- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 09-03-2022

- AUD/JPY bulls are looking for an optimal entry point.

- Weekly resistance in the 86.00 area could be calling.

AUD/JPY has been correcting from the daily highs this week and is now basing around a daily 61.8% Fibonacci retracement level near 84 the figure. The price has rallied from there leaving a strong bullish close on the charts from where demand could follow through for the days ahead and ultimately lead to prospects of a fresh high in this daily bullish cycle.

AUD/JPY daily chart

The bigger picture, however, is clouded by weekly highs. There is also a W-formation that is forming with this week's business. While there is scope to the upside, buying so close to resistance is always riskier:

AUD/JPY weekly chart

Meanwhile, for those that have more of an appetite for riskier set-ups, the 4-hour time frame is shaping up:

AUD/JPY H4 chart

The price is correcting from a strong bullish impulse and should the prior highs act as support, then demand could see the price lifted beyond the current resistance and continue towards the weekly resistance area.

- The EUR/JPY jumps 200-pips on an improved market mood spurred by Russia-Ukraine headlines.

- On Wednesday, the single currency led on the FX space, advancing against most G8 peers.

- EUR/JPY Technical Outlook: The pair is downward biased as long as the DMAs reside above the spot price.

On Wednesday, the EUR/JPY rallied around 240-pips and pared its weekly losses amid a risk-on market mood spurred by developments in the Russia-Ukraine conflict. At the time of writing, the EUR/JPY is trading at 128.31, as the Asian Pacific session kicks in.

Geopolitical headlines remain grabbing investors’ attention of late. On Wednesday, a risk-on market mood, originated by two headlines, mentioning that Ukraine would not join NATO, alongside a statement by Ukraine’s Deputy Chief of Staff saying that Ukraine is ready for a diplomatic solution, without trading a “single inch” of their territory.

Following that, the euro rallied vs. most G8 currencies. Why? Market players assess the chance of a cease-fire between Russia-Ukraine; however, the Russian posture remains what initially demanded, so the EUR rally in the last two days seems to be linked to profit-taking ahead of the ECB monetary policy meeting.

That said, market participants expect that the ECB will confirm the end of the PEPP by the end of March and that the APP will continue beyond as needed. Messaging is expected to reinforce flexibility, though the Russia-Ukraine war woes and their direct implications for the Euro area could trigger a dovish message by ECB’s President Christine Lagarde.

EUR/JPY Price Forecast: Technical outlook

The EUR/JPY reclaimed above the bottom-trendline of a descending channel drawn since August 2021, though faces strong resistance at January 25 daily high at 128.25. Worth noting that the 50-day moving average (DMA) is about to roll under the 100-DMA, in which case, the DMAs would be in a perfectly bearish order, further cementing the downward bias.

That said, the EUR/JPY first support would be 127.51, December 20, 2021. Breach of the latter would expose the bottom-trendline of the descending channel around the 126.90-95 area, followed by 125.09, January 18, 2021 low.

- USD/CHF retreated from 0.9300 on a positive undertone in the market amid ceasefire expectations.

- The DXY is settling below 98.00 despite the expectations of an aggressive interest rate hike.

- Investors will focus on stipulations by Russia in a ceasefire scenario during Putin-Zelenskyy peace talks.

The USD/CHF pair attracted significant offers near 0.9300 as investors shifted to risk-perceived assets on easing Russia-Ukraine tensions. Ukraine President Volodymyr Zelenskyy has agreed to a diplomatic situation for a ceasefire and a halt on the ongoing slaughter of Ukraine's economy.

Earlier, investors preferred the greenback against the Swiss franc on the escalation of the Russia-Ukraine war. The situation got worsened when the US prohibited Russian oil imports. The decision was supported by the Western allies as per their current capacity to co-operate. However, the gesture of compromise by Zelenskyy to save its arena has brought a win-win situation for the market. Risk-sensitive assets have found bids and positions in safe-haven assets have been trimmed after a juggernaut rally.

The Ukraine President has agreed to withdraw its membership application to NATO. Now investors will focus on stipulations to be dictated by the Kremlin upon agreement of a truce with Ukraine.

Meanwhile, focus shifts to the US dollar index (DXY), which looks to settle below 98.00 amid the weakening appeal of safe-haven assets. Investors are expecting an interest rate decision of 50 basis points (bps) hike in the March monetary policy meeting. To comply with the soaring inflation, Federal Reserve (Fed) may not take the bullet this time and gung ho on the restriction of liquidity injection in the economy.

The headlines from the Russia-Ukraine war still hold importance for the FX domain despite a highly likely ceasefire between the nations. Adding to that, investors will also focus on US Consumer Price Index (CPI) numbers and Initial Jobless Claims, which are due on Thursday. While the Swiss docket will report Trade Balance later next week.

- Silver bears take a breather following the biggest daily fall in six weeks.

- MACD turns bearish but key SMAs, trend lines defend buyers.

- Tops marked during July 2021 act as short-term key resistance.

Silver (XAG/USD) holds onto the U-turn from a one-week-old ascending support line around $25.80 amid the initial Asian session on Thursday.

The bright metal dropped the most since late January the previous day before taking a U-turn from $25.40, staying comfortably above weekly support.

It should be noted, however, that the rebound needs validation from the $26.00 threshold to reject the bearish signals from MACD.

Following that, July 2021 peak around $26.75-80 will be in focus as a clear break of which will propel XAG/USD prices towards a fresh high of 2022, currently around $27.00.

On the contrary, the nearby support line and the 50-SMA, respectively around $25.60 and $25.35 limit the quote’s immediate downside.

Following that, an upward sloping trend line from February 03, close to $24.85 and January’s peak of $24.70 will be crucial to watch.

In a case where silver bears conquer $24.70 support, a convergence of the 200-SMA and 61.8% Fibonacci retracement of February-March upside, near $23.85-90, could lure them.

Silver: Four-hour chart

Trend: Further upside expected

Russia said on Wednesday the United States must explain what Moscow claims are a military biological programme in Ukraine.

This is an allegation Washington has already dismissed as "absurd" misinformation.

Russian foreign ministry spokeswoman Maria Zakharova said evidence of the alleged programme had been uncovered by Russia during what it calls its military operation in Ukraine, which its forces invaded on Feb. 24. It involved deadly pathogens including plague and anthrax, she said.

In response. the White House has said, ''in light of Russia's misleading allegations, the US should be on the lookout for Russian use of chemical or biological weapons in Ukraine.

- EUR/USD is juggling around 1.1100 as investors await ECB’s monetary policy announcement.

- The risk-on impulse has underpinned the shared currency against the greenback.

- ECB may tap a status-quo on the expectation of higher inflation along with a stagnant growth rate.

The EUR/USD pair has witnessed a juggernaut rally after forming a base in a range of 1.0807-1.0942. The major has observed a bullish reversal after hitting a fresh 23-months low near 1.0810. Euro bulls regained their mojo as the undertone of the market turned positive after Ukrainian President Volodymyr Zelenskyy admitted to agreeing on a diplomatic solution. A situation of ceasefire has been underpinned on the headline of a compromise by Kyiv.

The shared currency found the bids after Zelenskyy agreed to compromise on the stipulations of Russian leader Vladimir Putin. The former will withdraw its membership application from NATO and will recognize the pro-Russian regions as ‘independent’ as said by Moscow before the invasion of Ukraine.

EUR/USD is likely to consolidate after a fancy rally as investors are waiting for the announcement of interest rate policy by the European Central Bank (ECB), which is due on Thursday. It is worth noting that the ECB has yet not followed the footprints of other central banks and has kept the interest rates at floor levels. The decision is likely to remain unchanged today on rising expectations of stagflation in the Eurozone.

Meanwhile, the US dollar index (DXY) has slipped below 98.00 amid fading safe-haven appeal in the market. Furthermore, investors are cautious over the disclosure of US Consumer Price Index (CPI) numbers, which may dictate the likely monetary policy action by the Federal Reserve.

According to a spokesperson of the US Pentagon, the US does not currently support the transfer of additional combat aircraft to Ukraine at this time, reported Reuters. Rather, the US sees the need for other weapons to be sent to help Ukraine, the spokesperson added, noting that Ukraine currently has several squadrons of fully mission-capable aircraft and thus the gain would be low, but could lead to an escalation of tensions with Russia.

The transfer of the MIG-29 aircraft to Ukraine had been assessed to be "high risk", noted the spokesperson adding that the US Defense Secretary would soon travel to Brussels for a meeting of NATO Defense Ministers.

- Spot gold prices reversed sharply lower from above $2050 to under $2000 on Wednesday, dropping nearly 3.0% on the day.

- A historic pullback in energy prices (and other commodities) saw inflation expectations fall, weighing on the demand for gold.

