- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 09-10-2020

On Monday, at 05:45 GMT, Switzerland will publish the economic forecast from SECO. At 11:00 GMT ECB chief Lagarde will deliver a speech. At 21:45 GMT, New Zealand will report changes in the level of food prices for September

On Tuesday, at 03:00 GMT, China will announce a change in the foreign trade balance for September. At 06:00 GMT, Britain will announce changes in the number of applications for unemployment benefits for September, as well as the unemployment rate and average earnings for August. At 06:00 GMT in Germany, the consumer price index for September will be released. At 09:00 GMT, Germany and the Euro zone will publish the ZEW Institute's business sentiment index for October. At 12:30 GMT, the US will present the consumer price index for September. At 18:00 GMT in the US, the monthly budget report for September will be released. At 23:30 GMT, Australia will release the Westpac consumer confidence index for October.

On Wednesday, at 04:30 GMT, Japan will announce changes in industrial production for August. At 08:00 GMT the IEA oil market report will be released. At 08:00 GMT ECB chief Lagarde will also deliver a speech. At 09:00 GMT, the Euro zone will report changes in industrial production for August. At 12:30 GMT, the US will release the producer price index for September. At 18:00 GMT in the US, the Fed's "Beige Book" will be released. At 21:45 GMT, the head of the RBA Lowe will speak.

On Thursday, at 00:00 GMT, Australia will announce a change in expectations for consumer price inflation for October, and at 00:30 GMT - a change in the unemployment rate and the number of people employed for September. Also at 00:30 GMT in Australia, the NAB business confidence indicator for the 3rd quarter will be released. At 01:30 GMT, China will publish the consumer price index and producer price index for September. At 04:30 GMT, Japan will present the index of activity in the service sector for August. At 06:30 GMT, Switzerland will release the producer and import price index for September. At 06:45 GMT, France will publish the consumer price index for September. At 08:30 GMT, Britain will release a report on credit conditions. At 12:30 GMT, the US will present the Fed-Philadelphia manufacturing index and the New York Fed's manufacturing activity index for October, the import price index for September, and report changes in the number of initial applications for unemployment benefits. At 15:00 GMT, the US will announce changes in oil reserves according to the Ministry of energy. At 21:30 GMT New Zealand will release the index of business activity in the manufacturing sector for September.

On Friday, at 09:00 GMT, the Euro zone will present the consumer price index for September and report changes in the foreign trade balance for August. At 12:30 GMT, Canada will announce changes in the foreign securities purchases and manufacturing shipments for August. Also at 12:30 GMT, the US will report changes in retail sales for September. At 13:15 GMT, the US will announce changes in the capacity utilization rate and industrial production for September. At 14:00 GMT, the US will release the consumer sentiment index from the University of Michigan and the housing market index from NAHB for October, and will report changes in the business inventories for August. At 16:00 GMT ECB chief Lagarde will deliver a speech. At 17:00 GMT, in the US, the Baker Hughes report on the number of active oil drilling rigs will be released. At 20:00 GMT, the US will announce changes in the net and total volume of purchases of long-term US securities by foreign investors for August.

On Sunday, at 23:50 GMT, Japan will report a change in the foreign trade balance for September.

USD/CAD: 1.3130 is a temporary stop-gap towards a retest of 1.30 - TDS

FXStreet reports that one of the lasting features of the COVID-19 shock is the redundancy of traditional drivers like nominal interest rates while a shift to a more lasting influence from equity markets on FX. This should be notable for pairs like USD/CAD. Tactically, analysts at TD Securities like the pair lower and believe 1.3130 is a temporary stop-gap towards a re-test of 1.30.

“Like much of the broader FX complex, broad USD variation and risk sentiment are dominant drivers for USD/CAD. The former is a reflection of the reflation strategy/trade where the enormous monetary and fiscal stimulus set the conditions for a global revival in growth and asset price inflation – a backdrop, we think, for USD weakness. On the other hand, one of the more notable features of this crisis is the persistence of equity/ FX correlations. We think this will become a more prominent and lasting feature in the COVID-19 era as nominal interest rates have rendered themselves moot.”

