- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 08-02-2023

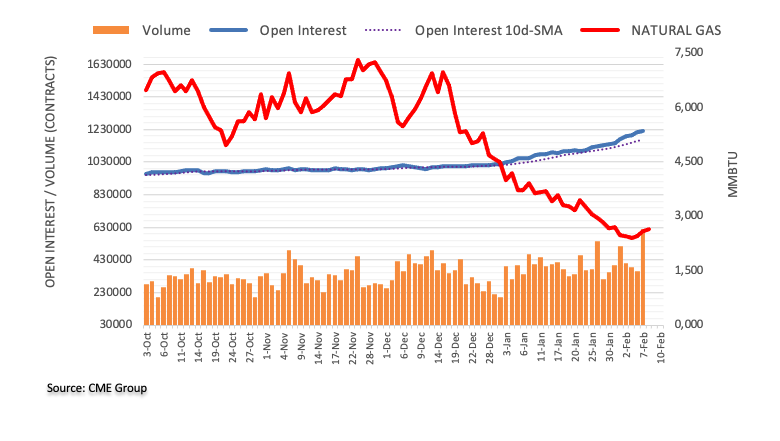

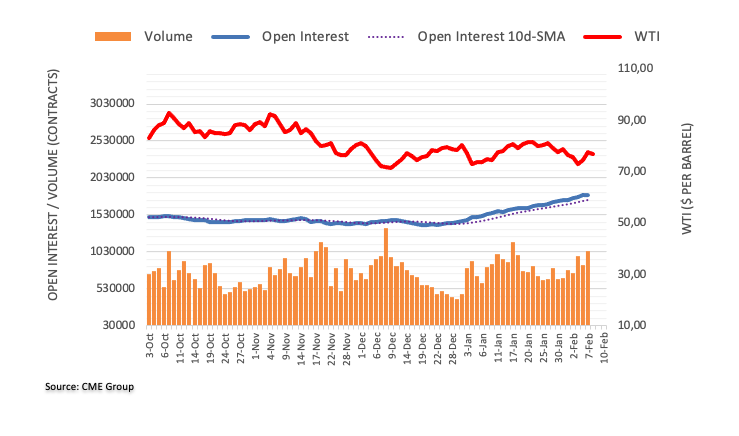

- WTI is showing a loss in the upside momentum after reaching near $78.50.

- Solid China recovery is expected to keep the oil price in bullish territory.

- The oil price has ignored fresh hawkish Fed bets as the interest rate hikes won’t be aggressive ahead.

West Texas Intermediate (WTI), futures on NYMEX, are struggling to extend their upside journey above the immediate resistance of $78.50 in the early Tokyo session. The oil price is expected to continue its upside as investors have ignored the hawkish stance from Federal Reserve (Fed) chair Jerome Powell and his teammates on interest rates.

Investors are anticipating a recession in the United States as the Fed has confirmed more interest rate hikes in its battle against inflation, which has become stubborn in nature. However, the pace of policy tightening by the Fed won’t be aggressive this time as the Consumer Price Index (CPI) is in a declining trend.

Meanwhile, US Treasury Secretary Janet Yellen cited “While inflation remained elevated, there were encouraging signs that supply-demand mismatches were easing in many sectors of the economy,”

On Wednesday, the release of a build-up of oil inventories by the US Energy Information Administration (EIA) failed to pause the upside momentum in the oil price. The EIA reported a build-up in oil stockpiles by 2.42 million barrels for the week ending February 03.

The US Dollar Index (DXY) is aiming to stabilize itself above the critical resistance of 103.00 amid fresh concerns about further interest rate hikes by the Fed.

Meanwhile, rising demand for oil in China after a bleak year amid a recovery in domestic demand and exports is supporting the oil price. This week, International Energy Agency (IEA) Executive Director Fatih Birol on the sidelines of the India Energy Week conference cited “Oil producers may have to reconsider their output policies following a demand recovery in China, the world's second-largest oil consumer,” as reported by Reuters. He further added, “Half of the growth in global oil demand this year will come from China.”

Meanwhile, an Iranian official delivered an encouraging outlook on oil prices citing that oil prices are going up to about $100/bbl in the second half of 2023.

- US Dollar Index reverses early-week pullback from monthly high.

- Fed officials, US Treasury Secretary Yellen highlight strong inflation to defend current policies.

- Receding fears of US-China tension, retreat in yields and light calendar challenge DXY traders.

- Multiple EU statistics, weekly US Jobless Claims may entertain traders.

US Dollar Index (DXY) holds onto the previous day’s recovery moves around 103.50 as bulls brace for the third consecutive weekly gain in a row amid hawkish comments from the US policymakers. It’s worth noting, however, that the lack of major data/events joins mixed concerns surrounding the latest geopolitical tension between the US and China to probe the greenback’s gauge versus the six major currencies.

Talking about the Federal Reserve (Fed) officials, Fed Governor Christopher Waller teased a long fight with a 2.0% inflation target by citing expectations of tighter monetary policy for longer than expected. New York Federal Reserve President John Williams was almost on the same line while saying that the labor market is still very strong and noted that they have more work to do on rates, adding data will determine the path of rate hikes.

Further, Fed Governor Lisa Cook said that the central bank remains focused on restoring price stability, as inflation is still running too high. She added that they would need a restrictive monetary policy for some time.

It should be noted that US Treasury Secretary Janet Yellen also mentioned, “While inflation remained elevated, there were encouraging signs that supply-demand mismatches were easing in many sectors of the economy.”

However, the former Fed Chair Yellen also mentioned that it was important to improve communications with Chinese counterparts on economic issues, which in turn eased the US-China tension which escalated on the weekend news of the US shooting a Chinese balloon and terming it a spy. Further, US President Joe Biden also tried placating the Sino-American tussle as he said, “We intend to compete completely with China but we are not seeking conflict, as that has been the case so far.”

Not only easing fears of China but a retreat in the US Treasury bond yields also challenges the US Dollar Index bulls. That said, the US 10-year Treasury bond yields reversed from a one-month high to snap a three-day uptrend on Wednesday, pressured around 3.62% at the latest. The same helped S&P 500 Futures to ignore Wall Street’s downbeat closing and remain mostly unchanged as of late.

Looking forward, multiple statistics from Europe relating to inflation and growth may entertain DXY traders on Thursday as the European Central Bank (ECB) officials are also hawkish but lack support from the data and can weigh on the US Dollar Index in case of strong economics. The same also highlights the US Weekly Initial Jobless Claims.

Technical analysis

A daily closing beyond the 50-DMA hurdle of 103.50 becomes necessary for the US Dollar Index bull’s conviction.

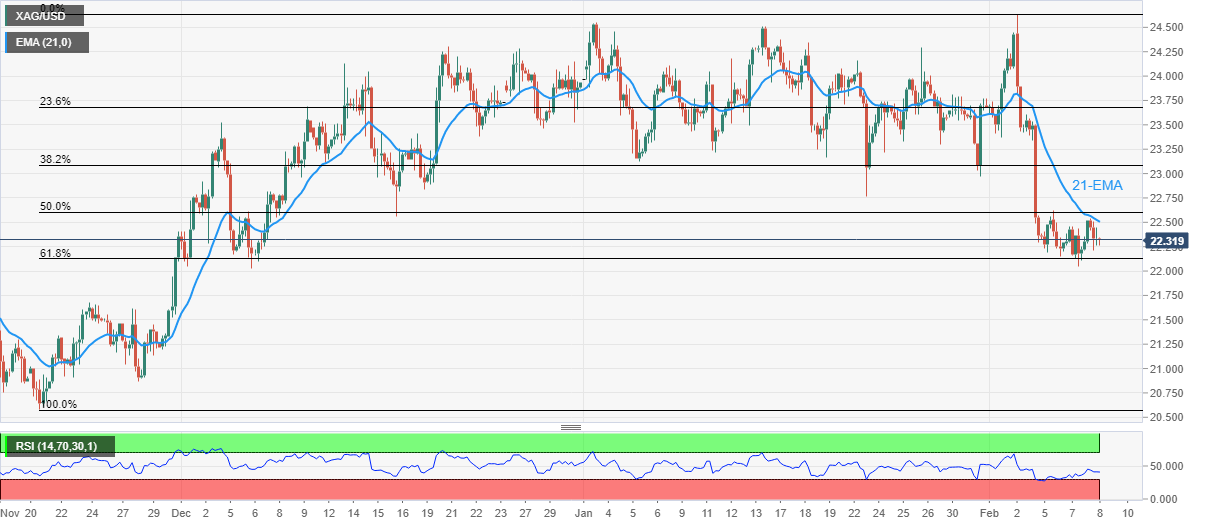

- Silver price seesaws between 50% and 61.8% Fibonacci retracement levels so far in the week.

- 21-EMA adds to the upside filters while downbeat RSI teases XAG/USD sellers.

- The $21.70, $20.90 can probe bears below the “Golden ratio”.

Silver price (XAG/USD) fades the previous day’s recovery moves as it retreats to $22.30 during early Thursday in Asia. Even so, the bright metal defends the weekly trading range inside crucial Fibonacci retracement levels of the quote’s upside from late November 2022 to early February 2023.

Even if the $0.50 range restricts Silver price moves of late, RSI conditions and the 21-bar Exponential Moving Average (EMA), around $22.50 by the press time, make it hard for the buyers to take control.

In a case where XAG/USD crosses the weekly trading range between $22.10 and $22.60, described by the 61.8% and 50% Fibonacci retracement levels respectively, the metal price could aim for the $23.00 round figure.

Following that, multiple hurdles near $23.10-15 could test the upside momentum before directing the quote to the $24.50 hurdle. Also acting as an upside filter is the monthly peak of $24.63.

On the flip side, a clear break of the $22.10 range support needs validation from the $22.00 round figure to convince the Silver bears.

In that case, the November 24 high near $21.70 and November 29 swing low near $20.90 could act as intermediate halts ahead of highlighting the $20.00 psychological magnet for the XAG/USD sellers.

Silver: Four-hour chart

Trend: Further downside expected

- NZD/JPY is subdued as the Asian session begins, following the formation of a doji, portraying indecision amongst traders.

- Bearish pennant in the NZD/JPY 1-hour chart warrants downward pressure lying ahead.

NZD/JPY failed to gain traction upward/downwards on Wednesday’s session, and meanders at around this week’s lows, as Thursday’s Asian Pacific session begins. At the time of writing, the NZD/JPY exchanges hands at 82.87, almost flat.

The NZD/JPY daily chart portrays the cross-currency pair as neutral to slightly downward biased, though it failed to gain traction on Wednesday. A doji surfaced nearby the low of the week of 82.65, which could exacerbate a consolidation in the near term. If that scenario plays out, the NZD/JPY will trade within the 82.65-83.00 for the remainder of the session unless a catalyst triggers the NZD/JPY to break above/below the range.

