- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 08-07-2014

Stock indices fell due to more European banks may be fined by U.S. authorities.

Germany's trade surplus increased to €18.8 billion in May from €17.2 billion in April. April's figure was revised down from a surplus of €17.7 billion. Analysts had expected the trade surplus to decline to €15.7 billion in May.

France's trade deficit widened to €4.9 billion in June from a deficit of €4.1 billion in May. May's figure was revised down from a deficit of €3.9 billion. Analysts had expected the trade deficit to increase to €4.1 billion in May.

Manufacturing production in the U.K. declined 1.3% in May, missing expectations for a 0.5% gain, after a 0.4% rise in April. That was the largest decline since January 2013.

Industrial production in the U.K. dropped 0.7% in May, missing forecasts of a 0.3% increase, after the 0.4% rise in April. That was the biggest decline since August 2013.

The National Institute of Economic and Social Research released its GDP estimate for U.K. NIESR estimates the GDP growth at 0.9% in the second quarter, up from 0.8% in the first quarter.

Air France-KLM shares dropped 8.7% after the company lowered its full-year profit forecast.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,738.45 -85.06 -1.25%

DAX 9,772.67 -133.40 -1.35%

CAC 40 4,342.53 -63.23 -1.44%

The U.S. dollar traded lower against the most major currencies due to decreasing U.S. Treasury yield. The yield on U.S. 10-Year Treasury notes declined to 2.58%.

Market participants are awaiting the release of the last Fed's monetary policy meeting on Wednesday.

The U.S. Bureau of Labor Statistics released its Job Openings and Labor Turnover Survey for May on Tuesday. Job openings increased to 4.6 million from 4.5 million in April.

The euro traded higher against the U.S. dollar after mixed economic data from the Eurozone. Germany's trade surplus increased to €18.8 billion in May from €17.2 billion in April. April's figure was revised down from a surplus of €17.7 billion. Analysts had expected the trade surplus to decline to €15.7 billion in May.

France's trade deficit widened to €4.9 billion in June from a deficit of €4.1 billion in May. May's figure was revised down from a deficit of €3.9 billion. Analysts had expected the trade deficit to increase to €4.1 billion in May.

The British pound declined against the U.S. dollar due to the weaker-than-expected manufacturing production in the U.K., but later recovered a part of its losses. Manufacturing production in the U.K. declined 1.3% in May, missing expectations for a 0.5% gain, after a 0.4% rise in April. That was the largest decline since January 2013.

On a yearly basis, manufacturing production in the U.K. increased 3.7% in May, missing expectations for a 5.6% rise, after a 4.4% gain in April.

Industrial production in the U.K. dropped 0.7% in May, missing forecasts of a 0.3% increase, after the 0.4% rise in April. That was the biggest decline since August 2013.

On a yearly basis, industrial production in the U.K. rose 2.3% in May, after the 3.0% gain in April. Analysts had expected an increase of 3.1%.

The National Institute of Economic and Social Research released its GDP estimate for U.K.

The Swiss franc traded lower against the U.S. dollar after the weaker-than-expected economic data from Switzerland, but later recovered its losses and traded higher. Retail sales in Switzerland declined 0.6% in May, missing expectations for a 1.5% rise, after a 0.4% increase in April.

The Swiss consumer price index decreased 0.1% in June, missing expectations for a 0.1% increase, after a 0.3% gain in May.

On a yearly basis, the Swiss consumer price index was flat in June, missing expectations for a 0.2% gain, after a 0.2% rise in May.

The New Zealand dollar increased against the U.S dollar as ratings agency Fitch raised New Zealand's outlook to positive from stable.

The NZIER business confidence index declined to 32 in the second quarter from 52 the previous quarter.

The Australian dollar traded higher against the U.S. dollar after the better-than-expected economic data from Australia. The National Australia Bank's Business Confidence index was up to 8 in June from 7 in May.

