- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 09-07-2014

Stock indices traded mixed ahead of the last Fed's monetary policy meeting. Market participants are awaiting the release of the last Fed's monetary policy meeting today. They will be looking for any signs of the recovery of the world's largest economy. There are speculations that stronger employment data may lead to interest rate hike by the Fed.

In the early trading session, stock were driven by the Chinese inflation data. The consumer price index in China increased 2.3% in June, missing expectations for a 2.4% rise, after a 2.5% gain in May.

Chinese producer price index fell 1.1% in June, in line with expectations, after a 1.4% drop in May.

These figures show that there is still weakness in the Chinese economy.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,718.04 -20.41 -0.30%

DAX 9,808.2 +35.53 +0.36%

CAC 40 4,359.84 +17.31 +0.40%

Сrude oil fell after supplies rose at Cushing, Oklahoma, the contract's delivery point. Brent slipped to a one-month low amid signs Libyan oil exports will gain.

Cushing stockpiles rose by 447,000 barrels to 20.9 million last week, Energy Information Administration data showed. Total inventories dropped 2.37 million barrels to 382.6 million.

Libya plans to gradually boost exports to avoid disrupting the market, said Samir Kamal, the nation's governor to the Organization of Petroleum Exporting Countries.

WTI for August delivery dropped to $102.47 a barrel (-1.4%) on the New York Mercantile Exchange.

Brent for August settlement fell to $108.49 a barrel (-0.35%) on the London-based ICE Futures Europe exchange.

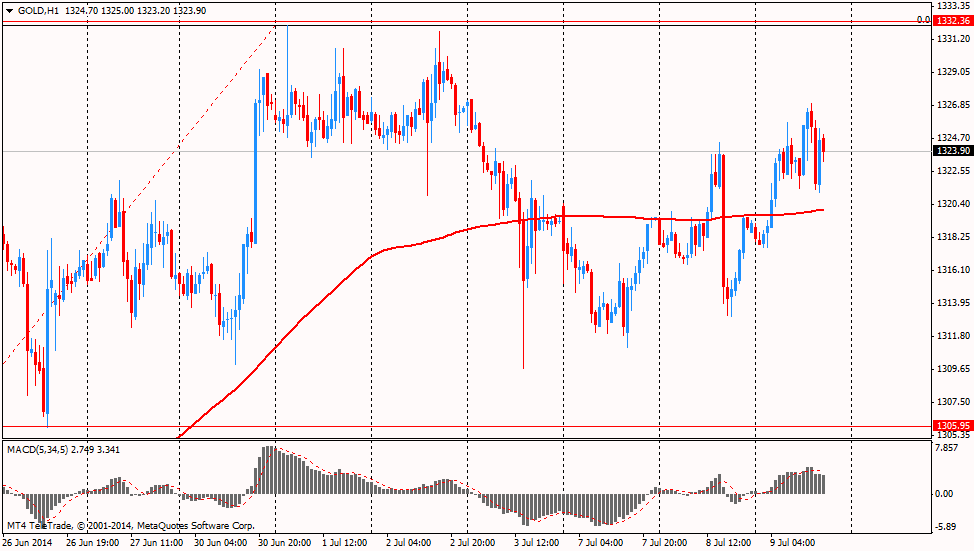

Gold rose as increasing tension in the Middle East boosted the appeal of the metal as a haven. Israel began a military offensive in the Gaza Strip this week by declaring its purpose was to halt Palestinian rocket attacks. The escalation in violence between Israel and Gaza-based militants is the worst since November 2012.

Gold futures for August delivery gained to $1323.90 an ounce (+0.61%).

The U.S. dollar traded lower against the most major currencies ahead Fed's monetary policy meeting. The U.S. currency remained under pressure after yesterday's comments by Minneapolis Fed President Narayana Kocherlakota. He said that inflation in the U.S. was more likely to be under Fed's 2% target until 2018. That may mean that interest rate in the U.S. will remain at the low level for a longer period.