Upwards, the NZD/JPY first resistance would be the 20-day Exponential Moving Average (EMA) at 83.44, ahead of the 200-day EMA at 83.85. On the downside, the NZD/JPY’s next support would be the lows of the week at 82.65, followed by the psychological 82.00 mark

In the short term, the NZD/JPY1-hour chart portrays the formation of a bearish-pennant, which suggests downward action lies ahead. A break below the pennant bottom-trendline will pave the way for further losses and, on its first leg-down, would slide toward the S1 daily pivot at 82.62.

The NZD/JPY downtrend’s next stop would be the S2 pivot at 82.44, ahead of the S3 daily pivot at 82.24.

NZD/JPY: One-hour chart

NZD/JPY key technical levels

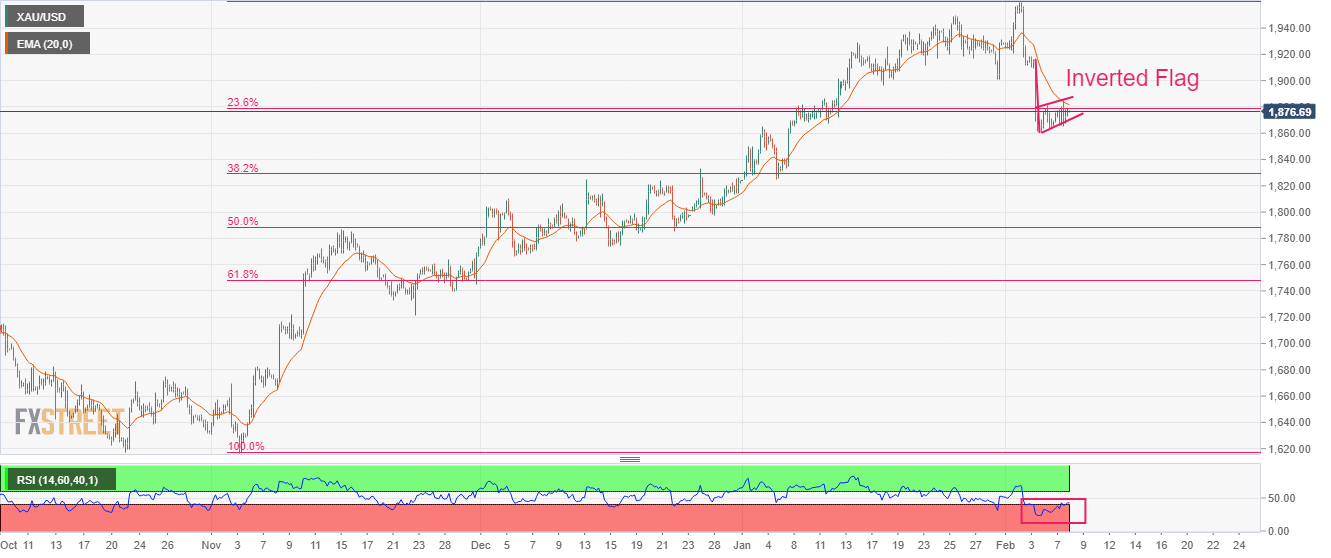

- A downside break of the Inverted Flag pattern will drag EUR/JPY firmly.

- The 50-and 200-EMAs have delivered a death cross, which adds to the downside filters.

- High volatility is expected from the cross as investors await German inflation data.

The EUR/JPY pair dropped after facing barricades around 141.00 in the early Asian session. The pullback move in the cross seems to lack strength, which could result in a resumption in the downside move. EUR/JPY is following the footprints of weaker EUR/USD, amid the risk aversion theme.

For further guidance, investors will keep an eye on the preliminary German inflation data. The annual Harmonized Index of Consumer Prices (HICP) (Jan) is expected to strengthen further to 10.0% from the prior release of 9.6%. The double-digit inflation figure might add to troubles for the European Central Bank (ECB), which has already pushed interest rates to 2.50%, and more interest rate hikes are in pipeline, according to the commentary from ECB policymaker Klass Knot.

EUR/JPY is auctioning an Inverted Flag chart pattern on an hourly chart, which indicates a sheer consolidation that is followed by a breakdown. Usually, the consolidation phase of the chart pattern serves as an inventory adjustment in which those participants initiate shorts, which prefer to enter an auction after the establishment of a bearish bias.

A death cross, represented by the 50-and 200-period Exponential Moving Averages (EMAs) at 141.32, adds to the downside filters.

The Relative Strength Index (RSI) (14) has entered into the 40.00-60.0 range from the bearish range of 20.00-40.00. However, the strength is missing in the recovery move, which could delight sellers with a pullback selling opportunity.

Should the cross breaks below February 7 low around 140.30, Japanese Yen bulls will drag the asset toward January 17 high at 139.62 followed by the horizontal support plotted from January 13 low around 138.00.

Alternatively, the cross needs to surpass January 25 high at 142.29 for an upside move, which will drive the asset toward January 11 high at 142.61 followed by October 24 low at 143.72.

EUR/JPY hourly chart

-638114940703231666.png)

“We intend to compete completely with China but we are not seeking conflict, as that has been the case so far,” said US President Joe Biden during a PBS interview late Wednesday.

US President Biden also confirmed that relations with China have not taken a big hit.

Market sentiment improves a bit

Comments from US President Biden join the recent statements from US Treasury Secretary Janet Yellen to tame the fears emanating from Sino-American ties. The same appears to have put a floor under the risk barometer AUD/USD pair around 0.6920, following the pair’s reversal from the weekly high the previous day.

Also read: AUD/USD declines towards 0.6900 as Fed policymakers sound hawkish on rate guidance

“While inflation remained elevated, there were encouraging signs that supply-demand mismatches were easing in many sectors of the economy,” US Treasury Secretary Janet Yellen spoke at an Ultium Cells LLC electric vehicle battery plant under construction near Nashville.

US Treasury Secretary Yellen also added, “Over the past two years, we have worked successfully to ease supply chain pressures, and that includes funding pop-up container yards and moving several ports to 24/7 operations.”

The diplomat also said she still hopes to be able to visit China but has no specific details on plans or timing.

“A team of US Treasury officials was scheduled to travel to China this month to prepare for a visit, but that was before a diplomatic row over a Chinese balloon that Washington claims were spying on the United States. The United States shot down the balloon on Saturday,” reported Reuters.

The former Fed Chair Yellen also mentioned that it was important to improve communications with Chinese counterparts on economic issues.

Market implications

The news seemed to have failed to inspire traders amid hawkish comments from Federal Reserve (Fed) officials.

Also read: EUR/USD stays pressured near 1.0700 as Fed, ECB policymakers defend higher interest rates

- USD/CAD grinds higher after bouncing off 50-SMA, one-week-old support line.

- Upbeat oscillators back the rebound from key support to help buyers approach three-week-long resistance line.

- Descending trend line from late December 2022 appears the key hurdle.

USD/CAD buyers take a breather around 1.3450 during Thursday’s sluggish Asian session, following their return to the desk from a one-week low. In doing so, the Loonie pair justifies the previous day’s rebound from a convergence of the 50-SMA and a weekly ascending trend line.

Also keeping the pair buyers hopeful is the impending bull cross on the MACD and the upbeat RSI (14) that backs the latest recovery.

As a result, the USD/CAD bulls approach a downward-sloping resistance line from January 19, close to 1.3470, a break of which could quickly propel prices towards the late January peak surrounding 1.3520.

It should be noted, however, that a seven-week-old descending resistance line, close to 1.3590, appears a crucial resistance for the bulls to watch past 1.3520 as it holds the key to a run-up towards 1.3700.

Alternatively, pullback moves remain elusive unless the quote stays beyond the 1.3370 support confluence including the aforementioned SMA and immediate trend line support.

Following that, the 1.3300 round figure and the monthly low near 1.3260 should gain the market’s attention.

In a case where USD/CAD remains bearish past 1.3260, an area comprising the last July’s top and November 2022 low, around 1.3220-25, could challenge the sellers.

USD/CAD: Four-hour chart

-09022023-638114929890109338.png)

Trend: Further upside expected

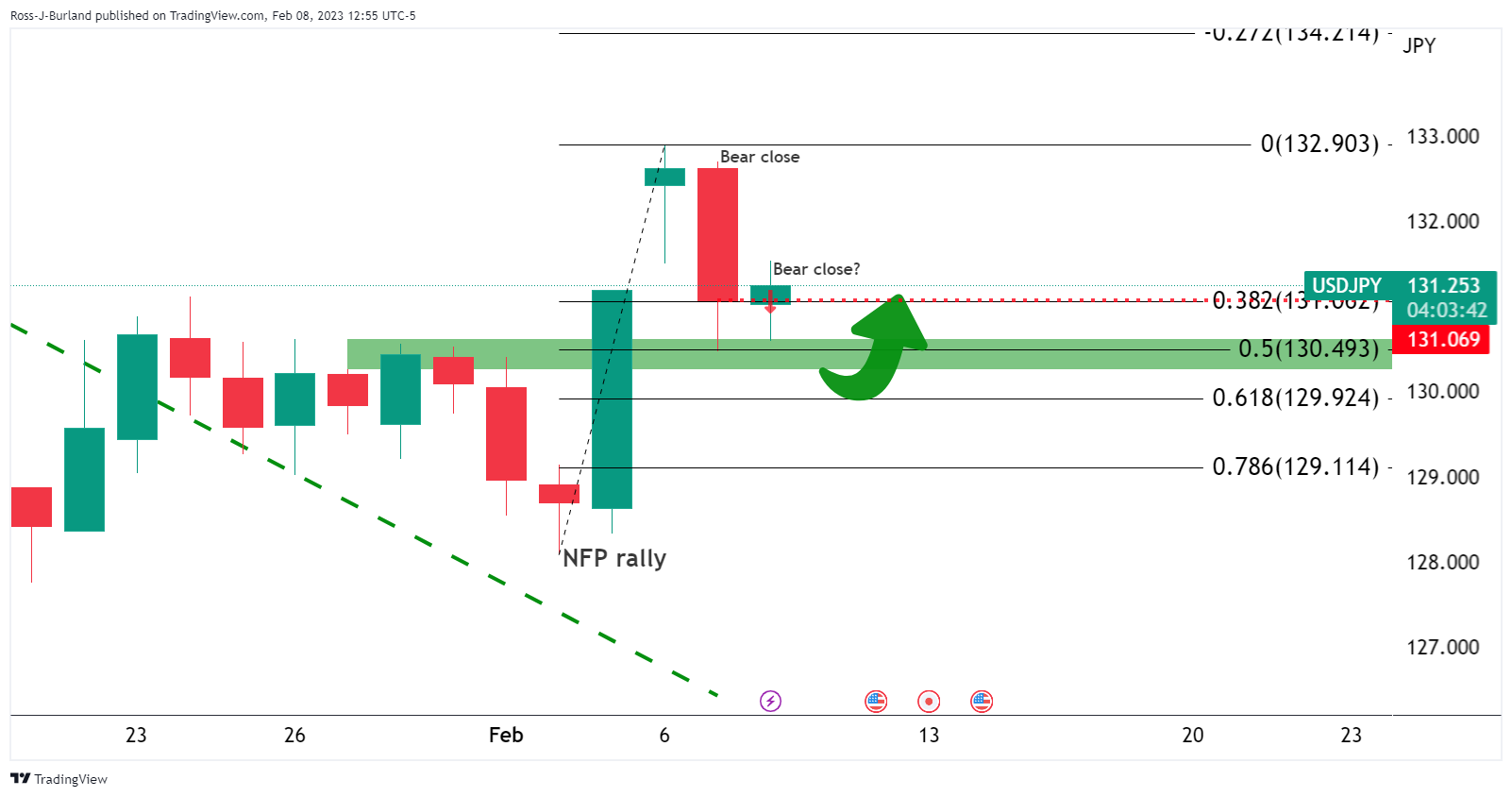

- USD/JPY registers minuscule gains as the Asian session starts after a 0.25% gain on Wednesday.

