- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 07-08-2014

(raw materials / closing price /% change)

Light Crude 97.63 +0.30%

Gold 1,314.50 +0.15%

(index / closing price / change items /% change)

Nikkei 225 15,232.37 +72.58 +0.48%

Hang Seng 24,387.56 -196.57 -0.80%

Shanghai Composite 2,187.67 -29.80 -1.34%

FTSE 100 6,597.37 -38.79 -0.58%

CAC 40 4,149.83 -57.31 -1.36%

Xetra DAX 9,038.97 -91.07 -1.00%

S&P 500 1,909.57 -10.67 -0.56%

NASDAQ 4,334.97 -20.09 -0.46%

Dow Jones 16,368.27 -75.07 -0.46%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3360 -0,17%

GBP/USD $1,6830 -0,12%

USD/CHF Chf0,9087 +0,14%

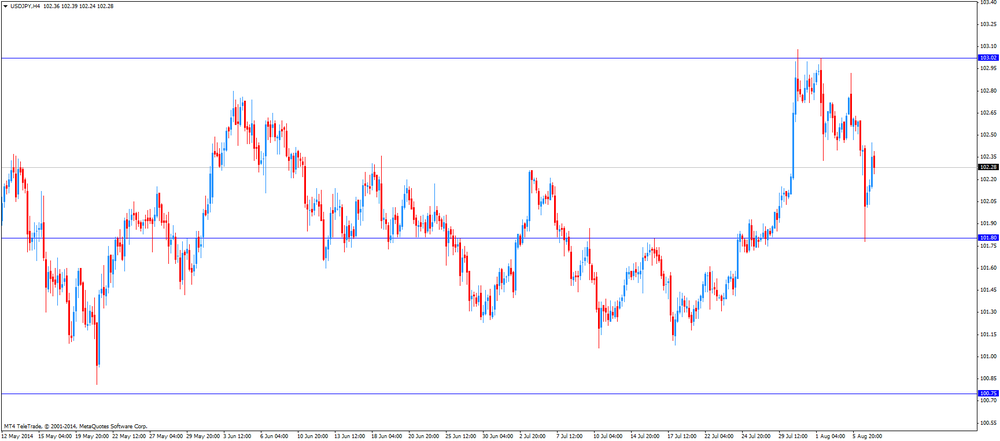

USD/JPY Y102,10 -0,01%

EUR/JPY Y136,41 -0,18%

GBP/JPY Y171,82 -0,13%

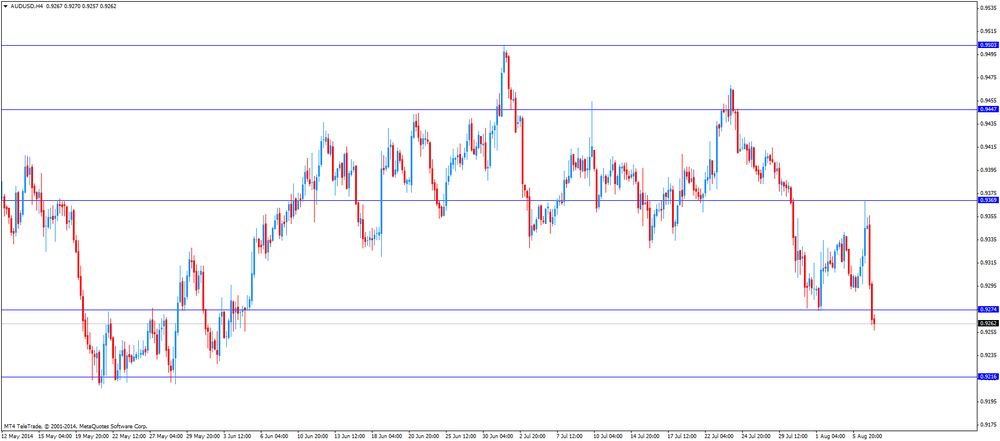

AUD/USD $0,9266 -0,87%

NZD/USD $0,8466 -0,07%

USD/CAD C$1,0926 +0,10%

(time / country / index / period / previous value / forecast)

