- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 07-10-2014

(raw materials / closing price /% change)

Light Crude 88.43 -0.47%

Gold 1,208.70 -0.31%

(index / closing price / change items /% change)

Nikkei 225 15,783.83 -107.12 -0.67%

Hang Seng 23,422.52 +107.48 +0.46%

S&P/ASX 200 5,284.2 -8.71 -0.16%

FTSE 100 6,495.58 -68.07 -1.04%

CAC 40 4,209.14 -77.38 -1.81%

Xetra DAX 9,086.21 -123.30 -1.34%

S&P 500 1,935.1 -29.72 -1.51%

NASDAQ Composite 4,385.2 -69.60 -1.56%

Dow Jones 16,719.39 -272.52 -1.60%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2664 +0,09%

GBP/USD $1,6095 +0,09%

USD/CHF Chf0,9567 -0,16%

USD/JPY Y108,14 -0,54%

EUR/JPY Y136,94 -0,45%

GBP/JPY Y174,03 -0,46%

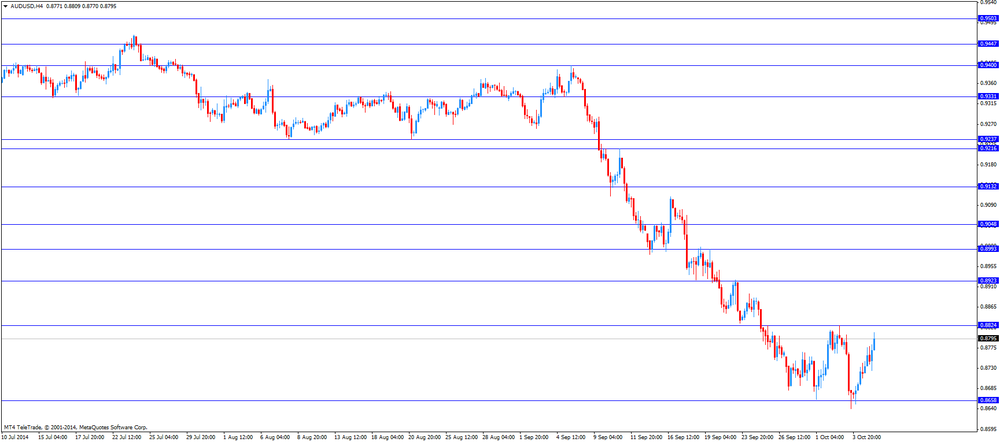

AUD/USD $0,8804 +0,52%

NZD/USD $0,7822 -0,14%

USD/CAD C$1,1161 +0,22%

(time / country / index / period / previous value / forecast)

01:45 China HSBC Services PMI September 54.1

05:00 Japan BoJ monthly economic report

05:00 Japan Eco Watchers Survey: Current September 47.4 48.2

05:00 Japan Eco Watchers Survey: Outlook September 50.4

05:45 Switzerland Unemployment Rate September 3.2% 3.2%

07:00 United Kingdom Halifax house price index September +0.1% +0.2%

07:00 United Kingdom Halifax house price index 3m Y/Y September +9,7%

12:15 Canada Housing Starts September 192 195

14:30 U.S. Crude Oil Inventories September -1.4

18:00 U.S. FOMC meeting minutes

23:01 United Kingdom RICS House Price Balance September 40% 38%

23:50 Japan Core Machinery Orders September +3.5% +1.1%

23:50 Japan Core Machinery Orders, y/y September +1.1% -5.1%

Stock indices closed lower due to the IMF's economic growth cut and disappointing German industrial production. The International Monetary Fund (IMF) cut its forecast for global economic growth to 3.3% in 2014, down from a previous forecast of 3.4%. 2015 forecast was lowered to 3.8%, down from a previous forecast of 4.0%.

German industrial production declined 4.0% in August, missing expectations for a 1.4% decrease, after a 1.6% rise in July. That was the largest drop since 2009.

July's figure was revised down from a 1.9% gain.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,495.58 -68.07 -1.04 %

DAX 9,086.21 -123.30 -1.34 %

CAC 40 4,209.14 -77.38 -1.81 %

The cost of oil futures has fallen markedly today amid fears that weak economic growth will lead to a reduction in demand.

