- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 08-04-2022

- The USD/JPY ended the week on the right foot, gaining 1.42%.

- High US Treasury yields underpinned the USD/JPY pair.

- USD/JPY Price Forecast: The pair is upward biased, but it might correct courtesy of RSI showing overbought conditions.

The USD/JPY is set to finish the week above the 124.00 mark for the first time in the year, though short of the YTD high at 125.10, amid a mixed market mood and upward pressured US Treasury yields. At the time of writing, the USD/JPY is trading at 124.27

US equities closed mixed, portraying the market sentiment. US Treasury yields rose, led by the 10-year benchmark note rate up to four and a half basis points, sat at 2.706%, a tailwind for the USD/JPY due to its positive correlation. If yields rise, the USD/JPY pair does it too.

On Friday, the USD/JPY opened around 123.90 but then fell towards the mid-pòint between the S1-Daily pivot point at 123.67, a price level where bulls took charge and lifted the pair towards fresh weekly highs at 124.67.

USD/JPY Price Forecast: Technical outlook

The USD/JPY remains upward biased. The daily moving averages (DMAs) reside well below the spot price, confirming the uptrend. However, the Relative Strenght Index (RSI) at 76.15 is aiming higher and at overbought levels, which means that the pair might be headed towards a correction before resuming up.

If the scenario of a lower correction plays out, the USD/JPY’s first support would be 124.00. A decisive break would expose 123.67. Once cleared, the next support would be March 244 daily high at 122.41.

Upwards, the USD/JPY’s first resistance will be 125.00, which once breached would send the pair towards the YTD high at 125.10, followed by June 2015 cycle highs near 125.85, and then the April 2001 swing high around 126.85.

- The EUR/USD to finish the week with losses of 1.56%.

- Geopolitics, FOMC minutes, and Fed speaking kept the euro pressured.

- EUR/USD Price Forecast: The pair is downward biased, but a dragon-fly doji suggests that the pair might consolidate in the near term.

The EUR/USD remains pressured and aims to finish the week on the wrong foot amidst a mixed market sentiment. The EUR/USD is trading at 1.0876 as traders prepare for the weekend.

Geopolitics and hawkish Fed keep sentiment mixed

Investors’ mood was mixed during the North American session. US equities fluctuated while market players’ focus turned to geopolitics and Fed speakers. However, in the next week, the attention will be on March’s Consumer Price Index, which could shed some light on Fed expectations of inflation.

Next week, the European Central Bank (ECB) will have its rate decision. Late in the mid-North American session, Bloomberg sources reported that the ECB is crafting a crisis tool if bond yields jump, but it is still in the design stage. Aside from central banking chatter, the EU announced a subsequent tranche of sanctions on Russian oligarchs and President Putin’s family members.

On Friday, US Treasury yields finished the session with gains along the yield curve, reflecting the aggressive stance of the Fed. The US 10-year benchmark note rose five basis points, sat at 2.701%, and underpinned the greenback, as shown by the US Dollar Index, up 0.09%, currently at 99.834.

The Federal Reserve March meeting minutes showed that most policymakers were looking for a 50-bps increase if not for the Ukraine conflict; instead, the Fed hiked 25 bps. At the same meeting, the US central bank laid the ground to reduce its $9 trillion balance sheet by $95 billion a month, $60 on US Treasuries, and $35 billion on mortgage-backed securities (MBS).

As the Friday North American session is about to finish, money market futures have priced in a 88% chance of a 0.50% rate hike to the Federal Funds Rate (FFR) in the May 4 meeting.

EUR/USD Price Forecast: Technical outlook

The EUR/USD bias remains downwards and further cemented it when on April 4, the EUR/USD broke the upslope trendline of a rising wedge, which opened the door towards 1.0700, but first would need to overcome some hurdles on its way down. Nevertheless, Friday’s price action is forming a candlestick named a “dragon-fly doji,” which means that bears jumped off the boat as bulls lifted the pair from weekly lows to the 1.0875 region.

That said, the EUR/USD first support would be 1.0848. A breach of the latter would expose the 2022 YTD low at 1.0806, followed by April 2020 swing lows around 1.0727, and then the abovementioned 1.0700 mark.

- US equity indices were mixed on Friday, with the S&P 500 a tad lower on the day just under 4500.

- The Dow, meanwhile, gained about 0.5% and the Nasdaq 100 dipped a further 1.2%, reflective of surging US yields.

Major US equity indices were mixed on Friday, with the S&P 500 ending the session flat near 4500, the Dow gaining about 0.5% to trade near 34,750 and the Nasdaq 100 index losing about 1.5% to fall to fresh weekly lows in the 14,300s, where it was testing its 50-Day Moving Average. All major indices ended the week in the red, though the Dow was down only about 0.1%, versus losses of more than 1.0% for the S&P 500 and nearly 3.5% for the Nasdaq 100.

The main driver of the divergence in performance between the Dow and Nasdaq on the final day of the week, and indeed the week in its entirety, has been the sharp rise in US bond yields amid recent hawkish Fed rhetoric. US 10-year yields jumped 30 bps on the week to end above 2.70%, as traders up their bets as to where the Fed’s terminal rate will be. The effect on equities is that stocks with a higher “opportunity cost” to hold, i.e. those whose valuation is based disproportionately more on expectations for future earnings growth rather than current earnings, perform worse.

These are disproportionately tech stocks that crowd the Nasdaq 100 and also dominate the S&P 500. Meanwhile, stocks with a positive correlation to interest rates, such as financials, have performed better. Indeed, the S&P 500 GICS Financials sector was up 1.2% on Friday, the second-best performing sector on the day after Energy, which rallied nearly 3.0%.

While geopolitics remains in the spotlight, Fed policy has returned to the forefront as the dominant equity market theme, and this is set to remain the case next week with investors on notice for the latest US Producer and Consumer Price Inflation readings. Next week also sees the unofficial start to the Q1 2022 earnings season as big US banks start reporting figures.

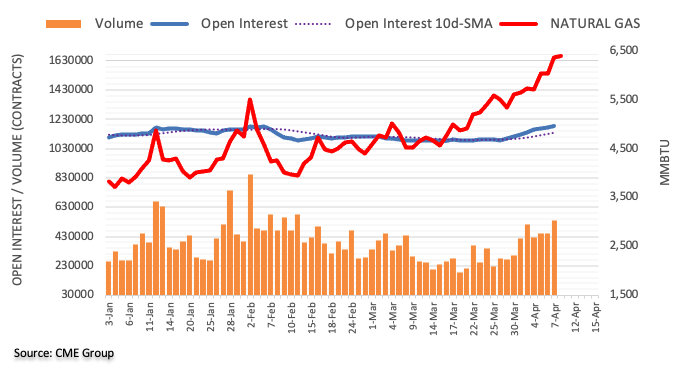

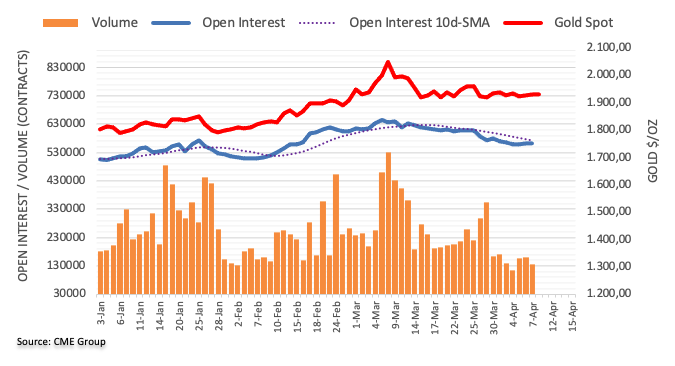

- The yellow metal advances some 0.60% on Friday as it shrugs off geopolitical issues.

- US Treasury yields rise, which would usually be a headwind for gold, but not today.

- The Federal Reserve lays the ground for 0.50% rate hikes and the beginning of Quantitative Tightening (QT) in May.

- JP Morgan warns that commodities could surge by 40% - via Bloomberg.

- Gold Price Forecast (XAU/USD): Consolidated, but upside risks remain as long as it stays above $1900.

Gold (XAU/USD) remains buoyant despite rising US Treasury yields amidst an upbeat market mood, as investors shrugged off the Ukraine-Russia brawl and a hawkish Federal Reserve, which according to March’s minutes, would hike 50-bps in the May meeting as well as reducing the $9 trillion balance sheet. At the time of writing, XAU/USD is trading at $1944 a troy ounce.

High US Treasury yields underpinned the greenback

On Friday, US Treasury yields keep reflecting the aggressive posture of the US central bank. Treasury yields from the 2-year bills to 30-year bonds gain between five and seven basis points. The US 10-year benchmark note is up to five basis points, sitting at 2.711%, the highest reached since May 2019.

The US Dollar Index, a gauge of the greenback’s value vs. a basket of its peers, rises 0.11%, and sits at 99.862, underpinned by US yields.

On Wednesday, the Federal Reserve released the minutes of its March meeting. The minutes showed that most policymakers were looking for a 50-bps increase if not for the Russian invasion of Ukraine, so hiking 25 bps was prudent to do. During the same meeting, the US central bank lay the ground to reduce its $9 trillion balance sheet by $95 billion a month, $60 on US Treasuries, and $35 billion on mortgage-backed securities (MBS).