“Our long-term/slow-moving valuation models suggest USD/CAD is more fairly valued between 1.27/1.30... We view 1.3130 as the next notable point of support, but only as a temporary stop-gap to a retest of 1.30.”

- BoE aims to keep borrowing costs at rock-bottom levels for as long as necessary to get economy moving

- Financial markets point to a lengthy period of very low-interest rates but things can change

- A credible vaccine announcement would significantly boost public and business confidence

FXStreet reports that the highly expansionary monetary policies conducted by the Federal Reserve (Fed) and the European Central Bank (ECB) are leading to abnormally strong rises in share prices. This mechanism may be unintentional (the real objective of the expansionary monetary policy is to stimulate demand and improve borrower solvency) or deliberate (to benefit from wealth effects, aid the financial sector). Economists at Natixis carry out an econometric and statistical analysis to find it out.

“The central banks’ objective is to stimulate investment by maintaining the solvency of borrowers, in particular governments. Monetary policy then has the side-effect of giving rise to an equity bubble. This effect is an unintended consequence.”

“The central banks’ objective is to drive up stock market indices to benefit from positive wealth effects on consumption and investment; and to bolster the financial sector (investment funds, institutional investors) by generating capital gains on their assets.”

“Our econometric analysis shows no significant negative effect of growth in the stock market index (year-on-year, quarter-on-quarter or month-on-month) on the central banks’ key interest rates.”

The Commerce

Department announced on Friday the U.S. wholesale inventories rose 0.4 percent

m-o-m in August, slightly worse than the preliminary estimate of a 0.5 percent

m-o-m gain. Anyway, this marked the first monthly rise in wholesale inventories

since April.

Economists had

forecast the reading to stay unrevised at +0.5 percent m-o-m.

In July,

wholesale inventories edged down 0.1 percent m-o-m.

According to

the report, durable goods inventories increased 0.6 percent m-o-m in August,

while stocks of nondurable goods were flat m-o-m.

In y-o-y terms,

wholesale inventories dropped 5.2 percent in August.

FXStreet reports that economists at Handelsbanken have revised lower their forecast for the UK economy which implies GBP/USD moving to 1.23 by mid-2021 and EUR/GBP trading within 0.91 and 0.95.

“Our forecast is for unemployment to peak at 8 percent in the latter part of this year and early 2021, as businesses assess demand for their goods and services in the longer-term.”

“Reflecting on the state of negotiations, and acknowledging that a last-minute deal remains a possibility, we now think, at least in the short-term, that the Brexit agreement is going to fall short of what had been hoped for and expected.”

“Our GDP forecast for the recovery in 2021 has fallen from 5.1 percent to 3.9 percent, and thereafter to 1.7 percent in 2022; not until 2024 is the trend rate of growth regained.”

“Much of the impact of the widening current account deficit will be taken by sterling, with our central forecast being that GBP/USD moves to 1.23 by mid-2021, while EUR/GBP will be 0.91 to 0.95 (the wide spread being an indication of the uncertainty of just what might be included in any mini deal).”

U.S. stock-index futures rose on Friday, as reports that U.S. President Donald Trump wants a deal on a comprehensive bill with House Speaker Nancy Pelosi raised investors' hopes that Democrats and Republicans can reach an agreement on a broader coronavirus legislative package before the November 3 Presidential elections.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 23,619.69 | -27.38 | -0.12% |

Hang Seng | 24,119.13 | -74.22 | -0.31% |

Shanghai | 3,272.08 | +54.02 | +1.68% |

S&P/ASX | 6,102.20 | +0.20 | 0.00% |

FTSE | 6,028.99 | +50.96 | +0.85% |

CAC | 4,943.20 | +31.26 | +0.64% |

DAX | 13,056.75 | +14.54 | +0.11% |

Crude oil | $41.03 | -0.39% | |

Gold | $1,923.60 | +1.56% |

NFXStreet notes that S&P 500 has confirmed its flagged “head & shoulders” base above the mid-September highs and 61.8% retracement of the fall from September at 3429/44 and analysts at Credit Suisse look for a resumption of the core uptrend.