Pressure on prices also had a decrease in the United States Department of Energy forecast for oil prices this year and next year. Now, experts expect that the average price of WTI crude oil this year and next year will be $ 97.72 and $ 94.58 per barrel, respectively. Previous projections assumed $ 98.28 this year and $ 94.67 next year. According to the Ministry, the average price of Brent crude oil in 2014 and 2015 to reach $ 104.42 and $ 101.67, respectively. Forecast for the last month estimated average price of $ 106 and $ 103, respectively. Meanwhile, the ministry raised its forecast for total oil production in the United States in 2014 to 8.54 million barrels a day compared with a previous forecast of 8.53 million barrels per day. The forecast for 2015 was lowered from 9.53 million barrels per day to 9.5 million barrels per day. Forecasts the volume of production in 2015 is likely to be the maximum average annual rate since 1970. Also, the Ministry of Energy lowered its forecast for global oil consumption to 91.47 million barrels a day this year and up to 92.71 million barrels per day next year. Last month, a similar forecast assumed 91,550,000 barrels per day in 2014 and 92.89 million barrels per day in 2015.

"In the oil market is a tendency to decrease. One of the main news - falling prices in Saudi Arabia, which excludes the possibility of reducing production in the near future, "Belgian Foreign at CMC Markets. Recall, Saudi Arabia gave a big discount to Asian customers on November party, demonstrating the desire to increase market share.

According to experts, the market does not put in quotes geopolitical risks, but it can influence events in the Middle East. The fighting between the Kurds and the Islamic state are on the border of Syria and Turkey, and NATO Secretary General promised to support Turkey if it will suffer from the actions of the Islamists.

The dynamics also affect the expectations of tomorrow's publication of data on oil reserves in the United States / According to a survey last week oil reserves could increase by 2 million barrels, while distillate inventories and gasoline - to cut. Meanwhile, we add that later today the American Petroleum Institute will release its inventories report.

The cost of the November futures for the American light crude oil WTI (Light Sweet Crude Oil) fell to $ 89.27 a barrel on the New York Mercantile Exchange (NYMEX).

November futures price for North Sea Brent crude oil mixture fell $ 1.17 to $ 91.68 a barrel on the London exchange ICE Futures Europe.

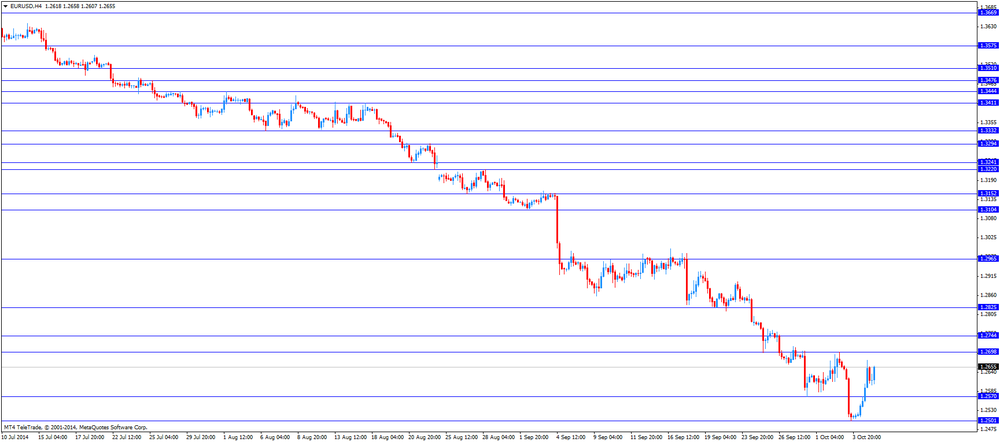

The U.S. dollar traded mixed against the most major currencies after the International Monetary Fund (IMF) lowered its forecast for global growth for 2014 and 2015. The IMF cut its forecast for global economic growth to 3.3% in 2014, down from a previous forecast of 3.4%. 2015 forecast was lowered to 3.8%, down from a previous forecast of 4.0%.

Job openings rose to 4.835 million in August from 4.6 million in July, exceeding expectations for an increase to 4.710 million.

The greenback remained supported by Friday's U.S. labour market data. The economy in the U.S. added 248,000 jobs in September, exceeding expectations for 216,000 jobs, after 180,000 jobs in August.

The unemployment rate dropped to 5.9% in September from 6.1% in August. That was the lowest level since July 2008.

The euro traded higher against the U.S. dollar. In the morning trading session, the euro declined against the greenback due to disappointing German industrial production. German industrial production declined 4.0% in August, missing expectations for a 1.4% decrease, after a 1.6% rise in July. That was the largest drop since 2009.

July's figure was revised down from a 1.9% gain.