- USD/JPY: To remain range-bound, trapped within the 20/50-day EMAs.

USD/JPY capped its losses at around the 20-day Exponential Moving Average (EMA) on Wednesday and is testing the January 18 daily high of 131.57 as Thursday’s Asian session begins. The USD/JPY is trading at 131.37 after hitting the 20-day EMA at around 130.70.

USD/JPY Price Analysis: Technical outlook

From a daily chart perspective, the USD/JPY entered a consolidation phase following Tuesday’s intervention by Japanese authorities in the FX space. The USD/JPY would likely finish the week trading within the 20/50-day EMAs, each at 130.70-132.72, respectively, amidst the lack of a market-moving event in the financial markets.

Nonetheless, oscillators like the Relative Strength Index (RSI) remain in bullish territory, though a flat slope suggests indecision amongst USD/JPY traders. The Rate of Change (RoC) portrays a scenario of bearish continuation.

If the USD/JPY aims higher, it will face key resistance levels. First, the 132.00 psychological level, followed by the 50-day EMA at 132.72, ahead of the 133.00 figure. On the other hand, a bearish continuation would send the USD/JPY sliding towards 131.00. Break below, and the 20-day EMA would be tested at 130.70. A breach of the latter will expose the 130.00 psychological level.

USD/JPY key technical levels

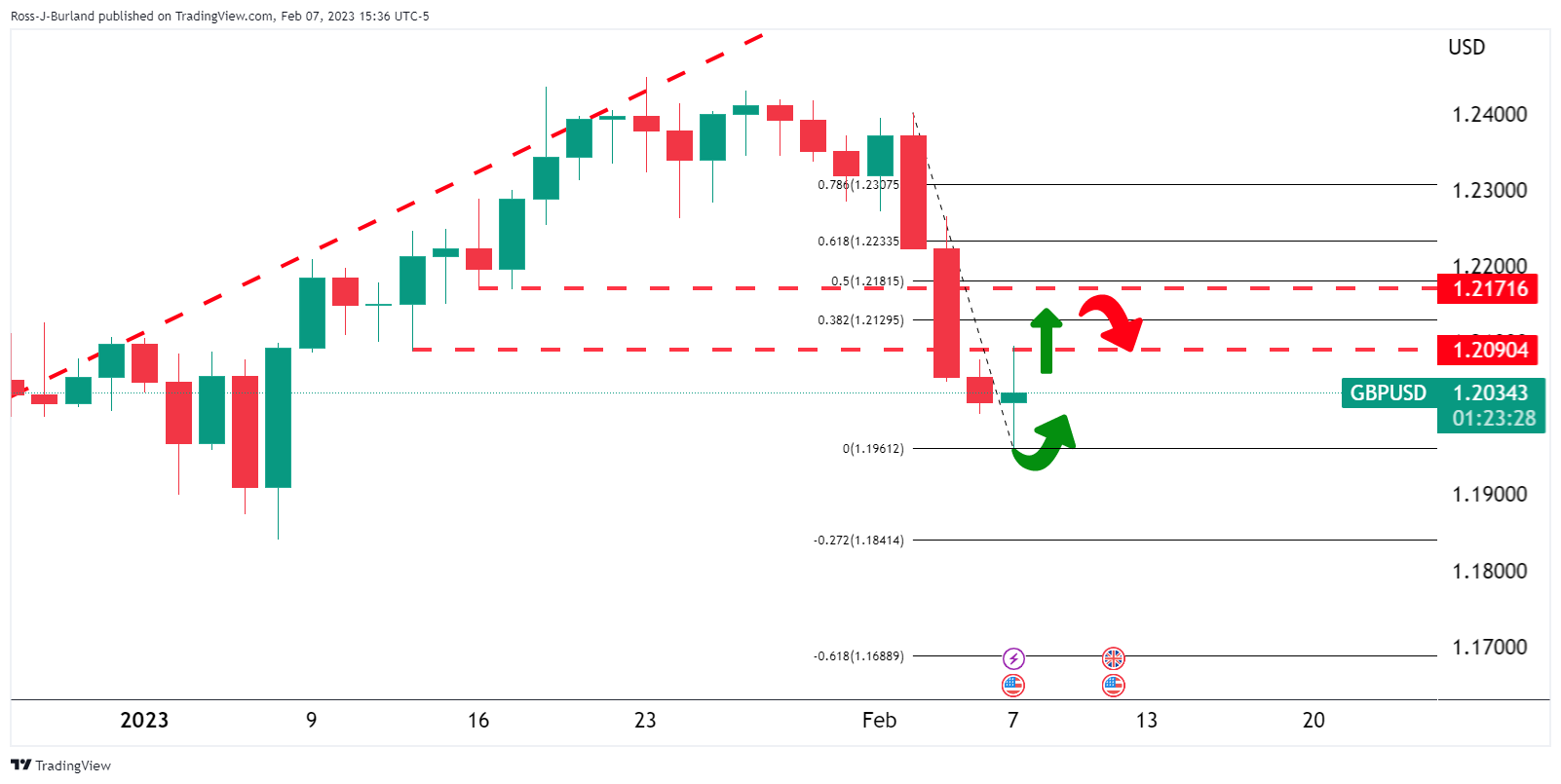

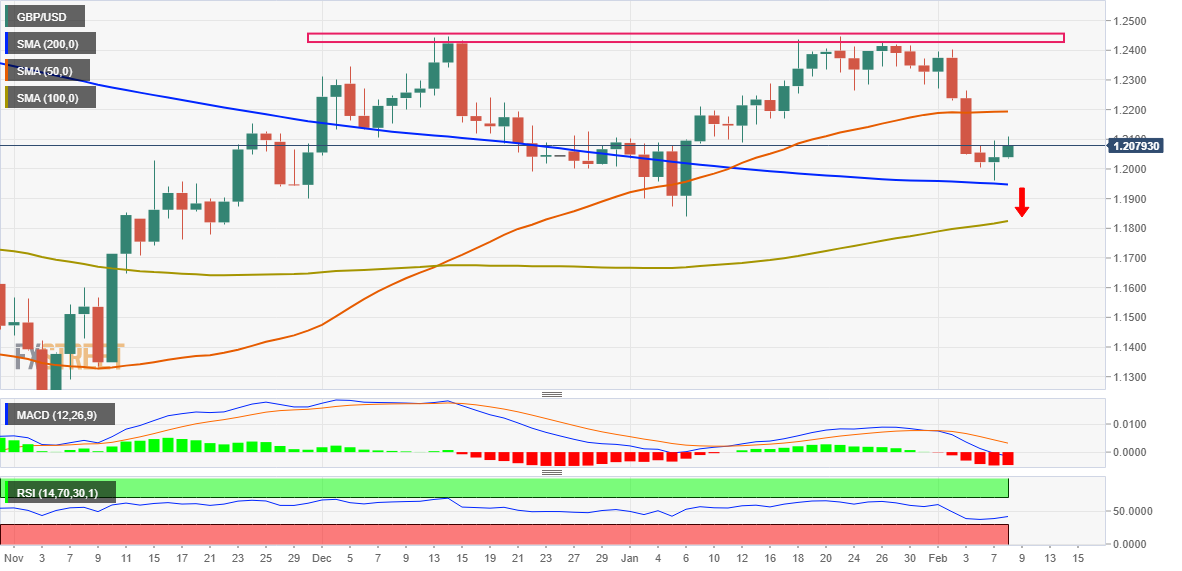

- GBP/USD is expected to witness more downside below 1.2050 amid the souring market mood.

- Fed policymakers have cleared that the battle against stubborn inflation will continue for a more extended period.

- The UK GDP is expected to display a flat performance on a quarterly basis on Friday.

The GBP/USD pair has gradually dropped to near 1.2065 and is expected to continue its downside journey after surrendering the immediate support of 1.2050. The Cable is struggling to maintain its feet as the risk appetite of the market participants has trimmed significantly. The odds of the continuation of the policy tightening streak by the Federal Reserve (Fed) is fading the appeal for risk-perceived assets.

S&P500 sensed a steep selling interest on Wednesday as Fed policymakers have cleared that the battle against stubborn inflation will continue for a longer period. Accordingly, the Fed would consider keeping higher interest rates for a more extended period to achieve price stability.

The US Dollar Index (DXY) is aiming to sustain itself above 103.00 as the street is expecting that strong demand for labor will be followed by higher employment bills. Job seekers might be having more negotiation power, which could result in a higher labor cost index ahead. Meanwhile, the yields on 10-year US Treasury bonds dropped to near 3.61%.

New York Fed President John Williams clarified that the Fed has yet not reached a restrictive policy, which could be sufficient enough to tame solid inflation. Also, the central bank will be required to maintain a hawkish policy for a few years to make sure that the 2% inflation target will achieve confidently, as reported by Wall Street Journal.

Meanwhile, the Pound Sterling is likely to display a power-pack action after releasing the United Kingdom Gross Domestic Product (GDP) (Q4) data, scheduled for Friday. As per the consensus, the preliminary annual GDP data is expected to expand by 0.4% lower than the former release of 1.9%. And, the quarterly data is expected to remain flat against a contraction of 0.3%.

Apart from the GDP figures, Industrial Production and Manufacturing Production will be of utmost importance.

- EUR/USD holds lower ground after reversing the corrective bounce before a few hours.

- Both Fed and ECB policymakers appear hawkish but the strong US data, yields help USD to pare previous losses.

- Markets remain dicey amid a lack of major data/events.

- German Inflation, EU economic forecasts and US Weekly Jobless Claims eyed.

EUR/USD remains pressured around 1.0710, following a reversal from 1.0760, as bears keep the reins for the fifth consecutive day during early Thursday. In doing so, the major currency pair justifies the hawkish comments from the European Central Bank (ECB) and the Federal Reserve (Fed) policymakers. It’s worth noting that the comparatively upbeat US data than Europe seems to defend the hawkish comments from the Fed and weigh on the EUR/USD price.

That said, Federal Reserve Governor Christopher Waller teased a long fight with a 2.0% inflation target by citing expectations of tighter monetary policy for longer than expected. On the same line, Governor Lisa Cook said that the central bank remains focused on restoring price stability, as inflation is still running too high. She added that they would need a restrictive monetary policy for some time.

Furthermore, New York Federal Reserve President John Williams said that the labor market is still very strong and noted that they have more work to do on rates, adding data will determine the path of rate hikes.