“The S&P 500 has as suspected easily reversed its bearish ‘reversal day’ from Tuesday and has pushed above key resistance from the mid-September highs and 61.8% retracement of the fall from September at 3429/44 (although on noticeably low volume). This suggests the flagged ‘head & shoulders’ base is now in place and with daily MACD momentum having already turned higher we look for a resumption of the core uptrend.”

“We see resistance at 3495 initially ahead of the 78.6% retracement of the September fall at 3507.”

“Support is seen at 3428 initially, with 3419 now ideally holding to keep the immediate risk higher. A break can see a pullback to 3395/85, but with better buyers expected here.”

(company / ticker / price / change ($/%) / volume)

ALCOA INC. | AA | 12.89 | 0.16(1.26%) | 28636 |

ALTRIA GROUP INC. | MO | 40.55 | 0.17(0.42%) | 16197 |

Amazon.com Inc., NASDAQ | AMZN | 3,212.00 | 21.45(0.67%) | 30580 |

American Express Co | AXP | 105.48 | -0.58(-0.55%) | 5920 |

AMERICAN INTERNATIONAL GROUP | AIG | 30.5 | 0.24(0.79%) | 818 |

Apple Inc. | AAPL | 115.59 | 0.62(0.54%) | 701685 |

Boeing Co | BA | 169.49 | 1.49(0.89%) | 101460 |

Caterpillar Inc | CAT | 157.5 | 0.84(0.54%) | 747 |

Chevron Corp | CVX | 75.69 | 0.47(0.63%) | 9907 |

Cisco Systems Inc | CSCO | 40.05 | 0.26(0.65%) | 31506 |

Citigroup Inc., NYSE | C | 44.99 | 0.27(0.60%) | 69932 |

Exxon Mobil Corp | XOM | 35.54 | 0.28(0.79%) | 108812 |

Facebook, Inc. | FB | 265 | 1.24(0.47%) | 52881 |

FedEx Corporation, NYSE | FDX | 273.5 | 2.44(0.90%) | 2728 |

Ford Motor Co. | F | 7.4 | 0.05(0.68%) | 73720 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 17.1 | 0.30(1.79%) | 25139 |