Market participants are awaiting the release of the last Fed's monetary policy meeting today. They will be looking for any signs of the recovery of the world's largest economy. There are speculations that stronger employment data may lead to interest rate hike by the Fed.

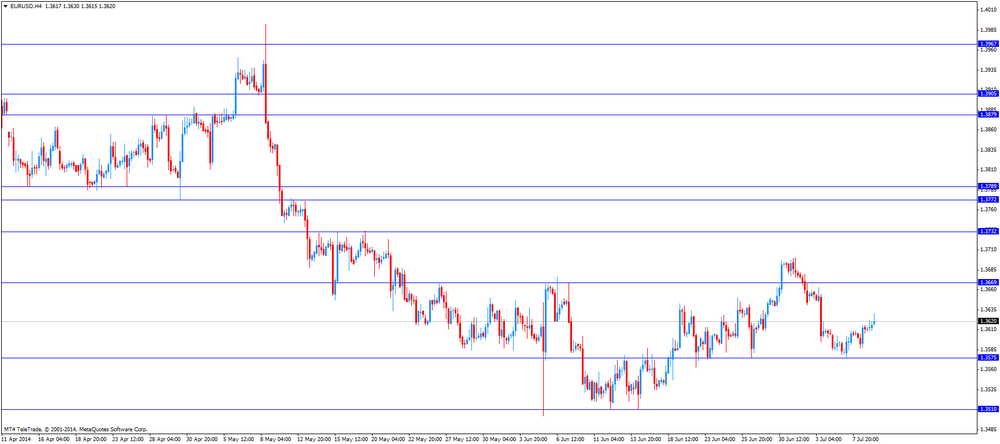

The euro increased against the U.S. dollar in the absence of any major economic reports in the Eurozone.

