- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 08-03-2022

- AUD/USD pauses two-day pullback from yearly resistance line.

- Easing bullish bias of MACD, clear break of 200-DMA favor sellers.

- Multiple moving averages, five-week-old ascending trend line restrict further downside.

AUD/USD struggles for clear directions around 0.7270 during Wednesday’s Asian session, after declining to the fresh one-week low on breaking the 200-DMA.

Read: RBA’s Lowe: RBA has scope to wait, assess information on uncertainties

Even so, the Aussie pair’s clear U-turn from the one-year-old descending trend line, followed by the 200-DMA break and the retreat of the MACD line keep the AUD/USD sellers hopeful.

That said, the 100-DMA and the 50-DMA levels, around 0.7230 and 0.7190 in that order, restrict the short-term downside of the pair.

Following that, an upward sloping support line from January 28, near 0.7150 by the press time, will be crucial to watch.

Meanwhile, recovery moves remain elusive below the 200-DMA level of 0.7317.

It’s worth noting that’s the AUD/USD recovery beyond the 200-DMA, will aim for the 0.7400 threshold but an aforementioned resistance line from March 2021, close to 0.7435 will challenge the pair buyers afterward.

Overall, AUD/USD remains pressured towards a five-week-old support line with a bumpy road.

AUD/USD: Daily chart

Trend: Further weakness expected

- Pullback towards 0.9280 may bring fresh bids towards the three-month high at 0.9343.

- A bullish crossover of the 50- and 200-EMAs adds to the upside filter.

- Bullish range shift in the RSI (14) has strengthened the greenback against the Swiss franc.

The USD/CHF pair has violated the trendline placed from February 10 highs of 0.9297 decisively after trading back and forth in a wide range of 0.9150-0.9297. In the early Tokyo session, the major has opened near Tuesday’s closing price and is aiming to scale higher amid a broad risk-off impulse.

On the four-hour chart, USD/CHF has managed to overstep the trendline placed from February 10 highs of 0.9297, which is adjoining the February 24 high at 0.9289. The pair has given a breakout above the trendline, which is followed by a pullback near the surface of the trendline at 0.9280.

The 50-period and 200-period Exponential Moving Averages are trading at 0.9225 and 0.9217 respectively, have delivered a bullish crossover, which adds to the upside filters.

Meanwhile, the Relative Strength Index (RSI) (14) has reported a range shift from 40.00-60.00 to 60.00-80.00, which indicates a fresh impulsive wave going forward.

As the major has witnessed a pullback towards the trendline at 0.7280, it is more likely that the pair will drift higher towards the January 28 high at 0.9330. A breach of the latter will send the pair towards January 31 high at 0.9343.

On the contrary, bulls can lose their grip if the major skids below March 8 low at 0.9250. This will bring significant offers and may hammer the pair towards March 7 average traded price at 0.9230 and 200 EMA at 0.9217.

USD/CHF four-hour chart

-637823778956112381.png)

- NZD/USD defends 0.6800 the figure after a two-day downtrend.

- New Zealand Q4 Manufacturing Sales rallied 8.2% versus -6.4% prior.

- Market sentiment dwindles even as Ukraine steps back from NATO membership intentions.

- Beijing’s trade link with NZ highlights China CPI, geopolitical headlines are the key.

NZD/USD treads water around 0.6800 round figure during early Wednesday morning in Asia. The Kiwi pair recently failed to cheer upbeat New Zealand (NZ) data as previously upbeat sentiment fades.

New Zealand’s Manufacturing Sales for the fourth quarter (Q4) of 2021 not only reversed the previous 6.4% contraction but rallied to 8.2%.

However, indecision over the Ukraine-Russia crisis, as well as waiting for inflation data from the key customer China, seems to have challenged the NZD/USD buyers of late.

Headlines from AFP, saying that Ukraine is reportedly no longer insisting on NATO membership seem to favor the earlier risk-on mood in the US session. On the same line was the confirmation of the first humanitarian corridor in Ukraine.

Though, sanctions on Russia's energy supplies from the US and the UK challenged the market’s optimism. The move was well-responded by Russian President Vladimir Putin as he bans the export of products and raw materials out of the Russian Federation until December 31.

Talking about data, the US trade deficit rallied to a record high and the small business confidence, as signaled by IBD/TIPP Economic Optimism gauge for March, dropped to the lowest in 13 months.

Amid these plays, Wall Street closed mixed after an initially positive performance whereas the US 10-year Treasury yields rose six basis points (bps) to 1.84% by the end of Tuesday’s North American session.

Looking forward, Consumer Price Index (CPI) and Producer Price Index (PPI) from China, expected 0.8% and 8.7% versus 0.9% and 9.1% respectively, will direct immediate moves of the NZD/USD pair. However, major attention will be given to the risk catalysts, especially relating to the Ukraine-Russia issue.

Technical analysis

Sustained trading below the 100-DMA, around 0.6835 by the press time, directs NZD/USD traders towards an ascending support line from late January, close to 0.6715 at the latest.

- EUR/USD confirmed bullish chart formation but struggles below three-week-old previous support line.

- Bullish MACD, higher lows favor buyers to overcome the immediate hurdle and aim for 200-SMA.

- Multiple supports to test bears before March 2020 low.

EUR/USD grinds lower around 1.0900, following the first positive daily closing in six. In doing so, the major currency pair fades Monday’s bounce off the lowest levels last seen during May 2020.

Even so, the resistance-turned-support line of a two-week-old falling wedge and bullish MACD signals keep EUR/USD buyers hopeful.

Though, a clear upside break of the previous support line from mid-February, around 1.0930 by the press time, becomes necessary to convince the pair buyers.

Following that, a run-up towards the 200-SMA level near 1.1260 and the 1.1300 round-figure can’t be ruled out.

It’s worth noting that February’s high around 1.1500 becomes crucial resistance for the pair buyers to watch during upside past 1.1300.

Alternatively, a downside break of 1.0885 defies the latest falling wedge confirmation, which in turn will direct the EUR/USD prices towards the latest bottom surrounding 1.0800.

Should EUR/USD bears keep reins past 1.0800, the lower line of the wedge and April 2020 bottom, respectively around 1.0740 and 1.0725, will test the south-rub before directing the quote towards the year 2020’s low of 1.0635.

EUR/USD: Four-hour chart

Trend: Recovery expected

Global rating agency Fitch downgrades Russia from ‘B’ to ‘C’, the second rating downgrade in a week, during Tuesday.

In addition to the rating cut, Fitch also mentioned, “The recent downgrade of a 'C' rating for Russia reflects belief that a sovereign default is imminent.”

Key quotes

The further ratcheting up of sanctions, and proposals that could limit trade in energy, increase the probability of a policy response by Russia that includes at least selective non-payment of its sovereign debt obligations.

To a lesser extent, the risk of imposition of technical barriers to servicing debt, including through the direct blocking of transfer of funds, or through clearing and settlement systems, have also risen somewhat since our last review.

Market implications

The news may propel USD/RUB towards another record high, around 129.70 by the press time.

Read: USD/RUB Price Analysis: Ruble keeps bounce off weekly resistance below 130.00

Names, including Coca-Cola, PepsiCo, Apple, Starbucks, McDonald's are suspending sales in Russia.

''Coca-Cola Co and PepsiCo Inc said on Tuesday they are suspending sales of their sodas in Russia, becoming the latest high-profile Western consumer brands to curtail operations in the region following Moscow's invasion of Ukraine,'' Reuters reported.

''Coca-Cola said its business in Russia and Ukraine contributed about 1% to 2% of the company's net operating revenue in 2021.

PepsiCo, whose colas were one of the few Western products allowed in the Soviet Union prior to its collapse, said it would continue to sell daily essentials, such as milk and other dairy offerings, baby formula and baby food, in Russia.''

Starbucks is also pulling out by suspending all business activity in Russia, and its licensee will temporarily shutter locations there.

The coffee chain has about 130 outlets in Russia and Ukraine, according to Bank of America Securities.

Restaurant giant McDonald’s said earlier on Tuesday that it would temporarily close its 850 restaurants in the country.

However, the list goes on, from Disney, Carlsberg, Airbnb, Adidas, Budvar, Volvo. VW, Toyota, Renault, Mercedes-Benz, Harley-Davidson, Ford and Ferrari, have all come forward in one way or another, suspending business activity with the Russian market.

Then, in the energy sector, which is a major blow for the elites of Russia who are immersed in such business dealings with the likes of Gazprom, Shell, Exxon, Equinor and BP are all abandoning JVs with Russia's oil and gas market.

- Spot silver continued to rally on Tuesday, at one point nearing $27.00/ounce before falling back under $26.50.

- As commodity markets broadly continue to rally, silver is likely to retain healthy inflation hedging-related demand.