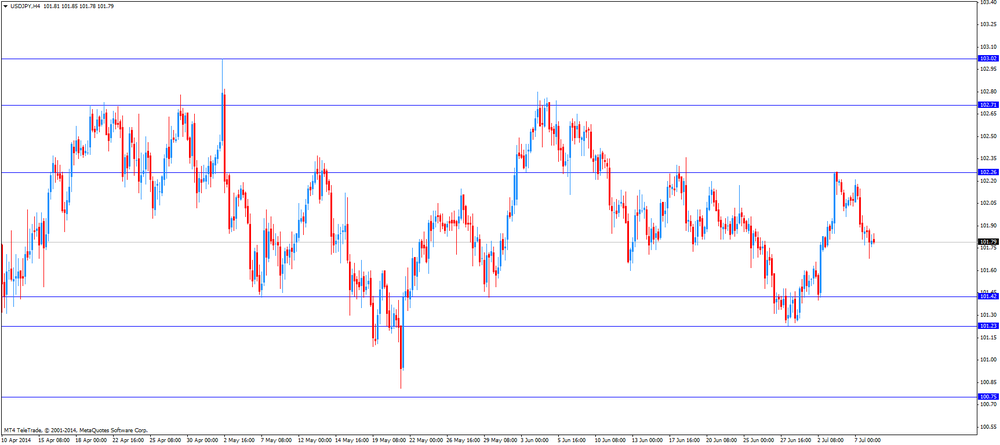

The Japanese yen climbed against the U.S. dollar due to strong economic data from Japan. Bank lending in Japan increased 2.5% in June from a rise of 2.4% in May, exceeding expectations for a 2.3% gain.

Japan's current account surplus rose to 522.8 billion yen in May from a surplus of 187.4 billion yen in April. Analysts had expected an increase to 417.5 billion yen.

EUR/USD $1.3540, $1.3585, $1.3600, $1.3625, $1.3635-45, $1.3650

USD/JPY Y101.50$, Y102.00, Y102.25, Y102.55

EUR/GBP stg0.7950, stg0.8000

AUD/USD $0.9415, $0.9450

AUD/JPY Y0.9460

USD/CAD C$1.0720, C$1.0735, C$1.0740

U.S. stock-index futures fell as investors weighed valuations before the start of the earnings season.

Global markets:

Nikkei 15,314.41 -65.03 -0.42%

Hang Seng 23,541.38 +0.46 0.00%

Shanghai Composite 2,064.02 +4.09 +0.20%

FTSE 6,780.37 -43.14 -0.63%

CAC 4,382.12 -23.64 -0.54%

DAX 9,858.61 -47.46 -0.48%

Crude oil $103.46 (-0.07%)

Gold $1323.50 (+0.49%)

(company / ticker / price / change, % / volume)

