- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 09-02-2022

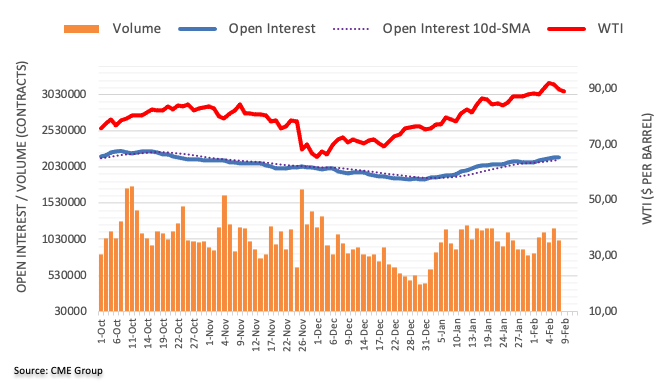

- WTI holds on to the bounce off weekly low, grinds higher of late.

- MACD teases bears but multiple supports to the south keep buyers hopeful.

- One-week-old resistance guards immediate upside ahead of recently flashed eight-year high.

WTI keeps the previous day’s bounce from short-term key supports around $89.00 during Thursday’s Asian session.

In doing so, the black gold grinds higher towards the weekly resistance line, near $89.65 at the latest.

Although a clear rebound from the 10-DMA and an upward sloping trend line from January 03, 2022, keeps buyers hopeful to overcome the immediate resistance surrounding $89.65, MACD teases bears and hints at a bumpy road ahead.

As a result, the $90.00 threshold will act as an extra filter to the north before directing the WTI crude oil prices towards the latest multi-month high of $91.77.

Should the black gold remains firmer past $91.77, the September 2014 peak of $95.90 will be in focus.

Alternatively, pullback moves may initially target the 10-DMA and the stated support line, respectively near $88.60 and $88.25, before directing sellers towards the 21-DMA level of $86.45.

In a case where the quote drops below $86.45, an extended pullback towards the late January swing lows near $81.70 can’t be ruled out.

WTI: Daily chart

Trend: Pullback expected

US inflation expectations, as measured by the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, add to the market’s anxiety over the US inflation data ahead of key Consumer Price Index (CPI) figures for January.

Read: US Inflation Preview: Core CPI above 6% could spark next dollar rally

The inflation precursor grind higher past the three-month low marked in late January, with the latest moves mostly steady around 2.42%.

It should be noted, however, that the White House (WH) earlier signaled an increase in the YoY figures before WH Adviser Brian Deese said that he sees reason to think that factors boosting inflation will moderate over time.

Amid these plays, US Treasury yields ease from the highest in 2.5 years while Wall Street remains firmer amid the upbeat performance of technology shares and earnings.

That said, the market’s reflation fear is the main driver of late and any surprise reduction in the headlines US CPI for January, expected 7.3% YoY versus 7.0% prior, may add to the latest risk-on mood.

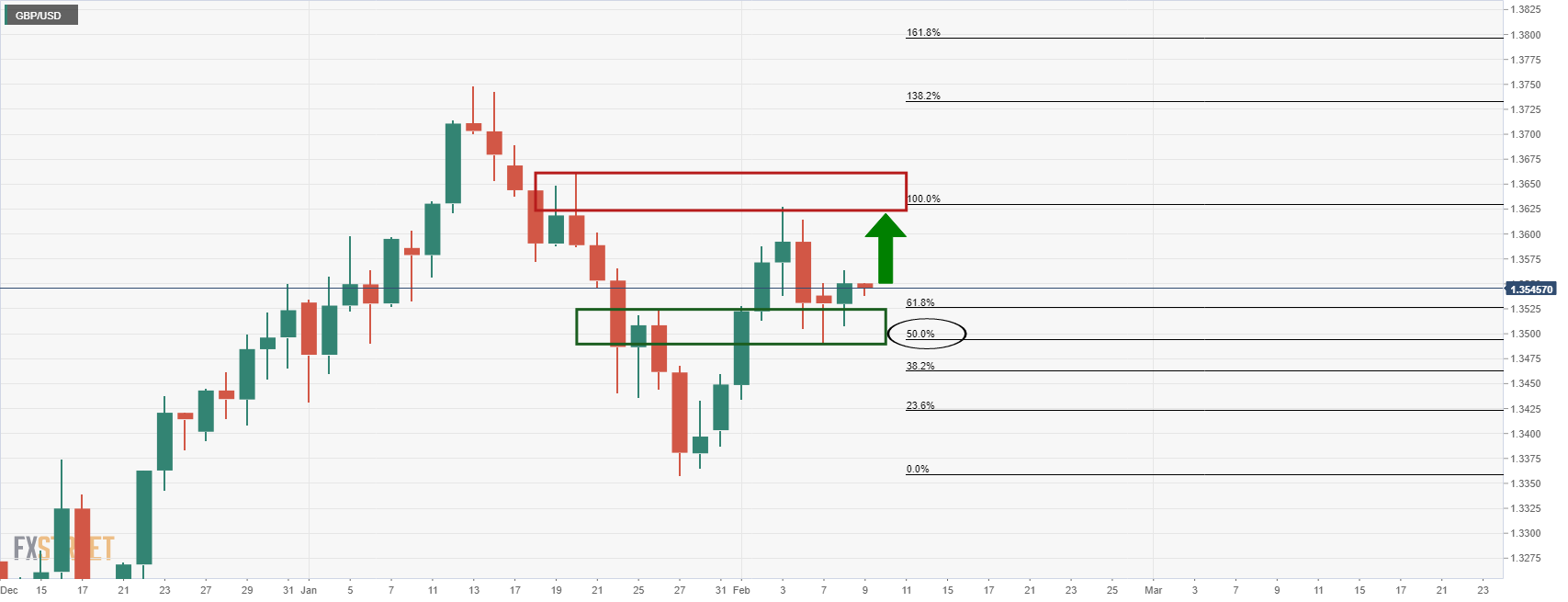

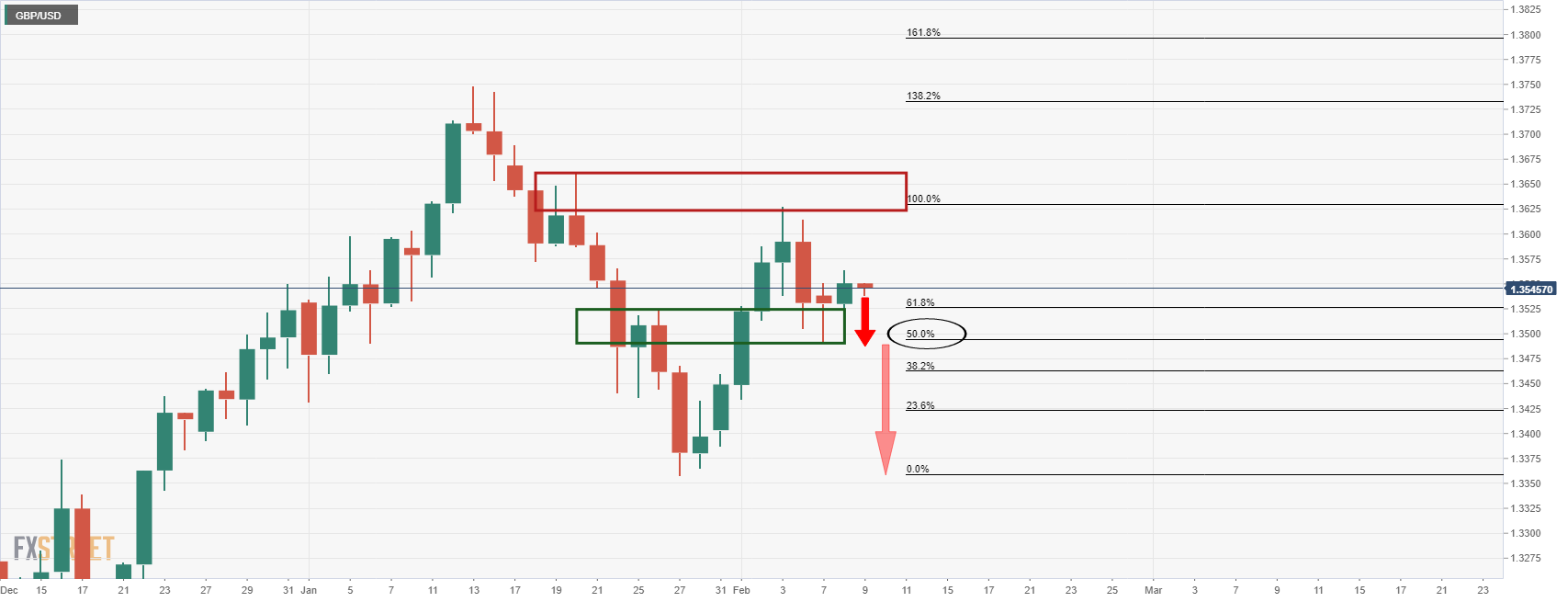

- GBP/USD struggles between 21-DMA and 100-DMA after easing from monthly resistance line.

- Downbeat Momentum line keeps sellers hopeful to test the key Fibonacci retracement levels.

- Buyers remain cautious til prices stay below 200-DMA.

GBP/USD seesaws around 1.3535-40 during Thursday’s Asian session, following a pullback from a one-month-old descending resistance line the previous day.

In doing so, the cable pair stays within the weekly range between the 21-DMA and 100-DMA. However, the recently downbeat Momentum line favors sellers.

That said, a clear downside break of the 100-DMA level near 1.3500 becomes necessary for the GBP/USD sellers to take entries.

Following that, the 50% and 61.8% Fibonacci retracement of December-January run-up, respectively around 1.3450 and 1.3385, will be in focus.

Also acting as a downside filter is the previous monthly low around 1.3355.

On the contrary, the 21-DMA and aforementioned resistance line, close to 1.3545 and 1.3585 in that order, guard the GBP/USD pair’s short-term upside.

Following that, the recent swing high near 1.3630 may offer an intermediate halt before fueling prices towards the 200-DMA level surrounding 1.3705.

GBP/USD: Daily chart

Trend: Further weakness expected

- The GBP/JPY bulls failure at 156.60 will keep the cross-currency pair within the 154.30-156.50 range.

- GBP/JPY Technical Outlook: Neutral biased as depicted by trendless daily moving averages (DMAs) despite being located below the spot price.

The GBP/JPY is subdued amid a positive market mood on the Wednesday trading session, weighed by the GBP/USD, which is also confined to familiar ranges ahead of the critical January US inflation report unveiled on Thursday. At the time of writing, the GBP/JPY is trading at 156.39.

Financial markets mood is upbeat, portrayed by US equities finishing in the green. Meanwhile, Asian stock futures point to a higher open, carrying on the North American session mood.

In the FX complex, risk-sensitive currencies posted gains led by antipodeans, the CAD, and the EUR, while the British pound was the weakest in the day, down 0.02%.

GBP/JPY Price Forecast: Technical outlook

The GBP/JPY is subdued in a narrow trading range. In the middle of the European session, threatened of breaking the top of the 154.30-156.50 range, but failure to print a daily close above the aforementioned exposed the GBP/JPY to selling pressure.

Upward, the GBP/JPY first resistance would be the January 18 daily high at 156.90. If the GBP bulls crack that level, the next resistance would be the January 12 daily high at 157.70, followed by the November 2021 swing highs at 158.22.

Contrarily, the GBP/JPY first buying zone would be 156.00. Breach of the latter would expose the February 7 daily low at 155.13, followed by February 3 155.04.

- NZD/USD grinds higher around fortnight top, pauses three-day uptrend.

- Upbeat market sentiment, softer USD helped buyers of late.

- White House triggered fears of higher US inflation, NZ PM Ardern tried to ignore protesters at Parliament.

- US CPI for January becomes the key data to watch for clear market direction.

NZD/USD struggles to extend the previous three-day uptrend, easing to 0.6680 during the early Thursday morning in Asia.

The market’s cautious sentiment ahead of the US Consumer Price Index (CPI) joins the mixed statements from the White House (WH) and New Zealand politics to test the bulls of late. Before that, the broad weakness of the US dollar and risk-on mood helped the Kiwi pair to remain firmer, by tracking the gains of the AUD/USD and equities.