A historic pullback in energy prices from multi-year highs amid a barrage of bearish headlines including the UAE and Iraq talking about pushing OPEC to increase output and further oil reserve releases by the US and its allies has seen market-based measures of inflation expectations fall and thus demand for inflation protection in the form of precious metals ease. US 10-year break-even inflation expectations pulled back to 2.86% from closer to 2.93% on Tuesday, pulling spot gold (XAU/USD) prices back from Asia Pacific session highs above $2050 per troy ounce to back under $2000. At current levels in the mid-$1990s, gold is set for an on-the-day decline of roughly 2.7%, its worst one-day performance since January 2021.

The prospect of higher OPEC output, of more crude oil reserve releases, and of potentially higher exports from Iran and Venezuela if the US can deal make effectively may be enough to take the wind out of the oil rally in the short term. That might help to ease acute stagflation fears which have been so supportive of the precious metals complex recently. But meaningful reprieve from high energy (and other Russia-linked commodities) prices can only come if the Russo-Ukrainian war and Western sanctions come to an end.

Hopes that a ceasefire might be in the offing when the Russian and Ukrainian Foreign Ministers meet in Turkey on Thursday amid more conciliatory rhetoric from both sides regarding a potential agreement in recent days supported risk appetite on Wednesday and was another factor weighing on gold. But geopolitical strategists for the most part do not see the talks yielding a ceasefire. Somewhat cynically, some think Russian President Vladimir Putin might be using the talks as a distraction as Russian troops regroup to up the ferocity of their assault on major Ukrainian cities like Kyiv.

Even if the best-case scenario on Thursday does come into fruition and the two sides reach a ceasefire, the sharp resultant gold downside (XAU/USD could drop all the way back to the low $1900s) likely won’t prove long-lasting. Western sanctions on Russia won’t just magically disappear. The West will continue to view Russia as a pariah state and continue with efforts to isolate and decouple from its economy. That means short-term Russia-related supply concerns likely aren’t going to abate anytime soon, no matter what happens regarding the war in Ukraine.

Another key event for traders to keep an eye on this coming Thursday is US Consumer Price Inflation figures for February. Headline CPI is seen nearing 8.0%. While this will solidify expectations for a 25bps rate hike from the Fed later in the month and for a series of subsequent rate hikes back towards neutral (i.e. about 2.0%), the prospect of near-term real rates (interest rates minus headline YoY CPI) turning positive any time soon remains slim. Indeed, the latest geopolitical events and subsequent commodity price move ensure that MoM inflation rates will only accelerate in the months ahead, keeping the YoY rate elevated at higher levels for longer. Until the Fed gets serious about tackling inflation (i.e. moving short-term rates about the YoY inflation rate), gold remains an attractive asset to hold.

US Energy Secretary Jennifer Granholm, speaking at the CERAWeek energy conference in Houston on Wednesday, said that the Biden administration wants to work with US oil & gas producers to raise supply, reported Reuters. The impacts of higher costs for fuel are "real and severe", Granholm added, saying that "we have a responsibility to increase short-term supply where we can to stabilise the market". She said that included more strategic reserve releases and energy companies producing more "where they can", adding that "in this moment of crisis, we need more supply".

Granholm noted that we "still have to reckon with the impact of climate change", but that the Biden administration needs to be pragmatic about what the energy transition means. "Right now, we need oil and gas production to rise to meet current demand", she continued, saying that the US is looking across the world to see who can increase output. Reserve releases "may have to happen again", she noted, adding that we are focused on "alleviating pain at the pump".

What you need to take care of on Thursday, March 10:

The American Dollar and commodity prices were sharply down on Wednesday amid hopes for a solution to the Ukraine-Russia crisis. Ukrainian President Volodymyr Zelenskyy said that Ukraine is ready for a diplomatic solution and prepared for certain compromises if the other part compromises too.

European Commission President von der Leyen said that they have purchased enough LNG to be independent of Russian gas till the end of the winter.

Crude oil prices crashed amid prevalent risk appetite and news that Iraq is ready to increase output if OPEC+ requires so. Ihsan Abdul Jabbar Ismail, the Oil Minister, added that the country has about 6% of production as spare capacity, and is producing 4.4 million. It is worth mentioning, however, that at the time being, the country is producing below its quote. WTI is currently changing hands at around $108.00 a barrel.

Spot gold shed roughly $90 per troy ounce and trades at $1,981.

The EUR/USD pair flirted with 1.1100, ending the day at around 1.1070. GBP/USD posted a modest advance and settled at 1.3160. The AUD/USD pair recovered the 0.7300 threshold, while USD/CAD pair edged lower and trades around 1.2826. Finally, the USD/JPY pair is back above 115.00.

On Thursday, the European Central Bank will announce its monetary policy decision, and market players are anticipating another round of hawkish words from President Christine Lagarde as inflation in the EU keeps hitting record highs. At the same time, the US will publish February’s inflation figures. The Consumer Price Index is foreseen at 7.8% YoY, which would be a multi-decade high and may end up pushing the US Federal Reserve into hiking rates by more than just 25 bps.

Bitcoin price climbs above $42,000 as $183 trillion in shorts liquidated

Like this article? Help us with some feedback by answering this survey:

Front-month WTI futures saw a sharp, sudden drop in recent trade, falling from the $116/barrel area to print daily lows in the $104/barrel area in a matter of minutes, before recovering to around $110 once more where it now trades down over $14 on the day. Ukrainian President Volodymyr Zelenskyy in an interview with the German press said that Ukraine is prepared to make compromises with Russia if they do as well and that he aims to end the war. Meanwhile, the UAE's ambassador to the US gave a statement saying the country is going to push for a larger OPEC+ oil output hike with prices at multi-year highs. The Iraqi oil minister was also recently on the wires, noting that the country was prepared to up output if OPEC requires it and has spare capacity of about 6%.

- NZD/USD is on course to stage an impressive rebound on Wednesday as it tracks an impressive recovery in risk appetite.

- It has recovered back to 0.6850, boosted as commodity prices ease and stocks rise on more constructive Russia/Ukraine rhetoric.

NZD/USD is on course to stage an impressive rebound on Wednesday as it tracks an aggressive recovery in the global equity space and benefits from a general improvement in risk appetite as energy and other commodity prices pull back. Though it remains far too soon to say that a ceasefire agreement might be reached, the tone of rhetoric from Ukrainian and Russian officials regarding a diplomatic solution has been more constructive on Wednesday. The Russian and Ukrainian Foreign Ministers will be meeting for talks in Turkey on Thursday and markets seem to be hoping for some sort of de-escalation.

NZD/USD has been able to rally over 0.75% to above 0.6850, rebounding confidently from sub-0.6800 levels hit during Asia Pacific trade. The broad rally in global commodity prices since Russia’s invasion of Ukraine has supported the pair to a more than 1.0% rally so far on the month. But concerns that the rally had gone to far and had gotten to the point where it might tip the global economy into recession saw NZD/USD underperform these last two days. That likely explains why weaker commodities has been a positive for the kiwi on Wednesday.

Ahead, NZD/USD bulls face a challenge in the form of US February Consumer Price Inflation data on Thursday, which is expected to show the headline YoY rate nearing 8.0%. That should solidify expectations for a 25bps rate hike from the Fed later this month and a series of further moves of the same magnitude in the coming months. With the markets having built up a great deal of hope for a ceasefire on Wednesday, should talks between Russian/Ukrainian officials on Thursday not go so well, risk assets may once more come under pressure and the US dollar may be the safe haven of choice given the backdrop of rising US interest rates.

- Silver’s appetite decreased as investors sought higher returns on an upbeat market mood.

- US Treasury yields rise, a headwind for the white metal.

- XAG/USD Technical Outlook: Still upward biased, despite the correction to the $25.60 area.

Silver (XAG/USD) retreats from eight-month-old highs near the $27.00 mark due to market players’ increase of risk appetite, spurred in part by Ukraine’s openness to discuss Russia’s demand for neutrality. At the time of writing, XAG/USD is trading at $26.13 during the North American session.

European and US equity markets lick their wounds and rise sharply as dip buyers snap a four-day sell-off, as Russia-Ukraine hostilities appear to diminish some, decreasing appetite for safe-haven assets, a reason why silver is down.

The greenback is trading softer in the US, with the US Dollar Index plummeting 0.90%, sitting near the 98.00 mark, while US Treasury yields rise, with the 10-year T-note up five basis points, at 1.922%, a headwind for the white metal.

Russia – Ukraine update

The Russia-Ukraine conflict appears to be finding a way out. On Tuesday, Ukraine’s President Volodymyr Zelensky said that Ukraine is not pushing for membership with NATO. He is open for talks with Russia as long as it’s given security guarantees. On Wednesday, Ukrainian President Deputy Chief of Staff Zhovkva said that “Ukraine is ready for a diplomatic solution” and added that Ukraine wouldn’t trade a “single inch” of its territory.