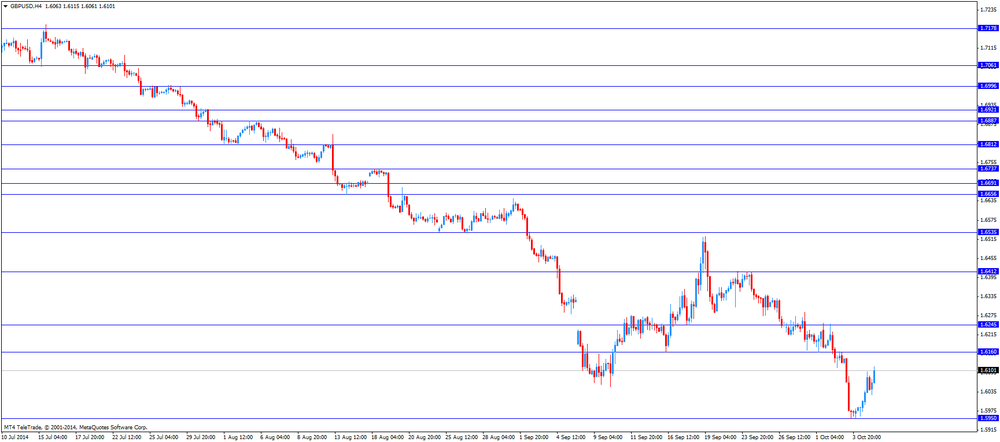

The British pound traded mixed against the U.S. dollar after the release of mixed economic data from the U.K. Manufacturing production in the U.K. increased 0.1% in August, missing expectations for a 0.2% rise, after a 0.3% gain in July.

On a yearly basis, U.K. manufacturing production jumped 3.9% in August, beating expectations for a 3.4% increase, after a 3.5% rise in July. July's figure was revised up from a 2.2% increase.

Industrial production in the U.K. was flat in August, in line with expectations, after a 0.4% increase in July. July' figure was revised down from a 0.5% rise.

On a yearly basis, U.K. industrial production rose 2.5% in August, missing expectations for a 2.6% gain, after a 2.2% increase in July. July's figure was revised up from a 1.7% rise.

The National Institute of Economic and Social Research (NIESR) released its gross domestic product (GDP) estimate for the U.K. today. NIESR estimated that GDP increased 0.7% in the third quarter.

The Swiss franc traded mixed against the U.S. dollar. Switzerland's consumer price index increased 0.1% in September, missing expectations for a 0.2% gain, after a flat reading in August.

Retail sales in Switzerland rose 1.9% in August, exceeding expectations for a 0.8% increase, after a 0.3% decline in July. July's figure was revised up from a 0.6% decrease.

The Swiss National Bank's foreign exchange reserves increased to 462.194 billion Swiss francs in September from 453.875 billion francs in August.

The Canadian dollar traded lower after the release of the disappointing Canadian building permits. Building permits in Canada dropped 27.3% in August, after a 11.6% rise in July. July's figure was revised down from a 11.8% gain.

The New Zealand dollar traded higher against the U.S. dollar. The New Zealand Institute of Economic Research released its business confidence index. The index dropped to 19 in the third quarter from 32 in the second quarter.

The Australian dollar traded higher against the U.S. dollar. The Reserve Bank of Australia (RBA) released its interest rate decision today. The RBA kept its interest rate unchanged at 2.50%. Analysts had expected this decision.

The RBA Governor Glenn Stevens said that the Aussie remained "high by historical standards" despite the recent decrease. He also said that Australia's economy grew moderately and "labour market data have been unusually volatile".

The AIG performance of construction index climbed to 59.1 in September from 55.0 in August.