WH conveyed expectations of a higher YoY inflation figure while also saying, “Its irrelevant month on month number will continue trending lower the rest of the year.” Following that, WH Economic Adviser Brian Deese said that he sees reason to think that factors boosting inflation will moderate over time.

The mixed comments on inflation add to the market’s anxiety ahead of crucial US inflation data and challenge the buyers of riskier assets like commodities and Antipodeans.

At home, New Zealand (NZ) Prime Minister Jacinda Ardern tried to tame the doubts over the government’s popularity as many protesters staged dislike for a push towards masks and vaccines at the Parliament. “Protesters at Parliament do not represent most of the country's views and evicting them from Parliament is a decision for police,” said NZ PM Ardern per NZ Herald.

It’s worth noting that the doubts over the US-China trade ties, as signaled by Washington’s communication of Beijing’s inability to match the Phase 1 trade deal target, joined the Russia-Ukraine tussles to test the NZD/USD bulls as well.

Previously, markets cheered upbeat performance of equities and commodities, as well as the US dollar weakness, to print gains amid mixed signals and a light calendar. It should be observed that Cleveland Fed President Loretta Mester supported the March rate hike while Atlanta Federal Reserve President Raphael Bostic told CNBC on Wednesday he is hopeful that they will start to see a decline in inflation. Fed’s Bostic also said, "Leaning toward the need for a fourth interest rate increase in 2022."

Looking forward, NZD/USD may consolidate recent gains during the pre-CPI caution. However, the bear’s performance will depend upon the US inflation data.

Read: US Consumer Price Index January Preview: Is this inflation different?

Technical analysis

Although a two-week-old ascending trend line joins firmer MACD to keep NZD/USD buyers hopeful, 21-DMA and December 2021 low, respectively around 0.6690 and 0.6700, challenge the quote’s immediate upside. Alternatively, sellers may take entries on witnessing a clear downside break of the stated support line, near 0.6640 at the latest.

- The Australian dollar continues its weekly rally vs. the Japanese yen, up 1.79% in the week.

- US equity indices finished Wednesday’s trading session with gains between 0.86% and 2.10%.

- AUD/JPY Technical Outlook: An upside break above 83.00 could pave the way towards 85.00.

The AUD/JPY extends its gains during the week rallies for the third straight day, taking advantage of an upbeat market mood. At the time of writing, the AUD/JPY is trading at 82.97.

Wall Street finished Wednesday’s trading session with gains, portraying the market player’s sentiment. The Nasdaq Composite rose 2.10%, up to 15.056.96, followed by the S&P 500, which jumped 1.45% towards 4,587.18, and the Dow Jones Industrial advanced 0.86%, closed at 35,768.06.

In the FX complex, risk-sensitive currencies posted gains led by antipodeans (NZD and AUD), the CAD, and the EUR, while safe-haven peers slid.

AUD/JPY Price Forecast: Technical outlook

On Tuesday’s article mentioned that “the AUD/JPY broke a bullish flag to the upside, though the 100-DMA capped the move.” Nevertheless, on Wednesday, AUD bulls reclaimed the 100-day moving average (DMA) at 82.56, sending the AUD/JPY near the 83.00 figure. Furthermore, a daily close above the aforementioned has been confirmed, confirming the shift to a neutral-bullish bias.

The AUD/JPY first resistance will be the 83.00 figure. An upside break would expose the four-month-old downslope trendline around the 83.25-40 range, followed by the January 5 daily high at 84.30 and then the 85.00 psychological figure.

On the flip side, failure at 83.00 could pave the way for further downward pressure in the cross-currency pair. The first support would be 82.00, extending the drop top-trendline of the bullish flag, viewed as a false breakout. A crackdown of the 82.00 mark would expose January 24 daily low at 80.69, followed by January 28 at 80.36.

Following the White House (WH) expectations of an upbeat inflation figure on YoY, Reuters conveyed comments from WH Economic Adviser Brian Deese from an online event hosted by the Council on Foreign Relations.

The diplomat’s initial statement was, “Reaching agreement with the U.S. Congress on a package of climate and social spending will be a challenge, but the Biden administration remains upbeat it can be done.”

Additional comments

US seeing strong labor market recovery, about 60% of decline due to pandemic has been recovered.

Sees opportunity to make 'lot of progress' on returning those not in labor force due to family care obligations.

Biden administration remains optimistic about getting 'something meaningful done' with congress on climate, social spending package.

If the proposals were fully paid for, as intended by the Biden administration, the spending package would not have a net impact on aggregate demand or inflation.

FX implications

The news tried to placate inflation fears but the pre-CPI mood in the market weighed on risk barometers like AUD/USD during the early hours of Thursday’s Asian session.

That said, the Aussie pair pauses three-day uptrend around 0.7180 by the press time.

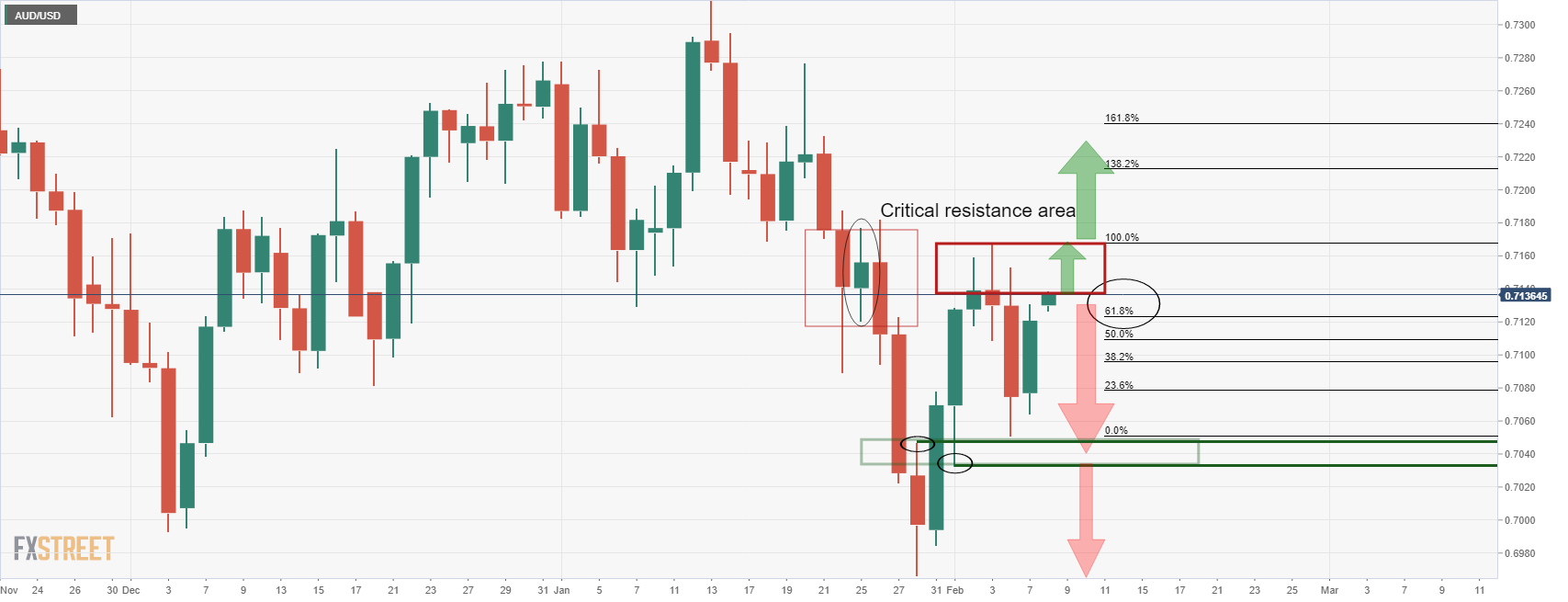

- AUR/USD bears eye a trip to the 38.2% ratio for the coming sessions

- Bulls need to hold the fort on the hourly time frame.

EUR/USD bulls have been trying to hold the fort but the downside is opening up, slowly. The US key event in the Consumer Price Index will be critical in this regard and it could be a slow grind into the event at this point. Nevertheless, there are bearish short-term structures that are noted on the hourly chart that guards the bigger picture's downside prospects as follows:

EUR/USD daily chart

The bears look for a move to the old resistance looking left which has a confluence with the 38.2% ratio near to the 1.1350 level. From a lower time frame perspective, the bears can look for bearish structure as follows:

EUR/USD H1 chart

A break of the trendline support and should te horizontal support around 1.14 the figure proves robust on a retest, 1.1330 is a compelling hourly old swing high that could be targeted.

