mid-95.00s on Thursday.

The inability of the index to garner convincing upside traction, ideally in the short term, could prompt sellers to return to the market. That scenario should force the dollar to initially retest the so far monthly low at 95.13 (February 4), while a breach of it could expose a deeper retracement to the 2022 low at 94.62 (January 14).

In the near term, the 5-month line around 95.15 is expected to hold the downside for the time being. Looking at the broader picture, the longer-term positive stance in the dollar remains unchanged above the 200-day SMA at 93.56.

DXY daily chart

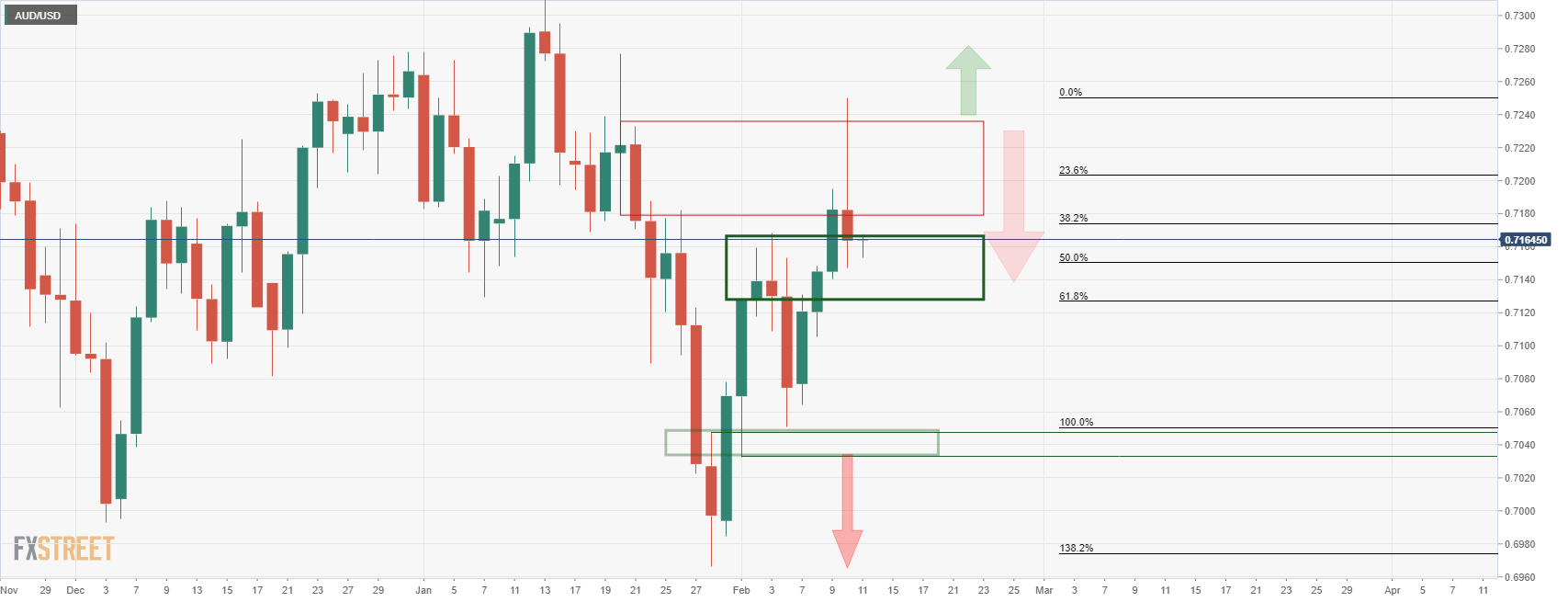

- AUD/USD turned positive for the fourth straight day and shot to a near three-week high.

- A convincing breakthrough the 0.7175-0.7180 confluence hurdle favours bullish traders.

- Bulls might now aim to reclaim the 0.7300 mark and test the 0.7315 area, or 2022 high.

The AUD/USD pair attracted some dip-buying near the 0.7160 region on Thursday and turned positive for the fourth successive day. The momentum pushed the pair to a near three-week high during the mid-European session, with bulls now looking to build on the momentum beyond the 0.7200 mark.

From a technical perspective, the latest leg up now seems to have confirmed a bullish breakout through a descending trend-line extending from 2022 high, around the 0.7315 area touched on January 13. The mentioned hurdle also coincided with the 61.8% Fibonacci level of the 0.7315-0.6967 downfall.

Given that technical indicators on the daily chart have just started gaining positive traction, the AUD/USD pair seems all set to prolong its recent recovery from a two-year low. That said, bulls are likely to wait for the US CPI report before positioning for any further appreciating move.