Aside from this, an absent US economic docket and the Federal Reserve blackout would keep silver traders adrift on pure market plays. Nevertheless, on Thursday, the US docket would feature the Consumer Price Index (CPI) for February, alongside Core CPI, just five days before Fed’s March meeting.

Money markets futures have priced in a 25 bps rate hike in March, while the chances of a 50 bps hike are less than 2%. For December of 2022, market players expect the Federal Funds Rate (FFR) to sit at 1.50%, meaning that investors expect at least six hikes of a quarter bps for the rest of the year.

XAG/USD Price Forecast: Technical outlook

XAG/USD’s despite falling is upward biased. In fact, Wednesday’s dip near $25.62 February 24 daily high, resistance-now-support, witnessed a quick bounce at it, as XAG’s buyers pushed the price above the $26.00 mark, keeping the rally intact.

If XAG/USD holds above $26.00, the first resistance would be $26.45, July 16, 2021 high. Breach of the latter and $26.77 would be the next price to challenge, followed by the YTD high at $26.94.

Otherwise, XAG/USD might correct towards the 50% Fibonacci level, which also confluences with November 2021 highs around $25.35-40, which could be a better price for dip buyers as they resume the uptrend.

- Mexican peso recovers on risk appetite, DXY extends losses.

- European markets end with strong gains, Dow Jones up by 2%.

- Crude oil falls almost 5%, metals under pressure.

The USD/MXN is giving up recent gains amid an improvement in market sentiment. The pair dropped back under 21.00, moving away from the three-month high it hit on Tuesday near 21.50.

Emerging market currencies rally on renewed risk appetite

As stock rally on Wednesday, emerging market currencies benefit. The Mexican peso is having the best day in months versus the US dollar. The USD/MXN dropped from 21.40 to as low as 20.91, a two-day low. The dollar is still up for the week, but off highs.

The best performer is the Polish zloty, with a decline in USD/PLN of 3.65% ahead of a meeting between Russia/Ukraine foreign ministers. Despite the overall recovery, the Russian ruble is still sharply lower. The USD/RUB trades at 135.20, up 6% for the day.

Mexico: inflation rises more than expected

The Consumer Price Index rose 0.83% in February, above the 0.80% expected. The annual rate increased from 7.07% to 7.28%. Inflation remains well above Banxico’s target, keeping further rate hikes on the table.

On Thursday, US inflation data is due. The next FOMC meeting is next week and a rate hike is already priced in. The signs about the future path of the Fed’s monetary policy will be relevant for financial markets and also for the upcoming March 24 Bank of Mexico meeting.

Technical levels

Gold has now surged higher. Strategists at Credit Suisse look for XAU/USD to move to a new record high, with $2285/2300 now their new core objective.

Uptrend in gold is now gaining momentum

“We continue to look for a move back to the $2,075 record high. Although a fresh pullback from here should be allowed for we look for a sustained break in due course with resistance seen at $2,120 initially ahead of $2,167 and eventually our new core upside objective at $2,285/2,300.”

“Support moves to $1,961 initially, with $1,878 ideally holding further setbacks.”

See – Gold Price Forecast: XAU/USD to perform strongly and surpass the $2,070 high – Standard Chartered

- The AUD/USD bounces off weekly losses though is down 0.65% in the week.

- Russia-Ukraine tussles and strong demands of both sides do not permit an advance in talks.

- AUD/USD Technical Outlook: At press time above the 200-DMA, a close above it would resume the uptrend.

The AUD/USD snaps two days of losses in the week and is surging during the North American session on a sudden improved market move, as portrayed by European equities rising, while US stock futures are in the green. At press time, the AUD/USD is trading at 0.7328.

Geopolitical headlines are still in control of newswires, so AUD/USD traders need to know the market mood. In the last hour, Ukrainian President Deputy Chief of Staff Zhovkva said that “Ukraine is ready for a diplomatic solution,” a headline that caused a slight jump on risk appetite, and Zhovkva also added that Ukraine wouldn’t trade a “single inch” of its territory.

That said, we are back at square one, as Russia demands to recognize Donetsk/Luhansk as sovereign Republics and Crimea as a Russian region. Late in the day, Ukraine and Russia Foreign Minister would meet in Turkey, as reported on Monday.

Apart from this, the Reserve Bank of Australia (RBA) Governor Philip Lowe reiterated that the bank would be “patient” regarding monetary policy. He emphasized that wages growth and underlying inflation in Australia are softer than in other countries, giving the central bank room to assess incoming data and geopolitical developments. When asked about a rate hike this year, he said it is “plausible.”

AUD/USD overnight was subdued near weekly lows within the 0.7264-80 range. However, as the European markets opened and risk-aversion abated, the pair rallied 50-pips towards the 100-hour simple moving average (SMA), sitting at 0.7330.

In the meantime, the Australian economic docket featured the Westpac Consumer Confidence for March, which came worse than expectations, though triggered no movement in the pair. Across the pond, the US JOLTs openings for January rose by 11.263M higher than the 10.925M foreseen.

AUD/USD Price Forecast: Technical outlook

On Tuesday, the AUD/USD closed above the 38.2% Fibonacci. That alongside February 10 daily high previous resistance-now-support around that area, and improved market mood spurred a jump on Today’s price action, also attributed to softer greenback demand.

The AUD/USD on its way north breach the 200-day moving average (DMA) at 0.7315. In the case of a move downwards, it would be first support. Nevertheless, a daily close above it would resume the uptrend. In that event, the AUD/USD first resistance would be 0.7367, followed by the 0.7400 mark and the YTD high at 0.7441, achieved on March 7.

Price action over the past 48 hours or so has looked more constructive for the EUR on hopes for progress in conflict resolution. Although EUR/USD has climbed above 1.10, economists at Scotiabank expect the pair to trade below the 1.12 level over the coming months.

Measures against high energy prices to give a minor boost to the euro

“The EU’s announcement of its plan to reduce its energy dependence on imports from Russia was received with little fanfare in markets yesterday. More details on EU joint issuance and plans for additional defense spending and measures against high energy prices may surface over the coming days and give the EUR a minor lift.”

“Continued steps towards détente should see the EUR climb above 1.10 but we think even a resolution to the immediate conflict will still see high energy prices and a dovish ECB that keep the EUR to below 1.12 over the coming months.”

Ukrainian President's Deputy Chief Of Staff Zhovkva on Wednesday said that Ukraine is a ready for a diplomatic solution, reported Bloomberg. The Russian demand for neutrality can be discussed, Zhovkva said, adding however that there must be security guarantees. Meanwhile, Zhovkva said that Ukraine is not willing to trade a "single inch" of its territory and Ukraine is looking for a clear response from the EU on its membership application.

Market Reaction

The dollar and other safe-haven currencies like the yen have been underperforming in recent trade amid the more positive commentary from Ukraine and, prior to that, Russia on the possibilities for a deal. EUR/USD lept towards 1.1050 from previously closer to 1.10 and is now up more than 1.2% on the day, while GBP/USD jumped back above 1.3150 and is roughly 0.5% up on the day.

The more positive-sounding commentary has seen oil prices come under pressure in recent trade and other commodities also pull back. While Ukraine and Russia have both sounded more amicable towards a deal on Wednesday, Ukraine's statement that it won't give up a "single inch" of its territory is at odds for Russian demands for Crimea and the recognition of L/DPR independence. That suggests it will remain difficult for a compromise to be found.

GBP/CAD is trying to stabilize after nine consecutive days of losses. Economists at Scotiabank expect the pair to inch higher towards 1.6950, then above the 1.70 level.

GBP/CAD is showing some signs of renewed demand

“GBP/CAD is showing some signs of renewed demand near the late 2021 lows which is consistent with the bullish, long-term technical signal that developed around the December rebound in the GBP. The Dec low at 1.6650 must hold for that signal to remain valid.”

“We remain of the view that GBP/CAD looks relatively ‘cheap’ here, near the base of the sideways range that has persisted since 2020, and we look for GBP gains through 1.6950 to trigger additional strength back to the low 1.70s.”

- Easing Ukraine-Russia tensions weighed on the XAUUSD demand.

- Gold Price corrected extreme overbought conditions, but bulls defend the downside.

- European indexes trade in the green, supporting Wall Street's futures.

Gold Price retreated sharply from $2,070.50 a troy ounce, now trading in the $1,990 price zone, as fears about an escalation in the Ukraine-Russia crisis eased. The market sentiment began improving on Tuesday as humanitarian corridors to evacuate civilians were put in place. And while the UK and the US announced bans on crude oil imports from Russia, the mood remained upbeat as Ukraine said it would not insist on NATO membership.