01:30 Australia Home Loans June 0.0% +0.7%

01:30 Australia RBA Monetary Policy Statement Quarter III

02:00 China Trade Balance, bln July 31.6 26.0

03:00 Japan BoJ Interest Rate Decision 0.10% 0.10%

03:00 Japan Bank of Japan Monetary Base Target 270 270

03:00 Japan BoJ Monetary Policy Statement

05:00 Japan Eco Watchers Survey: Current July 47.7 48.7

05:00 Japan Eco Watchers Survey: Outlook July 53.3

05:45 Switzerland Unemployment Rate July 3.2% 3.2%

06:00 Germany Current Account June 13.2

06:00 Germany Trade Balance June 18.8 19.8

06:45 France Industrial Production, m/m June -1.7% +1.1%

06:45 France Industrial Production, y/y June -3.7%

07:30 Japan BOJ Press Conference

08:30 United Kingdom Trade in goods June -9.2 -8.9

12:30 Canada Employment July -9.4 +25.4

12:30 Canada Unemployment rate July 7.1% 7.0%

12:30 U.S. Nonfarm Productivity, q/q Quarter II -3.2% +1.4%

12:30 U.S. Unit Labor Costs, q/q Quarter II +5.7% +1.3%

14:00 U.S. Wholesale Inventories June +0.5% +0.6%

Stock indices closed lower after the European Central Bank's interest rate decision and press conference. The ECB kept its interest rate unchanged at 0.15%.

The ECB President reiterated that interest rates will remain at low levels "for an extended period of time" and the ECB could launch unconventional measures to tackle low inflation.

Mr. Draghi warned that tensions between Russia and the EU over Ukraine may affect the economic recovery in the EU.

Germany's industrial production climbed 0.3% in June, after a 1.7% decline in May, but missing expectations for a 1.4% rise. May's figure was revised up from a 1.8% fall.

The Bank of England kept its interest rate at 0.50% and its asset purchase facility program at £375 billion. This decision was widely expected by investors.

Adidas AG shares declined 4.8% after the company lowered its profit forecast for 2014.

Beiersdorf AG dropped 1.8% after missing first-half revenue analyst's forecasts.

Nestle SA jumped 3.4% after the company announced plans to buy back up to eight billion Swiss francs of its shares.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,597.37 -38.79 -0.58%

DAX 9,038.97 -91.07 -1.00%

CAC 40 4,149.83 -57.31 -1.36%

The U.S. dollar higher to mixed against the most major currencies after the better-than-expected number of initial jobless claims in the U.S. The number of initial jobless in the week ending August 2 dropped by 14,000 to 289,000 from the previous week's figure of 303,000. Analysts had expected the number of initial jobless claims to climb by 2,000 to 305,000. The previous week's figure was revised down from 302,000.

The euro fell against the U.S. dollar after the European Central Bank's decision and ECB's press conference. The ECB kept its interest rate unchanged at 0.15%. This decision was expected by market participants.

The ECB President Mario Draghi said that the central bank "intensified" preparation for an Asset Backed Securities (ABS) program. This program should be launched if necessary.

The ECB President reiterated that interest rates will remain at low levels "for an extended period of time" and the ECB could launch unconventional measures to tackle low inflation.

Mr. Draghi warned that tensions between Russia and the EU over Ukraine may affect the economic recovery in the EU.

Germany's industrial production climbed 0.3% in June, after a 1.7% decline in May, but missing expectations for a 1.4% rise. May's figure was revised up from a 1.8% fall.

France's trade deficit widened to 5.4 billion euro in June from a deficit of 5.1 billion euro in May, missing forecasts of a decline to 5.0 billion euro deficit. May's figure was revised down from a deficit of 4.9 billion euro.

The British pound traded mixed against the U.S. dollar after the Bank of England's interest decision. The BoE kept its interest rate at 0.50%. This decision was expected by analysts.