General Electric Co | GE | 7.05 | 0.40(6.02%) | 3744616 |

General Motors Company, NYSE | GM | 32.45 | 0.24(0.74%) | 4889 |

Goldman Sachs | GS | 209.2 | 1.22(0.59%) | 4323 |

Google Inc. | GOOG | 1,492.00 | 6.07(0.41%) | 2652 |

Home Depot Inc | HD | 286 | 1.48(0.52%) | 1259 |

Intel Corp | INTC | 53.36 | -0.01(-0.02%) | 122277 |

International Business Machines Co... | IBM | 131.7 | 0.21(0.16%) | 25101 |

International Paper Company | IP | 43.56 | 1.07(2.52%) | 5413 |

Johnson & Johnson | JNJ | 149.5 | 0.61(0.41%) | 6920 |

JPMorgan Chase and Co | JPM | 102.49 | 0.71(0.70%) | 26428 |

McDonald's Corp | MCD | 226.86 | 1.06(0.47%) | 1552 |

Merck & Co Inc | MRK | 80.66 | 0.18(0.22%) | 1066 |

Microsoft Corp | MSFT | 211.7 | 1.12(0.53%) | 44134 |

Nike | NKE | 130.5 | 0.79(0.61%) | 887 |

Pfizer Inc | PFE | 36.9 | 0.01(0.03%) | 46112 |

Procter & Gamble Co | PG | 141.98 | 0.33(0.23%) | 2223 |

Starbucks Corporation, NASDAQ | SBUX | 89.85 | 0.32(0.36%) | 2401 |

Tesla Motors, Inc., NASDAQ | TSLA | 430.87 | 4.95(1.16%) | 417575 |

The Coca-Cola Co | KO | 50.62 | 0.16(0.32%) | 2858 |

Twitter, Inc., NYSE | TWTR | 46.3 | 0.29(0.63%) | 25400 |

UnitedHealth Group Inc | UNH | 325 | 2.59(0.80%) | 759 |

Verizon Communications Inc | VZ | 59.25 | 0.06(0.10%) | 6942 |

Visa | V | 203.8 | 0.82(0.40%) | 5752 |

Wal-Mart Stores Inc | WMT | 141.88 | 0.52(0.37%) | 13496 |

Walt Disney Co | DIS | 123.4 | 0.31(0.25%) | 8042 |

Yandex N.V., NASDAQ | YNDX | 60.82 | 0.03(0.05%) | 11731 |

Amgen (AMGN) downgraded to Mkt Perform from Outperform at Bernstein

Amgen (AMGN) downgraded to Hold from Buy at Truist; target $251

NVIDIA (NVDA) downgraded to Sell from Neutral at New Street; target $400

American Express (AXP) downgraded to Neutral from Positive at Susquehanna; target $110

International Paper (IP) upgraded to Overweight from Equal Weight at Wells Fargo; target raised to $52

Statistics

Canada reported on Friday that the number of employed people increased by 378,000

m-o-m in September (or +2.1 percent m-o-m) after an unrevised increase of 245,800

m-o-m in the previous month. Economists had forecast an advance of 156,600

m-o-m.

Meanwhile,

Canada's unemployment rate fell to 9.0 percent in September from 10.2 percent

in August, exceeding economists’ forecast for 9.7 percent. That was the lowest

rate since March.

According to

the report, full-time employment climbed by 334,000 (or +2.3 percent m-o-m) in

September, while part-time jobs rose by 44,200 (or +1.3 percent m-o-m).

In September,

the number of public sector employees surged by 143,600 (or +3.8 percent

m-o-m), while the number of private sector employees jumped by 259,800 (or +2.3

percent m-o-m). At the same time, the number of self-employed declined by 25,100

(or -0.9 percent m-o-m) last month.

Sector-wise,

employment increased both in goods-producing (+2.0 percent m-o-m) and

service-producing (+2.1 percent m-o-m) businesses.

AUD/USD: Pressure against the 0.7192/7009 key resistance area increases - Credit Suisse

FXStreet notes that AUD/USD is pressuring against the crucial 0.7192/7209 zone as the aussie continues to advance for the third straight session on Friday, up 0.3% on the day to 0.7185 at the time of writing. A break above 0.7192 would confirm an early resumption of the bull trend, according to the Credit Suisse analyst team.

“AUD/USD has turned back higher and is pressuring again against the crucial breakdown point to the small top and key moving averages at 0.7192/7209, although not yet managing to see a clear break, keeping the market within a consolidation range for now.”

“The risk of an early resumption of the core bull trend is clearly increasing given the improvement in risk sentiment and with this in mind, a clear close above 0.7192/7209 would negate the top and suggest that the corrective phase has already come to an end, with resistance seen initially at 0.7235. Whilst beneath 0.7192/7209 though, we still cannot rule out further near-term corrective weakness.”

- Will further stabilize employment

- Progress has been made this week in some areas, however, differences still remain on important issues

- Currently no plans to issue formal statement from negotiators on Friday

USD fell against its major rivals in the European session on Friday, as risk sentiment improved after the U.S. president signaled that he is open to the idea of a large-scale stimulus package.

The U.S. Dollar Index (DXY), measuring the U.S. currency's value relative to a basket of foreign currencies, dropped 0.31% to 93.31.

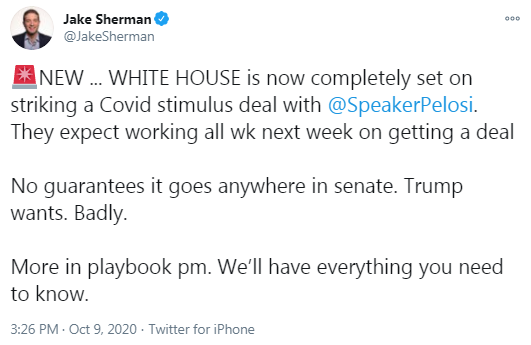

Nancy Pelosi's spokesman tweeted that Treasury Secretary Steven Mnuchin told House Speaker that the U.S. president Donald Trump is interested in reaching an imminent agreement on a comprehensive bill. This tweet came after Pelosi stated that she will not agree to a stand-alone aid bill for airlines unless the White House commits to a larger stimulus package. It also revealed another erratic reversal in Trump's position on stimulus talks. Earlier this week, he abruptly ordered his team to stop negotiations on a new economic stimulus package with Democrats.