Elsewhere, ECB policymaker Klaas Knot said that headline inflation appears to have peaked but added that keeping the current pace of hikes into May could well be needed if underlying inflation does not materially abate.

While a slew of Fed and ECB policymakers spoke much about defending the restrictive monetary policy, Friday’s upbeat US jobs report and activity data contrast with the comparatively lighter EU statistics to justify the Fed’s hawkish stand, which in turn exerts downside pressure on the EUR/USD price.

Additionally, a rebound in the US 10-year Treasury bond yields, after a downbeat start to Wednesday, joins Wall Street’s negative closing to weigh on the EUR/USD prices.

Moving on, preliminary readings of Germany’s Harmonized Index of Consumer Prices for January will precede the quarterly prints of European Commission releases Economic Growth Forecasts to entertain EUR/USD traders.

Technical analysis

An 11-week-old ascending support line joins the 50-day Exponential Moving Average (EMA) to highlight 1.0670-65 as the key level for the bear’s conviction.

- AUD/USD is eyeing more weakness to near 0.6900 amid hawkish Fed policymakers’ guidance.

- Fed Waller cited the battle to reach the 2% inflation target "might be a long fight".

- The Australian Dollar will dance to the tunes of China’s inflation data.

The AUD/USD pair has gauged an intermediate cushion around 0.6920 in the early Asian session. The Aussie asset is expected to continue the downside momentum as signs of a pullback are missing yet. Also, the risk profile is negative as investors are expecting that more interest rate hikes by the Federal Reserve (Fed) will deepen recession fears in the United States.

S&P500 witnessed a sell-off by the market participants as further rate hikes by the Fed will soften the economic activities further, portraying a risk aversion theme. Apart from that, the proposal from US President Joe Biden to tax billionaires heavily by quadrupling taxes on corporate buybacks to which investors show dissatisfaction.

The US Dollar Index (DXY) is aiming to shift its auction profile above 103.00 as upbeat labor market data has triggered the risk of further policy tightening by the Federal Reserve (Fed). Contrary to that, the return provided on 10-year US Treasury bonds dropped below 3.62%.

Fed Governor Christopher Waller said on Wednesday that inflation seems poised to continue slowing this year but the US central bank's battle to reach its 2% target "might be a long fight" with monetary policy kept tighter for longer than anticipated, as Reuters reported. The strong labor market data will also be followed by higher employment costs to address the former, which could trigger upward pressure on the inflation projections.

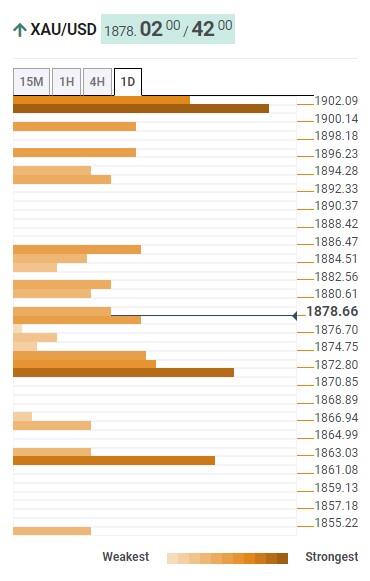

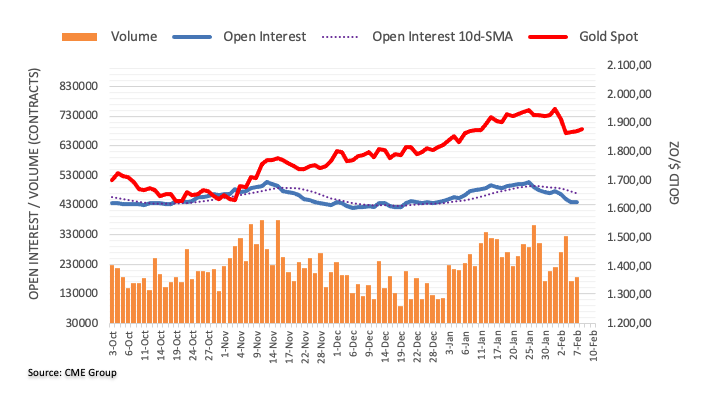

- The Gold price is correcting to a 38.2% Fibonacci retracement level.

- The Gold price bears are lurking around Federal Reserve's hawkish tones.

Gold price closed with its third-straight gain on Wednesday despite a firmer US Dollar that was recovering in a phase of hawkish Federal Reserve sentiment following Friday's US Nonfarm Payrolls job report. Gold price travelled between a low of $1,869.20 and $1,886.33 on the day.

Federal Reserve speakers out in force

Federal Reserve chair Jerome Powell on Tuesday said the central bank will stay the course despite strong economic data which gave rise to the bin in the Gold price. The Federal Reserve's mantra that interest rates will stay higher for longer, however, came to light on Wednesday which underpinned the hawkish take of comments from Federal Reserve Jerome Powell's Economic Club of Washington on Tuesday when he said rates might need to move higher if the US economy remained strong.

Federal Reserve's John Williams reinforced that interest rates were “barely into restrictive territory”, and rates would need to stay at a restrictive level “for a few years to make sure we get inflation to 2%”. Federal Reserve's Lisa Cook argued that they “need a restrictive policy for some time to cool prices”. Federal Reserve's Neel Kashkari emphasised that the “services side of the economy is still hot”, noting the lack of progress on core services inflation ex-housing. As a consequence, the US Dollar was able to run higher in the US session which helped the Gold price bears with a sell-off in the cash open on Wall Street.

Gold price technical analysis

The Gold price is correcting to a 38.2% Fibonacci retracement level within a 1000 pip box and a bias to the downside for the coming times while below $1,900 and on the backside of three weeks of rise.

- GBP/JPY rebounds at weekly lows and is forming a bullish harami, suggesting that prices could aim higher.

- Immediate resistance levels for the GBP/JPY lie at 159.00, ahead of the 20-DMA and 160.00.

- For a bearish continuation, the GBP/JPY needs to clear 157.42, aiming to reach 157.00.

The Pound Sterling (GBP) trims some of Tuesday’s losses, and climbs toward the 158.50 area on Wednesday, boosted by an upbeat sentiment across the financial markets. A speech by the Federal Reserve Chair Jerome Powell spurred a risk-on impulse and weakened safe-haven peers. At the time of writing, the GBP/JPY exchanges hands at 158.53.

GBP/JPY Price Analysis: Technical outlook

The GBP/JPY bounced from weekly lows reached on Tuesday at around 157.42, with the cross-currency pair testing a one-month-old downslope previous resistance trendline, which turned support and capped the GBP/JPY’s fall. However, as shown by the daily chart, GBP/JPY’s price action would remain sideways, though tilted downwards, as long as the long-term moving averages stay above the exchange rate.

For the GBP/JPY pair to continue its bearish path, it would need to break below the weekly low of 157.42, which, once cleared, would send the GBP/JPY sliding toward the February 3 low of 156.72. A breach of the latter and the 156.00 figure is up for grabs.

As an alternate scenario, the GBP/JPY key resistance areas lie at the 20-day Exponential Moving Average (EMA) at 159.42, followed by the 160.00 psychological level. Break above and the GBP/JPY could rally and test the 50-day EMA at 160.96.

GBP/JPY key technical levels

- NZD/USD bears are in play towards the close on Wall Street.

- US Dollar remains bid in a corrective phase on Fed sentiment.

NZD/USD recovered from one-month lows this week but failed to put in a fresh high on Wednesday, with the pair travelling between a low of 0.6296 and a high of 0.6348. The markets took a dovish view on comments from U.S. Federal Reserve Chairman Jerome Powell on Tuesday that helped to lift the commodity currencies despite Friday's strong US Nonfarm Payrolls jobs data.

Overall, however, on the day, both the Kiwi and the US dollar index, DXY, are little changed with it being a calendar void of catalysts besides Federal Reserve speakers who continued to emphasise the need for monetary policy settings to remain restrictive.

Fed's John Williams reinforced that interest rates were “barely into restrictive territory”, and rates would need to stay at a restrictive level “for a few years to make sure we get inflation to 2%”. Fed's Lisa Cook argued that they “need restrictive policy for some time to cool prices”. Fed's Neel Kashkari emphasised that the “services side of the economy is still hot”, noting the lack of progress on core services inflation ex-housing. As a consequence, the US Dollar was able to run higher in the US session, sinking all ships, including NZD/USD that continues to bleed into the cash close on Wall Street.

What you need to take care of on Thursday, February 9:

The US Dollar ended Wednesday mixed, as the optimism triggered by US Federal Reserve Chairman Jerome Powell faded throughout the day. European stock indexes managed to post modest advances, but Wall Street settled in the red. Still, US government bond yields remained steady around Tuesday’s closing levels, limiting the USD strength.

The Euro remains among the weakest US Dollar rivals, currently trading at around 1.0725. European Central Bank (ECB) officials were on the wires repeating their hawkish rhetoric. ECB policymaker Klaas Knot said that headline inflation appears to have peaked but added that keeping the current pace of hikes into May could well be needed if underlying inflation does not materially abate.

Across the pond, Fed Governor Lisa Cook said that the central bank remains focused on restoring price stability, as inflation is still running too high. She added that they would need a restrictive monetary policy for some time. Also, New York Federal Reserve President John Williams said that the labor market is still very strong and noted that they have more work to do on rates, adding data will determine the path of rate hikes. Finally, Fed Governor Christopher Waller warned that interest rates could go higher than expected.

The GBP/USD pair trades around 1.2070, holding on to modest intraday gains.

The Bank of Canada published the newly inaugurated Minutes of its latest monetary policy meeting- The document had no impact on the CAD as the BOC signaled a pause in rate hikes after announcing their decision. USD/CAD trades at around 1.3430.

AUD/USD is down to 0.6920 as the poor performance of Wall Street weighed on the pair. Finally, USD/JPY advanced, now hovering around 131.40.

Spot gold peaked at the beginning of the day at a fresh weekly high of $1,886.31 but quickly retreated, now trading at around $1,874. Crude oil prices, on the other hand, maintained the positive momentum, and WTI currently trades at $78.40 a barrel.

Like this article? Help us with some feedback by answering this survey:

- USD/CAD bulls are moving in despite the prior day's bearish close.

- The US Dollar has firmed on hawkish sentiment brewing around the Fed again and a dovish BoC.

In this scenario, we have a 61.8% Fibonacci retracement level near 1.3350 below the neckline near 1.3380. However, given that the price is attempting to close higher for the day, that will leave an emphasis on the upside where eyes look to 1.3475.

The Canadian Dollar is trapped between 1.3440 and 1.3420s, below a 2-½-month high of 1.326 that was scored at the start of the month.

The US Dollar continues with its relentless comeback as the markets fear that the Federal Reserve is not as close to a pivot as first presumed on the back of what was regarded as a dovish outcome from the Federal Reserve interest rate decision last week. At the same time, the Bank of Canada is expected to be the first major central bank to pause rate increases after delivering eight rate hikes in the past 11 months.