The BoE's asset purchase facility program remained at £375 billion. This decision was also expected by analysts.

The Swiss franc traded lower against the U.S. dollar. Switzerland's foreign currency reserves increased to 453.4 billion Swiss francs in July from 449.6 billion in June.

SECO consumer climate index declined to -1 in the second quarter from 1 in the previous quarter, missing expectations for a rise to 4.

The Canadian dollar traded mixed against the U.S. dollar after the better-than-expected economic data from Canada. The Ivey purchasing managers' index for Canada jumped to 54.1 in July from 46.9 in June, in line with expectations.

Canada's building permits increased 13.5% in June, beating expectations for a 1.8% fall, after a 15.4 rise in May. May's figure was revised up from a 13.8% gain.

The New Zealand dollar traded slightly higher against the U.S dollar in the absence of any major economic reports in New Zealand.

The Australian dollar traded lower against the U.S. dollar after the weak labour market data from Australia. The number of employed people in Australia declined by 300 in July, missing expectations for a rise of 13,500, after an increase of 14,900 in June. June's figure was revised down from a 15,900 rise.

Australia's unemployment rate climbed to 6.4% in July from 6.0% in June. Analysts had expected the unemployment rate to remain unchanged.

The Australian Industry Group/Housing Industry Association Australian performance of construction index rose to 52.6 in July from 51.8 in June.

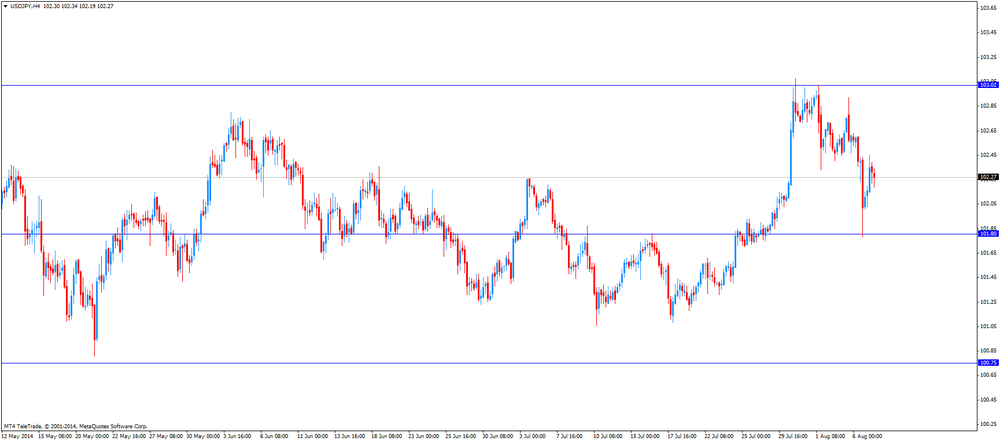

The Japanese yen traded higher against the U.S. dollar. In the overnight trading session, the Japanese yen declined against the U.S. dollar after Reuters reported today that Japan's Government Pension Investment Fund (GPIF) plans to buy more domestic stocks. GPIF's target is over 20% of funds in domestic stocks (current target: 12%).

No major economic reports were released in Japan.

Brent crude traded near its lowest closing level in nine months on speculation that supplies remain sufficient to meet demand. West Texas Intermediate was near a six-month low.

Futures were little changed in London. In Iraq, Kurdish exports remain unaffected by turmoil that also has spared supply from the nation's south, home to more than three-quarters of its crude output. Libyan lawmakers ordered feuding militias and other groups to end their fighting. Crude stockpiles remain above last year's level in the U.S., the world's biggest consumer, according to the Energy Information Administration.

"Market participants are overestimating the current level of oversupply on the market, while at the same time underestimating the risks of future production outages," Carsten Fritsch, an analyst at Commerzbank AG in Frankfurt, said in a report.