Spot silver’s (XAG/USD) ascent turned up a gear on Tuesday, with the precious metal rallying a further more than 3.0% on the day, taking its run of gains since the start of the month to over 8.0%. XAG/USD prices came within a whisker of hitting the $27.00 per troy ounce level and, in doing so, hit their highest point since mid-June 2021. The US announced a ban on Russian energy imports and the UK announced a plan to phase out Russian oil imports by the end of the year, further triggering fears of Western sanction-induced global stagflation and supporting precious metals.

Gold came within a whisker of hitting record levels in the $2075 per troy ounce area on Tuesday. Given that spot silver still remains some 12% below its record highs from early 2021, there may be some room for catch-up. The next major area that the bulls will be watching is the Q2 2021 highs in the $28.70 area, some 8.0% above current levels. With no end in sight to the fighting in Ukraine and Western sanctions on Russia likely to continue to tighten in the days and weeks ahead, it remains premature to call the top of the broad commodity market rally.

Silver and other precious metals are thus likely to continue to receive healthy demand as both hedges against in inflation and as safe-haven assets. US Consumer Price Inflation (CPI) metrics on Thursday should serve as a timely reminder as to just how far behind the curve the Fed is when it comes to tackling inflation (interest rates just above zero and headline CPI nearing 8.0% YoY). With MoM inflation rates seen surging in the months ahead to reflect recent commodity price action, real interest rates in major developed are not seen rising any time soon, which should maintain a strong incentive to hold non-yielding assets like silver.

- GBP/JPY has enjoyed some much-needed stabilisation in the mid-151.00s as global equities consolidate, having taken a beating in previous sessions.

- Bears targeting an eventual move to 149.00 support likely won’t lose heart in wake of Tuesday’s very modest rebound.

Though it hasn’t been quite the turnaround Tuesday that some of the GBP/JPY bulls would have been hoping for, the pair has enjoyed some much-needed stabilisation as global equities consolidate, having taken a beating in previous sessions. At current levels in the 151.60s, the pair is trading with gains of about 0.4% on the day and is above the mid-point of the day’s 151.00-152.00 ranges, having found good support in the form of Monday’s lows at 151.00.

Whether or not Tuesday’s respite can translate into a broader recovery over the course of the remainder of the week is the main question that traders will be asking. From a technical perspective, a rally back above 152.00 shouldn’t be too much of a difficulty, with a break above resistance just under 153.00 the real challenge. Prior to last Friday, this had been a key level of support so far in 2022.

As the West continues to tighten the sanctions noose around Russia’s economy (the US announced a ban on all Russian oil imports and the UK announced steps to phase out oil imports this year), the recent commodity price surge may have legs. That might prevent any lasting rebound in risk-sensitive assets (like GBP/JPY) as market participants continue to fret about stagflation. Short-term bears targeting an eventual move to test 149.00 support in the coming days/weeks likely won’t lose heart in wake of Tuesday’s very modest rebound. Indeed, GBP/JPY is still down more than 1.5% on the month.

What you need to take care of on Wednesday, March 9:

The market mood improved modestly as, earlier in the day. Ukraine confirmed the first humanitarian corridor, which allowed the evacuation from Sumy and Mariupol. So far, the UN has reported that the total number of refugees topped two million.

The sentiment improved further after news agencies reported Ukraine would no longer seek NATO membership, in a nod to Russia. Meanwhile, the next round of peace talks is scheduled for next Thursday in Turkey.

US President Joe Biden and UK Prime Minister Boris Johnson have announced sanctions on Russia amid its latest invasion of Ukraine. The first announced they are banning all crude oil imports from Moscow, including gas and energy, “after consulting with allies.” The ban on Russian energy applies to all new purchases. Market participants have already anticipated this move, as it has been making the rounds since Monday.

As for the UK government, they announced that they would phase out the import of Russian oil and oil products by the end of 2022. The idea is to transition to provide ample time for markets and businesses to replace Russian imports. Ever further, they noted that the current reliance on Russian natural gas accounts for 4% of the supply and that they are already looking into it.

Meanwhile, Russian President Vladimir Putin decided to ban the export of products and raw materials out of the Russian federation until December 31.

The EUR/USD pair peaked at 1.0957 but settled a handful of pips above the 1.0900 figure. GBP/USD ended the day struggling to retain the 1.3100 threshold. Commodity-linked currencies ended the day lower against the greenback. The AUD/USD pair trades around 0.7270, while USD/CAD flirts with 1.2900.

Spot gold soared to $2,070.50 a troy ounce, retreating sharply afterwards and ending the day around $2,031. Crude oil prices posted are little changed at the close, with the barrel of WTI changing hands at $123.60.

US indexes managed to recover some ground, ending Tuesday with modest gains.

Top 3 Price Prediction Bitcoin, Ethereum, XRP: Crypto bloodbath likely to continue until late March

Like this article? Help us with some feedback by answering this survey:

- GBP/USD bulls step in as there could be a light at the end of the tunnel in terms of the Ukraine invasion.

- Ukraine's president, Volodymyr Zelensky, is open to dialogue and NATO is not on the agenda.

GBP/USD is back in the green after rallying from 1.31 the figure and now on the march towards 1.3130. A phase of risk-on has happened in recent trade following remarks from Ukraine's president, Zelensky, that Ukraine was not about to join NATO, reminding the world that Ukraine was not regarded as being ready to join NATO.

"I have cooled down regarding this question a long time ago after we understood that ... NATO is not prepared to accept Ukraine," Zelensky said in an interview aired Monday night on ABC News.

This is essentially a rehash of what is already known so it may not have a lasting impact. There are a lot of criteria for NATO membership and Ukraine didn’t really meet any of those. Having said that, Zelensky has also said he is open to "compromise" on the status of two breakaway pro-Russian territories that President Vladimir Putin recognized as independent just before unleashing the invasion on February 24. Overall, Zelensky is open to dialogue.

"I'm talking about security guarantees," he said. He said these two regions "have not been recognized by anyone but Russia, these pseudo republics. But we can discuss and find the compromise on how these territories will live on."

Central banks in focus

Meanwhile, the Bank of England policymakers are set to enter the blackout period ahead of an interest rate decision on March 17.

We expect a 25bps hike then, but so do markets and economists, so the focus will be on how quickly the bank will increase rates (continue with back-to-back hikes?) and how high it is willing to take the bank rate," analysts at Scotiabank said. Money markets are currently fully pricing in a 25 basis point rate increase at the BoE's March meeting.

As for the US dollar, we are in the blackout period of Federal Reserve speakers ahead of next week's Federal Reserve meeting. ''Between the ongoing risk-off impulses and the Fed outlook for tightening, we believe the dollar uptrend remains intact,'' analysts at Brown Brothers Harriman said.

''Recent comments support our view that the Fed is on track to start the tightening cycle with a 25 bp hike March 16. WIRP suggests nearly 100% odds of liftoff then, which we think is spot on. We had always been skeptical about a 50 bp move and the Ukraine crisis has quashed expectations for a larger move,'' the analysts added.

''Looking ahead, nearly 175 bp of tightening is priced in over the next 12 months, up from 150 bp seen at the end of last week, followed by another 25 bp in the following 12 months. Such a path would see the Fed Funds rate peaking near 2.0% vs. 1.75% at the end of last week. We continue to believe that the terminal rate will have to be much higher but at least the market is moving in that direction again.''

According to a statement released by the UK government, the UK will phase out its imports of Russian oil and oil products by the end of 2022, reported Reuters on Tuesday. This transition will give the market, businesses and supply chains more than enough time to replace Russian imports, which currently make up 8% of UK demand. Businesses should use this year to ensure a smooth transition so that consumers will not be affected, the statement continued, adding that the government will also be working with companies through a new task force on oil to support them to make use of this period in finding alternative supplies.

The UK added that it will work with other import partners this year to secure further supplies and stated that is it not dependent on Russia for natural gas imports, which make up just 4.0% of the country's supply. The UK is exploring options to end this altogether.

- Yen gains momentum as equity markets turn negative in Wall Street.

- USD/JPY unable to break key resistance, remains range-bound.

- Metals and crude oil soar, DXY down 0.05%.

The USD/JPY pulled back during the American session and fell to 115.41, before rising back above 115.50. The yen recovered strength as the recovery in equity markets faded and despite higher US yields.

Earlier on Monday, the USD/JPY climbed to 115.78 and then lost momentum. The dollar failed to break the critical resistance area around 115.80 that is in place since mid-February. A firm break above would put the pair on its way to 116.00 and more.

On the flip side, the next support is seen at 115.30, followed by 114.85 and then the bottom of the current range around 114.50. Below that area, the yen could accelerate, pushing USD/JPY toward 114.00 and below.

Concerns keep USD/JPY limited

While higher US yields continue to boost the pair, the risk aversion environment favor the Japanese yen. In Wall Street, the Dow Jones opened in positive ground after Monday’s losses but during the last hours turned negative again.

The war in Ukraine continues to be the key driver. Market participants await the announcement of more sanctions from the US that will likely include an import ban on Russian oil and gas. Crude oil prices are at multi-year highs.