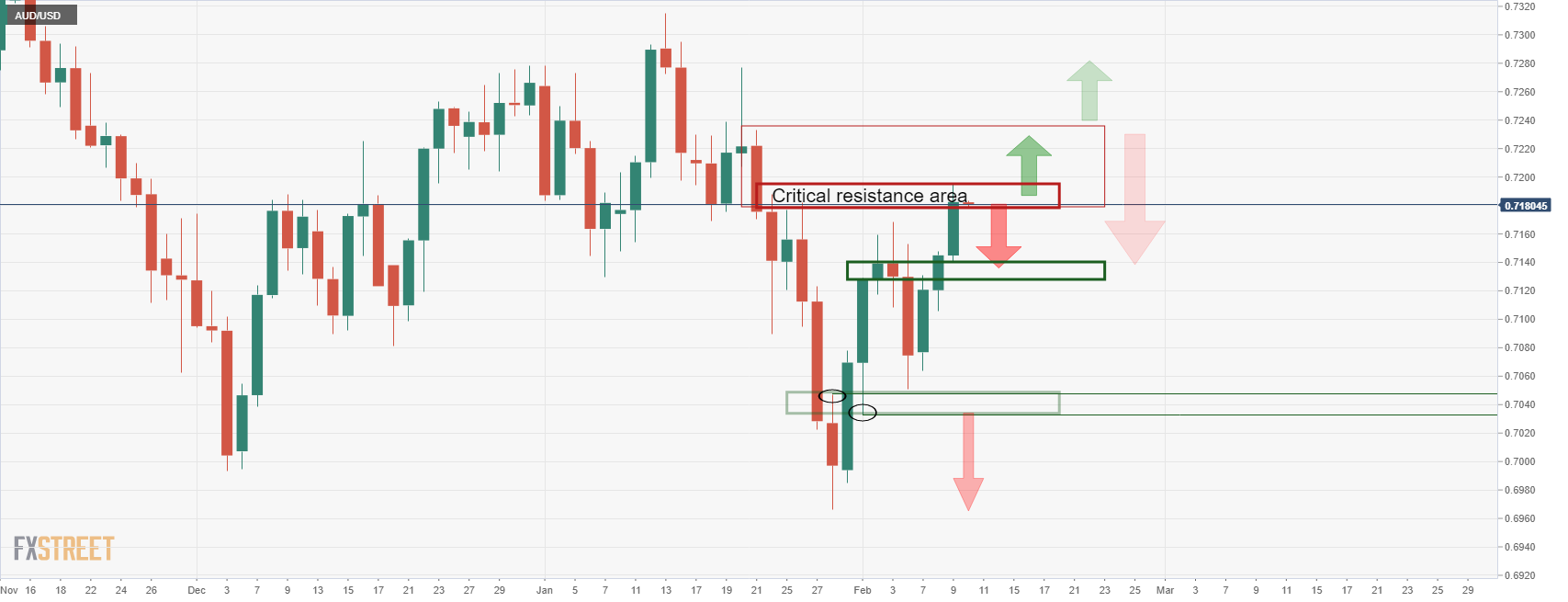

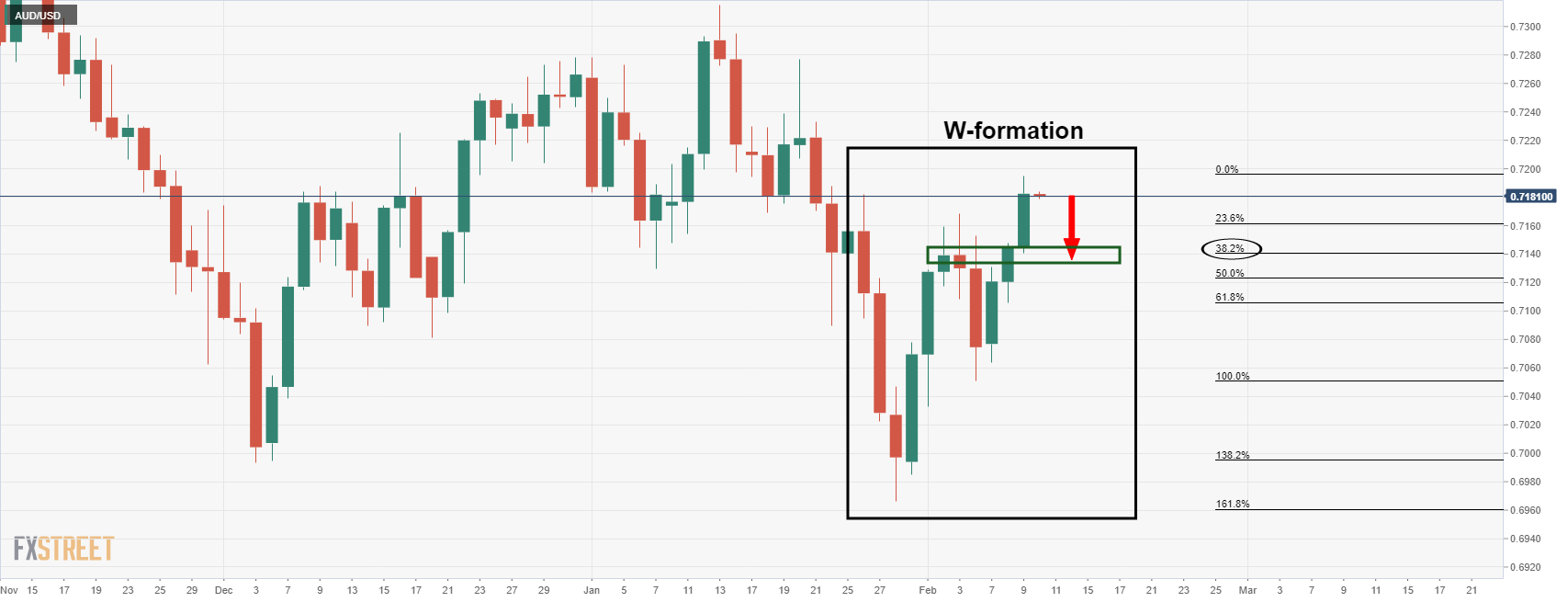

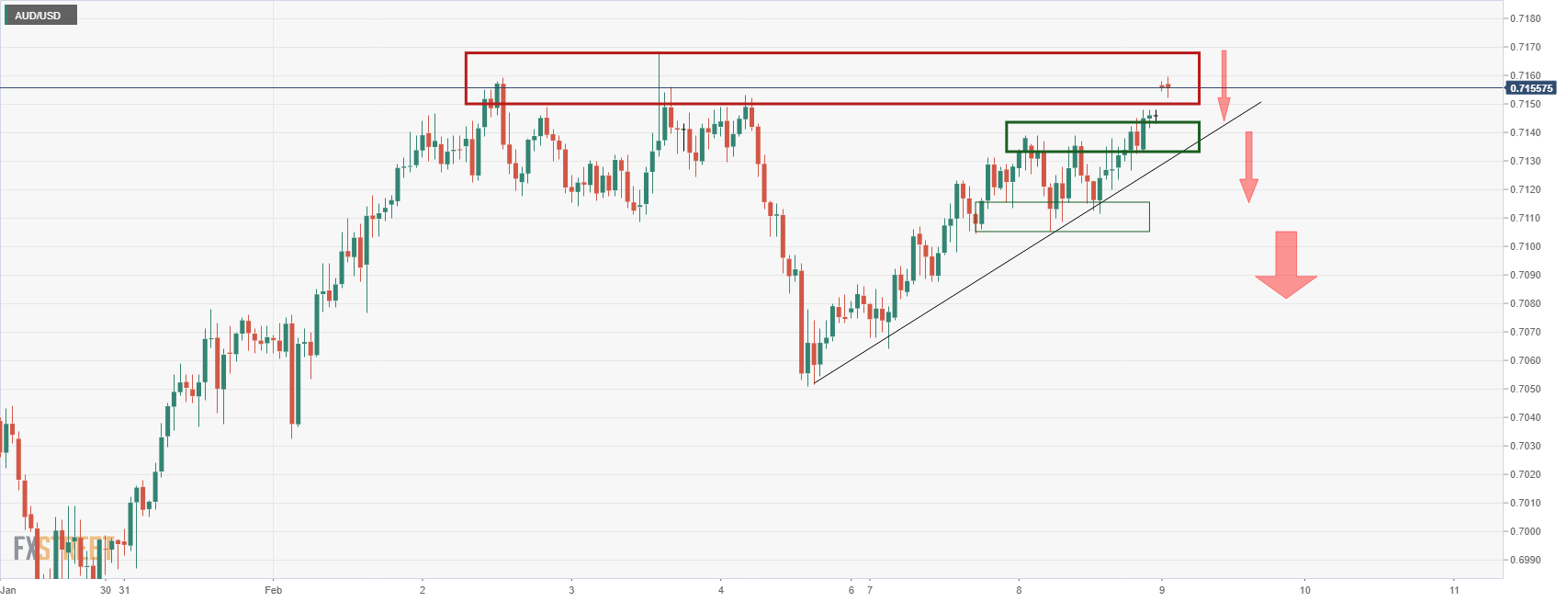

- AUD/USD bulls are in control as pull away into critical resistance.

- A break of 0.7200 will be a significant technical development.

The bulls have started to crack a significant amount of the critical supply area on the daily chart, ploughing through heavy volumes between 0.7180/90 area with eyes on 0.72 the figure:

AUD/USD daily chart

The bulls are firmly rooted in the critical resistance area following Wednesday's strong advance. A push beyond 0.72 the figure with a daily close could spell disaster for trapped bears.

However, the W-formation could hamstring the bulls and the 38.2% ratio is compelling as it currently meets with the neckline of the formation.

- EUR/GBP bulls take control as markets get set for the US CPI key event.

- ECB and BoE sentiment continues to drive the cross.

EUR/GBP is heading into the last hour of Wall Street on a strong footing ahead of the countdown into US Consumer Price Index which could be a trigger for the US dollar with implications for the euro and the EUR/GBP cross.

Meanwhile, at 0.8442, EUR/GBP is higher by some 0.23% having climbed from a low of 0.8413 and reaching a high of 0.8450 on the day. The euro managed to save face on the back of semi-conflicting central bank chatter. The European Central Bank board member Isabel Schnabel said on Wednesday that the ECB may need to raise interest rates on the back of higher energy prices.

This followed attempts to downplay the hawkishness of the ECB meeting by governor Christine Lagarde at the start of the week. Lagarde argued that any adjustment to monetary policy will be "gradual" and the ECB would remain "data-dependent" while assessing the implications for the medium-term inflation outlook.

Meanwhile deep uncertainty about the future path of the Bank of England’s monetary policy. The Bank of England Chief Economist Huw Pill spoke on Wednesday and said that it was reasonable for central banks to withdraw from providing detailed guidance on the policy outlook as prospects for the economy were not clear cut.

This rhymes with the message from last week's meeting where although the BoE hiked by 0.25bps, the Governor of The Old Lady, Andrew Bailey, warned markets not to take for granted the BoE was embarking on a long series of rate hikes. nevertheless, money markets are still pricing in a 25 bps rate increase in March and 125 bps by December 2022.

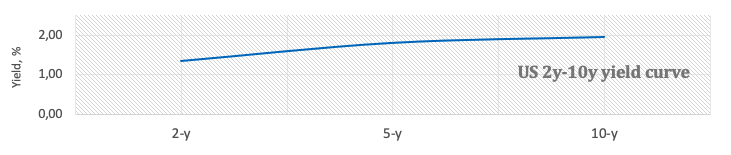

Meanwhile, the US CPI data on Thursday has the potential to move the needle in the forex market. ''If those readings come in hot, it could be the trigger for the next leg higher in U.S. yields and likely push the 10-year above 2% for the first time since August 2019,'' analysts at Brown Brothers Harriman warned. ''Fed tightening expectations would also pick up and likely push the short end of the US curve higher, which would support the dollar.''

On Friday, UK Gross Domestic Product data will be eyed. ''We look for UK GDP to contract 0.8% m/m in December, thus bringing GDP below its pre-COVID level once again,'' analysts at TD Securities explained.

''Manufacturing likely declined 0.3% MoM, while we expect the services sector to contract 0.9% MoM, in part driven by voluntary COVID measures and a substantial amount of people isolating due to the Omicron surge, but also due to a fade in consumer demand.''

- In the last week, the EUR gained 400-pips after ECB’s Lagarde failed to push back a rate hike in 2022.

- Central bank monetary policy divergence favors the NZD vs. the EUR.

- EUR/NZD Technical Outlook: Neutral, but a daily close below 1.7094, might send the pair tumbling towards 1.6940.

The EUR/NZD extends its losses to three consecutive days, following some ECB speaking that calmed the markets, as STIR futures have priced in 50 basis points of rate hikes of the ECB by the end of 2022. At the time of writing, the EUR/NZD cross-currency is trading at 1.7088.

Last Thursday, the European Central Bank (ECB) decided to keep its monetary policy unchanged. However, during the press conference, ECB’s President Christine Lagarde did not push back against hiking interest rates in 2022, as she did in previous monetary policy meetings.

The divergence between the RBNZ and the ECB bolstered the NZD

Market players perceived that as a hawkish pivot by the ECB, sending the EUR/USD rallying, breaking 1.1300 and 1.1400 on its way towards 1.1480s. Concerning the EUR/NZD, the pair rallied from 1.6960s towards 1.7357 regardless of the Reserve Bank of New Zealand (RBNZ), which already began tightening conditions with 50 bps of rate hikes in 2021.

Therefore, due to the RBNZ tightening monetary policy conditions with its Overnight Cash Rate (OCR) at 0.75% as of today, while the ECB’s deposit rate at 0% favors the prospects of a lower EUR/NZD pair.

EUR/NZD Price Forecast: Technical outlook

In the overnight session for North American traders, the EUR/NZD was rejected by the 100-hour simple moving average (SMA) at 1.7199, sending the pair tumbling during the rest of the day, breaking the 1.7100 figure on its way down.

That said, the EUR/NZD first support would be the February 3 daily high previous resistance-now-support at 1.7094. Breach of the latter would expose the February 3 daily low at 1.6974, followed by February 1 1.6940.

What you need to know on Thursday, February 10:

Easing government bond yields weighed on the American dollar, which anyway ended the day mixed across the FX board.

The yield on the US 10-year Treasury note stands at around 1.93%, down from its weekly peak at 1.97%.

The GBP/USD pair is unchanged on a daily basis trading at around 1.3525, while the EUR/USD pivots around 1.1430. Commodity-linked currencies were the best performers, as AUD/USD trades in the 0.7180 price zone, while USD/CAD fell to 1.2670. BOC’s Governor Tiff Macklem spoke in the Canadian Chamber of Commerce and highlighted the role of supply-chain issues on higher inflation. He said he was confident issues may soon recede, although the current truckers’ conflict may add to disruptions.

Gold peaked at $1,835.81 a troy ounce, ending the day nearby. Crude oil prices ended the day little changed, with WTI trading at $89.40 a barrel.

The White House warned about soaring inflation, one day ahead of the release of the January Consumer Price Index.

Global indexes closed in the green, with Wall Street posting substantial gains amid a bounce in the tech sector and solid earnings reports.