Brent for September settlement rose 3 cents to $104.62 a barrel on the London-based ICE Futures Europe exchange at 12:52 p.m. local time. It closed at $104.59 yesterday, the lowest since Nov. 7. The European benchmark crude was at a premium of $7.61 to WTI, after closing at $7.67 yesterday. The grade has lost 5.6 percent this year.

WTI for September delivery advanced 9 cents to $97.01 in electronic trading on the New York Mercantile Exchange. It declined earlier to $96.55 a barrel, the lowest since Feb. 4. The volume of all futures traded was about 5 percent below the 100-day average. Prices are down 1.4 percent this year.

Gold prices are kept in one-week high after data showed last week that the number of applications for unemployment benefits in the United States fell more than expected.

United States Department of Labor reported that the number of people who filed initial applications for unemployment benefits last week fell by 14 thousand. To 289 thousand. Analysts had expected that this figure will grow by 2 thousand. 305 thousand.

The average value over the past four weeks was 293.5 thousand., Down 4 thousand. Values from the previous week's 297.5 thousand., The lowest level since February 2006.

The monthly average is seen as a more accurate indicator of trends in the labor market, since it reduces the volatility of the weekly data.

Meanwhile, in the euro area, as many expected, the ECB announced that it leaves its main refinancing rate at 0.15%.

The central bank also kept the marginal rate of 0.40% and the deposit rate left unchanged at -0.10%.

During the press conference held after the meeting of the ECB, Draghi said that the central bank will continue to monitor developments and will consider all available tools to support growth.

Gold previously received support after Russia announced a ban on imports of certain products from the United States and Europe, in retaliation for sanctions for its support of the rebels in Ukraine.

This decision was followed by the announcement of NATO that Russia has accumulated about 20,000 military on the border with Ukraine and can invade, on the pretext of humanitarian or peacekeeping mission.

Gold is often seen as a safe haven for investment in times of geopolitical instability.

The cost of the August gold futures on the COMEX today rose to $ 1307.90 per ounce.

The European Central Bank (ECB) released its interest rate decision today. Interest rate remained unchanged at 0.15%. This decision was expected by market participants. The ECB President Mario Draghi said that the central bank "intensified" preparation for an Asset Backed Securities (ABS) program. This program should be launched if necessary.

Inflation increased 0.4% in July, missing expectations for a 0.5% rise.

Mario Draghi said inflation should remain low in the coming months, but it is expected to climb in 2015 and 2016. The ECB's inflation target is 2%.

The ECB President reiterated that interest rates will remain at low levels "for an extended period of time" and the ECB could launch unconventional measures to tackle low inflation.

Mr. Draghi warned that tensions between Russia and the EU over Ukraine may affect the economic recovery in the EU.

The French and Italian governments needed to implement economic reforms, so Draghi.

EUR/USD $1.3350, $1.3375, $1.3400, $1.3500

USD/JPY Y101.80, Y102.00, Y102.50, Y103.00, Y103.40

EUR/GBP stg0.7975

AUD/USD $0.9300, $0.9350, $0.9380

USD/CAD C$1.0975

U.S. stock futures advanced as better-than-estimated earnings from 21st Century Fox Inc. overshadowed concern that the crisis in Ukraine is escalating.

Global markets:

Nikkei 15,232.37 +72.58 +0.48%

Hang Seng 24,387.56 -196.57 -0.80%

Shanghai Composite 2,187.67 -29.80 -1.34%

FTSE 6,641.07 +4.91 +0.07%

CAC 4,190.38 -16.76 -0.40%

DAX 9,132.48 +2.44 +0.03%

Crude oil $97.26 (+0.36%)

Gold $1306.70 (-0.11%)