Technical levels

Economists at ING expect the European Central Bank (ECB) to retain maximum flexibility at its March meeting. While this is a largely priced-in scenario, it would leave the euro vulnerable to the adverse exposure to the conflict in Ukraine and high energy prices.

Euro to remain vulnerable

“When it comes to the ECB impact, we think markets have already priced in a cautious tone by President Christine Lagarde this week, and we do not expect a material negative impact on the EUR after the policy announcement.”

“Russia’s threat to stop the gas supply to Europe is currently adding to the downside risks that the euro is facing due to its proximity to the conflict and already elevated commodity prices.”

“A move to the 1.0640, 2020 lows, is a possibility in the near-term.”

- In the last hour, silver surged and reached a new YTD high at $26.94.

- A dismal market mood and the commodities market rally keep precious metals bid, weighing on the greenback.

- XAG/USD Technical Outlook: Upward biased, and once cleared $27.00, the next resistance would be above $28.00.

Silver (XAG/USD) rallies for the first time in the week and reaches a new YTD high of around $26.94, pressing towards the $27.00 mark. At the time of writing, XAG/USD is trading at $26.64

The market sentiment is slightly up due to the cease-fire between Russia and Ukraine on the evacuation of civilians. Nevertheless, market participants’ worries spurred a double-digit rally across the commodities complex, led by Oil, with WTI sitting a $125 per barrel. In the metals complex, gold is rising above the $2000 mark, and base metals like nickel spiked almost 250%, spurring a halt on its trading.

Global equity markets trade in the red for the second consecutive day while US Treasury yields rise, with the 10-year benchmark note at 1.858%, up to ten basis points, though ignored by precious metals traders. Contrarily the greenback is getting hit by an appetite for the safe-haven precious metals complex, with the US Dollar Index dropping 0.28% clings with its nails to the 99.00 mark.

The US economic docket featured the Trade Balance for January, which came at $-89.7B, worse than the $-87.1B estimated. In the same report, Exports decreased while Imports incremented, in a report with lower attention than expected.

XAG/USD Price Forecast: Technical outlook

Silver is upward biased. The daily chart shows that the moving averages reside well below the spot price, with the 200-DMA at $24.12 being the nearest to the price, followed by the 50-DMA and the 100-DMA.

With XAG/USD in full swing, the first resistance would be July 5, 2021, a daily high at $26.77. Breach of the latter would expose the $27.00 mark. Once cleared, there is no resistance until June 11, 2021, a daily high at $28.28, followed by May 18, 2021, a daily high at $28.75, on its way towards $29.00.

On the flip side, XAG/USD’s first support would be the November 16, 2021, daily high resistance-turned-support at $25.40.

EUR/USD has lost around 4% since the beginning of the Ukraine conflict to trade as low as 1.08. Economists at Scotiabank expect the world’s most popular currency pair to tick down towards the 1.05 mark in the coming days.

A close under the 1.10 mark for 2022 remains the most likely scenario

“The stark ECB-Fed monetary policy divergence and relatively sanguine US growth prospects vis-à-vis the Eurozone should weigh on the EUR/USD through the remainder of the year and a close under the 1.10 mark for 2022 remains the most likely scenario.”

“The ECB’s extended dovishness and the absence of a clear off-ramp for Russia to withdraw troops from Ukraine could see the EUR test its 2020 low in the coming weeks (if not days given the quickly evolving situation) toward support at 1.05; and erratic Russian leadership implies that we cannot rule out a test of parity in the coming weeks/months, although we think this is unlikely.”

“A resolution to the conflict may see the EUR rebound from depressed levels but we don’t anticipate a prompt removal of Russian sanctions. Persistently-elevated commodity prices (with a negative impact on economic growth) and lingering tensions should maintain dovish ECB settings.”

The ECB’s chief economist Lane indicated last week that the war would shave 0.3-0.4ppts off growth in 2022; updated projections out on Thursday should reflect this scenario at least but policymakers’ central expectations could well shift to reflect an even greater economic cost and pressure the EUR.”

- USD/TRY approaches the YTD high near 14.60.

- Geopolitical tensions continue to weigh on the lira.

- The Turkish central bank is seen on hold next week.

The Turkish lira loses ground for yet another session and encourages USD/TRY to flirt with the area of 2022 peaks around 14.60 on Tuesday.

USD/TRY keeps looking to Ukraine

USD/TRY advances for the seventh session in a row and keeps the 4-week positive streak well in place on the back of persistent selling pressure hitting the Turkish currency, particularly exacerbated after the Russian invasion of Ukraine.

Indeed, as crude oil prices skyrocketed following the Russian offensive in response to disruption fears, the outlook for an economy highly dependent on energy imports like Turkey now looks more vulnerable, which in turn fueled the selling pressure on TRY.

In the meantime, consensus prior to the next meeting by the Turkish central bank (CBRT) on March 17 sees the One-Week Repo Rate unchanged at 14.00% in spite of domestic inflation surpassing 50% in February.

What to look for around TRY

Further upside momentum motivates the pair to flirt with YTD highs near 14.60, at the same time leaving behind the 2-month consolidation theme sustained by surprising lira stability. The Turkish currency, however, is forecast to remain under scrutiny amidst rampant inflation, negative real interest rates, the omnipresent political pressure to keep the CBRT biased towards low interest rates and fresh concerns stemming from the geopolitical scenario.

Key events in Turkey this week: Unemployment Rate (Thursday) – Current Account, End Year CPI Forecast, Industrial Production (Friday).

Eminent issues on the back boiler: Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Much-needed structural reforms. Earlier Presidential/Parliamentary elections?

USD/TRY key levels

So far, the pair is advancing 1.31% at 14.5442 and a drop below 13.7143 (low Feb.25) would expose 13.5091 (low Feb.18) and finally 12.4317 (low Feb.11). On the other hand, the next up barrier lines up at 14.6052 (2022 high Feb.24) seconded by 18.2582 (all-time high Dec.20) and then 19.00 (round level).

The UK government will make an announcement at 1600GMT on Tuesday detailing plans to reduce Russian oil and gas imports over time, tweeted a Politico reporter on Tuesday.

Subsequent reports suggested that the UK is set to announce a ban on Russian oil imports that will be phased in over the course of a few months and won't include gas.

German Vice-Chancellor Robert Habeck said on Tuesday that the recent energy price "explosion" is unprecedented and his country wants to diversify energy supplies at "Tesla speed", reported Reuters. Habeck added that Germany hopes to have liquid natural gas terminals (LNG) up and running within two years and that EU sanctions against Russia are designed to be bearable for EU citizens and its economy.

- Easing tensions favor a better market mood, although Gold Price rallies anyway.

- Wall Street is posting substantial gains ahead of the opening, trimming Monday’s losses.

- XAUUSD is technically bullish, near-term buyers are aligned around $2,000.

XAUUSD is outperforming this Tuesday, rallying to fresh multi-month highs despite a more stable market’s mood. Gold Price hit an intraday high of $2,020.96 a troy ounce at the beginning of the day, finally breaking through the psychological $2,000 threshold and holding well above it.

Demand for the American currency eased partially, as concerns about developments in Eastern Europe cooled down a bit. Asian shares edged lower, although their European counterparts trade in the green, leading a comeback among US indexes up ahead of the opening, limiting the dollar’s demand to the benefit of the bright metal. The third round of peace talks that took place on Monday ended without material solutions, but Gold Price investors are now looking for fresh news, mainly another round of talks next Tuesday in Turkey.

Also read: Gold re-enters 2,000 zone; outlook bullish

Gold Price technical outlook

XAUUSD pulled back from the mentioned high but met buyers at $1,999.35, a sign that buyers are willing to defend the $2,000 mark. Gold Price is overbought in the near term, although there are no technical signs of bullish exhaustion, which maintains the risk skewed to the upside for the American session. Beyond the daily high, the next resistance level is $2,049.87, August 10, 2020, daily high, en route to the high set that month in 2,075.64 a troy ounce.

When measuring the January/March rally, from $1,780.15 to $2,020.96, the 38.2% retracement is located at $1,928.31, which means that a decline towards such a level could be considered corrective. For the short-term, once below the aforementioned $1,999.35, XAUUSD could decline to $1,964, the 23.6% retracement of the mentioned run.

- GBP/USD drifted into negative territory for the fourth straight day amid the cautious market mood.

- The Russia-Ukraine crisis, stagflation fears acted as a tailwind for the USD and capped intraday gains.

- BoE rate hike expectations held back bears from placing fresh bets and limit the downside, for now.

The GBP/USD pair struggled to capitalize on its modest intraday bounce and was last seen trading below the 1.3100 mark, or the lowest level since November 2020.

Following an uptick to the 1.3130-35 area during the European session, the GBP/USD pair met with a fresh supply on Tuesday and turned lower for the fourth successive day. The worsening situation in Ukraine overshadowed the early optimism led by reports that the European Union (EU) may consider massive joint bond sales to finance energy and defence. This was evident from modest decline in the equity markets, which assisted the safe-haven US dollar to pare its intraday losses and exerted some downward pressure on the major.