Cardano price screams “buy” ahead of bullish breakout

Like this article? Help us with some feedback by answering this survey:

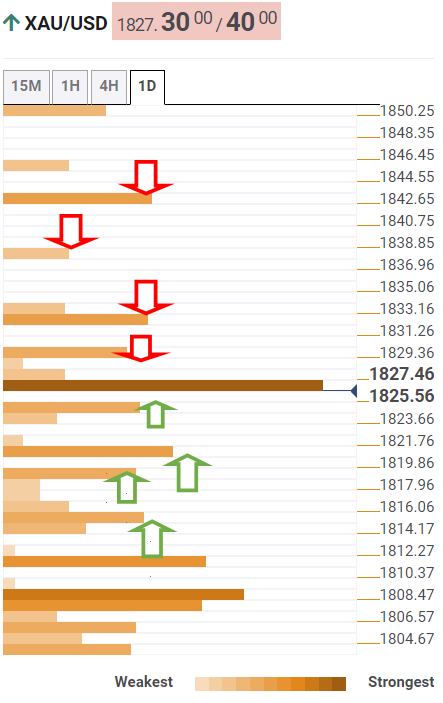

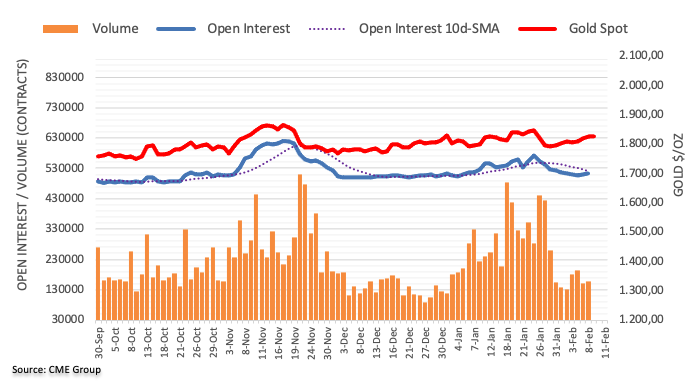

- Gold braces the July 2021 swing highs around $1,834 as the market prepares for US inflation.

- US Treasuries slide led by the 10-year benchmark note down at 1.923%.

- XAU/USD Technical Outlook: Neutral, unless it breaks above $1,834, which would shift the bias to neutral-bullish.

Gold (XAU/USD) rallies in the New York session taking advantage of a catalyst, alongside falling US Treasury yields, ahead of the US inflation report. At press time, XAU/USD is trading at $1834.61, advancing close to 0.50%.

Financial markets sentiment is upbeat, as reflected by equity markets. The global bond sell-off stopped as the US Department of Labour would reveal January’s inflation report on Thursday, widely expected by market players. That said, on Wednesday, US Treasuries yields are dropping led by the 10-year benchmark note down three basis points, sitting at 1.923%

Fed’s Mester expects a hike in March meeting

In the meantime, a light US economic docket left XAU/USD traders waiting for Fed speaking and market sentiment. Earlier, Cleveland’s Fed President Loretta Mester (voter 2022) said that she “expects inflation will moderate but would remain above 2% this year and next.” Worth noting that Mester supports a rate increase in March, followed by future rate hikes, which the economy will guide.

That said, market players prepare ahead of the US Consumer Price Index for January, to be released on Thursday. Estimations for the headline CPI lie at 7.3%, while Core CPI is foreseen at 5.9%.

Worth mentioning that analysts at TD securities expect inflation to “slow significantly in 2022, and fiscal stimulus fades and supply constraints ease, but for now, the data remain strong.” TD analysts’ estimates for January’s inflation are headline CPI at 7.2%, while core CPI at 5.8%. In the meantime, for the remainder of the year, TD analysts expect headline CPI to recede to 2.9% y/y in Q4 of 2022 while excluding volatile items, also called core CPI, at 3.0% y/y in Q4 of 2022.

XAU/USD Price Forecast: Technical outlook

On Wednesday, XAU/USD broke the central line of Pitchfork’s channel at $1,830, exposing July 2021 swing high at $1,834. Nevertheless, that price level has been unsuccessfully tested four times, though, by the end of November 2021, it was broken when XAU/USD reached $1,877 before retracing its gains towards $1753.

XAU/USD first resistance would be $1,834. A daily close above would expose the January 25 high at $1,853, followed by a nine-month-old downslope trendline around $1,860.

On the flip side, XAU/USD’s first support would be Pitchfork’s central line, around $1,820. Breach of the latter would expose the confluence of the 50 and 200-DMA around $1,806, followed by the 100-DMA at $1,798.

- The NZD bulls have moved in on old weekly lows.

- US CPI will be eyed for the next potential catalyst.

At 0.6690, NZD/USD is higher by 0.62% on the day as the North American session winds down and traders prepare for Thursday's key US Consumer Price Index event. The kiwi has travelled from a low of 0.6641 and reached a high of 0.6697 in mid-day US trade.

As analysts at ANZ Bank pointed out, ''the strong rally in the AUD overnight helped lift the Kiwi, with the former buoyed by gains in metals and a bounce in generalised market risk appetite.'' However, the analysts argued that ''in the context of moves seen last year, the NZD’s rally of around a cent off last Friday’s lows was pretty tame.''

''Bond yields are rising in unison globally, and that’s causing FX volatility rather than directionality, with the markets unsure whether it likes rate hikes (they should dampen inflation) or don’t (they might slow growth and weigh on asset prices).''

There has been a void of domestic drivers for the kiwi and the focus for this week stays with the US and global inflation story as a whole. As the old adage goes, when the US sneezes, the rest of the world catches a cold. Therefore, Thursday's CPI data could be one that moves the needle in forex if it surprises one way or the other.

''US CPI data tonight is important and will help settle the debate as to whether the Fed will lift off with a 25bp or 50bp hike. But it’s not clear the latter would actually benefit the USD,'' the analysts at ANZ Bank argued.

However, given how the greenback has been weighed by US rates taking a breather, This may be the calm before the storm. ''If those readings come in hot, it could be the trigger for the next leg higher in U.S. yields and likely push the 10-year above 2% for the first time since August 2019,'' analysts at Brown Brothers Harriman warned. ''Fed tightening expectations would also pick up and likely push the short end of the US curve higher, which would support the dollar.''

NZD/USD technical analysis

NZD/USD bulls are taking charge in a significant correction that is moving on old lows near 0.67 teh figure and towards the neckline of the M-formation near 0.6733. This resides between the 50% mean reversion and the 61.8% ratio.

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2022 is 0.7 percent on February 9, unchanged from February 8 after rounding.

''After this morning’s wholesale trade release from the US Census Bureau, the nowcast of the contribution of inventory investment to first-quarter real GDP growth decreased from -2.40 percentage points to -2.41 percentage points.

The next GDPNow update is Wednesday, February 16.''

Ahead of tomorrows key US Consumer Price Index data scheduled for New York's morning session, the White House says tomorrow's inflation data will show high year-on-year figure.

More to come...