Money market futures have priced in a 88% chance of a 0.50% rate hike to the Federal Funds Rate (FFR) in the May 4 meeting.

Elsewhere, analysts at JP Morgan warned that commodities could surge by 40% if investors boost their allocation to raw materials as elevating inflation accelerates, according to Bloomberg. That would trigger inflows to the yellow metal as a hedge against inflation as the Fed hikes rates to tame inflation but at the expense of slowing the economy.

On Thursday, St. Louis President James Bullard said that the Fed policy rate was too low, by 300 basis points. He added that the Fed is not that far behind the curve and expects the Federal Funds Rate (FFR) to end the year at around 3.5%.

Gold Price Forecast (XAU/USD):: Technical outlook

Gold is tilted upwards, but since March 15 consolidated in the $1900-$1966 range as the Fed hiked rates for the first time since 2018. Despite that price action is sideways, the daily moving averages (DMAs) reside below the spot price, with an upslope. Worth noting that the Relative Strenght Index (RSI) at 53.49 is in bullish territory, aiming higher, further cementing the upward bias.

With that said, XAU/USD’s first resistance would be March 31 daily high at $1949.71. A breach of the latter would expose March 24 swing high at $1966.02, followed by a test of the $2000 mark.

- GBP/USD has rebounded back to the 1.3030 area after earlier hitting its lowest since November 2020 at 1.29817.

- The pair is on course for a weekly loss of about 0.6%, weighed by buck strength amid hawkish Fed vibes.

GBP/USD hit its lowest level since November 2020 at 1.29817 in earlier Friday trade, weighed at the time by a broad strengthening of the US dollar that say the DXY momentarily eclipse 100 for the first time in nearly two years. But the currency pair has since rebounded to around the 1.3030 level, erasing the day’s losses to about 0.3% versus around 0.7% at worst levels.

That leaves cable on course to post a weekly loss of about 0.6%. The main driver of the USD strength that drove this week’s GBP/USD losses was Fed hawkishness, with the minutes released on Wednesday showing many of the bank’s policymakers were pushing for a 50 bps rate hike at the last meeting, despite Russia’s invasion of Ukraine. The minutes showed strong support for getting rates back to so-called “neutral” quickly, supporting market expectations that the Fed will lift rates in 50 bps intervals at coming meetings.

Meanwhile, the minutes touted a rapid balance sheet reduction rate of $95B per month to start potentially in May, seemingly in line with recent remarks from Fed policymakers that “rapid” balance sheet reduction should start “soon”. Safe-haven demand also likely supported the buck this week amid a drop in global equities, ongoing geopolitical angst and concerns about the upcoming French election.

UK factors did not play a big part in the price action this week, though arguably, sterling upside is being capped by expectations that the BoE is going to turn more dovish in the coming meetings. UK GDP, labour market and Consumer Price Inflation data next week will give traders a little more to think about, although for GBP/USD, US Consumer and Producer Price Inflation readings on Tuesday and Wednesday will be the main event.

An upside surprise in the US data might spur further hawkish Fed bets and further GBP/USD downside. Over the next weeks and months, bears are eyeing a move lower towards the November 2020 lows 1.2850 area and at 1.2680.

- The USD/CHF seesawed in the 0.9327-73 range as the pair failed to conquer 0.9400.

- An upbeat market mood was no excuse for the safe-haven Swiss franc to gain vs. the greenback.

- USD/CHF Price Forecast: A series of successive higher highs/lows in the 4-hour chart keep the uptrend intact.

The greenback gives back most of its weekly gains vs. the Swiss franc, as the USD/CHF gains 0.06% during the day amidst an upbeat market mood. At the time of writing, the USD/CHF is trading at 0.9338.

On Friday, global equities rallied, as Asian and European equities closed with gains. In the US, except for the heavy-tech Nasdaq, most indices are trading in the green as market players disregard Fed tightening and Russo-Ukraine tussles.

Overnight, the USD/CHF opened near the session’s lows early in the Asian Pacific session and since then edged higher, towards the daily high at 0.9373. However, once the North American session began, the pair slid and recorded a new daily low at 0.9327, right at the central daily pivot point.

USD/CHF Price Forecast: Technical outlook

The USD/CHF upward bias remains intact. The daily moving averages (DMAs) reside well below the spot price, though almost horizontally, beneath the 0.0.9264 50-DMA.

So far, the USD/CHF 4-hour chart shows that the spot price keeps trading above the bullish flag and printed successive series of higher highs/lows, meaning that the uptrend remains. In fact, the USD/CHF reached the daily high as the Relative Strength Index (RSI) headed towards 57.34, and since then, RSI consolidated as its slope turned horizontal.

That said, the USD/CHF might print another leg-up, and its first resistance would be 0.9349. A clear break would expose March 27 and 29 highs area around the 0.9370-80 region, which, once broken, might send the pairs towards March 16 daily high at 0.9460, but first would need to reclaim the 0.9400 mark once broken.

Technical levels to watch

- The USD/RUB is set to end the week with losses, of 6.18%, despite Friday’s jump.

- The Russia-Ukraine hostilities and peace talks continue but at a slower pace.

- USD/RUB Price Forecast: Bulls charged at the break of the 200-DMA and pushed the pair up 500-pips.

The USD/RUB fell and reached a fresh monthly low at 75.6625 but is back above the 200-day moving average (DMA), which lies at 78.2997, in the middle of a mixed sentiment trading session. At the time of writing, the USD/RUB is trading at 79.7500, up 0.64%.

Geopolitical jitters linked to the Russia-Ukraine war were shrugged off by market players, as shown by global equities rising. The Ukrainian advisor Podolyak said negotiations with Russia continue online constantly, but the mood changed after the Bucha events.

In the meantime, US Treasury yields remain higher on Friday, led by the 10-year T-note rising five basis points, sitting at 2.70%, while the buck rose. The US Dollar Index, a gauge of the greenback’s value vs. a basket of its rivals, is back below 100, up 0.09%, at 99.844, after reaching 100.189 for the first time since May 2020.

On Friday, the Russian Central Bank cut rates by 300 bps, from 20% to 17%, surprisingly, as market players expected the central bank to hold rates.

Elsewhere on Wednesday, the Federal Reserve revealed its March minutes. The Fed stated that most participants were eager to hike rates 50 bps if not for Ukraine. The Fed agreed to cap its balance sheet by an amount of $95 billion, $60 billion on US Treasuries, and $35 billion on mortgage-backed securities (MBS). Furthermore, the minutes showed that participants wanted the Quantitative Tightening to begin by May, following the May 4 meeting, where market participants, as demonstrated by STIRS, are pricing in an 88% chance of a 50 bps hike.

On Thursday, St. Louis President James Bullard said that the Fed policy rate was too low, by 300 basis points. He added that the Fed is not that far behind the curve and expects the Federal Funds Rate (FFR) to end the year at around 3.5%.

Late during the day, Chicago’s Fed President Charles Evans said that the Fed would probably going to get neutral setting by the end of this year or early next.

USD/RUB Price Forecast: Technical outlook

The USD/RUB upward bias was tested as the price broke below the 200-day moving average (DMA) at 78.3059. On Wednesday, I noted that “a daily close under the 80.3254 level would further extend losses, and the USD/RUB could aim toward the 200-day moving average (DMA).” On Thursday, that happened, and a close was achieved at 79.2467, opening the door for a test of the 200-DMA.

Early Friday, the USD/RUB broke the 200-DMA and reached a daily low at 75.9810, but higher US yields underpinned the greenback and lifted the pair above the 200-DMA and beyond the 79.5000 mark.

That said, the USD/RUB first resistance would be 82.7882. A breach of the latter would expose essential resistance levels. The next supply zone would be the 100-DMA at 83.8276, followed by the 50-DMA at 92.63305.

- EUR/JPY remains well within this week's ranges on Friday just above 135.00 and on course to end the week flat.

- Pre-French election nerves perhaps prevented the pair from benefitting from a rise in Eurozone yields.

Reports that the ECB has a new crisis tool in the works that would address disorderly moves in bond yields did not seemingly have a lasting impact on EUR/JPY, which continues to trade within this week’s 134.30-135.70ish ranges. Euro traders are likely to find it reassuring to hear the ECB is already thinking about how to essentially prevent a repeat of the wild bond market moves seen during the EU debt crisis a decade ago, and this might be supportive at the margin for the euro going forward amid lower risk premia.

At current levels just above 135.00, EUR/JPY looks set to close out the week flat, despite the fact that Eurozone yields rose. Thursday’s ECB minutes were more hawkish than expected, contributing alongside hawkish Fed minutes and Fed rhetoric to a rise in yields across developed (non-Japan) markets. In recent weeks, this has hurt the appeal of the yen. Some may still view the yen as oversold given its recent underperformance, which could partly explain why EUR/JPY didn’t rally this week.