At the time of writing, USD/CAD is trading towards the highs of the day but the bears are present, chipping away as a key support structure of the consolidation of the day's highs. USD/CAD has travelled between a low of 1.3359 and 1.3444 so far and has been forced higher on a dovish sentiment at the Bank of Canada that has hiked its key interest rate to 4.5% in January, the highest level in 15 years.

Meanwhile, however, Governor Tiff Macklem said no further rate hikes would be needed if, as expected, the economy stalled and inflation fell. The summary of Governing Council deliberations were released today and they showed that policymakers decided to hike rates in January because of labour-market tightness and stronger-than-expected growth.

As for the US Dollar, it too is trapped up high following today's rally, testing the boundaries of 104 the figure and 103.00 on the downside as per the DXY index as investors paused selling the greenback, a day after Federal Reserve Chair Jerome Powell did not significantly change his US interest rate outlook. There is an air of nervousness considering a very strong US jobs report last week although the outlook remained tilted to the downside as the Fed nears the end of its tightening cycle.

The markets are trying to price in rate cuts by the end of the year, although Fed officials keep sounding the alarm over the prospects of higher for longer inflation, dependent on data which is fuelling a recovery in the greenback:

The bulls are in charge while above 103.00 but the price is testing the dynamic trendline support. If this were to give way, a bearish thesis can be drawn for a continuation lower below 103.00.

USD/CAD technical analysis

Meanwhile, USD/CAD is up high in the day's range but the bias is to the downside given the draw of the W-formation's neckline:

The pattern is a reversion pattern and tends to pull the price toward the neckline for the restest of the support in that area. In this scenario, we have a 61.8% Fibonacci retracement level near 1.3350 below the neckline near 1.3380. However, given that the price is attempting to close higher for the day, that will leave an emphasis on the upside where eyes look to 1.3475.

An account of the deliberations of the Bank of Canada’s Governing Council leading to the monetary policy decision on January 25, 2023 has been released as follows:

"While Governing Council was acutely aware of ongoing uncertainty, they concluded that data since the October MPR had largely reinforced their confidence that inflation would come down through 2023.

"Members framed the decision along two dimensions: • whether to leave the policy rate where it was or to increase it by 25 basis points • whether to maintain similar forward-looking language as in the previous policy statement or to adjust it to signal a pause

"The case for leaving the policy rate at 4.25% was that developments with respect to both the economy and inflation were beginning to move in the right direction and that policy had been forceful and just needed more time to do its work.

"The case for raising the rate by an additional 25 basis points was twofold. First, doing so reflected the fact that developments in the real economy since the December decision had been quite strong:

• Labour market data continued to indicate tightness. • Third quarter GDP growth was stronger than expected, and fourth quarter economic activity was also likely to be stronger than previously projected.

"In other words, data on both the labour market and economic activity suggested that there was more excess demand in the economy in the fourth quarter of 2022 than previously forecast.

"A second rationale for raising the rate by an additional 25 basis points related to the risk of inflation getting stuck somewhere above 2% later in the projection.

"Putting in place some additional tightening now could help insure against that outcome.

"Members were in broad agreement that, going forward, it would be appropriate to pause any additional tightening to allow economic developments to unfold. The Bank had been forceful to date in tightening monetary policy, and the full impact was still to come. In addition, there were enough “green shoots” of progress. Allowing time for further progress to occur would recognize the lags in the transmission of monetary policy and balance the risk of over- versus under-tightening.

"Members discussed how to communicate this need to pause. They reflected on their previous communication in December, which had indicated Governing Council would consider whether the policy interest rate needs to rise further. That communication had also articulated three developments Council would be assessing:

• How tighter monetary policy is working to slow demand • how supply challenges are resolving • how inflation and inflation expectations are responding

"They agreed that the December communication conveyed more of a data-dependent, “decision-by-decision” stance about whether to raise the policy rate further. They debated whether that remained appropriate. Through further discussion, they drew a few conclusions:

• Council wanted to convey that the bar for additional rate increases was now higher. If the economy and inflation were to unfold broadly in line with the projection, they agreed they would probably not need to raise rates further. • Council also wanted to give a clear sense that they would need an accumulation of evidence to determine whether further rate increases would be required to return inflation to the 2% target. • Members also felt it was important to be clear about the conditionality of any pause. Given inflation was still well above the target, Governing Council continued to be more concerned about upside risks. In its determination to return inflation to the 2% target, Governing Council would be prepared to raise the policy rate further if these upside risks materialized.

"Governing Council reached a consensus to increase the policy rate by 25 basis points and adjust its communications to indicate a conditional pause on any further policy tightening.

USD/CAD update

The bulls are putting up a last-ditch effort to contain the price above the key structure around the 1.3420 as follows:

- USD/CHF remains range-bound though it meanders slightly below the 0.9200 figure.

- USD/CHF: If it reclaims the 50-day EMA, it will shift neutral; otherwise, a resumption of the downtrend is likely.

The USD/CHF drops for two consecutive days, though buyers are reclaiming the February 7 daily low of 0.9191, as they are eyeing to reclaim the 50-day EMA at 0.9299. At the time of writing, the USD/CHF exchanges hands at around 0.9200.

USD/CHF Price Analysis: Technical outlook

After dropping beneath 0.9200, the USD/CHF encountered solid support at around 0.9180s, beneath a two-month-old downslope resistance trendline, that turned support. It should be said that the USD/CHF pair is still neutral to downward biased, but with the 20-day Exponential Moving Average (EMA) resting at 0.9215, the USD/CHF could rally in the near term.

Nevertheless, oscillators like the Relative Strength Index (RSI) suggest that a bearish continuation is expected after crossing beneath the 50 mid-line. Contrarily, the Rate of Change (RoC) indicates sideways action.

For the USD/CHF to shift neutral, buyers must reclaim the 50-day EMA at 0.9299. Once that happens, then USD/CHF buyers could be poised to test the 100-day EMA at 0.9416. ahead of the 200-day EMA at 0.9478.

For a resumption of the downtrend, the USD/CHF needs to crack the February 3 daily low of 0.9112, which could pave the way for a retest of the YTD low at 0.9059.

USD/CHF key technical levels

Federal Reserve Governor Christopher Waller said on Wednesday that inflation seems poised to continue slowing this year but the US central bank's battle to reach its 2% target "might be a long fight" with monetary policy kept tighter for longer than anticipated, as Reuters reported.

Key comments

"There are signs that food, energy, and shelter prices will moderate this year," Waller said in remarks prepared for delivery at an Arkansas State University conference, and that the Fed's rapid increases in interest rates had begun "to pay off."

"But I'm not seeing signals of ... quick decline in the economic data, and I am prepared for a longer fight," Waller said.

The surprisingly strong gain of 517,000 jobs in January showed the economy was holding up well, for example, Waller said, but also meant that "labor income will also be robust and buoy consumer spending, which could maintain upward pressure on inflation in the months ahead."

Though wage growth has slowed, the decline is "not enough," Waller said.

"The Fed will need to keep a tight stance of monetary policy for some time."

US Dollar update

More to come...

- USD/JPY bears are testing structure support that guards yesterday's closing price.

- Bears will remain in control while below the micro-trendline resistance.

USD/JPY is starting to break down the bullish structure and the bears are moving in as the US Dollar comes under pressure following a Federal Reserve-speaker-fueled rally in the US session. The following illustrates a bias to the downside based on the week's closing prices so far with Tuesday snapping the Friday Nonfarm Payrolls-induced rally that had led to two days of higher closes.

USD/JPY daily charts

The thesis is bullish now that the price has broken to the backside of the old bearish trendline resistance. However, following Friday's bullish breakout, a correction is in play and the question is how far has this got to run still?

The thesis is that it is more common, following such a strong bearish close that the next day(s) will continue lower on the momentum of the first day. Therefore, Wednesday would be a high probability short set-up:

However, so far the bulls have been able to make a comeback on the day, moving in on the London session's lows around 130.60 and driving the bears all the way back to a high of 131.53 in the US session. For the thesis to play out, the bears need to get back below Tuesday's closing price of 130.99 and at the time of writing, there are some 20 pips to go. The ATR is around 170 pips and the range of the day so far has been 94 pips so there is room for a further push from the bears.

USD/JPY M15 chart

The bears are testing structure support that guards yesterday's closing price but they will remain in control while below the micro-trendline resistance.

- WTI is registering solid gains of 0.43% on Wednesday.

- Less hawkish comments by Fed Chair Jerome Powell underpinned oil prices.

- WTI Technical Analysis: Neutral- downward, though a leg-up can get as high as $80.00.

Western Texas Intermediate (WTI), the US crude oil benchmark, edges up by a margin of 0.50% as a risk-on impulse hits the market, which, worried about an astonishing US jobs report, expected a hawkish tilt of Federal Reserve (Fed) Chair Jerome Powell, on Tuesday. Nevertheless, Powell’s muted response gave the green light to traders seeking risk. At the time of writing, WTI is trading at $77.93 per barrel.

WTI has recovered from diving toward the weekly lows of $72.30 on Monday. Expectations after last Friday’s Nonfarm Payrolls report for January added that the US economy added more than 500K jobs, pressured investors as they scrambled to square off their positions in riskier assets ahead of yesterday’s speech by Jerome Powell.

Powell said interest rates would need to increase if solid labor market data threatened to derail the Fed’s progress to curb inflation. However, he declined to give any forward guidance regarding future rate hikes and their size.

That said, investors’ worries faded as higher interest rates in the United States (US) suggested the greenback could strengthen, which means oil prices are high for buyers holding other currencies.

The reopening of China after relaxing Covid-19 restrictions is expected to support the demand for fuel. In the meantime, the Organization of Petroleum Export Countries and its allies (OPEC+) decided to keep crude output unchanged, as an Iranian official said the cartel is likely to stick to its current policy on Wednesday.

Nevertheless, a solid inventory report from the US capped oil prices, as an increment in supply makes oil cheaper. The US Energy Information Administration (EIA) revealed that oil production in the US rose to its highest level since April 2020.

WTI technical analysis

Technically speaking, WTI remains neutral to downward biased, and the ongoing correction might offer sellers better entry prices. Nevertheless, if WTI’s bulls reclaim the 50-day Exponential Moving Average (EMA) at $78.71, a move toward the $80.00 figure is up for grabs. However, a resumption of the downtrend is likely to happen once WTI dives below the 20-day EMA at $77.70. Once cleared, oil prices could slide towards the February 7 low of $74.40, ahead of the weekly low of $72.30.

British fighter jet deliveries to Ukraine would have military and political ramifications for the entire European continent - Tass cites the Russian embassy.

More to come...