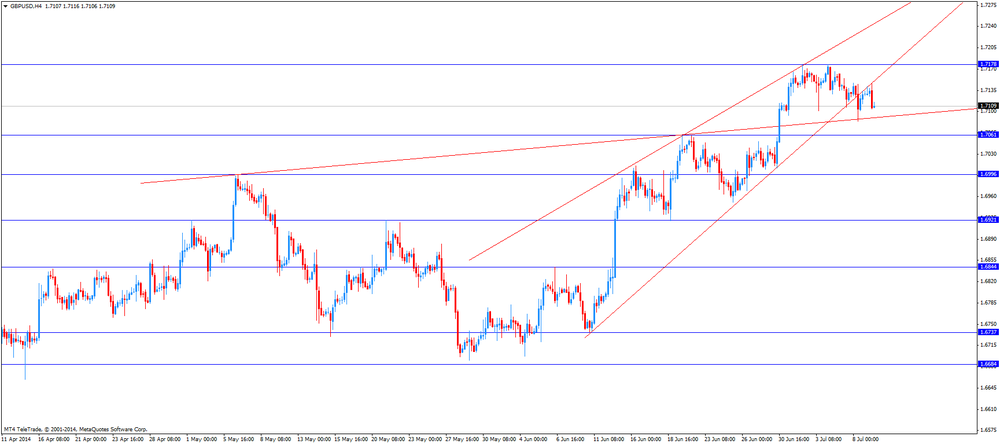

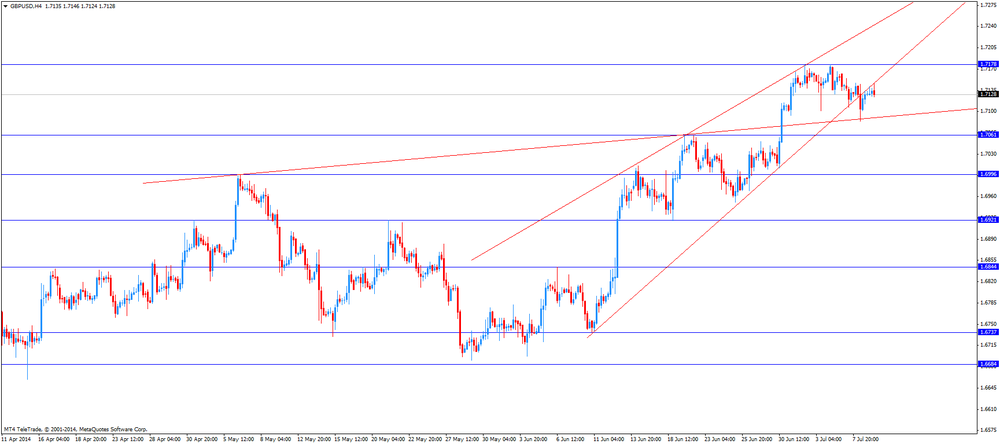

The British pound traded higher against the U.S. dollar. The Halifax house price index declined 0.6% in June, missing expectations for a 0.3% fall, after a 3.9% rise in May.

On a yearly basis, the Halifax house price index rose 8.8% in June, after a 8.7% gain in May.

The Canadian dollar rose against the U.S. dollar due to the better-than-expected housing starts in Canada. The number of housing starts in Canada increased to 198,200 units in June, beating expectations for a decline to 191,000 units, after 197,000 units in May. May's figure was revised down from 198,300 units.

The New Zealand dollar traded near 3-year highs against the U.S dollar due to decreasing demand for the U.S. currency ahead of Fed's meeting minutes. The kiwi was also supported by Fitch's decision. The ratings agency affirmed the New Zealand's AA rating yesterday and raised New Zealand's outlook to positive from stable.

The Australian dollar traded mixed against the U.S. dollar after the better-than-expected consumer confidence in Australia. The Westpac Banking Corporation released its consumer confidence index for Australia. The index increased 1.9% in July, after a 0.2% gain in June.