But if the trend in bond markets continues next week, then EUR/JPY might be headed above its recent range and back towards March highs in the 137.00s. But one risk event that could spoil and potential rally, and likely weighed on EUR/JPY this week, is the first round of the French Presidential election on Sunday. Far-right, anti-EU candidate Marianne Le Pen has caught up to President Emmanuel Macron in recent weeks and is nearly tied with him.

Her election could really stir things up in the European Union and presents a downside risk for the euro. Elsewhere, the ECB will be setting monetary policy and given it is one of those meetings where new forecasts are not released, no major policy changes are expected. The Governor of the BoJ will be appearing a few times and will likely reiterate the bank’s ultra-dovish stance.

Analysts at Danske Bank revised their forecast for the European Central Bank and now look for a rate hike in September and December. Despite the more hawkish stance from the ECB, they still forecast EUR/USD at 1.05 in twelve months.

Key Quotes:

“We revise our ECB call slightly after the recent Governing Council (GC) comments, hawkish minutes and inflation surprises. We now look for a 25bp rate hike in both September and December 2022. Beyond that, we do not look for a prolonged hiking cycle into 2023 at the current stage as inflation falls back to target and Fed tightening will also have contributed to a significant tightening of financing conditions globally – thereby worsening the economic outlook.”

“While we expect the statement to re-confirm the decisions taken at the March meeting just 4 weeks ago, with its guidance to end APP during Q3 and the first hike to come 'some time' after the end of net asset purchases, we believe the press conference will be the most interesting part, where we expect Lagarde to repeat the gradual, flexibility and optionality mantra. While we do not expect Lagarde to directly mention a September rate hike as a possibility, similar to other voices in the GC, we believe she will keep the door open as a way to respond to high inflation pressures.”

“It seems likely that ECB is moving towards a more hawkish stance. For EUR/USD, if this is indeed confirmed at the upcoming meeting then we may see some upside risk to spot on the day. However, looking beyond the event of the ECB meeting itself, downside risk to EUR/USD spot will likely persist as spreads widen further in Europe (vs. Germany) and the economy continues its slowdown. (…) We continue to forecast 1.05 in 12M.”

Expectations of a 50 bp interest rate hike from the Bank of Canada will help the Canadian dollar according to analysts at MUFG Bank. They have a trade idea of shorting USD/CAD at 1.2535, with a target at 1.2150.

Key Quotes:

“The data (jobs report) was consistent with the BoC hiking by a larger 50bps at its meeting next week. The 72.5k gain in jobs reflected job losses in part-time jobs but another hefty increase of 92.7k in full-time jobs. The unemployment rate as a result fell to 5.3%, a new low in the data going back to the mid-1970s. This clearly shows that the labour market in Canada is reaching capacity constraints which will raise concerns over the current monetary stance.”

“The balance between the BoC hiking by 25bps or 50bps is a close call but the market now is positioned slightly more in favour of 50bps and the jobs data coupled with near-term inflation risks and the opportunity to act more aggressively in sync with the Fed, we see a 50bp hike next week. That should keep CAD well supported at a time when we expect crude oil prices to begin drifting higher from here.”

- Despite the stronger dollar and higher US yields, gold pushed to fresh weekly highs in the $1940s in recent trade.

- In doing so, it broke above its 21DMA, and is now eyeing a test of late March highs in the $1960s.

- Demand for inflation protection is seemingly underpinning the precious metal, with US inflation data next week in focus.

Despite a continued push higher in the US dollar that on Friday saw the DXY hit 100 for the first time since May 2020, and a continued push higher in US yields across the curve, with the 10-year hitting 2.70% for the first time since March 2019, spot gold (XAU/USD) remains in demand. Even though a stronger dollar makes it more expensive for the holders of international currencies and higher yields increase its “opportunity cost” as a non-yielding asset, XAU/USD recently pushed to the north of its 21-Day Moving Average in the $1930s to advance to fresh weekly highs in the mid-$1940s.

XAU/USD bulls are eyeing a break above last week’s highs just under $1950, which could open the door to a push towards late March highs in the $1960s. Seemingly, gold is being supported at present in the face of unfavourable financial conditions (i.e. strong USD and higher yields) amid continued strong demand for 1) safe havens amid ongoing geopolitical worries and 2) inflation protection.

Indeed, gold traders will be closely eyeing the release of US Consumer and Producer Price Inflation metrics for March next Tuesday and Wednesday, which are likely to show a large MoM jump due to the impact of the Russo-Ukraine war. If even larger than expected, this could trigger fresh demand for inflation protection and launch XAU/USD towards the $1960s.

But a higher-than-expected inflation print will exert further pressure on the Fed to be even more hawkish than it already is. A difficulty that traders are going to have in the coming quarters is to judge the relative impact of Fed tightening (bearish for gold) against demand for inflation protection (bullish for gold).

Data released on Friday showed the Canadian economy created 73.000 jobs in March. Analysts at the National Bank of Canada point out that after a spectacular hiring spree in February, a pause would have been quite normal but did not occur. They explained private sector hiring continued, particularly in the sectors hardest hit by the pandemic, where employment levels are now at a cyclical high.

Key Quotes:

“We are also pleased that job gains stemmed from full-time employment. These developments have allowed the unemployment rate to reach an all-time low in the country. This is partly due to the significant drop in Quebec's unemployment rate to a new record low, but we also note that all but two provinces have unemployment rates at or below their pre-crisis levels.”

“After this recent boom, it should come as no surprise that employment gains will likely moderate from here on out. The tightness of the labour market means that while companies still have very elevated hiring intentions according to the Bank of Canada's latest Business Outlook Survey, they may have difficulty finding candidates.”

“While the current monetary policy would be appropriate in times of economic difficulty, it is simply inadequate in the present situation (arguably for several months now). This morning's report cements our view that the BoC will raise rates by 50 basis points next week.”

- USD/JPY heads for the highest daily close since August 2015.

- The US dollar remains strong versus the Japanese yen supported by higher US yields.

- The divergence between the Bank of Japan and the Fed is widening.

The USD/JPY is rising for the sixth day in a row on Friday. During the American session climbed to 124.67, the highest level since March 28, and then pulled back toward 124.30 on the back of a volatile US dollar.

US yields continue to tell the story

The USD/JPY continues to move in line with US yields. The 10-year peaked earlier at 2.72%, the highest since February 2019 and the 30-year to 2.73% the highest since May 2019. The key driver is the plan of the Federal Reserve to raise interest rates more aggressively and to start the reduction of its balance sheet.

The ongoing decline in bonds still offers support to the greenback. The DXY is now up just 0.10% but earlier, it reached 100.19, the highest in almost two years.

The yen is among the worst performers, also affected by the improvement in risk sentiment. Stocks in the US are trimming weekly losses. The Dow Jones is up by 0.63% and the Nasdaq is still down, falling by 0.61% but off lows.

The USD/JPY is about to post the fifth consecutive weekly gain. The divergence of the monetary policy path of the Federal Reserve and the Bank of Japan is set to widen and could continue to support the rally of the pair, which is trading at levels not seen since 2015.

Technical levels

- The British pound is set to finish the week on a negative tone, down 0.83%.

- The US Dollar Index pierced the 100 mark for the first time since May 2020.

- GBP/USD Price Forecast: Failure at 1.3200 exacerbated the fall towards 1.3000, which once broken, would send the pair towards 1.2855.

The British pound collapsed at one time under the 1.3000 mark early in the North American session, reaching a one-year and half fresh low at 1.2982. However, GBP bulls recovered the figure amidst a mixed market mood, with European equities gaining while US counterparts fluctuated. At the time of writing, the GBP/USD is trading at 1.3020.

Mixed market sentiment on higher US T-bond yields and a strong greenback weighs on cable

The war between Russia and Ukraine continues, though it appears to be disregarded in Friday’s session. Meanwhile, US Treasury yields are shooting higher, with the US 10-year benchmark note rising six basis points, sitting at 2.728%, underpinning the greenback. The US Dollar Index, a gauge of the buck’s value against a basket of its peers, rallies above 100, up 0.29%, at 100.026, for the first time since May 2020.

Fed speakers crossed the wires on Thursday, led by the uber hawk St. Louis President James Bullard. He said that the Fed policy rate was too low, by 300 basis points. Bullard added that the Fed is not that far behind the curve and expects the Federal Funds Rate (FFR) to end the year at around 3.5%.

In the meantime, Chicago’s Fed President Charles Evans said that the Fed would probably going to get neutral setting by the end of this year or early next.

An absent UK economy docket left GBP/USD traders adrift to US economic data. Meanwhile, the US docket featured Wholesale Inventories for February, which came at 2.5% m/m, higher than the 2.1% estimated.

GBP/USD Price Forecast: Technical outlook

The GBP/USD is further cementing its downward bias, with its failure to cling to 1.3200 opened the door to a re-test of the 1.3000 figure. It’s worth noting that despite the sharp fall of the GBP/USD towards fresh 17-month-lows, the Relative Strength Index (RSI) is at 33.81 within bearish territory, but with enough room to spare, so don’t discount another leg-down.

That said, the GBP/USD first support level on its way down would be 1.3000. A breach of the latter would expose the November 2020 lows near 1.2855, followed by September 2020 lows around 1.2675.