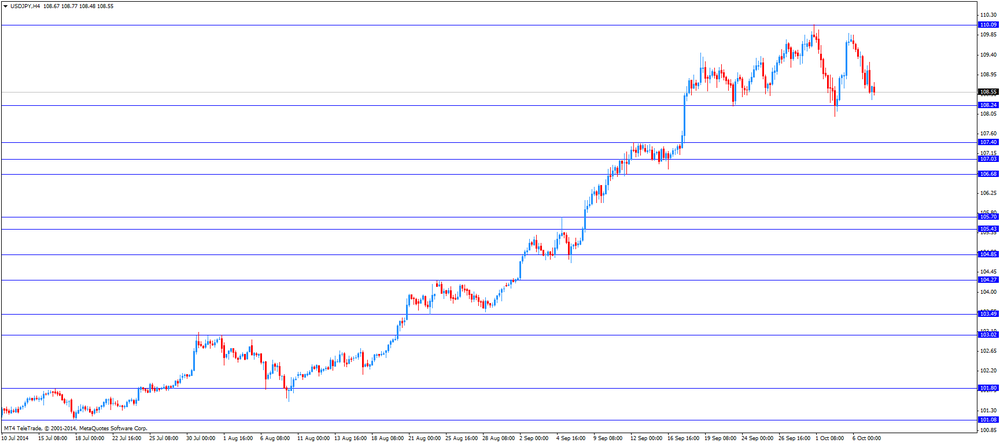

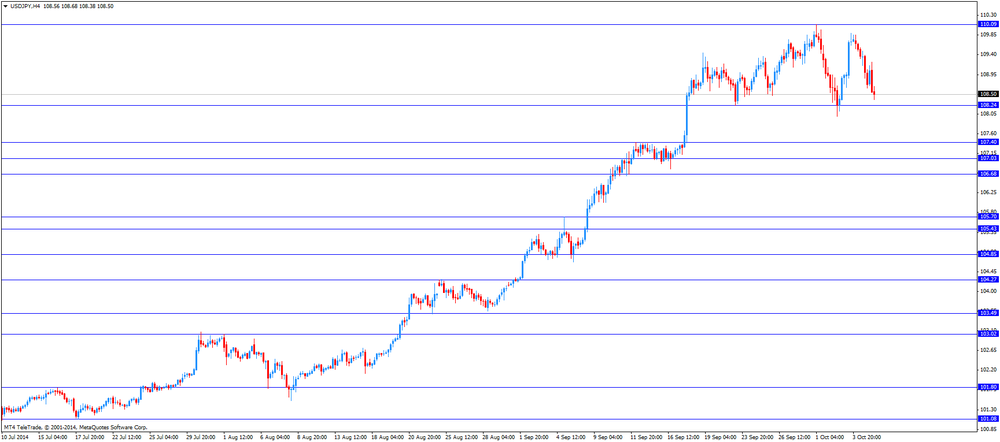

The Japanese yen rose against the U.S. dollar. Comments by Japanese Prime Minister Shinzo Abe supported the yen. Abe expressed concern about a weaker yen.

The Bank of Japan (BoJ) released its interest rate decision today. The BoJ kept its monetary policy unchanged.

The BoJ Governor Haruhiko Kuroda said at a press conference today that the BoJ will closely monitor the exchange rate. He added that the central bank will maintain its quantitative and qualitative monetary easing program until the inflation target of 2% is achieved. Kuroda noted the BoJ will adjust its quantitative and qualitative monetary easing program if necessary.

Japan's preliminary leading index declined to 104 in August from 105.4 in July, missing expectations for a decrease to 104.2. That was the lowest level since January 2013.

Japan's coincident index fell to 108.5 in August from 109.9 in July.

Gold prices rose slightly today, thereby exceeded the level of $ 1,210 per ounce, which was associated with a fall in the stock market and the weakening of the American currency.

"From a technical point of view, if the gold this week to stay above $ 1,180, it could be back in the area of $ 1.240-1.250. However, in the medium term will remain a tendency to decrease, "- said a trader at MKS Group James Gardiner.

Support prices also provides a revision of the IMF forecast for the economy for 2014 and 2015, as well as the expectations of the return on the market of Chinese players after the holiday week. Today, the IMF published a semi-annual forecasts for global economic growth, according to which growth will remain weak and uneven, subject to various risks. The IMF revised its forecast for 2014 from 3.4% to 3.3%, and for 2015 - up 3.8% from 4%. His decision to IMF experts explained concerns about the various assessments of the economy in some countries. United States and Britain have been named as the country with decent growth prospects, which is not the euro-zone countries - GDP forecast here has been reduced to 1.3% from 1.5%.

Meanwhile, we add that the participants are cautious on the eve of the publication of minutes of the September Fed meeting, scheduled for tomorrow, after the optimistic findings underscored last week, the view that the strengthening of the economic recovery may prompt the Federal Reserve to raise interest rates earlier than expected by the market. Recall, expectations of rising interest rates put pressure on gold as the precious metal is inferior in competition with earning assets with growth rates.

Investors are also waiting for tonight's speech by President Federal Reserve Bank of Minneapolis President Narayana Kocherlakoty and the New York Fed, William Dudley, who are voting members of the Monetary Policy Committee of the Fed.

The cost of the December gold futures on the COMEX today rose to 1210.60 dollars per ounce.

The Bank of Japan (BoJ) released its interest rate decision today. The BoJ kept its monetary policy unchanged.

Japan's central bank said that the economy recovered moderately as a trend. The BoJ added that production has showed some weakness due to a sales tax hike in April.

The BoJ Governor Haruhiko Kuroda said at a press conference today that the BoJ will closely monitor the exchange rate. He added that the central bank will maintain its quantitative and qualitative monetary easing program until the inflation target of 2% is achieved. Kuroda noted the BoJ will adjust its quantitative and qualitative monetary easing program if necessary.