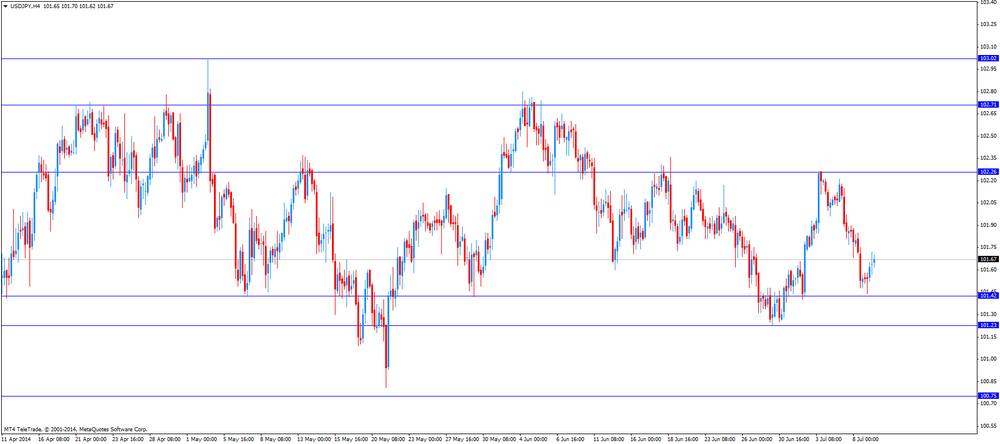

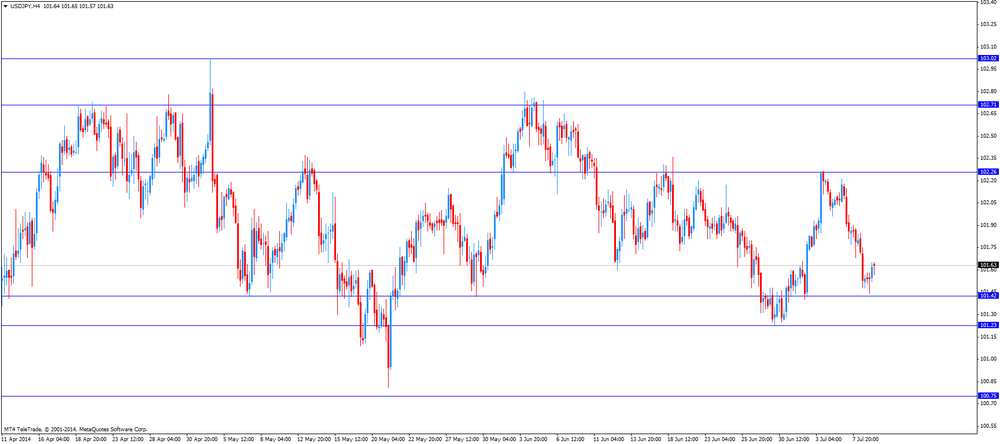

The Japanese yen traded lower against the U.S. dollar. The machine tool orders in Japan climbed 34.2% in June, after a 24.1% gain in May.

EUR/USD $1.3600, $1.3615, $1.3650

USD/JPY Y101.75, Y102.00, Y102.25

GBP/USD $1.7125

AUD/USD $0.9350, $0.9400, $0.9450

USD/CAD C$1.0625, C$1.0675, C$1.0700, C$1.0725, C$1.0730

EUR/GBP stg0.7925, stg0.8000, stg0.8050

U.S. stock-index futures rose slightly as investors awaited minutes from the Federal Reserve's last meeting and corporate earnings reports. Shares of Alcoa (AA) advanced more than 2% after reporting better-than-estimated profit and sales.

Global markets:

Nikkei 15,302.65 -11.76 -0.08%

Hang Seng 23,176.07 -365.31 -1.55%

Shanghai Composite 2,038.61 -25.41 -1.23%

FTSE 6,710.28 -28.17 -0.42%

CAC 4,346.01 +3.48 +0.08%

DAX 9,785.28 +12.61 +0.13%

Crude oil $103.10 (-0.29%)

Gold $1327.50 (+0.84%)

(company / ticker / price / change, % / volume)

| AT&T Inc | T | 35.60 | +0.11% | 1.3K |

| Goldman Sachs | GS | 165.20 | +0.18% | 1.1K |

| Verizon Communications Inc | VZ | 48.87 | +0.23% | 11.8K |

| Caterpillar Inc | CAT | 109.77 | +0.28% | 2.1K |

| JPMorgan Chase and Co | JPM | 55.95 | +0.34% | 0.2K |

| United Technologies Corp | UTX | 114.49 | +0.37% | 0.7K |

| General Electric Co | GE | 26.48 | +0.42% | 10.5K |

| Pfizer Inc | PFE | 30.30 | +0.50% | 0.1K |

| Microsoft Corp | MSFT | 42.00 | +0.53% | 12.0K |

| Boeing Co | BA | 128.11 | +1.04% | 6.2K |

| Intel Corp | INTC | 30.79 | 0.00% | 2.0K |

| Walt Disney Co | DIS | 85.86 | 0.00% | 0.3K |

| The Coca-Cola Co | KO | 41.85 | -0.21% | 1.5K |

Upgrades:

American Express (AXP) upgraded to Buy from Neutral at Guggenheim

Downgrades:

Other:

Alcoa (AA) target raised to $18.50 from $15 at JP Morgan

Apple (AAPL) target raised to $105 from $90 at Mizuho

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia National Australia Bank's Business Confidence June 7 8