The announcement that Trump wants a "big deal" with Pelosi raised investors' hopes that Democrats and Republicans can reach an agreement on a broader coronavirus legislative package before the November 3 Presidential elections. Pelosi and Mnuchin will resume negotiations later today.

In addition, investors bet that Joe Biden, the Democratic candidate for U.S. president, if elected, would quickly spend money to stimulate economic recovery.

FXStreet reports that USD/CAD has broken beneath the 55-day average at 1.3247/42, confirming a more direct resumption of the medium-term bear trend. Analysts at Credit Suisse see the next support at 1.3157, then a cluster of price supports at 1.3128/19.

“USD/CAD has seen a sharp fall and closed beneath the crucial ‘neckline’ to the small base and 55-day average at 1.3247/42, negating the former base and confirming a more direct resumption of the medium-term bear trend.”

“We now expect to see a fall back to 1.3171, ahead of the 61.8% retracement of the September surge at 1.3157. Beyond here can see a move back to a cluster of price supports at 1.3128/19, removal of which could open the door for a fall back to 1.3047/45.”

“Bigger picture, further weakness from current levels could be the start of the ‘right shoulder’ to much larger long term top, in which case weakness should accelerate sharply from here.”

FXStreet reports that Senior Economist at UOB Group Alvin Liew assessed the latest release of the FOMC minutes of the September meeting.

“The FOMC minutes highlighted the importance of US fiscal stimulus in supporting the US economic recovery and urged the US lawmakers for more fiscal stimulus to support the continued recovery. It warned that the Fed’s [economic] outlook assumed additional fiscal support and that if future fiscal support was significantly smaller or came significantly later than they expected, the pace of recovery could be slower than anticipated.”

“The Fed is currently satisfied with the new strategy of Average Inflation Targeting (AIT) and ‘there did not appear to be a need for enhanced forward guidance at this juncture or much scope for forward guidance to put additional downward pressure on yields’.”

“Going forward, as Powell has said that the guidance given in the September FOMC is ‘durable’, the Fed will likely maintain this accommodative monetary policy and economic outlook for now while we believe the Fed policy will continue its call for more fiscal stimulus.”

FXStreet notes that gold (XAU/USD) continues to benefit from the reduced haven demand for the US dollar and strategists at ANZ Bank forecast the yellow metal reaching the $2,300 level at the beginning of 2021.

“Ample money supply, lower interest rates and macro uncertainty should support gold investment.”

CNBC reports that according to an economist, a Biden presidency could bring 1 million barrels per day of Iranian oil back into the market, but lead to lower demand in the long run.

That’s because Democratic presidential candidate Joe Biden is likely to reestablish relations with Tehran if he is elected, but introduce environmental policies that limit U.S. oil and gas, said David Fyfe of Argus Media.

“Arguably, a Biden presidency would move fairly rapidly toward some sort of rapprochement with Iran,” he told CNBC.

“That of course could lead to maybe up to a million barrels a day of Iranian oil coming back onto the market,” he said. “It might not happen immediately, but you could see that happening within the sort of first six months of a Biden presidency.”

By contrast, the Trump administration has put maximum pressure on Iran, which has seen heavy economic sanctions imposed on the Islamic Republic, including on its oil exports.

According to the report from Istat, in August 2020 the seasonally adjusted industrial production index increased by 7.7% compared with the previous month. The change of the average of the last three months with respect to the previous three months was +34.6%. The index measures the monthly evolution of the volume of industrial production (excluding construction).

The calendar adjusted industrial production index decreased by 0.3% compared with August 2019 (calendar working days in August 2020 being the same as in August 2019).

The unadjusted industrial production index decreased by 0.3% compared with August 2019.

FXStreet reports that expansionary monetary policy can be sustained as long as full employment is not reached but not afterward, as per Natixis.

“Central banks (we look at the OECD and the world) now want to keep real interest rates very low with various objectives: supporting investment; ensuring the solvency of governments and all borrowers; driving up the employment rate by maintaining an expansionary monetary policy while the unemployment rate is already very low.”