On Wednesday, the Russian Ministry of Foreign Affairs Sergei Lavrov said that, due to sanctions, Moscow is diminishing its usage of the US currency in reserves and international settlements, which somehow undermines demand for the greenback across the FX board, and prevents XAUUSD from falling further. Also, Russia said it's not trying to overthrow the Ukrainian government, adding to the temporarily positive sentiment.

European stocks trade firmly higher, weighing on the bright metal, which trimmed half of its weekly gains. Wall Street futures, in the meantime, are up and poised to advance for a second consecutive day. Gold Price has broken below the $2,000 threshold, as it seems bulls are finally giving up.

Also read: Is it time to top-sell oil and commodities? [Video]

XAUUSD Technical outlook

Gold Price is correcting extreme oversold conditions, and there are technical signs that the bullish potential would recede, as the bright metal stands below the 23.6% retracement of this year's rally at $2,001.00, now providing near-term term resistance. The 38.2% Fibonacci retracement of the same rally is at around $1,975, the ultimate support level, as once below it, the risk will skew to the downside.

A new bout of risk aversion could send XAUSUSD above 2,025, the immediate resistance level, which will open the door for a retest of the 2,070 price zone. The record high stands at 2,075.64, a level that the bright metal achieved in August 2020.

- EUR/USD advances to 3-day highs past 1.1000 on Wednesday.

- The 10-day SMA at 1.1066 emerges as the next minor hurdle.

EUR/USD posts strong gains and retakes the 1.10 mark and above on the back of the firmer sentiment surrounding the risk complex.

While the ongoing rebound is deemed as technical only, it does carry the potential to initially extend to the 10-day SMA at 1.1066, where it should struggle to advance further. Looking at the broader picture, there is the palpable risk for the continuation of the downtrend in the near-term horizon with the next area of contention around the 2022 low in the 1.0800 neighbourhood.

The negative outlook for EUR/USD is expected to remain unchanged while below the key 200-day SMA, today at 1.1571.

EUR/USD daily chart

UK Defense Minister Ben Wallace said on Wednesday that the UK assesses Russia to have only been successful so far in one of its original objectives in its invasion of Ukraine. Russia has failed in its aim of taking out Ukrainian air defenses, he noted, and the UK will be supplying the Ukrainians with more anti-tank missiles. The UK is also exploring the donation of an anti-air missile system to Ukraine, Wallace said, noting also that it's vital that Ukraine maintains its ability to fly. The Russian military campaign will get more brutal, Wallace said.

- Gold witnessed some profit-taking on Wednesday and eroded a major part of the overnight gains.

- Strong recovery in the equity markets turned out to be a key factor that weighed on the commodity.

- Weaker USD, stagflation fears, Ukraine crisis warrant some caution for aggressive bearish traders.

Gold stalled its recent strong bullish momentum to the highest level since August 2020 and witnessed a corrective pullback on Wednesday. The downward trajectory extended through the mid-European session and dragged spot prices back closer to the key $2,000 psychological mark. The global equity markets made a solid comeback in reaction to the news that Russian Foreign Minister Sergey Lavrov and his Ukrainian counterpart Dmytro Kuleba have agreed to meet on Thursday. This would be the first potential talk between the two officials since Russian troops invaded Ukraine on February 24 and revived hopes of a diplomatic solution to end the war in Ukraine. The development triggered a risk-on trade, which, in turn, was seen as a key factor that prompted traders to lighten their bullish bets around the safe-haven precious metal.

This, along with a fresh leg up in the US Treasury bond yields, drove flows away from the non-yielding yellow metal. The recent monster gains in commodity prices have been fueling stagflation fears, which, acted as a tailwind for the US bond yields. Investors remain concerned about the rapidly deteriorating outlook and an inflation shock in the global economy. This might lend some support to gold, which is considered as a hedge against inflation. Apart from this, the ongoing US dollar retracement slide from the highest level since May 2020 could limit losses for the dollar-denominated commodity. Moreover, the risk of a further escalation in tensions between Russian and Western powers should cap the optimistic move in the markets.

In fact, US President Joe Biden on Tuesday imposed an immediate ban on Russian oil and other energy imports. Britain matched the move and announced that it would phase out the import of Russian oil by the end of 2022. the European Union announced new sanctions against Russian individuals and Belarus banks. The Russian foreign ministry reportedly said that the response to the Western sanctions will be sensitive and precise. The fundamental backdrop supports prospects for the emergence of some dip-buying, warranting some caution before confirming that gold prices have topped out and positioning for any meaningful corrective slide.

Technical outlook

From a technical perspective, a subsequent decline below the $2,000 mark could get extended towards the next relevant support near the $1.980 area. Some follow-through selling would negate the near-term positive bias and prompt aggressive long-unwinding trade, paving the way for deeper losses. Gold might then turn vulnerable to accelerate the fall towards the $1,950 support zone.

On the flip side, momentum back above the $2,020-$2,022 area now seems to confront resistance near the $2,050 region. This is followed by the overnight swing high, around the $2,070 zone, and the August 2020 peak near the $2,075 region. Sustained strength beyond would mark an uncharted territory gold and set the stage for a further near-term appreciating move, possibly towards the $2,100 round figure.

Key levels to watch

- EUR/JPY adds to the weekly bounce and retakes 127.00.

- Next on the upside emerges the 128.20 region in the near term.

EUR/JPY rebounds further and reclaims the area above the 127.00 barrier, or 3-day highs, on Wednesday.

In case the recovery picks up extra pace, the next resistance level turns up at the temporary 10-day SMA 127.57 prior to the 20-day SMA. If cleared, then the cross should re-focus on the January low at 128.24 (January 25). The surpass of the latter on a convincing fashion could well see the selling pressure mitigated and attempt a move to the 20-day SMA at 129.16 in the short-term horizon.

While below the 200-day SMA, today at 130.09, the outlook for the cross is expected to remain negative.

EUR/JPY daily chart

UOB Group’s Senior Economist Julia Goh and Economist Loke Siew Ting reviews the latest results from foreign portfolio inflows into the Malaysian economy.

Key Takeaways

“Foreign investors’ interest in Malaysian assets remained strong with non-resident portfolio inflows into the country reaching a six-month high at MYR5.9bn in Feb (Jan: +MYR3.8bn). Both Malaysian debt and equity markets witnessed net foreign purchases of MYR3.1bn and MYR2.8bn respectively last month (Jan: +MYR3.5bn and +MYR0.3bn).”

“Bank Negara Malaysia’s (BNM) foreign reserves fell for the second straight month by USD0.3bn m/m to a five-month low of USD115.8bn as at end-Feb (end-Jan: -USD0.8bn m/m to USD116.1bn). It is sufficient to finance 6.1 months of imports of goods and services, a new reserves adequacy indicator effective from 22 Feb 2022, and is 1.2 times total short-term external debt.”

“At present, risk-off sentiment and sky-rocketing commodity prices sparked by Russia-Ukraine tensions and sanctions are initiating some asset reallocation into commodity producing countries including Malaysia. However, expectations of narrower interest rate differentials, domestic policy uncertainty, constrained fiscal policy space, and increasing downside risks to domestic growth prospects are wildcards for Malaysia’s foreign portfolio flows and currency outlook, should geopolitical risks escalate further.”

Dutch Prime Minister Mark Rutte said, “let's first use existing instruments to the max," when asked about the possibility of joint EU funds to respond to the Ukraine crisis.

PM Rutte said, “I could imagine that Germany could rethink their decision over leaving the nuclear sector.”

Related reads

- EU may consider massive joint bond sales to fund energy, defense

- French EU Presidency: Member states have agreed on new sanctions against Russian leaders, oligarchs

French Presidency of EU said on Wednesday, “member states have agreed on new sanctions against Russian leaders and oligarchs over Ukraine invasion.”

Additional quotes

A meeting approved sanctions to complete and align with existing sanctions.

New sanctions target excluding three Belarus banks from swift.

These new sanctions clarify questions over cryptocurrencies.

Sanctions targeting maritime sector also approved ahead of EU leaders summit.

EU summit will formally adopt these new sanctions.

Market reaction

The shared currency remains unfazed by the above announcement, as EUR/USD keeps its recovery momentum intact towards 1.1000. The pair is testing highs at 1.0980, adding 0.74% on the day.

EUR/SEK has extended its rebound after breaking out from a rectangle in January. Next bullish target is located at the 11.05 mark, economists at Société Générale report.

Next supports aligns at 10.63 and 10.40

“EUR/SEK looks poised to head higher towards 11.05, the 76.4% retracement from 2020.”

“Daily Kijun line at 10.63 and 10.40 are near-term supports.”

EUR/USD has staged an initial bounce after testing 1.0806 earlier this week. Economists at Société Générale expect the world’s most popular currency pair to drift back lower on failure to surpass the 1.1040 mark.