The next relevant resistance pegged near the 0.7225 region ahead of the 100-day SMA, around mid-0.7200s. Some follow-through buying has the potential to lift the AUD/USD pair beyond the 0.7280 intermediate resistance, towards the 0.7300 mark and the 0.7315 region, or the YTD high.

On the flip side, the 0.7180-0.7175 confluence resistance breakpoint now seems to protect the immediate downside. Any subsequent slide might attract some buying and remain limited near the 50% Fibo. level, around the 0.7140 region, which if broken decisively will negate the positive outlook.

The AUD/USD pair would then turn vulnerable and accelerate the slide towards the 0.7100 round-figure mark. The downward trajectory could further get extended and drag spot prices back towards retesting the post-NFP swing low, around the 0.7050 region, support marked by the 23.6% Fibo. level.

AUD/USD daily chart

-637800937611795156.png)

Technical levels to watch

European Central Bank (ECB) Vice President Luis de Guindos argued on Thursday that the wage-bargaining process, perhaps, had been postponed in the euro area, as reported by Reuters.

"if we start to see second-round effects, then inflation will become much more complicated and monetary policy will have to respond," de Guindos added and noted that ECB President Lagarde's press conference reflected the majority view of the Governing Council.

Market reaction

These comments don't seem to be having a noticeable impact on the shared currency's performance against its rivals. As of writing, EUR/USD was up 0.12% on the day at 1.1435.

European Central Bank (ECB) Vice President Luis de Guindos said on Thursday that they expect growth to rebound strongly over the course of 2022 in the euro area, as reported by Reuters.

Additional takeaways

"Over the next three years, we anticipate that euro area growth will remain above its long-term average."

"Inflation is likely to remain elevated for longer than previously expected but to decline in the course of this year."

"There are upside risks to that inflation outlook."

"We need more than ever to maintain flexibility and optionality in the conduct of monetary policy."

"We stand ready to adjust all of our instruments, as appropriate, to ensure that inflation stabilises at our 2% target over the medium term."

"Our forward guidance on the conditions under which rates will be raised is clear."

"It’s natural that central banks around the globe won’t necessarily start raising rates at the same time."

"We are guided by our forward guidance conditions and will act if, and when, they have been met."

Market reaction

The EUR/SD pair showed no immediate reaction to these comments and was last seen posting small daily gains at 1.1432.

US CPI Overview

Thursday's US economic docket highlights the release of the critical US consumer inflation figures for January, scheduled later during the early North American session at 13:30 GMT. The headline CPI is anticipated to come in at 0.5% during the reported month, unchanged from December. The yearly rate, however, is projected to reach a fresh 39-year high and accelerate to 7.3% in January from 7.0% recorded at the end of 2021. Meanwhile, core inflation, which excludes food and energy prices, is anticipated to rise to 5.9% from a year ago as against 5.5% in the previous month.

Joseph Trevisani, Senior Analyst at FXStreet, explains: “The pandemic lockdown and the subsequent flood of liquidity from the Federal Reserve and the US government has combined, a year later, with labor and material shortages for manufacturing and a supply chain tangle that has stretched around the world, to produce the highest American consumer inflation rate in four decades.”

How Could it Affect EUR/USD?

The markets seem convinced that the US central bank would adopt a more aggressive policy response to combat stubbornly high inflation. A stronger than expected CPI print would further boost bets for a 50 bps Fed rate hike in March and push the US bond yields higher, along with the US dollar. Conversely, a softer reading – though seems unlikely – might do little to calm market fears about a faster policy tightening by the Fed or prompt any meaningful selling around the greenback. This, in turn, suggests that the path of least resistance for the EUR/USD pair is to the downside, though a more hawkish ECB last week should help limit deeper losses.

Meanwhile, Eren Sengezer, Editor at FXStreet, offered a brief technical outlook and outlined important levels to trade the EUR/USD pair: “The Relative Strength Index (RSI) indicator on the four-hour chart is sitting above 50 early Thursday, pointing to a bullish tilt in the near term. However, the pair might need to break above 1.1480 (static level) to convince buyers of another leg higher. Above that level, 1.1500 (psychological level, static level) aligns as the next resistance before 1.1550..”

“On the downside, supports ate located at 1.1400 (psychological level, Fibonacci 23.6% of the latest uptrend), 1.1350 (Fibonacci 38.2% retracement, 200 period-SMA) and 1.1320 (100-period SMA),” Eren added further.

Key Notes

• US Consumer Price Index January Preview: Is this inflation different?