“In the first stage, after a recession, there is underemployment. Expansionary monetary policy then leads to lower real interest rates. Low real interest rates lead to a rebound in investment, and the savings-investment equilibrium is ensured by the increase in GDP and income due to the expansionary monetary policy, which generates additional savings.”

“When full employment is reached, population ageing leads to a rise in real interest rates, as savings and investment need to be rebalanced to full employment with a fall in savings. The expansionary monetary policy can then no longer ensure low real interest rates and it drives up prices, both prices of goods and services and asset prices.”

eFXdata reports that Bank of America Global Research flags a scope for a delay in the EU Recovery Fund.

"Disagreements on rule of law are threatening a delay in the set up of the Recovery Fund (NGEU), initially expected for Jan-21".

"A delay shouldn't have major market impact, but one should hedge a scenario where markets think the project will be rejected...In our baseline, which sees EU countries compromise, we like EUR/CZK lower and paying rates in Poland. In case of a breakdown, as EUR/USD will likely be hit, CEE FX will suffer as a consequence, most likely the PLN given it is the most crowded," BofA adds.

FXStreet reports that USD/CNH could move lower and test the 6.7000 level in the next weeks, noted FX Strategists at UOB Group.

24-hour view: “We expected USD to ‘edge lower’ yesterday. However, USD traded in a relatively quiet manner between 6.7255 and 6.7478. USD opened on a soft note this morning and the bias still appears to be tilted to the downside. That said, a sustained decline below Monday’s (05 Oct) low of 6.7135 appears unlikely (next support is at 6.7000). Overall, USD is deemed to be under mild downward pressure unless it can move above 6.7500 (minor resistance is at 6.7380).”

Reuters reports that the Bank of Japan will conduct experiments on basic functions core to issuing central bank digital currencies (CBDCs) as early as possible during the fiscal year beginning in April 2021.

“The Bank will explore general-purpose CBDC in a more concrete and practical way by conducting experiments, rather than confining itself to conceptual research as before,” the BOJ said.

FXStreet reports that economists at Westpac have lifted Australian 2021 growth forecast to 2.8% from 2.5% and 2022 from 2.7% to 3.5% following the 2020/2021 Budget.

“The Budget provides two major sources of policy to boost the economy around household incomes and tax incentives to invest. We recognise both effects in our revised forecasts and, at the same time, see significant above trend growth in 2022 associated with a confidence boost.”

“We have lifted our GDP forecasts in 2021 from 2.5% to 2.8% and in 2022 from 2.7% to 3.5%.”

CNBC reports that according to a recent Pew Research Center, negative opinions about China have soared among countries and reached a record high for most of the 14 countries polled.

Negative views of China reached their “highest points” in 9 of those countries since the research center began polling on this issue more than 10 years ago. They were Australia, the United Kingdom, Germany, the Netherlands, Sweden, the United States, South Korea, Spain and Canada, according to Pew. The other five countries in the survey were Belgium, Denmark, France, Italy and Japan.

A majority in each of the surveyed countries had an unfavorable opinion of China, according to the survey, which polled 14,276 adults in 14 countries between June 10 to Aug. 3 this year.

Negative sentiment increased the most in Australia, where 81% of respondents said they viewed China unfavorably — a rise of 24 percentage points from last year. In the U.S., public opinion has also increasingly turned for the worst — up 13 points since last year, and nearly 20 points since U.S. President Donald Trump took office.

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 00:30 | Australia | Home Loans | August | 10.7% | 13.6% | |

| 00:30 | Australia | RBA Financial Stability Review | ||||

| 01:45 | China | Markit/Caixin Services PMI | September | 54 | 54.8 | |

| 06:00 | United Kingdom | Manufacturing Production (YoY) | August | -10.1% | -5.9% | -8.4% |

| 06:00 | United Kingdom | Industrial Production (YoY) | August | -7.4% | -4.6% | -6.4% |

| 06:00 | United Kingdom | Manufacturing Production (MoM) | August | 6.9% | 3% | 0.7% |

| 06:00 | United Kingdom | Industrial Production (MoM) | August | 5.2% | 2.5% | 0.3% |

| 06:00 | United Kingdom | GDP, y/y | August | -11.7% | -9.3 | |

| 06:00 | United Kingdom | GDP m/m | August | 6.4% | 4.6% | 2.1% |

| 06:00 | United Kingdom | Total Trade Balance | August | 1.7 | 1.4 | |

| 06:45 | France | Industrial Production, m/m | August | 3.8% | 1.7% | 1.3% |

During today's Asian trading, the dollar fell against major world currencies on signals that the US will still be able to take another major stimulus package soon.