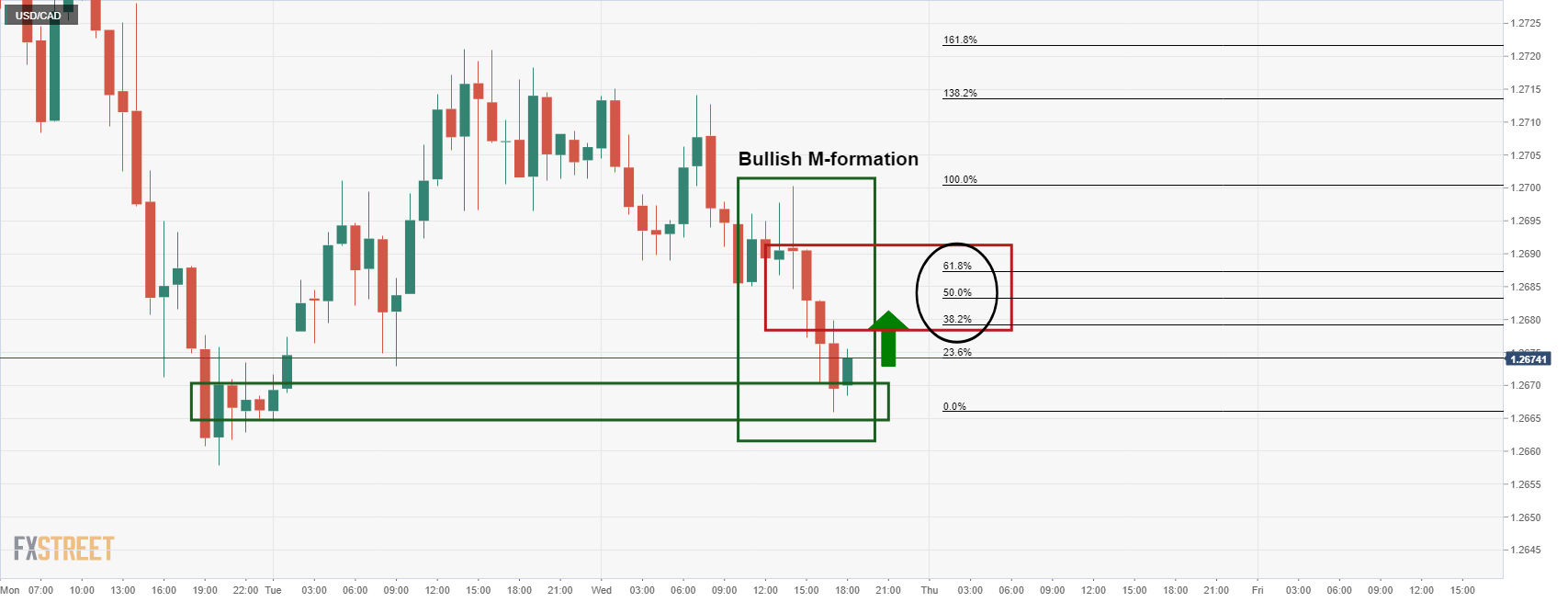

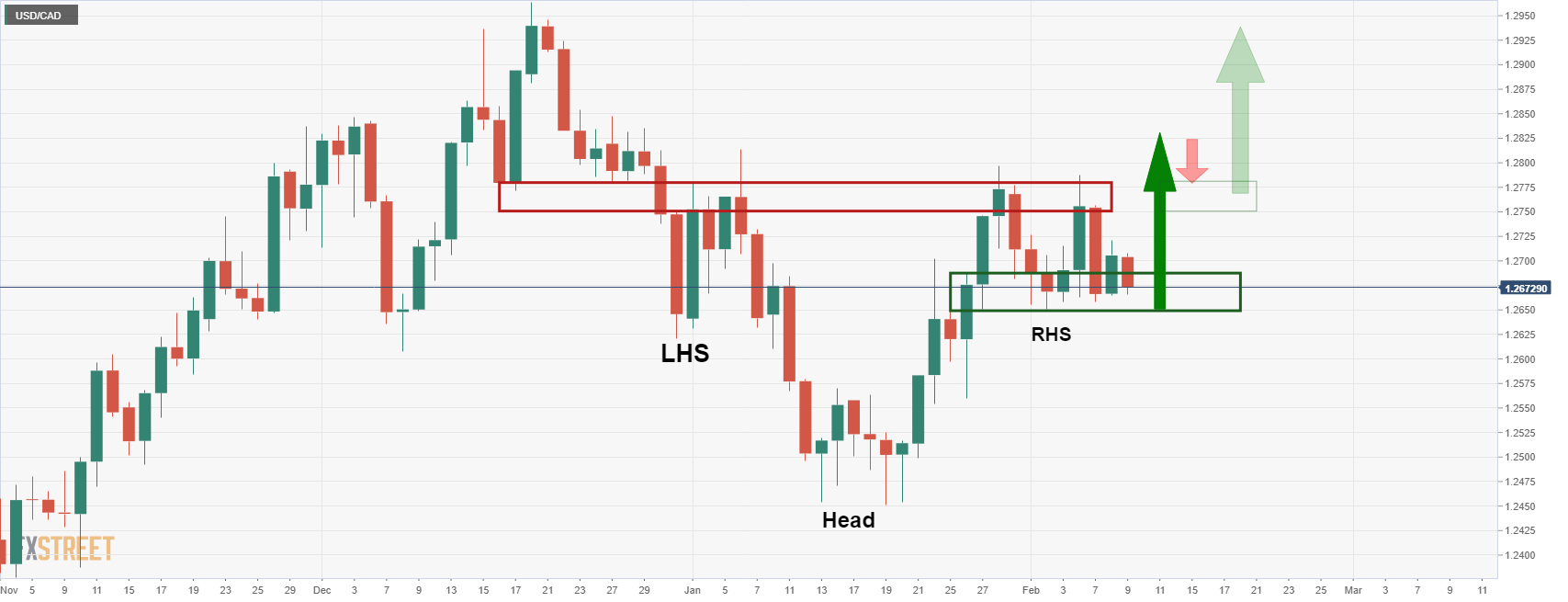

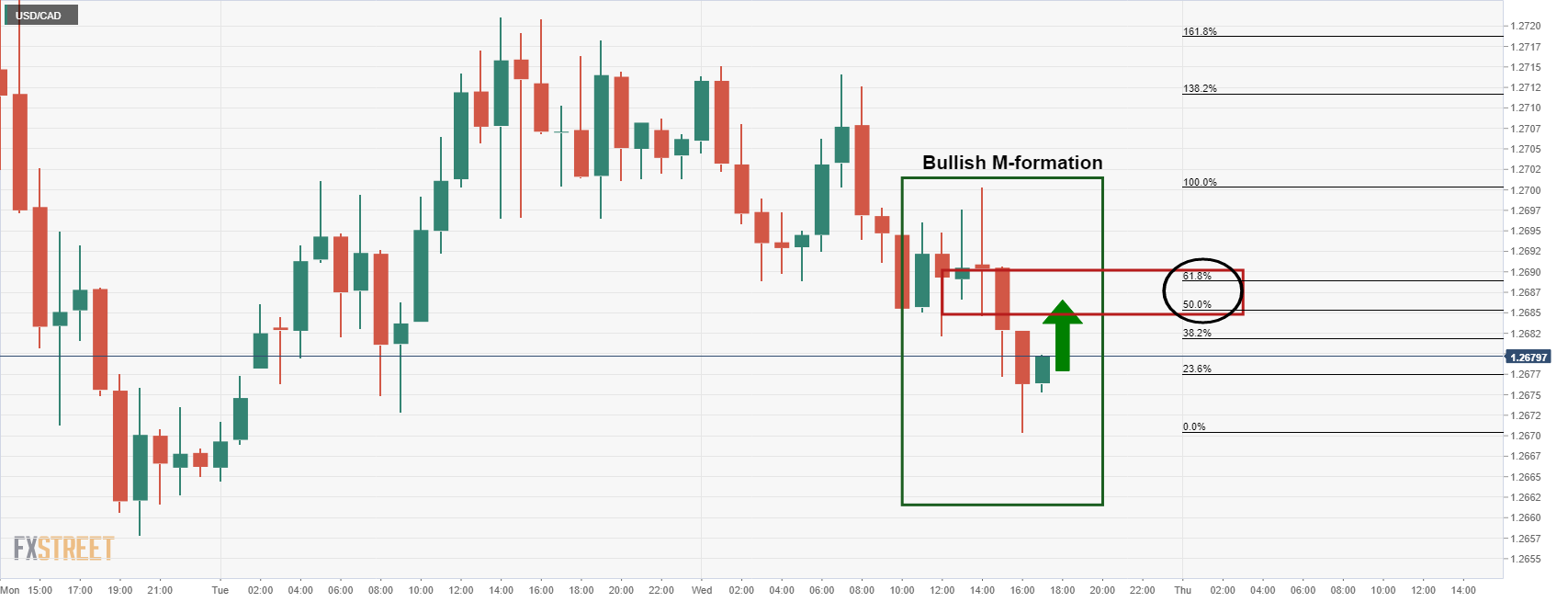

- USD/CAD is trading technically heavy, but inverse H&S offers solace for the bulls.

- Today's lows could be important in this regard while 1.2610 will be the last defence.

USD/CAD has been offered on the day but is running into a very important area of support. From a short-term perspective, the price is printing an overextended M-formation on the hourly chart:

USD/CAD H1 chart

The bulls are moving in as profits are taken off the table before the close of the North America session as traders will be keen to be square in the run-up to the critical US Consumer Price Index event in Thursday's morning New York trade. This raises prospects of a correction into the neckline of the M-formation where bulls can target the 1.2680's, namely the 38.2%, 50% and 61.8% ratios.

USD/CAD daily chart

Meanwhile, as per the prior analysis, USD/CAD Price Analysis: Bulls failed to break out, but Inverse H&S could now be the ticket, there is the case for the upside given the inverse H&S.

Therefore, it will be imperative that the shorter-term time frame support structures hold up under the current pressure. Today's lows could be important in this regard. 1.2610 will be the last defence otherwise.

- The GBP/USD is flat in a subdued session as investors prepare for the US inflation report.

- Risk-sensitive currencies rise, while the greenback drops 0.13% against its peers.

- GBP/USD Technical Outlook: Neutral biased unless GBP bulls reclaim the 200-DMA at 1.3700.

The British pound remains subdued on Wednesday during the New York session, so far up 0.02% in the day. At the time of writing, the GBP/USD is trading at 1.3539. Financial markets mood is positive, as European equity indices finished in the green. Across the pond, US equity indices led by the heavy tech Nasdaq Composite record gains between 0.74% and 1.47%.

In the FX complex, risk-sensitive currencies led by the antipodeans and the CAD rise, followed by the EUR and safe-haven peers. The greenback extends its losses during the day, with the US Dollar Index (DXY), a gauge of the buck’s value against a basket of six currencies, losses 0.13%, down at 95.51.

In the bond market, US Treasury yields recede from weekly highs. In the case of the 10-year T-note yield, it retraces after reaching 1.97%, a level last seen in 2019. The 10-year T-note is at 1.922% at press time, down three basis points in the session as market participants get ready for Thursday’s release of US inflation figures.

A light US economic docket left GBP/USD traders adrift to Fed speaking and market sentiment. At press time, Cleveland’s Fed President Loretta Mester (voter 2022) said that she “expects inflation will moderate but would remain above 2% this year and next.” Worth noting that Mester supports a rate increase in March, followed by future rate hikes, which the economy will guide.

GBP/USD Price Forecast: Technical outlook

The GBP/USD is neutral biased, regardless of trading above the 50 and the 100-day moving average (DMAs) lying at 1.3448 and 1.3505, each. However, the presence of the 200-DMA at 1.3702 keeps GBP/USD bears in charge unless a challenge to the abovementioned level is launched.

Upwards, the GBP/USD resistance levels would be the 1.3600 figure, followed by February’s three high at .13622, and then the five-month-old downslope trendline that passes near the 200-DMA at 1.3700.

Contrarily, the GBP/USD first support would be the 100-DMA at 1.3505. Breach of the latter would expose the 50-DMA at 1.3448 and then the 1.3400 figure.

Loretta J. Mester, president and CEO of the Federal Reserve Bank of Cleveland, is crossing the wires and has stated that there's a strong case to start reducing accommodation and she supports rate increase in March.

Key comments

Says future rate increases will be guided by the economy.

Says if inflation is not coming down by the middle of the year then the Fed will need to remove accommodation at a faster pace.

Says her view is the fed can move considerably faster to shrink balance sheet than it has in the past

Says fed will be careful with balance sheet plan to not disrupt financial markets.

Says having inflation be under control is going to help the fed sustain the expansion.

Says she doesn't see a compelling case to start with a 50 bp rate increase.

Says that is something the committee is going to have to talk about and decide.

Says each meeting is going to be in play.

Mester says she suspects the fed will need to get interest rates above neutral but doesn't see an immediate need to do that.

Says the balance sheet is not the Fed's primary policy tool.

Says she expects the fed will set the balance sheet on a path to reduce it and use the Fed funds rate as the main policy tool.

Says as balance sheet runs down that will remove some accommodation.

Sales of MBS would need to be done carefully to not disrupt the markets.

Says Fed is still talking about what the actual balance sheet plan would look like.

Says Fed would not necessarily sell mortgage-backed securities from the start.

Says active sales would come later.

Says it's important the fed return to a primary treasury portfolio.

Says with the economy doing well it's time to start reducing the balance sheet.

Says her view on bond sales might change as time goes on.

US dollar on the backfoot

The US dollar is on the backfoot in New York trade as measured by the DXY index against a basket of currencies. It is losing some 0.23% at the time of writing.

The Bank of Canada's governor, Tiff Macklem, is speaking live to the Canadian chamber of commerce. The global supply chain problems may have peaked, he states, for which he blames for higher inflation. He says, however, that Canadians should expect a rising path of interest rates.

Key comments

Covid recovery phase is chance to make long overdue gains in Canadian productivity.

Productivity growth is vital to economic growth, increasing wages without raising unit labour costs.

US capital has moved to higher-productivity sectors in larger amounts than in Canada, ‘has been more nimble’.

Expect that business investment will grow faster in Canada than in US.

Some evidence global supply chain problems may have peaked.

- Eyes on USD/CAD as BOC Governor Macklem responds to questions on economy

Watch live: BoC governor Macklem

Macklem speaks live to the Canadian chamber of commerce.

USD/CAD technical update

The price of USD/CAD is in an hourly corrective phase as the US dollar firms in the New York mid-day session. The M-formation is a bullish reversion pattern where the price has a high probability of moving in on the neckline of the formation. In this case, the 50% mean reversion target is located near 1.2680.

- Broad US dollar weakness across the board weighed on the USD/JPY pair.

- Falling US Treasury yields and demand for riskier assets keep the USD/JPY subdued.

- USD/JPY Technical Outlook: Remains upward biased ahead of the US CPI for January.

On Wednesday, the USD/JPY retreats from weekly highs ahead of the release of US inflation figures, alongside the slip of US Treasury yields. At the time of writing, the USD/JPY is trading at 115.44, down 0.08%.

Financial markets mood is positive, as shown by European and US equity indices printing gains. The US 10-year Treasury yield is dipping three basis points, to sit at 1.925%, while the US Dollar Index drops 0.20%, currently at 95.44.

USD/JPY Price Forecast: Technical outlook

In the overnight session for North American traders, the pair reached a daily high at 115.68, followed by a drop to the downslope one-month-old resistance/support trendline that passes around the 115.25-35 area. Even though the USD/JPY retreated to the abovementioned trendline, the pair remained above it, confirming the upward bias.

That said, the USD/JPY first resistance would be 116.00. Breach of the latter could pave the way for further gains and expose a 24-year-old downslope trendline drawn from August 1998, swing highs that pass around 117.00. An upward break would expose the January 2017 swing high at 118.61.

- EUR/USD manages to remain above 1.1400, with a modest bullish bias.

- US dollar weaker amid a retreat in yields and risk appetite.

The EUR/USD is moving sideways between 1.1425 and 1.1445 on Wednesday with a bullish bias, on the back of a weaker greenback across the board and amid tightening expectations from the European Central Bank.

DXY and yields down, stock up

The US Dollar Index (DXY) is falling 0.20% on Wednesday affected by the decline in US yields that moved away of multi-month highs. The US 10-year stands at 1.92% and the 30-year at 2.22%. Also higher equity prices weigh on the dollar. In Wall Street the Dow Jones again 0.82% and the Nasdaq 1.53%.

Market participants await Thursday US CPI reading. The index is expected to have climbed in January to 7.3% (annual rate). The numbers will likely influence on market expectations about the Federal Reserve’s policy.

The EUR/USD is up more than 150 pips from the level it had a week ago on the back of a change in tightening expectation from the ECB. The rally found resistance at the January top at 1.1480/85. The mentioned area continues to be a key level that if broken would clear the way for 1.1500 and more.

In the very short-term while above 1.1425, the intraday bullish bias is likely to remain in place. A slide below would expose again 1.1400. The next support below stands at 1.1370/80, the last defense to the current positive short-term outlook for the euro.

Technical levels

- On Wednesday, XAG/USD failed to capitalize on broad US dollar weakness across the board.

- US inflation report looms as financial assets begin to trade in narrow ranges.

- XAG/USD Technical Outlook: Neutral-upward biased that would need the confirmation of a daily close above the 100-DMA.

Silver (XAG/USD) faces strong resistance around the 100-DMA at $23.20, snapping three days of gains, barely dropping 0.04% in the New York session. At the time of writing is trading at $23.15. The market mood in the financial markets, ahead of Thursday’s US inflation report, is optimistic.

Meanwhile, US Treasury yields slid some after reaching new YTD highs led by the US 10-year T-note, down three basis points, sitting at 1.94%. At the same time, US 10-year TIPS yield, a proxy for real yields, which correlate4 inversely with precious metal prices, dips to -0.495%. It is worth noting that despite the fall in nominal and real yields, XAG/USD has been unable to capitalize, probably due to profit-taking, ahead of a volatile Thursday.

A light US economic docket would only feature Fed speakers throughout the day. Federal Reserve Governor Michell Bowman and Cleveland’s Fed President Loretta Mester would cross the wires at 15:30 GMT and 17:00 GMT, respectively. Both policymakers could shed light ahead of January’s Consumer Price Index (CPI) release.