1.1040 could cap bounce

“Short-term hurdle is at daily Tenkan line near 1.1040.”

“Failure to cross 1.1040 can extend the down move towards next potential supports at a multiyear trend line near 1.0700 and 2020 low of 1.0635.”

The Russian Foreign Ministry said on Wednesday, “operation’s aims do not include overthrowing Ukrainian government. “

The Ministry said: “It would be better if our goals in Ukraine are achieved through talks.”

Earlier on, RIA Novosti reported, citing the Russian Foreign Ministry, “The response to Western sanctions will be sensitive and precise.”

This comes a day of the peace talks arranged between the Russian and Ukrainian foreign ministers in Turkey.

Market reaction

Risk-recovery remains the key theme across the market so far this Wednesday, following days of intense risk-off sentiment amid escalating Russia-Ukraine conflict.

S&P 500 futures, the risk barometer, is rallying 1.70% on the day while the US dollar index sheds 0.43%, thus far.

Palladium is already at a new record high. Strategists at Credit Suisse see scope for a move to the next resistance at $3,545.

Above $3,545 next resistances align at $3,650, then $3,825

“The completion of a base above $2,218 has acted as the catalyst for a surge to new highs in palladium.”

“A touch overstretched near-term pullbacks will be seen as temporary ahead of further strength to Fibonacci projection resistance at $3,545. Above here, and we see next resistance at $3,650, then $3,825.”

The high inflation in 2021-2022 in the United States, the eurozone and the United Kingdom has important redistributive effects. Economists at Natixis look at who are the winners and losers from the very high inflation.

Who benefits from inflation?

“The portion of the inflation that results from the rise in the prices of commodities and other imported goods is negative for all economic agents since the country’s income is reduced by the increase in the value of imports.”

“If nominal wages are only partially indexed to prices, inflation benefits companies and is negative for wage earners.”

“The effect on governments’ accounts depends on the price sensitivity of tax revenues on the one hand and public spending on the other. Normally, a portion of public spending is only partially indexed to prices (spending is fixed in nominal terms in advance), in which case inflation then improves public finances. But we find that in reality, inflation has no significant effect on governments’ accounts.”

“The effect on savers depends on the reaction of nominal returns on the various forms of savings to inflation.”

The ongoing geopolitical uncertainties and the downside risks to global growth drive USD higher and the risk of a near-term overshoot is high, in the view of economists at HSBC

Fed’s policy normalisation may not provide further support for the USD

“The tailwinds to the USD are coming from two interconnected features, namely, the ongoing geopolitical uncertainties and the downside risks to global growth. The first is obvious, and the second is quickly gaining traction, given the spike in energy prices.”

“There is little sign that the USD is set to stabilise and, hence, the risk of a near-term overshoot is high.”

“The Fed’s policy normalisation may be less impactful on the USD, as short-term rate hike expectations and the market’s pricing of the Fed’s terminal rate converged.”

GBP/USD has collapsed sharply for a break of the key 1.3173/21 support cluster. A weekly close below the latter would warn of further significant weakness, according to analysts at Credit Suisse.

Resistance at 13272/73 to cap upside

“We look for a weekly close below the key 1.3173/21 support cluster – which includes the 38.2% retracement of the 2020/2021 uptrend, 2021 lows and 200-week average – to confirm the break, clearing the way for further weakness to next support at 1.2855/29.”

“The immediate risk should stay lower whilst below 1.3272/73.”

“The current high level of inflation-linked to soaring energy prices, following Russia's invasion of Ukraine, must not be followed by a period of stagflation,” French Finance Minister Bruno Le Maire said on Wednesday.

“Another whatever it costs type economic plan, similar to what France had for covid, would not be the right response to current energy market tensions,” Le Maire added.

Market reaction

EUR/USD keeps its recovery momentum intact, as it recaptures 1.0950 amid a relief rally seen in the global stocks. Focus shifts to the ECB meeting scheduled on Thursday.

Financial markets seem calmer this Wednesday despite the continuing tragedy in Ukraine. The US Dollar Index closed in negative territory on Tuesday and was last seen posting small daily losses below 99.00. Economists at ING expect DXY to consolidate before making a push to 100.

Consolidation comes through, but dollar to stay bid on dips

“Expectations for the Federal Reserve tightening cycle have remained quite robust and we would continue to back the dollar over coming months, where not only energy independence and liquidity support it – but also widening interest rate differentials.”

“DXY looks to be consolidating before making a push to 100 over the coming days/weeks.”

GBP/USD failed to stage a convincing rebound on Tuesday but trades in positive territory above 1.31 early Wednesday. But if the pair fails to move beyond the 131.50/80 area it would be at risk of suffering substantial losses toward 1.2850, economists at ING report.

Recession risks growing

“High energy prices are increasing the risks that the UK goes into a technical recession in the third and fourth quarters of this year. While these fears may be negative for GBP over the longer-term (and we do favour EUR/GBP higher next year), a hawkish Bank of England and a flatter or even inverted yield curve would probably keep GBP bid.”

“EUR/GBP can probably head back below 0.8300 again near t-term.”

“Cable is clinging onto support above 1.3100, but failure to move through the 1.3150/3180 area leaves it vulnerable to 1.2850 on renewed dollar strength.”

USD/IDR, traditionally a high-beta EM FX pair, has been remarkably stable. Analysts at Credit Suisse expect USD/IDR to remain stable within a 14,200-14,500 range.

Demand for coal, gas and nickel to continue rising amid supply concerns

“Assuming that the prices for coal, LNG and nickel remain elevated amid Russia sanctions uncertainty, Indonesia’s nominal exports stand to gain as long as the country’s overall production throughput and export volumes remain steady.”

“We think the potential gain in export values points to stability for the rupiah, offsetting the effects of geopolitical tensions and Fed tightening on the currency.”

“We expect USD/IDR to remain stable or fall within a 14,200-14,500 range.”

Commodity prices remain supportive for the kiwi, but stagflations risks and the looming FOMC meeting are offsets. Post-FOMC, economists at Westpac see scope for slippage towards 0.67. But multi-month, they are bullish, targeting 0.69+ by year-end.

Scope for slippage towards 0.67 in the near-term

“Since the Ukraine war started, commodities have accelerated higher, boosting commodity currencies such as the NZD. Yield spreads are also supportive, given the hawkish RBNZ.”

“There are near-term risks around the March FOMC which could boost the USD and push NZD/USD down to 0.67. But beyond that, we expect a rebound into year-end, to 0.69+.”

The question now is whether the USD/KRW pair can become entrenched at the 1,200 level, according to economists at Mizuho Bank. There will be two main factors to watch this month. Federal Reserve and Bank of Korea monetary policy and geopolitical risk related to Russia and Ukraine.

South Korean authorities to buy the won when the pair rises above 1,200

“With prices rising, though, the Fed is unlikely to shift its medium-term stance. In South Korea, meanwhile, the current BoK governor’s term ends this month and a presidential election is also looming, so with the BOK examining the timing of the next rate hike, the USD/KRW pair will continue to be supported by dollar buying on expectations for rising US interest rates.”

“The pair will be bought on geopolitical risk related to Russia and Ukraine, so USD/KRW will continue to be supported on the downside by strong concerns about the tense Ukraine situation. However, if excessive risk aversion drags on and stocks markets continue falling, this will impact rate hike policies and US interest rates will face downward pressure, with the pair’s topside capped as a result.”

“USD/KRW is unlikely to rise sharply this month, with the South Korean authorities also likely to buy the won when the pair rises substantially above 1,200. However, the pair will probably move firmly as the trend from the end of February continues into March.”

- Modest recovery in the risk sentiment prompted some profit-taking around gold on Wednesday.

- The worsening situation in Ukraine, stagflation fears should limit any meaningful corrective slide.

- Softer USD/US bond yields should further lend some support to the dollar-denominated metal.

Gold edged lower through the early European session on Wednesday and was last seen hovering near the lower boundary of its intraday trading range, just below the $2,040 level. A recovery in the risk sentiment turned out to be a key factor that prompted some profit-taking around the safe-haven XAU/USD. The risk sentiment stabilized a bit amid hopes for a positive outcome from the meeting between Russian and Ukrainian foreign ministers in Turkey on Thursday. The optimism, however, is likely to remain capped amid the risk of a further escalation in the tensions between Russian and Western powers.

In fact, US President Joe Biden on Tuesday imposed an immediate ban on Russian oil and other energy imports. The move was matched by Britain, announcing that it would phase out the import of Russian oil by the end of 2022. The Russian foreign ministry reportedly said on Wednesday that the response to the Western sanctions will be sensitive and precise. This, along with the recent monster gains in commodity prices that followed Russia's invasion of Ukraine, fueled fears about a major inflationary shock in the global economy. This should further act as a tailwind for gold, has a proven historical ability to act as a hedge against inflation.