(company / ticker / price / change, % / volume)

| UnitedHealth Group Inc | UNH | 81.00 | -0.61% | 1.7K |

| Caterpillar Inc | CAT | 102.30 | +0.80% | 1.7K |

| General Electric Co | GE | 25.60 | +0.63% | 18.0K |

| Home Depot Inc | HD | 81.00 | +0.60% | 0.3K |

| Johnson & Johnson | JNJ | 101.30 | +0.59% | 0.5K |

| JPMorgan Chase and Co | JPM | 56.50 | +0.48% | 0.2K |

| Intel Corp | INTC | 33.00 | +0.47% | 4.3K |

| Goldman Sachs | GS | 170.52 | +0.46% | 0.2K |

| International Business Machines Co... | IBM | 186.80 | +0.45% | 1.1K |

| Walt Disney Co | DIS | 86.97 | +0.44% | 2.1K |

| AT&T Inc | T | 34.75 | +0.38% | 4.8K |

| Boeing Co | BA | 118.78 | +0.37% | 1.4K |

| E. I. du Pont de Nemours and Co | DD | 65.00 | +0.36% | 0.1K |

| McDonald's Corp | MCD | 93.78 | +0.33% | 0.5K |

| Wal-Mart Stores Inc | WMT | 74.44 | +0.32% | 1.3K |

| Merck & Co Inc | MRK | 56.10 | +0.30% | 0.6K |

| Exxon Mobil Corp | XOM | 99.27 | +0.29% | 0.8K |

| Pfizer Inc | PFE | 28.36 | +0.28% | 0.5K |

| Microsoft Corp | MSFT | 42.84 | +0.23% | 0.1K |

| Chevron Corp | CVX | 126.00 | +0.21% | 7.3K |

| Procter & Gamble Co | PG | 81.20 | +0.14% | 0.8K |

| The Coca-Cola Co | KO | 39.97 | +0.13% | 3.0K |

| Cisco Systems Inc | CSCO | 24.96 | +0.12% | 2.5K |

| Verizon Communications Inc | VZ | 49.19 | +0.12% | 11.6K |

| 3M Co | MMM | 139.56 | +0.01% | 0.9K |

Upgrades:

Caterpillar (CAT) upgraded to Buy from Neutral at ISI Group

Downgrades:

Other:

FedEx (FDX) added to Focus List at Citigroup

UnitedHealth (UNH) removed from Conviction Buy list at Goldman

Barrick Gold (ABX) target raised to $25 from $23 at RBC Capital Mkts

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Unemployment rate July 6.0% 6.0% 6.4%

01:30 Australia Changing the number of employed July 15.9 13.5 -0.3

05:45 Switzerland SECO Consumer Climate Quarter II 1 4 -1

06:00 Germany Industrial Production s.a. (MoM) June -1.7% Revised From -1.8% +1.4% +0.3%

06:00 Germany Industrial Production (YoY) June +1.1% Revised From +1.3% -0.5%

06:45 France Trade Balance, bln June -5.1 Revised From -4.9 -5.0 -5.4

07:00 Switzerland Foreign Currency Reserves July 449.6 453.4

11:00 United Kingdom Asset Purchase Facility 375 375 375

11:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50% 0.50%

11:00 United Kingdom MPC Rate Statement

11:45 Eurozone ECB Interest Rate Decision 0.15% 0.15% 0.15%

The U.S. dollar traded mixed against the most major currencies ahead of the number of initial jobless claims in the U.S. The number of initial jobless claims in the U.S. is expected to climb by 3,000 to 305,000.

The euro traded little changed against the U.S. dollar after the European Central Bank's decision. The ECB kept its interest rate unchanged at 0.15%.

Germany's industrial production climbed 0.3% in June, after a 1.7% decline in May, but missing expectations for a 1.4% rise. May's figure was revised up from a 1.8% fall.

France's trade deficit widened to 5.4 billion euro in June from a deficit of 5.1 billion euro in May, missing forecasts of a decline to 5.0 billion euro deficit. May's figure was revised down from a deficit of 4.9 billion euro.

The British pound fell against the U.S. dollar after the Bank of England's interest decision. The BoE kept its interest rate at 0.50%. This decision was expected by analysts.

The BoE's asset purchase facility program remained at £375 billion. This decision was also expected by analysts.