Moreover, investors remain concerned about the economic fallout from Russia's invasion of Ukraine. Adding to this, the recent monster gains in commodity prices have been fueling fears about an inflation shock in the global economy, raising the risk of stagflation. This might continue to weigh on the global risk sentiment, which along with a sharp rise in the US Treasury bond yields, should act as a tailwind for the greenback. The fundamental backdrop suggests that the path of least resistance for the GBP/USD pair is to the downside.

That said, expectations that the Bank of England (BoE) would go ahead with hiking rates at its March meeting could lend support to the British pound. This could help limit losses for the GBP/USD pair amid slightly oversold conditions on the daily chart. In the absence of any major market-moving economic releases, the focus will remain on fresh developments surrounding the Russia-Ukraine saga. Apart from this, the US bond yields will influence the USD price dynamics and produce some short-term trading opportunities around the GBP/USD pair.

Technical levels to watch

Geopolitical uncertainty support short-term upswing in gold price. Nonetheless, the gold market rally is expected to reverse, in the view of economists at Citibank.

Geopolitical tensions and elevated volatility to support gold in the short-term

“We upgraded the 0-3m gold point-price target $125/oz to $1,950/oz but remain bearish spot/forwards with a 6-12m downside target of $1,750.”

“Even though gold trading tends to weaken into Fed lift-off, we think geopolitical tensions and elevated asset market volatility can support the yellow metal in the short-term.”

“Over the medium-term, higher real yields and stronger equities can weigh on bullion prices again, while risk premiums should erode. But robust physical demand in Asia and recession tail hedges might mute the extent of price downside in 2022.”

“If bullion markets stay strong into April, it might point to a new bullish price cycle, and it would need to re-think our gold/rates thesis.”

Canada posted a trade surplus of C$2.62B in the month of January, the largest since 2008, a release from Statistics Canada showed on Tuesday. That was a larger surplus than the C$2.0B expected and marked a strong rebound from December's surprise deficit of C$1.58B. Analysts said that, given recent commodity price gains, further upside in the country's trade surplus is expected.

Exports fell slightly to C$56.62B from $56.72B in December, down just 0.2% MoM. Meanwhile, Imports saw a much larger 7.4% MoM decline to $54.0B in January versus $58.30 in December.

Market Reaction

The loonie did not react to the latest Canadian data release, with FX markets for now more focused on geopolitics and related moves in commodity markets.

- EUR/GBP gained traction for the second straight day and build on the overnight recovery from the multi-year low.

- EU bond-sale plan, encouraging macro data underpinned the euro and remained supportive of the positive move.

- Stagflation fears held back the euro bulls from placing aggressive bets and capped any further gains for the cross.

The EUR/GBP cross maintained its bid tone through the mid-European session and was last seen hovering near the top of its intraday trading range, around the 0.8320 region.

The cross built on the overnight strong recovery move from the 0.8200 mark, or the lowest level since June 2016 and gained some follow-through traction for the second successive day on Tuesday. Reports indicated that the European Union (EU) may consider massive joint bond sales to finance energy and defence spending to cope with the fallout from the Russia-Ukraine war. This, along with encouraging macro data, turned out to be a key factor behind the shared currency's relative outperformance against its British counterpart.

The Eurostat confirmed its earlier estimates and reported that the region's economy expanded by 0.3% on a quarterly basis and by a 4.6% annual rate during the October-December period. Adding to this, German industrial production surpassed expectations and increased by 2.7% MoM in January despite supply-chain constraints. The previous month's reading was also revised higher and showed a 1.1% rise in the total industrial output as compared to the 0.3% decline estimated. This, along with modest US dollar pullback, benefitted the euro.

That said, worries about the worsening situation in Ukraine held back bulls from placing aggressive bets and kept a lid on any further gains for the EUR/GBP cross. Given its geographical proximity, the European economy would suffer the most from the spillover effects of the Ukraine crisis. Moreover, Russia's invasion of Ukraine also seems to have derailed the European Central Bank's plans to dial back stimulus. Hence, the market focus will remain glued to fresh developments surrounding the Russia-Ukraine saga and the ECB meeting on Thursday.

In the meantime, expectations that the Bank of England (BoE) would go ahead with hiking rates at its March meeting could act as a tailwind for sterling. This further warrants some caution before confirming that the EUR/GBP cross has bottomed out and positioning for any further near-term appreciating move.

Technical levels to watch

A review of the latest US Payrolls figures published last Friday by Alvin Liew, Senior Economist at UOB Group’s Global Economics & Markets Research.

Key Takeaways

“The Feb US employment gain of 678,000 and unemployment rate easing to 3.8%, both beat market expectations.”

“However, wage growth was surprisingly moderate at 0.0% m/m, 5.1% y/y despite anecdotal evidence of growing demand and persistent worker shortages.”

“The US employment gains in 2022 to date have added to labor market optimism, but the mild wage increase may be temporary and may re-accelerate due to the situation of hiring challenges and growing inflation worries in light of the Russia-Ukraine crisis.”

- Euro area GDP expanded by 0.3% in Q4 as expected.

- EUR/USD clings to modest daily gains, trades below 1.0900.

The data published by Eurostat showed on Tuesday that seasonally adjusted Gross Domestic Product (GDP) in the euro area expanded by 0.3% on a quarterly basis in the fourth quarter. This print came in line with the initial estimate and the market expectation. Compared with the same quarter of the previous year, GDP grew by 4.6%.

"For the year 2021 as a whole, GDP increased by 5.3% in both the euro area and EU, after -6.4% and -5.9% respectively in 2020," the publication further read.

Other data from the euro area revealed that the Employment Change in the fourth quarter was up 0.5%, matching analysts' forecast.

Market reaction

These data don't seem to be having a noticeable impact on the shared currency's performance against its rivals. As of writing, EUR/USD was up 0.25% on the day at 1.0880.

Economist at UOB Group Barnabas Gan reviews the latest release of Retail Sales in Singapore.

Key Takeaways

“Singapore’s retail sales surged 11.8% y/y (-2.5% m/m sa) in Jan 2022, surprising market estimates for a milder growth of 7.2%. Retail sales excluding motor vehicles rose 15.8% y/y in the same month.”

“Several factors contributed to the rise in retail sales. Seasonal factors such as the Lunar New Year (LNY) most likely fuelled consumer demand as LNY was in early Feb. Pent-up demand in line Singapore’s tighter labour market, and coupled with the low-base levels in Jan 2021, also likely contributed to retail sales demand.”

“Retail sales will likely continue to stay supported in 2022, in line with the positive economic prognosis and recovering labour market. Potential front-loading consumer demand in the year ahead could also help retail sales as consumers adjust for the higher GST rates in 2023. Barring the exacerbation of COVID-19-related risks in Singapore and around the region, we pencil retail sales to expand by 6.0% in 2022.”

- EUR/USD reverses the recent weakness and retakes 1.0900.

- Risk appetite shows some improvement on Tuesday.

- EMU flash Q4 GDP next of note in the calendar.

Finally, some respite for the European currency. In fact, the so far better mood in the risk complex lends support to the upside in EUR/USD to levels beyond 1.0900 the figure on turnaround Tuesday.

EUR/USD still under pressure on geopolitics

EUR/USD prints decent gains and manages to leave behind six consecutive sessions with losses, as market participants appear to favour the risk-associated galaxy early in the European morning.

Indeed, the better tone in the risk complex re-emerged in response to news citing the EU could be planning a massive joint bond sales to fund energy and defence spending against the backdrop of the current instability sparked in the wake of the Russian invasion of Ukraine.

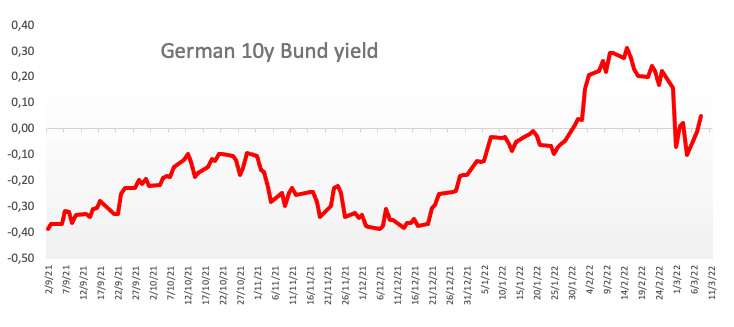

The daily recovery in the pair is also underpinned by the rebound in yields of the German 10y Bund back to the positive territory around 0.05%.

In the domestic calendar, German Industrial Production expanded at a monthly 2.7% in January. Later in the session, another revision of EMU GDP for the October-December period will take centre stage. In the US data space, Trade Balance and Wholesale Inventories are also to be published later in the NA session.