In a joint press conference alongside UK PM Boris Johnson on Friday, German Chancellor Olaf Scholz said that it is not possible to source the amount of gas that Germany needs without Russia, reported Reuters. However, he noted that he thought Germany would be able to substitute Russian oil imports this year, and said that Germany is optimistic that it is going to be able to end Russian gas imports (though he didn't give a time frame).

Scholz and Johnson both pledged to continue sending significant amounts of weapons to Ukraine.

The European Central Bank is creating a crisis tool to address a potential jump in bond yields, Bloomberg reported on Friday. The bank is yet to decide if this backstop would be announced pre-emptively, the report added, noting that the tool remains at the stage where it is still being designed by staff.

Market Reaction

The euro did not react to the latest reports. But the report highlights one of the key dilemmas, or balancing act, that the ECB must face. On the one hand, the bank clearly needs to move in a direction of tighter monetary policy conditions given the inflation backdrop in the Eurozone, something increasingly being recognised by the governing council.

The ECB likely needs to do this to a sufficient degree that it prevents further broad euro depreciation, given this depreciation worsens the inflation issue. On the other hand, the ECB must avoid a situation where markets lose confidence in the ability of the likes of Italy and other highly indebted EU nations to be able to sell their debt, and must thus remain present as a buyer of last resort.

They do not want a repeat of the EU debt crisis from a decade ago, hence the likely development of this new "crisis" tool.

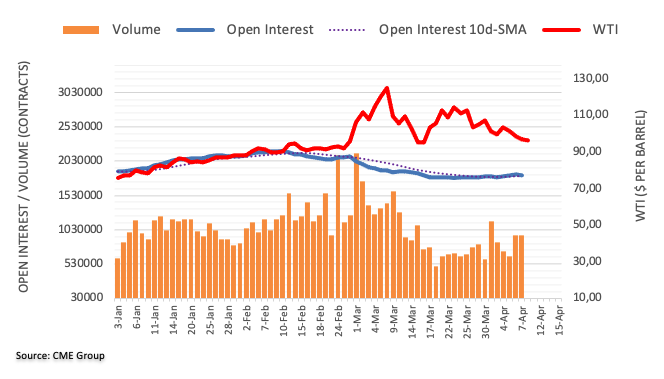

- WTI is set to end lower for a second week running, with traders citing this week’s IEA reserve release announcements.

- WTI currently trades a tad lower on the day in the $96.00s after nearly hitting March lows on Thursday.

- Technical selling after breaking below a long-term pennant could see WTI test $90, but fundamentals would likely then be supportive.

Oil prices were on the back foot on Friday, with front-month WTI futures set to close out a second successive weekend in the red after coming within a whisker of hitting March lows at $93.56 on Friday. At current levels in the mid-$96.00s, WTI is down about half a buck on the day, and just shy of $3.0 on the week.

Market commentators have cited announcements throughout the week from IEA nations of crude oil reserve release plans as weighing on crude oil market sentiment. In total, 240M barrels will be released in the coming months, which strategists say eases concerns about an acute shortage of oil in the near term.

That has overshadowed geopolitical developments, which have seen the EU move to expand sanctions on Russian energy imports, though not yet place an outright ban on oil and gas imports. As political pressure in the EU on a full Russia import energy embargo build, this could present an upside risk to WTI in the coming weeks.

So could the continued lack of progress in indirect US/Iran negotiations on a return to the 2015 nuclear pact that could release as much as 1.3M barrels per day in sanctioned oil exports, as well as OPEC+ reluctance to open the taps. Strategists have argued that recent reserve release announcements make a faster pace of output hike’s from the cartel significantly less likely in the coming months.

For now, though, the sellers have the upper hand, and technicals might be playing a part. WTI broke below a key long-term pennant that had been squeezing the price action earlier in the week, with some technicians taking this as a sign that WTI will fall back towards support in the $90 area. Amid the above-mentioned ongoing risks, an even deeper pullback at this stage seems unlikely.

The dollar remains firm. Economists at BBH expect the EUR/USD pair to test the March 7 low near 1.0805 while GBP/USD could tackle the September 2020 low near 1.2675 on a drop below 1.30.

USD/JPY set to test last week’s high near 125.10

“The euro remains heavy. A test of the March 7 low near 1.0805 is still in the cards.”

“The relentless rise in USD/JPY continues as it is up for the sixth straight day. We look for a test soon of last week’s high near 125.10.”

“GBP/USD should break below last month’s cycle low near 1.30, which would set up a test of the November 2020 low near 1.2855 and then possibly the September 2020 low near 1.2675.”

AUD/USD has reversed its break above key resistance at 0.7557. Although there is a risk of a deeper corrective pullback, analysts at Credit Suisse maintain a medium-term bullish outlook for an eventual move to 0.7777/85.

Medium-term technical picture is increasingly positive

“We stick with our core bullish view and look for 0.7455/41 to ideally hold any further decline on a closing basis. Thereafter, we look for a move back to 0.7593/7601, ahead of the recent high at 0.7653/62. Above here would clear the way for a move to the June high at 0.7777/85 in due course.”

“A close below 0.7455/41 would warn of a deeper setback and turn the short-term risk lower for a move to 0.7427 and then to 21st of March low at 0.7372/58.”

“The medium-term technical picture is increasingly positive, with weekly MACD now outright bullish and medium-term moving averages similarly close to crossing higher. We, therefore, see any weakness from the 21st of March low at 0.7372/58 as corrective whilst above 0.7300/7287.”

- USD/CAD is trading above 1.2600 and eyeing a test of its 200DMA at 1.2618, despite strong Canadian jobs data.

- Hawkish Fed vibes have driven the rally in the pair these last three days.

- Next week will be a busy one with US CPI, PPI and Retail Sales plus the BoC setting interest rates.

USD/CAD looks intent on testing its 200-Day Moving Average at 1.2618, with the latest decent Canadian employment figures not turning the tide on recent Canadian dollar depreciation versus its US counterpart. At current levels just above 1.2600, the pair is trading with on-the-day gains of about 0.15%, having earlier found support on a dip back towards the 1.2575 area. That means the pair is on course to post a third successive session in the green and, at levels above 1.2600, is trading at its highest since 23 March.

The main driver of recent strength has come from the US dollar side of the exchange rate. Hawkish commentary this week, most notably from Fed Vice Chair Lael Brainard and St Louis Fed President James Bullard, plus a hawkish sounding Fed minutes release, has ignited a rally in US yields as traders up their Fed tightening bets. This, combined with demand for safe-haven assets with global equities set to end the week lower, has supported the US dollar against most of its G10 peers.

The loonie has also been hit by an ongoing downtrend in global oil prices, the main driver of which has been recent oil reserve release announcements from IEA nations. Crude oil is one of Canada’s largest exports. Notably, Biden administration officials said earlier in the week that they were looking for ways to boost imports of oil from Canada. This could help support the loonie going forward, even if crude oil does continue declining.

Looking ahead, next week will be a busy one for USD/CAD traders. Key tier one US data, including Consumer and Producer Price Inflation plus Retail Sales data will be released. Meanwhile, the BoC will be deciding on interest rates, with the market’s base case assumption that they will raise interest rates by 50bps. The recently released jobs report should further solidify expectations for a large hike. USD/CAD choppiness is likely to continue and a key question will be whether traders take the recent rally back towards the 200DMA as an opportunity to sell.

- EUR/USD drops further and prints new lows near 1.0840.

- Further downside could see the 2022 low revisited.

EUR/USD extends the bearish move to fresh multi-week lows in the 1.0845/40 band on Friday.

Considering the ongoing price action, further decline remains well in place for the pair in the short-term horizon. That said, the 2022 low at 1.0805 (March 7) should come next followed by the May 2020 low at 1.0766 (May 7).

The medium-term negative outlook for EUR/USD is expected to remain unchanged while below the key 200-day SMA, today at 1.1459.