Current fall in crude oil prices is good for Japan's economy, Kuroda said.

The BoJ governor pointed out that job and income conditions are improving.

EUR/USD: $1.2525-30(E333mn), $1.2600(E881bn), $1.2650(E734mn), $1.2685-90(E600mn), $1.2700(E3.0bn)

USD/JPY: Y109.00($2.95bn), Y110.50($603mn)

EURYEN: Y137.30(1.8bn)

EUR/GBP: Stg0.7800(E290mn)

USD/CHF: Chf0.9400($570mn)

AUD/USD: $0.8700(A$378mn), $0.8775(A$757mn)

NZD/USD: $0.7950(NZ$440mn)

USD/CAD: C$1.1180($230mn), C$1.1200($400mn), C$1.1250($290mn)

U.S. stock-index futures declined, investors await corporate earnings reports to assess the strength of the American economy.

Global markets:

Nikkei 15,783.83 -107.12 -0.67%

Hang Seng 23,422.52 +107.48 +0.46%

FTSE 6,538.69 -24.96 -0.38%

CAC 4,242.03 -44.49 -1.04%

DAX 9,164.77 -44.74 -0.49%

Crude oil $89.96 (-0.42%)

Gold $1206.20 (-0.09%)

(company / ticker / price / change, % / volume)

| UnitedHealth Group Inc | UNH | 85.40 | +0.36% | 0.1K |

| Walt Disney Co | DIS | 88.52 | -0.05% | 1K |

| Goldman Sachs | GS | 187.28 | -0.11% | 0.5K |

| AT&T Inc | T | 35.45 | -0.11% | 3.7K |

| Home Depot Inc | HD | 93.15 | -0.12% | 1.2K |

| American Express Co | AXP | 86.92 | -0.13% | 0.1K |

| Johnson & Johnson | JNJ | 104.71 | -0.14% | 1.2K |

| Pfizer Inc | PFE | 29.13 | -0.14% | 0.3K |

| Cisco Systems Inc | CSCO | 24.97 | -0.16% | 5.7K |

| Exxon Mobil Corp | XOM | 94.34 | -0.19% | 0.5K |

| McDonald's Corp | MCD | 93.65 | -0.20% | 3.4K |

| United Technologies Corp | UTX | 104.00 | -0.21% | 0.2K |

| Verizon Communications Inc | VZ | 49.97 | -0.22% | 1.4K |

| General Electric Co | GE | 25.16 | -0.24% | 2.4K |

| International Business Machines Co... | IBM | 188.59 | -0.24% | 0.5K |

| Intel Corp | INTC | 34.02 | -0.26% | 1.6K |

| Wal-Mart Stores Inc | WMT | 77.14 | -0.27% | 3.1K |

| Microsoft Corp | MSFT | 45.90 | -0.41% | 3.1K |

| JPMorgan Chase and Co | JPM | 59.93 | -0.42% | 4.0K |

| The Coca-Cola Co | KO | 43.38 | -0.50% | 7.2K |

| Chevron Corp | CVX | 117.00 | -0.92% | 0.3K |

| Caterpillar Inc | CAT | 96.91 | -1.11% | 8.2K |

Upgrades:

Downgrades:

Deere (DE) downgraded to Underperform from Neutral at BofA/Merrill

Other:

Apple (AAPL) target raised to $120 from $115 at Susquehanna

Hewlett-Packard (HPQ) target raised to $45 at Brean Capital

UnitedHealth (UNH) initiated with a Overweight at Piper Jaffray, target $121

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 China Bank holiday

03:00 Japan BoJ Monetary Policy Statement

03:30 Australia Announcement of the RBA decision on the discount rate 2.50% 2.50% 2.50%

03:30 Australia RBA Rate Statement

04:54 Japan Bank of Japan Monetary Base Target 270 270 270

04:54 Japan BoJ Interest Rate Decision 0.10% 0.10% 0.10%

05:00 Japan Leading Economic Index August 105.4 104.2 104.0

05:00 Japan Coincident Index August 109.9 108.5

06:00 Germany Industrial Production s.a. (MoM) August +1.6% Revised From +1.9% -1.4% -4.0%