What to look for around EUR

EUR/USD collapsed to levels last seen in May 2020 near the 1.0800 yardstick on Monday, just to regain some composure afterwards. The European currency is expected to remain under heavy pressure for as long as the Russia-Ukraine conflict lasts along with the persistent risk aversion, altogether bolstering the “flight-to-safety” environment. In the longer run, occasional strength in the pair should remain underpinned by speculation of a potential interest rate hike by the ECB probably sooner than many anticipate, higher German yields, persevering elevated inflation, the decent pace of the economic recovery and auspicious results from key fundamentals in the region.

Key events in the euro area this week: EMU Flash Q4 GDP (Tuesday) – ECB interest rate decision (Thursday) – Germany Final CPI.

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the euro area. Speculation of ECB tightening/tapering later in the year. Presidential elections in France in April. Geopolitical concerns from the Russia-Ukraine conflict.

EUR/USD levels to watch

So far, spot is gaining 0.40% at 1.0896 and faces the next up barrier at 1.1096 (10-day SMA) followed by 1.1293 (55-day SMA) and finally 1.1395 (weekly high Feb.16). On the other hand, a drop below 1.0805 (2022 low Mar.7) would target 1.0766 (monthly low May 7 2020) en route to 1.0727 (monthly low Apr. 24 2020).

EUR/USD recovered yesterday from the intra-day low of 1.0806 but struggled to make much headway, drifting sideways. Economists at Société Générale expect the pair to test next supports at 1.0700 and 2020 low of 1.0635.

Signals of bounce still not visible

“The down move is a bit overstretched however signals of rebound are still not visible.”

“Multi-year trend line at 1.0700 and 2020 low of 1.0635 are next potential support levels.”

Brent has experienced a parabolic up move recently and has formed a peak near $139.00 earlier this week. A break above this level would open up further gains towards $146/48, then $154, strategists at Société Générale report.

Only at risk of declines on a break under $119

“Daily MACD histogram is at a record high which denotes the move is overstretched however signals of pullback are still not visible.”

“Overcoming $139 can lead Brent towards 2008 levels of $146/148 and projections of $154.”

“Only if bullish gap at $119 breaks, there would be a risk of a short-term down move.”

Risk sentiment is seeing fresh signs of life following a Bloomberg report that the European Union (EU) is set to outline a plan this week to jointly issue bonds on a potentially massive scale to finance energy and defense spending.

Additional details

“The proposal may be presented after the EU’s leaders hold an emergency summit in Versailles, France, March 10-11.”

“Officials are still working out the details on how the debt sales would work and how much money they intend to raise.”

Market reaction

Amid a renewed risk-on wave, the S&P 500 futures recovered losses, last seen up 0.20% on the day.

Meanwhile, gold prices fell back to test $2,000 after hitting the highest level since August 2020 at $2,021.

Economists at UBS detail three scenario analyses for markets. With military outcomes and political motives likely to remain opaque, they believe it is more practical to focus attention on the potential impact of the war and sanctions on commodity prices, which are visible and have a direct impact on economies around the world.

Central scenario

“We would expect sanctions to contribute to the gradual removal of Russia from global energy supply chains, rather than forcing an immediate halt to energy flows. Our Brent crude forecasts, in this case, are $125/bbl for June, $115/bbl for September, and $105/bbl for December.”

“Broadly stable corporate earnings expectations and falling geopolitical risk premia mean that in this scenario, we would expect markets to move higher by year-end. Our S&P 500 target for this scenario is 4,800 by the end of 2022, around 10% above today’s levels.”

Downside scenario

“Oil prices could rise above $150/bbl and gas could need to be rationed in Europe.”

“Lower corporate earnings expectations and a still-elevated geopolitical risk premium would mean global markets would likely move lower. Our S&P 500 target for this scenario is 3,700, around 15% lower than current levels.”

Upside scenario

“With consumer spending on services still expected to rebound because of the lifting of omicron-related restrictions, global growth should be robust in this scenario. Provided inflation also reduces over the course of the year, we believe the S&P 500 could end the year at 5,100 in this upside scenario, around 17% higher than current levels.”

The US dollar has continued to strengthen as global liquidity conditions deteriorate and energy prices have spiked again. Economists at ING expect the US Dollar Index (DXY) to hit the 100 level in the coming days.

Safe-haven inflows unlikely to stop soon

“A combination of elevated upside volatility in energy prices, equity underperformance and liquidity concerns continue to push investors seeking safety towards the greenback.”

“Along with the geographical vicinity and different correlation with risk sentiment, the disorderly rise in energy prices is what is generating a big divergence between the dollar (the US is largely energy-independent) and most European currencies (the region is largely dependent on Russian oil and gas). This looks unlikely to change soon.”

“A move to 100.00 in DXY seems plausible in the coming days.”

After staying surprisingly resilient against the dollar last week, the Australian dollar came under selling pressure during the Asian trading hours. Nonetheless, economists at ING expect the aussie to recapture the 200-day moving average (DMA) at 0.7320 soon.

The correction may not have long legs

“Tonight, a speech by Reserve Bank of Australia Governor Philip Lowe will be in focus, as markets try to gauge whether the recent global developments are prompting a change in the Bank’s patient stance on monetary tightening. This does not seem very likely given the RBA’s explicit focus on wage growth dynamics, but it is also hard to ignore positive external inputs, and above all the sharp rebound in iron ore prices.”

“We expect some relative outperformance of AUD over NZD in the coming days, and AUD/USD might even find its way back above the 0.7320 200-DMA soon.”

USD/JPY closed in positive territory on Monday and continues to edge higher toward 115.50 on Tuesday, trading in the upper-half of the 114.50-116.00 range. Economists at OCBC Bank expect the pair to remain in the range for now, but risks are still skewed to the upside.

Range-bound

“A diverse mix of drivers will point to diffused overall directionality for now.”

“The 114.50 and 116.00 range still limits the USD/JPY, with the pair now in the top-half of the range.”

“On a more structural basis, the USD/JPY upside arguments based on the hawkish Fed, and widening yield differentials remain largely intact.”

The EUR/USD decline stalled just held of 1.0800, before consolidating between the 1.0850/00 zone. Economists at OCBC Bank recommend selling any bounce in absence of any progress in reaching a truce or ceasefire between the Russian and Ukrainian delegations.

ECB decision unlikely to provide sustained relief

“Barring a clear improvement in the geopolitical conflict, the playbook for the pair should be to sell on rallies. In this case, expect selling pressure to pick up above 1.0900.”

“Further downside cannot be ruled out, with the ECB decision on Thu unlikely to provide sustained relief.”

Industrial Production in Germany jumped more than expected in January, the official data showed on Tuesday, suggesting that the manufacturing sector recovery is gathering steam.

Eurozone’s economic powerhouse’s industrial output climbed by 2.7% MoM, the federal statistics authority Destatis said in figures adjusted for seasonal and calendar effects, vs. a 0.5% increase expected and 1.1% last.

On an annualized basis, the German industrial production dropped by 1.8% in January versus a 2.7% drop registered in December. Markets expected the industrial output to rebound sharply by 4.2% in the reported month.

FX implications

The shared currency is pressurizing lows near 1.0850 on the mixed German industrial figures.

At the time of writing, EUR/USD is trading at 1.0853, modestly flat on the day.

About German Industrial Production

The Industrial Production released by the Statistisches Bundesamt Deutschland measures outputs of the German factories and mines. Changes in industrial production are widely followed as a major indicator of strength in the manufacturing sector. A high reading is seen as positive (or bullish) for the EUR, whereas a low reading is seen as negative (or bearish).

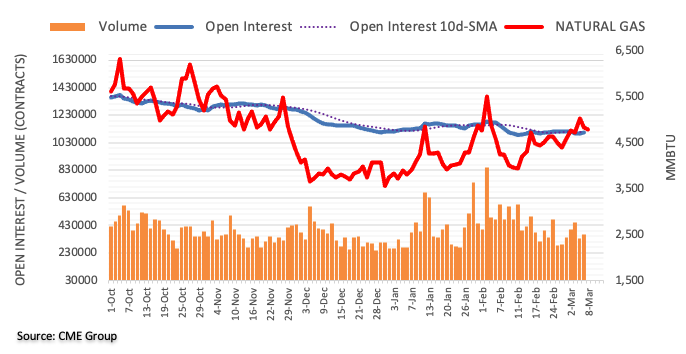

Considering advanced figures from CME Group for natural gas futures markets, open interest rose for the second consecutive session on Monday, now by around 5.3K contracts. Volume followed suit and went up by nearly 32K contracts, resuming the uptrend following the previous pullback.

Natural Gas: Upside limited around $5.20

Natural gas prices tested the $5.20 area on Monday before sparking a corrective downside along with rising open interest and volume. That said, extra decline now looks likely in the very near term with the next support of note at the 200-day SMA around $4.30 per MMBtu.

One-month risk reversal (RR) of AUD/USD, a gauge of calls to puts, drops the most since February 14 on daily basis, per data source Reuters. That said, the spread between call and put options prints -0.287 level by the press time of early Tuesday morning in Europe.