| Nike | NKE | 78.68 | +0.04% | 4.7K |

| Cisco Systems Inc | CSCO | 25.25 | +0.08% | 0.8K |

| 3M Co | MMM | 145.05 | +0.10% | 4.4K |

| AT&T Inc | T | 35.61 | +0.14% | 19.8K |

| Visa | V | 217.75 | +0.47% | 0.4K |

| Intel Corp | INTC | 31.02 | -0.03% | 1.0K |

| Wal-Mart Stores Inc | WMT | 76.04 | -0.04% | 0.9K |

| Procter & Gamble Co | PG | 80.14 | -0.06% | 0.9K |

| Merck & Co Inc | MRK | 58.48 | -0.07% | 0.1K |

| Walt Disney Co | DIS | 86.52 | -0.08% | 1.3K |

| Caterpillar Inc | CAT | 110.06 | -0.09% | 1K |

| United Technologies Corp | UTX | 114.96 | -0.12% | 0.9K |

| McDonald's Corp | MCD | 100.04 | -0.13% | 1.7K |

| Johnson & Johnson | JNJ | 106.29 | -0.17% | 3.6K |

| Verizon Communications Inc | VZ | 49.13 | -0.18% | 60.3K |

| International Business Machines Co... | IBM | 187.65 | -0.21% | 0.1K |

| Microsoft Corp | MSFT | 41.90 | -0.21% | 0.4K |

| The Coca-Cola Co | KO | 42.05 | -0.21% | 0.6K |

| Boeing Co | BA | 128.81 | -0.22% | 0.3K |

| Exxon Mobil Corp | XOM | 102.40 | -0.24% | 0.5K |

| Chevron Corp | CVX | 130.15 | -0.25% | 0.6K |

| JPMorgan Chase and Co | JPM | 56.51 | -0.28% | 8.3K |

| Pfizer Inc | PFE | 30.38 | -0.36% | 0.8K |

| General Electric Co | GE | 26.65 | -0.37% | 7.4K |

Upgrades:

Argus upgrades 3M (MMM) to Buy from Hold

Downgrades:

Other:

Visa (V) resumed with a Buy at Goldmanm target $250

MasterCard (MA) resumed with a Buy at Goldman, target $86

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia National Australia Bank's Business Confidence June 7 8

05:00 Japan Eco Watchers Survey: Current June 45.1 49.2 47.7

05:00 Japan Eco Watchers Survey: Outlook June 53.8 53.3

06:00 Germany Trade Balance May 17.7 15.7 18.8

06:45 France Trade Balance, bln June -4.1 Revised From -3.9 -4.1 -4.9

07:15 Switzerland Retail Sales Y/Y May +0.4% +1.5% -0.6%

07:15 Switzerland Consumer Price Index (MoM) June +0.3% +0.1% -0.1%

07:15 Switzerland Consumer Price Index (YoY) June +0.2% +0.2% 0.0%

08:30 United Kingdom Industrial Production (MoM) May +0.4% +0.3% -0.7%

08:30 United Kingdom Industrial Production (YoY) May +3.0% +3.1% +2.3%

08:30 United Kingdom Manufacturing Production (MoM) May +0.4% +0.5% -1.3%

08:30 United Kingdom Manufacturing Production (YoY) May +4.4% +5.6% +3.7%

09:00 Eurozone ECOFIN Meetings

09:00 Eurozone ECB's Vitor Constancio Speaks

The U.S. dollar traded lower against the most major currencies. The U.S. currency remained supported by Thursday's better-than-expected U.S. labour market data. U.S. companies added 288,000 jobs in June. The unemployment rate in the U.S. dropped to 6.1% in June from 6.3% in May.

Market participants speculate the Fed may hike its interest rate sooner than expected. They expect the release of the last Fed's monetary policy meeting on Wednesday.

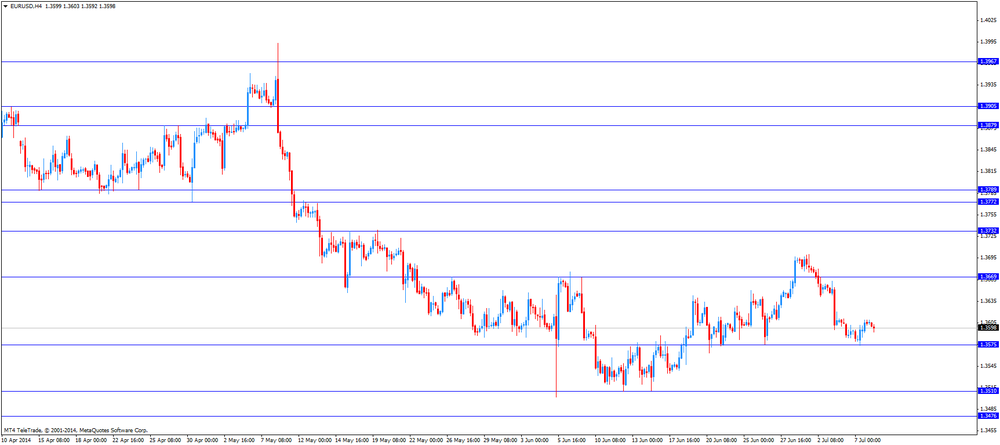

The euro traded lower against the U.S. dollar after mixed economic data from the Eurozone. Germany's trade surplus increased to €18.8 billion in May from €17.2 billion in April. April's figure was revised down from a surplus of €17.7 billion. Analysts had expected the trade surplus to decline to €15.7 billion in May.