06:00 Germany Industrial Production (YoY) August +2.5% -2.8%

07:00 Switzerland Foreign Currency Reserves September 453.8 462.2

07:15 Switzerland Retail Sales Y/Y August -0.6% +0.8% +1.9%

07:15 Switzerland Consumer Price Index (MoM) September 0.0% +0.2% +0.1%

07:15 Switzerland Consumer Price Index (YoY) September +0.1% 0.0% -0.1%

07:30 Japan BOJ Press Conference

08:30 United Kingdom Industrial Production (MoM) August +0.5% 0.0% 0.0%

08:30 United Kingdom Industrial Production (YoY) August +1.7% +2.6% +2.5%

08:30 United Kingdom Manufacturing Production (MoM) August +0.3% +0.2% +0.1%

08:30 United Kingdom Manufacturing Production (YoY) August +2.2% +3.4% +3.9%

08:30 United Kingdom BOE Credit Conditions Survey

The U.S. dollar traded mixed to higher against the most major currencies. The greenback remained supported by Friday's U.S. labour market data. The economy in the U.S. added 248,000 jobs in September, exceeding expectations for 216,000 jobs, after 180,000 jobs in August.

The unemployment rate dropped to 5.9% in September from 6.1% in August. That was the lowest level since July 2008.

The euro fell against the U.S. dollar due to disappointing German industrial production. German industrial production declined 4.0% in August, missing expectations for a 1.4% decrease, after a 1.6% rise in July. That was the largest drop since 2009.

July's figure was revised down from a 1.9% gain.

The British pound traded lower against the U.S. dollar after the release of mixed economic data from the U.K. Manufacturing production in the U.K. increased 0.1% in August, missing expectations for a 0.2% rise, after a 0.3% gain in July.

On a yearly basis, U.K. manufacturing production jumped 3.9% in August, beating expectations for a 3.4% increase, after a 3.5% rise in July. July's figure was revised up from a 2.2% increase.

Industrial production in the U.K. was flat in August, in line with expectations, after a 0.4% increase in July. July' figure was revised down from a 0.5% rise.

On a yearly basis, U.K. industrial production rose 2.5% in August, missing expectations for a 2.6% gain, after a 2.2% increase in July. July's figure was revised up from a 1.7% rise.

The Swiss franc traded mixed against the U.S. dollar. Switzerland's consumer price index increased 0.1% in September, missing expectations for a 0.2% gain, after a flat reading in August.

Retail sales in Switzerland rose 1.9% in August, exceeding expectations for a 0.8% increase, after a 0.3% decline in July. July's figure was revised up from a 0.6% decrease.

The Swiss National Bank's foreign exchange reserves increased to 462.194 billion Swiss francs in September from 453.875 billion francs in August.

The Canadian dollar traded mixed ahead of the Canadian building permits.