Not only the daily print but the fifth consecutive negative weekly print also portrays the market’s bearish bias over the AUD/USD. That said, the latest print of weekly RR is -0.175.

Given the AUD/USD pair’s risk-barometer status, the escalation in the Ukraine- Russia tussles seems to favor the options bears.

The pair’s latest performance also justifies the negative RR as AUD/USD renews intraday low around 0.7275 by the press time, down 0.50% on a day. That said, a speech from RBA Governor Philip Lowe, during late Tuesday, acts as a nearby catalyst for the pair traders to watch.

Read: AUD/USD Price Analysis: Pullback towards 0.7280 may bring fresh bids towards five-months high

Following the recent price action, extra gains in NZD/USD seems to have lost momentum for the time being, noted FX Strategists at UOB Group.

Key Quotes

24-hour view: “We highlighted yesterday that ‘strong momentum suggests further NZD strength even though the major resistance at 0.6975 is likely out of reach’. Our expectations did not materialize as NZD pulled back sharply from 0.6926 (low has been 0.6822). The rapid pullback appears to be running ahead of itself and NZD is unlikely to weaken much further. For today, NZD is more likely to trade sideways between 0.6800 and 0.6880.”

Next 1-3 weeks: “In our latest narrative from yesterday (07 Mar, spot at 0.6885), we highlighted that NZD ‘could advance further to 0.6940, as high as 0.6975’. NZD subsequently rose to 0.6926 before pulling back sharply (low has been 0.6822). The sharp pullback has diminished the odds for further NZD strength. However, only a breach 0.6800 (no change in ‘strong support’ level) would indicate that the upward pressure that started early last week has dissipated.”

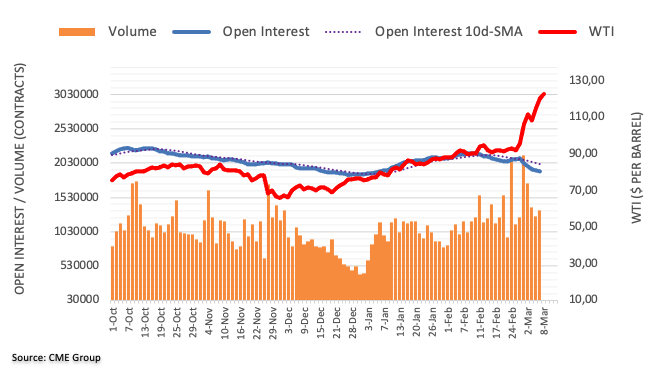

CME Group’s flash data for crude oil futures markets noted open interest extended the downtrend for yet another session at the beginning of the week, this time by around 23.1K contracts. On the flip side, volume went up by nearly 92K contracts following three daily pullbacks in a row.

WTI looks capped by $127.50

Prices of the barrel of WTI eased a tad from recent peaks past the $127.00 mark (March 7), although they remain well supported by the geopolitical landscape. Monday’s positive price action was in tandem with shrinking open interest, hinting at the idea that a probable corrective move could be in the offing aided by the current extreme overbought conditions of crude oil.

- USD/CHF prints short-term bullish pennant breakout to keep buyers hopeful.

- Receding bearish bias of MACD strengthens upside bias, 200-SMA acts as additional support.

USD/CHF renews intraday high to 0.9263 on confirming a bullish pennant chart formation heading into Tuesday’s European session. That said, the quote trades around 0.9260 by the press time.

The Swiss currency (CHF) pair’s latest upside momentum also gains support from the MACD line that seems to pause the previous downtrend.

As a result, the USD/CHF prices are ready to confront the support-turned-resistance line around 0.9280.

Following that, the 0.9300 threshold and February’s peak of 0.9343 will be in focus.

Alternatively, pullback moves remain elusive beyond the stated pennant’s support line, at 0.9248 by the press time.

Should the USD/CHF pullback break the 0.9248 support, the 200-SMA level surrounding 0.9210 and double bottoms surrounding 0.9150 should be watched carefully for additional short trades.

USD/CHF: 30-minute chart

Trend: Further upside expected

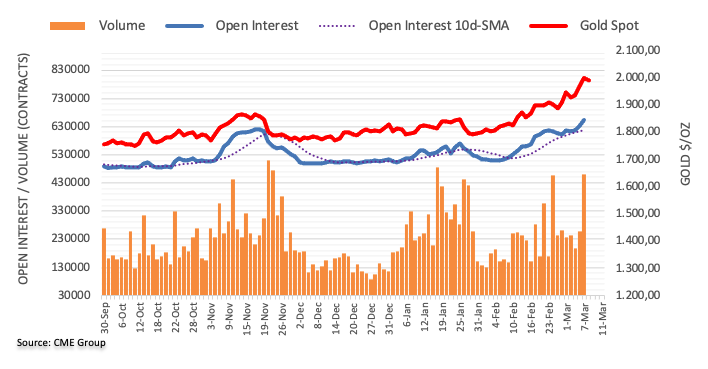

Open interest in gold futures markets increased for the third session in a row on Monday, this time by around 19.5K contracts according to preliminary readings from CME Group. In the same line, volume went up by the second consecutive session, now by around 203.1K contracts.

Gold remains capped by $2000

Monday’s strong uptick in gold prices was amidst increasing open interest and volume, leaving the door open to the continuation of the uptrend in the very near term. Despite the current overbought condition of the commodity could spark a corrective move, the underlying bullish bias in precious metal remains well in place for the time being.

- Gold consolidates recent gains around 19-month high, picking up bids of late.

- 61.8% FE guards immediate upside as Russia, Ukraine struggle over ceasefire, human corridor.

- EU, UK hesitate to support the US in banning Russian oil imports, opt for phase sanctions.

- Gold Price Forecast: XAU/USD needs a sustained move above $2,005 to unleash additional upside

Having failed to cross the short-term key hurdle around $2,000, gold (XAU/USD) prints mild losses near $1,990 heading into Tuesday’s Asian session. That said, the bright metal rose to the highest levels since last seen during late 2020 the previous day before retreating from $2,002.

While the supply-crunch fears remain on the table, keeping the gold buyers hopeful, a deadlock over the ceasefire and human corridor amid the Russia-Ukraine talks seems to probes the gold buyers of late. “Ukrainian officials said a Russian airstrike hit a bread factory in northern Ukraine on Monday, killing at least 13 civilians, while talks between Kyiv and Moscow made little progress towards easing the conflict,” said Reuters.

The news also quotes Russian media while saying, “Moscow would give the residents of the Ukrainian cities of Sumy and Mariupol the choice of moving elsewhere in Ukraine on Tuesday, setting a deadline in the early hours for Kyiv to agree.”

Elsewhere, the European Union (EU) and the UK’s rejection of the US plan to ban Russian oil imports in totality also seem to have favored the market’s latest consolidation.

Against this backdrop, the US 10-year Treasury yields extend the previous day’s rebound from two-month to 1.8%, up five basis points at the latest, whereas S&P 500 and the Euro Stoxx 50 Futures print mild intraday losses at the latest.

Looking forward, a light calendar and deadlock over the key geopolitical issues may keep challenging XAU/USD moves. However, a pause in Moscow’s invasion of Ukraine may extend the commodity’s latest pullback moves.

Technical analysis

Gold prices step back from the 61.8% Fibonacci Expansion (FE) of January-February moves amid overbought RSI conditions.

As a result, XAU/USD sellers remain hopeful to retest the 10-DMA support of $1,937.

However, any further weakness will be challenged by the convergence of the previous resistance line from September 2021 and the monthly ascending trend line, near $1,924.

On the contrary, a clear upside break of the 61.8% FE level surrounding the $2,000 threshold will direct gold buyers towards the $2015-20 area comprising multiple tops marked since July 2020.

Following that, the year 2020 peak near $2,075 and the $2,100 threshold will gain the market’s attention.

Gold: Daily chart

Trend: Pullback expected

FX Strategists at UOB Group noted EUR/USD remains focused on a potential test of the 1.0805 level in the next weeks.

Key Quotes

24-hour view: “We expected EUR to weaken yesterday but we noted that ‘the next support is a major level at 1.0805’. EUR weakened as expected, but it rebounded strongly from 1.0804. Deeply oversold conditions suggest EUR is unlikely to weaken further. For today, EUR is more likely to consolidate and trade between 1.0805 and 1.0925.”

Next 1-3 weeks: “Our update from yesterday (07 Mar, spot at 1.0875) still stands. As highlighted, EUR is still clearly weak and the next level to focus on is a major long-term support at 1.0805. Note that EUR subsequently dropped to 1.0804 before rebounding. Looking ahead, a clear break of 1.0805 could lead to rapid decline to 1.0740. The risk for further weakness is intact as long as EUR does not move above 1.1000 (no change in ‘strong resistance’ level from yesterday).”

- Asia-Pacific equities remain mostly negative even as market’s previous risk-aversion fades.

- The bloc being oil’s largest importer, WTI rally negatively affects equities.