France's trade deficit widened to €4.9 billion in June from a deficit of €4.1 billion in May. May's figure was revised down from a deficit of €3.9 billion. Analysts had expected the trade deficit to increase to €4.1 billion in May.

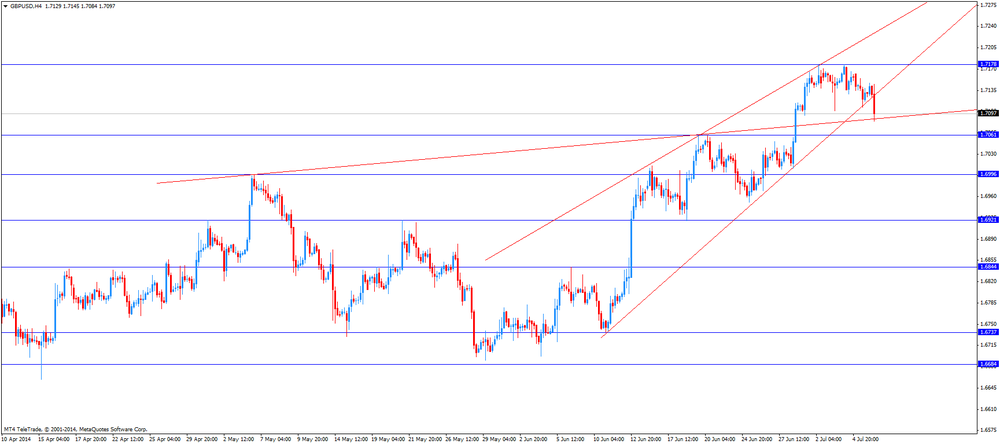

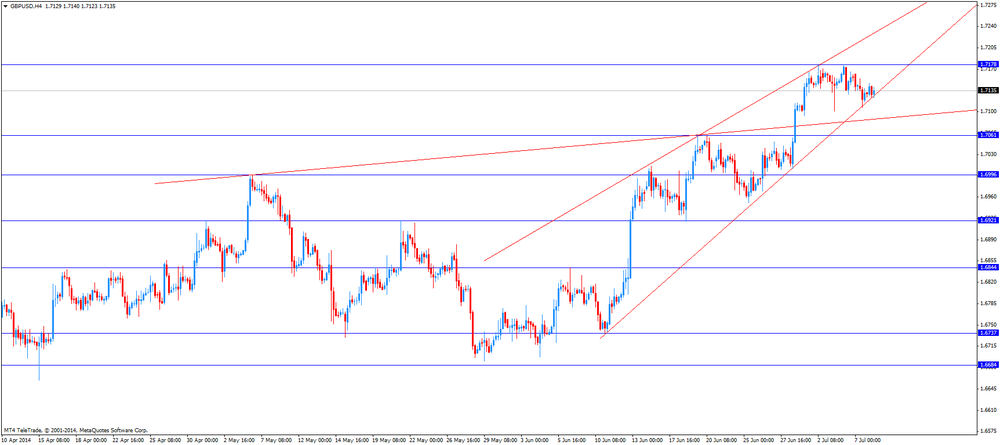

The British pound declined against the U.S. dollar due to the weaker-than-expected manufacturing production in the U.K. Manufacturing production in the U.K. declined 1.3% in May, missing expectations for a 0.5% gain, after a 0.4% rise in April. That was the largest decline since January 2013.

On a yearly basis, manufacturing production in the U.K. increased 3.7% in May, missing expectations for a 5.6% rise, after a 4.4% gain in April.

Industrial production in the U.K. dropped 0.7% in May, missing forecasts of a 0.3% increase, after the 0.4% rise in April. That was the biggest decline since August 2013.