The Swiss franc traded mixed against the U.S. dollar. Switzerland's foreign currency reserves increased to 453.4 billion Swiss francs in July from 449.6 billion in June.

SECO consumer climate index declined to -1 in the second quarter from 1 in the previous quarter, missing expectations for a rise to 4.

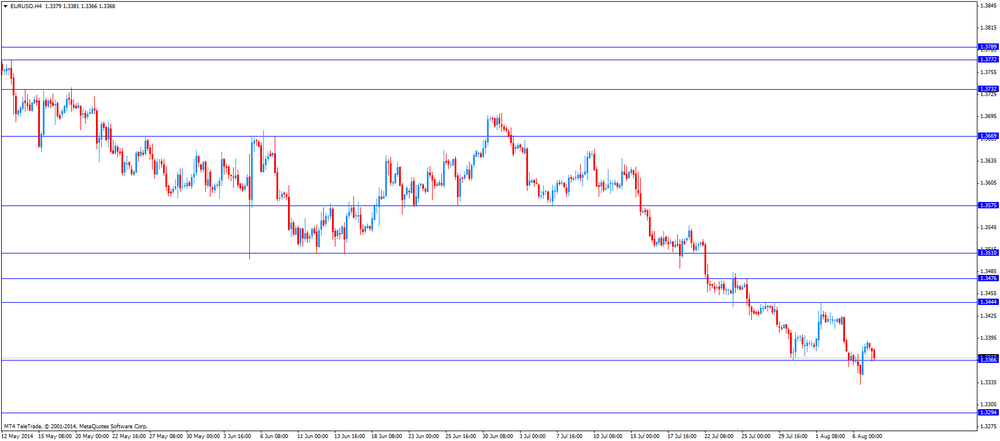

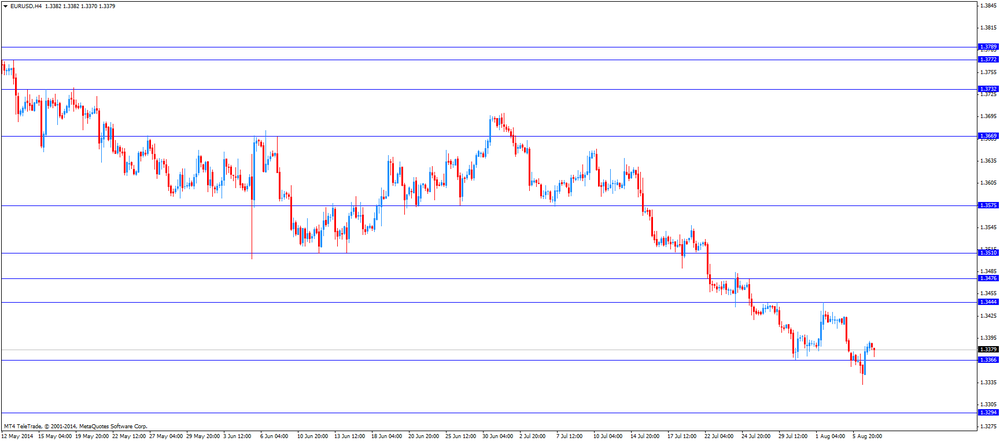

EUR/USD: the currency pair declined to $1.3364

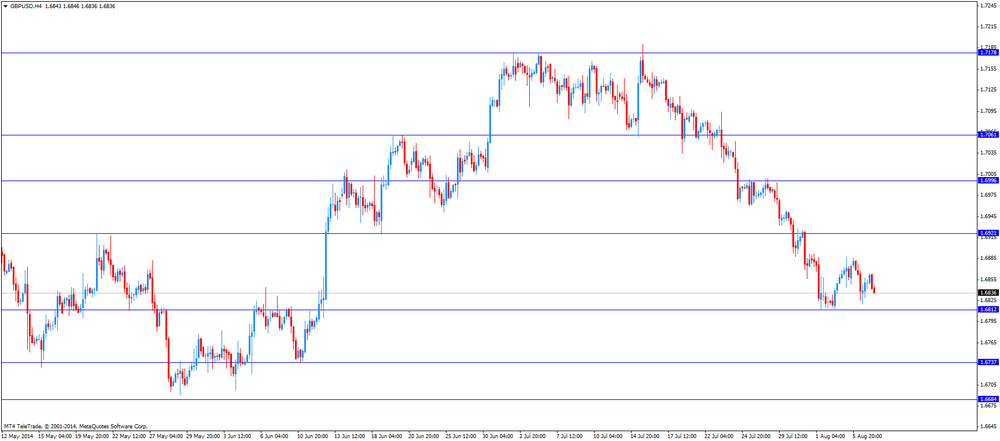

GBP/USD: the currency pair fell to $1.6833

USD/JPY: the currency pair decreased to Y102.19

The most important news that are expected (GMT0):

12:30 Eurozone ECB Press Conference

12:30 Canada Building Permits (MoM) June +13.8% -1.8%

12:30 U.S. Initial Jobless Claims July 302 305

14:00 Canada Ivey Purchasing Managers Index July 46.9 54.1

23:50 Japan Current Account (adjusted), bln June 384.6 110.0

EUR/USD

Offers $1.3530, $1.3500-10, $1.3485, $1.3445-50, $1.3400

Bids $1.3320, $1.3300, $1.3295

GBP/USD

Offers $1.6700, $1.6926, $1.6900

Bids $1.6800, $1.6785/80, $1.6750, $1.6700-693

AUD/USD

Offers $0.9505, $0.9465, $0.9400, $0.9370

Bids $0.9230, $0.9200, $0.9135

EUR/JPY

Offers Y138.80, Y138.50, Y138.00, Y137.30

Bids Y136.15, Y136.00, Y135.00

USD/JPY

Offers Y104.00, Y103.50, Y103.15, Y102.90

Bids Y101.80/70, Y101.30, Y101.05

EUR/GBP

Offers stg0.8100, stg0.8000, stg0.7985, stg0.7960

Bids stg0.7915, stg0.7900, stg0.7885, stg0.7870