EUR/USD daily chart

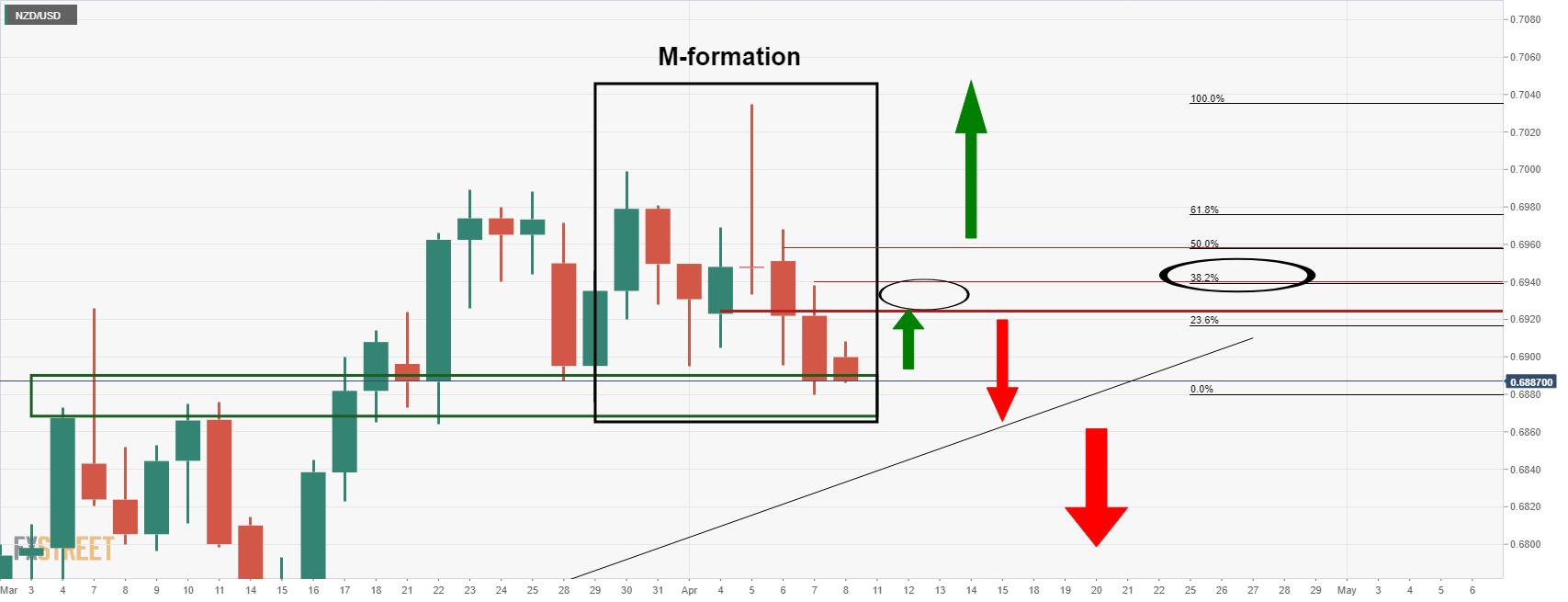

NZD/USD has broken short-term support at 0.6876/65, which suggests a corrective move lower. Nonetheless, support at 0.6782/78 is expected to hold, analysts at Credit Suisse report.

Only a sustained break above 0.7050 would confirm further medium-term upside

“NZD/USD has broken below the March lows at 0.6875/62. Below here is likely to lead to a test of 0.6842 next, then 0.6821, before the uptrend from the 2022 lows at 0.6795 and finally the 55-day average and 50% retracement of the recent upmove just below at 0.6782/78. Whilst above here the recent downmove will be viewed as corrective.”

“Assuming we hold above 0.6782/78, near-term resistance thereafter moves to 0.6905/10, above which would open the door to challenge the YTD high at 0.7030/34.”

“Only a sustained break above the mid-November high and the 2021 downtrend at 0.7050/54 would confirm further medium-term upside.”

“Below 0.6782/78 would open up 0.6728/22 next, below which would turn the risks back lower for a move to 0.6631 next.”

- AUD/USD extended its recent pullback from the YTD high and dropped to a near three-week low.

- Acceptance below 0.7500 and the subsequent decline has shifted bias in favour of bearish traders.

- Attempted recovery moves could attract fresh selling and remain capped near the 0.7535-40 area.

The AUD/USD pair extended this week's sharp retracement slide from the YTD peak - levels just above mid-0.7600s - and witnessed some selling for the third successive day on Friday. The downward trajectory dragged spot prices to a two-and-half-week low, around the 0.7440-0.7435 region during the early North American session.

More hawkish FOMC minutes, along with the continuous rise in the US Treasury bond yields, pushed the US dollar to its highest level since May 2020. This, in turn, was seen as a key factor that exerted downward pressure on the AUD/USD pair. Bulls seemed unimpressed by a positive risk tone, which tends to benefit the perceived riskier aussie.

The ongoing decline suggests that Tuesday's post-RBA strong move beyond an ascending channel extending from the YTD low was a false breakout. Some follow-through selling below the 0.7500 mark might have already shifted the bias in favour of bearish traders. A subsequent break through the 0.7450 horizontal support zone reaffirms the negative outlook.

Hence, the corrective pullback seems more likely to get extended towards the 0.7400 round-figure mark before the AUD/USD pair eventual drops to the 0.7375-0.7370 area. The next relevant support is pegged near the 0.7300 confluence region, comprising the very important 200-day SMA and the lower boundary of the aforementioned trend channel.

On the flip side, the 0.7500 mark now seems to act as immediate strong resistance. Any further recovery could attract fresh selling and remain capped near the 0.7535-0.7545 zone. Sustained strength beyond should allow the AUD/USD pair to reclaim the 0.7600 mark, which coincides with the channel resistance and act as a pivotal point.

AUD/USD daily chart

-637850207318045641.png)

Key levels to watch

Russian ruble trading remains puzzling to most. Levels are not a reliable indicator of offshore activity, while the forward market is quite clearly broken, which suggests that signs of stress remain despite a more reassuring message from the Bank of Russia (CBR), economists at TD Securities report.

More CBR easing ahead

“The CBR delivered an unscheduled and surprise 300bps Key Rate cut to 17.00%. We are compelled to revise our expectations to add more CBR easing ahead.”

“The CBR's focus is rapidly shifting to growth from inflation. The Bank states reduced financial and inflation risks, especially as the ruble has now appreciated to pre-war levels. But we think inflation will remain a problem for Russia.”

“The final hint that the currency market is mostly unreliable, and levels should not be taken as proof of success of the CBR's attempt to regain control of the RUB, is the extreme volatility recorded in forwards.”

“The forwards market is broken. Levels keep marking higher and lower, with traders only concerned about covering the day-to-day funding and cash balances, which leads to crazy fluctuations of the O/N and T/N implied-yield levels between 10% and 50% – this is a clear symptom that not much is right in the RUB market. And, therefore, despite the reassuring message the CBR is giving the market, indirect signs of stress appear in this direction.”

GBP/USD has continued moving lower. Economists at Credit Suisse stay bearish and look for a break below 1.30 to open up a fall to 1.2855/29.

Resistance seen at 1.3168/84

“We now look for an imminent break below 1.3013/00, which would reassert the core downtrend, especially if daily MACD also sees a confirmed cross lower. Support is then seen next at the lower end of the nine-month channel at 1.2910/05 and eventually the 50% retracement of the uptrend from 2020 and November 2020 low at 1.2855/29. We would look for a fresh floor here for a phase of consolidation.”

“Resistance is seen at 1.3108/09 initially, then 1.3168/84, a close above which can see a move back to 1.3223/26 and potentially a retest of 1.3287/99, which we would look to cap the market if reached, especially with the falling 55-day average now not far above at 1.3323.”

A number of headwinds have piled up for China lately, which will likely postpone the recovery into the second half and require more easing measures. A recovery in H2 should give upside for Chinese stocks. Economists at Danske Bank also look for USD/CNY to turn higher as the Chinese trade surplus is set to come down.

Upside for stocks and USD/CNY

“The Chinese economy has been hit by three new headwinds from covid outbreaks, the Ukraine war and financial stress. We expect this to delay a recovery into H2. We expect more economic stimulus, as China needs to step harder on the gas to lift the economy out of the current slump. The China weakness will add a further drag on the global economy in coming months, not least on Europe.”

“In recent weeks, Chinese stocks have recovered some of the lost ground and our call is still for Chinese offshore stocks to end the year higher than they started (but admittedly, the uncertainty is higher than normal).”

“Following a year of CNY appreciation despite all the challenges hitting China, we believe USD/CNY will move moderately higher over the next 12 months.”

“We already see signs exports will slow this year and later in the year, imports should start to recover on the back of stronger domestic demand.”

“We look for a rise in USD/CNY to 6.50 in 12M from the current level around 6.36.”

The European Central Bank (ECB) April meeting should not be one for major policy shifts. This means that the ECB may not come to the rescue of the euro, economists at ING report.

EUR/USD to trade in the 1.05-1.10 range into the summer months

“We do not expect the ECB to deliver a hawkish enough statement to offset the unsupportive external environment and valuation of the euro.”

“A sustained recovery in EUR/USD is not on the cards in the current environment, and we expect the pair to trade in the 1.05-1.10 range into the summer months.”

- Silver has pulled back under the $24.50 level as the US dollar and US yields press higher into the weekend.

- XAG/USD continues to trade close to its 50DMA.

- Hawkish Fed chatter is a downside risk, but silver continues to benefit from demand for inflation-protection.

Spot silver (XAG/USD) prices have pulled back from earlier session highs in the $24.70s to trade back under the $24.50 level once again, where they now trade down about 0.8% on the day. That means XAG/USD is back to within a few cents of its 50-Day Moving Average at $24.44, which has been acting as a bit of a magnet to the price action in recent days.

Selling pressure returned to precious metal markets in recent trade amid continued strength in the US dollar and upwards moves across the US yield curve. FX and bond markets have this week been reacting to hawkish rhetoric from Fed policymakers, who seem more and more onboard with 1) lifting rates quickly back to neutral and potentially above and 2) reducing the size of the balance sheet rapidly. Higher yields increase the opportunity cost of holding non-yielding assets such as silver, whilst a stronger dollar makes USD-denominated commodities more expensive for the holders of foreign currency.