On a yearly basis, industrial production in the U.K. rose 2.3% in May, after the 3.0% gain in April. Analysts had expected an increase of 3.1%.

The Swiss franc traded lower against the U.S. dollar after the weaker-than-expected economic data from Switzerland. Retail sales in Switzerland declined 0.6% in May, missing expectations for a 1.5% rise, after a 0.4% increase in April.

The Swiss consumer price index decreased 0.1% in June, missing expectations for a 0.1% increase, after a 0.3% gain in May.

On a yearly basis, the Swiss consumer price index was flat in June, missing expectations for a 0.2% gain, after a 0.2% rise in May.

EUR/USD: the currency pair declined to $1.3587

GBP/USD: the currency pair decreased to $1.7084

USD/JPY: the currency pair declined to Y101.70

The most important news that are expected (GMT0):

14:00 United Kingdom NIESR GDP Estimate June +0.9%

14:00 U.S. JOLTs Job Openings May 4455 4530

17:45 U.S. FOMC Member Narayana Kocherlakota

19:00 U.S. Consumer Credit May 26.8 21.3

20:30 U.S. API Crude Oil Inventories July -0.9

EUR/USD

Offers $1.3700-20, $1.3680/85, $1.3660, $1.3635

Bids $1.3565, $1.3550/40, $1.3500

GBP/USD

Offers $1.7300, $1.7250, $1.7230, $1.7200

Bids $1.7095/90, $1.7065, $1.7035/30, $1.7010

AUD/USD

Offers $0.9505, $0.9480, $0.9465/70, $0.9420, $0.9400

Bids $0.9360, $0.9330, $0.9320, $0.9300

EUR/JPY

Offers Y140.50, Y140.00, Y139.50, Y139.30, Y139.00

Bids Y138.20, Y138.00, Y137.90

USD/JPY

Offers Y102.80, Y102.65, Y102.50, Y102.30, Y102.00

Bids Y101.70, Y101.40/30, Y101.20, Y101.10/00, Y100.80

EUR/GBP

Offers stg0.8030, stg0.8000, stg0.7970, stg0.7950

Bids stg0.7905-890, stg0.7800

Stock indices traded lower after mixed economic data from the Eurozone and disappointing manufacturing production from the U.K. Germany's trade surplus increased to €18.8 billion in May from €17.2 billion in April. April's figure was revised down from a surplus of €17.7 billion. Analysts had expected the trade surplus to decline to €15.7 billion in May.

France's trade deficit widened to €4.9 billion in June from a deficit of €4.1 billion in May. May's figure was revised down from a deficit of €3.9 billion. Analysts had expected the trade deficit to increase to €4.1 billion in May.

Manufacturing production in the U.K. declined 1.3% in May, missing expectations for a 0.5% gain, after a 0.4% rise in April. That was the largest decline since January 2013.

Industrial production in the U.K. dropped 0.7% in May, missing forecasts of a 0.3% increase, after the 0.4% rise in April. That was the biggest decline since August 2013.

Air France-KLM shares dropped 4.6% after the company lowered its full-year profit forecast.

Commerzbank AG shares declined 4% after a person with knowledge of the matter said the bank was negotiating a settlement with U.S. authorities over their dealings with countries blacklisted by the U.S.

Current figures:

Name Price Change Change %

FTSE 100 6,790.67 -32.84 -0.48%

DAX 9,857.83 -48.24 -0.49%

CAC 40 4,385.81 -19.95 -0.45%

The Office for National Statistics released manufacturing production data for the U.K. Manufacturing production in the U.K. declined 1.3% in May, missing expectations for a 0.5% gain, after a 0.4% rise in April. That was the largest decline since January 2013.

On a yearly basis, manufacturing production in the U.K. increased 3.7% in May, missing expectations for a 5.6% rise, after a 4.4% gain in April.

Industrial production in the U.K. dropped 0.7% in May, missing forecasts of a 0.3% increase, after the 0.4% rise in April. That was the biggest decline since August 2013.