Analysts at TD securities expect inflation to “slow significantly in 2022, and fiscal stimulus fades and supply constraints ease, but for now, the data remain strong.” TD analysts’ estimates for January’s inflation are headline CPI at 7.2%, while core CPI at 5.8%.

Furthermore, noted that “For headline CPI, we forecast 2.9% y/y in 22Q4, down from 6.7% y/y in 21Q4. For core CPI, we forecast 3.0% y/y in 22Q4, down from 5.0% y/y in 21Q4. For the core PCE index, we forecast 2.5% y/y in 22Q4, down from 4.6% y/y in 21Q4.”

XAG/USD Price Forecast: Technical outlook

Silver is neutral-upward biased, but failure at the 100-DMA at $23.20 could exert downward pressure on the non-yielding metal.

That said, XAG/USD’s first support would be $23.00. Breach of the latter exposes the 50-DMA at $22.82, followed by a two-month-old upslope trendline that passes around the $22.65-75 area, which once broken, can challenge January 28 swing low at $22.15.

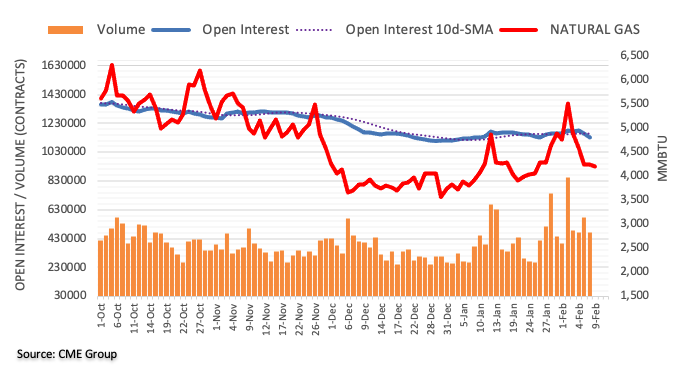

- Crude oil stocks tumble unexpectedly last week by 4.756M barrels.

- Crude oil price rise after inventory data, WTI hits fresh daily highs above $89.00.

Commercial crude oil inventories in the US dropped by 4.756 million barrels in the week ending February 5, a weekly report published by the US Energy Information Administration (EIA) revealed on Wednesday. Market consensus pointed to an increase in crude oil stocks.

Distillate stocks saw a smaller than expected decline of 929K barrels (forecasts were for a 1.7M barrel build). Gasoline stocks also dropped unexpectedly by 1.644M against market consensus of a 1.623M increase.

Market Reaction

WTI rose after the report hitting fresh daily highs above $89.00.

Isabel Schnabel, member of the Executive Board of the European Central Bank (ECB), mentioned during a Twitter session of Q&A that rising interest rates would not lower energy prices. She added that if current inflation “threatens to lead to a de-anchoring of inflation expectations, we may still need to respond”. According to her, inflation will remain high for longer than anticipated.

Additional takeaways:

“Asset purchases under the PEPP are guided by the ECB’s capital key. In the event of renewed market fragmentation related to the pandemic, PEPP reinvestments can be adjusted flexibly across time, asset classes and jurisdictions at any time.”

“Raising rates would not lower energy prices. But if high current inflation threatens to lead to a de-anchoring of inflation expectations, we may still need to respond, as our mandate is to preserve price stability.”

“Inflation will remain high for longer than anticipated. There is a risk that inflation continues to rise in the near term but it is likely to gradually decline towards the end of this year. There remains high uncertainty around the inflation outlook.”

- USD/TRY extends further its consolidation theme near 13.60.

- Turkey 10y bond yields drop further and approach 21%.

- Turkey Unemployment Rate next on tap on Thursday.

USD/TRY navigates a narrow range around the usual 13.50/60 band on Wednesday.

USD/TRY stays range bound, looks to CBRT

USD/TRY remains side-lined around the familiar 13.50/60 region for yet another session on Wednesday, extending the muted price action that kicked in in mid-January.

In the meantime, the lira appears vigilant and follows the recent developments from a series of meetings between finmin N.Nebati with investors in London.

Nebati outlined Ankara’s plans for a stable currency amidst an economic programme based on low borrowing rates (?), prevent further dollarization of the economy and bring inflation to single digits by mid-2023.

The Turkish finmin also said the government is expected to announce a scheme to motivate households to convert holdings of gold into the domestic currency.

What to look for around TRY

The pair keeps its multi-week consolidative theme well in place, always within the 13.00-14.00 range. While skepticism keeps running high over the effectiveness of the ongoing scheme to promote the de-dollarization of the economy – thus supporting the inflows into the lira - the reluctance of the CBRT to change the (collision?) course and the omnipresent political pressure to favour lower interest rates in the current context of rampant inflation and (very) negative real interest rates are a sure recipe to keep the domestic currency under pressure for the time being.

Key events in Turkey this week: Unemployment Rate (Thursday) - End Year CPI Forecast, Current Account, Industrial Production, Retail Sales (Friday).

Eminent issues on the back boiler: Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Much-needed structural reforms. Growth outlook vs. progress of the coronavirus pandemic. Earlier Presidential/Parliamentary elections?

USD/TRY key levels

So far, the pair is advancing 0.26% at 13.5825 and a drop below 13.3494 (55-day SMA) would expose 13.2327 (monthly low Feb.1) and finally 12.7523 (2022 low Jan.3). On the other hand, the next up barrier lines up at 13.9319 (2022 high Jan.10) followed by 18.2582 (all-time high Dec.20) and then 19.0000 (round level).

- The Australian dollar dominates the week vs. the greenback, reaffirming its neutral-upward bias.

- The economic docket would feature Fed speakers in the day as traders get ready for US CPI.

- AUD/USD Technical Outlook: The pair is neutral biased unless it reclaims the 100-DMA at 0.7248.

The AUD/USD print gains for the third straight day, so far up 1.5% in the week as market players prepare for Thursday’s US inflation figures. At the time of writing, the AUD/USD is trading at 0.7185.

Wednesday’s economic docket is light, except for Fed speakers Michelle Bowman and Loretta Mester, leaving AUD/USD’s traders adrift of market sentiment plays or positioning ahead of new financial data. On Thursday, January’s US Consumer Price Index (CPI) is foreseen at 7.3%. The so-called Core CPI, excluding volatile items like food and energy, is estimated at 5.9%, both readings annually based.

During the week, John Edwards, a former Reserve Bank of Australia (RBA) member, said that the RBA could raise rates four times in quick succession late in 2022. The last week, RBA Governor Philip Lowe “conceded” that tightening of monetary policy was a “plausible scenario.” Nevertheless, he emphasized, as noted in the Statement of Monetary Policy as well and in the press conference, that the beard is prepared to be “patient.”

Earlier in the Asian session, the Australian economic docket featured the Westpac Consumer Confidence Index for February at 100.2, lower than the 102.2 reported in January. On Thursday, Building Permits for December is estimated to increase by 8.2%.

AUD/USD Price Forecast: Technical outlook

The AUD/USD is neutral biased, as shown by the daily moving averages (DMAs). At press time, the AUD/USD is trading above the 50-DMA, which sits at 0.7163, but seems far from the 100-DMA at 0.7248, which intersects with a three-month-old downslope trendline around that area.

However, a daily close above the 50-DMA would expose 0.7200 as the following resistance level. Once that gives way, then and only then, AUD bulls would challenge the 100-DMA. A breach of the latter would expose the January 13 daily high 8-pips short of the 0.7300 figure.

EUR/GBP holds a base and a bullish “reversal week”. Analysts at Credit Suisse view the setback as temporary ahead of further strength to the 200-day moving average (DMA) at 0.8515.

Key support seen at 0.8362

“With a base and a large bullish ‘reversal week’ established following the successful defense of key long-term support at 0.8281/17, this is seen as a temporary pullback for now ahead of a fresh move higher to retest 0.8471/80. Beyond here can then clear the way for a test of what we expect to be tougher resistance at the 200-DMA at 0.8512/15, with a cap expected here at first.

“Support is seen at the 0.8412/04 initially, then 0.8394, with 0.8362 ideally holding to see an immediate upside bias maintained.”

EUR/USD continues to trade in a narrow 1.1400-1.1450 channel. Analysts at Scotiabank spot a technical pattern that could imply a move towards the 1.16 level.

Support past 1.1400/90 is 1.1370

“EUR price action is forming a bullish flag pattern that could see it break out toward a test of 1.16.”

“Resistance past the mid-figure zone is 1.1484 followed by 1.1515/25 (the lows of Oct/Nov).”

“Support past 1.1400/90 is 1.1370, the mid-1.13s, and the 50-day MA at 1.1324.”

USD/CAD trades modestly lower below the 1.27 level. The pair remains out of reach of key support at 1.2650 – removal of which would open up 1.26, economists at Scotiabank report.

Key resistance seen at 1.28

“A break under 1.2650 should see spot push back to the 1.25 area.”

“Resistance is 1.2720/30 and (key) 1.2800.”

EUR/CHF maintains its base above 1.0514. Analysts at Credit Suisse view the pullback from 1.0621/26 – the 38.2% retracement of its entire 2021/2022 fall – as temporary ahead of a test of its 200-day moving average (DMA) at 1.0699.

Support at 1.0494 to hold for strength back to 1.0699

“With a base in place above the 1.0514 January high, which itself is on the back of loss of momentum ahead of long-term support at 1.0254/35, this is seen as a temporary setback.”

“Above 1.0574 should clear the way for a retest of 1.0621/26. With weekly MACD momentum also having turned higher though, we look for a break above here in due course for a move to test the 200-DMA, currently placed at 1.0699.”

“Support is seen at 1.0538 initially, then the ‘neckline’ to the base at 1.0514/11 with support at 1.0494 ideally holding.”

- EUR/USD reverses two sessions in a row with losses.

- The 5-month support line holds the downside near 1.1400.

EUR/USD regains the smile and returns to the positive territory near 1.1440 on Wednesday.

In the meantime, further gains in the pair remains on the table while above the 5-month line in the 1.1400 neighbourhood. Beyond this area, EUR/USD should be able to attempt another visit to the 2022 high at 1.14834 (February 4) just ahead of the 200-week SMA, today at 1.1496. Between 1.1500 and 1.1600 there are no resistance levels of note, leaving the October 2021 top at 1.1692 as a potential longer-term target.

In the longer run, the negative outlook remains in place while below the key 200-day SMA at 1.1667.

EUR/USD daily chart

- USD/CAD struggled to capitalize on the overnight gains amid modest USD weakness.

- Retreating US bond yields turned out to be a key factor that weighed on the buck.

- A softer tone around oil prices undermined the loonie and helped limit deeper losses.

The USD/CAD pair remained on the defensive through the early North American session and was last seen trading with modest intraday losses, just below the 1.2700 mark.

A sharp pullback in the US Treasury bond yields, along with the risk-on impulse prompted some selling around the safe-haven US dollar. This, in turn, failed to assist the USD/CAD pair to capitalize on the overnight bounce from the 1.2450 support area. The downside, however, remains cushioned in the wake of a fresh leg down in crude oil prices, which tend to undermine the commodity-linked loonie.

Apart from this, expectations that the Fed would adopt a more aggressive policy response to contain stubbornly high inflation acted as a tailwind for the greenback and the USD/CAD pair. In fact, the markets have been pricing in the possibility of a 50 bps Fed rate hike move in March. Hence, the focus will remain glued to the release of the latest US consumer inflation figures on Thursday.

On the other hand, the Canadian dollar was pressured by softer crude oil prices. Traders opted to lighten their bullish bets around the commodity amid expectations that the revival of the 2015 nuclear deal could return more than 1 million barrels per day of Iranian oil in the markets. This, in turn, was seen as another factor that should extend support to the USD/CAD pair and limit losses.

In the absence of any major market-moving economic releases, the US bond yields will drive the USD demand. Traders will further take cues from the official report on the US crude inventories by Energy Information Administration, which will influence oil price dynamics. This, along with the Bank of Canada Governor Tiff Macklem's speech should provide some impetus to the USD/CAD pair.

Technical levels to watch

"Financial markets have come to expect a lot of guidance from central banks on where rates are heading," Bank of England Chief Economist Huw Pill said on Wednesday, as reported by Reuters.