05:00 Japan Eco Watchers Survey: Current June 45.1 49.2 47.7

05:00 Japan Eco Watchers Survey: Outlook June 53.8 53.3

06:00 Germany Trade Balance May 17.7 15.7 18.8

06:45 France Trade Balance, bln June -4.1 Revised From -3.9 -4.1 -4.9

07:15 Switzerland Retail Sales Y/Y May +0.4% +1.5% -0.6%

07:15 Switzerland Consumer Price Index (MoM) June +0.3% +0.1% -0.1%

07:15 Switzerland Consumer Price Index (YoY) June +0.2% +0.2% 0.0%

08:30 United Kingdom Industrial Production (MoM) May +0.4% +0.3% -0.7%

08:30 United Kingdom Industrial Production (YoY) May +3.0% +3.1% +2.3%

08:30 United Kingdom Manufacturing Production (MoM) May +0.4% +0.5% -1.3%

08:30 United Kingdom Manufacturing Production (YoY) May +4.4% +5.6% +3.7%

09:00 Eurozone ECOFIN Meetings

09:00 Eurozone ECB's Vitor Constancio Speaks

The U.S. dollar traded higher against the most major currencies ahead Fed's monetary policy meeting. The U.S. currency remained under pressure after yesterday's comments by Minneapolis Fed President Narayana Kocherlakota. He said that inflation in the U.S. was more likely to be under Fed's 2% target until 2018. That may mean that interest rate in the U.S. will remain at the low level for a longer period.

Market participants are awaiting the release of the last Fed's monetary policy meeting today. They will be looking for any signs of the recovery of the world's largest economy. There are speculations that stronger employment data may lead to interest rate hike by the Fed.

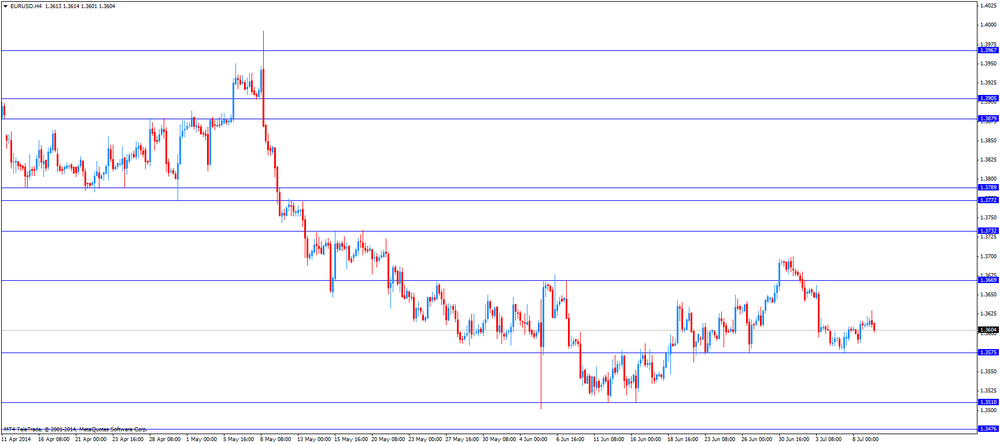

The euro traded lower against the U.S. dollar in the absence of any major economic reports in the Eurozone.

The British pound fell against the U.S. dollar after the Halifax house price index. The Halifax house price index declined 0.6% in June, missing expectations for a 0.3% fall, after a 3.9% rise in May.

On a yearly basis, the Halifax house price index rose 8.8% in June, after a 8.7% gain in May.

The Canadian dollar traded higher against the U.S. dollar ahead of the housing starts in Canada. The number of housing starts in Canada should be 191,000 units in June, after 198,000 units in May.