On a yearly basis, industrial production in the U.K. rose 2.3% in May, after the 3.0% gain in April. Analysts had expected an increase of 3.1%.

Despite these weak figures, the broader picture remained positive. Investors speculate that the Bank of England will hike its interest rate sooner than expected.

Asian stock indices traded little changed in a subdued trading session. Investors are awaiting the release of the Chinese consumer price index and producer price index and the Federal Reserve's last policy meeting on Wednesday.

Strong economic data was released in Japan. Bank lending in Japan increased 2.5% in June from a rise of 2.4% in May, exceeding expectations for a 2.3% gain.

Japan's current account surplus rose to 522.8 billion yen in May from a surplus of 187.4 billion yen in April. Analysts had expected an increase to 417.5 billion yen.

Indexes on the close:

Nikkei 225 15,314.41 -65.03 -0.42%

Hang Seng 23,541.38 +0.46 0.00%

Shanghai Composite 2,064.02 +4.09 +0.20%

EUR/USD $1.3585, $1.3600, $1.3625, $1.3635-45, $1.3650

USD/JPY Y101.50, Y102.00, Y102,.25

AUD/USD $0.9415, $0.9450

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia National Australia Bank's Business Confidence June 7 8

05:00 Japan Eco Watchers Survey: Current June 45.1 49.2 47.7

05:00 Japan Eco Watchers Survey: Outlook June 53.8 53.3

06:00 Germany Trade Balance May 17.7 15.7 18.8

06:45 France Trade Balance, bln June -4.1 Revised From -3.9 -4.1 -4.9

07:15 Switzerland Retail Sales Y/Y May +0.4% +1.5% -0.6%

07:15 Switzerland Consumer Price Index (MoM) June +0.3% +0.1% -0.1%

07:15 Switzerland Consumer Price Index (YoY) June +0.2% +0.2% 0.0%

08:30 United Kingdom Industrial Production (MoM) May +0.4% +0.3% -0.7%

08:30 United Kingdom Industrial Production (YoY) May +3.0% +3.1% +2.3%

08:30 United Kingdom Manufacturing Production (MoM) May +0.4% +0.5% -1.3%

08:30 United Kingdom Manufacturing Production (YoY) May +4.4% +5.6% +3.7%

The U.S. dollar traded lower against the most major currencies. The U.S. currency remained supported by Thursday's better-than-expected U.S. labour market data. U.S. companies added 288,000 jobs in June. The unemployment rate in the U.S. dropped to 6.1% in June from 6.3% in May.

Market participants speculate the Fed may hike its interest rate sooner than expected. They expect the release of the last Fed's monetary policy meeting on Wednesday.

The New Zealand dollar increased against the U.S dollar despite the weak business confidence data from New Zealand. The NZIER business confidence index declined to 32 in the second quarter from 52 the previous quarter.

The Australian dollar traded higher against the U.S. dollar after the better-than-expected economic data from Australia. The National Australia Bank's Business Confidence index was up to 8 in June from 7 in May.

The Japanese yen climbed against the U.S. dollar due to strong economic data from Japan. Bank lending in Japan increased 2.5% in June from a rise of 2.4% in May, exceeding expectations for a 2.3% gain.

Japan's current account surplus rose to 522.8 billion yen in May from a surplus of 187.4 billion yen in April. Analysts had expected an increase to 417.5 billion yen.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair declined to Y101.70

The most important news that are expected (GMT0):

09:00 Eurozone ECOFIN Meetings

09:00 Eurozone ECB's Vitor Constancio Speaks

14:00 United Kingdom NIESR GDP Estimate June +0.9%

14:00 U.S. JOLTs Job Openings May 4455 4530

17:45 U.S. FOMC Member Narayana Kocherlakota

19:00 U.S. Consumer Credit May 26.8 21.3

20:30 U.S. API Crude Oil Inventories July -0.9

EUR / USD

Resistance levels (open interest**, contracts)

$1.3704 (2298)