Stock indices traded lower ahead of the European Central Bank's decision. Analysts expect that the ECB will keep its interest unchanged at 0.15%.

Tensions over Ukraine also weighed on stock markets. Russia banned a range of food imports from the United States and Europe.

Germany's industrial production climbed 0.3% in June, after a 1.7% decline in May, but missing expectations for a 1.4% rise. May's figure was revised up from a 1.8% fall.

Adidas AG shares declined 3.8% after the company lowered its profit forecast for 2014.

Beiersdorf AG dropped 5% after missing first-half revenue analyst's forecasts.

Commerzbank AG shares increased 2.6% after the bank reported that second-quarter profit more than doubled.

Nestle SA jumped 3.4% after the company announced plans to buy back up to eight billion Swiss francs of its shares.

Current figures:

Name Price Change Change %

FTSE 100 6,620.83 -15.33 -0.23%

DAX 9,117.92 -12.12 -0.13%

CAC 40 4,183.99 -23.15 -0.55%

Most Asian stock closed lower. Tensions over Ukraine weighed on stock markets. Russia will ban all imports of food from the United States and all fruit and vegetables from Europe.

Investors are awaiting the European Central Bank's and Bank of England's interest decision today.

Reuters reported today that Japan's Government Pension Investment Fund (GPIF) plans to buy more domestic stocks. GPIF's target is over 20% of funds in domestic stocks (current target: 12%).