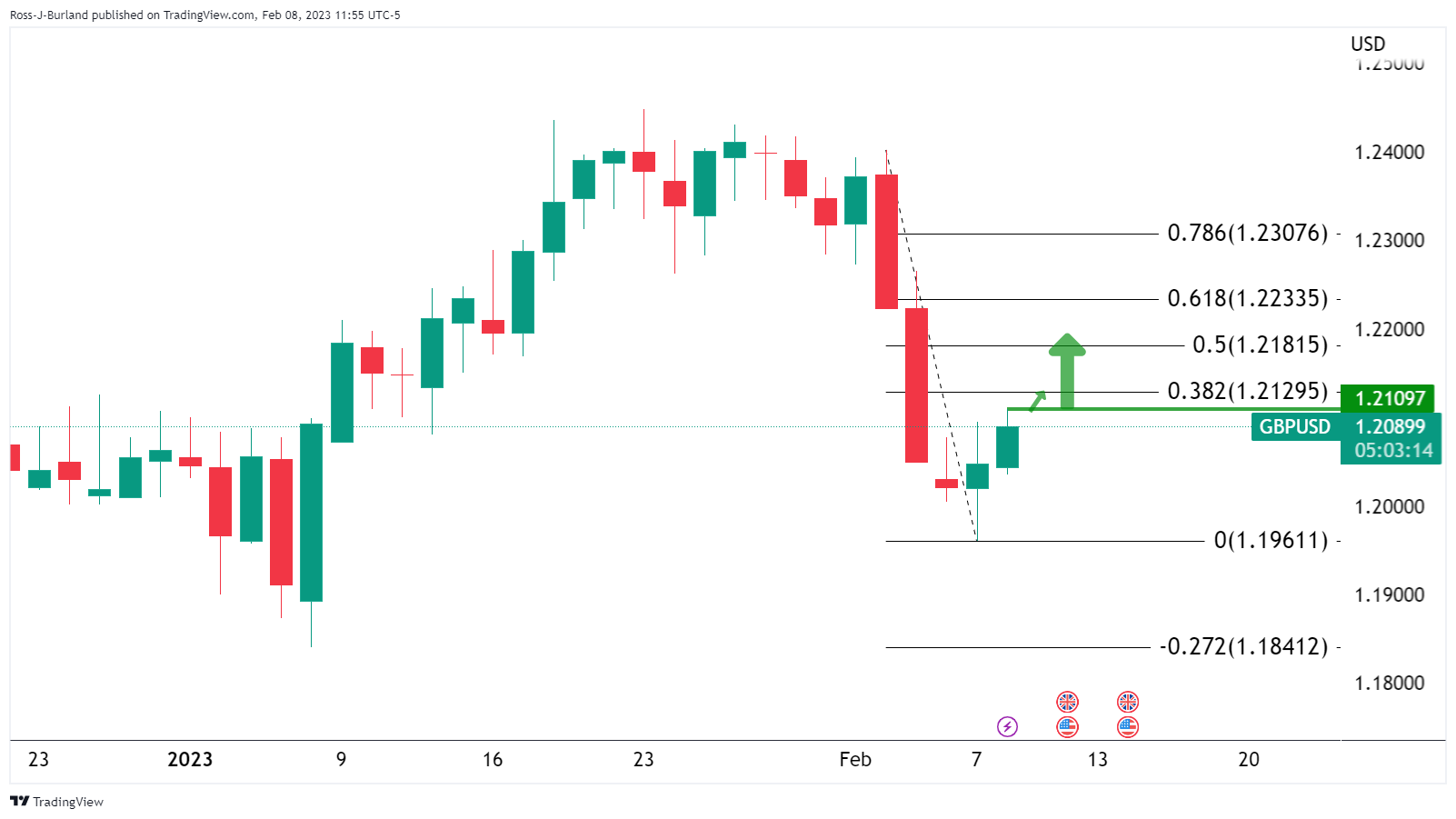

- GBP/USD is making tracks higher and bulls eye the 38.2% Fibonacci target of around the 1.2120s.

- On the 15-minute chart, GBP/USD is breaking the structure after putting in a higher low for the New York session.

- A break of 1.2092 is now what the bulls need to solidify the prospects of a push higher for the end of the day.

As per the prior analysis, GBP/USD Price Analysis: Bulls moving in on the bear's break of 1.2090 structure, the price rallied in a continuation of the bullish correction into the Daily bearish impulse as outlined in the article. We are now in the throws of a bullish reversal of the New York session with targets for a second bullish close for the middle of the week's trade as the following will illustrate.

GBP/USD prior analysis

GBP/USD bulls moved in on Tuesday and were setting the foundations for a bullish correction of the slide from the 1.23s at the start of February. The following illustrated the bullish bias for Wednesday (today):

The price had rallied from a low of 1.1960 to a high of 1.2095, taking out Monday's high, MH, and breaking structures, BoS, along the way, The price had also moved to the backside of the prior bearish dynamic resistance, (bearish trendline), that was expected to act as a counter-trendline.

The breakout of those structures left the directional bias in favour of a meanwhile bullish correction on the daily chart for Wednesday, pending a bullish close on Tuesday (yesterday):

Zoomed in...

This left the foundations of a long trade for whichever session traders were. Asia was a sideways session, setting the foundations for an explosive move to the upside in the London day whereby GBP/USD rallied from a low of 1.2037 to a high of 1.2109.

GBP/USD, what now?

The question is whether there is anything left in the tank from the bulls in the US session. For the day to close bullish, which was yesterday's thesis, the price must close higher than Tuesday's closing price of 1.2046. The daily ATR is 122 pips and for the day so far the range has been between 1.2030 and 1.2109, 79 pips. This leaves further to go on the upside if the minimum of the daily ATR is to be reached coming in at around 1.2250.

On Tuesday, looking for a bullish setup, the 1.2180s were eyed in a 50% mean reversion target. On the way there, a 38.2% Fibonacci retracement was located at 1.2129 which is still vulnerable for today and certainly for the remainder of the week:

On the 15-minute chart, the price is breaking the structure after putting in a higher low for the New York session. A break of 1.2092 is now what the bulls need to solidify the prospects of a push higher for the end of the day towards the 38.2% Fibonacci target of around the 1.2120s:

- Gold price is printing minimal gains of 0.14%, bolstered by lower US real yields.

- Federal Reserve officials remain committed to tackling high inflation in the US, as said by Fed’s Williams and Cook.

- Gold Price Forecast: Sideways, after diving from the YTD high to the 50-DMA.

Gold price is almost flat during the North American session, meandering around the $1870 area after hitting a daily high of $1886.35, though it failed to gain traction as the US Dollar (USD) pares some of its earlier losses. At the time of writing, XAU/USD is trading at around $1875, above its opening price.

Gold remains firm, even though Fed officials underpinned the US Dollar

US equity futures continued to trade negatively amidst a slew of Federal Reserve (Fed) officials emphasizing the need to raise rates to curb elevated inflation. Policymakers led by the New York Fed President John Williams said there’s “uncertainty” around inflation. He added that a jump in inflation could trigger a reaction by the US central bank.

Later, Fed Governor Lisa Cook said that even though the Fed sees improvement in inflation, it’s still running too high. She added that the US central bank is focusing on restoring price stability and reiterated the Fed is not done raising interest rates.

Market participants reacted, sending US Treasury bond yields higher, with the 10-year benchmark note rate at 3.679%. Consequently, the greenback, as shown by the US Dollar Index, registers minuscule gains of 0.09%, at 103.42.

Despite US Treasury yields being up and the buck too, the yellow metal clings to gains, underpinned by falling US Real Yields. The US 10-year TIPS, a proxy for Real Yields, stumbles from 1.351% to 1.326%, a tailwind for precious metals. The XAU/USD meanders around $1874, within the boundaries of the 20 and 50-day Exponential Moving Averages (EMAs), each at $1895.18 and $1856.20, respectively.

Gold Price Forecast: XAU/USD Technical Outlook

Gold’s daily timeframe suggests the yellow metal remains upward biased, though on an ongoing pullback. XAU/USD’s dip from the YTD high of S1959.74 towards Monday’s low of S1860.44 was capped by the 50-day EMA presence. Nevertheless, uncertainty clouds the outlook, as observed by XAU/USD’s price action, registering three successive candles with small bodies but longer upper wicks. That suggests that selling pressure remains.

Downwards, the XAU/USD first support would be $1869.16, followed by $1865.08 and $1860.44. Upwards, Gold’s first resistance would be $1886.35, followed by the 20-day EMA at $1895.30, ahead of the $1900 figure.

EUR/USD dropped to its lowest level since January 9 at 1.0667 on Tuesday. Economists at Rabobank maintain their three-month EUR/USD forecast of 1.06.

Fed’s rates unlikely to shift lower

“On the back of the remarks from Powell yesterday, Friday’s labour data release and our ongoing concerns surrounding the impact of tight labour market conditions, we have revised up our forecast for the top of the target range for the Fed funds rate to 5.5% from 5.0%. This underpins our expectation that EUR/USD will dip back to 1.06 on a three-month view and potentially to 1.03 in six-months.”

“Given that the market is positioned long EUR, we expect the upside for the EUR to remain capped.”

The Swiss Franc is in the doghouse, underperforming the Euro. Economists at HSBC expect this trend to continue over the coming month.

USD/CHF to move sideways over the coming month

“We look for modest CHF weakness against the EUR in the month ahead, given the rate market is prepared for additional tightening with 40 bps already priced in for the 23 March Swiss National Bank (SNB) meeting.

“We do not expect the CHF’s safe haven allure to be especially in demand for the next few weeks, as concerns over a possible Eurozone recession are on the retreat.”

“One upside risk to the CHF remains any shift in risk aversion owing to, for example, a potential escalation in the conflict in Ukraine.”

“We expect USD/CHF to move sideways over the coming month.”

Gold price is building on its recovery from four-week troughs of $1,860. Still, buyers seem to lack conviction, economists at TD Securities report.

Gold prices still remain overbought

“Shanghai Gold trader liquidations continue to suggest that behemoth Chinese buying activity over the last few months was likely exacerbated by Lunar New Year celebrations amid China's reopening, but is now on track to normalize. Still, with positioning now slightly below average, the pace of liquidations from this cohort could slow. This leaves investors as the marginal buyer or seller, which in the recent context increases the market's focus on upcoming data.”

“We don't expect substantial downside flow from CTAs until prices break the $1,840 range, but the margin of safety against a marginal buying program is razor-thin above $1,900. In turn, while prices still remain overbought, we don't see imminent downside flow without data corroborating a more hawkish path ahead.”

In an interview with MNI Market News, European Central Bank (ECB) policymaker Klaas Knot said that the headline inflation appears to have peaked, as reported by Reuters. Knot, however, added that keeping current pace of hikes into May could well be needed if underlying inflation does not materially abate.

Additional takeaways

"Sharp decrease in energy prices could bring down headline inflation faster than projected by the ECB."

"Slowdown in growth seems even more shallow, short-lived than expected."

"Increased activity may improve workers' bargaining power, lead to more inflation down the road."

"ECB focus has shifted from energy, headline inflation to breaking underlying inflation."

"Would expect inflation in core goods to start falling first."

"Core services inflation could prove more persistent."

"It will take some time before core inflation slows down."

"Forward-looking wage indicators confirm wage growth will increase further in 2023."

"Policy rates have swiftly been brought into the neutral range."

"Once we see a clear, decisive turn in underlying inflation dynamics, I expect us to move to smaller steps."