$1.3679 (2382)

$1.3645 (277)

Price at time of writing this review: $ 1.3603

Support levels (open interest**, contracts):

$1.3576 (312)

$1.3558 (1724)

$1.3533 (2315)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 21229 contracts, with the maximum number of contracts with strike price $1,3800 (3331);

- Overall open interest on the PUT options with the expiration date August, 8 is 28477 contracts, with the maximum number of contracts with strike price $1,3500 (6531);

- The ratio of PUT/CALL was 1.34 versus 1.38 from the previous trading day according to data from July, 7

GBP/USD

Resistance levels (open interest**, contracts)

$1.7402 (998)

$1.7303 (1486)

$1.7206 (1361)

Price at time of writing this review: $1.7127

Support levels (open interest**, contracts):

$1.7092 (1227)

$1.6996 (1578)

$1.6898 (1633)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 14887 contracts, with the maximum number of contracts with strike price $1,7250 (1981);

- Overall open interest on the PUT options with the expiration date August, 8 is 17766 contracts, with the maximum number of contracts with strike price $1,6900 (1633);

- The ratio of PUT/CALL was 1.19 versus 1.25 from the previous trading day according to data from Jule, 7

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

(raw materials / closing price /% change)

WTI Crude Oil 103.43 -0.10%

Natural Gas 4.22 -0.05%

Gold 100oz 1,316.5 0.00%

(index / closing price / change items /% change)

S&P/ASX 200 5,524.98 +33.73 +0.61%

TOPIX 1,285.24 +6.65 +0.52%

SHANGHAI COMP 2,059.37 -3.85 -0.19%

HANG SENG 23,546.36 +14.92 +0.06%

FTSE 100 6,865.71 +0.50 +0.01%

CAC 40 4,468.98 -20.90 -0.47%

DAX 10,009.17 -20.26 -0.20%

Dow +92.02 17,068.26 +0.54%

Nasdaq +28.2 4,485.93 +0.63%

S&P +10.82 1,985.44 +0.55%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3606 +0,08%

GBP/USD $1,7131 -0,16%

USD/CHF Chf0,8934 -0,02%

USD/JPY Y101,87 -0,21%

EUR/JPY Y138,61 -0,12%

GBP/JPY Y174,50 -0,34%

AUD/USD $0,9368 +0,04%

NZD/USD $0,8749 +0,11%

USD/CAD C$1,0681 +0,27%

(time / country / index / period / previous value / forecast)

01:30 Australia National Australia Bank's Business Confidence June 7

05:00 Japan Eco Watchers Survey: Current June 45.1 49.2

05:00 Japan Eco Watchers Survey: Outlook June 53.8

06:00 Germany Trade Balance May 17.7 15.7

06:45 France Trade Balance, bln June -3.9 -4.1

07:00 United Kingdom Halifax house price index June +3.9% -0.3%

07:00 United Kingdom Halifax house price index 3m Y/Y June +8.7%

07:15 Switzerland Retail Sales Y/Y May +0.4% +1.5%

07:15 Switzerland Consumer Price Index (MoM) June +0.3% +0.1%

07:15 Switzerland Consumer Price Index (YoY) June +0.2% +0.2%

08:30 United Kingdom Industrial Production (MoM) May +0.4% +0.3%

08:30 United Kingdom Industrial Production (YoY) May +3.0% +3.1%

08:30 United Kingdom Manufacturing Production (MoM) May +0.4% +0.5%

08:30 United Kingdom Manufacturing Production (YoY) May +4.4% +5.6%

09:00 Eurozone ECOFIN Meetings

09:00 Eurozone ECB's Vitor Constancio Speaks

14:00 United Kingdom NIESR GDP Estimate June +0.9%

14:00 U.S. JOLTs Job Openings May 4455 4530

17:45 U.S. FOMC Member Narayana Kocherlakota

19:00 U.S. Consumer Credit May 26.8 21.3

20:30 U.S. API Crude Oil Inventories July -0.9

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.