Apart from this, modest US dollar weakness and softer US Treasury bond yields could also lend some support to the dollar-denominated gold. Hence, it will be prudent to wait for strong follow-through selling before confirming that the XAU/USD has topped out and positioning for any meaningful corrective pullback. Nevertheless, the metal, for now, seems to have snapped four successive days of the winning streak to the highest level since August 2020 and remains at the mercy of developments surrounding the Russia-Ukraine saga.

Technical outlook

From a technical perspective, RSI (14) on short-term charts pointed to extremely overbought conditions and seemed to be the only factor that prompted some profit-taking. Any subsequent decline, however, is likely to find decent support near the $2,021 region. This is followed by the key $2,000 psychological mark, which should now act as a near-term base for gold. A convincing break below might prompt aggressive long-unwinding trade and drag spot prices towards the next relevant support near the $1.980 area.

On the flip side, the overnight peak, around the $2,070 zone now seems to act as an immediate resistance ahead of the August 2020 swing high, around the $2,075 region. Some follow-through buying would mark an uncharted territory and set the stage for a further near-term appreciating move for gold. Bulls might then aim to conquer the $2,100 round-figure mark.

Gold daily chart

-637824092008913821.png)

Key levels to watch

The shekel is a currency that is subject to mixed, rather than net negative, influences from the crisis in Ukraine. All in all, analysts at Credit Suisse lift their USD/ILS target range to 3.22-3.32.

Wobble in US equity markets makes local investors net USD/ILS buyers

“The shekel is likely to see capital inflows from Russian investors who opt to move their assets-held-abroad away from ‘sanctioning’ countries such as the UK and Germany.”

“The Russia/Ukraine shock is unlikely to derail the central bank’s intention to raise its policy rate in the coming months.”

“USD/ILS is expected to remain highly negatively correlated with the S&P500 due to locals’ hedging activity.”

“We have decided to set a new target range for USD/ILS of 3.22-3.32.”

The fact that USD/TRY has been drifting higher since the middle of last week suggests that the central bank is now likely to cap spikes above 15.00 instead of defending the 14.00 level that it previously seemed to focus on, economists at Credit Suisse report..

Turkey to see its current account deficit widen substantially

“Turkey is likely to see its current account deficit widen substantially not just as a result of sharp increases to their import bills, but also because of having a large tourism industry that is reliant on arrivals either from Russia or Ukraine.

“The pressure on the balance of payments, to the extent that it remains in place, is likely to challenge the Turkish central bank’s ability to maintain stability in USD/TRY exchange rate.”

“The fact that the central bank has allowed USD/TRY to drift higher since the middle of last week suggests to us that the central bank, in the context of its FX market intervention, has shifted its focus to a 15.00 level from 14.00 previously.”

The Swiss franc has appreciated significantly versus the euro in the last couple of weeks and even briefly dipped below parity. Economists at Credit Suisse lower their EUR/CHF target to 0.97 and look to fade moves towards 1.03.

Fading moves towards 1.03

“We believe that the downward pressure on EUR/CHF will likely persist for now and lower our EUR/CHF target to 0.97.”

“We suggest fading moves towards 1.03 potentially triggered by FX intervention and consider ourselves wrong at 1.0525.”

Gold is trading in a narrow channel near $2,050. A retest of the record highs at $2,075 remains well on the cards, as the metal’s technical setup continues to paint a bullish picture in the near term, FXStreet’s Dhwani Mehta reports.

XAU/USD remains on track to retest record highs at $2,075

“The path of least resistance appears to the upside for gold buyers, as they look to retest 19-month highs at $,2,071. If the latter is taken out on a sustained basis, then the August 2020 high of $2,075 will be challenged. That level marks the lifetime highs for XAU/USD. The next bullish target is envisioned at $2,100, as bulls are likely to be unstoppable beyond the record high.”

“If sellers regain control, then initial support is seen around the 21-Hourly Moving Average (HMA) around $2,037. The additional declines will call for a test of the ascending 50-HMA at $2,010.”

- USD/CHF takes a U-turn from five-week high to snap two-day winning streak, near intraday low of late.

- Clear break of short-term support line, bearish MACD signals direct traders towards key HMAs.

- The 0.9300 threshold, January’s peak add to the upside filters.

USD/CHF extends pullback from late January highs, down 0.08% intraday near 0.9280 heading into Wednesday’s European session.

The Swiss currency (CHF) pair’s latest losses could be linked to the downside break of a one-week-old rising trend line, as well as bearish MACD signals.

That said, the USD/CHF bears keep their eyes on the 100-HMA, around 0.9230, as nearby support.

However, the 200-HMA and 61.8% Fibonacci retracement of the pair’s one-week advances, close to 0.9220, appear a tough nut to crack for the pair bears.

On the contrary, a downward sloping trend line from late Tuesday, near the 0.9300 round figure, precedes the latest top surrounding 0.9305 to test the USD/CHF bulls.

Following that, highs marked during January 2022 and November 2021, around 0.9345 and 0.9375 in that order, will challenge the pair’s further upside.

Overall, USD/CHF is likely to witness further downside further bulls aren’t out of the woods.

USD/CHF: Hourly chart

Trend: Further weakness expected

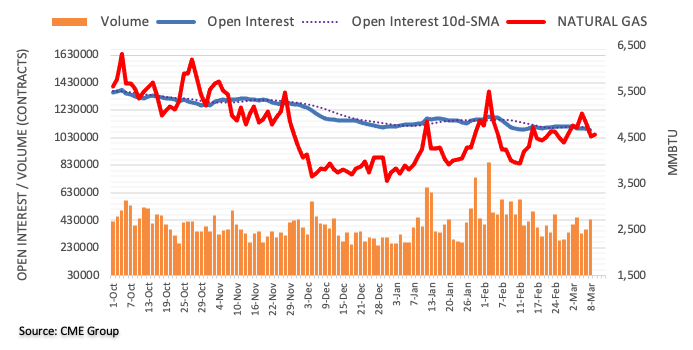

Open interest in natural gas futures markets shrank for the second straight session on Tuesday, this time by nearly 8K contracts in light of flash data from CME Group. On the other hand, volume went up for the second consecutive session, now by more than 72K contracts.

Natural Gas looks supported by the 200-day SMA

Tuesday’s downtick in prices of natural gas was against the backdrop of shrinking open interest, indicative that further weakness appears somewhat unlikely in the very near term. Against that, there is solid contention around the 200-day SMA, today at $4.352 per MMBtu.

- USD/TRY remains firmer around three-month high, pares intraday gains of late.

- Turkey-Israel attempts diplomatic peace for the first time in over a decade.

- World Bank raised concerns over growth of big importers of oil, including Turkey.

- Ukraine-Russia to meet in Ankara on Thursday, markets turn cautious;y optimistic as Kyiv dumps NATO plan.

USD/TRY remains on the front foot for the seventh consecutive day around 14.53 ahead of Wednesday’s European session. In doing so, the pair ignores the USD pullback amid fears of economic growth due to the recent jump in oil prices.

That said, the Turkish lira (TRY) pair rises 0.45% intraday at the latest, around the highest levels last seen on December 20, 2021.

Given Turkey’s status as a major importer of oil, the recently strong energy prices do raise a challenge for the economy that’s already struggling with inflation. Also keeping the USD/TRY hopeful is President Recep Tayyip Erdogan’s dominance over the monetary policy, as well as dislike for higher rates.

In this regard, a World Bank official said on Tuesday that persistent high oil prices prompted by Russia's invasion of Ukraine could cut a full percentage point off the growth off large oil-importing developing economies like China, Indonesia, South Africa and Turkey.

Elsewhere, Turkish and Israeli leaders are up for taming the age-old animosity as both the leaders gather in Ankara on Wednesday for the first time in over 10 years.

On a broader front, Ukraine’s retreat from NATO membership and confirmation of the first humanitarian corridor in Kyiv favor market sentiment. Also positive for the mood is Venezuela’s freeing of the American prisoner and the US hint of easing sanctions afterward. Though, doubts over Kyiv’s plans to join the European Union (EU) and Russian push for nationalizing foreign-owned factories that shut operations challenge market sentiment.

Amid these plays, the US 10-year Treasury yields drop two basis points (bps) to 1.85% whereas the S&P 500 Futures remain firmer on a day at the latest.

Looking forward, USD/TRY traders need to pay attention to the local politics for immediate directions. However, Thursday’s peace talks between Ukraine and Russian Foreign Ministers, as well as the US Consumer Price Index (CPI) for February, will be more important catalysts to watch.