EUR/USD: the currency pair declined to $1.3601

GBP/USD: the currency pair decreased to $1.7104

USD/JPY: the currency pair climbed to Y101.72

The most important news that are expected (GMT0):

14:00 United Kingdom NIESR GDP Estimate June +0.9%

14:00 U.S. JOLTs Job Openings May 4455 4530

17:45 U.S. FOMC Member Narayana Kocherlakota

19:00 U.S. Consumer Credit May 26.8 21.3

20:30 U.S. API Crude Oil Inventories July -0.9

EUR/USD

Offers $1.3700-20, $1.3680/85, $1.3660

Bids $1.3585, $1.3565, $1.3550/40, $1.3500

GBP/USD

Offers $1.7300, $1.7250, $1.7230, $1.7200

Bids $1.7065, $1.7035/30, $1.7010

AUD/USD

Offers $0.9505, $0.9480, $0.9465/70, $0.9420

Bids $0.9360, $0.9330, $0.9320, $0.9300

EUR/JPY

Offers Y140.00, Y139.50, Y139.30, Y139.00, Y138.65

Bids Y138.00, Y137.90, Y137.70

USD/JPY

Offers Y102.80, Y102.65, Y102.50, Y102.30, Y102.00

Bids Y101.40/30, Y101.20, Y101.10/00, Y100.80

EUR/GBP

Offers stg0.8030, stg0.8000, stg0.7970

Bids stg0.7925, stg0.7905-890, stg0.7800

Stock indices after the weaker-than-expected inflation data from China. The consumer price index in China increased 2.3% in June, missing expectations for a 2.4% rise, after a 2.5% gain in May.

Chinese producer price index fell 1.1% in June, in line with expectations, after a 1.4% drop in May.

These figures show that there is still weakness in the Chinese economy.

Market participants are awaiting the release of the last Fed's monetary policy meeting today. They will be looking for any signs of the recovery of the world's largest economy. There are speculations that stronger employment data may lead to interest rate hike by the Fed.

Current figures:

Name Price Change Change %

FTSE 100 6,703.57 -34.88 -0.52%

DAX 9,770.04 -2.63 -0.03%

CAC 40 4,334.66 -7.87 -0.18%

EUR/USD $1.3600, $1.3615, $1.3650

USD/JPY Y101.75, Y102.00, Y102.25

GBP/USD $1.7125

AUD/USD $0.9350, $0.9400, $0.9450

USD/CAD C$1.0625, C$1.0675, C$1.0700, C$1.0725, C$1.0730

EUR/GBP stg0.7925, stg0.8000, stg0.8050

Asian stock indices traded lower due to the weaker-than-expected inflation data from China. The consumer price index in China increased 2.3% in June, missing expectations for a 2.4% rise, after a 2.5% gain in May.

Chinese producer price index fell 1.1% in June, in line with expectations, after a 1.4% drop in May.

These figures show that there is still weakness in the Chinese economy.

Indexes on the close:

Nikkei 225 15,302.65 -11.76 -0.08%

Hang Seng 23,176.07 -365.31 -1.51%

Shanghai Composite 2,038.61 -25.41 -1.23%

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Westpac Consumer Confidence July +0.2% +1.9%

01:30 China PPI y/y June -1.4% -1.1% -1.1%

01:30 China CPI y/y June +2.5% +2.4% +2.3%

06:00 Japan Prelim Machine Tool Orders, y/y June +24.1% +34.2%

07:00 United Kingdom Halifax house price index June +3.9% -0.3% -0.6%

07:00 United Kingdom Halifax house price index 3m Y/Y June +8.7% +8.8%

The U.S. dollar traded lower against the most major currencies due to yesterday's comments by Minneapolis Fed President Narayana Kocherlakota. He said that inflation in the U.S. was more likely to be under Fed's 2% target until 2018. That may mean that interest rate in the U.S. will remain at the low level for a longer period.

Market participants are awaiting the release of the last Fed's monetary policy meeting today. They will be looking for any signs of the recovery of the world's largest economy. There are speculations that stronger employment data may lead to interest rate hike by the Fed.

The New Zealand dollar climbed toward 3-year highs against the U.S dollar due to decreasing demand for the U.S. currency ahead of Fed's meeting minutes. The kiwi was also supported by Fitch's decision. The ratings agency affirmed the New Zealand's AA rating yesterday and raised New Zealand's outlook to positive from stable.