XAG/USD now looks on course to post a weekly loss of about 0.7%, which is not as bad as some strategists might have expected given the extent of the recent moves higher in USD and US yields. Many silver bears were targeting another test of recent lows in the $24.00 area, which did not manifest (this week’s low point was at $24.12). Developments related to the Russo-Ukraine war, primarily its disruptive impact on the global economy, mean a geopolitical risk premia remains priced into precious metals, as well as demand for inflation protection.

Ahead of next week’s key US Consumer and Producer Price Inflation figures for March, investors may want to hold onto the likes of silver and gold. A big upside surprise might trigger a bounce, as has happened a few other times in the last six months, even though an upside surprise would also lead to further bets on Fed tightening.

- A combination of factors lifted USD/CHF to over a near two-week high on Friday.

- The Fed’s hawkish outlook and elevated US bond yields continued boosting the USD.

- A positive risk tone undermined the safe-haven CHF and remained supportive.

The USD/CHF pair maintained its bid tone through the early North American session and was last seen trading around mid-0.9300s, or a near two-week high.

Following the previous day's two-way/directionless price move, the USD/CHF pair attracted fresh buying on Friday and prolonged its recent strong rebound from sub-0.9200 levels. This marked the fifth day of a positive move in the previous six and was sponsored by a combination of factors. A goodish recovery in the equity markets undermined the safe-haven Swiss franc and acted as a tailwind for spot prices amid sustained US dollar buying, bolstered by the Fed's hawkish outlook.

In fact, the USD Index shot to the 100 psychological mark for the first time in nearly two years amid firming expectations that the Fed would tighten its monetary policy at a faster pace. The bets were reaffirmed by the March FOMC meeting minutes, which showed that many participants were prepared to raise interest rates by 50 bps in the coming months. This, along with worries over rising inflationary pressures, remained supportive of elevated US Treasury bond yields.

The latest leg up, summing up to a rally of over 150 pips from last week's swing low, comes on the back of bullish resilience below the very important 200-day SMA and supports prospects for further gains. Hence, a subsequent strength beyond the 0.9375 intermediate resistance, en-route the 0.9400 round-figure mark, remains a distinct possibility. The momentum could further get extended towards retesting the YTD high, around the 0.9460 region touched on March 16.

In the absence of any major market-moving economic releases from the US, the US bond yields will continue to play a key role in influencing the USD price dynamics. Apart from this, traders will take cues from fresh developments surrounding the Russia-Ukraine saga. The incoming geopolitical headlines should drive the broader market risk sentiment and demand for traditional safe-haven assets, including the CHF, which, in turn, should provide some impetus to the USD/CHF pair.

Technical levels to watch

Senior Economist at UOB Group Alvin Liew assesses the publication of the FOMC Minutes of the March meeting.

Key Takeaways

“The 15/16 Mar 2022 FOMC minutes was deemed hawkish as the Fed fleshed out details on balance sheet reduction/runoff [BSR] also termed as Quantitative Tightening, [QT], which it signaled will be phased into a monthly cap of US$95bn (‘about $60 billion for Treasury securities and about $35 billion for agency MBS’) faster than the QT of 2017/19 which topped at US$50bn monthly cap. It also spelt out that the QT process could start as early as after the conclusion of the 3-4 May FOMC.”

“The other key element was that while the Fed took the first step of its liftoff with a 25bps hike of the policy Fed Funds Target rate (FFTR), many of the Fed policy makers would have preferred a 50bps hike but deferred to the lower quantum due to the Russia-Ukraine conflict.”

“FOMC Outlook – Faster, Higher, & Expeditiously: Given the explicit indications for more aggressive hikes to combat inflation spelt out in the Mar FOMC minutes and the recent hawkish commentary from FOMC voters including Fed Governor Brainard, we now expect the FFTR will be hiked faster by 50bps in the May FOMC (from our previous forecast of 25bps). A more aggressive 50bps hike in May will also be further affirmed if the Mar CPI inflation (due on 12 Apr) prints comes well above 8% y/y. That said, we caution that any significant escalation of Russia-Ukraine situation (or volatile market conditions), could still trigger another walk-back by the Fed as they did at the Mar 2022 FOMC.”

“We continue to expect 25bps in every remaining meeting of this year. Including the Mar FOMC’s 25bps hike, this implies a cumulative 200bps of increases in 2022, bringing the FFTR higher to the range of 2.00-2.25% by end of 2022 (from our previous forecast of 175bps hikes to 1.75-2.00% by end 2022).”

- The Canadian economy added 72.5K jobs in March, a little less than the 80K expected.

- The Unemployment Rate dropped to 5.3% as forecast from 5.5%, and the BoC is likely to view the data as strong.

- The loonie did not see much of a reaction to the data.

The Canadian economy added 72,500 jobs in March, a tad below the median economist forecast for 80,000 jobs to have been added on the month, a report released by Statistics Canada on Friday showed. That marked a significant deceleration in the pace of job gains versus February when 336,600 jobs were added.

In terms of the breakdown, the Canadian economy added 92,700 full-time jobs and lost 20,300 part-time jobs. The Unemployment Rate dropped as expected to 5.3% from 5.5% in February, while the Participation Rate remained unchanged at 65.4%.

Market Reaction

The loonie did not really see much of a reaction to the latest broadly as expected Canadian labour market figures. The BoC is likely to interpret the report as strong, given it showed a decent pace of job gains last month, which is likely to underpin expectations that the bank hikes interest rates by 50 bps at its next meeting.

- DXY keeps the buying bias intact around the 100.00 zone.

- Beyond 100.00 the index should retest 100.55.

DXY extends the march north and flirts with the psychological barrier at 100.00 the figure on Friday.

The ongoing price action is supportive of extra gains in the very near term. Against that, the breakout of the 100.00 yardstick should put the index en route to test the May 2020 high at 100.55 sooner rather than later.

The current bullish stance in the index remains supported by the 6-month line near 96.30, while the longer-term outlook for the dollar is seen constructive while above the 200-day SMA at 95.05.

DXY daily chart

Canadian employment details overview

Statistics Canada is scheduled to publish the monthly jobs report for March later this Friday at 12:30 GMT. The Canadian economy is anticipated to have added 80K jobs during the reported month, marking a sharp deceleration from the 336.6K rise reported in February. Meanwhile, the unemployment rate is expected to edge lower from 5.5% to 5.4% in March.

Analysts at NBF offered a brief preview and sounded less optimistic about the report: “Although we believe that the labour market situation continued to improve during the month, supported by the amelioration of the epidemiological situation, we still expect a flat employment print. Far from being the start of a downtrend, this decline would in fact represent only a normalization after February’s breathtaking figure (+336.6K). Assuming the participation rate stayed unchanged at 65.4%, this result would leave the unemployment rate at 5.5%.”

How could the data affect USD/CAD?

Ahead of the key release, the USD/CAD pair was seen consolidating its recent strong recovery from the YTD low, around the 1.2400 mark touched earlier this week. Softer Canadian employment figures could exert pressure on the domestic currency and allow spot prices to push through the very important 200-day SMA barrier.

Conversely, a stronger reading might prompt some selling, though the immediate market reaction is likely to be short-lived. The prevalent bullish sentiment surrounding the US dollar should continue to lend support to the major amid weaker crude oil prices, which tend to undermine the commodity-linked loonie. This, in turn, suggests that the path of least resistance for the pair is to the upside.

Key Notes

• Canadian Net Change in Employment March Preview: Is the labor market passe?

• Canada Employment Preview: Forecasts from five major banks, building on the remarkable surge seen in the prior month

• USD/CAD: Loonie to benefit only temporarily from a positive Canadian jobs report – Commerzbank

About the Employment Change

The employment Change released by Statistics Canada is a measure of the change in the number of employed people in Canada. Generally speaking, a rise in this indicator has positive implications for consumer spending which stimulates economic growth. Therefore, a high reading is seen as positive, or bullish for the CAD, while a low reading is seen as negative or bearish.

About the Unemployment Rate

The Unemployment Rate released by Statistics Canada is the number of unemployed workers divided by the total civilian labour force. It is a leading indicator for the Canadian Economy. If the rate is up, it indicates a lack of expansion within the Canadian labour market. As a result, a rise leads to weaken the Canadian economy. Normally, a decrease of the figure is seen as positive (or bullish) for the CAD, while an increase is seen as negative or bearish.

- GBP/USD is ending the week on the back foot and eyeing a test of March lows in the 1.3000 area.

- The US dollar continues to advance as US yields surge following this week’s hawkish Fed vibes.

As the US dollar heads into the end of the week firmly on the front foot as US yields continue to press higher in wake of this week’s hawkish Fed minutes/policymaker commentary, GBP/USD looks on the verge of breaking below 1.3000. At current levels in the 1.3020s, the pair is trading with on the day losses of about 0.3% and eyeing a test of March lows at pretty much bang on the 1.3000 mark. On the week losses stand at around 0.7%, with the 21-Day Moving Average (currently in the 1.3110s) continuing to offer strong resistance, as has been the case over the past three or so weeks.