Technical analysis

An upward sloping resistance line from late December, around 14.75 by the press time, could restrict immediate USD/TRY upside. However, the pair buyers remain hopeful until the quote drops below the five-week-old support line near 13.70.

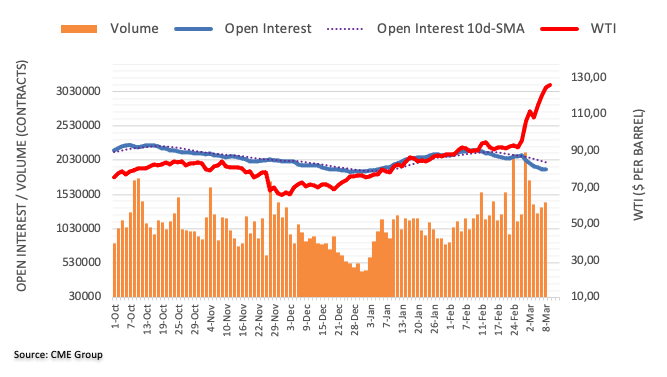

CME Group’s preliminary readings for crude oil futures markets noted traders added around 1.4K contracts to their open interest positions on Tuesday. Volume followed suit and added to the previous build, increasing by around 63.5K contracts.

WTI looks capped by $130.00

Prices of WTI extended the uptrend for yet another session on Tuesday. Extra gains remain well on the cards in the meantime, as noted by the uptick in both open interest and volume. That said, the immediate target emerges at the 2022 high at $129.49 (March 8).

As the global markets take a sigh of relief from the Ukraine-Russia crisis due to Kyiv’s dumping of NATO plans, Reuters quote Russian Defence Ministry to challenge the sentiment.

“Obtained documents that prove Ukraine planned an attack against Donbass in March,” the news said.

However, another piece of Reuters quoting the UK Defence Intelligence keeps the risk-on mood intact as it said, “Russian forces failing to make any significant breakthroughs in fighting north of Kyiv.”

Market implications

The news failed to move the markets as the S&P 500 Futures and Eurostoxx 50 Futures both print mild gains by the press time. The same weigh on the US Dollar Index (DXY) and keep the EUR/USD prices above the 1.0900 threshold.

Read: EUR/USD floats above 1.0900 as bulls and bears jostle over Ukraine crisis, inflation fears

Lee Sue Ann, Economist at UOB Group, believes the ECB could start its hiking cycle in 2023.

Key Quotes

“ECB President Christine Lagarde continues to play down the possibility of rate hikes this year. At this juncture, we still think that the ECB will stick to its road map, and we are still not expecting any rate increases by the ECB until next year.”

“This upcoming monetary policy meeting will be eyed, though, for updated growth and inflation forecasts.”

- USD/CAD extends pullback from 11-week high, dashes four-day winning streak.

- Bullish MACD signals, nearby key resistance lines keep buyers hopeful.

- 200-SMA acts as the key support, bulls eye December 2021 peak.

USD/CAD remains on the back foot around an intraday low of 1.2867, printing the first daily loss in five heading into Wednesday’s European session.

In doing so, the Loonie pair drops towards the previous resistance line from late December as it reversed from the 11-week top.

However, bullish MACD signals and the quote’s sustained trading beyond the resistance-turned-support, around 1.2860 by the press time, favor USD/CAD buyers.

Even if the quote drops below 1.2860, an upward sloping trend line from March and the 200-SMA, respectively around 1.2775 and 1.2715, will challenge the pair bears.

Alternatively, USD/CAD buyers need to conquer the 1.2900 round figure to retake control.

Following that, highs marked during December 2021 and 2020, close to 1.2960-65, will be crucial to watch as it holds doors for the pair’s run-up beyond the 1.3000 psychological magnet.

USD/CAD: Four-hour chart

Trend: Further upside expected

- Asian markets have witnessed a carry-forward buying after a positive Tuesday.

- Poor performance from Japan’s GDP numbers has not impacted local equities.

- The DXY is slipped below 99.00 after failing to tap the round level of 100.00.

Markets in the Asian domain part ways with the Chinese equities as the former are trading higher on subdued DXY while the latter slips more than 1% on China’s galloping inflation print. The monthly Consumer Price Index (CPI) print landed at 0.6%, much higher than the market estimates and prior figure of 0.3% and 0.4% respectively while the yearly CPI printed at 0.9% in line with the previous figure but higher than the street estimate of 0.8%.

At the press time, Japan’s Nikkei 225 surges 0.5%, and Nifty 50 jumps 0.8% while the China A50 tumbles 0.75%.

The underperformance from Japan’s Gross Domestic Product (GDP) has not impacted the rally in Japan’s equities. The Cabinet Office of Japan reported quarterly GDP at 1.1%, lower than the street estimates and previous print of 1.4% and 1.3% respectively.

Asian markets have witnessed a carry-forward buying after a positive Tuesday despite the intensifying fears of stagflation in Europe. A situation of soaring inflation with stagnant growth rate results in setbacks for equities.

However, a rebound in the Asian markets should not be considered a reversal as risk-perceived currencies are still trading vulnerably and are likely to face more heat on rising oil prices amid the prohibition of Russian oil on the US ports.

Meanwhile, the US dollar index (DXY) has slipped below 99.00 after struggling to kiss 100.00. The 10-year US Treasury yields are holding above 1.85% on rising expectation of a 50 basis point (bps) interest rate hike in March’s monetary policy meeting.

- EUR/USD fades the previous day’s rebound from 22-month low, sidelined of late.

- Softer yields, cautious optimism weigh on DXY as markets await Thursday’s Russia-Ukraine peace talks in Turkey.

- Fears of more economic hardships for the bloc, higher inflation keep EUR bears hopeful.

EUR/USD treads water around 1.0900 as traders take a sigh of relief, at least for now, from the Ukraine-Russia tensions during early Wednesday morning in Europe. Even so, anxiety ahead of Thursday’s key meeting in Ankara and fears of stagflation keeps the pair sellers hopeful.

The major currency pair posted the first positive daily closing in six the previous day as market Ukraine’s retreat from NATO membership joined the confirmation of the first humanitarian corridor in Kyiv to challenge the previous risk-off mood.

Following that, Venezuela’s freeing of the American prisoner and the US hint of easing sanctions afterward also favored the market sentiment and helps the EUR/USD buyers.

However, Russia may not cheer Kyiv’s intention to dump NATO membership on fears of joining the European Union (EU). The same demolishes President Vladimir Putin’s unsaid target of putting Kremlin-controlled leader in Ukraine and can keep the fears of further geopolitical tension on the table. Recently, Russia called for nationalizing foreign-owned factories that shut operations, which in turn raised doubt on the market’s optimism.

While portraying the mood, the US 10-year Treasury yields drop two basis points (bps) to 1.85% whereas the S&P 500 Futures remain firmer on a day at the latest.

Also testing the EUR/USD buyers is the fear of stagflation in the bloc. “The eurozone is particularly dependent on Russian energy and is, therefore, the most exposed to stagflation risks, though the United States isn't immune,” said Reuters.

Meanwhile, upbeat prints of German Industrial Production (IP) for January versus softer US economics favor EUR/USD to battle with the bears. German IP marked the strongest monthly growth since 2020 with a 2.7% mark. An increase in Eurozone’s Employment Change YoY for Q4, to 2.2% versus 2.1% expected and prior also favored the EUR/USD bulls. It should be observed that the Eurozone Q4 GDP confirmed 4.6% YoY growth on Tuesday.

On the other hand, the US trade deficit rallied to a record high and the small business confidence, as signaled by IBD/TIPP Economic Optimism gauge for March, dropped to the lowest in 13 months.

Moving on, a light calendar on Wednesday and mixed catalysts may keep troubling the EUR/USD traders ahead of the US Consumer Price Index (CPI) for February and Thursday’s peace talks between Ukraine and Russia in Turkey.

Technical analysis

The resistance-turned-support line of a two-week-old falling wedge and bullish MACD signals keep EUR/USD buyers hopeful.

That said, a clear upside break of the previous support line from mid-February, around 1.0930 by the press time, becomes necessary to convince the pair buyers.

Alternatively, a downside break of 1.0885 defies the latest falling wedge confirmation, which in turn will direct the EUR/USD prices towards the latest bottom surrounding 1.0800.

- USD/INR hits all-time high at 77.17 on rising crude oil prices and consistent withdrawal from FIIs.

- The Indian rupee will continue to depreciate further as a rally in oil prices is far from over.

- The expectation of stagflation in Europe is haunting the developing economies.

The USD/INR has claimed an all-time high of 77.17 on Tuesday as the rising crude oil prices have trimmed the potential of the Indian rupee against the mighty greenback.

India, being a major importer of crude oil has to face significant outflows in addressing higher crude oil prices. West Texas Intermediate (WTI) oil prices near $125.00, indicating a wider fiscal deficit for India going forward. The rally in crude oil is far from over and Indian equities may face some serious plunge in their margins in the upcoming earnings season.