• US Inflation Preview: Core CPI above 6% could spark next dollar rally

• EUR/USD Forecast: Euro holds its ground ahead of US CPI

About the US CPI

The Consumer Price Index released by the US Bureau of Labor Statistics is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services. The purchasing power of USD is dragged down by inflation. The CPI is a key indicator to measure inflation and changes in purchasing trends. Generally speaking, a high reading is seen as positive (or bullish) for the USD, while a low reading is seen as negative (or Bearish).

- EUR/JPY extends the rally and records new 2022 peaks.

- The next target of note aligns at the October 2021 high near 133.50.

EUR/JPY is contentedly maintaining its February rally and has advanced to fresh peaks near 132.60 on Thursday.

Considering the recent price action, further gains in the cross seem likely over the short-term horizon. That said, there is a minor hurdle at 132.91 (high October 29), which is considered as the last defence for a test of the October 2021 peak at 133.48 (October 20).

In the near term, further upside remains on the table while above the 3-month support line, today near 130.80. In the longer run, and while above the 200-day SMA at 130.46, the outlook for the cross is expected to remain constructive.

EUR/JPY daily chart

- Silver edged higher for the fifth straight day and climbed to a two-week high on Thursday.

- The overnight sustained move above the 100-day SMA supports prospects for further gains.

- Bulls might now aim to reclaim the $24.00 mark and test the YTD high touched in January.

Silver traded with a mild positive bias through the first half of the European session and was last seen hovering near a two-week high, around the $23.35 region. The uptick, however, lacked bullish conviction as traders now seemed to wait for the release of the US CPI report, due later during the early North American session.

From a technical perspective, the overnight sustained strength above the 100-day SMA could be seen as a fresh trigger for the XAG/USD bulls. Some follow-through buying beyond the $23.40-$23.45 resistance would reaffirm the positive bias and set the stage for an extension of the appreciating move witnessed over the past one week or so.

The positive outlook is reinforced by the fact that technical indicators on the daily chart have just started moving into bullish territory. Hence, a subsequent strength towards reclaiming the $24.00 round-figure mark, en-route the YTD high around the $24.70 area touched on January 20, remains a distinct possibility.

On the flip side, the 100-day SMA resistance breakpoint, around the $23.20-$23.15 region, now seems to protect the immediate downside ahead of the $23.00 mark. A convincing break below would expose the $22.75 support area before the XAG/USD drops to mid-$22.00, which if broken decisively will negate any near-term positive bias.

The XAG/USD would then turn vulnerable and accelerate the slide towards the next relevant support is near the $22.00 mark. Some follow-through selling will shift the bias in favour of bearish traders and pave the way for a slide towards challenging the double-bottom support, around the $21.40 region.

Silver daily chart

-637800860028129125.png)

Technical levels to watch

GBP/USD has regained its traction following Wednesday's wobbly action. Near-term bullish bias stays intact while eyes turn to US Consumer Price Index (CPI) data for January, FXStreet’s Eren Sengezer reports.

Dollar could capitalize on hot inflation data and force GBP/USD to turn south

“The US Bureau of Economic Analysis will release the CPI data for January. In case this report suggests that inflation in the US continued to heat up at the beginning of the year, market participants could price in an aggressive rate hike in March and help the dollar outperform its rivals. On the flip side, the greenback is likely to come under renewed selling pressure in case the CPI readings fall short of estimates.”

“1.3600 (psychological level) aligns as the next immediate target on the upside before 1.3620 (static level) and 1.3650 (static level).”

“In case the pair reverses its course on strong CPI figures, 1.3540 (200-period SMA) is the first support ahead of 1.3520 (Fibonacci 38.2% retracement of the latest uptrend, 100-period SMA) and 1.3500 (psychological level, Fibonacci 50% retracement).”

See – US CPI Preview: Forecasts from 10 major banks, higher but showing moderation

The European Commission announced on Thursday that it raised the eurozone 2022 inflation forecast to 3.5% from 2.2% in November's forecast, as reported by Reuters. For 2023, the Commission sees inflation at 2.2%, compared to 1.7% in November.

The publication further showed that the 2022 growth forecast got revised lower to 4% from 4.3%.

"Multiple headwinds have chilled Europe's economy this winter: the swift spread of Omicron, a further rise in inflation driven by soaring energy prices and persistent supply-chain disruptions," European Economic Commissioner Paolo Gentiloni said, per Reuters. "With these headwinds expected to fade progressively, we project growth to pick up speed again already this spring."