As market participants continue to up their hawkish Fed bets, spurring even greater strength in the US dollar, and as analysts become ever more wary on the ability of the BoE to live up to tightening expectations following recent more dovish commentary, many think GBP/USD is at risk of a bearish breakout. From a technical perspective, a break below 1.3000 would open the door to a run lower towards November 2020 lows in the mid-1.2800s. Below that are the September 2020 lows just under 1.2700.

- EUR/JPY keeps the consolidative mood well and sound.

- The 134.40 region keeps supporting the downside.

EUR/JPY extends the range bound theme near the 135.00 area at the end of the week.

In light of the recent price action, further consolidation remains likely in the very near term ahead of the potential resumption of the bullish bias. That said, the 2022 high at 137.54 (March 28) emerges as the immediate hurdle prior to the August 2015 peak at 138.99 (August 15) and ahead of the round level at 140.00.

In the meantime, while above the 200-day SMA at 130.17, the outlook for the cross is expected to remain constructive.

EUR/JPY daily chart

Economist at UOB Group Enrico Tanuwidjaja reviews the latest FX Reserves figures in Indonesia.

Key Takeaways

“Indonesia’s foreign exchange reserves decreased to USD139.1bn in March 2022; down by USD 2.3bn from the previous month.”

“The latest reserve level was equivalent to finance 7.2 months of import or 7.0 months of imports and servicing the government’s external debt. This is still well above the international adequacy standard of around 3 months of imports.”

“Bank Indonesia views that the official reserve assets will remain adequate, along with several accommodative policies to support long-term economic recovery.”

- NZD/USD witnessed selling for the third straight day and retreated further from the YTD high.

- The Fed’s hawkish outlook, elevated US bond yields underpinned the USD and exerted pressure.

- A positive risk tone might cap the safe-haven USD and limit losses for the perceived riskier kiwi.

The NZD/USD pair continued losing ground through the mid-European session and dropped to over a three-week low, around mid-0.6800s in the last hour.

The pair prolonged this week's sharp retracement slide from the 0.7035 region, or the highest level since November 2021 and witnessed some follow-through selling for the third successive day on Friday. The downward trajectory was exclusively sponsored by the blowout US dollar rally, bolstered by the Fed's hawkish outlook.

In fact, the March 15-16 FOMC minutes released on Wednesday showed that policymakers were prepared to hike interest rates by 50 bps at upcoming meetings. Moreover, there was a general agreement about reducing the Fed's massive near $9 trillion balance sheet at a maximum pace of $95 billion per month to tighten financial conditions.

This, along with worries that the recent surge in commodity prices would put upward pressure on the already higher consumer inflation, pushed the US Treasury bond yields to multi-year peaks. The combination of supporting factors assisted the USD to extend its one-week-old uptrend and jump to the highest level since May 2020.

Friday's downfall could further be attributed to some technical selling below the very important 200-day SMA. That said, a goodish recovery in the equity markets held back traders from placing aggressive bullish bets around the safe-haven greenback. This could help limit further losses for the perceived riskier kiwi, at least for now.

In the absence of any major market-moving economic releases from the US, the US bond yields will continue to play a key role in influencing the USD price dynamics. Traders will further take cues from developments surrounding the Russia-Ukraine saga, which would drive the market risk sentiment and provide some impetus to the NZD/USD pair.

Technical levels to watch

Commenting on the United Nation's decision to suspend Russia from the Human Rights Council, "anti-Russian pressure was exerted on countries who tried to adopt a balanced position and Moscow understands that," a Kremlin spokesperson said on Friday, per Reuters.

"Russia's special operation in Ukraine could be completed in foreseeable future given aims are being achieved and work is being carried out by the military and peace negotiators," the spokesperson added.

Market reaction

Risk flows continue to dominate the financial markets on Friday and the Euro Stoxx 600 Index was last seen rising more than 1% on a daily basis.

FX Strategists at UOB Group Quek Ser Leang and Lee Sue Ann keeps the neutral view on USD/CNH for the time being.

Key Quotes

24-hour view: “Our expectations for USD to ‘dip to 6.3550’ did not materialize as it traded between 6.3580 and 6.3683 before closing little changed at 6.3650 (+0.09%). Momentum indicators are mostly neutral and USD is likely to trade sideways, expected to be between 6.3580 and 6.3780.”

Next 1-3 weeks: “There is not much to add to our update from yesterday (07 Apr, spot at 6.3640). As highlighted, the outlook is mixed and USD could trade within a range of 6.3450/6.3850 for now.”

- USD/CAD was seen consolidating this week’s strong recovery move from the YTD low.

- An uptick in oil prices extended some support to the loonie and acted as a headwind.

- The strong USD bullish sentiment helped limit losses ahead of the Canadian jobs data.

The USD/CAD pair extended its sideways consolidative price move and remained confined in a narrow band, just below the 1.2600 mark through the first half of the European session.

The pair struggled to capitalize on its solid rebound from the 1.2400 mark, or the YTD low touched on Tuesday and oscillated in a range below the very important 200-day SMA on the last day of the week. Crude oil prices recovered a bit from the three-week low touched the previous day and extended some support to the commodity-linked loonie. This, in turn, acted as a headwind for the USD/CAD pair, though the prevalent bullish sentiment surrounding the US dollar helped limit the downside.

The USD climbed to its highest level since May 2020 and continued drawing support from expectations that the Fed would tighten its monetary policy at a faster pace. In fact, the March 15-16 FOMC minutes released on Wednesday showed that policymakers were prepared to hike interest rates by 50 bps at upcoming meetings. Moreover, there was a general agreement about reducing the Fed's massive near $9 trillion balance sheet at a maximum pace of $95 billion per month to tighten financial conditions.

Apart from the Fed's hawkish outlook, inflation fears remain supportive of elevated US Treasury bond yields, which further underpinned the greenback. Investors seem worried that the recent surge in commodities following Russia's invasion of Ukraine would put upward pressure on the already higher consumer inflation. That said, a goodish recovery in the global equity markets held back traders from placing fresh bullish bets around the safe-haven buck and capped gains for the USD/CAD pair.

Market participants also preferred to wait on the sidelines ahead of the Canadian monthly employment details, due for release later during the early North American session. In the absence of any major market-moving economic releases from the US, the US bond yields will play a key role in influencing the USD. This, along with oil price dynamics and developments surrounding the Russia-Ukraine saga, should provide impetus to the USD/CAD pair and allow traders to grab short-term opportunities.

Technical levels to watch

- EUR/USD regains some composure after dropping to 10850.

- The greenback climbs to fresh peaks near 100.00, recedes afterwards.

- The EU announces new sanctions against Moscow.

The single currency remains under pressure and drags EUR/USD to new 4-week lows in the 1.0850/45 band at the end of the week.

EUR/USD now targets the 2022 low near 1.0800

EUR/USD manages to trim part of the earlier drop to new multi-week lows, although it stays under intense downside pressure against the backdrop of geopolitical concerns and persevering USD buying.

Indeed, geopolitics are back to the fore after the EU announced new sanctions against Russia, this time targeting coal and opening the door to potential sanctions against Russian oil and gas sectors.

Also weighing on the risk complex appears the unabated advance in US yields amidst growing perception that the Fed could accelerate the pace of its normalization as well as the reduction of its balance sheet.

Nothing scheduled in the euro docket, while Wholesale Inventories will only be released across the pond.

What to look for around EUR

Sellers continue to rule the sentiment around EUR/USD, which extended the downtrend to fresh lows in the mid-1.0800s earlier on Friday. The multi-session negative performance of the pair came in response to the firmer pace of the greenback and renewed geopolitical concerns. As usual, pockets of strength in the single currency should appear reinforced by speculation the ECB could raise rates before the end of the year, while higher German yields, elevated inflation, the decent pace of the economic recovery and auspicious results from key fundamentals in the region are also supportive of a rebound in the euro.

Key events in the euro area this week: France Presidential Election (Sunday, April 10).

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the euro area. Speculation of ECB tightening/tapering later in the year. Presidential elections in France in April. Impact of the geopolitical conflict in Ukraine.

EUR/USD levels to watch

So far, spot is down 0.09% at 1.0867 and a breakdown of 1.0845 (monthly low April 8) would target 1.0805 (2022 low March 7) en route to 1.0766 (monthly low May 7 2020). On the flip side, immediate resistance comes at 1.1147 (55-day SMA) followed by 1.1184 (weekly high March 31) and finally 1.1222 (100-day SMA).

EUR/USD has edged down to its lowest levels since the early days of the Ukraine war at the start of March. Much of the move comes from a surge in the value of the USD. That said, the EUR faces issues of its own, economists at Rabobank report.

Grim realities

“Not only have polling ahead of the French Presidential election brought the market cause for concern, but the outlook for the Eurozone economy is still very uncertain given issues related to energy security. In reflection of these concerns we have maintained a forecast of EUR/USD 1 .08 on a one-month view.”

“Our three-month forecast of EUR/USD 1.10 assumes that Macron keeps the presidency in France and that growth sustains in the Eurozone this year leaving market expectations for an ECB rate hike around year-end intact.”

“In view of the region’s dependency on Russian’s energy, it is difficult not to be concerned about stagflation risks to Europe if Russian energy was embargoed. This remains a potential risk to the EUR in the months ahead.”