The White house, which announced earlier this week that it was ending negotiations with Congress on a new package, changed its tactics. US Treasury Secretary Steven Mnuchin told House speaker Nancy Pelosi that US President Donald Trump, who previously announced his intention to sign several bills to target certain segments of the economy, is still leaning towards the need for a full-scale stimulus package.

Pelosi told reporters on Thursday that the House of Representatives would not support the airline incentive bill, which Trump had called for a day earlier, outside of a large-scale financial aid package.

Growing hopes for new incentives are reducing the dollar's appeal, boosting demand for riskier assets.

The ICE index, which tracks the dynamics of the US dollar against six currencies (Euro, Swiss franc, yen, canadian dollar, pound sterling and Swedish Krona), fell 0.1%.

According to the report from INSEE, in August 2020, output increased more modestly than in July in the manufacturing industry (+1.0%, after +4.5%), as well as in the whole industry (+1.3%, after +3.8%). Economists had expected a 1.7% increase in the whole industry.

Compared to February (the last month before the beginning of the general lockdown), output remained significantly lower in the manufacturing industry (−7.4%), as well as in the whole industry (−6.3%).

In August, output increased again, but at a slower rate than in July, in “other manufacturing” (+2.4% after +4.1%), in the manufacture of transport equipment (+5.9% after +8.5%) and in mining and quarrying, energy, water supply (+2.8% after +0.2%). It fell back in the manufacture of machinery and equipment goods (−4.0% after +7.5%) and in the manufacture of food products and beverages (−2.0% after +2.0%). It kept decreasing sharply in the manufacture of coke and refined petroleum (−6.9% after −7.1%).

In most industrial activities, output yet remained below its February level. It plummeted in the manufacture of transport equipment (−18.4%), in the manufacture of coke and refined petroleum (−17.4%) and in the manufacture of machinery and equipment goods (−9.4%). Conversely, taking into account the increase observed in August, output got closer to its February level in the manufacture of basic metals and fabricated metal products (−3.5%) and in manufacturing of rubber and plastics products (−2.2%). In the manufacture of food products and beverages, output was less impacted and returned to a standard level since June − July.

According to the report from Office for National Statistics, in August 2020, the Index of Production is 6.0% below February 2020, the previous month of "normal" trading conditions, prior to the coronavirus (COVID-19) pandemic.

Production output rose by 0.3% between July 2020 and August 2020, with manufacturing providing the largest upward contribution, rising by 0.7%; electricity and gas also rose (1.6%), partially offset by a fall in mining and quarrying (4.1%). Economists had expected a 2.5% increase.

The monthly increase of 0.7% in manufacturing output was led by other manufacturing and repair; 8 of the 13 subsectors displayed upward contributions.

Total production output increased by 9.3% for the three months to August 2020, compared with the three months to May 2020; this was primarily because of the strength displayed during June and July 2020.

For the three months to August 2020, compared with the three months to August 2019, production output decreased by 8.6%; this was led by a fall in manufacturing of 11.4%.

According to the report from Office for National Statistics, monthly gross domestic product (GDP) grew by 2.1% in August 2020 following growth of 6.4% in July, 9.1% in June and 2.7% in May. Despite this, the level of output has not fully recovered from the record falls seen across March and April 2020, and is still 9.2% below the levels seen in February 2020, before the full impact of the coronavirus (COVID-19) pandemic.

Gross domestic product (GDP) grew by 8.0% in the three months to August 2020 as restrictions on movement eased across June, July and August.