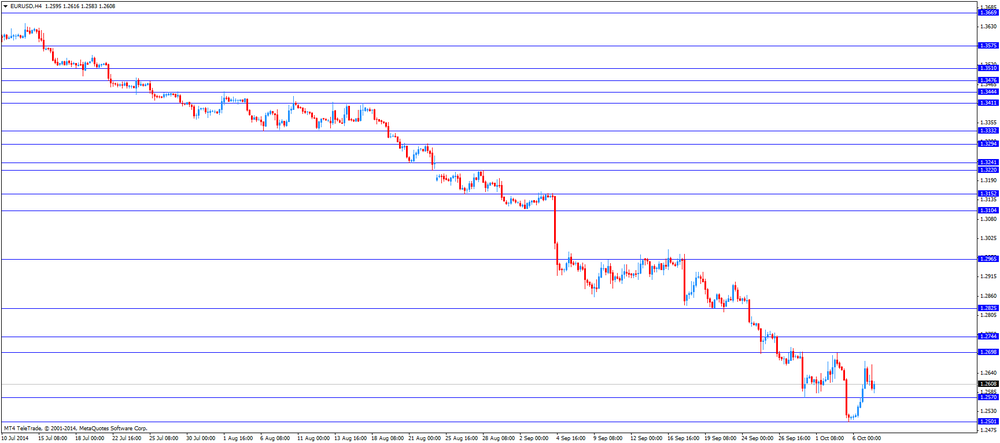

EUR/USD: the currency pair decreased to $1.2583

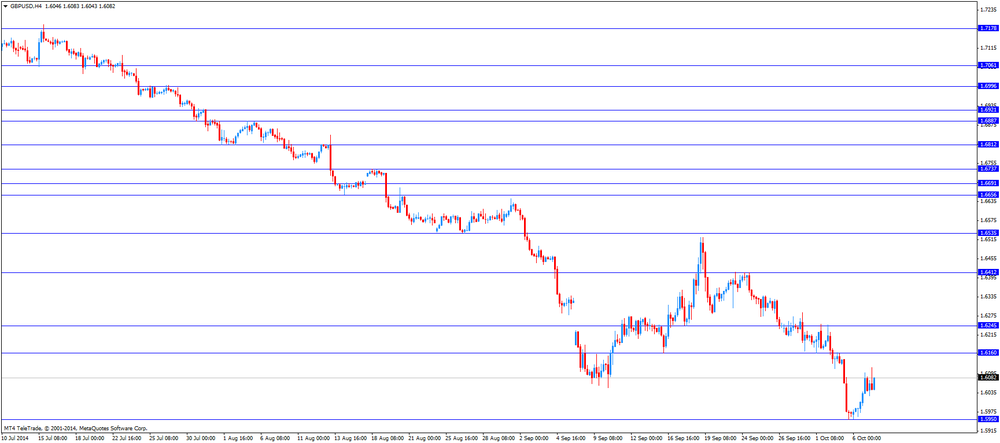

GBP/USD: the currency pair fell to $1.6043

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 Canada Building Permits (MoM) August +11.8%

14:00 United Kingdom NIESR GDP Estimate September +0.6%

14:00 U.S. JOLTs Job Openings August 4673 4710

17:20 U.S. FOMC Member Narayana Kocherlakota

19:00 U.S. FOMC Member Dudley Speak

23:50 Japan Current Account (adjusted), bln August 99.3 190

EUR/USD

Offers $1.2750, $1.2700/02

Bids $1.2500

GBP/USD

Offers $1.6120/25

Bids $1.6060-50, $1.6020, $1.6000, $1.5980

AUD/USD

Offers $0.8950, $0.8900, $0.8850

Bids $0.8755/50, $0.8700, $0.8680/60, $0.8650, $0.8640/20

EUR/JPY

Offers Y138.00, Y137.75/80, Y137.50

Bids Y136.50, Y136.00, Y135.50

USD/JPY

Offers Y110.10, Y110.00, Y109.50, Y108.90/00

Bids Y108.20, Y108.00, Y107.50, Y107.00

EUR/GBP

Offers stg0.7900

Bids stg0.7835/30

The Reserve Bank of Australia (RBA) released its interest rate decision today. The RBA kept its interest rate unchanged at 2.50%. Analysts had expected this decision.

The RBA Governor Glenn Stevens said that the Aussie remained "high by historical standards" despite the recent decrease. He also said that Australia's economy grew moderately and "labour market data have been unusually volatile".

Australia's central bank expects the economic growth to be below trend, so the RBA governor.

Stevens noted that wages growth fell "noticeably".

The central bank's monetary policy will remain accommodative, so Stevens.

Stock indices traded lower due to disappointing German industrial production. German industrial production declined 4.0% in August, missing expectations for a 1.4% decrease, after a 1.6% rise in July. That was the largest drop since 2009.

July's figure was revised down from a 1.9% gain.

Current figures:

Name Price Change Change %

FTSE 6,521.56 -42.09 -0.64%

DAX 9,133.33 -76.18 -0.83%

CAC 40 4,239.5 -47.02 -1.10%

Asian stock indices closed mixed.

Japanese stocks declined due to a stronger yen. The yen climbed after comments by Japanese Prime Minister Shinzo Abe and the Bank of Japan's interest rate decision. Abe expressed concern about a weaker yen.

The Bank of Japan (BoJ) kept its monetary policy unchanged.

The BoJ Governor Haruhiko Kuroda said at a press conference today that the BoJ will closely monitor the exchange rate. He added that the central bank will maintain its quantitative and qualitative monetary easing program until the inflation target of 2% is achieved. Kuroda noted the BoJ will adjust its quantitative and qualitative monetary easing program if necessary.

Japan's preliminary leading index declined to 104 in August from 105.4 in July, missing expectations for a decrease to 104.2. That was the lowest level since January 2013.

Japan's coincident index fell to 108.5 in August from 109.9 in July.

Hong Kong's stock index increased as Hong Kong officials and protest leaders agreed to talk.

Markets in Shanghai are closed until October 7 for a public holiday.

Indexes on the close:

Nikkei 225 15,783.83 -107.12 -0.67%

Hang Seng 23,422.52 +107.48 +0.46%

Shanghai Composite closed

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 China Bank holiday

03:00 Japan BoJ Monetary Policy Statement

03:30 Australia Announcement of the RBA decision on the discount rate 2.50% 2.50% 2.50%

03:30 Australia RBA Rate Statement

04:54 Japan Bank of Japan Monetary Base Target 270 270 270

04:54 Japan BoJ Interest Rate Decision 0.10% 0.10% 0.10%

05:00 Japan Leading Economic Index August 105.4 104.2 104.0

05:00 Japan Coincident Index August 109.9 108.5

06:00 Germany Industrial Production s.a. (MoM) August +1.6% Revised From +1.9% -1.4% -4.0%