Market reaction

This report doesn't seem to be having a significant impact on the shared currency's performance against its rivals. EUR/USD was last seen trading in the positive territory near mid-1.1400s.

- USD/CHF witnessed some selling on Wednesday amid subdued USD demand.

- The risk-on mood undermined the safe-haven CHF and helped limit the slide.

- Investors also seemed reluctant ahead of the release of the key US CPI report.

The USD/CHF pair remained on the defensive through the first half of the European session and was last seen hovering just a few pips above the daily low, around the 0.9235 region.

The US dollar edged lower on Thursday and exerted some downward pressure on the USD/CHF pair, though a generally positive risk tone undermined the safe-haven Swiss franc and extended some support. Apart from this, elevated US Treasury bond yields, along with hawkish Fed expectations acted as a tailwind for the greenback and further contributed to limiting the downside for the major.

Investors seem convinced that the Fed would adopt a more aggressive policy response to contain high inflation and have been pricing in a 50 bps rate hike in March. Thursday's release of the US consumer inflation figures should provide clues about the pace of the Fed's policy tightening cycle. This, in turn, will influence the USD and the near-term trajectory for the USD/CHF pair.

Looking at the broader picture, the pair has been oscillating in a familiar trading range since the beginning of this week. This further points to indecision among traders and warrants some caution before placing directional bets around the USD/CHF pair. Hence, it will be prudent to wait for a strong follow-through selling in order to confirm that the post-NFP rally has lost steam.

Thursday's US economic docket also features the release of the usual Weekly Initial Jobless Claims data late during the early North American session. This, along with the US bond yields, will drive the USD demand and provide some impetus to the USD/CHF pair. Apart from this, traders will further take cues from the broader market risk sentiment to grab some short-term opportunities.

Technical levels to watch

Thursday's Riksbank meeting erred more on the dovish side than economists at ING had expected. In their view, the Swedish krona can recover in the short-run, but upside capped in the medium-run.

Solidly dovish performance form the Riksbank

“Riksbank has defied hawkish expectations and is sticking to its past script of no rate hike before 2024 and no change to its balance sheet size in 2022. Both policies are likely to be adjusted earlier than the Riksbank is currently signaling, but with a lot of tightening already in the price, the medium-term upside for SEK is limited.”

“We still think EUR/SEK is mostly facing downside risks in the coming weeks, and we expect a move to the 10.30-10.35 area by the end of this quarter should global risk sentiment stabilise.”

“In the longer run, the Riksbank’s dovishness should continue to put a cap on SEK’s appreciation, especially considering there is still a good deal of tightening (65bp in the next 12 months) to be priced out of the SEK curve. We now expect EUR/SEK to stay above 10.00 for the remainder of the year.”

- WTI price is preserving a part of previous gains ahead of US inflation.

- Bulls cheer drawdown in US crude stockpiles, as Iran supply concerns loom.

- Upside appears more compelling if the daily rising trendline support holds.

WTI (NYMEX futures) is trading better bid so far this Thursday, clinging onto the previous gains but bulls turn cautious ahead of the critical US inflation.

A hotter US inflation report could boost the aggressive Fed’s tightening expectations, triggering a big leg up in the dollar, which could weigh negatively on the USD-denominated oil.

Further, looming concerns over a probable return of the Iranian oil supplies to the global markets, as Iran nuclear deal talks enter the final stretch, also keep the upside attempts limited in the black gold.

However, WTI bulls remain somewhat supported, courtesy of a big drawdown in the US crude stockpiles data published by the Energy Information Administration (EIA) on Wednesday.

The latest EIA data showed that the “US crude stocks fell by 4.8 million barrels last week to 410.4 million barrels, their lowest since October 2018, while overall product supplied, a proxy for demand, hit a record 21.9 million barrels per day over the past four weeks,” per Reuters.

All eyes now remain on the US inflation release and the sentiment on Wall Street for fresh trading impetus on the higher-yielding oil.

From a near-term technical perspective, WTI bulls manage to defend the over two-month-long rising trendline support at $88.42.

The 14-day Relative Strength Index (RSI) has pulled back from the overbought region, allowing room for a fresh upside.

The next bullish target is seen at $90.00, above which the February 8 highs of $90.61 will be challenged.

On the flip side, a breach of the aforesaid critical support will expose the ascending 21-Daily Moving Average (DMA) at 86.47.

The last line of defense for bulls is aligned at $86 – the round level.

WTI: Daily chart

- GBP/USD caught fresh bids on Thursday and was supported by modest USD weakness.

- A positive risk tone turned out to be a key factor that undermined the safe-haven USD.