"As we move back to a more normal monetary policy situation, it's natural for central banks to withdraw from detailed guidance," Pill added. "I am not going to give any specific view of what the yield curve should look like. It does not make sense to pre-empt market pricing judgements."

Market reaction

GBP/USD continues to trade in the positive territory above 1.3570 following these comments.

Atlanta Federal Reserve President Raphael Bostic told CNBC on Wednesday he is hopeful that they will start to see a decline in inflation, as reported by Reuters.

Additional takeaways

"Projecting 3% PCE inflation for the year."

"Leaning toward the need for a fourth interest rate increase in 2022."

"Would like to see the balance sheet reduced pretty significantly and for reductions to start soon."

"Fed decisions and signals sent this year will go a long way to address inflation."

"Thinking only about 25 bps hikes right now though, all options on the table."

"Seeing US growth comfortably through 2022 and 2023; much would have to happen for Fed policy to constrain growth."

Market reaction

The US Dollar Index stays under modest bearish pressure following these comments and was last seen losing 0.15% on the day at 95.48.

USD/JPY remains on the defensive on Wednesday. But in the view of analysts at Credit Suisse, a break above 115.69 should confirm the completion of a bullish continuation pattern for a resumption of the core uptrend back to 116.35/70.

Above 115.69 should see the sideways range resolved higher

“Key near-term resistance stays seen at the recent high at 115.69, above which can see a bullish continuation pattern complete to turn the trend higher again for a retest of the high and long-term downtrend from April 1990 at 116.35/70. Whilst a fresh rejection from here should be allowed for, we continue to look for an eventual clear break, with resistance seen next at 118.61/66.”

“Support is seen at 115.23 initially, with the 13-day ema and price support at 115.05/114.92 now ideally holding to keep the immediate risk higher. Below can see a retreat back to the 55-day average at 114.46/42.”

Bank of England Chief Economist Huw Pill said on Wednesday that a case can be made for a measured rather than an activist approach to policy decisions, as reported by Reuters.

Additional takeaways

"Must focus on more persistent developments in the data that have lasting implications for the outlook for price stability."

That is what I would label a ‘steady handed’ approach to monetary policy."

"Since September, BOE has consistent, measured and resolute set of actions intended to rebalance the stance of monetary policy and address the inflationary pressures."

"We have signalled that more is to come in the coming months if the path sketched out in our February forecast plays out."

"Equally we have flagged that the outlook for bank rate beyond the coming months is uncertain, reflecting the two-sided risks to inflation."

"Decision to vote for 25 bp hike rather than 50 bp decision was finely balanced for me as an individual voter on the MPC."

"I am sceptical of efforts to return bank rate quickly to some pre-defined neutral level or terminal rate."

"Such an approach risks increasing inflation and output volatility if the policy is miscalibrated."

"Better to adopt a more measured and data-dependent approach, which learns from how the economy responds to each step taken rather than pre-commits to a concept surrounded by uncertainty."

"Unusually large policy steps may validate a market narrative that bank policy is either foot-to-the-floor on the accelerator or foot-to-the-floor with the brake."

"I would certainly not wish to rule out changes in bank rate of more than the usual 25bp in all circumstances."

"Given the inflationary pressures we currently face, I can certainly understand why colleagues on the MPC voted for a 50bp hike last week."

"Restricting ourselves to a 25bp now – albeit with the prospect of more to come in the coming months – is an investment in containing market expectations of aggressive activism."

Market reaction

The GBP/USD pair edged slightly lower from session highs after these comments and was last seen trading at 1.3565, where it was up 0.18% on a daily basis.

EUR/JPY extends its high-level consolidation following the rally to the 78.6% retracement of the Q4 2021 fall at 132.18. This stays seen as a temporary breather ahead of further strength to the top of the eight-month downtrend channel from June last year at 132.92/98, in the view of analysts at Credit Suisse.

Support is seen at 130.50

“EUR/JPY is seeing a high-level pause following its strong move higher. This stays seen as a temporary pause only following the break above its downtrend from last October and more importantly its January highs.

“We continue to look for a clear break above 132.18 in due course to see strength extend to 132.58 next ahead of what we expect to be tougher resistance at the top of the eight-month downtrend channel from June last year at 132.92/98. We expect this to remain a tougher barrier.”

“Support stays seen at 131.47/44 initially, then 131.21 ahead of the back of the broken uptrend at 130.83. An immediate upside bias though should be maintained whilst above the recent reaction low and 200-day average at 130.50.”

Long-term interest rates have been low since the subprime crisis. Analysts at Natixis look at the three mechanisms that keep long-term interest rates low.

Why are long-term interest rates low?

“Risky asset prices are very high, which reinforces the need to buy risk-free bonds to stabilise the level of portfolio risk.”

“Investors are buying more and more illiquid assets, which they can offset by also holding more liquid government bonds.”

“As public debt ratios are high, there is strong pressure on central banks not to allow long-term interest rates to rise, which is what investors expect.”

- DXY comes under downside pressure near 95.40 on Wednesday.

- Below 95.13 comes the YTD low near 94.60.

DXY fades Tuesday’s uptick and resumes the downside, dropping as low as the 95.30 region so far midweek.

The inability of the index to garner convincing upside traction, ideally in the short term, could prompt sellers to return to the market. That scenario should force the dollar to initially retest the so far monthly low at 95.13 (February 4) ahead of the 2022 low at 94.62 (January 14).

In the near term, the 5-month line in the 95.10/15 band is expected to hold the downside for the time being. Looking at the broader picture, the longer-term positive stance in the dollar remains unchanged above the 200-day SMA at 93.54.

DXY daily chart

- GBP/USD gained strong positive traction on Wednesday and shot to a fresh weekly high.

- Retreating US bond yields undermined the USD and remained supportive of the move.

- Traders might be reluctant to place aggressive bullish bets ahead of the US CPI report.

The GBP/USD pair maintained its strong bid tone heading into the North American session and was last seen trading near the weekly high, just below the 1.3600 mark.

Following the two-way/directionless price moves witnessed over the past two trading sessions, the GBP/USD pair caught fresh bids on Wednesday and was supported by modest US dollar weakness. A sharp pullback in the US Treasury bond yields, along with the risk-on impulse turned out to be key factors that undermined the safe-haven greenback.

Apart from this, the intraday positive move could further be attributed to some technical buying above the 1.3550-1.3555 horizontal resistance. It, however, remains to be seen if bulls are able to capitalize on the upward trajectory or opt to lighten their bets ahead of the latest US consumer inflation figures, scheduled for release on Thursday.

It is worth recalling that the markets have been pricing in a more aggressive policy response by the Fed to combat stubbornly high inflation and anticipate a 50 bps rate hike in March. Hence, the US CPI report will play a key role in determining the Fed's policy outlook, which will influence the USD and provide a fresh directional impetus to the GBP/USD pair.

In the meantime, the US bond yields and the broader market risk sentiment will continue to play a key role in driving the USD demand. This, in turn, should provide some impetus to the GBP/USD pair and allow traders to grab some short-term opportunities amid absent relevant market-moving economic releases, either from the UK or the US.

Technical levels to watch

British Prime Minister Boris Johnson said on Wednesday that they will trigger Article 16 if the European Union doesn't show common sense on the Northern Ireland protocol, as reported by Reuters.

Commenting on the UK COVID situation, "Provided the current encouraging trends in the data continue, it is my expectation that we will be able to end the last remaining domestic restrictions, including the legal requirement to self-isolate if you test positive, a full month early," Johson said.

Market reaction

The GBP/USD pair clings to its daily gains following these comments and was last seen rising 0.25% on the day at 1.3575.

Economist at UOB Group Enrico Tanuwidjaja and Yari Mayaseti comment on the latest GDP figures in Indonesia.

Key Takeaways

“Indonesia’s economy expanded by 5.02% y/y in 4Q21, a notable increase from previous quarter which grew by 3.51% y/y and above the market consensus of 4.90%. Sequentially, Indonesia’s economy advanced by 1.06% q/q in 4Q21. Acceleration of the vaccination process and significantly lower COVID-19 cases have allowed for the economy to be reopened more durably during the Sep-Dec 2021 period, lifting growth above expectations. Overall, the economy grew 3.7% in 2021, higher than our forecast of 3.5%.”

“From the expenditure side, 4Q21 economic growth was well supported by the rise in government expenditure, investments as well as net exports of goods and service that grew by 33.00% q/q, 4.96% q/q and 3.90% q/q respectively. In terms of sectoral view, economic growth is mostly supported by 5 sectors that include manufacturing, agriculture, wholesale and retail, construction as well as mining and quarrying. Meanwhile, health and social services as well as transport and storage also expanded in 4Q21.”

“Higher than expected 4Q21 growth was also well reflected in the mobility indicator level that recently rose compared to the pre-pandemic level as well as the strengthening of Indonesia’s Purchasing Manager Index (PMI) that reached 53.5 in Dec 2021, a slight decline from 53.9 in Nov 2021.”

“Going forward, we believe that economic recovery will continue in 2022, as domestic demand (household and government consumption as well as investment demand) is likely to continue to expand respectably while contribution of exports is likely to remain strong, albeit more so in 1H22. On balance of all accounts, we are forecasting 2022 baseline growth forecast within a range of 4.7% to 5.3%.”

- NZD/USD gained traction for the third successive day and shot to a two-week high on Wednesday.

- The risk-on impulse in the markets was seen as a key factor that benefitted the perceived riskier kiwi.

- Retreating US bond yields undermined the USD and remained supportive of the ongoing move up.

The NZD/USD pair scaled higher through the mid-European session and shot to a two-week high, around the 0.6690 region in the last hour.

A combination of supporting factors assisted the NZD/USD pair to build on this week's positive move from the 0.6600 mark and gain traction for the third successive day on Wednesday. Moderation of the US Treasury bond yields prompted some US dollar selling. This, along with the risk-on impulse, further benefitted the perceived riskier kiwi and remained supportive of the momentum.

That said, growing market acceptance that the Fed will tighten its monetary policy at a faster pace than anticipated should act as a tailwind for the US bond yields and limit losses for the greenback. In fact, the market has been pricing in the possibility of a 50 bps rate hike by the US central bank in March amid worries about the persistent rise in inflationary pressures.

Hence, the market focus will remain glued to the release of the US CPI report on Thursday, which might determine the Fed's near-term policy outlook and influence the USD price dynamics. Heading into the key data risk, traders might refrain from placing aggressive bets, which, in turn, could cap the upside for the NZD/USD pair amid absent market-moving economic releases.

In the meantime, the US bond yields will continue to play a key role in driving the USD demand and provide some impetus to the NZD/USD pair. Apart from this, traders might take cues from the broader market risk sentiment to grab some short-term opportunities around the major.

Technical levels to watch

- EUR/JPY adds to Tuesday’s gains and approaches the YTD peak.

- Further upside now targets the mid-132.00s near term.

EUR/JPY extends the upside momentum further north of the 132.00 mark midweek, advancing for the second session in a row at the same time.

In light of the recent price action, further gains in the cross look likely in the short-term horizon. That said, the surpass of the YTD high at 132.16 (February 7) should open the door to 132.53 (high November 4) seconded by 132.91 (high October 29) and finally the October 2021 peak at 133.48 (October 20).

In the near term, further upside remains on the table while above the 3-month support line, today near 130.80. In the longer run, and while above the 200-day SMA at 130.46, the outlook for the cross is expected to remain constructive.

EUR/JPY daily chart

- Silver now seems to have entered a bullish consolidation phase near a two-week high.

- Bulls might wait for sustained move beyond the $23.45 area before placing fresh bets.

- Weakness below the $23.00 mark could attract some dip-buying and remain limited.

Silver was seen oscillating in a range around the $23.15-$23.30 region through the first half of the European session and consolidated its recent gains to a two-week high.

From a technical perspective, the XAG/USD, so far, has struggled to gain momentum beyond the 100-day SMA resistance. This is closely followed by the $23.40-$23.45 horizontal resistance, which should now act as a pivotal point for short-term traders.

Oscillators on the daily chart have just started moving into the positive territory, though lacked strong momentum. Hence, it will be prudent to wait for sustained strength beyond the aforementioned barrier before positioning for any further gains.