- BOJ’s Kuroda hint at further JGB buying, Morgan Stanley urges Fed for caution.

- Light calendar, sluggish negotiations between Ukraine and Russia allow market players to pause earlier risk-off but bears remain hopeful.

Shares in the Asia-Pacific region part ways from stock futures in the US and Europe as investors bear the burden of higher fuel prices and supply fears during Tuesday.

While portraying the mood, the MSCI’s index of Asia-Pacific shares outside Japan drops around 1.0% whereas Japan’s Nikkei 225 remains near a 16-month low, down 1.25% intraday heading into Tuesday’s European session.

It’s worth noting that the WTI crude oil prices rise 1.10% to $118.00 by the press time, following the week-start run-up to the levels last seen during 2008.

Read: WTI Price Analysis: Bounces off weekly support to regain $117.00

Headlines from Reuters indicate no major progress in the peace talks between Ukraine and Russia even as the human corridor is up for a restart. “Ukrainian officials said a Russian airstrike hit a bread factory in northern Ukraine on Monday, killing at least 13 civilians, while talks between Kyiv and Moscow made little progress towards easing the conflict,” said the news.

Even so, the UK and the EU’s resistance to fully ban the oil imports from Russia, as widely pushed by the US, joins the World Bank’s (WB) humanitarian aid to Kyiv to ease the previous risk-off mood. It should be observed that global bond trading major Morgan Stanley urged the U.S. Federal Reserve on Tuesday to take a more cautious approach to raising interest rates as Russia's invasion of Ukraine spurs already sky-rocketing global inflation, per Reuters, whch in turn challenge the optimists.

Hence, markets pause the previous day’s heavy bearish move but remain on the back foot in Asia. That said, Australia’s ASX 200 fails to cheer upbeat sentiment numbers from National Australia Bank (NAB) whereas New Zealand’s NZX 50 also drop 1.40% by the press time.

Chatters of expected easing in China inflation figures during the next month seem to have failed to recall the bulls as stock in Beijing and Hong Kong are mostly down.

It’s worth noting that Indonesia’s IDX Composite and India’s BSE Sensex do buck the broad downtrend with mild gains amid positive headlines concerning coronavirus.

On a broad front, the US 10-year Treasury yields extend the previous day’s rebound from two-month to 1.80%, up five basis points at the latest, whereas S&P 500 Futures print mild gains at the latest.

Moving on, updates concerning Ukraine will direct short-term market moves. Also important will be Thursday’s US Consumer Price Index (CPI).

Read: S&P 500 Futures, Nikkei 225 stay depressed, US T-bond yields extend recovery amid Ukraine crisis

Japanese Finance Minister Shunichi Suzuki said Tuesday, the “Bank of Japan (BOJ) has jurisdiction over how it exits easy policy.”

Additional quotes

“Specific monetary policy up to the BOJ to decide.”

“Turning JGBs held by the BOJ into perpetual bonds would be tantamount to debt financing, could trigger yield spike.”

Market reaction

At the time of writing, USD/JPY is keeping its range around 115.40, gaining 0.11% on the day,

.

- USD/RUB consolidates recent losses after refreshing the all-time high on Monday.

- Short-term key supports test sellers but bearish MACD signals hint at further weakness.

- 200-HMA adds to the downside filters, multiple hurdles to test the buyers.

USD/RUB bulls take a breather around 129.00, down 7.20% intraday during early Tuesday morning on Tuesday.

The Russian ruble pair rallied to the record top the previous day before taking a U-turn from 177.25

The pullback, however, failed to conquer the weekly support line, around 111.00 by the press time.

The resulting rebound crossed the 50-HMA and struggles with the 50% Fibonacci retracement of the pair’s upside from February 25.

That said, bearish MACD signals direct USD/RUB bears towards the 111.00 support retest should the quote drops below the 50-HMA level of 126.50.

Also acting as a downside filter is the 200-HMA level near 105.00 and the 100.00 threshold.

Meanwhile, 38.2% Fibonacci retracement level near 140.00 and the 150.00 round figure will challenge USD/RUB buyers before directing them to the latest high near 177.00.

Following that, the 200.00 psychological magnet will be in focus.

USD/RUB: Hourly chart

Trend: Further weakness expected

- Nickel prices rally around 10% on LME, Futures on Shanghai refreshed record top.

- LME registered nickel inventories drop to the lowest since 2019.

- Russia-Ukraine woes continue challenging global supply chain, especially related to commodities.

- Metal buyers stay hopeful with eyes on geopolitical headlines, US CPI.

Nickel prices pay a little attention to the recently improved market sentiment as the 3-month contract on the London Metal Exchange (LME) rises around 10% to $53,000 during Tuesday's Asian session. That said, the metal’s April contract on the Shanghai Futures Exchange refreshed an all-time high of 228,810 yuan ($36,255.74) a tonne amid the early day trading.

That said, nickel prices shot around 90% the previous day on LME to refresh the record top to $55,000, before closing with around $66.00% daily gains.

The quote’s latest upside could be linked to the depleting inventories and rising fears of a supply crunch due to the Russia-Ukraine tussles.

While portraying the inventory data, Reuters said, “Inventories of nickel in LME-registered warehouses are at their lowest since 2019 at 76,830 tonnes.”

It’s worth noting that Russia supplies 10% of the global nickel demand, majorly used for stainless steel and electric vehicle batteries. Hence, Russia’s invasion of Ukraine and global sanctions do challenge the major commodity producer, as well as the supply cycle.

Recently, no major progress in the Russia-Ukraine talks and Moscow’s continues invasion of Kyiv weigh on the market’s sentiment. As per Reuters, “Ukrainian officials said a Russian airstrike hit a bread factory in northern Ukraine on Monday, killing at least 13 civilians, while talks between Kyiv and Moscow made little progress towards easing the conflict.”

Amid these plays, nickel prices are likely to remain firmer towards refreshing the all-time high. However, any positive surprise from either Russia or through the exchange data, won’t be taken lightly.

Also important will be Thursday’s US Consumer Price Index (CPI), as well as chatters surrounding the US dollar and the Fed.

- USD/INR consolidates recent losses around all-time high, sidelined of late.

- India reports lowest covid infections in 22 months, rallying commodities challenge INR.

- Absence of major negatives from Russia-Ukraine front joins EU, UK’s resistance in sanctioning Moscow’s oil to favor market sentiment.

- Fed’s silence, light calendar can keep markets steady but geopolitical headlines will be key for fresh impulse.

USD/INR bulls take a breather around 77.00 during Tuesday’s Asian session, following a run-up to refresh the record top 77.14 the previous day.

The Indian rupee (INR) pair’s latest pullback could be termed as profit-booking amid sluggish markets and an absence of macro. Also challenging the USD/INR bulls is the latest improvement in the market sentiment, as well as improvement in India’s covid conditions.

As per the latest official figures, India reported the lowest daily rise in coronavirus infections since May 2020. Further, the active covid cases also dropped below 50,000 for the first time since May 14, 2020.

It should, however, be noted that India’s ballooning trade deficit probes USD/INR pullback as the oil prices rallied to a 14-year high the previous day. That said, the WTI crude oil prices jumped to the levels last seen during 2008 before closing the day around $120.00, up 1.50% near $121.20 by the press time.

On a broader front, the European Union (EU) and the UK’s rejection of the US plan to ban Russian oil imports seem to have triggered the latest consolidation in the markets. On the same line could be headlines from Reuters suggesting hopes of talks over the human corridor in Ukraine to evacuate civilians.

Though, no major progress in the Russia-Ukraine talks and Moscow’s continues invasion of Kyiv weigh on the market’s sentiment. As per Reuters, “Ukrainian officials said a Russian airstrike hit a bread factory in northern Ukraine on Monday, killing at least 13 civilians, while talks between Kyiv and Moscow made little progress towards easing the conflict.”

Against this backdrop, the US 10-year Treasury yields extend the previous day’s rebound from two-month to 1.8%, up five basis points at the latest, whereas S&P 500 Futures print mild gains at the latest. It should be observed that markets in India print losses amid chatters over increase in petrol prices, as well as Russia-Ukraine fears.

Moving on, geopolitical headlines could keep the driver’s seat and should be observed closely by the USD/INR traders.

Technical analysis

A daily closing below the previous resistance line from April 2021, around 76.95 by the press time, can drag USD/INR prices towards the year 2021 peak of 76.59. Meanwhile, an upside break above the latest high of 77.14 could extend the run-up towards 80.00 threshold.

It’s worth noting that the overbought RSI and shift in market sentiment seems to have triggered the latest pullback and the same is likely to extend should the quote drops below 76.95.

In light of the Russia-Ukraine war, analysts at Goldman Sachs raised their gold price target over different time horizons.

Key quotes

“Targets raised for:

3-month horizon to USD2,300 vs. $1950 previous.

6-month horizon to USD2,500, from $2050 previous.

12-month horizon to USD2,500 vs. $2150 previous.”