- Brexit jitters, hawkish Fed expectations should cap gains ahead of the key US CPI print.

The GBP/USD pair regained positive traction during the first half of the European session and shot to a fresh daily high, around the 1.3560-1.3565 region in the last hour.

Following the previous day's turnaround from the weekly low, the GBP/USD pair caught fresh bids on Thursday and was supported by modest US dollar weakness. A generally positive tone around the equity markets was seen as a key factor that undermined the greenback's relative safe-haven status. That said, elevated US Treasury bond yields and hawkish Fed expectations should limit any meaningful USD losses, warranting caution for bullish traders.

Investors seem convinced that the Fed will adopt a more aggressive policy response to combat high inflation and have been pricing in a 50 bps rate hike in March. This, in turn, had pushed the US bond yields to multi-year highs earlier this week. Hence, Thursday release of the US CPI report would be looked upon for fresh clues about the pace of the Fed's policy tightening cycle, which will play a key role in influencing the USD price dynamics.

In the meantime, some cross-driven strength stemming from a sharp spike in the GBP/JPY cross remained supportive of the move up. It, however, remains to be seen if bulls can retain their dominant position or the momentum meets with a fresh supply at higher levels amid renewed tensions over the Northern Ireland Protocol of the Brexit agreement. This makes it prudent to wait for some follow-through buying before positioning for any further gains.

Technical levels to watch

Barnabas Gan, Economist at UOB Group, reviews the latest BoT meeting (February 9).

Key Takeaways

“The Bank of Thailand (BOT) kept its one-day repurchase rate unchanged at 0.50% for its 14th consecutive meeting on 9 Feb 2022. The last time it made a move was in May 2020, when the benchmark rate was cut by 25 bps.”

“While the central bank made no adjustment to its 2022 GDP outlook of 3.4%, the decision to keep the monetary policy accommodative was largely expected given the economic risks surrounding the (1) development of COVID-19 outbreak amid the (2) risk of higher global energy prices and cost pass through.”

“We expect BOT to inject a token 25 basis point rate hike in 2022, possibly as early as 3Q22, in response to higher inflation risk and the faster-than-anticipated FOMC rate hike for the year ahead. Notwithstanding the projected 25bps hike later this year, we continue to view the monetary policy stance of BOT to be accommodative, especially against the backdrop of potentially higher global interest rates.”

- NZD/USD gained positive traction for the third successive day, though lacked bullish conviction.

- A positive risk tone extended support to the perceived riskier kiwi amid subdued USD demand.

- Traders seemed reluctant and preferred to wait on the sidelines ahead of the key US CPI report.

The NZD/USD pair traded with a mild positive bias through the early European session and was last seen hovering near a two-week high, just below the 0.6700 mark.

The pair edged higher for the third successive day on Thursday and might now be looking to build on its recent recovery from the 0.6530 area or lowest level since September 2020. A generally positive tone around the equity markets turned out to be a key factor that benefitted the perceived riskier kiwi amid subdued US dollar demand.

The uptick, however, lacked follow-through or a bullish conviction amid rising bets for a 50 bps Fed rate hike move in March, which continued acting as a tailwind for the greenback. The markets seem convinced that the US central bank will tighten its monetary policy at a faster pace than anticipated to combat stubbornly high inflation.

Hence, the market focus will remain glued to the latest US consumer inflation figures, due later during the early North American session. Ahead of the key release, traders might refrain from placing aggressive directional bets, which might further contribute to keeping a lid on any meaningful upside for the NZD/USD pair, at least for now.

Thursday's US economic docket also features the release of the usual Weekly Initial Jobless Claims data. This, along with the US bond yields, would influence the USD price dynamics and provide some impetus to the NZD/USD pair. Traders will further take cues from the broader market risk sentiment to grab some short-term opportunities.

Technical levels to watch

The European Central Bank (ECB) board is working with all its tools to stabilize inflation at its 2% target in the medium term, the central bank’s Governing Council Member Olli Rehn on Thursday.

He said, “it's better to progress step by step in normalizing monetary policy in an uncertain situation.”

His comments come ahead of the European Commission’s eurozone forecasts release, with the draft having shown inflation at 3.5% in 2022.

Market reaction

EUR/USD is keeping its range around 1.1430, largely unchanged on the day, with all eyes on the EU economic forecasts and the US inflation.

The major foreign exchange rates remain stable as they trade in a holding pattern ahead of the release later today of the latest US CPI report. Economists at MUFG Bank believe the risks are more skewed to the downside for the dollar heading into the release of January Consumer Price Index (CPI) data.

Annual CPI expected to climb to 7.2% in January