Indexes on the close:

Nikkei 225 15,232.37 +72.58 +0.48%

Hang Seng 24,387.56 -196.57 -0.80%

Shanghai Composite 2,187.67 -29.80 -1.34%

EUR/USD $1.3350, $1.3375, $1.3400, $1.3500

USD/JPY Y101.80, Y102.00, Y102.50, Y103.00, Y103.40

EUR/GBP stg0.7975

AUD/USD $0.9300, $0.9350, $0.9380

USD/CAD C$1.0975

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Unemployment rate July 6.0% 6.0% 6.4%

01:30 Australia Changing the number of employed July 14.9 13.5 -0.3

05:45 Switzerland SECO Consumer Climate Quarter II 1 4 -1

06:00 Germany Industrial Production s.a. (MoM) June -1.7% Revised From -1.8% +1.4% +0.3%

06:00 Germany Industrial Production (YoY) June +1.1% Revised From +1.3% -0.5%

06:45 France Trade Balance, bln June -5.1 Revised From -4.9 -5.0 -5.4

07:00 Switzerland Foreign Currency Reserves July 449.6 453.4

The U.S. dollar traded higher against the most major currencies. The U.S. currency was supported by yesterday's U.S. trade data. The U.S. trade deficit declined to $41.5 billion in June from a deficit of $44.7 billion in May, beating expectations for a decrease to $44.2 billion. May's figure was revised down from a deficit of $44.4 billion.

The New Zealand dollar traded slightly lower against the U.S dollar in the absence of any major economic reports in New Zealand.

The Australian dollar dropped against the U.S. dollar after the weak labour market data from Australia. The number of employed people in Australia declined by 300 in July, missing expectations for a rise of 13,500, after an increase of 14,900 in June. June's figure was revised down from a 15,900 rise.

Australia's unemployment rate climbed to 6.4% in July from 6.0% in June. Analysts had expected the unemployment rate to remain unchanged.

The Australian Industry Group/Housing Industry Association Australian performance of construction index rose to 52.6 in July from 51.8 in June.

The Japanese yen declined against the U.S. dollar after Reuters reported today that Japan's Government Pension Investment Fund (GPIF) plans to buy more domestic stocks. GPIF's target is over 20% of funds in domestic stocks (current target: 12%).

No major economic reports were released in Japan.

EUR/USD: the currency pair declined to $1.3379

GBP/USD: the currency pair decreased to $1.6841

USD/JPY: the currency pair climbed to Y102.45

AUD/USD: the currency pair was down to $0.9261

The most important news that are expected (GMT0):

11:00 United Kingdom Asset Purchase Facility 375 375

11:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50%

11:00 United Kingdom MPC Rate Statement

11:45 Eurozone ECB Interest Rate Decision 0.15% 0.15%

12:30 Eurozone ECB Press Conference

12:30 Canada Building Permits (MoM) June +13.8% -1.8%

12:30 U.S. Initial Jobless Claims July 302 305

14:00 Canada Ivey Purchasing Managers Index July 46.9 54.1

23:50 Japan Current Account (adjusted), bln June 384.6 110.0

EUR / USD

Resistance levels (open interest**, contracts)

$1.3502 (2805)

$1.3454 (2823)

$1.3414 (1550)

Price at time of writing this review: $ 1.3381

Support levels (open interest**, contracts):

$1.3338 (3199)

$1.3296 (2582)

$1.3249 (1423)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 34739 contracts, with the maximum number of contracts with strike price $1,3600 (4262);

- Overall open interest on the PUT options with the expiration date August, 8 is 32824 contracts, with the maximum number of contracts with strike price $1,3500 (5491);

- The ratio of PUT/CALL was 0.95 versus 0.98 from the previous trading day according to data from August, 6

GBP/USD

Resistance levels (open interest**, contracts)

$1.7100 (2737)

$1.7000 (1625)

$1.6901 (1332)

Price at time of writing this review: $1.6847

Support levels (open interest**, contracts):

$1.6799 (3334)

$1.6700 (1096)

$1.6600 (431)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 20885 contracts, with the maximum number of contracts with strike price $1,7100 (2737);

- Overall open interest on the PUT options with the expiration date August, 8 is 26808 contracts, with the maximum number of contracts with strike price $1,6800 (3334);

- The ratio of PUT/CALL was 1.28 versus 1.34 from the previous trading day according to data from August, 6

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.