06:00 Germany Industrial Production (YoY) August +2.5% -2.8%

07:00 Switzerland Foreign Currency Reserves September 453.8 462.2

07:15 Switzerland Retail Sales Y/Y August -0.6% +0.8% +1.9%

07:15 Switzerland Consumer Price Index (MoM) September 0.0% +0.2% +0.1%

07:15 Switzerland Consumer Price Index (YoY) September +0.1% 0.0% -0.1%

07:30 Japan BOJ Press Conference

08:30 United Kingdom Industrial Production (MoM) August +0.5% 0.0% 0.0%

08:30 United Kingdom Industrial Production (YoY) August +1.7% +2.6% +2.5%

08:30 United Kingdom Manufacturing Production (MoM) August +0.3% +0.2% +0.1%

08:30 United Kingdom Manufacturing Production (YoY) August +2.2% +3.4% +3.9%

08:30 United Kingdom BOE Credit Conditions Survey

The U.S. dollar mixed to higher against the most major currencies. The greenback remained supported by Friday's U.S. labour market data. The economy in the U.S. added 248,000 jobs in September, exceeding expectations for 216,000 jobs, after 180,000 jobs in August.

The unemployment rate dropped to 5.9% in September from 6.1% in August. That was the lowest level since July 2008.

The New Zealand dollar traded mixed against the U.S. dollar after the disappointing NZIER business confidence data from New Zealand. The New Zealand Institute of Economic Research released its business confidence index. The index dropped to 19 in the third quarter from 32 in the second quarter.

The Australian dollar traded mixed against the U.S. dollar after the release of the Reserve Bank of Australia's interest rate decision. The Reserve Bank of Australia (RBA) kept its interest rate unchanged at 2.50%. Analysts had expected this decision.

The RBA Governor Glenn Stevens said that the Aussie remained "high by historical standards" despite the recent decrease. He also said that Australia's economy grew moderately and "labour market data have been unusually volatile".

The AIG performance of construction index climbed to 59.1 in September from 55.0 in August.

The Japanese yen rose against the U.S. dollar after comments by Japanese Prime Minister Shinzo Abe. He expressed concern about a weaker yen.

The Bank of Japan (BoJ) released its interest rate decision today. The BoJ kept its monetary policy unchanged.

The BoJ Governor Haruhiko Kuroda said at a press conference today that the BoJ will closely monitor the exchange rate. He added that the central bank will maintain its quantitative and qualitative monetary easing program until the inflation target of 2% is achieved. Kuroda noted the BoJ will adjust its quantitative and qualitative monetary easing program if necessary.

Japan's preliminary leading index declined to 104 in August from 105.4 in July, missing expectations for a decrease to 104.2. That was the lowest level since January 2013.

Japan's coincident index fell to 108.5 in August from 109.9 in July.

EUR/USD: the currency pair fell to $1.2604

GBP/USD: the currency pair decreased to $1.6025

USD/JPY: the currency pair fell to Y108.53

AUD/USD: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 Canada Building Permits (MoM) August +11.8%

14:00 United Kingdom NIESR GDP Estimate September +0.6%

14:00 U.S. JOLTs Job Openings August 4673 4710

17:20 U.S. FOMC Member Narayana Kocherlakota

19:00 U.S. FOMC Member Dudley Speak

23:50 Japan Current Account (adjusted), bln August 99.3 190

EUR / USD

Resistance levels (open interest**, contracts)

$1.2811 (2362)

$1.2753 (1570)

$1.2711 (1664)

Price at time of writing this review: $ 1.2626

Support levels (open interest**, contracts):

$1.2572 (1897)

$1.2530 (1759)

$1.2472 (2999)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 47355 contracts, with the maximum number of contracts with strike price $1,2900 (4876);

- Overall open interest on the PUT options with the expiration date November, 7 is 45666 contracts, with the maximum number of contracts with strike price $1,2500 (4394);

- The ratio of PUT/CALL was 0.96 versus 1.05 from the previous trading day according to data from October, 6

GBP/USD

Resistance levels (open interest**, contracts)

$1.6304 (880)

$1.6206 (644)

$1.6110 (586)

Price at time of writing this review: $1.6064

Support levels (open interest**, contracts):

$1.5990 (1885)

$1.5593 (1068)

$1.5795 (1234)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 20397 contracts, with the maximum number of contracts with strike price $1,6750 (1897);

- Overall open interest on the PUT options with the expiration date November, 7 is 27098 contracts, with the maximum number of contracts with strike price $1,5400 (1936);

- The ratio of PUT/CALL was 1.33 versus 1.44 from the previous trading day according to data from October, 6

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.