All the headline sectors provided a positive contribution to GDP growth in the three months to August 2020. The services sector grew by 7.1%, production by 9.3% and construction by 18.5%.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1901 (4976)

$1.1851 (3073)

$1.1806 (2585)

Price at time of writing this review: $1.1772

Support levels (open interest**, contracts):

$1.1744 (2107)

$1.1699 (2635)

$1.1650 (2852)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date October, 9 is 70994 contracts (according to data from October, 8) with the maximum number of contracts with strike price $1,1900 (4976);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3151 (1542)

$1.3053 (357)

$1.2970 (946)

Price at time of writing this review: $1.2943

Support levels (open interest**, contracts):

$1.2915 (1045)

$1.2887 (677)

$1.2846 (900)

Comments:

- Overall open interest on the CALL options with the expiration date October, 9 is 16344 contracts, with the maximum number of contracts with strike price $1,3150 (1542);

- Overall open interest on the PUT options with the expiration date October, 9 is 18542 contracts, with the maximum number of contracts with strike price $1,3150 (2526);

- The ratio of PUT/CALL was 1.13 versus 1.12 from the previous trading day according to data from October, 8

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 43.08 | 3.14 |

| Silver | 23.79 | 0.04 |

| Gold | 1893.356 | 0.31 |

| Palladium | 2378.28 | 1.2 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 224.25 | 23647.07 | 0.96 |

| Hang Seng | -49.51 | 24193.35 | -0.2 |

| KOSPI | 5.02 | 2391.96 | 0.21 |

| ASX 200 | 65.8 | 6102.2 | 1.09 |

| FTSE 100 | 31.78 | 5978.03 | 0.53 |

| DAX | 113.64 | 13042.21 | 0.88 |

| CAC 40 | 29.94 | 4911.94 | 0.61 |

| Dow Jones | 122.05 | 28425.51 | 0.43 |

| S&P 500 | 27.39 | 3446.83 | 0.8 |

| NASDAQ Composite | 56.38 | 11420.98 | 0.5 |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 (GMT) | Australia | Home Loans | August | 10.7% | |

| 00:30 (GMT) | Australia | RBA Financial Stability Review | |||

| 01:45 (GMT) | China | Markit/Caixin Services PMI | September | 54 | |

| 06:00 (GMT) | Japan | Prelim Machine Tool Orders, y/y | September | -23.3% | |

| 06:00 (GMT) | United Kingdom | Manufacturing Production (YoY) | August | -9.4% | -5.9% |

| 06:00 (GMT) | United Kingdom | Industrial Production (YoY) | August | -7.8% | -4.6% |

| 06:00 (GMT) | United Kingdom | Industrial Production (MoM) | August | 5.2% | 2.5% |

| 06:00 (GMT) | United Kingdom | Manufacturing Production (MoM) | August | 6.3% | 3% |

| 06:00 (GMT) | United Kingdom | GDP, y/y | August | -11.7% | |

| 06:00 (GMT) | United Kingdom | GDP m/m | August | 6.6% | 4.6% |

| 06:00 (GMT) | United Kingdom | Total Trade Balance | August | 1.1 | |

| 06:45 (GMT) | France | Industrial Production, m/m | August | 3.8% | 1.7% |

| 12:30 (GMT) | Canada | Employment | September | 245.8 | 156.6 |

| 12:30 (GMT) | Canada | Unemployment rate | September | 10.2% | 9.7% |

| 13:00 (GMT) | United Kingdom | NIESR GDP Estimate | Quarter III | 7% | 8.7% |

| 14:00 (GMT) | U.S. | Wholesale Inventories | August | -0.1% | 0.5% |

| 17:00 (GMT) | U.S. | Baker Hughes Oil Rig Count | October | 189 | |

| 23:50 (GMT) | Japan | Core Machinery Orders, y/y | August | -16.2% | |

| 23:50 (GMT) | Japan | Core Machinery Orders | August | 6.3% |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.71665 | 0.42 |

| EURJPY | 124.624 | -0.02 |

| EURUSD | 1.17561 | -0.05 |

| GBPJPY | 137.019 | 0.16 |

| GBPUSD | 1.29265 | 0.14 |

| NZDUSD | 0.65812 | 0.08 |

| USDCAD | 1.31961 | -0.47 |

| USDCHF | 0.91674 | 0.07 |

| USDJPY | 105.995 | 0.02 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.