The European Council said in a statement on Friday, it has decided to impose a fifth package of economic and individual sanctions against Russia.

According to the press release, some the of key sanctions the package comprises are

A prohibition to purchase, import or transfer coal and other solid fossil fuels into the EU if they originate in Russia or are exported from Russia, as from August 2022. Imports of coal into the EU are currently worth EUR 8 billion per year.

A prohibition to provide access to EU ports to vessels registered under the flag of Russia. Derogations are granted for agricultural and food products, humanitarian aid, and energy.

A ban on any Russian and Belarusian road transport undertaking preventing them from transporting goods by road within the EU, including in transit.

Further export bans, targeting jet fuel and other goods such as quantum computers and advanced semiconductors, high-end electronics, software, sensitive machinery and transportation equipment, and new import bans on products such as: wood, cement, fertilisers, seafood and liquor.

Market reaction

EUR/USD is ranging below 1.0900 on the above announcement, keeping its recovery mode intact from the 1.0850 region.

The spot is trading flat at 1.0877, as of writing.

Further upside momentum could lift USD/JPY back to the 124.30 region in the next weeks, commented FX Strategists at UOB Group Quek Ser Leang and Lee Sue Ann.

Key Quotes

24-hour view: “USD traded sideways between 123.46 and 124.00 yesterday, narrower than our expected range of 123.10/123.95. Further sideway trading appears likely even though the firmed underlying tone suggests a higher range of 123.50/124.30.”

Next 1-3 weeks: “There is no change in our view from Wednesday (06 Apr, spot at 123.85). As highlighted, upward momentum is building and USD is likely to trade with an upward bias towards 124.30, possibly 124.60. On the downside, a breach of 123.00 (‘strong support’ level was at 122.40 yesterday) would indicate that the build-up in momentum has fizzled out.”

Japanese Prime Minister Fumio Kishida announced on Friday that they will ban imports of certain Russian products, including coal, as reported by Reuters.

Kishida further noted that they will also ban fresh investments in Russia and freeze the assets of Russia's Sberbank and Alfa Bank.

Market reaction

The market mood remains relatively upbeat following this development. As of writing, the S&P Futures were up 0.25% on a daily basis. Meanwhile, the USD/JPY pair was trading at 124.10, where it was up 0.15% on the day.

- The index pushes higher and records new cycle peaks.

- US yields keep the uptrend well and sound on Friday.

- February Wholesale Inventories are the sole release on the docket.

The bid bias around the greenback remains well in place for yet another session and lifts the US Dollar Index (DXY) to new cycle peaks just below the 100.00 mark at the end of the week.

US Dollar Index supported by yields, Fedspeak

The index advances for the seventh consecutive session so far on Friday on the back of the persistent selling bias in the risk complex and the relentless march north in US yields across the curve.

It is worth noting that the last time the index had such a positive streak was back in late January-early February 2019.

Firm speculation of a more aggressive tightening by the Federal Reserve in the next months was once again reinforced by Fed’s rate-setters throughout the week, which in turn morphed into extra wings to US yields.

In the US data space, Wholesale Inventories will be the sole release later in the NA session.

What to look for around USD

The dollar remains bid and finally manages to flirt with the psychological 100.00 barrier. So far, the near-term price action in the greenback continues to be dictated by geopolitics, while the case for a stronger dollar remains well propped up by the current elevated inflation narrative, a probable tighter rate path by the Fed, higher US yields and the solid performance of the US economy.

Key events in the US this week: Wholesale Inventories (Friday).

Eminent issues on the back boiler: Escalating geopolitical effervescence vs. Russia and China. Fed’s rate path this year. US-China trade conflict. Future of Biden’s Build Back Better plan.

US Dollar Index relevant levels

Now, the index is advancing 0.13% to 99.88 and a break above 99.99 (2022 high April 8) would open the door to 100.00 (psychological level) and finally 100.55 (monthly high May 14 2020). On the downside, initial contention is seen at 97.68 (weekly low March 30) seconded by 97.46 (55-day SMA) and then 96.82 (100-day SMA).

- USD/JPY edged higher for the fifth straight day and climbed to over a one-week high on Friday.

- The Fed-BoJ monetary policy divergence continued acting as a tailwind and remained supportive.

- The fundamental backdrop supports prospects for a move back towards the 125.00 round figure.

The USD/JPY pair traded with a mild positive bias through the first half of the European session and was last seen hovering around the 124.10 region, just a few pips below the weekly high.

A combination of factors assisted the USD/JPY pair to reverse an intraday dip to the 123.65 region and edge higher for the fifth successive day on Friday. The widening interest rate gap between Japan and the United States, along with a goodish rebound in the global equity markets, weighed on the safe-haven Japanese yen. Apart from this, the prevalent bullish sentiment surrounding the US dollar acted as a tailwind for spot prices.

The USD climbed to its highest level since May 2020 and continued drawing support from expectations that the Fed would tighten its monetary policy at a faster pace. In fact, the March 15-16 FOMC minutes released on Wednesday showed that policymakers were prepared to hike interest rates by 50 bps at upcoming meetings. This, along with inflation fears, remained supportive of elevated US Treasury bond yields and underpinned the USD.

Investors remain concerned that the recent surge in fuel costs following Russia's invasion of Ukraine could put upward pressure on the already higher consumer inflation. Despite the market worries, Bank of Japan board member Asahi Noguchi said on Thursday that the central bank must maintain its ultra-easy monetary policy.

Moreover, the BoJ has repeatedly said that it remains ready to use powerful tools to avoid long-term interest rates from rising too much. It is worth recalling that BoJ last week offered to buy unlimited 10-year Japanese government bonds to defend the 0.25% yield cap. This has led to a further widening of the US-Japanese bond yields differential.

The fundamental backdrop favours bullish traders and should continue to lend support to the USD/JPY pair. Even from a technical perspective, the formation of an ascending channel on short-term charts supports prospects for additional gains. Hence, a move back towards the 125.00 psychological mark, or the multi-year high, remains a distinct possibility.

In the absence of any major market-moving economic releases from the US, the US bond yields will influence the USD price dynamics and provide some impetus to the USD/JPY pair. Traders will further take cues from developments surrounding the Russia-Ukraine saga, which will drive the broader market risk sentiment and safe-haven demand.

Technical levels to watch

Economists at Credit Agricole CIB Research are changing USD/JPY trading bias from buy-on-dips to a sell-on-rallies. They still forecast the pair at 116 by end-2022.

End-Q2 forecast for USD/JPY revised up from 118 to 120

"We recently revised up our end-Q2 forecast for USD/JPY from 118 to 120 and have left the remainder of our forecast unchanged. We maintain an end-2022 forecast for USD/JPY of 116.”

"We have changed our trading bias for USD/JPY from a buy-on-dips to a sell-on-rallies. We see the risks to our USD/JPY forecasts as being to the upside."

The Bank of Russia announced on Friday that it cut its policy rate by 300 basis points to 17% from 20%.

"Today’s decision reflects a change in the balance of risks of accelerated consumer price growth, the decline in economic activity and financial stability risks," the policy statement read.

The bank noted that it will take into account risks posed by external and domestic conditions when deciding on policy settings and added that it will hold the prospects of further key rate reductions open at upcoming meetings.

Market reaction

The USD/RUB pair edged higher on this development and was last seen rising 0.6% on the day at 76.1800.

Gold defies headwind. XAU/USD is trading at around $1,930, which puts it within the same trading corridor of between $1,900 and $1,950 in which it has been fluctuating for most of the time since mid-March, strategists at Commerzbank report.

Gold still appears to be in demand as a safe haven and store of value

“The EUR/USD exchange rate is below 1.09 and the trade-weighted dollar index has climbed to its highest level in nearly two years following further hawkish Fed comments. Furthermore, yields on ten-year US Treasuries have risen to their highest level in over three years and real interest rates are gradually approaching zero; the last time they were in positive territory was a good two years ago. None of this has had any impact on the gold price, however.”

“Gold is showing relative strength. It still appears to be in demand as a safe haven and store of value, even if ETF inflows this week have been very moderate so far.”

- Silver built on its steady move up for the third successive day on Friday.

- A two-week-old descending trend-line resistance could cap the upside.

- Sustained weakness below $24.00 would set the stage for further losses.

Silver edged higher for the third straight day on Friday and climbed to the $24.65-$24.70 region during the early European session. Bulls might now be looking to build on the momentum beyond the 200-hour SMA, though any meaningful upside seems elusive. The XAG/USD was last seen flirting with the top boundary of a three-day-old ascending channel. This is followed by a downward sloping trend-line extending from the high touched on March 31, around the $24.80 region, which should act as a strong barrier.

Technical indicators on hourly charts have been gaining positive traction and have also recovered from the negative territory on the daily chart. Hence, a convincing break through the aforementioned confluence hurdle would set the stage for further gains. The XAG/USD might then aim to surpass the $25.00 psychological mark and accelerate the momentum towards the $25.35-$25.40 resistance zone. The upward trajectory could eventually lift spot prices to the $25.75-$25.80 area en-route the $26.00 round-figure mark.