The XAG/USD could then accelerate the positive move and aim towards reclaiming the $24.00 round-figure mark. The momentum could further get extended and allow bulls to challenge the YTD high, around the $24.70 area touched on January 20.

On the flip side, the $23.00 mark now seems to protect the immediate downside ahead of the overnight swing low, around the $22.75 region and mid-$22.00s. Some follow-through selling would negate the positive bias and make the XAG/USD vulnerable.

The next relevant support is pegged near the $22.00 mark, which if broken decisively will shift the bias firmly in favour of bearish traders. This, in turn, should pave the way for a slide towards the double-bottom support, around the $21.40 zone.

Silver daily chart

-637799994239409405.png)

Levels to watch

In an interview with Die Zeit newspaper, European Central Bank's Governing Council and Bundesbank President Joachim Nagel said that he would advocate normalizing monetary policy if the inflation picture doesn't change by March, as reported by Reuters.

Additional takeaways

"Expecting German inflation to rise significantly above 4% in 2022."

"The economic costs of acting too late are significantly higher than acting early."

"First step would be to end bond purchases, then rates could already rise in 2022."

"Would support stronger rules for government debt in Europe, with fewer exemptions."

Market reaction

EUR/USD edged slightly higher on these comments and was last seen rising 0.15% on the day at 1.1432.

As economists at Citibank note, the Bank of Japan (BoJ) is one of the last bastions of central bank dovishness. Subsequently, the Japanese yen is set to depreciate against both the US dollar and the euro.

Japanese political considerations to place limits on the extent of yen weakness

“We do not expect BoJ to review its policy parameters (YCC and cash target) anytime soon and not until after Governor Kuroda’s term in the BoJ expires in April 2023. This should retain yen’s bias to weaken against both USD and EUR.”

“The Japanese still retain USD denominated assets but we also note the rising cost of FX funding for JPY-denominated investors buying US paper following the re-pricing of the FOMC outlook. This creates more of an incentive for JPY-denominated investors to take the FX risk when buying USD assets which could potentially add to the upward bias in USD/JPY (and EUR/JPY).”

“PM Kishida is known to be less keen on a weaker yen than his predecessors. And given the rising price of imported crude oil, the new PM may begin to sense some need for correcting JPY’s depreciation as one way to shore up longer-term support for his administration. But this would probably argue more for a limit to the extent of yen weakness (to the 118.00 area) than an outrightly stronger JPY.”

See: USD/JPY should trade at 117.50, bullish bias over the coming weeks – Credit Agricole

GBP/USD has been edging higher since finding support near 1.3500. As FXStreet’s Eren Sengezer notes, the pound eyes 1.3600 as the next bullish target.

Cable pierces near-term resistance at 1.3560

“GBP/USD is trading slightly above 1.3560, the Fibonacci 23.6% retracement level of the latest uptrend. If buyers manage to defend this level, the pair could push higher toward 1.3600 (psychological level) and 1.3620 (static level) afterwards.”

“On the downside, the 200-period SMA forms dynamic support at 1.3540 before 1.3520 (Fibonacci 38.2% retracement) and 1.3500 (psychological level, 50-period SMA, 100-period SMA, Fibonacci 50% retracement).”

USD/JPY trades with modest losses but the downside seems limited. Economists at Credit Agricole CIB Research believe the pair is still undervalued as it should trade around the 117.50 level.

Higher US-T yields and a steepening UST curve imply the USD should be stronger

“While higher UST yields and a steepening UST curve imply the USD should also be stronger, it continues to struggle even against the JPY. Indeed, USD/JPY is judged as undervalued relative to its short-term fundamentals and should be trading around 117.50."

“10Y JGB yields are trading above 0.20% and near the top of the BoJ's tolerance band for the yield's deviation from the central bank's 0% target. Some of the rise in JGB yields is due to the rise in global yields in general, but is also in part due to the market pricing in some chance of the BoJ adjusting its YCC and moving in 10Y JGB target to a shorter tenor such as the 5Y JGB yield."

See: USD/JPY to soar towards 120 on US T-bond yields rising above the key 2% mark – SocGen

- Gold price pauses as bulls take a breather ahead of the US inflation data.

- Treasury yields and risk sentiment remain the key drivers impacting gold price.

- Gold has room to rise amid inflation fears and bull cross.

Gold price is treading water on Wednesday while sitting at the highest levels in roughly two weeks near $1,830. The pullback in the US Treasury yields from two-and-a-half year highs fuelled a drop in the dollar across its main peers, limiting the retreat in gold price. The further upside, however, remains capped by the risk-on market mood, thanks to the Wall Street tech boost.

In absence of significant US macro data, gold price will continue to track the yields’ price action, as investors keep an eye on the Russia-Ukraine geopolitical developments. Cleveland Fed Chief Loretta Mester’s speech and 10-year Treasuries auction will be awaited as well for any fresh impulse on gold trading but the reaction could be limited ahead of Thursday’s all-important US inflation data,

Read: Gold prices surge ahead of key inflation data – What’s next?

Gold Price: Key levels to watch

The Technical Confluences Detector shows that the gold price is yearning for acceptance above powerful resistance at $1,826, which is the convergence of the Fibonacci 23.6% one-day, Fibonacci 61.8% one-month and SMA5 four-hour.

The next bullish target is placed at the previous day’s high of $1,829, above which fresh buying opportunities will emerge towards $1,832, the confluence of the pivot point one-day R1 and pivot point one-week R2.

Further up, the pivot point one-day R2 at $1,837 will challenge the bearish commitments en-route $1,843, where the pivot point one-month R1 aligns.

On the flip side, immediate support is seen at the Fibonacci 38.2% one-day at $1,824, below which sellers will gear up for a test of $1,820.

That level is the point of intersection of the Fibonacci 61.8% one-day and pivot point one-week R1.

The additional declines will seek a test of a dense cluster of healthy support levels around $1,815, where the SMA200 four-hour, the previous week’s high and SMA5 one-day coincide.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

UOB Group’s Senior Economist Julia Goh and Economist Loke Siew Ting review the latest labour market results in the Malaysian economy.

Key Takeaways

“Malaysia’s labour market conditions continued to improve for five months in a row in Dec 2021, with the unemployment rate inching lower to a 21-month low of 4.2% (from 4.3% in Nov), matching our year-end estimate. Both the labour force participation rate and hiring also breached a new record high at 69.0% (Nov: 68.9%) and 15.65m (Nov: 15.61m) respectively.”

“The record high employment was thanks to higher employment in services, manufacturing, and construction sectors. This fully cushioned the contractions in agriculture, and mining & quarrying sectors since Aug 2020.”

“We reiterate our view that Malaysia’s labour market recovery remains on track. However, the momentum of gains may soften in 2022. Our channel checks suggest ongoing challenges posed by the pandemic to businesses particularly related to rising costs amid a cautious outlook. Rising vaccination rates (including booster doses) and ongoing government policy support are key to underpin the labour market recovery. We maintain our end-2022 jobless rate forecast at 3.6%.”

- A combination of factors assisted AUD/USD to gain traction for the third successive day.

- The risk-on impulse benefitted the perceived riskier aussie amid modest USD weakness.

- The upside potential seems limited as investors await the key US CPI report on Thursday.

The AUD/USD pair maintained its bid tone through the first half of the European session and was last seen trading near a two-week high, around the 0.7165-0.7170 region.

The pair built on its positive move witnessed since the beginning of this week and gained follow-through traction for the third successive day on Wednesday. The risk-on impulse in the markets benefitted the perceived riskier aussie and remained supportive amid modest US dollar weakness.

A softer tone surrounding the US Treasury bond yields weighed on the USD. That said, rising bets for a 50 bps Fed rate hike in March should limit the downside for the US bond yields and the buck. This, in turn, warrants some caution before placing aggressive bullish bets around the AUD/USD pair.

Investors seem convinced that the Fed would adopt a more aggressive policy response to contain high inflation. Hence, the focus will remain on the US CPI report, due on Thursday, which will influence the near-term USD price dynamics and provide a fresh directional impetus to the AUD/USD pair.

In the meantime, the US bond yields would continue to play a key role in driving the USD demand amid absent relevant market moving economic releases. Apart from this, traders will take cues from the broader market risk sentiment to grab some short-term opportunities around the AUD/USD pair.

Technical levels to watch

- USD/CAD oscillated in a narrow trading band through the first half of the European session.

- Softer crude oil prices undermined the loonie and extended some support to the major.

- Modest USD weakness acted as a headwind and kept a lid on any meaningful gains.

The USD/CAD pair lacked any firm intraday direction and seesawed between tepid gains/minor losses, around the 1.2700 mark through the first half of the European session.

A combination of diverging forces failed to assist the USD/CAD pair to capitalize on the previous day's bounce from the 1.2450 area and led to subdued/range-bound price action on Wednesday. Expectations that the revival of an international nuclear agreement could return more than 1 million barrels per day of Iranian oil in the markets weighed on crude oil prices. This, in turn, undermined the commodity-linked loonie and acted as a tailwind for the major, though modest US dollar weakness capped the upside, at least for the time being.

A softer tone surrounding the US Treasury bond yields turned out to be a key factor that kept the USD bulls on the defensive. That said, speculations for a faster policy tightening by the Fed should limit the downside for the US bond yields. Investors seem convinced that the Fed would adopt a more aggressive policy response to combat stubbornly high inflation and have been pricing in the possibility of a 50 bps Fed rate hike in March. This supports prospects for the emergence of some USD dip-buying, which should extend support to the USD/CAD pair.

Bulls, however, seemed reluctant to place aggressive bets and preferred to wait on the sidelines ahead of the release of the latest US consumer inflation figures on Thursday. In the meantime, the US bond yields will continue to play a key role in influencing the USD amid absent relevant market moving economic releases. This, along with oil price dynamics, should provide some impetus to the USD/CAD pair and allow traders to grab short-term opportunities.

Technical levels to watch

Following the meeting of the “Weimar Triangle”, Germany's permanent representative to the European Union (EU) Sebastian Fischer tweeted out, citing that Germany, France and Poland urge Russia to de-escalate the tensions around the Ukrainian border.

Fischer tweeted: “Germany, France and Poland call on #Russia to de-escalate the situation at the Ukrainian border + engage in a meaningful dialogue on security on the European continent. Any further military aggression by Russia against #Ukraine will have massive consequences + severe costs.”

The "Weimar Triangle" is, loosely, a grouping of Poland, Germany, and France, according to Wikipedia.

Market reaction

As the US and its NATO allies seek to de-escalate the Russia-Ukraine tensions, the S&P 500 futures take that in its stride, gaining 0.60% on the day.

Meanwhile, EUR/USD consolidates around 1.1425 amid a calm before the US inflation storm.

Enrico Tanuwidjaja, Economist at UOB Group, reviews the latest FX reserves results in Indonesia.

Key Takeaways

“Indonesia’s foreign exchange reserves decreased to USD141.3bn in Jan 2022; down by USD3.6bn from the previous month.”

“The decrease of reserve assets in Jan was attributable to the repayment of the government’s external debt and the decrease in foreign exchange placement in Bank Indonesia to anticipate foreign exchange liquidity needs in line with the recovery in economic activity.”

“Bank Indonesia views that the official reserve assets will remain adequate, along with several accommodative policies to support long-term economic recovery.”

- EUR/USD regains some poise and retakes the 1.1430 zone.

- German 1py Bund yields ease a tad from recent peaks.

- German trade surplus shrank to €6.8B in December.

Following two consecutive daily pullbacks, EUR/USD regains the smile and advances to the 1.1430 zone midweek.

EUR/USD looks to USD, yields

EUR/USD resumes the upside and leaves behind the recent bearish move following 2022 tops past 1.1480 (February 4). The near-term positive view in spot stays so far underpinned by the 5-month line, today around 1.1400.

In the meantime, the performance of yields on both sides of the Atlantic continues to dictate the price action in the pair along with tightening prospects from both the Federal Reserve and the European Central Bank, all against the backdrop of the persevering elevated inflation.

In the domestic docket, the German trade surplus shrank to €6.8B in December (from €10.9B), while the Current Account surplus increased to €23.9B, also in December. In Italy, Industrial Production figures are expected later.

In the NA session, usual weekly Mortgage Applications are due seconded by Wholesale Inventories, while Cleveland Fed L.Mester (voter, hawkish) is also due to speak.