Apart from the surging oil prices, Foreign Institutional Investors (FII) are continuously withdrawing their funds over the geopolitical tensions. Intensifying fears amid the Russia-Ukraine war has advocated a situation of stagflation in Europe. The old continent, being a leading market for India, will affect the latter's fiscal revenue and henceforth hurt the Indian rupee.

Meanwhile, the Ukrainian President has agreed to Russia’s condition in which Kyiv would withdraw its application of membership to NATO. This has brought a follow-up buying in global equities but risk-sensitive currencies need more assurance.

The US dollar index (DXY) is juggling around 99.10 as investors await a fresh trigger that may bring stimulus for further direction.

The headlines from the Ukraine crisis will continue to remain a key driver for the pair. However, investors will also focus on US Consumer Prices Index (CPI) numbers, which are due on Thursday.

- USD/JPY has recaptured 115.90 after Japan’s GDP delivered a poor show.

- The risk-on impulse is favoring equities but volatile currencies are still vulnerable.

- Major events this week: US CPI, US Initial Jobless Claims, Japan Overall Household Spending.

The USD/JPY pair has witnessed a juggernaut rally from March 4 low at 114.65 and has managed to reclaim its three-week-old resistance at 115.90. The pair has extended its rally after Japan’s Gross Domestic Product (GDP) numbers delivered a poor performance.

Japan’s quarterly GDP by the Cabinet Office came in at 1.1%, lower than the street estimates and previous print of 1.4% and 1.3% respectively, while the yearly GDP numbers slipped heavily to 4.6% from the market consensus of 5.6% and prior figure of 5.4%. This has underpinned the greenback against the Japanese yen.

On the geopolitical front, Ukraine President Volodymyr Zelenskyy has indicated some signs of truce after he confirmed a withdrawal of membership application for joining NATO. However, Ukraine’s intention of joining the European Union (EU) is still intact, which may keep Moscow from a ceasefire confirmation. Although the headline has managed to bring back some optimism in the equities, the risk-sensitive currencies are still underperforming against the mighty greenback.

Meanwhile, the US dollar index (DXY) has continued to oscillate in a tight range of 98.99-99.14 in the Asian session. A lackluster performance from the DXY is highly expected as the market participants are uncertain over Thursday’s US Consumer Price Index (CPI) numbers.

As per the market consensus, the US CPI is likely to print at 7.9% against the prior record of 7.8%. In addition to US inflation numbers, investors will also focus on US Initial Jobless Claims and Japan’s Overall Household Spending data, which are due on Thursday.

In yet another effort to lessen the impact of the US ban on Russian oil imports, US State Department Senior Adviser Amos Hochstein said early Wednesday, American and other nations would consider releasing more oil barrels from reserves, if necessary.

Key quotes

“The Biden administration is continuing to try to mitigate the surging cost of fuels following sanctions imposed by the United States and allies following Russia's invasion of Ukraine.”

“It would not be easy to replace Russia's crude exports.”

"If we need to do something again on a global basis with our allies, we will."

“Numerous buyers of Russian energy have self-sanctioned, avoiding purchasing those barrels "because there is such outrage in Europe about what is happening in Ukraine.”

Related content

- Easing of Venezuela sanctions on direct oil supply to US is in focus

- OPEC’s Barkindo: There is no physical shortage of oil

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 128.93 | 4.38 |

| Silver | 26.391 | 2.72 |

| Gold | 2050.16 | 2.64 |

| Palladium | 3154.5 | 5.74 |

- Gold prints the first intraday losses in five, steps back from 18-month high.

- Ukraine, Venezuela attempt de-escalation of market tensions but fears from Russia stay on the table.

- China CPI/PPI came in firmer for February but fears of stagflation could support gold buyers.

- Gold tries to hold above $2000 – Hard landing ahead?

Gold buyers take a breather around $2,042, down 0.40% intraday during Wednesday’s Asian session. In doing so, the yellow metal struggles to extend the previous four-day uptrend while staying around the highest levels last seen during August 2020.

Ukraine and Venezuela’s efforts to tame the respective geopolitical tensions with Russia and the US have recently improved market sentiment. As a result, the metal’s safe-haven demand gets a dent, which in turn triggered the latest pullback in XAU/USD prices.

Headlines from AFP, “In a nod to Russia, Ukraine is reportedly no longer insisting on NATO membership,” became the major risk-on catalyst the previous day. The news also joins the confirmation of the first humanitarian corridor in Ukraine to tame the market’s pessimism. Additionally favoring the risk appetite, as well as negatively affecting silver’s safe-haven appeal is Venezuela’s freeing of the American prisoner and the US hint of easing sanctions afterward.

On the contrary, Russia may not cheer Kyiv’s intention to dump NATO membership goal as Moscow may fear the enemy to join the European Union (EU), which in turn demolishes President Vladimir Putin’s unsaid target of putting Kremlin-controlled leader in Ukraine. Recently, Russia called for nationalizing foreign-owned factories that shut operations, which in turn raised doubt on the market’s optimism.

Talking about data, the US trade deficit rallied to a record high and the small business confidence, as signaled by IBD/TIPP Economic Optimism gauge for March, dropped to the lowest in 13 months. Further, China’s Consumer Price Index (CPI) rose past 0.8% forecast to reprint 0.9% prior figures while the Producer Price Index (PPI) crossed 8.7% market consensus with 8.8% YoY figures, versus 9.1% previous readouts.

While portraying the mood, the US 10-year Treasury yields drop two basis points (bps) to 1.85% whereas the S&P 500 Futures rise 0.40% on a day at the latest.

To sum up, the recently mixed geopolitical concerns may challenge gold buyers but concerning over stagflation, due to the latest rally in commodity prices and economic fears because of that, could keep XAU/USD buyers hopeful.

Technical analysis

Gold prices crossed the upper line of a six-week-old rising channel and multiple resistances marked during late 2020 the previous day. However, overbought RSI seems to have triggered the quote’s pullback from its record high of $2,075, printed during August 2020.

Given the latest challenges to the metal’s safe-haven demand, as well as the MACD line’s anticipated pullback from higher levels, gold sellers may attack the previous key resistance area around $2,020.

However, the quote’s weakness past $2,020 will make it vulnerable to breaking the $2,000 threshold while aiming for fortnight-long horizontal support near $1,975.

Meanwhile, buyers will keep their eyes on the $2,075 for fresh entry while targeting the $2,100.

It should be noted that an ascending trend line connecting highs marked in 2011 and 2020, surrounding $2,110 by the press time, will challenge gold buyers above $2,100.

Gold: Four-hour chart

Trend: Pullback expected

- AUD/USD picks up bids to refresh intraday high on upbeat China CPI, PPI for February.

- RBA’s Lowe hints at a rate-hike during late 2022 but refrains from entertaining hawks.

- Risk appetite improves as Ukraine dumps NATO membership goal, US-Venezuela also favored sentiment of late.

- Qualitative catalysts will be crucial, RBA’s Debelle will be important as well.

AUD/USD justifies firmer prints of China’s headlines inflation data during Wednesday’s Asian session. Also favoring the risk barometer is the recently improving market sentiment.

That said, China’s Consumer Price Index (CPI) rose past 0.8% forecast to reprint 0.9% prior figures while the Producer Price Index (PPI) crossed 8.7% market consensus with 8.8% YoY figures, versus 9.1% previous readouts.

Earlier in the day, March month’s Westpac Consumer Confidence for Australia, -4.2% versus -1.1% expected and -1.3% prior, also challenged the AUD/USD buyers.

Before that, Reserve Bank of Australia (RBA) Governor Philip Lowe spoke at the Australian Financial Review Business Summit. The policymaker initially said, “Plausible the cash rate will be increased later this year,” before stating, “Closer to point where inflation sustainably in the target range, but not there yet.”

It’s worth noting, however, that a pullback in commodity prices, mainly due to receding risks emanating from Ukraine, seems to offer a major challenge to the AUD/USD pair buyers.

That said, “In a nod to Russia, Ukraine is reportedly no longer insisting on NATO membership,” reported AFP on Tuesday, which in turn became the major risk-on catalyst. The news also joins the confirmation of the first humanitarian corridor in Ukraine to tame the market’s pessimism. Additionally favoring the risk appetite, as well as negatively affecting silver’s safe-haven appeal is Venezuela’s freeing of the American prisoner and the US hint of easing sanctions afterward.

On the contrary, Russia may not cheer Kyiv’s intention to dump NATO membership goal as Moscow may fear the enemy to join the European Union (EU), which in turn demolishes President Vladimir Putin’s unsaid target of putting Kremlin-controlled leader in Ukraine.