The Australian dollar traded mixed against the U.S. dollar after the better-than-expected consumer confidence in Australia. The Westpac Banking Corporation released its consumer confidence index for Australia. The index increased 1.9% in July, after a 0.2% gain in June.

The Japanese yen traded lower against the U.S. dollar after the better-than- expected preliminary machine tool orders from Japan. The machine tool orders in Japan climbed 34.2% in June, after a 24.1% gain in May.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair increased to Y101.65

The most important news that are expected (GMT0):

14:15 Canada Housing Starts June 198 191

20:00 U.S. FOMC meeting minutes

EUR / USD

Resistance levels (open interest**, contracts)

$1.3705 (2816)

$1.3680 (2562)

$1.3646 (278)

Price at time of writing this review: $ 1.3617

Support levels (open interest**, contracts):

$1.3592 (151)

$1.3559 (1803)

$1.3534 (2152)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 22315 contracts, with the maximum number of contracts with strike price $1,3800 (3433);

- Overall open interest on the PUT options with the expiration date August, 8 is 29623 contracts, with the maximum number of contracts with strike price $1,3500 (6890);

- The ratio of PUT/CALL was 1.33 versus 1.34 from the previous trading day according to data from July, 8

GBP/USD

Resistance levels (open interest**, contracts)

$1.7402 (1004)

$1.7303 (1483)

$1.7206 (1389)

Price at time of writing this review: $1.7131

Support levels (open interest**, contracts):

$1.7092 (1870)

$1.6996 (1617)

$1.6898 (1823)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 15152 contracts, with the maximum number of contracts with strike price $1,7250 (2035);

- Overall open interest on the PUT options with the expiration date August, 8 is 18938 contracts, with the maximum number of contracts with strike price $1,7100 (1870);

- The ratio of PUT/CALL was 1.25 versus 1.19 from the previous trading day according to data from Jule, 8

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

(index / closing price / change items /% change)

Nikkei 225 15,276.25 -38.16 -0.25%

Hang Seng 23,233.4 -307.98 -1.31%

Shanghai Composite 2,056.39 -7.63 -0.37%

FTSE 100 6,738.45 -85.06 -1.25%

CAC 40 4,342.53 -63.23 -1.44%

DAX 9,772.67 -133.40 -1.35%

S&P 500 1,963.71 -13.94 -0.70%

NASDAQ 4,391.46 -60.07 -1.35%

Dow Jones 16,906.62 -117.59 -0.69%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3611 +0,04%

GBP/USD $1,7130 -0,01%

USD/CHF Chf0,8928 -0,07%

USD/JPY Y101,54 -0,32%

EUR/JPY Y138,21 -0,29%

GBP/JPY Y173,92 -0,33%

AUD/USD $0,9397 +0,31%

NZD/USD $0,8785 +0,41%

USD/CAD C$1,0676 -0,05%

(time / country / index / period / previous value / forecast)

00:30 Australia Westpac Consumer Confidence July +0.2%

01:30 China PPI y/y June -1.4% -1.1%

01:30 China CPI y/y June +2.5% +2.4%

06:00 Japan Prelim Machine Tool Orders, y/y June +24.1%

07:00 United Kingdom Halifax house price index June +3.9% -0.3%

07:00 United Kingdom Halifax house price index 3m Y/Y June +8.7%

12:15 Canada Housing Starts June 198 191

14:30 U.S. Crude Oil Inventories July -3.2

18:00 U.S. FOMC meeting minutes

22:30 New Zealand Business NZ PMI June 52.7

23:01 United Kingdom RICS House Price Balance June 57% 55%

23:50 Japan Core Machinery Orders May -9.1% +0.9%

23:50 Japan Core Machinery Orders, y/y May +17.6% +9.5%

23:50 Japan Tertiary Industry Index May -5.4% +1.9%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.