Market reaction

These comments don't seem to be helping the Euro gather strength against its rivals. As of writing, the EUR/USD pair was posting small daily losses at 1.0716.

- EUR/GBP retreats further south of the 0.8900 yardstick.

- The appetite for the risky assets loses momentum on Wednesday.

- Flash German CPI, UK GDP figures take centre stage later in the week.

The upside bias in the British pound weighs on EUR/GBP and drags it to weekly lows near 0.8870 on Wednesday.

EUR/GBP weaker on GBP recovery

EUR/GBP retreats for the third session in a row midweek and extend the offered bias following recent 5-month peaks near 0.8980 (February 3).

Indeed, the recent sharp decline in the European currency, particularly in the wake of the US NFP results, put the cross under heavy downside pressure and sponsored the ongoing drop to 4-day lows.

Moving forward, the next steps from both the ECB and the BoE are expected to drive the price action around the cross as well as the progress of the Fed’s normalization process.

So far, the ECB has already anticipated a 25 bps rate hike in March, while investors also appear to lean towards a similar rate hike by the “Old Lady” following the bank’s more optimistic projections unveiled at the latest gathering.

EUR/GBP key levels

The cross is losing 0.15% at 0.8889 and the breakdown of 0.8758 (55-day SMA) would expose 0.8721 (2023 low January 19) and finally 0.8636 (200-day SMA). On the other hand, the next up barrier emerges at 0.8978 (2023 high February 3) followed by 0.9000 (round level) and then 0.9277 (2022 high September 26).

Federal Reserve Governor Lisa Cook said on Wednesday that inflation is still running too high even though it has moderated, as reported by Reuters.

Key takeaways

"Strongly committed to both price stability and employment mandates of the Fed."

"Data are telling a pretty clear story of a historically strong labor market, with still elevated inflation."

"Fed is focused on restoring price stability, will need restrictive monetary policy for some time."

"Without stable prices it will be hard to maintain maximum employment."

"Fed recognizes the benefits a sustained expansion will bring to low and moderate income communities."

"Inflation has severe costs and falls hardest on those living paycheck to paycheck."

"Inflation can be contained without a large increase in unemployment."

"Possible the path of the unemployment rate will be lower than most recent Fed projections."

"In times of uncertainty important not to take too much signal from two or three data points."

"Appropriate now to move in smaller steps as Fed assesses cumulative impact of rate increases so far."

"Fed will stay the course until inflation is contained."

"Fed is starting to see some improvement in inflation data."

"Expect inflation will continue falling this year and next, though progress may be uneven."

"Path of policy rates will depend on how quickly inflation moves towards the 2% goal.

Market reaction

The US Dollar Index edged slightly higher and was last seen posting small daily gains at 103.42.

- USD/MXN recovers some ground after dropping to weekly lows of 18.8231.

- Despite the ongoing upward correction, the USD/MXN is still downward biased.

- USD/MXN: Failure to crack 19.0000 could exacerbate a retest of the YTD lows of 18.50.

The Mexican peso (MXN) is losing ground against the US Dollar (USD) after recovering some ground on Tuesday, following “dovish” perceived remarks by the US Federal Reserve (Fed) Chair Jerome Powell. The USD/MXN dropped from around 19.1783 towards the week’s lows at 18.8691, but on Wednesday, the buck is recovering. At the time of writing, the USD/MXN exchanges hands at 18.9475, above its opening price by 0.17%.

USD/MXN Price Analysis: Technical outlook

Before Wall Street opened, the USD/MXN pair was trading at around the day’s lows, around 18.8231. However, a risk-off impulse increased demand for the US Dollar, so the USD/MXN is moving upwards.

The USD/MXN daily chart suggests further downside is expected, but the ongoing correction could open the door for further gains. At the time of typing, the USD/MXN has broken the 20-day Exponential Moving Average (EMA) at $18.9134 and could extend its gains towards 19.0000, a psychological resistance. A breach of the latter and the USD/MXN could rally toward January 19 daily high at 19.1085.

For the resumption of the downtrend, the USD/MXN needs a break below the 20-day EMA at 18.9134. Once cleared, that would expose critical support levels. Firstly, the February 7 low of 18.8691, followed by the day’s low at 18.8231, and then the YTD low at 18.50

USD/MXN Key Technical Levels

Economists at Wells Fargo forecast a softer greenback than previously and believe the US Dollar has already embarked upon a prolonged period of depreciation.

US Dollar's depreciation to gather pace in 2024

“Given more resilient growth internationally and a hawkish shift by some foreign central banks in recent months (notably the European Central Bank and Bank of Japan), we believe the USD has embarked upon a prolonged period of depreciation.”

“In the short term, we expect USD depreciation to be gradual as the US economy falls into recession, while the Fed hesitates to lower interest rates prematurely.

“We expect the US Dollar's depreciation to gather pace in 2024 as we believe the Fed will start cutting interest rates quicker than foreign central banks.”

New York Federal Reserve President John Williams said on Wednesday that the labor market is still very strong and added that they have more work to do on rates, as reported by Reuters.

"The Fed will watch the data to determine the path of rate rises," Williams added and argued that inflation could prove more persistent. "Maybe services prices stay elevated, and if that happens we'll need higher rates."

Market reaction

The US Dollar Index showed no immediate reaction to these remarks and was last seen posting small daily losses at 103.25.

Additional takeaways

"Last year we had a long way to go on rates and that needed big steps."

"We are likely now closer to peak and can take smaller steps."

"25 bps rate hikes seem the best option for now, they allow us to more easily assess rates."

Will USD/CAD eventually fall in 2023? Economists at Bank of America Global Research expect the pair to dive towards 1.25 by the end of the year.

USD/CAD Q1 forecast remains at 1.32

“We maintain our downtrend USD/CAD forecast for the year despite the Bank of Canada rate hike pause.”

“We believe the Canadian Dollar will benefit from supportive equity factor, energy factor, and seasonality in the coming months.”

“We maintain our Q1 forecast of 1.32 and year-end forecast of 1.25 for the USD/CAD pair.”

- EUR/USD fails to extend the bounce past the 1.0780 level.

- The 3-month line near 1.0780 keeps capping the upside.

EUR/USD bounces off Tuesday’s lows near 1.0670, although the bullish attempt runs out of steam near 1.0760.

As long as the 3-month resistance line near 1.0780 continues to cap the upside, the pair is expected to remain under pressure and thus another move to the February low near 1.0670 should not be discarded just yet.

In the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0319.

EUR/USD daily chart

Equity investors appear optimistic, but US government bonds, Gold and Oil tell a less encouraging story, Lisa Shalett, Chief Investment Officer, Wealth Management at Morgan Stanley, reports.

Equity gains are merely another bear market bounce

“Recent equity gains are merely another bear market bounce – not the beginning of a sustainable bull market. The current rally seems to be based not on improving economic fundamentals but on easing financial conditions, which we believe are likely to reverse later this year.”

“Even as stocks trade higher, recent market action for other asset classes paints a starkly different picture. US government bonds: Treasury yield curves remain deeply inverted, a time-tested signal that an economic downturn is on the horizon. Gold: Since the October low for the S&P 500, Gold continues to outperform both the S&P 500 and the Nasdaq. Oil: If equity investors are expecting a ‘soft landing’ and potential rebound in economic growth later in 2023, oil prices do not reflect that.”

- GBP/USD scales higher for the second straight day, albeit lacks follow-through buying.

- The risk-off mood drives some haven flows towards the USD and caps gains for the pair.

- The technical setup supports prospects for an eventual break below the 200-day SMA.

The GBP/USD pair builds on the overnight bounce from the 1.1960 area, or over a one-month low and gains some positive traction for the second successive day on Wednesday. Spot prices, however, struggle to capitalize on the move or find acceptance above the 1.2100 mark and retreat around 35 pips from the daily top. The pair is currently placed around the 1.2075 region, still up over 0.30% for the day.

The prevalent risk-off environment - as depicted by a generally weaker tone around the equity markets - assists the safe-haven US Dollar to recover a major part of its intraday losses. This, in turn, is seen as a key factor acting as a headwind for the GBP/USD pair. That said, the prospects for an imminent pause in the Fed's rate-hiking cycle hold back the USD bulls from placing aggressive bets and remain supportive of the bid tone surrounding the major.

Looking at the broader picture, the recent repeated failures near the 1.2450 supply zone constitute the formation of a bearish multiple-top pattern on the daily chart. That said, the emergence of some buying near a technically significant 200-day SMA warrants some caution for bearish traders. This makes it prudent to wait for strong follow-through selling below the overnight swing low, around the 1.1960 zone before positioning for a further depreciating move.

With oscillators on the daily chart holding in the negative territory, the GBP/USD pair might then turn vulnerable to accelerate the fall towards the 1.1900 round figure. The downward trajectory could get extended further towards testing the YTD low, around the 1.1840 region touched on January 6, en route to the 100-day SMA, currently near the 1.1815-1.1810 area.

On the flip side, any meaningful rally beyond the 1.2100 mark is likely to confront stiff resistance ahead of the 1.2200 round figure. The latter coincides with the 100-day SMA, which if cleared might negate the bearish outlook and prompt some short-covering. The GBP/USD pair could then climb to the 1.2235-1.2280 barrier before aiming to reclaim the 1.2300 mark.

GBP/USD daily chart

Key levels to watch

- USD/CAD attracts some buyers near the 1.3360 area, or the weekly low touched on Wednesday.

- A modest pullback in crude oil prices undermines the Loonie and lends some support to the pair.

- A weaker risk tone benefits the USD’s safe-haven status and contributes to the intraday bounce.

The USD/CAD pair rebounds from the weekly low touched this Wednesday and climbs to a fresh daily high, which bulls now looking to build on the momentum beyond the 1.3400 mark.

Crude oil prices surrender a major part of the intraday gains to a one-week low, which, in turn, is seen undermining the commodity-linked Loonie. Apart from this, the prevalent risk-off mood benefits the US Dollar's relative safe-haven status and assists the USD/CAD pair to attract some buyers near the 1.3360 region.

From a technical perspective, any subsequent move up might continue to confront stiff resistance near the top end of over a two-month-old descending channel. The said hurdle is pegged near the 1.3455 area and is followed by the last week's swing high, around the 1.3475 zone, which should now act as a pivotal point.

A sustained strength beyond will be seen as a fresh trigger for bullish traders and set the stage for an extension of the recent recovery move from the lowest level since November 16. Some follow-through buying beyond the 50-day SMA will reaffirm the positive bias and push the USD/CAD pair beyond the 1.3500 psychological mark.

The momentum could get extended towards a technically significant 100-day SMA support breakpoint, now turned resistance near the 1.3530 region, above which bulls might aim to reclaim the 1.3600 mark.

On the flip side, the daily low, around the 1.3360 area, now becomes immediate support to defend ahead of the 1.3300 mark. A convincing break below will make the USD/CAD pair vulnerable to fall below the YTD low, around the 1.3265-1.3266 zone, and test the 1.3200 mark en route to the channel support, around the 1.3160-1.3155 zone.

USD/CAD daily chart

Key levels to watch

- The index struggles to extend the upside and returns to the low-103.00s.