“An increase in demand from consumers, investors, central banks due to the rising geopolitical uncertainty.”

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 124.17 | -3.01 |

| Silver | 25.671 | -1.06 |

| Gold | 1997.2 | 0.81 |

| Palladium | 2984.33 | -2.61 |

- WTI pares intraday losses around multi-year high, rebounds from daily low of late.

- Monthly support line, 100-DMA restricts immediate downside before 200-HMA.

- Weekly resistance line guards recovery moves towards the highest levels since 2008.

- Firmer RSI, sustained trading beyond short-term key supports keep buyers hopeful.

WTI picks up bids to consolidate recent losses around $117.30, down 0.30% intraday during Tuesday’s Asian session.

The black gold rallied to the highest levels last seen during 2008 the previous day before reversing from $125.00.

The pullback moves, however, fail to conquer a nearby horizontal area surrounding $114.50-90.

As the steady RSI backs the commodity’s rebound, WTI crude oil prices are likely to revisit the latest peak surrounding $125.00.

However, a descending trend line from the previous day, near $118.90, as well as the $120.00 round figure may test the oil buyers.

Meanwhile, pullback moves below $114.50 will challenge a confluence of the 100-HMA and an ascending support line from February 25, near 111.80.

Following that, the 200-HMA level close to $103.60 holds the key to WTI’s further downside towards the $100 psychological magnet.

WTI: Hourly chart

Trend: Further upside expected

“Oil price could more than double to over $300 per barrel,” Russia’s Deputy Prime Minister Alexander Novak warned in a statement early Tuesday.

Novak said, “a rejection of Russian oil would lead to catastrophic consequences for the global market.”

Additional comments

Europe is pushing us toward an embargo on gas deliveries through ignored tree and one, but we are not taking this decision yet.

Nobody would benefit from an embargo on the gas deliveries through Nordstrom one.

Replacing Russian oil deliveries to Europe would take more than a year.

Embargo on Russian oil could push prices over $300 per barrel.

Has information provocations being planned against Ukrainian as transport system.

Russia knows where it would redirect oil to if Europe and the United States refuse it.

Related reads

- Japan’s Matsuno announces a ban on oil refining equipment exports to Russia

-

WTI Price Analysis: Bounces off weekly support to regain $117.00

Japanese Chief Cabinet Secretary Hirokazu Matsuno announced on Tuesday, the country bans oil refining equipment exports to Russia.

Earlier on, the Financial Times (FT) reported that the European Union (EU) plans to slash Russian gas imports by two-thirds in twelve months.

“The plan, to be presented Tuesday, will propose steps such as tapping new gas supplies and increasing energy efficiency already this year, one of the officials said, and aims to deliver independence from the region's biggest supplier of the fossil fuel well before 2030 -- sooner than previous projections,” Bloomberg reported, citing two unnamed EU officials with knowledge of the matter.

Separately, “the prime minister announced yesterday that the government was drawing up proposals to intensify Britain’s energy self-reliance by boosting the deployment of renewable electricity and “using more of our own hydrocarbons” in the North Sea,” per the UK Times.

- Bulls eye 100.00 amid the absence of any material outcome in Russia-Ukraine peace talks.

- The odds of a 50 bps Fed rate hike in March’s monetary policy meeting are scaling higher.

- US CPI, Initial Jobless Claims, and Michigan Consumer Sentiment Index are next on tap later this week.

The US dollar index (DXY) is hovering around 99.27, awaiting a fresh impetus from the Russia-Ukraine war. The DXY has capitalized on each negative headline from the Ukraine crisis, Eurozone recession expectations, bloodbath in the Asian markets, etc.

Now that the dollar-backed index is closer to 52-weeks high at 103.00, the asset awaits a new trigger from the Russia-Ukraine war to bring significant bids by the market participants.

Status of expectations from the Federal Reserve (Fed)

Fed’s Chair Jerome Powell is set to announce the interest rate decision next week. Investors are looking forward to the extent of an increase in the benchmark rates by the Fed. A 25 basis point (bps) is already confirmed by Fed chair Jerome Powell in his testimony last week but higher inflation and upbeat US Nonfarm Payrolls (NFP) could push the extent of interest rates by a 50 bps. However, with rising oil prices and eventually higher commodity prices, a situation of stagflation is imminent going forward. Therefore, US central bank will face tremendous pressure while dictating its monetary policy next week.

Key events in the US this week: Goods and Services Trade Balance (Tuesday), JOLTS Job Openings (Wednesday), Consumer Price Index (Thursday), Initial Jobless Claims (Thursday), Michigan Consumer Sentiment Index (Friday).

Eminent issues on the back boiler: Russia-Ukraine peace talks, Ban on Russian oil imports, European Central Bank (ECB)’s interest rate decision.

- Risk appetite remains sluggish amid indecision over Ukraine-Russia moves, Western sanctions.

- Supply crunch fears propel commodity prices, Antipodeans of late.

- S&P 500 Futures, Nikkei 225 remain near multi-day bottom, US Treasury yields keeps bounce off two-month low.

Having witnessed a volatile start to the week, global investors stay cautious during early Tuesday amid a soft coverage on Russia-Ukraine macro, as well as a light calendar. Though, the risk-off mood remains on the table amid escalating woes over the supply chain and inflation.

While portraying the sentiment, the US 10-year Treasury yields extend the previous day’s rebound from two-month to 1.76% up 1.5 basis points at the latest. However, Japan’s Nikkei 225 drops 0.60% by the press time whereas the S&P 500 Futures decline 0.15% intraday at the latest.

The Western sanctions on Russia and the military invasion of Ukraine are the key causes for the market’s latest supply crunch woes.

Headlines from Reuters indicate no major progress in the peace talks between Ukraine and Russia even as the human corridor is up for a restart. “Ukrainian officials said a Russian airstrike hit a bread factory in northern Ukraine on Monday, killing at least 13 civilians, while talks between Kyiv and Moscow made little progress towards easing the conflict,” said the news.

Even so, the UK and the EU’s resistance to fully ban the oil imports from Russia, as widely pushed by the US, joins the World Bank’s (WB) humanitarian aid to Kyiv to ease the previous risk-off mood.

That said, the gold prices rallied to a 19-month high whereas WTI crude oil rallied to the levels last seen during 2008 the previous day. Also cheering the supply fears are the nickel buyers as the metal refreshed an all-time high of around $50,550 on the London Metal Exchange (LME).

Looking forward, updates concerning Ukraine and Russia will join the supply-chain related headlines to direct short-term market moves. Also important will be Thursday’s US Consumer Price Index (CPI).

Read: What inflation reports are you trading this week?

- AUD/USD picks up bids to refresh intraday top, reverses previous day’s pullback from four-month high.

- Australia’s NAB Business Confidence, Business Conditions improved in February.

- Market sentiment remains sour, gold, oil stay firmer around multi-year high, Nickel refreshes record top.

- Speech from RBA Governor Orr may offer intermediate clues amid the push to release brakes on rate-hike.

AUD/USD refreshes intraday high to 0.7334, up 0.18% on a day as it pares the week-start losses from multi-day high during Tuesday’s Asian session. The Aussie pair’s latest rebound could be linked to the firmer commodity prices, as well as recently upbeat sentiment data from home.

National Australia Bank (NAB) released February’s Business Confidence and Business Conditions data before a few minutes and offered recent strength to the AUD/USD prices. “Tuesday's survey from National Australia Bank (NAB) showed its index of business conditions rose 7 points to +9 in February, reversing all of January's drop. The index of confidence climbed 9 points to +13, well above December's low of -12,” said Reuters.

It’s worth noting that the escalating fears of a devastating impact on the global supply chain, due to the Ukraine-Russia stand-off recently propelled commodities and Antipodeans. That said, the gold prices rallied to Gold rallied to a 19-month high whereas WTI crude oil rallied to the levels last seen during 2008 the previous day. Also cheering the supply fears are the nickel buyers as the metal refreshed an all-time high of around $50,550 on the London Metal Exchange (LME).

As per the latest developments, the UK and the EU’s resistance to fully ban the oil imports from Russia, as widely pushed by the US, joins the World Bank’s (WB) humanitarian aid to Kyiv to ease the previous risk-off mood. However, headlines from Reuters indicate no major progress in the peace talks between Ukraine and Russia even as the human corridor is up for a restart.

Amid these plays, the US 10-year Treasury yields extend the previous day’s rebound from two-month to 1.77% up 2.5 basis points at the latest. However, Japan’s Nikkei 225 drops more than 1.0% by the press time whereas the S&P 500 Futures decline 0.30% at the latest.

Moving on, risk catalysts are likely to keep the driver’s seat but early Wednesday’s speech from Reserve Bank of Australia (RBA) Governor Philip Lowe will be eyed closely amid a broad push to dump the “wait-and-watch” approach of the Aussie central bank.

Technical analysis

AUD/USD rebounds from the 200-DMA level of 0.7320 to again aim for a one-year-old downward sloping trend line, close to 0.7440 by the press time.