- Bullish attempts should meet the next hurdle around 104.00.

DXY loses some momentum and adds to the rejection from Tuesday’s monthly highs just ahead of the 104.00 hurdle.

While above the 3-month support line near 102.00, further gains look likely, although the index needs to clear the February high at 103.96 (February 7) to allow for the continuation of the uptrend to the 2023 top at 105.63 (January 6).

In the longer run, while below the 200-day SMA at 106.45, the outlook for the index remains negative.

DXY daily chart

EUR/USD losses appear to be steadying around the 1.07 point. A break past the 1.0765/70 area could lift the pair to the 1.08 level, economists at Scotiabank report.

Hawkish messaging from the ECB to keep the EUR underpinned

“We think the relatively hawkish messaging from the ECB will serve to keep the EUR underpinned in the short run and that losses to the 1.07 area may provide an opportunity for bargain-hunters to step up to re-establish long positions that were squeezed out by the past week’s volatility.”

“Intraday gains through 1.0765/70 should see spot pick up a little more support towards 1.08.”

- EUR/JPY alternates gains with losses around 140.50 midweek.

- The 143.00 region remains a tough near-term resistance zone.

EUR/JPY navigates within a narrow range in the mid-140.00s following Tuesday’s sharp sell-off.

While the cross is expected to maintain the side-lined theme in the short term, the 143.00 area remains a solid barrier for bulls. This key resistance zone also appears reinforced by the 100-day SMA, today at 142.89

If the cross breaches the 200-day SMA at 141.00 on a sustainable fashion, the outlook is expected to shift to bearish.

EUR/JPY daily chart

Ahead of tomorrow’s Riksbank decision, economists at Credit Suisse raise their EUR/SEK Q1 target from 11.30 to 11.50 and would look to fade consolidation triggered by hawkish policy rate projections.

Further SEK weakness remains the path of least resistance

“Ahead of tomorrow’s Riksbank decision, we raise our EUR/SEK Q1 target from 11.30 to 11.50.”

“There is a possibility that hawkish policy rate projections could trigger a consolidation in EUR/SEK to the 11.00-11.10 zone: we would expect SEK weakness to resume thereafter.”

See – Riksbank Preview: Forecasts from seven major banks, 50 bps, but the peak is not far off

- USD/JPY remains on the defensive and is pressured by a combination of factors.

- Powell’s less hawkish stance, sliding US bond yields exert pressure on the USD.

- Hawkish BoJ expectations and a weaker risk tone benefit the safe-haven JPY.

The USD/JPY pair edges lower for the second straight day and remains on the defensive through the mid-European session on Wednesday. The pair is currently placed around the 130.80 region, just a few pips above the weekly low touched the previous day.

The US Dollar comes under some renewed selling pressure amid a fresh leg down in the US Treasury bond yields and acts as a headwind for the USD/JPY pair. Fed Chair Jerome Powell on Tuesday acknowledged that rates might need to move higher than expected if the economy remained strong, though struck a balanced tone on inflation. This, in turn, fueled speculations about an imminent pause in the Fed's policy-tightening cycle, which, in turn, is seen dragging the US bond yields lower.

The Japanese Yen (JPY), on the other hand, draws support from expectations that high inflation could invite a more hawkish stance from the Bank of Japan (BoJ) later this year. Apart from this, a weaker risk tone further benefits the safe-haven JPY and exerts downward pressure on the USD/JPY pair. The market sentiment remains fragile amid worries about economic headwinds stemming from rising borrowing costs, the COVID-19 outbreak in China and fears about worsening US-China relations.

The aforementioned fundamental backdrop suggests that the path of least resistance for the USD/JPY pair is to the downside. That said, the lack of follow-through selling warrants some caution for aggressive bearish traders in the absence of any relevant market-moving economic releases. That said, speeches by influential FOMC members could provide some impetus to the greenback. Apart from this, the broader risk sentiment should allow traders to grab short-term opportunities around the USD/JPY pair.

Technical levels to watch

Lee Sue Ann, Economist at UOB Group, comments on the latest RBA interest rate decision (February 7).

Key Takeaways

“The Reserve Bank of Australia (RBA) decided to increase the cash rate target by 25bps to 3.35% at its first meeting of the year. Taking into account today’s move, the RBA has raised the cash rate by 325bps since May 2022.”

“The RBA stated that its priority is to return inflation to target, and that further increases in interest rates will be needed over the months ahead. We are penciling in another two more 25bps hike, which will take the OCR to 3.85%, before looking for a pause.”

“That said, the releases of 4Q22 wage price index later this month on 22 Feb and 4Q22 GDP on 1 Mar will be closely watched. Before that, the RBA will be releasing its Statement of Monetary Policy (SoMP) coming Fri (10 Feb).”

GBP/USD stages bull reversal. Gains through the low/mid-1.21 area should see Cable pick up a little more momentum, economists at Scotiabank report.

Dips likely to be taken advantage of by buyers

“Cable formed bullish key reversal session yesterday (new low, higher close and higher high relative to Monday), strongly signaling a reversal in the pound’s recent slide.”

“Intraday gains are struggling a little around the 1.21 point but modest dips are likely to be taken advantage of by buyers.”

“Gains through the low/mid-1.21 area should see the GBP pick up a little more momentum in the next few days.”

“Support is 1.2045/50.”

- AUD/USD attracts some buyers for the second successive day, though lacks bullish conviction.

- Expectations for a less hawkish Fed, sliding US bond yields weigh on the USD and lend support.

- Looming recession risks and the cautious mood act as a headwind for the risk-sensitive Aussie.

The AUD/USD pair adds to the previous day's strong gains and edges higher for the second successive day on Wednesday. Spot prices, however, seem to struggle to capitalize on the move and remain below the 0.7000 psychological mark through the mid-European session.

The Australian Dollar continues to draw some support from the RBA's hawkish outlook, signalling that further rate increases will be needed to ensure that inflation returns to target. Apart from this, the emergence of fresh selling around the US Dollar turns out to be another factor acting as a tailwind for the AUD/USD pair.

Against the backdrop of the upbeat US NFP report, Fed Chair Jerome Powell on Tuesday acknowledged that interest rates might need to move higher than expected if the economy remained strong. Powell, however, reiterated that the process of disinflation was underway and fueled speculations that interest rates may not rise much further.

Reviving bets for an imminent pause in the Fed's policy-tightening cycle triggers a fresh leg down in the US Treasury bond yields, which, in turn, weighs on the USD and lends support to the AUD/USD pair. That said, a generally weaker tone around the equity markets holds back bulls from placing fresh bets around the risk-sensitive Aussie.

The market sentiment remains fragile amid worries about economic headwinds stemming from the continuous rise in borrowing costs, the COVID-19 outbreak in China and the protracted Russia-Ukraine war. Apart from this, fears about worsening US-China relations further temper investors' appetite for riskier assets and cap the AUD/USD pair.

The aforementioned mixed fundamental backdrop makes it prudent to wait for some follow-through buying before confirming that the recent pullback from the highest level since June 2022 has run its course. In the absence of any relevant market-moving US macro data, traders on Wednesday will take cues from speeches by influential FOMC members.

Technical levels to watch

USD/INR is not far off the 83.00 psychological barrier. A break past 82.95/83.3o would clear the path for more gains, economists at Société Générale report.

82.30 is short-term support

“USD/INR faced stiff resistance at 83.30 last October and since then it has evolved within a sideways consolidation resembling a symmetrical triangle. It is now close to the upper limit of this range at 82.95/83.30. This remains a crucial resistance, only a break above would mean next leg of uptrend.”

“Recent bullish gap at 82.30 is a short-term support. In case this gets violated, there could be a risk of a pullback towards the lower band at 81.00/80.90.”

Economist at UOB Group Enrico Tanuwidjaja assesses the latest GDP results in Indonesia.

Key Takeaways

“4Q22 GDP growth came in relatively well within general expectations at 5.0% y/y (3Q22: 5.7%) or slowing to 0.4% q/q from 1.8% in the preceding quarter. This has brought about the full year 2022 GDP growth at 5.3%, strongest in the aftermath of post-pandemic recovery (2020: -2%; 2021: 3.7%).”

“Though easing, contribution from all the expenditure side, except continued contraction in government spending, continue to sustain growth momentum. From the sectoral output basis, all sectors recorded growth in 3Q22, with transportation and logistics topping growth pace for 2 quarters in a row, consistent with the ongoing reopening that virtually has undone all the pandemic mobility and activity restrictions.”

“Moderating global commodity prices as well as the inflation-biting impact on the domestic household consumption is likely to render slower growth for the Indonesian economy this year. We also have factored in seasonally higher fiscal impacts from election-related unto growth in the latter half of this year. All in all, we forecast Indonesia’s GDP to grow by around 5% in 2023.”

For EUR/USD, immediate support lies at 1.0680. A break below here would open up room for more losses towards January low of 1.0480, economists at Société Générale report.

January peak of 1.0940 should cap

“EUR/USD has staged a pullback towards the 50-DMA at 1.0680 which is a potential support. A bounce is not ruled out, however, January peak of 1.0940 should cap.”

“Break of 1.0680 can extend the decline towards 1.0560 and January low of 1.0480.”

See – EUR/USD: Further explorations below 1.0700 are possible in the coming days – ING

Comments from Fed officials are set to drive US Dollar's action. The Dollar still faces moderate upside risks this week, but stabilization looks more likely today, in the view of economists at ING.

There is room for the general Fed rhetoric to stay on the hawkish side

“We think markets may feel relatively comfortable with the current pricing for a 5.15% peak rate for now, even though risks are skewed towards another 10 bps of tightening being added into the curve. This means that the Dollar’s upward correction may have a bit more to run, but we doubt this will morph into a sustained USD uptrend from this point on.”

“There is room for the general Fed rhetoric to stay on the hawkish side and while we think the absence of key data can favour some stabilisation in the Dollar today, risks are skewed towards another small leg higher in the greenback.”

Japan’s government said that cooperation with the business and labor circles is essential. Economists at Commerzbank analyze the implications of the upcoming negotiations on wage rises.

Japan’s version of Germany’s contrat social of the 1960s and 70s?

“This time it is being reported that the government was planning to bring employers’ representatives and unions together for them to agree on wage rises. Any German reader with a good memory (and who is old enough) might remember a similar arrangement in Germany in the 1960s and 1970s (‘konzertierte Aktion’ or contrat social).”

“The Germans do not have fond memories of such an arrangement. It ended in bitter disagreement. That might work better in Japan. And even if one was sceptical, a government initiative like that would be informative for JPY investors. It would prove that the government is interested after all in creating sustainable reflation. In that context, the nomination of a hawkish BoJ Chair would be illogical.”

“Before you run off and sell JPY, let me warn you: a government’s behavior is not always as consistent as I have assumed up to this point. If the government urges the two sides of industry towards higher wages, this could be due to an attempt to gain the support of the voters rather than a coherent macroeconomic plan.”

Senior Economist at UOB Group Alvin Liew reviews the recently published US jobs report for the month of January.

Key Takeaways